Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - Avalon GloboCare Corp. | s109269_ex32-2.htm |

| EX-32.1 - EXHIBIT 32.1 - Avalon GloboCare Corp. | s109269_ex32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - Avalon GloboCare Corp. | s109269_ex31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - Avalon GloboCare Corp. | s109269_ex31-1.htm |

U.S. Securities and Exchange Commission

Washington, DC 20549

FORM 10-K

☐ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED

December 31, 2017

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from__________________ to _______________________.

Commission File Number 000-55709

(Exact name of registrant as specified in its charter)

| Delaware | 47-1685128 | |

| (State or other jurisdiction of incorporation) | (I.R.S. Employer Identification No.) |

4400 Route 9 South, Suite 3100

Freehold, New Jersey 07728

(Address of principal executive offices)

Issuer’s telephone number: 646-762-4517

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common Stock, $.0001 Par Value Per Share

Indicate by check mark whether the registrant is a well-known seasoned issuer as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definition of ”large accelerated filer,” “accelerated filer”, ”smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Non-accelerated filer ☐ | Smaller Reporting Company ☒ |

| Emerging growth company ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Exchange Act) Yes ☐ No ☒

As of June 30, 2017, the aggregate market value of the issued and outstanding common stock held by non-affiliates of the registrant, based upon the closing price of the common stock as traded on the OTCQB of $0.51 was approximately $6,593,597. For purposes of the above statement only, all directors, executive officers and 10% shareholders are assumed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for any other purpose.

As of March 12, 2018, there were 70,278,622 shares of common stock, par value $0.0001 per share, outstanding.

Documents incorporated by reference: NONE

AVALON GLOBOCARE CORP.

2017 FORM 10-K ANNUAL REPORT

TABLE OF CONTENTS

| 2 |

FORWARD-LOOKING STATEMENTS

CERTAIN STATEMENTS IN THIS ANNUAL REPORT MAY CONSTITUTE “FORWARD LOOKING STATEMENTS”. WHEN THE WORDS “BELIEVES,” “EXPECTS,” “PLANS,” “PROJECTS,” “ESTIMATES” AND SIMILAR EXPRESSIONS ARE USED, THEY IDENTIFY FORWARD-LOOKING STATEMENTS. THESE FORWARD-LOOKING STATEMENTS ARE BASED ON MANAGEMENT’S CURRENT BELIEFS AND ASSUMPTIONS AND INFORMATION CURRENTLY AVAILABLE TO MANAGEMENT AND INVOLVE KNOWN AND UNKNOWN RISKS, UNCERTAINTIES AND OTHER FACTORS WHICH MAY CAUSE THE ACTUAL RESULTS, PERFORMANCE OR ACHIEVEMENTS OF THE COMPANY TO BE MATERIALLY DIFFERENT FROM ANY FUTURE RESULTS, PERFORMANCE OR ACHIEVEMENTS EXPRESSED OR IMPLIED BY THESE FORWARD-LOOKING STATEMENTS. INFORMATION CONCERNING FACTORS THAT COULD CAUSE OUR ACTUAL RESULTS TO DIFFER MATERIALLY FROM THESE FORWARD-LOOKING STATEMENTS CAN BE FOUND IN OUR PERIODIC REPORTS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION. WE UNDERTAKE NO OBLIGATION TO PUBLICLY RELEASE REVISIONS TO THESE FORWARD-LOOKING STATEMENTS TO REFLECT FUTURE EVENTS OR CIRCUMSTANCES OR REFLECT THE OCCURRENCE OF UNANTICIPATED EVENTS.

Unless otherwise indicated, references to “we,” “us,” “our,” “Company,” or “Avalon” mean Avalon GloboCare Corp. and its subsidiaries, and references to “fiscal” mean the Company’s fiscal year ended December 31. References to the “parent company” mean Avalon GloboCare Corp.

General

Unless the context otherwise requires, in this report, the terms “Avalon GloboCare” or “Company”, “we”, or “our”, or “Avalon” refers to, Avalon GloboCare Corp. (f/k/a Global Technologies Corp.) a Delaware corporation. Avalon GloboCare’s principal office is located at 4400 Route 9 South, Suite 3100, Freehold, New Jersey 07728. The Company’s telephone number is (646) 762-4517. Avalon GloboCare reports its operations using a fiscal year ending December 31 and the operations reported on this Form 10-K, are presented on a consolidated basis.

The Company files Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, registration statements and other items with the Securities and Exchange Commission (“SEC”). Avalon GloboCare provides access free of charge to all of these SEC filings, as soon as reasonably practicable after filing, on its internet site located at www.avalon-globocare.com. In this report on Form 10-K, the language “this fiscal year” or “current fiscal year” refers to the 12-month period ended December 31, 2017.

In addition, the public may read and copy any materials Avalon files with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Room 1580, Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an internet site (www.sec.gov) that contains reports, proxy and information statements regarding issuers, like Avalon GloboCare, that file electronically with the SEC.

Business Development

Avalon was incorporated under the laws of the State of Delaware on July 28, 2014. On October 18, 2016, the Company changed its name to Avalon GloboCare Corp. and completed a reverse split of its shares of common stock at a ratio of 1:4.

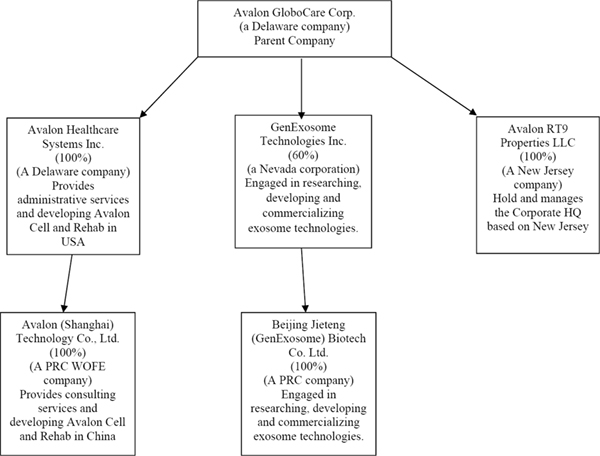

Avalon GloboCare which owns 100% of the capital stock of Avalon Heathcare Systems, Inc., a Delaware company (“AHS”) which it acquired on October 19, 2016. AHS was incorporated on May 18, 2015 under the laws of the State of Delaware. In addition, Avalon GloboCare, through AHS, owns 100% of the capital stock of Avalon (Shanghai) Healthcare Technology Co., Ltd. (“Avalon Shanghai”), which is a wholly foreign-owned enterprise (WOFE) organized under the laws of the People’s Republic of China (“PRC” or “China”). Avalon Shanghai was incorporated on April 29, 2016 and is engaged in medical related consulting services for customers. On February 7, 2017, Avalon formed Avalon RT 9 Properties, LLC, a New Jersey limited liability company, and on January 23, 2017, Avalon incorporated Avalon (BVI) Ltd, a British Virgin Island company (dormant to be dissolved). In July 2017, the Company formed GenExosome Technologies Inc., a Nevada corporation (“GenExosome”). On October 25, 2017, GenExosome and the Company entered into a Securities Purchase Agreement pursuant to which the Company acquired 600 shares of GenExosome in consideration of $1,326,087 in cash and 500,000 shares of common stock of the Company. On October 25, 2017, GenExosome entered into and closed an Asset Purchase Agreement with Yu Zhou, MD, PhD, pursuant to which the Company acquired all assets, including all intellectual property, held by Dr. Zhou pertaining to the business of researching, developing and commercializing exosome technologies in consideration of $876,087 in cash, 500,000 shares of common stock of the Company and 400 shares of common stock of GenExosome. As a result of the above transactions, the Company holds 60% of GenExosome and Dr. Zhou holds 40% of GenExosome. On October 25, 2017, GenExosome entered into and closed a Stock Purchase Agreement with Beijing Jieteng (GenExosome) Biotech Co. Ltd., a corporation incorporated in the People’s Republic of China (“Beijing GenExosome”) and Dr. Zhou, the sole shareholder of Beijing GenExosome, pursuant to which GenExosome acquired all of the issued and outstanding securities of Beijing GenExosome in consideration of a cash payment in the amount of $450,000.

| 3 |

The following diagram illustrates our corporate structure as of December 31, 2017:

Overview

We are dedicated to integrating and managing global healthcare services and resources, as well as empowering high-impact biomedical innovations and technologies to accelerate their clinical applications. Operating through two major platforms, namely “Avalon Cell”, and “Avalon Rehab”, our “Technology + Service” ecosystem covers the areas of regenerative medicine, cell-based immunotherapy, exosome technology, as well as rehabilitation medicine.

In addition, we are engaged in the development of exosome technology to improve diagnosis and management of diseases. Exosomes are tiny, subcellular, membrane-bound vesicles in diameter of 30-150 nm that are released by almost all cell types and that can carry membrane and cellular proteins, as well as genetic materials that are representative of the cell of origin. Profiling various bio-molecules in exosomes may serve as useful biomarkers for a wide variety of diseases. Our isolation system is designed to be used by researchers for biomarker discovery and clinical diagnostic development, and the advancement of targeted therapies. Currently, isolation systems and service are available to isolate exosomes or extract exosomal RNA/protein from serum/plasma, urine and saliva samples. We are seeking to decode proteomic and genomic alterations underlying a wide-range of pathologies, thus allowing for the introduction of novel non-invasive “liquid biopsies”. Our mission is focused toward diagnostic advancements in the fields of oncology, infectious diseases and fibrotic diseases, and discovery of disease-specific exosomes to provide disease origin insight necessary to enable personalized clinical management. There is no guarantee that we will be able to successfully achieve our stated mission.

We currently produce revenue by selling exosome isolation systems in China and the U.S through our Joint Venture GenExosome Technologies, Inc. In addition, we provide medical related consulting services in advanced areas of immunotherapy and second opinion/referral services through our wholly owned subsidiary Avalon (Shanghai) Healthcare Technology Co., Ltd. (“Avalon Shanghai”). We also own and operate commercial real estate in New Jersey where we are headquartered.

The value of the Renminbi (“RMB”), the main currency used in China, fluctuates and is affected by, among other things, changes in China’s political and economic conditions. The conversion of RMB into foreign currencies such as the U.S. dollar have generally been based on rates set by the People’s Bank of China, which are set daily based on the previous day’s interbank foreign exchange market rates and current exchange rates on the world financial markets.

| 4 |

Our Markets

Avalon GloboCare is dedicated to integrating and managing global healthcare services and resources, as well as empowering high-impact biomedical innovations and technologies to accelerate their clinical applications. Operating through two major platforms, namely “Avalon Cell”, and “Avalon Rehab”, our “Technology + Service” ecosystem covers the areas of regenerative medicine, cell-based immunotherapy, exosome technology, as well as rehabilitation medicine. We plan to integrate these services through joint ventures and accretive acquisitions that bring shareholder value both in the short term, through operational entities as part of Avalon Rehab and long term, through biomedical innovation development as part of Avalon Cell, such as our recent Joint Venture for the advancement of exosome isolation systems and related products.

Sales and Marketing

We seek to develop new business through relationships driven by our senior management, which have extensive contacts throughout the healthcare system. Our senior management will be seeking opportunities for joint ventures, strategic relationships and acquisitions in consulting, biomedical innovations, and telemedicine, and rehabilitation centers.

Services

We currently produce revenue through related party strategic relationships through Avalon Shanghai that provide consultative services in advanced areas of immunotherapy and second opinion/referral services. Our services include research studies; executive education; daily online executive briefings; tailored expert advisory services; and consulting and management services. We typically charge an annual fee. Through our services we attempt to focus our clients on important problems by providing an analysis of the evolving healthcare industry and the methods prevalent in the industry to solve those problems through counsel, business planning and support. We plan to expand our business services throughout the United States via our two major “Technology + Service” platforms, “Avalon Cell”, and “Avalon Rehab”.

Strategic Partnerships

We are actively seeking potential strategic partnerships in our area of focus. In addition, we are actively seeking target acquisitions that add accretive value to our strategic plan. There is no guarantee that we will be able to successfully sign a definitive agreement, close or implement such business arrangement. Through our recent Joint Venture in the area of exosome technology, we are actively developing strategic relationships for the distribution and sale of our exosome isolation system and for the commercialization of exosome related products and diagnostic services.

Markets

The Company will focus on the following markets in developing its core business:

Platform “Avalon Cell”

Regarded as the future of medicine, the Company believes cell-based therapeutics will replace pharmaceuticals as a more effective and functional modality in disease treatment. Avalon is actively engaging in this revolutionary trend and positioning to take a leading role in cell-based technology and therapeutics. The business model for our “Avalon Cell” platform is based on stringent criteria in selection and evaluation of candidate projects at different stages of their developmental cycle. We particularly focus on projects with strong intellectual property and distinctive innovation, translational, application-driven, as well as commercialization-ready. Our technology-based platform, “Avalon Cell”, comprises four programs:

| ● | Exosome technology, small extracellular vesicles that have great potential to be used as a vehicle for drug delivery for the treatment of various diseases and biomarkers for early stage diagnosis. The Company has commenced developing collaborative sites at Weill Cornell Medical College, MD Anderson Cancer Center and Mayo Clinic in the United States, as well as Lu Daopei Hospital of Daopei Medical Group (DPMG) and Da An Gene Co, Ltd. (Shenzhen, China), focused on exosome-based diagnostics, therapeutics, bio-banking, as well as “Exosomics Big Data”, in the unmet areas of oral cancer, ovary cancer and liver fibrosis); |

| ● | Endothelial cell, namely therapeutics involving the cells that line blood vessels and regulate exchanges between the bloodstream and surrounding tissue. These programs will occur with our collaborative sites at Weill Cornell Medical College Department of Pathology and Ansary Stem Cell Institute, focusing on standardization of EC banking and therapeutics; |

| ● | Regenerative medicine; and Cell-based immunotherapy (including cells such as NK, DC-CIK, CAR-T…etc). |

Platform Avalon Rehab

A growing trend in China is in the sector of rehabilitation medicine. With our strong capability in integrating global technology and resources in physical medicine and rehabilitation, Avalon will position to take a leading role in this area through our “Avalon Rehab” platform: a turnkey, full suite of rehab services including PT, OT, robotic engineering, cybernectics, and clinical nutrition. Avalon will also engage in strategic partnership with our institutional clients, building the leading and most authoritative network of integrated physical medicine and rehabilitation, particularly for cancer rehab patients. Our initial flagship clinical bases for Avalon Rehab include: Hebei Yanda Lu Daopei Hospital, Beijing Lu Daopei Hospital, and Beijing Daopei Hematology Hospital, with participating strategic partners MD Anderson Cancer Center and Kessler Rehabilitation Institute. Focus will be on accretive acquisitions and joint venture strategic partnerships that are in revenue generating, cash flow positive positions to support biomedical innovation development while providing immediate shareholder value.

5

Services

Our services are targeted at serving our clients and using our insights and deep expertise to produce tangible and significant results. Our services include research studies; executive education; daily online executive briefings; tailored expert advisory services; and consulting and management services. We typically charge an annual fee. Through our services we attempt to focus our clients on important problems by providing an analysis of the evolving healthcare industry and the methods prevalent in the industry to solve those problems. We target these solutions to the clients specific strategic challenges, operational issues, and management concerns. As part of this, we provide personnel support for each client that will provide counsel, business planning and support.

Revenue

GenExosome Technologies, Inc.

Through our majority owned subsidiary, GenExosome Technologies, Inc. (“GenExosome”), the Company markets and sells its proprietary exosome isolation systems. Exosomes are small extracellular vesicles that we believe may be used as a vehicle for drug delivery for the treatment of various diseases, and biomarkers or early stage diagnosis and as enhancements to certain cosmetic treatments and procedures. We currently produce our isolation systems in China and the U.S. and sell these systems primarily to research laboratories and universities.

Further, we produce revenue by performing development services for hospitals and sales of related products developed to hospitals through GenExosome and Beijing Jieteng (GenExosome) Biotech Co., Ltd. (“Beijing GenExosome”), GenExosome’s wholly-owned subsidiary.

Avalon RT 9 Properties, LLC

In May 2017, the Company acquired commercial property located in Freehold, New Jersey. This property is now the Avalon corporate headquarters and contains several commercial tenants that generate revenue through rental income. The revenue generated from the commercial tenants in its Freehold, New Jersey headquarters is facilitated through a management agreement with a company, which is controlled by Wenzhao Lu, the Company’s major shareholder and chairman of the Board of Directors, based in the USA.

Avalon Shanghai

We currently produce revenue by providing medical related consulting services in advanced areas of immunotherapy and second opinion/referral services through Avalon (Shanghai) Healthcare Technology Co., Ltd. (“Avalon Shanghai”). Our medical related consulting services include research studies; executive education; daily online executive briefings; tailored expert advisory services; and consulting and management services. We typically charge an annual fee. Through our services we attempt to focus our clients on important problems by providing an analysis of the evolving healthcare industry and the methods prevalent in the industry to solve those problems through counsel, business planning and support. The revenue generated from its related parties in China are managed through its employees residing in China and through contactors that are retained as needed. We have several service and consulting contracts with related parties in China. These related parties primarily have relationships with our Chairman and CEO. Some of these contracts expire March 31, 2018, however it is expected that the majority will automatically renew. There are three such major revenue generating sources in China.

| ● | Nanshan Memorial Stem Cell Biotechnology Co., Ltd. ( “NMSCB”), which is a related party to our Chairman. We have been outsourced by NMSCB to provide consulting and advisory services to enhance their business and international status. According to our service contract with NMSCB, we will continue to provide such consulting and advisory services to NMSCB to further enhance the business operation as well as the international status of their Wuhan Biolake Stem Cell Bank. |

| ● | Hebei Yanda Ludaopei Hospital Co., Ltd. (“HYLH”), which is a related party to the Chairman. We have been outsourced by HYLH to provide consulting and advisory services to develop and facilitate several events and programs for the Hebei Yanda Ludaopei Hospital. According to our service contract with HYLH, we will continue to provide such consulting and advisory services to HYLH to facilitate their clinical programs in telemedicine and rehabilitation, as well as international academic/clinical collaborations, training, and knowledge exchange. |

| ● | Daopei Investment Management (Shanghai) Co., Ltd. (herein referred to as “DIMS”), which is a related party to the Chairman. We have been outsourced by DIMS to provide consulting and advisory services to enhance their “Ludaopei” branding via network partnership, as well as to develop long-range integration of hematology/oncology programs with other hospitals in China. According to our service contract with LIMS, we will continue to provide such consulting and advisory services to LIMS to facilitate the “Ludaopei” brand expansion with respect to facilitating the operation and management of existing network Ludaopei Hematology-Oncology Centers, as well as to develop further qualified “Ludaopei” network partnership in China. |

6

Strategic Development

We intend to focus on three components. The initial component will be focused on acquiring and/or managing fixed assets including healthcare real estate as well as stem cell banks. In addition, we intend to pursue the acquisition and development of healthcare related technologies through acquisition, licensing or joint ventures. We will also consider a third avenue of investing in certain technologies.

Intellectual Property

Through GenExosome, we own four patents in China with related trademarks. We are in the process of applying for those same patents and trademarks in the United States and are also in the process of developing additional patents and related intellectual property. We own and control a variety of trade secrets, confidential information, trademarks, trade names, copyrights, and other intellectual property rights that, in the aggregate, are of material importance to our business. We consider our trademarks, service marks, and other intellectual property to be proprietary, and rely on a combination of copyright, trademark, trade secret, non-disclosure, and contractual safeguards to protect our intellectual property rights.

Competition

GenExosome Technologies, Inc.

We currently market for sale of our proprietary Exosome isolation system. There are other companies that produce Exosome isolation systems. However, our internal analysis shows that most Exosome isolation systems use a centrifuge process for isolation which takes several hours and results in a low purity. Our isolation system is a membrane system which isolates exosomes in a few minutes with a higher purity than competing systems.

We believe that our proprietary isolation system is superior to competing systems and plan to continue to improve our process to maintain competitive advantages in the market.

Avalon Shanghai

In our current consulting business in the Peoples Republic of China (“PRC” or “China”), we compete with a number of advisory firm offering similar service including consulting and strategy firms; market research, data, benchmarking, and forecasting providers; technology vendors and services firms; health care information technology firms; technology advisory firms; outsourcing firms; and specialized providers of educational and training services. Other organizations, such as state and national trade associations, group purchasing organizations, non-profit think-tanks, and database companies, also may offer research, consulting, tools, and education services to health care and education organizations.

We believe that the principal competitive factors in our market include quality and timeliness of our services, strength and depth of relationships with our clients, ability to meet the changing needs of current and prospective clients, measurable returns on customer investment, and service and affordability.

As our business develops and we expand through joint ventures, acquisitions and strategic partnerships in the U.S and PRC, we will have competition with other direct service providers, emerging technologies and medical communication platforms. Avalon will seek to maintain a competitive advantage through intellectual property, superior quality management and cutting edge technology.

Rt. 9 Properties, LLC.

Our executive commercial building in Freehold, New Jersey is located on a major highway and is one of the largest buildings in the surrounding areas. It is centrally located and maintains high occupancy. There are other commercial properties in the vicinity that offer similar amenities. However, premier executive offices are limited and as such we expect to continue to maintain high occupancy in the near term.

Legal Proceedings

From time to time, we are subject to ordinary routine litigation incidental to our normal business operations. We are not currently a party to, and our property is not subject to, any material legal proceedings.

Employees

As of March 12, 2018, we employed 13 employees, seven of which are full time employees. None of our employees are represented by a collective bargaining arrangement.

Government Regulation

The health care industry in the PRC and U.S. is highly regulated and subject to changing political, legislative, regulatory, and other influences. Further, the healthcare industry is currently undergoing rapid change. We are uncertain how, when or in what context these new changes will be adopted or implemented. These new regulations could create unexpected liabilities for us, could cause us or our members to incur additional costs and could restrict our or our clients’ operations. Many of the laws are complex and their application to us, our clients, or the specific services and relationships we have with our members are not always clear. Our failure to anticipate accurately the application of these laws and regulations, or our other failure to comply, could create liability for us, result in adverse publicity, and otherwise negatively affect our business.

7

Despite efforts to develop its legal system over the past several decades, including but not limited to legislation dealing with economic matters such as foreign investment, corporate organization and governance, commerce, taxation and trade, the PRC continues to lack a comprehensive system of laws. Further, the laws that do exist in the PRC are often vague, ambiguous and difficult to enforce, which could negatively affect our ability to do business in China and compete with other companies in our segments.

In September 2006, the Ministry of Commerce (“MOFCOM”) promulgated the Regulations on Foreign Investors’ Mergers and Acquisitions of Domestic Enterprises (“M&A Regulations”) in an effort to better regulate foreign investment in PRC. The M&A Regulations were adopted in part as a needed codification of certain joint venture formation and operating practices, and also in response to the government’s increasing concern about protecting domestic companies in perceived key industries and those associated with national security, as well as the outflow of well-known trademarks, including traditional Chinese brands.

As a U.S. based company doing business in PRC, we seek to comply with all PRC laws, rules and regulations and pronouncements, and endeavor to obtain all necessary approvals from applicable PRC regulatory agencies such as the MOFCOM, the State Assets Supervision and Administration Commission, the State Administration for Taxation, the State Administration for Industry and Commerce, the China Securities Regulatory Commission, and the State Administration of Foreign Exchange (“SAFE”).

Company History

On October 19, 2016, we entered into and closed a Share Exchange Agreement with the shareholders of Avalon Healthcare System, Inc., a Delaware corporation (“AHS”), each of which are accredited investors (“AHS Shareholders”) pursuant to which we acquired 100% of the outstanding securities of AHS in exchange for 50,000,000 shares of our common stock (the “AHS Acquisition”). Considering that, following the acquisition, the AHS Shareholders control the majority of our outstanding voting common stock and we effectively succeeded our otherwise minimal operations to those that are theirs, AHS is considered the accounting acquirer in this reverse-acquisition transaction. A reverse-acquisition transaction is considered, and accounted for as, a capital transaction in substance; it is equivalent to the issuance of AHS securities for our net monetary assets, which are deminimus, accompanied by a recapitalization. Accordingly, we have not recognized any goodwill or other intangible assets in connection with this reverse acquisition transaction. AHS is the surviving and continuing entities and the historical financials following the reverse acquisition transaction will be those of AHS. We were a “shell company” (as such term is defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended) immediately prior to our acquisition of AHS pursuant to the terms of the Share Exchange Agreement. AHS owns 100% of the capital stock of Avalon (Shanghai) Healthcare Technology Co., Ltd. (“Avalon Shanghai”), which is a wholly foreign-owned enterprise organized under the laws of the PRC. Avalon Shanghai was incorporated on April 29, 2016 and is engaged in medical related consulting services for customers. Consequently, we believe that acquisition has caused us to cease to be a shell company as we no longer have nominal operations.

On September 29, 2016, effective October 18, 2016, the Company filed a Certificate of Amendment of Certificate of Incorporation (the “Certificate”) with the State of Delaware to (i) effect a reverse stock split of its outstanding and authorized shares of common stock at a ratio of 1 for 4 (the “Reverse Stock Split”) and (ii) effectuate a name change (“Name Change”). Fractional shares that resulted from the Reverse Stock Split were rounded up to the next highest number. As a result of the Name Change, the Company’s name changed from “Global Technologies Corp.” to “Avalon GloboCare Corp.”. The Certificate was approved by the majority of the Company’s shareholders and by the Board of Directors of the Company. The effective date of the Reverse Stock Split and the Name Change was October 18, 2016.

In connection with the above, the Company filed an Issuer Company-Related Action Notification Form with the Financial Industry Regulatory Authority. The Reverse Stock Split and the Name Change were implemented by FINRA on October 18, 2016. Our symbol on the OTCQB was GTHCD for 20 business days from October 18, 2016 (the “Notification Period”). Following the Notification Period, our symbol was changed to “AVCO”. Our new CUSIP number is 05344R 104.

On December 22, 2016, the Company entered into an Agreement of Sale (the “Purchase Agreement”) with Freehold Craig Road Partnership (“Seller”), a New Jersey partnership, to purchase certain real property located in the Township of Freehold, County of Monmouth, State of New Jersey, having a street address of 4400 Route 9 South, Freehold, NJ 07728 (the “Property”). All rights under the Purchase Agreement were assigned by the Company to Avalon RT 9 Properties, LLC, the Company’s wholly owned subsidiary (“Avalon RT 9”). Avalon Properties closed on the purchase of the Property on May 5, 2017. The purchase price including adjustments paid by the Company for the Property was $7.65 million in cash. The Seller also assigned all lease agreements for all tenants on the Property to Avalon RT 9.

In July 2017, the Company formed GenExosome Technologies Inc., a Nevada corporation (“GenExosome”). On September 29, 2017, Dr. David K. Jin was appointed as the sole director and as the Chief Executive Officer, Chief Medical Officer and President, Meng Li was appointed as Chief Operating Officer and Secretary and Luisa Ingargiola was appointed as Chief Financial Officer. On October 25, 2017, GenExosome and the Company entered into a Securities Purchase Agreement pursuant to which the Company acquired 600 shares of GenExosome in consideration of $1,326,087 in cash and 500,000 shares of common stock of the Company.

On October 25, 2017, GenExosome entered into and closed an Asset Purchase Agreement with Yu Zhou, MD, PhD, pursuant to which the Company acquired all assets, including all intellectual property, held by Dr. Zhou pertaining to the business of researching, developing and commercializing exosome technologies including, but not limited to, patent application number CN 2016 1 0675107.5 (application of an Exosomal MicroRNA in plasma as biomarker to diagnosis liver cancer), patent application number CN 2016 1 0675110.7 (clinical application of circulating exosome carried miRNA-33b in the diagnosis of liver cancer), patent application number CN 2017 1 0330847.X (saliva exosome based methods and composition for the diagnosis, staging and prognosis of oral cancer) and patent application number CN 2017 1 0330835.7 (a novel exosome-based therapeutics against proliferative oral diseases). In consideration of the assets, GenExosome agreed to pay Dr. Zhou $876,087 in cash no later than November 24, 2017, transfer 500,000 shares of common stock of the Company to Dr. Zhou no later than November 24, 2017 and issue Dr. Zhou 400 shares of common stock of GenExosome no later than November 24, 2017. The above transactions have since been completed and and as a result, the Company holds 60% of GenExosome and Dr. Zhou holds 40% of GenExosome.

8

On October 25, 2017, GenExosome entered into and closed a Stock Purchase Agreement with Beijing Jieteng (GenExosome) Biotech Co. Ltd., a corporation incorporated in the People’s Republic of China (“Beijing GenExosome”) and Dr. Zhou, the sole shareholder of Beijing GenExosome, pursuant to which GenExosome acquired all of the issued and outstanding securities of Beijing GenExosome in consideration of a cash payment in the amount of $450,000, which shall be paid upon Beijing GenExosome recording the change in ownership with the Ministry of Commerce of the People’s Republic of China in accordance with the Interim Measures for Record Management regarding the Establishment and Change of Foreign-invested Enterprises (revised).

On October 25, 2017, GenExosome increased its size of its board of directors from one to four and appointed Wenzhao “Daniel” Lu, Meng Li and Dr. Zhou to the board of directors. In addition, Dr. Zhou was appointed as Co-Chief Executive Officer of GenExosome.

On October 25, 2017, Dr. Zhou and GenExosome entered into an Executive Retention Agreement pursuant to which Dr. Zhou agreed to serve as Co-Chief Executive Officer in consideration of an annual salary of $160,000. Dr. Zhou and GenExosome also entered into an Invention Assignment, Confidentiality, Non-Compete and Non-Solicit Agreement.

Beijing GenExosome is engaged in the development of exosome technology to improve diagnosis and management of diseases. Exosomes are tiny, subcellular, membrane-bound vesicles in diameter of 30-150 nm that are released by almost all cell types and that can carry membrane and cellular proteins, as well as genetic materials that are representative of the cell of origin. Profiling various bio-molecules in exosomes may serve as useful biomarkers for a wide variety of diseases. Beijing GenExosome’s research kits are designed to be used by researchers for biomarker discovery and clinical diagnostic development, and the advancement of targeted therapies. Currently, research kits and service are available to isolate exosomes or extract exosomal RNA/protein from serum/plasma, urine and saliva samples. Beijing GenExosome is seeking to decode proteomic and genomic alterations underlying a wide-range of pathologies, thus allowing for the introduction of novel non-invasive “liquid biopsies”. Its mission is focused toward diagnostic advancements in the fields of oncology, infectious diseases and fibrotic diseases, and discovery of disease-specific exosomes to provide disease origin insight necessary to enable personalized clinical management. There is no guarantee that Beijing GenExosome will be able to successfully achieve its stated mission.

You should carefully consider the following material risk factors as well as all other information set forth or referred to in this report before purchasing shares of our common stock. Investing in our common stock involves a high degree of risk. The Company believes all material risk factors have been presented below. If any of the following events or outcomes actually occurs, our business operating results and financial condition would likely suffer. As a result, the trading price of our common stock could decline, and you may lose all or part of the money you paid to purchase our common stock.

General Operating and Business Risks

Our limited operating history makes it difficult for us to evaluate our future business prospects and make decisions based on those estimates of our future performance.

We did not begin operations of our business through AHS until May 2015. We have a limited operating history and limited revenue. As a consequence, it is difficult, if not impossible, to forecast our future results based upon our historical data. Reliance on the historical results may not be representative of the results we will achieve, particularly in our combined form. Because of the uncertainties related to our lack of historical operations, we may be hindered in our ability to anticipate and timely adapt to increases or decreases in revenues or expenses. If we make poor budgetary decisions as a result of unreliable historical data, we could be less profitable or incur losses, which may result in a decline in our stock price.

Our results of operations have not resulted in profitability and we may not be able to achieve profitability going forward.

We incurred a net loss amounting to $4,049,645 for the year ended December 31, 2017. If we incur additional significant losses, our stock price, may decline, perhaps significantly. Our management is developing plans to achieve profitability. Our business plan is speculative and unproven. There is no assurance that we will be successful in executing our business plan or that even if we successfully implement our business plan, that we will be able to curtail our losses now or in the future. Further, as we are a new enterprise, we expect that net losses will continue and our working capital deficit will increase.

We depend upon key personnel and need additional personnel.

Our success depends on the continuing services of Wenzhao Lu, David Jin, Meng Li and Luisa Ingargiola, our executive officers and directors. The loss of Mr. Lu, Dr. Jin, Ms. Li or Ms. Ingariola could have a material and adverse effect on our business operations. Additionally, the success of the Company’s operations will largely depend upon its ability to successfully attract and maintain competent and qualified key management personnel. As with any company with limited resources, there can be no guaranty that the Company will be able to attract such individuals or that the presence of such individuals will necessarily translate into profitability for the Company. Our inability to attract and retain key personnel may materially and adversely affect our business operations.

9

Currently, we have several service and consulting contracts with related parties in China. The loss of such customers could adversely impact our financial condition and results of operations.

During the year ended December 31, 2017, we recognized an aggregate of $1,077,550 in revenue, of which $222,611 was generated from related parties. Wenzhao Lu, our Chairman and significant shareholder, is the Chairman of each of the related parties. Although we maintain close working relationships with our related party customers, the consulting agreements expire March 31, 2018. The loss of any related party customer would have a material adverse effect on our financial condition or results of operation, the loss of more than one such related party customer, or our failure to replace such customer with other customers, could have a material adverse effect on our financial condition and our results of operations.

Our auditors have issued a “going concern” audit opinion.

Our independent auditors have indicated, in their report on our December 31, 2017 consolidated financial statements, that there is substantial doubt about our ability to continue as a going concern. The Company had an accumulated deficit of $3,517,654 at December 31, 2017. The Company has a limited operating history and its continued growth is dependent upon the continuation of providing medical consulting services to three related parties, generating rental revenue from its income-producing real estate property in New Jersey and generating revenue from proprietary Exosome Isolation Systems by developing proprietary diagnostic and therapeutic products leveraging exosome technology; hence generating revenues, and obtaining additional financing to fund future obligations and pay liabilities arising from normal business operations. In addition, the current cash balance cannot be projected to cover the operating expenses for the next twelve months from the filing date of this report. These matters raise substantial doubt about the Company’s ability to continue as a going concern. The ability of the Company to continue as a going concern is dependent on the Company’s ability to raise additional capital, implement its business plan, and generate significant revenues. There are no assurances that the Company will be successful in its efforts to generate significant revenues, maintain sufficient cash balance or report profitable operations or to continue as a going concern. The Company plans on raising capital through the sale of equity or debt instruments to implement its business plan. However, there is no assurance these plans will be realized and that any additional financings will be available to the Company on satisfactory terms and conditions, if any.

We must effectively manage the growth of our operations, or our company will suffer.

To manage our growth, we believe we must continue to implement and improve our services and products. We may not have adequately evaluated the costs and risks associated with our planned expansion, and our systems, procedures, and controls may not be adequate to support our operations. In addition, our management may not be able to achieve the rapid execution necessary to successfully offer our products and services and implement our business plan on a profitable basis. The success of our future operating activities will also depend upon our ability to expand our support system to meet the demands of our growing business. Any failure by our management to effectively anticipate, implement, and manage changes required to sustain our growth would have a material adverse effect on our business, financial condition, and results of operations.

Our business requires substantial capital, and if we are unable to maintain adequate financing sources our profitability and financial condition will suffer and jeopardize our ability to continue operations.

In connection with the strategic development portion of our business, we will need significant capital in order to implement acquisitions of technologies. In addition, we will need a significant amount of capital in order to fully implement our advisory business, maintain our rental property and further develop our Exosome business. If we are unable to maintain adequate financing or other sources of capital are not available, we could be forced to suspend, curtail or reduce our operations, which could harm our revenues, profitability, financial condition and business prospects.

Our revenue and results of operations may suffer if we are unable to attract new clients, continue to engage existing clients, or sell additional products and services.

We presently derive our revenue from providing medical related consulting services to related parties, generating rental revenue from our income-producing real estate property in New Jersey and generating revenue from proprietary Exosome Isolation Systems by developing proprietary diagnostic and therapeutic products leveraging exosome technology. Our growth therefore depends on our ability to attract new clients, maintain existing clients and properties and sell additional products and services to existing clients. This depends on our ability to understand and anticipate market and pricing trends and our clients’ needs and our ability to deliver consistent, reliable, high-quality services. If we fail to engage new clients, continue to re-engage with our existing clients or to cross-sell additional services our results could be materially and adversely affect our operating results.

Our prospects will suffer if we are not able to hire, train, motivate, manage, and retain a significant number of highly skilled employees.

We only recently commenced business and we presently generate medical related consulting services to related parties, generating rental revenue from our income-producing real estate property in New Jersey and generating revenue from proprietary Exosome Isolation Systems by developing proprietary diagnostic and therapeutic products leveraging exosome technology. On the consulting side, Wenzhao Lu, our Chairman and significant shareholder, is the Chairman of each of the clients in which we provide consulting services. Our future success depends upon our ability to hire, train, motivate, manage, and retain a significant number of highly skilled employees, particularly research analysts, technical experts, and sales and marketing staff. We will experience competition for professional personnel in each of our business lines. Hiring, training, motivating, managing, and retaining employees with the skills we need is time consuming and expensive. Any failure by us to address our staffing needs in an effective manner could hinder our ability to continue to provide high-quality products and services and to grow our business.

10

Potential liability claims may adversely affect our business.

Our services, which may include recommendations and advice to organizations regarding complex business and operational processes and regulatory and compliance issues may give rise to liability claims by our clients or by third parties who bring claims against our clients. Healthcare organizations often are the subject of regulatory scrutiny and litigation, and we also may become the subject of such litigation based on our advice and services. Any such litigation, whether or not resulting in a judgment against us, may adversely affect our reputation and could have a material adverse effect on our financial condition and results of operations. We may not have adequate insurance coverage for claims against us.

In accordance with our strategic development policy, we may invest in companies for strategic reasons and may not realize a return on our investments.

Similar to the development of our majority owned subsidiary, GenExosome, from time to time, we may make investments in companies. These investments may be for strategic objectives to support our key business initiatives but may also be stand alone investments or acquisitions. Such investments or acquisitions could include equity or debt instruments in private companies, many of which may not be marketable at the time of our initial investment. These companies may range from early-stage companies that are often still defining their strategic direction to more mature companies with established revenue streams and business models. The success of these companies may depend on product development, market acceptance, operational efficiency, and other key business factors. The companies in which we invest may fail because they may not be able to secure additional funding, obtain favorable investment terms for future financings, or take advantage of liquidity events such as public offerings, mergers, and private sales. If any of these private companies fails, we could lose all or part of our investment in that company. If we determine that impairment indicators exist and that there are other-than-temporary declines in the fair value of the investments, we may be required to write down the investments to their fair value and recognize the related write-down as an investment loss.

Our growing operations in the PRC could expose us to risks that could have an adverse effect on our costs of operations.

Our client base is presently located in the PRC. We intend to grow this client base in the PRC as well as the United States. As a result, we expect to continue to add personnel in the PRC. With a significant focus of our operations in the PRC, our reliance on a workforce in the PRC exposes us to disruptions in the business, political, and economic environment in that region. Maintenance of a stable political environment between the PRC and the United States is important to our operations, and any disruption in this relationship may directly negatively affect our operations. Our operations in the PRC require us to comply with complex local laws and regulatory requirements and expose us to foreign currency exchange rate risk. Our operations may also be subject to reduced or inadequate protection of our intellectual property rights, and security breaches. Further, it may be difficult to transfer funds from our Chinese operations to our US parent company. Negative developments in any of these areas could increase our costs of operations or otherwise harm our business.

We face intense competition which could cause us to lose market share.

In the healthcare markets in the United States and the Peoples Republic of China, we will compete with large healthcare providers who have more significant financial resources, established market positions, long-standing relationships, and who have more significant name recognition, technical, marketing, sales, distribution, financial and other resources than we do. The resources available to our competitors to develop new services and products and introduce them into the marketplace exceed the resources currently available to us. This intense competitive environment may require us to make changes in our services, products, pricing, licensing, services, distribution, or marketing to develop a market position.

Our success is heavily dependent on protecting our intellectual property rights.

Through GenExosome, we own four patents in China with related trademarks. We are in the process of applying for those same patents and trademarks in the United States and are also in the process of developing additional patents and related intellectual property. We own and control a variety of trade secrets, confidential information, trademarks, trade names, copyrights, and other intellectual property rights that, in the aggregate, are of material importance to our business. We consider our trademarks, service marks, and other intellectual property to be proprietary, and rely on a combination of copyright, trademark, trade secret, non-disclosure, and contractual safeguards to protect our intellectual property rights. Our success will, in part, depend on our ability to obtain trademarks and patents. We have also entered into confidentiality agreements with our employees and consultants. We cannot be certain that others will not gain access to these trade secrets or that our patents will provide adequate protection. Others may independently develop substantially equivalent proprietary information and techniques or otherwise gain access to our trade secrets.

We may be exposed to liabilities under the Foreign Corrupt Practices Act, and any determination that we violated the Foreign Corrupt Practices Act or Chinese anti-corruption law could have a material adverse effect on our business.

We are subject to the Foreign Corrupt Practice Act, or FCPA, and other laws that prohibit improper payments or offers of payments to foreign governments and their officials and political parties by U.S. persons and issuers as defined by the statute for the purpose of obtaining or retaining business. Chinese anti-corruption law also strictly prohibits bribery of government officials. We have operations, agreements with third parties and make sales in China, where corruption may occur. Our activities in China create the risk of unauthorized payments or offers of payments by one of the employees, consultants, sales agents or distributors of our company, even though these parties are not always subject to our control. It is our policy to implement safeguards to prevent these practices by our employees. However, our existing safeguards and any future improvements may prove to be less than effective, and the employees, consultants, sales agents or distributors of our company may engage in conduct for which we might be held responsible.

11

Violations of the FCPA or other anti-corruption laws may result in severe criminal or civil sanctions, and we may be subject to other liabilities, which could negatively affect our business, operating results and financial condition. In addition, the United States government may seek to hold our company liable for successor liability FCPA violations committed by companies in which we invest or that we acquire.

Risks Related to Doing Business in China

If we become directly subject to the recent scrutiny, criticism and negative publicity involving certain U.S.-listed Chinese companies, we may have to expend significant resources to investigate and resolve the matter which could harm our business operations, stock price and reputation and could result in a loss of your investment in our stock, especially if such matter cannot be addressed and resolved quickly.

Recently, U.S. public companies that have substantially all of their operations in China, particularly companies like us which have completed so-called reverse merger transactions, have been the subject of intense scrutiny, criticism and negative publicity by investors, short sellers, financial commentators and regulatory agencies, such as the United States Securities and Exchange Commission. Much of the scrutiny, criticism and negative publicity has centered around financial and accounting irregularities and mistakes, a lack of effective internal controls over financial accounting, inadequate corporate governance policies or a lack of adherence thereto and, in many cases, allegations of fraud. As a result of the scrutiny, criticism and negative publicity, the publicly traded stock of many U.S. listed Chinese companies has sharply decreased in value and, in some cases, has become virtually worthless. Many of these companies are now subject to shareholder lawsuits, SEC enforcement actions and are conducting internal and external investigations into the allegations. It is not clear what affect this sector-wide scrutiny, criticism and negative publicity will have on our company, our business and our stock price. If we become the subject of any unfavorable allegations, whether such allegations are proven to be true or untrue, we will have to expend significant resources to investigate such allegations and/or defend our company. This situation could be costly and time consuming and distract our management from growing our company. If such allegations are not proven to be groundless, our company and business operations will be severely impacted and your investment in our stock could be rendered worthless.

Adverse changes in political and economic policies of the PRC government could impede the overall economic growth of China, which could reduce the demand for our products and damage our business.

Presently, we generate our revenue in China although we intend to pursue various opportunities in the United States and our headquarters is based in the United States. Accordingly, our business, financial condition, results of operations and prospects are affected significantly by economic, political and legal developments in China. The PRC economy differs from the economies of most developed countries in many respects, including:

| ● | the higher level of government involvement; |

| ● | the early stage of development of the market-oriented sector of the economy; |

| ● | the rapid growth rate; |

| ● | the higher level of control over foreign exchange; and |

| ● | the allocation of resources. |

As the PRC economy has been transitioning from a planned economy to a more market-oriented economy, the PRC government has implemented various measures to encourage economic growth and guide the allocation of resources. While these measures may benefit the overall PRC economy, they may also have a negative effect on us or the healthcare industry in general.

Although the PRC government has in recent years implemented measures emphasizing the utilization of market forces for economic reform, the PRC government continues to exercise significant control over economic growth in China through the allocation of resources, controlling payment of foreign currency-denominated obligations, setting monetary policy and imposing policies that impact particular industries or companies in different ways.

Any adverse change in the economic conditions or government policies in China could have a material adverse effect on the overall economic growth and the level of new healthcare investments and expenditures in China, which in turn could lead to a reduction in demand for our services and consequently have a material adverse effect on our business and prospects.

Uncertainties with respect to the PRC legal system could limit the legal protections available to you and us.

We conduct substantially all of our business through our operating subsidiary in the PRC. Our operating subsidiary is generally subject to laws and regulations applicable to foreign investments in China and, in particular, laws applicable to foreign-invested enterprises. The PRC legal system is based on written statutes, and prior court decisions may be cited for reference but have limited precedential value. Since 1979, a series of new PRC laws and regulations have significantly enhanced the protections afforded to various forms of foreign investments in China. However, since the PRC legal system continues to rapidly evolve, the interpretations of many laws, regulations and rules are not always uniform and enforcement of these laws, regulations and rules involve uncertainties, which may limit legal protections available to you and us. In addition, any litigation in China may be protracted and result in substantial costs and diversion of resources and management attention. In addition, all of our executive officers and almost all of our directors are residents of China and not of the United States, and substantially all the assets of these persons are located outside the United States. As a result, it could be difficult for investors to affect service of process in the United States or to enforce a judgment obtained in the United States against our Chinese operations and subsidiary.

12

The PRC government exerts substantial influence over the manner in which we must conduct our business activities.

The PRC government has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through regulation and state ownership. Our ability to operate in China may be harmed by changes in its laws and regulations. We believe that our operations in China are in material compliance with all applicable legal and regulatory requirements. However, the central or local governments of the jurisdictions in which we operate may impose new, stricter regulations or interpretations of existing regulations that would require additional expenditures and efforts on our part to ensure our compliance with such regulations or interpretations.

Accordingly, government actions in the future, including any decision not to continue to support recent economic reforms and to return to a more centrally planned economy or regional or local variations in the implementation of economic policies, could have a significant effect on economic conditions in China or particular regions thereof.

We may be unable to complete a business combination transaction efficiently or on favorable terms due to complicated merger and acquisition regulations implemented on September 8, 2006.

The recent PRC Regulation on Mergers and Acquisitions of Domestic Companies by Foreign Investors also governs the approval process by which a PRC company may participate in an acquisition of its assets or its equity interests. Depending on the structure of the transaction, the new regulation will require the Chinese parties to make a series of applications and supplemental applications to the government agencies. In some instances, the application process may require the presentation of economic data concerning a transaction, including appraisals of the target business and evaluations of the acquirer, which are designed to allow the government to assess the transaction. Government approvals will have expiration dates by which a transaction must be completed and reported to the government agencies. Compliance with the new regulations is likely to be more time consuming and expensive than in the past and the government can now exert more control over the combination of two businesses. Accordingly, due to the new regulation, our ability to engage in business combination transactions is extremely complicated, time consuming and expensive, and we may not be able to negotiate a transaction that is acceptable to our stockholders or sufficiently protect their interests in a transaction.

The new regulation allows PRC government agencies to assess the economic terms of a business combination transaction. Parties to a business combination transaction may have to submit to MOFCOM and the other government agencies an appraisal report, an evaluation report and the acquisition agreement, all of which form part of the application for approval, depending on the structure of the transaction. The regulations also prohibit a transaction at an acquisition price obviously lower than the appraised value of the Chinese business or assets and in certain transaction structures, require that consideration must be paid within defined periods, generally not in excess of a year. The regulation also limits our ability to negotiate various terms of the acquisition, including aspects of the initial consideration, contingent consideration, holdback provisions, indemnification provisions and provisions relating to the assumption and allocation of assets and liabilities. Transaction structures involving trusts, nominees and similar entities are prohibited. Therefore, such regulation may impede our ability to negotiate and complete a business combination transaction on financial terms that satisfy our investors and protect our stockholders’ economic interests.

Under the Current Enterprise Income Tax, or EIT, Law, we may be classified as a “resident enterprise” of China. Such classification will likely result in unfavorable tax consequences to us and our non-PRC stockholders.

We are a holding company incorporated under the laws of Delaware. We conduct substantially all of our business through our wholly-owned and majority-owned subsidiaries, and we derive all of our income from these entities. Prior to January 1, 2008, dividends derived by foreign enterprises from business operations in China were not subject to the Chinese enterprise income tax. However, such tax exemption ceased as of January 1, 2008 and thereafter with the effectiveness of the new Enterprise Income Tax Law, or EIT Law.

Under the EIT Law, if we are not deemed to be a “resident enterprise” for Chinese tax purposes, a withholding tax at the rate of 10% would be applicable to any dividends paid by our Chinese subsidiaries to us. However, if we are deemed to be a “resident enterprise” established outside of China whose “place of effective management” is located in China, we would be classified as a resident enterprise for Chinese tax purposes and thus would be subject to an enterprise income tax rate of 25% on all of our income on a worldwide basis.

The regulations promulgated pursuant to the EIT Law define the term “place of effective management” as “establishments that carry out substantial and overall management and control over the manufacturing and business operations, personnel, accounting, properties, etc. of an enterprise.” The State Administration of Taxation issued a SAT Circular 82 on April 22, 2009, which provides that the “place of effective management” of a Chinese-controlled overseas-incorporated enterprise is located in China if the following requirements are satisfied: (i) the senior management and core management departments in charge of its daily operations function are mainly located in the PRC; (ii) its financial and human resources decisions are subject to determination or approval by persons or bodies located in the PRC; (iii) its major assets, accounting books, company seals, and minutes and files of its board and shareholders’ meetings are located or kept in the PRC; and (iv) no less than half of the enterprise’s directors or senior management with voting rights reside in the PRC. SAT Circular 82 applies only to overseas registered enterprises controlled by PRC enterprises, not to those controlled by PRC individuals. If the Company’s non-PRC incorporated entities are deemed PRC tax residents, such entities would be subject to PRC tax under the EIT Law. The Company has analyzed the applicability of the EIT Law and related regulations, and for each of the applicable periods presented, the Company has not accrued for PRC tax on such basis. In addition, although under the EIT Law and the related regulations dividends paid to us by our PRC subsidiaries would qualify as “tax-exempted income,” we cannot assure you that such dividends will not be subject to a 10% withholding tax, as the PRC foreign exchange control authorities, which enforce the withholding tax, have not yet issued guidance with respect to the processing of outbound remittances to entities that are treated as resident enterprises for PRC enterprise income tax purposes. As a result of such changes, our historical operating results will not be indicative of our operating results for future periods and the value of our shares of common stock may be adversely affected. We are actively monitoring the possibility of “resident enterprise” treatment and are evaluating appropriate organizational changes to avoid this treatment, to the extent possible.

13

We may be subject to fines and legal sanctions if we or our Chinese employees fail to comply with PRC regulations relating to employee stock options granted by overseas listed companies to PRC citizens.

On December 25, 2006, the People’s Bank of China issued the Administration Measures on Individual Foreign Exchange Control, and its Implementation Rules were issued by the State Administration of Foreign Exchange (“SAFE”) on January 5, 2007. Both took effect on February 1, 2007. Under these regulations, all foreign exchange matters involved in an employee stock holding plan, stock option plan or similar plan in which PRC citizens’ participation requires approval from the SAFE or its authorized branch. On March 28, 2007, the SAFE issued the Application Procedure for Foreign Exchange Administration for Domestic Individuals Participating in Employee Stock Holding Plans or Stock Option Plans of Overseas Listed Companies, or Notice 78. Under Notice 78, PRC individuals who participate in an employee stock option holding plan or a stock option plan of an overseas listed company are required, through a PRC domestic agent or PRC subsidiary of the overseas listed company, to register with the SAFE and complete certain other procedures. If we and our Chinese employees are granted shares or stock options pursuant to our share incentive plan they would be subject to Notice 78. However, in practice, there are significant uncertainties with regard to the interpretation and implementation of Notice 78. We are committed to complying with the requirements of Notice 78. However, we cannot provide any assurance that we or our Chinese employees will be able to qualify for or obtain any registration required by Notice 78. In particular, if we and/or our Chinese employees fail to comply with the provisions of Notice 78, we and/or our Chinese employees may be subject to fines and legal sanctions imposed by the SAFE or other PRC government authorities, as a result of which our business operations and employee option plans could be materially and adversely affected.

The new M&A Rules establish more complex procedures for some acquisitions of Chinese companies by foreign investor which could make it more difficult for us to pursue growth through acquisitions in China.

The New M&A Rules that became effective on September 8, 2006 established additional procedures and requirements that could make merger and acquisition activities by foreign investors more time-consuming and complex, including requirements in some instances that the Ministry of Commerce be notified in advance of any change-of-control transaction in which a foreign investor takes control of a PRC domestic enterprise. Complying with the requirements of the M&A Rules to complete such transactions could be time-consuming, and any required approval processes, including obtaining approval from the Ministry of Commerce, may delay or inhibit our ability to complete such transactions, which could materially adversely affect our ability to grow our business through acquisitions in China.

Risks Relating to our Securities

Our status as an emerging growth company may result in reduced disclosure obligations.

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act, which we refer to as the JOBS Act, and we are eligible to take advantage of certain exemptions from various reporting and financial disclosure requirements that are applicable to other public companies, that are not emerging growth companies, including, but not limited to, (1) not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act, (2) reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and (3) exemptions from the requirements of holding a non-binding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. We intend to take advantage of these exemptions. Because of the reduced disclosure and because a portion of our business is conducted in China, investors may find investing in our common stock less attractive as a result, which could have an adverse effect on our stock price.

In addition, Section 102 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended, for complying with new or revised accounting standards. As a result, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We elected to opt out of such extended transition period and acknowledge such election is irrevocable pursuant to Section 107 of the JOBS Act.

We could remain an emerging growth company for up to five years, or until the earliest of (1) the last day of the first fiscal year in which our annual gross revenues exceed $1.07 billion, (2) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our ordinary shares that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter and we have been publicly reporting for at least 12 months, or (3) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three-year period.

14

We are a “smaller reporting company,” and we cannot be certain if the reduced disclosure requirements applicable to smaller reporting companies will make our common stock less attractive to investors.

We are currently a “smaller reporting company”, meaning that we are not an investment company, an asset- backed issuer, or a majority-owned subsidiary of a parent company that is not a smaller reporting company and have a non-affiliated public float of less than $75 million and annual revenues of less than $50.0 million during the most recently completed fiscal year. In the event that we are still considered a “smaller reporting company,” at such time as we cease being an “emerging growth company,” we will be required to provide additional disclosure in our SEC filings. However, similar to an “emerging growth companies”, “smaller reporting companies” are able to provide simplified executive compensation disclosures in their filings; are exempt from the provisions of Section 404(b) of the Sarbanes-Oxley Act requiring that independent registered public accounting firms provide an attestation report on the effectiveness of internal control over financial reporting; and have certain other decreased disclosure obligations in their SEC filings, including, among other things, only being required to provide two years of audited financial statements in annual reports and in a registration statement under the Exchange Act on Form 10. Decreased disclosures in our SEC filings due to our status as a “smaller reporting company” may make it harder for investors to analyze our results of operations and financial prospects.

If securities or industry analysts do not publish research or reports about our business, or if they issue an adverse or misleading opinion regarding our stock, our stock price and trading volume could decline.

The trading market for our common stock will be influenced by the research and reports that industry or securities analysts publish about us or our business. We do not currently have and may never obtain research coverage by securities and industry analysts. If no or few securities or industry analysts commence coverage of us, the trading price for our stock would be negatively impacted. In the event we obtain securities or industry analyst coverage, if any of the analysts who cover us issue an adverse or misleading opinion regarding us, our business model, our intellectual property or our stock performance, or if our operating results fail to meet the expectations of analysts, our stock price would likely decline. If one or more of these analysts cease coverage of us or fail to publish reports on us regularly, we could lose visibility in the financial markets, which in turn could cause our stock price or trading volume to decline.

We may be exposed to additional risks as a result of “going public” by means of a reverse acquisition transaction.

We may be exposed to additional risks because we became a public company through a “reverse merger” transaction. There has been increased focus by government agencies on reverse merger transactions in recent years, and we may be subject to increased scrutiny by the SEC and other government agencies and holders of our securities as a result of the completion of our reverse merger transaction. Additionally, our “going public” by means of a reverse merger transaction may make it more difficult for us to obtain coverage from securities analysts of major brokerage firms following the reverse merger transaction because there may be little incentive to those brokerage firms to recommend the purchase of our common stock. Further, investment banks may be less likely to agree to underwrite secondary offerings on our behalf than they might if we became a public reporting company by means of an initial public offering because they may be less familiar with our company as a result of more limited coverage by analysts and the media, and because we became public at an early stage in our development. The failure to receive research coverage or support in the market for our shares will have an adverse effect on our ability to develop a liquid market for our common stock. The occurrence of any such event could cause our business or stock price to suffer.