Attached files

| file | filename |

|---|---|

| EX-32.1 - GULF RESOURCES, INC. | e617832_ex32-1.htm |

| EX-31.2 - GULF RESOURCES, INC. | e617832_ex31-2.htm |

| EX-31.1 - GULF RESOURCES, INC. | e617832_ex31-1.htm |

| EX-23.1 - GULF RESOURCES, INC. | e617832_ex23-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2017

Or

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ________________ to ________________

Commission file number 001-34499

Gulf Resources, Inc.

(Exact name of registrant as specified in its charter)

| Nevada | 13-3637458 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

| Level 11,Vegetable Building, Industrial Park of the East Shouguang City, Shandong, China | 262700 | |

| (Address of principal executive offices) | (Zip Code) |

+86 (536) 567-0008

Registrant’s telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered |

| Common Stock, $0.0005 par value | NASDAQ Global Select Market |

Securities registered pursuant to section 12(g) of the Act:

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer," "accelerated filer,” and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer o | Emerging Growth Company o |

| Non-accelerated filer (Do not check if a smaller reporting company) o | Smaller reporting company x | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes o No x

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter. As of June 30, 2017, the aggregate market value of the common stock of the registrant held by non-affiliates (excluding shares held by directors, officers and others holding more than 5% of the outstanding shares of the class) was $52,265,626 based upon a closing sale price of $1.59.

APPLICABLE ONLY TO REGISTRANTS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PRECEDING FIVE YEARS:

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15 of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

Yes o No o

(APPLICABLE ONLY TO CORPORATE REGISTRANTS)

As of March 14, 2018, the registrant had outstanding 46,803,791 shares of common stock.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s Proxy Statement relating to the Registrant’s 2018 Annual Meeting of Shareholders are incorporated by reference into Part III of this Annual Report on Form 10-K.

EXPLANATORY NOTE: THIS AMENDMENT TO THE ANNUAL REPORT ON FORM 10-K FOR THE FISCAL YEAR ENDED DECEMBER 31, 2017 IS BEING FILED TO (I) UPDATE ITEM 1. BUSINESS TO PROVIDE INFORMATION ON NEW DEVELOPMENTS ON THE RECTIFICATION PROCESS FOR OUR BROMINE AND CRUDE SALT FACTORIES AND THE RELOCATION PROCESS FOR CHEMICAL FACTORIES, AND (II) PROVIDE AN UPDATED AUDITOR’S CONSENT.

| PART I | |||

| Item 1. | Business | 1 | |

| Item 1A. | Risk Factors | 11 | |

| Item 1B | Unresolved Staff Comments | 12 | |

| Item 2. | Properties | 12 | |

| Item 3. | Legal Proceedings | 19 | |

| Item 4. | Mine Safety Disclosures | 19 | |

| PART IV | |||

| Item 15. | Exhibits and Financial Statement Schedules | 20 | |

| Signatures | 21 | ||

Special Note Regarding Forward Looking Information

This report contains forward-looking statements that reflect management's current views and expectations with respect to our business, strategies, future results and events, and financial performance. All statements made in this report other than statements of historical fact, including statements that address operating performance, events or developments that management expects or anticipates will or may occur in the future, including statements related to future reserves, cash flows, revenues, profitability, adequacy of funds from operations, statements expressing general optimism about future operating results and non-historical information, are forward-looking statements. In particular, the words "believe", "expect", "intend", "anticipate", "estimate", "plan", "may", "will", variations of such words and similar expressions identify forward-looking statements, but are not the exclusive means of identifying such statements and their absence does not mean that the statement is not forward-looking. Readers should not place undue reliance on forward-looking statements which are based on management's current expectations and projections about future events, are not guarantees of future performance, are subject to risks, uncertainties and assumptions. Our actual results, performance or achievements could differ materially from the results expressed in, or implied by, these forward-looking statements. Factors that could cause or contribute to such differences include those discussed in this report, particularly under the caption "Risk Factors". Except as required under the federal securities laws, we do not undertake any obligation to update the forward-looking statements in this report.

PART I

Introduction

We manufacture and trade bromine and crude salt, natural gas, manufacture and sell chemical products used in oil and gas field exploration, oil and gas distribution, oil field drilling, papermaking chemical agents, inorganic chemicals, and manufacture and sell materials for human and animal antibiotics. To date, our products have been sold only within the People’s Republic of China. As used in this report, the terms "we," "our," "Company" and "Gulf Resources" refers to Gulf Resources, Inc. and its wholly-owned subsidiaries, and the terms “ton” and “tons” refers to metric tons, in each case, unless otherwise stated or the context requires otherwise. All information in this report gives retroactive effect to a 4-for-1 reverse stock split of our common stock effected on October 12, 2009.

The functional currency of the Company’s operating foreign subsidiaries is the Renminbi (“RMB”), which had an average exchange rate of $0.15062 and $0.14811 during fiscal years 2016 and 2017, respectively. The functional and reporting currency of the Company is the United States dollar (“USD” or $”).

1

Our Corporate History

We were originally incorporated in Delaware and subsequently re-incorporated in Nevada. From November 1993 through August 2006, we were engaged in the business of owning, leasing and operating coin and debit card pay-per copy photocopy machines, fax machines, microfilm reader-printers and accessory equipment under the name “Diversifax, Inc.”. Due to the increased use of internet services, demand for our services declined sharply, and in August 2006, our Board of Directors decided to discontinue our operations.

Upper Class Group Limited, incorporated in the British Virgin Islands in July 2006, acquired all the outstanding stock of Shouguang City Haoyuan Chemical Company Limited ("SCHC"), a company incorporated in Shouguang City, Shandong Province, the People's Republic of China (the “PRC”), in May 2005. At the time of the acquisition, members of the family of Mr. Ming Yang, our president and former chief executive officer, owned approximately 63.20% of the outstanding shares of Upper Class Group Limited. Since the ownership of Upper Class Group Limited and SCHC was then substantially the same, the acquisition was accounted for as a transaction between entities under common control, whereby Upper Class Group Limited recognized the assets and liabilities transferred at their carrying amounts.

On December 12, 2006, our Company, then known as Diversifax, Inc., a public "shell" company, acquired Upper Class Group Limited and SCHC. Under the terms of the agreement, the stockholders of Upper Class Group Limited received 13,250,000 (restated for the 2-for-1 stock split in 2007 and the 1-for-4 stock split in 2009) shares of our voting common stock in exchange for all outstanding shares of Upper Class Group Limited. Members of the Yang family received approximately 62% of our common stock as a result of the acquisition. Under accounting principles generally accepted in the United States, the share exchange is considered to be a capital transaction rather than a business combination. That is, the share exchange is equivalent to the issuance of stock by Upper Class Group Limited for the net assets of Gulf Resources, Inc., accompanied by a recapitalization, and is accounted for as a change in capital structure. Accordingly, the accounting for the share exchange is identical to that resulting from a reverse acquisition, except no goodwill is recorded. Under reverse takeover accounting, the post reverse acquisition comparative historical consolidated financial statements of the legal acquirer, Diversifax, Inc., are those of the legal acquiree, Upper Class Group Limited. Share and per share amounts stated have been retroactively adjusted to reflect the share exchange. On February 20, 2007, we changed our corporate name to Gulf Resources, Inc.

On February 5, 2007, we acquired Shouguang Yuxin Chemical Industry Co., Limited ("SYCI"), a company incorporated in the People's Republic of China. Under the terms of the acquisition agreement, the stockholders of SYCI received a total of 8,094,059 (restated for the 2-for-1 stock split in 2007 and the 1-for-4 stock split in 2009) shares of common stock of Gulf Resources, Inc. in exchange for all outstanding shares of SYCI's common stock. Simultaneously with the completion of the acquisition, a dividend of $2,550,000 was paid to the former stockholders of SYCI. At the time of the acquisition, approximately 49.1% of the outstanding shares of SYCI were owned by Ms. Yu, Mr. Yang’s wife, and the remaining 50.9% of the outstanding shares of SYCI were owned by SCHC, all of whose outstanding shares were owned by Mr. Yang and his wife. Since the ownership of Gulf Resources, Inc. and SYCI are substantially the same, the acquisition was accounted for as a transaction between entities under common control, whereby Gulf Resources, Inc. recognized the assets and liabilities of SYCI at their carrying amounts. Share and per share amounts have been retroactively adjusted to reflect the acquisition.

To satisfy certain ministerial requirements necessary to confirm certain government approvals required in connection with the acquisition of SCHC by Upper Class Group Limited, all of the equity interest of SCHC were transferred to a newly formed Hong Kong corporation named Hong Kong Jiaxing Industrial Limited (“Hong Kong Jiaxing”) all of the outstanding shares of which are owned by Upper Class Group Limited. The transfer of all of the equity interest of SCHC to Hong Kong Jiaxing received approval from the local State Administration of Industry and Commerce on December 10, 2007.

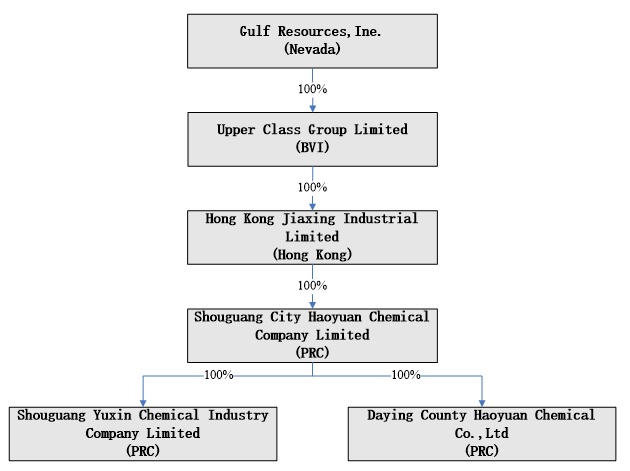

As a result of the transactions described above, our corporate structure is linear. That is Gulf Resources owns 100% of the outstanding shares of Upper Class Group Limited, which owns 100% of the outstanding shares of Hong Kong Jiaxing, which owns 100% of the outstanding shares of SCHC, which owns 100% of the outstanding shares of SYCI. Further, as a result of our acquisitions of SCHC and SYCI, our historical consolidated financial statements, as contained in our Consolidated Financial Statements and Management's Discussion and Analysis, appearing elsewhere in the report, reflect the accounts of SCHC and SYCI.

On October 12, 2009, we completed a 1-for-4 reverse stock split of our common stock, such that for each four shares outstanding prior to the stock split there was one share outstanding after the reverse stock split. All shares of common stock referenced in this report have been adjusted to reflect the stock split figures. On October 27, 2009, our shares began trading on the NASDAQ Global Select Market under the ticker symbol “GFRE” and on June 30, 2011 we changed our ticker symbol to “GURE” to better reflect our corporate name.

On January 12, 2015, the Company and SCHC entered into an Equity Interest Transfer Agreement with Shouguang City Rongyuan Chemical Co., Ltd (“SCRC”) pursuant to which SCHC agreed to acquire SCRC and all rights, title and interest in and to all assets owned by SCRC, a leading manufacturer of materials for human and animal antibiotics in China and other parts of Asia.

On February 4, 2015 the Company closed the transactions contemplated by the agreement between the Company, SCHC and SCRC.

On the Closing Date, the Company issued 7,268,011 shares of its common stock, par value $0.0005 per share (the “Shares”), at the closing market price of $1.84 per Share on the closing date to the four former equity owners of SCRC .The issuance of the Shares was exempt from registration pursuant to Regulation S of the Securities Act of 1933, as amended. On the Closing Date, the Company entered into a lock-up agreement with the four former equity owners of SCRC. In accordance with the terms of the lock-up agreement, the shareholders agreed not to sell or transfer the Shares for five years from the date the stock certificates evidencing the Shares were issued.

The sellers of SCRC agreed as part of the purchase price to accept the Shares, based on a valuation of $2.00, which was a 73% premium to the price on the day the agreement was reached. For accounting purposes, the Shares are now being valued at $1.84, which was the closing price of our stock on the closing date of the agreement. The price difference between the original $2.00 and the current $1.84 is solely for accounting purposes. There has been no change in the number of shares issued.

On November 24, 2015, Gulf Resources, Inc., a Delaware corporation consummated a merger with and into its wholly-owned subsidiary, Gulf Resources, Inc., a Nevada corporation. As a result of the reincorporation, the Company is now a Nevada corporation.

2

On December 15, 2015, the Company registered a new subsidiary in the Sichuan Province of the PRC named Daying County Haoyuan Chemical Company Limited (“DCHC”) with registered Capital of RMB50,000,000, and there was RMB13,848,730 capital contributed by SCHC as of December 31, 2017. DCHC was established to further explore and develop natural gas and brine resources (including bromine and crude salt) in China.

On September 2, 2016, the Company announced the planned merger of two of its 100% owned subsidiaries, ShouguanYuxin Chemical Co., Limited (“SYCI”) and ShouguanRongyuan Chemical Co., Ltd (“SCRC”). On March 24, 2017, the legal process of the merger was completed and SCRC was officially deregistered on March 28, 2017. The results of these two subsidiaries were reported as SYCI in the fiscal year 2017.

Our current corporate structure chart is set forth in the following diagram:

Our executive offices are located in China at Level 11,Vegetable Building, Industrial Park of the East in Shouguang City, Shandong Province, P.R.C. Our telephone number is +86 (536) 5670008. Our website address is www.gulfresourcesinc.com. The information contained on or accessed through our website is not intended to constitute and shall not be deemed to constitute part of this Form 10-K.

Closure and rectification process of our Bromine, Crude Salt and Chemical Products factories

On September 1, 2017, the company received letters from the Yangkou County, Shouguang City government to each of its subsidiaries, Shouguang City Haoyuan Chemical Company Limited and Shouguang Yuxin Chemical Industry Co., Limited, which stated that in an effort to improve the safety and environmental protection management level of chemical enterprises, the plants are requested to immediately stop production and perform rectification and improvements in accordance with the country's new safety, environmental protection requirements.

Later on the local government organized the Safety Supervision and Administration Department and the Environmental Protection Departments conducted inspections of every bromine production enterprise within its jurisdiction, in order to improve security, environmental protections, pollution, and safety. The Company has been working closely with the County authorities developing rectification plans for both its bromine and its chemical businesses. The Company and the government agreed on a rectification plan for Haoyuan Chemicals, the Company’s bromine business which is currently under process.

The Company has converted its bromine and crude salt factories from coal to electricity, installed computerized production monitoring and safety equipment, lined all of the salt ponds, paved roads, and performed some other upgrades. The total cost of rectification is estimated to be approximately $35 million. During 2017, the Company spent $17.9 million on this process. The largest portion, $13.7 million was spent on enhancement work in the salt fields. The additional $4.2 million was primarily for equipment. In 2018, the Company will continue to invest in this project on enhancement projects for transmission channels and ducts, equipment and upgrades.

In addition to the $35 million, the Company expects to spend an additional $40 million in 2018 to carry out enhancement projects for its extraction wells. This should allow the Company to increase its efficiency and utilization.

We expect to complete the rectification and improvements of the bromine and crude salt factories and be ready for the government inspection in the first half of 2018, and will resume operations upon receipt of approval from the government. Once we receive the approval from government, we will begin test production, and will begin to carefully ramp up production in each of the factories. Full production should be achieved in a few months.

After the completion of the rectification, the only potential constraint is the waste water treatment. It is still unclear if the government will place some small limitations on waste water. We are currently working with the government on the waste water issue. In the worst case, it is possible we may have a small reduction in capacity.

Because many smaller producers have not had the capital to conduct the rectification required by the government, management believes there could be some extremely attractive acquisition opportunities in bromine. At the present time, All of management’s attention is focused on getting its facilities approved and in full production. However, management could consider acquisitions in this segment in the future if the prices were sufficiently attractive.

On November 24, 2017, we received a letter from the People’s Government of Yangkou County, Shouguang City notifying the Company that due to the new standards and regulations relating to safety production and environmental pollution, from certain local governmental departments, such as the municipal environmental protection department, the security supervision department and the fire department, have decided to relocate chemical enterprises to a new industrial park called Bohai Marine Fine Chemical Industry Park. Chemical companies that are not invited into the park will be permanently closed. Although we are in compliance with regulations within the county, due to the proximity of our subsidiary, Shouguang Yuxin Chemical Co.’s, production plant in or near a residential area, we have been invited to relocate our chemical production plant to Bohai Marine Fine Chemical Industry Park. This is due to the country’s effort to improve the development of the chemical industry, manage safe production and curb environmental pollution accidents effectively, as well as ensure the quality of the environment for residents. All chemical enterprises which do not comply with the requirements of the safety and environmental protection regulations will be ordered to shut down. However, we must not commence activities until we have relocated the production plant and received qualified acceptances from related departments.

3

To date, we have secured the land for the chemical factory. We are currently working on the design of the factory as well as the relevant documents to apply for construction and project plan certificates. We expect this process of take several months. The level of capital expenditures in 2018 will depend on the timing of the approvals. As soon as the design, project plan, and construction are approved, Gulf will move ahead as quickly as possible We expect the new factory will be fully operational by the beginning of 2020. However, we are working very hard to get the project completed earlier. There is an impairment loss on the property, plant and equipment related to the relocation of our chemical production plant to Bohai Marine Fine Chemical Industry Park in the amount of $16,636,322, since much of the equipment that was used in the chemical factories was relatively old. Further, even if it had been newer, we believe that it might not have passed new environmental tests. The total cost of the new factories is currently estimated to be $60 million. We have incurred a relocation cost of $9,732,118 for land lease.

We are not writing off any of the goodwill related to our chemicals business. We believe the new chemical factory should be able to produce strong sales and profits. There may be much less capacity in the chemical industry, as many factories may be permanently closed. In addition, other factories will have their capacity reduced. We should have a very modern factory that operates highly efficiently. With less competition and better equipment, we believe can generate sales and earnings in this segment at a level well above previous results.

We will continue to control the land and buildings where the old chemical factories are located. At this time, we have not considered how or if we can monetize this asset.

Our Business Segments

Our business operations are conducted in four segments, bromine, crude salt, chemical products, and natural gas. We manufacture and trade bromine, crude salt and natural gas, and manufacture and sell chemical products used in oil and gas field exploration, oil and gas distribution, oil field drilling, papermaking chemical agents, inorganic chemicals and manufacturer of materials for human and animal antibiotics. We conduct all of our operations in China.

Bromine and Crude Salt

We manufacture and distribute bromine through our wholly-owned subsidiary, Shouguang City Haoyuan Chemical Company Limited, or SCHC. Bromine (Br2) is a halogen element and it is a red volatile liquid at standard room temperature which has reactivity between chlorine and iodine. Elemental bromine is used to manufacture a wide variety of bromine compounds used in industry and agriculture. Bromine is also used to form intermediates in organic synthesis, in which it is somewhat preferable over iodine due to its lower cost. Our bromine is commonly used in brominated flame retardants, fumigants, water purification compounds, dyes, medicines and disinfectants.

The extraction of bromine in the Shandong Province is limited by the Provincial Government to licensed operations. We hold one such license. As part of our business strategy, it is our plan to continue acquiring smaller scaled and unlicensed producers and to use our bromine to expand our downstream chemical operations.

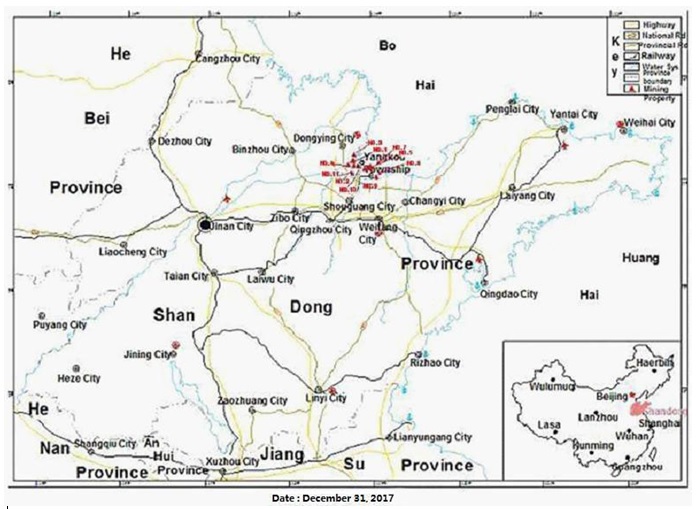

Location of Production Sites

Our production sites are located in the Shandong Province in northeastern China. The productive formation (otherwise referred to as the “working region”), extends from latitude N 36°56’ to N 37°20’ and from longitude E 118°38’ to E 119°14’, in the north region of Shouguang city, from the Xiaoqing River of Shouguang city to the west of the Dan River, bordering on Hanting District in the east, from the main channel of “Leading the Yellow River to Supply Qingdao City Project” in the south to the coastline in the north. The territory is classified as coastal alluvial – marine plain with an average height two to seven meters above the sea level. The terrain is relatively flat.

Geological background of this region

The Shandong Province working region is located to the east of Lubei Plain and on the south bank of Bohai Laizhou Bay. The geotectonic location bestrides on the North China Platte (I) and north three-level structure units, from west to east including individually the North China Depression, Luxi Plate, and Jiaobei Plate. Meanwhile, 4 V-level structure units including the Dongying Sag of Dongying Depression (IV) of North China Depression, the Buried Lifting Area of Guangrao, Niutou sag and Buried Lifting Area of Shuanghe and are all on two V-level structure units including Xiaying Buried Lifting Area of Weifang Depression (IV) of Luxi Plate and Chuangyi Sag, as well as on a V-level structure units of Jiaobei Buried Lifting Area of Jiaobei Plate.

Processing of Bromine

Natural brine is a complicated salt-water system, containing many ionic compositions in which different ions have close interdependent relationships and which can be reunited to form many dissolved soluble salts such as sodium chloride, potassium chloride, calcium sulfate, potassium sulfate and other similar soluble salts. The goal of natural brine processing is to separate and precipitate the soluble salts or ions away from the water. Due to the differences in the physical and chemical characteristics of brine samples, the processing methods are varied, and can result in inconsistency of processing and varied technical performance for the different useful components from the natural brine.

Bromine is the first component extracted during the processing of natural brine. In natural brine, the bromine exists in the form of bromine sodium and bromine magnesium and other soluble salts.

The bromine production process is as follows:

| 1. | natural brine is pumped from underground through extraction wells by subaqueous pumps; | |

| 2. | the natural brine then passes through transmission pipelines to storage reservoirs; | |

| 3. | the natural brine is sent to the bromine refining plant where bromine is extracted from the natural brine. In neutral or acidic water, the bromine ion is easily oxidized by adding the oxidative of chlorine, which generates the single bromine away from the brine. Thereafter the extracted single bromine is blown out by forced air, then absorbed by sulfur dioxide or soda by adding acid, chlorine and sulfur. Extracted bromine is stored in containers of different sizes; and | |

| 4. | the wastewater from this refining process is then transported by pipeline to brine pans. |

Our production feeds include (i) natural brine; (ii) vitriol; (iii) chlorine; (iv) sulfur; and (v) coal.

4

Crude Salt

We also produce crude salt, which is produced from the evaporation of the wastewater after our bromine production process. Once the brine is returned to the surface and the bromine is removed, the remaining brine is pumped to on-site containing pools and then exposed to natural sunshine. This causes the water to evaporate from the brine, resulting in salt being left over afterwards. Crude salt is the principal material in alkali production as well as chlorine alkali production and is widely used in the chemical, food and beverage, and other industries.

Chemical Products

We produce chemical products through our wholly-owned subsidiary, Shouguang Yuxin Chemical Industry Company Limited, or SYCI. The products we produce and the markets in which they are sold include, among others:

| Product name | Application sector |

| Hydroxyl guar gum | Oil Exploration & Production |

| Demulsified agent | Oil Exploration & Production |

| Corrosion inhibitor for acidizing | Oil Exploration & Production |

| Bactericide | Oil Exploration / Agricultural |

| Iron ion stabilizer | Oil Exploration & Production |

| Clay stabilizing agent | Oil Exploration & Production |

| Solid lubricant | Oil Exploration & Production |

| Polyether lubricant | Oil Exploration & Production |

| Bromopropane | Agricultural |

| Chlorantraniliprole | Agricultural |

| Remaining agent | Paper Making |

| Enhanced mild paper expansion agent | Paper Making |

| Chelant | Paper Making |

| Semi-finished Product of Tetramethylbenzidine | Pharmaceutical intermediates |

| Semi-finished Product of Trimethylolpropane | Pharmaceutical intermediates |

| Material of Lactic acid Trimethylolpropane | Pharmaceutical intermediates |

| Sodium Methoxide | By Products |

| Hydrobroic Acid | By Products |

| Sodium Bromide | By Products |

| Di Bromo Aldehyde | Agricultural &Pharmaceutical intermediates |

| Environment-friendly Solid Lubricants | Oil Exploration & Production |

| Environment-friendly Polyether Lubricants | Oil Exploration & Production |

SYCI concentrates its efforts on the production and sale of chemical products that are used in oil and gas field exploration, oil and gas distribution, oil field drilling, papermaking chemical agents, inorganic chemicals and manufacture and sell materials that are used for human and animal antibiotics.. SYCI also engages in depth study of existing products and new product research and development at the same time. Currently, SYCI's annual production of oil and gas field exploration products and related chemicals is over 26,000 tons, and its production of papermaking-related chemical products is over 5,000 tons. These products are mainly distributed to large domestic papermaking manufacturers and major oilfields such as Shengli Oilfield and Talimu Oilfields. SYCI's annual production capacity of materials that are used for human and animal antibiotics is over 6,800 tons.

SYCI’s factories are located in Shouguang City at 2nd Living District, Qinghe Oil Factory, Shouguang City, Shandong Province, China. The company has been certified as ISO9001-2000 compliant and received the Quality Products and Services Guarantee Certificate from China Association for Quality. SYCI has been accredited by Shandong as a Provincial Credit Enterprises and is a Class One supplier for both China Petroleum & Chemical Corporation (“SINOPEC”) and Petro China Company Limited.

Segment disclosure

We have four reportable segments: bromine, crude salt, chemical products and natural gas.

5

The amounts set forth below are based upon on an average RMB to USD exchange rates of $0.15062 and $0.14811 during fiscal years 2016 and 2017, respectively.

| Net Revenue by Segment | ||||||||||||||||

| Year Ended December 31, 2017 | Year Ended December 31, 2016 | |||||||||||||||

| Segment: | % of total | % of total | ||||||||||||||

| Bromine | $ | 42,224,901 | 39 | % | $ | 56,811,730 | 38 | % | ||||||||

| Crude Salt | $ | 8,986,080 | 8 | % | $ | 8,985,852 | 6 | % | ||||||||

| Chemical Products | $ | 56,311,460 | 53 | % | $ | 83,477,420 | 56 | % | ||||||||

| Total sales | $ | 107,522,441 | 100 | % | $ | 149,275,002 | 100 | % | ||||||||

| Segment: | Percentage Decrease in Net Revenue from fiscal year 2016 to 2017 | |||

| Bromine | (26 | %) | ||

| Crude Salt- | — | |||

| Chemical Products | (33 | %) | ||

| SCHC’s products sold in metric tons | Year ended December 31, 2017 | Year ended December 31, 2016 | Percentage Change Decrease | |||||||||

| Bromine | 10,681 | 14,955 | (29 | %) | ||||||||

| Crude Salt | 274,534 | 316,161 | (13 | %) | ||||||||

| Chemical products segment sold in metric tons | Year ended December 31, 2017 | Year ended December 31, 2016 | Percentage Change Decrease | |||||||||

| Oil and gas exploration additives | 6,751 | 10,505 | (36 | %) | ||||||||

| Paper manufacturing additives | 2,016 | 3,032 | (33 | %) | ||||||||

| Pesticides manufacturing additives | 1,309 | 2,179 | (40 | %) | ||||||||

| Pharmaceutical intermediates | 1,058 | 1,617 | (35 | %) | ||||||||

| By products | 7,638 | 12,043 | (37 | %) | ||||||||

| 18,772 | 29,376 | (36 | %) | |||||||||

| Income from Operations by Segment | ||||||||||||||||

| Year ended December 31, 2017 | Year ended December 31, 2016 | |||||||||||||||

| Segment: | % of total | % of total | ||||||||||||||

| Bromine | $ | 12,460,230 | 90 | % | $ | 21,224,862 | 45 | % | ||||||||

| Crude Salt | $ | 2,426,137 | 18 | % | 9,076 | — | ||||||||||

| Chemical Products | $ | (1,024,569 | ) | (7 | %) | $ | 25,473,792 | 55 | % | |||||||

| Natural Gas | $ | (116,465 | ) | (1 | %) | $ | (4,906 | ) | — | |||||||

| Income from operations before corporate costs | $ | 13,745,333 | 100 | % | $ | 46,702,824 | 100 | % | ||||||||

| Corporate costs | $ | (1,015,963 | ) | $ | (682,210 | ) | ||||||||||

| Unrealized translation difference | $ | (1,557,759 | ) | $ | 1,702,728 | |||||||||||

| Income from operations | $ | 11,171,611 | $ | 47,723,342 | ||||||||||||

6

Year Ended December 31, 2017 | Bromine * | Crude Salt * | Chemical Products | Natural Gas | Segment Total | Corporate | Total | |||||||||||||||||||||

| Net revenue (external customers) | $ | 42,224,901 | $ | 8,986,080 | $ | 56,311,460 | $ | — | $ | 107,522,441 | $ | — | $ | 107,522,441 | ||||||||||||||

| Net revenue (intersegment) | 6,305,642 | — | — | — | 6,305,642 | — | 6,305,642 | |||||||||||||||||||||

| Income from operations before income taxes | 12,460,230 | 2,426,137 | (1,024,569 | ) | (116,465 | ) | 13,745,333 | (2,573,722 | ) | 11,171,611 | ||||||||||||||||||

| Income taxes | 3,156,016 | 585,521 | (131,397 | ) | — | 3,610,140 | 5,402,000 | 9,012,140 | ||||||||||||||||||||

| Income from operations after income taxes | 9,304,214 | 1,840,616 | (893,172 | ) | (116,465 | ) | 10,135,193 | (7,975,722 | ) | 2,159,471 | ||||||||||||||||||

| Total assets | 147,124,127 | 51,512,530 | 186,677,501 | 2,119,756 | 387,433,914 | 65,509 | 387,499,423 | |||||||||||||||||||||

| Depreciation and amortization | 14,533,169 | 2,452,737 | 3,211,407 | — | 20,197,313 | — | 20,197,313 | |||||||||||||||||||||

| Capital expenditures | 465,655 | 17,411,762 | — | 61,235 | 17,938,652 | — | 17,938,652 | |||||||||||||||||||||

| Goodwill | — | — | 29,374,909 | — | 29,374,909 | — | 29,374,909 | |||||||||||||||||||||

Year Ended December 31, 2016 | Bromine * | Crude Salt * | Chemical Products | Natural Gas | Segment Total | Corporate | Total | |||||||||||||||||||||

| Net revenue (external customers) | $ | 56,811,730 | $ | 8,985,852 | $ | 83,477,420 | $ | — | $ | 149,275,002 | $ | — | $ | 149,275,002 | ||||||||||||||

| Net revenue (intersegment) | 8,484,617 | — | — | — | 8,484,617 | — | 8,484,617 | |||||||||||||||||||||

| Income from operations before income taxes | 21,224,862 | 9,076 | 25,473,792 | (4,906 | ) | 46,702,824 | 1,020,518 | 47,723,342 | ||||||||||||||||||||

| Income taxes | 5,306,216 | 9,022 | 6,494,969 | — | 11,810,207 | — | 11,810,207 | |||||||||||||||||||||

| Income from operations after income taxes | 15,918,646 | 54 | 18,978,823 | (4,906 | ) | 34,892,617 | 1,020,518 | 35,913,135 | ||||||||||||||||||||

| Total assets | 143,145,960 | 33,980,033 | 186,676,983 | 1,799,094 | 365,602,070 | 89,283 | 365,691,353 | |||||||||||||||||||||

| Depreciation and amortization | 15,056,980 | 5,221,667 | 4,601,599 | — | 24,880,246 | — | 24,880,246 | |||||||||||||||||||||

| Capital expenditures | 12,912,583 | 2,335,963 | — | 1,747,316 | 16,995,862 | — | 16,995,862 | |||||||||||||||||||||

| Goodwill | — | — | 27,668,539 | — | 27,668,539 | — | 27,668,539 | |||||||||||||||||||||

Sales and Marketing

We have an in-house sales staff of 19 persons. Our customers send their orders to us first. Our in-house sales staff then attempts to satisfy these orders based on our actual production schedules and inventories on hand. Many of our customers have a long term relationship with us. We expect this to continue due to stable demand for mineral products, however, these relationship can not be guaranteed in the future.

Principal Customers

We sell a substantial portion of our products to a limited number of PRC customers. Our principal customers during 2017 were Shandong Morui Chemical Company Limited, Shandong Brother Technology Limited, Kuerle Xingdong Trading Limited, Shouguang Weidong Chemical Company Limited and Shouguang Shen Runfa Ocean Chemical Company Limited. We have ongoing policies in place to ensure that sales are made to customers who are credit-worthy. We are not aware of any allowances for doubtful debts required for each of the years ended December 31, 2017 and 2016.

7

During each of the years ended December 31, 2017 and 2016, sales to our three largest bromine customers, based on net revenue from such customers, aggregated $17,950,659 and $23,862,341, respectively, or approximately 43% and 42% of total net revenue from sale of bromine; and sales to our largest customer represented approximately 19% and 17%, respectively, of total net revenue from the sale of bromine.

During each of the years ended December 31, 2017 and 2016, sales to our three largest crude salt customers, based on net revenue from such customers, aggregated $8,947,283 and $8,985,852, respectively, or approximately 100% and 100% of total net revenue from sale of crude salt; and sales to our largest customer represented approximately 42% and 43%, respectively, of total net revenue from the sale of crude salt.

During each of the years ended December 31, 2017 and 2016, sales to our three largest chemical products customers, based on net revenue from such customers, aggregated $8,269,199 and $12,887,715, respectively, or approximately 15% and 15% of total net revenue from sale of chemical products; and sales to our largest customer represented approximately 6% and 7%, respectively, of total net revenue from the sale of chemical products.

This concentration of customers for all three segments makes us vulnerable to an adverse near-term impact, should one or more of these relationships be terminated.

Principal Suppliers

Our principal external suppliers are Shandong Xinlong Biological Technology Company limited, Shouguang City Rongguang Trading Company Limited and Shandong Xinlong Group Company limited, Shouguang Hongye Trading Company Limited and Zibo City Zichuan Fuli Chemical Raw Material Factory.

During each of the years ended December 31, 2017 and 2016, we purchased 66% and 61%, respectively, of raw materials for our bromine and crude production from three suppliers.

During each of the years ended December 31, 2017 and 2016, we purchased 55% and 70%, respectively, of raw materials for our chemical products production from three suppliers. We purchased a portion of the bromine produced by the Company internally as well, at cost totaling $6,305,642 and $8,484,617, for the years ended December 31, 2017 and 2016 respectively, for the production of chemical products.

This supplier concentration makes us vulnerable to a near-term adverse impact, should the relationships be terminated.

8

Business Strategy

Expansion of Production Capacity to Meet Demand

▼ Bromine and Crude Salt

In view of keen competition and the trend of less bromine contraction of brine water being extracted in Shouguang City, Shandong Province, the Company had announced its intent to access more bromine and crude salt resources by finding new underground brine water resources in the Sichuan Province. The Company completed the drilling of its first exploratory well in December 2011 and announced in mid-January 2012 that the Company discovered underground brine water resources in Daying County. In September 2014, the Company started deeper drilling exploration under its existing well and did an exploration analysis on the resources from different levels. On January 30, 2015 we announced that we had found natural gas resources under our bromine well in the Sichuan area. On November 23, 2015 the company’s wholly owned subsidiary SCHC entered into an agreement with the People’s Government of Daying County in Sichuan Province for the exploration and development of natural gas and brine resources (including bromine and crude salt). On January 11, 2017, the Company announced that it completed the first brine water and natural gas well field construction in Sichuan Province. Later on January 20, 2017 it announced the commencement of trial production. Then later on, the company found some issues related to the water and other potential impurities in the natural gas during trial production.

Currently, the company has found the solution to solve the waste water problem in the natural gas project. Now it is trying to solve the technical drilling problem. The Company had been working with Xinan Shiyou Daxue (Southwest Petroleum University) and found the way to solve the technical drilling problem of DCHC and ordered custom equipment. The natural gas project may commence production gradually once such equipment arrives and are being installed. The Company will strive for completion in the first half of 2018.

In order to improve the bromine and crude salt production capacity, the Company will continue to enhance its existing bromine and crude salt production facilities. In the fourth quarter of 2017, the Company incurred enhancement works in our crude salt field at a cost of approximately $13.7 million. The Company expects to carry out enhancement projects for the extraction wells in 2018, which will cost approximately $40 million. We also expect to carry out enhancement projects for the transmission channels and ducts for rectification and improvement in order to meet the new environmental rules in China in 2018, which will costs of approximately $8.5 million. The company will also expect to invest approximately $1.0 million in Sichuan Province for the natural gas resource project in 2018. The Company expects such enhancement expenditures will be funded by the Company’s cash on hand.

On September 1, 2017, the Company received notification from the Government of Yangkou County, Shouguang City of PRC that production at all its factories be halted with immediate effect in order for the Company to perform rectification and improvement in accordance with the county’s new safety and environmental protection requirements.

The Company has been working closely with the County authorities to develop rectification plans for both its bromine and crude salt businesses and had agreed on a plan in October 2017. SCHC is currently under rectification process. The Company believes this rectification and improvement process will cost approximately $35 million in total. The Company incurred rectification and improvements in the amount of $17,938,652 as of December 31, 2017. The Company expects to complete the rectification and improvements of the bromine and crude salt factories and be ready for the government inspection in the first half of 2018, and will resume operations upon receipt of approval from the government.

▼ Chemical Products

On November 24, 2017, the Company received a letter from the Government of Yangkou County, Shouguang City notifying the Company to relocate its two chemical production plants located in the second living area of the Qinghe Oil Extraction Plant to the Bohai Marine Fine Chemical Industrial Park. This is because the two plants are located in a residential area and their production activities will have certain impact on the living environment of the residents. This is as a result of the country’s effort to improve the development of the chemical industry, manage safe production and curb environmental pollution accident effectively, and ensure the quality of living environment of residents. All chemical enterprises which do not comply with the requirements of the safety and environmental protection regulations will be ordered to shut down. The Company believes this relocation process will cost approximately $60 million in total. The Company incurred relocation cost in the amount of $9,732,118 as of December 31, 2017 and estimated that the new factory will be fully operational by the beginning of 2020.

9

Competition

To date, our sales have been limited to customers within the PRC and we expect that our sales will remain primarily domestic for the immediate future. Our marketing strategy involves developing long term ongoing working relationships with customers based on large multi-year agreements which foster mutually advantageous relationships.

We compete with PRC domestic private companies and state-owned companies. Certain state-owned and state backed competitors are more established and have more control of certain resources in terms of pricing than we do. We compete in our business based on price, our reputation for quality and on-time delivery, our relationship with suppliers and our geographical proximity to natural brine deposits in the PRC for bromine, crude salt and chemical productions. Management believes that our stable quality, manufacturing processes and plant capacity for the production of bromine, crude salt and chemical products are key considerations in awarding contracts in the PRC.

Our principal competitors in the bromine business are Shandong Yuyuan Group Company Limited, Shandong Haihua Group Company Limited, Shandong Dadi Salt Chemical Group Company Limited and Shandong Haiwang Chemical Company Limited, all of which produce bromine principally for use in their chemicals businesses and sell part of the bromine produced to customers. These companies may switch to selling bromine to the market if they no longer use bromine in their chemical businesses.

Our principal competitors in the crude salt business are Shandong Haiwang Chemical Company Limited, Shandong Haihua Group Company Limited, Shandong Weifang Longwei Industrial Company Limited, Shandong Yuyuan Group Company Limited and Shandong Caiyangzi Saltworks.

Our principal competitors in the chemical business are Beijing Shiji Zhongxing Energy Technology Co., Ltd, Yanan Chaozheng Nijiang Co., Ltd, Shandong Dacheng Pesticides Company Limited, Binhua Group Company Limited, Dongying City Dongchen (Group) Chemical Industry Company Limited, Beijing Peikangjiaye Technologies Limited, Shouguang Fukang Pharmaceutical Co., Ltd. Shandong Xinhua Pharmaceutical Limited by Share Ltd, Hunan Erkang Pharmaceutical Limited by Share Ltd and Xinan Synthetic Pharmaceutical Limited by Share Ltd.

Government Regulation

China has begun to reinforce the environmental requirements for the entire chemical industry, demanding the closure or rectification of those factories that do not meet the emission requirements and are highly polluting. In early 2017, the government announced the closure or relocation of those chemical industry facilities that are close to residential areas and the new environmental law officially came into full effect in January 2018.

The following is a summary of the principal governmental laws and regulations that are or may be applicable to our operations in the PRC. The scope and enforcement of many of the laws and regulations described below are uncertain. We cannot predict the effect of further developments in the Chinese legal system, including the promulgation of new laws, changes to existing laws or the interpretation or enforcement of laws.

In the natural resources sector, the PRC and the various provinces have enacted a series of laws and regulations over the past 20 years, including laws and regulations designed to improve safety and decrease environmental degradation. The "China Mineral Resources Law" declares state ownership of all mineral resources in the PRC. However, mineral exploration rights can be purchased, sold and transferred to foreign owned companies. Mineral resource rights are granted by the Central Government permitting recipients to conduct mineral resource activities in a specific area during the license period. These rights entitle the licensee to undertake mineral resource activities and infrastructure and ancillary work, in compliance with applicable laws and regulations, within the specific area covered by the license during the license period. The licensee is required to submit a proposal and feasibility studies to the relevant authority and to pay the Central Government a natural resources tax in an amount equal to a percent of annual crude salt sales and tones of bromine sold. Shandong Province has determined that bromine is to be extracted only by licensed entities and we hold one of such licenses. Despite the province desire to limit extraction to licensed entities hundreds of smaller operations continue to extract bromine without licenses.

The Ministry of Land and Resources (“MLR”) is the principal regulator of mineral rights in China. The Ministry has authority to grant licenses for land-use and exploration rights, issue permits for mineral rights and leases, oversee the fees charged for them and their transfer, and review reserve evaluations. We are required to hold a bromine and salt production license in order to operate our bromine and salt production business in the PRC. Our bromine and salt production license is subject to a yearly audit. If we do not successfully pass the yearly approval by relevant government authorities, our bromine and salt production operations may be suspended until we are able to comply with the license requirements which could have a material adverse effect on our business, financial condition and results of operations.

10

All of our operating activities in China have been authorized by or obtained written consent from land and resources departments of local governments except bromine Factory No.10 and 11. In addition, all of our operations are subject to and have passed government safety inspections. We also have been granted environmental certification from the PRC Bureau of Environmental Protection that is not subject to expiration.

Employees

As of December 31, 2017, we employed approximately 699 full-time employees, of whom approximately 64% are with SCHC, 35% are with SYCI. Approximately 6% of our employees are management personnel and 4% are sales and procurement staff. None of our employees are represented by a union.

Our employees in China participate in a state pension arrangement organized by Chinese municipal and provincial governments. We are required to contribute to the arrangement at the rate of 19% of the average monthly salary. In addition, we are required by Chinese law to cover employees in China with other types of social insurance. Our total contribution amounts to 30% of the average monthly salary. We have purchased social insurance for almost all of our employees. Expense related to social insurance was approximately $1,093,716 for fiscal year 2017.

Available Information

We make available free of charge on or through our internet website, www.gulfresourcesinc.com, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and all amendments to those reports, if any, filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 as soon as reasonably practicable after they are electronically filed with, or furnished to, the Securities and Exchange Commission. The information contained on our website is not intended to be incorporated into this Annual Report on Form 10-K.

Pursuant to Item 301(c) of Regulation S-K (§ 229.301(c)), the Company is not required to provide the information required by this Item as it is a “smaller reporting company,” as defined by Rule 229.10(f)(1).

11

Item 1B. Unresolved Staff Comments.

None.

FIGURE 2.1 - REGIONAL MAP OF MINING PROPERTIES

12

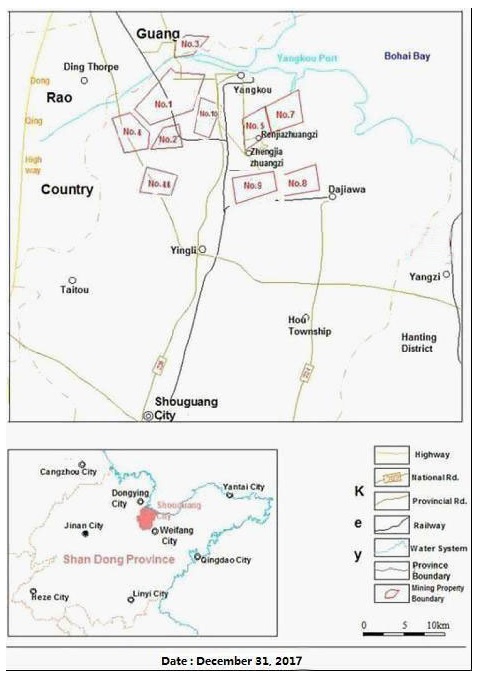

FIGURE 2.2 - DETAILED MAP OF MINING PROPERTIES

We do not own any land, although we do own some of the buildings on land we lease. Our executive offices are located in China at Level 11, Vegetable Building, Industrial Park of the East in Shouguang City, Shandong Province, P.R.C, which also is the headquarters of SCHC and SYCI. These offices were purchased from Shandong Shouguang Vegetable Seed industry Group Co., Ltd, in which Mr. Ming Yang, the Chairman of the Company, had 99% equity interest.

SYCI concentrates its efforts on the production and sale of chemical products that are used in oil and gas field exploration, oil and gas distribution, oil field drilling, papermaking chemical agents, inorganic chemicals and manufacture and sell materials that are used for human and animal antibiotics in China located in at 2nd Living District, Qinghe Oil Factory, Shouguang City, Shandong Province, China.

DCHC, is a registered company exploring and developing natural gas and brine resources (including bromine and crude salt) in China located in No.14 team, Liguanggou Village, Tianbao Township, Daying County, Suining City, Sichuan Province, China.

13

The Company operates its bromine and crude salt production facilities through its wholly-owned subsidiary SCHC. SCHC has land use rights to one property (10,790 square meters, or approximately 3 acre) as bromine production area for Factory No. 1 and land lease contracts to ten properties (approximately 24,179 acre), totaling nearly 24,183 acre, located on the south bank of Laizhou Bay on the Shandong Peninsula of the People’s Republic of China (“China”). Each of the properties is accessible by road. The Yiyang railway line is within 50 kilometers and the Yangkou port is five kilometers away.

Each of the ten properties contains natural brine deposits which are extracted through wells and are used to extract bromine and produce crude salt. Bromine is a simple molecular element which is produced by extracting the bromine ion from natural brine. Crude salt is sodium chloride. Bromine is an important chemical raw material in flame retardants, fire extinguishing agents, refrigerants, photographic materials, pharmaceuticals, pesticides, and oil and other industries. Crude salt, also known as industrial salt, is used in a wide range of chemical industries, is the major raw material in the soda and chlor-alkali industries and can be widely used in agricultural, animal husbandry, fisheries and food processing industries. Crude salt is also the main raw material for edible salt.

Nature of Ownership Interest in the Properties

All of the land in the PRC is owned by the State. Individuals and companies are permitted to acquire rights to use land or land use rights for specific purposes at no cost. In the case of land used for industrial purposes, the land use rights are granted for a period of 50 years. This period may be renewed at the expiration of the initial and any subsequent terms. Granted land use rights are transferable and may be used as security for borrowings and other obligations. The Company does not own any land but has entered into contracts with the local government and original owners of the land use rights to acquire their rights for a period of 50 years. The contracts required us to pay a one-time fee plus an annual rent.

Mineral Rights

The Chinese and provincial governments have enacted a series of laws and regulations relating to the natural resources sector over the past 20 years, including laws and regulations designed to improve safety and decrease environmental degradation. The “China Mineral Resources Law” declares state ownership of all mineral resources in China. However, mineral exploration rights can be purchased, sold and transferred to both domestic and foreign owned companies. Mineral resource rights are granted by the central government permitting recipients to conduct mineral resource activities in a specific area during the license period. These rights entitle the licensee to undertake mineral resource activities and infrastructure and ancillary work, in compliance with applicable laws and regulations, within the specific area covered by the license during the license period. The licensee is required to submit a proposal and feasibility studies to the relevant authority and to pay the central government a natural resources tax in an amount equal to RMB 1,050 per tonne of bromine sales volumes. The Company was exempt from paying the fee prior to January 1, 2008. Shandong province has determined that bromine is to be extracted only by licensed entities.

Our mineral rights are issued by the local government and allow for a one year period of mining. The rights provide us with the exclusive rights to explore and extract natural brine under the leased land and produce bromine and crude salt. The government performs an annual inspection of the company’s previous year’s state of production & operations at beginning of each year. The annual inspection reviews: (1) whether the production is safe and if any accidents occurred during the previous year; (2) whether the natural resources tax and other taxes were timely paid; (3) whether employees’ salary and welfare benefits were timely paid; and (4) whether the Company meets environment protection meet standards. Only those companies who pass the inspection receive mineral rights for another one year term. For those companies who do not pass the inspection, additional mineral rights are not allocated until they can meet the requirements. If there is major safety accident, the government may revoke the mining permit. All of the relevant documentation to apply for renewal of mining rights must be filed with the Land and Resources Bureau before March 31st each year.

All of our bromine and crude salt production facilities have been authorized by the local land and resources departments except bromine Factory No.10 and 11, of which Factories No. 1 to No. 4 are included under a single permit, which was originally issued in January 2005. And this permit was updated on July 2016, which Factories No. 1 to No. 4, and Factory 7 are included under a single permit issued on July 2016. For Factories No. 5, 8, 9, 10 and 11, the related mining permit applications are under review by the local land and resources departments, nevertheless we have obtained written consent from the local land and resources department to commence the production for Factories No. 5, 8 and 9. In addition, all of our operations are subject to and have passed government safety inspections. We also have been granted environmental certification from the PRC Bureau of Environmental Protection.

Factories No. 1 to No. 11 are in their production stage and operate bromine extraction and crude salt production facilities. The facilities each include wells, which are used to extract natural brine from underground, natural brine transmission pipelines, natural brine storage reservoirs, bromine refining equipment, wastewater transport pipes, and drying brine drying pans.

14

The equipment and facilities described above were constructed within three months after the acquisition of each of our respective properties using the latest technology and equipment and do not currently require modernization. Because bromine is a highly corrosive liquid, the equipment undergoes inspection and maintenance each year, especially the subaqueous pumps which need to be regularly inspected and maintained or replaced. Also, enhancements to certain protective shells to the crude salt fields, extraction wells and transmission channels and ducts are carried out every 5 to 8 years, depending on the erosion rate, which is affected by different weather conditions and the change in acid components of brine water over time.

As of December 31, 2017, the Company had invested approximately $97.4 million in its eleven production factories and facilities (including the demolition of Factory No.6 in 2016) and paid approximately $20.3 million in prepaid land lease payments and mineral rights. The Company incurred enhancement works in our protection shells to crude salt fields at costs of approximately $13.74 million for the fiscal year 2017. In light of the increased labor and raw materials costs of construction projects in recent years, the cost to replace those eroded parts increased the overall cost of the enhancement project to its current level.

Each of the ten bromine production facilities is provided with electricity and water by local government utilities.

The following is a description of the land use and mineral rights related to each of the ten properties held by SCHC as of December 31, 2017.

All of the bromine factories are under rectification process without production.

| Property | Factory No. 1 – Haoyuan General Factory |

| Area | 6,442 acres |

| Date of Acquisition | February 5, 2007 |

| Land Use Rights Lease Term | Fifty Years |

| Land Use Rights Expiration Date | 2054 (for mining areas only) |

| The number of remaining years to expiration of the of the land lease as of December 31, 2017 |

36.25 Years

|

| Prior fees paid for land use rights | RMB8.6 million |

| Annual Rent | RMB186,633 |

| Mining Permit No.: | C3707002009056220022340 |

| Date of Permission: | July 2016, subject to renewal per three years |

| Period of Permission: | Three year |

| Property | Factory No. 1 branch – State-owned Shouguang Qinshuibo Farm |

| Area | 0.79 acres |

| Date of Factory lease | January 1, 2011 |

| Factory Lease Term | Twenty Years |

| Factory lease Expiration Date | 2030 |

| The number of remaining years to expiration of the of the factory lease as of December 31, 2017 |

13.0 Years

|

| Prior Fees Paid for Land Use Rights | Not applicable |

| Annual Rent | RMB5,000,000 |

| Mining Permit No.: | Under application |

| Property | Factory No. 2 – Yuwenbo |

| Area | 1,846 acres |

| Date of Acquisition | April 7, 2007 |

| Land Use Rights Lease Term | Fifty Years |

| Land Use Rights Expiration Date | 2052 |

| The number of remaining years to expiration of the of the land lease as of December 31, 2017 |

35 Years

|

| Prior Fees Paid For Land Use Rights | RMB7.5 million |

| Annual Rent | RMB162,560 |

| Mining Permit No.: | C3707002009056220022340 |

| Date of Permission: | July 2016, subject to renewal per three years |

| Period of Permission: | Three year |

| Property | Factory No. 2 – State Operated Shouguang Qingshuibo Farm |

| Area | 568 acres |

| Date of Acquisition | December 30, 2010 |

| Land Use Rights Lease Term | Thirty Years |

| Land Use Rights Expiration Date | 2040 |

| The number of remaining years to expiration of the of the land lease as of December 31, 2017 |

23.7 Years

|

| Prior Fees Paid for Land Use Rights | Not applicable |

| Annual Rent | RMB172,500 (increase 5% per year) |

| Mining Permit No.: | Under application |

15

| Property | Factory No. 3 – Yangdonghua |

| Area | 2,318 acres |

| Date of Acquisition | June 8, 2007 |

| Land Use Rights Lease Term | Fifty Years |

| Land Use Rights Expiration Date | 2052 |

| The number of remaining years to expiration of the of the land lease as of December 31, 2017 |

34.3 Years

|

| Prior Fees Paid For Land Use Rights | RMB5 million |

| Annual Rent | RMB111,317 |

| Mining Permit No.: | C3707002009056220022340 |

| Date of Permission: | July 2016, subject to renewal per three years |

| Period of Permission: | Three year |

| Property | Factory No. 4 – Liuxingji |

| Area | 2,310 acres |

| Date of Acquisition | October 26, 2007 |

| Land Use Rights Lease Term | Fifty Years |

| Land Use Rights Expiration Date | 2054 |

| The number of remaining years to expiration of the of the land lease as of December 31, 2017 |

36.83 Years

|

| Annual Rent | RMB139,255 |

| Prior Fees Paid For Land Use Rights | RMB6.5 million |

| Mining Permit No.: | C3707002009056220022340 |

| Date of Permission: | July 2016, subject to renewal per three years |

| Period of Permission: | Three year |

| Property | Factory No. 4 – Shouguan City Yangkou Government |

| Area | 5.6 acres |

| Date of Land lease | February 20, 2012 |

| Land Use Rights Lease Term | Twenty Years |

| Land Use Rights Expiration Date | 2031 |

| The number of remaining years to expiration of the of the land lease as of December 31, 2017 |

14 Years

|

| Annual Rent | RMB 100,000 |

| Prior Fees Paid For Land Use Rights | Not applicable |

| Mining Permit No.: | Not applicable |

| Property | Factory No. 5 – Wangjiancai |

| Area | 2,165 acres |

| Date of Acquisition | October 25, 2007 |

| Land Use Rights Lease Term | Fifty Years |

| Land Use Rights Expiration Date | 2054 |

| The number of remaining years to expiration of the of the land lease as of December 31, 2017 |

37 Years

|

| Annual Rent | RMB176,441 |

| Prior Fees Paid for Land Use Rights | RMB8.3 million |

| Mining Permit No.: | Under application, written consent obtained from local land and resources departments |

| Property | Factory No. 7 – Qiufen Yuan |

| Area | 1,611 acres |

| Date of Acquisition | January 7, 2009 |

| Land Use Rights Lease Term | Fifty Years |

| Land Use Rights Expiration Date | 2059 |

| The number of remaining years to expiration of the of the land lease as of December 31, 2017 |

41.17 Years

|

| Prior Fees Paid for Land Use Rights | Not applicable |

| Annual Rent | RMB171,150 (increase 5% per two years) |

| Mining Permit No.: | C3707002009056220022340 |

| Date of Permission: | July 2016, subject to renewal per three years |

| Period of Permission: | Three year |

16

| Property | Factory No. 8 – Fengxia Yuan |

| Area | 2,723 acres |

| Date of Acquisition | September 7, 2009 |

| Land Use Rights Lease Term | Fifty Years |

| Land Use Rights Expiration Date | 2059 |

| The number of remaining years to expiration of the of the land lease as of December 31, 2017 |

41.66 Years

|

| Prior Fees Paid for Land Use Rights | Not applicable |

| Annual Rent | RMB347,130 (increase 5% per two years) |

| Mining Permit No.: | Under application, written consent obtained from local land and resources departments |

| Property | Factory No. 9 – Jinjin Li |

| Area | 759 acres |

| Date of Acquisition | June 7, 2010 |

| Land Use Rights Lease Term | Fifty Years |

| Land Use Rights Expiration Date | 2060 |

| The number of remaining years to expiration of the of the land lease as of December 31, 2017 |

42.5 Years

|

| Prior Fees Paid for Land Use Rights | Not applicable |

| Annual Rent | RMB184,000 (increase 5% per two years) |

| Mining Permit No.: | Under application, written consent obtained from local land and resources departments |

| Property | Factory No. 10 – Liangcai Zhang |

| Area | 1,700 acres |

| Date of Acquisition | December 22, 2011 |

| Land Use Rights Lease Term | Ten Years |

| Land Use Rights Expiration Date | 2021 |

| The number of remaining years to expiration of the of the land lease as of December 31, 2017 |

4.0 Years

|

| Prior Fees Paid for Land Use Rights | Not applicable |

| Annual Rent | RMB688,000 (increase 5% per year) |

| Mining Permit No.: | Under application |

| Property | Factory No. 11 – Chengyong Zhao |

| Area | 1,730 acres |

| Date of Acquisition | November 26, 2012 |

| Land Use Rights Lease Term | Twenty Years |

| Land Use Rights Expiration Date | 2032 |

| The number of remaining years to expiration of the of the land lease as of December 31, 2017 |

15.0 Years

|

| Prior Fees Paid for Land Use Rights | Not applicable |

| Annual Rent | RMB918,800 (increase 5% per year) |

| Mining Permit No.: | Under application |

17

Leased Facility

On November 5, 2010, SCHC entered into a Lease Contract with State-Operated Shouguang Qingshuibo Farm. Pursuant to the Lease Contract, SCHC shall lease certain property with an area of 3,192 square meters (or 0.8 acres) or and buildings adjacent to the Company’s Factory No. 1. There are currently non-operating bromine production facilities on the property which have not been in production for more than 12 months. The annual lease payment for the property is RMB 5.0 million, approximately $794,550, per year and shall be paid by SCHC no later than June 30th of each year. The term of the Lease Contract is for twenty years commencing from January 1, 2011. The Lease Contract may be renewed by SCHC for an additional twenty year period on the same terms. The Lessor has agreed to permit SCHC to reconstruct and renovate the existing bromine production facilities on the property.

The chart below represents the annual production capacity and annualized utilization ratios for our bromine producing properties currently leased by the Company, which are all located in Shouguang City, Shandong Province, China. There are no proven and probable reserves located on our properties.

| Bromine Property | Facility Acquisition Date | Acres | Annual Production (in tons) | 2017 Utilization Ratio | 2016 Utilization Ratio | |||||||||||||||

| Factory No. 1 | — | 6,442 | 6,681 | 44 | % | 38 | % | |||||||||||||

| Factory No. 2 | April 7, 2007 | 1,846 | 4,844 | 40 | % | 36 | % | |||||||||||||

| Factory No. 3 | June 8, 2007 | 2,318 | 4,701 | 39 | % | 33 | % | |||||||||||||

| Factory No. 4 | October 26, 2007 | 2,310 | 3,801 | 43 | % | 37 | % | |||||||||||||

| Factory No. 5 and Factory No. 7 * | October 25, 2007/ January 7, 2009 | 3,776 | 6,986 | 45 | % | 39 | % | |||||||||||||

| Factory No. 6* | January 8, 2008 | 2,641 | 4,539 | — | 32 | % | ||||||||||||||

| Factory No. 8 | September 7, 2009 | 2,723 | 4,016 | 43 | % | 38 | % | |||||||||||||

| Factory No. 9 | June 7, 2010 | 759 | 2,793 | 39 | % | 35 | % | |||||||||||||

| Subdivision of Factory No. 1 | January 1, 2011 | 1 | 3,186 | 38 | % | 34 | % | |||||||||||||

| Factory No. 10 | December 22, 2011 | 1,700 | 3,000 | 42 | % | 37 | % | |||||||||||||

| Factory No. 11 | November 26, 2012 | 1,730 | 2,800 | 40 | % | 36 | % | |||||||||||||

| * | Bromine production for Factory No. 5 and Factory No. 7 were combined in early 2010 as both factories are located adjacent to each other. |

| * | Bromine production for Factory No. 6 was demolished in November 2016. |

| # | Except for Factory No. 10 and No.11 which were acquired after the assessment performed, annual production capacities for other factories were reassessed by Grant Sherman Appraisal Limited on October 28, 2011. |

Each of the properties described above was not in operation when the Company acquired the asset. The owners of each of the properties did not hold the proper license for the exploration and production of bromine, and production at each of the assets acquired had been previously halted by the government. With respect to Factory No. 2, the property had not been operational for nine months; with respect to Factory No. 3, the property had not been operational for eleven months; with respect to Factory No. 4 and No. 5, the property had not been operational for fifteen months; with respect to Factory No. 6, the property had not been operational for eighteen months; with respect to Factory No. 7, the property had not been operational for thirteen months; with respect to Factory No. 8, the property had not been operational for fourteen months; and with respect to Factories No. 9 No. 10 and No.11, the assets had not been operational for six months.

The following table shows the annual bromine produced and sold for each of our production facilities and the weighted average price received for all products sold for the last two years.

| 2017 | 2016 | |||||||||||||||||||||||

| Bromine Facility | Produced (in tons) | Sold (in tons) | Selling price (RMB/ton) | Produced (in tons) | Sold (in tons) | Selling price (RMB/ton) | ||||||||||||||||||

| Factory No. 1 | 1,948 | 2,050 | 26,897 | 2,556 | 2,584 | 25,152 | ||||||||||||||||||

| Factory No. 2 | 1,283 | 1,297 | 26,863 | 1,737 | 1,737 | 25,214 | ||||||||||||||||||

| Factory No. 3 | 1,215 | 1,257 | 27,101 | 1,530 | 1,526 | 25,184 | ||||||||||||||||||

| Factory No. 4 | 1,083 | 1,130 | 26,954 | 1,413 | 1,414 | 25,192 | ||||||||||||||||||

| Factory No. 5 and Factory No. 7 * | 2,096 | 2,154 | 26,919 | 2,735 | 2,715 | 25,141 | ||||||||||||||||||

| Factory No. 6* | — | — | — | 1,457 | 1,525 | 25,116 | ||||||||||||||||||

| Factory No. 8 | 1,146 | 1,176 | 26,954 | 1,514 | 1,513 | 25,197 | ||||||||||||||||||

| Factory No. 9 | 722 | 757 | 26,897 | 976 | 977 | 25,192 | ||||||||||||||||||

| Subdivision of Factory No. 1 | 843 | 863 | 27,105 | 1,096 | 1,096 | 25,180 | ||||||||||||||||||

| Factory No. 10 | 817 | 837 | 26,904 | 1,089 | 1,088 | 25,200 | ||||||||||||||||||

| Factory No. 11 | 739 | 766 | 26,983 | 1,006 | 999 | 25,192 | ||||||||||||||||||

| Total(Note A) | 11,892 | 12,287 | 17,110 | 17,173 | ||||||||||||||||||||

| * | Bromine production for Factory No. 5 and Factory No. 7 were combined in early 2010 as both factories are located adjacent to each other. |

| * | Bromine production for Factory No. 6 was demolished in November 2016. |

| Note A | This includes sale to the chemical segment |

18

The following table shows the annual crude salt produced and sold for each of our production facilities and the weighted average price received for all products sold for the last two years.

| 2017 | 2016 | |||||||||||||||||||||||

| Crude Salt Facility | Produced (in tons) | Sold (in tons) | Selling price (RMB/ton) | Produced (in tons) | Sold (in tons) | Selling price (RMB/ton) | ||||||||||||||||||

| Factory No. 1 | 4,950 | 7,721 | 211 | 7,220 | 5,543 | 189 | ||||||||||||||||||

| Factory No. 2 | 17,148 | 17,164 | 210 | 25,980 | 21,988 | 190 | ||||||||||||||||||

| Factory No. 5 and Factory No. 7 * | 91,329 | 151,265 | 223 | 129,900 | 117,796 | 189 | ||||||||||||||||||

| Factory No. 6* | — | — | — | 29,800 | 40,364 | 189 | ||||||||||||||||||

| Factory No. 8 | 58,420 | 68,064 | 214 | 88,400 | 78,426 | 189 | ||||||||||||||||||

| Factory No. 9 | 30,258 | 30,320 | 215 | 49,400 | 52,045 | 189 | ||||||||||||||||||

| Total | 202,105 | 274,534 | 330,700 | 316,161 | ||||||||||||||||||||

| * | Bromine production for Factory No. 5 and Factory No. 7 were combined in early 2010 as both factories are located adjacent to each other. |

| * | Bromine production for Factory No. 6 was demolished in November, 2016. |

The following table shows the chemical products produced and sold for our SYCI’s production facilities and the weighted average price received for all products sold for the last two years.

| 2017 | 2016 | |||||||||||||||||||||||

| Chemical Products | Produced (in tons) | Sold (in tons) | Selling price (RMB/ton) | Produced (in tons) | Sold (in tons) | Selling price (RMB/ton) | ||||||||||||||||||

| Oil and gas exploration additives | 6,547 | 6,751 | 12,994 | 10,488 | 10,505 | 14,696 | ||||||||||||||||||

| Paper manufacturing additives | 1,973 | 2,016 | 7,696 | 3,033 | 3,032 | 8,838 | ||||||||||||||||||

| Pesticides manufacturing additives | 1,297 | 1,309 | 36,279 | 2,179 | 2,179 | 39,824 | ||||||||||||||||||

| Pharmaceutical intermediates | 2,689 | 1,075 | 155,251 | 4,088 | 1,617 | 139,891 | ||||||||||||||||||

| By products | 7,627 | 7,638 | 8,324 | 12,044 | 12,043 | 8,123 | ||||||||||||||||||

| Total | 20,133 | 18,789 | 31,832 | 29,376 | ||||||||||||||||||||

None

Item 4. Mine Safety Disclosures.

Not applicable.

19

PART IV

Item 15. Exhibits and Financial Statement Schedules.

(a) Financial Statements and Schedules

| (1) | Financial Statements – The financial statements filed as part of this filing are listed on the index to the Financial Statements and Supplementary Data, Item 8 of Part II, on page F-1.** |

| (2) | Financial Statement Schedules – “Schedule I – Parent Only Financial Information” filed as part of this filing is listed on the Financial Statements and Supplementary Data, Item 8 of Part II, on pages S-1 and S-2. All other financial statement schedules have been omitted because they are not applicable, or the information required is set forth in the Consolidated Financial Statements or related notes thereto.** |

(b) Exhibit Index

* Filed herewith.