Attached files

| file | filename |

|---|---|

| EX-21.1 - SUBSIDIARIES OF THE REGISTRANT - ABV CONSULTING, INC. | abvn_ex211.htm |

| EX-32.2 - CERTIFICATION - ABV CONSULTING, INC. | abvn_ex322.htm |

| EX-32.1 - CERTIFICATION - ABV CONSULTING, INC. | abvn_ex321.htm |

| EX-31.2 - CERTIFICATION - ABV CONSULTING, INC. | abvn_ex312.htm |

| EX-31.1 - CERTIFICATION - ABV CONSULTING, INC. | abvn_ex311.htm |

| EX-10.4 - EMPLOYMENT AGREEMENT - ABV CONSULTING, INC. | abvn_ex104.htm |

| EX-10.3 - EMPLOYMENT AGREEMENT - ABV CONSULTING, INC. | abvn_ex103.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2017

or

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____________ to _____________

Commission file number: 333-198567

|

ABV Consulting, Inc. |

|

(Exact name of registrant as specified in its charter) |

|

Nevada |

46-3997344 | |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|

Unit 1101-1102, 11/F, Railway Plaza 39 Chatham Road S. Tsim Sha Tsui, Kowloon, Hong Kong |

N/A | |

|

(Address of principal executive offices) |

(Zip Code) |

(852) 3758-2226

Registrant’s telephone number, including area code

Securities registered pursuant to Section 12(b) of the Exchange Act:

|

Title of each class: |

Name of each exchange on which registered: | |

|

None |

None |

Securities registered pursuant to Section 12(g) of the Exchange Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

x |

Accelerated filer |

¨ |

|

Non-accelerated filer |

¨ (Do not check if a smaller reporting company) |

Smaller reporting company |

¨ |

|

Emerging growth company |

¨ |

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the voting and non-voting stock held by non-affiliates of the Registrant, as of June 30, 2017, the last business day of the Registrant’s most recently completed second fiscal quarter, was approximately $3,623,400,000. Solely for purposes of this disclosure, shares of common stock held by executive officers and directors of the Registrant as of such date have been excluded because such persons may be deemed to be affiliates. This determination of executive officers and directors as affiliates is not necessarily a conclusive determination for any other purposes.

5,533,000 shares of common stock were issued and outstanding as of March 13, 2018.

Form 10-K

For the Fiscal Year Ended December 31, 2017

TABLE OF CONTENTS

| 2 |

| Table of Contents |

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

This Annual Report on Form 10-K contains “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Because they discuss future events or conditions, forward-looking statements may include words such as “anticipate,” “believe,” “estimate,” “intend,” “could,” “should,” “would,” “may,” “seek,” “plan,” “might,” “will,” “pursue,” “expect,” “anticipate,” “predict,” “project,” “goals,” “strategy,” “future,” “likely,” “forecast,” “potential,” “continue,” negatives thereof or similar references to future periods. Examples of forward-looking statements include, among others, statements we make regarding:

|

|

· | Potential acquisition or merger targets; |

|

|

· | Business strategies; |

|

|

· | Future cash flows; |

|

|

· | Financing plans; |

|

|

· | Plans and objectives of management; |

|

|

· | Any other statements regarding future acquisitions, future cash needs, future operations, business plans and future financial results; and |

|

|

· | Any other statements that are not historical facts. |

Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Our actual future results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from those indicated in the forward-looking statements include, among others, the following:

|

|

· | Volatility or decline of our stock price; |

|

|

· | Potential fluctuation of quarterly results; |

|

|

· | Failure of the Company to earn revenues or profits; |

|

|

· | Inadequate capital to continue or expand our business, and inability to raise additional capital or financing to implement its business plans; |

|

|

· | Decline in demand for our products and services; |

|

|

· | Rapid adverse changes in markets; |

|

|

· | Litigation with or legal claims and allegations by outside parties against the Company; |

|

|

· | Insufficient revenues to cover operating costs; |

|

|

· | Inability to source attractive investment deal flow on terms favorable to the Company; and |

|

|

· | Such other factors as discussed throughout Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations of our Annual Report on Form 10-K for the year ended December 31, 2017. |

There is no assurance that we will be profitable, we may not be able to attract or retain qualified executives and personnel, we may not be able to obtain customers for future products or services, additional dilution in outstanding stock ownership may be incurred due to the issuance of more shares, warrants and stock options, or the exercise of outstanding warrants and stock options, and other risks inherent in our businesses.

Because the statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by the forward-looking statements. We caution you not to place undue reliance on the statements, which speak only as of the date of this Annual Report on Form 10-K. The cautionary statements contained or referred to in this section should be considered in connection with any subsequent written or oral forward-looking statements that we or persons acting on our behalf may issue. We do not undertake any obligation to review or confirm analysts’ expectations or estimates or to release publicly any revisions to any forward-looking statements to reflect events or circumstances after the date of this Annual Report, or to reflect the occurrence of unanticipated events.

| 3 |

| Table of Contents |

Overview of Corporate History

ABV Consulting, Inc. (“we,” “us,” “our,” “ABVN” or the “Company”) was incorporated in the state of Nevada on October 15, 2013. At formation, the Company authorized 100,000,000 shares of common stock, par value $0.0001 per share, and 10,000,000 shares of preferred stock, par value $0.0001 per share. In connection with our formation, the Company’s founder, Andrew Gavrin, received 5,000,000 shares of common stock as founder shares, and Mr. Gavrin served as the Company’s chief executive officer, chief financial officer and sole director from the time of incorporation until August 22, 2016.

The Company was originally formed to engage in merchandising and consulting services to craft beer brewers and distributors, as well as providing additional branding and marketing support within the craft beer industry to retailers and other organizations. The Company’s customer base consisted of alcohol beverage manufacturers, distributors, retailers, beer festival operators and other organizations involved in the sale and marketing of craft beer.

We focused our early efforts on pro bono engagements and secured one paid engagement for $2,000 by the close of our second quarter in 2016.

On August 22, 2016, in connection with the sale of a controlling interest in the Company, Mr. Gavrin sold to Ms. Ping Zhang the entire amount of his 5,000,000 shares of common stock for an aggregate price of $228,400 (the “Change of Control Transaction”). In connection with the Change of Control Transaction, Mr. Gavrin agreed pay $25,186.25 of debts of the Company in addition to the cancellation of $35,000 worth of debt owed to him by the Company. Concurrent with the Change of Control Transaction, Mr. Gavrin resigned from all corporate officer and director roles, and was replaced in all roles by Mr. Wai Lim Wong.

On December 19, 2016, the Company amended its articles of incorporation to increase the authorized number of shares of the Company’s common stock from 100,000,000 to 3,000,000,000 shares, par value $0.0001.

On February 24, 2017, ABV entered into a Share Exchange Agreement (the “Agreement”) with Allied Plus (Samoa) Limited, an international company incorporated in Samoa with limited liability (“APSL”), and each of APSL’s shareholders (collectively, the “Sellers”), pursuant to which, and subject to the terms and conditions contained therein, the Company would effect an acquisition of APSL by acquiring from the Sellers all outstanding equity interests of APSL (the “Acquisition”).

Pursuant to the Agreement, in exchange for all of the outstanding shares of APSL, the Company would issue 1,980,000,000 shares of common stock of the Company (the “Exchange Shares”) to the Sellers. The Exchange Shares to be allocated among the Sellers pro-rata based on each Seller’s ownership of APSL prior to the Acquisition. The Exchange Shares to be subject to a lock-up as set forth in the Agreement.

On February 28, 2017, ABV closed the share exchange (the “Exchange”) pursuant to the terms of Agreement. In connection with the closing, on February 28, 2017, the Company filed Articles of Exchange with the Secretary of State for the State of Nevada, which Articles of Exchange became effective upon filing

At the closing of the Exchange, the Company acquired 100% of the outstanding equity interests of APSL from the Sellers, and the Company issued to the Sellers, pro-rata based on each Seller’s ownership percentage of APSL prior to the Exchange, 1,980,000,000 shares of the Company’s common stock, par value $0.0001 per share (representing approximately 99.72% of the Company’s outstanding common stock). As a result, the Sellers became stockholders of the Company and APSL became a subsidiary of the Company.

APSL was incorporated in Samoa on January 11, 2016, for the purposes of sourcing and developing tourism and entertainment-related investment projects in Malaysia and Southeast Asia in connection with the People’s Republic of China’s broad “One Belt, One Road” regional investment and development initiative, and for other purposes.

| 4 |

| Table of Contents |

On June 19, 2017, APSL acquired 100% issued and outstanding equity of ABV Consulting Limited (“ABV HK”) which was incorporated in Hong Kong, China, and ABV HK became the wholly subsidiary of APSL.

On December 19, 2017, the board of directors of ABV and certain shareholders of the Company (“Shareholders”) entered into a Mutual Rescission Agreement (the “Rescission Agreement”). The Rescission Agreement rescinded the share exchange agreement dated February 24, 2017 (the “Share Exchange Agreement”), between the equity interest owners of Allied Plus (Samoa) Limited (“Allied Plus”), who are also the Shareholders, and the Company.

The Share Exchange Agreement provided for the acquisition of all of the outstanding equity interests of Allied Plus (“Equity Interests”) by the Company in consideration of the issuance of 1,980,000,000 shares of the Company’s common stock (the “Shares”) to the Shareholders. The Shares were issued to the Shareholders and the Equity Interests were transferred to the Company.

The Rescission Agreement provides that the Shareholders will return all of the Shares to the Company in consideration for the return of the Equity Interests to the Shareholders. The Shares will be cancelled and returned to the Company’s treasury. The Shareholders have signed stock powers (“Stock Powers”) in favor of the Company, and the Stock Powers and Shares have been delivered to the Company’s transfer agent for cancellation.

With the completion of the Rescission Agreement, APSL is no longer a subsidiary of the Company.

Accordingly, APSL sold the 100% issued and outstanding equity of ABV Consulting Limited (“ABV HK”) to the Company, and ABV HK became our wholly owned subsidiary.

Overview of Current Business

Following the Change of Control Transaction, our new management decided to pursue a strategic acquisition strategy focused on acquisition target companies with operations located primarily in Southeast Asia, the Pacific Islands, the People’s Republic of China (including Hong Kong and Macau) (the “PRC”), Taiwan and other jurisdictions within Asia. In connection with this new strategy, we moved our corporate headquarters from Pennsylvania to Hong Kong. We believe that the PRC’s “One Belt, One Road” (“OBOR”) regional cooperation initiative will be a significant driver for strategic investment opportunities throughout Asia.

“One Belt, One Road”

Between September and October 2013, the PRC government disclosed its plan to pursue a regional trade, investment, infrastructure and cultural exchange program incorporating approximately sixty countries located along the historic silk road trading route connecting Africa, the Middle East, Europe and Central and East Asia—called the “Silk Road Economic Belt”—and also nations located in the South China Sea, the South Pacific Ocean and the Indian Ocean—called the “Maritime Silk Road.” The initiative has since been labeled “One Belt, One Road” or “OBOR” for short, and in 2014 the Chinese foreign minister identified OBOR as the single most important feature of Chinese President Xi Jinping’s foreign policy.

The PRC government intends to invest at least $4 trillion over an indefinite time period on projects located within OBOR constituent countries, and hundreds of projects worth approximately $1 trillion have been approved to date.

OBOR-Related Investment Opportunities

We anticipate that entities based in Hong Kong will continue their historic gatekeeping function as financial and advisory intermediaries between the PRC and the world at large, and Asia in particular. We intend to avail ourselves of this strategic advantage to pursue strategic co-investments with entities deploying OBOR-related funds and to invest into companies and assets that are well positioned to benefit from OBOR-related investments.

| 5 |

| Table of Contents |

Objectives and Strategies

We explored a number of strategic investment opportunities following the Change of Control Transaction, but we did not enter into any definitive agreements by the end of FY2017. See our Current Report on Form 8-K, dated March 2, 2017, for a description of our former acquisition of Allied Plus (Samoa) Limited (“APSL”), which closed on February 28, 2017 and rescinded on December 19, 2017.

In pursuing our acquisition strategy, we are guided by our core objective of maximizing stockholder value by sourcing and acquiring assets with stable cash flow and/or significant growth potential connected to OBOR-related investment and trade and our ability to assist the investment target with securing economic and financial resources.

APSL primarily engaged in the business of providing services to agents and financial advisers in Southeast Asia. The management of APSL possesses certain knowledge of investment criteria of OBOR-related investment entities, and provides consulting services to regional consultants and brokers with regard to their efforts to source and promote attractive investment opportunities.

After the completion of the Rescission Agreement, ABV HK has been taking over the OBOR-related roles from APSL.

Marketing and Sales Efforts, Pricing

We engaged a lot of efforts in marketing and sales during 2017, ABV HK entered into two Memorandum of Understanding (“MOU”) in mid-2017 with two China based companies: Shangdong Rushan Victoria Bay Tourism Development Company Ltd. (“Victoria”) and Zhejiang Zhongmeng United Enterprise Management Shareholding Co. Ltd. (“Zhongmeng UEM”) for developing a Tourism Resort and Organic Pig Farms businesses respectively. See our report on Form 8-K dated August 25, 2017. These two development projects are still in processing to finalize the co-operation Agreement due to the changing policies by the PRC government.

In addition, ABV HK entered a consulting project contract with a Hong Kong based Kid-Friendly Restaurant in September 2017 for providing market research and business plan for Hong Kong region as well as expanding business to Asian markets such as Singapore, Taiwan and China. This consulting project has generated a phase 1 revenue of US$25,641 (HK$200,000) in September 2017, and upon its completion of phase 2 in mid-2018, it will generate another revenue of US$38,462 (HK$300,000).

Competition

We face substantial competition from individuals and entities that seek to invest into Asia. Although we feel that the personal relationships developed by our management and business partners provide us with a competitive advantage in sourcing, analyzing, and approving optimal deals, we compete with corporate strategic investors, financial investors like private equity funds, wealth management offices, high net worth individuals and ultra-high net worth individuals, sovereign wealth funds, and any entities which engage in investment activities in Asia. Our management and the management of ABV HK compete primarily on the basis of reputation for honest and thoughtful business practices, as well as quality of network and strategic relationships.

Intellectual Property and Other Contracts

We do not have any patents, trademarks, licenses, franchises, concessions, royalty agreements, or labor contracts.

Employees

We have four paid full-time employees who provide services on an at-will basis.

| 6 |

| Table of Contents |

WHERE YOU CAN FIND MORE INFORMATION

You are advised to read this Form 10-K in conjunction with other reports and documents that we file from time to time with the SEC. In particular, please read our Quarterly Reports on Form 10-Q and Current Reports on Form 8-K that we file from time to time. You may obtain copies of these reports directly from us or from the SEC at the SEC’s Public Reference Room at 100 F. Street, N.E. Washington, D.C. 20549, and you may obtain information about obtaining access to the Reference Room by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains information for electronic filers at its website http://www.sec.gov.

The following discussion of risk factors contains forward-looking statements. These risk factors may be important to understanding other statements in this Form 10-K. The following information should be read in conjunction with Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and related notes in Part II, Item 8, “Financial Statements and Supplementary Data” of this Form 10-K.

The business, financial condition and operating results of the Company can be affected by a number of factors, whether currently known or unknown, including but not limited to those described below, any one or more of which could, directly or indirectly, cause the Company’s actual financial condition and operating results to vary materially from past, or from anticipated future, financial condition and operating results. Any of these factors, in whole or in part, could materially and adversely affect the Company’s business, financial condition, operating results and stock price.

Because of the following factors, as well as other factors affecting the Company’s financial condition and operating results, past financial performance should not be considered to be a reliable indicator of future performance, and investors should not use historical trends to anticipate results or trends in future periods.

As described in Note 2 of our accompanying financial statements, our auditors have issued a going concern opinion regarding the Company. This means there is substantial doubt we can continue as an ongoing business for the next twelve months. The financial statements do not include any adjustments that might result from the uncertainty regarding our ability to continue in business. As such, we may have to adjust our operations model to avoid investors’ investment losses in the Company.

We have losses which we expect to continue into the future. There is no assurance our future operations will result in profitable revenues.

Since we divested our interest in Allied Plus (Samoa) Limited (“Allied Plus”), we have no operating history upon which an evaluation of our future success or failure can be made. Our net loss since inception to December 31, 2017, was $345,355. Our ability to achieve and maintain profitable and positive cash flows is dependent upon:

|

|

· | Our ability to attract customers who will buy our services, and |

|

|

· | Our ability to generate revenue through the sale of our services. |

Based upon current plans, we expect to incur operating losses in future periods because we will be incurring expenses.. We cannot guarantee that we will be successful in generating revenues in the future. In the event the Company is unable to generate revenues, it may be required to seek additional funding. Such funding may not be available, or may not be available on terms which are beneficial and/or acceptable to the Company. In the event the Company cannot generate revenues and/or secure additional financing, the Company may adjust its operations model to avoid investors’ losses of their investment in the Company.

If our proposed business plans are not accepted by the public at sufficient levels, our business plan may need to be modified or we may fail.

We have not yet fully completed our plan to develop our business. The success of our proposed business will depend on the completion of our plan and the acceptance of our services by the general public. Achieving such acceptance will require significant marketing investment. Once we are capable of providing good and services, it may not be accepted by consumers at sufficient levels to support our operations and build our business. If our products are not accepted at sufficient levels, our business may fail.

| 7 |

| Table of Contents |

We are exploring business opportunities for additional source of funding for our business plans., If we are unable to find any such funding if and when needed, it may result in the failure of our business.

If we do find an alternative source of capital, the terms and conditions of acquiring such capital may result in dilution and the resultant lessening of value of the shares of stockholders.

If we are not successful in raising sufficient capital in the future, we will be faced with several options:

1. abandon our business plans, cease operations and go out of business;

2. continue to seek alternative and acceptable sources of capital; or

3. bring in additional capital that may result in a change of control.

In the event any of the above circumstances occur, you could lose all or a substantial part of your investment.

We face substantial competition from individuals and entities that seek to invest into Asia.

Because we face substantial competition from individuals and entities that seek to invest into Asia, and wish to participate in the One Belt One Road initiative of the PRC, we may have difficulty in establishing a profitable business assisting companies and may be required to modify our business plans based on the difficulty of securing streams of revenue.

We are dependent upon our current officers, Wai Chi Chan as the Company’s Chief Financial Officer, Wai Lim Wong as the Company’s sole Director, President and Chief Executive Officer, Ching Yau Chu as the Company’s Chief Operating Officer, and Chi Lin Chow as the Company’s Secretary.

We currently are managed by 4 officers and 1 director and we are entirely dependent upon them in order to conduct our operations. If they resign or die, there will be a risk to the Company and we will be required to secure new officers and/or directors in order to continue our active business operations to avoid investors losing some or all of their investment in the Company.

Our stock is considered a penny stock. The market for penny stock has suffered in recent years from patterns of fraud and abuse.

Stockholders should be aware that, according to SEC Release No. 34-29093, the market for penny stocks has suffered in recent years from patterns of fraud and abuse. Such patterns include:

|

|

· | Control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer; |

|

|

· | Manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases; |

|

|

· | Boiler room practices involving high-pressure sales tactics and unrealistic price projections by inexperienced salespersons; |

|

|

· | Excessive and undisclosed bid-ask differential and markups by selling broker-dealers; and, |

|

|

· | The wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the resulting inevitable collapse of those prices and with consequential investor losses. |

Our management is aware of the abuses that have occurred historically in the penny stock market. Although we do not expect to be in a position to dictate the behavior of the market or of broker-dealers who participate in the market, management will strive within the confines of practical limitations to prevent the described patterns from being established with respect to our securities. The occurrence of these patterns or practices could increase the volatility of our share price.

| 8 |

| Table of Contents |

Due to the lack of a trading market for our securities, you may have difficulty selling any shares you purchase.

There currently is little public trading market for our common stock. The lack of a public trading market for our shares may have a negative effect on your ability to sell your shares in the future and it also may have a negative effect on the price, if any, for which you may be able to sell your shares. As a result, an investment may be illiquid in nature and investors could lose some or all of their investment in the Company.

We will incur ongoing costs and expenses for SEC reporting and compliance, without revenue we may not be able to remain in compliance, making it difficult for investors to sell their shares, if at all.

Going forward, the Company will have ongoing SEC compliance and reporting obligations. Such ongoing obligations will require the Company to expend additional amounts on compliance, legal and auditing costs. In order for us to remain in compliance, we will require future revenues to cover the cost of these filings, which could comprise a substantial portion of our available cash resources. If we are unable to generate sufficient revenues to remain in compliance, it may be difficult for you to resell any shares you may purchase, if at all.

We Are Unlikely To Pay Dividends

To date, we have not paid, nor do we intend to pay in the foreseeable future, dividends on our common stock, even if we become profitable. Earnings, if any, are expected to be used to advance our activities and for general corporate purposes, rather than to make distributions to stockholders. Prospective investors will likely need to rely on an increase in the price of Company stock to profit from his or her investment. There are no guarantees that any market for our common stock will ever develop or that the price of our stock will ever increase. If prospective investors purchase stock, they must be prepared to be unable to liquidate their investment and/or lose their entire investment.

Since we are not in a financial position to pay dividends on our common stock, and future dividends are not presently being contemplated, investors are advised that return on investment in our common stock is restricted to an appreciation in the share price. The potential or likelihood of an increase in share price is questionable at best.

Item 1B. Unresolved Staff Comments

None.

Our principal executive office is located at Unit 1101-1102, 11/F, Railway Plaza, 39 Chatham Road S., Tsim Sha Tsui, Kowloon, Hong Kong. Our telephone number is (852) 3758-2226. Our principal executive office is approximately 5,000 square feet, and this office is provided to us rent free by an officer of the Company.

The Company is currently not a party to any pending or threatened litigation, the outcome of which would be expected to have a material adverse effect on its financial condition or the results of its operations.

Item 4. Mine Safety Disclosures

Not applicable.

| 9 |

| Table of Contents |

The Company’s common stock is quoted on the OTCMarkets under the symbol ABVN.

Price Range of Common Stock

The price range per share of common stock presented below represents the highest and lowest intraday sales prices for the Company’s common stock on the OTCMarkets during each quarter of the two most recent years.

|

|

Fourth Quarter |

|

Third Quarter |

|

Second Quarter |

|

First Quarter |

|

2017 price range per share |

$2.99 – $1.50 |

|

$8.50 – $1.23 |

|

$3.01 – $1.25 |

|

$3.01 – $1.00 |

|

2016 price range per share |

$2.75 – $1.00 |

|

$50.00 – $0.20 |

|

$100.00 – $50.00 |

|

$NA - $NA |

Holders

As of March 13, 2018, there were 27 shareholders of record.

Dividends

To date, we have not declared or paid any dividends on our common stock. We currently do not anticipate paying any cash dividends in the foreseeable future on our common stock. Our Board of Directors has the authority to declare and pay dividends at its discretion in the future. Payment of dividends in the future will depend upon our earnings, capital requirements, and any other factors that our Board of Directors deems relevant.

Equity Compensation Plans

None.

Recent Sales of Unregistered Securities

None.

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

On December 19, 2017, we repurchased 1,980,000,000 shares of the Company’s common stock from certain shareholders. See Item 1 above.

Company Stock Performance

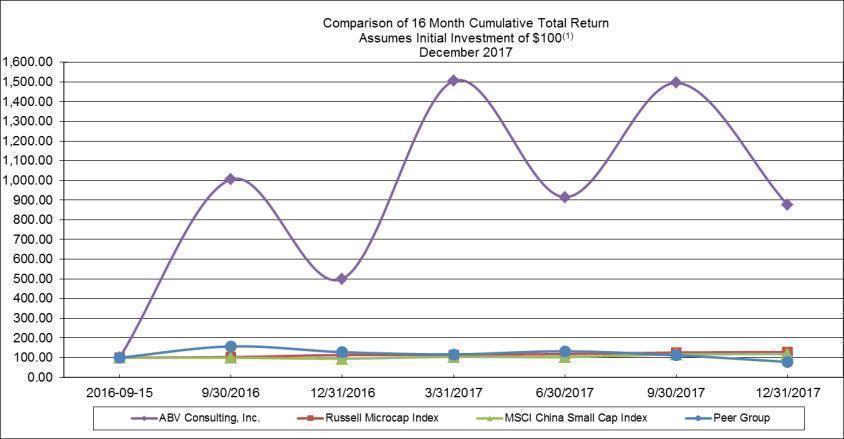

The following graph shows a comparison of cumulative total shareholder return, calculated on a dividend reinvested basis, for the Company, the Russell Microcap Index, the MSCI China Small Cap Index and a peer group (the “Peer Group”) for the 16 months ended December 31, 2017. The graph assumes $100 was invested in each of the Company’s common stock, the Russell Microcap Index, the MSCI China Small Cap Index and the Peer Group as of the market close on September 15, 2016. Note that historic stock price performance is not necessarily indicative of future stock price performance. The Peer Group is comprised of Global Equity International Inc., HPIL Holding, Hubilu Venture Corporation, Asia Equity Exchange Group, Inc., AF Ocean Investment Management Co., CD International Enterprises, Inc., SNM Global Holdings, and Uni Core Holdings Corporation.

| 10 |

| Table of Contents |

(1) Further assumes such amount was invested on September 15, 2016.

|

Prepared by Zacks Investment Research, Inc. Used with permission. All rights reserved. Copyright 1980-2018. |

|

Copyright Russell Investments. Used with permission. All rights reserved. |

| 11 |

| Table of Contents |

|

|

|

September 15, |

|

|

December 31, |

|

|

December 31 |

| |||

|

|

|

2016 |

|

|

2016 |

|

|

2017 |

| |||

|

ABV Consulting, Inc. |

|

$ | 100 |

|

|

$ | 500 |

|

|

$ | 875 |

|

|

Russell Microcap Index |

|

$ | 100 |

|

|

$ | 113 |

|

|

$ | 128 |

|

|

MSCI China Small Cap Index |

|

$ | 100 |

|

|

$ | 95 |

|

|

$ | 118 |

|

|

Peer Group |

|

$ | 100 |

|

|

$ | 128 |

|

|

$ | 78 |

|

Item 6. Selected Financial Data

The information set forth below for the five years ended December 31, 2017, is not necessarily indicative of results of future operations, and should be read in conjunction with Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and related notes thereto included in Part II, Item 8 of this Form 10-K to fully understand factors that may affect the comparability of the information presented below.

| 12 |

| Table of Contents |

|

|

|

Year Ended December 31, |

| |||||||||||||||||

|

|

|

2017 |

|

|

2016 |

|

|

2015 |

|

|

2014 |

|

|

2013 |

| |||||

|

Revenue |

|

$ | 25,641 |

|

|

$ | 2,000 |

|

|

$ | - |

|

|

$ | - |

|

|

$ | - |

|

|

Operating expenses |

|

$ | 189,053 |

|

|

$ | 71,523 |

|

|

$ | 46,383 |

|

|

$ | 54,527 |

|

|

$ | (10,814 | ) |

|

Loss from continuing operations |

|

$ | (163,412 | ) |

|

$ | (69,872 | ) |

|

$ | (46,730 | ) |

|

$ | 54,527 |

|

|

$ | (10,814 | ) |

|

Loss from discontinued operations |

|

$ | - |

|

|

$ | - |

|

|

$ | - |

|

|

$ | - |

|

|

$ | - |

|

|

Net loss |

|

$ | (163,412 | ) |

|

$ | (69,872 | ) |

|

$ | (46,730 | ) |

|

$ | (54,527 | ) |

|

$ | (10,814 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and Diluted |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from continuing operations |

|

$ | (0.00 | ) |

|

$ | (0.01 | ) |

|

$ | (0.01 | ) |

|

$ | (0.01 | ) |

|

$ | (0.00 | ) |

|

Loss from discontinued operations |

|

$ | - |

|

|

$ | - |

|

|

$ | - |

|

|

$ | - |

|

|

$ | - |

|

|

Net loss |

|

$ | (0.00 | ) |

|

$ | (0.01 | ) |

|

$ | (0.01 | ) |

|

$ | (0.01 | ) |

|

$ | (0.00 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares used in computing loss per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

|

1,600,382,315 |

|

|

|

5,533,000 |

|

|

|

5,533,000 |

|

|

|

5,204,977 |

|

|

|

5,000,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash dividends declared per share |

|

$ | - |

|

|

$ | - |

|

|

$ | - |

|

|

$ | - |

|

|

$ | - |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total cash and cash equivalents |

|

$ | 299 |

|

|

$ | 1,636 |

|

|

$ | 8,513 |

|

|

$ | 30,624 |

|

|

$ | 5,000 |

|

|

Total assets |

|

$ | 299 |

|

|

$ | 1,636 |

|

|

$ | 8,513 |

|

|

$ | 30,624 |

|

|

$ | 5,000 |

|

|

Total current liabilities |

|

$ | 185,664 |

|

|

$ | 23,589 |

|

|

$ | 4,648 |

|

|

$ | 21,876 |

|

|

$ | - |

|

|

Total long-term obligations |

|

$ | - |

|

|

$ | - |

|

|

$ | 35,347 |

|

|

$ | - |

|

|

$ | - |

|

|

Total liabilities |

|

$ | 185,664 |

|

|

$ | 23,589 |

|

|

$ | 39,995 |

|

|

$ | 21,876 |

|

|

$ | - |

|

|

Total shareholders’ equity (deficit) |

|

$ | (185,365 | ) |

|

$ | (21,953 | ) |

|

$ | (31,482 | ) |

|

$ | 8,748 |

|

|

$ | 5,000 |

|

| 13 |

| Table of Contents |

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

This section and other parts of this Annual Report on Form 10-K (“Form 10-K”) contain forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995, that involve risks and uncertainties. Forward-looking statements provide current expectations of future events based on certain assumptions and include any statement that does not directly relate to any historical or current fact. Forward-looking statements can also be identified by words such as “future,” “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “predicts,” “will,” “would,” “could,” “can,” “may,” and similar terms. Forward-looking statements are not guarantees of future performance and the Company’s actual results may differ significantly from the results discussed in the forward-looking statements. Factors that might cause such differences include, but are not limited to, those discussed in Part I, Item 1A of this Form 10-K under the heading “Risk Factors,” which are incorporated herein by reference. The following discussion should be read in conjunction with the consolidated financial statements and notes thereto included in Part II, Item 8 of this Form 10-K. All information presented herein is based on the Company’s fiscal calendar. Unless otherwise stated, references to particular years, quarters, months or periods refer to the Company’s fiscal years ended in December and the associated quarters, months and periods of those fiscal years. Each of the terms the “Company” and “ABV Consulting” as used herein refers collectively to ABV Consulting, Inc., unless otherwise stated. The Company assumes no obligation to revise or update any forward-looking statements for any reason, except as required by law.

Results of Operations

Our financial statements have been prepared assuming that we will continue as a going concern and, accordingly, do not include adjustments relating to the recoverability and realization of assets and classification of liabilities that might be necessary should we be unable to continue in operation. We expect we will require additional capital to meet our long term operating requirements. Assuming that we continue to require additional capital, and under ideal market conditions, we expect to raise additional capital through, among other things, the sale of equity or debt securities.

Comparison of the years ended December 31, 2017 and 2016

|

|

|

Year ended |

|

|

|

|

|

| ||||||||

|

|

|

December 31, |

|

|

|

|

|

| ||||||||

|

|

|

2017 |

|

|

2016 |

|

|

Change |

|

|

% |

| ||||

|

Revenue |

|

$ | 25,641 |

|

|

$ | 2,000 |

|

|

$ | 23,641 |

|

|

|

1,182 | % |

|

General and administrative expenses |

|

|

97,270 |

|

|

|

22,053 |

|

|

|

75,217 |

|

|

|

341 | % |

|

Professional fees |

|

|

91,783 |

|

|

|

49,470 |

|

|

|

42,313 |

|

|

|

86 | % |

|

Interest expense |

|

|

- |

|

|

|

349 |

|

|

|

(349 |

) |

|

|

- |

|

|

Loss from continuing operations |

|

|

(163,412 | ) |

|

|

(69,872 | ) |

|

|

(93,540 | ) |

|

|

134 | % |

|

Loss from discontinued operations |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Net loss |

|

$ | (163,412 | ) |

|

$ | (69,872 | ) |

|

$ | (93,540 | ) |

|

|

134 | % |

Our revenue was $25,641 for the year ended December 31, 2017, as compared to $2,000 for the same period in 2016. The increase in revenue was primarily due to the Company’s subsidiary in Hong Kong engaging in consulting project during the year.

Our general and administrative expenses were $97,270 for the year ended December 31, 2017, as compared to $22,053 for the same period in 2016. The increase in general and administrative expenses was primarily due to an establishment of the operation of its Company’s subsidiary in Hong Kong.

| 14 |

| Table of Contents |

Expenses for professional fees were $91,783 for the year ended December 31, 2017, as compared to $49,470 for the same period in 2016. The increase in professional fees was primarily due to the Allied Plus (Samoa) Limited (“APSL”) acquisition and disposal and ongoing legal and accounting fees for SEC reporting requirements.

Comparison of the years ended December 31, 2016 and 2015

|

|

|

Year ended |

|

|

|

|

|

| ||||||||

|

|

|

December 31, |

|

|

|

|

|

| ||||||||

|

|

|

2016 |

|

|

2015 |

|

|

Change |

|

|

% |

| ||||

|

Revenue |

|

$ | 2,000 |

|

|

$ | - |

|

|

$ | 2,000 |

|

|

|

- |

|

|

General and administrative expenses |

|

|

22,053 |

|

|

|

15,984 |

|

|

|

6,069 |

|

|

|

38 | % |

|

Professional fees |

|

|

49,470 |

|

|

|

30,399 |

|

|

|

19,071 |

|

|

|

63 | % |

|

Interest expense |

|

|

349 |

|

|

|

347 |

|

|

|

2 |

|

|

|

- |

% |

|

Loss from continuing operations |

|

|

(69,872 | ) |

|

|

(46,730 | ) |

|

|

(23,142 | ) |

|

|

50 | % |

|

Loss from discontinued operations |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Net loss |

|

$ | (69,872 | ) |

|

$ | (46,730 | ) |

|

$ | (23,142 | ) |

|

|

50 | % |

Our revenue was $2,000 for the year ended December 31, 2016, as compared to $0 for the same period in 2015.

Our general and administrative expenses were $22,053 for the year ended December 31, 2016, as compared to $15,984 for the same period in 2015. The increase in general and administrative expenses was primarily due to DTC fees.

Expenses for professional fees were $49,470 for the year ended December 31, 2016, as compared to $30,399 for the same period in 2015. The increase in professional fees was primarily due an increase in professional fee for complying with SEC reporting requirements.

Liquidity and Capital Resources

|

|

|

December 31, |

|

|

December 31, |

|

|

| ||||

|

|

|

2017 |

|

|

2016 |

|

|

Change |

| |||

|

Cash |

|

$ | 299 |

|

|

$ | 1,636 |

|

|

$ | (1,337 | ) |

|

Total assets |

|

$ | 299 |

|

|

$ | 1,636 |

|

|

$ | (1,337 | ) |

|

Total liabilities |

|

$ | 185,664 |

|

|

$ | 23,589 |

|

|

$ | 162,075 |

|

|

Stockholders’ equity |

|

$ | (185,365 | ) |

|

$ | (21,953 | ) |

|

$ | (163,412 | ) |

Working Capital

|

|

|

December 31, |

|

|

December 31, |

|

|

| ||||

|

|

|

2017 |

|

|

2016 |

|

|

Change |

| |||

|

Current assets |

|

$ | 299 |

|

|

$ | 1,636 |

|

|

$ | (1,337 | ) |

|

Current liabilities |

|

$ | 185,664 |

|

|

$ | 23,589 |

|

|

$ | 162,075 |

|

|

Working capital deficiency |

|

$ | (185,365 | ) |

|

$ | (21,953 | ) |

|

$ | (163,412 | ) |

The Company’s cash and cash equivalents, our only assets, were $299 at December 31, 2017, as compared to $1,636 at December 31, 2016. The decrease in cash was primarily due to an increase of operating expenses.

As at December 31, 2017, current liabilities consisted of accounts payable of $7,820 and $177,844 owed to related parties, as compared to December 31, 2016, current liabilities consisted of accounts payable of $3,589 and $20,000 owed to related parties. The increase in current liabilities is due to the operating expenses as discussed above and the advances from related parties to finance the operations of the Company.

| 15 |

| Table of Contents |

Cash Flows

Fiscal year 2017 compared with fiscal year 2016

The following tables presents our cash flow for the year ended December 31, 2017 and 2016:

|

|

|

Year ended |

|

|

| |||||||

|

|

|

December 31, |

|

|

| |||||||

|

|

|

2017 |

|

|

2016 |

|

|

Change |

| |||

|

Cash used in operating activities |

|

$ | (159,181 | ) |

|

$ | (67,332 | ) |

|

$ | (91,849 | ) |

|

Cash provided by investing activities |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Cash provided by financing activities |

|

|

157,844 |

|

|

|

60,455 |

|

|

|

97,389 |

|

|

Net decrease in cash and cash equivalents for the period |

|

$ | (1,337 | ) |

|

$ | (6,877 | ) |

|

$ | 5,540 |

|

Cash Flow from Operating Activities

Cash flows used in operations increased $91,849 to $159,181 during the fiscal year 2017, mainly due to an increase of net loss.

Cash Flow from Financing Activities

During the year ended December 31, 2017, our company received $157,844 from a related party. During the year ended December 31, 2016, our company received $20,000 from a related party, $40,455 from capital contribution and $12,500 from note payable and used $12,500 for repayment of note payable.

Fiscal year 2016 compared with fiscal year 2015

The following tables presents our cash flow for the year ended December 31, 2016 and 2015:

|

|

|

Year ended |

|

|

| |||||||

|

|

|

December 31, |

|

|

| |||||||

|

|

|

2016 |

|

|

2015 |

|

|

Change |

| |||

|

Cash used in operating activities |

|

$ | (67,332 | ) |

|

$ | (57,111 | ) |

|

$ | (10,221 | ) |

|

Cash provided by investing activities |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Cash provided by financing activities |

|

|

60,455 |

|

|

|

35,000 |

|

|

|

25,455 |

|

|

Net decrease in cash and cash equivalents for the period |

|

$ | (6,877 | ) |

|

$ | (22,111 | ) |

|

$ | 15,234 |

|

Cash Flow from Operating Activities

Cash flows used in operations increased $10,221 to $67,332 during the fiscal year 2016, mainly due to an increase in operating expenses.

Cash Flow from Investing Activities

During the year ended December 31, 2016 and 2015, our company did not have any investing activities

Cash Flow from Financing Activities

During the year ended December 31, 2016, our company received $20,000 from a related party, $40,455 from capital contribution and $12,500 from note payable and used $12,500 for repayment of note payable. During the year ended December 31, 2015, our company received $35,000 from a related party.

| 16 |

| Table of Contents |

Off-Balance Sheet Arrangements and Contractual Obligations

None.

Critical Accounting Policies and Estimates

We have identified the policies below as critical to our business operations and the understanding of our results of operations. The impact on our business operations and any associated risks related to these policies are discussed throughout Management’s Discussion and Analysis of Financial Condition and Results of Operations when such policies affect our reported or expected financial results.

In the ordinary course of business, we have made a number of estimates and assumptions relating to the reporting of results of operations and financial condition in the preparation of our financial statements in conformity with accounting principles generally accepted in the United States (“GAAP”). We base our estimates on historical experience and on various other assumptions that we believe are reasonable under the circumstances. The results form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results could differ significantly from those estimates under different assumptions and conditions. We believe that the following discussion addresses our most critical accounting policies, which are those that are most important to the portrayal of our financial condition and results of operations and require our most difficult, subjective, and complex judgments, often as a result of the need to make estimates about the effect of matters that are inherently uncertain.

Basis of Accounting and Going Concern

Our consolidated financial statements have been prepared on the accrual basis of accounting in conformity with GAAP. In addition, the accompanying consolidated financial statements have been prepared assuming that we will continue as a going concern, which contemplates the realization of assets and the liquidation of liabilities in the normal course of business. We generated accumulated losses of approximately $345,355 through December 31, 2017 and have insufficient working capital and cash flows to support operations. These factors raise substantial doubt about our ability to continue as a going concern. The consolidated financial statements do not include any adjustments relating to the recoverability and classification of recorded asset amounts or the amounts and classification of liabilities that might result from this uncertainty.

Revenue Recognition

Our company pursues opportunities to realize revenues from consulting services. It is our company’s policy that revenues and gains will be recognized in accordance with ASC Topic 605-10-25, “Revenue Recognition.” Under ASC Topic 605-10-25, revenue earning activities are recognized when all of the following criteria are met: (i) persuasive evidence of an arrangement exists, (ii) the services have been rendered to the customer, (iii) the sales price is fixed or determinable, and (iv) collectability is reasonably assured.

Also, refer Note 3 – Summary of Significant Accounting Policies in the consolidated financial statements that are included in this Report.

Recent accounting pronouncements

For discussion of recently issued and adopted accounting pronouncements, please see Note 3 to the consolidated financial statements included herein.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

We are exposed to economic risk from foreign exchange rates and equity prices.

Foreign Currency Exchange Risks

Certain forecasted transactions, assets, and liabilities are exposed to foreign currency risk. We monitor our foreign currency exposures to offset the risks and maximize the economic effectiveness of our foreign currency positions.

| 17 |

| Table of Contents |

Item 8. Financial Statements and Supplementary Data

All financial statement schedules have been omitted, since the required information is not applicable or is not present in amounts sufficient to require submission of the schedule, or because the information required is included in the consolidated financial statements and notes thereto.

| F-1 |

| Table of Contents |

Report of Independent Registered Public Accounting Firm

The Board of Directors and Shareholders of

ABV Consulting, Inc.:

Opinion on the Financial Statements and Internal Control Over Financial Reporting

We have audited the accompanying consolidated balance sheets of ABV Consulting, Inc. and subsidiaries’ (the “Company”) as of December 31, 2017 and 2016, the related consolidated statements of operations, changes in stockholders' deficit and cash flows for each of the years in the two-year period ended December 31 2017, and the related notes (collectively, the consolidated financial statements). We have also audited the Company’s internal control over financial reporting as of December 31, 2017, based on criteria established in Internal Control - Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO).

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the consolidated financial position of the Company as of December 31, 2017 and 2016, and the consolidated results of its operations and its cash flows for each of the years in the two-year period ended December 31, 2017, in conformity with accounting principles generally accepted in the United States of America. Also in our opinion, because of the effect of the material weaknesses identified below on the achievement of the objectives of the control criteria, the Company has not maintained effective internal control over financial reporting as of December 31, 2017, based on criteria established in Internal Control - Integrated Framework (2013) issued by COSO.

Emphasis of Matter

As discussed in Note 2 to the consolidated financial statements, during 2017, the Company experienced a net loss of $163,412 and negative operating cash flows of $159,181, at December 31, 2017, the Company had incurred cumulative net losses of $345,355. Management’s plans in regard to this matter are described in Note 2.

Basis for Opinion

The Company’s management is responsible for these consolidated financial statements, maintaining effective internal control over financial reporting, and for its assessment of the effectiveness of internal control over financial reporting, included in the accompanying Management’s Report on Internal Control Over Financial Reporting. Our responsibility is to express an opinion on the Company’s consolidated financial statements and an opinion on the Company’s internal control over financial reporting based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (PCAOB) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether effective internal control over financial reporting was maintained in all material respects. Our audit of the consolidated financial statements included performing procedures to assess the risks of material misstatement of the consolidated financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the consolidated financial statements. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements. Our audit of internal control over financial reporting included obtaining an understanding of internal control over financial reporting, assessing the risk that a material weakness exists, and testing and evaluating the design and operating effectiveness of internal control based on the assessed risk. Our audit also included performing such other procedures as we considered necessary in the circumstances. We believe that our audits provide a reasonable basis for our opinions.

Definition and Limitations of Internal Control Over Financial Reporting

A company’s internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. A company’s internal control over financial reporting includes those policies and procedures that (i) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company; (ii) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and (iii) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the company’s assets that could have a material effect on the financial statements.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

Material Weakness

A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of the Company’s annual or interim financial statements will not be prevented or detected on a timely basis. The following material weaknesses have been identified:

|

|

(1) |

lack of a functioning audit committee and lack of a majority of outside directors on the Company’s board of directors, resulting in ineffective oversight in the establishment and monitoring of required internal controls and procedures; |

|

|

(2) |

inadequate segregation of duties consistent with control objectives; |

|

|

(3) |

insufficient written policies and procedures for accounting and financial reporting with respect to the requirements and application of U.S. GAAP and SEC disclosure requirements; and |

|

|

(4) |

ineffective controls over period end financial disclosure and reporting processes. |

We considered these material weaknesses in in determining the nature, timing, and extent of the audit tests applied in our audit of the Company’s consolidated financial statements as of and for the year ended December 31, 2017, and our opinion on such consolidated financial statements was not affected.

/s/ HKCMCPA Company Limited

We have served as the Company’s auditor since 2017.

Hong Kong, China

March 19, 2018

| F-2 |

| Table of Contents |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors of ABV Consulting, Inc.

We have audited ABV Consulting, Inc. (the “Company”) statements of operations, changes in shareholders’ deficit and cash flows for the year ended December 31, 2015. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly in all material respects, the results of its operations and its cash flows for the year ended December 31, 2015, in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 2 to the financial statements, the Company has a net loss of $46,730 and used cash in operations of $57,111 for the year ended December 31, 2015. These factors raise substantial doubt about the Company's ability to continue as a going concern. Management's plans concerning these matters are also described in Note 2. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

LIGGETT & WEBB, P.A.

Certified Public Accountants

Boynton Beach, Florida

March 23, 2016

| F-3 |

| Table of Contents |

Consolidated Balance Sheets

|

|

|

December 31, |

|

|

December 31, |

| ||

|

|

|

2017 |

|

|

2016 |

| ||

|

ASSETS | ||||||||

|

Current Assets |

|

|

|

|

|

| ||

|

Cash and cash equivalents |

|

$ | 299 |

|

|

$ | 1,636 |

|

|

Total Current Assets |

|

|

299 |

|

|

|

1,636 |

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL ASSETS |

|

$ | 299 |

|

|

$ | 1,636 |

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' DEFICIT | ||||||||

|

Current Liabilities |

|

|

|

|

|

|

|

|

|

Accounts payable and accrued liabilities |

|

$ | 7,820 |

|

|

$ | 3,589 |

|

|

Due to related parties |

|

|

177,844 |

|

|

|

20,000 |

|

|

Total Current Liabilities |

|

|

185,664 |

|

|

|

23,589 |

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES |

|

|

185,664 |

|

|

|

23,589 |

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders' Deficit |

|

|

|

|

|

|

|

|

|

Preferred stock: 10,000,000 authorized; $0.0001 par value |

|

|

|

|

|

|

|

|

|

No shares issued and outstanding |

|

|

- |

|

|

|

- |

|

|

Common stock: 3,000,000,000 shares authorized; $0.0001 par value |

|

|

|

|

|

|

|

|

|

5,533,000 shares issued and outstanding at December 31, 2017 and 2016, respectively |

|

|

553 |

|

|

|

553 |

|

|

Additional paid in capital |

|

|

159,437 |

|

|

|

159,437 |

|

|

Accumulated deficit |

|

|

(345,355 | ) |

|

|

(181,943 | ) |

|

Total Stockholders' Deficit |

|

|

(185,365 | ) |

|

|

(21,953 | ) |

|

TOTAL LIABILITIES AND STOCKHOLDERS' DEFICIT |

|

$ | 299 |

|

|

$ | 1,636 |

|

The accompanying notes are an integral part of these consolidated financial statements.

| F-4 |

| Table of Contents |

Consolidated Statements of Operations

|

|

|

Years ended |

| |||||||||

|

|

|

December 31, |

| |||||||||

|

|

|

2017 |

|

|

2016 |

|

|

2015 |

| |||

|

|

|

|

|

|

|

|

|

|

| |||

|

Revenue, net |

|

$ | 25,641 |

|

|

$ | 2,000 |

|

|

$ | - |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative |

|

|

97,270 |

|

|

|

22,053 |

|

|

|

15,984 |

|

|

Professional fees |

|

|

91,783 |

|

|

|

49,470 |

|

|

|

30,399 |

|

|

Total Operating Expenses |

|

|

189,053 |

|

|

|

71,523 |

|

|

|

46,383 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating loss |

|

|

(163,412 | ) |

|

|

(69,523 | ) |

|

|

(46,383 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Expense |

|

|

- |

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

- |

|

|

|

(349 | ) |

|

|

(347 | ) |

|

Total other expense |

|

|

- |

|

|

|

(349 | ) |

|

|

(347 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for income taxes |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss from continuing operations |

|

|

(163,412 | ) |

|

|

(69,872 | ) |

|

|

(46,730 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Discontinued operations |

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from discontinued operation |

|

|

(32,873 | ) |

|

|

- |

|

|

|

- |

|

|

Gain on disposal of subsidiary |

|

|

32,873 |

|

|

|

- |

|

|

|

- |

|

|

Loss from discontinued operations, net of tax |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

$ | (163,412 | ) |

|

$ | (69,872 | ) |

|

$ | (46,730 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and dilutive loss per common share |

|

|

|

|

|

|

|

|

|

|

|

|

|

Continuing operations |

|

$ | (0.00 | ) |

|

$ | (0.01 | ) |

|

$ | (0.01 | ) |

|

Discontinued operations |

|

$ | (0.00 | ) |

|

$ | - |

|

|

$ | - |

|

|

Net loss |

|

$ | (0.00 | ) |

|

$ | (0.01 | ) |

|

$ | (0.01 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of common shares outstanding – Basic and diluted |

|

|

1,600,382,315 |

|

|

|

5,533,000 |

|

|

|

5,533,000 |

|

The accompanying notes are an integral part of these consolidated financial statements.

| F-5 |

| Table of Contents |

Consolidated Statement of Change in Stockholders’ Deficit

For the Years Ended December 31, 2017, 2016 and 2015

|

|

|

Common Stock |

|

|

Additional |

|

|

|

|

Total |

| |||||||||

|

|

|

Number of Shares |

|

|

Par Value |

|

|

Paid in Capital |

|

|

Accumulated Deficit |

|

|

Stockholders' Deficit |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

Balance as of January 1, 2015 |

|

|

5,533,000 |

|

|

$ | 553 |

|

|

$ | 73,536 |

|

|

$ | (65,341 | ) |

|

$ | 8,748 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Imputed Compensation |

|

|

- |

|

|

|

- |

|

|

|

6,500 |

|

|

|

- |

|

|

|

6,500 |

|

|

Net loss |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(46,730 | ) |

|

|

(46,730 | ) |

|

Balance as of December 31, 2015 |

|

|

5,533,000 |

|

|

|

553 |

|

|

|

80,036 |

|

|

|

(112,071 | ) |

|

|

(31,482 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contribution of capital |

|

|

- |

|

|

|

- |

|

|

|

76,151 |

|

|

|

- |

|

|

|

76,151 |

|

|

Imputed Compensation |

|

|

- |

|

|

|

- |

|

|

|

3,250 |

|

|

|

- |

|

|

|

3,250 |

|

|

Net loss |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(69,872 | ) |

|

|

(69,872 | ) |

|

Balance as of December 31, 2016 |

|

|

5,533,000 |

|

|

$ | 553 |

|

|

$ | 159,437 |

|

|

$ | (181,943 | ) |

|

$ | (21,953 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|