Attached files

| file | filename |

|---|---|

| EX-31.2 - EXHIBIT 31.2 - SYNALLOY CORP | synl-20171231x10kex312.htm |

| EX-21 - EXHIBIT 21 - SYNALLOY CORP | synl-20171231x10kex21.htm |

| EX-32 - EXHIBIT 32 - SYNALLOY CORP | synl-20171231x10kex32.htm |

| EX-31.3 - EXHIBIT 31.3 - SYNALLOY CORP | synl-20171231x10kex313.htm |

| EX-31.1 - EXHIBIT 31.1 - SYNALLOY CORP | synl-20171231x10kex311.htm |

| EX-23.1 - EXHIBIT 23.1 - SYNALLOY CORP | synl-20171231x10kex231.htm |

| EX-10.11 - EXHIBIT 10.11 - SYNALLOY CORP | synl-20171231x10kex1011.htm |

| EX-10.8 - EXHIBIT 10.8 - SYNALLOY CORP | synl-20171231x10kex108.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED DECEMBER 31, 2017 |

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

COMMISSION FILE NUMBER 0-19687

SYNALLOY CORPORATION

(Exact name of registrant as specified in its charter)

Delaware | 57-0426694 | |

(State of incorporation) | (I.R.S. Employer Identification No.) | |

4510 Cox Road, Suite 201, Richmond, Virginia, 23060 | ||

(Address of principal executive offices) (Zip Code) | ||

Registrant's telephone number, including area code: (864) 585-3605 | ||

Securities registered pursuant to Section 12(b) of the Act | Name of each exchange on which registered: | |

Common Stock, $1.00 Par Value | NASDAQ Global Market | |

(Title of Class) | ||

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act. (Check one)

Large accelerated filer | ¨ | Accelerated filer | x |

Non-accelerated filer | ¨ Do not check if smaller reporting company | Smaller reporting company | ¨ |

Emerging growth company | ¨ | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

Based on the closing price as of June 30, 2017, which was the last business day of the registrant's most recently completed second fiscal quarter, the aggregate market value of the common stock held by non-affiliates of the registrant was $92.9 million. Based on the closing price as of March 9, 2018, the aggregate market value of common stock held by non-affiliates of the registrant was $109.8 million. The registrant did not have any non-voting common equity outstanding at either date.

The number of shares outstanding of the registrant's common stock as of March 9, 2018 was 8,757,434.

Documents Incorporated By Reference

Portions of the Proxy Statement for the 2017 annual shareholders' meeting are incorporated by reference into Part III of this Form 10-K.

Synalloy Corporation

Form 10-K

For Period Ended December 31, 2017

Table of Contents

Page # | |||

Report of Independent Registered Public Accounting Firm - Consolidated Financial Statements - KPMG LLP | |||

Report of Independent Registered Public Accounting Firm - Internal Control - KPMG LLP | |||

1

Forward-Looking Statements

This Annual Report on Form 10-K includes and incorporates by reference "forward-looking statements" within the meaning of the federal securities laws. All statements that are not historical facts are forward-looking statements. The words "estimate," "project," "intend," "expect," "believe," "should," "anticipate," "hope," "optimistic," "plan," "outlook," "should," "could," "may" and similar expressions identify forward-looking statements. The forward-looking statements are subject to certain risks and uncertainties, including without limitation those identified below, which could cause actual results to differ materially from historical results or those anticipated. Readers are cautioned not to place undue reliance on these forward-looking statements. The following factors could cause actual results to differ materially from historical results or those anticipated: adverse economic conditions; the impact of competitive products and pricing; product demand and acceptance risks; raw material and other increased costs; raw materials availability; employee relations; ability to maintain workforce by hiring trained employees; labor efficiencies; customer delays or difficulties in the production of products; new fracking regulations; a prolonged decrease in nickel and oil prices; unforeseen delays in completing the integrations of acquisitions; risks associated with mergers, acquisitions, dispositions and other expansion activities; financial stability of our customers; environmental issues; negative or unexpected results from tax law changes; unavailability of debt financing on acceptable terms and exposure to increased market interest rate risk; inability to comply with covenants and ratios required by our debt financing arrangements; ability to weather an economic downturn; loss of consumer or investor confidence and other risks detailed from time-to-time in Synalloy Corporation's Securities and Exchange Commission filings. Synalloy Corporation assumes no obligation to update any forward-looking information included in this Annual Report on Form 10-K.

PART I

Item 1 Business

Synalloy Corporation, a Delaware corporation, was incorporated in 1958 as the successor to a chemical manufacturing business founded in 1945. Its charter is perpetual. The name was changed on July 31, 1967 from Blackman Uhler Industries, Inc. The Company's executive office is located at 4510 Cox Road, Suite 201, Richmond, Virginia 23060 with an additional corporate and shared services office at 775 Spartan Boulevard, Suite 102, Spartanburg, South Carolina 29301. Unless indicated otherwise, the terms "Company," "we" "us," and "our" refer to Synalloy Corporation and its consolidated subsidiaries.

The Company's business is divided into two reportable operating segments, the Metals Segment and the Specialty Chemicals Segment. The Metals Segment operates as three reporting units, all International Organization for Standardization ("ISO") certified manufacturers, including Bristol Metals, LLC ("BRISMET"), a wholly-owned subsidiary of Synalloy Metals, Inc., Palmer of Texas Tanks, Inc. ("Palmer") and Specialty Pipe & Tube, Inc. ("Specialty"). BRISMET manufactures stainless steel and other alloy pipe and tube. Palmer manufactures liquid storage solutions and separation equipment, and Specialty is a master distributor of seamless carbon pipe and tube. The Metals Segment's markets include the oil and gas, chemical, petrochemical, pulp and paper, mining, power generation (including nuclear), water and waste water treatment, liquid natural gas ("LNG"), brewery, food processing, petroleum, pharmaceutical and other heavy industries. The Specialty Chemicals Segment operates as one reporting unit which includes Manufacturers Chemicals, LLC ("MC"), a wholly-owned subsidiary of Manufacturers Soap and Chemical Company ("MS&C"), and CRI Tolling, LLC ("CRI Tolling"). The Specialty Chemicals Segment produces specialty chemicals for the chemical, paper, metals, mining, agricultural, fiber, paint, textile, automotive, petroleum, cosmetics, mattress, furniture, janitorial and other industries. MC manufactures lubricants, surfactants, defoamers, reaction intermediaries and sulfated fats and oils. CRI Tolling provides chemical tolling manufacturing resources to global and regional chemical companies and contracts with other chemical companies to manufacture certain, pre-defined products.

General

Metals Segment – This segment is comprised of three wholly-owned subsidiaries: Synalloy Metals, Inc., which owns 100 percent of BRISMET, located in Bristol, Tennessee and Munhall, Pennsylvania; Palmer, located in Andrews, Texas; and Specialty, located in Mineral Ridge, Ohio and Houston, Texas.

BRISMET manufactures welded pipe and tube, primarily from stainless steel, but also from other corrosion-resistant metals. Pipe is produced in sizes from one-half inch to 120 inches in diameter and wall thickness up to one and one-half inches. Eighteen-inch and smaller diameter pipe is made on equipment that forms and welds the pipe in a continuous process. Pipe larger than 18 inches in diameter is formed on presses or rolls and welded on batch welding equipment. Pipe is normally produced in standard 20-foot lengths. However, BRISMET has unusual capabilities in the production of long length pipe without circumferential welds. This can reduce the installation cost for the customer. Lengths up to 60 feet can be produced in sizes up to 18 inches in diameter. In larger sizes, BRISMET has a unique ability among domestic producers to make 48-foot lengths in diameters up to 36 inches. Over the past four years, BRISMET has made substantial capital improvements, installing an energy efficient furnace to anneal pipe

2

quicker while minimizing natural gas usage; system improvements in pickling to maintain the proper chemical composition of the pickling acid; and developing a heavy wall/quick turn welded pipe production shop by adding a 4,000 tonne press along with all necessary ancillary processes. BRISMET's Munhall facility manufactures welded pipe as well as new product offerings in welded tubing in diameters from 5/8 inch to 8 inches and gauges in diameters from 0.028 inches to 0.120 inches. The Munhall facility was designed for improved product flow and the latest technology including laser welding and in-line annealing.

Palmer is a manufacturer of fiberglass and steel storage tanks for the oil and gas, waste water treatment and municipal water industries. Located in Andrews, Texas, Palmer is ideally located in the heart of a significant oil and gas production territory. Palmer produces made-to-order fiberglass tanks, utilizing a variety of custom mandrels and application specific materials. Its fiberglass tanks range from two feet to 30 feet in diameter at various heights. The majority of these tanks are used for oil field waste water capture and are an integral part of the environmental regulatory compliance of the drilling process. Each fiberglass tank is manufactured to American Petroleum Institute Q1 standards to ensure product quality. Palmer's steel storage tank facility enables efficient, environmentally compliant production with designed-in expansion capability to support future growth. Finished steel tanks range in size predominantly from 50 to 1,500 barrels and are used to store extracted oil. During 2014, Palmer obtained all of the necessary certifications to produce certified pressure vessels. These certifications allow Palmer to sell all of the separator and storage equipment needed at a well site.

Specialty is a leading master distributor of hot finish, seamless, carbon steel pipe and tubing, with an emphasis on large outside diameters and exceptionally heavy wall thickness. Specialty's products are primarily used for mechanical and high pressure applications in the oil and gas, capital goods manufacturing, heavy industrial, construction equipment, paper and chemical industries. Operating from facilities located in Mineral Ridge, Ohio and Houston, Texas, Specialty is well-positioned to serve the major industrial and energy regions and successfully reach other target markets across the United States. Specialty performs value-added processing on approximately 80 percent of products shipped, which would include cutting to length, heat treatment, testing, boring and end finishing and typically processes and ships orders in 24 hours or less. Based upon its short lead times, Specialty plays a critical role in the supply chain, supplying long lead-time items to markets that demand fast deliveries, custom lengths and reliable execution of orders.

In order to establish stronger business relationships, the Metals Segment uses only a few raw material suppliers. Nine suppliers furnish approximately 80 percent of total dollar purchases of raw materials, with one supplier furnishing 40 percent of material purchases. However, the Company does not believe that the loss of this supplier would have a materially adverse effect on the Company as raw materials are readily available from a number of different sources, and the Company anticipates no difficulties in fulfilling its requirements.

Specialty Chemicals Segment – This segment consists of the Company's wholly-owned subsidiary MS&C. MS&C owns 100 percent of the membership interests of MC, which has a production facility in Cleveland, Tennessee. This segment also includes CRI Tolling which is located in Fountain Inn, South Carolina. MC and CRI Tolling are aggregated as one reporting unit and comprise the Specialty Chemicals Segment. Both facilities are fully licensed for chemical manufacture. MC manufactures lubricants, surfactants, defoamers, reaction intermediaries and sulfated fats and oils. CRI Tolling provides chemical tolling manufacturing resources to global and regional companies and contracts with other chemical companies to manufacture certain pre-defined products.

MC produces over 1,100 specialty formulations and intermediates for use in a wide variety of applications and industries. MC's primary product lines focus on the areas of defoamers, surfactants and lubricating agents. These three fundamental product lines find their way into a large number of manufacturing businesses. Over the years, the customer list has grown to include end users and chemical companies that supply paper, metal working, surface coatings, water treatment, paint, mining, oil and gas and janitorial applications. MC's capabilities also include the sulfation of fats and oils. These products are used in a wide variety of applications and represent a renewable resource, animal and vegetable derivatives, as alternatives to more expensive and non-renewable petroleum derivatives.

MC's strategy has been to focus on industries and markets that have good prospects for sustainability in the U.S. in light of global trends. MC's marketing strategy relies on sales to end users through its own sales force, but it also sells chemical intermediates to other chemical companies and distributors. It also has close working relationships with a significant number of major chemical companies that outsource their production for regional manufacture and distribution to companies like MC. MC has been ISO registered since 1995.

The Specialty Chemicals Segment maintains six laboratories for applied research and quality control which are staffed by eleven employees.

Most raw materials used by the segment are generally available from numerous independent suppliers and approximately 52 percent of total purchases are from its top 15 suppliers. While some raw material needs are met by a sole supplier or only a few suppliers, the Company anticipates no difficulties in fulfilling its raw material requirements.

3

Please see Note 15 to the Consolidated Financial Statements, which are included in Item 8 of this Form 10-K, for financial information about the Company's segments.

Sales and Distribution

Metals Segment – The Metals Segment utilizes separate sales organizations for its different product groups. Stainless steel pipe is sold worldwide under the BRISMET trade name through authorized stocking distributors at warehouse locations throughout the country. Producing sales and providing service to the distributors and end-user customers are BRISMET's President, two outside sales employees, seven independent manufacturers' representatives and eight inside sales employees. Additionally, BRISMET operates international offices in Brussels, Belgium and Shanghai, China, with one person in each office.

Palmer employs three sales professionals that manage the relationship with customers and partnerships to identify and secure new sales. Additionally, the Metals Segment President assists in account relationship management with large customers. Customer feedback and in-field experience generate product enhancements and new product development.

Approximately 80 percent of Specialty's pipe and tube sales are to North American pipe and tube distributors with the remainder comprised of sales to end use customers. In addition to Specialty's President, Specialty utilizes two manufacturers' representatives and nine inside sales employees, whom are located at both locations, to obtain sales orders and service its customers.

The Metals Segment had one domestic customer that accounted for approximately 14 percent of the segment's revenues for 2015. There were no customers representing more than ten percent of the Metals Segment's revenues for 2017 or 2016.

Specialty Chemicals Segment – Specialty chemicals are sold directly to various industries nationwide by five full-time outside sales employees and eight manufacturers' representatives. The Specialty Chemicals Segment has one customer that accounted for approximately 23, 25 and 31 percent of the segment's revenues for 2017, 2016 and 2015, respectively. The concentration of sales to this customer declined as a result of this customer moving production of the products previously produced and sold by the Specialty Chemicals Segment in house.

Competition

Metals Segment – Welded stainless steel pipe is the largest sales volume product of the Metals Segment. Although information is not publicly available regarding the sales of most other producers of this product, management believes that the Company is one of the largest domestic producers of such pipe. This commodity product is highly competitive with eight known domestic producers, including the Company, and imports from many different countries.

Due to the size of the tanks produced and shipped to its customers, the majority of Palmer's products is sold within a 300 mile radius from its plant in Andrews, Texas. There are currently 18 tank producers, with similar capabilities, servicing that same area.

Specialty is a leader in the specialized products segment of the pipe and tube market by offering an industry-leading in-stock inventory of a broad range of high quality products, including specialized products with limited availability. Specialty's dual branches have both common and regional-specific products and capabilities. There are four known significant pipe and tube distributors with similar capabilities to Specialty.

Specialty Chemicals Segment – The Company is the sole producer of certain specialty chemicals manufactured for other companies under processing agreements and also produces proprietary specialty chemicals. The Company's sales of specialty products are insignificant compared to the overall market for specialty chemicals. The market for most of the products is highly competitive and many competitors have substantially greater resources than does the Company.

Mergers, Acquisitions and Dispositions

The Company is committed to a long-term strategy of (a) reinvesting capital in our current business segments to foster their organic growth, (b) disposing of underperforming business segments and (c) completing acquisitions that expand our current business segments or establish new manufacturing platforms. Targeted acquisitions are priced to be economically feasible and focus on achieving positive long-term benefits. These acquisitions may be paid for in the form of cash, stock, debt or a combination thereof. The amount and type of consideration and deal charges paid could have a short-term dilutive effect on the Company's earnings per share. However, such transactions are anticipated to provide long-term economic benefit to the Company.

On December 9, 2016, the Company's subsidiary BRISMET, entered into a definitive agreement to acquire the stainless steel pipe and tube assets of Marcegaglia USA, Inc. ("MUSA") located in Munhall, PA to enhance its on-going business with additional capacity and technological advantages. The transaction closed on February 28, 2017. The agreement was structured as an asset purchase and excluded MUSA's galvanized and ornamental tubing products. The purchase price for the transaction, which excludes real estate and certain other assets, totaled $14,954,000; the assets purchased from MUSA include inventory, production and

4

maintenance supplies and equipment less specific identified liabilities assumed. In accordance with the agreement, on December 9, 2016, BRISMET entered into an escrow agreement and deposited $3,000,000 into the escrow fund. During the fourth quarter of 2017, the Company finalized the purchase price allocation for the acquisition. As part of the MUSA transaction, BRISMET assumed all of MUSA's rights and obligations pursuant to the Collective Bargaining Agreement between MUSA and the United Steel, Paper and Forestry, Rubber, Manufacturing, Energy, Allied Industrial and Service Workers International Union AFL-CIO, on behalf of Local Union 5852-22 (the "Union") dated October 1, 2013 (the "CBA"). At the closing of the transaction, BRISMET and the Union amended the CBA to include a modest wage increase and to extend the CBA's termination date to September 30, 2018. A new CBA was ratified that extends the termination date to January 2023.

Environmental Matters

Environmental expenditures that relate to an existing condition caused by past operations and do not contribute to future revenue generation are expensed. Liabilities are recorded when environmental assessments and/or cleanups are probable and the costs of these assessments and/or cleanups can be reasonably estimated. Changes to laws and environmental issues, including climate change, are made or proposed with some frequency and some of the proposals, if adopted, might directly or indirectly result in a material reduction in the operating results of one or more of our operating units. We are presently unable to foresee the future well enough to quantify such risks. See Note 7 to the Consolidated Financial Statements, which are included in Item 8 of this Form 10-K, for further discussion.

Research and Development Activities

The Company spent approximately $556,000 in 2017, $603,000 in 2016 and $548,000 in 2015 on research and development activities that were expensed in its Specialty Chemicals Segment. Five individuals, all of whom are graduate chemists, are engaged primarily in research and development of new products and processes, the improvement of existing products and processes, and the development of new applications for existing products.

Seasonal Nature of the Business

With the exception of Palmer and Specialty's Houston location, which primarily serves the oil and gas industry, the Company’s businesses and products are generally not subject to any seasonal impact that results in significant variations in revenues from one quarter to another. Fourth quarter revenue and profit for Palmer and Specialty Houston can be as much as 25 percent below the other three quarters due to vacation schedules for customer field crews working at the drill sites.

Backlogs

The Specialty Chemicals Segment operates primarily on the basis of delivering products soon after orders are received. Accordingly, backlogs are not a factor in this business. The same applies to seamless, carbon steel pipe and tubing sales in the Metals Segment. However, backlogs are important in the Metals Segment's welded stainless steel pipe and tank manufacturing operations, where both businesses incur significant dollar value of committed orders in advance of production. Its backlog of open orders for welded stainless steel pipe were $28,783,000 and $18,752,000 and for tanks were $17,192,000 and $9,878,000 at the end of 2017 and 2016, respectively.

Employee Relations

At December 31, 2017, the Company had 533 employees. The Company considers relations with employees to be strong. The number of employees of the Company represented by unions, located at the Bristol, Tennessee, Munhall, Pennsylvania and Mineral Ridge, Ohio facilities, is 223, or 42 percent of the Company's employees. They are represented by three locals affiliated with the United Steelworkers. Collective bargaining contracts for the Steelworkers expire in July 2019, June 2020 and January 2023, respectively.

Financial Information about Geographic Areas

Information about revenues derived from domestic and foreign customers is set forth in Note 15 to the Consolidated Financial Statements.

Available information

The Company electronically files with the Securities and Exchange Commission ("SEC") its annual reports on Form 10-K, its quarterly reports on Form 10-Q, its periodic reports on Form 8-K, amendments to those reports filed or furnished pursuant to Section 13(a) of the Securities Exchange Act of 1934 (the "1934 Act"), and proxy materials pursuant to Section 14 of the 1934 Act. The SEC maintains a site on the Internet, www.sec.gov, which contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The Company also makes its filings available, free of charge,

5

through its Web site, www.synalloy.com, as soon as reasonably practical after the electronic filing of such material with the SEC. The information on the Company's Web site is not incorporated into this Annual Report on Form 10-K or any other filing the Company makes with the SEC.

Item 1A Risk Factors

There are inherent risks and uncertainties associated with our business that could adversely affect our operating performance and financial condition. Set forth below are descriptions of those risks and uncertainties that we believe to be material, but the risks and uncertainties described are not the only risks and uncertainties that could affect our business. Reference should be made to "Forward-Looking Statements" above, and "Management's Discussion and Analysis of Financial Condition and Results of Operations" in Item 7 below.

The cyclical nature of the industries in which our customers operate causes demand for our products to be cyclical, creating uncertainty regarding future profitability. Various changes in general economic conditions affect the industries in which our customers operate. These changes include decreases in the rate of consumption or use of our customers’ products due to economic downturns. Other factors causing fluctuation in our customers’ positions are changes in market demand, capital spending, lower overall pricing due to domestic and international overcapacity, lower priced imports, currency fluctuations, and increases in use or decreases in prices of substitute materials. As a result of these factors, our profitability has been and may in the future be subject to significant fluctuation.

Domestic competition could force lower product pricing and may have an adverse effect on our revenues and profitability. From time-to-time, intense competition and excess manufacturing capacity in the commodity stainless steel industry have resulted in reduced selling prices, excluding raw material surcharges, for many of our stainless steel products sold by the Metals Segment. In order to maintain market share, we would have to lower our prices to match the competition. These factors have had and may continue to have an adverse impact on our revenues, operating results and financial condition and may continue to do so in the future.

Our business, financial condition and results of operations could be adversely affected by an increased level of imported products. Our business is susceptible to the import of products from other countries, particularly steel products. Import levels of various products are affected by, among other things, overall world-wide demand, lower cost of production in other countries, the trade practices of foreign governments, government subsidies to foreign producers, the strengthening of the U.S. dollar and governmentally imposed trade restrictions in the United States. Although imports from certain countries have been curtailed by anti-dumping duties, imported products from

other countries could significantly reduce prices. Increased imports of certain products, whether illegal dumping or legal imports, could reduce demand for our products in the future and adversely affect our business, financial position, results of operations or cash flows.

The Specialty Chemicals Segment uses significant quantities of a variety of specialty and commodity chemicals in its manufacturing processes, which are subject to price and availability fluctuations that may have an adverse impact on our financial performance. The raw materials we use are generally available from numerous independent suppliers. However, some of our raw material needs are met by a sole supplier or only a few suppliers. If any supplier that we rely on for raw materials ceases or limits production, we may incur significant additional costs, including capital costs, in order to find alternate, reliable raw material suppliers. We may also experience significant production delays while locating new supply sources, which could result in our failure to timely deliver products to our customers. Purchase prices and availability of these critical raw materials are subject to volatility. Some of the raw materials used by the Specialty Chemicals Segment are derived from petrochemical-based feedstock, such as crude oil and natural gas, which have been subject to historical periods of rapid and significant movements in price. These fluctuations in price could be aggravated by factors beyond our control such as political instability, and supply and demand factors, including Organization of the Petroleum Exporting Countries ("OPEC") production quotas and increased global demand for petroleum-based products. At any given time, we may be unable to obtain an adequate supply of these critical raw materials on a timely basis, at prices and other terms acceptable, or at all. If suppliers increase the price of critical raw materials, we may not have alternative sources of supply. We attempt to pass changes in the prices of raw materials along to our customers. However, we cannot always do so, and any limitation on our ability to pass through any price increases could have an adverse effect on our financial performance. Any significant variations in the cost and availability of our specialty and commodity materials may negatively affect our business, financial condition or results of operations, specifically for the Specialty Chemicals Segment.

We rely on a small number of suppliers for our raw materials and any interruption in our supply chain could affect our operations. In order to foster stronger business relationships, the Metals Segment uses only a few raw material suppliers. During the year ended December 31, 2017, nine suppliers furnished approximately 80 percent of our total dollar purchases of raw materials, with

6

one supplier providing 40 percent. However, these raw materials are available from a number of sources, and the Company anticipates no difficulties in fulfilling its raw materials requirements for the Metals Segment. Raw materials used by the Specialty Chemicals Segment are generally available from numerous independent suppliers and approximately 52 percent of total purchases were made from our top 15 suppliers during the year ended December 31, 2017. Although some raw material needs are met by a single supplier or only a few suppliers, the Company anticipates no difficulties in fulfilling its raw material requirements for the Specialty Chemicals Segment. While the Company believes that raw materials for both segments are readily available from numerous sources, the loss of one or more key suppliers in either segment, or any other material change in our current supply channels, could have an adverse effect on the Company’s ability to meet the demand for its products, which could impact our operations, revenues and financial results.

A substantial portion of our overall sales is dependent upon a limited number of customers, and the loss of one or more of such customers would have a material adverse effect on our business, results of operation and profitability. The products of the Specialty Chemicals Segment are sold to various industries nationwide. The Specialty Chemicals Segment has one customer that accounted for approximately 23 percent, 25 percent and 31 percent of revenues for 2017, 2016 and 2015, respectively. The concentration of sales to this customer declined as a result of this customer moving production of the products previously produced and sold by the Specialty Chemicals Segment in house. The loss of this customer would have a material adverse effect on the revenues of the Specialty Chemicals Segment of the Company.

The Metals Segment had one customer that accounted for approximately 14 percent of revenues for 2015. There were no customers representing more than ten percent of the Metals Segment's revenues in 2017 or 2016. Palmer and Specialty, which are a part of the Metals Segment, sell much of their products to the oil and gas industry. Any change in this industry, or any change in this industry’s demand for their products, would have a material adverse effect on the profits of the Metals Segment and the Company.

Our operating results are sensitive to the availability and cost of energy and freight, which are important in the manufacture and transport of our products. Our operating costs increase when energy or freight costs rise. During periods of increasing energy and freight costs, we might not be able to fully recover our operating cost increases through price increases without reducing demand for our products. In addition, we are dependent on third party freight carriers to transport many of our products, all of which are dependent on fuel to transport our products. The prices for and availability of electricity, natural gas, oil, diesel fuel and other energy resources are subject to volatile market conditions. These market conditions often are affected by political and economic factors beyond our control. Disruptions in the supply of energy resources could temporarily impair the ability to manufacture products for customers and may result in the decline of freight carrier capacity in our geographic markets, or make freight carriers unavailable. Further, increases in energy or freight costs that cannot be passed on to customers, or changes in costs relative to energy and freight costs paid by competitors, has adversely affected, and may continue to adversely affect, our profitability.

Oil prices are extremely volatile. A substantial or extended decline in the price of oil could adversely affect our financial condition and results of operations. Prices for oil can fluctuate widely. Our Palmer and Specialty (Houston, Texas) units' revenues are highly dependent on our customers adding oil well drilling and pumping locations. Should oil prices decline such that drilling becomes unprofitable for our customers, such customers will likely cap many of their current wells and cease or curtail expansion. This will decrease the demand for our tanks and pipe and tube and adversely affect the results of our operations.

Significant changes in nickel prices could have an impact on the sales of the Metals Segment. The Metals Segment uses nickel in a number of its products. Nickel prices are currently at a relatively low level, which reduces our manufacturing costs for certain products. When nickel prices increase, many of our customers increase their orders in an attempt to avoid future price increases, resulting in increased sales for the Metals Segment. Conversely, when nickel prices decrease, many of our customers wait to place orders in an attempt to take advantage of subsequent price decreases, resulting in reduced sales for the Metals Segment. On average, the Metals Segment turns its inventory of commodity pipe every six months, but the nickel surcharge on sales of commodity pipe is established on a monthly basis. The difference, if any, between the price of nickel on the date of purchase of the raw material and the price, as established by the surcharge, on the date of sale has the potential to create an inventory price change gain or loss. If the price of nickel steadily increases over time, as it did from 2005 to 2007, the Metals Segment is the beneficiary of the increase in nickel price in the form of metal price change gains. Conversely, if the price of nickel steadily decreases over time, as it did from 2011 to 2016, the Metals Segment suffers metal price change losses. 2017 was a highly volatile year, with nickel prices starting at a peak in January, and declining through the first nine months, with a steep trough during the third quarter (average down 25 percent from the first quarter), before rebounding to almost beginning of year levels by December. This volatile pattern did result in average nickel prices being up 48 percent for the full year of 2017 and up 38 percent for the fourth quarter 2017, when compared to the same periods of the prior year; however, substantial declines within the year generated cumulative inventory price change losses that exceeded inventory price change gains by $2,634,000 for the year. We will incur inventory price losses in the future if nickel prices decrease. Any material changes in the cost of nickel could impact our sales and result in fluctuations in the profits for the Metals Segment.

7

The Company began hedging its nickel exposure effective in the beginning of 2016 to provide coverage against extreme downside product pricing exposure related to the content of nickel alloy contained in purchased stainless steel inventory. The sales price of stainless steel product (containing nickel alloy) is subject to a variable pricing component for alloys (nickel, chrome, molybdenum and iron) contained in the product. Each month, industry pricing indices are published which set the following month’s price surcharges for those alloys. The Company typically holds approximately six to seven months of inventory, with fixed priced purchase orders (where the alloy pricing index is “locked”, eliminating the Company’s exposure) consisting of approximately 50 percent of held stainless steel inventories. As a result, the eventual sales prices for approximately 50 percent of held stainless steel inventories will vary until a customer order commitment is received, and the selling price is established. In the past, the Company fully absorbed the potential negative market volatility that resulted from sales prices declining during the inventory hold period. In 2017 and 2016, the cumulative negative impact during the inventory hold period totaled $2,634,000 and $5,751,000, respectively, due to a substantial and prolonged period of nickel commodity pricing declines.

The Company’s nickel hedge program covers approximately three months of pricing exposure, via forward contracts, to sell nickel at fixed prices. Other alloys do not have hedge contracts available in the marketplace. The Company reviews the current nickel pricing level and if it believes there is significant downside exposure in future pricing, management will protect against these projected declines by purchasing contracts to “Put” nickel pounds to the trading party, with strike prices at 15 percent below the three-month forward price at the time of the contract. As a result, there is zero hedge coverage for the first 15 percent of nickel price decline, but dollar for dollar coverage for 100 percent of any decline below that level.

As of December 31, 2017 and December 31, 2016, the Company had a hedge position equal to 1,351,000 and 639,000, respectively, of pounds of nickel, representing 53 and 34 percent, respectively, of the Company’s total nickel content of stainless steel pounds in inventory. The Company does not utilize hedge accounting for these transactions but marks to market the value of the outstanding contracts with all adjustments being included in cost of sales in the Consolidated Statements of Operations. The fair value of the nickel contracts at December 31, 2017 and December 31, 2016 was an asset of approximately $9,000 and $87,000, respectively. The Company’s downside exposure is limited to the potential that the total of the fair value of the nickel contracts would be reduced to zero, if nickel pricing does not decline to the contracted strike prices. The program is designed to mitigate but not eliminate the Company's nickel pricing exposure.

We encounter significant competition in all areas of our businesses and may be unable to compete effectively, which could result in reduced profitability and loss of market share. We actively compete with companies producing the same or similar products and, in some instances, with companies producing different products designed for the same uses. We encounter competition from both domestic and foreign sources in price, delivery, service, performance, product innovation and product recognition and quality, depending on the product involved. For some of our products, our competitors are larger and have greater financial resources than we do. As a result, these competitors may be better able to withstand a change in conditions within the industries in which we operate, a change in the prices of raw materials or a change in the economy as a whole. Our competitors can be expected to continue to develop and introduce new and enhanced products and more efficient production capabilities, which could cause a decline in market acceptance of our products. Current and future consolidation among our competitors and customers also may cause a loss of market share as well as put downward pressure on pricing. Our competitors could cause a reduction in the prices for some of our products as a result of intensified price competition. Competitive pressures can also result in the loss of major customers. If we cannot compete successfully, our business, financial condition and profitability could be adversely affected.

Our lengthy sales cycle for the Specialty Chemicals Segment makes it difficult to predict quarterly revenue levels and operating results. Purchasing the products of the Specialty Chemicals Segment is a major commitment on the part of our customers. Before a potential customer determines to purchase products from the Specialty Chemicals Segment, the Company must produce test product material so that the potential customer is satisfied that we can manufacture a product to their specifications. The production of such test materials is a time-consuming process. Accordingly, the sales process for products in the Specialty Chemicals Segment is a lengthy process that requires a considerable investment of time and resources on our part. As a result, the timing of our revenues is difficult to predict, and the delay of an order could cause our quarterly revenues to fall below our expectations and those of the public market analysts and investors.

Our operations expose us to the risk of environmental, health and safety liabilities and obligations, which could have a material adverse effect on our financial condition, results of operations or cash flows. We are subject to numerous federal, state and local environmental protection and health and safety laws governing, among other things:

• | the generation, use, storage, treatment, transportation, disposal and management of hazardous substances and wastes; |

• | emissions or discharges of pollutants or other substances into the environment; |

• | investigation and remediation of, and damages resulting from, releases of hazardous substances; and |

• | the health and safety of our employees. |

8

Under certain environmental laws, we can be held strictly liable for hazardous substance contamination of any real property we have ever owned, operated or used as a disposal site. We are also required to maintain various environmental permits and licenses, many of which require periodic modification and renewal. Our operations entail the risk of violations of those laws and regulations, and we cannot assure you that we have been or will be at all times in compliance with all of these requirements. In addition, these requirements and their enforcement may become more stringent in the future.

We have incurred, and expect to continue to incur, additional capital expenditures in addition to ordinary costs to comply with applicable environmental laws, such as those governing air emissions and wastewater discharges. Our failure to comply with applicable environmental laws and permit requirements could result in civil and/or criminal fines or penalties, enforcement actions, and regulatory or judicial orders enjoining or curtailing operations or requiring corrective measures such as the installation of pollution control equipment, which could have a material adverse effect on our financial condition, results of operations or cash flows.

We are currently, and may in the future be, required to investigate, remediate or otherwise address contamination at our current or former facilities. Many of our current and former facilities have a history of industrial usage for which additional investigation, remediation or other obligations could arise in the future and that could materially adversely affect our business, financial condition, results of operations or cash flows. In addition, we are currently, and could in the future be, responsible for costs to address contamination identified at any real property we used as a disposal site.

Although we cannot predict the ultimate cost of compliance with any of the requirements described above, the costs could be material. Non-compliance could subject us to material liabilities, such as government fines, third-party lawsuits or the suspension of non-compliant operations. We also may be required to make significant site or operational modifications at substantial cost. Future developments also could restrict or eliminate the use of or require us to make modifications to our products, which could have a significant negative impact on our results of operations and cash flows. At any given time, we are involved in claims, litigation, administrative proceedings and investigations of various types involving potential environmental liabilities, including cleanup costs associated with hazardous waste disposal sites at our facilities. We cannot assure you that the resolution of these environmental matters will not have a material adverse effect on our results of operations or cash flows. The ultimate costs and timing of environmental liabilities are difficult to predict. Liability under environmental laws relating to contaminated sites can be imposed retroactively and on a joint and several basis. We could incur significant costs, including cleanup costs, civil or criminal fines and sanctions and third-party claims, as a result of past or future violations of, or liabilities under, environmental laws.

We could be subject to third party claims for property damage, personal injury, nuisance or otherwise as a result of violations of, or liabilities under, environmental, health or safety laws in connection with releases of hazardous or other materials at any current or former facility. We could also be subject to environmental indemnification claims in connection with assets and businesses that we have acquired or divested.

There can be no assurance that any future capital and operating expenditures to maintain compliance with environmental laws, as well as costs to address contamination or environmental claims, will not exceed any current estimates or adversely affect our financial condition and results of operations. In addition, any unanticipated liabilities or obligations arising, for example, out of discovery of previously unknown conditions or changes in laws or regulations, could have an adverse effect on our business, financial condition, results of operations or cash flows.

We are dependent upon the continued operation of our production facilities, which are subject to a number of hazards. In both of our business segments, but especially in the Specialty Chemicals Segment, our production facilities are subject to hazards associated with the manufacture, handling, storage and transportation of chemical materials and products, including leaks and ruptures, explosions, fires, inclement weather and natural disasters, unscheduled downtime and environmental hazards which could result in liability for workplace injuries and fatalities. In addition, some of our production capabilities are highly specialized, which limits our ability to shift production to another facility in the event of an incident at a particular facility. If a production facility, or a critical portion of a production facility, were temporarily shut down, we likely would incur higher costs for alternate sources of supply for our products. We cannot assure you that we will not experience these types of incidents in the future or that these incidents will not result in production delays, failure to timely fulfill customer orders or otherwise have a material adverse effect on our business, financial condition or results of operations.

Certain of our employees in the Metals Segment are covered by collective bargaining agreements, and the failure to renew these agreements could result in labor disruptions and increased labor costs. As of December 31, 2017, we had 223 employees represented by unions at our Bristol, Tennessee, Munhall, Pennsylvania and Mineral Ridge, Ohio facilities, which is 42 percent of the aggregate number of Company employees. These employees are represented by three local unions affiliated with the United Steelworkers (the “Steelworkers Union"). The collective bargaining contracts for the Steelworkers Unions will expire in July 2019, June 2020 and January 2023. Although we believe that our present labor relations are satisfactory, our failure to renew these agreements on

9

reasonable terms as the current agreements expire could result in labor disruptions and increased labor costs, which could adversely affect our financial performance.

Our current capital structure includes indebtedness, which is secured by all or substantially all of our assets and which contains restrictive covenants that may prevent us from obtaining adequate working capital, making acquisitions or capital improvements.

Our existing credit facility contains restrictive covenants that limit our ability to, among other things, borrow money or guarantee the debts of others, use assets as security in other transactions, make investments or other restricted payments or distributions, change our business or enter into new lines of business, and sell or acquire assets or merge with or into other companies. In addition, our credit facility requires us to meet a minimum fixed charge coverage ratio which could limit our ability to plan for or react to market conditions or meet extraordinary capital needs and could otherwise restrict our financing activities. Our ability to comply with the covenants and other terms of our credit facility will depend on our future operating performance. If we fail to comply with such covenants and terms, we will be in default and the maturity of any then outstanding related debt could be accelerated and become immediately due and payable. In addition, in the event of such a default, our lender may refuse to advance additional funds, demand immediate repayment of our outstanding indebtedness, and elect to foreclose on our assets that secure the credit facility.

There were no events of default under our credit facility at December 31, 2017. Although we believe we will remain in compliance with these covenants in the foreseeable future and that our relationship with our lender is strong, there is no assurance our lender would consent to an amendment or waiver in the event of noncompliance; or that such consent would not be conditioned upon the receipt of a cash payment, revised principal payout terms, increased interest rates or restrictions in the expansion of the credit facility for the foreseeable future, or that our lender would not exercise rights that would be available to them, including, among other things, demanding payment of outstanding borrowings. In addition, our ability to obtain additional capital or alternative borrowing arrangements at reasonable rates may be adversely affected. All or any of these adverse events would further limit our flexibility in planning for, or reacting to, downturns in our business.

We may need new or additional financing in the future to expand our business or refinance existing indebtedness, and our inability to obtain capital on satisfactory terms or at all may have an adverse impact on our operations and our financial results. If we are unable to access capital on satisfactory terms and conditions, we may not be able to expand our business or meet our payment requirements under our existing credit facility. Our ability to obtain new or additional financing will depend on a variety of factors, many of which are beyond our control. We may not be able to obtain new or additional financing because we may have substantial debt, our current receivable and inventory balances do not support additional debt availability or because we may not have sufficient cash flows to service or repay our existing or future debt. In addition, depending on market conditions and our financial performance, equity financing may not be available on satisfactory terms or at all. If we are unable to access capital on satisfactory terms and conditions, this could have an adverse impact on our operations and our financial results.

Our existing property and liability insurance coverages contain exclusions and limitations on coverage. We maintain various forms of insurance, including insurance covering claims related to our properties and risks associated with our operations. From time-to-time, in connection with renewals of insurance, we have experienced additional exclusions and limitations on coverage, larger self-insured retentions and deductibles and higher premiums, primarily from the operations of the Specialty Chemicals Segment. As a result, our existing coverage may not be sufficient to cover any losses we may incur and in the future our insurance coverage may not cover claims to the extent that it has in the past and the costs that we incur to procure insurance may increase significantly, either of which could have an adverse effect on our results of operations or cash flows.

We may not be able to make the operational and product changes necessary to continue to be an effective competitor. We must continue to enhance our existing products and to develop and manufacture new products with improved capabilities in order to continue to be an effective competitor in our business markets. In addition, we must anticipate and respond to changes in industry standards that affect our products and the needs of our customers. We also must continue to make improvements in our productivity in order to maintain our competitive position. When we invest in new technologies, processes or production capabilities, we face risks related to construction delays, cost over-runs and unanticipated technical difficulties.

The success of any new or enhanced products will depend on a number of factors, such as technological innovations, increased manufacturing and material costs, customer acceptance and the performance and quality of the new or enhanced products. As we introduce new products or refine existing products, we cannot predict the level of market acceptance or the amount of market share these new or enhanced products may achieve. Moreover, we may experience delays in the introduction of new or enhanced products. Any manufacturing delays or problems with new or enhanced product launches will adversely affect our operating results. In addition, the introduction of new products could result in a decrease in revenues from existing products. Also, we may need more capital for product development and enhancement than is available to us, which could adversely affect our business, financial condition or results of operations. We sell our products in industries that are affected by technological changes, new product introductions and changing industry standards. If we do not respond by developing new products or enhancing existing products

10

on a timely basis, our products will become obsolete over time and our revenues, cash flows, profitability and competitive position will suffer.

In addition, if we fail to accurately predict future customer needs and preferences, we may invest heavily in the development of new or enhanced products that do not result in significant sales and revenue. Even if we successfully innovate in the development of new and enhanced products, we may incur substantial costs in doing so, and our profitability may suffer. Our products must be kept current to meet the needs of our customers. To remain competitive, we must develop new and innovative products on an on-going basis. If we fail to make innovations, or the market does not accept our new or enhanced products, our sales and results could suffer.

Our inability to anticipate and respond to changes in industry standards and the needs of our customers, or to utilize changing technologies in responding to those changes, could have a material adverse effect on our business and our results of operations.

Our strategy of using acquisitions and dispositions to position our businesses may not always be successful, which may have a material adverse impact on our financial results and profitability. We have historically utilized acquisitions and dispositions in an effort to strategically position our businesses and improve our ability to compete. We plan to continue to do this by seeking specialty niches, acquiring businesses complementary to existing strengths and continually evaluating the performance and strategic fit of our existing business units. We consider acquisitions, joint ventures and other business combination opportunities as well as possible business unit dispositions. From time-to-time, management holds discussions with management of other companies to explore such opportunities. As a result, the relative makeup of the businesses comprising our Company is subject to change. Acquisitions, joint ventures and other business combinations involve various inherent risks, such as: assessing accurately the value, strengths, weaknesses, contingent and other liabilities and potential profitability of acquisition or other transaction candidates; the potential loss of key personnel of an acquired business; significant transaction costs that were not identified during due diligence; our ability to achieve identified financial and operating synergies anticipated to result from an acquisition or other transaction; and unanticipated changes in business and economic conditions affecting an acquisition or other transaction. If acquisition opportunities are not available or if one or more acquisitions are not successfully integrated into our operations, this could have a material adverse impact on our financial results and profitability.

The loss of key members of our management team, or difficulty attracting and retaining experienced technical personnel, could reduce our competitiveness and have an adverse effect on our business and results of operations. The successful implementation of our strategies and handling of other issues integral to our future success will depend, in part, on our experienced management team. The loss of key members of our management team could have an adverse effect on our business. Although we have entered into employment agreements with key members of our management team including Craig C. Bram, President and Chief Executive Officer, Dennis M. Loughran, Senior Vice President and Chief Financial Officer, Sally M. Cunningham, Vice President of Corporate Administration, J. Kyle Pennington, President of Metals Segment, James G. Gibson, General Manager and President of Specialty Chemicals Segment, Steven J. Baroff, President and General Manager of Specialty, K. Dianne Beck, Vice President of Specialty, Christopher D. Sitka, Vice President of Specialty and Kevin Van Zandt, Vice President of Bristol Metals-Munhall, employees may resign from the Company at any time and seek employment elsewhere, subject to certain non-competition restrictions. Additionally, if we cannot retain our technical personnel or attract additional experienced technical personnel, our ability to compete could be harmed.

Federal, state and local legislative and regulatory initiatives relating to hydraulic fracturing, as well as governmental reviews of such activities could result in delays or eliminate new wells from being started, thus reducing the demand for our fiberglass and steel storage tanks, pressure vessels and heavy walled pipe and tube. Hydraulic fracturing (“fracking”) is currently an essential and common practice to extract oil from dense subsurface rock formations and this lower cost extraction method is a significant driving force behind the surge of oil exploration and drilling in several locations in the United States. However, the Environmental Protection Agency, U.S. Congress and state legislatures have considered adopting legislation to provide additional regulations and disclosures surrounding this process. In the event that new legal restrictions surrounding the fracking process are adopted in the areas in which our customers operate, we may see a dramatic decrease in Palmer's and Specialty - Texas' profitability which could have an adverse impact on our financial results.

Our allowance for doubtful accounts may not be adequate to cover actual losses. An allowance for doubtful accounts in maintained for estimated losses resulting from the inability of our customers to make required payments. This allowance may not be adequate to cover actual losses, and future provisions for losses could materially and adversely affect our operating results. The allowance for doubtful accounts is based on an evaluation of the outstanding receivables and existing economic conditions. The amount of future losses is susceptible to changes in economic, operating and other outside forces and conditions, all of which are beyond our control, and these losses may exceed current estimates. Although management believes that the allowance for doubtful accounts is adequate to cover current estimated losses, management cannot make assurances that we will not further increase the allowance for doubtful accounts. A significant increase in the allowance for doubtful accounts could adversely affect our earnings.

11

We depend on third parties to distribute certain of our products and because we have no control over such third parties we are subject to adverse changes in such parties’ operations or interruptions of service, each of which may have an adverse effect on our operations. We use third parties over which we have only limited control to distribute certain of our products. Our dependency on these third party distributors has increased as our business has grown. Because we rely on these third parties to provide distribution services, any change in our ability to access these third party distribution services could have an adverse impact on our revenues and put us at a competitive disadvantage with our competitors.

Freight costs for products produced in our Palmer facility restrict our sales area for this facility. The freight and other distribution costs for products sold from our Palmer facility are extremely high. As a result, the market area for these products is restricted, which limits the geographic market for Palmer’s tanks and the ability to significantly increase revenues derived from sales of products from the Palmer facility.

New regulations related to “conflict minerals” may force us to incur additional expenses, may make our supply chain more complex and may result in damage to our reputation with customers. On August 22, 2012, under the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”), the SEC adopted new requirements for companies that use certain minerals and metals, known as conflict minerals, in their products, whether or not these products are manufactured by third parties. These regulations require companies to conduct annual due diligence and disclose whether or not such minerals originate from the Democratic Republic of Congo and adjoining countries. Tungsten and tantalum are designated as conflict minerals under the Dodd-Frank Act. These metals are used to varying degrees in our welding materials and are also present in specialty alloy products. These new requirements could adversely affect the sourcing, availability and pricing of minerals used in our products. In addition, we could incur additional costs to comply with the disclosure requirements, including costs related to determining the source of any of the relevant minerals and metals used in our products. Since our supply chain is complex, we may not be able to sufficiently verify the origins for these minerals and metals used in our products through the due diligence procedures that we implement, which may harm our reputation. In such event, we may also face difficulties in satisfying customers who could require that all of the components of our products are conflict mineral-free.

Our inability to sufficiently or completely protect our intellectual property rights could adversely affect our business, prospects, financial condition and results of operations. Our ability to compete effectively in both of our business segments will depend on our ability to maintain the proprietary nature of the intellectual property used in our businesses. These intellectual property rights consist largely of trade-secrets and know-how. We rely on a combination of trade secrets and non-disclosure and other contractual agreements and technical measures to protect our rights in our intellectual property. We also depend upon confidentiality agreements with our officers, directors, employees, consultants and subcontractors, as well as collaborative partners, to maintain the proprietary nature of our intellectual property. These measures may not afford us sufficient or complete protection, and others may independently develop intellectual property similar to ours, otherwise avoid our confidentiality agreements or produce technology that would adversely affect our business, prospects, financial condition and results of operations.

Our internal controls over financial reporting could fail to prevent or detect misstatements. Because of its inherent limitations, internal controls over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate. Any failure to maintain effective internal controls or to timely effect any necessary improvement in our internal controls and disclosure controls could, among other things, result in losses from fraud or error, harm our reputation or cause investors to lose confidence in our reported financial information, all of which could have a material adverse effect on our financial condition, results of operations and cash flows.

Cyber security risks and cyber incidents could adversely affect our business and disrupt operations. Cyber incidents can result from deliberate attacks or unintentional events. These incidents can include, but are not limited to, gaining unauthorized access to digital systems for purposes of misappropriating assets or sensitive information, corrupting data, or causing operational disruption. The result of these incidents could include, but are not limited to, disrupted operations, misstated financial data, liability for stolen assets or information, increased cyber security protection costs, litigation and reputational damage adversely affecting customer or investor confidence.

Loss of key supplier authorizations, lack of product availability, or changes in supplier distribution programs could adversely affect our sales and earnings. Our business depends on maintaining an immediately available supply of various products to meet customer demand. Many of our relationships with key product suppliers are longstanding, but are terminable by either party. The loss of key supplier authorizations, or a substantial decrease in the availability of their products, could put us at a competitive disadvantage and have a material adverse effect on our business. Supply interruptions could arise from raw material shortages, inadequate manufacturing capacity or utilization to meet demand, financial problems, labor disputes or weather conditions affecting suppliers' production, transportation disruptions or other reasons beyond our control.

12

In addition, as a master distributor, we face the risk of key product suppliers changing their relationships with distributors generally, or Specialty in particular, in a manner that adversely impacts us. For example, key suppliers could change the following: the prices we must pay for their products relative to other distributors or relative to competing products; the geographic or product line breadth of distributor authorizations; supplier purchasing incentive or other support programs; or product purchase or stock expectations.

The purchasing incentives we earn from product suppliers can be impacted if we reduce our purchases in response to declining customer demand. Certain of our product and raw material suppliers have historically offered to their customers and distributors, including us, incentives for purchasing their products. In addition to market or customer account-specific incentives, certain suppliers pay incentives to the customer or distributor for attaining specific purchase volumes during the program period. In some cases, in order to earn incentives, we must achieve year-over-year growth in purchases with the supplier. When the demand for our products declines, we may be less willing to add inventory to take advantage of certain incentive programs, thereby potentially adversely impacting our profitability.

The ongoing effects of the Tax Cuts and Jobs Act ("The Act") and the refinement of provisional estimates could make our results difficult to predict. Our effective tax rate may fluctuate in the future as a result of The Act, which was enacted on December 22, 2017. The Act introduced significant changes to U.S. income tax law that will have a meaningful impact on our provision for income taxes. Accounting for the income tax effects of the Tax Act requires significant judgments and estimates in the interpretation and calculations of the provisions of the The Act.

Due to the timing of the enactment and the complexity involved in applying the provisions of the The Act, we made reasonable estimates of the effects and recorded provisional amounts in our financial statements for the year ended December 31, 2017. The U.S. Treasury Department, the Internal Revenue Service ("IRS"), and other standard-setting bodies may issue guidance on how the provisions of the The Act will be applied or otherwise administered that is different from our interpretation. As we collect and prepare necessary data, and interpret the The Act and any additional guidance issued by the IRS or other standard-setting bodies, we may make adjustments to the provisional amounts that could materially affect our financial position and results of operations as well as our effective tax rate in the period in which the adjustments are made.

Item 1B Unresolved Staff Comments

None.

13

Item 2 Properties

The Company operates the major plants and facilities listed below, all of which are in adequate condition for their current usage. All facilities throughout the Company are believed to be adequately insured. The buildings are of various types of construction including brick, steel, concrete, concrete block and sheet metal. All have adequate transportation facilities for both raw materials and finished products. In September 2016, the Company sold its real estate properties previously owned in Tennessee, South Carolina, Texas and Ohio to Store Funding and concurrently leased back these real properties; see Note 12 to the Consolidated Financial Statements included in Item 8 of this Form 10-K. On February 28, 2017, the Company purchased certain stainless steel pipe and tube assets of MUSA in Munhall, PA. As part of this acquisition, the Company entered into a 15-month lease with the sellers for the current manufacturing facility. The lease was amended to extend the term of the lease to May 31, 2023. A parcel of land in Mineral Ridge, OH used for inventory storage, the corporate headquarters located in Richmond, VA, and the shared service center located in Spartanburg, SC continue to be leased by the Company from other parties.

Location | Principal Operations | Building Square Feet | Land Acres | |||

Munhall, PA | Manufacturing stainless steel pipe | 284,000 | 20.0 | |||

Bristol, TN | Manufacturing stainless steel pipe | 275,000 | 73.1 | |||

Cleveland, TN | Chemical manufacturing and warehousing facilities | 143,000 | 18.8 | |||

Fountain Inn, SC | Chemical manufacturing and warehousing facilities | 136,834 | 16.9 | |||

Andrews, TX | Manufacturing liquid storage solutions and separation equipment | 122,662 | 19.6 | |||

Houston, TX | Cutting facility and storage yard for heavy walled pipe | 29,821 | 10.0 | |||

Mineral Ridge, OH | Cutting facility and storage yard for heavy walled pipe | 12,000 | 12.0 | |||

Mineral Ridge, OH | Storage yard for heavy walled pipe | — | 4.6 | |||

Richmond, VA | Corporate headquarters | 5,911 | — | |||

Spartanburg, SC | Office space for corporate employees and shared service center | 4,858 | — | |||

Augusta, GA | Chemical manufacturing (1) | — | 46.0 | |||

(1) | Property owned by Company; plant was closed in 2001 and all structures and manufacturing equipment have been removed. |

Item 3 Legal Proceedings

For a discussion of legal proceedings, see Notes 7 and 13 to the Consolidated Financial Statements included in Item 8 of this Form 10-K.

Item 4 Mine Safety Disclosures

Not applicable.

14

PART II

Item 5 Market for the Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

The Company had 468 common shareholders of record at March 9, 2018. The Company's common stock trades on the NASDAQ Global Market under the trading symbol SYNL. The Company's credit agreement restricts the payment of dividends indirectly through a minimum fixed charge coverage covenant. The Company paid a $0.13 cash dividend on November 6, 2017 and a $0.30 cash dividend on December 8, 2015. No dividends were declared or paid in 2016. The prices shown below are the high and low sales prices for the common stock for each full quarterly period in the last two fiscal years as quoted on the NASDAQ Global Market.

2017 | 2016 | |||||||||||||||

Quarter | High | Low | High | Low | ||||||||||||

1st | $ | 13.35 | $ | 9.75 | $ | 10.07 | $ | 6.42 | ||||||||

2nd | 13.75 | 10.40 | 8.50 | 7.25 | ||||||||||||

3rd | 13.10 | 10.30 | 9.68 | 6.56 | ||||||||||||

4th | 15.30 | 11.88 | 11.70 | 8.57 | ||||||||||||

The information required by Item 201(d) of Regulation S-K is set forth in Part III, Item 12 of this Annual Report on Form 10-K.

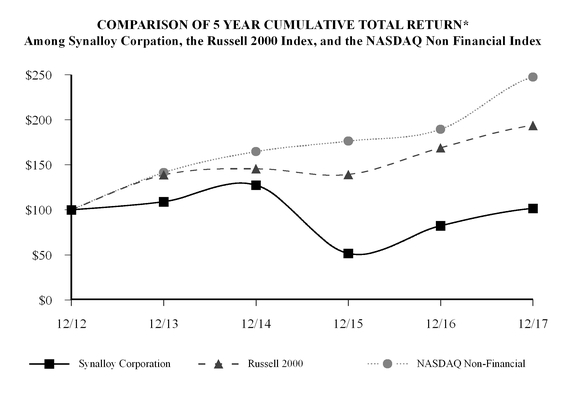

*$100 invested on 12/31/12 in stock or index, including reinvestment of dividends. |

Fiscal year ending December 31. |

Source: Russell Investment Group |

15

Comparison of 5 Year Cumulative Total Return Graph

12/12 | 12/13 | 12/14 | 12/15 | 12/16 | 12/17 | |||||||||||||||||||

Synalloy Corporation | $ | 100.00 | $ | 109.05 | $ | 127.38 | $ | 51.74 | $ | 82.35 | $ | 101.67 | ||||||||||||

Russell 2000 | 100.00 | 138.82 | 145.62 | 139.19 | 168.85 | 193.58 | ||||||||||||||||||

NASDAQ Non-Financial | 100.00 | 141.29 | 164.62 | 176.19 | 189.29 | 247.35 | ||||||||||||||||||

This graph and related information shall not be deemed to be “filed” with the Securities and Exchange Commission or “soliciting material” or subject to Regulation 14A, or the liabilities of Section 18 of the 1934 Act, except to the extent the Company specifically requests that such information be treated as soliciting material or specifically incorporates it by reference into a filing under the Securities Act of 1933 or the 1934 Act.

Unregistered Sales of Equity Securities