Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SURO CAPITAL CORP. | tv488371_8k.htm |

| EX-99.1 - EXHIBIT 99.1 - SURO CAPITAL CORP. | tv488371_ex99-1.htm |

Exhibit 99.2

Invest in tomorrow ’ s stars. Today. FOURTH QUARTER 2017 GSV Capital financial data as of 12/31/17; Market data as of 3 /13/ 18 , unless otherwise noted

Invest in tomorrow ’ s stars. Today. This presentation contains forward - looking statements that involve substantial risks and uncertainties . All forward - looking statements included in this presentation are made only as of the date hereof and are subject to change without notice . Actual outcomes and results could differ materially from those suggested by this presentation due to the impact of many factors beyond the control of GSV Capital Corp . ( “ GSVC ” ), including those listed in the "Risk Factors" sections of our filings with the Securities and Exchange Commission ( “ SEC ” ) . GSVC assumes no obligation to update or revise any such forward - looking statements unless required to do so by law . Certain information discussed in this presentation (including information relating to portfolio companies) was derived from third - party sources and has not been independently verified . GSVC makes no representation or warranty with respect to this information . The following slides contain summaries of certain financial and statistical information about GSVC . The information contained in this presentation is summary information intended to be considered in connection with review of our SEC filings and other public announcements we may make, by press release or otherwise, from time to time . We undertake no duty or obligation to publicly update or revise the information contained in this presentation unless required to do so by law . In addition, information related to past performance, while it may be helpful as an evaluative tool, is not indicative of future results, the achievement of which cannot be assured . You should not view the past performance of GSVC or any of its portfolio companies, or information about the market, as indicative of GSVC’ s or any of its portfolio companies ’ future results . The performance data stated herein may have been due to extraordinary market or other conditions, which may not be duplicated in the future . Current performance may be lower or higher than the performance data quoted . This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities of GSVC . 2 Forward - Looking Statements

Invest in tomorrow ’ s stars. Today. 3 Recent Steps to Enhance Shareholder Value 1. GSV CAPITAL FEE STRUCTURE : Comprehensive modifications to GSV Capital’s fee structure, including the following key components (as detailed in the Current Report on Form 8 - K GSV Capital filed with the SEC on February 5, 2018): - GSV Asset Management will forfeit $5 million of its previously accrued, but unearned incentive fee. This action will be refle cte d in our first quarter 2018 earnings report. - GSV Asset Management has agreed to achieve certain high - water marks before receiving any incentive fee. Specifically, no incenti ve fee will be paid until GSV Capital’s stock price and its last reported net asset value per share are equal to or greater than $12.55. - Effective February 1, 2018, management fees will be reduced from 2.0% to 1.75%. GSV Asset Management voluntarily waived its m ana gement fee by 25 basis points in 2017 as well. - Effective February 1, 2018, GSV Asset Management has agreed to waive management fees on cash balances until GSV Capital’s 5.2 5% Convertible Senior Notes due in 2018 are retired or repurchased. 2. SHARE REPURCHASE PROGRAM : We announced a $5.0 million discretionary open - market share repurchase program on GSV Capital’s second quarter 2017 earnings call. Subsequently, the Company’s Board of Directors authorized an expansion of the program to a n a ggregate of $10.0 million and an extension through November 6, 2018, whichever comes first. To date, GSV Capital has repurchased an aggre gat e of approximately $6.2 million in shares of its common stock under the program. 3. CONVERTIBLE DEBT TENDER : On December 15, 2017, GSV Capital commenced a tender offer for its outstanding 5.25% Convertible Senior Notes due in 2018. At the time, there was $69 million in aggregate principal of notes outstanding. As of the expiration of th e T ender Offer on January 17, 2018, $4.8 million aggregate principal amount, or 7.0% of the outstanding notes, was validly tendered. 4. INVESTMENT ADVISOR STRATEGIC TRANSACTION : On December 14, 2017, GSV Asset Management announced a strategic investment from a group led by HMC Capital, a leading Latin American advisory and investment firm with more than $9 billion in assets un der management. We believe that this alliance with HMC will enhance GSV Asset Management’s investment capabilities. HMC’s team includes over 80 inv estment professionals across five countries with deep experience in private markets and alternative investments. Additionally, we bel iev e that HMC’s global network of institutional investors and strategic relationships will expand GSV Asset Management’s capital access and provide val uable connectivity for GSV Capital portfolio companies.

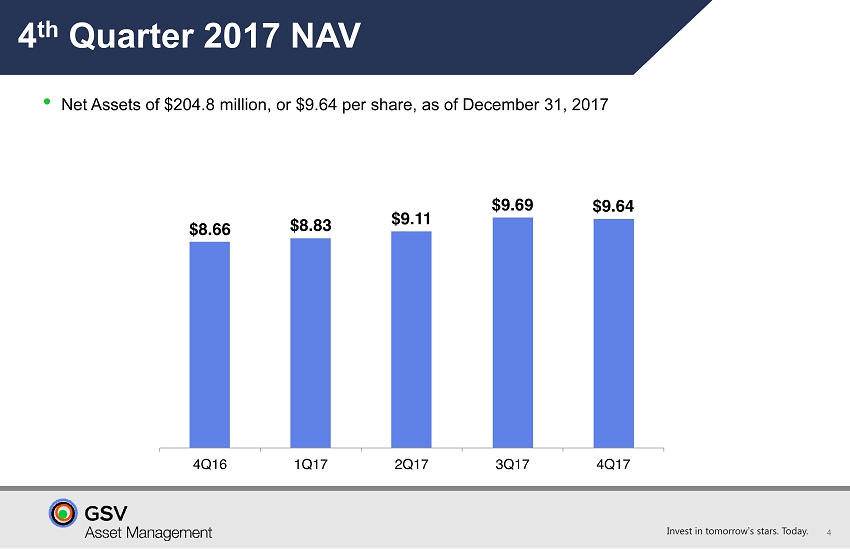

Invest in tomorrow ’ s stars. Today. 4 4 th Quarter 2017 NAV • Net Assets of $ 204.8 million, or $9.64 per share, as of December 31, 2017

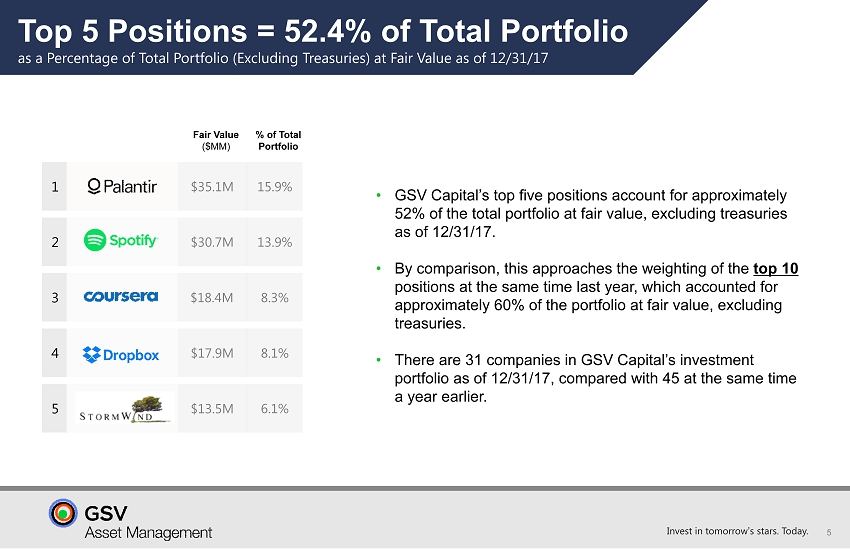

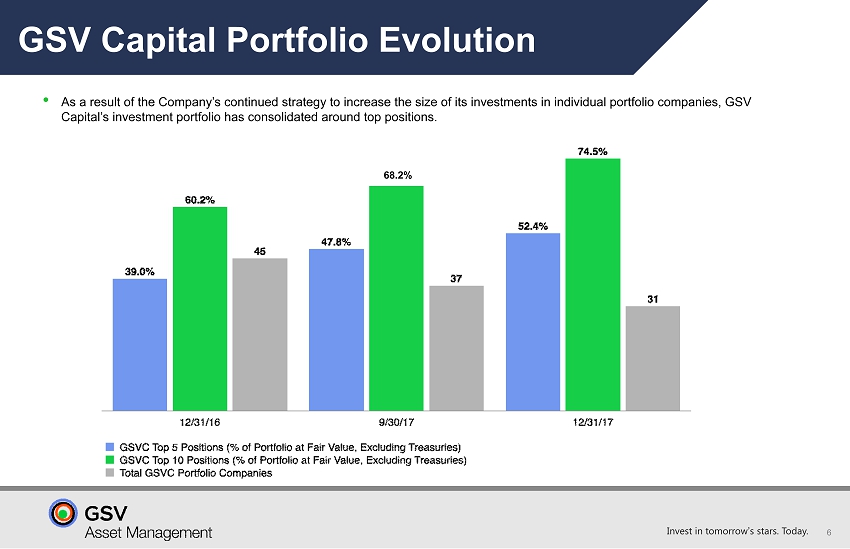

Invest in tomorrow ’ s stars. Today. Top 5 Positions = 52.4% of Total Portfolio as a Percentage of Total Portfolio (Excluding Treasuries) at Fair Value as of 12/31/17 5 Fair Value ($MM) % of Total Portfolio 5 $ 13.5M 6.1 % 4 $ 17.9M 8.1 % 3 $ 18.4M 8.3 % 2 $ 30.7M 13.9% 1 $ 35.1M 15.9 % • GSV Capital’s top five positions account for approximately 52% of the total portfolio at fair value, excluding treasuries as of 12/31/17. • By comparison, this approaches the weighting of the top 10 positions at the same time last year, which accounted for approximately 60% of the portfolio at fair value, excluding treasuries. • There are 31 companies in GSV Capital’s investment portfolio as of 12/31/17, compared with 45 at the same time a year earlier.

Invest in tomorrow ’ s stars. Today. • As a result of the Company’s continued strategy to increase the size of its investments in individual portfolio companies, GS V Capital’s investment portfolio has consolidated around top positions. 6 GSV Capital Portfolio Evolution 68.2%

Invest in tomorrow ’ s stars. Today. • As a result of the Company’s continued strategy to increase the size of its investments in individual portfolio companies, GS V Capital’s investment portfolio has consolidated around top positions. 6 GSV Capital Portfolio Evolution

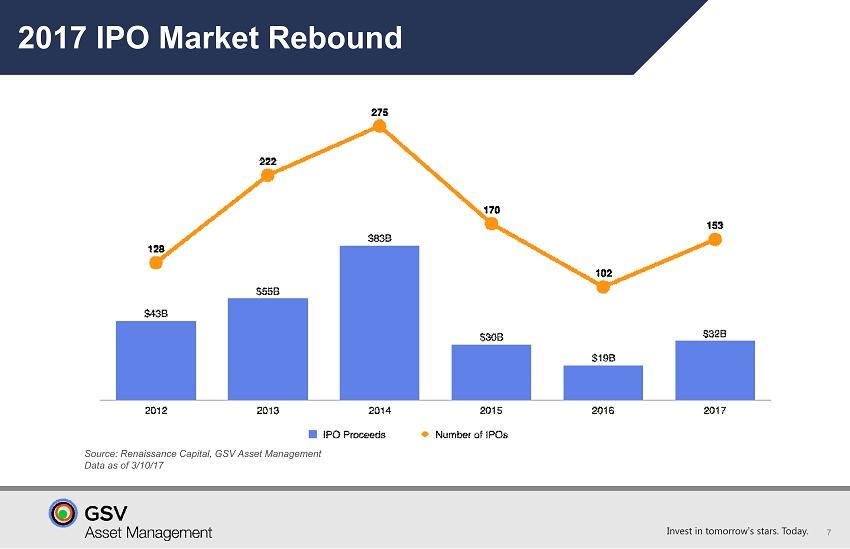

Invest in tomorrow ’ s stars. Today. 7 2017 IPO Market Rebound Source: Renaissance Capital, GSV Asset Management Data as of 3/10/17

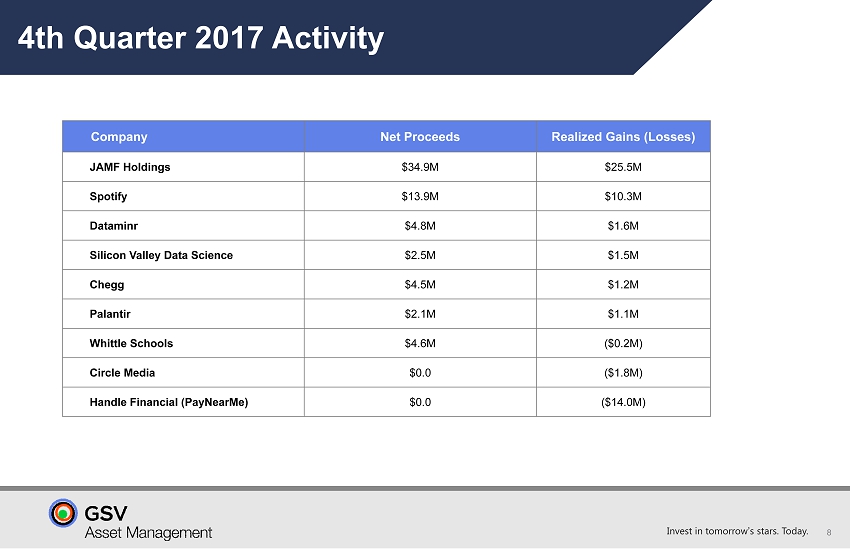

Invest in tomorrow ’ s stars. Today. 4th Quarter 2017 Activity 8 Company Net Proceeds Realized Gains (Losses) JAMF Holdings $34.9M $25.5M Spotify $13.9M $10.3M Dataminr $4.8M $1.6M Silicon Valley Data Science $2.5M $1.5M Chegg $4.5M $1.2M Palantir $2.1M $1.1M Whittle Schools $4.6M ($0.2M) Circle Media $0.0 ($1.8M) Handle Financial (PayNearMe) $0.0 ($14.0M)

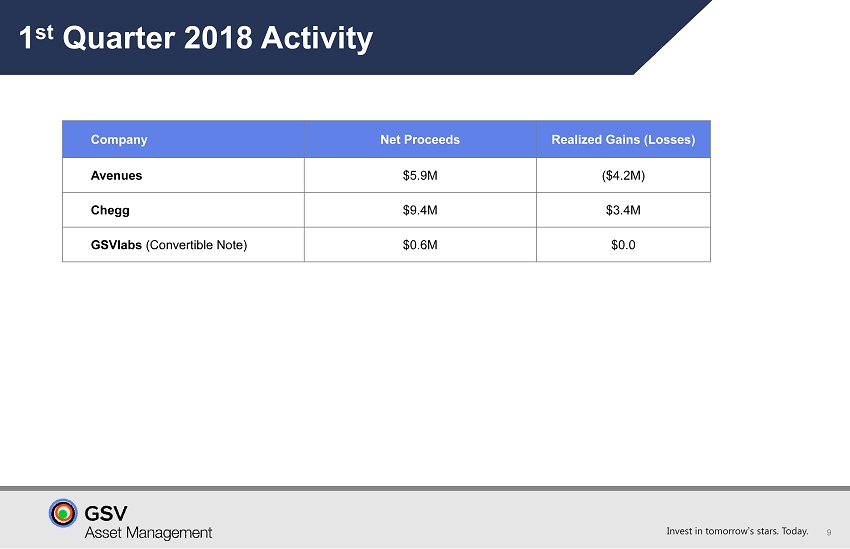

Invest in tomorrow ’ s stars. Today. 1 st Quarter 2018 Activity 9 Company Net Proceeds Realized Gains (Losses) Avenues $5.9M ($4.2M) Chegg $9.4M $3.4M GSVlabs (Convertible Note) $0.6M $0.0

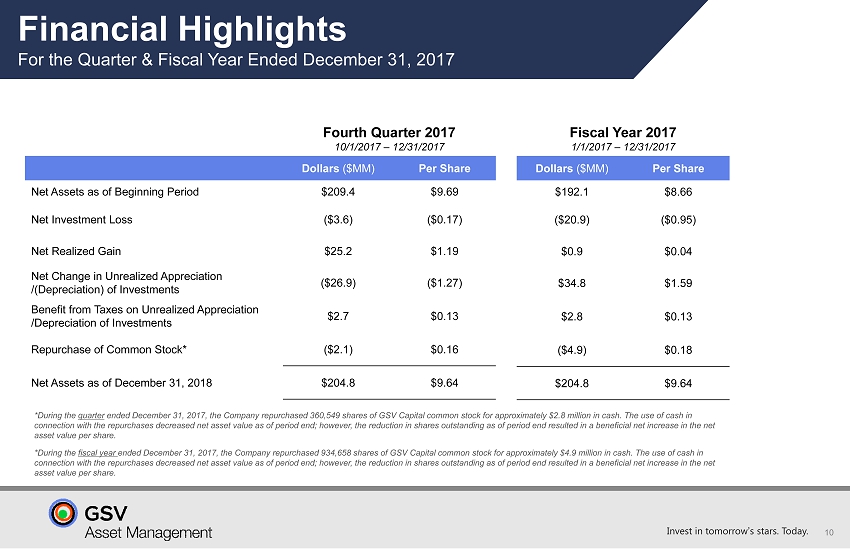

Invest in tomorrow ’ s stars. Today. 10 Fourth Quarter 2017 10/1/2017 – 12/31/2017 Dollars ($MM) Per Share Net Assets as of Beginning Period $209.4 $ 9.69 Net Investment Loss ( $3.6 ) ( $0.17) Net Realized Gain $25.2 $1.19 Net Change in Unrealized Appreciation /(Depreciation) of Investments ($26.9) ($1.27) Benefit from Taxes on Unrealized Appreciation /Depreciation of Investments $2.7 $0.13 Repurchase of Common Stock* ( $2.1) $0.16 Net Assets as of December 31, 2018 $ 204.8 $ 9.64 Financial Highlights For the Quarter & Fiscal Year Ended December 31, 2017 *During the quarter ended December 31, 2017, the Company repurchased 360,549 shares of GSV Capital common stock for approximately $2.8 million in c ash. The use of cash in connection with the repurchases decreased net asset value as of period end; however, the reduction in shares outstanding as o f p eriod end resulted in a beneficial net increase in the net asset value per share. Fiscal Year 2017 1/1/2017 – 12/31/2017 Dollars ($MM) Per Share $192.1 $8.66 ( $20.9) ( $0.95) $0.9 $0.04 $34.8 $1.59 $2.8 $0.13 ( $4.9) $0.18 $ 204.8 $ 9.64 *During the fiscal year ended December 31, 2017, the Company repurchased 934,658 shares of GSV Capital common stock for approximately $4.9 million in ca sh. The use of cash in connection with the repurchases decreased net asset value as of period end; however, the reduction in shares outstanding as o f p eriod end resulted in a beneficial net increase in the net asset value per share.

Invest in tomorrow ’ s stars. Today. 11