Attached files

| file | filename |

|---|---|

| 8-K - 8-K - NACCO INDUSTRIES INC | d549367d8k.htm |

Exhibit 99

FOCUSED NACCO INDUSTRIES, INC. THE NORTH AMERICAN COAL CORPORATION 2017 ANNUAL REPORT 1

North American Coal Operations The Coteau Properties Company The Falkirk Mining Company Coyote Creek Mining Company NoDak Energy Services LLC Bisti Fuels Company Caddo Creek Resource Company The Sabine Mining Company Mississippi Lignite Mining Company Liberty Fuels Company Corporate Office For 2016 Large Surface Coal Mines Awarded to The Freedom Mine The North American Coal Corporation Contents Discussion of Results . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 Selected Financial and Operating Data . . . . . . . . . . . . . 2 Letter to Stockholders . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 Form 10-K . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11 Directors and Officers . . . . . . . . . . . . . . . . . . . . . . . . . 118 Corporate Information . . . . . . . . . . . .Inside Back Cover Cover Photo: The Coteau Properties Company’s Freedom Mine uses a Bucyrus-Erie 2570W dragline to remove overburden before the coal below is mined. The Freedom Mine is North American Coal’s largest mining operation. The Freedom Mine operates three 2570 draglines, and each can remove as much as 120 cubic yards of overburden in one bucket. 2

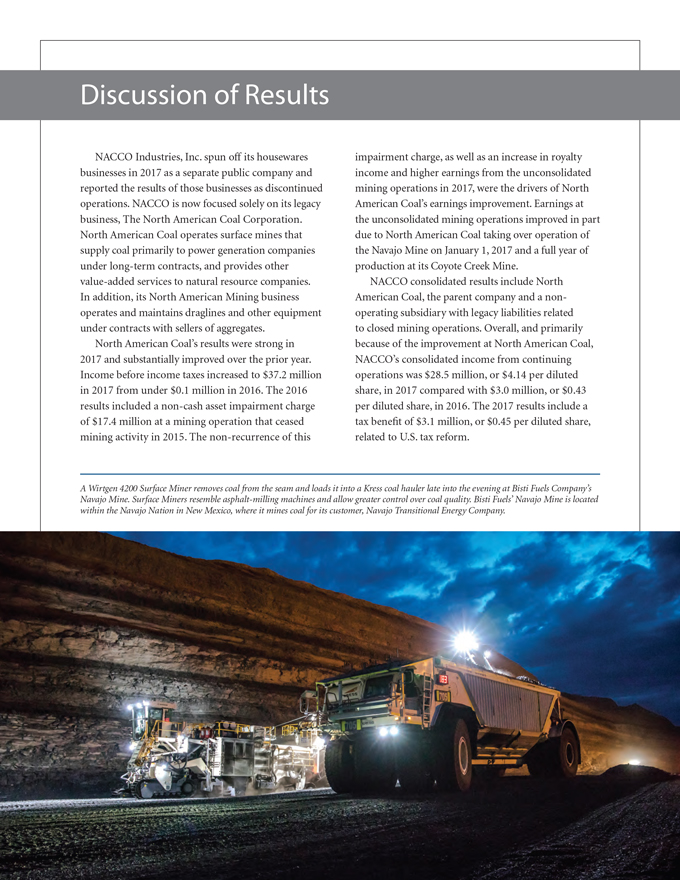

Discussion of Results NACCO Industries, Inc. spun off its housewares businesses in 2017 as a separate public company and reported the results of those businesses as discontinued operations. NACCO is now focused solely on its legacy business, The North American Coal Corporation. North American Coal operates surface mines that supply coal primarily to power generation companies under long-term contracts, and provides other value-added services to natural resource companies. In addition, its North American Mining business operates and maintains draglines and other equipment under contracts with sellers of aggregates. North American Coal’s results were strong in 2017 and substantially improved over the prior year. Income before income taxes increased to $37.2 million in 2017 from under $0.1 million in 2016. The 2016 results included a non-cash asset impairment charge of $17.4 million at a mining operation that ceased mining activity in 2015. The non-recurrence of this impairment charge, as well as an increase in royalty income and higher earnings from the unconsolidated mining operations in 2017, were the drivers of North American Coal’s earnings improvement. Earnings at the unconsolidated mining operations improved in part due to North American Coal taking over operation of the Navajo Mine on January 1, 2017 and a full year of production at its Coyote Creek Mine. NACCO consolidated results include North American Coal, the parent company and a non-operating subsidiary with legacy liabilities related to closed mining operations. Overall, and primarily because of the improvement at North American Coal, NACCO’s consolidated income from continuing operations was $28.5 million, or $4.14 per diluted share, in 2017 compared with $3.0 million, or $0.43 per diluted share, in 2016. The 2017 results include a tax benefit of $3.1 million, or $0.45 per diluted share, related to U.S. tax reform. A Wirtgen 4200 Surface Miner removes coal from the seam and loads it into a Kress coal hauler late into the evening at Bisti Fuels Company’s Navajo Mine. Surface Miners resemble asphalt-milling machines and allow greater control over coal quality. Bisti Fuels’ Navajo Mine is located within the Navajo Nation in New Mexico, where it mines coal for its customer, Navajo Transitional Energy Company. 3

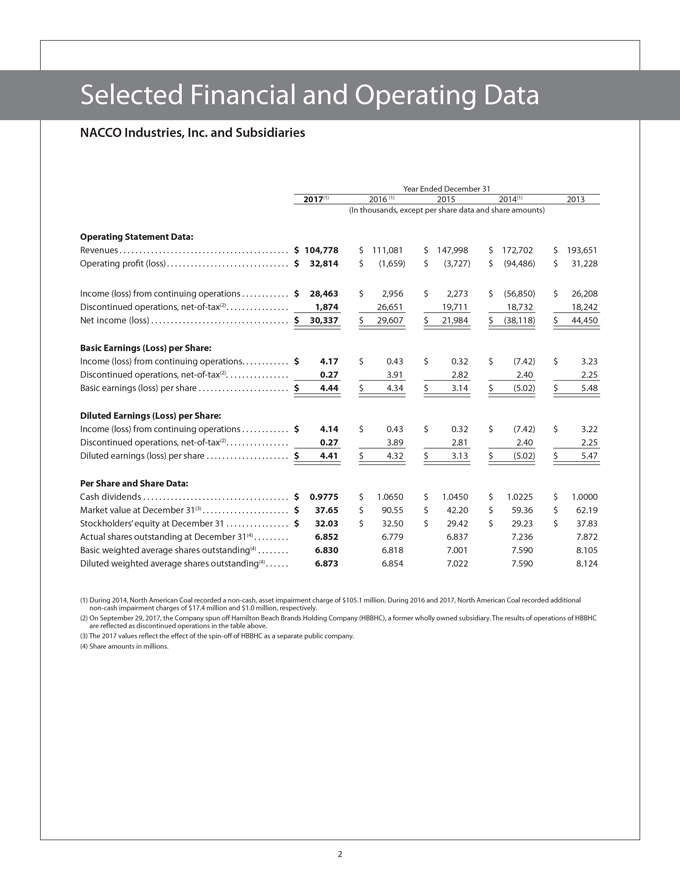

Selected Financial and Operating Data NACCO Industries, Inc. and Subsidiaries Year Ended December 31 2017(1) 2016 (1) 2015 2014(1) 2013 (In thousands, except per share data and share amounts) Operating Statement Data: Revenues . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 104,778 $ 111,081 $ 147,998 $ 172,702 $ 193,651 Operating profit (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 32,814 $ (1,659) $ (3,727) $ (94,486) $ 31,228 Income (loss) from continuing operations . . . . . . . . . . . . $ 28,463 $ 2,956 $ 2,273 $ (56,850) $ 26,208 Discontinued operations, net-of-tax(2). . . . . . . . . . . . . . . . 1,874 26,651 19,711 18,732 18,242 Net income (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 30,337 $ 29,607 $ 21,984 $ (38,118) $ 44,450 Basic Earnings (Loss) per Share: Income (loss) from continuing operations. . . . . . . . . . . . $ 4.17 $ 0.43 $ 0.32 $ (7.42) $ 3.23 Discontinued operations, net-of-tax(2). . . . . . . . . . . . . . . . 0.27 3.91 2.82 2.40 2.25 Basic earnings (loss) per share . . . . . . . . . . . . . . . . . . . . . . . $ 4.44 $ 4.34 $ 3.14 $ (5.02) $ 5.48 Diluted Earnings (Loss) per Share: Income (loss) from continuing operations . . . . . . . . . . . . $ 4.14 $ 0.43 $ 0.32 $ (7.42) $ 3.22 Discontinued operations, net-of-tax(2). . . . . . . . . . . . . . . . 0.27 3.89 2.81 2.40 2.25 Diluted earnings (loss) per share . . . . . . . . . . . . . . . . . . . . . $ 4.41 $ 4.32 $ 3.13 $ (5.02) $ 5.47 Per Share and Share Data: Cash dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 0.9775 $ 1.0650 $ 1.0450 $ 1.0225 $ 1.0000 Market value at December 31(3) . . . . . . . . . . . . . . . . . . . . . . $ 37.65 $ 90.55 $ 42.20 $ 59.36 $ 62.19 Stockholders’ equity at December 31 . . . . . . . . . . . . . . . . $ 32.03 $ 32.50 $ 29.42 $ 29.23 $ 37.83 Actual shares outstanding at December 31(4) . . . . . . . . . 6.852 6.779 6.837 7.236 7.872 Basic weighted average shares outstanding(4) . . . . . . . . 6.830 6.818 7.001 7.590 8.105 Diluted weighted average shares outstanding(4) . . . . . . 6.873 6.854 7.022 7.590 8.124 (1) During 2014, North American Coal recorded a non-cash, asset impairment charge of $105.1 million. During 2016 and 2017, North American Coal recorded additional non-cash impairment charges of $17.4 million and $1.0 million, respectively. (2) On September 29, 2017, the Company spun off Hamilton Beach Brands Holding Company (HBBHC), a former wholly owned subsidiary. The results of operations of HBBHC are reflected as discontinued operations in the table above. (3) The 2017 values reflect the effect of the spin-off of HBBHC as a separate public company. (4) Share amounts in millions. 4

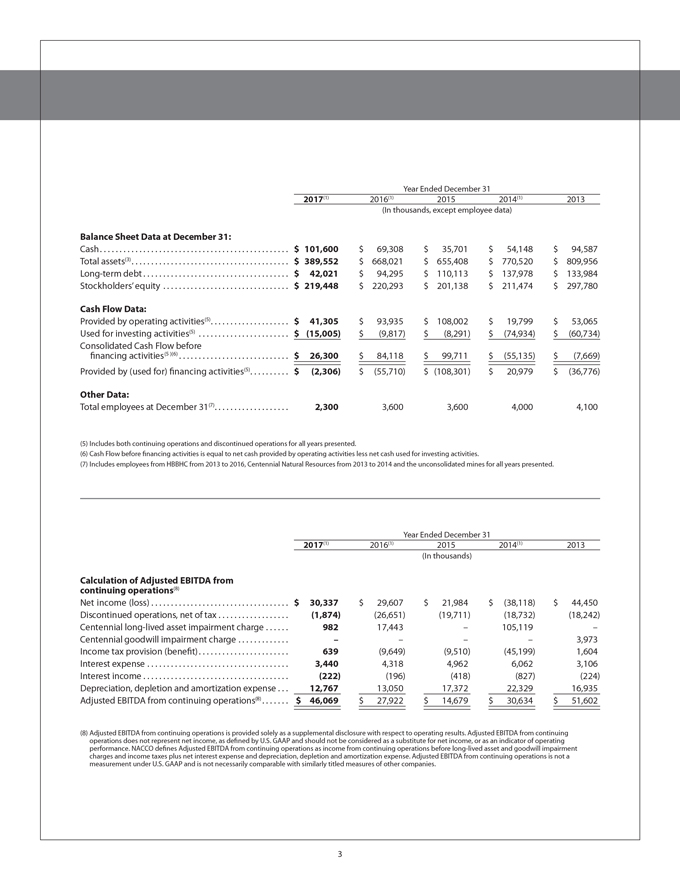

Year Ended December 31 2017(1) 2016(1) 2015 2014(1) 2013 (In thousands, except employee data) Balance Sheet Data at December 31: Cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 101,600 $ 69,308 $ 35,701 $ 54,148 $ 94,587 Total assets(3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 389,552 $ 668,021 $ 655,408 $ 770,520 $ 809,956 Long-term debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 42,021 $ 94,295 $ 110,113 $ 137,978 $ 133,984 Stockholders’ equity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 219,448 $ 220,293 $ 201,138 $ 211,474 $ 297,780 Cash Flow Data: Provided by operating activities(5). . . . . . . . . . . . . . . . . . . . $ 41,305 $ 93,935 $ 108,002 $ 19,799 $ 53,065 Used for investing activities(5) . . . . . . . . . . . . . . . . . . . . . . . $ (15,005) $ (9,817) $ (8,291) $ (74,934) $ (60,734) Consolidated Cash Flow before financing activities(5 )(6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 26,300 $ 84,118 $ 99,711 $ (55,135) $ (7,669) Provided by (used for) financing activities(5). . . . . . . . . . $ (2,306) $ (55,710) $ (108,301) $ 20,979 $ (36,776) Other Data: Total employees at December 31(7). . . . . . . . . . . . . . . . . . . 2,300 3,600 3,600 4,000 4,100 (5) Includes both continuing operations and discontinued operations for all years presented. (6) Cash Flow before financing activities is equal to net cash provided by operating activities less net cash used for investing activities. (7) Includes employees from HBBHC from 2013 to 2016, Centennial Natural Resources from 2013 to 2014 and the unconsolidated mines for all years presented. Year Ended December 31 2017(1) 2016(1) 2015 2014(1) 2013 (In thousands) Calculation of Adjusted EBITDA from continuing operations(8) Net income (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 30,337 $ 29,607 $ 21,984 $ (38,118) $ 44,450 Discontinued operations, net of tax . . . . . . . . . . . . . . . . . . (1,874) (26,651) (19,711) (18,732) (18,242) Centennial long-lived asset impairment charge . . . . . . 982 17,443 – 105,119 –Centennial goodwill impairment charge . . . . . . . . . . . . . – – – – 3,973 Income tax provision (benefit) . . . . . . . . . . . . . . . . . . . . . . . 639 (9,649) (9,510) (45,199) 1,604 Interest expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,440 4,318 4,962 6,062 3,106 Interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (222) (196) (418) (827) (224) Depreciation, depletion and amortization expense . . . 12,767 13,050 17,372 22,329 16,935 Adjusted EBITDA from continuing operations(8) . . . . . . . $ 46,069 $ 27,922 $ 14,679 $ 30,634 $ 51,602 (8) Adjusted EBITDA from continuing operations is provided solely as a supplemental disclosure with respect to operating results. Adjusted EBITDA from continuing operations does not represent net income, as defined by U.S. GAAP and should not be considered as a substitute for net income, or as an indicator of operating performance. NACCO defines Adjusted EBITDA from continuing operations as income from continuing operations before long-lived asset and goodwill impairment charges and income taxes plus net interest expense and depreciation, depletion and amortization expense. Adjusted EBITDA from continuing operations is not a measurement under U.S. GAAP and is not necessarily comparable with similarly titled measures of other companies. 5

To Our Stockholders 2017 was another transformational year for NACCO Industries. NACCO’s commitment to creating shareholder value was again demonstrated through the spin-off of its Hamilton Beach and Kitchen Collection businesses on September 29, 2017 to form Hamilton Beach Brands Holding Company. This newly independent public company is traded on the New York Stock Exchange under the ticker symbol HBB. This follows the successful 2012 spin-off of NACCO’s material handling business to form Hyster-Yale Materials Handling, Inc., which is now traded on the New York Stock Exchange under the ticker symbol HY. On August 18, 2017, the day before the announcement of the spin-off of the housewares businesses, NACCO’s stock price closed at $66.30. The stock reached a high of $92.60 in September 2017 following the announcement, and closed on September 29, 2017 at $85.80. The spin-off was completed after the market closed on September 29th when the Company distributed one share of Hamilton Beach Brands Holding Company Class A common stock and one share of Hamilton Beach Brands Holding Company Class B common stock to NACCO stockholders for each share of NACCO Class A common stock or Class B common stock owned. On its first day of trading post-spin, NACCO’s stock closed at $32.65, and it achieved an average price of $40.19 for the fourth quarter of 2017. Hamilton Beach Brands Holding Company’s stock closed at $30.23 per share on its first day of post-spin trading and achieved an average price of $30.09 for the fourth quarter of 2017. Combining the value of one NACCO share with the value of two Hamilton Beach shares received by NACCO stockholders in the spin-off, stockholders saw a combined closing value of $93.11 on the first day after the spin-off and $100.37 per share on average for the fourth quarter. In many ways, the Company has come full circle. North American Coal itself was a public company, traded on the NYSE, from 1961 to 1986. As its leadership pursued growth and diversification in the 1980s, North American Coal created NACCO in 1986 as an operating holding company to oversee the businesses that ultimately became Hyster-Yale, Hamilton Beach Brands and Kitchen Collection, in addition to North American Coal. Today, those businesses have been spun off to stockholders, and once again, North American Coal is NACCO’s sole focus. North American Coal operates surface mines that supply coal primarily to power generation companies under long-term contracts, and provides other value-added services to natural resource companies. North American Coal operates in nine states and maintains its headquarters in Dallas, Texas. The headquarters for NACCO remains in Cleveland, Ohio, where a small group of people are responsible for public company activities. NACCO’s commitment to creating shareholder value was again demonstrated through the spin-off of its housewares businesses on September 29, 2017. NACCO’s stated objective remains steady – to increase long-term shareholder value, with a particular focus on taxable investors. We believe strongly in the merits of this approach, and believe that NACCO, focused solely on North American Coal, is well-suited to create shareholder value over the long term. North American Coal Business Overview North American Coal is not a typical coal company; it operates much more like a service business. North American Coal’s mines operate under contracts to supply coal to an individual customer’s power plant or coal processing facility for a long period of time, typically for decades. The mines and the customer facilities are in close proximity, often adjacent to one another. North American Coal also provides value-added services, such as operating and maintaining draglines for independently owned limerock quarries through its North American Mining business, operating and maintaining coal-processing and rail loadout systems for customers and providing ash-hauling services for power plants and other facilities. North American Coal’s business model aligns company goals with customer objectives so that both sides work toward common success. Customer contracts typically are based on a “management fee” approach, whereby North American Coal’s compensation includes reimbursement of all operating costs, 6

plus a comparatively small but consistent fee on each ton of coal or cubic yard of limerock delivered. North American Coal only receives fee compensation when its customers take deliveries. North American Coal maintains a laser-like focus on its customers’ objectives, and aligns its focus to help customers achieve their desired results, whether they be reduction of costs, improvement in quality or other specific areas of focus. All but one of North American Coal’s contracts to produce coal include management fee pricing terms. Each management fee contract specifies the indices and mechanics by which agreed profits change over time, generally in line with broad measures of U.S. inflation rates. Financing for these mines is supported by, or in some instances actually provided by, North American Coal’s customers to minimize costs, and generally is without recourse to North American Coal or NACCO. The Company refers to mining operations that utilize this model as “unconsolidated” because they are not consolidated in the Company’s financial statements. The pre-tax profits generated from these operations are shown separately in the Company’s income statement as “Earnings of unconsolidated mines.” North American Coal and its customers strongly believe that the structure of these long-term management fee contracts fully aligns both parties’ interests to ensure low customer costs over the long term. North American Coal’s analysis of historical data indicates that the power plants served by North American Coal are lower-cost producers of electricity on their respective grids. North American Coal’s unconsolidated mining operations, which constitute a large majority of its earnings and cash generation capabilities, provide a strong core that is central to North American Coal’s business model. The company has been very fortunate to enter into management fee contracts with 10 new customers since 2009 to develop new mines, take over the operation of an existing mine or quarry, or provide value-added services to customers. In what has been an extremely challenging environment for coal companies, North American Coal has built and opened five new coal mines and assumed operation of an existing coal mine. This recent growth provides validation of the company’s capabilities and the strength of its business model. Camino Real Fuels LLC’s Eagle Pass Mine in South Texas operates and maintains the coal handling and train loadout facility for its customer. This value-added service helps Camino Real’s customer ensure that coal deliveries are on time. 7

North American Coal took over operation of a mine for the Navajo Transitional Energy Company (NTEC) on January 1, 2017. North American Coal’s subsidiary, Bisti Fuels, acts as NTEC’s contract miner at NTEC’s Navajo Mine, a surface coal mine located within the Navajo Nation near Fruitland, New Mexico. The agreement with NTEC is a management fee arrangement. NTEC sells the coal produced by Bisti Fuels to the third-party owners of the nearby Four Corners Generating Station. North American Coal began operating the Navajo Mine in New Mexico on January 1, 2017. The owners of the Four Corners Generating Station have made, and continue to make, significant investments in that power plant by installing additional environmental controls. While installation of this equipment limited the plant’s ability to take coal deliveries in the fourth quarter of 2017 and is expected to cause a significant reduction in coal deliveries in the first half of 2018, this plant should enjoy the benefits of an improved environmental profile in the future. Production at Bisti Fuels is anticipated to be 5 million to 6 million tons of coal per year when the plant is operating at expected levels. North American Coal’s Mississippi Lignite Mining Company (MLMC) subsidiary operates pursuant to a more traditional business model in which MLMC pays all operating costs and provides the capital for the mine. MLMC delivers coal to a single power plant adjacent to the mine under a long-term contract. This coal mining operation is referred to as a “consolidated mine” because its results are consolidated in the Company’s financial statements. MLMC’s revenue is not subject to spot coal price fluctuations, as its customer pays a contractually agreed-upon price which adjusts monthly, primarily based on changes in the level of established indices which reflect general U.S. inflation rates, including cost components such as labor and diesel fuel. Profitability at MLMC is affected by its customer’s demand for coal, changes in the indices that determine MLMC’s sales price and actual costs incurred. As diesel fuel is heavily weighted among the indices used to determine coal sales prices, the persistence of low diesel fuel prices has and may continue to negatively affect earnings at MLMC. North American Mining operates a dragline (shown at left) and an electric rope shovel (shown at right) at a new customer’s quarry in South Florida. The contract with this customer was executed in 2017. The addition of the electric rope shovel demonstrates advancement of North American Mining’s growth strategy to expand beyond dragline operations. 8

Despite its many successes, North American Coal was unsuccessful in its attempt to enter the metallurgical coal market through its 2012 acquisition in Alabama. North American Coal management is committed to avoiding transactions and business arrangements involving risks similar to those that led to the losses associated with its Alabama coal mining operations: exposure to spot coal price fluctuations, uncommitted production and shifting customer quality requirements. In 2010, North American Coal’s Liberty Fuels subsidiary entered into an agreement to develop and operate a mine to supply lignite to a coal gasification and power generation facility in Kemper County, Mississippi. Unfortunately, the customer did not achieve commercial operation of its coal gasification facility. As a result, in early 2018, the customer instructed Liberty to permanently cease all mining and delivery of lignite and to commence mine reclamation. The contract between Liberty Fuels and its customer specifies that the customer is responsible for all mine closure costs and that Liberty Fuels is the contractor to complete final mine reclamation. The customer’s decision to close the mine does not negatively impact NACCO’s outlook for Liberty Fuels during 2018, but it does unfavorably affect North American Coal’s long-term earnings potential from this mine. North American Mining The company operates and maintains draglines and other equipment for extraction of limerock at independently owned limerock quarries through a business called North American Mining. North American Mining’s business is built on the company’s management fee business model. Compensation includes reimbursement for all mining costs, plus an agreed management fee on cubic yards excavated or limerock delivered. North American Mining creates value for its customers by focusing on the mining aspects of the customer’s quarry operations. North American Mining leverages experience gained across the entire company to increase production and improve efficiencies for its customers. Over the last two years, North American Mining has grown from serving two customers with seven quarries utilizing 10 draglines, to serving five customers with 15 quarries utilizing 23 draglines and an electric rope shovel as of December 31, 2017. This growth started A Bucyrus-Erie 2570W dragline removes overburden at The Coteau Properties Company’s Freedom Mine in North Dakota. in 2016 as North American Mining expanded its geographic footprint to cover new quarries in Central Florida for an existing customer and extended that contract through 2023. Also in 2016, North American Mining secured a new customer in Central Florida. A second base of operations has been established in Central Florida to support these new operations. North American Mining entered into contracts with two new customers in South Florida during 2017. One of these contracts includes operation of a dragline and an electric rope shovel. The addition of this electric rope shovel is an important aspect of the growth strategy for North American Mining to expand beyond dragline operations. North American Mining has long believed that it could leverage the company’s extensive mining skills to operate customer equipment other than draglines, and the addition of the shovel in Florida demonstrates that this is true. In addition, North American Mining is exploring opportunities to operate and maintain mining equipment for customers operating outside Florida, and is considering how to support customers that mine base material and minerals other than limerock. We are 9

encouraged by recent successes and the prospects for further growth. Accordingly, North American Mining is committed to dedicating the resources necessary to expand the business beyond its current geography, equipment spread and customer base. Other Value-added Services North American Coal’s “management fee” business model also applies to its value-added service operations, which are provided to a number of customers. The company’s Camino Real Fuels subsidiary operates and maintains a coal handling and train loadout facility for its customer. Bisti Fuels operates and maintains a sophisticated coal blending and handling facility for its customer, including an approximately 15-mile rail operation with two locomotives used to transport coal from the mine to the power plant. NoDak Energy Services, LLC operates and maintains a coal drying system that is embedded inside a customer’s power plant. Other mines provide ash handling and ash management services for their customers. North American Coal Royalty Company provides surface and mineral acquisition and lease maintenance services for North American Coal and on behalf of many of its customers. It also manages the leasing of North American Coal’s surface, coal, oil and gas holdings. North American Coal consistently ranks among the safest and most environmentally responsible coal mining companies in the country. Safety and Environmental Excellence North American Coal consistently ranks among the safest and most environmentally responsible coal mining companies in the country. Safety is at the very core of the company’s culture, embedded deeply in employee training programs, operating procedures and best practices shared among all of the company’s operations. North American Coal’s largest mine, The Coteau Properties Company’s Freedom Mine, was awarded the Sentinels of Safety Award in 2017. This is the nation’s most prestigious safety award, recognizing that Coteau’s Freedom Mine was the safest large surface coal mine in the nation in 2016. To put this in perspective, this mine operated 881,243 employee hours without a Lost Time Accident or Reportable Injury, ending the year with a Zero Incident Rate. Considering the 2016 National Average for all surface coal mining was an Incident Rate of 1.12 accidents per 200,000 hours worked, Coteau’s Zero Incident Rate is a significant achievement. North American Coal’s permitting, mining and reclamation activities utilize state-of-the-art technology and a commitment to excellence to ensure that activities comply with, or exceed, legal requirements. Work on mine sites is performed with the greatest degree of care to ensure that land is returned to a productive natural state. Frequently, North American Coal employees and their families are farmers, ranchers and outdoor enthusiasts who live near mining areas. They care deeply about the land, water and wildlife where they live, and are excellent stewards. Strategic Initiatives and Long-term View The Company continues to take an extremely disciplined approach with respect to growth. This includes thoughtful deployment of North American Coal’s core skills, strengths and relationships. Opportunities may exist to serve as a contract miner for those who continue to need coal for power generation or other processes using coal. Also, strategic growth could come from projects based on new technologies that utilize coal, such as integrated gasification combined cycle power generation, and production of alternative fuels made from coal, as well as other clean coal technologies and non-traditional products derived from coal. North American Coal is also well-suited to serve as a contract miner in non-coal mining operations, such as aggregates or other minerals. Of course, North American Coal will continue to look for internal and external opportunities to grow in existing businesses and to expand its range of activities over the long term. The Company believes that a large majority of consumers in the United States would benefit from a domestic energy policy that balances affordability, energy needs and environmental responsibility. The 10

Company believes that, for the foreseeable future, coal must remain an integral part of the nation’s total energy mix for the United States to continue to be competitive in a global economy. NACCO and North American Coal will continue to monitor pending regulations and legislation and will take a leadership role to help encourage reasonable regulation by the government. Both NACCO and North American Coal expect to continue to address changes to domestic environmental regulatory requirements by working collaboratively with customers, trade associations, representatives of regulatory bodies, and government officials. Any significant growth in domestic coal-fired power plants, and thus in coal mining opportunities, is largely dependent on the United States adopting a more balanced energy policy in which coal continues to play a key role, including through new coal technologies. Developing new coal mining opportunities and securing new contracts is a long-term initiative that will take time. This is a significant strategic priority for North American Coal, as well as NACCO. Overall, North American Coal’s attractive but unusual business model, based largely on long-term management fee contracts, provides a solid foundation for its coal and limerock mining operations and value-added service businesses. This business model offers generally stable cash flow and requires minimal capital investment. Only MLMC, with its more traditional business model, will continue to require ongoing replacement capital. North American Coal expects to continue its record of operational excellence in safety, environmental stewardship and production at each of its mining operations. The Company expects North American Coal to continue to generate significant cash flow, which will be used to maintain a conservative balance sheet, for selected strategic growth initiatives and to pay dividends to NACCO as appropriate. NACCO expects to use its cash resources to pay dividends and repurchase stock, when that is an attractive investment for its stockholders, and to deliver long-term value to its stockholders over time. In February 2018, the Company announced a stock repurchase program, which permits the repurchase of up to $25 million of the Company’s outstanding Class A common stock. â– â– â– Several leadership changes occurred during 2017 that are worth noting. On behalf of our employees and directors, I would like to thank Alfred M. Rankin, Jr. for his 28 This Atlas Copco drill in the foreground, operated by Bisti Fuels at the Navajo Mine, is used to drill overburden prior to blasting. Bisti Fuels also operates the Marion 8750 dragline in the background to cost-effectively remove overburden above the coal. Bisti Fuels became the contract miner for the Navajo Mine in New Mexico at the beginning of 2017. 11

years of executive leadership, including 26 years as NACCO’s Chief Executive Officer. Al has served on NACCO’s Board of Directors for 45 years and we look forward to him continuing to serve as Non-Executive Chairman of NACCO’s Board. During his tenure, the materials handling and housewares businesses were acquired, strengthened and spun off into independent public companies. North American Coal has grown substantially and is well-positioned for long-term success. Al’s steady pursuit of excellence has played a large part in the successes of each of these businesses. Again, we are thankful for his past leadership and appreciate his continued involvement on our Board of Directors. We are a better company because of his many contributions. We believe that managing in the interests of long-term taxable stockholders is the right thing to do. Jim Ratner contributed greatly to the NACCO Board of Directors from 2012 to September 2017. Jim transitioned from the NACCO Board to the newly formed Board of Directors for Hamilton Beach Brands Holding Company when that company was spun off. Jim’s insights into the changing retail landscape will be quite valuable for Hamilton Beach Brands Holding Company, and we thank him for his service to NACCO. David Taplin also transitioned from the NACCO Board to the newly formed Hamilton Beach Brands Holding Company Board. David served on the NACCO Board from 1997 until September 2017. As a grandson of Frank E. Taplin, the founder of North American Coal, David brought the perspective of a long-term taxable stockholder. We appreciate David’s 20 years of service on our Board. Three new directors were added to the NACCO Board at the time of the spin-off. Each of them brings valuable knowledge and experience to our Board. Governor Jack Dalrymple joined the NACCO Board in September. Jack served as North Dakota’s Governor from 2010 to 2016, and as its Lieutenant Governor from 2000 to 2010. Jack’s experience includes serving as the leader of a large successful multi-generation agribusiness in North Dakota. Jack’s perspective on government and regulatory matters, and his experience leading a successful business, will provide useful insights. Timothy Light joined the NACCO Board of Directors after a long and successful career at American Electric Power, one of the largest electric utilities in the U.S. Tim served in many leadership roles at AEP, including as Senior Vice President. Tim’s deep understanding of utility fuel choices, power plant dispatch considerations and utility industry practices is directly applicable to North American Coal’s core business. Matthew Rankin is the President and CEO of Carlisle Residential Properties, which offers property management services for multi-family housing projects in North Carolina and South Carolina. Prior to his service with Carlisle, Matthew spent 12 years at Wells Fargo and Wachovia Bank, including as a Senior Vice President and Relationship Manager in the commercial banking group. Matthew also brings the perspective of a long-term taxable stockholder as the great-grandson of Frank E. Taplin. Many people contribute to our success. We thank our many business partners – customers and vendors alike – for their continued trust and support. We and they have proven that a collaborative approach to business leads to enduring success. We are also grateful for the partnership of our terrific employees at NACCO and at North American Coal. This is an incredibly resourceful and dedicated group of people and we appreciate all that they do for our customers and for the Company. Finally, we would like to thank NACCO’s stockholders for their continued support. We believe that managing the Company in the interests of long-term taxable stockholders is the right thing to do. President and Chief Executive Ofcer, NACCO Industries, Inc. and The North American Coal Corporation This annual report to stockholders contains forward-looking statements. For a discussion of the factors that may cause the Company’s actual results to differ from these forward-looking statements, refer to page 45 in the attached Form 10-K. 12

Directors and Officers NACCO Industries, Inc. Directors: J.C. Butler, Jr. President and Chief Executive Officer, NACCO Industries, Inc. President and Chief Executive Officer, The North American Coal Corporation John S. Dalrymple Former Governor of the State of North Dakota John P. Jumper Retired Chief of Staff, United States Air Force Dennis W. LaBarre Retired Partner, Jones Day Timothy K. Light Retired Senior Vice President, American Electric Power Service Corporation Michael S. Miller Retired Managing Director, The Vanguard Group Richard de J. Osborne Retired Chairman and Chief Executive Officer, ASARCO Incorporated Alfred M. Rankin, Jr. Non-Executive Chairman, NACCO Industries, Inc. Chairman, President and Chief Executive Officer, Hyster-Yale Materials Handling, Inc. Executive Chairman, Hamilton Beach Brands Holding Company Matthew M. Rankin President and Chief Executive Officer, Carlisle Residential Properties Britton T. Taplin Self employed (personal investments) David B. H. Williams Partner, Williams, Bax & Saltzman, P.C. Officers: J.C. Butler, Jr. President and Chief Executive Officer Elizabeth I. Loveman Vice President and Controller Thomas A. Maxwell Vice President – Financial Planning and Analysis and Treasurer John D. Neumann Vice President, General Counsel and Secretary Sarah E. Fry Associate General Counsel and Assistant Secretary Miles B. Haberer Associate General Counsel Jesse L. Adkins Associate Counsel and Assistant Secretary North American Coal Corporation Officers: J. C. Butler, Jr. President and Chief Executive Officer Carroll L. Dewing Vice President – Operations LaVern K. Lund Vice President – Business Development John D. Neumann Vice President, General Counsel and Secretary J. Patrick Sullivan, Jr. Vice President and Chief Financial Officer Harry B. Tipton, III Vice President – Engineering Eric A. Dale Treasurer and Senior Director, Financial Planning and Analysis John R. Pokorny Controller Sarah E. Fry Associate General Counsel and Assistant Secretary Miles B. Haberer Associate General Counsel, Assistant Secretary and President, North American Coal Royalty Company Jesse L. Adkins Associate Counsel and Assistant Secretary 13

Corporate Information Annual Meeting The Annual Meeting of Stockholders of NACCO Industries, Inc. will be held on May 16, 2018, at 11:00 a.m. at the corporate office located at: 5875 Landerbrook Drive, Cleveland, Ohio 44124 Form 10-K Additional copies of the Company’s Form 10-K filed with the Securities and Exchange Commission are available free of charge through NACCO Industries’ website (www.nacco.com) or by request to: Investor Relations NACCO Industries, Inc. 5875 Landerbrook Drive, Suite 220 Cleveland, Ohio 44124 (440) 229-5130 Stock Transfer Agent and Registrar Stockholder Correspondence: Computershare P.O. Box 505000 Louisville, KY 40233-5000 Overnight Correspondence: Computershare 462 South 4th St., Suite 1600 Louisville, KY 40202 (800) 622-6757 (U.S., Canada and Puerto Rico) (781) 575-4735 (International) Legal Counsel McDermott Will & Emery LLP 444 West Lake Street Chicago, Illinois 60606 Independent Registered Public Accounting Firm Ernst & Young LLP 950 Main Ave., Suite 1800 Cleveland, Ohio 44113 Stock Exchange Listing The New York Stock Exchange Symbol: NC Investor Relations Contact Investor questions may be addressed to: Investor Relations NACCO Industries, Inc. 5875 Landerbrook Drive, Suite 220 Cleveland, Ohio 44124 (440) 229-5130 E-mail: ir@naccoind.com NACCO Industries Website Additional information about NACCO Industries may be found at www.nacco.com. The Company considers this website to be one of the primary sources of information for investors and other interested parties. North American Coal Website Additional information about North American Coal may be found at www.nacoal.com. 14

5875 Landerbrook Drive, Suite 220 • Cleveland, Ohio 44124 An Equal Opportunity Employer 15