Attached files

| file | filename |

|---|---|

| 8-K - 8-K - AGILYSYS INC | form8-kinvestorpresentatio.htm |

Investor Presentation

March 2018

TECHNOLOGY | INNOVATION | SOLUTIONS

Forward-looking Statements & Non-GAAP

Financial Information

Forward-Looking Language

This press release contains "forward-looking statements" within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-

looking statements can be identified by words such as: "anticipate," "intend," "plan," "goal," "seek," "believe," "project," "estimate," "expect," "strategy," "future," "likely," "may,"

"should," "will" and similar references to future periods. Examples of forward-looking statements include, among others, our guidance relating to revenue and adjusted earnings

from operations, and statements we make regarding our ability to achieve revenue growth, profitability, and improvements in f inancial results and shareholder value.

Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations and assumptions

regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking

statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are diff icult to predict and many of which are outside of our

control. Our actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these

forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from those indicated in the forward-looking

statements include, among others, our ability to achieve operational efficiencies and meet customer demand for products and services and the risks described in the Company's

filings with the Securities and Exchange Commission, including the Company's reports on Form 10-K and Form 10-Q.

Any forward-looking statement made by us in this press release is based only on information currently available to us and speaks only as of the date on which it is made. We

undertake no obligation to publicly update any forward-looking statement that may be made from time to time, whether written or oral, whether as a result of new information,

future developments or otherwise.

Use of Non-GAAP Financial Information

To supplement the unaudited condensed consolidated financial statements presented in accordance with U.S. GAAP in this press release, certain non-GAAP financial

measures as defined by the SEC rules are used. These non-GAAP financial measures include adjusted EBITDA and adjusted earnings from operations. Management believes

that such information can enhance investors' understanding of the company's ongoing operations. See the accompanying table below for a reconciliation of adjusted EBITDA

and adjusted earnings from operations to the most closely related GAAP measure.

2

WHO WE ARE AND WHAT WE DO

TECHNOLOGY | INNOVATION | SOLUTIONS

4

Agilysys Overview

• Agilysys is a Technology Solutions Company Exclusively

Focused on the Hospitality Sector

• Our Solutions Drive Substantial Customer Benefits

Including Increased Revenue, Reduced Cost, Enhanced

Guest Experiences and Improved Employee Morale

• Offices in 10 Locations Globally with Corporate Services

in Alpharetta, Georgia

Note: Revenue data is for the trailing twelve months ended December 31, 2017.

$125.9M

Total

Revenue

53%

Recurring Revenue as a

% of Total Revenue

28%

SaaS Revenue as a %

of Recurring Revenue

30%

Approx. SaaS Revenue

Growth Rate

TECHNOLOGY | INNOVATION | SOLUTIONS

5

Agilysys Overview

Total

Resources

833

Research &

Development

391

Professional

Services

126

General &

Administrative

98

Customer

Support

80

Sales &

Marketing

69

Technical

Services

40

Operations

29

Note: Headcount as of February 28, 2018.

Resources by Department

TECHNOLOGY | INNOVATION | SOLUTIONS

HELP OUR CUSTOMERS IMPROVE

GUEST EXPERIENCE AND LOYALTY

WHATEVER IT TAKES, INCLUDING

INTEGRATION WITH 3rd PARTY

PARTNERS

WITH DEDICATION TO PAST, PRESENT

& FUTURE CUSTOMER INVESTMENTS

IN OUR PRODUCTS AND SERVICES.

Agilysys Mission

6

TECHNOLOGY | INNOVATION | SOLUTIONS

We Provide Leading Hospitality Solutions

Lodging Solutions

~255k rooms at 12/31/17

+5% since 12/31/16

F&B Solutions

~45k end points at 12/31/17

+17% since 12/31/16

62%

of Revenue

26%

of Revenue

9%

of Revenue

INVENTORY &

PROCUREMENT

3%

of Revenue

DOCUMENT

MANAGEMENT

PROPERTY

MANAGEMENT

Note: Revenue contribution figures represent percentage for the trailing twelve months ended December 31, 2017

7

POINT-OF-SALE

Product Technology 93%

of Revenue WELL-ESTABLISHED

7%

of Revenue

rGUEST

TECHNOLOGY | INNOVATION | SOLUTIONS

Gaming – 52% of Revenue

Hotels, Resorts and Cruise – 25% of Revenue

Food Service ce – 21% of Revenue

We Serve Leading Hospitality Brands

Restaurants, Universities, Stadia and Healthcare – 2% of Revenue

8

Note: Revenue contribution figures represent percentage for the trailing twelve months ended December 31, 2017

TECHNOLOGY | INNOVATION | SOLUTIONS

• Guests Increasingly Demand New Technology-Enabled Access and Ease of Use

• New Guest Experience Solutions: Mobile, Self-Service, Preference-Based, Social-Aware

• Competition for Guest Loyalty From OTAs, Other Brands, Shared Rentals

• Single View of Guest Demands Integration With Other Hospitality Solutions

• Few Vendors Focused Solely on Hospitality

• Large Enough to Meet Enterprise Needs

• Small Enough to be Flexible & Agile

Dining Experience Lodging Experience

HOTEL

Growing Need for Agilysys Products

9

TECHNOLOGY | INNOVATION | SOLUTIONS

rGuest Well-Established Partner

Food &

Beverage

Lodging

Cross-

Functional

Agilysys Products

10

TECHNOLOGY | INNOVATION | SOLUTIONS

APAC

$1.36B

28%

EMEA

$1.36B

29%

NA

$1.72B

36%

SA

$0.35B

7%

ARR Market Opportunity

$4.79 Billion

POS

$3.18B

66%

PMS

$1.61B

34%

ARR Product Opportunity

Billions

Agilysys Revenue ~ $125.9M*

Hospitality Market

*Trailing twelve months ended December 31, 2017.

11

TECHNOLOGY | INNOVATION | SOLUTIONS

130

150

170

190

210

230

250

270

290

FY18 FY19 FY20 FY21 FY22

Revenue Possibilities

20% CAGR 15% CAGR 10% CAGR

Estimated 10% - 20% Four-Year Revenue Growth CAGR

12

Adjusted Earnings from Operations at 10%-20% of Revenue is Possible by FY2020

TECHNOLOGY | INNOVATION | SOLUTIONS

Staff From Line Level Roles Within

Industries We Serve

Best Practice Solution

Capabilities

Scalable to Largest

Global Properties

Agility to Meet Custom

Requirements

Single View of Guest

Average Customer Life

– 10 yrs

Exclusively Hospitality

Focused

Continuous

Improvement

Competitive

Strengths

End to End Guest

Lifecycle Solutions

rGuest Platform Links

Guest Preferences

Enterprise Level Architecture

What Makes Agilysys Different?

13

World Class Customer

Service

TECHNOLOGY | INNOVATION | SOLUTIONS

OBSESSIVELY CUSTOMER CENTRIC

ENGINEERING DRIVEN COMPANY

IN EVERY MARKET WE SERVE

Go To Market Strategy

14

96%

increase in

developer

capacity vs.

FY2017

~25%

improvement

in customer

retention vs.

FY2017

TECHNOLOGY | INNOVATION | SOLUTIONS

15

Growth in Engineering Capacity

Jan 1, 2017 Feb 28, 2018 Growth

R&D 229 391 71%

Developers 134 263 96%

Total Headcount 725 833 15%

R&D/HC 32% 47%

Developers/HC 18% 32%

Contractors 102 31

TECHNOLOGY | INNOVATION | SOLUTIONS

Chennai

• 34,000 Square Feet

• 330 Employee Capacity

• ~240 Already Onboard

• Full Capacity by June 2018

• Other Tenants – Amazon, Cisco,

Citi, GE, Fidelity, AstraZeneca

India Development Center

16

TECHNOLOGY | INNOVATION | SOLUTIONS

INCREASED PRODUCT DEVELOPMEMENT VELOCITY

GREATER PROCESS EFFICIENCIES

EMPLOYEE & LEADERSHIP DEVELOPMENT

PROFITABLE REVENUE GROWTH

DIFFERENTIATING PRODUCT BREADTH

INTERNATIONAL EXPANSION

OBSESSIVE CUSTOMER CENTRICITY

INNOVATION AND EXECUTION

GOALS

Strategic Initiatives

17

TECHNOLOGY | INNOVATION | SOLUTIONS

TONY PRITCHETT

Chief Financial Officer

Tony is a certified public accountant who joined Agilysys in 2012 as controller of the Retail Solutions Group, bringing

with him prior financial experience with software and SaaS companies.

RAMESH SRINIVASAN

President and Chief Executive Officer

Ramesh is an accomplished CEO with leadership and turnaround success across multiple industries resulting in rapid

and sustainable long-term growth and significant increases in shareholder value.

18

Senior Management Leading New Growth Vision

KYLE C. BADGER

Senior Vice President, General Counsel and Secretary

Kyle leads our global legal and human resources teams, and brings over 22 years of legal experience representing

public and private companies in general corporate matters.

DON DEMARINIS

Senior Vice President Sales, Americas

Don brings extensive industry experience and success at Oracle and Micros selling hospitality technology and

services to global clients across markets where he led sales increases of up to 30% per annum.

TECHNOLOGY | INNOVATION | SOLUTIONS

SRIDHAR LAVETI

Vice President of Established Products and Customer Support

Sridhar leads the product engineering and management teams for established Agilysys products and oversees

customer support. He brings 25+ years of technology and general management leadership across multiple industries.

ROB JACKS

Vice President of Professional Services

Rob is responsible for building and delivering a high-caliber professional services team. As a prior CIO in gaming, Rob

brings a reputation as a transformational executive who can deploy complex solutions with a measurable ROI.

19

Senior Management Leading New Growth Vision

LARRY STEINBERG

Senior Vice President and Chief Technology Officer

Larry leads many of the key new product initiatives at Agilysys. Prior to Agilysys, as a Development Manager for

Microsoft, he focused on automation, interoperability, cross-platform, and cloud and datacenter solutions.

PRAKASH BHAT

Vice President and Managing Director (India)

Prakash brings 30+ years of practical experience in technology and management with an impressive track record of

building new companies to create a strong market presence for established organizations in new locations.

FINANCIAL OVERVIEW

TECHNOLOGY | INNOVATION | SOLUTIONS

Financial Metrics and Valuation (*TTM)

Share Price (3/7/18) $11.55

Diluted Shares Outstanding 22.8M

Diluted Market Capitalization $263.3M

Cash (as of 12/31/17) $37.6M

Debt (as of 12/31/17) $0.2M

Enterprise Value $225.9M

Revenue $125.9M

Gross Profit $63.1M

Adjusted EBITDA^ $5.8M

Adjusted Earnings from Operations^ ($10.3M)

Earnings per Share ($0.59)

EV/Revenue 1.8x

EV/Gross Profit 3.6x

Business Metrics (as of 12/31/17)

Direct POS End Points Managed

Y/Y Growth

~45k

17%

Direct Hotel Rooms Managed

Y/Y Growth

~255k

5%

Recurring Revenue*

As % of Total Revenue

53%

Subscription Revenue*

As % of Recurring Revenue

28%

Subscription Revenue Growth Y/Y 26%

rGuest as % of Total Revenue* 7%

New Customer Count* 85

^Non-GAAP measure, see reconciliation on slide 25.

*Trailing twelve months ended December 31, 2017.

Evolving Business, Evolving P&L

21

TECHNOLOGY | INNOVATION | SOLUTIONS

Consolidated Balance Sheet (in thousands)

March 31, 2017 December 31, 2017

Cash, Cash Equivalents and Marketable Securities $49,255 $37,615

Other Current Assets 24,265 23,726

Long-Term Assets 93,785 94,577

Total Assets $167,305 $155,918

Current Liabilities $46,337 $41,564

Other Liabilities 7,299 6,140

Total Liabilities $53,636 $47,704

Shareholders’ Equity 113,669 108,214

Total Liabilities and Shareholders’ Equity $167,305 $155,918

Strong Balance Sheet

22

TECHNOLOGY | INNOVATION | SOLUTIONS

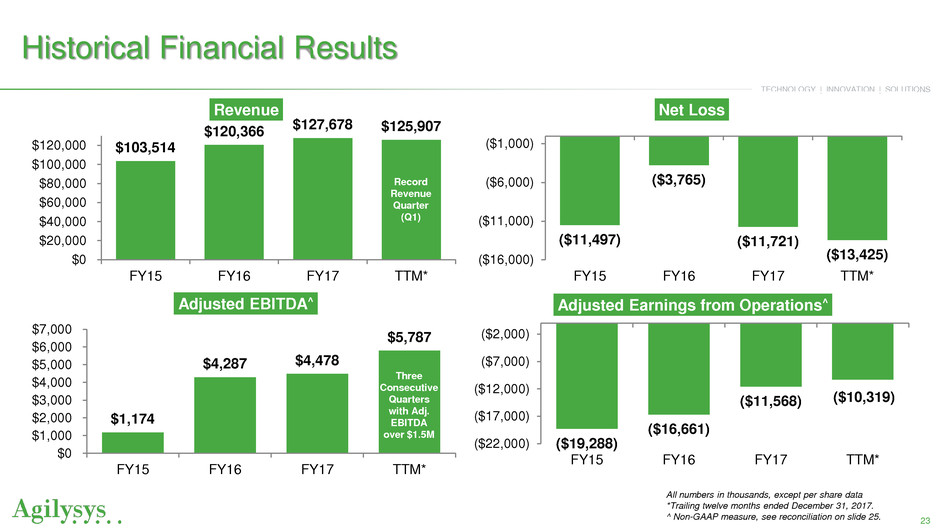

All numbers in thousands, except per share data

*Trailing twelve months ended December 31, 2017.

^ Non-GAAP measure, see reconciliation on slide 25.

$103,514

$120,366 $127,678 $125,907

$0

$20,000

$40,000

$60,000

$80,000

$100,000

$120,000

FY15 FY16 FY17 TTM*

Revenue

($19,288)

($16,661)

($11,568) ($10,319)

($22,000)

($17,000)

($12,000)

($7,000)

($2,000)

FY15 FY16 FY17 TTM*

Adjusted Earnings from Operations^

$1,174

$4,287 $4,478

$5,787

$0

$1,000

$2,000

$3,000

$4,000

$5,000

$6,000

$7,000

FY15 FY16 FY17 TTM*

Adjusted EBITDA^

($11,497)

($3,765)

($11,721)

($13,425) ($16,000)

($11,000)

($6,000)

($1,000)

FY15 FY16 FY17 TTM*

Net Loss

Historical Financial Results

23

Three

Consecutive

Quarters

with Adj.

EBITDA

over $1.5M

Record

Revenue

Quarter

(Q1)

APPENDIX

TECHNOLOGY | INNOVATION | SOLUTIONS

*Trailing twelve months ended December 31, 2017.

Non-GAAP Reconciliation

25

TTM* 2017 2016 2015

Net loss (13,425)$ (11,721)$ (3,765)$ (11,497)$

Income tax expense (benefit) (1,455) 236 6 (1,054)

Loss before taxes (14,880) (11,485) (3,759) (12,551)

Depreciation of fixed assets 2,510 2,409 2,199 2,225

Amortization of intangibles 1,782 1,392 1,243 3,461

Amortization of developed technology 9,678 8,012 1,022 1,294

Interest income (81) (147) (63) (62)

EBITDA (b) (991) 181 642 (5,633)

Share-based compensation 5,421 2,427 3,405 3,141

Restructuring, severance and other charges 1,318 1,561 283 1,482

Asset write-offs and other fair value adjustments - - 180 1,836

Other non-operating (income) expense (111) 224 (491) 146

Legal settlements 150 85 268 203

Adjusted EBITDA (a) 5,787$ 4,478$ 4,287$ 1,174$

Capital expenditures (6,120) (4,158) (5,900) (4,650)

Capitalized software development costs (9,986) (11,888) (15,048) (15,813)

Adjusted Earnings from Operations (c) (10,319)$ (11,568)$ (16,661)$ (19,288)$

(a) Adjusted EBITDA, a non-GAAP financial measure, is defined as income before income taxes, interest expense (net of interest income),

depreciation and amortization (including amortization of developed technology), and excluding charges relating to i) legal settlements,

ii) restructuring, severance, and other charges, iii) asset write-offs and other fair value adjustments, iv) share-based compensation, and

v) other non-operating (income) expense

(b) EBITDA is defined as net income before income taxes, interest expense, depreciation and amortization

(c) Adjusted Earnings from Operations, a non-GAAP financial measure, is defined as Adjusted EBITDA,

less capital expe ditures and capitalized software development costs

AGILYSYS, INC.

RECONCILIATION OF NET LOSS TO ADJUSTED EARNINGS FROM OPERATIONS

(UNAUDITED)

(In thousands)

Twelve Months Ended

March 31

TECHNOLOGY | INNOVATION | SOLUTIONS

Cash Flow

*Trailing twelve months ended December 31, 2017.

26

Principal Location

Country with Installation

Reseller

Santa Barbara, CA

Seattle, WA

Las Vegas, NV

Alpharetta, GA

Windsor, UK

Hong Kong

Manila, Philippines

Singapore

Kuala Lumpur, Malaysia

Chennai, India

Agilysys Corporate Services

• Alpharetta, Georgia

Agilysys US Offices

• Las Vegas, Nevada

• Santa Barbara, California

• Bellevue, Washington

Agilysys EMEA Office

• United Kingdom

Agilysys APAC Offices

• Hong Kong

• Malaysia

• Philippines

• Singapore

Agilysys Demonstration Centers

• Alpharetta, Georgia

• Las Vegas, Nevada

India Development Center

• Chennai, India

Agilysys Global Footprint

27

Contact:

Richard Land / Norberto Aja

JCIR

(212) 835-8500

agys@jcir.com

Tony Pritchett

Chief Financial Officer

(770) 810-7941

InvestorRelations@agilysys.com

28