Attached files

| file | filename |

|---|---|

| 8-K - 8-K - AVISTA CORP | investorpresentation8-k03x.htm |

Positioned for performance:

An overview of 2017 and beyond

West Coast Utilities Seminar

Las Vegas, Nevada

March 21-22, 2018

NYSE: AVA www.avistacorp.com

Exhibit 99.1

Disclaimer

2

All forward-looking statements in this presentation are based on underlying

assumptions (many of which are based, in turn, upon further assumptions). These

statements are subject to a variety of risks and uncertainties and other factors. Most

of these factors are beyond our control and may have a significant effect on our

operations, results of operations, financial condition or cash flows, which could cause

actual results to differ materially from those anticipated in the forward-looking

statements.

Such risks, uncertainties and other factors include, among others, those included in

the appendix herein and in our most recent Annual Report on Form 10-K, or Quarterly

Report on Form 10-Q, filed with the Securities and Exchange Commission. Those

reports are also available on our website at www.avistacorp.com

3

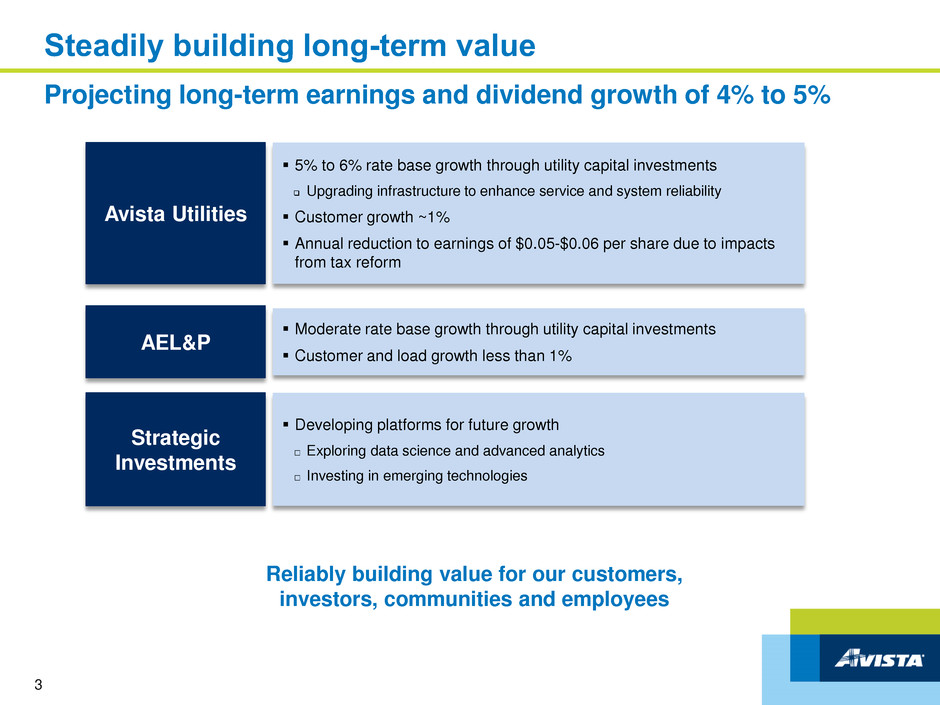

Steadily building long-term value

Reliably building value for our customers,

investors, communities and employees

Projecting long-term earnings and dividend growth of 4% to 5%

Avista Utilities

AEL&P

Strategic

Investments

5% to 6% rate base growth through utility capital investments

Upgrading infrastructure to enhance service and system reliability

Customer growth ~1%

Annual reduction to earnings of $0.05-$0.06 per share due to impacts

from tax reform

Moderate rate base growth through utility capital investments

Customer and load growth less than 1%

Developing platforms for future growth

□ Exploring data science and advanced analytics

□ Investing in emerging technologies

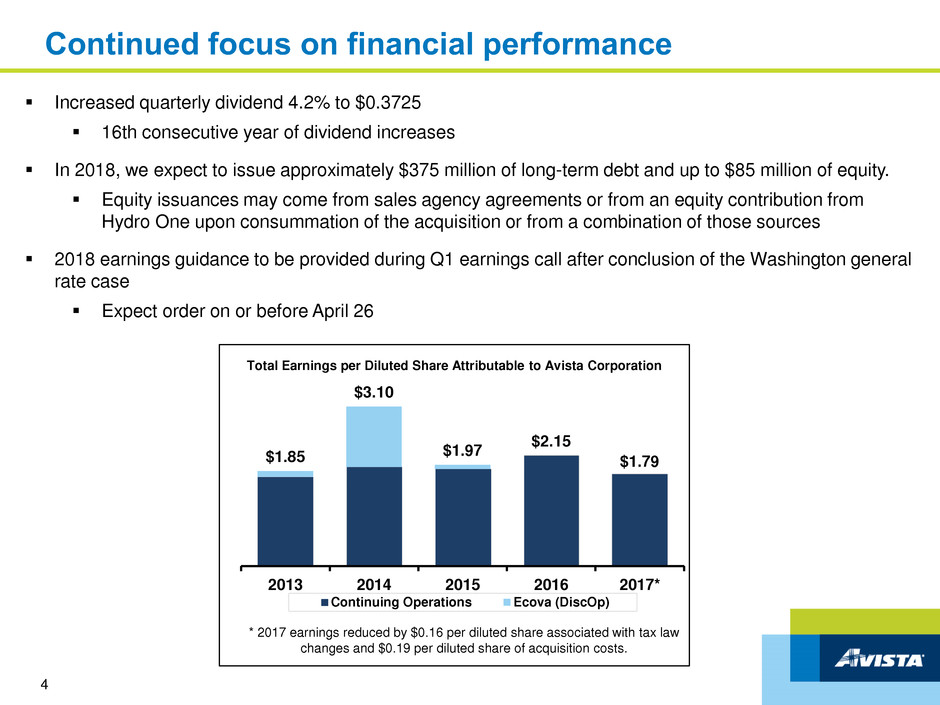

Continued focus on financial performance

4

Increased quarterly dividend 4.2% to $0.3725

16th consecutive year of dividend increases

In 2018, we expect to issue approximately $375 million of long-term debt and up to $85 million of equity.

Equity issuances may come from sales agency agreements or from an equity contribution from

Hydro One upon consummation of the acquisition or from a combination of those sources

2018 earnings guidance to be provided during Q1 earnings call after conclusion of the Washington general

rate case

Expect order on or before April 26

$1.85

$3.10

$1.97

$2.15

2013 2014 2015 2016 2017*

Continuing Operations Ecova (DiscOp)

$1.79

Total Earnings per Diluted Share Attributable to Avista Corporation

* 2017 earnings reduced by $0.16 per diluted share associated with tax law

changes and $0.19 per diluted share of acquisition costs.

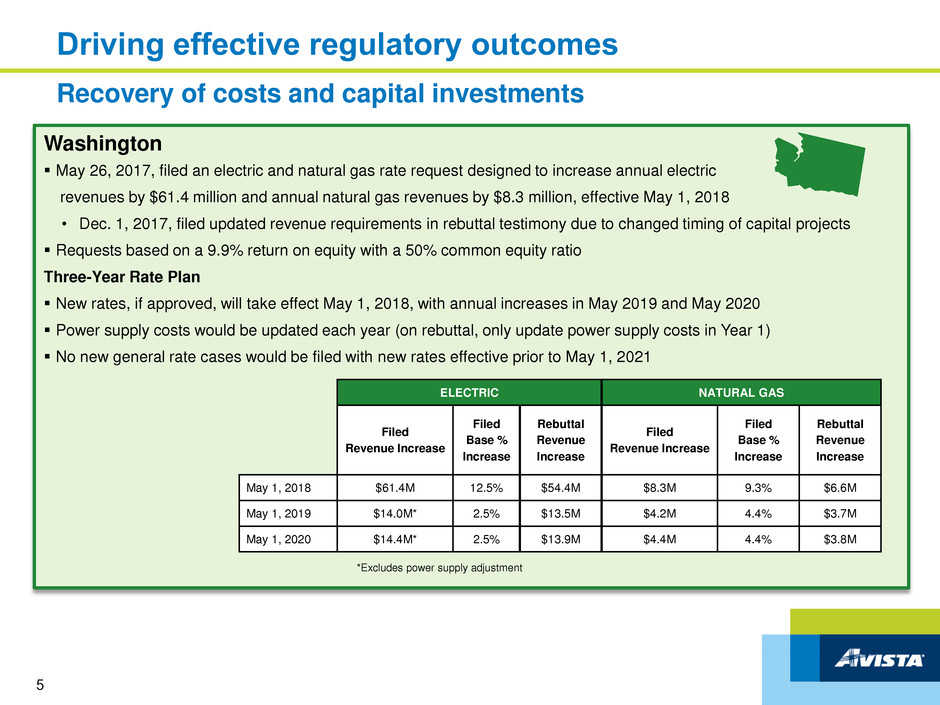

5

Washington

May 26, 2017, filed an electric and natural gas rate request designed to increase annual electric

revenues by $61.4 million and annual natural gas revenues by $8.3 million, effective May 1, 2018

• Dec. 1, 2017, filed updated revenue requirements in rebuttal testimony due to changed timing of capital projects

Requests based on a 9.9% return on equity with a 50% common equity ratio

Three-Year Rate Plan

New rates, if approved, will take effect May 1, 2018, with annual increases in May 2019 and May 2020

Power supply costs would be updated each year (on rebuttal, only update power supply costs in Year 1)

No new general rate cases would be filed with new rates effective prior to May 1, 2021

Driving effective regulatory outcomes

Recovery of costs and capital investments

ELECTRIC NATURAL GAS

Filed

Revenue Increase

Filed

Base %

Increase

Rebuttal

Revenue

Increase

Filed

Revenue Increase

Filed

Base %

Increase

Rebuttal

Revenue

Increase

May 1, 2018 $61.4M 12.5% $54.4M $8.3M 9.3% $6.6M

May 1, 2019 $14.0M* 2.5% $13.5M $4.2M 4.4% $3.7M

May 1, 2020 $14.4M* 2.5% $13.9M $4.4M 4.4% $3.8M

*Excludes power supply adjustment

6

Working through the impacts of Tax Reform

2017 Impacts

Recorded a $442.3 million regulatory liability

$339.9 million in excess deferred taxes and $102.4 million in income tax

gross-up of the excess deferred taxes

Recorded a $10.2 million, or $0.16 per diluted share, adjustment to

income tax expense in fourth quarter

$7.5 million related to Avista Utilities and $2.7 million related to other

businesses

Ongoing

Impacts

Estimated customer benefit of $50-$60 million annually

Current regulatory proceedings to address impacts

Expect annual reduction to earnings of $0.05-$0.06 per diluted share

Future operating cash flows are negatively affected and could impact credit

rating agency metrics

Moody’s rating outlook changed to negative

7

Avista to be acquired by Hydro One

Key

Transaction

Terms

Offer price of US$53.00 per Avista common share in cash

Represents a 24% premium to Avista’s closing price on July 18, 2017 of US$42.74

Equity purchase price of US$3.4 billion (C$4.4 billion)

Total enterprise value of US$5.3 billion (C$6.7 billion), including Avista debt assumed

Avista preserves corporate identity and maintains headquarters in Spokane

Timing

and

Approvals

Shareholder approval obtained at special meeting on Nov. 21, 2017

Filed for approval with all five state regulators and FERC

Received FERC approval

Requested state regulatory decisions by August 2018

Proposed customer rate credit of $31.5 million over 10 years

Upcoming key dates:

3/27: WA settlement agreement filed by parties

3/29: OR company rebuttal due

4/10: WA testimony in support of settlement agreement

4/12: OR settlement conference #2

4/26: ID settlement conference #1

Expect to file other regulatory approvals in 2018

Expected closing date in the second half of 2018

8

Our focus in 2018

Photo: Pullman Energy Storage Project

Continue to operate our business consistent with our 129 year history

Focused on regulatory approval process and successful completion of the merger with Hydro

One in the second half of 2018

Business as usual

We welcome your questions

Company Contact

Lauren Pendergraft, Investor Relations Manager

509-495-2998

Lauren.pendergraft@avistacorp.com

www.avistacorp.com

Photo: Huntington Park, Spokane, Wash.

9

Appendix

10

11

Strong and stable utility core

Regulated electric and natural gas operations

Serves customers in Washington, Idaho and Oregon

Contributes about 95% of earnings

Regulated electric operations

Serves customers in City and Borough of Juneau

Avista Utilities

Alaska Electric Light

& Power Company

(AEL&P)

Long history of service, trust,

innovation and collaboration

Photo: Spokane River Upper Falls

Avista Utilities

Significant investments in utility infrastructure

12

13

Diverse customer base

□ 30,000 square mile service territory

□ Service area population 1.6 million

– 382,000 electric customers

– 347,000 natural gas customers

Strong customer focus

□ 90% percent or better customer satisfaction

ratings every year since 1999

□ Developing key customer initiatives

Invested in our communities

□ More than $2.5 million per year in charitable

donations and over 48,500 volunteer hours

from our employees

Providing safe and reliable service for 129 years

Solid foundation and continued commitment to innovation

Information as of Dec. 31, 2017

14

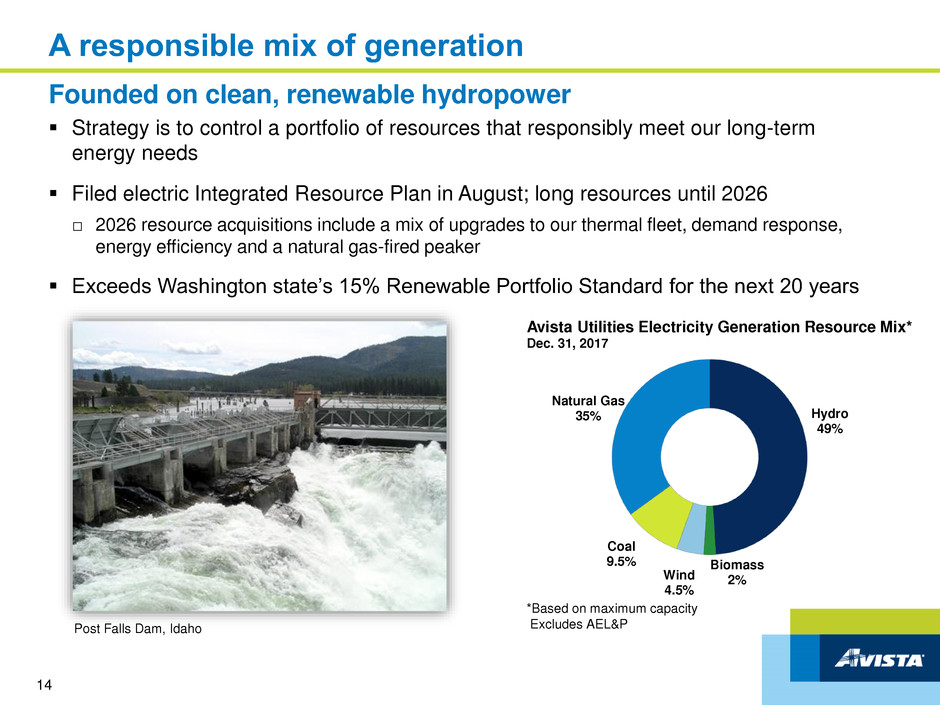

A responsible mix of generation

Hydro

49%

Biomass

2%Wind

4.5%

Coal

9.5%

Natural Gas

35%

Avista Utilities Electricity Generation Resource Mix*

Dec. 31, 2017

Strategy is to control a portfolio of resources that responsibly meet our long-term

energy needs

Filed electric Integrated Resource Plan in August; long resources until 2026

□ 2026 resource acquisitions include a mix of upgrades to our thermal fleet, demand response,

energy efficiency and a natural gas-fired peaker

Exceeds Washington state’s 15% Renewable Portfolio Standard for the next 20 years

Founded on clean, renewable hydropower

*Based on maximum capacity

Excludes AEL&PPost Falls Dam, Idaho

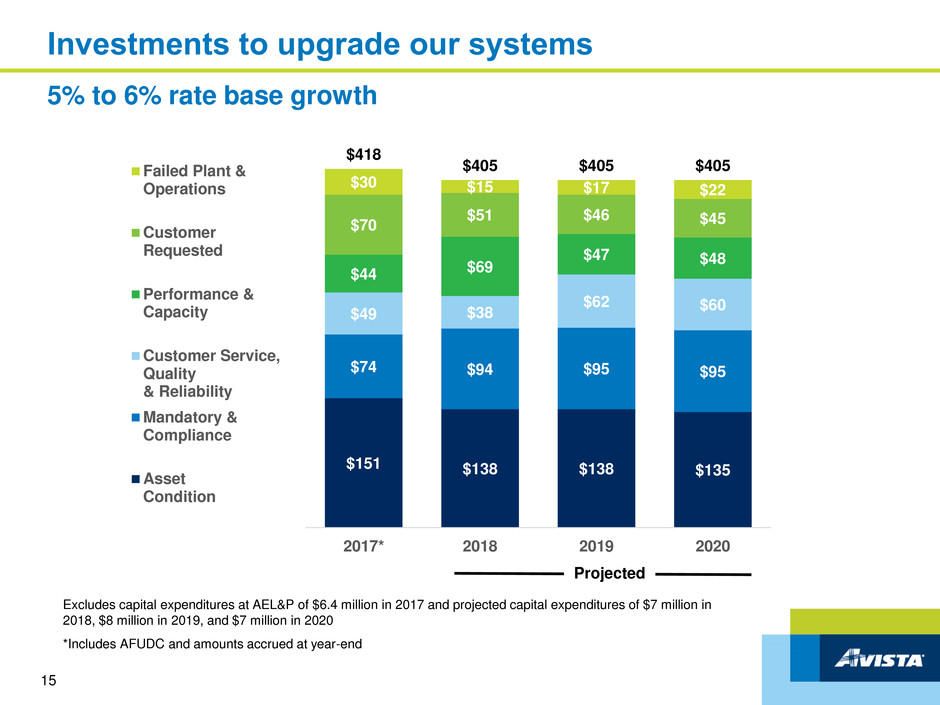

Projected

Investments to upgrade our systems

5% to 6% rate base growth

15

$151 $138 $138 $135

$74 $94 $95 $95

$49 $38

$62 $60

$44 $69

$47 $48

$70

$51 $46 $45

$30 $15 $17 $22

$418

$405 $405 $405

2017* 2018 2019 2020

Failed Plant &

Operations

Customer

Requested

Performance &

Capacity

Customer Service,

Quality

& Reliability

Mandatory &

Compliance

Asset

Condition

Excludes capital expenditures at AEL&P of $6.4 million in 2017 and projected capital expenditures of $7 million in

2018, $8 million in 2019, and $7 million in 2020

*Includes AFUDC and amounts accrued at year-end

16

Investing to enhance service and system reliability

Little Falls Plant Upgrade

Grid Modernization

Aldyl A Natural Gas

Pipe Replacement

Advanced Metering

Infrastructure (AMI)

Electric Vehicle Pilot

Program

Customer Facing

Technology

17

Driving effective regulatory outcomes

Recovery of costs and capital investments

Idaho

Dec. 28, 2017, the Idaho Public Utilities Commission approved a multi-party settlement agreement designed to increase annual

electric base revenues by $12.9 million, or 5.2 percent, effective Jan. 1, 2018, and by $4.5 million, or 1.8 percent, effective Jan. 1, 2019

For natural gas, the settlement agreement is designed to increase annual base revenues by $1.2 million, or 2.9 percent, effective Jan. 1, 2018, and

by $1.1 million, or 2.7 percent on Jan. 1, 2019

Based on 50% equity ratio and 9.5% return on equity

Alaska

Nov. 15, 2017, all-party settlement agreement approved by Regulatory Commission of Alaska designed to increase base

revenues by 3.86% or $1.3 million, the level of interim rates that went into effect Nov. 23, 2016

Previously approved additional $2.9 million annually from interruptible service will be decreased to $2.06 million annually; a one-time $0.9 million

credit will be credited back to customers through the Cost of Power Adjustment (COPA)

Based on a 58.18% equity ratio and an 11.95% return on equity

Oregon

Sept. 13, 2017, received Commission approval of an all-party settlement agreement designed to increase annual natural gas base

revenues by 5.9% or $3.5 million

Rate adjustment of $2.6 million was effective Oct. 1, 2017, and a second adjustment of $0.9 million was effective Nov. 1, 2017

Based on 50% equity ratio and 9.4% return on equity

Alaska Electric Light & Power Company

(AEL&P)

Growing the utility core

18

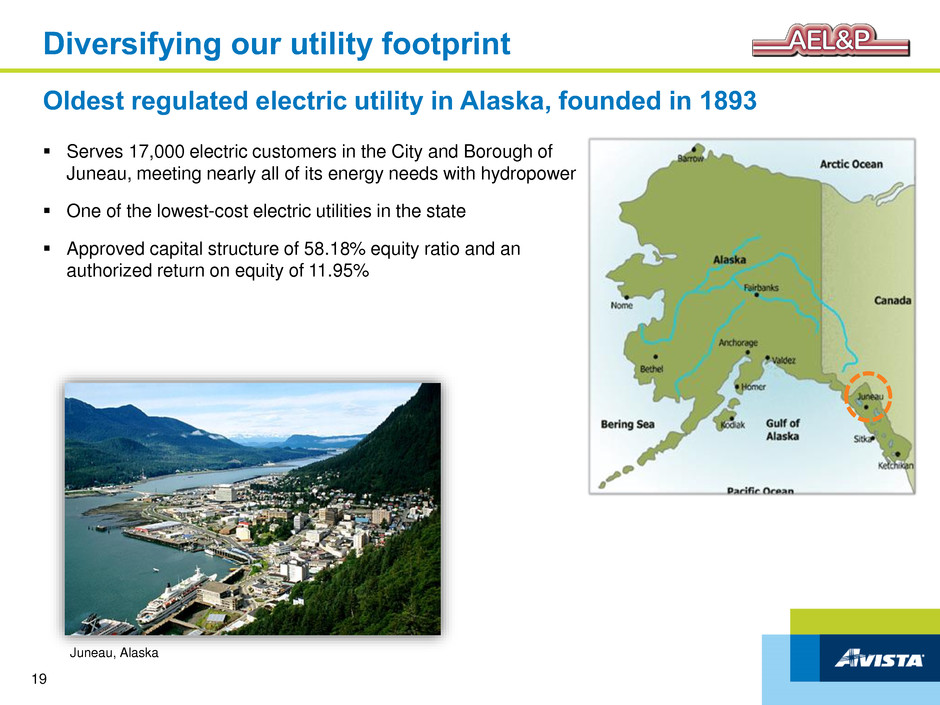

Oldest regulated electric utility in Alaska, founded in 1893

19

Serves 17,000 electric customers in the City and Borough of

Juneau, meeting nearly all of its energy needs with hydropower

One of the lowest-cost electric utilities in the state

Approved capital structure of 58.18% equity ratio and an

authorized return on equity of 11.95%

Diversifying our utility footprint

Juneau, Alaska

20

Strategic Investments

Developing platforms for future growth

LNG opportunities continue to be impacted by current market

economics

□ Salix (subsidiary)

– Generation – substitution for diesel

– Marine and rail fueling

□ Plum Energy

– Small LNG project investments

Targeted investments

□ Energy Impact Partners

– Private equity fund that invests in emerging technologies,

services, and business models throughout electric supply chain

with a collaborative, strategic investment approach

□ TROVE

– Leverage AMI, consumer and other data through predictive

analytics to create utility value

□ Spirae

– Microgrid and distributed energy resource management platform

Creating new growth platforms

21

*LNG: Liquefied natural gas

22

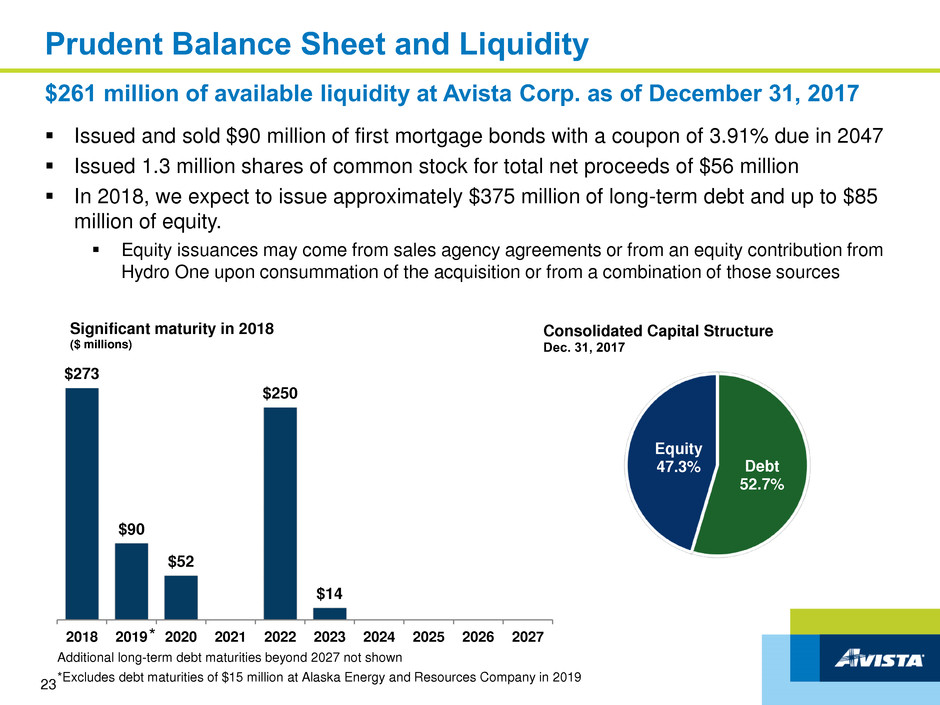

Financial

Performance Metrics

Prudent Balance Sheet and Liquidity

Debt

52.7%

Equity

47.3%

Consolidated Capital Structure

Dec. 31, 2017

23

Additional long-term debt maturities beyond 2027 not shown

*Excludes debt maturities of $15 million at Alaska Energy and Resources Company in 2019

$261 million of available liquidity at Avista Corp. as of December 31, 2017

Issued and sold $90 million of first mortgage bonds with a coupon of 3.91% due in 2047

Issued 1.3 million shares of common stock for total net proceeds of $56 million

In 2018, we expect to issue approximately $375 million of long-term debt and up to $85

million of equity.

Equity issuances may come from sales agency agreements or from an equity contribution from

Hydro One upon consummation of the acquisition or from a combination of those sources

$273

$90

$52

$250

$14

2018 2019 2020 2021 2022 2023 2024 2025 2026 2027

Significant maturity in 2018

($ millions)

*

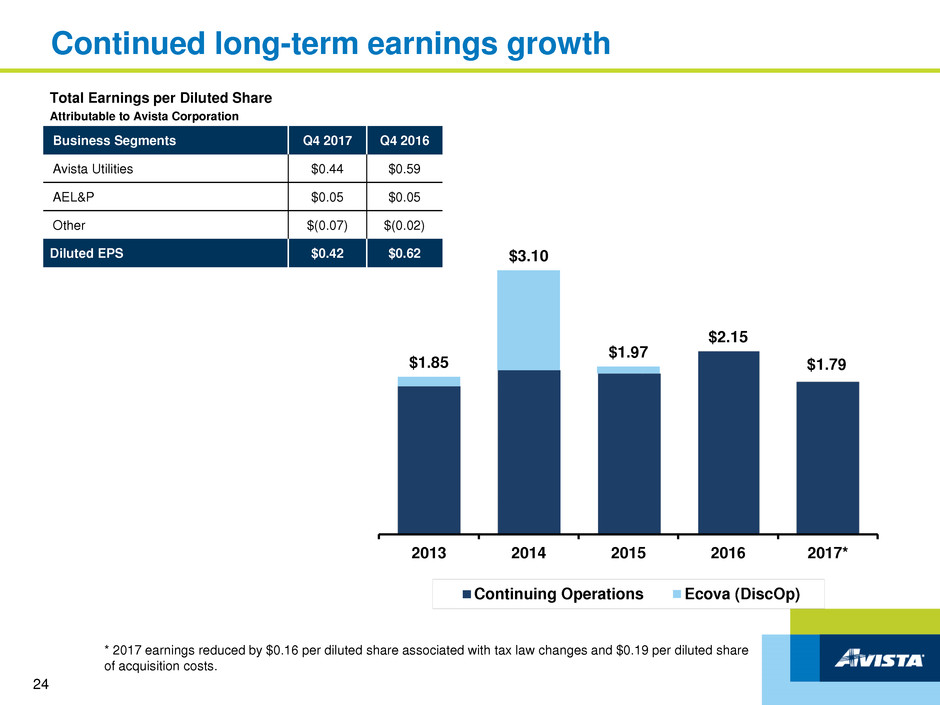

$1.85

$3.10

$1.97

$2.15

2013 2014 2015 2016 2017*

Continuing Operations Ecova (DiscOp)

$1.79

24

Continued long-term earnings growth

Total Earnings per Diluted Share

Attributable to Avista Corporation

Business Segments Q4 2017 Q4 2016

Avista Utilities $0.44 $0.59

AEL&P $0.05 $0.05

Other $(0.07) $(0.02)

Diluted EPS $0.42 $0.62

* 2017 earnings reduced by $0.16 per diluted share associated with tax law changes and $0.19 per diluted share

of acquisition costs.

*Current quarterly dividend of $0.3725 annualized

25

Dividend growth expected to keep pace with long-term earnings growth

Attractive and growing dividend

$1.27

$1.32

$1.37

$1.43

$1.49*

2014 2015 2016 2017 2018

26

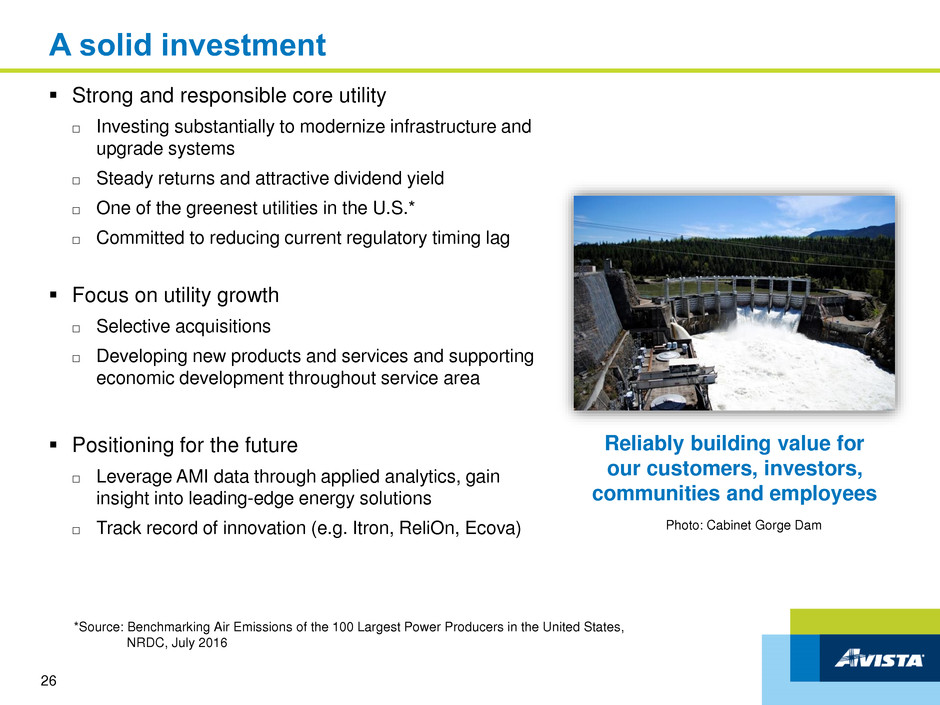

A solid investment

Strong and responsible core utility

□ Investing substantially to modernize infrastructure and

upgrade systems

□ Steady returns and attractive dividend yield

□ One of the greenest utilities in the U.S.*

□ Committed to reducing current regulatory timing lag

Focus on utility growth

□ Selective acquisitions

□ Developing new products and services and supporting

economic development throughout service area

Positioning for the future

□ Leverage AMI data through applied analytics, gain

insight into leading-edge energy solutions

□ Track record of innovation (e.g. Itron, ReliOn, Ecova)

*Source: Benchmarking Air Emissions of the 100 Largest Power Producers in the United States,

NRDC, July 2016

Photo: Cabinet Gorge Dam

Reliably building value for

our customers, investors,

communities and employees

Risk factors that may affect future results

27

The following are among the important factors that could cause actual results to differ materially from the forward-looking statements: weather conditions (temperatures, precipitation levels and wind patterns),

which affect both energy demand and electric generating capability, including the effect of precipitation and temperature on hydroelectric resources, the effect of wind patterns on wind-generated power,

weather-sensitive customer demand, and similar effects on supply and demand in the wholesale energy markets; our ability to obtain financing through the issuance of debt and/or equity securities, which can

be affected by various factors including our credit ratings, interest rates and other capital market conditions and the global economy; changes in interest rates that affect borrowing costs, our ability to

effectively hedge interest rates for anticipated debt issuances, variable interest rate borrowing and the extent to which we recover interest costs through retail rates collected from customers; changes in

actuarial assumptions, interest rates and the actual return on plan assets for our pension and other postretirement benefit plans, which can affect future funding obligations, pension and other postretirement

benefit expense and the related liabilities; deterioration in the creditworthiness of our customers; the outcome of legal proceedings and other contingencies; economic conditions in our service areas, including

the economy's effects on customer demand for utility services; declining energy demand related to customer energy efficiency and/or conservation measures; changes in long-term climates, both globally and

within our utilities' service areas, which can affect, among other things, customer demand patterns and the volume and timing of streamflows to our hydroelectric resources; state and federal regulatory

decisions or related judicial decisions that affect our ability to recover costs and earn a reasonable return including, but not limited to, disallowance or delay in the recovery of capital investments, operating

costs, commodity costs, interest rate swap derivatives and discretion over allowed return on investment; possibility that our integrated resource plans for electric and natural gas will not be acknowledged by

the state commissions, which could result in future resource acquisitions based on the integrated resource plans that are later deemed imprudent; volatility and illiquidity in wholesale energy markets, including

the availability of willing buyers and sellers, changes in wholesale energy prices that can affect operating income, cash requirements to purchase electricity and natural gas, value received for wholesale sales,

collateral required of us by counterparties in wholesale energy transactions and credit risk to us from such transactions, and the market value of derivative assets and liabilities; default or nonperformance on

the part of any parties from whom we purchase and/or sell capacity or energy; potential environmental regulations affecting our ability to utilize or resulting in the obsolescence of our power supply resources;

severe weather or natural disasters, including, but not limited to, avalanches, wind storms, wildfires, earthquakes, snow and ice storms, that can disrupt energy generation, transmission and distribution, as well

as the availability and costs of materials, equipment, supplies and support services; explosions, fires, accidents, mechanical breakdowns or other incidents that may impair assets and may disrupt operations

of any of our generation facilities, transmission, and electric and natural gas distribution systems or other operations and may require us to purchase replacement power; explosions, fires, accidents or other

incidents arising from or allegedly arising from our operations that may cause wildfires, injuries to the public or property damage; blackouts or disruptions of interconnected transmission systems (the regional

power grid); terrorist attacks, cyber attacks or other malicious acts that may disrupt or cause damage to our utility assets or to the national or regional economy in general, including any effects of terrorism,

cyber attacks or vandalism that damage or disrupt information technology systems; work force issues, including changes in collective bargaining unit agreements, strikes, work stoppages, the loss of key

executives, availability of workers in a variety of skill areas, and our ability to recruit and retain employees; increasing costs of insurance, more restrictive coverage terms and our ability to obtain insurance;

delays or changes in construction costs, and/or our ability to obtain required permits and materials for present or prospective facilities; increasing health care costs and cost of health insurance provided to our

employees and retirees; third party construction of buildings, billboard signs, towers or other structures within our rights of way, or placement of fuel receptacles within close proximity to our transformers or

other equipment, including overbuild atop natural gas distribution lines; the loss of key suppliers for materials or services or disruptions to the supply chain; adverse impacts to our Alaska operations that could

result from an extended outage of its hydroelectric generating resources or their inability to deliver energy, due to their lack of interconnectivity to any other electrical grids and the extensive cost of

replacement power (diesel); changing river regulation at hydroelectric facilities not owned by us, which could impact our hydroelectric facilities downstream; compliance with extensive federal, state and local

legislation and regulation, including numerous environmental, health, safety, infrastructure protection, reliability and other laws and regulations that affect our operations and costs; the ability to comply with the

terms of the licenses and permits for our hydroelectric or thermal generating facilities at cost-effective levels; cyber attacks on us or our vendors or other potential lapses that result in unauthorized disclosure

of private information, which could result in liabilities against us, costs to investigate, remediate and defend, and damage to our reputation; disruption to or breakdowns of information systems, automated

controls and other technologies that we rely on for our operations, communications and customer service; changes in costs that impede our ability to effectively implement new information technology systems

or to operate and maintain current production technology; changes in technologies, possibly making some of the current technology we utilize obsolete or introducing new cyber security risks; insufficient

technology skills, which could lead to the inability to develop, modify or maintain our information systems; growth or decline of our customer base and the extent to which new uses for our services may

materialize or existing uses may decline, including, but not limited to, the effect of the trend toward distributed generation at customer sites; the potential effects of negative publicity regarding our business

practices, whether true or not, which could hurt our reputation and result in litigation or a decline in our common stock price; changes in our strategic business plans, which may be affected by any or all of the

foregoing, including the entry into new businesses and/or the exit from existing businesses and the extent of our business development efforts where potential future business is uncertain; non-regulated

activities may increase earnings volatility; failure to complete the proposed acquisition of the Company by Hydro One, which would negatively impact the market price of Avista Corp.'s common stock and could

result in termination fees that would have a material adverse effect on our results of operations, financial condition, and cash flows; changes in environmental laws, regulations, decisions and policies, including

present and potential environmental remediation costs and our compliance with these matters; the potential effects of initiatives, legislation or administrative rulemaking at the federal, state or local levels,

including possible effects on our generating resources of restrictions on greenhouse gas emissions to mitigate concerns over global climate changes; political pressures or regulatory practices that could

constrain or place additional cost burdens on our distribution systems through accelerated adoption of distributed generation or electric-powered transportation or on our energy supply sources, such as

campaigns to halt coal-fired power generation and opposition to other thermal generation, wind turbines or hydroelectric facilities; wholesale and retail competition including alternative energy sources, growth

in customer-owned power resource technologies that displace utility-supplied energy or that may be sold back to the utility, and alternative energy suppliers and delivery arrangements; failure to identify

changes in legislation, taxation and regulatory issues which are detrimental or beneficial to our overall business; the new federal income tax law and its intended and unintended consequences on financial

results and future cash flows, including the potential impact to credit ratings, which may affect our ability to borrow funds or increase the cost of borrowing in the future; policy and/or legislative changes

resulting from the current presidential administration in various regulated areas, including, but not limited to, environmental regulation and healthcare regulations; and the risk of municipalization in any of our

service territories.