Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ABRAXAS PETROLEUM CORP | a8kmarchupdate.htm |

Abraxas Petroleum

Corporate Update

March 2018

Raven Rig #1; McKenzie County, ND

Exhibit 99.1

2

The information presented herein may contain predictions, estimates and other forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Although the Company believes that its expectations are based on

reasonable assumptions, it can give no assurance that its goals will be achieved.

Important factors that could cause actual results to differ materially from those included in the forward-looking statements include the timing and

extent of changes in commodity prices for oil and gas, availability of capital, the need to develop and replace reserves, environmental risks, competition,

government regulation and the ability of the Company to meet its stated business goals.

Oil and Gas Reserves. The SEC permits oil and natural gas companies, in their SEC filings, to disclose only reserves anticipated to be economically

producible, as of a given date, by application of development projects to known accumulations. We use certain terms in this presentation, such as total

potential, de-risked, and EUR (expected ultimate recovery), that the SEC’s guidelines strictly prohibit us from using in our SEC filings. These terms

represent our internal estimates of volumes of oil and natural gas that are not proved reserves but are potentially recoverable through exploratory

drilling or additional drilling or recovery techniques and are not intended to correspond to probable or possible reserves as defined by SEC regulations.

By their nature these estimates are more speculative than proved, probable or possible reserves and subject to greater risk they will not be realized.

Non-GAAP Measures. Included in this presentation are certain non-GAAP financial measures as defined under SEC Regulation G. Investors are urged to

consider closely the disclosure in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2016 and its subsequently filed

Quarterly Reports on Form 10-Q and Current Reports on Form 8-K and the reconciliation to GAAP measures provided in this presentation.

Initial production, or IP, rates, for both our wells and for those wells that are located near our properties, are limited data points in each well’s

productive history. These rates are sometimes actual rates and sometimes extrapolated or normalized rates. As such, the rates for a particular well may

change as additional data becomes available. Peak production rates are not necessarily indicative or predictive of future production rates, expected

ultimate recovery, or EUR, or economic rates of return from such wells and should not be relied upon for such purpose. Equally, the way we calculate

and report peak IP rates and the methodologies employed by others may not be consistent, and thus the values reported may not be directly and

meaningfully comparable. Lateral lengths described are indicative only. Actual completed lateral lengths depend on various considerations such as lease-

line offsets. Standard length laterals, sometimes referred to as 5,000 foot laterals, are laterals with completed length generally between 4,000 feet and

5,500 feet. Mid-length laterals, sometimes referred to as 7,500 foot laterals, are laterals with completed length generally between 6,500 feet and 8,000

feet. Long laterals, sometimes referred to as 10,000 foot laterals, are laterals with completed length generally longer than 8,000 feet.

Forward-Looking Statements

3

2018 Operating and Financial Guidance

2018 Capex Budget Allocation 2018 Operating Guidance

Operating Costs

Low

Case

High

Case

LOE ($/BOE) $4.00 $6.00

Production Tax (% Rev) 8.0% 9.0%

Cash G&A ($mm) $8.5 $12.5

Production (boepd) 10,000 12,000

(1) Yearly CAPEX for each year ending December 31, 2013, 2014, 2015, 2016 and 2017. 2018 based on midpoint of management guidance.

(2) Average estimated production for 2018 based on the midpoint of management guidance.

66%

22%

12%

2018 Expected Production Mix

Oil Gas NGL

Area

Capital

($MM)

% of

Total

Gross

Wells

Net

Wells

Permian - Delaware $71.2 50.9% 12.0 9.0

Bakken/Three Forks 33.8 24.1% 10.0 4.7

Eagle Ford/Austin Chalk 0.0 0.0% 0.0 0.0

Acquisitions/Facilities/Other 35.0 25.0% 0.0 0.0

Total $140.0 100% 22.0 13.7

$0

$50,000

$100,000

$150,000

$200,000

$250,000

0

2,000

4,000

6,000

8,000

10,000

12,000

20

13

A

20

14

A

20

15

A

20

16

A

20

17

A

20

18

E (

2)

Daily Production vs Yearly CAPEX (1)

4

0

2,000

4,000

6,000

8,000

10,000

12,000

14,000

16,000

Ju

l-

1

7

A

u

g-

1

7

Se

p

-1

7

Oct

-1

7

N

o

v-

1

7

D

e

c-

1

7

Ja

n

-1

8

Fe

b

-1

8

M

ar

-1

8

A

p

r-

1

8

M

ay

-1

8

Ju

n

-1

8

Ju

l-

1

8

A

u

g-

1

8

Se

p

-1

8

Oct

-1

8

N

o

v-

1

8

D

e

c-

1

8

Ja

n

-1

9

Fe

b

-1

9

M

ar

-1

9

A

p

r-

1

9

M

ay

-1

9

Ju

n

-1

9

Ju

l-

1

9

A

u

g-

1

9

Se

p

-1

9

Oct

-1

9

N

o

v-

1

9

D

e

c-

1

9

Bakken/Three Forks Wolfcamp

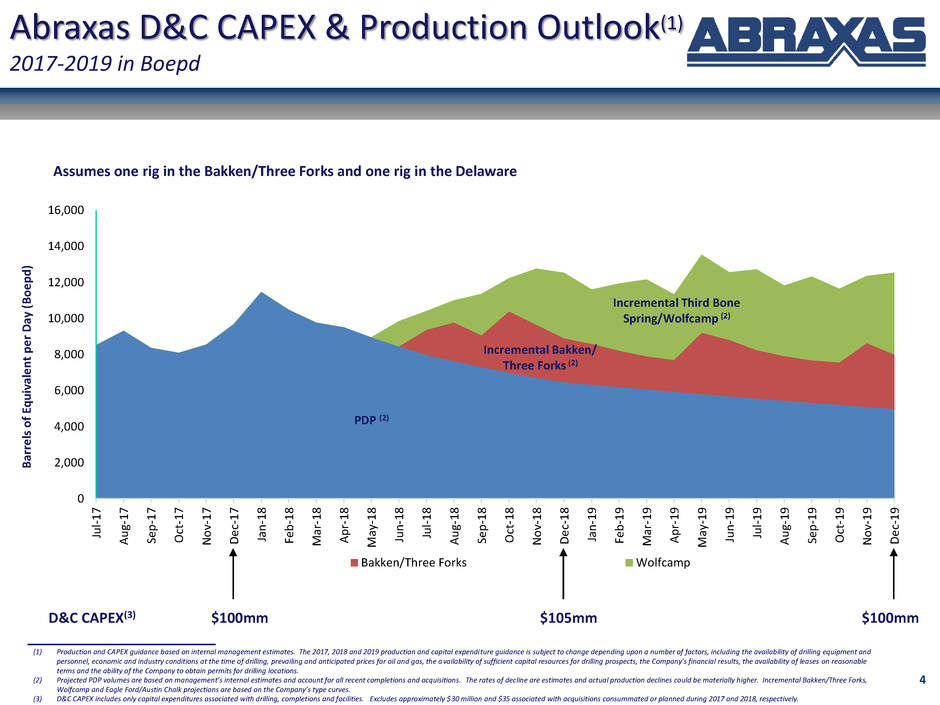

Abraxas D&C CAPEX & Production Outlook(1)

2017-2019 in Boepd

Assumes one rig in the Bakken/Three Forks and one rig in the Delaware

D&C CAPEX(3) $100mm $105mm $100mm

PDP (2)

Incremental Bakken/

Three Forks (2)

Incremental Third Bone

Spring/Wolfcamp (2)

B

ar

re

ls

o

f

Eq

u

iv

al

e

n

t

p

e

r

D

ay

(

B

o

e

p

d

)

(1) Production and CAPEX guidance based on internal management estimates. The 2017, 2018 and 2019 production and capital expenditure guidance is subject to change depending upon a number of factors, including the availability of drilling equipment and

personnel, economic and industry conditions at the time of drilling, prevailing and anticipated prices for oil and gas, the availability of sufficient capital resources for drilling prospects, the Company’s financial results, the availability of leases on reasonable

terms and the ability of the Company to obtain permits for drilling locations.

(2) Projected PDP volumes are based on management’s internal estimates and account for all recent completions and acquisitions. The rates of decline are estimates and actual production declines could be materially higher. Incremental Bakken/Three Forks,

Wolfcamp and Eagle Ford/Austin Chalk projections are based on the Company’s type curves.

(3) D&C CAPEX includes only capital expenditures associated with drilling, completions and facilities. Excludes approximately $30 million and $35 associated with acquisitions consummated or planned during 2017 and 2018, respectively.

5

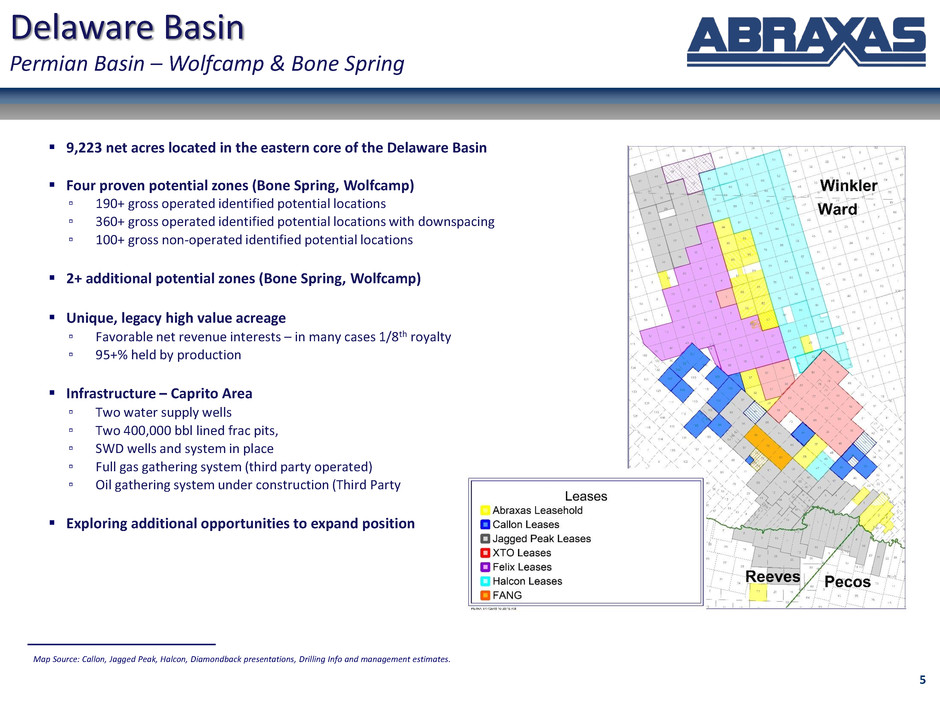

9,223 net acres located in the eastern core of the Delaware Basin

Four proven potential zones (Bone Spring, Wolfcamp)

▫ 190+ gross operated identified potential locations

▫ 360+ gross operated identified potential locations with downspacing

▫ 100+ gross non-operated identified potential locations

2+ additional potential zones (Bone Spring, Wolfcamp)

Unique, legacy high value acreage

▫ Favorable net revenue interests – in many cases 1/8th royalty

▫ 95+% held by production

Infrastructure – Caprito Area

▫ Two water supply wells

▫ Two 400,000 bbl lined frac pits,

▫ SWD wells and system in place

▫ Full gas gathering system (third party operated)

▫ Oil gathering system under construction (Third Party

Exploring additional opportunities to expand position

Delaware Basin

Permian Basin – Wolfcamp & Bone Spring

Map Source: Callon, Jagged Peak, Halcon, Diamondback presentations, Drilling Info and management estimates.

6

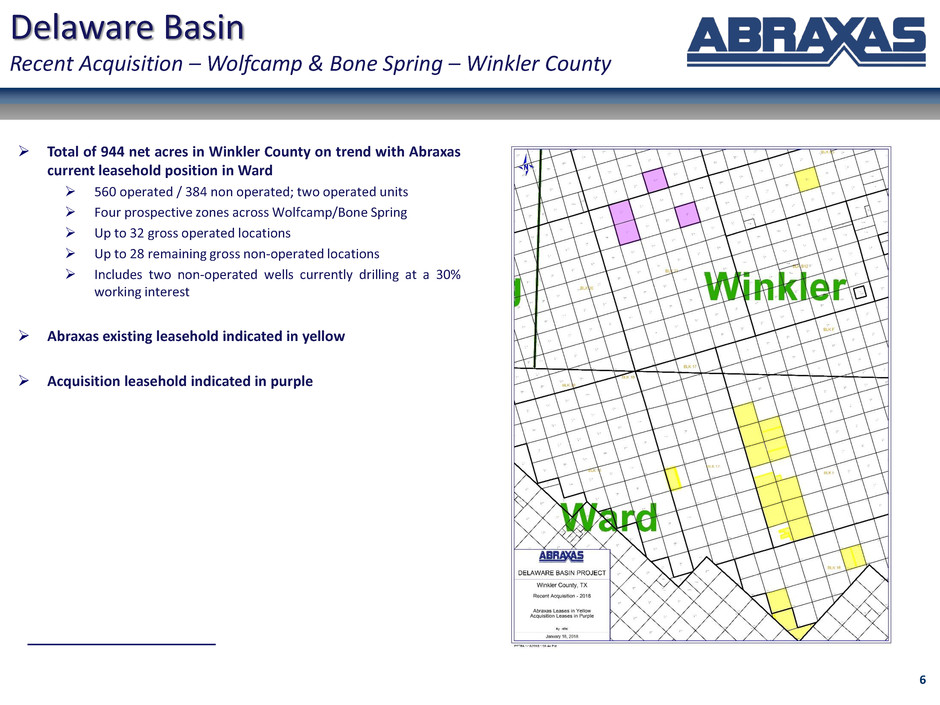

Delaware Basin

Recent Acquisition – Wolfcamp & Bone Spring – Winkler County

Total of 944 net acres in Winkler County on trend with Abraxas

current leasehold position in Ward

560 operated / 384 non operated; two operated units

Four prospective zones across Wolfcamp/Bone Spring

Up to 32 gross operated locations

Up to 28 remaining gross non-operated locations

Includes two non-operated wells currently drilling at a 30%

working interest

Abraxas existing leasehold indicated in yellow

Acquisition leasehold indicated in purple

7

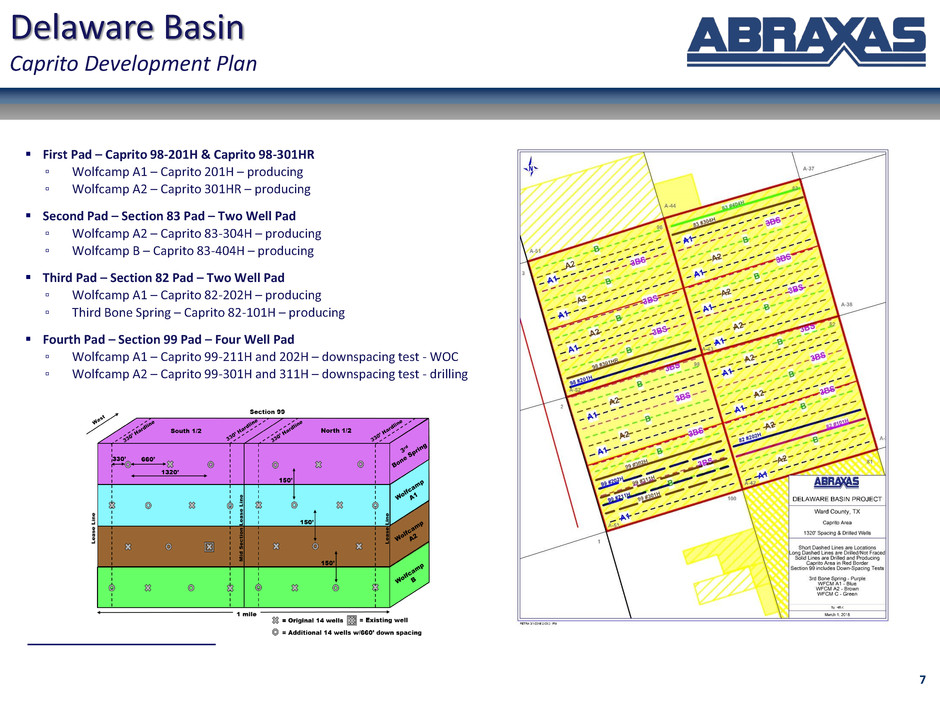

Delaware Basin

Caprito Development Plan

(1)

(1)

First Pad – Caprito 98-201H & Caprito 98-301HR

▫ Wolfcamp A1 – Caprito 201H – producing

▫ Wolfcamp A2 – Caprito 301HR – producing

Second Pad – Section 83 Pad – Two Well Pad

▫ Wolfcamp A2 – Caprito 83-304H – producing

▫ Wolfcamp B – Caprito 83-404H – producing

Third Pad – Section 82 Pad – Two Well Pad

▫ Wolfcamp A1 – Caprito 82-202H – producing

▫ Third Bone Spring – Caprito 82-101H – producing

Fourth Pad – Section 99 Pad – Four Well Pad

▫ Wolfcamp A1 – Caprito 99-211H and 202H – downspacing test - WOC

▫ Wolfcamp A2 – Caprito 99-301H and 311H – downspacing test - drilling

8

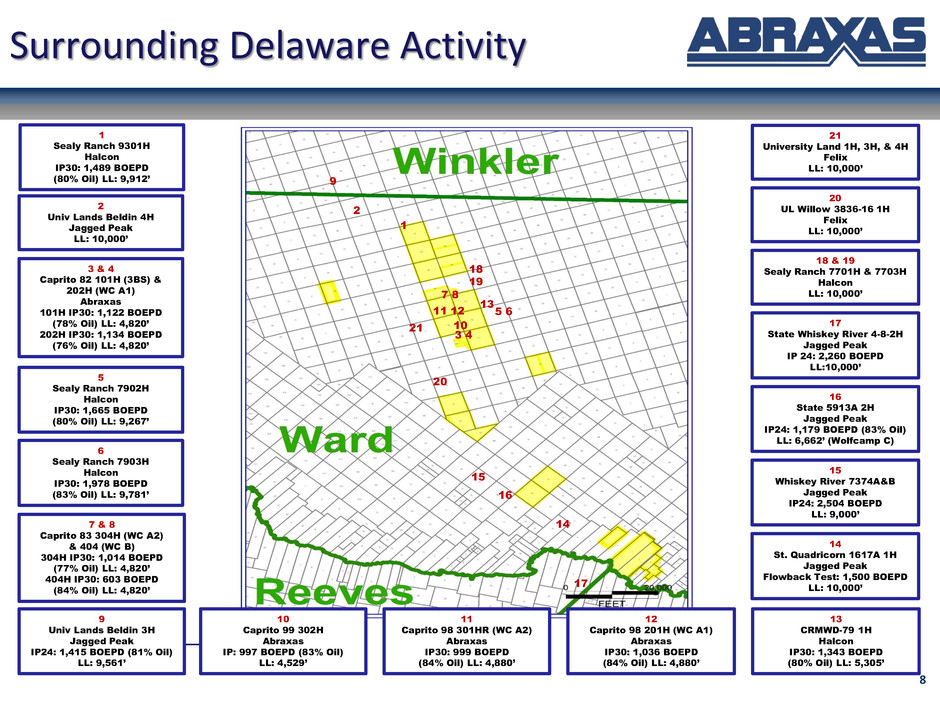

1

2

3 4

5 6

7 8

9

10

11 12

13

14

16

17

18

19

15

20

21

9

Univ Lands Beldin 3H

Jagged Peak

IP24: 1,415 BOEPD (81% Oil)

LL: 9,561’

Surrounding Delaware Activity

2

Univ Lands Beldin 4H

Jagged Peak

LL: 10,000’

3 & 4

Caprito 82 101H (3BS) &

202H (WC A1)

Abraxas

101H IP30: 1,122 BOEPD

(78% Oil) LL: 4,820’

202H IP30: 1,134 BOEPD

(76% Oil) LL: 4,820’

5

Sealy Ranch 7902H

Halcon

IP30: 1,665 BOEPD

(80% Oil) LL: 9,267’

7 & 8

Caprito 83 304H (WC A2)

& 404 (WC B)

304H IP30: 1,014 BOEPD

(77% Oil) LL: 4,820’

404H IP30: 603 BOEPD

(84% Oil) LL: 4,820’

1

Sealy Ranch 9301H

Halcon

IP30: 1,489 BOEPD

(80% Oil) LL: 9,912’

10

Caprito 99 302H

Abraxas

IP: 997 BOEPD (83% Oil)

LL: 4,529’

13

CRMWD-79 1H

Halcon

IP30: 1,343 BOEPD

(80% Oil) LL: 5,305’

11

Caprito 98 301HR (WC A2)

Abraxas

IP30: 999 BOEPD

(84% Oil) LL: 4,880’

12

Caprito 98 201H (WC A1)

Abraxas

IP30: 1,036 BOEPD

(84% Oil) LL: 4,880’

17

State Whiskey River 4-8-2H

Jagged Peak

IP 24: 2,260 BOEPD

LL:10,000’

18 & 19

Sealy Ranch 7701H & 7703H

Halcon

LL: 10,000’

15

Whiskey River 7374A&B

Jagged Peak

IP24: 2,504 BOEPD

LL: 9,000’

14

St. Quadricorn 1617A 1H

Jagged Peak

Flowback Test: 1,500 BOEPD

LL: 10,000’

16

State 5913A 2H

Jagged Peak

IP24: 1,179 BOEPD (83% Oil)

LL: 6,662’ (Wolfcamp C)

20

UL Willow 3836-16 1H

Felix

LL: 10,000’

21

University Land 1H, 3H, & 4H

Felix

LL: 10,000’

6

Sealy Ranch 7903H

Halcon

IP30: 1,978 BOEPD

(83% Oil) LL: 9,781’

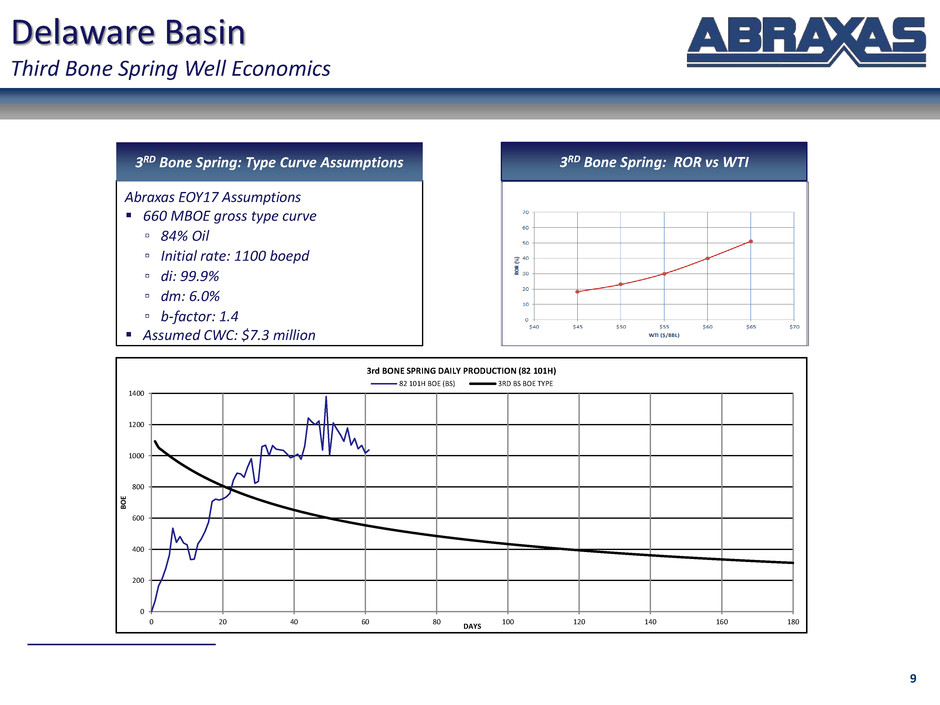

Delaware Basin

Third Bone Spring Well Economics

3RD Bone Spring: ROR vs WTI

Abraxas EOY17 Assumptions

660 MBOE gross type curve

▫ 84% Oil

▫ Initial rate: 1100 boepd

▫ di: 99.9%

▫ dm: 6.0%

▫ b-factor: 1.4

Assumed CWC: $7.3 million

3RD Bone Spring: Type Curve Assumptions

9

0

200

400

600

800

1000

1200

1400

0 20 40 60 80 100 120 140 160 180

B

O

E

DAYS

3rd BONE SPRING DAILY PRODUCTION (82 101H)

82 101H BOE (BS) 3RD BS BOE TYPE

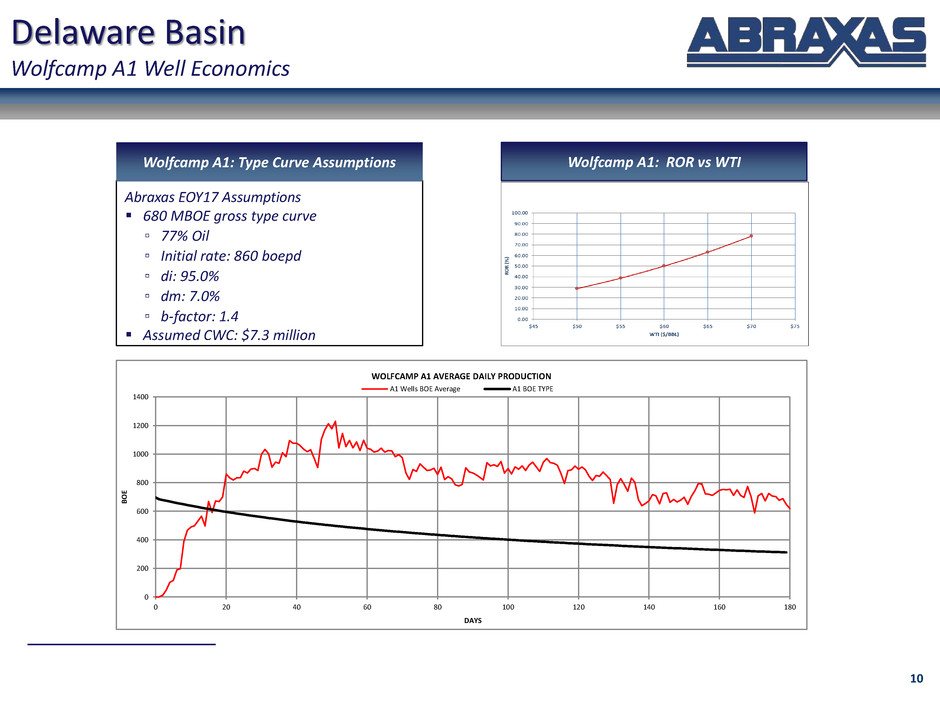

Delaware Basin

Wolfcamp A1 Well Economics

Wolfcamp A1: ROR vs WTI

Abraxas EOY17 Assumptions

680 MBOE gross type curve

▫ 77% Oil

▫ Initial rate: 860 boepd

▫ di: 95.0%

▫ dm: 7.0%

▫ b-factor: 1.4

Assumed CWC: $7.3 million

Wolfcamp A1: Type Curve Assumptions

10

0

200

400

600

800

1000

1200

1400

0 20 40 60 80 100 120 140 160 180

B

O

E

DAYS

WOLFCAMP A1 AVERAGE DAILY PRODUCTION

A1 Wells BOE Average A1 BOE TYPE

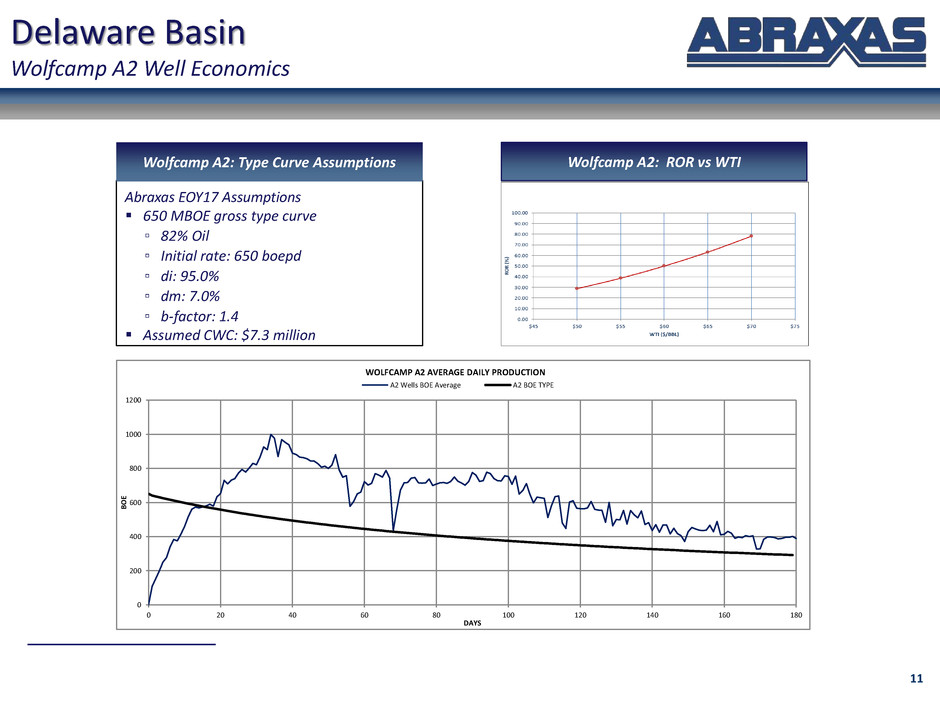

Delaware Basin

Wolfcamp A2 Well Economics

Wolfcamp A2: ROR vs WTI

Abraxas EOY17 Assumptions

650 MBOE gross type curve

▫ 82% Oil

▫ Initial rate: 650 boepd

▫ di: 95.0%

▫ dm: 7.0%

▫ b-factor: 1.4

Assumed CWC: $7.3 million

Wolfcamp A2: Type Curve Assumptions

11

0

200

400

600

800

1000

1200

0 20 40 60 80 100 120 140 160 180

B

O

E

DAYS

WOLFCAMP A2 AVERAGE DAILY PRODUCTION

A2 Wells BOE Average A2 BOE TYPE

Delaware Basin

Wolfcamp B Well Economics

Wolfcamp B: ROR vs WTI

Abraxas EOY17 Assumptions

535 MBOE gross type curve

▫ 85% Oil

▫ Initial rate: 580 boepd

▫ di: 95.0%

▫ dm: 7.0%

▫ b-factor: 1.4

Assumed CWC: $7.3 million

Wolfcamp B: Type Curve Assumptions

12

0

100

200

300

400

500

600

700

800

0 20 40 60 80 100 120 140 160 180

B

O

E

DAYS

WOLFCAMP B DAILY PRODUCTION (83 404H)

393 B BOE TYPE

13

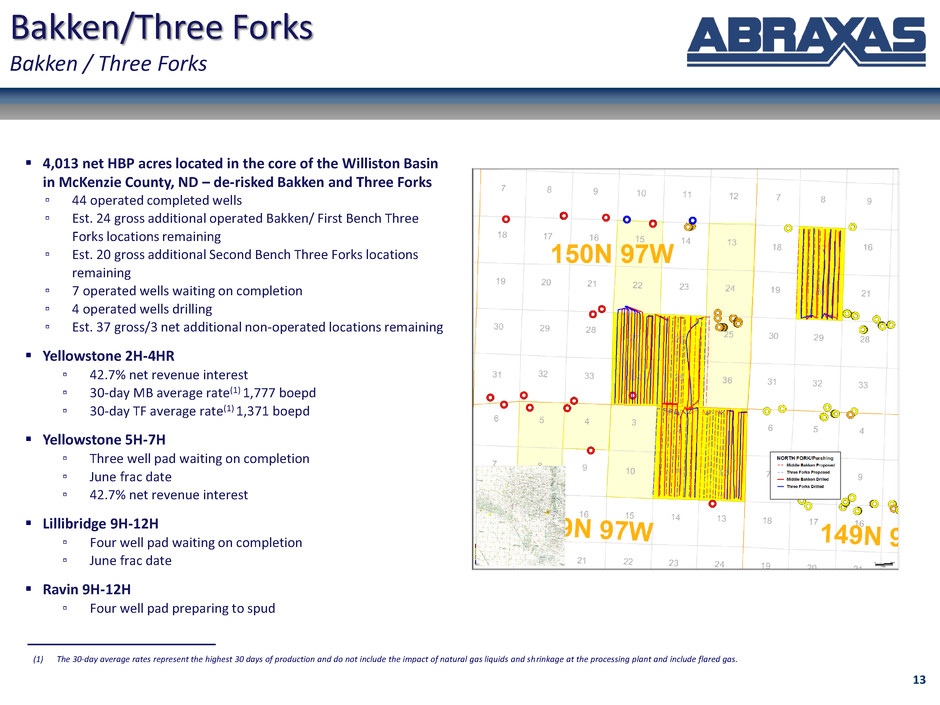

Bakken/Three Forks

Bakken / Three Forks

4,013 net HBP acres located in the core of the Williston Basin

in McKenzie County, ND – de-risked Bakken and Three Forks

▫ 44 operated completed wells

▫ Est. 24 gross additional operated Bakken/ First Bench Three

Forks locations remaining

▫ Est. 20 gross additional Second Bench Three Forks locations

remaining

▫ 7 operated wells waiting on completion

▫ 4 operated wells drilling

▫ Est. 37 gross/3 net additional non-operated locations remaining

Yellowstone 2H-4HR

▫ 42.7% net revenue interest

▫ 30-day MB average rate(1) 1,777 boepd

▫ 30-day TF average rate(1) 1,371 boepd

Yellowstone 5H-7H

▫ Three well pad waiting on completion

▫ June frac date

▫ 42.7% net revenue interest

Lillibridge 9H-12H

▫ Four well pad waiting on completion

▫ June frac date

Ravin 9H-12H

▫ Four well pad preparing to spud

(1) The 30-day average rates represent the highest 30 days of production and do not include the impact of natural gas liquids and shrinkage at the processing plant and include flared gas.

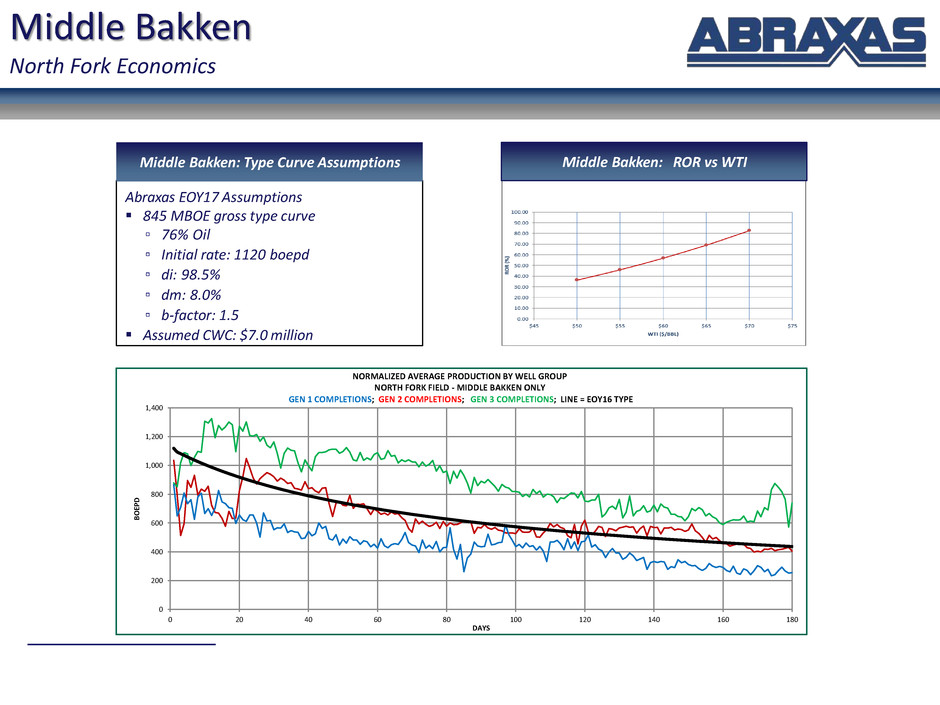

Middle Bakken

North Fork Economics

Middle Bakken: ROR vs WTI

Abraxas EOY17 Assumptions

845 MBOE gross type curve

▫ 76% Oil

▫ Initial rate: 1120 boepd

▫ di: 98.5%

▫ dm: 8.0%

▫ b-factor: 1.5

Assumed CWC: $7.0 million

Middle Bakken: Type Curve Assumptions

0

200

400

600

800

1,000

1,200

1,400

0 20 40 60 80 100 120 140 160 180

B

O

EP

D

DAYS

NORMALIZED AVERAGE PRODUCTION BY WELL GROUP

NORTH FORK FIELD - MIDDLE BAKKEN ONLY

GEN 1 COMPLETIONS; GEN 2 COMPLETIONS; GEN 3 COMPLETIONS; LINE = EOY16 TYPE

Three Forks

North Fork Economics

Three Forks: ROR vs WTI

Abraxas EOY17 Assumptions

723 MBOE gross type curve

▫ 73% Oil

▫ Initial rate: 1050 boepd

▫ di: 98.5%

▫ dm: 8.0%

▫ b-factor: 1.5

Assumed CWC: $7.0 million

Three Forks: Type Curve Assumptions

0

200

400

600

800

1000

1200

1400

0 20 40 60 80 100 120 140 160 180

B

O

EP

D

DAYS

NORMALIZED AVERAGE PRODUCTION BY WELL GROUP

NORTH FORK FIELD - THREE FORKS ONLY

GEN 1 COMPLETIONS; GEN 2 COMPLETIONS; GEN 3 COMPLETIONS; LINE=EOY16 TYPE

16

(1) 2018 daily volumes indicated for February – December 2018.

(2) Straight line average price. Includes 2,651 and 1,200 of WTI swaps in 2018 and 2019, respectively. Includes 500 Bopd and 1,000 Bopd of LLS swaps in 2018 and 2019, respectively.

Abraxas Hedging Profile

2018 (1) 2019 2020

Oil Swaps (bbls/day) 4,453 2,783 2,206

NYMEX (2) $53.74 $55.66 $54.34