Attached files

| file | filename |

|---|---|

| EX-32.1 - EX-32.1 - Sienna Biopharmaceuticals, Inc. | d696689dex321.htm |

| EX-31.2 - EX-31.2 - Sienna Biopharmaceuticals, Inc. | d696689dex312.htm |

| EX-31.1 - EX-31.1 - Sienna Biopharmaceuticals, Inc. | d696689dex311.htm |

| EX-23.1 - EX-23.1 - Sienna Biopharmaceuticals, Inc. | d696689dex231.htm |

| EX-21.1 - EX-21.1 - Sienna Biopharmaceuticals, Inc. | d696689dex211.htm |

Table of Contents

Index to Financial Statements

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2017

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 001-38155

Sienna Biopharmaceuticals, Inc.

(Exact Name of Registrant as Specified in its Charter)

| Delaware | 27-3364627 | |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) | |

| 30699 Russell Ranch Road, Suite 140 Westlake Village, California |

91362 | |

| (Address of Principal Executive Offices) | (Zip Code) | |

(818) 629-2256

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Name of Each Exchange on Which Registered | |

| Common Stock, $0.0001 par value per share | The Nasdaq Global Select Market, Inc. |

Securities Registered Pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Exchange Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

☐ |

Accelerated filer |

☐ | |||

| Non-accelerated filer |

☒ (Do not check if a smaller reporting company) |

Smaller reporting company |

☐ | |||

| Emerging growth company |

☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The registrant was not a public company as of the last business day of its most recently completed second fiscal quarter and, therefore, cannot calculate the aggregate market value of its voting and non-voting common equity held by non-affiliates as of such date.

As of March 9, 2018, the number of outstanding shares of the registrant’s common stock, par value $0.0001 per share, was 20,733,079.

DOCUMENTS INCORPORATED BY REFERENCE:

Portions of the registrant’s Proxy Statement for the registrant’s 2018 Annual Meeting of Stockholders will be filed with the Commission within 120 days after the close of the registrant’s 2017 fiscal year and are incorporated by reference in Part III.

Table of Contents

Index to Financial Statements

Sienna Biopharmaceuticals, Inc.

i

Table of Contents

Index to Financial Statements

Special Note Regarding Forward-Looking Statements [and Market Data]

This Annual Report on Form 10-K, including “Business” in Part I Item I and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Part II Item 7, contains “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. All statements other than statements of historical fact are statements that could be deemed forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “aim,” “anticipate,” “assume,” “believe,” “contemplate,” “continue,” “could,” “due,” “estimate,” “expect,” “goal,” “intend,” “may,” “objective,” “plan,” “predict,” “potential,” “positioned,” “seek,” “should,” “target,” “will,” “would,” and other similar expressions that are predictions of or indicate future events and future trends, or the negative of these terms or other comparable terminology. These forward-looking statements include, but are not limited to, statements about:

| • | our expectations regarding the potential market size and size of the potential patient populations for our product candidates, if approved or cleared for commercial use; |

| • | our clinical and regulatory development plans for our product candidates; |

| • | our expectations with regard to our platform technologies and our ability to utilize these platforms to discover, develop and advance additional product candidates; |

| • | the timing of commencement of future nonclinical studies and clinical trials and research and development programs; |

| • | our ability to acquire, discover, develop and advance product candidates into, and successfully complete, clinical trials; |

| • | our intentions and our ability to establish collaborations and/or partnerships; |

| • | the timing or likelihood of regulatory filings and approvals or clearances for our product candidates; |

| • | our commercialization, marketing and manufacturing capabilities and expectations; |

| • | our intentions with respect to the commercialization of our product candidates; |

| • | the pricing and reimbursement of our product candidates, if approved; |

| • | the implementation of our business model and strategic plans for our business, product candidates and technology platforms, including additional indications for which we may pursue; |

| • | the scope of protection we are able to establish and maintain for intellectual property rights covering our product candidates, including the projected terms of patent protection; |

| • | estimates of our expenses, future revenue, capital requirements, our needs for additional financing and our ability to obtain additional capital; |

| • | our future financial performance; and |

| • | developments and projections relating to our competitors and our industry, including competing therapies and procedures. |

These statements relate to future events or to our future financial performance and involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by these forward-looking statements. Factors that may cause actual results to differ materially from current expectations include, among other things, those listed under “Item 1A. Risk Factors” and elsewhere in this Annual Report on Form 10-K. Any forward-looking statement in this Annual Report on Form 10-K reflects our current views with respect to future events and is subject to these and other risks, uncertainties and assumptions relating to our operations, results of operations, industry and future growth. Given these uncertainties, you should not place

1

Table of Contents

Index to Financial Statements

undue reliance on these forward-looking statements. Except as required by law, we assume no obligation to update or revise these forward-looking statements for any reason, even if new information becomes available in the future.

This Annual Report on Form 10-K also contains estimates, projections and other information concerning our industry, our business, and the markets for our product candidates, including data regarding the estimated patient population and market size for our product candidates, as well as data regarding market research, estimates and forecasts prepared by our management. Information that is based on estimates, forecasts, projections or similar methodologies is inherently subject to uncertainties and actual events or circumstances may differ materially from events and circumstances reflected in this information. Unless otherwise expressly stated, we obtained this industry, business, market and other data from reports, research surveys, studies and similar data prepared by third parties, industry, medical and general publications, government data and similar sources. In some cases, we do not expressly refer to the sources from which this data is derived. In that regard, when we refer to one or more sources of this type of data in any paragraph, you should assume that other data of this type appearing in the same paragraph is derived from the same sources, unless otherwise expressly stated or the context otherwise requires.

2

Table of Contents

Index to Financial Statements

| ITEM 1. | Business. |

Overview

We are a clinical-stage biopharmaceutical company focused on bringing innovations in biotechnology to the discovery, development and commercialization of first-in-class, targeted, topical products in medical dermatology and aesthetics. Our objective is to develop our multi-asset pipeline of topical therapies that enhance the health, appearance and quality of life of dermatology patients. We are advancing multiple product candidates derived from our Topical by Design™ platform, all of which are designed to be suitable for chronic administration in patients with inflammatory skin diseases and other dermatologic and aesthetic conditions. Our lead candidate from this platform, SNA-120, is a first-in-class inhibitor of Tropomyosin receptor kinase A, or TrkA, in Phase 2b clinical development for the treatment of pruritus, or itch, associated with psoriasis, as well as for psoriasis itself. Our second Topical by DesignTM product candidate, SNA-125, is a dual JAK3/TrkA inhibitor being developed for the treatment of atopic dermatitis, psoriasis and pruritus. Additionally, we have advanced SNA-001, a silver particle treatment derived from our Topical Photoparticle Therapy™ platform, into pivotal clinical trials for both acne vulgaris and the reduction of unwanted light-pigmented hair. We believe our management team is well-positioned to execute on our objectives, having served in clinical and commercial leadership roles at several marquee dermatology, aesthetics and biotechnology companies, including Kythera, Allergan, Medicis, and Amgen.

There is a significant opportunity to address the historical lack of innovation in topical products for dermatology patients. Recent advances in biotechnology have enabled the development of novel, biologic drugs which act on specific molecular targets and pathways, and have been utilized to address inflammatory disorders. However, despite having shown impressive efficacy, use of these drugs has been limited to patients with more severe forms of disease due to the potentially significant side effects associated with systemic administration and their relatively high cost. Accordingly, the 80-90% of dermatology patients who present with mild-to-moderate disease severity or more localized disease have not benefitted from these advances. Today, such patients typically resort to non-specific, topical therapies such as corticosteroids and emollients, which are either marginally effective or unsuitable for chronic administration due to their side effects. We are focused on filling this innovation gap in dermatology by developing targeted topical products suitable for chronic administration to serve the vast majority of patients suffering from these inflammatory skin diseases and other dermatologic and aesthetic conditions.

Through our proprietary Topical by DesignTM platform we develop targeted, topical treatments for inflammatory skin diseases and other conditions by creating new chemical entities, or NCEs, based on small molecules with well understood mechanisms of action. Using this technology, we site-selectively direct the conjugation of small polyethylene glycol, or PEG, polymers to selected pharmacologically active compounds. This modification alters the pharmacological activity of the active compound to refine its target selectivity while also changing its physicochemical profile. The resulting NCEs are designed to permeate the skin or other targeted surfaces, such as the eye, the gastrointestinal tract or the respiratory tract, for highly localized delivery of the drug against the selected targets or pathway, while minimizing systemic exposure. By utilizing this targeted, topical approach, we create topical therapies that are specifically designed to be highly effective and suitable for chronic administration. Our lead product candidates from our Topical by DesignTM platform are:

| • | SNA-120 (pegcantratinib), a first-in-class topical TrkA inhibitor for the treatment of pruritus associated with psoriasis, and which may also be effective for the treatment of psoriasis itself. A Phase 2b trial was completed for SNA-120 that demonstrated statistically significant improvements in pruritus associated with psoriasis, positive trends in the improvement of psoriasis severity, and a favorable safety and tolerability profile. We initiated a second Phase 2b clinical trial in October 2017 in order to expand our understanding of SNA-120 in pruritus and the underlying psoriasis and provide additional endpoint evaluation and validation, with data expected in the first quarter of 2019. |

3

Table of Contents

Index to Financial Statements

| • | SNA-125, a topical Janus kinase 3 (JAK3)/TrkA inhibitor with the potential to treat various inflammatory conditions, including atopic dermatitis, psoriasis and pruritus. Nonclinical studies have demonstrated anti-inflammatory activity in an animal model, and a favorable safety profile. We believe that by inhibiting both JAK3 and TrkA, SNA-125 has the potential to be a differentiated, best-in-class topical therapy. We initiated first-in-human, Phase 1/2 proof-of-concept clinical trials in February 2018 for psoriasis and in March 2018 for atopic dermatitis, with data expected in the third and fourth quarters of 2018, respectively. |

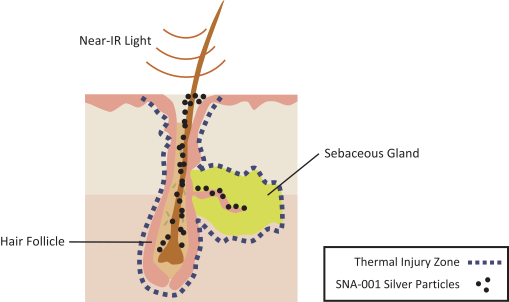

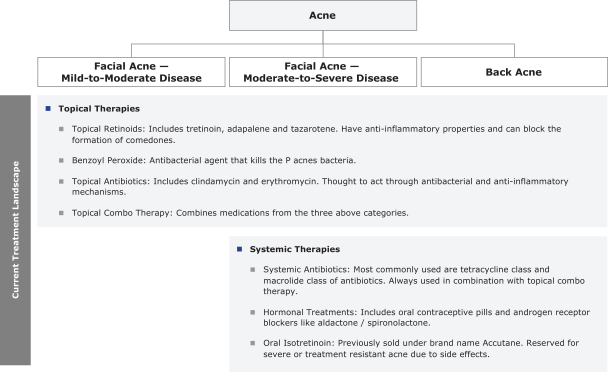

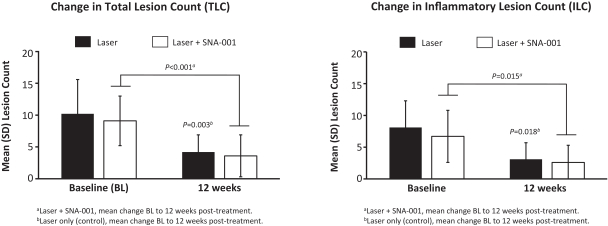

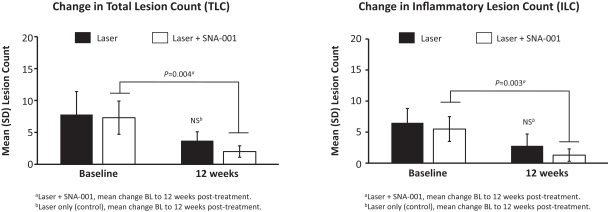

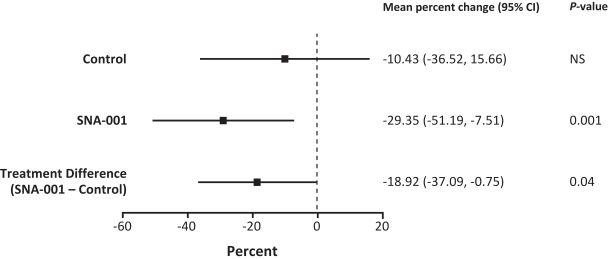

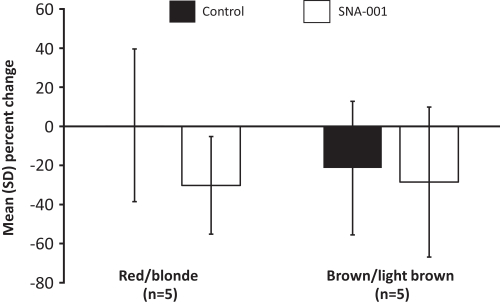

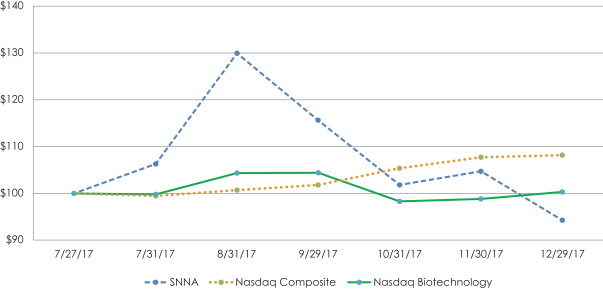

Our second technology platform, Topical Photoparticle TherapyTM, utilizes silver particles applied to the skin to direct the light from commercially available lasers to the sebaceous gland and hair follicle to cause selective photothermolysis, a method of using light energy to produce heat in a specific tissue and facilitate local tissue injury. SNA-001, our lead product candidate from this platform, is a topical suspension of silver particles under development for the treatment of acne and for the reduction of light-pigmented hair, including white, gray, blonde, light brown and light red hair. In the case of acne, SNA-001 targets one of the key structures implicated in the pathogenesis of acne, the sebaceous gland. In the case of unwanted light or mixed pigmented hair, which cannot be removed with lasers alone, SNA-001 targets the hair follicle. Our studies have shown significant reductions in acne lesions and in light-pigmented hair following a small number of procedures with SNA-001. We are currently conducting three pivotal trials for the treatment of acne and anticipate reporting initial topline data from these studies in the second half of 2018. Concurrently, we are conducting three pivotal trials for SNA-001 for the reduction of light-pigmented hair, with initial topline data expected in the second half of 2018. Assuming data from these trials are positive, we expect to file the first 510(k) premarket notifications in the second half of 2019 for both indications.

Prescription medical dermatology products represented an approximately $19 billion global market in 2016, which is projected to grow to over $25 billion by 2020. Prescription drugs indicated for the treatment of psoriasis, atopic dermatitis and acne accounted for approximately 50% of this market, and we believe that the treatment of pruritus, which affects the vast majority of psoriasis and atopic dermatitis patients and a large percentage of patients with other chronic conditions, presents a substantial additional market opportunity. Demand for treatments of dermatologic conditions is driven, in part, by the highly visible nature of skin disease and distressing symptoms the patient experiences, such as itch, burning, or pain, all of which negatively impact quality of life. As new products are developed to address these unmet needs, we believe patients, physicians and payors will prefer the use of effective topical treatments that are suitable for chronic use in the broader patient population. We design and develop our targeted topical products with these criteria in mind, and believe they will play an important role in the treatment of various underserved skin conditions in the future.

The market for non-surgical, aesthetic dermatologic procedures was estimated at $6.8 billion in the United States in 2016, and is characterized by the significant willingness of patients to pay out of pocket for aesthetic improvements. In addition to addressing acne in the medical dermatology market, our Topical Photoparticle TherapyTM platform targets an aesthetic market opportunity in the reduction of unwanted light-pigmented hair, and we believe our Topical Photoparticle TherapyTM product candidate SNA-001, if cleared, will play an important role in the market for non-surgical, aesthetic dermatologic procedures.

In comparison to many other segments of the biopharmaceutical industry, we believe that product development and commercialization in medical dermatology and aesthetics can be relatively efficient in terms of time and cost. In many cases, clinical studies to evaluate efficacy and safety are conducted using well established endpoints and regulatory pathways that allow for comparatively modest sample sizes and shorter durations of therapy. Additionally, the prescribing base of dermatologists in the United States is relatively concentrated compared to other medical specialties. We believe a targeted, specialty sales and marketing organization focused on dermatologists and aesthetic physicians will allow us to directly address these physicians and capture market share for our product candidates in North America. To realize the full commercial potential of our product candidates in other geographic markets and sales channels, we will evaluate alternate commercialization

4

Table of Contents

Index to Financial Statements

strategies, including licensing and co-commercialization agreements with third parties. We believe that these industry dynamics provide an attractive backdrop to establish ourselves as a leader in medical dermatology and aesthetic product development and commercialization.

We have assembled a management team with extensive experience in product development and commercialization at several leading dermatology, aesthetics and biotechnology companies, including Kythera, Allergan, Medicis, and Amgen. In these roles, members of our senior management team were integrally involved in securing regulatory approval from the U.S. Food and Drug Administration, or FDA, for multiple new dermatology and aesthetic products, and establishing several leading global brands, including Botox, Juvederm, Kybella, Latisse, Dysport, Restylane, and Solodyn. We believe this collective experience and achievement provides us with significant and differentiated insight into scientific, regulatory and commercial aspects of drug development that can influence our overall success, as well as a broad network of relationships with leaders within the industry and medical community.

Our Strategy

Our strategy is to develop and commercialize innovative and differentiated medical dermatology and aesthetic treatment solutions that we believe can be successful in the marketplace. The key components of our strategy are to:

| • | Leverage our proprietary technology platforms to design and develop targeted, topical therapies. There is an untapped opportunity to bring innovative topical therapies to the 80-90% of dermatology patients with mild-to-moderate inflammatory disease severity, for whom systemic therapies are inappropriate and existing topical therapies are marginally effective or unsuitable for chronic administration. We believe that our two proprietary technology platforms, Topical by DesignTM and Topical Photoparticle TherapyTM, are positioned to yield multiple topical products for this large underserved population, as well as potentially in other therapeutic areas where topical approaches may provide clinical benefit. We have validated our platforms by advancing lead product candidates from both platforms beyond clinical proof-of-concept. Importantly, by applying our technology platforms to well understood biological targets and pathways, we may be able to reduce the risks associated with the development of novel, targeted topical therapies. |

| • | Rapidly advance our existing product candidates through clinical development. Our first Topical by DesignTM product candidate, SNA-120, has shown statistically significant and clinically meaningful reductions in the pruritus associated with psoriasis in a Phase 2b trial. We initiated a second Phase 2b trial in October 2017. We initiated two clinical trials for our next product candidate from the Topical by DesignTM platform, SNA-125, in February 2018 for psoriasis and in March 2018 for atopic dermatitis, and expect to report proof-of-concept data in the third and fourth quarters of 2018, respectively. We believe these highly differentiated topical therapies have the potential to address multi-billion dollar market opportunities across atopic dermatitis, psoriasis, and pruritus. Our Topical Photoparticle TherapyTM product candidate, SNA-001, is currently in pivotal trials for both acne vulgaris and the reduction of unwanted light-pigmented hair. We intend to complete these trials efficiently and advance SNA-001 to our first regulatory filing in the United States and international markets in the second half of 2019. |

| • | Continue building a diversified multi-asset pipeline of novel topical therapies. Our objective is to build a well-balanced, multi-asset portfolio targeting the medical dermatology and aesthetics markets, with a strong focus on topical products and large patient populations with unmet needs. To achieve this, we will selectively pursue development of our current product candidates SNA-120, SNA-125 and SNA-001 in additional indications where they could have meaningful impact while, over time, selecting additional clinical development candidates from our preclinical pipeline of NCEs based on our Topical by DesignTM technology. We also plan to invest in our internal research efforts to bring forth new product candidates for medical dermatology and aesthetics, as well as in other therapeutic |

5

Table of Contents

Index to Financial Statements

| areas for which localized, topical drug delivery could deliver clinical benefit. Our internal research efforts are led by the scientific team that originally developed the Topical by DesignTM technology platform. In addition to our internal discovery efforts, we may choose to selectively in-license or acquire complementary, external product candidates by leveraging the insights, network and experience of our management team. |

| • | Maximize the global commercial potential of our product candidates. We retain worldwide commercial rights to all of our product candidates. If approved, we intend to commercialize our product candidates independently by establishing specialized field medical, sales and marketing organization focused on dermatologists and aesthetic physicians in North America. In certain sales channels and geographies, we will evaluate alternate strategies to maximize the potential value of our assets, such as licensing and co-commercialization agreements with third parties. |

| • | Leverage the extensive experience of our management team in developing and commercializing multiple leading global dermatology brands. We have assembled a management team with extensive experience in product development and commercialization at several leading dermatology and aesthetics companies, including Kythera, Allergan, Medicis, and Amgen. Our Chief Executive Officer and Chief Medical Officer are practicing dermatologists whose close proximity to patients provides them with deep insight into the needs of patients as well as the changing treatment landscape. We have long-standing experience in the dermatology community and strong relationships with opinion leaders, regulatory agencies, advocacy groups and medical practitioners. In addition, our team has established credibility from a track record of success working with regulators to attain approval of multiple products, many of which were first-in-class and required the development and validation of new endpoints and agreement on the development pathways. These experiences enable us to better understand unmet medical needs, design and execute efficient clinical trial programs, craft effective regulatory strategies and identify new development opportunities. Recent consolidation in the medical dermatology and aesthetics industry has created an opportunity for us to work closely with physicians to identify unmet needs and deliver innovative products to patients. |

Overview of the Dermatology Market

Dermatology is a medical specialty encompassing a broad range of conditions, diseases, and aesthetic concerns associated with the skin, hair, nails and mucous membranes. The specialty is generally segmented into two categories: medical dermatology, which refers to the treatment of conditions and diseases including psoriasis, atopic dermatitis, pruritus, acne and rosacea, and aesthetics, which focuses on improving the patient’s appearance, most frequently the signs of aging or undesirable cosmetic features, such as unwanted wrinkles, fat or excessive body hair.

Dermatologic conditions can have significant effects on patients’ quality of life, due to the highly visible nature of skin disease and distressing symptoms felt by the patient, such as itching, burning, or pain. For example, itch from psoriasis has been shown to have a strong negative correlation with a patient’s quality of life on par with other severe chronic conditions. Acne vulgaris frequently results in significant emotional distress and other psychological issues from the social stigma associated with disease, and severe acne can cause permanent scarring, anxiety, and depression.

Due to the severe impact on patients’ lives, the medical dermatology market is large, with approximately $19 billion in global sales in 2016. Given high unmet need in indications for which there are currently no approved or adequate topical therapies, such as pruritus, psoriasis and atopic dermatitis, we expect the demand for innovative topical products to continue to expand. Similarly, the market for non-surgical, aesthetic procedures is large, estimated at approximately $6.8 billion in the United States in 2016, driven by consumers’ strong desire to reduce visible signs of aging and cosmetic concerns. The physician practice of dermatology has evolved to encompass both medical dermatology and aesthetics as a means to satisfy patient needs and improve practice revenue as trends in consumer demand and the health of the economy fluctuate. The increasing appetite of consumers for cosmetic improvements to their appearance has fueled a cash pay market in aesthetic dermatology

6

Table of Contents

Index to Financial Statements

that has favorable economic implications for treating physicians. Reflecting this convergence of medical and aesthetic dermatology, most dermatologists practice in both medical dermatology and aesthetics. For example, in a survey of 103 dermatologists that we conducted, 89% indicated that their practices are “Medical and Aesthetic Dermatology.” Dermatology procedures and other treatments have aligned with current practice and enable dermatologists to address medical as well as aesthetic concerns, with some procedures serving as an adjunct or alternative therapy. Procedural treatments are an integral part of the well-established approach to treating dermatological conditions with multiple therapeutic options, whereby many patients use multiple drugs and procedural treatments in parallel or in sequence, due to the limited availability of effective, targeted therapeutics suitable for long-term use.

The vast majority of dermatology patients are treated with topical products. The most frequently prescribed topical products are corticosteroids, which accounted for approximately 40 million prescriptions in the United States in 2015 according to IMS Health. Despite their efficacy, topical corticosteroids are often used for only short-term relief of chronic conditions such as atopic dermatitis and psoriasis, because side effects limit their long-term use. As a result, we believe there is a significant unmet need for non-steroidal topical therapies suitable for long-term use. This is evidenced by the topical calcineurin inhibitors Elidel and Protopic rapidly displacing topical steroids for atopic dermatitis, until boxed warnings for side effects significantly limited their use. Additionally, Eucrisa, a topical PDE4 inhibitor that was recently approved for atopic dermatitis, is projected to have multi-billion dollar peak sales potential globally, primarily driven by its safety profile.

Our Technology Platforms and Product Candidates

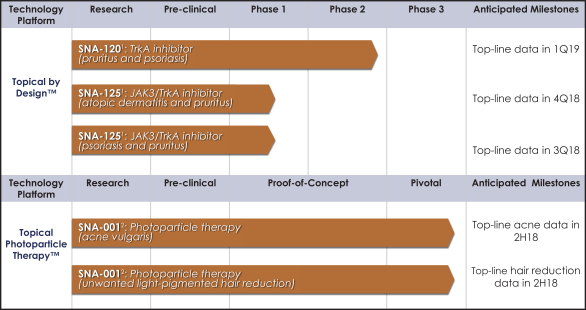

We have two proprietary technology platforms focused on topical dermatology products: our Topical by DesignTM platform and our Topical Photoparticle TherapyTM platform. We are utilizing these technology platforms to build a pipeline of product candidates that we believe will address significant unmet needs in medical dermatology and aesthetics, as summarized in Figure 1 below:

Figure 1. Our Pipeline

| 1. | Regulated as a drug pursuant to a new drug application (NDA) regulatory pathway. |

| 2. | Regulated as a Class II medical device under 510(k) marketing clearance pathway. |

7

Table of Contents

Index to Financial Statements

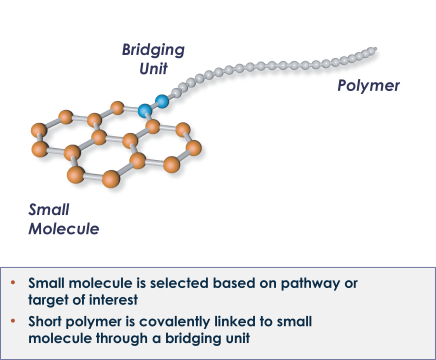

Topical by DesignTM Platform

Our proprietary Topical by DesignTM platform is designed to enable the topical application of potent active pharmaceuticals against known biologic targets while minimizing exposure to the systemic circulation. Applying this technology, we have created a pipeline of drug candidates with unique pharmacological profiles that are designed to be suitable for chronic administration. The principal innovation of the Topical by DesignTM technology is the linkage of a short polymer to a pharmacologically active compound, typically a small molecule, through a bridging unit, resulting in an NCE, as illustrated in Figure 2 below.

Figure 2. Creation of New Chemical Entities with the Topical by DesignTM Platform

The active compound is selected based on the target or pathway of interest. For example, one of our lead product candidates, SNA-125, targets JAK3 which is a validated target in atopic dermatitis and psoriasis. In a single chemical transformation, a short polymer is covalently linked to the small molecule through a bridging unit. Both the polymer, a short PEG tail, and the bridging unit, define the pharmacology of the active compound and refine its target selectivity. Furthermore, the polymer changes the physicochemical characteristics of the new molecule. The Topical by DesignTM technology creates new molecules; it is not a drug-delivery system, nor does it create prodrugs. The drug candidates derived from the Topical by DesignTM technology are necessarily amphiphilic, soluble in both aqueous and lipid environments. This enables sufficient permeation into the skin, where the drug effect is desired, and achievement of high local drug concentrations with low systemic absorption. To the extent there is any systemic absorption, in our nonclinical studies, the drug candidates have demonstrated pharmacokinetics consistent with rapid clearance by the kidneys in minutes. We have not detected systemic exposure of SNA-120, another lead product candidate, at the limit of detection in our clinical studies to date.

Clinically, the advantageous physicochemical properties resulting in high resident drug concentration in the skin and low systemic exposure may allow for concentrated, local treatment of cutaneous inflammation and other dermatoses by efficiently addressing validated targets while maintaining a favorable safety profile. Further, these

8

Table of Contents

Index to Financial Statements

drug candidates, if successfully developed and approved, may be eligible for regulatory exclusivity as NCEs. Our primary focus is the development of drug candidates for dermatological conditions. However, we believe that our Topical by DesignTM technology may also address other therapeutic needs in inflammation and immunology where localized drug delivery that avoids systemic exposure is desirable, such as ophthalmological, gastrointestinal or pulmonary conditions. To the extent we believe applications beyond dermatology are viable, we may explore alternatives to monetize the potential for our Topical by DesignTM platform.

Our lead product candidates developed through the Topical by DesignTM technology platform are SNA-120 and SNA-125.

SNA-120

SNA-120 is designed to selectively inhibit TrkA, the high affinity receptor for nerve growth factor, or NGF, a known mediator of pruritus, or itch, and neurogenic inflammation associated with psoriasis. TrkA and NGF are recognized targets in psoriasis and are overexpressed in plaques. We believe that SNA-120 has the potential to treat pruritus associated with psoriasis, as well as improve the underlying psoriasis, while being suitable for chronic administration. SNA-120 has demonstrated statistically significant and clinically meaningful reductions in the pruritus associated with psoriasis, as well as favorable tolerability in psoriasis patients in a Phase 2b clinical trial. We initiated a second Phase 2b clinical trial in October 2017 in order to expand our understanding of SNA-120 in the treatment of pruritus and the underlying psoriasis and to provide additional endpoint evaluation and validation, with data expected in the first quarter of 2019.

Pruritus

Pruritus is a common and persistent symptom of many inflammatory skin diseases and is often described as one of the most distressing symptoms. The medical community’s awareness of the clinical significance of pruritus has grown in recent years as endpoints measuring the intensity of pruritus have demonstrated a strong impact on patients’ quality of life. Pruritus manifests itself in different ways in different diseases and may be driven by different mechanisms of action. As such, the FDA recommends that pruritus treatments be studied in the context of the specific disease for which they will be used, which in the case of SNA-120 is pruritus associated with psoriasis.

Psoriasis and Associated Pruritus Market

Psoriasis vulgaris is a chronic inflammatory skin disease that affects approximately 2-3% of the global population. Psoriasis is characterized by thickened plaques of inflamed, itchy, red skin covered with thick, silvery scales typically found at the elbows, knees, trunk and scalp. Patients are generally categorized as mild, moderate or severe, with approximately 80-90% of patients having mild or moderate forms of the disease according to GlobalData. The disease ranges from a single, small, localized lesion in some patients to a severe generalized eruption with complete body coverage. It is a chronic, complex, multifactorial immune-mediated disease that requires long-term treatment. According to Kalorama Information, sales of drugs for the treatment of psoriasis globally were $4.8 billion in 2016 and expected to grow to $8.1 billion by 2020. Drug spend is driven largely by the recent introductions of new systemic biologic therapies, which can be highly effective in reducing the appearance of plaques, but are only prescribed for the roughly 10-20% of the psoriasis population with more severe disease. The majority of patients use at least one topical therapy and pricing for these topicals is approximately $500-800 per 60g tube, which generally represents a one-month supply of a single therapy for mild disease.

Pruritus is one of the most common chronic symptoms in psoriasis. In fact, the word “psoriasis” originates from the Greek word psora, which means “to itch.” Chronic itch poses specific problems and is a particularly relevant clinical and patient concern as resultant scratch can lead to the appearance of new plaques or the exacerbation of existing psoriatic plaques, a well described process known as the Koebner phenomenon. A

9

Table of Contents

Index to Financial Statements

National Psoriasis Foundation study of 17,488 patients found that pruritus was experienced by 79% of patients, making it the second most commonly reported symptom, after scaling (94%). In a clinical study we conducted of 160 psoriatic patients, 97.4% of patients had pruritus and 68.7% had at least moderate pruritus at baseline.

Previously there has been a lack of awareness of the substantial effect of pruritus on psoriatic patients’ quality of life, with dermatologists primarily focusing on improving the visible appearance of psoriasis. Because the itch of psoriasis has a burning quality to it, it may at times have been categorized as pain rather than itch, resulting in itch being under-appreciated. Increased attention in the literature has revealed pruritus to be as important to patients as the visible appearance. At a recent FDA public meeting to discuss patient-focused drug development for psoriasis, patients rated the symptom of “itching” as having the most significant impact on their daily lives, equal in importance to “flaking and scaling.” Psoriatic patients with pruritus have a significant decrease in Health Related Quality of Life, or HRQoL, compared to those without pruritus, with a significant correlation between Dermatology Life Quality Index scoring and pruritus intensity. In patients with moderate-to-severe psoriasis, improvement in pruritus has been reported to correlate with improvement in quality of life scores.

Limitations of Current Therapies

The typical psoriasis patient has moderately pruritic plaques covering less than 10% body surface area and is prescribed topical medication. The most common topicals are corticosteroids, Vitamin D derivatives, such as Dovonex, Vitamin A derivatives, such as Tazorac, and crude coal tar preparations. None of these topical therapies adequately treat the important and often neglected symptom of pruritus associated with psoriasis. There are no specific, chronic topical anti-pruritic therapies to treat the pruritus associated with psoriasis vulgaris that have been approved. Our research indicates that patients often seek relief from pruritus by using an array of topical products available over the counter, or OTC, and without prescription. However, OTC medications like antihistamines offer little relief for the itch associated with psoriasis.

Corticosteroids, as monotherapy or in combination with Vitamin D derivatives, are the most effective topicals for treating plaques and may modestly impact pruritus in some patients, but are limited to short-term use because of association with localized atrophy or thinning of the skin and the potential to systemically suppress the body’s ability to make normal amounts of endogenous corticosteroids. Non-steroidal topicals, such as Vitamin D derivatives, have moderate efficacy and can cause skin irritation with some patients reporting burning sensations associated with their use, potentially exacerbating pruritic symptoms.

Ultraviolet, or UV, light therapy is recommended for those patients who are not well managed with topical therapy and/or have more widespread and diffuse psoriatic plaque involvement. These treatments can be effective but require multiple visits to the doctor’s office each week and have been shown to increase patients’ risk of developing skin cancer. For patients with more severe psoriatic plaque involvement, those who do not respond to UV therapy or seeking more rapid onset of relief, systemic drugs may be prescribed. The most common oral treatments are the immunosuppressive drug methotrexate, cyclosporine, and the Vitamin A derivative acitretin. These treatments are associated with systemic side effects including liver toxicity, hypertension, renal impairment, and, in the case of acitretin, the risk of birth defects, and therefore require routine monitoring. More recently, the Phosphodiesterase-4, or PDE, inhibitor apremilast has been approved as a systemic therapy for moderate-to-severe psoriasis with good efficacy, however side effects including neutropenia and depression have been reported. Moreover, despite improvement in visible plaques, based on patient reports, these treatments may not be adequately effective in treating the pruritus associated with psoriasis. This is particularly relevant given that studies have found no correlation between visible psoriasis plaque severity and pruritus disease severity in patients.

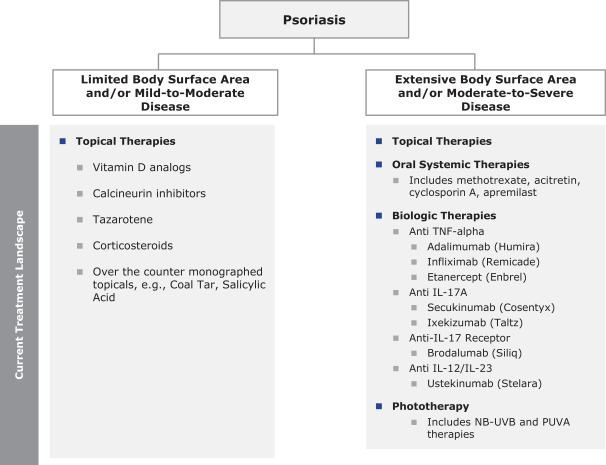

For patients that have moderate psoriasis and do not respond to oral treatments or UV therapy, or for patients that have severe psoriasis, physicians prescribe injectable biologic treatments. A number of injectable or intravenous biologic drugs have been approved over the years, including Enbrel, Humira, Remicade, Stelara,

10

Table of Contents

Index to Financial Statements

Cosentyx and Taltz. Many of these drugs are monoclonal antibodies, a type of complex protein molecule. Some of these drugs act by inhibiting TNF-alpha, IL-17 or IL-12/IL-23. While these injectable biologic drugs can have exceptional efficacy in reducing the appearance of plaques, they may have potentially life-threatening side effects resulting from infection or cancer, especially when used as a chronic treatment. Furthermore, these drugs are very expensive, costing tens of thousands of dollars annually, and as such are reserved for the severe patient populations or those patients with extensive body surface area coverage that do not respond to other treatments. Despite significant reductions in the visible plaques of patients on injectable biologic drugs, some patients still have persistent pruritus. Figure 3 below illustrates the current paradigm for the treatment of psoriasis.

Figure 3. Current Psoriasis Treatment Paradigm

Our Solution: SNA-120

SNA-120 is our topical product candidate for the treatment of pruritus and psoriasis. We are studying SNA-120 in mild-to-moderate psoriasis patients with associated pruritus. In addition, we believe SNA-120 has the potential to treat residual pruritus in patients with moderate-to-severe psoriasis who utilize a combination of topical and systemic treatments. SNA-120 is designed to address pruritus associated with psoriasis as well as the underlying psoriasis and biology of the disease, and, if approved, would likely be the first prescription topical treatment indicated for pruritus associated with psoriasis.

11

Table of Contents

Index to Financial Statements

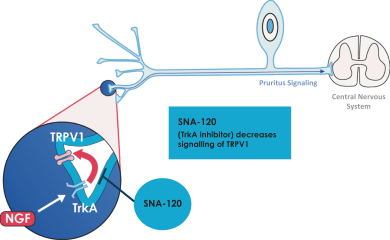

The target of SNA-120 is TrkA, the high affinity receptor for NGF. Binding of NGF to TrkA induces TrkA autophosphorylation and leads to the activation of transient receptor potential cation channel subfamily V member 1 (TRPV1) through phosphatidylinositol-4,5-bisphosphate 3-kinase (PI3K) and protein kinase C (PKC). TRPV1 activation results in the transmission of pain, burning and itch sensation to the central nervous system by peripheral sensory nerves. Both NGF and TrkA are upregulated in the epidermis, the outer layer of the skin, of psoriasis patients. In psoriatic lesions specifically, NGF is overexpressed by keratinocytes and causes sustained activation of the TrkA-TRPV1 axis, contributing to neurogenic inflammation, nerve sensitization, neurite outgrowth and the clinical manifestation of burning/itching sensation in the skin. In pruritic patients, psoriatic skin is more heavily innervated in the superficial dermis and epidermis with cutaneous nerves expressing elevated levels of NGF and TrkA.

SNA-120 inhibits the intracellular kinase domain of TrkA, blocking downstream over-activation of TRPV1 and reducing the signaling of itch sensation by peripheral nerves. Persistent inhibition of TrkA also decreases upregulation and potentiation of TRPV1 activity, an important component of neurogenic inflammation in psoriasis. We believe that SNA-120 also has the potential to address the underlying pathophysiology of psoriatic lesion development in addition to its effect on itch. Figure 4 below illustrates the pathophysiology of psoriatic itch and the mechanism of action of SNA-120.

Figure 4. Pathophysiology of Psoriatic Itch and the Mechanism of Action of SNA-120

SNA-120 Clinical Development

SNA-120 is being developed for the treatment of pruritus associated with mild-to-moderate psoriasis and we believe it also has the potential to concurrently improve the psoriatic plaques, including associated scaling, erythema, and induration. We initiated a second Phase 2b clinical trial in October 2017 in order to expand our understanding of SNA-120 in the treatment of pruritus and the underlying psoriasis and provide additional endpoint evaluation and validation, with data expected in the first quarter of 2019. An investigational new drug application, or IND, for SNA-120 was submitted to the FDA in July 2010 for evaluation in the treatment of mild-to-moderate psoriasis by Creabilis, which remains the IND sponsor. To date, seven sponsor-initiated clinical trials and one investigator-initiated trial have been completed, four in Phase 1 and four in Phase 2. SNA-120 has been administered to 36 healthy volunteers and 336 patients, for up to 12 weeks. In these trials, SNA-120 was observed to be well tolerated, with a favorable safety profile and no demonstrable systemic exposure at the specified detection limit used in the trial. Additionally, SNA-120 showed statistically significant improvements in pruritus associated with psoriasis and had a positive impact on psoriasis disease severity among pruritic subjects.

12

Table of Contents

Index to Financial Statements

The key attributes of SNA-120 observed in our development program to date are:

| • | Effective relief of chronic pruritus associated with psoriasis, as supported by clinically meaningful and statistically significant Phase 2b results; |

| • | Favorable safety profile and low systemic exposure, potentially enabling chronic use across a wide range of patients; and |

| • | Positive impact on psoriasis disease severity among pruritic subjects. |

Clinical Development Plan

In our interactions with the FDA, the FDA has recognized pruritus due to psoriasis as a distinct indication. Based on these interactions, and prior to commencing our Phase 3 trials, we plan to conduct additional nonclinical chronic toxicity studies, additional manufacturing work and scale development and validation for endpoints in pivotal Phase 3 trials.

We initiated a second Phase 2b clinical trial in October 2017 in order to further inform the patient population, clinical endpoints, duration of treatment and dose for our anticipated Phase 3 trials. In this new Phase 2b trial we are evaluating SNA-120 efficacy, safety and tolerability in a refined target population, focusing on patients with at least moderate itch associated with mild-to-moderate psoriasis, exploring two doses across multiple endpoints for 12 weeks, validating the use of the 11-point itch Numeric Rating Scale, or I-NRS, for measuring pruritus severity, defining a clinically meaningful improvement in pruritus in the study population, and capturing more extensive patient and clinician reported data on the impact of pruritus and psoriasis on patient HRQoL. We expect to report topline data from this trial in the first quarter of 2019.

To gain approval of SNA-120, we must submit nonclinical, clinical and chemistry data that adequately demonstrate the safety, purity, potency, efficacy and compliant manufacturing of the product in a new drug application, or NDA, or other applicable regulatory filing. Nonclinical studies for SNA-120 required for NDA submission include safety pharmacology, pharmacokinetics/bioavailability and single/repeat-dose toxicity studies, including chronic studies of up to nine months duration, a two-year dermal carcinogenicity study, genotoxicity, local tolerance and relevant reproductive toxicity testing.

We must also submit two adequate and well-controlled Phase 3 clinical trials, of similar design, with statistically significant results to demonstrate the safety and efficacy of the drug. As with all topical drug products, satisfactory data on dermal safety and maximal use conditions with SNA-120 must be provided. SNA-120 is an NCE; thus, data from a cardiovascular safety study to measure the effect of the drug on the QT interval, or evidence supporting a waiver for this study, must be provided. SNA-120 is intended for long-term intermittent use; therefore, data from a long-term safety study must be submitted.

Prior to approval, the FDA will inspect the manufacturing facilities at which the product is produced to assess compliance with current good manufacturing practice, or cGMP, requirements and to assure that the facilities, methods and controls are adequate to preserve the drug’s identity, strength, quality and purity.

Regulatory feedback obtained from two European medicines regulatory agencies, the Medicines and Healthcare products Regulatory Agency (MHRA), in the United Kingdom and the Medicines Evaluation Board (MEB), in the Netherlands, indicated that the pivotal Phase 3 trials could leverage the placebo-controlled design used in the completed Phase 2b trial, rather than using approved products as the comparator, given that there are currently no approved topical therapies for pruritus. Additional meetings with European medicines regulatory agencies are expected and will provide further guidance.

13

Table of Contents

Index to Financial Statements

Ongoing Phase 2b Trial

Concurrent with the toxicology studies required to initiate Phase 3 pivotal trials, we initiated a multicenter, randomized, double-blind, placebo-controlled, Phase 2b trial to evaluate the efficacy, safety and tolerability of SNA-120 in subjects with moderate pruritus associated with mild-to-moderate psoriasis vulgaris. The primary objectives of this study are to characterize the efficacy of SNA-120 at two doses, 0.05% and 0.5% w/w where w/w denotes the mass fraction, as compared to placebo when administered topically twice daily (BID) for the treatment of pruritus associated with psoriasis, as well as the underlying psoriasis itself. Pruritus severity will be assessed using the 11-point I-NRS where 10 corresponds to “worst itch imaginable” and 0 corresponds to “no itch.” Additionally, the patient administered 100 mm itch visual analog scale, or VAS, a continuous scale with 100 mm corresponding to the “worst possible itch” and 0 mm corresponding to “no itch” will be assessed for concordance with the I-NRS. Psoriasis disease severity will be measured using both the 5-point Investigator’s Global Assessment, or IGA, from 0 (none) to 4 (severe), as well as the Psoriasis Area and Severity Index, or PASI, which is a weighted sum of symptom scores for erythema, scaling and plaque thickness over different parts of the body. Scores for the PASI range from 0 (no disease) to 72 (maximal disease).

Further, this study is expected to:

| • | Establish the threshold for a clinically meaningful change on the I-NRS, in a pre-defined pruritic population with NRS ³ 5, in anticipation of the scale being utilized as the primary endpoint measurement in our pivotal Phase 3 trials; |

| • | Determine sample size required to power the Phase 3 trials; and |

| • | Validate new patient-reported outcome, or PRO, measures that specifically assess: |

| • | Impacts of psoriasis on self-perceptions (including self-perceived bother, embarrassment, self-consciousness, and attractiveness); |

| • | Impact of itch on sleep; |

| • | Psoriasis signs and symptoms, such as bleeding, burning, flaking and pain; and |

| • | Impact of pruritus and psoriasis on patient HRQoL. |

Following completion of this trial, we intend to hold an End-of-Phase 2, or EOP2, meeting with the FDA ahead of initiating our Phase 3 clinical program to further refine our clinical and nonclinical development plans for SNA-120. Following the EOP2 meeting, we plan to seek a special protocol assessment, or SPA, for our Phase 3 protocols.

Completed Phase 2b Trial

SNA-120 was evaluated in a multicenter, randomized, double-blind, placebo-controlled Phase 2b clinical trial in 160 subjects that were 18 years of age and older with stable, mild-to-moderate psoriasis affecting up to 10% body surface area. The primary efficacy objective of this study was to characterize the efficacy of SNA-120 at three doses (0.05% w/w, 0.1% w/w and 0.5% w/w) as compared to placebo when administered topically twice daily (BID) for eight weeks for the treatment of psoriasis. There were three pre-specified efficacy measures:

| • | Overall management of psoriasis as measured by IGA (primary endpoint); |

| • | Improvement of psoriasis severity as measured by mPASI (secondary endpoint); and |

| • | Improvement in the psoriatic pruritus subpopulation as measured by VAS (secondary endpoint) |

No significant improvements in disease response rates were observed for SNA-120 as measured by IGA. However, after eight weeks, SNA-120 treatment groups achieved a mean reduction in disease severity as measured by mPASI between 37.1% and 42.8%, with one dose (0.05% w/w) reaching statistical significance (p=0.0180) as compared to vehicle control.

14

Table of Contents

Index to Financial Statements

The pre-specified pruritus secondary endpoint, specifically, the change from baseline in pruritus VAS score in subjects with at least moderate psoriasis-related pruritus at baseline, was included in the Phase 2b trial due to the understood role of the NGF-TrkA-TRPV1 axis in signaling itch through sensory nerves. Additionally, we believed that inclusion of this endpoint was important based on increasing evidence that the incidence and severity of chronic pruritus was substantially under-reported in psoriasis.

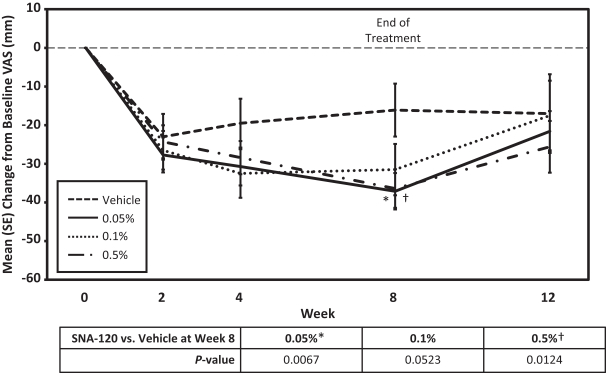

In the 108-subject subset, or 70.6 % of the full study population, reporting at least moderate pruritus (VAS ³40 mm) at baseline, a reduction in pruritus VAS was observed for all SNA-120 treatment groups, with statistical significance compared to vehicle control reached for the 0.05% (p=0.0067) and 0.5% (p=0.0124) dose groups at week 8 (secondary endpoint). The mean changes in baseline VAS for the 0.05%, 0.1%, and 0.5% doses at week 8 were -37.1mm, -31.5 mm, and -36.4 mm, respectively, compared with vehicle at -16.1 mm. Figure 5 below sets forth the mean reductions from baseline VAS in all SNA-120 treatment groups in the completed Phase 2b trial.

For purposes of the presentation of the statistical results, a p-value is a measure of statistical significance of the observed results, or the probability that the observed results was achieved purely by chance. By convention, a p-value of 0.05 or lower is commonly considered statistically significant (e.g., a p-value of <0.05 means that there is a 5% chance that the observed result was purely due to chance). The FDA utilizes the reported statistical measures when evaluating the results of a clinical trial, including statistical significance as measured by p-value as an evidentiary standard of efficacy, to evaluate the reported evidence of a drug product’s safety and efficacy.

Figure 5. Impact of SNA-120 on Pruritus VAS Compared to Vehicle in Subgroup with Baseline Pruritus VAS ³40 mm (N=108)

The Phase 2b trial also resulted in the following findings:

| • | SNA-120 treated subjects with at least moderate baseline pruritus experienced 43-59% reduction in itch severity from baseline to week eight; |

15

Table of Contents

Index to Financial Statements

| • | 62-69% of SNA-120 treated subjects in the pruritic population had mild or no pruritus by end of treatment as measured by VAS compared with 41% of subjects treated with vehicle; and |

| • | 46-62% of SNA-120 treated subjects had at least a 50% reduction in VAS from baseline at week eight compared to 32% of subjects on vehicle. |

Post-Hoc Analysis of Psoriasis Disease Severity in Phase 2b Trial

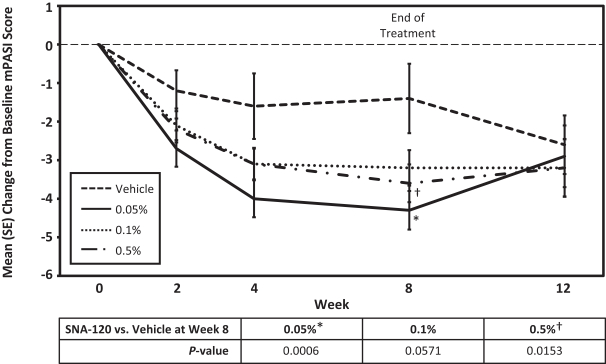

We also conducted a post-hoc analysis of psoriasis disease severity among subjects reporting at least moderate pruritus (VAS ³40 mm) at baseline. This analysis revealed that at week 8, all SNA-120 treatment groups experienced greater mean reductions in total mPASI scores than the vehicle group. Statistical significance was reached for the 0.05% (p<0.001) and 0.5% (p<0.02) dose groups. Subjects treated with SNA-120 experienced about a 40% reduction in baseline disease severity, as measured by mPASI, compared to a 17% reduction for vehicle treated subjects. In conjunction with the effect on pruritus in this population, we believe these data suggest that SNA-120 improves both pruritus and the underlying psoriasis. Improvement in psoriasis may reflect the anti-proliferative effects of TrkA inhibition by SNA-120 on keratinocyte proliferation. It also may be a consequence of inhibiting pruritus, by blocking of NGF-TrkA-TRPV1 signaling in sensory neurons, and breaking the “itch-scratch” cycle. Figure 6 below sets forth the mean reductions from baseline mPASI total score in all SNA-120 treatment groups in the completed Phase 2b trial.

Figure 6. Impact of SNA-120 on mPASI Total Score Compared to Vehicle in Subgroup with Baseline Pruritus VAS ³40 mm (N=108)

To explore a potential dose range, the doses selected for the Phase 2b trial of 0.5% and 0.05% w/w were above and below the dose studied in a previously completed Phase 2a trial (0.1% w/w). The Phase 2b trial was not powered to detect differences in doses and the results demonstrated no significant difference or obvious trends in efficacy between the three doses in assessments of either psoriasis disease severity or pruritus severity.

16

Table of Contents

Index to Financial Statements

This finding of no dose response may indicate that our selected dose range is approaching the top of the dose-response curve. Nonclinical work undertaken in parallel with the trial provided some rationale for this conclusion. At the lowest concentration of 0.05%, SNA-120 reached levels in the skin that elicited greater than 90% inhibition of the target kinase.

In our Phase 2b trial, SNA-120 exhibited a favorable safety profile. Specifically, we observed the following:

| • | Low incidence of adverse events, or AEs, which were characterized as mostly mild or moderate; |

| • | No SNA-120 was detected in blood samples down to a detection limit of 2.5ng/ml; and |

| • | No drug-related application site AEs were observed. |

In the safety population of 160 subjects, 73 experienced treatment emergent AEs, or TEAEs. TEAEs occurred in 33-55% of subjects in the SNA-120 group and 53% of subjects in the vehicle group. The most frequently reported AEs were pruritus, headache, nasopharyngitis and diarrhea. Figure 7 below sets forth the incidence and types of adverse events experienced by subjects in the completed Phase 2b trial.

Figure 7. Phase 2b Trial Adverse Events (Incidence ³ 5%), Number (%) of Subjects

| Adverse Event | SNA-120 0.05% n=40 |

SNA-120 0.1% n=40 |

SNA-120 0.5% n=40 |

SNA-120 Overall n=120 |

Vehicle n=40 | |||||

| Total TEAEsa |

13 (33) | 17 (43) | 22 (55) | 52 (43) | 21 (53) | |||||

|

Nasopharyngitis |

1 (3) | 0 | 3 (8) | 4 (3) | 1 (3) | |||||

|

Headache |

2 (5) | 2 (5) | 1 (3) | 5 (4) | 0 | |||||

|

Diarrhea |

0 | 1 (3) | 2 (5) | 3 (3) | 1 (3) | |||||

|

Psoriasis |

0 | 0 | 2 (5) | 2 (2) | 1 (3) | |||||

|

URTI |

0 | 0 | 0 | 0 | 2 (5) | |||||

|

Pruritus |

4 (10) | 2 (5) | 3 (8) | 9 (7.5) | 6 (15) | |||||

| Back pain |

0 | 2 (5) | 0 | 2 (2) | 0 | |||||

|

Fatigue |

2 (5) | 0 | 0 | 2 (2) | 0 | |||||

| Cough |

2 (5) | 0 | 0 | 2 (2) | 0 |

a Counting is by subject, not event.

Pruritus was reported as an AE in nine (7.5%) SNA-120 subjects and six (15%) vehicle subjects. Five (12.5%) study subjects withdrew due to this AE in the vehicle arm as compared to the withdrawal of three (2.5%) subjects in the SNA-120 arm. There were no drug-related serious AEs, or SAEs.

Summary of Phase 2b safety profile for SNA-120

The findings for SNA-120 in the completed Phase 2b trial are consistent with data from prior SNA-120 clinical studies. To date, 36 healthy volunteers and 336 patients have received SNA-120 for up to 12 weeks. SNA-120 has been shown to be well-tolerated at concentrations up to 0.5% (w/w) for up to eight weeks twice daily (BID) and 12 weeks once daily (QD) application. To date, no clinically significant changes in safety laboratory tests, physical examination, vital signs or 12-lead ECG have been observed.

Six SAEs were reported in these prior trials, none of which was considered drug related. Reported AEs were mostly mild or moderate in severity. The most common AEs reported across the seven prior trials were pruritus, eczema, headache, nasopharyngitis and application-site pruritus. The frequency of events does not appear to be dose dependent. Figure 8 below sets forth the incidences and types of treatment emergent adverse events from SNA-120 sponsor-initiated studies.

17

Table of Contents

Index to Financial Statements

Figure 8. Treatment Emergent Adverse Events from all SNA-120 Sponsor-Initiated Studies, Treatment for up to 8 Weeks, All Doses Combined (Incidence ³1%)

| Adverse events | SNA-120 n=350 |

Vehicle n=127 | ||

|

Pruritus |

21 (6%) | 9 (7%) | ||

|

Eczema |

20 (6%) | 4 (3%) | ||

|

Headache |

16 (5%) | 3 (2%) | ||

|

Nasopharyngitis |

11 (3%) | 3 (2%) | ||

|

Application site pruritus |

11 (3%) | 3 (2%) | ||

|

Application site reaction |

9 (3%) | 2 (2%) | ||

|

Diarrhea |

9 (3%) | 2 (2%) | ||

|

Dermatitis atopic |

7 (2%) | 6 (5%) | ||

|

Rhinitis |

7 (2%) | 3 (2%) | ||

|

Cough |

7 (2%) | 0 | ||

| Upper respiratory tract infection |

6 (2%) | 4 (3%) | ||

| Back pain |

6 (2%) | 1 (<1%) | ||

|

Rash |

5 (1%) | 0 | ||

|

Dermatitis |

4 (1%) | 2 (2%) | ||

|

Psoriasis |

4 (1%) | 1 (<1%) | ||

|

Fatigue |

4 (1%) | 1 (<1%) | ||

|

Vomiting |

4 (1%) | 1 (<1%) |

Human plasma from over 340 patients treated with SNA-120 has been analyzed for concentrations of SNA-120, its putative metabolite (the amide of SNA-120) and K252a, the unconjugated parent compound of SNA-120. None of the samples analyzed have been found to have plasma levels above the lower level of quantification for SNA-120, amide of SNA-120 or K252a, following single and multiple administrations. These clinical data are generally consistent with nonclinical in vivo experiments detecting very limited levels of SNA-120 or its derivatives in plasma following epicutaneous administration. SNA-120 is rapidly cleared following intravenous delivery. The pharmacokinetic profile reveals a volume of distribution similar to blood volume, meaning once in the blood it does not appear to be distributed out of the blood and into tissues readily. Because the drug remains in the systemic circulation once there, and its molecular size is below the threshold limit for glomerular filtration, it is rapidly cleared by the renal system. Following intravenous administration, the half-life for SNA-120 is only 10 minutes. Taken together, this evidence supports our belief that drug candidates produced from the Topical by DesignTM platform demonstrate low systemic exposure.

Other Planned Studies

We intend to conduct additional studies to support the clinical development and regulatory submission package. In addition to ongoing maximal use pharmacokinetic studies to confirm the low systemic exposure of SNA-120, these studies may include two Phase 3 pivotal trials to demonstrate safety and efficacy, dermal safety studies, a drug-drug interaction study, a concomitant use study with a topical reference drug, studies in the pediatric population, a thorough QT study and a long-term safety study.

Market Opportunity for SNA-120

There are currently no approved prescription products indicated for treatment of pruritus associated with psoriasis, and, if approved, SNA-120 would likely be the first targeted topical pruritus treatment available to patients by prescription. Reduced itching is the primary benefit sought by psoriatic patients, on par with reduced

18

Table of Contents

Index to Financial Statements

flaking and scaling, when considering new treatments according to a recent FDA patient panel. Additionally, although we have not yet conducted any head-to-head clinical studies of SNA-120 compared to other non-steroidal topical drugs intended for chronic use, such as Vitamin D analogues, we have seen SNA-120’s improvement in the visible appearance of psoriasis in our clinical studies to date at a level consistent with third party studies of those other non-steroidal topicals. Based on these factors, we believe that physicians could prescribe SNA-120 as a first-line treatment for pruritus associated with psoriasis, thereby helping patients avoid the prolonged use of topical corticosteroids.

We anticipate that SNA-120, if approved, would be marketed to dermatologists with a strong focus on medical conditions. In the United States, there are approximately 7.9 million psoriasis patients, of which approximately 80% have pruritus. We estimate that approximately 1.7 million patients will visit their dermatologists to seek treatment for their chronic pruritus annually. Of particular focus for SNA-120 are the majority of patients who seek chronic management of the signs and symptoms of disease while avoiding the use of corticosteroids or systemic therapy.

If approved, we expect SNA-120 to be priced in line with branded topical medications for psoriasis including Taclonex, Dovenex, and Tazorac. Branded topical pricing is well established and payors are supportive of cost-effective therapies that can address patient needs without having to resort to expensive biologics. We expect patients would require about 100g of topical product per month assuming a twice daily application on 7% body surface area, the average body surface area for patients in our previous Phase 2b trial.

Over time, there could be an opportunity to expand the addressable opportunity for SNA-120 by broadening the label to other pruritus indications and/or populations including prurigo nodularis and pruritus in the elderly population, where NGF is thought to play a role. Other opportunities could include developing additional formulations for intensely pruritic areas such as the scalp. Finally, we could expand the opportunity through a sales force targeting physicians beyond dermatology, such as primary care, likely through partnerships.

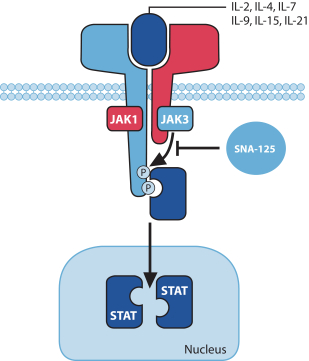

SNA-125

Our second lead product candidate derived from our Topical by DesignTM platform is SNA-125. It is a dual kinase inhibitor (JAK3/TrkA) in clinical development for the treatment of atopic dermatitis, psoriasis, and pruritus. SNA-125 represents a novel approach to the treatment of inflammatory skin diseases and associated pruritus through a validated pathway, JAK3, that is well understood in this disease setting. SNA-125 also inhibits TrkA at a higher level of potency than SNA-120. JAK3 is required for immune cell development, and published literature supports that inhibition of JAK3 blocks the signaling of key cytokines, such as IL-2, IL-4 and IL-15, in T cells and NK cells, and results in a reduction in the severity of autoimmune and inflammatory diseases in which those cytokines play a pivotal role. In an in vitro profiling study on human cells, SNA-125 was observed to decrease the release of key pro-inflammatory cytokines such as IL17A, IL-17F and IL-2, as well as TNF-α. In a nonclinical study, we have observed anti-inflammatory effects of SNA-125 consistent with inhibition of JAK3, including the reduction of immune cell infiltration in a rabbit scar model. Figure 9 below shows the JAK3 signaling pathway and the point of SNA-125 inhibitory action.

19

Table of Contents

Index to Financial Statements

Figure 9. Inhibitory Action of SNA-125 on JAK3 Pathway

There is clinical evidence to support the role of topical JAK3 inhibitors, such as tofacitinib, for the treatment of atopic dermatitis and/or psoriasis. In a randomized, double-blind, prospective, vehicle-controlled Phase 2 study of 69 subjects with atopic dermatitis conducted by Pfizer, topical tofacitinib demonstrated clinical efficacy with patients experiencing a mean 82% reduction in their Eczema Area Severity Index total score, compared with a 30% decrease in vehicle-treated controls after 4 weeks treatment. In a randomized, double-blind, prospective, vehicle-controlled Phase 2b trial of 435 subjects with mild-to-moderate plaque psoriasis, topical tofacitinib (2%, BID) demonstrated significant efficacy compared with control treatment whereby 22.5% of subjects achieved clear or almost clear and ³2 grade improvement on the Calculated Physician’s Global Assessment at week 8. The study also demonstrated rapid and significant improvement in pruritus severity for tofacitinib compared with control. The clinical benefit of JAK inhibition, combined with SNA-125’s higher potency on TrkA, may confer a greater effect on psoriasis disease endpoints in addition to pruritus and result in an improved profile in this indication. We believe the potential systemic safety issues that limit the use of tofacitinib and other JAK inhibitor compounds in topical administration, can be overcome with SNA-125 through our Topical by DesignTM technology that confers low systemic exposure. As a result, we believe SNA-125 has the potential to provide substantial improvements over currently approved topical therapies for atopic dermatitis, psoriasis and associated pruritus, including improved efficacy, by targeting both conventional and neurogenic inflammatory pathways, targeting pruritus, and providing better local tolerability and minimal systemic exposure. Further, because of the minimal to no systemic exposure, we believe that SNA-125 has the potential to be better suited for chronic administration than other topical JAK3 inhibitors, such as topical tofacitinib.

Overview of atopic dermatitis

Atopic dermatitis is an inflammatory skin disease involving an abnormal skin barrier and disruption in the skin’s ability to insulate the body from exposure to external stimuli. It is a disease of unknown origin that usually starts in early infancy and is typified by pruritus, eczematous lesions, xerosis (dry skin), and lichenification of the skin (thickening of the skin and increase in skin markings). Atopic dermatitis is also referred to as eczema and

20

Table of Contents

Index to Financial Statements

atopic eczema. Atopic dermatitis is associated with other atopic diseases, for example, asthma, allergic rhinitis, urticaria, acute allergic reactions to foods and increased immunoglobulin E production, in many patients. The American Academy of Dermatology estimates that up to 25% of children suffer from atopic dermatitis. Safety concerns with steroids are very high in this population and parents of affected children are highly focused on minimizing short- and long-term side effects from steroid use. Generally, the disease burden of atopic dermatitis decreases as patients age, leaving 2-3% of adults suffering from atopic dermatitis. As of 2016, the prevalence of atopic dermatitis is estimated at 16 million in the United States. Approximately 75% of atopic dermatitis patients have mild-to-moderate disease according to GlobalData.

There is an unmet need for new therapies for atopic dermatitis, as there are few safe and effective non-steroidal options suitable for chronic use. Topical corticosteroids are the predominant therapies used for mild-to-moderate atopic dermatitis, which is also treated with other topical immunomodulators such as calcineurin inhibitors. The treatment paradigm begins with education on proper skin care including the use of mild soaps and moisturizing lotions (emollients) and the elimination of any potential allergen triggers. Topical steroids are used next, and research indicates that these work well for a large proportion of atopic dermatitis patients; however, current topical medications have local and systemic safety risks. Side effects associated with topical corticosteroid use include local application-site reactions, such as atrophy or thinning of the skin. Because of the abnormal skin barrier and systemic absorption of steroids, there are concomitant systemic side effect risks such as diabetes, weight gain, hirsutism and the potential to systemically suppress the body’s ability to make normal amounts of endogenous corticosteroids, which can lead to reduced or delayed growth in adolescents. Chronic inadvertent exposure of the eye to topical steroids may also result in glaucoma or cataracts. Non-steroidal topical therapies used in the treatment of atopic dermatitis include the topical calcineurin inhibitors Elidel and Protopic, but these have boxed warnings for side effects that limit their use.

Patients who do not achieve sustained alleviation of symptoms with topical treatments are prescribed systemic steroids or other systemic immunosuppressive agents such as cyclosporine, a calcineurin inhibitor. While these are effective as temporary treatments of flare-ups, extended use has been associated with many potential side effects or adverse events. In fact, it is generally recommended that patients have no more than two rounds of systemic steroid treatment per year. Prednisone is an option; however, its long-term side effects make it unsuitable for chronic use and following discontinuation severe exacerbations of atopic dermatitis symptoms can occur. Cyclosporine is also not suitable for long-term use as it has been associated with renal toxicity, hirsutism, nausea, and lymphoma, and patients must discontinue use after one year. Furthermore, cyclosporine may not be used in patients with high blood pressure due to an increased risk of hypertension, which precludes its use in a large proportion of older patients. With a lack of safe and effective options, many patients with moderate-to-severe atopic dermatitis have serious, life-long consequences. Scarring may occur, and there is an elevated risk of depression and suicide.

In March 2017, the FDA approved Dupixent (dupilumab), an IL-4R antagonist biologic for the treatment of moderate-to-severe atopic dermatitis. Just as with psoriasis, Dupixent and other biologics in development have the potential to improve the treatment of atopic dermatitis for the more severe population, but we believe the safety profile of these drugs will limit their use in the larger population with mild-to-moderate disease and in children and adolescents. In December 2016, the FDA approved Eucrisa (crisaborole) as a topical treatment for mild-to-moderate atopic dermatitis. Eucrisa is a PDE4 inhibitor and acts on TNF-alpha, IFN-gamma, IL-12, IL-23 and other cytokines. It was studied in multiple clinical trials in atopic dermatitis and demonstrated adequate efficacy and a favorable safety profile. We expect that the global market for prescription atopic dermatitis drugs will grow significantly from its 2014 level of $3.6 billion driven by these recent approvals.

Market Opportunity for SNA-125

We believe SNA-125 has the potential to be suitable for the chronic topical treatment of atopic dermatitis due to its dual mechanism of action (JAK3/TrkA) and the expectation of low systemic exposure seen in clinical studies to date utilizing our Topical by DesignTM technology. If approved for atopic dermatitis with a profile on

21

Table of Contents

Index to Financial Statements

par with Eucrisa, we believe there is a significant market opportunity for SNA-125. If SNA-125 is able to demonstrate better efficacy than Eucrisa while maintaining a strong safety profile, we estimate that SNA-125 could capture a significantly larger share than Eucrisa, exceeding the current market expectations for that drug.