Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ARCH RESOURCES, INC. | a18-8190_18k.htm |

Investor Presentation Forward-looking information This presentation contains “forward-looking statements” – that is, statements related to future, not past, events. Forward-looking statements address our expected future business and financial performance including our financial projections and often contain words such as “believes”, “could”, “should”, “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” or “will.” Forward-looking statements by their nature address matters that are, to different degrees, uncertain and depend upon important estimates and assumptions concerning our financial and operating results, including with respect to our coal pricing expectations, many of which are subject to change. No representations or warranties are made by us as to the accuracy of any such forward-looking statements. The inclusion of this information should not be regarded as an indication that we consider it to be necessarily predictive of actual future results. The information contained herein reflect numerous estimates and assumptions with respect to coal market conditions, general economic conditions, weather conditions, natural gas prices, competition in our industry, production capacity, availability of surety bonds, and matters other matters specific to our business, all of which are difficult to predict and many of which are beyond our control. Uncertainties arise from changes in the demand for and pricing of our coal by the domestic electric generation industry; from legislation and regulations relating to the Clean Air Act and other environmental initiatives; from operational, geological, permit, labor and weather-related factors; from fluctuations in the amount of cash we generate from operations; from future integration of acquired businesses; and from numerous other matters of national, regional and global scale, including those of a political, economic, business, competitive or regulatory nature. There is significant risk that our current estimates and assumptions may not be accurate and that our actual results will vary significantly from our anticipated results. Readers are cautioned not to rely on the forward-looking statements contained herein. We do not undertake to update our forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law. For a description of some of the risks and uncertainties that may affect our future results, you should see the risk factors described from time to time in the reports we file with the Securities and Exchange Commission. This presentation includes certain non-GAAP financial measures, including, Free Cash Flow, Adjusted EBITDAR, Adjusted EBITDA and cash costs per ton. These non-GAAP financial measures are not measures of financial performance in accordance with generally accepted accounting principles and may exclude items that are significant in understanding and assessing our financial results. Therefore, these measures should not be considered in isolation or as an alternative to net income from operations, cash flows from operations, earnings per fully-diluted share or other measures of profitability, liquidity or performance under generally accepted accounting principles. You should be aware that our presentation of these measures may not be comparable to similarly-titled measures used by other companies. A reconciliation of these financial measures to the most comparable measures presented in accordance with generally accepted accounting principles has been included at the end of this presentation. 2

Investor Presentation Arch Coal in brief Arch is a premier U.S. producer and marketer of high-quality coking coals – – – We operate large, modern coking coal mines at the low end of the U.S. cost curve Our product slate is dominated by High-Vol A coals that earn a market premium Arch has exceptional, long-lived reserves that provide valuable optionality for long-term growth Arch’s strong coking coal position is supplemented by our top-tier thermal franchise – – We operate highly competitive mines in the Powder River Basin and other key supply regions Our mines have modest capital needs and generate significant free cash Arch has deep expertise in mining, marketing and logistics – and, critically, in mine safety and environmental stewardship – and levers those competencies in both steel and power markets Arch generates high levels of free cash flow and has demonstrated a commitment to returning excess cash to shareholders through a robust stock buyback program and a recurring quarterly dividend 3

Investor Presentation We operate a streamlined portfolio of large, modern, well-capitalized and low-cost mines that can generate free cash flow at all points in the cycle POWDER RIVER BASIN: METALLURGICAL: BLACK THUNDER COAL CREEK LEER SENTINEL MOUNTAIN LAUREL BECKLEY OTHER THERMAL: WEST ELK VIPER COAL-MAC HEADQUARTERS 4

Arch’s Strong Financial Position Arch’s Leading Position in a Strengthening Met Market

Investor Presentation Arch has a demonstrated approach to returning capital to shareholders and an exceptionally strong balance sheet Increase in recurring quarterly dividen d 12/31/17 10/5/16 Source: ARCH *Since the announcement of the capital return program on 5/2/17 SHARE S OF COMMON STOCK OUTSTANDINGARCH CASH AND DEBT POSITION (IN MILLIONS)(IN MILLIONS $, AT 12/31/20 17) 25 $429 14% announced on February 13, 2018 PPublic RReelilsistitninggDeceYmebaerrE3n1d, 2017CashDebt $302 million* in buybacks$24 million* in dividends$103 million net cash position $326 21 4.0 m shares 6

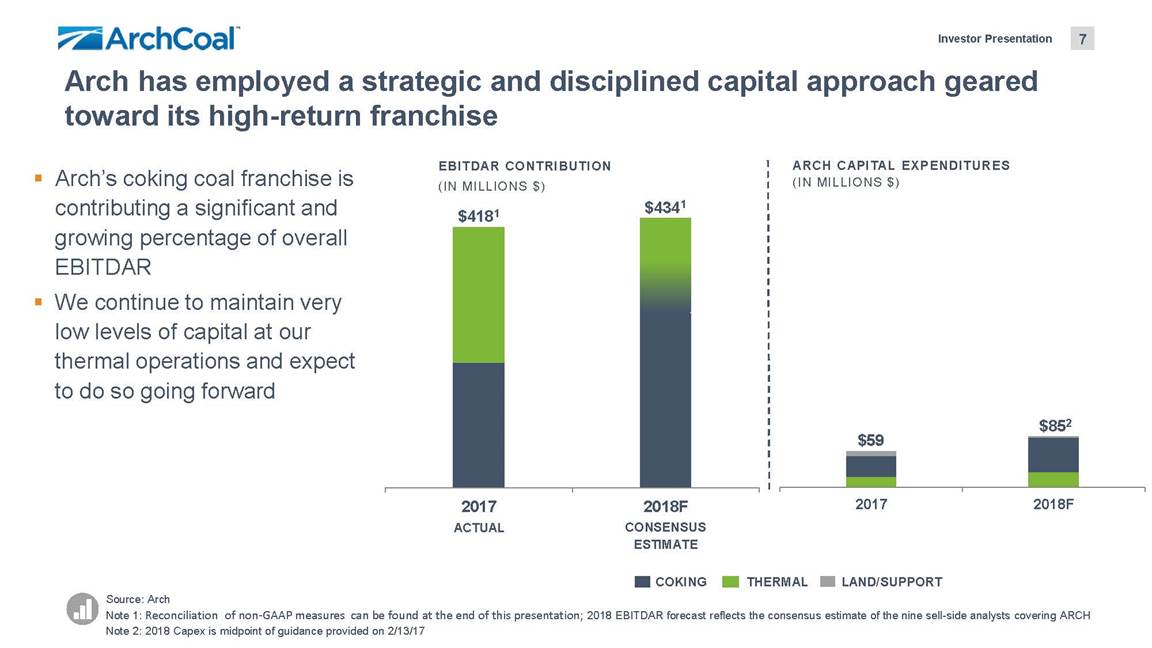

Investor Presentation Arch has employed a strategic and disciplined capital approach geared toward its high-return franchise ARCH CAP ITAL EXPENDITURE S (IN MILLIONS $) EBITDAR CONTRIBUTION (IN MILLIONS $) Arch’s coking coal franchise is contributing a significant and growing percentage of overall EBITDAR We continue to maintain very low levels of capital at our thermal operations and expect to do so going forward $4341 $4181 $852 2017 ACTUAL 2018F CONSENSUS ESTIMATE 2017 2018F LAND/SUPPORT COKING THERMAL Source: Arch Note 1: Reconciliation of non-GAPP measures can be found at the end of this presentation; 2018 EBITDAR forecast reflects the consensus estimate of the nine sell-side analysts covering ARCH Note 2: 2018 Capex is midpoint of guidance provided on 2/13/17 $59 7

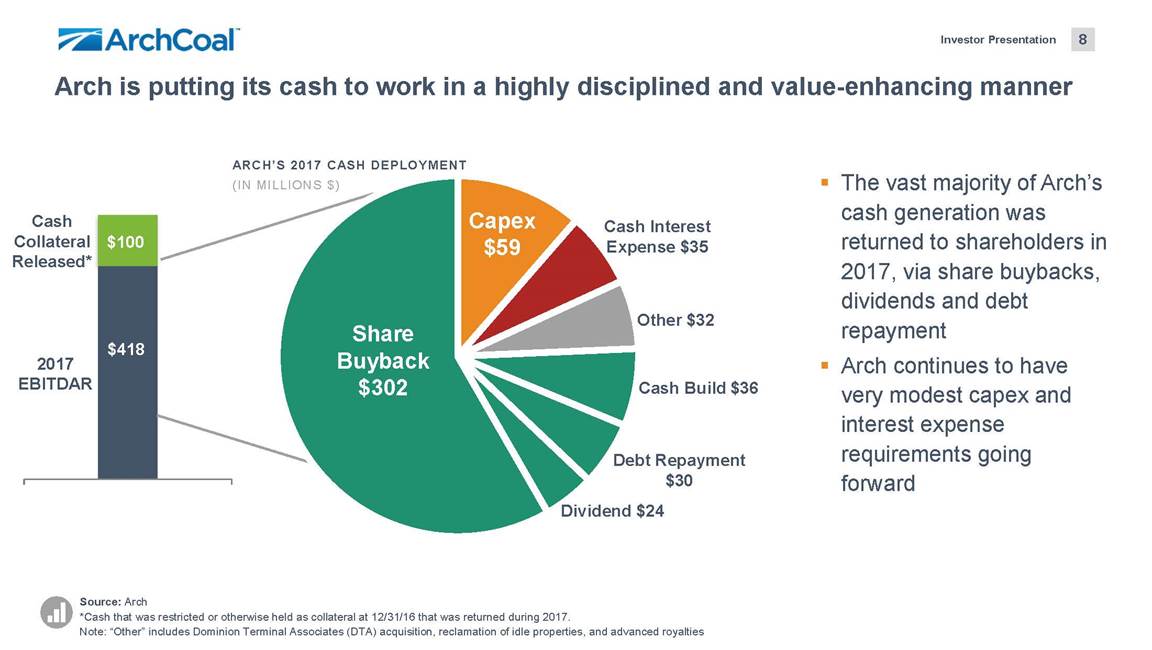

Investor Presentation Arch is putting its cash to work in a highly disciplined and value-enhancing manner ARCH’S 2017 CASH DEPLOYME NT (IN MILLIONS $) The vast majority of Arch’s cash generation was returned to shareholders in 2017, via share buybacks, dividends and debt repayment Arch continues to have very modest capex and interest expense requirements going forward Cash Interest Expense $35 Collateral Released* Other $32 EBITDAR Cash Build $36 Debt Repayment $30 Dividend $24 Source: Arch *Cash that was restricted or otherwise held as collateral at 12/31/16 that was returned during 2017. Note: “Other” includes Dominion Terminal Associates (DTA) acquisition, reclamation of idle properties, and advanced royalties Cash 2017 $100 $418 8

Arch’s Premier Coking Coal Franchise

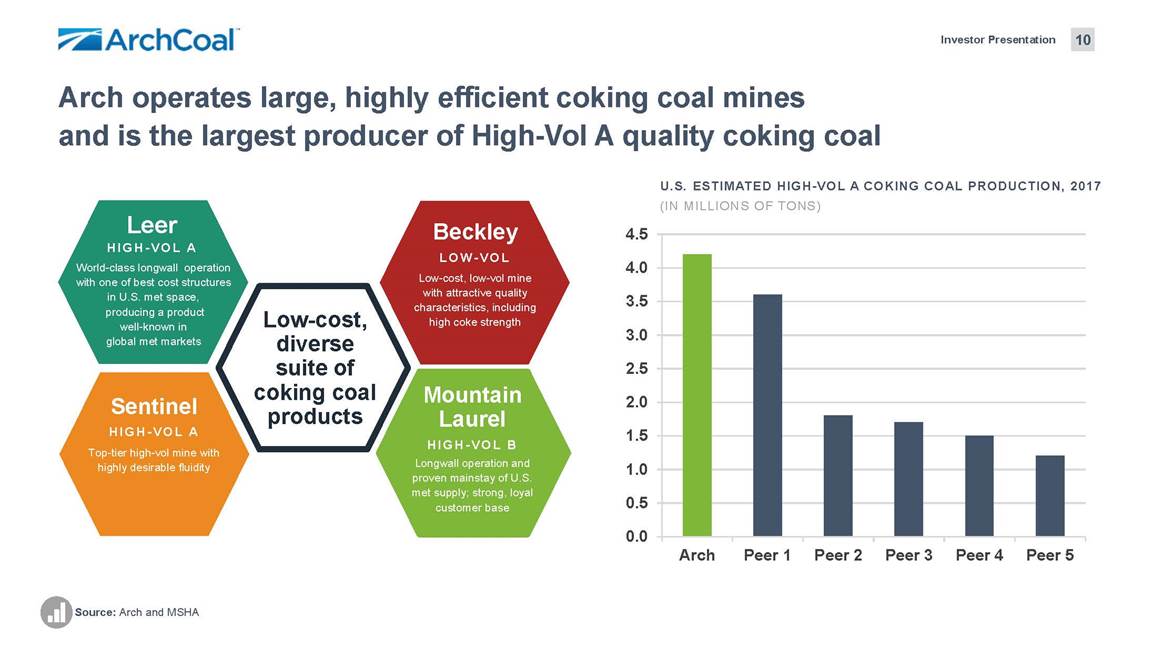

Investor Presentation Arch operates large, highly efficient coking coal mines and is the largest producer of High-Vol A quality coking coal U.S. ESTIMATE D HIGH-V OL A COKING COAL PRODUCTION, 2017 (IN MILLIONS OF TONS) Leer HIGH-V OL A World-class longwall operation with one of best cost structures in U.S. met space, producing a product well-known in global met markets Beckley LOW - VOL Low-cost, low-vol mine with attractive quality characteristics, including high coke strength 4.5 4.0 3.5 Low-cost, diverse suite of coking coal products 3.0 2.5 Mountain Laurel HIGH-V OL B Longwall operation and proven mainstay of U.S. met supply; strong, loyal customer base 2.0 Sentinel HIGH-V OL A Top-tier high-vol mine with highly desirable fluidity 1.5 1.0 0.5 0.0 Arch Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Source: Arch and MSHA 10

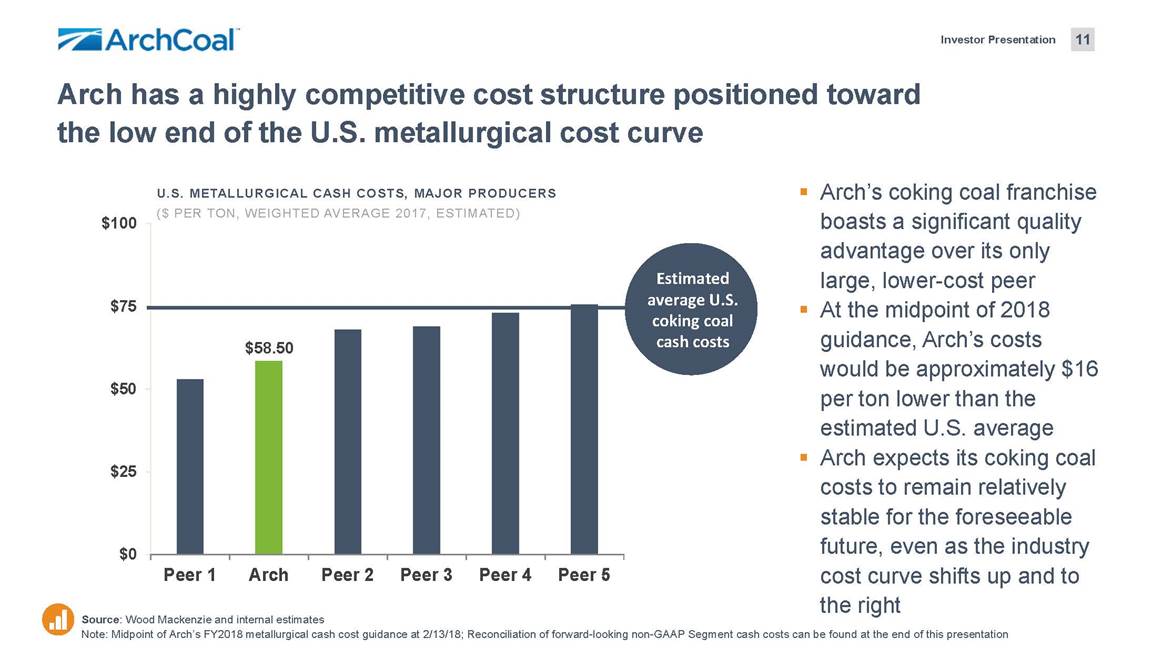

Investor Presentation Arch has a highly competitive cost structure positioned toward the low end of the U.S. metallurgical cost curve Arch’s coking coal franchise boasts a significant quality advantage over its only large, lower-cost peer At the midpoint of 2018 guidance, Arch’s costs would be approximately $16 per ton lower than the estimated U.S. average Arch expects its coking coal costs to remain relatively stable for the foreseeable future, even as the industry cost curve shifts up and to the right U.S. METALLURGICAL CASH COSTS, MAJOR PRODUCERS ($ PER TON, WEIGHTED AVERA GE 2017, ESTIMATED) $100 imated average U.S. ing coal $75 cash costs $50 $25 $0 Peer 1 Arch Peer 2 Peer 3 Peer 4 Peer 5 Source: Wood Mackenzie and internal estimates Note: Midpoint of Arch’s FY2018 metallurgical cash cost guidance at 2/13/18; Reconciliation of forward-looking non-GAAP Segment cash costs can be found at the end of this presentation Est cok $58.50 11

Investor Presentation U.S. coking coals – particularly high-vol products – are a core component of global coke blends ARCH’S 2018 PROJECTED COKING COAL SHIPMENTS BY DEMAND REGION Arch has a highly strategic, 36-percent equity interest in Dominion Terminal Associates (DTA) in Newport News, Va. Map reflects Arch’s historical global customer base 12

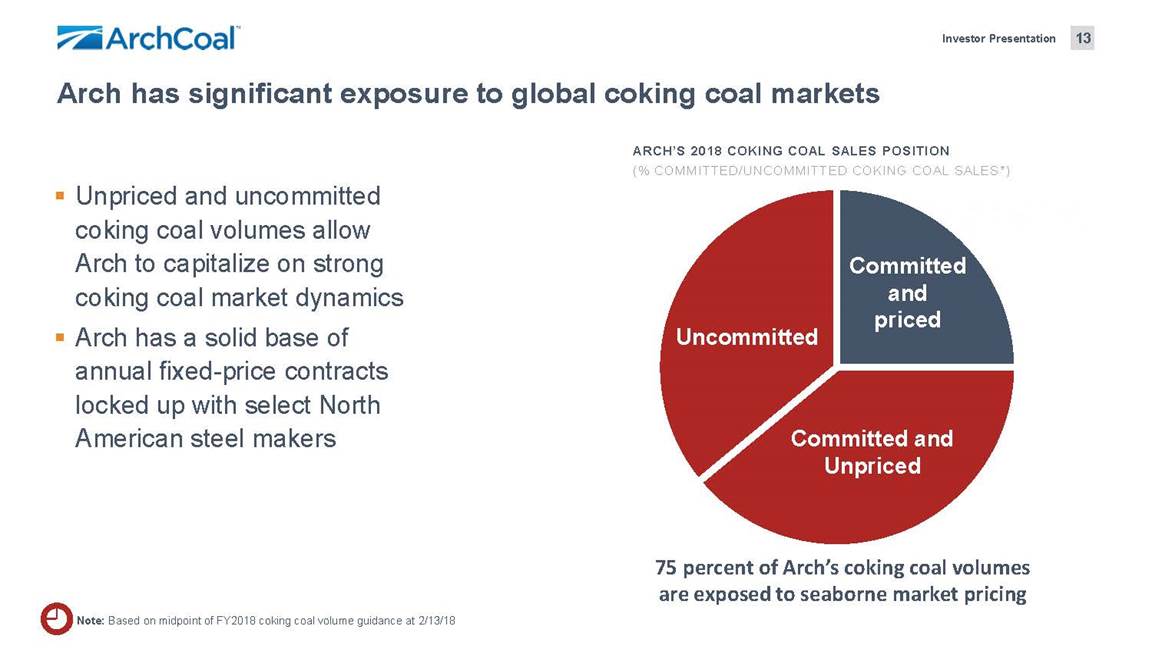

Investor Presentation Arch has significant exposure to global coking coal markets ARCH’S 2018 COKING COAL S ALE S POSITION (% COMMITTED/UNCOMMITED COKING COAL SALES*) Unpriced and uncommitted coking coal volumes allow Arch to capitalize on strong coking coal market dynamics Arch has a solid base of annual fixed-price contracts locked up with select North American steel makers 75 percent of Arch’s coking coal volumes are exposed to seaborne market pricing Note: Based on midpoint of FY2018 coking coal volume guidance at 2/13/18 13

Investor Presentation Global coking coal markets continue to trade at attractive levels High-Vol A coals are currently trading at an $18 premium to Low-Vol coals and a $70 premium to High-Vol B products High-Vol A coals have traded at a premium to Low-Vol coals in 11 of the past 20 quarters We expect High-Vol A coals to remain in tight supply and continue to compete with U.S. Low-Vol products for a market premium MONTHLY AVERAGE HIGH-VOL A ASSESSMENT, U.S. EAST COAST ($ PER METRIC TON) $300 $250 $200 $150 $100 $50 Source: Platts Note: Platts Daily Assessments, U.S. East Coast as of 3/9/18 HVA : $217.00 LV:$199.50 HVB:$148.50 14

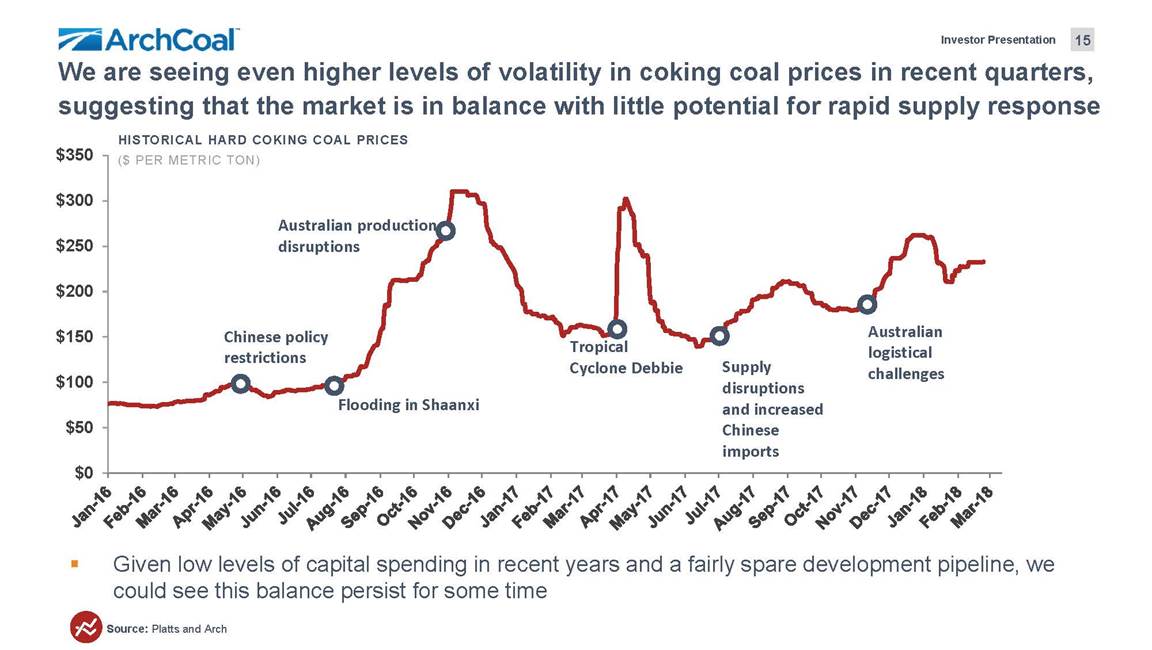

Investor Presentation We are seeing even higher levels of volatility in coking coal prices in recent quarters, suggesting that the market is in balance with little potential for rapid supply response HISTORICAL HARD COKING COAL PRICES $350 $300 $250 $200 $150 logistical restrictions Supply Cyclone Debbie $100 Flooding in Shaanxi and increased $50 $0 Given low levels of capital spending in recent years and a fairly spare development pipeline, we could see this balance persist for some time Source: Platts and Arch ($ PER METRIC TON) Australian production disruptions Chinese policyTropicalAustralian disruptionschallenges Chinese imports 15

Investor Presentation Global coking coal demand appears well-supported 1,675 Dalian most traded Singapore sw aps 1,587 Up 14% Source: World Steel Association, Platts, Metal Bulletin at 3/12/18 and FIS at 3/12/18 GLOBAL STEEL AND HOT METAL PRODUCTIONCHINESE AND INIDIAN MET IMPORTS (IN MILLIONS OF METRIC TONS)(IN MILLIONS OF METRIC TONS) 70 futuresmarket $200$171 ombinedMay 20182019 20162017201622001177 STEELHOT METALCHINAINDIA 1,175 1,162 59 52 C 16

Investor Presentation Over the next eight years, solid demand growth is forecast for major U.S. coking coal consuming regions EXPECTE D GLOBAL COKING COAL IMPORTS (IN MILLIONS OF METRIC TONS) The seaborne coking coal market is projected to grow by 40 million metric tons through 2025 Metallurgical imports into Europe and Brazil – both major demand centers for U.S. High-Vol A coals – should climb India represents a significant opportunity for the seaborne market – both directly and as a sink for Australian output We expect Chinese imports to remain sizeable and stable as declining BF/BOF production is counter-balanced by coking coal cost pressures and quality degradation 77 Europe South Korea Brazil 2025 India 2017 Source: Consensus of AME, CRU and Wood Mackenzie 60 53 52 3537 1518 17

Investor Presentation Sustained high pricing will be required to induce sufficient supply to meet demand growth $900 8 $500 4 $200 0 Coal market forecasters are projecting significant demand growth between now and 2025 Australian producers will need to increase capital spending appreciably to achieve the projected increases U.S. exports are projected to decline due to higher costs and ongoing degradation and depletion The coking coal build-out in Mozambique is projected to slow appreciably after 2018 Source: BHP, Anglo and Bloomberg; Wood Mackenzie and Internal Q3 12 Q4 12 Q1 13 Q2 13 Q3 13 Q4 13 Q1 14 Q2 14 Q3 14 Q4 14 Q1 15 Q2 15 Q3 15 Q4 15 Q1 16 Q2 16 Q3 16 Q4 16 Q1 17 Q2 17 Q3 17 U. S. M ET SEABORNE EXPORTSAUSTRALI AN M ETALLURGI CAL COAL ANNOUNCED CAPEXM OZAM BI QUE M ETALLURGI C AL COAL PRODUCTI ON (IN MILLIONS OF TONS)(IN MILLION $)(I N MI LLI ONS OF METRI C TONS) $1,00014 $80012 $70010 $600 $4006 $300 $1002 $0 20172025F20172018P2019P2020P2021P 51 46 BHP Queensland Anglo Met Coal 18

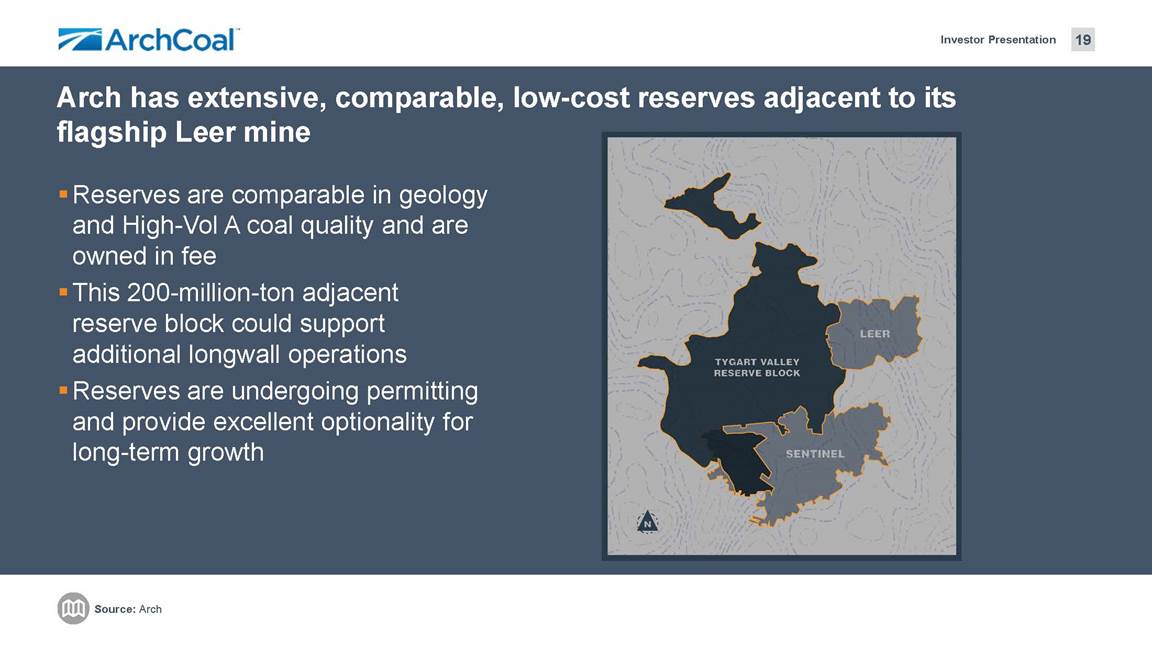

Investor Presentation Source: Arch Arch has extensive, comparable, low-cost reserves adjacent to its flagship Leer mine Reserves are comparable in geology and High-Vol A coal quality and are owned in fee This 200-million-ton adjacent reserve block could support additional longwall operations Reserves are undergoing permitting and provide excellent optionality for long-term growth 19

Arch’s Well-Positioned Thermal Coal Franchise

Investor Presentation Arch’s PRB portfolio generates significant ongoing capital requirements Arch produces the vast majority of its thermal coal from its Powder River Basin operations Arch’s flagship thermal operation is the Black Thunder mine cash flows with modest – Highest heat content coal in the southern PRB Rightsized to produce 70 to 80 million tons annually One of the lowest cost mines in the U.S. – – Coal Creek mine rounds out Arch’s strong PRB portfolio – This low-cost, low-ratio operation is well-positioned on the joint line and serves a stable customer base 21

Investor Presentation We expect PRB demand to remain sizable and relatively stable in the near to intermediate term We expect PRB’s market share to increase modestly at the expense of other basins Demand for high-quality 8,800 Btu coal is expected to outstrip other qualities Black Thunder’s output is currently approaching 9,000 Btus and is particularly well-positioned ANNUAL PRB DEMAND, CONSENSUS FORECAS T (IN MILLIONS OF TONS) 400 350 300 250 200 150 100 50 0 2017A 2018 2019 2020 2021 Source: Consensus forecast includes EIA, DTC, IHS, EVA, SNL and Arch 22

Investor Presentation We expect a pickup in PRB spot buying activity as stockpiles decline and assuming natural gas prices remain in a competitive range Customers are now entering the year less committed on coal purchases, which has led to a more active spot market Generator stockpiles have declined more than 65 million tons since the start of 2016, ending February at an estimated 130 million tons We expect continued liquidation as we progress through the year POWER GENERATOR’S HEDGED POSITIONS ENTERING YEAR (% of ANNUAL COAL PURCHASES) HISTORICAL CURRENT VOLUME OPEN VOLUME HEDGED Source: Arch 23

Investor Presentation railroads. portfolio is Viper is an efficient Illinois deep mine supported by PRB generator and complementary industrial customers. and ILB of the lowest net cost structures in the region. basins high-heat, low-sulfur coal for domestic and Coal-Mac is a low-cost West Virginia surface mine with an Arch’s thermalCAPPcustomer base and access to both Tier 1 rooted in its PRB positiona long-term supply contract with a nearby municipal supplementedKnight Hawk, in which Arch holds a 49-percent by low-costequity interest, is a mid-sized ILB producer with one operations in other key WBIT West Elk is a low-cost Colorado longwall mine that international power generators as well as industrial customers throughout the Southwest. 24

Investor Presentation Arch continues to leverage strong international prices to move its high-quality thermal products into seaborne thermal markets Arch is exporting thermal volumes to power generators in Asia, South and Central America, and Europe International thermal markets remain advantageous Newcastle prices currently exceed $90 per metric ton, which provides an attractive netback to Arch’s West Elk mine Recent strength in API-2 prices allowed Arch to secure fixed-price export commitments from its Coal-Mac operation for 2018 Arch has contracted nearly four million tons of thermal coal for export this year 25

Investor Presentation Looking ahead Global metallurgical markets are robust, Arch’s market exposure is substantial, and market fundamentals remain healthy and supportive Domestic thermal fundamentals are improving and vigorous seaborne thermal demand is creating attractive opportunities for our Other Thermal segment Arch’s overall financial position is exceptionally strong, we have negative net debt, and cash requirements should remain modest for the foreseeable future We have a proven and demonstrated cash return policy that is driving significant value for our shareholders Our exceptional undeveloped coking coal reserves offer optionality for long-term growth 26

March 2018 Investor Presentation

Investor Presentation Reconciliation of Non-GAAP measures Included in this presentation, we have disclosed certain non-GAAP measures as defined by Regulation G. The following reconciles these items to net income and cash flows as reported under GAAP. Adjusted EBITDAR is defined as net income attributable to the Company before the effect of net interest expense, income taxes, depreciation, depletion and amortization, accretion on asset retirement obligations, amortization of sales contracts and reorganization items, net. Adjusted EBITDAR may also be adjusted for items that may not reflect the trend of future results by excluding transactions that are not indicative of the Company's core operating performance. Adjusted EBITDAR is not a measure of financial performance in accordance with generally accepted accounting principles, and items excluded from Adjusted EBITDAR are significant in understanding and assessing our financial condition. Therefore, Adjusted EBITDAR should not be considered in isolation, nor as an alternative to net income, income from operations, cash flows from operations or as a measure of our profitability, liquidity or performance under generally accepted accounting principles. The Company uses adjusted EBITDAR to measure the operating performance of its segments and allocate resources to the segments. Furthermore, analogous measures are used by industry analysts and investors to evaluate our operating performance. Investors should be aware that our presentation of Adjusted EBITDAR may not be comparable to similarly titled measures used by other companies. The table below shows how we calculate Adjusted EBITDAR. Successor Tw e lve M onths Ende d De ce m be r 31, 2017 (Unaudited) 238,450 (35,255) 24,256 122,464 30,209 53,985 (21,297) 2,547 2,398 Net income Benefit from income taxes Interest expense, net Depreciation, depletion and amortization Accretion on asset retirement obligations Amortization of sales contracts, net Gain on sale of Lone Mountain Processing, Inc. Net loss resulting from early retirement of debt and debt restructuring Reorganization items, net $ Adjusted EBITDAR $ 417,757 28

Investor Presentation Reconciliation of Non-GAAP measures The Company is unable to present a quantitative reconciliation of its forward-looking non-GAAP Segment cash cost per ton sold financial measures to the most directly comparable GAAP measures without unreasonable efforts due to the inherent difficulty in forecasting and quantifying with reasonable accuracy significant items required for the reconciliation. The most directly comparable GAAP measure, GAAP cost of sales, is not accessible without unreasonable efforts on a forward-looking basis. The reconciling items for this non-GAAP measure are transportation costs, which are a component of GAAP revenues and cost of sales; the impact of hedging activity related to commodity purchases that do not receive hedge accounting; and idle and administrative costs that are not included in a reportable segment. Management is unable to predict without unreasonable efforts transportation costs due to uncertainty as to the end market and FOB point for uncommitted sales volumes and the final shipping point for export shipments. Management is unable to predict without unreasonable efforts the impact of hedging activity related to commodity purchases that do not receive hedge accounting due to fluctuations in commodity prices, which are difficult to forecast due to their inherent volatility. These amounts have historically and may continue to vary significantly from quarter to quarter and material changes to these items could have a significant effect on our future GAAP results. Idle and administrative costs that are not included in a reportable segment are expected to be between $15 million and $20 million in 2018. 29