Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - COMMUNITY HEALTH SYSTEMS INC | d555346d8k.htm |

Exhibit 99.1

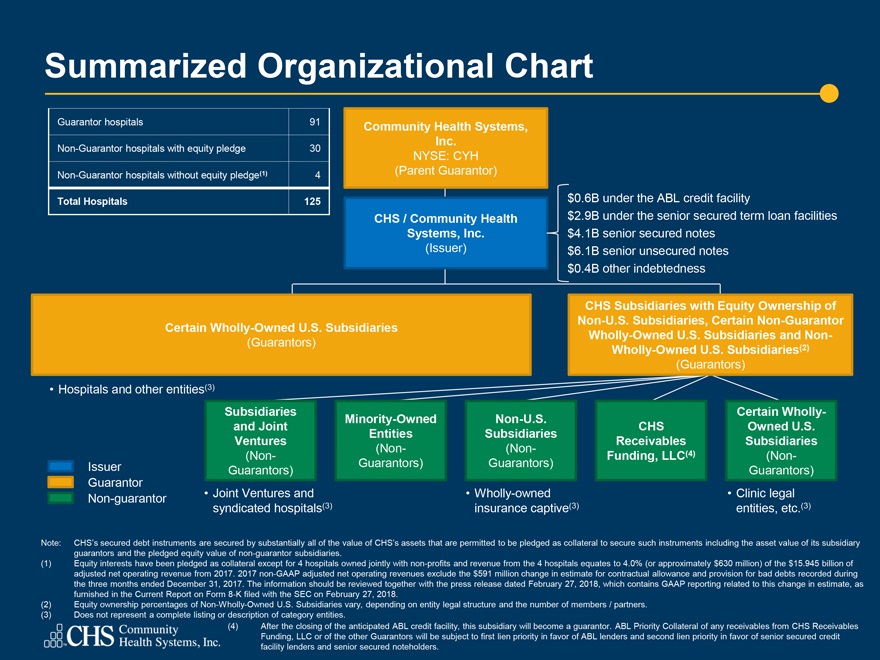

Summarized Organizational Chart Guarantor hospitals 91 Non-Guarantor hospitals with equity pledge 30 Non-Guarantor hospitals without equity pledge(1) 4 Total Hospitals 125 Community Health Systems, Inc. NYSE: CYH (Parent Guarantor) CHS / Community Health Systems, Inc. (Issuer) $0.6B under the ABL credit facility $2.9B under the senior secured term loan facilities $4.1B senior secured notes $6.1B senior unsecured notes $0.4B other indebtedness Certain Wholly-Owned U.S. Subsidiaries (Guarantors) CHS Subsidiaries with Equity Ownership of Non-U.S. Subsidiaries, Certain Non-Guarantor Wholly-Owned U.S. Subsidiaries and Non-Wholly-Owned U.S. Subsidiaries(2) (Guarantors) • Hospitals and other entities(3) Subsidiaries Certain Wholly- Minority-Owned Non-U.S. and Joint CHS Owned U.S. Entities Subsidiaries Ventures Receivables Subsidiaries (Non- (Non (Non Funding, LLC(4) (Non- Issuer Guarantors) Guarantors) Guarantors) Guarantors) Guarantor Non-guarantor • Joint Ventures and • Wholly-owned • Clinic legal syndicated hospitals(3) insurance captive(3) entities, etc.(3) Note: CHS’s secured debt instruments are secured by substantially all of the value of CHS’s assets that are permitted to be pledged as collateral to secure such instruments including the asset value of its subsidiary guarantors and the pledged equity value of non-guarantor subsidiaries. (1) Equity interests have been pledged as collateral except for 4 hospitals owned jointly with non-profits and revenue from the 4 hospitals equates to 4.0% (or approximately $630 million) of the $15.945 billion of adjusted net operating revenue from 2017. 2017 non-GAAP adjusted net operating revenues exclude the $591 million change in estimate for contractual allowance and provision for bad debts recorded during the three months ended December 31, 2017. The information should be reviewed together with the press release dated February 27, 2018, which contains GAAP reporting related to this change in estimate, as furnished in the Current Report on Form 8-K filed with the SEC on February 27, 2018. (2) Equity ownership percentages of Non-Wholly-Owned U.S. Subsidiaries vary, depending on entity legal structure and the number of members / partners. (3) Does not represent a complete listing or description of category entities. (4) After the closing of the anticipated ABL credit facility, this subsidiary will become a guarantor. ABL Priority Collateral of any receivables from CHS Receivables Funding, LLC or of the other Guarantors will be subject to first lien priority in favor of ABL lenders and second lien priority in favor of senior secured credit facility lenders and senior secured noteholders.