Attached files

| file | filename |

|---|---|

| EX-10.7 - EX-10.7 - Exela Technologies, Inc. | a2234859zex-10_7.htm |

| EX-31.1 - EX-31.1 - Exela Technologies, Inc. | a2234859zex-31_1.htm |

| EX-32.2 - EX-32.2 - Exela Technologies, Inc. | a2234859zex-32_2.htm |

| EX-32.1 - EX-32.1 - Exela Technologies, Inc. | a2234859zex-32_1.htm |

| EX-31.2 - EX-31.2 - Exela Technologies, Inc. | a2234859zex-31_2.htm |

| EX-23.1 - EX-23.1 - Exela Technologies, Inc. | a2234859zex-23_1.htm |

| EX-21.1 - EX-21.1 - Exela Technologies, Inc. | a2234859zex-21_1.htm |

| EX-10.9 - EX-10.9 - Exela Technologies, Inc. | a2234859zex-10_9.htm |

| EX-10.8 - EX-10.8 - Exela Technologies, Inc. | a2234859zex-10_8.htm |

| EX-10.6 - EX-10.6 - Exela Technologies, Inc. | a2234859zex-10_6.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| (Mark One) | ||

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended December 31, 2017 |

||

or |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from to |

||

Commission File Number: 001-36788

EXELA TECHNOLOGIES, INC.

(Exact Name of Registrant as Specified in its Charter)

| Delaware (State of or other Jurisdiction Incorporation or Organization) |

47-1347291 (I.R.S. Employer Identification No.) |

|

2701 E. Grauwyler Rd. Irving, TX (Address of Principal Executive Offices) |

75061 (Zip Code) |

Registrant's Telephone Number, Including Area Code: (844) 935-2832

Securities Registered Pursuant to Section 12(b) of the Act:

| Title of Each Class | Name of Each Exchange On Which Registered | |

|---|---|---|

| Common Stock, Par Value $0.0001 per share | The Nasdaq Stock Market LLC |

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. o Yes ý No

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. o Yes ý No

Indicate by check mark whether the Registrant (1) has filed all reports required by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ý Yes o No

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). ý Yes o No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of "large accelerated filer", "accelerated filer", "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer ý | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company o Emerging growth company o |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Act). o Yes ý No

The aggregate market value of the Registrant's voting common equity held by non-affiliates of the Registrant, computed by reference to the price at which such voting common equity was last sold as of June 30, 2017, was approximately $201,313,414.72 (based on a closing price of $9.92). As a result, the Registrant is an accelerated filer as of December 31, 2017. For purposes of this computation, shares of the voting common equity beneficially owned by each executive officer and director of the Registrant disclosed in the Registrant's Definitive Proxy Statement on Schedule 14A, filed with the SEC on June 26, 2017 were deemed to be owned by affiliates of the Registrant as of June 30, 2017. Such determination should not be deemed an admission that such executive officers and directors are, in fact, affiliates of the Registrant or affiliates as of the date of this Annual Report on Form 10-K. As of March 16, 2018, the Registrant had 152,565,218 shares of Common Stock outstanding.

2

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements included in this Annual Report on Form 10-K are not historical facts but are forward-looking statements for purposes of the safe harbor provisions under The Private Securities Litigation Reform Act of 1995. Forward-looking statements generally are accompanied by words such as "may", "should", "would", "plan", "intend", "anticipate", "believe", "estimate", "predict", "potential", "seem", "seek", "continue", "future", "will", "expect", "outlook" or other similar words, phrases or expressions. These forward-looking statements include statements regarding our industry, future events, the estimated or anticipated future results and benefits of the Business Combination, future opportunities for the combined company, and other statements that are not historical facts. These statements are based on the current expectations of Exela management and are not predictions of actual performance. These statements are subject to a number of risks and uncertainties regarding Exela's businesses, and actual results may differ materially. The factors that may affect our results include, among others: the impact of political and economic conditions on the demand for our services; the impact of a data or security breach; the impact of competition or alternatives to our services on our business pricing and other actions by competitors; our ability to address technological development and change in order to keep pace with our industry and the industries of our customers; the impact of terrorism, natural disasters or similar events on our business; the effect of legislative and regulatory actions in the United States and internationally; the impact of operational failure due to the unavailability or failure of third-party services on which we rely; the effect of intellectual property infringement; and other factors discussed in this report under the headings "Risk Factors", "Legal Proceedings", "Management's Discussion and Analysis of Financial Condition and Results of Operations" and otherwise identified or discussed in this Annual Report on Form 10-K. You should consider these factors carefully in evaluating forward-looking statements and are cautioned not to place undue reliance on such statements, which speak only as of the date of this report. It is impossible for us to predict new events or circumstances that may arise in the future or how they may affect us. We undertake no obligation to update forward-looking statements to reflect events or circumstances occurring after the date of this report. We are not including the information provided on the websites referenced herein as part of, or incorporating such information by reference into, this Annual Report on Form 10-K. In addition, forward-looking statements provide Exela's expectations, plans or forecasts of future events and views as of the date of this report. Exela anticipates that subsequent events and developments will cause Exela's assessments to change. These forward-looking statements should not be relied upon as representing Exela's assessments as of any date subsequent to the date of this report.

References to the "Company", "we", "us", or "our" in this Annual Report on Form 10-K refer to Exela Technologies, Inc. and its consolidated subsidiaries, and where applicable, our predecessors SourceHOV and Novitex prior to the closing of the Business Combination. "Following is a glossary of other abbreviations and acronyms that are found in this Annual Report on Form 10-K."

"Annual Report on Form 10-K" means this annual report on Form 10-K filed by the Company with the SEC pursuant to the Exchange Act.

"Apollo" means Apollo Global Management, LLC, together with its subsidiaries and affiliates, as applicable

"BPA" means business process automation.

"BPO" means business process outsourcing

"Business Combination" means the transactions contemplated by the Business Combination Agreement, which closed on July 12, 2017 and resulted in SourceHOV and Novitex becoming our wholly-owned subsidiaries and the financing transactions in connection therewith.

3

"Business Combination Agreement" means that certain Business Combination Agreement, dated February 21, 2017, among Quinpario Merger Sub I, Inc. ("SourceHOV Merger Sub"), the Company, Quinpario Merger Sub II, Inc. ("Novitex Merger Sub"), SourceHOV, Novitex, HOVS LLC, HandsOn Fund 4 I, LLC and Novitex Parent, L.P., as amended by that certain Consent, Waiver and Amendment, dated June 15, 2017, by and among the Company, SourceHOV Merger Sub, Novitex Merger Sub, SourceHOV, Novitex, Novitex Parent, Ex-Sigma LLC, HOVS LLC and HandsOn Fund 4 I, LLC.

"Code" means the Internal Revenue Code of 1986, as amended.

"Common Stock" means the common stock of the Company, par value $0.0001.

"EIM" means enterprise information management,

"Exchange Act" means the Securities Exchange Act of 1934, as amended.

"GAAP" means generally accepted accounting principles in the United States.

"HGM Group" means, collectively, HOVS LLC and HandsOn Fund 4 I, LLC and certain of their respective affiliates.

"HITECH Act of 2009" means the Health Information Technology for Economic and Clinical Health Act, enacted under Title XIII of the American Recovery and Reinvestment Act of 2009.

"HIPAA" means the Health Insurance Portability and Accountability Act of 1996.

"IT" mean information technology.

"JOBS Act" means the Jumpstart our Business Startups Act.

"MegaCenter" means the Company's Tier-III document processing and outsourcing centers in Windsor, Connecticut, and Austin, Texas.

"Nasdaq" means The Nasdaq Stock Market.

"Novitex" means Novitex Holdings, Inc., a Delaware corporation.

"Novitex Holdings" means Apollo Novitex Holdings, L.P., a Delaware limited partnership, which is owned and controlled by certain funds managed by affiliates of Apollo.

"Novitex Parent" means Novitex Parent, L.P., a Delaware limited partnership, which is owned and controlled by certain funds managed by affiliates of Apollo.

"PCIDSS" means the Payment Card Industry Data Security Standard.

"PIPE Investment" means the sale of shares of Common Stock in the private placement transaction of Common Stock entered into in connection with the Business Combination.

"Quinpario" means Quinpario Acquisition Corp. 2, a Delaware corporation.

"SEC" means the United States Securities and Exchange Commission.

"Securities Act" means the Securities Act of 1933, as amended.

"SourceHOV" means SourceHOV Holdings, Inc., a Delaware corporation.

"TCJA" means the Tax Cut and Jobs Act.

"TPS" means transaction processing solutions.

4

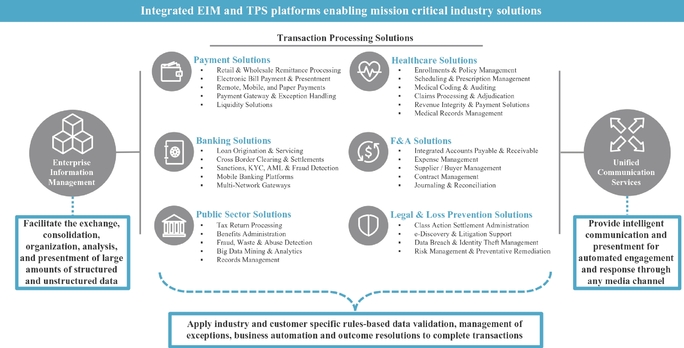

Exela Technologies, Inc. ("Exela") is a global business process automation leader combining industry-specific and industry-agnostic enterprise software and solutions (deployed on premise or on the cloud) with decades of experience. We enable our customers' organizations to more efficiently and effectively execute transactions, make decisions, drive revenue and profitability, and communicate critical information to their employees, customers, partners, and vendors. We serve over 60% of the Fortune® 100 and our solutions are deployed in banking, healthcare, insurance and other industries to support mission-critical environments. With the increased scale resulting from our Business Combination in July 2017, we are poised to expand relationships with existing customers and realize substantial synergies.

As part of the broader business process outsourcing ("BPO") industry, our technology-enabled solutions allow global organizations to address the challenges resulting from the massive amounts of data obtained and created through their daily operations. That data, and the supporting technology architecture, have become increasingly complex to manage as the volume, velocity, and variety continue to increase, requiring aggregation and integration across disparate parts of our customers' organizations. To effectively execute transactions and manage mission-critical processes, decisions need to be executed accurately, with rapid turn-around time, and often subject to various regulatory and compliance requirements. We believe our process expertise, information technology capabilities and operational insights enable our customers' organizations to more efficiently and effectively execute transactions, make decisions, drive revenue and profitability, and communicate critical information to their employees, customers, partners, and vendors. With solutions focused on enhancing the user experience, quality, and efficiency of our customers' most critical processes, we believe our value proposition positions us to be a core operations and technology partner to our customers.

We have approximately 22,000 employees as of December 31, 2017 that provide solutions and services to over 3,500 customers worldwide. For the fiscal year ended December 31, 2017, we generated $1,152.3 million of revenue of which approximately 90% is recurring in nature and supported by long-term customer contracts.

Our solutions address the life cycle of transaction processing and enterprise information management, from enabling multi-channel payment gateways and digital mailrooms with data exchanges across siloed systems, to matching inputs against contracts and handling exceptions, to ultimately depositing payments and distributing communications. As a leader in complex information processing, we specialize in transactions that require multiple layers of validation, supporting documentation processing, and reconciliation. Our suite of offerings combines platform modules across information management, payments, finance & accounting, legal & loss prevention, and unified communication services to provide both industry specific solutions, and solutions which span across multiple industries.

At the foundation of our industry-specific solution offerings, we use a combination of data-driven processes, technology, and human capital, delivered through integrated enterprise information management ("EIM") and transaction processing solutions ("TPS") platforms:

- •

- our proprietary EIM platforms facilitate the exchange, consolidation, organization, and analysis of large amounts of structured and

unstructured data that are crucial to an enterprise's ability to effectively manage decisions, and enable the presentment of critical information through our unified communication solutions. These

platforms can be hosted on customer premises, within our data centers, and/or in a cloud hosting and computing environment.

- •

- our TPS offerings then use the structured data output from our EIM platforms and apply industry and customer specific rules-based data validation, management of exceptions, business

5

- •

- our model is to provide integrated EIM and TPS platforms as industry-specific solutions, with reliable information workflows through data aggregation, seamless connectivity, and automated processes that significantly reduce cycle times and improve quality. As a result, we believe we can execute a wide range of business processes, across multiple industries that are deeply embedded in, and essential to, our customers' most critical organizational workflows.

automation, and outcome resolutions to complete transactions, customer interactions, and other operational processes.

We seek to develop long-term relationships with organizations that are information-intensive and require specialized processing or subject matter expertise. We offer solutions to highly regulated and information sensitive industries such as healthcare, banking and financial services, insurance, public, legal, and commercial sectors.

We believe that our global presence benefits our customers with a balance of proximity, solutions, and cost to meet their needs. We use a global delivery model to serve multi-national customers in over 50 countries, where we provide solutions from a network of over 1,100 onsite customer facilities and approximately 150 delivery centers, strategically located throughout the Americas, Europe, and Asia. We believe our global delivery model uniquely positions us to offer multi-lingual capabilities, optimize logistical requirements, access a large employee pool, and provide a flexible "right-shoring" solution for our customers.

Overview of Revenues

Our business consists of the following three reportable segments:

Information and Transaction Processing Solutions ("ITPS"). The ITPS segment is our largest segment, with $827.1 million of revenues for the fiscal year ended December 31, 2017, representing 72% of our revenues. ITPS provides industry-specific solutions for banking and financial services, including lending solutions for mortgages and auto loans, and banking solutions for clearing, anti-money laundering, sanctions, and cross-border settlement; property and casualty insurance solutions for enrollments, claims processing, and communications; public sector solutions for income tax processing, benefits administration, and records management; industry-agnostic solutions for payment

6

processing and reconciliation, integrated receivable and payables management, document logistics and location services, records management, and electronic storage of data/documents; and software, hardware, and maintenance related to information and transaction processing automation, among others. We generate ITPS revenues primarily from a transaction-based pricing model for the various types of volumes processed, licensing and maintenance fees for technology sales, and a mix of fixed management fee and transactional revenue for document logistics and location services.

Healthcare Solutions ("HS"). The HS segment generated $233.6 million of revenues for the fiscal year ended December 31, 2017, representing 20% of our revenues. Our HS offerings include revenue cycle solutions, integrated accounts payable and accounts receivable, and information management for both the healthcare payer and provider markets. Our payer service offerings include claims processing, claims adjudication and auditing services, enrollment processing and policy management, and scheduling and prescription management. Our provider service offerings include medical coding and insurance claim generation, underpayment audit and recovery, and medical records management. As a leader in complex claims processing, we specialize in transactions that require multiple layers of validation, supporting documentation processing, reconciliation, and management of exceptions. We generate HS revenues primarily from a transaction-based pricing model for the various types of volumes processed for healthcare payers and providers.

Legal & Loss Prevention Services ("LLPS"). The LLPS segment generated $91.6 million of revenues for the fiscal year ended December 31, 2017, representing 8% of our revenues. Our LLPS solutions include processing of legal claims for class action and mass action settlement administrations, involving project management support, notification, and outreach to claimants; and collection, analysis, and distribution of settlement funds. Additionally, we provide data and analytical services in the context of litigation consulting, economic and statistical analysis, expert witness services, and revenue recovery services for delinquent accounts receivable. We generate LLPS revenues primarily based on time and materials pricing as well as through transactional services priced on a per item basis.

Additional financial information for our three business segments is included in Note 17 within our consolidated financial statements.

We provide services to our customers on a global basis. In 2017, our revenues by geography were as follows: $1,001.8 million in the United States (86.9% of total revenues), $135.6 million in Europe (11.8% of total revenues), and $15.0 million from the rest of the world (1.3% of total revenues). We present additional geographical financial information in Note 17 within our consolidated financial statements.

Our revenues can be affected by various factors such as our customers' demand pattern for our services. These factors have historically resulted in higher revenues and profits in the fourth quarter. Backlog is not a metric that we use to measure our business.

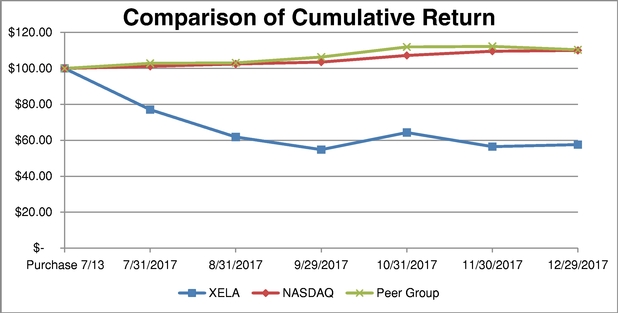

History and Development of Our Company

Exela is a Delaware corporation that was formed through the strategic combination of SourceHOV Holdings, Inc. ("SourceHOV") a leading global transaction processing company, and Novitex Holding, Inc. ("Novitex"), a cloud-based document outsourcing company, pursuant to a business combination agreement dated February 21, 2017. Formerly known as Quinpario Acquisition Corp. 2 ("Quinpario"), Exela was originally formed as a blank check company on July 15, 2014 and completed its initial public offering on January 22, 2015. In conjunction with the completion of the Business Combination in July 2017, Quinpario was renamed "Exela Technologies, Inc." Exela began trading under the ticker "XELA" on the Nasdaq stock market on July 13, 2017.

The Business Combination was accounted for as a reverse merger for which SourceHOV was determined to be the accounting acquirer. The acquisition of Novitex was accounted for using the acquisition method. As a result, the financial information presented in this Annual Report on

7

Form 10-K is not pro forma (unless labeled as such); it includes the financial information and activities for SourceHOV for the entire year ending December 31, 2017, but only reflects the financial information and activities of Novitex for the period following the Business Combination from July 13, 2017 to December 31, 2017.

Key Business Strategies

The key elements of our growth strategy are described below:

Pursue meaningful revenue synergy opportunities. We believe we have a number of meaningful revenue synergy opportunities, including expanding the scope of our existing customer relationships, pursuing new customer opportunities, and utilizing our combined platform to develop new process capabilities and industry expertise.

- •

- Leverage BPA suite across on-site services.

Approximately 6,000 of our employees currently work at customers in an on-site capacity. We believe this on-site presence is a competitive differentiator and a valuable asset as we

pursue future growth opportunities. We aim to deploy our BPA software across these customer locations, and we believe that by offering our customers enhanced productivity and quality through our

onsite employees, we will create additional opportunities to expand our footprint and wallet share across the organization. For example, in customers where we provide underwriting support and claims

processing, we can enable our onsite employees to accelerate the aggregation and analysis of datasets while also increasing accuracy and automatically flagging deficiencies. By enhancing the

productivity and quality of our onsite employees, we believe we will increase the demand from our customers to replicate our processes across the organization, bolstering our cross-sell/up-sell

initiatives. By having our BPA suite already approved and deployed within existing onsite engagements, we believe our ability to expand into new lines of business will be streamlined and accelerated.

- •

- Expand relationships with existing customers.

We intend to aggressively pursue cross-sell and up-sell opportunities within our existing customer base. With an installed base of over 3,500 customers, we believe we have meaningful

opportunities to offer a bundled suite of services and be a "one-stop-shop" for our customers' information and transaction processing needs. Our sales force will continue to be organized on an

industry basis and will be re-deployed to remove duplication, and utilize solutions and relationships to better serve our customers across all levels of their organizations. Our sales force will be

incentivized to drive additional revenue opportunities across our bases while also driving higher-margin bundled solutions. As an example, we now offer a full suite of healthcare-focused solutions by

bundling enrollments, policy and plan management, claims processing, audit and recovery services, payment solutions, integrated accounts payable and receivable, medical records management, and unified

communication services for payers and providers.

- •

- Pursue new customer opportunities. We plan to

continue to develop new long-term, strategic customer relationships, especially where we have an opportunity to deliver a wide range of our capabilities and can have a meaningful impact on our

customers' business outcomes. For example, we plan to dedicate resources within the legal industry in order to pursue opportunities in e-discovery and contract management services.

- •

- Develop additional process capabilities and industry expertise. We will focus on developing additional process capabilities and market expertise for our core industries. We will continue to invest in technology and innovation that will accelerate the build-out of our portfolio of next-generation solutions, such as platform-based descriptive and predictive analytics services for processing flows of "Big Data" to help customers gain better insight into their processes and businesses. As an example, on behalf of our customers, we are deploying Big Data automation platforms to analyze individual consumer behavior and interaction patterns to identify

8

opportunities for revenue enhancement and loss prevention, and configure optimal outreach campaigns to drive sales, loyalty, and profitability.

Pursue meaningful cost synergy opportunities and accelerate long-term profitability. We have identified significant cost synergies that may result from the closing of the Business Combination. Due to similar operating infrastructures between SourceHOV and Novitex, we continue to believe we have opportunities across information technology, operations, facilities, and corporate functions to achieve cost savings executable over the course of 2 years from the closing of the Business Combination. We believe these cost savings are in the following categories:

- •

- Information Technology. We have opportunities

for consolidation of Information Technology ("IT") management, insourcing of third-party vendors, and savings related to consolidation of IT services and software license replacement with in-house

platforms.

- •

- Operations. We have opportunities for data

entry offshoring, regional management rationalization, and broader implementation and adoption of our own technology across our organization to replace vendor spend.

- •

- Facilities. We have opportunities for lease

and headcount savings resulting from facilities consolidation.

- •

- Corporate and Shared Services. We have opportunities for cost savings primarily across shared services, including the finance, accounting, legal, and human resources departments, in addition to vendor savings from consolidation of costs such as audit and tax, insurance, and enterprise resource planning.

Additionally, we intend to further improve our margins through increased focus on operational best practices and cost efficiency through further process standardization, increasing use of automation, and increased focus on quality. Our strategy is that over time this will result in margin expansion and enhanced productivity.

Capitalize on our enhanced scale and operating capacity. We intend to utilize our increased global scale and brand recognition to strengthen our ability to bid on new opportunities. We plan to dedicate more resources to pursue whitespace coverage to expand our range of service offerings and pursue additional cross-selling opportunities. We will also look to use our increased scale and operations expertise to improve utilization of our assets. As an example, we will pursue a strategy of consolidating smaller regional document processing centers to our two Tier-III document processing and outsourcing centers in Windsor, Connecticut, and Austin, Texas that we call "MegaCenters," which will increase efficiency through economies of scale. By driving utilization up from the current levels of the MegaCenters, we will benefit from high flow through margins from increased revenues with minimal incremental investment.

Customers

We serve over 3,500 customers across a variety of industries, including over 60% of the Fortune® 100. We believe our customers are among the leading players in their respective industries, and many of them are recurring customers that have maintained long-term relationships with us and our predecessor companies.

We have successfully leveraged our relationships with customers to offer extended value chain services, creating stickier customer relationships and increasing overall margins. Customers are increasingly turning to us due to a demonstrated ability to work on large-scale projects, past performance and record of delivery, and deep domain expertise accumulated from years of experience in key verticals. As a result, our stable base of customers and sticky, long-term relationships lead to highly predictable revenues.

9

Customer and Industry Highlights

We maintain a strong mix of diversified customers with low customer concentration. No customer accounts for more than 10% of 2017 revenue. The diversity of our customer base has contributed to the stability and predictability of our revenue streams and cash flows. We have been able to effectively balance our customer mix and reduce dependency on any single customer or vertical by penetrating a diverse set of end markets.

Research and Development

Our ability to continue to compete successfully depends heavily upon our ability to ensure a timely flow of competitive products, services and technologies to the marketplace while also leveraging our domain expertise to demonstrate our understanding in implementing solutions across the industries we serve. Through regular and sustained investment, licensing of intellectual property and acquisition of third-party businesses and technology, we continue to develop new knowledge platforms, applications and supporting service bundles that enhance and expand our existing suite of services. Additional financial information regarding our R&D expense is included in Note 2 within our consolidated financial statements.

Intellectual Property

We deploy a combination of internally-developed proprietary knowledge platforms, applications and generally available third-party licensed software as part of our scalable and flexible solutions and services. Our intellectual property is our competitive strength.

Our platforms aim to enhance information management and workflow processes through automation and process optimization to minimize labor requirements or improve labor performance. Our decisioning engines have been built with years of deep domain expertise, incorporating hundreds of thousands of customer and industry specific rules which enable the most efficient and lowest cost preparation and decisioning of transactions. Our business processes and implementation methodologies are confidential and proprietary and include trade secrets that are important to our business. We own a variety of trademarks and patents, which are registered or in the application process.

We regularly enter into nondisclosure agreements with customers, business partners, employees, and contractors that require confidential treatment of our information to establish, maintain and enforce our intellectual property rights. Our licensed intellectual properties are generally governed by written agreements of varying durations, including some with fixed terms that are subject to renewal based on mutual agreement. Generally, each agreement may be further extended and we have historically been able to renew existing agreements before they expire. We expect these and other similar agreements to be extended so long as it is mutually advantageous to both parties at the time of renewal.

Competition

We believe that the principal competitive factors in providing our solutions include proprietary platforms, industry specific knowledge, quality, reliability and security of service, and price. We are differentiated competitively given our scale of operations, reputation as a trusted partner with deep

10

domain expertise, innovative solutions, and highly integrated technology platforms that provide customers with end-to-end services addressing many aspects of their mission-critical operational processes. We continue to integrate best practice delivery processes into our service-delivery capabilities to improve its quality and service levels and to increase operational efficiencies. The markets in which we serve are competitive with both large and small businesses, as well as global companies:

- •

- Multi-national companies that provide EIM and TPS services, such as Fiserv, Jack Henry, First Data, FIS, Black Knight Financial, Open Text,

Broadridge Financial Solutions, Computershare, DST Systems and Iron Mountain;

- •

- Multi-shore BPO companies, such as Genpact, Capita, Cognizant, Exlservice, Conduent, Wipro, and WNS; and

- •

- Smaller, niche service providers in specific verticals or geographic markets.

Regulation and Compliance

We handle, directly or indirectly through customer contracts and business associate agreements, a significant amount of information, including personal and health-related information, which results in our being subject to federal, state and local privacy laws, including the Gramm-Leach-Bliley Act, HIPAA and the HITECH Act of 2009. Further, we are subject to the local rules and regulations in the other countries in which we operate, including those relating to the handling of information. In addition, services in our LLPS segment, though not directly regulated, must be provided in a manner consistent with the relevant legal framework. For example, our bankruptcy claims administration services must be provided in accordance with the requirements and deadlines of the United States Bankruptcy Code and Federal Rules of Civil Procedure. In addition, some of our customers are subject to regulatory oversight, which may result in our being reviewed from time to time by such oversight bodies. Further, as a government contractor, we are subject to associated regulations and requirements.

Other laws apply to our processing of individually identifiable information. These laws have been subject to frequent changes, and new legislation in this area may be enacted at any time. Changes to existing laws, introduction of new laws in this area, or failure to comply with existing laws that are applicable to us may subject us to, among other things, additional costs or changes to our business practices, liability for monetary damages, fines and/or criminal prosecution, unfavorable publicity, restrictions on our ability to obtain and process information and allegations by our customers and customers that we have not performed our contractual obligations, any of which may have a material adverse effect on profitability and cash flow.

Privacy and Information Security Regulations

The processing and transfer of personal information is required to provide certain of our services. Data privacy laws and regulations in the U.S. and foreign countries apply to the access, collection, transfer, use, storage, and destruction of personal information. In the U.S., our financial institution customers are required to comply with privacy regulations imposed under the Gramm-Leach-Bliley Act, in addition to other regulations. As a processor of personal information in our role as a provider of services to financial institutions, we are required to comply with privacy regulations and are bound by similar limitations on disclosure of the information received from our customers as apply to the financial institutions themselves. We also perform services for healthcare companies and are, therefore, subject to compliance with laws and regulations regarding healthcare information, including in the U.S., HIPAA. We also perform credit-related services and agree to comply with payment card standards, including the PCIDSS. In addition, federal and state privacy and information security laws, and consumer protection laws, which apply to businesses that collect or process personal information, also apply to our businesses.

11

Privacy laws and regulations may require notification to affected individuals, federal and state regulators, and consumer reporting agencies in the event of a security breach that results in unauthorized access to, or disclosure of, certain personal information. Privacy laws outside the U.S. may be more restrictive and may require different compliance requirements than U.S. laws and regulations, and may impose additional duties on us in the performance of our services.

There has been increased public attention regarding the use of personal information and data transfer, accompanied by legislation and regulations intended to strengthen data protection, information security and consumer and personal privacy. The law in these areas continues to develop and the changing nature of privacy laws in the U.S., the European Union and elsewhere could impact our processing of personal information of our employees and on behalf of our customers. The European Union adopted a comprehensive General Data Privacy Regulation (the "GDPR") in May 2016 that will replace the current EU Data Protection Directive and related country-specific legislation. The GDPR will become fully effective in May 2018. While we believe that we are compliant with its regulatory responsibilities, information security threats continue to evolve resulting in increased risk and exposure. In addition, legislation, regulation, litigation, court rulings, or other events could expose us to increased costs, liability, and possible damage to our reputation.

Employees

The continued success of our business is driven by our people. Our senior leadership team has extensive experience within the larger BPO as well as the BPA industry. As we were formed through a series of acquisitions, we have retained an experienced and cohesive leadership team. The combination of our employees with our technology is the backbone of our ability to provide customers with holistic solutions designed to meet the rapidly evolving needs of our customers.

As of December 31, 2017, we had approximately 22,000 total employees, which included approximately 20,700 full-time and 1,300 part-time employees. We have a global workforce with a majority of our employees located in the United States, and the remainder located in Europe, India, the Philippines, Mexico, and China. Our employee count fluctuates from time to time based upon the timing and duration of our engagements. We consider our relationship with our employees to be good.

We locate our operation centers in areas where the value proposition it offers is attractive to the employees in the area relative to other local opportunities, resulting in an engaged workforce that is able to make a meaningful global contribution from their local marketplace. To supplement the skills available in certain markets, we offer our employees a focused set of training programs to increase their skills and leadership capabilities with the goal of creating a long-term funnel of talent to support the Company's continued growth. Additionally, our proprietary platforms enable rapid learning and facilitate knowledge transfer among employees, reducing training time.

Available Information

Our website address is www.exelatech.com. We are not including the information provided on our website as a part of, or incorporating it by reference into, this Annual Report on Form 10-K. We make available free of charge (other than an investor's own internet access charges) through our website our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to these reports, as soon as reasonably practicable after we electronically file such material with, or furnish such material to, the Securities and Exchange Commission (the "SEC"). In addition, we make available our code of ethics entitled "Global Code of Ethics and Business Conduct" free of charge through our website. We intend to post on our website all disclosures that are required by law or Nasdaq listing standards concerning any amendments to, or waivers from, any provision of our code of ethics.

The public may read and copy any materials filed by us with the SEC at the SEC's Public Reference Room at 100 F Street, NE, Room 1580, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an internet site that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC at www.sec.gov. The information contained on the websites referenced in this Form 10-K is not incorporated by reference into this filing.

12

In addition to the other information contained in this Annual Report on Form 10-K, the following risks impact our business and operations. These risk factors are not exhaustive and all investors are encouraged to perform their own investigation with respect to our business, financial condition and prospects. Unless otherwise indicated or the context otherwise requires, references in this "Risk Factors" section to "Exela," "we," "our," "us" and other similar terms refer to Exela Technologies, Inc. and its consolidated subsidiaries.

Risks Related to our Business

Our results of operations could be adversely affected by economic and political conditions, creating complex risks, many of which are beyond our control.

Our business depends on the continued demand for our services, and, if current global economic conditions worsen, our business could be adversely affected by our customers' financial condition and level of business activity. Along with our customers we are subject to global political, economic and market conditions, including inflation, interest rates, energy costs, the impact of natural disasters, military action and the threat of terrorism. In particular, we currently derive, and are likely to continue to derive, a significant portion of revenues from customers located in the U.S. Any future decreases in the general level of economic activity, such as decreases in business and consumer spending and increases in unemployment rates, could result in a decrease in demand for our services, thus reducing our revenue. For example, certain customers may decide to reduce or postpone their spending on the services we provide, and we may be forced to lower our prices. Other developments in response to economic events, such as consolidations, restructurings or reorganizations, particularly involving our customers, could also cause the demand for our services to decline, negatively affecting the amount of business that we are able to obtain or retain. We may not be able to predict the impact such conditions will have on the industries we serve and may be unable to plan effectively for or respond to such impact. In response to economic and market conditions, from time to time we have undertaken or may undertake initiatives to reduce our cost structure where appropriate, such as consolidation of resources to provide functional region-wide support to our international subsidiaries in a centralized fashion. These initiatives, as well as any future workforce and facilities reductions we may implement, may not be sufficient to meet current and future changes in economic and market conditions and allow us to continue to achieve the growth rates expected. In addition, costs actually incurred in connection with certain restructuring actions may be higher than our estimates of such costs and/or may not lead to the anticipated cost savings.

In addition, any future disruptions or turbulence in the global credit markets may adversely affect our liquidity and financial condition, and the liquidity and financial condition of our customers. Such disruptions may limit our ability to access financing, increase the cost of financing needed to meet liquidity needs and affect the ability of our customers to use credit to purchase our services or to make timely payments to us, adversely affecting our financial condition and results of operations.

Cybersecurity issues, vulnerabilities, and criminal activity resulting in a data or security breach could result in risks to our systems, networks, products, solutions and services resulting in liability or reputational damage.

We collect and retain large volumes of internal and customer data, including personally identifiable information and other sensitive data both physically and electronically, for business purposes, and our various information technology systems enter, process, summarize and report such data. We also maintain personally identifiable information about our employees. Safeguarding customer, employee and our own data is a key priority for us, and our customers and employees have come to rely on us for the protection of their personal information. Augmented vulnerabilities, threats and more sophisticated and targeted cyber-related attacks pose a risk to our security and the security of our customers, partners, suppliers and third-party service providers, and to the confidentiality, availability

13

and integrity of data owned by us or our customers. Despite our efforts to protect sensitive, confidential or personal data or information, we may be vulnerable to material security breaches, theft, misplaced or lost data, programming errors, employee errors and/or malfeasance that could potentially lead to the compromising of sensitive, confidential or personal data or information, improper use of our systems, software solutions or networks, unauthorized access, use, disclosure, modification or destruction of information, defective products, production downtimes and operational disruptions. Despite protective measures, we may not be successful in preventing security breaches which compromise the confidentiality and integrity of this data. While an attempt is made to mitigate these risks by employing a number of measures, including employee training, monitoring and testing, and maintenance of protective systems and contingency plans, we remain vulnerable to such threats.

The sensitive, confidential or personal data or information that we have access to is also subject to privacy and security laws, regulations or customer-imposed controls. The regulatory environment, as well as the requirements imposed on us by the industries we serve governing information, security and privacy laws is increasingly demanding. Maintaining compliance with applicable security and privacy regulations may increase our operating costs and/or adversely impact our ability to provide services to our customers. Furthermore, a compromised data system or the intentional, inadvertent or negligent release or disclosure of data could result in theft, loss, fraudulent or unlawful use of customer, employee or our data which could harm our reputation or result in remedial and other costs, fines or lawsuits. In addition, a cyber-related attack could result in other negative consequences, including damage to our reputation or competitiveness, remediation or increased protection costs, litigation or regulatory action. Fraud, employee negligence, unauthorized access, including, without limitation, malfunctions, viruses and other events beyond our control, may lead to the misappropriation or unauthorized disclosure of sensitive or confidential information we process, store and transmit, including personal information, for our customers, failure to prevent or mitigate data loss or other security breaches, including breaches of our vendors' technology and systems, could expose us or our customers to a risk of loss or misuse of such information, adversely affect our operating results, result in litigation or potential liability for us and otherwise harm our business. As a result, we may be subject to monetary damages, regulatory enforcement actions or fines under federal legislation, such as, the Gramm-Leach-Bliley Act and HIPAA, as well as various states laws. Similarly, regulations such as the Health Information Technology for Economic and Clinical Health Act provisions of the American Recovery and Reinvestment Act of 2009 expand the obligations of "covered entities" and their business associates, including certain mandatory breach notification requirements. In addition to any legal liability, data or security breaches may lead to negative publicity, reputational damage and otherwise adversely affect the results of our operations.

Our industry may be adversely impacted by a negative public reaction in the U.S. and elsewhere to providing certain of our services from outside the U.S. and recently proposed related legislation.

We have based our strategy of future growth on certain assumptions regarding our industry and future demand in the market for the provision of business process solutions in part using offshore resources. However, providing services from offshore locations is a politically sensitive topic in the U.S. and elsewhere, and many organizations and public figures have publicly expressed concern about a perceived association between offshore service providers and the loss of jobs in their home countries. In addition, there has been limited publicity about the negative experience of certain companies that provide their services offshore, particularly in India. The trend of providing business process solutions offshore may not continue and could reverse if companies elect to develop and perform their business processes internally or are discouraged from transferring these services to offshore service providers. Any slowdown or reversal of existing industry trends could negatively affect the amount of business that we are able to obtain or retain.

14

A variety of U.S. federal and state legislation has been proposed that, if enacted, could restrict or discourage U.S. companies from providing their services from outside the U.S., including recently introduced proposals for providing tax and other economic incentives for companies that create jobs in the U.S. by reducing their reliance on offshore locations. Other state bills have proposed requiring offshore service providers to disclose their geographic locations, requiring notice to individuals whose personal information is disclosed to non-U.S. affiliates or subcontractors, requiring disclosures of companies' foreign outsourcing practices or restricting U.S. private sector companies that have government contracts, grants or guaranteed loan programs from providing their services. Because most of our customers are located in the U.S., any expansion of existing laws or the enactment of new legislation that constrains our ability to provide our solutions from offshore or otherwise makes using our services unappealing or impractical for our customers could have a material and adverse effect on our business, results of operations, financial condition and cash flows.

The HGM Group has significant influence over us and our corporate governance.

The HGM Group beneficially owns over 50% of our Common Stock. As long as the HGM Group owns or controls a significant percentage of outstanding voting power, it will have the ability to strongly influence all corporate actions requiring stockholder approval, including the election and removal of directors and the size of our board of directors, any amendment of our certificate of incorporation or bylaws, or the approval of any merger or other significant corporate transaction, including a sale of substantially all of our assets. In addition, pursuant to the terms of the Director Nomination Agreement, the HGM Group (as well as Novitex Holdings) have certain nomination rights with respect to our board of directors and consent rights over certain of our corporate actions.

Additionally, the HGM Group's interests may not align with the interests of our other stockholders. The HGM Group is in the business of making investments in companies and may acquire and hold interests in businesses that compete directly or indirectly with us. The HGM Group may also pursue acquisition opportunities that may be complementary to our business, and, as a result, those acquisition opportunities may not be available to us. In addition, our certificate of incorporation provides that we renounce any interest or expectancy in the business opportunities of the HGM Group and that it shall not have any obligation to offer to us those opportunities unless presented to one of our directors or officers in his or her capacity as a director or officer.

Certain services we provide to customers in our public sector vertical may be subject to additional restrictions or limitations.

Our engagements with entities in the public sector, including educational institutions, may be subject to compliance with additional legislative or regulatory requirements. Certain state and local governments and agencies have adopted, or may in the future adopt, legislation or rules imposing additional requirements on services provided to the public sector, including restrictions as to where certain services can be performed or where certain data can be stored, even within the U.S. Additionally, our employees who are staffed on certain public sector engagements may be subject to strict background checks or other certifications. These additional requirements may make it more difficult to staff large public sector engagements, require us to turn down new engagements, affect our ability to meet customer expectations, deadlines or other specifications and otherwise increase our costs or decrease our revenues. Further, there can be no assurances that a public sector entity will not face funding shortages or reallocate funding for our services to other priorities, either prior to or after we have begun to perform our services, which could impact whether we are fully compensated for our services and could have a material adverse effect on our business, results of operations, financial condition and cash flows.

15

Certain of our contracts are subject to termination rights, audits and/or investigations, which, if exercised, could negatively impact our reputation and reduce our ability to compete for new contracts and have an adverse effect on our business, results of operations and financial condition.

Many of our customer contracts may be terminated by our customers without cause and without any fee or penalty, with only limited notice. Any failure to meet a customer's expectations, as well as factors beyond our control, including a customer's financial condition, strategic priorities, or mergers and acquisitions, could result in a cancellation or non-renewal of such a contract or a decrease in business provided to us and cause our actual results to differ from our forecasts. We may not be able to replace any customer that elects to terminate or not renew its contract with us, which would reduce our revenues.

In addition, a portion of our revenues is derived from contracts with the U.S. federal and state government and their agencies and from contracts with foreign governments and their agencies. Government entities typically finance projects through appropriated funds. While these projects are often planned and executed as multi-year projects, government entities usually reserve the right to change the scope of or terminate these projects for lack of approved funding and/or at their convenience. Changes in government or political developments, including budget deficits, shortfalls or uncertainties, government spending reductions (e.g., Congressional sequestration of funds under the Budget Control Act of 2016 or during a government shutdown) or other debt or funding constraints, such as those recently experienced in the U.S. and Europe, could result in lower governmental sales and in our projects being reduced in price or scope or terminated altogether, which also could limit our recovery of incurred costs, reimbursable expenses and profits on work completed prior to the termination. The federal procurement environment is unpredictable and this could adversely affect our ability to perform work under new and existing contracts. Also, our government business is subject to the risk that one or more of our potential contracts or contract extensions may be diverted by the contracting agency to a small or disadvantaged or minority-owned business pursuant to set-aside programs administered by the Small Business Administration, or may be bundled into large multiple award contracts for very large businesses. These risks can potentially have an adverse effect on our revenue growth and profit margins.

If the government finds that it inappropriately charged any costs to a contract, the costs are not reimbursable or, if already reimbursed, the cost must be refunded to the government. Additionally, if the government discovers improper or illegal activities or contractual non-compliance (including improper billing), we may be subject to various civil and criminal penalties and administrative sanctions, which may include termination of contracts, forfeiture of profits, suspension of payments, fines and suspensions or debarment from doing business with the government. Any resulting penalties or sanctions could materially adversely affect our results of operations and financial condition. Moreover, government contracts are generally subject to audits and investigations by government agencies. Further, the negative publicity that could arise from any such penalties, sanctions or findings in such audits or investigations could have an adverse effect on our reputation in the industry and reduce our ability to compete for new contracts and could materially adversely affect our results of operations and financial condition.

Our services and facilities may be impacted by terrorism, natural disasters and other disruptions, resulting in an adverse effect on our profitability and financial condition.

Our ability to provide services may be impacted or disrupted as a result of natural disasters, technical disruptions (including power outage and telecommunications failure), man-made events (including cyber-attacks, war and terrorist attacks), and global health risks or pandemics, as well as the threat or perceived threat of any of these events in the U.S. or any of the locations in which we operate. A significant portion of our employees and key operations centers are located in India and the Philippines, with, particularly in India, limited diversification or redundancy. India and the Philippines

16

are particularly susceptible to natural disasters, including typhoons, tsunamis, floods and earthquakes, and the Philippines is additionally susceptible to volcanic eruptions. Our operations in these locations, as well as certain other countries outside of the U.S., are also at greater risk of disruptions in electricity, other public utilities or network services due to substandard infrastructure. Although all of our operations centers have disaster management plans, certain disaster management facilities, particularly in India, may not be adequate to protect against potential disruptions due to natural or other disasters. Damage, destruction or disruptions, including to our MegaCenters, could make it difficult or impossible for employees to reach our business locations or otherwise interrupt our ability to provide our services. Sustained periods of interruption in our services could adversely affect our reputation and relationships with our customers, cause us to incur substantial expenses and expose us to liability. Our insurance coverage may not be sufficient to cover all of our potential losses and our business, results of operation and financial condition could be adversely affected.

Any disruption related to our U.S. data centers or MegaCenters due to any of the foregoing events may cause significant disruptions in our ability to provide our services to our customers and result in a material adverse effect on our reputation, results of operations and financial condition and our business, results of operations and financial condition could be adversely affected.

Although we believe that our insurance coverage with respect to disruptive events is reasonable, significant events such as acts of war and terrorism, economic conditions, judicial decisions, legislation, natural disasters and large losses could materially affect our insurance obligations and future expense.

Our executives, senior management team and other key personnel are critical to our continued success and the loss of such personnel, or an inability to attract, engage, retain and integrate our executives and other key employees could harm our business.

Our future success substantially depends on the continued service and performance of our executives, senior management team, as well as other key individuals in senior leadership positions. These personnel possess business and technical capabilities that are difficult to replace. The loss of any of our key personnel, particularly to competitors, may adversely affect our ability to effectively manage our current operations or meet ongoing and future business challenges. Further, identifying, developing internally or hiring externally, training and retraining highly-skilled managerial, technical, sales and services, finance and marketing personnel are critical to our future. Failure to successfully hire executives and key employees or the loss of any executives and key employees could have a significant impact on our operations.

Our business, financial position, and results of operations could be harmed by adverse rating actions by credit rating agencies.

If the credit ratings of our outstanding indebtedness are downgraded, or if rating agencies indicate that a downgrade may occur, our business, financial position, and results of operations could be adversely affected and perceptions of our financial strength could be damaged. A downgrade would have the effect of increasing our borrowing costs, and could decrease the availability of funds we are able to borrow, adversely affecting our business, financial position, and results of operations. In addition, a downgrade could adversely affect our relationships with our customers.

Our management team has limited experience managing a public company.

Most members of our management team have limited experience managing a publicly traded company, interacting with public company investors and complying with the increasingly complex laws pertaining to public companies. Our management team may not successfully or efficiently manage the next stages of our transition to being a public company subject to significant regulatory oversight and reporting obligations under the federal securities laws and the scrutiny of securities analysts and

17

investors. These new obligations and constituents will require significant attention from our management team and could divert their attention away from the day-to-day management of our business, which could materially adversely affect our business, financial condition and operating results.

The requirements of being a public company may strain our resources, divert management's attention and affect our ability to attract and retain qualified board members.

As a public company, we are subject to the reporting requirements of the Exchange Act, the listing requirements of the Nasdaq and other applicable securities rules and regulations. Compliance with these rules and regulations will increase our legal and financial compliance costs, make some activities more difficult, time-consuming or costly, and increase demand on our systems and resources, particularly as we are no longer an emerging growth company. Among other things, the Exchange Act requires that we file annual, quarterly and current reports with respect to our business and operating results and maintain effective disclosure controls and procedures and internal control over financial reporting. In order to maintain and, if required, improve our disclosure controls and procedures and internal control over financial reporting to meet this standard, significant resources and management oversight may be required. As a result, management's attention may be diverted from other business concerns, which could harm our business and operating results. Although we have already hired additional employees to comply with these requirements, we may need to hire even more employees in the future, which will increase our costs and expenses.

We are currently evaluating our internal controls, identifying and remediating any deficiencies in those internal controls and documenting the results of our evaluation, testing and remediation. We may not be able to complete our evaluation, testing and any required remediation in a timely fashion. During the evaluation and testing process, if we identify one or more material weaknesses in our internal control over financial reporting that we are unable to remediate before the end of the same fiscal year in which the material weakness is identified, we will be unable to assert that our internal controls are effective. If we are unable to assert that our internal control over financial reporting is effective, or if our auditors are unable to attest to management's report on the effectiveness of our internal controls, we could lose investor confidence in the accuracy and completeness of our financial reports, which would cause the price of our Common Stock to decline.

In addition, changing laws, regulations and standards relating to corporate governance and public disclosure are creating uncertainty for public companies, increasing legal and financial compliance costs and making some activities more time consuming. These laws, regulations, and standards are subject to varying interpretations, in many cases due to their lack of specificity, and, as a result, their application in practice may evolve over time as new guidance is provided by regulatory and governing bodies. This could result in continuing uncertainty regarding compliance matters and higher costs necessitated by ongoing revisions to disclosure and governance practices. We intend to invest resources to comply with evolving laws, regulations and standards, and this investment may result in increased general and administrative expense and a diversion of management's time and attention from revenue-generating activities to compliance activities. If our efforts to comply with new laws, regulations and standards differ from the activities intended by regulatory or governing bodies, regulatory authorities may initiate legal proceedings against us and our business may be harmed.

As a result of being a public company and these new rules and regulations, it is more expensive for us to obtain director and officer liability insurance, and in the future we may be required to accept reduced coverage or incur substantially higher costs to obtain coverage. These factors could also make it more difficult for us to attract and retain qualified members of our board of directors, particularly to serve on our audit committee and compensation committee, and qualified executive officers.

18

Failure to establish and maintain effective internal controls in accordance with Section 404 of the Sarbanes-Oxley Act could have a material adverse effect on our business and stock price.

For purposes of this annual report, we are not required to comply with the rules of the SEC implementing Section 404 of the Sarbanes-Oxley Act and are therefore not required to make a formal assessment of the effectiveness of our internal control over financial reporting for that purpose. As a newly public company, we are required to comply with the SEC's rules implementing Sections 302 and 404 of the Sarbanes-Oxley Act, which requires management to certify financial and other information in our quarterly and annual reports and provide an annual management report on the effectiveness of controls over financial reporting. Though we are required to disclose changes made in our internal controls and procedures on a quarterly basis, we are not required to make our first annual assessment of our internal control over financial reporting pursuant to Section 404 until the year following our first annual report required to be filed with the SEC. Our independent registered public accounting firm will not be required to formally attest to the effectiveness of our internal control over financial reporting pursuant to Section 404 until the year following our first annual report required to be filed with the SEC. At such time, our independent registered public accounting firm, and management, may issue a report that is adverse in the event it is not satisfied with the level at which our controls are documented, designed or operating.

To comply with the requirements of being a public company, we have undertaken various actions, and may need to take additional actions, such as implementing new internal controls and procedures and hiring additional accounting staff. Testing and maintaining internal control can divert our management's attention from other matters that are important to the operation of our business. Additionally, when evaluating our internal control over financial reporting, we may identify material weaknesses that we may not be able to remediate in time to meet the applicable deadline imposed upon us for compliance with the requirements of Section 404. If we identify any material weaknesses in our internal control over financial reporting or are unable to comply with the requirements of Section 404 in a timely manner or assert that our internal control over financial reporting is effective, or if our independent registered public accounting firm is unable to express an opinion as to the effectiveness of our internal control over financial reporting once we are no longer an emerging growth company, investors may lose confidence in the accuracy and completeness of our financial reports and the market price of our Common Stock could be materially adversely affected, and we could become subject to investigations by the stock exchange on which our securities are listed, the SEC or other regulatory authorities, which could require additional financial and management resources.

Elevated levels of leverage may harm our financial condition and results of operations.

As of December 31, 2017, we had approximately $1.276 billion of long-term debt, excluding current maturities. We and our subsidiaries may incur additional indebtedness in the future. Our indebtedness could: decrease our ability to obtain additional financing for working capital, capital expenditures, general corporate or other purposes; limit our flexibility to make acquisitions; increase our cash requirements to support the payment of interest; limit our flexibility in planning for, or reacting to, changes in our business and our industry; and increase our vulnerability to adverse changes in general economic and industry conditions. Our ability to make payments of principal and interest on our indebtedness depends upon our future performance, which will be subject to general economic conditions and financial, business and other factors affecting our consolidated operations, many of which are beyond our control. In addition, if our outstanding senior notes are downgraded to below investment grade, we may incur additional interest expense. If we are unable to generate sufficient cash flow from operations in the future to service our debt and meet our other cash requirements, we may be required, among other things: to seek additional financing in the debt or equity markets; to refinance or restructure all or a portion of our indebtedness; or to reduce or delay planned capital or operating expenditures. Such measures might not be sufficient to enable us to service our debt and

19

meet our other cash requirements. In addition, any such financing, refinancing or sale of assets might not be available at all or on economically favorable terms.

If more stringent labor laws become applicable to us or if a significant number of our employees unionize, our profitability may be adversely affected.

Increased labor costs due to competition, increased minimum wage or employee benefits costs (including various federal, state and local actions to increase minimum wages), unionization activity or other factors would adversely impact our cost of sales and operating expenses. For example, the State of California has passed regulations which increased minimum wage rates from $10.50 per hour to $11.00 per hour, effective January 1, 2018, and will gradually increase to $15.00 per hour by 2022. In addition, the federal government and a number of other states are evaluating various proposals to increase their respective minimum wage. As minimum wage rates increase, we may need to increase not only the wages of our minimum wage employees but also the wages paid to employees at wage rates that are above minimum wage. As a result, we anticipate that our labor costs will continue to increase.

We are subject to applicable rules and regulations relating to our relationship with our employees, including minimum wage and break requirements, health benefits, unemployment and sales taxes, overtime, and working conditions and immigration status. Legislated increases in the minimum wage and increases in additional labor cost components, such as employee benefit costs, workers' compensation insurance rates, compliance costs and fines, as well as the cost of litigation in connection with these regulations, would increase our labor costs. Unionizing and collective bargaining efforts have received increased attention nationwide in recent periods. While a small number of our employees belong to unions, should our employees become represented by unions, we would be obligated to bargain with those unions with respect to wages, hours, and other terms and conditions of employment, which is likely to increase our labor costs. Moreover, as part of the process of union organizing and collective bargaining, strikes and other work stoppages may occur, which would cause disruption to our business. Similarly, many employers nationally in similar environments have been subject to actions brought by governmental agencies and private individuals under wage-hour laws on a variety of claims, such as improper classification of workers as exempt from overtime pay requirements and failure to pay overtime wages properly, with such actions sometimes brought as class actions. These actions can result in material liabilities and expenses. Should we be subject to employment litigation, such as actions involving wage-hour, overtime, break, and working time, we may distract our management from business matters and result in increased labor costs. If costs of labor increase significantly, our business, results of operations, and financial condition may be adversely affected.

We may not always offset increased costs with increased fees under long-term contracts.

The pricing and other terms of our customer contracts, particularly our long-term contact center agreements, are based on estimates and assumptions we make at the time we enter into these contracts. These estimates reflect our best judgments regarding the nature of the engagement and our expected costs to provide the contracted services and could differ from actual results. Not all our larger long-term contracts allow for escalation of fees as our cost of operations increase and those that allow for such escalations do not always allow increases at rates comparable to increases that we experience due to rising minimum wage costs and related payroll cost increases. If we cannot negotiate long-term contract terms that provide for fee adjustments to reflect increases in our cost of service delivery, our business, financial conditions, and results of operation would be materially impacted.

20

Our business process solutions often require long selling cycles and long implementation periods that may result in significant upfront expenses that may not be recovered.