Attached files

| file | filename |

|---|---|

| EX-10.5 - EX-10.5 - Aptevo Therapeutics Inc. | apvo-ex105_281.htm |

| EX-32.2 - EX-32.2 - Aptevo Therapeutics Inc. | apvo-ex322_547.htm |

| EX-32.1 - EX-32.1 - Aptevo Therapeutics Inc. | apvo-ex321_546.htm |

| EX-31.2 - EX-31.2 - Aptevo Therapeutics Inc. | apvo-ex312_548.htm |

| EX-31.1 - EX-31.1 - Aptevo Therapeutics Inc. | apvo-ex311_549.htm |

| EX-23.1 - EX-23.1 - Aptevo Therapeutics Inc. | apvo-ex231_599.htm |

| EX-10.38 - EX-10.38 - Aptevo Therapeutics Inc. | apvo-ex1038_189.htm |

| EX-10.7 - EX-10.7 - Aptevo Therapeutics Inc. | apvo-ex107_280.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2017

OR

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO |

Commission File Number 001-37746

APTEVO THERAPEUTICS INC.

(Exact name of Registrant as specified in its Charter)

|

Delaware |

81-1567056 |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|

2401 4th Avenue, Suite 1050 Seattle, Washington |

98121 |

|

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (206) 838-0500

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class |

Name of Each Exchange on Which Registered |

|

Common Stock, $0.001 par value |

The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ☐ NO ☒

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. YES ☐ NO ☒

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ☒ NO ☐

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). YES ☒ NO ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See the definition of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

|

|

|

|

|

|

|

|

|

Non-accelerated filer |

|

☐ (Do not check if a small reporting company) |

|

Small reporting company |

|

☒ |

|

|

|

|

|

Emerging growth company |

|

☒ |

If an emerging growth company, indicate b check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 12(a) of the Exchange Act. ☒

The aggregate market value of common stock held by non-affiliates of the Registrant as of June 30, 2017, the last business day of the registrants most recently completed second fiscal quarter, was $35.8 million, based upon the closing price of the Registrant’s common stock on the NASDAQ Stock Market LLC on such date.

Excludes an aggregate of 4,033,743 shares of the Registrant’s common stock held as of such date by officers, directors, and stockholders that the registrant has concluded are or were affiliates of the Registrant. Exclusion of such shares should not be construed to indicate that the holder of any such shares possesses the power, direct or indirect, to direct or cause the direction of the management or policies of the Registrant or that such person is controlled by or under common control with the Registrant.

As of March 9, 2018, the number of shares of Registrant’s common stock outstanding was 21,112,605

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s definitive proxy statement to be filed with the Securities and Exchange Commission pursuant to Regulation 14A, not later than 120 days after the end of the fiscal year covered by this Annual Report on Form 10-K, relating to the Registrant’s 2018 Annual Meeting of Stockholders are incorporated by reference into Part III of this Report.

|

|

|

|

|

Page |

|

|

|

|

|

|

|

Item 1. |

|

|

1 |

|

|

Item 1A. |

|

|

19 |

|

|

Item 1B. |

|

|

44 |

|

|

Item 2. |

|

|

45 |

|

|

Item 3. |

|

|

45 |

|

|

Item 4. |

|

|

45 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 5. |

|

|

46 |

|

|

Item 6. |

|

|

46 |

|

|

Item 7. |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

47 |

|

Item 7A. |

|

|

58 |

|

|

Item 8. |

|

|

59 |

|

|

Item 9. |

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

|

84 |

|

Item 9A. |

|

|

84 |

|

|

Item 9B. |

|

|

85 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 10. |

|

|

86 |

|

|

Item 11. |

|

|

86 |

|

|

Item 12. |

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

86 |

|

Item 13. |

|

Certain Relationships and Related Transactions, and Director Independence |

|

86 |

|

Item 14. |

|

|

86 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 15. |

|

|

87 |

|

|

Item 16. |

|

|

92 |

In this Annual Report on Form 10-K, “we,” “our,” “us,” “Aptevo,” and the “Company” refer to Aptevo Therapeutics Inc. and, where appropriate, its consolidated subsidiaries.

ii

Cautionary Note Regarding Forward-Looking Information

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are based on our management’s beliefs and assumptions and on information currently available to our management. All statements other than statements of historical facts are “forward-looking statements” for purposes of these provisions, including those relating to future events or our future financial performance and financial guidance. In some cases, you can identify forward-looking statements by terminology such as “may,” “might,” “will,” “should,” “expect,” “plan,” “anticipate,” “project,” “believe,” “estimate,” “predict,” “potential,” “intend” or “continue,” the negative of terms like these or other comparable terminology, and other words or terms of similar meaning in connection with any discussion of future operating or financial performance. These statements are only predictions. All forward-looking statements included in this Annual Report on Form 10-K are based on information available to us on the date hereof, and we assume no obligation to update any such forward-looking statements. Any or all of our forward-looking statements in this document may turn out to be wrong. Actual events or results may differ materially. Our forward-looking statements can be affected by inaccurate assumptions we might make or by known or unknown risks, uncertainties and other factors. We discuss many of these risks, uncertainties and other factors in this Annual Report on Form 10-K in greater detail under the heading “Item 1A—Risk Factors.” We caution investors that our business and financial performance are subject to substantial risks and uncertainties.

OVERVIEW

We are a biotechnology company focused on novel oncology (cancer) and hematology (blood disease) therapeutics to meaningfully improve patients’ lives. Our core technology is the ADAPTIR™ (modular protein technology) platform. We currently have one revenue-generating product in the area of hematology, as well as various investigational stage product candidates in immuno-oncology and autoimmune and inflammatory diseases.

In August 2015, Emergent BioSolutions Inc., or Emergent, announced a plan to separate into two independent publicly traded companies, one a biotechnology company and the other a global specialty life sciences company. To accomplish this separation, Emergent created a new company, Aptevo Therapeutics Inc., or Aptevo, to be the parent company for the development-based biotechnology business focused on novel oncology, hematology, and autoimmune and inflammatory therapeutics. We were incorporated in Delaware in February 2016 as a wholly owned subsidiary of Emergent. To effect the separation, Emergent made a pro rata distribution of Aptevo’s common stock to Emergent’s stockholders on August 1, 2016.

Our product portfolio is composed of a marketed product for hematology and investigational stage candidates based on our ADAPTIR platform, primarily focused on immuno-oncology indications. IXINITY is our marketed commercial product. It is a coagulation factor IX (recombinant) therapeutic indicated in adults and children 12 years of age and older with hemophilia B for control and prevention of bleeding episodes, and management of bleeding during operations. Our clinical investigational stage product candidates in immuno-oncology, APVO414 (formerly MOR209/ES414), otlertuzumab and our preclinical candidates, APVO436, APVO210 and a proof of concept bispecific immunotherapeutic protein targeting ROR1 are built on our novel ADAPTIR platform, which is designed to expand on the utility and effectiveness of therapeutic antibodies. The platform can be used to produce monospecific, bispecific and multispecific immunotherapeutic proteins that specifically bind to one or more targets, which we believe provide structural and functional advantages over monoclonal antibodies. The mechanisms of action for APVO414, otlertuzumab and our preclinical candidates, APVO436, APVO210 and a proof of concept bispecific immunotherapeutic protein targeting ROR1, include: direct tumor cytotoxicity, antibody-dependent cell-cytotoxicity, redirected T-cell cytotoxicity (RTCC), or targeted cytokine delivery. The structural differences of ADAPTIR molecules over monoclonal antibodies allow for the development of other ADAPTIR immunotherapeutics that engage immune effector cells and disease targets in a novel manner to produce unique signaling responses. We are skilled at product candidate generation, validation and subsequent pre-clinical and clinical development using the ADAPTIR platform. We intend to progress ADAPTIR molecules from concept to

1

marketed product by way of our protein engineering, pre-clinical development, process development and CRO management, cGMP manufacturing oversight and clinical development capabilities. We also expect to have the ability to launch, market and commercialize these product candidates upon approval and might also use contracted resources to augment our capabilities.

On August 31, 2017, we entered into an LLC purchase agreement with Saol International Limited (Saol) whereby we agreed to sell our Hyperimmune Business, which consisted of the following products: WinRho® SDF for autoimmune platelet disorder and hemolytic disease of the newborn; HepaGam B® for the prevention of Hepatitis B following liver transplantation and for treatment following hepatitis B exposure; and VARIZIG® for treatment following exposure to varicella zoster virus for individuals with compromised immune systems.

On September 28, 2017, we announced that we completed the sale of our Hyperimmune Business to Saol for total consideration of up to $74.5 million. At the closing of the acquisition, Saol paid us an upfront payment totaling $65.0 million, including $3.3 million which was deposited in an escrow account for the purposes of satisfying any indemnification claims brought by Saol pursuant to the LLC purchase agreement. In addition, we may receive (1) an additional potential milestone payment totaling up to $7.5 million related to the achievement of certain gross profit milestones and (2) up to $2.0 million related to collection of certain accounts receivable after the closing.

STRATEGY

We seek to grow our business by, among other things:

Advancing our ADAPTIR™ platform, initially focusing on immunotherapy and the development of novel bispecific proteins for the treatment of cancer. We focus on product development using our ADAPTIR platform. We plan to generate additional bispecific protein immunotherapies for early development, potentially with other collaborative partners, to further validate the potential of the ADAPTIR platform. We intend to favor the development of bispecific candidates that have the potential to demonstrate proof of concept early in development and are differentiated in key oncology indications. We expect to continue to expand the ADAPTIR product pipeline to address areas of unmet medical need. Bispecifics and multispecific ADAPTIR proteins will be generated to target tumors using the immune system or direct cytokine delivery to selective cell populations. We believe these product candidates may have utility in oncology, autoimmune disease and other therapeutic areas.

Continuing to develop new products. We are committed to new product development. We have expertise in molecular biology, antibody engineering and the development of protein therapeutics, including cell line development, protein purification, process development and analytical characterization. We believe that these core areas of expertise enable the development of therapeutics based on the ADAPTIR platform technology from design, pre-clinical testing, and clinical development to preparation of a biologics license application, or BLA.

Establishing collaborative partnerships to broaden our pipeline and provide funding for research and development. We intend to continue to develop and grow our product portfolio through internal research and development as well as through collaborations with other biotechnology and pharmaceutical companies, academia and non-governmental organizations.

Supporting the future growth of our pipeline by maximizing the financial contribution of IXINITY. We intend to continue to maximize the financial contribution of IXINITY for the purpose of funding our research and development efforts. This may require further investments.

PLATFORM TECHNOLOGY AND PRODUCT CANDIDATES

Platform Technology

ADAPTIR Platform. The platform can be used to produce monospecific, bispecific and multispecific immunotherapeutic proteins that specifically bind to one or more targets and receptors found on immune cells to mediate tumor killing and improve disease response by modulating the immune cells directly or immune environment. We believe we are well positioned for the development of bispecific therapeutics, which are antibody-based molecules that are able to bind multiple targets of therapeutic interest, utilizing our innovative ADAPTIR (modular protein technology) platform. This allows us to take a novel approach to cancer immunotherapy.

2

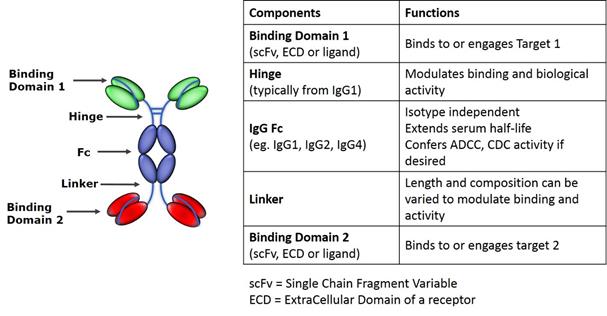

Structurally, ADAPTIR molecules are similar to antibodies; they can exhibit the same biological functions of an antibody, but can be easily modified to either eliminate or incorporate new activities, all the while maintaining a similar size, stability and manufacturing advantages of a monoclonal antibody. The ADAPTIR molecules are single-chain polypeptides comprising customized elements including a protein domain that binds to one or more target binding domains to a hinged domain and a set of antibody constant domains known as the fragment crystallizable region, or Fc region of a human antibody. The antibody Fc region can elicit an immune response by binding to the corresponding Fc receptors found on various immune cells such as natural killer (NK) cells, and other cells, including cancer cells to mediate antibody-dependent cell cytotoxicity resulting in killing of the cancer cell. With the ADAPTIR platform, the Fc region can be modified to enhance or eliminate these functions. Incorporation of the Fc region into the ADAPTIR platform also provides for an extended serum half-life by engaging recycling via the neonatal Fc receptor (FcRn). A long serum half-life could potentially reduce dosing frequency and dose quantity.

Multispecific ADAPTIR molecules are similar in structure to monospecific ADAPTIR molecules with the exception that they have two or more customized target binding domains on the ends of the Fc region. Multiple targeting domains allow ADAPTIR molecules to bind to two or more targets. We have created several bispecific molecules that are able to redirect T-cell cytotoxicity. T-cells are white blood cells that fight infections and tumor cells. RTCC ADAPTIR molecules cause T-cells to specifically kill a tumor by binding to a common component (CD3) found on the T-cell and then binding to a specific tumor antigen on a specific tumor, activating a T-cell to kill the tumor.

We believe the ADAPTIR platform is a promising platform technology within the rapidly growing field of immuno-oncology therapeutics. The structural differences between ADAPTIR molecules and monoclonal antibodies, allow for the development of new immunotherapeutics that engage disease targets in a novel manner and produce a unique signaling response. By customizing the binding domains of our ADAPTIR molecules, we are able to select for desired potency, half-life, toxicity and stability/manufacturability. We have the potential to develop products with mechanisms of action including but not limited to RTCC and targeted cytokine delivery. We are able to expand our ADAPTIR platform to generate bispecifics that target tumor antigens in combination with costimulatory molecules including TNF-Receptor family members. We believe the ADAPTIR platform may prove to have advantages over other immunotherapeutics and other bispecific T-cell engaging technologies. In pre-clinical studies, we have gathered data indicating that APVO414 and APVO436 may have high potency and activity at low doses, a long half-life, and reduced cytokine release. This molecule is able to be produced using standard manufacturing practices. Further clinical and preclinical studies may not confirm or establish the anticipated benefits of this platform.

3

We own all ADAPTIR platform intellectual property. See section entitled “Intellectual Property” for additional information about the ownership rights to ADAPTIR intellectual property. We have a non-exclusive research license with Lonza Sales AG, or Lonza, for certain Chinese hamster ovary, or CHO, cell lines, which are cells derived from the ovary of a Chinese hamster. The Lonza CHO cell line is often used in the production of therapeutic proteins, in protein expression and the GS (glutamine synthetase) Gene Expression SystemTM, or GS System (GS Gene Expression System is a registered trademark of Lonza).

Product Portfolio

Product Candidates

Our pipeline includes investigational stage product candidates in immuno-oncology.

APVO414 (formerly known as MOR209/ES414). APVO414 is a targeted immunotherapeutic protein under development for metastatic castration-resistant prostate cancer, currently in Phase 1 clinical development. APVO414, a bispecific protein, was constructed using our ADAPTIR platform technology. It activates host T-cells to specifically kill tumor cells expressing prostate specific membrane antigen, or PSMA, an enzyme that is commonly overexpressed on the surface of prostate cancer cells. APVO414 contains two pairs of binding domains, one targeting the CD3 of the TCR complex and one targeting PSMA on tumor cells; these binding domains are linked to opposite ends of an antibody Fc region which extends the serum half-life and enables use of a purification process typical of antibodies. In pre-clinical studies, APVO414 has been shown to redirect T-cell cytotoxicity towards prostate cancer cells expressing PSMA.

In December 2015, after a review of data from the ongoing Phase 1 dose escalation study in prostate cancer patients, we concluded that the dosing regimen and administration required adjustment. The decision to adjust was not based on safety aspects but was driven by the high complexity and properties of this first generation ADAPTIR bispecific molecule. Patients receiving weekly doses APVO414 developed antibodies against the drug; this is called anti-drug antibodies, or ADA. ADA developed in most patients including those receiving the maximum tolerated dose drug that could be given safely on a weekly basis. These antibodies bind to the drug, reducing the concentration of APVO414 in the blood and thus could potentially reduce its efficacy. We observed no safety issues related to the development of ADA. The cause of these antibodies is unclear but could be due to the weekly administration of the drug. The protocol has been amended to continuous intravenous infusion as a way to administer higher levels of drug and prevent the development of ADA and the amended trail commenced December 2016.

Otlertuzumab. Otlertuzumab is a monospecific protein therapeutic intended for the treatment of peripheral T-cell lymphoma (PTCL). PTCL is a malignancy involving T-cells. Otlertuzumab is a humanized anti-CD37 monospecific protein therapeutic built using the ADAPTIR platform technology. It specifically binds to CD37, a receptor found on malignant B-cells and T-cells. It functions like an antibody by direct killing of tumor and also engages natural killer cells, which are lymphocytes of the immune system, and other effector cells to kill the tumor cell. We believe that otlertuzumab’s novel properties may provide patients with improved therapeutic options and enhanced efficacy when used in combination with chemotherapy or other targeted therapeutics.

We completed a Phase 2 clinical trial evaluating the combination of otlertuzumab and bendamustine (a chemotherapy agent) versus bendamustine alone in patients with relapsed CLL. In that clinical trial the combination of otlertuzumab and bendamustine was superior to bendamustine alone. The combination was well tolerated with significantly increased response rate and prolonged progression free survival rate (15.9 months vs. 10.1 months) over single agent bendamustine treatment. The overall incidence of serious adverse events was similar between the two treatment cohorts. There was a higher incidence of adverse events of fever, neutropenia (which is a low white blood cell count which can predispose a patient to infection) and thrombocytopenia (which is a low platelet count that if severe could lead to bleeding) with the combination. The addition of otlertuzumab did not appear to increase the number of serious adverse events, as there were fewer discontinuations for adverse events with the combination compared to bendamustine alone.

We are conducting a Phase 2 clinical trial to evaluate the safety and efficacy of otlertuzumab in combination with bendamustine, in patients with relapsed PTCL. The trial plan is to enroll 24 patients, with the first patient enrolled in January 2018.

4

APVO436. We have developed APVO436, a preclinical ADAPTIR bispecific immunotherapeutic protein targeting CD123, a cell surface receptor highly expressed on several hematological malignancies and CD3, a component of the T-cell receptor. APVO436 utilizes redirected T-cell cytotoxicity (RTCC) to initiate killing of CD123 expressing tumor cells. Preclinical data on this anti-CD123 ADAPTIR bispecific was presented at the 2017 annual meeting of the American Association for Cancer Research and 2017 American Society of Hematology (ASH). These data demonstrate in vitro RTCC activity and in vivo tumor cell killing in animal models of disease (AACR) and demonstrate that APVO436 can kill AML blasts using patient derived peripheral blood cells in the presence of APVO436.

APVO210. APVO210 is an anti-inflammatory molecule engineered using our ADAPTIR platform technology currently in pre-clinical development. It is under development for the treatment of psoriasis and inflammatory bowel disease, including ulcerative colitis and Crohn’s Disease, and other autoimmune and inflammatory diseases. APVO210 is a targeted cytokine therapeutic, specifically, it is designed to deliver a modified form of the anti-inflammatory cytokine, IL-10, to antigen presenting cells, or APCs, that express CD86. APCs are a therapeutic target of interest for an anti-inflammatory therapeutic such as APVO210 because, as described further below, APCs play a critical role in the immune response. Structurally, APVO210 contains a modified form of IL-10, coupled to binding sites specific for CD86, linked by an antibody Fc region. The mechanism of action results in suppression of T-cell responses through inhibition of antigen presentation. Antigen presenting cells play a central role in the generation and regulation of immune response and inflammation; therefore, inhibiting their function represents a therapeutic opportunity to suppress immunopathological processes in autoimmune and inflammatory disease. APVO210 preclinical data demonstrate potent in vitro and in vivo antagonism of T-cell proliferation in human mixed lymphocyte reactions and in a humanized graft-versus-host disease model. Humanized refers to chemically altering animal proteins to resemble natural human amino acid sequences (or the order in which they bond). The APVO210 ADAPTIR molecule also has potential to suppress immune responses and serve in anti-inflammation applications that occurs in inflammatory bowel disease, psoriasis, rheumatoid arthritis, graft versus host disease (GVHD) and in the treatment of transplant rejection. As a molecule designed using our ADAPTIR platform technology, the APVO210 half-life is extended as demonstrated in preclinical rodent studies. Also, manufacturing benefits are realized because the platform enables use of a purification process that is typically used for making antibodies.

ALG.APV-527. ALG.APV-527 is a bispecific antibody candidate, partnered with Alligator Bioscience, featuring a novel mechanism of action designed to simultaneously target 4-1BB (CD137) and 5T4, a tumor antigen widely overexpressed in a number of different types of cancer. 4-1BB, a costimulatory receptor on T cells, is known to enhance the immune response to cancer through activation of tumor-specific T cells and is believed to be a promising target for new immunotherapeutic approaches. ALG.APV-527 could potentially have utility in the treatment of a broad spectrum of cancers over-expressing the tumor antigen, including breast, cervical, non-small-cell-lung, prostate, renal, gastric, colorectal and bladder cancers.

ROR1 Bispecific. ROR1 Bispecific is a proof-of-concept bispecific candidate targeting ROR1, an antigen found on several solid tumors and hematologic, or blood-related malignancies. Initial preclinical data demonstrate redirected T cell killing of tumors expressing ROR1 in vitro and in vivo in animal models.

ADAPTIR Therapeutic Candidates. We have multiple additional candidates that are focused on immuno-oncology and based on the ADAPTIR platform technology that are in different stages of pre-clinical development.

Potential adverse events related to our product candidates

Experimental drugs may have a variety of adverse events related to their target, mechanism of action or off target toxicities. Clinical trials are conducted to define the efficacy and safety of a new molecule and this data is reviewed by the FDA prior to FDA approval. The majority of the drugs that we are developing are intended for the treatment of cancer. Because cancer is a serious and life threatening disease, these patients experience a number of serious adverse events as part of their disease. The risk-benefit ratio for new treatments of cancer is different than other less serious diseases. For example, for the treatment of hypertension, it is not acceptable for a drug to lower the number of white blood cells that fight infections. However, chemotherapy for the treatment of cancer frequently lowers the number of white blood cells and infections do occur, which physicians manage in the course of a patient’s cancer treatment. In order to distinguish whether a new drug causes adverse events, a controlled trial is frequently conducted comparing a new drug to another therapy.

5

In clinical trials to date with otlertuzumab, a variety of adverse events have been reported. The events that have been reported with infusion of the drug include: infusion reactions, fever, neutropenia and thrombocytopenia. Severe infusion reactions were infrequent. When these reactions are severe they lead to hypotension (low blood pressure) and bronchospasm (difficulty breathing). Neutropenia is a low white blood cell count that could predispose a patient to infection. The neutropenia observed with otlertuzumab was mild to moderate, not prolonged and did not increase the infection rate in a controlled clinical trial. Thrombocytopenia is a low platelet count that if severe could lead to bleeding. The thrombocytopenia observed with otlertuzumab was infrequent and not associated with bleeding. Any of these events or others that have not yet been experienced, could lead to adverse events, including death and severely limit the drug’s use in the market or even its ability to be approved by a regulatory body.

APVO414 is currently being tested in its first clinical trial in humans. Twenty-one patients have received the drug. One of the significant serious adverse events associated with the drug to date is infusion reactions. Infusion reactions are often associated with the infusion of a protein and are expected with a drug that activates T-cells. The other serious adverse events that have been reported with infusion of the drug include: fever, fatigue, hypertension, bronchospasm, chills and rigors. The severity of these reactions varied by patient and were managed medically and resolved.

Competition

Our product candidates face significant competition. Any product candidate that we successfully develop and commercialize is likely to compete with currently marketed products, as well as other novel product candidates that are in development for the same indications. Specifically, the competition with respect to our product candidates includes the following:

|

|

• |

APVO414. If approved for the treatment of metastatic castration-resistant prostate cancer, we anticipate that APVO414 would compete with Taxotere® (Sanofi-Aventis U.S. LLC), Jevtana (Sanofi-Aventis U.S. LLC), Zytiga® (Janssen Biotech, Inc.), Xtandi® (Astellas Pharma, Inc.), Xofigo® (Bayer HealthCare Pharmaceuticals Inc.), and potentially other products currently under development. There is a potential that APVO414 could also be used in combination with these same agents. According to the American Cancer Society, prostate cancer is the most common cancer in men in the United States. Screening, radiation, surgery and hormone ablation therapy have greatly improved the detection and treatment of early stage prostate cancer. New therapies approved recently for patients with metastatic castration-resistant prostate cancer only improve life expectancy by a few months, and a significant medical need still exists for these individuals. |

|

|

• |

Otlertuzumab. If approved for PTCL, otlertuzumab would compete with other targeted agents and chemotherapies, including: Istodax (Celgene) and Folotyn (Spectrum). |

|

|

• |

APVO436. If approved for AML, we anticipate that APVO436 would compete with other agents targeting CD123 that are in development if they are also approved. Bispecifics in development targeting CD123 include: MGD006 (Macrogenics), JNJ-63709178 (Janssen) and XmAb14045 (Xencor). There are at least two CAR-T therapies in development: CART123 (University of Penn.) and CARTCD123 (NCI/City of Hope). Other competitive products targeting CD123 are: SGN-CD123A (antibody drug conjugate, Seattle Genetics), SL-401 (antibody immunotoxin, Stemline), KHK2833 (monoclonal antibody, Kyowa Hakko Kirin Pharma), and CSL362 (monoclonal antibody, CSL/Janssen). |

|

|

• |

APVO210. If approved, we anticipate that APVO210 would compete with products indicated for inflammatory bowel diseases such as ulcerative colitis, including: HUMIRA® (AbbVie Inc.), Remicade® (Janssen Pharmaceuticals, Inc. of Johnson and Johnson) and Entyvio® (Takeda Pharmaceuticals U.S.A., Inc., a subsidiary of Takeda Pharmaceutical Company Limited). Depending on what APVO210 is approved for, we anticipate that it could also compete with products indicated for moderate to severe Crohn’s Disease, including: Stelara (Janssen Pharmaceuticals, Inc. of Johnson and Johnson) and Xeljanz (Pfizer Inc.). For other autoimmune disease there are a number of other drugs which APVO210 would compete against. For example, in psoriasis alone there are four anti-TNF inhibitors and four anti-interleukins approved by the FDA. |

6

Collaboration with Alligator Bioscience AB

On July 20, 2017, our wholly owned subsidiary, Aptevo Research and Development LLC, or Aptevo R&D, entered into a collaboration and option agreement (Collaboration Agreement) with Alligator Bioscience AB, or Alligator, pursuant to which Aptevo R&D and Alligator will collaboratively develop ALG.APV-527, Under this collaboration agreement, Alligator also granted to Aptevo R&D a time-limited option to enter into a second agreement with Alligator for the joint development of a separate bispecific antibody candidate simultaneously targeting 4-1BB (CD137) and 5T4.

In accordance with the terms of this Collaboration Agreement, the parties intend to develop the lead bispecific antibody candidate targeting 4-1BB (CD137) through the completion of Phase II clinical trials in accordance with an agreed upon development plan and budget. Subject to certain exceptions for Aptevo R&D’s manufacturing and platform technologies, the parties will jointly own intellectual property generated in the performance of the development activities under the Collaboration Agreement.

Following the completion of the anticipated development activities under the Collaboration Agreement, the parties intend to seek a third-party commercialization partner for this product candidate, or, in certain circumstances, may elect to enter into a second agreement granting rights to either Aptevo R&D or Alligator to allow such party to continue the development and commercialization of this product. Under the terms of the Collaboration Agreement, the parties intend to share revenue received from a third-party commercialization partner equally, or, if the development costs are not equally shared under the Collaboration Agreement, in proportion to the development costs borne by each party.

The Collaboration Agreement also contains several points in development at which either party may elect to “opt-out” (i.e., terminate without cause) and, following a termination notice period, cease paying development costs for this product candidate, which would be borne fully by the continuing party. Following an opt-out by a party, the continuing party will be granted exclusive rights to continue the development and commercialization of this product candidate, subject to a requirement to pay a percentage of revenue received from any future commercialization partner for this product, or, if the continuing party elects to self-commercialize, tiered royalties on the net sales of this product by the continuing party ranging from the low to mid-single digits, based on the point in development at which the opt-out occurs. The parties have also agreed on certain technical criteria or ‘stage gates” related to the development of this product that, if not met, will cause an automatic termination and wind-down of the Collaboration Agreement and the activities thereunder, provided that the parties do not agree to continue.

The Collaboration Agreement contains industry standard termination rights, including for material breach following a specified cure period, and in the case of a party’s insolvency.

Collaboration with MorphoSys AG

In August 2014, Aptevo entered into a collaboration agreement with MorphoSys AG (MorphoSys Agreement) for the joint development of MOR209/ES414, a targeted immunotherapeutics protein, which activates host T-cell immunity specifically against cancer cells expressing prostate specific membrane antigen, an antigen commonly overexpressed on prostate cancer cells. Effective August 31, 2017, MorphoSys terminated the MorphoSys Agreement. As a result of the termination, Aptevo has no ongoing obligation related to this agreement and therefore recognized the total remaining deferred revenue balance of $3.7 million as Collaborations revenue in the third quarter of 2017.

MARKETED PRODUCT

IXINITY (coagulation factor IX (recombinant)). IXINITY is a third-generation recombinant human coagulation factor IX approved in the United States for the control and prevention of bleeding episodes and for perioperative management in adults and children 12 years of age or older with hemophilia B. Hemophilia B, also known as Christmas disease, is a rare, inherited bleeding disorder. The blood of hemophilia B patients has an

7

impaired clotting ability, which results from substantially reduced or missing factor IX activity. Patients with hemophilia B commonly experience joint bleeding with pain and swelling, which can result in irreversible joint damage. They may also experience more serious or life-threatening hemorrhages. People with hemophilia B require factor IX injections to restore normal blood coagulation temporarily. Many patients use regular, prophylactic treatment to try to prevent bleeding episodes, while others use on-demand treatment to control bleeding episodes after they occur. Treatment selection and approach is individualized based on factors including the patient’s condition and age, factor level severity, bleeding pattern, activity level and individual pharmacokinetic parameters.

Manufacturing

We rely primarily on AGC Biologics, formally known as CMC Biologics, Inc. (AGC) for drug substance manufacture of IXINITY, on Patheon UK Limited for fill-finish services of IXINITY and on Rovi Contract Manufacturing, S.L. for supply of the syringe pre-filled with water for injection packaged with IXINITY.

Sources and Availability of Raw Materials

Agreement with AGC Biologics. We rely on AGC, for the manufacture of the substance that becomes the active ingredient (the bulk drug substance) in the production of our IXINITY product. On June 17, 2017, we entered into a non-exclusive Commercial Supply (Manufacturing Services) Agreement with AGC, pursuant to which, subject to specified exceptions, we are obligated to purchase at least four batches and AGC is obligated to maintain a maximum capacity for ten batches of IXINITY bulk drug substance per full year. The agreement has a five-year term renewable with twenty-four months’ prior notice before the expiry of the term for successive two-year terms. AGC is obligated to use commercially reasonable efforts to perform services in accordance with our forecast and projected delivery dates. In the event there is a supply failure as defined under the agreement, the agreement becomes non-exclusive with respect to 50% of our forecasted demand (or up to the unsupplied quantities until supply reinstatement).

The agreement provides for fees for services. Each party may terminate the agreement if the other party fails to pay any amount properly due and payable with ten business days of notice demanding payment after the expiration of the original payment term or if the other party materially breaches the agreement and fails to remedy any such breach capable of remedy during a twenty business day notice period. Each party may terminate the agreement if the other party experiences certain bankruptcy events. This agreement may be terminated by either party in the event of a material breach by the other party; however, termination shall not affect the accrued rights of either party. We may also terminate our obligations under the agreement with a specified amount of prior notice, if AGC has any material permit or regulatory license permanently revoked preventing the performance of services by AGC, if AGC is subject to certain competitor change of control events, or where there is a supply failure prior to a supply reinstatement where AGC does not reinstate supply within twelve months of the supply failure.

8

Agreement with Patheon UK Limited. Patheon UK Limited, or Patheon, through an affiliate, is currently the sole source third-party manufacturer that performs the services of filling the bulk drug substance into vials for our IXINITY product. We have a non-exclusive Manufacturing Services Agreement with Patheon pursuant to which Aptevo is obligated to order, and Patheon agrees to perform, a specified amount of such services on an annual basis. Under the agreement, Patheon also agrees to use commercially reasonable efforts to perform services in excess of such minimum purchase commitments subject to its available capacity. The agreement has an initial three-year term expiring on May 26, 2018, and will automatically renew for successive terms of two years each, unless either party gives the other party at least eighteen months’ notice. We may terminate the agreement on a specified amount of notice if a regulatory authority prevents us from importing, exporting, purchasing or selling the product or if we no longer order services for a product due to the product’s discontinuance in the market; however, we must still perform any surviving obligations as specified in the agreement. Patheon may terminate the agreement upon six months’ notice if we assign our rights under the agreement to an assignee that, in Patheon’s opinion acting reasonably, is not a credit-worthy substitute, a Patheon competitor, or an entity with whom Patheon has had prior unsatisfactory business relations. Each party may terminate the agreement if the other party breaches the agreement and the breach is not cured within a specified period of time, if the other party experiences certain bankruptcy events, or upon a period of notice if the parties do not agree upon certain pricing adjustments. Except in respect of liability for certain third party claims, breach of confidentiality obligations, or replacement of defective product, Patheon’s liability is limited under the agreement to 10% of the revenues for such year to Patheon under the agreement. Patheon’s liability in respect of replacement of defective product is limited to the amount paid by us to Patheon for such product. Except in respect of a breach of confidentiality obligations, neither party is liable to the other under the agreement for any loss of profits or other damages of an indirect or consequential nature.

Agreement with Rovi Contract Manufacturing, S.L. Rovi Contract Manufacturing, S.L., or Rovi, is currently the sole source third-party manufacturer that supplies the syringe pre-filled with water for injection, that is packaged with and required for reconstitution of our IXINITY product. We have a non-exclusive supply agreement with Rovi pursuant to which Rovi is obligated to use its best efforts to supply the quantity of syringes ordered by us. The agreement has a five-year term expiring on April 28, 2019, and will automatically renew for successive five-year terms, unless Rovi provides us with written notice of its intent not to renew at least twenty-four months prior to the expiration of the term or any renewal term. We may terminate the agreement for any reason on at least twelve months’ prior notice. Each party may terminate the agreement if the other party breaches the agreement and the breach is not cured within a specified period of time.

License with the University of North Carolina to IXINITY intellectual property rights

In connection with our separation from Emergent, we assumed an exclusive license from the University of North Carolina, or UNC, to make, have made, use, offer for sale, sell and import factor IX and factor VII(a) therapeutics, including IXINITY, under certain UNC’s patents. We are required to pay a low single digit royalty obligation to UNC under the license. The license agreement expires when the last of the licensed patents expire, on a country-by-country basis. The last of the licensed patents expires in or around September 2024. We have received notification that patent term extension has been approved in the United States, and once granted, the last patent to expire in the United States will expire in or around November 2028. UNC may terminate the license if a material breach is not cured forty-five days after notice, we become bankrupt or insolvent, or we do not pay a yearly minimum earned royalty (in the mid-five digits). We can terminate the license with sixty days’ notice to UNC.

Trademark License Agreement with Emergent

We entered into a trademark license agreement with Emergent pursuant to which Emergent granted us a non-exclusive, royalty-free, worldwide, non-sublicensable license under certain trademarks of Emergent to distribute the physical inventory of packaging and marketing materials assigned to us as part of the distribution, solely to sell, offer to sell and otherwise commercialize the commercial products until such inventory of packaging and marketing materials is depleted or, if earlier, the third anniversary of the distribution. We may terminate our rights under the agreement at any time by providing written notice to Emergent. Emergent may terminate the agreement if we breach the agreement and the breach is not cured within a specified period of time or is uncurable.

9

Our IXINITY product is sold in the United States by our commercial sales force and distributed to end-users through major U.S. distributors and wholesalers, including McKesson Corporation, and other specialty distributors. All third-party logistics (including, for instance, warehousing, inventory management, and shipping) of final drug product are provided by a third-party logistics company.

Marketing & Sales

We have biotechnology commercial operations and medical affairs teams with experience in sales, marketing, distribution, reimbursement and medical support.

The commercial operations team includes a U.S.-based field sales forces. This hemophilia sales team focuses its selling efforts primarily on hemophilia treatment centers and hematology clinics. Orders are filled upon receipt, and we generally have no orders on backlog. Reimbursement support, patient assistance/compassionate use and non-medical customer inquiries are handled by customer service personnel within our commercial operations team.

Our medical affairs team includes field-based medical science liaisons, who respond to customer requests for information, establish and maintain company relationships with researchers and clinicians, train our product specialists and sales personnel and interface with clinical trial investigators. Our medical affairs team also supports customers by providing medical information, drug safety and pharmacovigilance services.

Competition

Currently, IXINITY competes with five recombinant factor IX products that are marketed in North America. Two are standard half-life products: BeneFIX® (Pfizer Inc.) and RIXUBIS® (Shire US Inc.), and three are enhanced half-life products: IDELVION® (CSL Behring LLC), ALPROLIX® (Bioverativ Therapeutics Inc.), and Rebinyn® (Novo Nordisk Inc.).

INTELLECTUAL PROPERTY

We actively seek intellectual property protection for our products and product candidates. We own or exclusively license patent rights supporting IXINITY, the ADAPTIR platform and pipeline products including APVO414, APVO210, and otlertuzumab. We practice patent life cycle management by filing patent applications to protect new inventions relating to meaningful improvements to our products and related methods. We primarily seek patent protection for inventions that support our products and product candidates, but from time to time we seek patent protection for inventions that could, for instance, support a potential business opportunity or block a competitor from designing around our existing patents.

In general, and where possible, we pursue patent protection in countries where we believe there will be a significant market for the corresponding product or product candidate. We generally do not seek patent protection in countries where we have reason to believe we would not be able to enforce patents. For instance, we tend to not file in countries that are frequently listed on the Priority Watch List of the Special 301 Report prepared by the Office of the United States Trade Representative, with the exception that we typically file patent applications in China, Russia and India. We may also decide to take a narrower filing approach for secondary and improvement type inventions as compared to inventions that are more foundational to our products. We do not seek patent protection in countries which are on the United Nations, or U.N., list of Least Developed Countries.

The term of protection for various patents associated with and expected to be associated with our marketed product and product candidates is typically twenty years from the filing date but may vary depending on a variety of factors including the date of filing of the patent application or the date of patent issuance and the legal term of patents in the countries in which they are obtained. The protection afforded by a patent varies on a product-by-product basis and country-to-country basis and depends upon many factors, including the type of patent, the scope of its coverage, the availability of regulatory-related extensions, the necessity for terminal disclaimers, the availability of legal remedies in a particular country and the validity and enforceability of the patents.

10

In some cases, we may decide that the best way to protect our intellectual property is to retain proprietary information as trade secrets and confidential information rather than to apply for patents, which would involve disclosure of proprietary information to the public. When determining whether to protect intellectual property as a trade secret, we consider many factors including, for instance, our ability to maintain the trade secret, the likelihood that a competitor will independently develop the information, our ability to patent protect the intellectual property and the likelihood we would be able to enforce a resulting patent.

We are a party to a number of license agreements under which we license patents, patent applications and other intellectual property. These agreements impose various commercial diligence and financial payment obligations on us. We expect to continue to enter into these types of license agreements in the future.

ADAPTIR Platform. We protect the ADAPTIR platform technology through a combination of patents and trade secrets. We own all ADAPTIR platform intellectual property, with the exception that we have non-exclusive commercial licenses and a research license with Lonza to certain intellectual property related to Lonza’s CHO cell lines and vectors. Under our Lonza research license, we have an option to take a license to use the GS System to develop and manufacture therapeutic proteins for our commercial purposes.

The intellectual property we own that supports our ADAPTIR platform was generated internally at Emergent or at Trubion Pharmaceuticals, Inc., or Trubion, prior to its acquisition by Emergent in 2010, or at Aptevo following the separation. One patent family which supports use of unique linkers in the homodimer (a molecule consisting of two identical halves) version of the platform was invented jointly by Trubion and Wyeth Pharmaceuticals, Inc., or Wyeth, as part of a collaboration between the two companies. Upon termination of a product license agreement between Wyeth and Trubion, Wyeth assigned the rights it had in that platform patent family to Trubion. These rights have since transferred to us.

In order to differentiate our platform inventions from antibodies and other antibody-like constructs that have been publicly disclosed, many of our patents and patent applications are directed to unique aspects or components of our platform such as linkers or binding domains. Our ADAPTIR platform can be homodimeric or heterodimeric. Although most of our patent families protect both homodimeric and heterodimeric forms of the platform, we also have a patent family that is focused on the heterodimeric form of the platform.

We have filed patent applications for the ADAPTIR platform in the United States and in countries and territories, including Australia, Brazil, Canada, China, Egypt, Europe, India, Indonesia, Israel, Japan, Malaysia, Mexico, New Zealand, Singapore, South Africa, South Korea, United Arab Emirates and Vietnam. We plan to continue to improve our ADAPTIR platform and to file patent applications on those improvements. Our decision as to where to file any new ADAPTIR improvement inventions will be based in part on the significance of the improvement. If patents issue on the pending ADAPTIR patent applications, the patent term for those patents are estimated to expire between June 2027 and September 2036.

IXINITY (coagulation factor IX (recombinant)). We license patents and patent applications from UNC, which support the manufacture of factor IX and other Vitamin K Dependent Proteins. In addition to the patent assets licensed from UNC, we own a patent portfolio with claims generally directed to factor IX pharmaceutical compositions, methods of making recombinant factor IX protein, and cell lines producing recombinant factor IX protein. This patent portfolio includes issued patents in Australia, Europe and Japan and pending patent applications in other territories including the United States. If patents issue on our pending patent applications, the patent term for those patents is estimated to expire between December 2026 and October 2030. The estimated patent expirations are subject to change based on patent term adjustments, extensions or terminal disclaimers.

11

APVO414. We have patents and pending patent applications supporting the APVO414 product candidate. We have foundational patents and patent applications in countries and territories including the United States, Australia, Brazil, Canada, China, Egypt, Europe, Hong Kong, India, Indonesia, Israel, Japan, Malaysia, Mexico, New Zealand, Singapore, South Africa, United Arab Emirates and Vietnam. The foundational patents which grant in this patent family are estimated to expire in April 2032. The estimated patent expirations are subject to change based on patent term adjustments, extensions or terminal disclaimers.

otlertuzumab. We have patents and pending patent applications supporting the otlertuzumab product candidate. We have foundational patents and patent applications in countries and territories, including the United States, Canada, China, Europe, Hong Kong, India, Israel, Japan, Mexico, New Zealand, Russia, South Africa and South Korea. The foundational patents and patent applications which grant in these patent families are estimated to expire between July 2026 and April 2029. The estimated patent expirations are subject to change based on patent term adjustments, extensions or terminal disclaimers.

APVO210. We have patents and pending patent applications supporting our APVO210 product candidate. We have foundational patents and patent applications in countries and territories, including the United States, Australia, Brazil, Canada, China, Eurasia, Europe, Hong Kong, India, Japan, Mexico, New Zealand, Singapore, South Africa and South Korea. The foundational patents which grant in this patent family are estimated to expire in October 2029 outside of the United States and October 2030 inside the United States. The estimated patent expirations are subject to change based on patent term adjustments, extensions or terminal disclaimers.

Trademarks owned by Aptevo Therapeutics Inc. and its subsidiaries. Where possible, we pursue registered trademarks for our marketed products in significant markets. We own trademark registrations and pending applications for the marks: APTEVO THERAPEUTICS, APTEVO BIOTHERAPEUTICS, APTEVO RESEARCH AND DEVELOPMENT, the Aptevo logo, IXINITY, IXINITY with logo, IXPERIENCE, and ADAPTIR in relevant jurisdictions. We own registrations or pending trademark applications for the mark APTEVO per se in Iraq, Nicaragua, Pakistan, and Ukraine.

REGULATION

Regulations in the United States and other countries have a significant impact on our product development, manufacturing and marketing activities.

Product Development for Therapeutics

Pre-clinical Testing. Before beginning testing of any compounds with potential therapeutic value in human subjects in the United States, stringent government requirements for pre-clinical data must be satisfied. Pre-clinical testing includes both in vitro, or in an artificial environment outside of a living organism, and in vivo, or within a living organism, laboratory evaluation and characterization of the safety and efficacy of a drug and its formulation. We perform pre-clinical testing on all of our product candidates before we initiate any human trials.

Investigational New Drug Application. Before clinical testing may begin, the results of pre-clinical testing, together with manufacturing information, analytical data and any other available clinical data or literature, must be submitted to the United States Food and Drug Administration, or FDA, as part of an Investigational New Drug Application, or IND. The sponsor must also include an initial protocol detailing the first phase of the proposed clinical investigation, together with information regarding the qualifications of the clinical investigators. The pre-clinical data must provide an adequate basis for evaluating both the safety and the scientific rationale for the initial clinical studies in human volunteers. The IND automatically becomes effective 30 days after receipt by the FDA, unless the FDA imposes a clinical hold within that 30-day time period.

12

Clinical Trials. Clinical trials involve the administration of the drug to healthy human volunteers or to patients with the target disease or disorder under the supervision of a qualified physician (also called an investigator) pursuant to an FDA-reviewed protocol. Human clinical trials typically are conducted in three sequential phases, although the phases may overlap with one another. Clinical trials must be conducted under protocols that detail the objectives of the study, the parameters to be used to monitor safety and the efficacy criteria, if any, to be evaluated. Each protocol must be submitted to the FDA as part of the IND.

|

|

• |

Phase 1 clinical trials test for safety, dose tolerance, absorption, bio-distribution, metabolism, excretion and clinical pharmacology and, if possible, for early evidence regarding efficacy. |

|

|

• |

Phase 2 clinical trials involve a small sample of individuals with the target disease or disorder and seek to assess the efficacy of the drug for specific targeted indications to determine dose response and the optimal dose range and dose regimen and to gather additional information relating to safety and potential adverse effects. |

|

|

• |

Phase 3 clinical trials consist of expanded, large-scale studies of patients with the target disease or disorder to obtain definitive statistical evidence of the efficacy and safety of the proposed product and dosing regimen. The safety and efficacy data generated from Phase 3 clinical trials typically form the basis for FDA approval of the product candidate. |

|

|

• |

Phase 4 clinical trials, if conducted, are conducted after a product has been approved. These trials can be conducted for a number of purposes, including to collect long-term safety information or to collect additional data about a specific population. As part of a product approval, the FDA may require that certain Phase 4 studies, which are called post-marketing commitment studies, be conducted post-approval. |

Good Clinical Practice. All of the phases of clinical studies must be conducted in conformance with the FDA’s bioresearch monitoring regulations and Good Clinical Practices, or GCP, which are ethical and scientific quality standards for conducting, recording and reporting clinical trials to assure that the data and reported results are credible and accurate and that the rights, safety and well-being of trial participants are protected. Additionally, an Institutional Review Board at each site participating in a trial must obtain ongoing approval for conduct of the trial at that site.

Marketing Approval—Biologics

Biologics License Application. All data obtained from a comprehensive development program, including research and product development, manufacturing, pre-clinical and clinical trials, labeling and related information are submitted in a biologics license application, or BLA, to the FDA and in similar regulatory filings with the corresponding agencies in other countries for review and approval. The submission of an application is not a guarantee that the FDA will find the application complete and accept it for filing. The FDA may refuse to file the application and request additional information rather than accept the application for filing, in which case the application must be resubmitted with the supplemental information. The FDA has two months to review an application for its acceptability for filing. Once an application is accepted for filing, the Prescription Drug User Fee Act, or PDUFA, establishes a two-tiered review system: Standard Review and Priority Review. When conducting Priority Review, the FDA has a goal to review and act on BLA submissions within six months from the date of the FDA’s acceptance for filing of the application, rather than the ten-month goal under a Standard Review. The FDA gives Priority Review status to product candidates that provide safe and effective therapies where no satisfactory alternative exists or to a product candidate that constitutes a significant improvement compared to marketed products in the treatment, diagnosis or prevention of a disease.

In addition, under the Pediatric Research Equity Act of 2003, or PREA, BLAs and certain supplements must contain data to assess the safety and efficacy of the product for the claimed indications in all relevant pediatric subpopulations and to support dosing and administration for each pediatric subpopulation for which the product is safe and effective. The FDA may grant deferrals for submission of data or full or partial waivers. Unless otherwise required by regulation, PREA does not apply to any drug or biologic for an indication for which orphan designation has been granted.

13

In reviewing a BLA, the FDA may grant approval or deny the application through a complete response letter if it determines the application does not provide an adequate basis for approval requesting additional information. Even if such additional information and data are submitted, the FDA may ultimately decide that the BLA does not satisfy the criteria for approval. The receipt of regulatory approval often takes many years, involving the expenditure of substantial financial resources. The speed with which approval is granted often depends on a number of factors, including the severity of the disease in question, the availability of alternative treatments and the risks and benefits demonstrated in clinical trials. The FDA may also impose conditions upon approval. For example, it may require a Risk Evaluation and Mitigation Strategy, or REMS, for a product. This can include various required elements, such as publication of a medication guide, patient package insert, a communication plan to educate health care providers of the drug’s risks and/or restrictions on distribution and use, such as limitations on who may prescribe or dispense the drug. The FDA may also significantly limit the indications approved for a given product and/or require, as a condition of approval, enhanced labeling, special packaging or labeling, post-approval clinical trials, expedited reporting of certain adverse events, pre-approval of promotional materials or restrictions on direct-to-consumer advertising, any of which could negatively impact the commercial success of a drug.

Fast Track Designation. The FDA may designate a product as a fast track drug if it is intended for the treatment of a serious or life-threatening disease or condition and demonstrates the potential to address unmet medical needs for this disease or condition. Sponsors granted a fast track designation for a drug are granted more opportunities to interact with the FDA during the approval process and are eligible for FDA review of the application on a rolling basis, before the application has been completed.

Breakthrough Therapy. Under the provisions of the Food and Drug Administration Safety and Innovation Act, or FDASIA, the FDA may designate a product as a breakthrough therapy if the product is intended, alone or in combination with one or more other products, to treat a serious or life-threatening disease or condition, and preliminary clinical evidence indicates that the product may demonstrate substantial improvement over existing therapies on one or more clinically significant endpoints, such as substantial treatment effects observed early in clinical development. Products designated as breakthrough therapies are also eligible for accelerated approval. The FDA must take certain actions, such as holding timely meetings and providing advice, intended to expedite the development and review of an application for approval of a breakthrough therapy.

Orphan Drugs. Under the Orphan Drug Act, an applicant can request the FDA to designate a product as an “orphan drug” in the United States if the drug is intended to treat an orphan, or rare, disease or condition. A disease or condition is considered orphan if it affects fewer than 200,000 people in the United States. Orphan drug designation must be requested before submitting a BLA. Products designated as orphan drugs are eligible for special grant funding for research and development, FDA assistance with the review of clinical trial protocols, potential tax credits for research, waived filing fees for marketing applications and a seven-year period of market exclusivity after marketing approval. Orphan drug exclusivity (afforded to the first applicant to receive approval for an orphan designated drug) prevents FDA approval of applications by others for the same drug for the designated orphan disease or condition. The FDA may approve a subsequent application from another applicant if the FDA determines that the application is for a different drug or different use, or if the FDA determines that the subsequent product is clinically superior, or that the holder of the initial orphan drug approval cannot assure the availability of sufficient quantities of the drug to meet the public’s need. A grant of an orphan designation is not a guarantee that a product will be approved. Our product candidate otlertuzumab was granted orphan drug designation for the treatment of CLL by the FDA in November 2011 and received orphan medicinal product designation from the European Commission in December 2012 for the treatment of CLL. Orphan designation in Europe qualifies a drug for certain development and commercial incentives, including protocol assistance, access to centralized authorization procedures, reduced fees for regulatory activities, and ten years of market exclusivity after approval.

Post-Approval Requirements. Any biologic for which we receive FDA approval will be subject to continuing regulation by the FDA, including, among other things, record keeping requirements, reporting of adverse experiences, providing the FDA with updated safety and efficacy information, product sampling and distribution requirements, current good manufacturing practices, or cGMP, and restrictions on advertising and promotion. Adverse events that are reported after marketing approval can result in additional limitations being placed on the product’s distribution or use and, potentially, withdrawal or suspension of the product from the market. In addition, the FDA authority to require post-approval clinical trials and/or safety labeling changes if warranted. In certain circumstances, the FDA may impose a REMS after a product has been approved. Facilities involved in the

14

manufacture and distribution of approved products are required to register their establishments with the FDA and certain state agencies and are subject to periodic unannounced inspections by the FDA for compliance with cGMP and other laws. The FDA also closely monitors advertising and promotional materials we may disseminate for our products for compliance with restrictions on off-label promotion and other laws. We may not promote our products for conditions of use that are not included in the approved package inserts for our products. Certain additional restrictions on advertising and promotion exist for products that have boxed warnings in their approved package inserts.

Pricing, Coverage and Reimbursement

In the United States and internationally, sales of our products and our ability to generate revenues on such sales are dependent, in significant part, on the availability and level of reimbursement from third-party payors, including state and federal governments and private insurance plans. Insurers have implemented cost-cutting measures and other initiatives to enforce more stringent reimbursement standards and likely will continue to do so in the future. These measures include the establishment of more restrictive formularies and increases in the out-of-pocket obligations of patients for such products. In addition, we are required to provide discounts and pay rebates to state and federal governments and agencies in connection with purchases of our products that are reimbursed by such entities. Various provisions of the Patient Protection and Affordable Care Act (as amended by the Health Care and Education Reconciliation Act), collectively referred to as the Affordable Care Act, increased the levels of rebates and discounts that we have to provide in connection with sales of such products that are paid for, or reimbursed by, certain state and federal government agencies and programs. It is possible that future legislation in the United States and other jurisdictions could be enacted, which could potentially impact the reimbursement rates for our products and also could further impact the levels of discounts and rebates we are required to pay to state and federal government entities. The most significant governmental reimbursement programs in the United States relevant to our products are described below:

Medicare Part B. Medicare Part B covers certain drug products provided in a physician’s office or hospital outpatient setting under a payment methodology using “average sales price,” or ASP, information. We are required to provide ASP information to the Centers for Medicare & Medicaid Services, or CMS, on a quarterly basis. Medicare payment rates using an ASP methodology are currently set at ASP plus six percent, although this rate could change in future years. If we fail to timely or accurately submit ASP, we could be subject to civil monetary penalties and other sanctions.

Medicaid Rebate Program. For products to be covered by Medicaid, drug manufacturers must enter into a rebate agreement with the Secretary of HHS on behalf of the states and must regularly submit certain pricing information to CMS. The pricing information submitted, including information about the “average manufacturer price,” or AMP, and “best price” for each of our covered drugs, determines the amount of the rebate we must pay. The total rebate also includes an “additional” rebate, which functions as an “inflation penalty.” The Affordable Care Act increased the amount of the basic rebate and, for some “line extensions,” increased the additional rebate. It also requires manufacturers to pay rebates on utilization by enrollees in managed care organizations. If we fail to timely or accurately submit required pricing information, we could be subject to civil, monetary and other penalties. In addition, the Affordable Care Act changed the definition of AMP to address which manufacturer sales are to be considered, which affected the rebate liability for our products.

340B/PHS Drug Pricing Program. The availability of federal funds to pay for IXINITY under the Medicaid and Medicare Part B programs requires that we extend discounts under the 340B/Public Health Service, or PHS, drug pricing program. The 340B/PHS drug pricing program requires participating manufacturers to charge no more than a statutorily-defined “ceiling” price to a variety of community health clinics and other covered entities that receive health services grants from the PHS, as well as the outpatient departments of hospitals that serve a disproportionate share of Medicaid and Medicare beneficiaries. A product’s ceiling price for a quarter reflects its Medicaid AMP from two quarters earlier less its Medicaid rebate amount from two quarters earlier. Therefore, the above-mentioned revisions to the Medicaid rebate formula and AMP definition enacted by the Affordable Care Act could cause the discount produced by the ceiling price to increase. Under the Affordable Care Act, several additional classes of entities were made eligible for these discounts, increasing the volume of sales for which we must now offer the 340B/PHS discounts.

15

Federal Supply Schedule. We make IXINITY available for purchase by authorized users of the Federal Supply Schedule, or FSS, administered by the Department of Veterans Affairs, or DVA, pursuant to our FSS contract with the DVA. Under the Veterans Health Care Act of 1992, we are required to offer deeply discounted FSS contract pricing to four federal agencies—the DVA, the Department of Defense, or DoD, the Coast Guard and the PHS (including the Indian Health Service)—for federal funding to be made available for reimbursement of any of our products under the Medicaid program, Medicare Part B and for our products to be eligible to be purchased by those four federal agencies and certain federal grantees. FSS pricing to those four federal agencies must be equal to or less than the “Federal Ceiling Price,” which is, at a minimum, 24% less than the Non-Federal Average Manufacturer Price for the prior fiscal year.

Foreign Regulation

Currently, we maintain a commercial presence in the United States. In the future, we may further expand our commercial presence to additional foreign countries and territories. In the European Union, or EU, medicinal products are authorized following a process similarly demanding as the process required in the United States. Medicinal products must be authorized in one of two ways, either through the decentralized procedure, which provides for the mutual recognition procedure of national approval decisions by the competent authorities of the EU Member States or through the centralized procedure by the European Commission, which provides for the grant of a single marketing authorization that is valid for all EU member states. The authorization process is essentially the same irrespective of which route is used. We are also subject to many of the same continuing post-approval requirements in the EU as we are in the United States (e.g., good manufacturing practices). We will be subject to varying preapproval, approval and post-approval regulatory requirements similar to those imposed by the FDA in each foreign country in which we conduct regulated activities.

Healthcare Fraud and Abuse and Anti-Corruption Laws