Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - MULESOFT, INC | d554902dex991.htm |

| 8-K - 8-K - MULESOFT, INC | d554902d8k.htm |

Salesforce Announces Agreement to Acquire MuleSoft March 20, 2018 Exhibit 99.2

Call Participants Greg Schott Chairman & Chief Executive Officer, MuleSoft Mark Hawkins President & Chief Financial Officer, Salesforce Keith Block Vice Chairman, President & Chief Operating Officer, Salesforce Bret Taylor President & Chief Product Officer, Salesforce

Forward-Looking Statements This presentation contains forward-looking information related to Salesforce, MuleSoft and the acquisition of MuleSoft by Salesforce that involves substantial risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed or implied by such statements. Forward-looking statements in this presentation include, among other things, statements about the potential benefits of the proposed transaction, Salesforce and MuleSoft's plans, objectives, expectations and intentions, the financial condition, results of operations and business of Salesforce and MuleSoft, and the anticipated timing of closing of the proposed transaction. Risks and uncertainties include, among other things, risks related the ability of Salesforce and MuleSoft to consummate the proposed transaction on a timely basis or at all, including due to complexities resulting from the adoption of new accounting pronouncements and associated system implementations; the satisfaction of the conditions precedent to consummation of the proposed transaction, including having a sufficient number of MuleSoft's shares being validly tendered into the exchange offer to meet the minimum condition; Salesforce’s and MuleSoft’s ability to secure regulatory approvals on the terms expected, in a timely manner or at all; Salesforce’s ability to successfully integrate MuleSoft's operations; Salesforce’s ability to implement its plans, forecasts and other expectations with respect to MuleSoft's business after the completion of the transaction and realize expected synergies; risks related to the ability to realize the anticipated benefits of the proposed transaction, including the possibility that the expected benefits from the proposed transaction will not be realized or will not be realized within the expected time period; disruption from the transaction making it more difficult to maintain business and operational relationships; negative effects of the announcement or the consummation of the proposed transaction on the market price of Salesforce’s common stock or on Salesforce's operating results; significant transaction costs; unknown liabilities; the risk of litigation and/or regulatory actions related to the proposed transaction; the pace of change and innovation in enterprise cloud computing services; the competitive nature of the market in which Salesforce and MuleSoft participate; Salesforce’s and MuleSoft’s service performance and security, including the resources and costs required to prevent, detect and remediate potential security breaches; the expenses associated with new data centers and third-party infrastructure providers; additional data center capacity; Salesforce and MuleSoft’s ability to protect their intellectual property rights and develop their brands; dependency on the development and maintenance of the infrastructure of the Internet; the ability to develop new services and product features; other business effects, including the effects of industry, market, economic, political or regulatory conditions; future exchange and interest rates; changes in tax and other laws, regulations, rates and policies, including those related to the provision of services on the Internet, those related to accessing the Internet, and those addressing data privacy and import and export controls; future business combinations or disposals; the uncertainties inherent in research and development; competitive developments and climate change. Further information on these and other risk and uncertainties relating to Salesforce and MuleSoft can be found in their respective reports on Forms 10-K, 10-Q and 8-K and in other filings Salesforce and MuleSoft make with the SEC from time to time and available at www.sec.gov. These documents are available on the SEC Filings section of the Investor Information section of the Salesforce’s website at www.salesforce.com/investor and the Investor section of MuleSoft’s website at https://investors.mulesoft.com/. The forward-looking statements included in this communication are made only as of the date hereof. Salesforce and MuleSoft assume no obligation and do not intend to update these forward-looking statements, except as required by law. Financial metrics are based on ASC605 standard throughout this presentation. Statement under the Private Securities Litigation Reform Act of 1995 3

Additional Information and Where to Find it The exchange offer referenced in this communication has not yet commenced. This communication is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell shares, nor is it a substitute for any offer materials that Salesforce and its acquisition subsidiary will file with the U.S. Securities and Exchange Commission (the “SEC”). At the time the exchange offer is commenced, Salesforce and its acquisition subsidiary will file a tender offer statement on Schedule TO, Salesforce will file a registration statement on Form S-4 and MuleSoft will file a Solicitation/Recommendation Statement on Schedule 14D-9 with the SEC with respect to the exchange offer. THE EXCHANGE OFFER MATERIALS (INCLUDING AN OFFER TO EXCHANGE, A RELATED LETTER OF TRANSMITTAL AND CERTAIN OTHER EXCHANGE OFFER DOCUMENTS) AND THE SOLICITATION/RECOMMENDATION STATEMENT WILL CONTAIN IMPORTANT INFORMATION. MULESOFT STOCKHOLDERS ARE URGED TO READ THESE DOCUMENTS CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION THAT HOLDERS OF MULESOFT SECURITIES SHOULD CONSIDER BEFORE M AKING ANY DECISION REGARDING EXCHANGING THEIR SECURITIES. The Offer to Exchange, the related Letter of Transmittal and certain other exchange offer documents, as well as the Solicitation/Recommendation Statement, will be made available to all holders of MuleSoft stock at no expense to them. The exchange offer materials and the Solicitation/Recommendation Statement will be made available for free at the SEC’s website at www.sec.gov. Copies of the documents filed with the SEC by Salesforce will be available free of charge on the SEC Filings section of the Investor Information section of Salesforce’s website at www.salesforce.com/investor or by contacting Salesforce’s Investor Relations department at investor@salesforce.com. Copies of the documents filed with the SEC by MuleSoft will be available free of charge on the Investor section of MuleSoft's website at https://investors.mulesoft.com or by contacting MuleSoft’s Investor Relations department at investorrelations@mulesoft.com. In addition to the Offer to Exchange, the related Letter of Transmittal and certain other exchange offer documents, as well as the Solicitation/Recommendation Statement, Salesforce and MuleSoft file annual, quarterly and current reports and other information with the SEC. You may read and copy any reports or other information filed by Salesforce and MuleSoft at the SEC public reference room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the public reference room. Salesforce’s and MuleSoft’s filings with the SEC are also available to the public from commercial document-retrieval services and at the website maintained by the SEC at http://www.sec.gov. 3

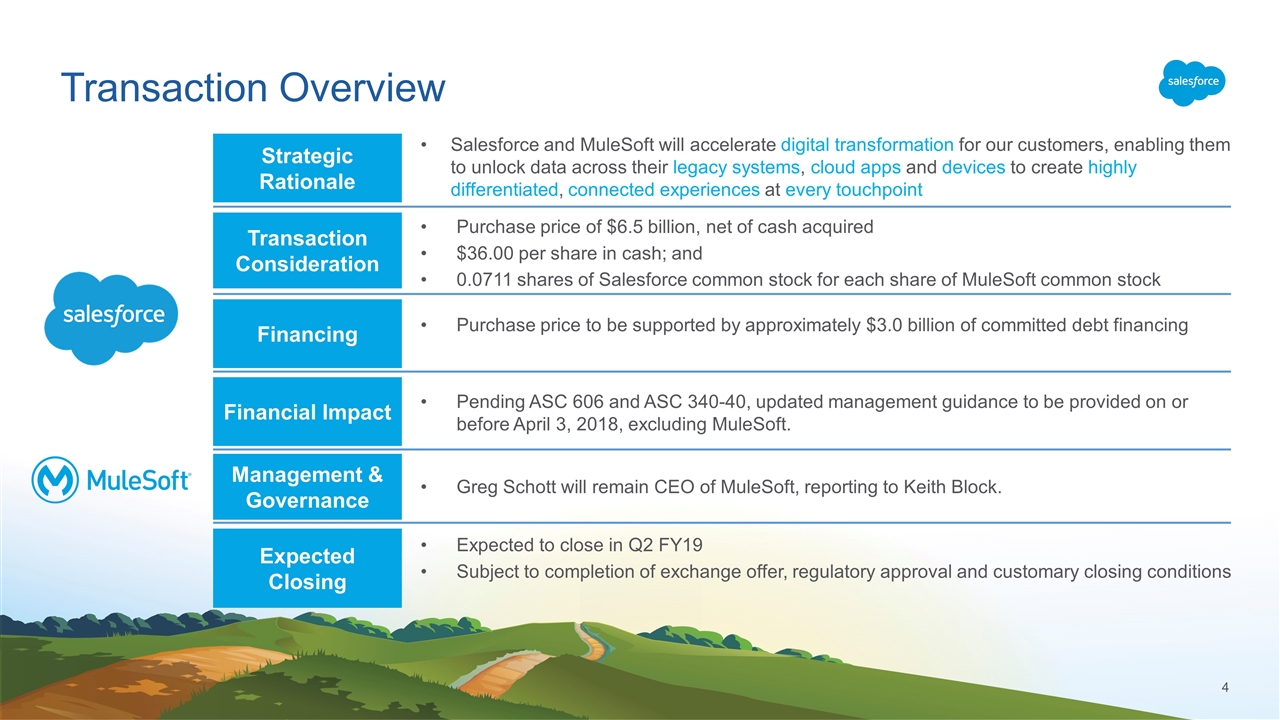

Transaction Overview Purchase price of $6.5 billion, net of cash acquired $36.00 per share in cash; and 0.0711 shares of Salesforce common stock for each share of MuleSoft common stock Purchase price to be supported by approximately $3.0 billion of committed debt financing Pending ASC 606 and ASC 340-40, updated management guidance to be provided on or before April 3, 2018, excluding MuleSoft. 4 Expected to close in Q2 FY19 Subject to completion of exchange offer, regulatory approval and customary closing conditions Salesforce and MuleSoft will accelerate digital transformation for our customers, enabling them to unlock data across their legacy systems, cloud apps and devices to create highly differentiated, connected experiences at every touchpoint Transaction Consideration Financing Financial Impact Expected Closing Strategic Rationale Management & Governance Greg Schott will remain CEO of MuleSoft, reporting to Keith Block.

Driving Digital Transformation Together Two industry-leading companies sharing a common mission The #1 CRM enabling companies to connect with their customers in whole new ways Connecting in New Ways To Enable Customer Success, Speed & Innovation Enables organizations to change and innovate faster by making it easy to connect to the world’s applications, data, and devices 5

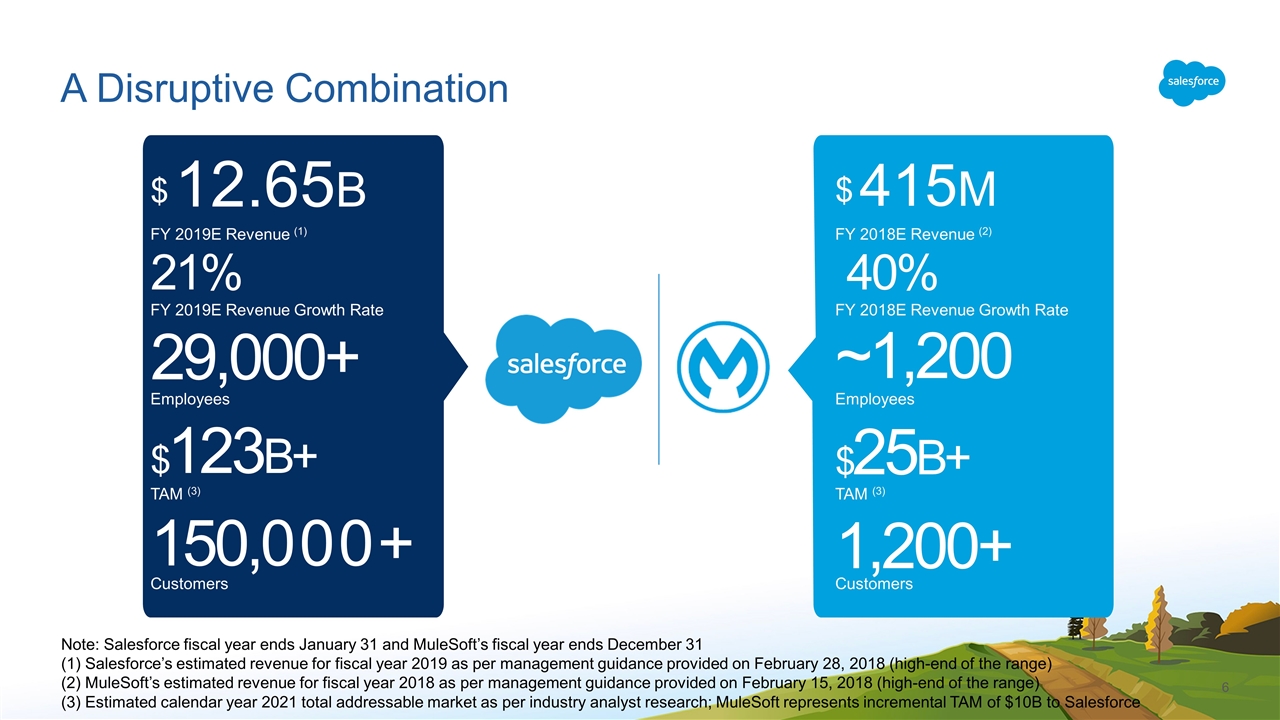

A Disruptive Combination Note: Salesforce fiscal year ends January 31 and MuleSoft’s fiscal year ends December 31 Salesforce’s estimated revenue for fiscal year 2019 as per management guidance provided on February 28, 2018 (high-end of the range) MuleSoft’s estimated revenue for fiscal year 2018 as per management guidance provided on February 15, 2018 (high-end of the range) Estimated calendar year 2021 total addressable market as per industry analyst research; MuleSoft represents incremental TAM of $10B to Salesforce 29,000+ Employees $ 12.65B FY 2019E Revenue (1) 150,000+ 21% FY 2019E Revenue Growth Rate Customers Employees $ 415M FY 2018E Revenue (2) 40% FY 2018E Revenue Growth Rate 1,200+ ~1,200 TAM (3) $123B+ $25B+ Customers TAM (3) 6

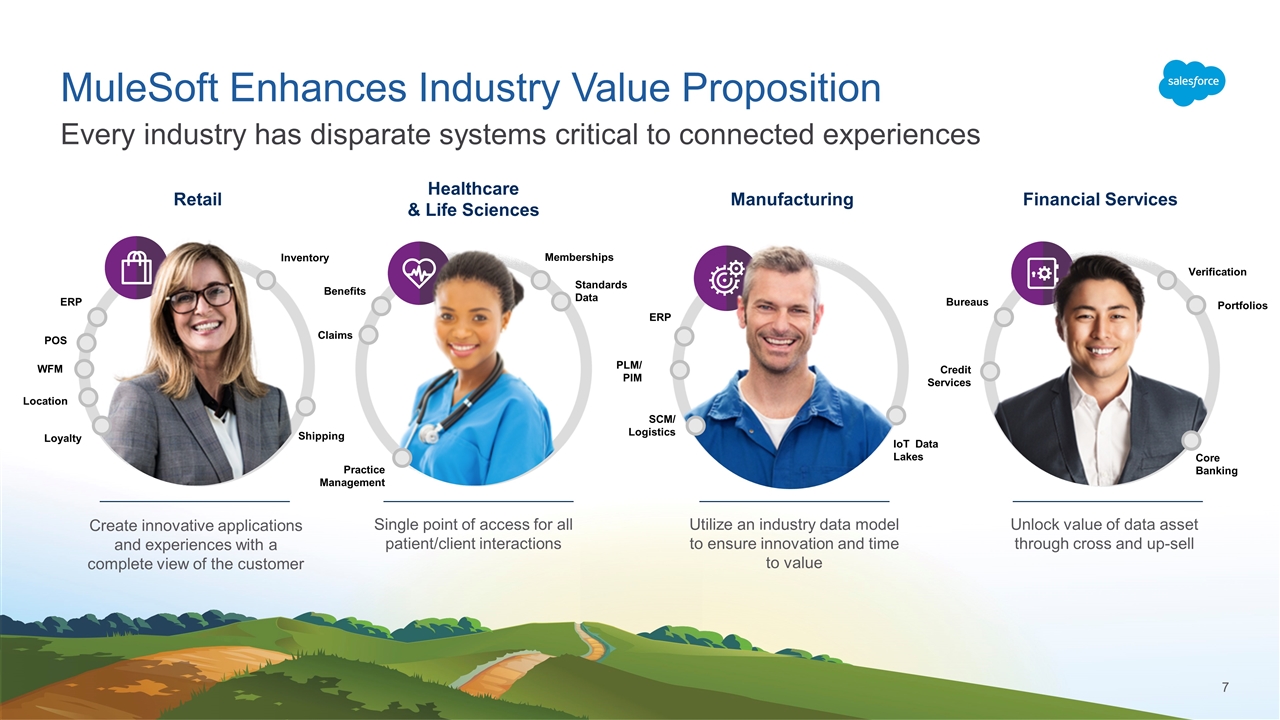

MuleSoft Enhances Industry Value Proposition Every industry has disparate systems critical to connected experiences Manufacturing Financial Services Retail Healthcare & Life Sciences Inventory POS ERP WFM Location Shipping Memberships Claims IoT Data Lakes Bureaus Credit Services Verification Practice Management Loyalty Standards Data Benefits ERP SCM/ Logistics PLM/ PIM Core Banking Portfolios Utilize an industry data model to ensure innovation and time to value Unlock value of data asset through cross and up-sell Create innovative applications and experiences with a complete view of the customer Single point of access for all patient/client interactions 7

Connecting Anything and Changing Everything SCM ERP Invoicing Inventory Management Field Service Employee Records Logistics Online Video Commerce CRM Blog Social Media Single Platform for All Use Cases Enterprise-Class Performance Vibrant Developer Community Security by Design 8

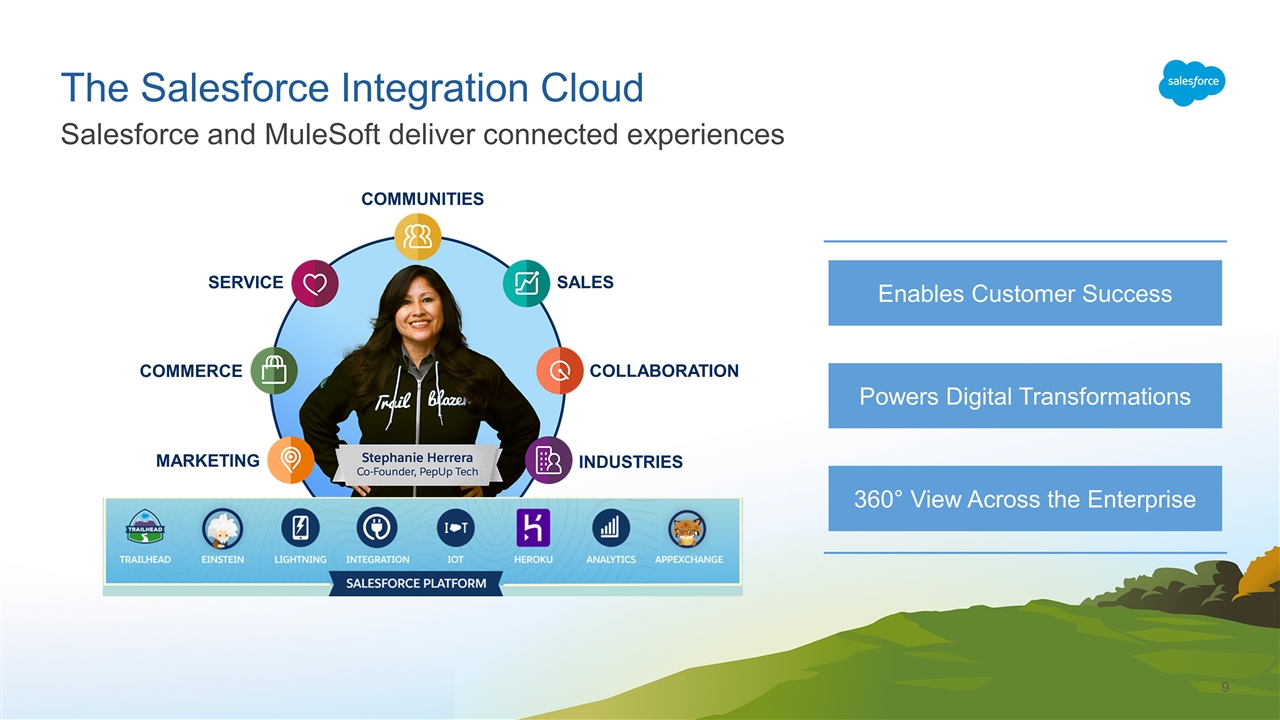

The Salesforce Integration Cloud Salesforce and MuleSoft deliver connected experiences Enables Customer Success Powers Digital Transformations 360° View Across the Enterprise MARKETING SERVICE SALES COMMERCE INDUSTRIES COMMUNITIES COLLABORATION 9

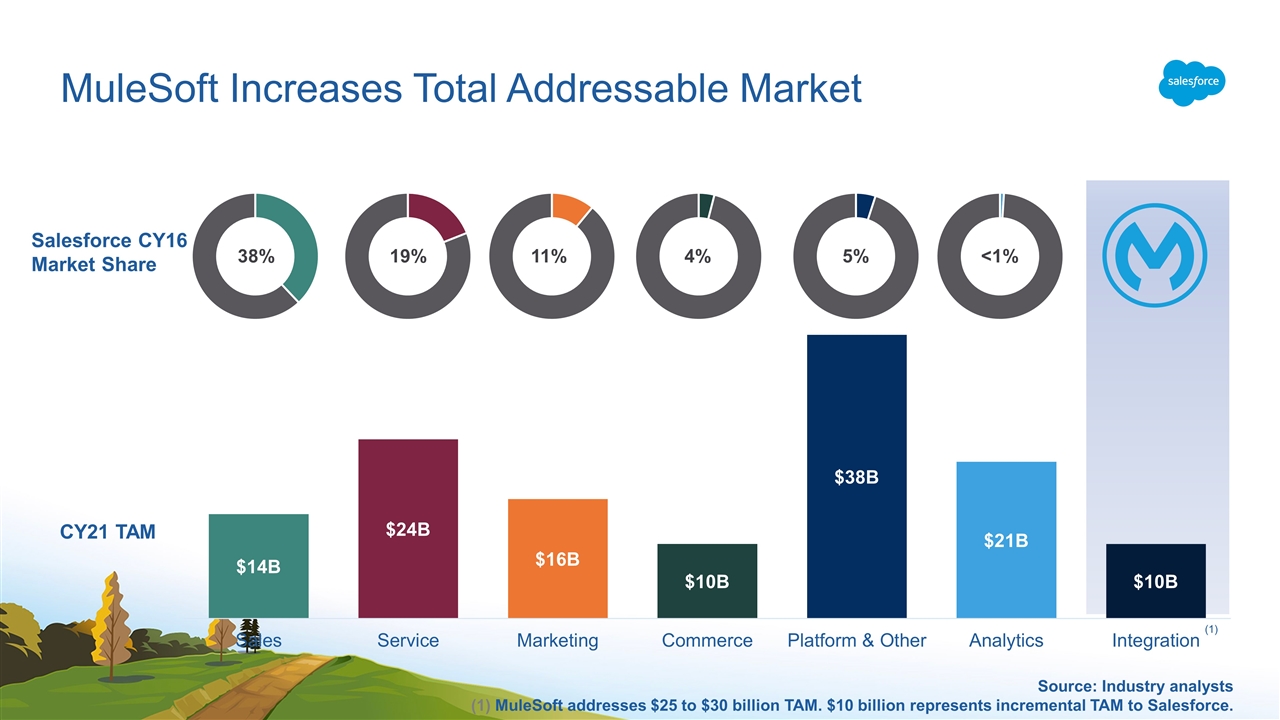

MuleSoft Increases Total Addressable Market CY21 TAM Salesforce CY16 Market Share 38% 19% 11% 4% 5% <1% (1) 10 Source: Industry analysts MuleSoft addresses $25 to $30 billion TAM. $10 billion represents incremental TAM to Salesforce. (1)

MuleSoft in the Enterprise Complements Salesforce’s enterprise success ~119% dollar-based net retention rate Average subscription & support rev. per customer of ~$185K in Q4 CY17, up 30% YoY 45 customers with >$1M+ in annual recurring revenue, up 50% from 30 customers at the IPO Key Highlights Source: MuleSoft November 2017 investor presentation and Q4 CY17 earnings call 11 1,200+ customers; approximately 60% overlap with Salesforce

13 +