Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Hamilton Beach Brands Holding Co | d741991d8k.htm |

Exhibit 99

No Spacing;EVERYDAY GOOD THINKING Hamilton Beach Brands Holding Company 2017 Annual Report

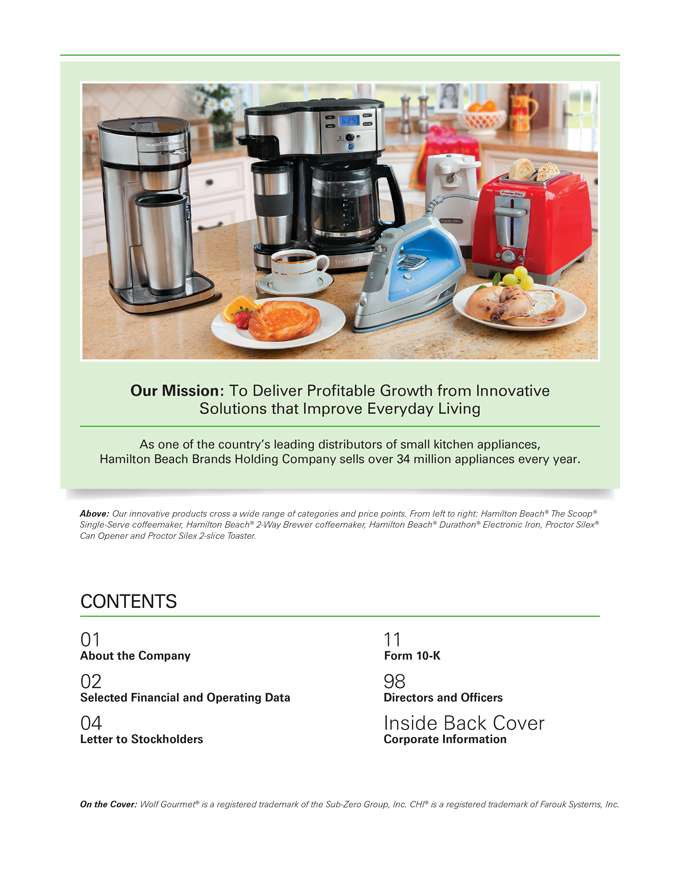

Our Mission: To Deliver Profitable Growth from Innovative Solutions that Improve Everyday Living

As one of the country’s leading distributors of small kitchen appliances, Hamilton Beach Brands Holding Company sells over 34 million appliances every year. Above: Our

innovative products cross a wide range of categories and price points. From left to right: Hamilton Beach® The Scoop® Single-Serve coffeemaker, Hamilton Beach® 2-Way Brewer coffeemaker, Hamilton Beach® Durathon® Electronic Iron,

Proctor Silex® Can Opener and Proctor Silex 2-slice Toaster. CONTENTS

01 11 About the Company Form 10-K

02 98 Selected Financial and Operating Data Directors and Officers

04 Inside Back Cover Letter

to Stockholders Corporate Information

On the Cover: Wolf Gourmet® is a registered trademark of the Sub-Zero Group, Inc. CHI® is a registered trademark of

Farouk Systems, Inc.

ABOUT THE COMPANY On September 29, 2017, Hamilton Beach Brands Holding Company was spun off from its former parent company to become an independent public company traded on the New York Stock Exchange under the ticker symbol HBB. Hamilton Beach Brands Holding Company is an operating holding company for two separate businesses: consumer and commercial small appliances and specialty retail. Hamilton Beach Brands, Inc. is a leading designer, marketer and distributor of branded, small electric household and specialty housewares appliances, as well as commercial products for restaurants, bars and hotels. The Kitchen Collection, LLC is a national specialty retailer of kitchenware in outlet and traditional malls throughout the United States. Hamilton Beach Brands Holding Company’s culture of Good Thinking began over 110 years ago. When the phrase Good Thinking is used, it means approaching all aspects of the business in an inquisitive, fact-based, strategic and creative manner. Good Thinking is practiced when the Company develops the many innovations it introduces year after year. Good Thinking is demonstrated in how the Company supports its customers. Hamilton Beach Brands Holding Company’s global team is focused on Good Thinking in every department and functional area. Good Thinking can only happen when a company has smart, hardworking people and Hamilton Beach Holding believes it has the best team in the industry. Most importantly, the Company believes its Good Thinking culture will ensure its stockholders are rewarded over the long term. Above: Breakfast is the most important meal of the day. The Hamilton Beach® Breakfast Sandwich Maker makes a fresh grab- and-go breakfast sandwich. 1

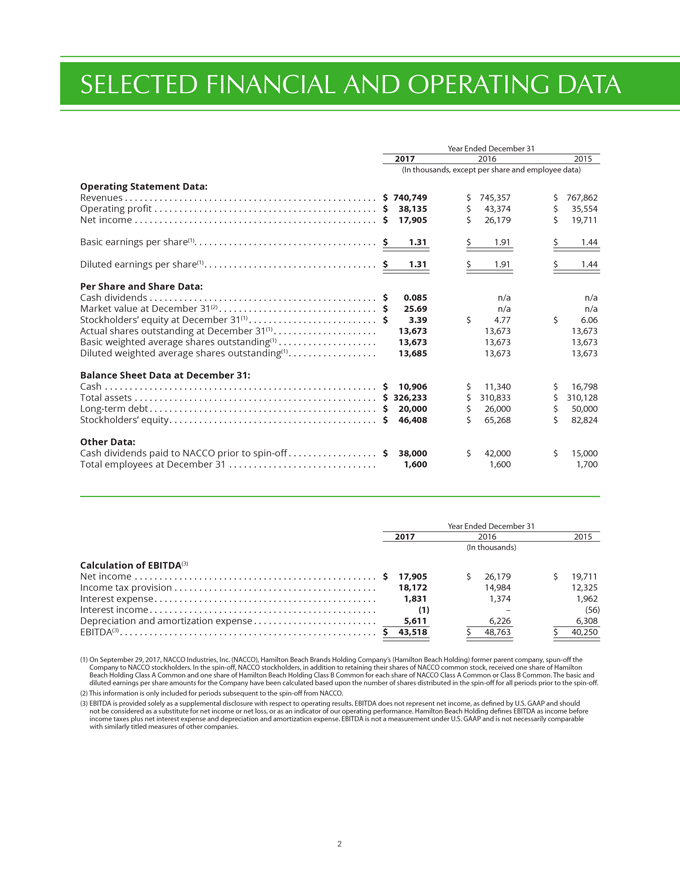

SELECTED FINANCIAL AND OPERATING DATA

Year Ended

December 31 2017 2016 2015 (In thousands, except per share and employee data)

Operating Statement Data: Revenues $ .740,749 $ .745,357 $ .767,862. Operating profit

$. 38,135 $ . 43,374 $ . 35,554

Net income $ .17,905 $ 26,179 $ 19,711. Basic earnings per share(1) $ 1.31 $ 1.91 $ 1.44 Diluted earnings per share(1) $ 1.. 31 $

1.91 $ 1.44 Per Share and Share Data: Cash dividends $ . 0.. 085 n/a n/a Market value at December 31(2) $ 25.69 n/a n/a

Stockholders’ equity at December 31(1)

$ 3.39 $ 4.77 $ 6.06 Actual shares outstanding at December 31(1) 13,673 13,673 13,673

Basic weighted average shares outstanding(1) 13,673 13,673 13,673 Diluted

weighted average shares outstanding(1) 13,685. 13,673 13,673 Balance Sheet Data at December 31: Cash $. 10,906 $ . 11,340 $ . 16,798 Total assets $ 326,233 $. 310,833 $. 310,128

Long-term debt $ . 20,000 $ 26,000 $ 50,000 Stockholders’ equity $ 46,408 $ . 65,268. $ 82,824 Other Data: Cash dividends paid to NACCO prior to spin-off $ . 38,000 $ 42,000 $

15,000 Total employees at December 31 1,600 1,600 1,700

Year Ended December 31 2017 2016 2015 (In thousands) Calculation of EBITDA(3) Net income $ .17,905 $ 26,179

$ 19,711. Income tax provision 18,172 14,984 12,325 Interest expense 1,831 1,374 1,962 Interest income (1) – . (56) Depreciation and amortization expense 5,611 6,226 6,308 EBITDA(3) $. 43,518 $ . 48,763 $ 40,250 (1) On September 29, 2017, NACCO

Industries, Inc. (NACCO), Hamilton Beach Brands Holding Company’s (Hamilton Beach Holding) former parent company, spun-off the Company to NACCO stockholders. In the spin-off, NACCO stockholders, in addition to retaining their shares of NACCO

common stock, received one share of Hamilton Beach Holding Class A Common and one share of Hamilton Beach Holding Class B Common for each share of NACCO Class A Common or Class B Common. The basic and diluted earnings per share amounts for the

Company have been calculated based upon the number of shares distributed in the spin-off for all periods prior to the spin-off. (2) This information is only included for periods subsequent to the spin-off from NACCO. (3) EBITDA is provided solely as

a supplemental disclosure with respect to operating results. EBITDA does not represent net income, as defined by U.S. GAAP and should not be considered as a substitute for net income or net loss, or as an indicator of our operating performance.

Hamilton Beach Holding defines EBITDA as income before income taxes plus net interest expense and depreciation and amortization expense. EBITDA is not a measurement under U.S. GAAP and is not necessarily comparable with similarly titled measures of

other companies. 2

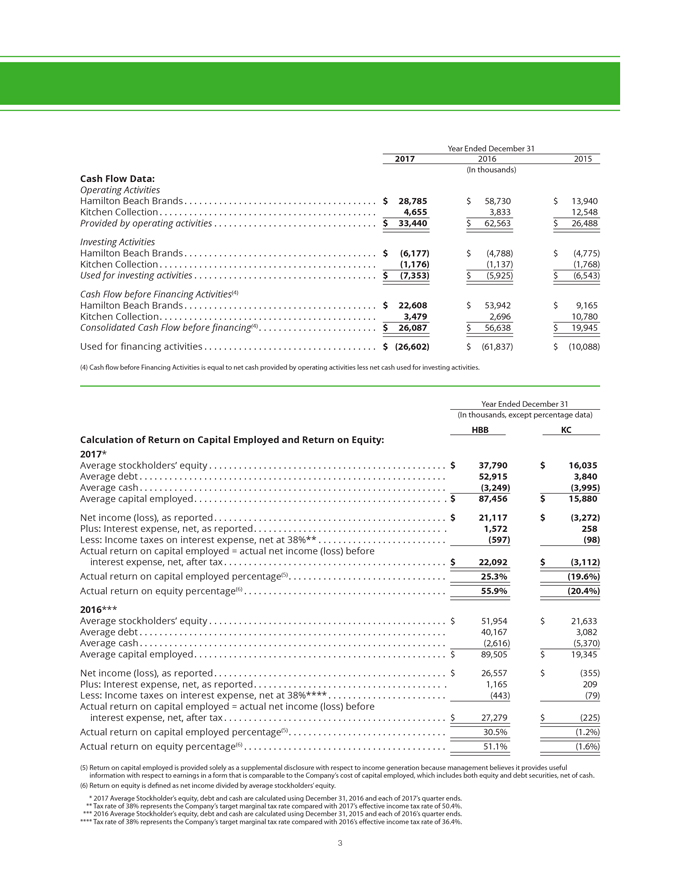

Year Ended December 31

2017 2016 2015 (In

thousands)

Cash Flow Data: Operating Activities

Hamilton Beach Brands $ .

28,785 $ 58,730. $ 13,940 Kitchen Collection 4,655 3,833 12,548 Provided by operating activities $ . 33,440 $ . 62,563. $ 26,488 Investing Activities Hamilton Beach Brands $ . (6,177) $ (4,788). $ (4,775)

Kitchen Collection (1,176) (1,137) (1,768) Used for investing activities $ . (7,353) $ (5,925). $ (6,543) Cash Flow before Financing Activities(4) Hamilton Beach Brands $ . 22,608

$ 53,942. $ 9,165 Kitchen Collection 3,479 2,696 10,780 Consolidated Cash Flow before financing(4) $ . 26,087 $ 56,638 $ 19,945 Used for financing activities $. (26,602) $ (61,837). $ (10,088) (4) Cash flow before Financing Activities is equal to

net cash provided by operating activities less net cash used for investing activities. Year Ended December 31 (In thousands, except percentage data) HBB KC Calculation of Return on Capital Employed and Return on Equity: 2017* Average

stockholders’ equity $ 37,790 $ 16,035 Average debt 52,915 3,840 Average cash (3,249) (3,995) Average capital employed $ 87,456 $ 15,880 Net income (loss), as reported $ 21,117 $ (3,272) Plus: Interest expense, net, as reported 1,572 258 Less:

Income taxes on interest expense, net at 38%** (597) (98) Actual return on capital employed = actual net income (loss) before interest expense, net, after tax $ 22,092 $ (3,112). Actual return on capital employed percentage(5) 25.. 3% (19.6%) Actual

return on equity percentage(6) 55.. 9% (20.. 4%) 2016*** Average stockholders’ equity $ 51,954 $ 21,633 Average debt 40,167 3,082 Average cash (2,616) (5,370) Average capital employed $ 89,505 $ 19,345. Net income (loss), as reported $ 26,557 $

(355) Plus: Interest expense, net, as reported 1,165 209 Less: Income taxes on interest expense, net at 38%**** (443). (79) Actual return on capital employed = actual net income (loss) before interest expense, net, after tax $ 27,279 $ (225) Actual

return on capital employed percentage(5) 30.. 5% (1.2%) Actual return on equity percentage(6) 51.. 1% (1.6%) (5) Return on capital employed is provided solely as a supplemental disclosure with respect to income generation because management believes

it provides useful information with respect to earnings in a form that is comparable to the Company’s cost of capital employed, which includes both equity and debt securities, net of cash. (6) Return on equity is defined as net income divided

by average stockholders’ equity. **** 2017 Average Stockholder’s equity, debt and cash are calculated using December 31, 2016 and each of 2017’s quarter ends. **** Tax rate of 38% represents the Company’s target marginal tax rate

compared with 2017’s effective income tax rate of 50.4%. **** 2016 Average Stockholder’s equity, debt and cash are calculated using December 31, 2015 and each of 2016’s quarter ends. **** Tax rate of 38% represents the Company’s

target marginal tax rate compared with 2016’s effective income tax rate of 36.4%. 3

TO OUR STOCKHOLDERS Introduction: 2017 was a transformational year for our company. We are pleased to be writing Hamilton Beach Brands Holding Company’s (“Hamilton Beach Holding”) first annual report as an independent public company. While we are a new public company, we have been in business for decades and some of our trusted brands have been in existence for over 110 years. Our Company is made up of multiple brands, products and businesses that consumers trust and use to improve their everyday living. Our Competitive Advantage On September 29, 2017, the housewares businesses of Hamilton Beach Brands, Inc. and The Kitchen Collection, LLC were spun off from NACCO Industries, Inc. as Hamilton Beach Brands Holding Company, trading on the New York Stock Exchange under the ticker symbol “HBB”. Our management team is enthusiastic about driving a focused, independent company that continuously strives to be a leader in the housewares industry with high-quality, trusted brands and products. As an independent public company, we are focused on serving our customer needs and responding fiexibly to changing market conditions. In addition, we now have greater fiexibility to pursue strategic growth opportunities in the housewares industry, with direct access to the equity capital markets and enhanced fiexibility in the use of the debt capital markets. Finally, we are strengthening the alignment of our senior management incentives with the performance of the Company to ensure management is focused on achieving its long-term financial and strategic objectives, which we expect will enhance stockholder value. Hamilton Beach Holding is a dynamic company with a number of strengths that create strong competitive advantages. The Company’s Good Thinking culture is a core strength that provides the foundation for all of the decisions made by Hamilton Beach Holding’s stable and knowledgeable team of employees, as well as the Company’s interactions with its customers and suppliers. This solid foundation has generated the following competitive advantages: • Hamilton Beach Holding believes it leads the industry in developing innovative new products across a wide range of categories and price points. It is this stable pipeline of consumer-preferred brands and innovative products that is Hamilton Beach Holding’s most important competitive advantage. • The Company is known for its iconic brands that cover consumer price points from the value to luxury segments; Hamilton Beach Holding participates in over 50 categories with a strong share ranking in a majority of these categories. • The Company has the #1 presence in key retail and commercial sales channels and has strong relationships with leading retail and ecommerce customers. 4

The Company’s Hamilton Beach® brand holds the #1 brand rank in the U.S. market for small kitchen appliances and is a leading competitor across North America. • Hamilton Beach Holding has built a global platform with commercial and retail capabilities that are currently expanding from the Company’s historical North American base. • The Company has developed a trusted, efficient and low-cost supply chain to support its growth objectives. All of these factors have helped Hamilton Beach Holding’s subsidiaries maintain their strong working capital management and sound cash fiow generation capabilities. As a result, the Company has delivered solid operating results and substantial cash fiows in a challenging retail environment in each of the past two years. In 2017, Hamilton Beach Holding generated revenues of $740.7 million compared with $745.4 million in 2016. Modest revenue growth of 1.6% at the Company’s Hamilton Beach Brands, Inc. (Hamilton Beach) subsidiary was more than offset by an 11% revenue decrease at its Kitchen Collection business, as this segment experienced reduced customer traffic and closed stores to combat the effects of the challenging brick and mortar retail environment. In late December 2017, Congress enacted U.S. tax reform legislation that resulted in the Company taking a discrete tax charge of $4.7 million. This charge, in combination with one-time costs of $2.5 million, or $2.1 million after taxes of $0.4 million, incurred to effect the spin-off, and lower results at Kitchen Collection from reduced revenues, led to consolidated net income decreasing to $17.9 million in 2017 from $26.2 million in 2016. The Company is known for its iconic brands that cover consumer price points from the value to luxury segments. A more in-depth understanding of the Company is best achieved by focusing on each of its two independently managed businesses as outlined below. Hamilton Beach’s Long-Term Strategic Initiatives Hamilton Beach has a long-term objective of delivering annual sales of $750 million to $1 billion by executing its key strategic initiatives. As Hamilton Beach achieves this target sales level, it expects to take advantage of increasing economies of scale to improve its operating profit margins to between 9% and 10%. With 2017 revenues of $615.1 million and an operating profit margin of 6.7%, there is still work to be done to accomplish these objectives. The Company’s iconic brands cover price points that range from value to luxury. The Company’s Good Thinking culture makes it a leader in developing innovative new products. Examples include from left to right: the Hamilton Beach FlexBrew 2-Way coffeemaker, Proctor Silex 5-in-1 Indoor Grill, Weston #12 Electric Meat Grinder & Sausage Stuffer, CHI Electronic Iron with Retractable Cord, and Hamilton Beach Premium Big Mouth 2- Speed Juice Extractor.5

Inspired by 100 years of experience designing products used in commercial kitchens, Hamilton Beach® Professional is a line of countertop kitchen appliances with professional-level components designed to deliver exceptional performance and superior durability for the serious home cook. Pictured here from left to right are the Hamilton Beach Professional 14-cup Dicing Food Processor with storage case, All Metal Drink Mixer, Quiet Blender and 6-Quart Sous Vide and Slow Cooker. The small kitchen appliance market grew modestly in 2017, and looking forward, it is expected to grow modestly again in 2018. In addition, the international and commercial markets in which Hamilton Beach participates are expected to continue to grow. Hamilton Beach is encouraged with the progress made on its strategic initiatives during 2017 and their positive effect on its gross margins, but there is room for further progress. Hamilton Beach is optimistic it can continue to improve revenues and its operating profit margin in 2018 and beyond through continued execution of its strategic initiatives, which are: Placement Expertise: The most impactful component of increasing market presence and profitability is through increasing placements and revenue in Hamilton Beach’s core North American consumer business. Hamilton Beach’s product and placement track record is strong due to innovation processes centered on understanding and meeting end-user needs and focusing on quality and best-in-class customer service. Hamilton Beach’s experience is that new products help increase customer and consumer satisfaction and enable the company’s products to remain relevant and in line with a fast-changing retail landscape. In the North American consumer market, Hamilton Beach believes it has a stronger and deeper portfolio of new products than its competitors. Hamilton Beach will continue to introduce new products across a wide range of brands, price points and categories, leveraging its strong brand portfolio which includes Hamilton Beach, Proctor Silex, Weston and Hamilton Beach Professional, as well as its licensed brands of Wolf Gourmet and CHI. Ecommerce: Ecommerce plays a significant role in the housewares industry in which Hamilton Beach competes. While some industries are experiencing much lower ecommerce penetration levels, the U.S. small appliance industry has one of the highest and most developed ecommerce penetration levels, with approximately one-third of total industry revenue generated through ecommerce partners. To be a key player in this market, a significant focus and expertise is required to remain strong and relevant. Hamilton Beach has proven its abilities by becoming a leader in this distribution channel. Geographically, ecommerce penetration in countries outside of the United States varies significantly, but it is growing quickly in every country where the company competes. Hamilton Beach is investing in people, products and capabilities to provide the base that will allow its global ecommerce sales to grow at a faster rate than the industry. Retailers and commercial customers are looking for partners that can not only provide products, but also have the 6

capabilities and support for promotion, marketing and distribution programs appropriate for the online channel. As consumers’ shopping habits continue to evolve to rely more on the Internet, Hamilton Beach is focused on providing best-in-class retailer support, increasing engagement with end users, and enhancing the programs designed to make it the preferred partner for retail and commercial small appliances. Hamilton Beach believes it has a stronger and deeper portfolio of new products than its competitors. Only-the-Best Expansion: Hamilton Beach has increased focus and investment around its strategy to become a leader in the “only-the-best” high-end small kitchen appliance market segment, which accounts for approximately one-third of the U.S. small kitchen appliance market as measured by revenue. This only-the-best segment offers a strong growth opportunity in an area in which Hamilton Beach has only recently begun to participate in a meaningful way. Through a multi-year licensing agreement with Wolf Appliance, Inc., which began in 2014, Hamilton Beach now has products that participate in this segment. Wolf Gourmet® brand products, which include cutlery and cookware in addition to small appliances, are currently available in a number of North American retail outlets and have recently expanded to the United Kingdom. A robust roadmap of additional product introductions is scheduled over the coming years, and Hamilton Beach expects to expand distribution to additional countries over time. In addition, the company recently launched the Hamilton Beach® Professional line, which was created to leverage Hamilton Beach’s commercial product development expertise and provide products that enable consumers to achieve professional results at home. Hamilton Beach is expanding the Weston® brand, which is focused on the field-to-table and farm-to-table segments, to include products sold in the only-the-best category. Hamilton Beach has recently introduced a CHI®-branded garment care line as a result of a multi-year licensing deal with Farouk Systems, Inc., the owner of the CHI® brand and a proven global leader in the beauty industry. International Market Growth: Hamilton Beach is focused on expanding its retail presence internationally, specifically in the emerging growth markets of Asia and Latin America. To achieve this 7

growth, Hamilton Beach is working to enhance its understanding of local consumers’ needs, developing products to meet those needs and increasing sales and marketing resources allocated to these markets, especially in the mid- to high-end segments. While Hamilton Beach has a long-standing presence in the global commercial product market, the company’s historical strength in the retail segment has been in the U.S. consumer goods market, with approximately 23% of its total sales occurring outside the United States in 2017. Hamilton Beach has an objective to increase international sales to 35% to 45% of total Consumers trust Hamilton Beach to bring high-quality, safe products to market at the right value proposition. sales by concentrating on key markets. Hamilton Beach’s efforts will focus on continuing to expand its established positions in Canada, Mexico, Central America and South America, as well as further expanding its position in emerging markets such as China. Hamilton Beach expects to selectively pursue other markets by leveraging the Hamilton Beach®, Hamilton Beach® Professional, Proctor Silex® and Wolf Gourmet® brands. Global Commercial Leadership: While Hamilton Beach has a leading position in the global commercial market, it continues to focus on achieving further penetration through a commitment to an enhanced product line for chains and distributors serving the global food service and hospitality markets. Hamilton Beach is enhancing its global commercial product line, particularly with innovative, new juicing, blending and mixing platforms, and is strengthening its food service and hospitality offerings to achieve further market penetration in this segment. As the Internet begins to alter the food-service industry from a product marketing, customer penetration and selling perspective, Hamilton Beach is increasing its investments and expertise to ensure it has industry-leading capabilities. Category and Channel Expansion: Driven by changes brought about by ecommerce, Hamilton Beach sees a meaningful opportunity to leverage its branding, sourcing, distribution and ecommerce expertise by expanding more quickly into new durable goods categories through ecommerce partners. Consumers trust Hamilton Beach to bring high-quality, safe products to market at the right value proposition. Once Hamilton Beach establishes ecommerce success in a particular new category, it expects to be well positioned to expand those new categories into physical retail outlets. Strategic Acquisitions: Hamilton Beach will continue to prudently evaluate strategic acquisition opportunities. The company’s last strategic acquisition was the Weston business in December 2014. After a few years focusing on organic growth, Hamilton Beach has once again turned its focus to potential acquisition opportunities and has developed a specific list of acquisition criteria. The company is evaluating and actively pursuing companies that best fit these criteria. While Hamilton Beach anticipates that its other strategic initiatives will drive the most growth through more organic means, 8

it firmly believes this strategic initiative will play a larger role in its growth goals going forward than it has in the past.

Hamilton Beach believes that through its past and continued investments in and execution of its strategic initiatives, it is well positioned to see meaningful

progress from these initiatives in the coming years. Kitchen Collection’s Strategic Development Kitchen Collection’s focus is to be a consumer-preferred, specialty retailer of kitchenware in outlet malls throughout the United States. A

shift in consumer shopping patterns has led to declining consumer traffic to physical retail locations, including outlet malls, and has reduced in-store transactions as consumers buy more over the Internet or utilize the Internet for comparison

shopping. The small appliance and housewares categories that Kitchen Collection specializes in are very well-developed, ecommerce categories. Financial pressures on middle-market consumers interested in housewares and small appliances continue to

persist and have adversely affected sales trends in these categories over the last few years. Over the past several years, Kitchen Collection has taken a number of strategic steps to position the business to deliver an acceptable financial return in

the near term. Kitchen Collection has reduced its store count from 337 stores in 2011 to 210 stores at the end of 2017. Kitchen Collection has consistently delivered strong gross margins by focusing on critical factors that many of its peers

struggle to do effectively. Kitchen Collection has reduced inventory levels and overhead costs through Good Thinking and made difficult decisions when necessary. Kitchen Collection has been able to generate positive cash fiow in the past few years

while working through this challenging process. While these efforts were appropriate given the market conditions, the progress has not been adequate to overcome the challenge of continued declining foot traffic to physical retail locations, and the

business is not currently delivering the desired financial returns. In 2018, Kitchen Collection expects to continue the process of strategically rightsizing its business by taking the following steps: • Maximizing comparable store sales at

existing stores by delivering products and prices that ensure consumers traveling to outlet malls find compelling offers and values. Kitchen Collection is continuing its focus on increasing sale closure rates, items per transaction and the average

sales price. These steps are expected to maximize the sales potential of the customer activity at the Kitchen Collection® stores. • Closing stores that are unable to generate an acceptable profit. Kitchen Collection will continue to close

stores that don’t achieve acceptable profit goals, including a number of stores in the first half of 2018. By the end of 2018, Kitchen Collection has a goal of having approximately two-thirds of its stores with leases of one year or less. That

percentage is expected to increase further each year. This short-term lease strategy will allow Kitchen Collection to negotiate appropriate lease rates or to close stores that cannot generate an acceptable return. Kitchen Collection believes it can

create a stronger, Hamilton Beach is fast becoming a leader in the high-end small appliance market segment with its “only-the-best” expansion through new product development and licensing agreements. New products in this segment include,

from left to right, the Weston Pro® Series Blender, CHI® Easy Steam™ Garment Steamer, Wolf Gourmet® Multi-Function Cooker, Hamilton Beach® Temp Tracker™ 6-Quart Slow Cooker, and Wolf Gourmet® Precision Griddle.9 11

more profitable business focused on 100 to 150 stores, although the optimal number of stores is dependent on changing foot traffic patterns and expense reduction efforts. • Right-sizing store and headquarters expenses to align with the reduced store count. Kitchen Collection will continue to work closely with landlords to align rents with the reality of the foot traffic coming to the malls, and will continue to manage headquarters expenses and other store level expenses to ensure the most efficient execution store by store. • Capital spending is expected to be modest. Kitchen Collection has invested capital to upgrade its stores and its point of sale system over the past few years. As a result, Kitchen Collection does not currently require additional meaningful capital investments and can focus on right sizing its store footprint. Overall, Kitchen Collection is dealing with a difficult environment and evolving aggressively in a constructive manner. Looking forward Hamilton Beach Holding continues to maintain a long-term view and believes that the necessary strategic initiatives are in place to help the Company achieve its long-term business objectives. In addition, the Company believes the execution of its key strategic initiatives, combined with its strong balance sheet, financial fiexibility and expected continued strong cash generation can lead to an enhanced stockholder value in the future, all of which make Hamilton Beach Brands Holding Company a compelling investment opportunity. At its first Board meeting in November 2017, the Board of Directors of Hamilton Beach Holding established a new dividend equal to an annual rate of $0.34 per share. The Company expects to continue to evaluate its dividend level going forward. Hamilton Beach Holding expects strong cash filow generation in 2018 and in future years. The Company expects to continue to focus on utilizing this cash to support its strategic initiatives, including selectively funding strategic acquisitions, should opportunities arise. It will also, as appropriate, return capital to its stockholders through dividends. As a final priority, the Company will consider share repurchases at prices attractive to its stockholders. Overall, we are a strong company focused on increasing stockholder value over the long term. We have great confidence in the ability of our management team to achieve the Company’s financial objectives in the years ahead as our many experienced and highly motivated professionals build on the Company’s solid 2017 financial results. G G G We are pleased to be moving forward as a stand-alone public company. We have strong leaders throughout our business and a long list of opportunities we are pursuing to drive us toward our revenue and profit goals. We believe stockholders with a long-term view will be rewarded for investing in the Hamilton Beach Holding business. Overall, we are a strong company focused on increasing shareholder value over the long term. Our thanks go out to the many customers and consumers around the world that purchase our products every day. We also want to thank our employees for their hard work, dedication and Good Thinking. Without such a strong team, we would not be able to achieve our goals. We welcome our new Board of Directors and are very pleased to have such a knowledgeable and experienced board. Finally, we would like to thank our stockholders for entrusting us to build value for them in the coming years. We look forward to our first full year as an independent public company and to the years beyond with enthusiasm. Gregory H. Trepp resident and Chief Executive Officer of Hamilton Beach Brands Holding Company and Hamilton Beach Brands, Inc., and Chief Executive Officer of The Kitchen Collection, LLC Alfred M. Rankin, Jr. Executive Chairman Hamilton Beach Brands Holding Company This annual report to stockholders contains forward-looking statements. For a discussion of the factors that may cause the Company’s actual results to differ from these forward-looking statements, refer to page 41 in the attached Form 10-K. 10

No Spacing;

DIRECTORS AND OFFICERS

Hamilton Beach Brands Holding Company Officers of Subsidiaries Directors: Mark R. Belgya Vice Chair and Chief Financial Officer of The J. M. Smucker Company J.C. Butler, Jr.

President and Chief Executive Officer of NACCO Industries, Inc.

President and Chief Executive Officer of The North American Coal Corporation John P. Jumper Retired

Chief of Staff, United States Air Force Dennis W. LaBarre Retired Partner, Jones Day Michael S. Miller Retired Managing Director, The Vanguard Group

Alfred M.

Rankin, Jr. Executive Chairman of Hamilton Beach Brands Holding Company Non-Executive Chairman of NACCO Industries, Inc. Chairman, President and Chief Executive Officer of Hyster-Yale Materials Handling, Inc. Roger F. Rankin Self-employed (personal

investments) Thomas T. Rankin Retired Owner and President of Cross Country Marketing James A. Ratner Non-Executive Chairman of Forest City Realty Trust, Inc. David F. Taplin Self-employed (tree farming) Gregory H. Trepp President and Chief Executive

Officer of Hamilton Beach Brands Holding Company President and Chief Executive Officer of Hamilton Beach Brands, Inc. Chief Executive Officer of The Kitchen Collection, LLC Officers: Alfred M. Rankin, Jr. Executive Chairman Gregory H. Trepp

President and Chief Executive Officer Gregory E. Salyers Senior Vice President, Global Operations - Hamilton Beach Brands, Inc. R. Scott Tidey Senior Vice President, North America Sales and Marketing - Hamilton Beach Brands, Inc. Keith B. Burns Vice

President, Engineering and Information Technology - Hamilton Beach Brands, Inc. Dana B. Sykes Vice President, General Counsel and Secretary James H. Taylor Vice President, Chief Financial Officer and Treasurer Robert O. Strenski President - The

Kitchen Collection, LLC Hamilton Beach Brands, Inc. Gregory H. Trepp President and Chief Executive Officer Gregory E. Salyers Senior Vice President, Global Operations R. Scott Tidey Senior Vice President, North America Sales and Marketing Keith B.

Burns Vice President, Engineering and Information Technology Dana B. Sykes Vice President, General Counsel and Secretary James H. Taylor Vice President and Chief Financial Officer D. Scott Butler Senior Director, Controller Richard E. Moss Senior

Director, Finance & Treasurer Derek R. Redmond Assistant Secretary and Senior Counsel The Kitchen Collection, LLC Gregory H. Trepp Chief Executive Officer Robert O. Strenski President Randy L. Sklenar Vice President, Field Operations and Human

Resources L. J. Kennedy Director of Finance, Treasurer and Secretary Derek R. Redmond Assistant Secretary Dana B. Sykes Assistant Secretary

CORPORATE INFORMATION Annual Meeting The Annual Meeting of Stockholders of Hamilton Beach Brands Holding Company will be held at 11:00 a.m. on May 15, 2018, at: 5875 Landerbrook Drive, Cleveland, Ohio 44124 Form 10-K Additional copies of the Company’s Form 10-K filed with the Securities and Exchange Commission are available free of charge through Hamilton Beach Brands Holding Company’s website (www.hamiltonbeachbrands.com) or by request to: Investor Relations Hamilton Beach Brands Holding Company 4421 Waterfront Drive Glen Allen, Virginia 23060 (804) 418-7745 Stock Transfer Agent and Registrar Stockholder Correspondence: Computershare P.O. Box 505000 Louisville, KY 40233-5000 Overnight Correspondence: Computershare 462 South 4th St., Suite 1600 Louisville, KY 40202 (800) 622-6757 (U.S., Canada and Puerto Rico) (781) 575-4735 (International) Legal Counsel McDermott Will & Emery LLP 444 West Lake Street Chicago, Illinois 60606 Independent Registered Public Accounting Firm Ernst & Young LLP 950 Main Ave., Suite 1800 Cleveland, Ohio 44113 Stock Exchange Listing The New York Stock Exchange Symbol: HBB Investor Relations Contact Investor questions may be addressed to: Investor Relations Hamilton Beach Brands Holding Company 4421 Waterfront Drive Glen Allen, Virginia 23060 (804) 418-7745 E-mail: ir@hamiltonbeach.com Hamilton Beach Brands Holding Company’s Website Additional information on Hamilton Beach Brands Holding Company may be found at the corporate website, www.hamiltonbeachbrands.com. The Company considers this website to be one of the primary sources of information for investors and other interested parties. Subsidiary Company Websites The websites for the Company’s subsidiaries are as follows: Hamilton Beach Brands–U.S.: www.hamiltonbeach.com www.proctorsilex.com www.commercial.hamiltonbeach.com Hamilton Beach Brands–Mexico: www.hamiltonbeach.com.mx Weston Brands: www.westonproducts.com Kitchen Collection: www.kitchencollection.com The FSC® Trademark identifies wood fibers coming from forests which have been certified in accordance with the rules of the Forest Stewardship Council®. Environmental Benefits This Annual Report on Form 10-K is printed using post-consumer waste recycled paper and vegetable-based inks. By using this environmental paper, Hamilton Beach Brands Holding Company saved the following resources: served s s for pre the borne waste wastewater solid waste greenhouse BTUs energy future not created flow saved not generated gases prevented not consumed

4421 Waterfront Drive, Glen Allen VA 23060 www.hamiltonbeachbrands.com An Equal Opportunity Employer