Attached files

| file | filename |

|---|---|

| 8-K - 8-K - IEC ELECTRONICS CORP | a8-k20180314annualmeetingp.htm |

Annual Meeting

March 14, 2018

IEC ELECTRONICS 2018©

2

Cautionary Note Regarding Forward-Looking Statements

References in this report to “IEC,” the “Company,” “we,” “our,” or “us” mean IEC Electronics Corp. and its subsidiaries except where the context otherwise

requires. This presentation contains forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “may,” “will,”

“should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “targets,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential” or

“continue” or the negative of these terms or other similar expressions. These forward-looking statements include, but are not limited to, statements

regarding future sales and operating results, future prospects, the capabilities and capacities of business operations, any financial or other guidance and all

statements that are not based on historical fact, but rather reflect our current expectations concerning future results and events. The ultimate correctness of

these forward-looking statements is dependent upon a number of known and unknown risks and events and is subject to various uncertainties and other

factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements

expressed or implied by these forward-looking statements.

The following important factors, among others, could affect future results and events, causing those results and events to differ materially from those views

expressed or implied in our forward-looking statements: business conditions and growth or contraction in our customers’ industries, the electronic

manufacturing services industry and the general economy; variability of our operating results; our ability to control our material, labor and other costs; our

dependence on a limited number of major customers; the potential consolidation of our customer base; availability of component supplies; dependence on

certain industries; variability and timing of customer requirements; technological, engineering and other start-up issues related to new programs and

products; uncertainties as to availability and timing of governmental funding for our customers; the impact of government regulations, including FDA

regulations; risks related to the accuracy of the estimates and assumptions we used to revalue our net deferred tax assets in accordance with the Tax Cuts

and Jobs Act; the types and mix of sales to our customers; litigation and governmental investigations or proceedings arising out of or relating to accounting

and financial reporting matters; intellectual property litigation; our ability to maintain effective internal controls over financial reporting; unforeseen product

failures and the potential product liability claims that may be associated with such failures; the availability of capital and other economic, business and

competitive factors affecting our customers, our industry and business generally; failure or breach of our information technology systems; and natural

disasters. Any one or more of such risks and uncertainties could have a material adverse effect on us or the value of our common stock. For a further list and

description of various risks, relevant factors and uncertainties that could cause future results or events to differ materially from those expressed or implied in

our forward-looking statements, see our Annual Report on Form 10-K, our Quarterly Reports on Form 10-Q and our other filings with the Securities and

Exchange Commission (the “SEC”).

All forward-looking statements included in this presentation are made only as of the date indicated or as of the date of this presentation. We do not

undertake any obligation to, and may not, publicly update or correct any forward-looking statements to reflect events or circumstances that subsequently

occur or which we hereafter become aware of, except as required by law. New risks and uncertainties arise from time to time and we cannot predict these

events or how they may affect us and cause actual results to differ materially from those expressed or implied by our forward-looking statements. Therefore,

you should not rely on our forward-looking statements as predictions of future events.

2

IEC ELECTRONICS 2018©

3

Agenda

‣ Business Overview

‣ Performance Review

‣ The Path to Growth

‣ Q&A

3

IEC ELECTRONICS 2018©

Electronics Manufacturing

Service Provider

100% US Manufacturing

Life-Saving and Mission Critical

Products

Partner to Fortune 500

Companies in Regulated

Markets

4

IEC ELECTRONICS 2018©

5

Electronics Manufacturing Landscape

$425B Outsourced to

Contract

Manufacturers

Electronics Product Assembly

$1.4 Trillion2

80% is Consumer

Based High Volume

Products

$40B Outsourced

in the

United States

2 Worldwide Electronics Manufacturing Services Market – 2017 Edition

Our Target Markets

~$18B within the

Americas

5

IEC ELECTRONICS 2018©

Aerospace & Defense Medical Industrial

Our Target Markets

$3.1B TAM*

4.3% CAGR

$6.0B TAM*

5.8% CAGR

$8.8B TAM*

5.9% CAGR

Highly Regulated Markets

High Switching Costs

*Represented by revenue observed in 2016 for contract manufacturers in the Americas. Ref. Worldwide Electronics Manufacturing Services Market – 2017 Edition

6

IEC ELECTRONICS 2018©

*Source: Yahoo Finance as of February 2018;

Outperforming Average Industry GM

Consumer,

Computing, Auto

Portfolio Mix

Medical, Industrial,

Aerospace & Defense

18%

14%

10%

6%

Mixed Portfolio

High Concentration High Concentration

G

ro

ss

Ma

rgi

n

(

T

TM

)*

Sparton’s margin reflects only its MDS segment

7

2016

IEC ELECTRONICS 2018©

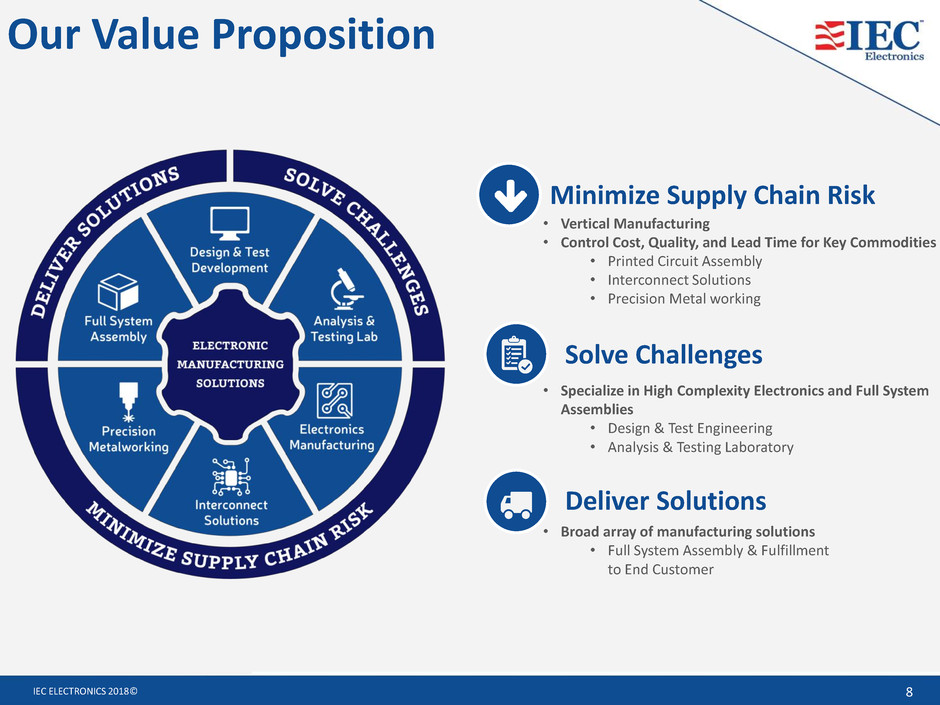

Deliver Solutions

Solve Challenges

Minimize Supply Chain Risk

Our Value Proposition

• Vertical Manufacturing

• Control Cost, Quality, and Lead Time for Key Commodities

• Printed Circuit Assembly

• Interconnect Solutions

• Precision Metal working

• Specialize in High Complexity Electronics and Full System

Assemblies

• Design & Test Engineering

• Analysis & Testing Laboratory

• Broad array of manufacturing solutions

• Full System Assembly & Fulfillment

to End Customer

8

IEC ELECTRONICS 2018©

52%

18%

28%

• Missile Launch Platforms

• Encrypted Communication Systems

• Targeting & Surveillance Systems

Aerospace & Defense

Our 2017 Portfolio

• Resuscitation Systems

• Surgical Navigation Systems

• Infusion Delivery Systems

Medical

• Semi-conductor Manufacturing Equipment

• Locomotive Tracking & Asset Monitoring

Industrial Representative Customers

9

IEC ELECTRONICS 2018©

10

10

Performance Review

IEC ELECTRONICS 2018©

Our Turnaround Priorities

*EBITDA and EBITDA Margin are Non-GAAP Measures. Reconciliation of GAAP to Non-GAAP measures can be found at the end of this presentation.

11

IEC ELECTRONICS 2018©

$0

$50

$100

$150

$200

$250

Peak Sales $260M

Consumer/Computer Products

Sales erode to

$19M due to

off-shoring

Company repositioned

to support highly

regulated, complex

products

Several acquisitions made

to expand capabilities

IEC Electronics ranked #3 in

Forbes Top 100 Best Small

Companies List

Sales (M)

Note: Results from continuing operations excludes revenues of Southern California Braiding divested July 2015

12

Historical Perspective

IEC ELECTRONICS 2018©

-$15

-$10

-$5

$0

$5

2013 2014 2015 2016 2017

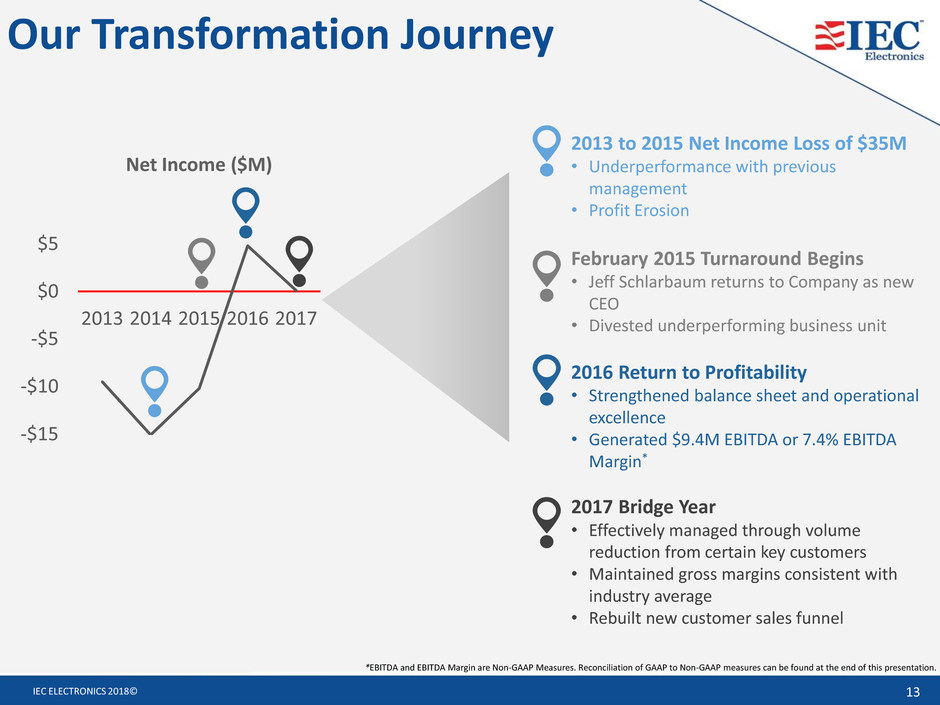

2013 to 2015 Net Income Loss of $35M

• Underperformance with previous

management

• Profit Erosion

February 2015 Turnaround Begins

• Jeff Schlarbaum returns to Company as new

CEO

• Divested underperforming business unit

2016 Return to Profitability

• Strengthened balance sheet and operational

excellence

• Generated $9.4M EBITDA or 7.4% EBITDA

Margin*

2017 Bridge Year

• Effectively managed through volume

reduction from certain key customers

• Maintained gross margins consistent with

industry average

• Rebuilt new customer sales funnel

Net Income ($M)

*EBITDA and EBITDA Margin are Non-GAAP Measures. Reconciliation of GAAP to Non-GAAP measures can be found at the end of this presentation.

13

Our Transformation Journey

IEC ELECTRONICS 2018©

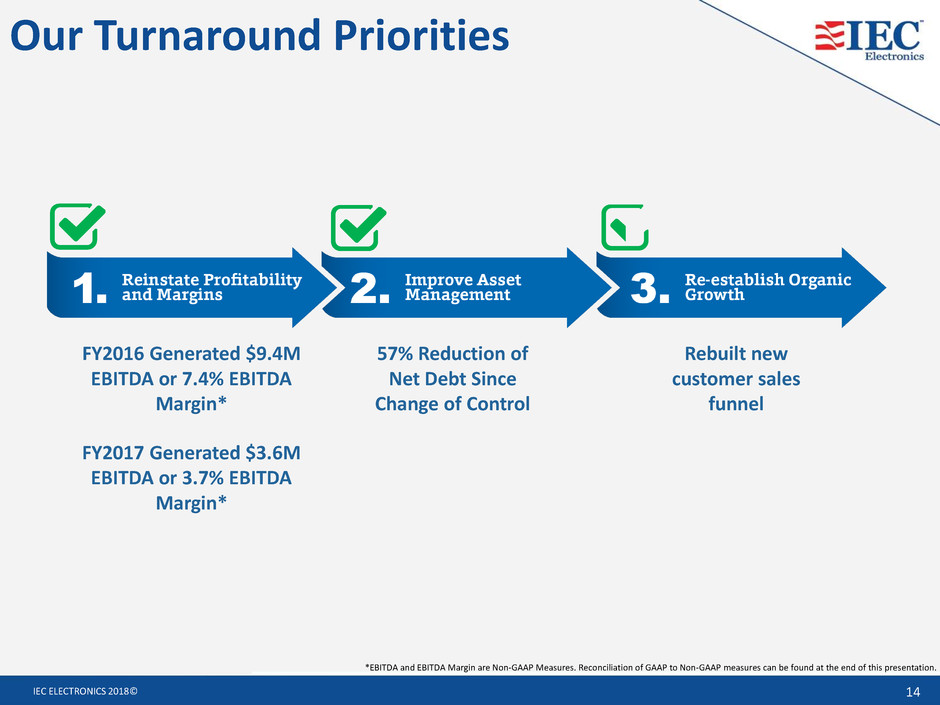

Our Turnaround Priorities

FY2016 Generated $9.4M

EBITDA or 7.4% EBITDA

Margin*

FY2017 Generated $3.6M

EBITDA or 3.7% EBITDA

Margin*

57% Reduction of

Net Debt Since

Change of Control

Rebuilt new

customer sales

funnel

*EBITDA and EBITDA Margin are Non-GAAP Measures. Reconciliation of GAAP to Non-GAAP measures can be found at the end of this presentation.

14

IEC ELECTRONICS 2018©

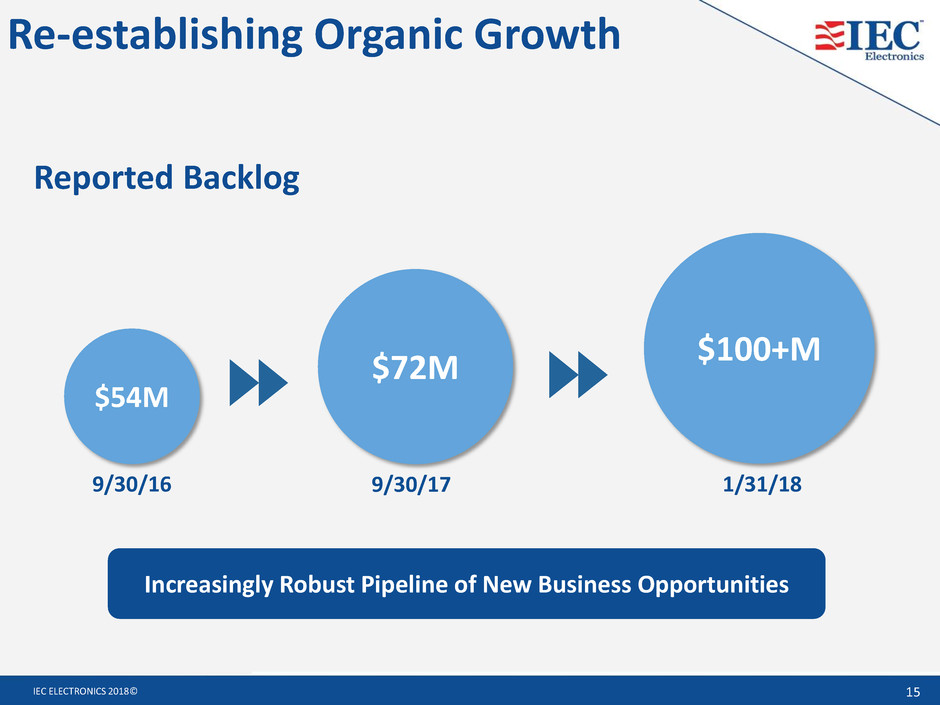

$54M

$72M

$100+M

9/30/16 9/30/17 1/31/18

Increasingly Robust Pipeline of New Business Opportunities

Reported Backlog

15

Re-establishing Organic Growth

IEC ELECTRONICS 2018©

16

The Path to Continued Growth

16

IEC ELECTRONICS 2018©

The Path To Continued Growth

Focus on Target

Markets/Customers

Drive Sales Conversions

Continued Operational Excellence

17

IEC ELECTRONICS 2018©

The Path To Continued Growth

Focus on Target

Markets/Customers

• Deliberate focus on the right customers

• Complex, highly engineered products

• Long-term, strategic partners

• Product life-cycles contribute to longer term

relationships

• 100% US Based Manufacturing Advantages

• Aerospace & Defense requires domestic

manufacturing partners for many products

• Intellectual property protection

• “Local” manufacturing for high mix, higher margin

programs

18

IEC ELECTRONICS 2018©

Drive Sales Conversions

The Path To Continued Growth

19

• Expand Opportunities with Existing

Customers

• Foundations of trust have been re-established

• Financial health of IEC

• Operational execution

• Brisk rate of new programs being awarded over the

last 6 months

• Rebuilt New Business Pipeline

• Non-existent in 2015

• Restructured sales and marketing platform in 2017

• Robust sales opportunity funnel

IEC ELECTRONICS 2018©

Continued Operational Excellence

• High Customer Satisfaction Levels

• Flexibility and responsiveness are critical contributors

The Path To Continued Growth

20

IEC ELECTRONICS 2018©

Continued Operational Excellence

• Continuous Improvement for On-boarding New Programs

• Challenges within global supply chain for procurement of certain

electrical components

• Lengthy process development and customer acceptance timeline

• Multiple New Projects in Early Fiscal 2018

The Path To Continued Growth

Develop Robust

Manufacturing

Process for

Qualification

Customer

Acceptance

For Qualification

Order

Low Rate Initial

Production Runs

Full Production Receive

Materials

9-12 Month Process

Margin Pressure Margin Expansion

21

IEC ELECTRONICS 2018©

Continued Operational Excellence

• Investment in Enterprise Resource Planning System

• Multi-year project to integrate and upgrade our systems

• Improve productivity and streamline processes to drive efficiency

within the company as well as customer service

• Currently have five ERP systems across the company

• Project in final verification stages; implementation expected by end of

year at our Newark location

The Path To Continued Growth

22

ERP

System

Operations

Financial Supply Chain

Quality

IEC ELECTRONICS 2018©

• Expansion of Newark Operations

• Current facility is 100+ year old building that

requires extensive capital investment to update

• 150,000 sq. ft. state-of-the-art facility

anticipated to open in mid-2019 at Silver Hill

Technology Park

• Expected to be a $22M project

• 15 Year Lease with developer

• Up to $5M funded by State of New York tied

to job creation and capital equipment

• Expected to add 362 jobs to New York State

over 5 years

Recent Announcement

23

Future

location

IEC ELECTRONICS 2018©

Draft Renderings of New Newark Facility

The Path To Growth

24

IEC ELECTRONICS 2018©

25

Looking Forward

25

2012

Success

• Revenue

$130M

• Gross Margin

18.9%

2013-14

Retraction

• Loss of $35M

through 2015

• Profit erosion

2015-16

Rebuild

• Turnaround

commenced

• Returned to

profitability

• Strengthened

balance sheet

2017

Bridge

• Rebuilt new

customer

sales funnel

• Proactively

addressed

volume

decline

2018

Growth

• Backlog of

$100+M as of

Jan 31

• Drive Organic

Growth

IEC ELECTRONICS 2018©

Value Proposition Resonates

with Fortune 500 Customers

Solid Organization with Proven

Industry Veterans Leading Key

Positions

Industry Leading EMS Business

Fundamentals

Transitioning into a Growth

Company

Key Takeaways

26

Thank you

IEC ELECTRONICS 2018©

28

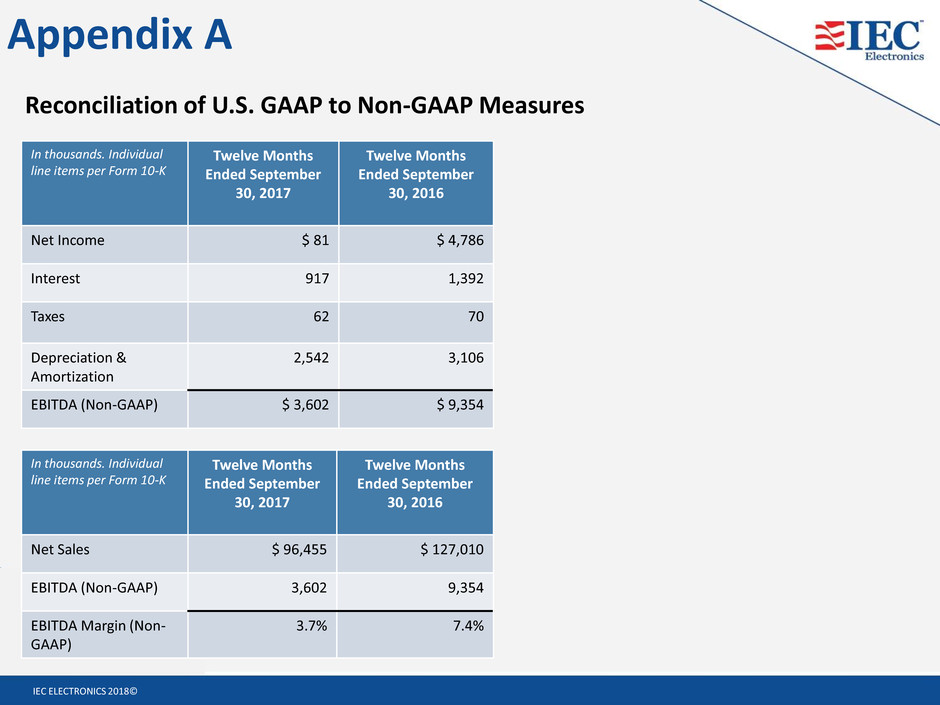

Reconciliation of U.S. GAAP to Non-GAAP Measures

In thousands. Individual

line items per Form 10-K

Twelve Months

Ended September

30, 2017

Twelve Months

Ended September

30, 2016

Net Income $ 81 $ 4,786

Interest 917 1,392

Taxes 62 70

Depreciation &

Amortization

2,542 3,106

EBITDA (Non-GAAP) $ 3,602 $ 9,354

In thousands. Individual

line items per Form 10-K

Twelve Months

Ended September

30, 2017

Twelve Months

Ended September

30, 2016

Net Sales $ 96,455 $ 127,010

EBITDA (Non-GAAP) 3,602 9,354

EBITDA Margin (Non-

GAAP)

3.7% 7.4%

Appendix A