Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - DELTA AIR LINES, INC. | delta_8k.htm |

Exhibit 99.1

Delta: Built to Last J.P. Morgan Aviation, Transportation and Industrials Conference March 13, 2018

Safe Harbor Statements in this presentation that are not historical facts, including statements regarding our estimates, expectations, beliefs, intentions, projections o r strategies for the future, may be "forward - looking statements" as defined in the Private Securities Litigation Reform Act of 199 5. All forward - looking statements involve a number of risks and uncertainties that could cause actual results to differ materially from the estimates, expectat ion s, beliefs, intentions, projections and strategies reflected in or suggested by the forward - looking statements. These risks and uncertainties include, but are not limi ted to, the cost of aircraft fuel; the impact of fuel hedging activity including rebalancing our hedge portfolio, recording mark - to - market adjustments or posting colla teral in connection with our fuel hedge contracts; the availability of aircraft fuel; the performance of our significant investments in airlines in other parts of the world; the possible effects of accidents involving our aircraft; breaches or security lapses in our information technology systems; disruptions in our infor mat ion technology infrastructure; our dependence on technology in our operations; the restrictions that financial covenants in our financing agreements could have on our financial and business operations; labor issues; the effects of weather, natural disasters and seasonality on our business; the effects of an extend ed disruption in services provided by third party regional carriers; failure or inability of insurance to cover a significant liability at Monroe’s Trainer refiner y; the impact of environmental regulation on the Trainer refinery, including costs related to renewable fuel standard regulations; our ability to retain senior management and ke y employees; damage to our reputation and brand if we are exposed to significant adverse publicity through social media; the effects of terrorist attack s o r geopolitical conflict; competitive conditions in the airline industry; interruptions or disruptions in service at major airports at which we operate; the effect s o f extensive government regulation on our business; the sensitivity of the airline industry to prolonged periods of stagnant or weak economic conditions; uncertainty i n e conomic conditions and regulatory environment in the United Kingdom related to the likely exit of the United Kingdom from the European Union; and the effects o f t he rapid spread of contagious illnesses. Additional information concerning risks and uncertainties that could cause differences between actual results and forward - lookin g statements is contained in our Securities and Exchange Commission filings, including our Annual Report on Form 10 - K for the fiscal year ended Dec. 31, 2017. C aution should be taken not to place undue reliance on our forward - looking statements, which represent our views only as of March 13, 2018, and which we have no current intention to update. 1

Delta Delivers Again in 2017 2 Balanced Capital Deployment Solid performance driven by better than expected revenue momentum across all geographic regions and an improving cost trajectory Leveraging our key competitive differentiators to drive our continued success into the future Positive outlook for 2018 with revenue - driven earnings growth, industry - leading operations and customer satisfaction, and further upside from fleet, partnerships and tax reform Delta: Built to Last Delivering a Solid March Quarter 2018: Setting Up Well Right Strategic Advantages Running the world’s most reliable, customer - focused airline, with strong financial results, an investment grade balance sheet, and solid returns for our owners

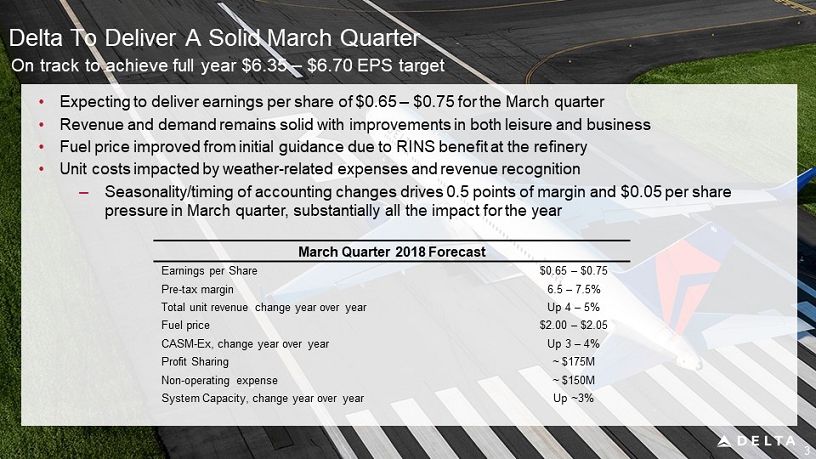

Delta T o Deliver A Solid March Quarter 3 March Quarter 2018 Forecast Earnings per Share $0.65 – $0.75 Pre - tax margin 6.5 – 7.5% Total unit revenue change year over year Up 4 – 5% Fuel price $2.00 – $2.05 CASM - Ex , change year over year Up 3 – 4% Profit Sharing ~ $175M Non - operating expense ~ $150M System Capacity, change year over year Up ~3% • Expecting to deliver earnings per share of $0.65 – $0.75 for the March quarter • Revenue and demand remains solid with improvements in both leisure and business • Fuel price improved from initial guidance due to RINS benefit at the refinery • Unit costs impacted by weather - related expenses and revenue recognition ‒ Seasonality/timing of accounting changes drives 0.5 points of margin and $0.05 per share pressure in March quarter, substantially all the impact for the year On track to achieve full year $6.35 – $6.70 EPS target

2018 Setting Up Well 4 BEST GLOBAL PARTNERS • Leading joint ventures in every entity providing our customers more choice • Developing complementary products and driving additional value through deeper integration with our partners • Leveraging investments to create value for all stakeholders – driving $275 million benefit in 2018 AMERICA’S BEST - RUN AIRLINE • Improving upon our industry - leading operational performance: 242 days of zero mainline cancellations in 2017 • Delivering record customer satisfaction levels through strong culture and employee engagement: NPS growth in all geographic regions in 2017 SOLID TOP - LINE GROWTH • Highest revenue premium in the industry and positive RASM in all geographic regions • Leading the industry in segmentation – driving incremental $300 million in 2018 • G rowing , high - margin loyalty revenue stream from American Express relationship driving $3+ billion contribution in 2018 IMPROVING COST TRAJECTORY • Addressing non - fuel costs should bring growth below 2% in 2018 • 60+ aircraft deliveries expected to produce some of the largest efficiency gains in Delta’s history • “One Delta” – producing $200 million savings this year and $1 billion by 2020

Delta Has The Right Combination Of Strategic Advantages 5 Domestic Network Customer Loyalty Investment Grade Balance Sheet Best connecting hub complex – including the world’s most efficient hub in Atlanta – enhanced by investments in New York, LA and Seattle Solid foundation with lower interest expense, more cash flow flexibility and access to higher quality credit markets for future needs Delta’s ascending brand and strong partnership with American Express combine to produce high - value loyalty program Culture At the core of Delta – passionate and determined professionals with an innate sense of caring for our customers Operational Reliability America’s best - run airline, consistently delivering industry - leading operational results and driving further improvement and efficiencies through innovation

Q&A