Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - SYNTHESIS ENERGY SYSTEMS INC | exh_992.htm |

| 8-K - FORM 8-K - SYNTHESIS ENERGY SYSTEMS INC | f8k_031318.htm |

Exhibit 99.1

Synthesis Energy Systems, Inc. 30 th Annual ROTH Conference March 2018 Clean | Economic | Sustainable Global Energy Growth With Blue Skies

©2018 Synthesis Energy Systems, Inc., All Rights Reserved Forward - Looking Statements This presentation includes "forward - looking statements" within the meaning of Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities Exchange Act of 1934 , as amended . All statements other than statements of historical fact are forward - looking statements and are subject to certain risks, trends and uncertainties that could cause actual results to differ materially from those projected . Although we believe that in making such forward - looking statements, our expectations are based upon reasonable assumptions, such statements may be influenced by factors that could cause actual outcomes and results to be materially different from those projected by us . Among those risks, trends and uncertainties are the ability of Batchfire Resources Pty Ltd (“BFR”) and Australian Future Energy Pty Ltd (“AFE”) management to successfully grow and develop their Australian assets and operations, including Callide and Pentland ; the ability of AFE and BFR to produce earnings and pay dividends ; the ability of SES EnCoal Energy sp . z o . o . management to successfully grow and develop projects, assets and operations in Poland ; our ability to raise additional capital ; our indebtedness and the amount of cash required to service our indebtedness ; our ability to develop and expand business of the Tianwo - SES Joint Venture in the joint venture territory ; our ability to develop our power business unit and our other business verticals, including DRI steel, through our marketing arrangement with Midrex Technologies ; our ability to successfully develop our licensing business ; the ability of our project with Yima to produce earnings and pay dividends ; the economic conditions of countries where we are operating ; events or circumstances which result in an impairment of our assets ; our ability to reduce operating costs ; our ability to make distributions and repatriate earnings from our Chinese operations ; our ability to maintain our listing on the NASDAQ Stock Market ; our ability to successfully commercialize our technology at a larger scale and higher pressures ; commodity prices, including in particular coal, natural gas, crude oil, methanol and power ; the availability and terms of financing ; our customers’ and/or our ability to obtain the necessary approvals and permits for future projects ; our ability to estimate the sufficiency of existing capital resources ; the sufficiency of internal controls and procedures ; and our results of operations in countries outside of the U . S . , where we are continuing to pursue and develop projects . We cannot assure you that the assumptions upon which these statements are based will prove to be correct . Please refer to our latest Form 10 - K available on our website at www . synthesisenergy . com . 2

©2018 Synthesis Energy Systems, Inc., All Rights Reserved 3 CLEAN ENERGY PRODUCTION VARIETY OF ENERGY PRODUCTS UNIQUE TECHNOLOGY COMMERCIALLY PROVEN NEW PROJECTS COMING FORWARD ENVIRONMENTALLY SUPERIOR LOWER COST THAN LNG & CONVENTIONAL COAL Proven Technology, Low - Cost Clean Energy SES Yima Joint Venture Plant, China ̹ 2018 Synthesis Energy Systems, Inc. All Rights Reserved

©2018 Synthesis Energy Systems, Inc., All Rights Reserved Investment Highlights • Clean Energy Company – 2007 Nasdaq: SES • Unique Proven Technology – enables low - cost, clean synthesis gas energy production • Growing Asset Base – well - positioned to grow company value • Diversified Business Model – multiple channels for delivering financial results • Experienced Leadership – management and Board from Fortune 100 and top energy companies, plus long - established partnerships with regional experts 4 NASDAQ: SES As of Feb. 28, 2018 Market Cap $28.52 MM Shares Outstanding 10.97 MM Public Float 8.7 MM % Officers and Directors 4.2% % Held by Institutions 23.7%

©2018 Synthesis Energy Systems, Inc., All Rights Reserved OUTLOOK • Expanding 30% by 2040, population 7.4B to 9B • 1 in 5 people without electricity today • Rapid electrification of energy – wildcard • Renewables grow from 9% to 13% by 2040 • 30% increase in global gas demand by 2040 • Coal remains primary fuel for electricity in 2040 5 Global Energy SES BRINGS A UNIQUE, PROVEN SOLUTION TO ENERGY EXPENSIVE REGIONS OF THE WORLD ̹ 2018 Synthesis Energy Systems, Inc. All Rights Reserved Sources: 2017 World Energy Outlook, Cheniere 2017 Corp. Presentation, Industry Data and SES Internal Analysis CHALLENGES • High - growth regions lack low - cost gas • Renewables challenged to produce • Steady baseload power production • Transportation fuels & industrial energy • Global gas/LNG demand drives up price • Coal is abundant but needs cleaner solutions

©2018 Synthesis Energy Systems, Inc., All Rights Reserved 6 Our Technology CLEAN Superior environmental performance with low air emissions and water usage, and carbon capture capability EFFICIENT 98%+ Carbon Conversion 80%+ Cold Gas Efficiency Integrated heat utilization LOW CAPEX & OPEX Low - cost feedstock produces low - cost syngas Scalable and modular capable 20 MW to 500MW+ (Thermal) PROVEN Rooted in 40 years of development and 5 completed commercial operating facilities FLEXIBLE Converts coal, coal wastes, biomass, municipal wastes to synthesis gas (Syngas) VERSATILE Like natural gas, SES’s syngas can make chemicals, electric power, fertilizers, transportation fuels, and industrial energy

©2018 Synthesis Energy Systems, Inc., All Rights Reserved Target Markets x High - priced natural gas x Abundant low - cost coal and waste resources (1) x Need for cleaner utilization of indigenous coal Value Creation x Establish regional growth platform companies x Partnerships with strong local expertise x Leverage technology to secure lowest cost feedstocks x Supply technology plus build, own and operate projects x Enable low - cost producer projects Regional Growth Platforms x Develop attractive energy projects for investment x Raise project funds locally x Own coal and renewable energy resources x Secure 3 rd party projects for SES Technology supply 7 (1) Thermal coal, lignite and brown coal, coal wastes , biomass and municipal wastes (MSW, RDF, ASR) (2) Varies with project scale. Realized over 1 - year development and 2 - to 3 - year construction to start - up period Strategy and Business Model Top Line Revenue/Bottom Line Earnings $50MM - $150MM - Total Order Value Per Project (2) • Technology – Technology License Royalties • Services – Technology Engineering and Design • Equipment – Proprietary Technology Hardware Sales Equity Income Dividends • Joint Venture Project Operations • Ownership in Coal Mining Operations • Ownership in Growth Platforms

©2018 Synthesis Energy Systems, Inc., All Rights Reserved +5 Years China Australia Future Energy Batchfire Poland - SES EnCoal Energy SES Technologies +2 Years China Australia Future Energy Batchfire Poland - SES EnCoal Energy SES Technologies Current China Australia Future Energy Batchfire Poland - SES EnCoal Energy SES Technologies Positioned for Growth 8 BATCHFIRE RESOURCES SES TECHNOLOGIES AUSTRALIAN FUTURE ENERGY CHINA SES ENCOAL ENERGY - POLAND CURRENT +2 YEARS OUT +5 YEARS OUT ~$70 Million ~$320 Million ~$500 Million Projected (1) Value of Assets (Millions USD) Current +2 Years +5 Years Australia (AFE) 17 88 106 Batchfire 31 132 178 Poland (SEE) - 10 70 China 9 9 9 SES Technologies 15 85 143 (1) (1) (1) (1) Projections based on internal business plans and forecast for existing SES assets using risk weighted discounted NPV methodology. SES corporate overhead cost ~$6 million annually not included

©2018 Synthesis Energy Systems, Inc., All Rights Reserved • Spin - off from AFE founded in 2016 • Acquired 100% of Callide Coal Mine, Queensland • ~1.7B metric ton resource • ~230MM metric tons reserves • Current production: ~10MM metric tons annually • Potential for further expansion • Lowering costs to near bottom of global cost curve • Positive cash flow operations with coal sales of: • ~5.5MM metric tons: 1500MW Power Plant • ~1MM metric tons: domestic Gladstone • ~3.5MM metric tons exported to Asia – expanding • Significant asset of which SES owns 11.4% • Founded 2014, Brisbane HQ • Objective to grow a large - scale vertically integrated energy enterprise in Australia • SES holds 39% ownership of AFE • 3 focus projects in development now • 270MM metric ton Coal Resource • 280 MW Electric Power - Phase 1 • Syngas: Industrial Fuel & Ammonia • Estimated annual EBIDTA ~$260 Million • AFE anticipates holding ~50% of each project • First project revenue expected in 2020 9 Growth Platform 1 – Australia

©2018 Synthesis Energy Systems, Inc., All Rights Reserved • Initial Customer of Polish Platform • Tauron is a large Polish utility – 5.1GW capacity • Leading innovation for clean coal • Project 1: 200MW power boiler conversion • Convert coal boilers to syngas • Utilization of waste coals and municipal waste • Potential for multiple follow - on projects • SES Technology Package supply • SES’s Poland Platform Company • Formed Nov. 2017, Warsaw HQ • Large market with clean coal demand • Targets Polish waste coals to energy • Power, chemicals and industrial fuel • 4+ projects in early development • SES Technology supply order near - term • Longer term build, own and operate • SES owns 50% 10 Growth Platform 2 – Poland

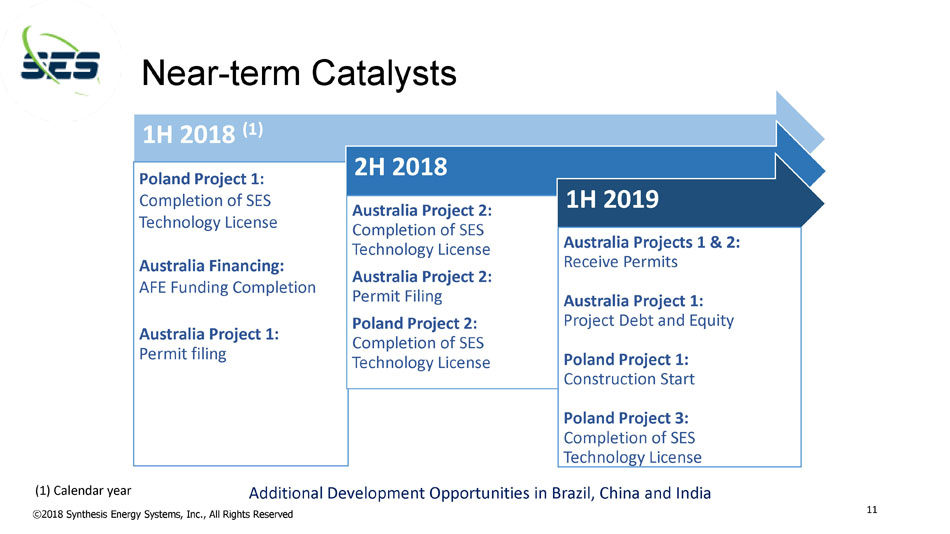

©2018 Synthesis Energy Systems, Inc., All Rights Reserved Near - term Catalysts 1H 2018 (1) Poland Project 1: Completion of SES Technology License Australia Financing: AFE Funding Completion Australia Project 1: Permit filing 2H 2018 Australia Project 2: Completion of SES Technology License Australia Project 2: Permit Filing Poland Project 2: Completion of SES Technology License 1H 2019 Australia Projects 1 & 2: Receive Permits Australia Project 1: Project Debt and Equity Poland Project 1: Construction Start Poland Project 3: Completion of SES Technology License Additional Development Opportunities in Brazil, China and India (1) Calendar year 11

©2018 Synthesis Energy Systems, Inc., All Rights Reserved 12 Why Synthesis Energy Systems Now • Existing Valuable Assets with Rapid Growth Potential • Growing Global Demand in Clean Energy Sector • Unique Technology for Low - Cost Producer Energy Projects • Proven Technology with 5 Projects Completed • Regional Growth Platforms with Next Wave of Projects • Business Model for Top Line and Bottom Line Results • Owners in Existing Mining Operations Clean | Economic | Sustainable Global Energy Growth With Blue Skies ©2017 Synthesis Energy Systems, Inc., All Rights Reserved

Nasdaq: SES synthesisenergy.com Growth With Blue Skies Investor Relations: MDC GROUP Contact: David Castaneda, (414) 351 - 9758 IR@synthesisenergy.com