Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Braemar Hotels & Resorts Inc. | ahpinvestorpresentation8-k.htm |

March 2018

Company Presentation // March 2018

Forward Looking Statements and Non-GAAP Measures

2

In keeping with the SEC's "Safe Harbor" guidelines, certain statements made during this presentation could be considered forward-looking

and subject to certain risks and uncertainties that could cause results to differ materially from those projected. When we use the words "will

likely result," "may," "anticipate," "estimate," "should," "expect," "believe," "intend," or similar expressions, we intend to identify forward-looking

statements. Such forward-looking statements include, but are not limited to, our business and investment strategy, our understanding of our

competition, current market trends and opportunities, projected operating results, and projected capital expenditures.

These forward-looking statements are subject to known and unknown risks and uncertainties, which could cause actual results to differ

materially from those anticipated including, without limitation: general volatility of the capital markets and the market price of our common

stock; changes in our business or investment strategy; availability, terms and deployment of capital; availability of qualified personnel;

changes in our industry and the market in which we operate, interest rates or the general economy, and the degree and nature of our

competition. These and other risk factors are more fully discussed in the company's filings with the Securities and Exchange Commission.

EBITDA is defined as net income before interest, taxes, depreciation and amortization. EBITDA yield is defined as trailing twelve month EBITDA

divided by the purchase price or debt amount. A capitalization rate is determined by dividing the property's net operating income by the

purchase price. Net operating income is the property's funds from operations minus a capital expense reserve of either 4% or 5% of gross

revenues. Hotel EBITDA flow-through is the change in Hotel EBITDA divided by the change in total revenues. EBITDA, FFO, AFFO, CAD and

other terms are non-GAAP measures, reconciliations of which have been provided in prior earnings releases and filings with the SEC or in the

appendix to this presentation.

The calculation of implied equity value is derived from an estimated blended capitalization rate (“Cap Rate”) for the entire portfolio using

the capitalization rate method. The estimated Cap Rate is based on recent Cap Rates of publically traded peers involving a similar blend of

asset types found in the portfolio, which is then applied to Net Operating Income (“NOI”) of the company’s assets to calculate a Total

Enterprise Value (“TEV”) of the company. From the TEV, we deduct debt and preferred equity and then add back working capital and the

company’s investment in Ashford Inc. to derive an equity value.

The capitalization rate method is one of several valuation methods for estimating asset value and implied equity value. Among the

limitations of using the capitalization rate method for determining an implied equity value are that it does not take into account the

potential change or variability in future cash flows, potential significant future capital expenditures, the intended hold period of the asset, or

a change in the future risk profile of an asset.

This overview is for informational purposes only and is not an offer to sell, or a solicitation of an offer to buy or sell, any securities of Ashford

Hospitality Prime, Inc. or any of its respective affiliates, and may not be relied upon in connection with the purchase or sale of any such

security.

Company Presentation // March 2018

Management Team

3

20 years of hospitality

experience

1 year with Ashford

15 years with Morgan Stanley

Cornell School of Hotel

Administration, BS

University of Pennsylvania

MBA

RICHARD J. STOCKTON

Chief Executive Officer &

President

18 years of hospitality

experience

15 years with Ashford

3 years with ClubCorp

CFA charterholder

Southern Methodist University

BBA

DERIC S. EUBANKS, CFA

Chief Financial Officer

13 years of hospitality

experience

8 years with Ashford (5 years

with Ashford predecessor)

5 years with Stephens

Investment Bank

Oklahoma State University BS

JEREMY J. WELTER

Chief Operating Officer

Company Presentation // March 2018

Strategic Overview

4

Bardessono Hotel & Spa

Yountville, CA

Pier House Resort

Key West, FL

The Ritz-Carlton St. Thomas

St. Thomas, USVI

Focused strategy of investing in luxury hotels and resorts

Grow organically through strong revenue and cost

control initiatives

Grow externally through accretive acquisitions of

high quality assets

Targets conservative leverage of Net Debt / Gross

Assets of 45% with non-recourse property debt

Highly-aligned management team and advisory

structure

Company Presentation // March 2018

2017 Q4 and Full Year Hotel Operating Results

5

Comparable Operating Results(1)

Q4

2017 2016

% Variance

ADR $ 243.78 $ 257.29 (5.25)%

REVPAR $ 188.15 207.27 (9.22)%

Occupancy 77.18% 80.56% (4.20)%

Revenues $ 89,572 $ 98,900 (9.43)%

Hotel EBITDA $ 27,092 $ 26,961 0.49%

Hotel EBITDA Margin 30.25 % 27.26% 2.99%

(1) Includes: Bardessono, Hotel Yountville, Ritz-Carlton St. Thomas, Pier House, Marriott Seattle Waterfront, Capital

Hilton, Sofitel Chicago, Hilton Torrey Pines, Courtyard San Francisco, Renaissance Tampa, Courtyard Philadelphia,

and Park Hyatt Beaver Creek.

Comparable Operating Results(1)

Full Year

2017 2016

% Variance

ADR 268.07 $ 269.85 (0.66)%

REVPAR $ 219.15 224.71 (2.47)%

Occupancy 81.75% 83.27% (1.83)%

Revenues $ 409,741 $ 422,292 (2.97)%

Hotel EBITDA $ 126,921 $ 126,714 0.16%

Hotel EBITDA Margin 30.98 % 30.01% 0.97%

Company Presentation // March 2018

Q4 Earnings Highlights

6

• Adjusted EBITDA was $22.0mm for the quarter, compared with $21.6mm for the prior year quarter

• Comparable RevPAR for all hotels that did not incur business interruption claims decreased 1.1%

• Adjusted funds from operations (AFFO) was $0.31 per diluted share for the quarter as compared with $0.34

per diluted share from prior-year quarter

• The Company booked $4.1mm of business interruption revenue

• Capex invested during the quarter was $10.3mm

QUARTERLY DIVIDEND PER SHARE AFFO PER SHARE

REVPAR GROWTH

$0.05 $0.05 $0.10

$0.16 $0.05 $0.10

$0.12

$0.16

$0.05

$0.10

$0.12

$0.16

$0.05

$0.10

$0.12

$0.16

$0.00

$0.10

$0.20

$0.30

$0.40

$0.50

$0.60

$0.70

2014 2015 2016 2017

Q1 Q2 Q3 Q4

-4.0%

-2.0%

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

2014 2015 2016 2017

Full Year Highlights

• Adjusted EBITDA was $102.5mm for the year, compared with $101.4mm for the prior year

• Comparable RevPAR for all hotels decreased 2.5%

• Adjusted funds from operations (AFFO) was $1.62 per diluted share for the year, compared with $1.73 per

diluted share for the prior year

• Capex invested during the year was $43.0mm

ADJUSTED EBITDA

$80,000

$85,000

$90,000

$95,000

$100,000

$105,000

2015 2016 2017

(i

n

t

h

o

u

sa

n

ds

)

$0.18 $0.26

$0.39 $0.46

$0.45

$0.62

$0.60 $0.50

$0.42

$0.42

$0.38 $0.37 $0.21

$0.20

$0.34 $0.31

$0.00

$0.20

$0.40

$0.60

$0.80

$1.00

$1.20

$1.40

$1.60

$1.80

2014 2015 2016 2017

Company Presentation // March 2018

Business Interruption Recoveries

7

Note:

(1) Expected to Reopen 11/1/19. BI claims can be submitted for 18 months after reopening

(2) Expected BI Recoveries for Q1 2018

PIER HOUSE RESORT

RITZ-CARLTON ST. THOMAS(1)

HOTEL YOUNTVILLE

BARDESSONO

Properties Affected

HURRICANE IRMA

HURRICANE IRMA

NAPA WILDFIRES

NAPA WILDFIRES

Event

($520K)

($608K)

($227K)

($273K)

BI Deductible

($1.6mm)

$1.3mm

$2.8mm

$1.0mm

$1.3mm

Gross BI

$6.4mm

$1.3mm

BI Booked

4Q2017 1Q2018E(2)

-

$2.8mm -

- $0.8mm

- $1.0mm

$4.1mm $1.8mm

3Q2017

($0.5mm)

($0.6mm)

($1.1mm)

Company Presentation // March 2018

Recent Developments

8

Meets Defined Strategy

Luxury Chainscale Segment

Increases portfolio RevPAR by $5

Replaces critically needed EBITDA

Attractive Financial returns

No need to raise equity

Property Financial Overview

Hotel Net Operating Income of

$10.2MM

12.8x Hotel EBITDA multiple

Hotel EBITDA $13.3MM

Property Highlights

26,000 sq. ft. Beach Club with 410

feet of beachfront

Private, luxury Tom Fazio-

designed Golf Club

Award-winning 15,000 sq. ft. Ritz-

Carlton Spa Club,

Eight food and beverage outlets,

including the acclaimed Jack

Dusty waterfront restaurant

29,000 sq. ft. of flexible indoor

meeting space

Two outdoor pools

24-hour state-of-the-art fitness club

Lighted tennis courts and the Ritz

Kids Club

RITZ-CARLTON SARASOTA

We have entered into a definitive agreement to acquire the 266-room Ritz-

Carlton Sarasota in Sarasota, Florida for $171mm

Stabilized Yield(2): 8% IRR(3): 10% RevPAR(1): $284

(1) TTM RevPAR at time of announcement

(2) Expected unlevered stabilized yield

(3) Underwritten unlevered IRR

TTM Cap Rate: 6%

Company Presentation // March 2018

Portfolio Overview

9

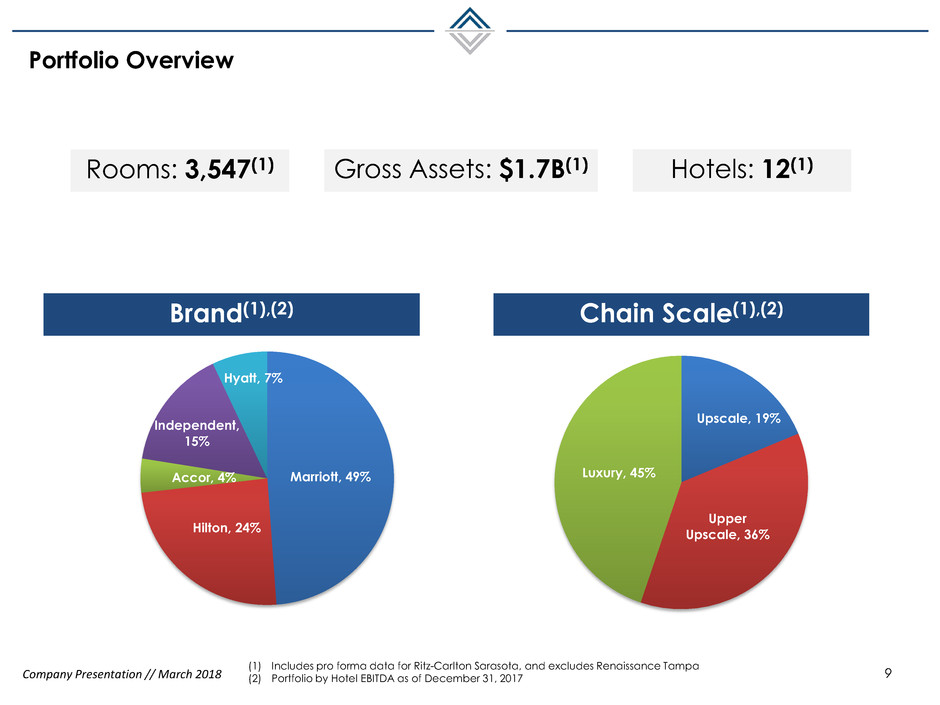

Rooms: 3,547(1) Hotels: 12(1) Gross Assets: $1.7B(1)

Brand(1),(2) Chain Scale(1),(2)

(1) Includes pro forma data for Ritz-Carlton Sarasota, and excludes Renaissance Tampa

(2) Portfolio by Hotel EBITDA as of December 31, 2017

Upscale, 19%

Upper

Upscale, 36%

Luxury, 45% Marriott, 49%

Hilton, 24%

Accor, 4%

Independent,

15%

Hyatt, 7%

Company Presentation // March 2018

High-Quality Hotels in Leading Urban & Resort Markets

10 Non-Core Assets

Marriott Seattle

Seattle, WA

Hilton Torrey Pines

La Jolla, CA

Bardessono Hotel & Spa

Yountville, CA

Pier House Resort

Key West, FL

Renaissance Tampa

Tampa, FL

Sofitel Chicago Magnificent

Mile

Chicago, IL

Capital Hilton

Washington D.C.

Courtyard San Francisco

San Francisco, CA

Courtyard Philadelphia

Philadelphia, PA

Capital Hilton

Washington D.C.

The Ritz-Carlton St. Thomas

St. Thomas, USVI

Hotel Yountville

Yountville, CA

Park Hyatt Beaver Creek

Beaver Creek, CO

Core Assets

The Ritz-Carlton,

Sarasota, FL

Renaissance Tampa

Tampa, FL

Pending Close

Company Presentation // March 2018

• Core portfolio quality unparalleled in the

public lodging REIT sector

• Geographically diversified portfolio

located in strong markets

Portfolio Detail

11

(1) Pro Forma TTM as of December 31, 2017

(2) Announced repositioning to Autograph Collection by Marriott

Note: Hotel EBITDA in thousands

$219

OVERALL REVPAR

$243

CORE REVPAR

(2)

(2)

Number of TTM TTM TTM TTM Hotel % of

Core Location Rooms ADR

(1) OCC(1) RevPAR(1) EBITDA(1) Total

Bardessono Napa Valley, CA 62 $770 77% $593 $4,441 3.5%

Hotel Yountville Napa Valley, CA 80 $544 73% $398 $5,157 4.1%

Ritz-Carlton St. Thomas St. Thomas, USVI 180 $553 80% $442 $10,595 8.3%

Pier House Key West, FL 142 $431 77% $332 $10,982 8.7%

Park Hyatt Beaver Creek Beaver Creek, CO 190 $442 61% $271 $9,387 7.4%

Marriott Seattle Waterfront Seattle, WA 361 $272 88% $240 $16,209 12.8%

Capital Hilton Washington D.C. 550 $238 89% $211 $17,672 13.9%

Sofitel Chicago Magnificent Mile Chicago, IL 415 $203 81% $164 $5,778 4.6%

Hilton Torrey Pines La Jolla, CA 394 $205 84% $172 $14,740 11.6%

Total Core 2,374 $297 82% $243 $94,961 74.8%

Non-Co e

Courty rd San Francisco Downtown San Francisco, CA 408 $270 80% $216 $12,737 10.0%

Renaissance Tampa Tampa, FL 293 $192 82% $158 $7,002 5.5%

Courtyard Philadelphia Downtown Philadelphia, PA 499 $177 82% $145 $12,221 9.6%

Total Non-Core 1,200 $212 81% $172 $31,960 25.2%

Total Portfolio 3,574 $268 82% $219 $126,921 100.0%

Company Presentation // March 2018

Why We Focus on Luxury

12

(1) Total nominal growth from December 1987 to December

2017

Source: STR

Greatest long-term

RevPAR growth of

256%(1)

LUXURY

Second greatest long-

term RevPAR growth of

155%(1)

UPPER-UPSCALE

R

e

v

PAR

(

In

d

exe

d

)

50

100

150

200

250

300

350

D

e

c

-8

7

O

c

t-

8

8

Au

g

-8

9

Jun

-9

0

A

p

r-

9

1

Fe

b

-9

2

D

e

c

-9

2

O

c

t-

9

3

Au

g

-9

4

Jun

-9

5

A

p

r-

9

6

Fe

b

-9

7

D

e

c

-9

7

O

c

t-

9

8

Au

g

-9

9

Jun

-0

0

A

p

r-

0

1

Fe

b

-0

2

D

e

c

-0

2

O

c

t-

0

3

Au

g

-0

4

Ju

n

-0

5

A

p

r-

0

6

Fe

b

-0

7

D

e

c

-0

7

O

c

t-

0

8

Au

g

-0

9

Jun

-1

0

A

p

r-

1

1

Fe

b

-1

2

D

e

c

-1

2

O

c

t-

1

3

Au

g

-1

4

Jun

-1

5

A

p

r-

1

6

Fe

b

-1

7

D

e

c

-1

7

Luxury Class Upper Upscale Class Upscale Class Upper Midscale Class Midscale Class Economy Class

Company Presentation // March 2018

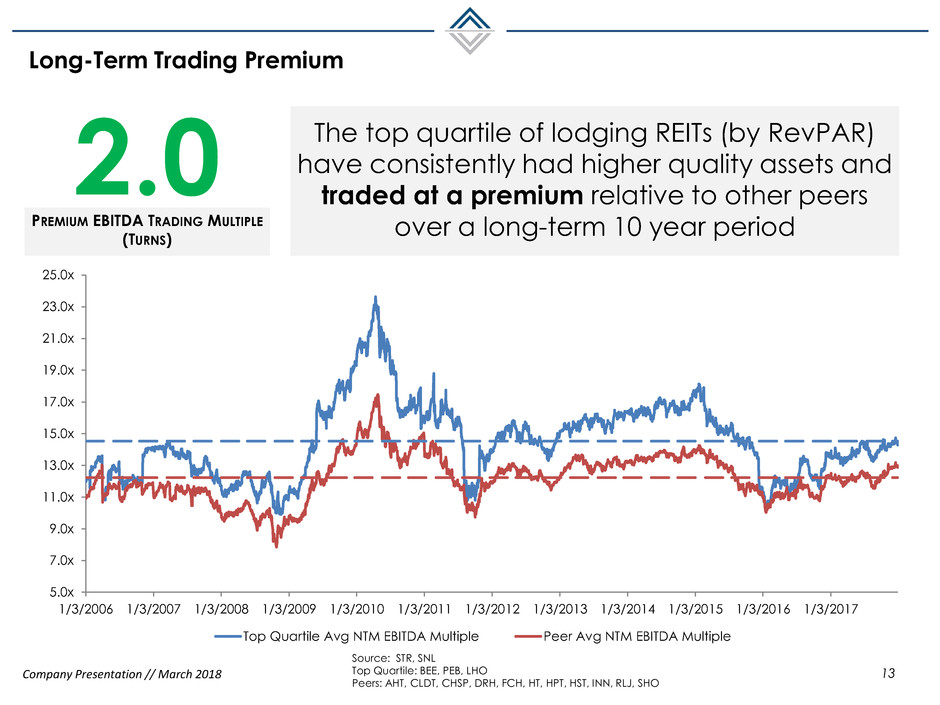

Long-Term Trading Premium

13

Source: STR, SNL

Top Quartile: BEE, PEB, LHO

Peers: AHT, CLDT, CHSP, DRH, FCH, HT, HPT, HST, INN, RLJ, SHO

The top quartile of lodging REITs (by RevPAR)

have consistently had higher quality assets and

traded at a premium relative to other peers

over a long-term 10 year period

2.0

PREMIUM EBITDA TRADING MULTIPLE

(TURNS)

5.0x

7.0x

9.0x

11.0x

13.0x

15.0x

17.0x

19.0x

21.0x

23.0x

25.0x

1/3/2006 1/3/2007 1/3/2008 1/3/2009 1/3/2010 1/3/2011 1/3/2012 1/3/2013 1/3/2014 1/3/2015 1/3/2016 1/3/2017

Top Quartile Avg NTM EBITDA Multiple Peer Avg NTM EBITDA Multiple

Company Presentation // March 2018

Highly Aligned Management Team

14

Management has significant personal wealth invested in the Company

REIT Avg includes: AHT, HT, APLE, CLDT, CHSP, RLJ, PEB, INN, HST, DRH, SHO, XHR, LHO, PK

Source: Company filings

* Insider equity ownership for Ashford Prime includes direct interests and interests of related parties

15%

Insider ownership 4.2x higher than REIT industry average 4.2x

Total dollar value of insider ownership (as of 3/6/18) $54mm

18.9%

14.9%

7.6%

6.1%

3.6% 3.5%

2.5% 2.3% 2.0% 1.7% 1.6% 1.1% 0.8% 0.5% 0.4% 0.3%

0.00%

2.00%

4.00%

6.00%

8.00%

10.00%

12.00%

14.00%

16.00%

18.00%

20.00%

AHT AHP HT APLE CLDT REIT

Avg

CHSP RLJ PEB INN HST DRH SHO XHR LHO PK

Highly-aligned management team with

among highest insider equity ownership

of publicly-traded Hotel REITs

Company Presentation // March 2018

Asset Management Overview

15

Senior Oversight

1 – COO

8 – Asset managers

2 – Legal

+ 1 – Director of Underwriting

+ 1 – Analyst

+ 2 – Revenue Optimization

+ 1 – Analyst

+ 4 – Capex Specialists

+ 1 – Property Tax specialist

+ 1 – Analyst

+ 3 – Risk & Insurance

+ 1 – Analyst

Acquisition

Underwriting

Revenue

Optimization

Expense

Control

Risk

Management

Company Presentation // March 2018

Past Operating Performance Relative to Peers

16

RevPAR Growth

7.3%

4.2%

Hotel EBITDA Growth

8.5%

8.3%

-2.5%

-0.2%

0.2%

-2.3%

2015

2.4%

1.7%

3.7%

2.5%

2016 2017

Note: Comparable Results. Peers include CHSP, PEB,

DRH, LHO, and SHO.

• Prime has outperformed its REIT peers 3 of the past 4 years (Prime results

in green, or red; REIT averages in black)

Company Presentation // March 2018

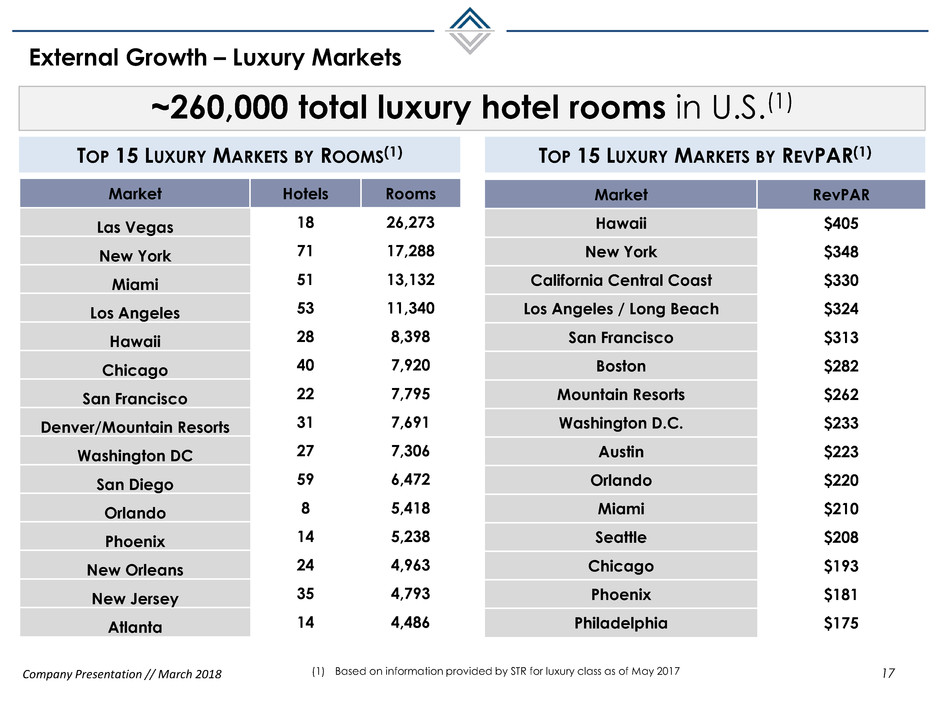

External Growth – Luxury Markets

17

TOP 15 LUXURY MARKETS BY ROOMS(1)

(1) Based on information provided by STR for luxury class as of May 2017

Market Hotels Rooms

Las Vegas 18 26,273

New York 71 17,288

Miami 51 13,132

Los Angeles 53 11,340

Hawaii 28 8,398

Chicago 40 7,920

San Francisco 22 7,795

Denver/Mountain Resorts 31 7,691

Washington DC 27 7,306

San Diego 59 6,472

Orlando 8 5,418

Phoenix 14 5,238

New Orleans 24 4,963

New Jersey 35 4,793

Atlanta 14 4,486

TOP 15 LUXURY MARKETS BY REVPAR(1)

Market RevPAR

Hawaii $405

New York $348

California Central Coast $330

Los Angeles / Long Beach $324

San Francisco $313

Boston $282

Mountain Resorts $262

Washington D.C. $233

Austin $223

Orlando $220

Miami $210

Seattle $208

Chicago $193

Phoenix $181

Philadelphia $175

~260,000 total luxury hotel rooms in U.S.(1)

Company Presentation // March 2018

Target Market Analysis(1)

18 (1) Based on internal analysis

Market Size Fundamentals Pricing Desirability

0

10

20

30

40

50

60

Fundamentals Market Size Pricing

Company Presentation // March 2018

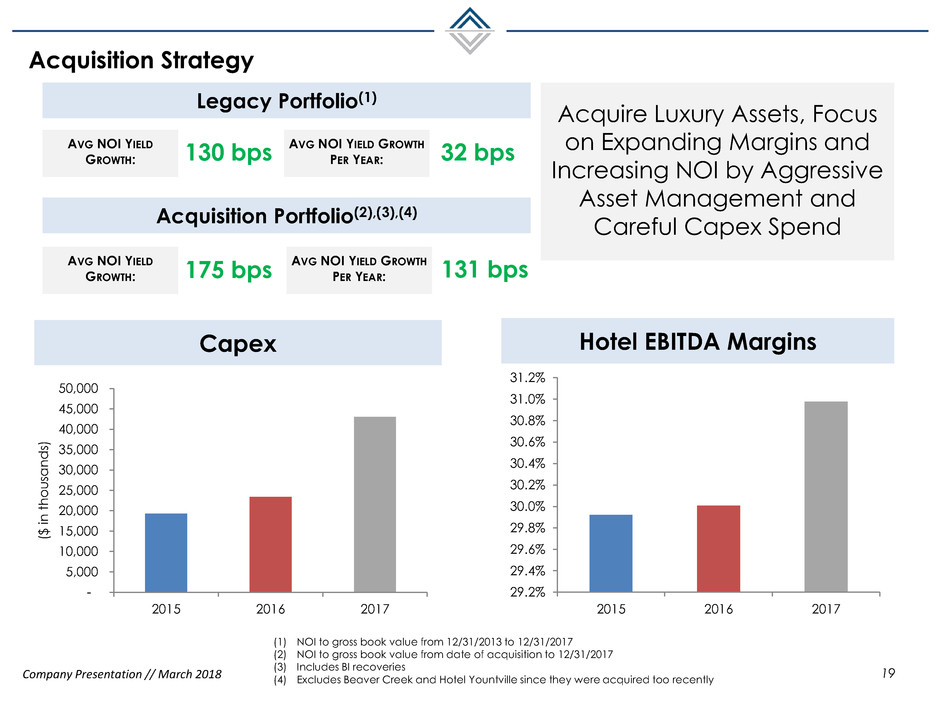

Acquisition Strategy

19

Hotel EBITDA Margins

-

5,000

10,000

15,000

20,000

25,000

30,000

35,000

40,000

45,000

50,000

2015 2016 2017

($

i

n

t

h

o

u

sa

n

ds

)

Capex

130 bps

175 bps

AVG NOI YIELD

GROWTH:

Acquisition Portfolio(2),(3),(4)

AVG NOI YIELD

GROWTH:

Acquire Luxury Assets, Focus

on Expanding Margins and

Increasing NOI by Aggressive

Asset Management and

Careful Capex Spend

Legacy Portfolio(1)

(1) NOI to gross book value from 12/31/2013 to 12/31/2017

(2) NOI to gross book value from date of acquisition to 12/31/2017

(3) Includes BI recoveries

(4) Excludes Beaver Creek and Hotel Yountville since they were acquired too recently

AVG NOI YIELD GROWTH

PER YEAR:

AVG NOI YIELD GROWTH

PER YEAR:

32 bps

131 bps

29.2%

29.4%

29.6%

29.8%

30.0%

30.2%

30.4%

30.6%

30.8%

31.0%

31.2%

2015 2016 2017

Company Presentation // March 2018

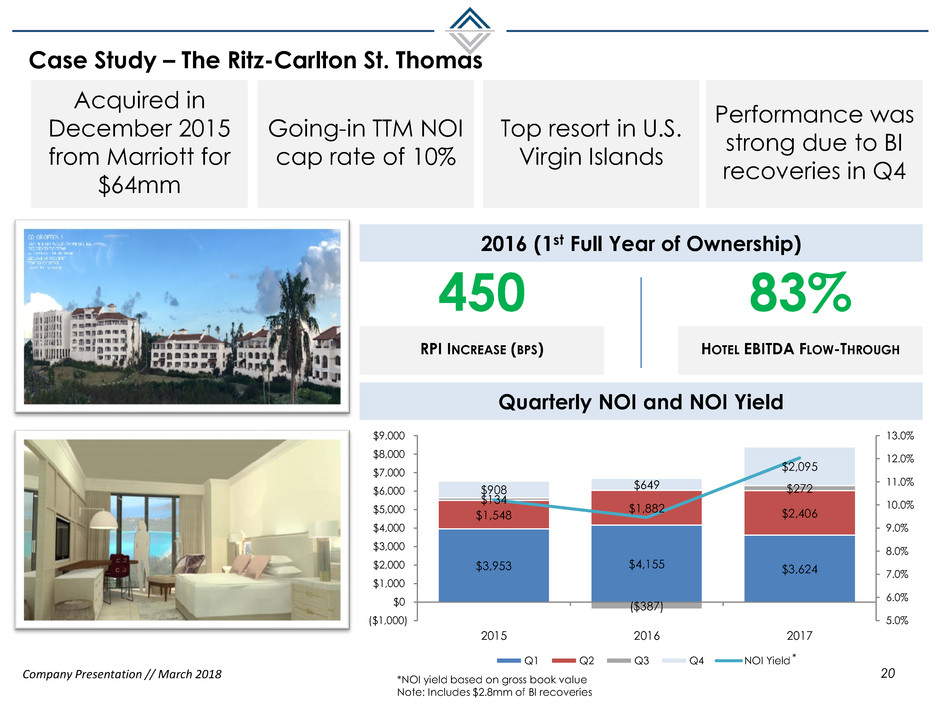

Case Study – The Ritz-Carlton St. Thomas

20

2016 (1st Full Year of Ownership)

450 83%

RPI INCREASE (BPS) HOTEL EBITDA FLOW-THROUGH

Acquired in

December 2015

from Marriott for

$64mm

Going-in TTM NOI

cap rate of 10%

Performance was

strong due to BI

recoveries in Q4

Top resort in U.S.

Virgin Islands

Quarterly NOI and NOI Yield

*NOI yield based on gross book value

Note: Includes $2.8mm of BI recoveries

$3,953 $4,155 $3,624

$1,548

$1,882 $2,406

$134

($387)

$272 $908 $649

$2,095

5.0%

6.0%

7.0%

8.0%

9.0%

10.0%

11.0%

12.0%

13.0%

($1,000)

$0

$1,000

$2,000

$3,000

$4,000

$5,000

$6,000

$7,000

$8,000

$9,000

2015 2016 2017

Q1 Q2 Q3 Q4 NOI Yield *

Company Presentation // March 2018

Case Study – Pier House Resort

21

• Ashford Prime purchased the asset in early 2014 for $92.7mm

• Remington had recently taken over property management & has a proven ability to

deliver superior results

2015

2.5% 255 86%

RPI GROWTH

HOTEL EBITDA MARGIN

INCREASE (BPS)

HOTEL EBITDA

FLOW-THROUGH

2016

4.9% 170 206%

RPI GROWTH

HOTEL EBITDA MARGIN

INCREASE (BPS)

HOTEL EBITDA FLOW-

THROUGH

2017

0.6% 362 469%

RPI GROWTH

HOTEL EBITDA MARGIN

INCREASE (BPS)

HOTEL EBITDA FLOW-

THROUGH

Quarterly NOI and NOI Yield

*NOI yield based on gross book value

Note: Includes $1.3mm of BI recoveries in Q4 2017

$2,854 $3,224 $3,385 $3,383

$1,773

$2,104 $2,185 $2,469

$1,116

$1,317 $1,480 $999

$2,020

$2,157 $2,242

$3,203

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

$0

$2,000

$4,000

$6,000

$8,000

$10,000

$12,000

2014 2015 2016 2017

Q1 Q2 Q3 Q4 NOI Yield *

Company Presentation // March 2018

Case Study – Bardessono Hotel & Spa

22

• Purchased for $85 million unencumbered by management. Installed Remington as

property manager

• Initial TTM cap rate was 4.6%, current yield on cost is 7.4%*

2016 (First Full Year of Ownership)

9.7% 518 242%

REVPAR GROWTH

HOTEL EBITDA MARGIN

INCREASE (BPS)

HOTEL EBITDA FLOW-

THROUGH

2017

-4.2% -147 52%

REVPAR GROWTH

HOTEL EBITDA MARGIN

INCREASE (BPS)

HOTEL EBITDA FLOW-

THROUGH

Quarterly NOI and NOI Yield

*NOI yield based on gross book value

Note: 2017 Reflects $1.0mm adjustment for BI expected to be booked in Q1

2018 related to Q4 2017, which is net of deductible

Despite California wildfire negative

impact in Q4, property continues to grow

yield on cost

($438)

$4 $93

$1,025 $1,339

$1,369

$1,566

$1,692

$1,915

$1,061

$1,238

$1,314

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

6.0%

7.0%

8.0%

($1,000)

$0

$1,000

$2,000

$3,000

$4,000

$5,000

2015 2016 2017

Q1 Q2 Q3 Q4 NOI Yield *

Company Presentation // March 2018

Conservative Capital Structure(1)

23

45%

TARGET LEVERAGE

Net Debt

Gross Assets

(1) As of December 31, 2017

Non-recourse debt

lowers risk profile of

the platform

OVERVIEW

Floating-rate debt

provides a natural

hedge to hotel cash

flows

Maximizes flexibility

in all economic

environments

Long-standing lender

relationships

100%

NON-RECOURSE DEBT

100%

PROPERTY LEVEL,

MORTGAGE DEBT

0%

CORPORATE LEVEL DEBT

DEBT PROFILE

Company Presentation // March 2018

Cash Management Strategy

24

(1) As of December 31, 2017

(2) At market value as of 3/6/2018

NET WORKING CAPITAL(1)

10-15%

CASH TO GROSS DEBT TARGET

17%

CURRENT CASH TO

GROSS DEBT(1)

Defend our assets at financing maturity

BENEFITS

Hilton Torrey Pines

La Jolla, CA

$4.38

NWC / SHARE

Opportunistic investments in severe

economic downtown

(2)

Cash & Cash Equivalents $131.8

Restricted Cash 46.1

Accounts Receivable, net 13.5

Insurance Receivable 8.8

Prepaid Expenses 3.5

Due from Affiliates, net (1.4)

Due from Third-Party Hotel Managers, net 3.0

Investment in Ashford Inc. 18.5

Total Current Assets $224.0

Accounts Payable, net & Accrued Expenses $54.1

Dividends Payable 8.1

Total Current Liabilities $62.3

Net Working Capital $161.8

Company Presentation // March 2018

Value-Add

Refinancings

Long-Term Interest Rate Improvement

Cash Flow and Dividends

25

(1) As of December 31, 2017

(2) GAAP reconciliation in appendix

$12mm

3-PACK REFI - JAN 2017

$45mm

CAD(1),(2),(3) 4.3% 2017

Expected Cash Flow Savings

$1mm

BARDESSONO REFI - AUG 2017

Expected Cash Flow Savings

$13mm

Total Expected Annual

Cash Flow Savings

+ =

4.8% 2016

4.7% 2015

5.0% 2014

5.3% 2013

~1

0

0

b

p

s to

ta

l inte

res

t ra

te

im

p

ro

v

e

m

e

n

t since

2

0

1

3

6.5%

DIVIDEND

YIELD(4)

53%

CAD

PAYOUT RATIO(1)

Bardessono Hotel & Spa

Yountville, CA

(3) Deducts preferred dividends and actual FF&E reserve payments which are

between 4% and 5% of hotel revenue and adds back amortization of loan costs

(4) As of 3/6/2018

37%

AFFO

PAYOUT RATIO(1)

Company Presentation // March 2018

Laddered debt maturities

Debt Maturities

26

2019

NEXT HARD DEBT MATURITY

2.1x

FCCR

OVERVIEW(1)

(1) As of December 31, 2017

(2) Adjusted for sale of the Marriott Plano Legacy

Note: Excludes an $8.1mm TIF note maturing in 2018

Courtyard Philadelphia

Philadelphia, PA

(2)

$80.0 $112.0

$177.5

$436.1

0

50

100

150

200

250

300

350

400

450

500

2017 2018 2019 2020 2021 Thereafter

Fixed-Rate Floating-Rate

Company Presentation // March 2018

AHP

SHO

DRH

CHSP

LHO

PEB

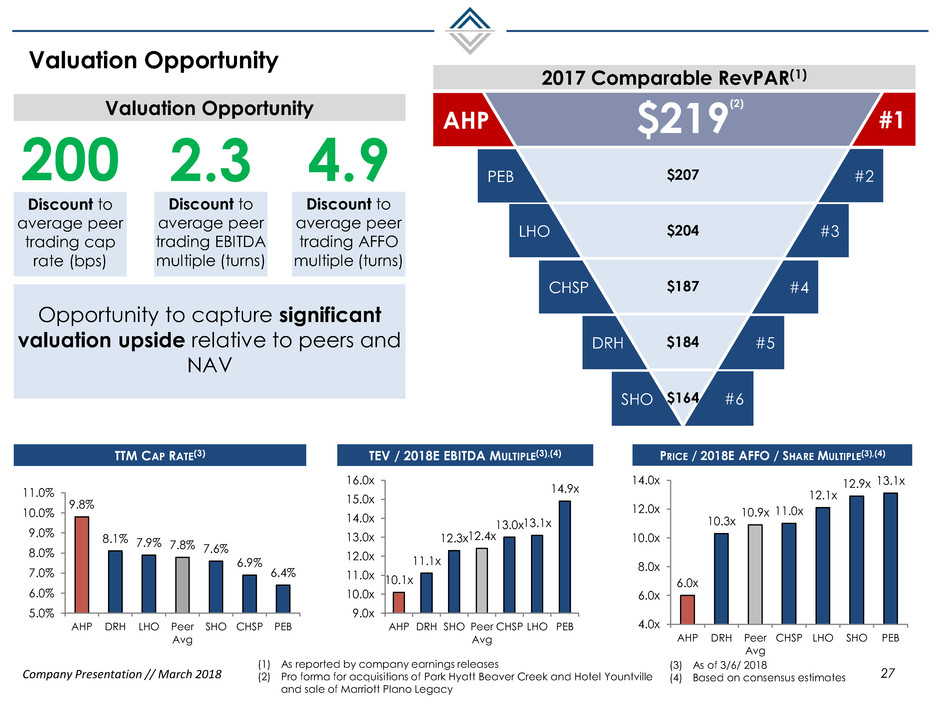

Valuation Opportunity

27

(1) As reported by company earnings releases

(2) Pro forma for acquisitions of Park Hyatt Beaver Creek and Hotel Yountville

and sale of Marriott Plano Legacy

TEV / 2018E EBITDA MULTIPLE(3),(4) PRICE / 2018E AFFO / SHARE MULTIPLE(3),(4) TTM CAP RATE(3)

Discount to

average peer

trading cap

rate (bps)

Valuation Opportunity

2017 Comparable RevPAR(1)

200

Discount to

average peer

trading AFFO

multiple (turns)

4.9

Discount to

average peer

trading EBITDA

multiple (turns)

2.3

Opportunity to capture significant

valuation upside relative to peers and

NAV

#1

#2

#3

#4

#5

#6

$219

$207

$204

$187

$184

$164

(2)

(3) As of 3/6/ 2018

(4) Based on consensus estimates

6.0x

10.3x

10.9x 11.0x

12.1x

12.9x 13.1x

4.0x

6.0x

8.0x

10.0x

12.0x

14.0x

AHP DRH Peer

Avg

CHSP LHO SHO PEB

9.8%

8.1% 7.9% 7.8% 7.6%

6.9%

6.4%

5.0%

6.0%

7.0%

8.0%

9.0%

10.0%

11.0%

AHP DRH LHO Peer

Avg

SHO CHSP PEB

10.1x

11.1x

12.3x 12.4x

13.0x 13.1x

14.9x

9.0x

10.0x

11.0x

12.0x

13.0x

14.0x

15.0x

16.0x

AHP DRH SHO Peer

Avg

CHSP LHO PEB

Company Presentation // March 2018

ASHFORD PRIME PORTFOLIO

*(ADJUSTED FOR SALE OF MARRIOTT PLANO)

(mms) Low-End High-End

TTM NOI*(5) $100.8 $100.8

Cap Rate(6) 8.0% 6.5%

Implied Value $1,261 $1,551

NWC*(7),(8) $162 $162

Preferred Equity(7) ($124) ($124)

Debt*(7) ($779) ($779)

Implied Equity Mkt Cap $519 $810

Intrinsic Value(1),(2)

28

Valuation

Disconnect

$361mm

Current Equity

Market Cap(3)

$665mm

Implied Equity

Market Cap(4)

$303mm

Implied Equity

Value Upside

(1) See valuation methodology disclaimer

(2) Excludes termination fee

(3) As of 3/6/2018

(4) Based on average of estimated cap rates

(5) See GAAP reconciliation in appendix

(6) Based on current implied cap rates of publicly traded peers

(7) As of December 31, 2017; Adjusted for Hilton JV

(8) Investment in Ashford Inc. at market value as of 3/6/2018

--

84% Increase

$361

$519

$665

$810

Current Market

Cap

Low End -

Implied Equity

Market Cap

Avg - Implied

Equity Market

Cap

High End -

Implied Equity

Market Cap

Company Presentation // March 2018

Key Takeaways

29

Bardessono Hotel & Spa

Yountville, CA

Pier House Resort

Key West, FL

The Ritz-Carlton St. Thomas

St. Thomas, USVI

Highest Quality Portfolio Amongst All Lodging REITs…In

The Segment With Greatest Growth Trajectory

Growing Organically: Rigorous Asset Management

While Mining Portfolio for Investment Opportunities

Growing Externally: Redeploying Capital into

Accretive Acquisitions

Shares Are Significantly Undervalued vs Peers

Highly Aligned Mgmt. Team That Is a Major Shareholder

Appendix

Company Presentation // March 2018

Reconciliation of Net Income (Loss) to Hotel NOI

31

Year Ended December 31, 2017

Net income (loss) 82,469$

(Income) loss from consolidated entities attributable to

noncontrolling interest (5,176)

Net (income) loss attributable to redeemable noncontrolling

interests in operating partnership -

Net income (loss) attributable to the Company 77,293

Non-property adjustments (22,712)

Interest income (51)

Interest expense 9,214

Amortization of loan cost 1,018

Depreciation and amortization 52,158

Income tax expense (benefit) (512)

Non-hotel EBITDA ownership expense 6,716

Income (loss) from consolidated entities attributable to

noncontrolling interest 5,176

Hotel EBITDA including amounts attributable to noncontrolling

interest 128,300

Less: EBITDA adjustments attributable to noncontrolling interest (2,927)

(Income) loss from consolidated entities attributable to

noncontrolling interest (5,176)

Net income (loss) attributable to redeemable noncontrolling

interests in operating partnership -

Hotel EBITDA attributable to the Company and OP unitholders 120,197$

Non-comparable adjustments (1,379)

Comparable hotel EBITDA 126,921$

FFE reserve (19,264)$

Comparable net operating income 107,657$

NOI adjustments attributable to noncontrolling interests (6,812)

NOI attributable to the Company and OP unitholders 100,845$

Company Presentation // March 2018

Reconciliation of Net Income (Loss) to Cash Available for Distribution

32

Year Ended December 31, 2017

Net income (loss) 28,324$

(Income) loss from consolidated entities attributable to noncontrolling interest (3,264)

Net (income) loss attributable to redeemable noncontrolling interests in operating partnership (2,038)

Preferred div idends (6,795)

Net income (loss) attributable to common stockholders 16,227

Depreciation and amortization on real estate 49,361

Impairment charges on real estate 1,068

Net income (loss) attributable to redeemable noncontrolling interests in operating partnership 2,038

Gain on sale of hotel property (23,797)

FFO available to common stockholders and OP unitholders 44,897

Preferred div idends 6,795

Transaction and management conv ersion costs 6,774

Other (income) expense 377

Write-off of loan costs and exit fees 3,874

Unrealized (gain) loss on inv estments (9,717)

Unrealized (gain) loss on deriv ativ es 2,053

Non-cash stock/unit-based compensation (1,327)

Legal, adv isory and settlement costs 3,711

Contract modification cost 5,000

Software implementation costs 79

Uninsured hurricane related costs 3,821

Tax reform (161)

Adjusted FFO available to the Company and OP unitholders 66,176$

FFE reserv e (net of noncontrolling interest) (19,336)

Preferred div idends (6,795)

Amortizatoin of Loan costs 4,804

Cash av ailable for distribution to the Company and OP unitholders 44,849$