Attached files

| file | filename |

|---|---|

| EX-2.1 - MERGER AGREEMENT - WESTMOUNTAIN Co | ex2_1.htm |

| EX-99.1 - PRESS RELEASE - WESTMOUNTAIN Co | ex99_1.htm |

| EX-16.1 - EMPLOYMENT SERVICES AGREEMENT - BOURG - WESTMOUNTAIN Co | ex16_1.htm |

| EX-10.3 - PLACEMENT AGENCY AGREEMENT - WESTMOUNTAIN Co | ex10_3.htm |

| EX-10.2 - SECURITIES PURCHASE AGREEMENT - WESTMOUNTAIN Co | ex10_2.htm |

| EX-10.1 - LOCK-UP AGREEMENT - WESTMOUNTAIN Co | ex10_1.htm |

FORM 8-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of the Report (Date of earliest event reported): March19, 2018

WESTMOUNTAIN COMPANY

(Exact Name if Business Issuer as specified in its Charter)

|

Colorado

|

0-53030

|

26-1315305

|

||

|

(State or other Jurisdiction of Incorporation)

|

(Commission File Number)

|

(IRS Employer Identification Number)

|

||

|

3463 Magic Drive, Suite 120

|

||||

|

San Antonio, TX 78229

|

(Address of principal executive offices, including zip code)

(210) 767-2727

(Registrant's telephone number including area code)

(Former Name or Former Address, if Changed Since the Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

As used in this Current Report on Form 8-K, unless otherwise stated, all references to the "Company", "we," "our" and "us" refer to WestMountain Company and its consolidated subsidiaries, including after the Merger (as described below), CytoBioscience, Inc.

Item 1.01 Entry into a Material Definitive Agreement

The information contained in Items 2.01, 3.02, and 5.02 below relating to the various agreements described therein is incorporated herein by reference.

Item 2.01 Completion of Acquisition or Disposition of Assets

Merger Agreement

On March 19, 2018, WestMountain Company, a Colorado corporation ("WestMountain") entered into an Agreement of Merger and Plan of Reorganization, dated March 19, 2018 (the "Merger Agreement"), with WASM Acquisition Corp., a Colorado corporation and a subsidiary of the Company ("WASM"), and CytoBioscience, Inc., a Delaware corporation ("CytoBioscience"). Pursuant to the terms of the Merger Agreement, on March 19, 2018 (the "Closing Date"), WASM merged with and into CytoBioscience (the "Merger"), with CytoBioscience surviving the Merger and becoming a wholly-owned subsidiary of the Company, and the shareholders of CytoBioscience became shareholders of WestMountain.

On the Closing Date, all outstanding shares of capital stock of CytoBioscience were cancelled and exchanged for 42,522,598 newly issued shares of common stock of WestMountain ("Common Stock"). The shares issued to the CytoBioscience shareholders in the Merger constitute approximately 74.44% of the issued and outstanding shares of Common Stock of the Company as of and immediately after the consummation of the Merger. In addition, warrants to purchase 2,040,000 shares of Common Stock of WestMountain ("Warrants") were issued in exchange for all outstanding warrants of CytoBioscience, which were cancelled, and WestMountain assumed 160,000 underwriter warrants consisting of Units to purchase additional shares of Common Stock and Warrants, as defined and described below at Item 3.02. The CytoBioscience warrants and the Units were issued in connection with the private offering described in Item 3.02 of this Form 8-K.

In addition, the directors of WestMountain will seek shareholder approval to change the name of the Company to CytoBioscience, Inc. Additionally, the Merger Agreement provides for the resignation and election of certain directors of the Company, subject to compliance with Section 14(f) of the Securities Exchange Act of 1934, as amended (the "Exchange Act") and the rules of the Securities and Exchange Commission ("SEC") thereunder. The transactions contemplated by the Merger Agreement, including the change in composition of the Board of Directors of the Company as described herein, will result in a change of control of WestMountain.

The foregoing description of the Merger Agreement does not purport to be complete and is qualified in its entirety by reference to the copy of the Merger Agreement filed as Exhibit 2.1 to this Form 8-K, and incorporated herein by this reference.

Until the Closing Date, Steven Anderson, Brian L. Klemsz, and Joni K. Troska were the officers of WestMountain, and Brian Klemsz was the sole director of WestMountain. On the Closing Date, Brian L. Klemsz, submitted his resignation from WestMountain's Board of Directors (the "Board") and appointed Shing Leong Hui, Sue Lynn Hui, Paul Castella, Ian Clements, Alan Dean, James Garvin, and Thomas Knott to serve on the Board. The resignation of Brian L. Klemsz, and the appointment of Shing Leong Hui, Sue Lynn Hui, Paul Castella, Ian Clements, Alan Dean, and Thomas Knott will become effective on the 10th day following the filing of the Schedule 14F with the SEC (the "Effective Date"), while the appointment of James R. Garvin became effective at closing.

- 2 -

On the Closing Date, Brian L. Klemsz, Joni K. Troska and Steven Anderson also submitted their resignations as the officers of the Company, and on the same date, the Board appointed Dr. James R. Garvin as the President and Chief Executive Officer of the Company, Dr. Thomas Knott as the Chief Science Officer of the Company, and Henry C. Bourg, CPA, MBA as the Chief Financial Officer of the Company, effective immediately.

The appointment of the new directors to the Board will be effective 10 days after the Company's filing of a Schedule 14F-1 with the SEC, which was filed on March 23, 2018. See Item 5.02 of this Current Report on Form 8-K.

Lock-Up Agreement

All of the shares issued to CytoBioscience shareholders in the Merger are subject to a lock-up agreement ("Lock-Up Agreement") subject to a leak out schedule which concludes in two years, with limited exceptions for gifts, estate-related transactions and distributions to equity holders of certain entities. The foregoing description of the Lock-Up Agreement does not purport to be complete and is qualified in its entirety by reference to the copy of the Lock-Up Agreement filed as Exhibit 10.1 to this Form 8-K, and incorporated herein by this reference.

About CytoBioscience, Inc.

Overview

The address of our principal executive office is 3463 Magic Drive, Suite 120, San Antonio, Texas 78229. Our telephone number is (210) 612-2727. Our website is http://www.cytobioscience.com.

Our common stock is quoted on the OTCBB ("Over-the-Counter-Bulletin-Board") under the symbol "WASM".

CytoBioscience is an established, revenue-generating ion channel screening business providing medical instrumentation and research services to organizations in the pharmaceutical and drug research market. Today it costs in excess of $2 billion dollars and takes 10+ years to bring a new drug to market. This cost, coupled with increased regulatory pressure, has created both a challenge and an opportunity - how to reduce costs and how to do it accurately, efficiently, and effectively.

The Company's answer to this challenge is its flagship instrument, the CytoPatch Freedom. The CytoPatch Freedom provides accurate and efficient ion channel research data that helps drug developers reduce time and costs. The CytoPatch Freedom was chosen by the Food and Drug Administration (FDA) to be its key test instrument in developing new regulations for determining efficacy and effectiveness in drug development. This proposed regulation, CiPA (Comprehensive In-Vitro Proarrhythmia Assay) requires that all new drugs, regardless of their intended purpose, be tested in a series of assays to determine if they possess pro-arrhythmia potential or not. The CytoPatch Freedom instrument is capable of performing an entire series of assays in one unit, without add-ons, without delay and without the need for additional personnel.

CytoBioscience develops and manufactures related consumables, including various cell lines, and, further leveraging its instrument, provides Contract Research services on an in vitro and in vivo basis for a growing list of clients worldwide. Finally, the Company's product line includes the HSC instrument, which is used to rapidly determine protein solubility; a key component of protein-based drug development. HSC is manufactured the Company's wholly-owned subsidiary, Soluble Bioscience.

Each of these revenue-generating segments; instruments, consumables and contract research, is a leader in its technology and in its capacity. Having undergone years of testing, starting, restarting, and honing its development into the cutting edge it is today, the Company is experiencing accelerating revenue growth and is well-positioned to reach its potential.

- 3 -

At the core of the Company's business is its instrumentation, the CytoPatch Freedom. The CytoPatch is the leading hands-free robotic patch clamping instrument, which uses the Company's proprietary software and microchips to test individual cells for specific ion channel responses. The Company's instrumentation is also used for peptide and protein analysis, water temperature units for specific laboratory use and laboratory compressors, vacuum pump units for running laboratory instruments and disposable shipping units for transporting cells at physiological temperature.

The Company's consumables are its microchips, designed for use exclusively in the CytoPatch, cell lines and pre-seeded MEA plates, both of which are used in drug development, analysis and safety testing, plus, buffers and solutions for specific laboratory applications.

1. KEY STRENGTHS OF THE COMPANY

The Company's solutions provide value to clients by significantly improving data accuracy and collection used to make timely and informed decisions on pharmaceutical compounds and their potential uses.

These deliverables are centered on proprietary technologies in the Company's microchips, software and cell lines.

The Company's combined offerings are synergistic; CytoPatch use consumes microchips and cells, while CRO work promotes instrument sales.

The Company's market is experiencing strong growth, driven by both regulation and rising demand for outsourced safety pharmacological work.

The company is engaged with both private and public partners globally, including the FDA. Exchange between academic, pharmaceutical and independent researchers promotes further growth.

The Company is established and has the scale to compete effectively with the largest service and instrumentation providers in the industry. Increasingly complex demands of both regulators and clients drive recurring revenues.

Management is led by Dr. James Garvin and has a combined 140 years of experience in the biotechnology industry. The scientific team, Dr Thomas Knott, Dr Susan Judge, Dr. Stefan Mann, Dr Juliane Heide, and Dr Christa Nutzhorn are internationally recognized in the field of ion channel and cardiac research.

2. ION CHANNEL SCREENING AND ITS APPLICATIONS

Ion channel screening enables accurate and detailed examination of cellular activity in order to conduct drug research and assess drug efficacy and safety, in addition to providing detailed analysis of how different diseases respond to different treatments. It is used by drug developers, drug researchers and pharmaceutical companies, to better address important information required for the creation of new drugs and identifying new cures and treatments.

- 4 -

3. HISTORY AND BACKGROUND OF THE COMPANY

Timeline of significant events

|

2011

|

·

|

Cytocentrics Bioscience GmbH established in Rostock, Germany

|

|

2012

|

·

|

Completed the development of the CytoPatch1 instrument

|

|

·

|

Developed a chip cleaning process for the academic markets

|

|

|

·

|

Serviced the first Multi-Electrode-Arrays customer

|

|

|

2013

|

·

|

Developed unique Assay Designer software with Drag and Drop capability to cut assay procedure adjustment time from days to seconds

|

|

·

|

Developed full cardiac panel – Assay and published Application Note

|

|

|

·

|

Completed modular assembly system finished for outsourced module manufacturing

|

|

|

·

|

Completed CytoPatch2 application and makes available for customer demo

|

|

|

·

|

Filed Patent P7 as a method and device for optical patch clamp chip

|

|

|

·

|

Established manufacturing system for mechanical, electrical and pneumatic modules

|

|

|

2014

|

·

|

Developed DRG neurons-Assay and published subsequent Application Note

|

|

·

|

Filed Patent P8 filed as method and device for cancer research / tissue patch

|

|

|

·

|

Obtained first customer for cardiac-screening-panel on myocytes

|

|

|

·

|

Established / Validated CIPA big 3 panel under physiological temperatures

|

|

|

·

|

Established fully automated self-testing Routine on CytoPatch2 including measurement head analysis

|

|

|

·

|

Filed Patent P10 for model-based therapeutic planning with ps-iPSC-CMs (patient specific induced pluripotent stem cell cardiomyocytes)

|

|

|

·

|

Established routine recording in in-house lab of stem cell cardiomyocyte action potentials (CIPA initiative)

|

|

|

·

|

Developed iPSC derived Cardiac-Myocyte-Assay and published subsequent Application Note

|

|

|

2015

|

·

|

Acquired by CytoBioscience and Company re-organized and headquartered in the US

|

|

·

|

Acquired Zenas Technologies, a leading cardiac safety CRO

|

|

|

·

|

Filed Patent P11 for culturing cells on micro-substrates

|

|

|

·

|

Signed joint venture agreements with Cyprotex (UK) and DSTC (Japan)

|

|

|

·

|

Analytical division added to increase CRO offerings and drive additional revenue

|

|

|

·

|

Only company in the US to offer pre-seeded MEA plates with cardiomyocytes

|

|

|

·

|

Selected by FDA as instrumentation for CiPA research studies

|

|

|

2016

|

·

|

Acquired the assets of Soluble Therapeutics

|

Background of CytoBioscience

Cytocentrics Bioscience, GmbH, founded by Dr. Thomas Knott (currently the Company's Chief Science Officer) was spun-out of academia. It was set up to focus on automation in patch clamp techniques. Early efforts of Cytocentrics Bioscience to bring a commercial product to market were under-capitalized. However, as research and development continued to advance, Cytocentrics Bioscience created the CytoPatch, the Company's high-throughput, hands free patch clamp instrument.

- 5 -

CytoBioscience was established in July 2014 in Delaware. On March 5, 2015, CytoBioscience acquired Cytocentrics BioScience GmbH.

Following a re-organization of the Company's structure and the integration of Cytocentrics Biosciences GmbH in 2015, the Company focused on developing products and services towards broader commercialization. In addition, the Company implemented cutting costs measures. From August 2015, the Company began to actively market its products and services and gained commercial traction.

The Company is headquartered in San Antonio, Texas, where it develops and completes the majority of its manufacturing, houses its R&D facility and serves as the Company's largest contract research organization (CRO) facility. The CRO group has a separate GLP facility in Cologne, Germany, and a separate cell development facility in Birmingham, Alabama. The facility in Cologne provides services to the European market and supports research and CRO in our U.S. based facilities.

In addition, the Company has a strategic alliance that develops business with DSTC in Tokyo, Japan.

4. BUSINESS OVERVIEW

CytoBioscience is an established revenue-generating US-based company, with a focus on high accuracy ion channel screening and research. The Company has three operating segments:

Instrumentation, based on the Company's proprietary CytoPatch instrument, an ion channel measurement device;

Consumables, particularly using the Company's patented technology in its microchip, which has been made exclusively for use in the CytoPatch, as well as cells and cell lines; and

Contract research services for third parties.

The Company employs a scientific team with a multidisciplinary background and regulatory expertise. The Directors and senior management team has significant experience in biotechnology manufacturing and sales. The Company has an experienced management team, market leading products and services, high-caliber clients and partners and a focused strategy for growth through product development and sales, new strategic partnerships and strategic acquisitions. The Directors believe that the Company is well positioned to draw market share from both manual patch clamp and automated patch clamp ("APC") testing competitors.

Core business areas

CytoPatch

The CytoPatch represents a unique blend technology and bioscience that creates new frontiers of discovery and understanding about human cells. Those discoveries, those understandings, are the pathways to a far more effective utilization of drugs, and drug therapy. The underlying technology behind this, known as "patch clamping" – which involves no patch and no clamping, is what opens these amazing vistas.

- 6 -

The "Art" of the Screen

In a business where speed and cost are everything, ion channels don't fit neatly into the traditional process of drug discovery. Pharmaceutical companies cannot easily apply their million-compound libraries to ion channels, because these channels don't behave like proteins. Ion channels are membrane-spanning macromolecules that regulate the flow of charged molecules such as Na+, K+, Cl−, and Ca2+ across an otherwise impermeable barrier. They don't catalyze enzymatic reactions, and induce no secondary, amplified signal. Instead, upon activation—whether by changes in voltage, ligand binding, or mechanical force—these channels open, creating a pore in the membrane through which charged molecules can flow.

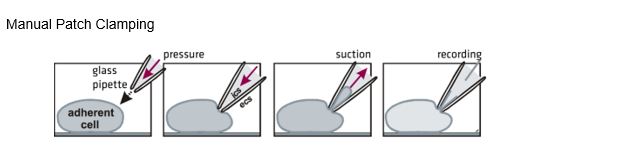

Manual Patch Clamping

In traditional patch clamping, a skilled operator must manually manipulate cells and a pipet to form a seal, perhaps recording from just 10 cells in a day.

The resulting currents are small and fast—on the order of picoamperes, and often occurring on a millisecond timescale. Yet they are substantial enough to kick-start a chain reaction that, depending on the context and location, results in effects as varied as pain, muscle contraction, or even fertilization.

The bottom line is that it's not enough to know whether a potential drug compound binds a particular ion channel; scientists need to actually measure its impact on that flow of ions across the cell membrane. Researchers can measure these electrophysiologic changes indirectly, by using voltage-or ion-sensitive fluorescent dyes or atomic absorption spectroscopy for instance. But to do it right—that is, to directly measure the current flow across individual ion channels—requires the technique that won Neher and Sakmann their Nobel Prize: patch clamping.

- 7 -

Consumables

Microchips

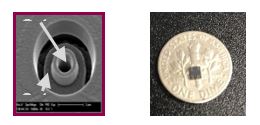

Central to CytoBioscience's business is its patented electrophysiological technology used in the Company's microchip which drives the instrumentation, the CytoPatch, to provide a high throughput and highly accurate platform to analyze ion channel analysis. The microchip enables the Company to complete hands-free patch clamping to deliver data and information to its clients with 99% accuracy, one of the best accuracy rates in the market.

The microchip enables the CytoPatch to capture a single cell, hold it in place, insert a probe and receive readings from the ion channels in those cells in order to assess the safety, efficacy and efficiency of a drug through the detailed examination of the cellular activity. The readings produced are electrical signals caused by the movements of proteins within the ion channels. These small signals are identified by the probe, sent to an amplifier through the microchip, and then displayed as a readable signal on a computer for a researcher to observe.

The opening inside the microchip is smaller than the size of a human cell and allows for cells to be held in place and analyzed. The design, patented as the CytoPatch Opening, is the core of what makes the instrument unique. The Company's patented technology uses a multiple channel opening, as opposed to a single hole approach applied by a number of its competitors. This enables multiple options, more detailed data and greater information flow because within the CytoPatch Opening there is a better catch, a better seal and ultimately better and more accurate data flow.

The Company's technology enables the CytoPatch to differentiate itself from other instruments in the market, particularly automated high-throughput machines, by completing a number of significant outcomes, including:

| · |

Completing the entire CiPA panel at 37 degrees C, the temperature of the human body, which is the optimal environment for the testing cells;

|

| · |

Completing longer and more stable recordings, which provides more accurate data and saves time compared to machines with shorter recording periods;

|

| · |

Completing stem cell cardiomyocytes and fast ligand gates ion channels (NMDA) which the Company believe are not able to be tested on alternative systems; and

|

| · |

Completing mechanical stimulation of cells in order to record the effects on the cell when they are moved or sheeted

|

- 8 -

The Company believes that the ability of the CytoPatch to accomplish these outcomes distinguishes the it from its competitors and is a significant reason the FDA chose to use the CytoBioscience instrument for its ion channel CiPA research. In addition, the Company also received the award for Best Human Cell Technology Research Developers 2016.

Other Consumables

The Cyto-PTU Shipping Container keeps internal temperature at 37 ± 0.1 C for up to 100 hours. This enables the Company to ship live cells, pre-seeded MEA plates and tissue samples domestically or world-wide without cell loss. Conventional shipping is dependent on freezing. The container is completely disposable, with no return shipping costs. This is a previously untapped market, and interest is growing rapidly.

Cell lines and cells and per-seeded MEA plates, all of which are used by researchers in drug safety, drug analysis and drug development projects, and finally, buffers and solutions for specific laboratory applications.

Contract research

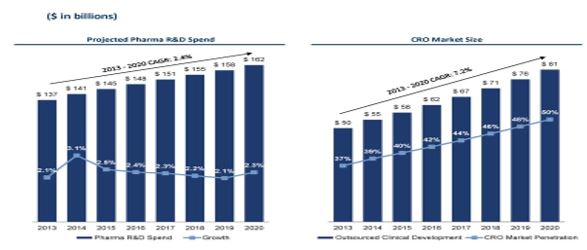

There is a growing trend in the pharmaceutical industry to outsource safety screening and efficacy or drug discovery and drug development work. This is a result of a pronounced decrease in productivity caused by an increase in R&D spending which has not, in recent years, yielded a proportional increase in new drug approvals. Increased demands from regulators are also making the process costlier.

As a result, the last five years have seen a period of consolidation with the closure of a number of R&D sites of many of the large pharmaceutical companies. At the same time, there has been a growth in pharmaceutical companies outsourcing to CROs. CytoBioscience, which has developed a highly automated and efficient instrument together with expertise in the ion channel screening market are benefitting from this trend.

Intellectual property

The Company's intellectual property estate is wholly-owned and managed by the Company. The intellectual property portfolio consists of five active patents and four pending patents in the US, EU and Japan.

The Company believes that the corporation's intellectual property portfolio is significant to its future growth and defensible market share.

5. INDUSTRY OVERVIEW

When the Human Genome Project completed in 2003, the ability to recognize the molecular basis for a disease and identify, among other things, the specific genes and proteins involved became easier. In the same year, Drug Discovery World first reported the emergence of automated patch clamping as a higher throughput alternative to traditional electrophysiological investigations made using manual patch clamp1. In the period since this was first reported, APC platforms have been identified as central to ion channel drug discovery. Ion channels are proteins that form pores in cell membranes. They are involved in the control of many fundamental physiological processes in various tissues, and alterations in their functions give rise to pathological conditions. Ion channels were discovered in the membrane of electrically excitable cells such as neurons, cardiomyocytes, and skeletal muscle fibers and, for decades, drugs modulating cell excitability have been targeted by the pharmaceutical industry. Ion channels also play many roles in non-excitable tissues.

1 Source: Comley. J, PATCHERS vs SCREENERS – divergent opinion on high throughput electro-physiology!, Drug Discovery World, 2003

- 9 -

In 2010, approximately 13% of marketed commercial drugs acted on ion channels. In recent years APC systems have evolved considerably and new ion channel screening technologies continue to be developed to discover new drugs. Patch-clamp is the gold standard technique to record ion channel activity, however, the costs associated with this technique are high as a result of the need for top-quality equipment, such as an anti-vibrating table, micro-manipulator, a microscope with IR-CCD camera, highly trained personnel and low throughput.

Over the years, there have been attempts to build devices to increase throughput, notably with automated electrophysiology systems. Such systems have revolutionized ion channel drug discovery by enabling the screening of numerous compounds on many types of ion channels and cellular models. These systems have also been important for safety pharmacology testing of many types of ion channels. These methods, however, still require improvements with respect to throughput, quality of the electrophysiological recordings and the physiological cellular models used for drugs and safety testing.

The development of new technologies has increased the number of drugs that can be identified, synthesized, characterized, screened and tested for therapeutic efficacy and safety. However, the process of drug discovery is long and expensive. Pharmaceutical companies spend approximately $50 billion annually in R&D and the average cost to bring a new drug to the market is estimated to be $1.8 billion2. Most compounds fail in clinical trials, requiring development of new strategies, and methodologies.

Since ion channels control conduction of electrical activity in the heart, it is crucial to discern if off-target activities of drug candidates include cardiac ion channels. Möller and Witchel (2011) reviewed the most recent methods to screen drug candidates in major cardiac ion channels. These methods include APC using heterologous expression systems and automated action potential recordings from stem-cell derived cardiomyocyte. The developments in the field of ion channel screening technologies described indicate that the future is pointed toward the screening of drugs in more physiological relevant cellular models and networks.

Market size

The Company's core business is focused on the ion channel screening and drug screening market, principally through the Company's patented technology used in the CytoPatch to provide a high throughput and highly accurate platform to analyze ion channel drug discovery. More broadly, the Company operates in the pharmaceutical and biotechnology market, through its consumables, instrumentation and CRO work. This is a large and growing industry. In 2015, life sciences research and development exceeded $200 billion with an estimated 4 percent growth rate. It is estimated that the CRO market growth rate is between 6 and 9 percent. The drug discovery technologies sector is valued at $88 billion with an estimated 15% CAGR3, which is comparable to estimates for preclinical research and development4, in vitro/in silico oxicology testing and growth in nanomedicine5. Electrophysiology outside of medical devices is estimated to grow at 10.3%6 and 13% for analytical instruments.

2 Source: Paul et al., (2010)

3 Source: Omics: biomedical Perspectives and Applications, 2012, D. Barth, K. Blum, M. A. Madigan, Global Industry Analysts Inc.

4 Source: Outsourcing Pharma.com (3/714), HTStec Ltd:Top 10 Drug Discovery Technologies Market, (2010-2015), Research And Markets, 6/13: 2012 30.4bn to $45.2bn 2016, Furthermore, Biopta/Reprocell estimate a 7 trillion Yen R&D value, 25% in preclinical.

5 Nanotechnology in Medical Applications: The Global Market September 2015, IVD/ISD toxicology estimated at a 15% CAGR, 5B in 2012, 10B in 2017 (BCC Research, the journal of precision medicine)

6 http://www.marketsandmarkets.com/PressReleases/electrophysiologyE.satsipmates Electrophysiol ogy CAGR 10.3% 2014-2019 to $4.75B

- 10 -

The market for ion channel screening is anticipated to grow to $10 billion by 2021, led by a number of key industry trends including specific regulatory developments, the cost of drug development, an increase in outsourcing, and a reduced field of competition. The Company believes that these products and services provide a significant opportunity to capitalize on these trends to build and maintain its position as a market leader in the ion channel screening market.

The intertwined markets of ion channel instrumentation, ion channel CRO work, and the consumables are estimated to be greater than $4 billion. Approximately two-thirds of CRO business is funded by the pharmaceutical industry, another 27% from biotechnology, and the rest by the medical device, foundation and government sectors. Approximately 46% of clinical trials are conducted in the United States, 30% in Europe and the remainder in Asia, Latin America, Africa and the Middle East. That being said, 70% of the safety pharmacology works is in the United States.

As the chart below indicates7, the CRO business, which is where ion channel research and testing is embedded, has risen and continues to rise, since 2010.

Key industry trends

The Company have identified the following key trends driving the industry:

Regulatory developments

The Company's business and market generally are altered and impacted by the introduction of new guidelines by regulatory authorities. In 2012, the FDA and the European Medicines Agency (EMA) both released revised guidelines on drug interactions, including good laboratory practices (GLP) requirements. The Company's core instrument, the CytoPatch, is GLP compliant and can support the full FDA and EMA requirements. The most pertinent and significant regulatory development that directly affects CytoBioscience is the pending CiPA initiative in the US, which is driving a significant amount of the drug safety and drug efficacy work.

7 Source: Pharma and William Blair Equity Research (April 25, 2014)

- 11 -

Cost of drug development

Any process and/or instrumentation that helps to reduce the overall cost of drug development, safety screening, efficacy, is being sought out by pharmaceutical companies of all size.

Increase in outsourcing

There is a growing trend in the pharmaceutical industry to outsource safety screening and efficacy or drug discovery and drug development work. This is a result of a pronounced decrease in productivity caused by an increase in R&D spending which has not, in recent years, yielded a proportional increase in new drug approvals. Increased demands from regulators are also making the process costlier. As a result, in the last five years there has been a period of consolidation with the closure of a number of R&D sites of many of the large pharmaceutical companies. Instead, there has been a growth in pharmaceutical companies outsourcing to CROs. CytoBioscience, which has developed a highly automated and efficient instrument together with expertise in the ion channel screening market are benefitting from this trend.

Reduced field of competition

The ion channel screening market is relatively nascent and growing quickly, however there has been a consolidation in recent years. Specifically, the level of competition has been reduced, particularly CRO, by consolidation amongst competitors in the industry, which has reduced the number of companies performing CRO work.

The Company is actively taking advantage of the industry trends driving the increased demand for ion channel screening, including the FDA, who have recognised that the Company's technology and product produces the best results for assessing drug efficacy and safety, and exclusively use the CytoPatch for their drug screening process.

6. PRINCIPAL CUSTOMERS

The Company has a wide range of international customers, principally in the pharmaceutical, biotechnology and medical research industries along with CRO organisations and regulatory authorities. In addition, the Company's customers also include DSTC and its network of pharmaceutical research companies in Japan, the Victor Chang Institute in Australia and the FDA.

7. COMPETITION

The Company's core markets, ion channel screening and drug efficacy, broadly fall into the life science tools and services sector, which also includes molecular diagnostics, genetic analysis and sequencing, CROs and analytic equipment. Within this broad sector there has been a high level of consolidation and less than 20 companies control 80% of the market.

In 2014, the APC space was dominated by a small number of companies, including Molecular Devices (UK) Ltd, Sophion, Nanion Technologies and Fluxion Biosciences. The Company believes that no competitor has a unique instrument that provides the accuracy and quality of results that the CytoPatch offers.

In particular, inexact nomenclature makes for indirect comparison with the instrumentation the Company builds as its focus lies outside of mainstream, high throughput APC.

The Company is well-positioned to take advantage of this expansion and distance itself from others competing within the ion channel screening and drug efficacy market.

- 12 -

8. EMPLOYEES

We currently employ 24 people.

Item 3.02 Unregistered Sales of Equity Securities.

Private Offering

Prior to the Merger, CytoBioscience completed a private placement ("Private Offering") in which it issued units ("Units") consisting of shares and warrants exercisable for shares of CytoBioscience common stock to three accredited investors (the "Purchasers"), one of whom is the Placement Agent (as defined below), for total consideration of $1.53 million. The other two Purchasers were BOCO Investment, LLC, and Shing Leong Hui. The Private Offering was completed by CytoBioscience on March 1, 2018. Such securities were issued in reliance upon an exemption from the registration requirements of the Securities Act pursuant to Section 4(a)(2) thereof and Rule 506 of Regulation D promulgated thereunder. Approximately $48,570 of the proceeds of the Private Offering were used to repay amounts payable to Dr. James Garvin, the Chief Executive Officer, representing advances he made to CytoBioscience for working capital purposes. Approximately $200,000 of the proceeds of the Private Offering were used to repay amounts lent in a line of credit by Ian Clements, a Director of the Company. The remaining proceeds were used to repay indebtedness, to pay transaction costs and fees, and for working capital purposes. CytoBioscience was represented in the Private Offering by Divine Capital Markets LLC, a registered broker-dealer, which acted in a best efforts capacity as sole placement agent (the "Placement Agent"). At the closing of the Private Offering, the Placement Agent earned a cash commission of $90,000 and underwriter warrants consisting of Units to purchase shares and warrants to purchase shares of CytoBioscience common stock at 125% of the Private Offering price. The Placement Agent also elected to invest $30,000 of its cash commission in the Units.

Securities Purchase Agreement

The terms of the Private Offering are set forth in a Securities Purchase Agreement. Under the Securities Purchase Agreement, the Purchasers purchased Units consisting of one share of common stock and a warrant to purchase one shares of common stock, for $0.75 per unit. The Securities Purchase Agreement requires the Company to file a registration statement on Form S-1 with the SEC (the "Registration Statement") to register the resale by the Purchasers of all shares of Common Stock and shares underlying the Warrants within 90 days of the Closing and to cause such Registration Statement to become effective within 180 days of the Closing. The foregoing description of the Securities Purchase Agreement does not purport to be complete and is qualified in its entirety by reference to the copy of the Securities Purchase Agreement filed as Exhibit 10.2 to this Form 8-K, and incorporated herein by this reference.

All of the shares and warrants issued by CytoBioscience in the Private Offering were cancelled and exchanged for shares and warrants, respectively, of WestMountain in connection with the Merger.

WestMountain Shares and Warrants Issued in the Merger

The information regarding the Merger Agreement and the issuance of the shares of Common Stock of the Company and the Warrants to purchase Common Stock contemplated thereunder set forth in Item 2.01 of this Current Report on Form 8-K is incorporated by reference into this Item 3.02.

- 13 -

Upon the closing of the Merger on March 19, 2018, the Company issued (i) a total of 42,522,598 shares of common stock ("Merger Shares") to CytoBioscience's stockholders ("Shareholders") in exchange for all of the outstanding shares of common and preferred stock of CytoBioscience, and (ii) Warrants for a total of 2,040,000 shares of Common Stock in exchange for the warrants for common stock of CytoBioscience. WestMountain assumed 160,000 underwriter warrants consisting of Units to purchase additional shares of Common Stock and Warrants. Such Merger Shares, Warrants, and Units were issued in reliance upon an exemption from the registration requirements of the Securities Act of 1933, as amended ("Securities Act"), pursuant to Section 4(a)(2) thereof, which exempts transactions by an issuer not involving any public offering. The issuance of such securities was not a public offering for purposes of Section 4(a)(2) because of its being made only to approximately 25 current Shareholders of CytoBioscience, such Shareholders' status as accredited investors and the manner of the issuance, including that the Company did not engage in general solicitation or advertising with regard to the issuance of the securities and did not, and will not, offer the shares to the public in connection with the issuance.

Item 4.01. Changes in Registrant's Certifying Accountant.

Effective on March 20, 2018, and with the approval of our Board of Directors, we dismissed EKS&H LLLP, or EKS&H, as our independent registered public accounting firm engaged to audit our financial statements.

During the years ended December 31, 2017 and 2016, and the subsequent interim period through March 22, 2018, there were no (1) disagreements (as defined in Item 304(a)(1)(iv) of Regulation S-K and related instructions) with EKS&H on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of EKS&H, would have caused EKS&H to make reference to the subject matter of the disagreement in their reports, or (2) reportable events (as defined in Item 304(a)(1)(v) of Regulation S-K).

The audit reports of EKS&H on the Company's consolidated financial statements as of and for the years ended December 31, 2017 and 2016, did not contain any adverse opinion or disclaimer of opinion, nor were they qualified or modified as to uncertainty, audit scope or accounting principles.

The Company has provided EKS&H with a copy of the disclosures it is making in this Item 4.01 prior to the filing of this Current Report on Form 8-K with the SEC, and has requested EKS&H to furnish the Company with a letter addressed to the SEC stating whether or not it agrees with the statements made herein, and if not, stating the reasons for their disagreement. A copy of EKS&H's letter dated March 23, 2018 is attached as Exhibit 16.1 to this Current Report on Form 8-K.

Item 5.01 Change in Control of Registrant.

The information contained in Item 2.01 of this Current Report on Form 8-K is incorporated by reference into this Item 5.01.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Director Resignations and Appointments

On the Closing Date, in accordance with the Merger Agreement, Brian L. Klemsz, submitted his resignations from the Board and appointed Shing Leong Hui, Sue Lynn Hui, Paul Castella, Ian Clements, Alan Dean, James Garvin, and Thomas Knott to serve on the Board. The resignation of Brian L. Klemsz and the appointment of Shing Leong Hui, Sue Lynn Hui, Paul Castella, Ian Clements, Alan Dean, and Thomas Knott will become effective on the 10th day following the filing of the Schedule 14F with the SEC, while the appointment of James R. Garvin became effective at closing. The resignations were not the result of any disagreements with the Company.

The Board expects to appoint Mr. Dean and Mr. Castella to the Audit Committee, and Mr. Clements and Mr. Hui to the Compensation Committee.

- 14 -

Officer Resignations and Appointments

On the Closing Date, Brian L. Klemsz, Joni Troska and Steven Anderson also submitted their resignations as the officers of the Company, and on the same date, the Board appointed Dr. James R. Garvin as the President and Chief Executive Officer of the Company, Dr. Thomas Knott as the Chief Science Officer of the Company, and Henry C. Bourg, CPA, MBA as the Chief Financial Officer of the Company, effective at the closing of the Merger.

James R. Garvin has served as the CEO, President and a Director of CytoBioscience since March 2015. Dr. Garvin has twenty-nine years of experience in working in the biotech sector and finance. His work has been recognized by the French Academy of Science and he was named one of sixteen healthcare innovators in the state of Texas for 2017. As a former investment banker, he has worked on a number of different biotechnology acquisitions, in the United States, Europe and in Israel. He has been a board member of a number of companies and currently is on the board of the Zerah Foundation which provides educational opportunities for underprivileged children in India. His international range of experiences and interests has been diverse but this has allowed him to have an outside of the box perspective that has served him well in working with companies and situations over the years. Dr. Garvin received his PhD in Economic Systems from the University of New Orleans, as well as his Masters in Administration and his BA (Hons) in English and International Relations from the State University of New York, Albany.

Thomas Knott, PhD has served as the Chief Science Officer of CytoBioscience since March 2015. Dr. Thomas Knott is an innovative technology driven entrepreneur who founded Cytocentrics CCS GmbH, a high-tech scientific instrumentation and biotech company specializing in the field of ion channel electrophysiology in 2001. Dr. Knott single-handedly developed the Cytocentrics instrument for ion channel analysis, the CytoPatch™, demonstrating a more complete feature set in patch clamp capabilities than any existing manual patch clamp system (whole cell voltage clamp and current clamp, perforated patch clamp, extracellular and intracellular perfusion, temperature control, fast ligand gated ion channels, mechano-stimulation, GLP, and network capability). He has worked with three Nobel Prize winning teams.

Henry C. Bourg, CPA, has served as the CFO of CytoBioscience since September 2017. Henry is an accomplished senior finance and accounting professional with over thirty years' experience with start-ups, mid-sized and multi-billion dollar global organizations. He started his career with Ernst & Young in Texas and later in Maryland and New York. While with Ernst & Young, he served primarily financial institution clients such as American General Life Insurance, Capital One and MBNA America Bank. In addition to his public accounting experience, Henry has served in senior finance and accounting roles with the US Government in Europe; The Shaw Group, Inc., Chicago Bridge & Iron, and Westinghouse Electric Company in Asia; Inktomi Corporation and Bookham, Inc. (now Oclaro) as well as several technology start-ups in Silicon Valley. He earned his Bachelor of Science degree in Accounting from Louisiana State University and a Master of Business Administration from Santa Clara University.

Employment Agreements

The Company expects to enter into new employment agreements with Dr. Garvin and Mr. Bourg. The terms of the agreements have not been, but will be, determined by the Board.

Related Party Transactions

In April of 2016, Buschier, S.p.A agreed, on behalf of itself and its related or affiliated entities, to forbear from collecting or otherwise enforcing CytoBioscience's then outstanding obligations to those entities. The initial outstanding obligations consisted of approximately $9,551,922.22 due under the agreements with those entities. In April 2016, Buschier agreed to forgive $4,750,000 of that debt in exchange for CytoBioscience paying $750,000 cash against the debt and entering into a new note for $4,051,977.22 with the new note being due December of 2016.

In October of 2016, Buschier agreed to accept a $1,000,000 payment and amend the note to $3,172,537.42 with a new due date of June 2017. In June of 2017, the note was amended to have a new due date of August 2017. In August of 2017, the note was amended to reflect a due date of October 2017. In November of 2017, an agreement was reached between Buschier and CytoBioscience to convert the remaining debt to equity, with a 1.5% rate applied to the debt to determine the total number of shares to exchange, and 5,058,415 shares were then issued to Buschier.

- 15 -

In February of 2017, Targeted Technology Fund II, L.P. ("TTF II"), whose partners include Paul Castella, Ian Clements and Alan Dean who are on the board of directors of the Company, loaned the company $300,000 at a 12% annual interest.

In May of 2017, Targeted General Partner, L.P. ("TGP"), whose partners include Paul Castella, Ian Clements and Alan Dean who are on the board of directors of the Company, loaned the company $400,000 at a 12% annual interest rate.

In June of 2017, TGP loaned the company $300,000 at a 12% annual interest rate.

In February 2018, the three notes (the February 2017 TTF II note, May 2017 TTGP note and June 2017 TGP note) were combined into an interest only $1,362,572.44 Promissory Note which matures in February 2021. On the Closing Date $575,541.00 of the Note was converted into 766,667 shares of CytoBioscience.

In March of 2017, Ian Clements, a Director of the Company, loaned the company $300,000 at 12% annual interest and with a 30% warrant option. That note is still outstanding but has been amended to a 5% Note maturing in February 2021.

In July of 2017, Alan Dean, a director of the Company, loaned the Company $50,000 at 12% annual interest. That note was converted to shares at closing whereby 73,189 were issued (and included in the total shares of beneficial ownership detailed above).

In December of 2017, Ian Clements, a director of the Company, established a line of credit of $200,000 from his personal funds at 12% annual interest. $200,000 of that line had been used and repaid in full.

Item 8.01 Other Events.

On March 23, 2018, the Company issued a press release announcing that it had completed the Merger. A copy of the press release is attached to this Current Report on Form 8-K as Exhibit 99.1 and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits

(a) Financial statements of business acquired. We will file the audited financial statements of CytoBioscience, Inc. required under applicable rules of the SEC within 71 days after the date this Form 8-K reporting the acquisition of CytoBioscience, Inc. is required to be filed.

(b) Pro forma financial information. We will file the pro forma financial information required under applicable rules of the SEC within 71 days after the date this Form 8-K reporting the acquisition of CytoBioscience, Inc. is required to be filed.

- 16 -

(d) Exhibits.

The exhibits listed in the following Exhibit Index are filed as part of this Current Report on Form 8-K:

|

Exhibit

Number

|

Description

|

|

2.1*

|

Agreement of Merger and Plan of Reorganization dated as of March 19, 2018 by and among the Registrant, WASM Acquisition Corp. and CytoBioscience, Inc.

|

|

10.1

|

Lock-up Agreement between the Registrant and the officers, directors and shareholders party thereto

|

|

10.2

|

Securities Purchase Agreement between the Registrant and the investor parties thereto

|

|

10.3

|

Investment Banking Agreement dated December 15, 2017 between Registrant and Divine Capital

|

|

Markets LLC

|

|

|

16.1

|

Letter from EKS&H LLLP to the Securities and Exchange Commission dated March 23, 2018

|

|

99.1

|

Press Release dated March 23, 2018

|

* Schedules and similar attachments to the Purchase and Sale Agreement have been omitted pursuant to Item 6.01(b)(2) of Regulation S-K. The registrant will furnish a supplemental copy of any omitted schedule or similar attachment to the Securities and Exchange Commission upon request.

- 17 -

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

March 23, 2018

|

WESTMOUNTAIN COMPANY

|

|

|

|

|

|

|

|

By

|

/s/ James R. Garvin,

|

|

|

|

James R. Garvin, Chief Executive Officer, and Director (Principal Executive Officer)

|

- 18 -