Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - INDEPENDENCE HOLDING CO | tv488752_8k.htm |

Exhibit 99.1

22 ND ANNUAL INSURANCE CONFERENCE CFA Society New York and Raymond James March 19, 2018 Independence Holding Company © 201 8 The IHC Group David Kettig President, IHC

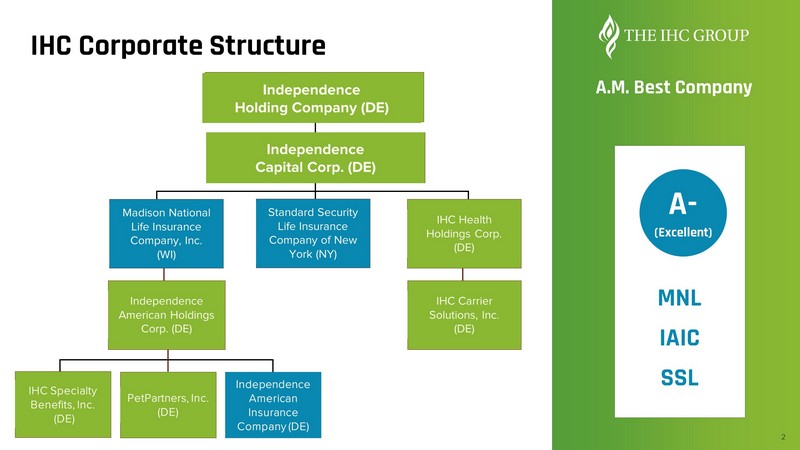

Independence Capital Corp. (DE) IHC Carrier Solutions , Inc. ( DE) IHC Corporate Structure 2 Independence Holding Company (DE) Madison National Life Insurance Company, Inc. ( WI) Standard Security Life Insurance Company of New York (NY) IHC Health Holdings Corp. ( DE) Independence American Holdings Corp. (DE ) Independence American Insurance Company (DE) PetPartners , Inc. (DE) IHC Specialty Benefits, Inc . (DE) A.M. Best Company MNL IAIC SSL A - (Excellent)

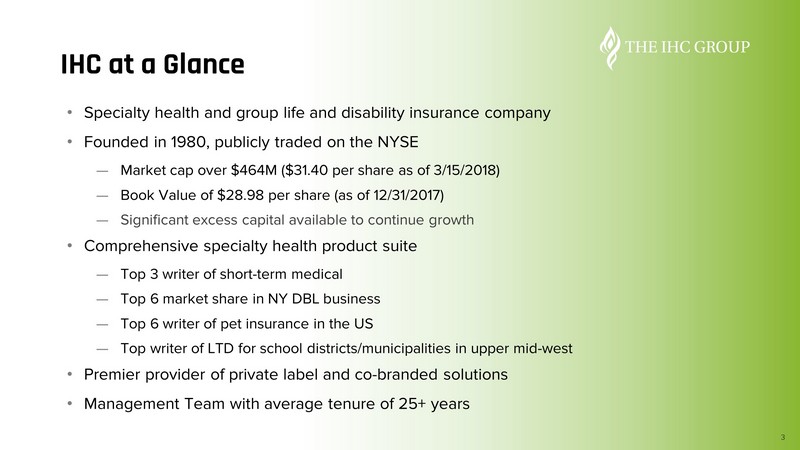

3 IHC at a Glance • Specialty health and group life and disability insurance company • Founded in 1980, publicly traded on the NYSE — Market cap over $ 4 64 M ($ 31.40 per share as of 3 / 15 /201 8 ) — Book Value of $ 28.98 per share (as of 12 /3 1 /2017) — Significant excess capital available to continue growth • Comprehensive specialty health product suite — Top 3 writer of short - term medical — Top 6 market share in NY DBL business — Top 6 writer of pet insurance in the US — Top writer of LTD for school districts/municipalities in upper mid - west • Premier p rovider of p rivate l abel and c o - b randed s olutions • Management Team with average tenure of 25+ years

4 IHC 2016 - 2018 • IHC has spent recent years transforming its business into a specialty health franchise with a niche group LTD, Disability (DBL) and life business • Sold Employer Stop Loss business to Swiss Re March 2016 • In 2017, we more than doubled sales of specialty health products to $167 million, while maintaining underwriting profitability • In 2018, we are projecting continued exceptional growth in specialty health benefits

One Year Stock Performance 52 Week Range $17.59 - $31.55 3/15/17 - 3/15/18

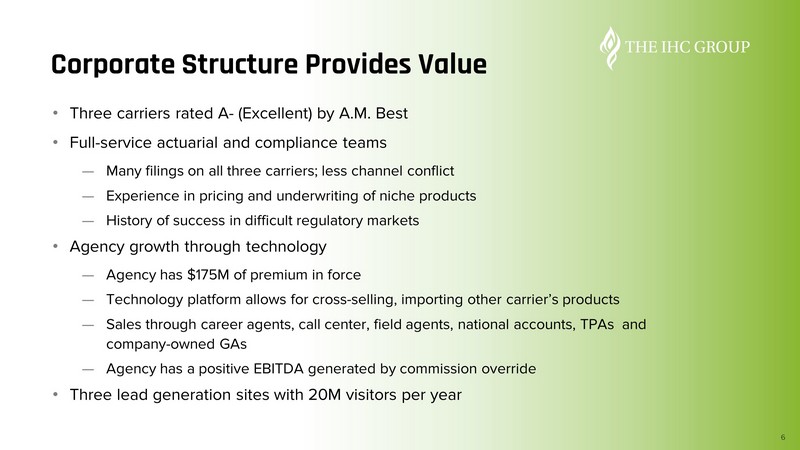

6 Corporate Structure Provides Value • Three carriers rated A - (Excellent) by A.M. Best • Full - service actuarial and compliance teams — Many filings on all three carriers; less channel conflict — Experience in pricing and underwriting of niche products — History of success in difficult regulatory markets • Agency growth through technology — Agency has $175M of premium in force — Technology platform allows for cross - selling, importing other carrier’s products — Sales through career agents, call center, field agents, national accounts, TPAs and company - owned GAs — Agency has a positive EBITDA generated by commission override • Three lead generation sites with 20M visitors per year

Key 2018 Growth Opportunities In 2018, we are projecting continued growth in specialty health as a result of: • Expected extension of STM duration to up to 364 days (or more) subject to state laws – Federal Government predicts expansion of sales and profits • Next generation STM product being introduced 4/20 • Growing market for Hospital Indemnity Plans to supplement ACA coverage • NY DBL with PFL • New pet distribution Short Term Medical Disability (DBL) Hospital Indemnity Pet Insurance

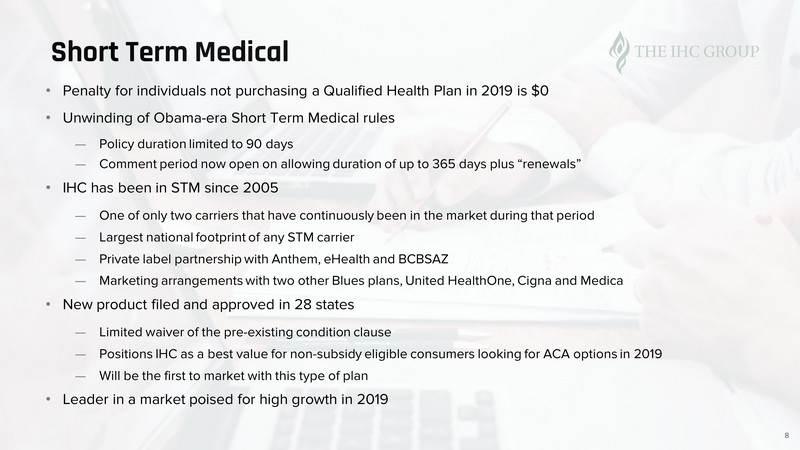

Short Term Medical 8 • Penalty for individuals not purchasing a Qualified Health Plan in 2019 is $0 • Unwinding of Obama - era Short Term Medical rules — Policy duration limited to 90 days — Comment period now open on allowing duration of up to 365 days plus “renewals” • IHC has been in STM since 2005 — One of only two carriers that have continuously been in the market during that period — Largest national footprint of any STM carrier — Private label partnership with Anthem, eHealth and BCBSAZ — Marketing arrangements with two other Blues plans, United HealthOne , Cigna and Medica • New product filed and approved in 28 states — Limited waiver of the pre - existing condition clause — Positions IHC as a best value for non - subsidy eligible consumers looking for ACA options in 2019 — Will be the first to market with this type of plan • Leader in a market poised for high growth in 2019

9 Hospital Indemnity (HIP) • Designed to be sold to replace or supplement an ACA plan — Could cover the deductible gap in ACA plan or bundled offering replaces ACA — Private label plans with Anthem, Medica and United Health — Private label plans with key distributors such as eHealth • Higher margin business than STM — Better underwriting margin for the carrier — More revenue for the marketer • Bundling eliminates financial risk — Combining STM and HIP provides first dollar coverage plus catastrophic protection — “Free” Bronze ACA plans come with high deductibles; consumers want financial protection

Disability Benefits Law 10 • Top six carrier in NY Disability Benefits Law • Addition of Paid Family Leave (PFL) expected to double the block • Long - time market leader — Niche is smaller businesses; generally under 50 employees — Efficient systems allow for low admin cost and high touch service • Consistently profitable • More states likely to add PFL in next several years, and processes are scalable on a national level

Summary 11 • Sale of stop loss business has freed up capital and surplus to grow • Legacy group life, disability and DBL lines provide consistent earnings while specialty health grows top and bottom line revenue • Uniquely positioned to take advantage of disruption in the ACA — Management experience in STM and Gap plans — Products are filed and approved — Lead generation sites capture consumers looking for options — Proven advantages in speed to market — Technology focused agency can pivot quickly as opportunities change

Questions

13 FORWARD - LOOKING STATEMENTS Certain statements in this presentation are “forward - looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995 with respect to the financial condition, results of operations, cash flows, plans, objectives, future performance and business of IHC. Forward - looking statements by their nature address matters that are, to differing degrees, uncertain. With respect to IHC, particular uncertainties that could adversely or positively affect our future results include, but are not limited to, economic conditions in the markets in which we operate, new federal or state governmental regulation, our ability to effectively operate, integrate and leverage any past or future strategic acquisition, and other factors which can be found in our news releases and filings with the Securities and Exchange Commission. These uncertainties may cause IHC’s actual future results to be materially different than those expressed in this presentation. IHC does not undertake to update its forward - looking statements.