Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Valeritas Holdings Inc. | a8-k31218.htm |

Valeritas

Corporate Presentation

NASDAQ: VLRX

March 2018

©2018 Valeritas, Inc..

Improving health and simplifying life for people with diabetes

©2018 Valeritas, Inc.. 2

NASDAQ: VLRX

John Timberlake, CEO

Improving health and simplifying life for people with diabetes

Forward Looking Statements

This presentation shall not be deemed an offer to sell securities nor a solicitation of an offer to purchase securities. Any sale by the company shall be made pursuant to a

definitive purchase agreement. Unless otherwise stated in this presentation, references to “Valeritas,” “we,” “us,” “our” or “our company” refer to Valeritas

Holdings, Inc.. and its subsidiaries.

This presentation contains estimates, projections and forward-looking statements. Our estimates, projections and forward-looking statements are based on our

management’s current assumptions and expectations of future events and trends, which affect or may affect our business, strategy, operations or financial

performance, including but not limited to our revenue, gross margin and cash-flow break-even projections. Although we believe that these estimates,

projections and forward-looking statements are based upon reasonable assumptions and expectations, they are subject to numerous known and unknown risks

and uncertainties and are made in light of information currently available to us. Many important factors may adversely and materially affect our results as

indicated in forward-looking statements. All statements other than statements of historical fact are forward-looking statements. The words “believe,” “may,”

“might,” “could, “would,” “will,” “aim,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “plan” and similar words are intended to identify estimates,

projections and forward-looking statements. Estimates, projections and forward-looking statements speak only as of the date they are made, and, except to the

extent required by law, we undertake no obligation to update or review any estimate, projection or forward-looking statement because of new information,

future events or other factors.

Our estimates, projections and forward-looking statements may be influenced by one or more of the following factors:

• our history of operating losses and uncertainty regarding our ability to achieve profitability;

• our reliance on V-Go® Wearable Insulin Delivery device, or V-Go, to generate all of our revenue;

• our inability to retain a high percentage of our patient customer base or our significant wholesale customers;

• the failure of V-Go to achieve and maintain market acceptance;

• our inability to operate in a highly competitive industry and to compete successfully against competitors with greater resources;

• competitive products and other technological breakthroughs that may render V-Go obsolete or less desirable;

• our inability to maintain or expand our sales and marketing infrastructure;

• any inaccuracies in our assumptions about the insulin-dependent diabetes market;

• manufacturing risks, including risks related to manufacturing in Southern China, damage to facilities or equipment and failure to efficiently increase

production to meet demand;

• our dependence on limited source suppliers and our inability to obtain components for our product;

• our failure to secure or retain adequate coverage or reimbursement for V-Go by third-party payers;

• our inability to enhance and broaden our product offering, including through the successful commercialization of the V-Go® SIMTM and V-Go® pre-fill;

• our inability to protect our intellectual property and proprietary technology;

• our failure to comply with the applicable governmental regulations to which our product and operations are subject;

• our ability to operate as a going concern; and

• our liquidity.

©2018 Valeritas, Inc.. 3

We know diabetes is a serious problem!

©2018 Valeritas, Inc.. 4

Insulin is the most potent

glucose-lowering agent2

Do we really need

another new insulin?

1. (1) American Diabetes Association Diabetes Fast Facts 2015. Available at

https://www.professional.diabetes.org/content/fast-facts-data-and-statistics-about-diabetes. Accessed March 10, 2018., .

2. ACE/ACE Consensus Statement, ENDOCRINE PRACTICE Vol 23 No. 2 Feb. 2017.

~ 5.6 Million

Patients in U.S. with

Type 2 Diabetes take insulin3

Do we need another

new diabetes drug?

“Drugs don’t work in people who

don’t take them.”

– C. Everett Koop, M.D. (4)

We need to help the 5.6 Million

T2 patients ALREADY on insulin to

ACTUALLY take their insulin

$ 245 Billion

Cost of Diagnosed

Diabetes in U.S. in 20121

3. U.S. Roper Diabetes Market Study provided by GfK Customer Research LLC.

4. Eur J Heart Fail. 2017 Nov;19(11):1412-1413.

1

©2018 Valeritas, Inc.. 5

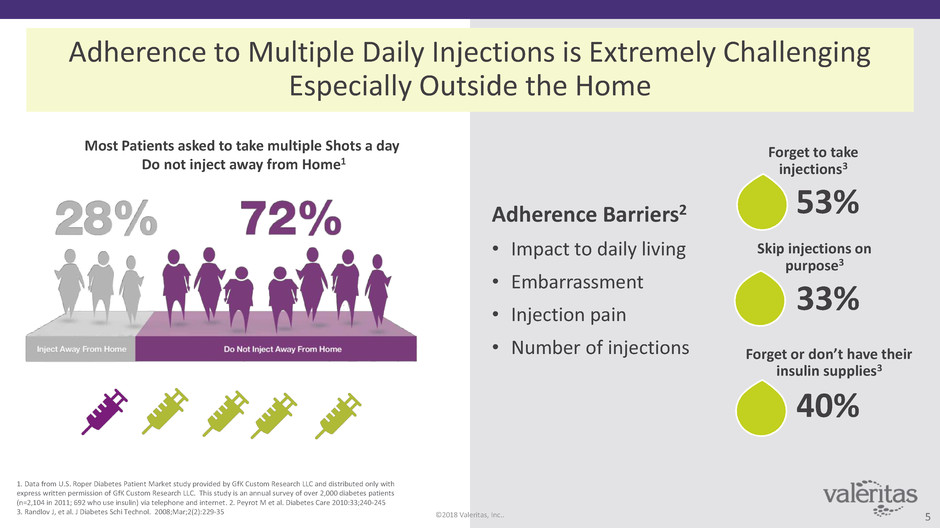

Adherence to Multiple Daily Injections is Extremely Challenging

Especially Outside the Home

Adherence Barriers2

• Impact to daily living

• Embarrassment

• Injection pain

• Number of injections

Forget to take

injections3

53%

Forget or don’t have their

insulin supplies3

40%

Skip injections on

purpose3

33%

1. Data from U.S. Roper Diabetes Patient Market study provided by GfK Custom Research LLC and distributed only with

express written permission of GfK Custom Research LLC. This study is an annual survey of over 2,000 diabetes patients

(n=2,104 in 2011; 692 who use insulin) via telephone and internet. 2. Peyrot M et al. Diabetes Care 2010:33;240-245

3. Randlov J, et al. J Diabetes Schi Technol. 2008;Mar;2(2):229-35

Most Patients asked to take multiple Shots a day

Do not inject away from Home1

©2018 Valeritas, Inc.. 6

Most Patients with Type 2 Diabetes

on Insulin are NOT at Goal1

6

20%

AT A1c Goal

80%

NOT AT A1c Goal

Impact of Improving

Glucose Control2

Deaths from Diabetes

21%

Microvascular Complications

37%

Heart Attacks

14%

Peripheral Vascular Disease

43%

1. Grabner M, et al. Clinicoecon Outcomes Res. 2013;5:471-479 2. Stratton IM et al. BMJ. 2000;321:405-412.

For every 1% reduction in A1C (blood glucose/sugar)

there is a decrease in:

©2018 Valeritas, Inc..

Valeritas’ Mission is for V-Go® to be the Preferred

Insulin Delivery Method for Patients with Type 2 Diabetes

7

Achieving this mission will ELIMINATE the need for Multiple Daily Injections of Insulin

©2018 Valeritas, Inc..

8

The V-Go® Solution

Breakfast

Lunch

Snack

Dinner

Bedtime

Insulin delivery that is worn like a patch

Only FDA & E.U. approved 24-hour, single-use,

fully disposable insulin delivery device

• that provides basal (background) and

bolus (mealtime) insulin delivery

• No batteries, programming or alarms

Designed for the patient with type 2 diabetes

Convenient drug-like fulfilment at the

pharmacy model

Reimbursed by Medicare Part D and most

Commercial Insurance

Valeritas - Entering Growth Stage with Significant Market Opportunity

©2018 Valeritas, Inc.. 9

Entering Growth Stage

• 3rd Consecutive quarter of

growth

• 40% of sales reps were hired

in 2017

• Planned introduction of

Bluetooth V-Go SIMTM

Partnering

• Executed distribution agreements

in Italy & Puerto Rico, and looking

at other International markets

• Evaluating cloud based diabetes

management companies to

partner with V-Go SIMTM

• Exploring insulin providers to

develop V-Go Prefill

Commercial Stage

• $20.2M revenue in U.S. in 2017

• 45% Gross Margin in Q4

• Established reimbursement: Cost

neutral/benefit to patients & payers

• V-Go® proven to deliver strong

clinical and economic benefits

Guidance

• 2018

• $26-$28 Million in

revenue

• 50% gross margin in Q4

* 4.5M patients x $6.50 per V-Go x 360 days x 15% share = approx. $1.6 Billion

Significant Market Opportunity: A 15% market share of U.S. patients with type 2 on insulin but not at their glucose goal would represent $1.6B in revenue*

~

4

.5

M

N

o

t

a

t

A

1c

G

o

a

l

5.6M Patients with Type 2

Diabetes On Insulin1

©2018 Valeritas, Inc.. 10

Significant Market Opportunity for Valeritas in the U.S.

U.S. Type 2 Diabetes

15%

Initial V-Go® Target Market

2M Type 2 on Multiple Daily Shots

Longer-Term V-Go Market

(with V-Go pipeline products)

15%

With National Sales Force

“IF” Market Share V-Go Revenue

15% $700 Million3

V-Go Potential Revenue

With Current Sales Force

“IF” Market Share V-Go Revenue

15% $75 Million2

2.5M on

1-2 Shots

2M on

MDI

1.5M at

A1c Goal

$1.6 Billion V-Go Potential Revenue4

(“IF” at 15% market share)

2. 221,500 Total Meal Time Insulin TRx’s written by Valeritas Reachable Customers x $6.50 x 360 x 15% = ~$75 million

3. 2M patients x $6.50 per V-Go x 360 days x 15% share = ~ $700 million

4. 4.5M patients x $6.50 per V-Go x 360 days x 15% share = ~$1.6B

1 Number of patients with T2DM on insulin are approximate and based on 2014 US Roper Diabetes Patient

Market Study provided by GfK Customer Research LLC and achievement of A1C goal based on Grabner et al.

ClinicoEconomics and Outcomes Research. 2013:5 471–479.

4.5M on

Insulin

©2018 Valeritas, Inc.. 11

Sales & Marketing Model

PATIENT PHYSICIAN

• Target high insulin volume prescribers

• High frequency of office contact

• High support & service for prescriber & patient

• Activate patients to seek and ask for V-Go

• Direct-to-Patient multi-channel marketing

• Patient education and support

WANT PRESCRIBE

EDUCATION AWARENESS

ASK FOR

©2018 Valeritas, Inc.. 12

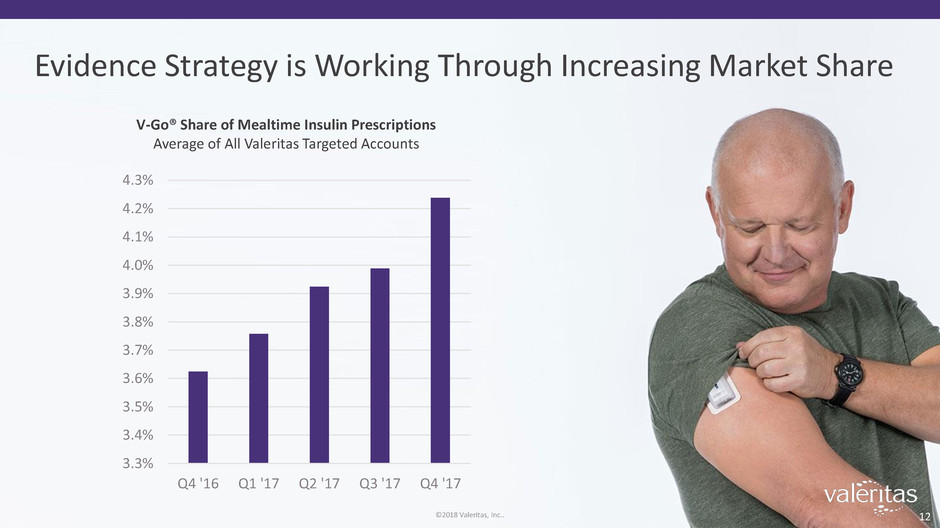

Evidence Strategy is Working Through Increasing Market Share

Q4 '16 Q1 '17 Q2 '17 Q3 '17 Q4 '17

3.3%

3.4%

3.5%

3.6%

3.7%

3.8%

3.9%

4.0%

4.1%

4.2%

4.3%

V-Go® Share of Mealtime Insulin Prescriptions

Average of All Valeritas Targeted Accounts

©2018 Valeritas, Inc.. 13

Targeted Accounts

(Monthly TRx's)

$2,000

$2,500

$3,000

$3,500

$4,000

$4,500

$5,000

$5,500

$6,000

$6,500

Q1'16 Q2'16 Q3'16 Q4'16 Q1'17 Q2'17 Q2'17 Q3'17 Q4'17

Quarterly Revenue

(2015-2017)

Strong Prescription Growth from Targeted Accounts

Driving Accelerating Revenue

Turning point for growth,

fueled by high touch /

higher service model

Turning point for growth,

fueled by high touch /

higher service model

©2018 Valeritas, Inc.. 14

V-Go® is Cost-effective for Both Payers & Patients

Product is Primarily Fulfilled at Retail Pharmacy

*What a Payor Pays (Net of Rebates & Co-pays when V-Go Contracted in Preferred Position)

$17 / day calculated based on published Wholesale Acquisition Prices less estimated rebates and sales deductions.

1.Avg. Nat’l Tier 2 or Tier 3 Co-pay for commercial plans is $31 and $53, respectively, The Kaiser Family Foundation and Health Research & Education Trust Employer Health Benefits 2016 Annual Survey.

Neutral Cost to Patients

(~$17 /day)

between Regimens*

$33

co-pay1

$33

co-pay1

$11

co-pay1

$2.50

Patient co-pay / day

$33

monthly co-pay1

$33 or $57

monthly co-pay1

$2 to $3

Patient co-pay / day

Basal/Bolus

Pen Therapy

V-Go® Therapy

Neutral Cost to Payers

©2018 Valeritas, Inc.. 15

Demonstrated Statistically

Significant Improvements in A1C1-6

Improved Quality of Life1

Lowered Total Daily Dose of Insulin

(Prescribed / Administered)1-6

11

48

Published

Clinical Papers

V-Go Patients

Studied

Presentations

at National

Conferences

1. Rosenfeld CR, et al. Endocr Pract. 2012; 18 (5):660-667. 2. Grunberger, G, et al. Poster presented at 73rd Scientific

Sessions of the ADA; 2013 June 21-25; Chicago, IL. 985-P. 3. Omer, A. et al. Poster presented at 73rd Scientific Sessions of

the ADA; 2013 June 21-25; Chicago, IL. 980-P. 4. Lajara, R, et al. Drugs-Real World Outcomes 2016 Jun 2;3(2):191-199. 5.

Lajara R, et al. Diabetes Ther. 2015;6 (4):531-545.; 6. Lajara R et al. Endocr Pract. 2016 June; 22 (6): 726-725.

Demonstrated Cost Reductions4

Strong Clinical Evidence

1K>

©2018 Valeritas, Inc.. 16

Use of a Simple Titration Approach with V-Go®

Significantly Lowered A1C (glucose)

Use of a weekly physician-driven mealtime dosing titration approach with patients with T2D uncontrolled on prior regimens

13%

Before V-Go

< 7%

< 8%

≤ 9%

On V-Go

47%

40% 87%

67% 100%

A1C Goal Achievement8.7

7.1*

A

1

C

(

%

)

144

60*

TD

D

(

Units

)

Before V-Go On V-Go (4 months)

Texas Health Resources. MOTIV (Managing Optimization and Titration of Insulin Delivery with V-Go) Retrospective Study

T2D=Type 2 diabetes, TDD=Total daily dose of insulin *Significant compared to baseline N=15

Mehta. S, et al. Presented as a poster at OMED, Philadelphia, PA 2017, DTM, Bethesda, MD 2017 and ATTD, Venice, AT, 2018

Hypoglycemia (very low blood glucose) incidence

decreased from 23% at baseline to 7% of patients.

Patients Who Utilize V-Go® Like How

it Fits into Their Lifestyle

Extremely Satisfied = 39% Very Satisfied= 32%

Satisfied= 16% Somewhat Satisfied= 7%

Not Satisfied=6%

>90%

of Patients are

satisfied with the

ability of V-Go to fit

with their Lifestyle

N=720 patients prescribed V-Go

dLife Survey 1Q 2016, commissioned by Valeritas, Inc.. as part of the V-Go Life Online Educational Program

©2018 Valeritas, Inc.. 17

©2018 Valeritas, Inc.. 18

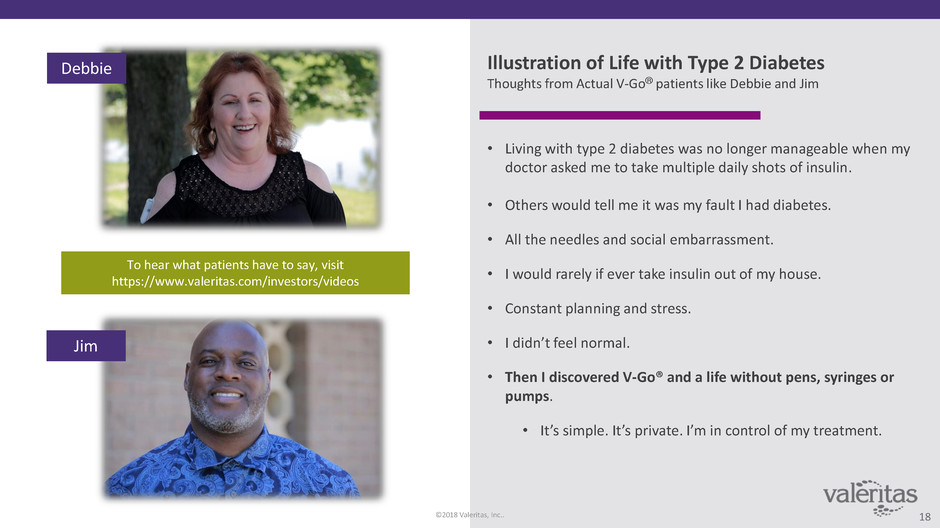

Illustration of Life with Type 2 Diabetes

Thoughts from Actual V-Go® patients like Debbie and Jim

• Living with type 2 diabetes was no longer manageable when my

doctor asked me to take multiple daily shots of insulin.

• Others would tell me it was my fault I had diabetes.

• All the needles and social embarrassment.

• I would rarely if ever take insulin out of my house.

• Constant planning and stress.

• I didn’t feel normal.

• Then I discovered V-Go® and a life without pens, syringes or

pumps.

• It’s simple. It’s private. I’m in control of my treatment.

To hear what patients have to say, visit

https://www.valeritas.com/investors/videos

Debbie

Jim

©2018 Valeritas, Inc.. 19

Valeritas Generated 45% Gross Margins at Significantly Lower Revenue

$5.8

$21.4

$27.0

$61.1

$-

$10

$20

$30

$40

$50

$60

$70

Valeritas Q4'17 Dexcom Q2'11 Tandem Q3'17 Insulet Q3'13

Quarterly Revenue

(1st Q Company reached 45% GM)*

*Respective Company Public Filings. Gross Margins from each

Company and Product may not be directly comparable

Valeritas Projected

Gross Margins

• 50% GM in Q4 2018

with $7M to $8M

quarterly revenue

©2018 Valeritas, Inc.. 20

V-Go® Line Extension Products Provide Path to the

Broader Diabetes & Insulin Market

V-Go® SIMTM

(Simple Insulin Management)2

Expected to:

• Provide connectivity to smart phones and data

aggregation glucose meters and other devices

• Permit tracking and reporting of basal rate and

bolus insulin usage

• Be used as diagnostic tool to make treatment

adjustments

• Increase patient adherence

V-Go®

• Current product

• Filled by patient by transferring insulin

from vial using V-Go EZ Fill

• Commercially available in U.S.

• Approved in E.U. with initial country

distribution agreement executed

V-Go® Prefill2

Expected to:

• Eliminate filling step as it would include a

prefilled insulin cartridge

• Eliminate need for & cost of V-Go EZ Fill

• Lower number of co-pays1

• Provide revenue from insulin

• Expand target population (1st line Insulin)

• Extend patent life to 2032

1. Assumes V-Go devices and insulin cartridges packaged in a single box under a single NDC thereby

potentially reducing the number of prescriptions and the number of co-pays required per patient.

2. Product currently under development.

©2018 Valeritas, Inc.. 21

V-Go® with V-Go® SIMTM Technology (Simple Insulin Management)*

The Future of Type 2 Diabetes Management

PATIENT PHYSICIAN INDUSTRY PAYERS

MANAGEMENT APPLICATIONS

CLOUD HOSTING

Partner

* Product currently under development.

©2018 Valeritas, Inc..

Growth & Expansion Strategy

22

Increase market share within

existing base of business

(with current sales coverage)

Grow share by expanding

number of prescribers

through increased sales

coverage

Maximize share and

penetration with

expanded R&D

pipeline

+

High Touch / High Service Model

Direct-to-Patient Campaign

Expand International Presence

V-Go® Prefill

V-Go® SIMTMExpand U.S. Field Presence

Financial Summary

($ in millions)

4th Quarter Summary 2H Summary

4Q17 4Q16 Change 2H-2017 2H-2016 Change

Revenue $5.8 $4.8 +21% $10.8 $9.7 +12.3%

Gross Profit $2.6 $1.8 +47% $4.6 $3.5 +32.0%

Gross Margin 45.2% 37.1% +810 bp 42.7% 36.3% +640 bp

Net Loss $15.5 $9.8 +57% $25.5 $19.0 +34.2%

Cash Used in Operations $15.7 $10.7 +46.1%

Total Debt1 $36.0 $59.0 -38.9%

Cash and Cash Equivalents* $26.0 $9.9 +163.1%

©2018 Valeritas, Inc.. 23

Valeritas: Financial Summary – December 31, 2017

* Balances as of 12/31/17

Investor Highlights

Strong quarterly growth that will accelerate

in 2018 and beyond

Established reimbursement:

Cost neutral / benefit to patients & payers

V-Go® delivers clinically-relevant glucose

lowering with less insulin

50% Gross Margin in Q4 2018 with ability

to increase with additional sales volume

Substantial market potential with current

V-Go in U.S. and Internationally

Significant market expansion opportunities

with R&D pipeline

©2018 Valeritas, Inc.. 24

©2018 Valeritas, Inc.. 25

Improving health and simplifying life for people with diabetes

NASDAQ: VLRX

March 2018

ART-1236 Rev A 03/2018

Valeritas

Corporate Presentation

APPENDIX

©2018 Valeritas, Inc.. 26

Significant Number of People with Diabetes

Worldwide (2017 and 2045 est.)

©2018 Valeritas, Inc.. 27

IDF Diabetes Atlas, Eighth Edition, 2017

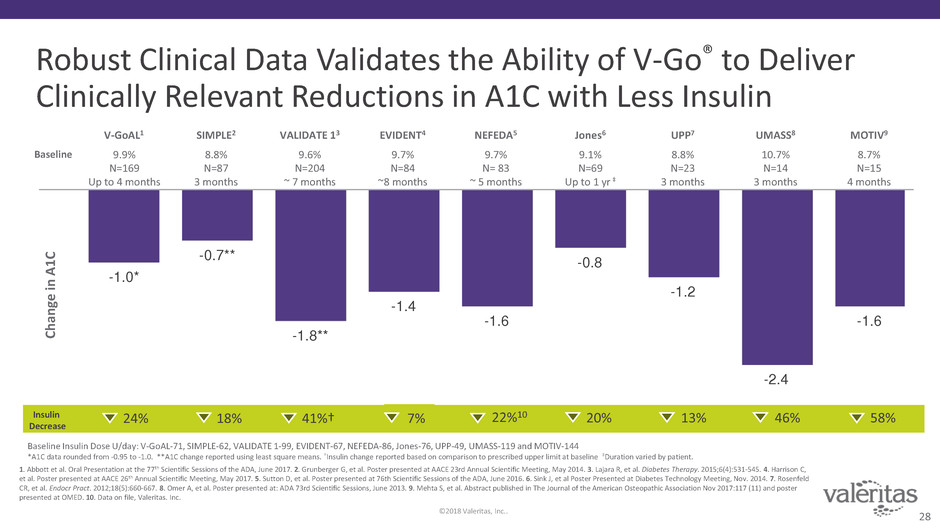

Robust Clinical Data Validates the Ability of V-Go® to Deliver

Clinically Relevant Reductions in A1C with Less Insulin

1. Abbott et al. Oral Presentation at the 77th Scientific Sessions of the ADA, June 2017. 2. Grunberger G, et al. Poster presented at AACE 23rd Annual Scientific Meeting, May 2014. 3. Lajara R, et al. Diabetes Therapy. 2015;6(4):531-545. 4. Harrison C,

et al. Poster presented at AACE 26th Annual Scientific Meeting, May 2017. 5. Sutton D, et al. Poster presented at 76th Scientific Sessions of the ADA, June 2016. 6. Sink J, et al Poster Presented at Diabetes Technology Meeting, Nov. 2014. 7. Rosenfeld

CR, et al. Endocr Pract. 2012;18(5):660-667. 8. Omer A, et al. Poster presented at: ADA 73rd Scientific Sessions, June 2013. 9. Mehta S, et al. Abstract published in The Journal of the American Osteopathic Association Nov 2017:117 (11) and poster

presented at OMED. 10. Data on file, Valeritas. Inc.

-1.0*

-0.7**

-1.8**

-1.4

-1.6

-0.8

-1.2

-2.4

-1.6

Baseline Insulin Dose U/day: V-GoAL-71, SIMPLE-62, VALIDATE 1-99, EVIDENT-67, NEFEDA-86, Jones-76, UPP-49, UMASS-119 and MOTIV-144

*A1C data rounded from -0.95 to -1.0. **A1C change reported using least square means. †Insulin change reported based on comparison to prescribed upper limit at baseline ‡Duration varied by patient.

Insulin

Decrease

18% 41%† 22%10 20% 13% 46% 58%

UPP7 UMASS8

8.8%

N=23

3 months

10.7%

N=14

3 months

9.7%

N= 83

~ 5 months

VALIDATE 13

9.6%

N=204

~ 7 months

Ch

an

ge

in

A1

C

NEFEDA5

9.1%

N=69

Up to 1 yr ‡

Jones6

8.7%

N=15

4 months

MOTIV9SIMPLE2

8.8%

N=87

3 months

V-GoAL1

9.9%

N=169

Up to 4 months

EVIDENT4

9.7%

N=84

~8 months

24% 7%

Baseline

©2018 Valeritas, Inc..

28

Switching from Multiple Daily Injections to V-Go® Results in

Significant Reductions in Total Insulin and A1C (glucose)

©2018 Valeritas, Inc.. 29

117

102

88

61*

M

e

a

n

T

o

ta

l

Da

il

y

D

o

s

e

o

f

In

s

ulin

(

U

/d

a

y

)

Patient

Reported

Prescribed

-1.2*

C

h

a

nge

in

A

1

C

(

%

)

n=86

*p<0.0001 compared to baseline

Lajara R, et al. AACE 24th Annual Scientific and Clinical Congress. May 2015; Nashville, TN

VALIDATE evaluated patients switched to V-Go when Glycemic Control was Suboptimal on Prior Regimens

Multiple Daily Injections (MDI) On V-Go

On V-Go

©2018 Valeritas, Inc.. 30

Prospective Study Conducted by HealthCore, Inc.1 Demonstrated

V-Go® Improved A1C (lowered glucose) with Less Insulin

-0.95*

-0.46*

Chan

ge

in

A

1

C

1 HealthCore, Inc.., an outcomes research subsidiary of Anthem, Inc..

*Significant compared to baseline, Significant between groups

Baseline A1C (%): V-Go 9.88 and STO 9.34 Baseline total daily insulin dose (u/day): V-Go 71 and STO 72

2 Cost includes the WAC cost for all diabetes treatments and medications and based on per patient/day (PPPD) at study end.

The cost is calculated as the sum of published price of insulin, device and concomitant medications.

Abbott, S, et al. Presented as an oral presentation at the 77th ADA Scientific Sessions, San Diego, CA 2017

29%

Less Insulin

with V-Go

vs SOC

at 4 months

(54 vs 72 u/day)

P<0.001

N= 415 patients across 52 Sites with duration of up to 4 months

V-Go was compared to Standard Treatment Optimization (STO) in a

Prospective Pragmatic Clinical Study and Demonstrated Real-World Clinical and Economic Benefits

V-Go proved to be

more cost-effective than STO

V-Go $24.48 vs STO $39.95 per patient per day

for each drop in 1% A1c 2

P = 0.0018

STO

n=246

V-Go

n=169

V-Go® with V-Go SIMTM Technology (Simple Insulin Management)*

The Future of Type 2 Diabetes Management

PATIENT PHYSICIAN INDUSTRY PAYERS

V-Go SIM sends data one-way to

Smart Device. SIM app provides

data on V-Go insulin dosages/timing.

SIM app transfers data to Cloud.

Cloud and other Apps can provide

add’l data to patient. Message by

email and/or secure login.

V-Go SIM will enable simple and

timely access to data that can be

used to improve clinical decision

making and deliver individualized

care. Partnerships will allow the

integration of glucose and insulin

dosing information.

Adherence, utilization and other

health data can improve success

and effectiveness of therapies.

The data can inform clinical trial

development and business

decision making.

Evidence of treatment

effectiveness, adherence

and other data to bolster

payer relationships

MANAGEMENT APPLICATIONS

CLOUD HOSTING

Partner

©2018 Valeritas, Inc.. 31* Product currently under development.

©2018 Valeritas, Inc.. 32

V

A

L

U

E

Scalable Business Model to Drive Shareholder Value

CONTINUED GROTH IN U.S. WITH HIGH TOUCH / HIGH SERVICE MODEL

SHORT-TERM 6 – 18 months MID-TERM 1. – 3 Years LONGER-TERM > 3 years

Advance

V-Go Next

Gen / Line

Extensions

Expand

Sales Force

prudently in

U.S.

Begin to

Commercialize

V-Go® Int’l with

Distrib. Partners

Launch

V-Go SIMTM

(U.S.)

Collaborate

with h-Patch

Technology

Launch

V-Go Prefill

Product

Core Technology= h-patch platform OUS= Outside the United States Line Extensions= V-Go® Link, V-Go® Prefill and future product developments

Expand

Sales Force

in U.S.

Increase

Share in U.S.

Targeted

Accounts

Launch

V-Go SIM

(Int’l)

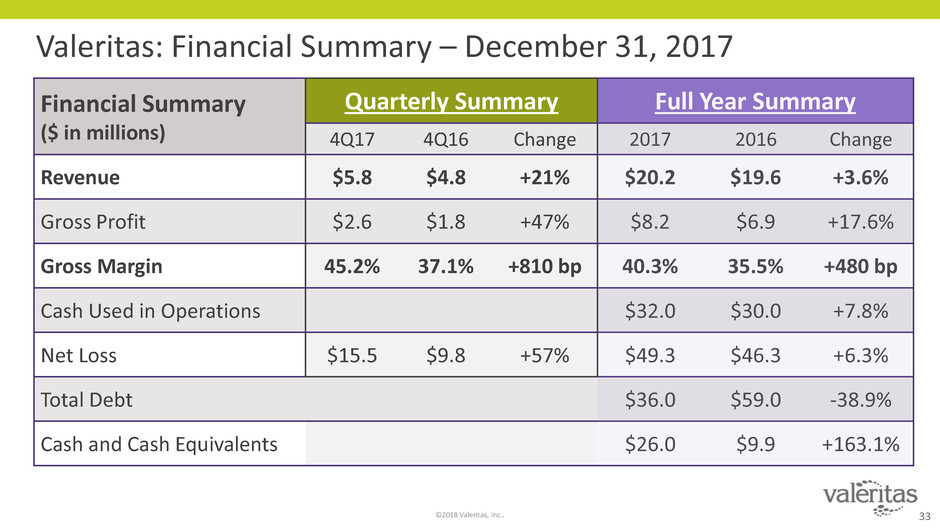

Valeritas: Financial Summary – December 31, 2017

Financial Summary

($ in millions)

Quarterly Summary Full Year Summary

4Q17 4Q16 Change 2017 2016 Change

Revenue $5.8 $4.8 +21% $20.2 $19.6 +3.6%

Gross Profit $2.6 $1.8 +47% $8.2 $6.9 +17.6%

Gross Margin 45.2% 37.1% +810 bp 40.3% 35.5% +480 bp

Cash Used in Operations $32.0 $30.0 +7.8%

Net Loss $15.5 $9.8 +57% $49.3 $46.3 +6.3%

Total Debt $36.0 $59.0 -38.9%

Cash and Cash Equivalents $26.0 $9.9 +163.1%

©2018 Valeritas, Inc.. 33

• Simple filling does not require calculations,

measuring or needles

• Prevents accidental needle sticks

Bolus Chamber

Insulin

Fluid

Fluid

Basal Chamber

Piston

Needle

24 hour Basal rate begins

with the push of a button

4.6 mm, 30 gauge

“Floating needle”

On-demand bolus

function is

manually activated

in 2-step process

Basal rate

flow

restrictor

Basal rate is

spring-driven

V-Go® is Designed for Patient Ease of Use with High Quality Commercial Scale Manufacturing

©2018 Valeritas, Inc.. 34

V-Go Device Overview V-Go® EZ FILLTM

Robust IP with 95 patents issued and 42 pending