Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - Trinity Place Holdings Inc. | tv485315_ex32-2.htm |

| EX-32.1 - EXHIBIT 32.1 - Trinity Place Holdings Inc. | tv485315_ex32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - Trinity Place Holdings Inc. | tv485315_ex31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - Trinity Place Holdings Inc. | tv485315_ex31-1.htm |

| EX-23.1 - EXHIBIT 23.1 - Trinity Place Holdings Inc. | tv485315_ex23-1.htm |

| EX-21.1 - EXHIBIT 21.1 - Trinity Place Holdings Inc. | tv485315_ex21-1.htm |

| EX-10.18 - EXHIBIT 10.18 - Trinity Place Holdings Inc. | tv485315_ex10-18.htm |

| EX-10.17 - EXHIBIT 10.17 - Trinity Place Holdings Inc. | tv485315_ex10-17.htm |

| EX-10.16 - EXHIBIT 10.16 - Trinity Place Holdings Inc. | tv485315_ex10-16.htm |

| EX-10.15 - EXHIBIT 10.15 - Trinity Place Holdings Inc. | tv485315_ex10-15.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark one)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2017

or

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______ to _____

Commission file number 1-08546

TRINITY

PLACE HOLDINGS INC.

(Exact name of registrant as specified in its charter)

| Delaware (State or Other Jurisdiction of Incorporation or Organization) |

No. 22-2465228 (I.R.S. Employer Identification No.) |

| 340 Madison Avenue, New York, New York (Address of Principal Executive Offices) |

10173 (Zip Code) |

Registrant’s telephone number, including area code: (212) 235-2190

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Name of each exchange on which registered |

| Common Stock $0.01 Par Value Per Share | NYSE American |

Securities registered pursuant to Section 12 (g) of the Act: NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer ¨ | Accelerated Filer x |

| Non-Accelerated Filer ¨ (Do not check if a smaller reporting company) | Smaller Reporting Company ¨ |

| Emerging Growth Company ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No x

As of June 30, 2017, the aggregate market value of the registrant’s Common Stock held by non-affiliates of the registrant was approximately $175,834,000.

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distributions of securities under a plan confirmed by a court.

Yes x No ¨

As of March 15, 2018, there were 31,554,643 shares of the registrant’s Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement relating to the registrant’s 2018 Annual Meeting of Shareholders to be filed hereafter are incorporated by reference into Part III of this Annual Report on Form 10-K.

Form 10-K Index

Cautionary Note Regarding Forward-Looking Statements

This Annual Report on Form 10-K, including information included or incorporated by reference in this Annual Report on or any supplement to this Annual Report, may include forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and information relating to us that are based on the beliefs of management as well as assumptions made by and information currently available to management. These forward-looking statements include, but are not limited to, statements about our plans, objectives, expectations and intentions that are not historical facts, and other statements identified by words such as “may,” “will,” “expects,” believes,” “plans,” “estimates,” “potential,” or “continue,” or the negative thereof or other and similar expressions. In addition, in some cases, you can identify forward-looking statements by words or phrases such as “trend,” “potential,” “opportunity,” “believe,” “comfortable,” “expect,” “anticipate,” “current,” “intention,” “estimate,” “position,” “assume,” “outlook,” “continue,” “remain,” “maintain,” “sustain,” “seek,” “achieve,” and similar expressions. Such statements reflect our current views with respect to future events, the outcome of which is subject to certain risks, including among others:

| · | our limited revenues from operations and reliance on external sources of financing to fund operations in the future; |

| · | our ability to execute our business plan, including as it relates to the development of our largest asset, a property located at 77 Greenwich Street (“77 Greenwich”) in Lower Manhattan; |

| · | adverse trends in the Manhattan condominium market; |

| · | general economic and business conditions, including with respect to real estate, and their effect on the New York City real estate market in particular; |

| · | our investment in property development may be more costly than anticipated and investment returns from our properties planned to be developed may be less than anticipated; |

| · | competition for new acquisitions; |

| · | risks associated with acquisitions and investments in owned and leased real estate generally, including risks related to closing, obtaining suitable financing in connection with and achieving the intended benefits of the potential acquisition of the apartment building located at 237 11th Street, Brooklyn, New York (“237 11th Street”); |

| · | our ability to enter into new leases and renew existing leases with tenants at our commercial and residential properties; |

| · | risks associated with partnerships or joint ventures; |

| · | our ability to receive or maintain certain state tax benefits with respect to our properties, and to obtain required permits, site plan approvals and/or other governmental approvals in connection with the development or redevelopment of our properties; |

| · | costs associated with complying with environmental laws and environmental contamination, as well as the Americans with Disabilities Act or other safety regulations and requirements; |

| · | loss of key personnel; |

| · | our ability to obtain additional financing and refinance existing loans and on favorable terms; |

| · | the failure of our subsidiaries to repay outstanding indebtedness; |

| · | the effects of new tax laws; |

| · | our ability to utilize our net operating loss carryforwards (“NOLs”) to offset future taxable income and capital gains for U.S. Federal, state and local income tax purposes; |

| · | risks associated with current political and economic uncertainty; |

| · | risks associated with breaches of information technology systems; |

| 1 |

| · | stock price volatility; |

| · | the influence of certain significant stockholders; |

| · | limitations in our certificate of incorporation on acquisitions and dispositions of our common stock designed to protect our ability to utilize our NOLs and certain other tax attributes, which may not succeed in protecting our ability to utilize such tax attributes, and/or may limit the liquidity of our common stock; |

| · | certain provisions in our charter documents and Delaware law may have the effect of making more difficult or otherwise discouraging, delaying or deterring a takeover or other change of control of us; and |

| · | unanticipated difficulties which may arise and other factors which may be outside our control or that are not currently known to us or which we believe are not material. |

In evaluating such statements, you should specifically consider the risks identified under the section entitled “Risk Factors” in this Annual Report on Form 10-K, any of which could cause actual results to differ materially from the anticipated results. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results or outcomes may vary materially from those contemplated by any forward looking statements. Subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements in this paragraph and elsewhere described in this Annual Report on Form 10-K and other reports filed with the Securities and Exchange Commission (the “SEC”). All forward-looking statements speak only as of the date of this Annual Report on Form 10-K or, in the case of any documents incorporated by reference in this Annual Report on Form 10-K, the date of such document, in each case based on information available to us as of such date, and we assume no obligation to update any forward-looking statements, except as required by law.

| Item 1. | BUSINESS |

Overview

Trinity Place Holdings Inc. (“Trinity,” “we”, “our”, or “us”) is a real estate holding, investment and asset management company. Our business is primarily to acquire, invest in, own, manage, develop or redevelop and sell real estate assets and/or real estate related securities. Our largest asset is currently a property located at 77 Greenwich in Lower Manhattan. 77 Greenwich was a vacant building that was demolished and is under development as a residential condominium tower that also includes plans for retail and a New York City elementary school. We also own a retail strip center located in West Palm Beach, Florida, a property formerly occupied by a retail tenant in Paramus, New Jersey, and, through a joint venture, a 50% interest in a newly constructed 95-unit multi-family property, known as The Berkley, located in Brooklyn, New York (see Item 2. Properties for a more detailed description of our properties). We are also under contract to purchase a newly built 105-unit, 12 story apartment building located at 237 11th Street for $81.0 million, which we expect to close in the spring of 2018 (see Transactions, Development and Other Activities During 2017 - Acquisitions and Divestitures below for more details). We continue to evaluate new investment opportunities.

We also control a variety of intellectual property assets focused on the consumer sector, a legacy of our predecessor, Syms Corp. (“Syms”), including our on-line marketplace at FilenesBasement.com, our rights to the Stanley Blacker® brand, as well as the intellectual property associated with the Running of the Brides® event and An Educated Consumer is Our Best Customer® slogan. We also had approximately $231.0 million of federal NOLs at December 31, 2017.

| 2 |

Business and Growth Strategies

Our primary business objective is to maximize the risk adjusted return on investment in our portfolio properties and new acquisitions and investments across all points of the economic cycle. Our strategies to achieve this objective include, among others, the following:

| · | Legacy Properties. Continue the development, redevelopment and leasing of our legacy properties, including the development of 77 Greenwich and the redevelopment and repositioning of our legacy retail properties; |

| · | New Acquisitions and Investments. Identify additional acquisition and investment opportunities, including, but not limited to, the following: |

| · | high-quality, multi-family real estate in the boroughs of New York City and other select submarkets, that is designed to meet the demands of today’s tenants who desire newly constructed and efficiently designed apartment buildings located in close proximity to public transportation, and manage those facilities so as to become the landlord of choice for both existing and prospective tenants; |

| · | retail and office properties that present opportunities for us to leverage our redevelopment and repositioning expertise; and |

| · | opportunistic acquisitions of assets which increase our market share in the markets in which we concentrate, as well as potential new markets, which exhibit an opportunity to improve or preserve returns through repositioning (through a combination of capital improvements and shift in marketing strategy), changes in management focus and leasing, as well as assets or interests in assets that offer strong long-term fundamentals, but which may be out of favor in the short term; |

| · | Joint Ventures. Explore joint venture opportunities with existing property owners located in desirable locations, who seek to benefit from the depth of market knowledge and management expertise we are able to provide, and/or to explore joint venture opportunities with strategic institutional partners, leveraging our skills as owners and operators; and |

| · | Capital Structure. Enhance our capital structure through our access to a variety of sources of capital and proactively manage our debt maturities. |

Competition

The markets in which our properties are located are inherently competitive. With respect to our properties currently located in Paramus, New Jersey; West Palm Beach, Florida; our joint venture property located in Brooklyn, New York, and with respect to any future real estate assets that we acquire or develop, we will be competing for some of the same tenants, contractors, lenders and potential purchasers or investors with respect to other properties within the same markets but owned by other investors.

Competitive factors with respect to 77 Greenwich may have a more material effect on us as it is currently our most significant real estate asset. Various municipal entities are making and have indicated an intent to continue to make significant investments in the immediate vicinity of 77 Greenwich to support the growth of the downtown Manhattan neighborhood as a vibrant 24/7 community to work, visit and live. Several privately funded commercial and residential developments are being constructed or have been proposed to take advantage of the increasing desirability of the neighborhood. The impact of these changing supply and demand characteristics is uncertain, and they could positively or negatively impact our plan to maximize the value of 77 Greenwich.

In addition, we will face competition in identifying and completing new investment and acquisition opportunities, including from larger and more established real estate firms with greater capital resources and access to financing.

Regulatory Matters

Environmental Compliance

Under various federal, state and local laws, ordinances and regulations, a current or previous owner or operator of real-estate may be required to investigate and remediate hazardous or toxic substances at a property, and may be held liable to a governmental entity or to third parties for property damage or personal injuries and for investigation and clean-up costs incurred by the parties in connection with the contamination. These laws often impose liability without regard to whether the owner or operator had knowledge of, or was responsible for, the release of the hazardous or toxic substances. The presence of contamination or the failure to remediate contamination may adversely affect the owner’s ability to sell or lease real estate or to borrow using the real estate as collateral.

| 3 |

Other federal, state and local laws, ordinances and regulations require abatement or removal of asbestos-containing materials in the event of demolition or certain renovations or remodeling, the cost of which may be substantial for certain redevelopment projects that a potential purchaser would want to undertake with respect to any particular parcel of real estate we own. Such laws, ordinances and regulations also govern emissions from and exposure to asbestos fibers in the air. Federal and state laws also regulate the operation and removal of underground storage tanks. In connection with the ownership and management of certain properties, we could be held liable for the costs of remedial action with respect to these regulated substances or related claims.

Zoning and Planning

In connection with any development or redevelopment of our properties, whether currently owned or acquired or invest in the future, we will be required to comply with applicable zoning, land-use, building, occupancy, and other laws and regulations. In many cases we are and will continue to be required to obtain governmental permits, site plan approvals and/or other authorizations, or seek variances, prior to proceeding with planned development, acquisition or other activities.

Chapter 11 Cases and Plan of Reorganization of Syms Corp.

Trinity is the successor to Syms, which also owned Filene’s Basement. Syms and its subsidiaries filed for relief under the United States Bankruptcy Code in 2011. In September 2012, the Syms Plan of Reorganization (the “Plan”) became effective and Syms and its subsidiaries consummated their reorganization under Chapter 11 through a series of transactions contemplated by the Plan and emerged from bankruptcy. As part of those transactions, reorganized Syms merged with and into Trinity, with Trinity as the surviving corporation and successor issuer pursuant to Rule 12g-3 under the Exchange Act.

On or about March 8, 2016, a General Unsecured Claim Satisfaction occurred under the Plan. On March 14, 2016, we made the final Majority Shareholder payment (as defined in the Plan) to the former Majority Shareholder in the amount of approximately $6.9 million. Together these satisfied our remaining payment and reserve obligations under the Plan. In January 2017, we received approximately $1.0 million as part of a settlement concerning, among other things, funds that were being held as collateral by our pre-petition insurance carrier on account of escrows and draws on certain letters of credit. As of December 31, 2017, the amount of remaining multiemployer pension plan claims was $1.7 million (see Note 8 – Pension and Profit Sharing Plans to the Consolidated Financial Statements). In addition, we had other pension liabilities of $2.5 million.

On January 18, 2018, Syms and certain of its subsidiaries (together, the “Reorganized Debtors”) filed with the United States Bankruptcy Court for the District of Delaware (the “Bankruptcy Court”) a motion (the “Motion”) for entry of a final decree (the “Final Decree”) (i) closing the chapter 11 cases of the Reorganized Debtors; (ii) terminating the services of the claims and noticing agent; and (iii) retaining the Bankruptcy Court’s jurisdiction as provided for in the Plan, including to enforce or interpret its own orders pertaining to the chapter 11 cases including, but not limited to, the Plan and Final Decree. On the same date, the Reorganized Debtors filed a Final Report in support of the Motion. On February 6, 2018, the Bankruptcy Court entered the Final Decree pursuant to which the chapter 11 cases of the Reorganized Debtors were closed.

The descriptions of certain transactions, payments and other matters contemplated by the Plan above and elsewhere in this Annual Report on Form 10-K are summaries only and do not purport to be complete and are qualified in all respects by the actual provisions of the Plan and related documents.

Trademarks

Various trademarks are controlled and/or owned by us, including “Filene’s Basement”®, “Stanley Blacker”®, “Running of the Brides”® and “An Educated Consumer is Our Best Customer,”® and have been registered with the United States Patent and Trademark Office.

| 4 |

Employees

As of December 31, 2017, we had nine full-time employees and one part time employee staffed in executive, management, finance, accounting, operations and administrative capacities.

General Information about Trinity

Trinity was incorporated in Delaware immediately prior to the effective date of the Plan. Trinity maintains its headquarters at 340 Madison Avenue, New York, New York, 10173, and the telephone number is (212) 235-2190.

Available Information

We are a public company and are subject to the informational requirements of the Exchange Act. Accordingly, we file periodic reports and other information with the SEC. Such reports and other information may be obtained by visiting the Public Reference Room of the SEC at 100 F Street, NE, Room 1580, Washington, D.C. 20549 or by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains a website (http://www.sec.gov) that contains reports, proxy and information statements and other information regarding us and other issuers that file electronically.

Our website address is www.trinityplaceholdings.com or www.tphs.com. We make available without charge, through our website in the “Financials” section, copies of our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after such reports are filed with or furnished to the SEC. References in this document to our website are not and should not be considered part of this Annual Report on Form 10-K, and the information on our website is not incorporated by reference into this Annual Report.

| Item 1A. | RISK FACTORS |

Our business, operations and financial condition are subject to various risks. Some of these risks are described below, and stockholders should take such risks into account in evaluating us or any investment decision involving us. This section does not describe all risks that may be applicable to us, our industry or our business, and it is intended only as a summary of certain material risk factors. Additional risks and uncertainties that we do not presently know about or that we currently believe are not material may also adversely affect our business. More detailed information concerning certain of the risk factors described below is contained in other sections of this Annual Report on Form 10-K. Stockholders should also refer to the other information contained in our periodic reports, including the Cautionary Note Regarding Forward-Looking Statements section, our consolidated financial statements and the related notes and Management’s Discussion and Analysis of Financial Condition and Results of Operations section for a further discussion of the risks, uncertainties and assumptions relating to our business.

Risk Factors Related to Our Business

We have not generated a profit and consequently our business plan is difficult to evaluate and our long term viability cannot be assured.

Our prospects for financial success are difficult to assess because we have a limited operating history since we began reporting as a going concern. Our predecessor filed for Chapter 11 relief on November 2, 2011, we were formed, and emerged from bankruptcy on September 14, 2012. We resumed reporting on the going concern basis of accounting on February 10, 2015. Since our formation, we have generated limited revenues and had negative cash flow from operations. The development of our business plan will require substantial capital expenditures. Our business could be subject to any or all of the problems, expenses, delays and risks inherent in the establishment of a new business enterprise, including, but not limited to capital resources. There can be no assurance that our business will be successful, that we will be able to achieve or maintain a profitable operation, or that we will not encounter unforeseen difficulties that may deplete our capital resources more rapidly than anticipated. There can be no assurance that we will achieve or sustain profitability or positive cash flows from our operating activities.

| 5 |

We have generated minimal revenues from operations and have limited cash resources, and will be reliant on external sources of capital to fund ongoing operations.

Our revenue generating activities have not yet produced sufficient funds for profitable operations. In addition, we are required to set aside specified minimum levels of liquidity in connection with the development and financing of 77 Greenwich, and we anticipate that we may be required to do so in connection with the development and financing of other current and future properties as well. While 77 Greenwich is currently our most significant asset, the amounts required to be set aside in other situations could also be substantial. As a result, these amounts would not be available for investment or operating activities. Our continued operation will be dependent upon the success of future operations and will require raising additional capital on acceptable terms. We have relied and may continue to rely substantially upon equity and debt financing to fund our ongoing operations. There can be no assurance that additional sources of capital will be available to us on commercially favorable terms should our capital requirements exceed cash available from operations and existing cash and cash equivalents.

A significant part of our current business plan is focused on the development of 77 Greenwich, and an inability to execute this business plan due to adverse trends in the Manhattan condominium market or otherwise could have a material adverse effect on our financial condition and results of operations.

Our business plan includes the development or redevelopment of our remaining commercial real estate properties and in particular the development of 77 Greenwich, which currently is our largest asset. As a result, our revenues and future growth are heavily dependent on the success of implementing our business plan for 77 Greenwich, which is currently under development.

Our plans for 77 Greenwich currently call for approximately 90 luxury residential condominium apartments, in addition to retail and a New York City elementary school. There are a variety of factors that determine Manhattan condominium trends and that will ultimately impact the sales and pricing of condominiums at 77 Greenwich, including among others, supply, changes in interest rates, the availability of home mortgages, foreign exchange rates and local employment trends, prices and velocity of sales. Sales of condominiums in general, and in particular in Manhattan, have historically experienced greater volatility than detached single family houses, which may expose us to more risk. These and other factors fluctuate over time and their status at the time we actually commence sales, which is itself uncertain, is inherently uncertain. An inability to successfully execute our business plan with respect to 77 Greenwich could have a material adverse effect on our financial condition and results of operations.

Our investment in property development for 77 Greenwich and other properties may be more costly than anticipated.

We intend to continue to develop or redevelop our current and future properties. Our current and future development and construction activities, including with respect to 77 Greenwich, may be exposed to the following risks:

| · | we may be unable to proceed with the development of properties because we cannot obtain financing on favorable terms, or at all; |

| · | we may incur construction costs for a development project that exceed our original estimates due to increases in interest rates and increased materials, labor, leasing or other costs, which could make completion of the project less profitable because market rents may not increase sufficiently to compensate for the increase in construction costs; |

| · | we may be unable to obtain, or face delays in obtaining, required zoning, land-use, building, occupancy, and other governmental permits and authorizations, which could result in increased costs and could require us to abandon our activities entirely with respect to a project; |

| · | we may abandon development opportunities after we begin to explore them and as a result we may lose deposits or fail to recover expenses already incurred; |

| · | we may expend funds on and devote management’s time to projects which we do not complete; |

| · | we may be unable to complete construction and/or leasing of our rental properties and sales of our condominium projects (currently limited to 77 Greenwich) on schedule, or at all; and |

| 6 |

| · | we may suspend development projects after construction has begun due to changes in economic conditions or other factors, and this may result in the write-off of costs, payment of additional costs or increases in overall costs when the development project is restarted. |

Investment returns from 77 Greenwich and other properties we may develop may be less than anticipated.

Our properties planned to be developed may be exposed to the following risks:

| · | we may sell condominiums at 77 Greenwich and other future developed properties at prices, and/or lease commercial and residential properties at current or future properties, that are less than the prices projected at the time we decide to undertake the development; |

| · | the velocity of leasing at commercial and residential properties, and/or condominium sales at future developed properties may fluctuate depending on a number of factors, including market and economic conditions, and may result in our investments being less profitable than we expected or not profitable at all; and |

| · | operating expenses may be greater than projected at the time of development, resulting in our investment being less profitable than we expected. |

Competition for new acquisitions may reduce the number of acquisition opportunities available to us and increase the costs of those acquisitions.

We may face competition for acquisition opportunities from other investors, particularly those investors who are willing to incur more leverage, and this competition may adversely affect us by subjecting us to the following risks:

| · | an inability to acquire a desired property because of competition from other well-capitalized real estate investors, including publicly traded and privately held REITs, private real estate funds, domestic and foreign financial institutions, life insurance companies, sovereign wealth funds, pension trusts, partnerships and individual investors; and |

| · | an increase in the purchase price for such acquisition property. |

If we are unable to successfully acquire additional properties, our ability to grow our business could be adversely affected. In addition, increases in the cost of acquisition opportunities could adversely affect our results of operations.

We face risks associated with acquisitions of and investments in new properties.

We may acquire interests in properties, individual properties and portfolios of properties, including potentially large portfolios that could significantly increase our size and alter our capital structure. Our acquisition and investment activities may be exposed to, and their success may be adversely affected by, the following risks:

| · | we may be unable to complete proposed acquisitions or other transactions due to an inability to meet required closing conditions; |

| · | we may expend funds on, and devote management time to, acquisition opportunities which we do not complete, which may include non-refundable deposits; |

| · | we may be unable to finance acquisitions and developments of properties on favorable terms or at all; |

| · | we may be unable to lease our acquired properties on the same terms as contemplated as part of our underwriting; |

| · | acquired properties may fail to perform as we expected; |

| · | our estimates of the costs we incur in renovating, improving, developing or redeveloping acquired properties may be inaccurate; |

| 7 |

| · | we may not be able to obtain adequate insurance coverage for acquired properties; and |

| · | we may be unable to quickly and efficiently integrate new acquisitions and developments, particularly acquisitions of portfolios of properties, into our existing operations, and therefore our results of operations and financial condition could be adversely affected. |

In addition, we may acquire properties subject to both known and unknown liabilities and without any recourse, or with only limited recourse to the seller. As a result, if a liability were asserted against us arising from our ownership of such a property, we might have to pay substantial sums to settle it, which could adversely affect our cash flow. Unknown liabilities with respect to properties acquired might include:

| · | claims by tenants, vendors or other persons arising from dealing with the former owners of the properties; |

| · | liabilities incurred in the ordinary course of business; |

| · | claims for indemnification by general partners, directors, officers and others indemnified by the former owners of the properties; and |

| · | liabilities for clean-up of undisclosed environmental contamination. |

Our revenues and the value of our portfolio are affected by a number of factors that affect investments in leased commercial and residential real estate generally.

We are subject to the general risks of investing in and owning leased real estate in connection with our existing shopping centers, the residential property owned by our joint venture and new properties or investments in leased real estate. These risks include the ability to secure leases with new tenants, the non-performance of lease obligations by tenants, leasehold improvements that will be costly or difficult to remove or certain upgrades that may be needed should it become necessary to re-rent the leased space for other uses, rights of termination of leases due to events of casualty or condemnation affecting the leased space or the property or due to interruption of the tenant’s quiet enjoyment of the leased premises, and obligations of a landlord to restore the leased premises or the property following events of casualty or condemnation. The occurrence of any of these events, particularly with respect to larger leases at our commercial real estate properties, could adversely impact our results of operations, liquidity and financial condition.

In addition, if our competitors offer space at rental rates below our current rates or the market rates, we may lose current or potential tenants to other properties in our markets. Additionally, we may need to reduce rental rates below our current rates or offer incentives in order to retain tenants upon expiration of their leases or to attract new tenants. Our results of operations and cash flow may be adversely affected as a result of these factors.

We may be unable to lease vacant space, renew our current leases, or re-lease space as our current leases expire.

We cannot assure you that leases at our properties will be renewed or that such properties will be re-leased at favorable rental rates. If the rental rates for our properties decrease, our tenants do not renew their leases or we do not re-lease a significant portion of our available space, including vacant space resulting from tenant defaults or space that is currently unoccupied, and space for which leases are scheduled to expire, our financial condition, results of operations and cash flows could be materially adversely affected. There are numerous commercial developers, real estate companies, financial institutions and other investors with greater financial resources than we have that compete with us in seeking tenants who will lease space in our properties.

The bankruptcy of, or a downturn in the business of, any of the major tenants at our commercial real estate properties that causes them to reject their leases, or to not renew their leases as they expire, or renew at lower rental rates, may adversely affect our cash flows and property values. In addition, retailers at our properties face increasing competition from e-commerce, outlet malls, discount shopping clubs, direct mail and telemarketing, which could reduce rents payable to us and reduce our ability to attract and retain tenants at our properties leading to increased vacancy rates at our properties.

| 8 |

In addition, if we are unable to renew leases or re-lease a property, the resale value of that property could be diminished because the market value of a particular property will depend in part upon the value of the leases of such property.

We are subject to the risks associated with partnerships and joint ventures.

We formed a joint venture with a third party to acquire and operate The Berkley in Brooklyn, New York. We may become involved in additional partnerships and/or joint ventures in the future with respect to current or future properties. Partnerships and joint venture investments may involve risks not otherwise present for investments made or owned solely by us, including the possibility that our partner or co-venturer might become bankrupt, or may take action contrary to our instructions, requests, policies or objectives. Other risks of joint venture investments include impasse on decisions, such as a sale, because neither we nor a joint venture partner would have full control over the joint venture, activities conducted by a partner that have a negative impact on the joint venture or us, and disputes with our partner. Also, there is no limitation under our organizational documents as to the amount of our funds that may be invested in joint ventures.

We may not receive or be able to maintain certain tax benefits if we are not in compliance with certain requirements of the NYC Department of Housing Preservation and Development.

We may not receive or be able to maintain certain existing or anticipated tax benefits related to The Berkley or our pending acquisition of 237 11th Street if we are not in compliance with certain requirements of the NYC Department of Housing Preservation and Development (the “HPD”). Both of these properties currently benefit from a real estate tax exemption under New York Real Property Tax Law (the “RPTL”) Section 421-a, as a result of a specified percentage of the units in such buildings being designated as affordable rate units or market rate units and/or subject to rent stabilization guidelines, among other requirements. Section 421-a of the New York RPTL provides an exemption from real estate taxes on the amount of the assessed value of newly constructed improvements if certain requirements are met. A property cannot maintain or continue to receive Section 421-a tax benefits without HPD’s determination that all Section 421-a eligibility requirements have and continue to be met. Although the HPD has issued a final Certificate of Eligibility with respect to the 421-a tax benefits for The Berkley property and we are currently in compliance with all applicable 421-a requirements for such property, and the HPD has issued a preliminary Certificate of Eligibility with respect to the 421-a tax benefits for the 237 11th Street property and the seller of the 237 11th Street property has represented to us that it is complying with all applicable 421-a requirements for such property, there can be no assurance that compliance with the 421-a requirements for either property will continue to be maintained. If we are not able to maintain compliance with the requirements of the Section 421-a partial tax exemption program, as applicable to either of the properties, the HPD may find that such property is ineligible to receive the tax exemption benefits related to the Section 421-a partial tax exemption program.

Our ability to develop or redevelop our properties and enter into new leases with tenants will depend on our obtaining certain permits, site plan approvals and other governmental approvals from local municipalities, which we may not be able to obtain on a timely basis or at all.

In order to develop or redevelop our properties, we will be required to obtain certain permits, site plan approvals or other governmental approvals from local municipalities. We may not be able to secure all the necessary permits or approvals on a timely basis or at all, which may prevent us from developing or redeveloping our properties according to our business plan. Additionally, potential acquirors or tenants may also need to obtain certain permits or approvals in order to utilize our properties in the manner they intend to do so. The specific permit and approval requirements are set by the state and the various local jurisdictions, including but not limited to city, town, county, township and state agencies having control over the specific properties. Our inability to obtain permits and approvals to develop or redevelop our properties, or the inability of potential purchasers and tenants of our properties to obtain necessary permits and approvals, could severely and adversely affect our business.

| 9 |

We may incur significant costs to comply with environmental laws and environmental contamination may impair our ability to lease and/or sell real estate.

Our operations and properties are subject to various federal, state and local laws and regulations concerning the protection of the environment, including air and water quality, hazardous or toxic substances and health and safety. Under some environmental laws, a current or previous owner or operator of real estate may be required to investigate and clean up hazardous or toxic substances released at a property. The owner or operator may also be held liable to a governmental entity or to third parties for property damage or personal injuries and for investigation and clean-up costs incurred by those parties because of the contamination. These laws often impose liability without regard to whether the owner or operator knew of the release of the substances or caused the release. The presence of contamination or the failure to remediate contamination may impair our ability to sell or lease real estate or to borrow using the real estate as collateral. Other laws and regulations govern indoor and outdoor air quality including those that can require the abatement or removal of asbestos-containing materials in the event of damage, demolition, renovation or remodeling and also govern emissions of and exposure to asbestos fibers in the air. The maintenance and removal of lead paint and certain electrical equipment containing polychlorinated biphenyls (PCBs) are also regulated by federal and state laws. We are also subject to risks associated with human exposure to chemical or biological contaminants such as molds, pollens, viruses and bacteria which, above certain levels, can be alleged to be connected to allergic or other health effects and symptoms in susceptible individuals. We could incur fines for environmental compliance and be held liable for the costs of remedial action with respect to the foregoing regulated substances or related claims arising out of environmental contamination or human exposure to contamination at or from our properties.

Each of our properties has been subject to varying degrees of environmental assessment. To date, these environmental assessments have not revealed any environmental condition material to our business. However, identification of new compliance concerns or undiscovered areas of contamination, changes in the extent or known scope of contamination, human exposure to contamination or changes in clean-up or compliance requirements could result in significant costs to us.

Compliance or failure to comply with the Americans with Disabilities Act or other safety regulations and requirements could result in substantial costs.

The Americans with Disabilities Act (“ADA”) generally requires that public buildings, including our properties, meet certain federal requirements related to access and use by disabled persons. These rules are subject to interpretation and change. Noncompliance could result in the imposition of fines by the federal government or the award of damages to private litigants and/or legal fees to their counsel. If, under the ADA, we are required to make substantial alterations and capital expenditures in one or more of our operating properties, including the removal of access barriers, it could adversely affect our financial condition and results of operations.

Our properties are subject to various federal, state and local regulatory requirements, such as state and local fire and life safety requirements. If we fail to comply with these requirements, we could incur fines or private damage awards. We do not know whether existing requirements will change or whether compliance with future requirements will require significant unanticipated expenditures that will affect our cash flow and results of operations.

The loss of key personnel upon whom we depend to operate our business or the inability to attract additional qualified personnel could adversely affect our business.

We believe that our future success will depend in large part on our ability to retain or attract highly qualified management and other personnel, including in particular our President and Chief Executive Officer, Matthew Messinger. We may not be successful in retaining key personnel or in attracting other highly qualified personnel. Any inability to retain or attract qualified management and other personnel could have a material adverse effect on our business, results of operations and financial condition.

The failure of our subsidiaries to repay or refinance outstanding loans, and any liability we incur as a result of the financing arrangements and our guarantees of those loans, could have a material adverse impact on our financial condition, results of operations and cash flows.

All of our properties secure loan agreements. The failure by our borrower subsidiaries to make scheduled repayments under the loan agreements, or the default of any of the obligations under the loans, would have an adverse impact on our financial condition, results of operations and cash flows. Upon the occurrence of an event of default, the applicable subsidiary may be required to immediately repay all amounts outstanding under the respective loan and the lenders may exercise other remedies available to them, including foreclosing on the respective property securing the loan. See Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations - Liquidity and Capital Resources and Note 10 – Loans Payable and secured line of credit to our consolidated financial statements, for further discussion regarding our financing activities.

| 10 |

New U.S. tax laws.

On December 22, 2017, the U.S. Tax Cuts and Jobs Act was signed into law. This law imposes significant changes on the way we are taxed, including, among other things, changes to U.S. federal tax rates, imposing significant additional limitations on the deductibility of interest, and the migration to a new international system of taxation. There is substantial uncertainty regarding both the timing and the details of how these changes will affect us and the industry in which we operate.

Our ability to utilize our NOLs to reduce future tax payments may be limited as a result of future transactions.

We had approximately $231.0 million of federal NOLs at December 31, 2017. Section 382 of the Internal Revenue Code, or the Code, contains rules that limit the ability of a company that undergoes an ownership change, which is generally any change in ownership by certain stockholders of more than 50% of its stock over a three-year period, to utilize its NOLs after the ownership change. These rules generally operate by focusing on ownership changes involving stockholders who directly or indirectly own 5% or more of the stock of a company and any change in ownership arising from a new issuance of stock by us. Generally, if an ownership change occurs, the annual taxable income limitation on the use of NOLs is equal to the product of the applicable long term tax exempt rate and the value of our stock immediately before the ownership change. If we experience an ownership change, our ability to utilize our NOLs would be subject to significant limitations.

Political and economic uncertainty could have an adverse effect on us.

We cannot predict how current political and economic uncertainty, including uncertainty related to taxation and increases in interest rates, will affect our critical tenants, joint venture partners, lenders, financial institutions and general economic conditions, including consumer confidence and the volatility of the stock market and real estate market.

Political and economic uncertainty poses a risk to us in that it may cause consumers to postpone discretionary spending in response to tighter credit, reduced consumer confidence and other macroeconomic factors affecting consumer spending behavior, resulting in a downturn in the business of our tenants. In the event current political and economic uncertainty results in financial turmoil affecting the banking system and financial markets or significant financial service institution failures, there could be a new or incremental tightening in the credit markets, low liquidity, and extreme volatility in fixed income, credit, currency and equity markets. Each of these could have an adverse effect on our business, financial condition and operating results.

Breaches of information technology systems could materially harm our business and reputation.

We collect and retain on information technology systems certain financial, personal and other sensitive information provided by third parties, including tenants, vendors and employees. We also rely on information technology systems for the collection and distribution of funds.

There can be no assurance that we will be able to prevent unauthorized access to sensitive information or the unauthorized distribution of funds. Any loss of this information or unauthorized distribution of funds as a result of a breach of information technology systems may result in loss of funds to which we are entitled, legal liability and costs (including damages and penalties), as well as damage to our reputation, that could materially and adversely affect our business and financial performance.

Risks Related to Our Common Stock

Our common stock is thinly traded and the price of our common stock may fluctuate significantly.

Our common stock, listed on the NYSE American, is thinly traded. We cannot assure stockholders that an active market for our common stock will develop in the foreseeable future or, if developed, that it will be sustained. As a result stockholders may not be able to resell their common stock. Because our common stock is thinly traded, even small trades can have a significant impact on the market price of our common stock. Volatility in the market price of our common stock may prevent stockholders from being able to sell their shares at or above the price paid for such shares. The market price of our common stock could fluctuate significantly for various reasons, many of which are beyond our control, including:

| 11 |

| · | the potential issuance of additional shares of common stock including at prices that are below the then-current trading price of our common stock; |

| · | volatility in global and/or U.S. equities markets; |

| · | changes in the real estate markets in which we operate; |

| · | our ability to develop or redevelop 77 Greenwich and our other properties; |

| · | our ability to identify new acquisition and investment opportunities and/or close on previously announced acquisitions or investments; |

| · | our financial results or those of other companies in our industry; |

| · | the public’s reaction to our press releases and other public announcements and our filings with the SEC; |

| · | new laws or regulations or new interpretations of laws or regulations applicable to our business; |

| · | changes in general conditions in the United States and global economies or financial markets, including those resulting from war, incidents of terrorism or responses to such events; |

| · | sales of common stock by our executive officers, directors and significant stockholders; |

| · | changes in generally accepted accounting principles, policies, guidance, or interpretations; and |

| · | other factors described in our filings with the SEC, including among others in connection with the risks noted in this Annual Report on Form 10-K. |

In addition, until our common stock is more widely held and actively traded, small sales or purchases may cause the price of our common stock to fluctuate dramatically up or down without regard to our financial health or business prospects.

Stockholders may experience dilution of their ownership interests because of the future issuance of additional shares of our common stock.

In the future, we may issue additional equity securities in capital raising transactions or otherwise, resulting in the dilution of the ownership interests of our present stockholders. We are currently authorized to issue an aggregate of 120,000,000 shares of capital stock consisting of 79,999,997 shares of common stock, two shares of a class of preferred stock (which were redeemed in accordance with their terms and may not be reissued), one share of a class of special stock and 40,000,000 shares of blank-check preferred stock. As of December 31, 2017, there were 31,451,796 shares of our common stock and one share of special stock outstanding.

Any future issuance of our equity securities may dilute then-current stockholders’ ownership percentages and could also result in a decrease in the fair market value of our equity securities, because our assets would be owned by a larger pool of outstanding equity. We may need to raise additional capital through public or private offerings of our common stock or other securities that are convertible into or exercisable for our common stock. We may also issue such securities in connection with hiring or retaining employees and consultants, as payment to providers of goods and services, in connection with future acquisitions and investments, development, redevelopment and repositioning of assets, or for other business purposes. Our board of directors may at any time authorize the issuance of additional common stock without stockholder approval, unless the approval of our common stockholders is required by applicable law, rule or regulation, including NYSE American regulations, or our certificate of incorporation. The terms of preferred equity securities we may issue in future transactions may be more favorable to new investors, and may include dividend and/or liquidation preferences, superior voting rights and the issuance of warrants or other derivative securities, which may have a further dilutive effect. Also, the future issuance of any such additional shares of common stock or other securities may create downward pressure on the trading price of our common stock. There can be no assurance that any such future issuances will not be at a price or have exercise prices below the price at which shares of the common stock are then traded.

| 12 |

A sale of a substantial number of shares of our common stock may cause the price of our common stock to decline and may impair our ability to raise capital in the future.

Capital-raising transactions resulting in a large amount of newly issued shares that become readily tradable, or other events that cause current stockholders to sell shares, could place downward pressure on the trading price of our stock. In addition, the lack of a robust resale market may require a stockholder who desires to sell a large number of shares of common stock to sell the shares in increments over time to mitigate any adverse impact of the sales on the market price of our stock.

If our stockholders sell, or the market perceives that our stockholders intend to sell for various reasons, including the ending of restrictions on resale of substantial amounts of our common stock in the public market, including shares issued upon the exercise of outstanding options, the market price of our common stock could fall. A significant amount of restricted shares previously issued by us have been registered for resale on registration statements filed with the SEC.

In addition, sales of a substantial number of shares of our common stock may make it more difficult for us to sell equity or equity-related securities in the future at a time and price that we deem reasonable or appropriate, which would impair our ability to raise capital.

More than 50% of our shares of common stock are currently controlled by five of our stockholders who may have the ability to influence the election of directors and the outcome of matters submitted to our stockholders.

More than 50% of our shares of common stock are controlled by five of our stockholders. As a result, these stockholders may have the ability to significantly influence the outcome of issues submitted to our stockholders for a vote. The interests of these stockholders may not always coincide with our interests or the interests of other stockholders, and they may act in a manner that advances their best interests and not necessarily those of other stockholders. The concentration of ownership could also deter unsolicited takeovers, including transactions in which stockholders might otherwise receive a premium for their shares over then current market prices.

The holder of our special stock has the right to appoint a member to our board of directors and, consequently, the ability to exert influence over us.

In connection with the investment in us by Third Avenue Trust, on behalf of Third Avenue Real Estate Value Fund (“Third Avenue”), a beneficial holder of 15.56% of our common stock, Third Avenue was issued one share of a class of special stock and our certificate of incorporation was amended to provide that, subject to the other terms and conditions of our certificate of incorporation, from the issuance of the one share of special stock and until the “Special Stock Ownership Threshold” of 2,345,000 shares of common stock is no longer satisfied, Third Avenue has the right to elect one director to the board of directors. As a result, this stockholder may be able to exert influence over our policies and management, potentially in a manner which may not be in our best interests or the best interests of the other stockholders, until such time as the Special Stock Ownership Threshold is no longer satisfied.

In order to protect our ability to utilize our NOLs and certain other tax attributes, our certificate of incorporation includes certain transfer restrictions with respect to our stock, which may limit the liquidity of our common stock.

To reduce the risk of a potential adverse effect on our ability to use our NOLs and certain other tax attributes for U.S. Federal income tax purposes, our certificate of incorporation contains certain transfer restrictions with respect to our stock by substantial stockholders. These restrictions may adversely affect the ability of certain holders of our common stock to dispose of or acquire shares of our common stock and may have an adverse impact on the liquidity of our stock generally.

| 13 |

We have not paid dividends on our common stock in the past and do not expect to pay dividends on our common stock for the foreseeable future. Any return on investment may be limited to the value of our common stock.

No cash dividends have been paid on our common stock. We expect that any income received from operations will be devoted to our future operations and growth. We do not expect to pay cash dividends on our common stock in the near future. Payment of dividends in the future will depend upon our profitability at the time, cash available for those dividends, and such other factors as our board of directors may consider relevant. If we do not pay dividends, our common stock may be less valuable because a return on an investor’s investment will only occur if our stock price appreciates.

Our charter documents and Delaware law could prevent a takeover that stockholders consider favorable and could also reduce the market price of our stock.

Our certificate of incorporation and bylaws and Delaware law contain provisions that could delay or prevent a change in control of us. These provisions could also make it more difficult for stockholders to elect directors and take other corporate actions. In addition to the matters identified in the risk factors above relating to the provisions of our certificate of incorporation, these provisions include:

| · | a classified board of directors with two-year staggered terms; |

| · | limitations in our certificate of incorporation on acquisitions and dispositions of our common stock designed to protect our NOLs and certain other tax attributes; and |

| · | authorization for blank check preferred stock, which could be issued with voting, liquidation, dividend and other rights superior to our common stock. |

These and other provisions in our certificate of incorporation and bylaws and under Delaware law could discourage potential takeover attempts, reduce the price that investors might be willing to pay in the future for shares of common stock and result in the market price of the common stock being lower than it would be without these provisions.

| Item 1B. | UNRESOLVED STAFF COMMENTS |

None.

| Item 2. | PROPERTIES |

Below is certain information regarding our commercial real estate properties as of December 31, 2017:

| Property Location | Type of Property | Building

Size (estimated rentable square feet) | Number of Units | Leased

at December 31, 2017 | Occupancy at December 31, 2017 | Occupancy at December 31, 2016 | ||||||||||||||||

| Owned Locations | ||||||||||||||||||||||

| New York, New York (77 Greenwich) (1) | Property under development | - | - | N/A | N/A | N/A | ||||||||||||||||

| Paramus, New Jersey (2) | Property under development | 77,000 | - | 100 | % | 100.0 | % | 100 | % | |||||||||||||

| West Palm Beach, Florida (3) | Retail | 112,000 | - | 67.3 | % | 67.3 | % | 67.8 | % | |||||||||||||

| Total Owned Square Feet | 189,000 | |||||||||||||||||||||

| Joint Venture | ||||||||||||||||||||||

| 223 North 8th Street, Brooklyn, New York - 50% (4) | Multi-family | 65,000 | 95 | 94.7 | % | 94.7 | % | 72.6 | % | |||||||||||||

| Grand Total Square Feet | 254,000 | |||||||||||||||||||||

(1) 77 Greenwich. We are currently in the development stage for the development of an over 300,000 gross square foot mixed-use building that corresponds to the approximate total of 233,000 zoning square feet. The plans call for the development of approximately 90 luxury residential condominium apartments, 7,500 square feet of street level retail space, a 476-seat elementary school serving New York City District 2, includes the adaptive reuse of the landmarked Robert and Anne Dickey House, and construction of a new handicapped accessible subway entrance on Trinity Place. The school project has obtained city council and mayoral approval. Environmental remediation and demolition was completed in the third quarter of 2017, and excavation and foundation work has begun. On December 22, 2017, we closed on a $189.5 million construction loan. We will draw down proceeds available to us under the construction loan as costs related to the construction are incurred over the next few years. We currently anticipate that the proceeds available under the construction loan, together with equity funded by us to date and future contributions by the New York City School Construction Authority (“SCA”), will be sufficient to finance the construction and development of 77 Greenwich without us making any further equity contributions. (see Note 10 – Loans Payable and Secured Line of Credit for further information).

Through a wholly-owned subsidiary, we also entered into an agreement with the SCA, whereby we will construct a school that will be sold to the SCA as part of our condominium development at the 77 Greenwich property. Pursuant to the agreement, the SCA will pay us $41.5 million which has been allocated to land and reimburse us for the costs associated with constructing the school (including a construction supervision fee of approximately $5.0 million). Payments for construction will be made by the SCA to the general contractor in installments as construction on their condominium progresses. Payments for the land and development fee will be received starting in January 2018 through September 2019. Upon Substantial Completion, as defined, the SCA shall purchase the school condominium unit. We are required to substantially complete construction of the school by September 6, 2023. To secure our obligations, the 77 Greenwich property has been ground leased to the SCA and leased back to us until title to the school is transferred to the SCA. We have also guaranteed certain obligations with respect to the construction. The condominium apartments along with the subway improvements are currently scheduled to be completed by year end 2020.

| 14 |

(2) Paramus Property. The Paramus property consists of a one-story and partial two-story, 73,000 square foot freestanding building and an outparcel building of approximately 4,000 square feet, for approximately 77,000 total square feet of rentable space. The primary building is comprised of approximately 47,000 square feet of ground floor space, and two separate mezzanine levels of approximately 21,000 and 5,000 square feet. The 73,000 square foot building was leased pursuant to a short-term license agreement to Restoration Hardware Holdings, Inc. (NYSE: RH) (“Restoration Hardware”) from October 15, 2015 to February 29, 2016 when the tenant vacated the property. Subsequently, we entered into a new twelve month license agreement with Restoration Hardware that began on June 1, 2016, which is terminable upon one month’s notice to the other party, and which has since been extended to end on March 31, 2019. The outparcel building is leased to a tenant whose lease expires on March 31, 2019. The tenant has been in the space since 1996. The land area of the Paramus property consists of approximately 292,000 square feet, or approximately 6.7 acres. We have entered into an option agreement with Carmax (NYSE:KMX), pursuant to which Carmax will construct a new building after we obtain approvals and demolish the existing buildings. The option agreement includes a fully negotiated lease agreement. This transaction is subject to town approvals based on the potential tenant’s intended use of the site.

(3) West Palm Beach Property. The West Palm Beach property consists of a one-story neighborhood retail strip center that is comprised of approximately 112,000 square feet of rentable area, which includes three outparcel locations with approximately 11,000 combined square feet. The land area of the West Palm Beach property consists of approximately 515,000 square feet, or approximately 11.8 acres. Our redevelopment and repositioning of the center is complete. We will incur additional lease-up costs as the current vacancies are filled. Our two largest tenants are Walmart Marketplace, with 41,662 square feet of space and Tire Kingdom, a national credit tenant who took possession of a 5,400 square feet outparcel.

(4) 223 North 8th Street. Through a joint venture with Pacolet Milliken Enterprises, Inc., we own a 50% interest in the entity formed to acquire and operate The Berkley, a newly constructed 95-unit multi-family property encompassing approximately 99,000 gross square feet (65,000 rentable square feet) on 223 North 8th Street in North Williamsburg, Brooklyn, New York. The Berkley is in close proximity to public transportation and offers a full amenity package. Apartments feature top-of-the-line unit finishes, central air conditioning and heating and most units have private outdoor space. The property benefits from a 25-year 421-a real estate tax exemption.

Lease Expirations

The following chart shows the tenancy, by year of lease expiration, of our retail properties for all tenants in place as of December 31, 2017, excluding the license agreement with Restoration Hardware (dollars in thousands):

| Number of Tenants | Leased Square Feet by Year of Expiration | Annualized Rent in Year of Expiration (A) | ||||||||||

| 2018 | (B) | 1 | 1,200 | $ | 13 | |||||||

| 2019 | 1 | 4,000 | 140 | |||||||||

| 2020 | 8 | 12,488 | 245 | |||||||||

| 2021 | 2 | 7,063 | 119 | |||||||||

| 2022 | 1 | 1,200 | 21 | |||||||||

| Thereafter | 5 | 53,662 | 1,066 | |||||||||

| 18 | 79,613 | $ | 1,604 | |||||||||

| (A) | This is calculated by multiplying the rent in the final month of the lease by 12. |

| (B) | Reflects tenants with a month-to-month tenancy. |

| 15 |

Corporate Headquarters

We lease our corporate headquarters in New York, New York (approximately 6,271 square feet). The lease expires in March 2025.

| Item 3. | LEGAL PROCEEDINGS |

We are a party to routine legal proceedings, which are primarily incidental to our former business. Some of the actions to which we are a party are covered by insurance and are being defended or reimbursed by our insurance carriers. Based on an analysis performed by our actuary and available information and taking into account accruals where they have been established, management currently believes that any liabilities ultimately resulting from this routine litigation will not, individually or in the aggregate, have a material adverse effect on our consolidated financial position or results of operations.

Additionally, as discussed in Item 1. Business, on January 18, 2018, the Reorganized Debtors filed with the Bankruptcy Court a motion (the “Motion”) for entry of the Final Decree (i) closing the chapter 11 cases of the Reorganized Debtors; (ii) terminating the services of the claims and noticing agent; and (iii) retaining the Bankruptcy Court’s jurisdiction as provided for in the Plan, including to enforce or interpret its own orders pertaining to the chapter 11 cases including, but not limited to, the Plan and Final Decree. On the same date, the Reorganized Debtors filed a Final Report in support of the Motion. On February 6, 2018, the Bankruptcy Court entered the Final Decree pursuant to which the chapter 11 cases of the Reorganized Debtors were closed.

| Item 4. | MINE SAFETY DISCLOSURES |

Not applicable.

| Item 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

On December 21, 2015 our common stock began trading on the NYSE American. The trading symbol of our common stock is “TPHS”.

The following table summarizes the quarterly high and low sales prices per share of the common stock as reported in the NYSE American for the years ended December 31, 2017 and December 31, 2016, respectively.

| For the Year Ended December 31, 2017 | For the Year Ended December 31, 2016 | |||||||||||||||

| High | Low | High | Low | |||||||||||||

| First Quarter | $ | 9.97 | $ | 6.65 | $ | 7.18 | $ | 5.25 | ||||||||

| Second Quarter | $ | 7.71 | $ | 6.56 | $ | 8.05 | $ | 6.36 | ||||||||

| Third Quarter | $ | 7.50 | $ | 6.53 | $ | 10.37 | $ | 6.91 | ||||||||

| Fourth Quarter | $ | 7.59 | $ | 6.70 | $ | 10.13 | $ | 8.77 | ||||||||

Outstanding Common Stock and Holders

As of March 15, 2018, we had 36,984,753 shares issued and 31,554,643 shares outstanding and there were approximately 177 record holders of our common stock.

| 16 |

Dividends

No dividends were paid during either of the years ended December 31, 2017 and December 31, 2016.

Recent Sales of Unregistered Securities

In accordance with the terms of the employment agreement between us and Matthew Messinger, our President and Chief Executive Officer, on December 29, 2017, Mr. Messinger was granted 30,000 restricted stock unit awards (the “RSU Awards”). The issuance of the RSU Awards was exempt from registration pursuant to Section 4(a)(2) of the Securities Act.

Issuer Purchases of Equity Securities

We did not repurchase any stock during the year ended December 31, 2017.

Performance Graph

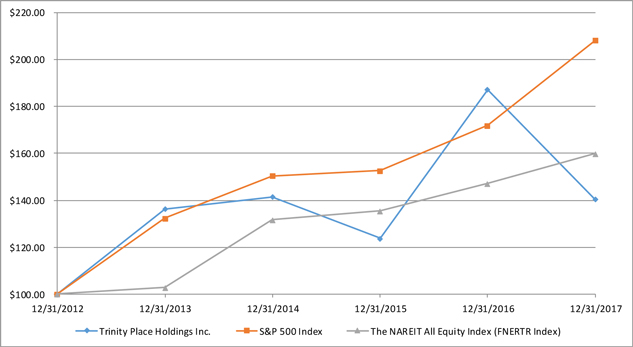

The following graph is a comparison of the cumulative return of our shares of common stock from January 1, 2013 through December 31, 2017, the Standard & Poor’s 500 Index (the “S&P 500 Index”) and the FTSE National Association of Real Estate Investment Trusts’ (“NAREIT”) All Equity Index, a peer group index. The graph assumes that $100 was invested on January 1, 2013 in our shares of common stock, the S&P 500 Index and the NAREIT All Equity Index and assumes the reinvestment of all dividends (if applicable), and that no commissions were paid. There can be no assurance that the performance of our shares will continue in line with the same or similar trends depicted in the graph below.

| 12/31/2012 | 12/31/2013 | 12/31/2014 | 12/31/2015 | 12/31/2016 | 12/31/2017 | |||||||||||||||||||

| Trinity Place Holdings Inc. | $ | 100.00 | $ | 136.36 | $ | 141.41 | $ | 123.83 | $ | 187.27 | $ | 140.40 | ||||||||||||

| S&P 500 Index | $ | 100.00 | $ | 132.39 | $ | 150.51 | $ | 152.59 | $ | 171.84 | $ | 208.14 | ||||||||||||

| The NAREIT All Equity Index (FNERTR Index) | $ | 100.00 | $ | 102.86 | $ | 131.68 | $ | 135.40 | $ | 147.09 | $ | 159.85 | ||||||||||||

| Item 6. | SELECTED FINANCIAL DATA |

The following table sets forth our selected financial data and should be read in conjunction with our Financial Statements and notes thereto included in Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Item 8, “Financial Statements and Supplementary Data” in this Annual Report on Form 10-K.

| 17 |

The below selected financial data does not include any information prior to February 10, 2015 as we were reporting on the liquidation basis of accounting during the periods prior to February 10, 2015. Under the liquidation basis of accounting, assets are stated at their net realizable value, liabilities are stated at their net settlement amount and estimated costs over the period of liquidation are accrued to the extent reasonably determinable. Our accounting basis reverted to the going concern basis of accounting on February 10, 2015, resulting in all remaining assets and liabilities at that date being adjusted to their net book value less an adjustment for depreciation and/or amortization calculated from the date we entered liquidation through the date we emerged from liquidation. Accordingly, this change in accounting basis resulted in a decrease in the reporting basis of the respective assets and liabilities. Also on November 12, 2015, our Board of Directors approved a change to our fiscal year end from the Saturday closest to the last day of February to a December 31 calendar year end, effective with the year ended December 31, 2015. The period that resulted from this change is March 1, 2015 to December 31, 2015. Because the bases of accounting are non-comparable to each other as well as due to the change in our fiscal year, we are not reporting selected financial data for the periods prior to February 10, 2015.

| For the Year Ended December 31, 2017 | For the Year Ended December 31, 2016 | For the Period March 1, 2015 to December 31, 2015 | For the Period February 10, 2015 to February 28, 2015 | |||||||||||||

| (In thousands, except per share amounts) | ||||||||||||||||

| Statement of Operations Data | ||||||||||||||||

| Total revenues | $ | 1,862 | $ | 1,856 | $ | 841 | $ | 43 | ||||||||

| Total operating expenses | 11,081 | 9,034 | 7,583 | 346 | ||||||||||||

| Operating loss | (9,219 | ) | (7,178 | ) | (6,742 | ) | (303 | ) | ||||||||

| Equity in net loss of unconsolidated joint venture | (1,057 | ) | (308 | ) | - | - | ||||||||||

| Interest income (expense), net | 215 | 42 | (246 | ) | (40 | ) | ||||||||||

| Interest expense - amortization of deferred finance costs | - | (98 | ) | (63 | ) | (17 | ) | |||||||||

| Reduction of claims liability | 1,043 | 132 | 557 | - | ||||||||||||

| Loss before gain on sale of real estate and taxes | (9,018 | ) | (7,410 | ) | (6,494 | ) | (360 | ) | ||||||||

| Gain on sale of real estate | 3,853 | - | - | - | ||||||||||||

| Tax benefit (expense) | 3,144 | (26 | ) | (67 | ) | (2 | ) | |||||||||

| Net loss available to common stockholders | $ | (2,021 | ) | $ | (7,436 | ) | $ | (6,561 | ) | $ | (362 | ) | ||||

| Loss per share - basic and diluted | $ | (0.07 | ) | $ | (0.29 | ) | $ | (0.32 | ) | $ | (0.02 | ) | ||||