Attached files

| file | filename |

|---|---|

| EX-32.1 - Qualigen Therapeutics, Inc. | ex32-1.htm |

| EX-31.2 - Qualigen Therapeutics, Inc. | ex31-2.htm |

| EX-31.1 - Qualigen Therapeutics, Inc. | ex31-1.htm |

| EX-23.1 - Qualigen Therapeutics, Inc. | ex23-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| [X] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2017

or

| [ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 001-37428

RITTER PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 26-3474527 | |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

1880 Century Park East, Suite 1000 Los Angeles, California |

90067 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (310) 203-1000

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Name of Each Exchange on Which Registered | |

| Common Stock, par value $0.001 per share | NASDAQ Capital Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ ]

No [X]

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes [ ]

No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | [ ] | Accelerated filer | [ ] |

| Non-accelerated filer | [ ] (Do not check if a smaller reporting company) | Smaller reporting company | [X] |

| Emerging growth company | [X] |

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

As of June 30, 2017 (the last business day of the registrant’s most recently completed second fiscal quarter), the aggregate market value of the registrant’s common stock held by non-affiliates was approximately $8.1 million based upon the closing price for shares of the registrant’s common stock of $0.55 as reported by the NASDAQ Capital Market on that date. For purposes of this calculation, the registrant has assumed that its directors, executive officers and holders of 5% or more of the outstanding common stock are affiliates.

As of March 19, 2018, there were 49,406,521 shares outstanding of the registrant’s common stock, par value $0.001 per share.

DOCUMENTS INCORPORATED BY REFERENCE

None.

RITTER PHARMACEUTICALS, INC.

ANNUAL REPORT ON FORM 10-K

For the Year Ended December 31, 2017

Table of Contents

| 2 |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS AND INDUSTRY DATA

This Annual Report on Form 10-K (“Annual Report”) contains forward-looking statements that involve substantial risks and uncertainties. All statements other than statements of historical facts contained in this Annual Report, including statements regarding our strategy, future operations, future financial position, future revenue, projected costs, prospects, plans, objectives of management and expected market growth are forward-looking statements. The words “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will,” “would” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. These statements are subject to known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

Some of the factors that we believe could cause actual results to differ from those anticipated or predicted include:

| ● | our ability to obtain additional financing on acceptable terms; | |

| ● | the accuracy of our estimates regarding expenses, future revenues and capital requirements; | |

| ● | the success and timing of our preclinical studies and clinical trials; | |

| ● | our ability to obtain and maintain regulatory approval of RP-G28 and any other product candidates we may develop, and the labeling under any approval we may obtain; | |

| ● | regulatory developments in the United States and other countries; | |

| ● | the performance of third-party manufacturers; | |

| ● | our ability to develop and commercialize RP-G28 and any other product candidates we may develop; | |

| ● | our ability to obtain and maintain intellectual property protection for RP-G28 and any other product candidates we may develop; | |

| ● | the successful development of our sales and marketing capabilities; | |

| ● | the potential markets for RP-G28 and any other product candidates we may develop and our ability to serve those markets; | |

| ● | the rate and degree of market acceptance of RP-G28 and any other product candidates we may develop; | |

| ● | the success of competing drugs that are or become available; and | |

| ● | the loss of key scientific or management personnel. |

Although we believe that we have a reasonable basis for each forward-looking statement contained in this Annual Report, we caution you that forward-looking statements are not guarantees of future performance and that our actual results of operations, financial condition and liquidity, and the development of the industry in which we operate may differ materially from the forward-looking statements contained in this Annual Report.

Any forward-looking statement that we make in this Annual Report speaks only as of the date of this Annual Report, and we undertake no obligation to update such statements to reflect events or circumstances after the date of this Annual Report. You should also read carefully the factors described in the “Risk Factors” section of this Annual Report to better understand the risks and uncertainties inherent in our business and underlying any forward-looking statements.

This Annual Report includes statistical and other industry and market data that we obtained from industry publications and research, surveys and studies conducted by third-parties. Industry publications and third-party research, surveys and studies generally indicate that their information has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. While we believe these industry publications and third-party research, surveys and studies are reliable, we have not independently verified such data.

| 3 |

Overview

Ritter Pharmaceuticals, Inc. develops novel therapeutic products that modulate the gut microbiome to treat gastrointestinal diseases. We are advancing gut health research by exploring the gut microbiota and translating the functionality of prebiotic-based therapeutics into applications intended to have a meaningful impact on a patient’s health.

Our first novel microbiome modulator, RP-G28, an orally administered, high purity galacto-oligosaccharide, is currently under development for the treatment of lactose intolerance. RP-G28 is designed to selectively stimulate the growth of lactose-metabolizing bacteria in the colon, thereby effectively adapting the gut microbiome to assist in digesting lactose (the sugar found in milk) that reaches the large intestine. RP-G28 has the potential to become the first drug approved by the Food and Drug Administration (“FDA”) for the treatment of lactose intolerance. RP-G28 has been studied in Phase 2a and Phase 2b clinical trials and is a first-in-class compound.

On March 28, 2017, we announced top-line results from our Phase 2b clinical trial of RP-G28 for the treatment of lactose intolerance. The Phase 2b trial was a double-blind, placebo-controlled, three-arm, multi-center study evaluating safety, efficacy and tolerability of two dosing regimens of RP-G28 in patients with lactose intolerance. Enrollment was initiated in March 2016 and the last patient completed dosing in October 2016. The study aimed to evaluate a patient’s ability to consume dairy foods post-treatment with improved tolerance and reduced digestive symptoms. A total of 368 subjects were randomized in the trial with 18 clinical sites participating throughout the United States. Patients underwent a screening period and a 30-day treatment period, followed by a 30-day post-treatment “real world” observation of milk and dairy product consumption period.

A subset of subjects enrolled into a 12-month extension study to evaluate long-term durability of treatment. The extension study also evaluated each participant’s microbiome, expanding knowledge of the effects that RP-G28 may have on adapting the gut microbiota in a beneficial manner. We completed this study in the fourth quarter of 2017.

We held a Type C meeting with the FDA’s Division of Gastroenterology and Inborn Errors Products in March 2017, prior to the unblinding of our Phase 2b data, to discuss our development plans and Phase 2b clinical trial. The focus of the meeting was to obtain the FDA’s feedback on our Phase 2b clinical trial, including our statistical analysis plan (“SAP”), prior to unblinding any data.

We held an End-of-Phase 2 meeting with the FDA’s Division of Gastroenterology and Inborn Errors Products in August 2017. The purpose of the meeting was to obtain the FDA’s feedback on our Phase 3 program. We reached general consensus with the FDA on certain elements of our current Phase 3 program and have received clear guidance and recommendations on many necessary components of our Phase 3 program; including the clinical, non-clinical, and chemistry, manufacturing and controls (CMC) requirements needed to support an NDA submission.

We have incorporated much of this guidance into our Phase 3 program. Our current Phase 3 clinical program will consist of two confirmatory clinical trials of similar trial design as our Phase 2b clinical trial and will include additional components that may allow for claims for durability of effect. These additional trials may be run in parallel. We anticipate that the first Phase 3 clinical trial will begin in the second quarter of 2018.

The Gut Microbiome

The human gut is a relatively under-explored ecosystem but provides a great opportunity for using dietary intervention strategies to reduce the impact of gastrointestinal disease. The human body carries about 100 trillion microorganisms in the intestines, which is 10 times greater than the number of cells in the human body. This microbial population is responsible for a number of beneficial activities such as fermentation, strengthening the immune system, preventing growth of pathogenic bacteria, providing nutrients, and providing hormones. The increasing knowledge of how these microbial populations impact human health provides opportunities for novel therapies to treat an assortment of diseases such as neurological disease, cardiovascular disease, obesity, irritable bowel syndrome, inflammatory bowel disease, colon cancer, allergies, autism and depression.

Lactose Intolerance

Lactose intolerance is a common condition attributed to the absence or insufficient levels of the enzyme lactase, which is needed to properly digest lactose, a complex sugar found in milk and milk-containing foods.

| 4 |

Studies have suggested that lactose intolerance is a widespread condition affecting over one billion people worldwide and over 40 million people in the United States (or 15% of the U.S. population), with an estimated nine million of those individuals demonstrating moderate to severe symptoms.

Current annual spending on over-the-counter lactose intolerance aids in the United States has been estimated at approximately $2.45 billion. However, these options are limited and there is no long-term treatment available.

Unlike many common gastrointestinal conditions, such as irritable bowel syndrome, inflammatory bowel diseases, gastroesophageal reflux disease, or dyspepsia (among many others), lactose intolerance symptoms can be completely abated by avoiding dietary lactose. In this regard, lactose intolerance is an avoidance condition, similar to celiac sprue, food intolerances, or various environmental allergies. However, dairy avoidance may lead to inadequate calcium and vitamin D intake, which can predispose individuals to decreased bone accrual, osteoporosis, hypertension, rickets, osteomalacia, and possibly certain cancers. Although supplements and calcium-rich foods are available, several studies have shown that lactose intolerance patients had an average calcium intake of only 300-388 mg/day, significantly less than the 1000-1200 mg/day adult dietary recommended levels. The 2010 National Institutes of Health conference on lactose intolerance highlighted the long-term consequences of dairy avoidance demonstrating both the importance of treating the condition and the need to find improved solutions for patients.

Diagnosis

Lactose intolerance is often diagnosed by evaluating an individual’s clinical history, which reveals a relationship between lactose ingestion and onset of symptoms. Hydrogen breath tests may also be utilized to diagnose lactose malabsorption and a milk challenge may be used to differentiate between lactose malabsorption and lactose intolerance. Further tests can be conducted to rule out other digestive diseases or conditions, including: stool examination to document the presence of a parasite, blood tests to determine the presence of celiac disease, and intestinal biopsies to determine mucosal problems leading to malabsorption, such as inflammatory bowel disease or ulcerative colitis.

Health Consequences

Substantial evidence indicates that lactose intolerance is a major factor in limiting calcium intake in the diet of individuals who are lactose intolerant. Studies suggest that these individuals avoid milk and dairy products, resulting in an inadequate intake of calcium and significant nutritional and health risks.

At the 2010 National Institute of Health (“NIH”) Consensus Development Conference: Lactose Intolerance and Health, the NIH highlighted numerous health risks tied to lactose intolerance such as: osteoporosis; hypertension; and low bone density. There is substantial evidence indicating that lactose intolerance is a major factor in limiting calcium and nutrient intake in the diet of people who are lactose intolerant. Adequate calcium intake is essential to reducing the risks of osteoporosis and hypertension. In addition, chronic calcium depletion has been linked to increased arterial blood pressure, thereby establishing a relationship between hypertension and low calcium intake. Moreover, there is evidence of a correlation between calcium intake and both colon and breast cancer.

Decreased Calcium Intake Increases the Risk for Hypertension

Numerous published reports show that chronic calcium depletion may lead to increased arterial blood pressure. Many additional papers have corroborated this relationship between hypertension and a low calcium intake.

A growing body of evidence indicates that a nutritionally sound diet rich in fruits, vegetables and a generous component of low-fat dairy foods (sometimes referred to as the DASH diet) is optimal for reducing the risk of hypertension. Several reports have confirmed this finding in middle-aged and elderly women. Further, it appears that the DASH diet with generous low-fat dairy is associated with low prevalence of metabolic syndrome. Studies have suggested that the levels of dairy foods (three to four servings per day) required to achieve these effects are well above current U.S. averages and even further above those of lactose intolerant individuals who are avoiding dairy due to symptoms.

Our History

We were formed as a Nevada limited liability company on March 29, 2004 under the name Ritter Natural Sciences, LLC. Our first prototype, Lactagen™, was an alternative lactose intolerance treatment method. In 2004, clinical testing was conducted, which included a 61-subject double-blind placebo controlled clinical trial. The results were published in the Federation of American Societies for Experimental Biology in May 2005 and demonstrated Lactagen™ to be an effective and safe product for reducing symptoms for nearly 80% of the clinical participants who were on Lactagen™.

| 5 |

In 2008, we expanded our focus by developing a prescription drug development program. We initiated the program by developing RP-G28, a second generation edition of Lactagen™. We believe that RP-G28 enables us to state stronger claims, garner more medical community support and reach a wider market in the effort to treat lactose intolerance.

To help fund the development of RP-G28, we were awarded a grant from the United States government’s Health Care Bill program, the Qualifying Therapeutic Discovery Project, in 2008. The grant program provides support for innovative projects that are determined by the U.S. Department of Health and Human Services to have reasonable potential to result in new therapies that treat areas of unmet medical need and/or prevent, detect or treat chronic or acute diseases and conditions.

On September 16, 2008, we converted into a Delaware corporation under the name Ritter Pharmaceuticals, Inc.

We completed our initial public offering in June 2015. Our common stock is traded on the Nasdaq Capital Market under the trading symbol “RTTR”.

Our Leading Product Candidate — RP-G28

Overview

RP-G28 is a novel highly purified GOS, which is synthesized enzymatically. The product is being developed for the treatment of lactose intolerance. The therapeutic is taken orally (a powder solution mixed in water) for 30 consecutive days. The proposed mechanism of action of RP-G28 is to increase the intestinal growth and colonization of bacteria that can metabolize lactose to compensate for a patient’s intrinsic inability to digest lactose. Once colonization of bacteria has occurred, it is hypothesized that patients will continue to tolerate lactose as long as they maintain their microflora balance. RP-G28 has the potential to become the first FDA-approved drug for the reduction of symptoms associated with lactose intolerance.

Galacto-oligosaccharides (GOS)

RP-G28 is a >95% purified GOS product derived from a commercially available GOS food ingredient, which is designated as generally recognized as safe (GRAS) by the FDA. GOS refers to a group of compounds containing β-linkages of 1 to 6 galactose units with a single glucose on the terminal end and are found at low levels in human milk. GOS is purified to a pharmaceutical grade by minimizing residual glucose, lactose, galactose and other impurities. Further processing includes ultra-filtration, nano-filtration, decolorization, deionization, and concentration to yield GOS 95 syrup, which is the starting material for RP-G28.

GOS products resist hydrolysis by salivary and intestinal enzymes because of the configuration of their glycosidic bonds and reach the colon virtually intact. The undigested GOS enhances the growth of beneficial, lactose metabolizing, colonic bacteria that already exist in the subject’s digestive track, including multiple species and strains of bifidobacteria and lactobacilli. Once colonies of these bacteria have increased, continued lactose exposure should maintain tolerability of lactose without further exposure to RP-G28.

While formal nonclinical studies evaluating the safety of RP-G28 have not been performed, other commercially available GOS products have been evaluated in acute and repeat-dose general toxicology studies, reproductive toxicology studies, juvenile toxicology studies, genetic toxicology studies, and in long-term safety studies.

Clinical studies of GOS products were reviewed as part of the safety evaluation to support the Investigational New Drug Application (“IND”) for RP-G28. These include studies in adults (including pregnant women and geriatrics), children, infants and newborns (preterm and full term). The safety of GOS products in humans has been evaluated in 1316 adults at doses of 2.5 to 20 g/day for up to 12 months, and in 1125 children > 1 year of age at doses of 2.0 to 12 g/day for up to 1 year. Overall, no safety concerns attributable to the consumption of GOS were reported. Where side effects were observed, they were typically mild and limited to increased flatulence, abdominal discomfort, and changes in stool consistency and frequency; however, effects were not consistently observed in all studies. Similar observations of increased flatulence have been reported following the consumption fructo-oligosaccharies (FOS) (15 g/day) over a 7-day period (Alles, 1996), and this symptom represents a localized effect that is expected in association with the consumption of indigestible fiber in large quantities. There were no reports of events in other System Organ Class (SOC) suggestive of systemic toxicity.

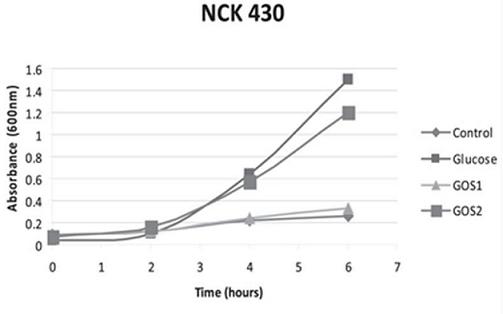

The significance of a higher purity GOS, namely RP-G28, was highlighted in a 2010 study by Klaenhammer. The in vitro study concluded that RP-G28 promoted growth of lactobacilli and bifidobacteria, but did not promote multiple strains of E. coli. In contrast, lower purity GOS stimulated both bifidobacteria as well as the strains of E. coli evaluated. (As seen below in Figure 1, NCK 430 (e. coli) grew in the presence of low purity GOS (GOS 2). Alternatively, the higher purity GOS (RP-G28/GOS 1) did not promote the growth of E. coli.).

| 6 |

Figure 1

Mechanism of Action

RP-G28 is understood to resist hydrolysis by salivary and intestinal enzymes due to the configuration of their glycosidic bonds and consequently reach the colon virtually intact. The product is then broken down intracellularly by galactosidases, and eventually β-galactosidase hydrolyzes the terminal lactose. This leads to selective alterations in the composition and activity of the microbiome in which RP-G28 enhances the growth of lactose-metabolizing bacteria, including species of Bifidobacteria and Lactobacilli (30). In our Phase 2a Clinical Trial (G28-001), shifts in the fecal microbiome in 82% of participants on treatment and increases in relative abundance of both Bifidobacteria and Lactobacilli were reported. RP-G28 had a bifidogenic effect in 90% of responders, which included species Bifidobacterium longum, Bifidobacterium adolenscentis, Bifidobacterium catenulatum, Bifidobacterium breve, and Bifidobacterium dentium (30). The understood mechanism of action is that by increasing lactose-metabolizing bacteria, less undigested lactose is fermented, and thus reduces gas production and related LI symptoms. Data correlating bacterial taxa and symptom metadata support this proposed hypothesis. In the G28-001 study, microbiome changes correlated with clinical outcomes of improved lactose tolerance in which an increase in Bifidobacterium was associated with decreased pain and cramping outcomes.

Our Market Opportunity

Unmet Medical Needs

Lactose intolerance is a challenging condition to manage. According to a market research study conducted by Objective Insights in April 2012, approximately 60% of lactose intolerant sufferers reported experiencing symptoms daily, or bi-weekly. Not only can symptoms be painful and embarrassing, they can also dramatically affect one’s quality of life, social activities, and health. Currently there are few reliable, or effective, treatments available that provide consistent or satisfactory relief.

Currently, there is no approved prescription treatment for lactose intolerance. Most persons with lactose intolerance avoid ingestion of milk and dairy products while others substitute non-lactose-containing foods in their diet. However, complete avoidance of lactose-containing foods is difficult to achieve (especially for those with moderate to severe symptoms) and can lead to significant long-term morbidity (i.e., dietary deficiencies of calcium and vitamin D).

| 7 |

Treatment Options

Doctors generally recommend the following treatments for the management of lactose intolerance: (1) dairy avoidance; (2) lactase supplements; (3) probiotics/dietary supplements; and (4) dairy substitutes/lactose free products. Despite educating their patients on all viable treatment options, physicians tend to advise their patients to refrain from consuming any dairy products whatsoever. However, in a 2008 survey conducted by Engage Health, 47% of lactose intolerance sufferers reported that this method was not effective (largely due to hidden dairy products in ingredients), and only 30% of lactose intolerance sufferers reported lactase supplements as being effective in managing their lactose intolerance. Further, while probiotics/dietary supplements have been demonstrated to aid and support one’s digestive system, helping break down general foods consumed, they don’t directly help with lactose intolerance. The 2008 survey by Engage Health suggests that the majority of lactose intolerance patients are dissatisfied with current treatment options.

Patients Unsatisfied with Current Management Options

Growing Awareness

Lactose intolerance is a condition that continues to expand as society advances and evolves. It has been estimated that gastroenterologists see approximately 15 new patients with lactose intolerance each month. Education and awareness have increased, and the American diet has greatly changed over the past decade to include more dairy-based goods. As the populace is growing older, the prevalence of lactose intolerance is increasing because more people tend to develop lactose intolerance later in life. Increased education and diagnosis is making more people aware of their allergies and digestive conditions. Physicians may compound the growth of lactose intolerance prevalence and its associated disorders by recommending individuals to avoid dairy products, a practice which in and of itself may increase severity of the intolerance.

| 8 |

Our Competitive Strengths

Market Opportunity

RP-G28 has the potential to become the first approved drug in the United States and Europe for the treatment of lactose intolerance.

Renowned Scientific Team and Management Team

Our leadership team has extensive biotechnology/pharmaceutical expertise in discovering, developing, licensing and commercializing therapeutic products. We have attracted a scientific team comprised of innovative researchers who are renowned in their knowledge and understanding of the host-microbiome in the field of lactose intolerance and gastroenterology.

Patent Portfolio

We have issued patents in the United States, in select countries in Europe (Germany, the United Kingdom, France, Spain, the Netherlands, Spain), and in other jurisdictions, directed to pharmaceutical compositions, methods of making such compositions, and methods of using such compositions for the treatment of lactose intolerance and certain of its symptoms. Additional worldwide patent applications are pending. The patent applications include claims covering pharmaceutical compositions, methods of making, methods of use, formulations and packaging.

In addition, in July 2015 we acquired the rights, title and interest to certain patents and related patent applications with claims covering a process for producing ultra-high purity galacto-oligosaccharide active pharmaceutical ingredients, including RP-G28 from our supplier. See “Manufacturing” for additional details regarding the second amendment to the exclusive supply agreement and our exercise of the exclusive option.

See “Intellectual Property” for additional information regarding our patent portfolio.

Our Growth Strategy

In order to achieve our objective of developing safe and effective applications to treat conditions associated with microbiome disfunctions, our near-term and long-term strategies include the following:

| ● | proceed into Phase 3 clinical trials of RP-G28 for the treatment of lactose intolerance; | |

| ● | complete remaining Phase 3 activities needed for an NDA; | |

| ● | develop and commercialize RP-G28 either by ourselves or in collaboration with others throughout the world; | |

| ● | explore the use of RP-G28 for additional potential therapeutic indications and orphan indications; | |

| ● | establish ourselves as a leader in developing therapeutics that modulates the human gut microbiome; | |

| ● | continue to develop a robust and defensible patent portfolio, including those we own and those we plan to in-license in the future; and | |

| ● | continue to optimize our product development and manufacturing capabilities both internally and externally through outside manufacturers. |

Clinical and Regulatory

IND Application/Phase 1

The IND for RP-G28 was activated initially to support a Phase 2a safety, tolerability and efficacy study in lactose intolerant patients. Standard Phase 1 single and repeat dose safety and tolerability studies in healthy volunteers were not needed because other GOS products that contain similar GOS constituents are generally regarded as safe (GRAS) and therefore supported the safety of RP-G28 in humans.

| 9 |

In 2018, a Phase 1 study will be conducted to understand the potential for systemic absorption of RP-G28 and any impact the presence of food may have on the pharmacokinetic profile of RP-G28. A Phase 1 QT/QTc study may be needed if there is measurable systemic exposure of RP-G28. Phase 1 systemic drug-drug-interaction (DDI) studies may also be needed if there is measurable systemic exposure of RP-G28, or if DDI potential within the gut is suggested by the results of in vitro DDI studies.

Phase 2a Study

We completed a double-blinded, randomized, multi-center, placebo-controlled Phase 2a clinical trial to validate the efficacy, safety and tolerance of RP-G28 compared to a placebo. We evaluated RP-G28 in 62 patients with lactose intolerance over a treatment period of 35 consecutive days. Post-treatment, subjects reintroduced dairy into their diets and were followed for an additional 30 days to evaluate lactose digestion, as measured by hydrogen production and symptom improvements. In order to confirm lactose intolerance and study participation, subjects underwent a 25-gram lactose challenge in the clinic. Lactose intolerance symptoms and hydrogen production via hydrogen breath test were assessed for six hours post-lactose dose. Eligible subjects were required to demonstrate a minimum symptom score and a “positive” hydrogen breath test in order to be eligible for randomization. A “positive” breath test was defined as a hydrogen gas elevation of 20 parts per million (ppm) at two time-points within the six hours following a lactose-loading dose. The primary endpoints included tracking patients’ gastrointestinal symptoms via a patient-reported symptom assessment instrument (a Likert Scale, measuring individual symptoms of flatulence, bloating, cramping, abdominal pain and diarrhea, on a scale of 0 (none) to 10 (worst)) at baseline, day 36 and day 66; as well as the measurement of hydrogen gas levels in their breath following a 25-gram lactose challenge.

Positive trends were seen when the entire per protocol study population was analyzed, including some statistically significant subgroup analysis, suggesting a therapeutically positive effect. Although there were few primary and secondary efficacy endpoints with statistically significant results, the combined data suggest that RP-G28 is exerting a positive therapeutic effect

Key findings of the Phase 2a clinical trial included:

| ● | RP-G28 was well tolerated with no significant study-drug related adverse effects. The benign adverse event safety profile of RP-G28 with dose levels up to 15 gm/day observed in this study is consistent with the known safety of GOS products administered up to 20 gm/day reported in literature. | |

| ● | Subjects in the RP-G28 group reported a reduction in total symptoms after treatment. Reported symptom improvement continued 30 days post-treatment. Improvement in symptoms was assessed in the study using several different measures, including a pain Likert scale and a patient global assessment. Subjects receiving RP-G28 had greater improvement in most of their symptoms (cramps, bloating and gas) following lactose challenge compared to placebo, but the differences were not statistically significant given the small cohort size. However, a clinically meaningful reduction in abdominal pain was seen in subjects receiving RP-G28 compared to placebo. | |

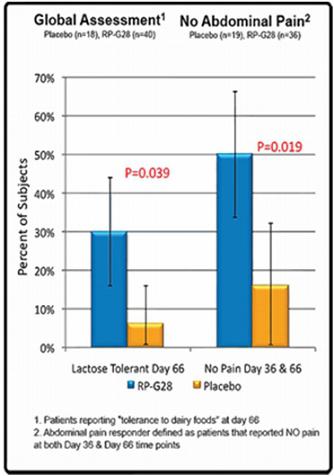

| ● | An analysis of “responders” for abdominal pain (defined as subjects who reported a score of zero in abdominal pain severity following a lactose challenge at Day 36/Hour 6 and Day 66/Hour 6) was performed. In the 55 subjects who noted abdominal pain following the baseline (Day 0) lactose challenge, 50% of RP-G28-treated subjects reported no abdominal pain compared to 17% of the placebo-treated subjects. This difference was statistically significant (p = 0.0190). See Figure 2 below. | |

| ● | An analysis of “responders” for abdominal pain (defined as subjects who reported a greater than 50% decrease in abdominal pain severity following lactose challenge between Day 0/Hour 6 and Day 36/Hour 6) was performed. In the 55 subjects who noted abdominal pain following the baseline (Day 0) lactose challenge, 72.2% of RP-G28-treated subjects reported a >50% reduction in abdominal pain severity compared to 42.1% of the placebo-treated subjects. This difference was also statistically significant (p=0.0288). | |

| ● | Six times as many patients in the treatment group versus the placebo group described themselves as lactose tolerant in the global assessment and did not report symptoms associated with lactose intolerance on Day 66. After completion of study treatment at Day 36, subjects were encouraged to re-introduce dairy foods into their diet. Thirty days later (Day 66), subjects were asked to provide an assessment of their symptom status, i.e., whether they considered themselves still lactose intolerant compared with subjects receiving placebo (Yes/No). As seen below in Figure 2 below, in the 58 subjects providing responses, a significantly larger percentage of subjects receiving RP-G28 (30%) considered themselves no longer lactose intolerant compared with subjects receiving placebo (5.6%); this result was statistically significant (p=0.0389). | |

| ● | Shifts in the fecal microbiome in 82% of participants on treatment (31) and increases in relative abundance of both Bifidobacteria and Lactobacilli were reported. Pre-treatment, three distinct clusters were identified, while post-treatment (Day 66) two distinct clusters were identified, demonstrating a clear shift in certain species represented before and after treatment. RP-G28 had a bifidogenic effect in 90% of responders, which included species Bifidobacterium longum, Bifidobacterium adolenscentis, Bifidobacterium catenulatum, Bifidobacterium breve, and Bifidobacterium dentium (30). |

| 10 |

Figure 2

| 11 |

The clinical results of our Phase 2a study were published in Nutrition Journal in a manuscript entitled “Improving lactose digestion and symptoms of lactose intolerance with a novel galacto-oligosaccharide (RP-G28): a randomized, double-blind clinical trial.” The microbiome results were published in the Proceedings of the National Academy of Science in a manuscript entitled “Impact of short-chain galacto-oligosaccharides on the gut microbiome of lactose-intolerant individuals.”

Type C Meeting with the FDA

We held a Type C meeting with the FDA’s Division of Gastroenterology and Inborn Errors Products on February 2013. The purpose of the meeting was to obtain the FDA’s feedback on the planned Phase 2 program and Phase 3 programs, inform the FDA of our ongoing development plans, gain feedback on relevant clinical trial design and end points related to patient meaningful benefits, and to inform the FDA of the status of our product characterization.

Phase 2b Clinical Trial

Enrollment in our Phase 2b clinical trial of RP-G28 was initiated in March 2016 and completed in August 2016. The final patient completed dosing and all monitoring visits in October 2016.

The Phase 2b trial was a multi-center, randomized, double-blind, placebo-controlled, parallel-group trial of 368 subjects designed to determine the efficacy, safety, and tolerability of two dosing regimens of RP-G28 in subjects with moderate to severe lactose intolerance. Two hundred and forty-seven (247) subjects received RP-G28 while 121 subjects received placebo. Twenty-four (24) subjects were discontinued prematurely from the study and 344 (91.2%) completed the study.

The trial assessed patients with lactose intolerance symptoms as measured on a Likert scale after a lactose challenge. Entry criteria in the Phase 2b trial included a hydrogen breath test to validate lactase deficiency. The Phase 2b trial design included a screening period, a 30-day course treatment period, and a 30-day post-treatment “real world” observation period during which subjects were followed while lactose containing food products were re-introduced into their diets. The study was designed to escalate the dose beyond the 15 gm/day dose level evaluated in the Phase 2a study. Study subjects abstained from lactose containing food products and were then randomized evenly (1:1:1) to receive one of two doses of RP-G28 or placebo for 30 days.

The primary endpoint for the Phase 2b clinical trial was a LI symptom composite score response at day 31. A response was based on change from baseline (Day -7, visit 1) to end of treatment period at day 31 (visit 5), combined average of four maximum symptom scores taken over 0.5, 1, 2, 3, 4, and 5 hours for each symptom (abdominal pain, cramping, bloating, and gas movement) after a lactose challenge test. A response was defined as a 4-point or greater decrease from baseline or a composite score of zero at day 31. The Phase 2b trial further required the collection of fecal samples from patients enrolled to evaluate the baseline and changes to the patient’s microbiome that correlate to symptom reduction and lactose tolerance.

| 12 |

We held a Type C meeting with the FDA in March 2017, to discuss our development plans and Phase 2b clinical trial. The focus of the meeting was to obtain the FDA’s feedback on our Phase 2b clinical trial, including our SAP, prior to unblinding any data.

In order to gather long-term data on subjects exposed to RP-G28, we also offered enrollment in an observational 12-month extension study, G28-003XA, to subjects who completed the Phase 2b protocol. As RP-G28 is expected to provide extended relief from lactose intolerance symptoms beyond the initial 30-day treatment phase, this extension study for the Phase 2b program will assess the long-term treatment effect. The study is also evaluating each participant’s microbiome, expanding our knowledge of the effects that RP-G28 may have on adapting the gut microbiota in a beneficial manner. We completed this study in the fourth quarter of 2017. We intend for the results from this study to support durability of treatment and guide the need to evaluate an additional 30-day course of treatment in subjects who experience the return of lactose intolerance symptoms after an initial course of RP-G28.

Topline results of the Phase 2b clinical trial were announced in March 2017. Due to inconsistent data results from one study site, the data from this site was excluded from the primary analysis population (Efficacy Subset mITT). After excluding the data from the one anomalous study site, results showed a clinically meaningful benefit to subjects in the reduction of lactose intolerance symptoms across a variety of outcome measures. The majority of analyses showed positive outcome measures and the robustness of the data point to a clear drug effect. Treatment patients not only reported meaningful reduced symptoms, but also 30-days after taking the treatment, patients reported adequate relief from lactose intolerance symptoms and satisfaction with the results of the treatment, with RP-G28 preventing or treating their lactose intolerance symptoms. Greater milk and dairy product consumption was also reported by patients.

Because the efficacy data from one study site was found to be significantly different from that of the other study sites, the data from this site was excluded from the primary analysis population (Efficacy Subset mITT. n=296). It was decided that, in addition to the efficacy analysis for the mITT Population, the Efficacy Subset mITT population would be used to perform all efficacy analyses.

In the Efficacy Subset mITT Analysis group, the primary endpoint met statistical significance, (39.7% of the pooled dosing group compared to 25.8% of the placebo group responded (p=0.0159)). Because the primary analysis was statistically significant, the primary endpoint comparison between the high dose group and the placebo group was then tested and also met statistical significance (38.1% of the high dose group, compared to 25.8% of the placebo group responded (p=0.0294)). The comparison between the low dose group and the placebo group further met statistical significance (p=0.0434).

In the entire study population (mITT population), including patients from the excluded study site, taking at least one dose of drug (n=368), the comparison between the pooled treatment groups and the placebo group narrowly missed statistical significance (p=0.0618), (40.1% of the pooled treatment group responded compared to 31.4% of the placebo group). Both low dose and high dose group arms demonstrated a higher proportion of responders than the placebo group.

In the Efficacy Subset Per-protocol population (Efficacy Subset PP), significant and meaningful symptom improvement was consistently seen across key individual lactose intolerance symptoms by patients reporting a ≥4-point improvement from baseline (proportion of subjects on treatment that reported improvement in severity of each symptom). Of the treatment patients, 56.1% reported significant improvement in abdominal pain compared to 45.7% in the placebo group (p=0.1046). Of the treatment patients, 54.5% reported statistically significant improvement in cramping compared to 40.2% in the placebo group (p=0.0257). Of the treatment patients, 55% reported statistically significant improvement in bloating compared to 41.3% in the placebo group (p=0.0282). Finally, 44.4% of treatment patients reported significant improvement in gas movement compared to 32.6% in the placebo group (p=0.0599). See Figure 4 below.

| 13 |

Figure 4

In a more stringent assessment, many patients reported that they experienced complete elimination of lactose intolerance symptoms, scoring a 0 out of 10 on a Likert pain scale post-treatment (Efficacy Subset PP). Of the treatment patients, 37.0% reported complete elimination of abdominal pain compared to 21.7% in the placebo group (p=0.0144). Of the treatment patients, 34.9% reported complete elimination of cramping compared to 16.3% in the placebo group (p=0.0020). Of the treatment patients, 29.6% reported complete elimination of bloating compared to 16.3% in the placebo group (p=0.015). Of the treatment patients, 16.4% reported complete elimination of gas movement compared to 2.2% in the placebo group (p=0.0005). Symptoms of abdominal pain, cramping, bloating and gas movement were then combined into a composite endpoint representing the key symptoms of lactose intolerance. Of the treatment patients, 13% experienced complete elimination of lactose intolerance symptoms compared to 2% in the placebo group (p=0.004). See Figure 5 below.

Figure 5

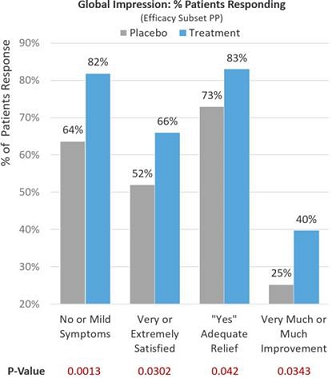

Observing global patient-reported assessments (Efficacy Subset PP) on multiple aspects of their symptom severity and treatment benefit experience 30 days after treatment and adding dairy and milk products back into their diets, 81.9% of treatment patients reported no or mild lactose intolerance symptoms compared to 63.7% in the placebo group (p=0.0013). Of the treatment patients, 66.3% reported being very or extremely satisfied with RP-G28 preventing or treating their lactose intolerance symptoms compared to 51.6% in the placebo group (p=0.0302). Of the treatment patients, 83.2% reported adequate relief from lactose intolerance symptoms compared to 72.5% in the placebo group (p=0.042). Of the treatment patients, 39.7% reported much or very much improvement in their lactose intolerance symptoms compared to 25.3% in the placebo group (p=0.0343). See Figure 6 below.

| 14 |

Figure 6

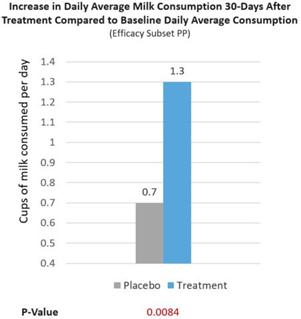

Further, a real-world milk intake assessment was conducted on treatment and placebo group patients (Efficacy Subset PP). At baseline, lactose intolerance patients reported consuming 0.2 cups/d of milk. After RP-G28, treatment patients increased their milk consumption to 1.5 cups/d of milk, consuming 1.3 cups/d more of milk (p=0.0084), 39% more milk consumed per day than placebo patients reported consuming (See Figure 7 below). We believe this is significant because the USDA recommends healthy individuals to consume 1.5 cups/d of milk. Overall, 62% of treatment patients consumed ≥1 cups/d of milk after being treated (p=0.0095). The increase in milk consumption is meaningful for dairy avoiders because it reflects increased lactose tolerance and may lead to more dietary calcium intake post-treatment as milk contains a higher percentage of one’s daily intake of calcium.

Figure 7

No serious adverse events related to treatment were reported and the number of adverse events reported was similar between treatment and placebo groups.

| 15 |

End-of-Phase 2 Meeting with the FDA

We held an End-of-Phase 2 meeting with the FDA’s Division of Gastroenterology and Inborn Errors Products in August 2017. The purpose of the meeting was to obtain the FDA’s feedback on our planned Phase 3 program. We reached general consensus with the FDA on certain elements of our Phase 3 program and have received clear guidance and recommendations on many necessary components of our Phase 3 program; including the clinical, non-clinical, and chemistry, manufacturing and controls (CMC) requirements needed to support an NDA. We have incorporated much of this guidance into our Phase 3 program.

Elements of our Phase 3 program are expected to include the following:

| ● | Trial Design: Will consist of two confirmatory clinical trials of similar trial design and size as our Phase 2b clinical trial and will include additional components that may allow for claims for durability of effect. The trials may be run in parallel. | |

| ● | Protocol design: Will consist of multi-center, randomized, doubled-blind, placebo-controlled, parallel-group trials designed to determine the efficacy, safety and durability of RP-G28 compared to a placebo in subjects with lactose intolerance. The protocol designs include screening to determine lactose intolerance, 30-day course of treatment, and 6-months of post-treatment observation. | |

| ● | Primary endpoint: Will evaluate a patient’s LI symptom composite score (including abdominal pain, cramping, bloating and gas) after a lactose challenge, comparing the mean difference between baseline symptom score to 30-days post-treatment symptom score. | |

| ● | Secondary endpoints: Will evaluate LI signs and symptoms and global assessment outcomes to evaluate and assess a patient’s continued meaningful treatment benefit. |

In preparation for Phase 3, we have had regular communications with the FDA and have received feedback from the FDA on the Phase 3 protocols, the statistical analysis plan (SAP), non-clinical matters, chemistry and controls, as well as other items.

The FDA has provided the following recommendations with respect to our revised Phase 3 protocols, SAP and other items (all of which we intend to implement):

| ● | The FDA has confirmed that two confirmatory pivotal studies are required for a NDA filing. | |

| ● | A primary endpoint was agreed upon. | |

| ● | The FDA has indicated that retreatment must be evaluated in order to provide proper labeling information for clinicians regarding when they should prescribe retreatment, and that we must continue the evaluation of efficacy and safety. | |

| ● | The FDA has indicated that a pharmacokinetic (PK) study, in a fed and fasted state, must be conducted to confirm no to low systemic exposure in order to permit a broad definition of renal classes allowed for inclusion criteria. |

Nonclinical Safety Plans

Given the established safety profile of GOS in humans and the lack of significant safety concerns with RP-G28 administered to subjects in the Phase 2a and Phase 2b clinical trials, it was agreed with the FDA (August 2017 End-of-Phase 2 meeting) that no additional non-clinical safety studies are required to support continued evaluation of RP-G28 in the Phase 3 program. The FDA also agreed that no rat fertility, rat peri-post natal reproductive toxicity, genotoxicity or, importantly, rodent carcinogenicity studies are needed for the NDA submission.

As recommended by the FDA, we will continue to evaluate females of child-bearing potential who are willing to use appropriate contraception throughout the duration of any study. ICH-compliant embryo-fetal development toxicology studies of RP-G28 in the rat and rabbit will be conducted to support the NDA submission. Additional general toxicity studies may also need to be conducted for the NDA submission.

Manufacturing

We do not own or operate manufacturing facilities, nor do we have plans to develop our own manufacturing operations in the foreseeable future. We have an exclusive worldwide agreement (the “Supply Agreement”) to manufacture a higher purity form of GOS (referred to as “Improved GOS”) with Ricerche Sperimentali Montaleor (“RSM”) in connection with our clinical and nonclinical studies we will need to conduct prior to receiving regulatory approval for RPG-28. RSM has also agreed that it will not, except as necessary for RSM to perform its obligations under the Supply Agreement, market or sell Improved GOS, or any galacto-oligosaccharides that are of greater purity to any third party.

| 16 |

Pursuant to the terms of the Supply Agreement, as amended on July 24, 2015, we purchased the exclusive worldwide assignment of all right, title and interest to the Improved GOS (the “Improved GOS IP”) on July 30, 2015 for $800,000. We also issued 100,000 shares of our common stock to RSM pursuant to a stock purchase agreement.

Under the terms of the Supply Agreement, as amended, if we fail to make any future option payment required under the terms of the Supply Agreement, we may be required to return the Improved GOS IP to RSM. The terms of the Supply Agreement, as amended, require us to pay RSM $400,000 within 10 days following FDA approval of a new drug application for the first product owned or controlled by us using Improved GOS as its active pharmaceutical ingredient.

Commercialization

Given our stage of development, we have not yet established a commercial organization or distribution capabilities. RP-G28, if approved, is intended to be prescribed to patients suffering from lactose intolerance. These patients are normally under the care of a gastroenterologist and/or a primary care physician. Our current plan is to evaluate a possible partnership to commercialize RP-G28 for the treatment of lactose intolerance in patients in the United States and Europe if it is approved. We may also build our own commercial infrastructure or utilize contract reimbursement specialists, sales people and medical education specialists, and take other steps to establish the necessary commercial infrastructure at such time as we believe that RP-G28 is approaching marketing approval. Outside of the United States and Europe, subject to obtaining necessary marketing approvals, we will likely seek to commercialize RP-G28 through distribution or other collaboration arrangements for patients suffering from lactose intolerance.

Competition

The biopharmaceutical industry is characterized by intense competition and rapid innovation. Although we know of no drug candidate, other than RP-G28, in advanced clinical trials for treating lactose intolerance, other biopharmaceutical companies may be able to develop compounds or drugs that are able to achieve similar or better results. Our potential competitors include major multinational pharmaceutical companies, established biotechnology companies, specialty pharmaceutical companies and universities and other research institutions. Some of the pharmaceutical and biotechnology companies we expect to compete with include microbiome-based development companies such as Second Genome, Inc., Seres Health, Inc., Enterome SA, Vedanta Biosciences, Inc., and Rebiotix, Inc. Smaller or early-stage companies may also prove to be significant competitors, particularly through collaborative arrangements with large, established companies. We will also compete with providers of a wide variety of lactase supplements (the most widely used supplement in the United States being Lactaid®), probiotic/dietary supplements, and lactose-free and dairy-free products. We believe the key competitive factors that will affect the development and commercial success of our product candidates are efficacy, safety and tolerability profile, reliability, convenience of dosing, price and reimbursement.

Intellectual Property

The proprietary nature of, and protection for, our product candidates and our discovery programs, processes and know-how are important to our business. We have sought patent protection in the United States and internationally for uses of RP-G28 and our discovery programs, and any other inventions to which we have rights, where available and when appropriate. Our policy is to pursue, maintain and defend patent rights, whether developed internally or licensed from third parties, and to protect the technology, inventions and improvements that are commercially important to the development of our business. We also rely on trade secrets that may be important to the development of our business. We do not have composition of matter patent protection in the United States for RP-G28, which may result in competitors being able to offer and sell products so long as these competitors do not infringe any other patents that we hold, including patents directed to methods of manufacturing and purified RP-G28 or directed to methods of using RP-G28.

Our commercial success will depend in part on obtaining and maintaining patent protection and trade secret protection of RP-G28 and any future product candidates and the methods used to develop and manufacture them, as well as successfully defending these patents against third-party challenges. Our ability to stop third parties from making, using, selling, offering to sell or importing our products depends on the extent to which we have rights under valid and enforceable patents or trade secrets that cover these activities. We cannot be sure that patents will be granted with respect to any of our pending patent applications or with respect to any patent applications filed by us in the future, nor can we be sure that any of our existing patents or any patents that may be granted to us in the future will be commercially useful in protecting our product candidates, discovery programs and processes from commercial competition. Furthermore, we cannot be sure that issued patents will not be challenged in court as invalid or in the Patent Office as unpatentable. For this and more comprehensive risks related to our intellectual property, please see “Risk Factors — Risks Relating to Our Intellectual Property.”

| 17 |

Patents and Proprietary Rights Covering Our Drug Candidates

We

strive to protect our product candidates and exclusivity rights, as well as both maintain and fortify our position in the field

of reduction of symptoms associated with lactose intolerance. We believe our intellectual property portfolio consists of early

and broad filings in the area. We have focused on patents and patent applications directed to use of our products in disease treatment.

We have sought and continue to seek the strongest possible intellectual property protection available to us in order to prevent

others from directly competing with us, as well as to exclude competition around our products, their manufacture, and methods

for use of the products in disease treatment. Our intellectual property portfolio directed to RP-G28 contains four issued patents

relating to RP-G28 and its uses. That portfolio also includes at least 15 other related, pending patent applications in the United

States and worldwide. We also own a patent family, including claims generally directed to processes for producing

an improved form of galacto-oligosaccharides (GOS) mixtures (higher purity); this family includes issued patents in United

States (not expiring until 2030), Italy (not expiring until 2029), and China, Germany, and the Netherlands (not expiring

until 2030), as well as applications pending in the United States, Japan, India, and other jurisdictions that, if issued, will

not expire until 2030.

This portfolio includes patents and proprietary rights related to:

| ● | U.S. Patent No. 8,486,668, which has a current expiry date of February 17, 2030, includes claims generally directed to methods for treating lactose intolerance comprising administering, for a predetermined number of days, a high purity galacto-oligosaccharides (GOS) pharmaceutical composition, and wherein the administration leads to a persistent decrease in at least one symptom of lactose intolerance; | |

| ● | U.S. Patent No. 8,492,124, which has a current expiry date of February 17, 2030, includes claims generally directed to methods for treating lactose intolerance comprising administering, for a predetermined number of days, a controlled release pharmaceutical composition that contains galacto-oligosaccharides (GOS), but does not contain a probiotic; | |

| ● | U.S. Patent No. 8,785,160, which has a current expiry date of February 17, 2030, includes claims generally directed to methods for treating lactose intolerance comprising administering a hydrogen breath test, diagnosing lactose intolerance based upon the hydrogen breath test, and administering a high purity galacto-oligosaccharides (GOS) pharmaceutical composition; | |

| ● | U.S. Patent No. 9,200,303, which has a current expiry date of August 6, 2030 (subject to the payment of maintenance fee), includes claims generally directed to the processes for producing ultra-pure galacto-oligosaccharides (GOS) pharmaceutical compositions by utilizing sequential microbiological purifications; | |

| ● | U.S. Patent No. 9,370,532, which has a current expiry date of February 17, 2030, includes claims generally directed to methods for preventing or reducing diarrhea associated with lactose intolerance, and methods for the reduction of severity of diarrhea associated with lactose intolerance, comprising administering a high purity galacto-oligosaccharides (GOS) having 1-10% by weight pentasaccharides and at least a 45% by weight trisaccharides; | |

| ● | U.S. Patent No. 9,579,340, which has a current expiry date of February 17, 2030, includes claims generally directed to an oral dosage form comprising a GOS composition having 95% or more galacto-oligosaccharides (GOS) by weight and less than 5% digestible saccharides by weight, and having 45% by weight trisaccharides; | |

| ● | U.S. Patent No. 9,775,860, which has a current expiry date of February 17, 2030, includes claims generally directed to methods of improving gastrointestinal health, including heartburn, stomach upset, bloating, diarrhea, constipation, or gas by administering a composition having 95% or more GOS by weight and less than 5% digestible saccharides by weight, and having at least 45% by weight trisaccharides; | |

| ● | U.S. Patent No. 9,592,248, which has a current expiry date of February 17, 2030, includes claims generally directed to an oral dosage form having one or more dosing units, each having 0.1 to 10 g of a liquid GOS composition in a gelatin capsule, where the GOS composition has at least about 95% GOS by weight, less than about 5% digestible saccharides by weight, and at least 45% by weight trisaccharides; | |

| ● | U.S. Patent No. 9,808,481, which has a current expiry date of February 17, 2030, includes claims generally directed to a GOS composition having at least 95% by weight GOS and 5% or less by weight digestible saccharides, and having about 5-25% pentasaccharides; |

| 18 |

| ● | United Kingdom Patent No. GB2480042, which has a current expiry date of February 16, 2030, includes claims generally directed to a solid oral unit-dosage form of a high purity galacto-oligosaccharides (GOS); | |

| ● | Canadian Patent No. CA2752800, which has a current expiry date of February 16, 2030 (subject to payment of annuities), includes claims generally directed to the daily use of GOS compositions to increase lactose tolerance or to treat lactose intolerance; | |

| ● | Japanese Patent No. JP6105680, which has a current expiry date of August 6, 2030 (subject to payment of annuities), includes claims generally directed to the production of ultra-pure galacto-oligosaccharides (GOS) pharmaceutical compositions by utilizing sequential microbiological purifications; | |

| ● | European Patent No. EP 2,462,234, validated in six European countries, including Germany, Great Britain, and France, which has a current expiry date of August 6, 2030 (subject to payment of annuities), includes claims generally directed to the processes for producing preparing ultra-pure galacto-oligosaccharides (GOS) pharmaceutical compositions by utilizing sequential microbiological purifications; | |

| ● | Italian Patent No. IT 1,395,068, which has a current expiry date of August 7, 2029 (subject to the payment of annuities), includes claims generally directed to the production of ultra-pure galacto-oligosaccharides (GOS) pharmaceutical compositions by utilizing sequential microbiological purifications; and |

| ● | Chinese Patent No. ZL 201080035013.2, which has a current expiry date of August 6, 2030 (subject to payment of annuities), includes claims generally directed to the production of ultra-pure galacto-oligosaccharides (GOS) pharmaceutical compositions by utilizing sequential microbiological purifications. |

We also are pursuing patent applications. These applications are pending in the United States, Europe, Japan and other jurisdictions, and, if they issue as patents, will not expire until at least 2030, and include claims generally directed to (i) oral dosage forms of a higher purity galacto-ologosaccharides (GOS), (ii) use of galacto-ologosaccharides (GOS) for treating lactose intolerance, and (iii) methods of preventing or reducing certain symptoms of lactose intolerance using galacto-ologosaccharides (GOS) dosage forms. For example, we have paid issue fees (and expect patents to issue in due course) in two United States patent applications: one includes claims directed to an oral dosage forms comprising a prebiotic composition comprising 95% or more galacto-oligosaccharides (GOS) by weight and less than 5% digestible saccharides by weight, in which the GOS comprises at least 45% by weight trisaccharides, and the other includes claims directed to oral dosage forms of GOS, comprising 0.1 to 10 g of a liquid GOS composition encapsulated in a gelatin capsule, in which the GOS composition comprises at least about 95% galacto-oligosaccharides (GOS) by weight, less than about 5% digestible saccharides by weight, and at least 45% by weight trisaccharides.

Trade Secrets

In addition to patents, we rely on trade secrets and know-how to develop and maintain our competitive position. Trade secrets and know-how can be difficult to protect. We seek to protect our proprietary processes, in part, by confidentiality agreements and invention assignment agreements with our employees, consultants, scientific advisors, contractors and commercial partners. These agreements are designed to protect our proprietary information. We also seek to preserve the integrity and confidentiality of our data, trade secrets and know-how by maintaining physical security of our premises and physical and electronic security of our information technology systems.

Government Regulation and Product Approval

Governmental authorities in the United States, at the federal, state and local level, and other countries extensively regulate, among other things, the research, development, testing, manufacture, labeling, packaging, promotion, storage, advertising, distribution, marketing and export and import of products such as those we are developing. Our product candidates must be approved by the FDA through the NDA process before they may be legally marketed in the United States and by the European Medicines Agency (the “EMA”) through the Marketing Authorization Application (“MAA”) process before they may be legally marketed in Europe. Our product candidates will be subject to similar requirements in other countries prior to marketing in those countries. The process of obtaining regulatory approvals and the subsequent compliance with applicable federal, state, local and foreign statutes and regulations require the expenditure of substantial time and financial resources.

| 19 |

United States Government Regulation

NDA Approval Processes

In the United States, the FDA regulates drugs under the Federal Food, Drug, and Cosmetic Act (the “FDCA”) and implemented regulations. Failure to comply with the applicable FDA requirements at any time during the product development process or approval process, or after approval, may subject an applicant to administrative or judicial sanctions, any of which could have a material adverse effect on us. These sanctions could include:

| ● | refusal to approve pending applications; | |

| ● | withdrawal of an approval; | |

| ● | imposition of a clinical hold; | |

| ● | warning letters; | |

| ● | product seizures and/or condemnation and destruction; | |

| ● | total or partial suspension of production or distribution; or | |

| ● | injunctions, fines, disgorgement, or civil or criminal penalties. |

The process required by the FDA before a drug may be marketed in the United States generally involves the following:

| ● | completion of nonclinical laboratory tests, animal studies and formulation studies conducted according to Good Laboratory Practices (“GLPs”) or other applicable regulations; | |

| ● | submission to the FDA of an IND, which must become effective before human clinical trials may begin; | |

| ● | performance of adequate and well-controlled human clinical trials according to Good Clinical Practices (“GCPs”), to establish the safety and efficacy of the proposed drug for its intended use; | |

| ● | submission to the FDA of a marketing application such as a NDA; | |

| ● | satisfactory completion of an FDA inspection of the manufacturing facility or facilities at which the product is produced to assess compliance with current Good Manufacturing Practices (“cGMPs”) to assure that the facilities, methods and controls are adequate to preserve the drug’s identity, strength, quality and purity; and | |

| ● | FDA review and approval of the marketing application. |

Once a pharmaceutical candidate is identified for development, it enters the preclinical or nonclinical testing stage. Nonclinical tests include laboratory evaluations of product chemistry, toxicity and formulation, as well as animal studies. A sponsor of an IND must submit the results of the nonclinical tests, together with manufacturing information and analytical data, to the FDA as part of the IND. Some nonclinical testing may continue even after the IND is submitted. In addition to including the results of the nonclinical studies, the IND will also include a clinical protocol detailing, among other things, the objectives of the clinical trial, the parameters to be used in monitoring safety and the effectiveness criteria to be evaluated if the first phase lends itself to an efficacy determination. The IND automatically becomes effective 30 days after receipt by the FDA, unless the FDA, within the 30-day time period, notifies the sponsor of a clinical hold. In such a case, the IND sponsor and the FDA must resolve any outstanding concerns before clinical trials can begin. A clinical hold may occur at any time during the life of an IND, and may affect one or more specific studies or all studies conducted under the IND.

All clinical trials must be conducted under the supervision of one or more qualified investigators in accordance with GCPs. They must be conducted under protocols detailing the objectives of the trial, dosing procedures, research subject selection and exclusion criteria and the safety and effectiveness criteria to be evaluated. Each protocol must be submitted to the FDA as an amendment to the IND, and progress reports detailing the status of the clinical trials must be submitted to the FDA annually in the IND Annual Report. Sponsors must also report to the FDA, within required timelines, serious and unexpected adverse reactions, any clinically important increase in the rate of a serious suspected adverse reaction over that listed in the protocol or investigation brochure, or any findings from other studies or animal or in vitro testing that suggest a significant risk in humans exposed to the drug. An institutional review board (“IRB”) at each institution participating in the clinical trial must review and approve the protocol before a clinical trial commences at that institution and must also approve the information regarding the trial and the consent form that must be provided to each research subject or the subject’s legal representative, monitor the study until completed and otherwise comply with IRB regulations.

| 20 |

Human clinical trials are typically conducted in three sequential phases that may overlap or be combined:

| ● | Phase 1. The drug is initially introduced into healthy human subjects and tested for safety, dosage tolerance, absorption, metabolism, distribution and elimination. In the case of some products for severe or life-threatening diseases, such as cancer, especially when the product may be inherently too toxic to ethically administer to healthy volunteers, the initial human testing is often conducted in patients. | |

| ● | Phase 2. Clinical trials are performed on a limited patient population intended to identify possible adverse effects and safety risks, to preliminarily evaluate the efficacy of the product for specific targeted diseases and to determine dosage tolerance and optimal dosage. Although there are no statutory or regulatory definitions for Phase 2a and Phase 2b, Phase 2a is commonly used to describe a Phase 2 clinical trial designed to evaluate efficacy, adverse effects and safety risks and Phase 2b is commonly used to describe a subsequent Phase 2 clinical trial that also evaluates dosage tolerance and optimal dosage. | |

| ● | Phase 3. Clinical trials are undertaken to further evaluate dosage, clinical efficacy and safety in an expanded patient population at geographically dispersed clinical study sites. These studies are intended to establish the overall risk-benefit ratio of the product and provide an adequate basis for product labeling. |

Human clinical trials are inherently uncertain and Phase 1, Phase 2 and Phase 3 testing may not be successfully completed. The FDA or the sponsor may suspend a clinical trial at any time for a variety of reasons, including a finding that the research subjects or patients are being exposed to an unacceptable health risk. Similarly, an IRB can suspend or terminate approval of a clinical trial at its institution if the clinical trial is not being conducted in accordance with the IRB’s requirements or if the drug has been associated with unexpected serious harm to patients.

During the development of a new drug, sponsors are given opportunities to meet with the FDA at certain points. These points may be prior to the submission of an IND, at the end of Phase 2 and before an NDA is submitted. Meetings with the FDA may be granted at other times during the development program when requested. For instance, we held a Type C meeting with the FDA’s Division of Gastroenterology and Inborn Errors Products on February 20, 2013. The purpose of the meeting was to obtain the FDA’s feedback on the planned clinical development program and future necessary clinical studies, inform the FDA of our ongoing development plans, gain feedback on relevant clinical trial design and end points related to patient meaningful benefits, and to inform the FDA of the status of our product characterization. Following analysis of the Phase 2a clinical trial, discussions with the FDA during the Type C Meeting in early 2013 about our clinical development plan, and further discussions with our regulatory consultants, we initiated the Phase 2b clinical trial of RPG-28 in March 2016 and completed final enrollment and dosing in October 2016.

FDA meetings can provide an opportunity for the sponsor to share information about the data gathered to date and for the FDA to provide advice on the next phase of development. Sponsors typically use the meeting at the end of Phase 2 to discuss their Phase 2 clinical results and present their plans for the pivotal Phase 3 clinical trial that they believe will support the approval of the new drug. Sponsors may request a Special Protocol Assessment (“SPA”), only if the sponsor has already had an end-of-phase 2/pre-phase 3 meeting or end-of-phase 1 meeting as appropriate. The purpose of the SPA is to reach agreement with the FDA on clinical trial protocol design and analysis that will form the primary basis of an efficacy claim.

According to published guidance on the SPA process, a sponsor which meets the prerequisites may make a specific request for a SPA and ask specific questions regarding the design and size of the proposed clinical trial. The FDA has a goal to evaluate the protocol within 45 days of the request to assess whether the proposed trial is adequate, and that evaluation may result in discussions and a request for additional information. A SPA request must be made before the proposed trial begins, and all open issues must be resolved before the trial begins. If a written agreement is reached, it will be documented and made part of the record. The agreement will be binding on the FDA and may not be changed by the sponsor or the FDA after the trial begins except with the written agreement of the sponsor and the FDA or if the FDA determines that a substantial scientific issue essential to determining the safety or efficacy of the drug was identified after the testing began.

Concurrent with clinical trials, sponsors usually complete additional animal safety studies and also develop additional information about the chemistry and physical characteristics of the drug and finalize a process for manufacturing commercial quantities of the product in accordance with cGMP requirements. The manufacturing process must be capable of consistently producing quality batches of the drug and the manufacturer must develop methods for testing the identity, strength, quality, purity and potency of the drug. Additionally, appropriate packaging must be selected and tested and stability studies must be conducted to demonstrate that the drug candidate does not undergo unacceptable deterioration over its proposed shelf-life.

The results of product development, nonclinical studies and clinical trials, along with descriptions of the manufacturing process, analytical tests and other control mechanisms, proposed labeling and other relevant information are submitted to the FDA as part of an NDA requesting approval to market the product. The submission of an NDA is subject to the payment of user fees, but a waiver of such fees may be obtained under specified circumstances. The FDA has 60 days from its receipt of an NDA to determine whether the application will be accepted for filing based on the agency’s threshold determination of whether it is sufficiently complete to permit substantive review. It may request additional information rather than accept an NDA for filing. In this event, the NDA must be resubmitted with the additional information. The resubmitted application also is subject to review before the FDA accepts it for filing.

| 21 |