Attached files

| file | filename |

|---|---|

| EX-23.2 - EX-23.2 - Evoqua Water Technologies Corp. | a2234800zex-23_2.htm |

| EX-23.1 - EX-23.1 - Evoqua Water Technologies Corp. | a2234800zex-23_1.htm |

| EX-10.33 - EX-10.33 - Evoqua Water Technologies Corp. | a2234800zex-10_33.htm |

| EX-5.1 - EX-5.1 - Evoqua Water Technologies Corp. | a2234800zex-5_1.htm |

| EX-1.1 - EX-1.1 - Evoqua Water Technologies Corp. | a2234800zex-1_1.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

As filed with the Securities and Exchange Commission on March 12, 2018

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Evoqua Water Technologies Corp.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

3999 (Primary Standard Industrial Classification Code Number) |

46-4132761 (I.R.S. Employer Identification No.) |

210 Sixth Avenue

Pittsburgh, Pennsylvania 15222

(724) 772-0044

(Address, including zip code, and telephone number, including

area code, of registrant's principal executive offices)

Ronald C. Keating

Chief Executive Officer

210 Sixth Avenue

Pittsburgh, Pennsylvania 15222

(724) 772-0044

(Name, address, including zip code, and telephone number including area code, of agent for service)

| Copies of all communications, including communications sent to agent for service, should be sent to: | ||||

Andrew B. Barkan, Esq. Meredith L. Mackey, Esq. Fried, Frank, Harris, Shriver & Jacobson LLP One New York Plaza New York, New York 10004 (212) 859-8000 |

Vincent Grieco, Esq. General Counsel Evoqua Water Technologies Corp. 210 Sixth Avenue Pittsburgh, Pennsylvania 15222 (724) 772-0044 |

Marc D. Jaffe, Esq. Ian D. Schuman, Esq. Peter J. Sluka, Esq. Latham & Watkins LLP 885 Third Avenue New York, New York 10022 (212) 906-1200 |

||

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act. (Check One):

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý |

Smaller reporting company o Emerging growth company o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

CALCULATION OF REGISTRATION FEE

|

||||||||

| Title of Each Class of Securities to be Registered |

Amount to be Registered(1) |

Proposed Maximum Offering Price Per Share(2) |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee |

||||

|---|---|---|---|---|---|---|---|---|

Common Stock, par value $0.01 per share |

20,125,000 | $24.20 | $487,025,000 | $60,634.61 | ||||

|

||||||||

- (1)

- Includes

shares and the offering price of shares that may be purchased by the underwriters upon the exercise of their option to purchase additional shares.

- (2)

- Estimated solely for the purpose of calculating the registration fee. In accordance with Rule 457(c) under the Securities Act of 1933, as amended, the price shown is the average of the high and low sales prices of our common stock on March 9, 2018, as reported on the New York Stock Exchange.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. The selling stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell, and it is not soliciting an offer to buy, these securities in any jurisdiction where the offer or sale is not permitted.

Subject to completion, dated March 12, 2018

PRELIMINARY PROSPECTUS

17,500,000 Shares

Evoqua Water Technologies Corp.

Common Stock

The selling stockholders identified in this prospectus are offering 17,500,000 shares of common stock of Evoqua Water Technologies Corp. We are not selling any shares of common stock in this offering, and we will not receive any of the proceeds from the sale of shares of our common stock by the selling stockholders.

Our common stock is listed on the New York Stock Exchange (the "NYSE") under the symbol "AQUA." The last reported sale price of our common stock on March 9, 2018 was $24.45 per share.

The underwriters have an option for a period of 30 days to purchase up to a maximum of 2,625,000 additional shares of our common stock from the selling stockholders.

We are a "controlled company" within the meaning of the corporate governance standards of the NYSE.

Investing in our common stock involves risk. See "Risk Factors" beginning on page 23 to read about factors you should consider before buying shares of our common stock.

|

||||||

| |

Price to Public |

Underwriting Discounts and Commissions(1) |

Proceeds, Before Expenses, to the Selling Stockholders |

|||

|---|---|---|---|---|---|---|

Per Share |

$ | $ | $ | |||

Total |

$ | $ | $ | |||

|

||||||

- (1)

- See "Underwriting" for additional information regarding underwriting compensation.

Delivery of the shares of common stock will be made on or about , 2018.

Neither the Securities and Exchange Commission ("SEC") nor any other regulatory body has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| J.P. Morgan | Credit Suisse | RBC Capital Markets |

| Citigroup | Goldman Sachs & Co. LLC |

| Morgan Stanley | Baird | Cowen | Raymond James | Stifel | Wells Fargo Securities |

The date of this prospectus is , 2018.

You should rely only on the information contained in this prospectus and any free writing prospectus prepared by or on behalf of us that we have referred to you. Neither we, the selling stockholders nor the underwriters have authorized anyone to provide you with additional information or information different from that contained in this prospectus or in any free writing prospectus prepared by or on behalf of us that we have referred to you. If anyone provides you with additional, different, or inconsistent information, you should not rely on it. Offers to sell, and solicitations of offers to buy, shares of our common stock are being made only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our common stock. Our business, financial condition, results of operations or prospects may have changed since such date.

No action is being taken in any jurisdiction outside the United States to permit a public offering of our common stock or possession or distribution of this prospectus in that jurisdiction. Persons who come into possession of this prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any restriction as to this offering and the distribution of this prospectus applicable to those jurisdictions.

i

This prospectus includes estimates regarding market and industry data that we prepared based on our management's knowledge and experience in the markets in which we operate, together with information obtained from various sources, including publicly available information, industry reports and publications, surveys, our customers, distributors, suppliers, trade and business organizations and other contacts in the markets in which we operate. In addition, certain market and industry data has been derived from market research prepared for us by Amane Advisors in 2017, based on 2016 results.

In presenting this information, we have made certain assumptions that we believe to be reasonable based on such data and other similar sources and on our knowledge of, and our experience to date in, the markets for our products. Market share data is subject to change and may be limited by the availability of raw data, the voluntary nature of the data gathering process and other limitations inherent in any statistical survey of market share data. In addition, customer preferences are subject to change. Accordingly, you are cautioned not to place undue reliance on such market share data or any other such estimates. While we believe such information is reliable, neither we nor the underwriters can guarantee the accuracy or completeness of this information, and neither we nor the underwriters have independently verified any third-party information and data from our internal research has not been verified by any independent source. While we believe the estimated market and industry data included in this prospectus are generally reliable, such information, which is derived in part from management's estimates and beliefs, is inherently uncertain and imprecise.

Projections, assumptions and estimates of our future performance and the future performance of the markets in which we operate are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in "Risk Factors" and "Cautionary Note Regarding Forward-Looking Statements." These and other factors could cause results to differ materially from those expressed in the estimates made by the independent parties and by us.

CERTAIN TRADEMARKS, TRADE NAMES AND SERVICE MARKS

This prospectus includes trademarks and service marks owned by us, including "EVOQUA," "BIOMAG," "CAPAC," "CHLOROPAC," "COMAG," "DAVCO," "DEFENDER," "DELTA UV," "ENVIREX," "IONPURE," "JWI," "MEMCOR," "MEMPULSE," "NEXED," "OSEC," "SEACURE," "TRANSFORMING WATER. ENRICHING LIFE.," "WALLACE & TIERNAN," "WATER ONE," "VANOX" and "VORTISAND." This prospectus also contains trademarks, trade names and service marks of other companies, which are the property of their respective owners. Solely for convenience, trademarks, trade names and service marks referred to in this prospectus may appear without the ®, ™ or SM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks, trade names and service marks. We do not intend our use or display of other parties' trademarks, trade names or service marks to imply, and such use or display should not be construed to imply, a relationship with, endorsement of or sponsorship of us by, these other parties.

On January 15, 2014, Evoqua Water Technologies Corp. (formerly EWT Holdings I Corp.) acquired, through its wholly-owned entities, EWT Holdings II Corp. and EWT Holdings III Corp., all of the outstanding shares of Siemens Water Technologies, a group of legal entity businesses formerly owned by Siemens Aktiengesellschaft ("Siemens"). This acquisition, which we refer to as the "Acquisition," closed on January 15, 2014 and was effective January 16, 2014. The stock purchase price, net of cash received, was approximately $730.6 million. Certain affiliates of AEA Investors LP (collectively, "AEA" or our "Sponsor") currently own 40.6% of our common stock.

ii

Unless otherwise indicated or the context otherwise requires, all references to "the Company," "Evoqua," "Evoqua Water Technologies Corp.," "EWT Holdings I Corp.," "we," "us," "our" and similar terms refer to Evoqua Water Technologies Corp. and its consolidated subsidiaries.

Our fiscal year ends on September 30 of each year. References in this prospectus to a fiscal year mean the year in which that fiscal year ends. References in this prospectus to: "fiscal 2015" or "FY 2015" relate to the fiscal year ended September 30, 2015, "fiscal 2016" or "FY 2016" relate to the fiscal year ended September 30, 2016 and "fiscal 2017" or "FY 2017" relate to the fiscal year ended September 30, 2017.

Numerical figures included in this prospectus have been subject to rounding adjustments. Accordingly, numerical figures shown as totals in various tables may not be arithmetic aggregations of the figures that precede them. In addition, we round certain percentages presented in this prospectus to the nearest whole number. As a result, figures expressed as percentages in the text may not total 100% or, as applicable, when aggregated may not be the arithmetic aggregation of the percentages that precede them.

USE OF NON-GAAP FINANCIAL MEASURES

This prospectus contains "non-GAAP financial measures," which are financial measures that are not calculated and presented in accordance with generally accepted accounting principles in the United States, or "GAAP."

The SEC has adopted rules to regulate the use in filings with the SEC and in other public disclosures of non-GAAP financial measures. These rules govern the manner in which non-GAAP financial measures are publicly presented and require, among other things:

- •

- a presentation with equal or greater prominence of the most comparable financial measure or measures calculated and presented in accordance

with GAAP; and

- •

- a statement disclosing the purposes for which the registrant's management uses the non-GAAP financial measure.

Specifically, we make use of the non-GAAP financial measure "Adjusted EBITDA" in evaluating our past performance and future prospects. For the definition of Adjusted EBITDA and a reconciliation to net income (loss), its most directly comparable financial measure presented in accordance with GAAP, see footnotes 2 and 3 to the table under the heading "Prospectus Summary—Summary Consolidated Financial and Operating Data."

Adjusted EBITDA is one of the primary metrics used by management to evaluate the financial performance of our business. We present Adjusted EBITDA, which is not a recognized financial measure under GAAP, because we believe it is frequently used by analysts, investors and other interested parties to evaluate companies in our industry. Further, we believe it is helpful in highlighting trends in our operating results, because it excludes, among other things, certain results of decisions that are outside the control of management, while other measures can differ significantly depending on long-term strategic decisions regarding capital structure, the tax jurisdictions in which we operate and capital investments. Management uses Adjusted EBITDA to supplement GAAP measures of performance as follows:

- •

- to assist investors and analysts in comparing our operating performance across reporting periods on a consistent basis by excluding items that

we do not believe are indicative of our core operating performance;

- •

- in our management incentive compensation which is based in part on components of Adjusted EBITDA;

iii

- •

- in certain calculations under our senior secured credit facilities, which use components of Adjusted EBITDA;

- •

- to evaluate the effectiveness of our business strategies;

- •

- to make budgeting decisions; and

- •

- to compare our performance against that of other peer companies using similar measures.

In addition to the above, our chief operating decision maker uses EBITDA of each reportable segment to evaluate the operating performance of such segments. For the definition of EBITDA on a segment basis and a reconciliation to our segment operating profit presented in accordance with GAAP, see our segment results discussed under "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations" in our Annual Report on Form 10-K for the fiscal year ended September 30, 2017, which is incorporated by reference in this prospectus.

Adjusted EBITDA has limitations as an analytical tool, and you should not consider it either in isolation or as a substitute for analyzing our results as reported under GAAP. Some of these limitations include the following:

- •

- Adjusted EBITDA does not reflect every expenditure, future requirements for capital expenditures or contractual commitments;

- •

- Adjusted EBITDA does not reflect changes in our working capital needs;

- •

- Adjusted EBITDA does not reflect the significant interest expense, or the amounts necessary to service interest or principal payments on our

senior secured credit facilities;

- •

- Adjusted EBITDA does not reflect income tax expense (benefit), and because the payment of taxes is part of our operations, tax expense is a

necessary element of our costs and ability to operate;

- •

- although depreciation and amortization are eliminated in the calculation of Adjusted EBITDA, the assets being depreciated and amortized will

often have to be replaced in the future, and Adjusted EBITDA does not reflect any costs of such replacements;

- •

- Adjusted EBITDA does not reflect the noncash component of employee compensation;

- •

- Adjusted EBITDA does not reflect the impact of earnings or charges resulting from matters we consider not to be reflective, on a recurring

basis, of our ongoing operations; and

- •

- other companies in our industry may calculate Adjusted EBITDA or similarly titled measures differently than we do, limiting its usefulness as a comparative measure.

We compensate for these limitations by relying primarily on our GAAP results and using Adjusted EBITDA only as supplemental information.

iv

This summary highlights selected information included or incorporated by reference in this prospectus. Because this is only a summary, it does not contain all of the information that you should consider in making your investment decision. Before investing in our common stock, you should carefully read this entire prospectus, including our consolidated financial statements and related notes thereto incorporated by reference in this prospectus and the information in "Risk Factors" and "Cautionary Note Regarding Forward-Looking Statements."

We are a leading provider of mission critical water treatment solutions, offering services, systems and technologies to support our customers' full water lifecycle needs. With over 200,000 installations worldwide, we hold leading positions in the industrial, commercial and municipal water treatment markets in North America. We offer a comprehensive portfolio of differentiated, proprietary technology solutions sold under a number of market-leading and well-established brands. We deliver and maintain these mission critical solutions through the largest service network in North America, assuring our customers continuous uptime with 87 branches which are located no further than a two-hour drive from more than 90% of our customers' sites. We believe that the customer intimacy created through our service network is a significant competitive advantage.

Our solutions are designed to provide "worry-free water" by ensuring that our customers have access to an uninterrupted quantity and level of quality of water that meets their unique product, process and recycle or reuse specifications. We enable our customers to achieve lower costs through greater uptime, throughput and efficiency in their operations and support their regulatory compliance and environmental sustainability. We have worked to protect water, the environment and our employees for over 100 years. As a result, we have earned a reputation for quality, safety and reliability and are sought out by our customers to solve the full range of their water treatment needs, and maintaining our reputation is critical to the success of our business.

Our vision "to be the world's first choice in water solutions" and our values of "integrity, customers and performance" foster a corporate culture that is focused on employee enablement, empowerment and accountability, which creates a highly entrepreneurial and dynamic work environment. Our purpose is "Transforming water. Enriching life." We draw from a long legacy of water treatment innovations and industry firsts, supported by more than 1,250 granted or pending patents, which in aggregate are important to our business and solution set. Our core technologies are primarily focused on removing impurities from water, rather than neutralizing them through the addition of chemicals, and we are able to achieve purification levels which are 1,000 times greater than typical drinking water.

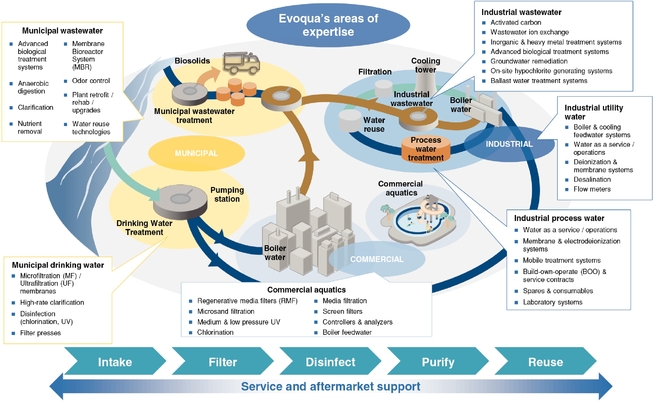

We provide solutions across the entire water cycle. The water cycle begins with "influent" water, which is sourced from oceans, rivers, lakes, as well as other sources. We treat the influent water so that it can be used for a wide variety of industrial, commercial and municipal applications. In industrial applications, influent water, after it is treated, is used as process water for applications, such as microelectronic production, as an ingredient in the production of food and beverage and other goods and in utility applications including boiler feed water, cooling water and steam condensate. Commercial applications for influent water include laboratory testing and aquatic activities, while municipal applications for influent water include treatment to produce safe drinking water and wastewater that is compliant with applicable regulations. After the water is used it is considered "effluent water," and we enable its treatment through the removal of impurities so that it can be discharged safely back into the environment or reused for industrial, commercial or municipal applications. As our solutions span the entire water cycle, we believe we have the most comprehensive and innovative range of solutions in the entire water treatment industry. Our future growth is dependent upon our ability to accretively develop

1

and acquire products, services and solutions, adapt our businesses to meet the demands of our customers, comply with changes to government regulations and achieve market acceptance.

We have developed a broad set of well-established, unique relationships across a highly diverse customer base. These relationships produce a visible flow of reoccurring business, with approximately 55% of our revenue for fiscal 2017 derived from service, consumables and aftermarket parts that come from our repeat business and backlog. Additionally, approximately 23% of our revenue for fiscal 2017 consisted of capital orders already in backlog at the beginning of fiscal 2017, resulting in significant visibility into over 78% of our overall annual sales for fiscal 2017. In the industrial market we serve over 25,000 customers, including a substantial majority of the industrial companies within the Fortune 500. We partner with our industrial customers through our direct sales and service team, which is organized geographically and by specific end market. In the municipal market we serve over 7,800 U.S. wastewater sites and over 1,800 global drinking water treatment sites, providing solutions that help treat over 40% of the U.S. municipal wastewater sites as of September 30, 2017. Our deep institutional relationships with independent sales representatives across North America, who serve as the primary channel for new municipal water treatment projects, and upon whom we depend to successfully market and sell our products, services and solutions, provide us significant access to new projects up for bid and for servicing our installed base.

For the fiscal year ended September 30, 2017, we generated 86% of our revenues in North America with a strong and growing international presence and we currently employ approximately 4,000 individuals across eight countries. For the fiscal year ended September 30, 2017, we generated revenue, net income and Adjusted EBITDA of $1.2 billion, $6.4 million and $207.7 million, respectively. For more information on Adjusted EBITDA, including a reconciliation to the most directly comparable GAAP financial measure, see "—Summary Consolidated Financial and Operating Data."

We serve our customers through three segments: Industrial, Municipal and Products. These segments all draw from the same reservoir of leading technologies, shared manufacturing infrastructure, common business processes and corporate philosophies. Our Industrial Segment provides fully-

2

integrated systems and service solutions that selectively utilize our comprehensive portfolio of water treatment technologies to satisfy our customers' unique water needs. Our Municipal Segment provides engineered water treatment equipment and solutions based on our proprietary technology and odor and corrosion control services. Our Products Segment sells equipment, based on our broad technology portfolio, which is used as components in integrated solutions specified by water treatment designers and offered by original equipment manufacturers ("OEMs"), engineering firms, integrators and our own Industrial and Municipal Segments.

| |

Industrial | Municipal | Products | ||||

|---|---|---|---|---|---|---|---|

| Overview | • Tailored solutions in collaboration with our customers backed by life-cycle services including on-demand water, build-own-operate ("BOO"), recycle / reuse and emergency response service alternatives to improve operational reliability, performance and environmental compliance |

• Delivers solutions, equipment and services to engineering firms, OEMs and municipalities to treat wastewater and purify drinking water |

• Highly differentiated and scalable range of products and technologies specified by global water treatment designers, OEMs, engineering firms and integrators |

||||

Channel |

• Direct sales with market vertical focus |

• Independent representative network supported by technical sales team

• Direct sales and aftermarket channels |

• Direct and indirect sales and aftermarket channels |

||||

Key offerings |

• Full lifecycle service and solutions for influent, effluent and process water, including on-demand water, BOO, recycle / reuse and emergency response services

• Equipment systems for industrial needs: influent water, boiler feed water, ultrahigh purity, process water, wastewater treatment and recycle / reuse

• Full-scale outsourcing of operations and maintenance |

• Wide range of wastewater solutions:

— Ultrafiltration membrane bioreactors

— Advanced biological treatment

— Clarifiers, aerators, screens and dewatering

— Ballasted clarification

— Odor and corrosion control equipment and services

• Ultrafiltration for drinking water

• Retrofit, rehabilitation and aftermarket |

• Filtration

— Regenerative media and microsand

— Self-cleaning filters and intake screens

• Disinfection

— Low and medium pressure ultraviolet ("UV")

— Electrochlorination and gas chlorination

• Anode technology

• Electrodeionization

• Analyzers and controllers |

||||

Percentage of FY 2017 revenue |

52% |

22% |

26% |

As depicted in the table below, we target attractive global end-markets that utilize water as a critical part of their operations or production processes including pharmaceuticals and health sciences, microelectronics, food and beverage, hydrocarbon and chemical processing, power, general manufacturing, municipal drinking water and wastewater, marine and aquatics end markets. While a decline in general global and economic conditions could adversely affect us, our business is highly

3

diversified across our key attractive and growing end markets presented below, and we believe that no single end market drives the overall results of our business.

|

• Meets stringent process and wastewater requirements in both research and development and manufacturing as defined by the U.S. Food and Drug Administration standards |

|

• Provides equipment and support for utility water, boiler feed water, cooling water and steam condensate |

|||

|

• Enables next generation of wafer size/geometry with ultra-pure input water and treatment of contaminated wastewater |

|

• Manages water intake screens, boiler feedwater systems (including polishing using continuous electrodeionization) and condensate polishing |

|||

|

• Ensures process / product water complies with regulations for food and beverage production |

|

• Provides full service process water and wastewater treatment services supported by a mobile fleet guaranteeing maximum up-time |

|||

|

• Provides reliably clean drinking water to the largest cities in the world through integrated membrane systems and disinfection products |

|

• Provides solutions and services to the industry for marine growth prevention, biological fouling protection and ballast water treatment |

|||

|

• Develops efficient and reliable waste treatment systems to handle specific geographic needs

• Offers comprehensive and customizable odor and corrosion control solutions and services |

|

• Meets the rigorous treatment demands across aquatic applications for leisure facilities, fountains, water features and theme parks |

Industrial. Our Industrial Segment provides application-specific solutions and full lifecycle services for critical water applications. We focus on treating industrial process water, utility water and wastewater. Industrial process water requires specific purity standards, which are used in making goods in industries such as microelectronics, pharmaceuticals and health sciences and food and beverage, including ingredient water. Industrial utility water is used for critical industrial applications including boiler feed and cooling water. Industrial wastewater is effluent water discharged from plants or facilities which is treated before it is returned to the environment or recycled or reused within the water cycle. Our operations across the water cycle are complex and, if conducted improperly, may result in potential costs and liabilities, including as a result of environmental damage. Our comprehensive solutions are comprised of capital systems and related recurring aftermarket services, parts and consumables, along with long-term and short-term service contracts and emergency services. Our comprehensive capabilities range from discrete offerings to the provision of highly complex, fully integrated solutions. We are able to leverage our broad range of products and technologies to deliver a tailored solution that best addresses a specific customer's needs, including a growing portfolio of smart water technologies encompassed in our Water One platform. Key capital and related aftermarket service and product offerings include filtration, reverse osmosis, ion exchange and continuous deionization. As a result of our speed, capabilities and experience, we are a trusted partner to 25,000 industrial customers,

4

including a substantial majority of Fortune 500 industrial companies. As water is a critical component in many industrial production processes, unavailability of proper water purity, specification or quality can lead to significant constraints, downtime and increased operating costs.

The cost of an installation can range from a few thousand dollars to a few million dollars and often presents an ongoing service and aftermarket revenue opportunity that can reach or exceed the original project cost. The service and aftermarket sales component is supported by our broad application and process expertise and the largest integrated industrial service network in North America, based on management's estimate. Our network is comprised of certified technicians and the largest fleet of mobile reverse osmosis and deionization water treatment systems in North America based on management's estimate, and enables us to provide a complete range of services spanning from regular maintenance and emergency support to our unique Water One platform. Water One provides remote monitoring capabilities which enable us to optimize our routine service calls through predictive analytics and provide customers a more predictable, cost-efficient water solution. We offer services which include water on-demand, mobile solutions and smart water systems that leverage our extensive branch network, technical personnel and technology portfolio.

We market our Industrial offerings through our direct sales force, which is organized by market vertical and is complemented by an inside sales force, field sales engineers and a growing e-commerce platform.

Municipal. Our Municipal Segment leverages its proven application expertise to provide engineered solutions and equipment for the treatment of wastewater, purification of drinking water and odor and corrosion control for municipalities. Our portfolio of solutions includes ultrafiltration systems, advanced biological treatment, clarifiers, aerators, odor and corrosion control services, equipment for new municipal plant builds and retrofit, rehabilitation and aftermarket parts and services for our extensive installed base. We have provided solutions across a large municipal installed base with capacities ranging from 25,000 gallons per day to over 100 million gallons per day. Our operations are focused within the U.S. market, with a presence in the United Kingdom, Australia, Canada and Singapore.

We maintain a comprehensive municipal representative network that broadly covers the United States, providing us with a differentiated ability to influence specifications and the basis of design for new treatment facilities. We also maintain relationships with engineering firms, operators and other key influencers through our direct technical sales force to drive adoption of our offerings.

Products. Our Products Segment sells differentiated technologies to a diverse set of water treatment system specifiers, integrators and end users globally. Our offerings are highlighted by our filtration and disinfection, electrodeionization and electrochlorination technologies, separation technologies and anodes offerings. Our filtration and disinfection offerings include our Defender line of products, which is a regenerative media filtration leader in the commercial aquatics market. Our IONPURE electrodeionization solutions allow customers to achieve ultrahigh purity water without the use of chemicals in the treatment process. Our electrochlorination products provide extensive water treatment solutions for the maritime, oil and gas and power markets. We also have extensive capabilities in anode technologies, cathodic protection, solid and liquid separation technologies and various aftermarket parts, consumables and accessories. All of our offerings are highly scalable and designed to meet current and future water treatment needs, with a focus on generating repeat business from our customers. We generally service the equipment we provide our customers; however, their failure to properly use, safeguard or maintain their equipment or product defects or unanticipated use of our products could result in liability to us.

5

Our portfolio of technologies and products are sold either as discrete offerings or as components of broader Evoqua solutions through our Industrial and Municipal Segments. Our Products Segment also sells externally to a customer base comprised of globally located OEMs, integrators, regional distributors, customers, regional engineering firms and various other end users that we reach through multiple established sales and aftermarket channels.

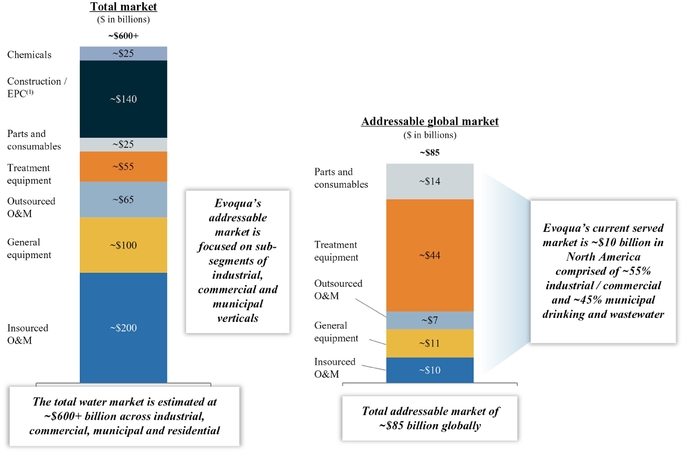

We estimate the global water and wastewater market to represent more than $600 billion in total revenue and include both capital and operating expenditures for the treatment and transportation of water by industrial, municipal, commercial and residential end users. Within the global water and wastewater market, we estimate our addressable market, comprised of equipment, consumables, aftermarket parts and operations-related and maintenance-related services for the treatment of water for industrial, commercial and municipal end users, to represent over $85 billion in total revenue. Our addressable market is further refined to include our served market, which is currently focused on the North American region, and totals approximately $10 billion in total revenue according to Amane Advisors. As compared to our larger addressable market, our served market excludes sectors that would require meaningful growth investment on our part to capture new customers or market opportunities. The following diagram illustrates the breakdown of total revenue in our total market and our addressable global market:

Source: Management estimates, Amane Advisors.

- (1)

- Evoqua does not provide engineering, procurement and construction ("EPC") services, but does sell products and solutions to EPC firms.

6

While a decline in general global economic and business conditions may adversely affect demand for our products, services and solutions, we believe the global water market will continue to experience growth, supported by a variety of anticipated secular trends that will drive demand for water across a multitude of industrial, commercial and municipal applications. These secular trends include global population growth, urbanization, industrialization and overall economic growth. In addition, the supply of clean water could be adversely impacted by factors including an aging water infrastructure within North America and increased levels of water stress from seasonal rainfall, inadequate water storage options or treatment technologies. More specific to our business, water is a critical component and byproduct of many processes, including in manufacturing and product development. As such, as global consumption patterns evolve and water shortages persist, demand for equipment and services will continue to increase. We estimate the global water market is expected to grow in total revenue by approximately 3% annually from 2017 to 2020, although such growth may not be concentrated in the markets that we serve or may be otherwise affected by global or regional economic conditions.

We hold the number one position, with approximately 11% market share, in the highly fragmented North American water treatment market we serve, based on fiscal 2016 revenue, according to Amane Advisors. Our approximately 11% market share is over 1.5 times that of our nearest competitor across the combined industrial, commercial and municipal market verticals, according to Amane Advisors. As a result of the complex route to market and diverse set of customers, most market participants are niche-offering focused, with a majority of the broader market served by a large number of small, regional providers. More specifically, according to Amane Advisors, the top five market participants comprised approximately 30% of the North American market share in 2016 with a significant tail of smaller, regionally focused competitors. Our leading positions in our market verticals have been cultivated by our suite of differentiated solutions and our comprehensive service network, which had over four times as many locations as our closest competitor at September 30, 2017. Despite our leading positions in the individual market verticals where we participate, our market share did not exceed 25% in any single market vertical in which we participated during fiscal 2016. We must continue to maintain and improve our competitive position, which requires focus on product performance, application expertise and compliance with environmental and regulatory requirements.

We serve three primary market verticals: (i) industrial, (ii) commercial and (iii) municipal. Industrial and commercial customers vary in size, scope and the complexity of their water treatment needs and include small manufacturing clients with a single facility, large commercial waterparks and multinational corporations with a significant global footprint. The municipal market consists of potable water and wastewater treatment solutions that are sold to municipalities and private companies operating under a concession agreement to own and operate treatment facilities on behalf of municipalities. We serve each market with a full range of solutions, services, technologies and aftermarket offerings.

Industrial and commercial markets. The served North America industrial and commercial markets represent an approximately $6 billion revenue opportunity, according to Amane Advisors. Our served North America industrial and commercial water markets consist of industrial process water, industrial utility and wastewater and commercial aquatics. Industrial process water includes the treatment of an influent water source prior to its direct use within a specific industrial application such as an ingredient in the development of a product. Industrial customers rely on specific purity standards for process water with purity needs that range from a small volume of water requiring minimal treatment to ultrapure water that support advanced manufacturing processes and are derived from highly advanced water treatment systems. Industrial utility water treatment includes solutions to remove contaminants before water is utilized to support an industrial process such as boiler feed water. Wastewater is then treated before it is either discharged to a municipal wastewater system or discharged directly to the environment or reused within the facility. Commercial aquatics include the filtration and disinfection of water within large commercial applications including pools and water parks.

7

The industrial market is comprised of direct end market distribution channels. The commercial market includes a variety of routes to market including direct and third-party channel relationships.

Municipal market. There were more than 19,500 municipalities in the United States as of 2012, according to the United States Census Bureau. Together, these municipalities provided drinking and wastewater services to over 282 million people in 2016, according to the United States Environmental Protection Agency (the "U.S. EPA"). According to Amane Advisors, our served municipal market in North America is estimated to be approximately $4 billion in total revenue. The criticality of water has also increased due to heightened safety standards, stricter environmental regulation and aging infrastructure. The municipal market is comprised of a wide range of drinking and wastewater treatment facilities. Key market participants include engineering firms and EPC companies that drive plant design and specifications, along with local municipal sales representatives.

Number one market position in North America offering comprehensive, mission-critical lifecycle water treatment solutions. According to Amane Advisors, we are the leader in the highly fragmented approximately $10 billion North American served water treatment market across industrial, commercial and municipal process and wastewater treatment, based on our fiscal 2016 revenue. We have a global installed base that exceeds 200,000 installations and supports the full breadth of our water lifecycle solutions including application specific treatment equipment, aftermarket parts, consumables and routine or emergency service. Our approximately 11% market share in the North American water treatment market is nearly 1.5 times that of our closest competitor according to Amane Advisors, and yet we still enjoy room for growth given the highly fragmented nature of the market made up predominately of smaller, local companies. According to Amane Advisors, we operate in a highly competitive but fragmented industry, with the top five companies in our industry representing approximately 30% of the market. Our growth is supported by our global manufacturing capabilities, differentiated channels to market and deep technology reservoir.

We believe our market position is derived from our ability to provide holistic water solutions as compared to our competitors who lack both the breadth of our product and technology portfolio and our extensive North American service network. We have a vast array of products and systems with the expertise to adapt core technologies to meet specific customer needs, particularly within the industrial space. Additionally, we are able to offer our clients a full outsourced water experience with guaranteed water quality and quantity through a full suite of mobile technologies, including our national fleet of over 700 mobile treatment assets as of December 31, 2017.

Positioned to capitalize on favorable industry growth dynamics and benefit from diverse end-market exposure. While a decline in general global economic and business conditions may adversely affect demand for our products, services and solutions, water treatment is an essential, non-discretionary market that is growing in importance as access to clean water has become an international priority. A number of global, long-term secular trends underpin anticipated industry growth dynamics and have resulted in increasingly stringent effluent regulations along with a growing demand for cleaner and sustainable waste streams for reuse. These trends include the growing global population, increasing levels of urbanization and continued global economic growth. We have seen these trends manifest themselves within our various end markets creating multiple avenues of growth, but we are unable to predict the impact of potential countervailing considerations. For example, within the industrial market, water is an integral component in the production of a wide range of goods spanning from consumer electronics to automobiles. Additionally, recent events such as the crisis in Flint, Michigan have renewed focus on clean drinking water in the United States, which, combined with a historical increases in infrastructure investment, translates to growing demand for our solutions and services in the municipal market. Furthermore, our long-standing reputation among engineering firms and independent

8

sales representatives positions us to benefit from increased municipal demand, particularly as water treatment plants are upgraded and expanded.

Given the wide use and importance of water, we enjoy low concentration within our end markets, with no single market vertical comprising over 17% of our revenue and no single customer comprising over 2% of our revenue for the fiscal year ended September 30, 2017. As a result, we believe our business is diversified and insulated from dislocations in specific market verticals. We estimate our end markets are growing at a weighted average of approximately 3% per annum. Further, we believe many of our end markets represents significant market opportunities because they are highly fragmented and not yet fully penetrated.

Unparalleled channels to market and service network to support our diversified, blue-chip customer base. With over four times as many branches as our next largest competitor based on management's estimates and analysis, our 87 service branches are located within a two-hour drive of more than 90% of our more than 25,000 industrial customer sites in North America. Across our global service branches, we have nearly 600 sales and support personnel and 800 field technicians. We believe our direct sales force is important to our customers. Most of our sales personnel are assigned to specific end markets and possess extensive application-specific knowledge, allowing us to provide customized and fully integrated solutions leading to a unique level of intimacy with our end users. Our continued success depends on our ability to retain or attract skilled technical, engineering, sales and other key personnel, for whom competition is intense, both in retaining our existing employees and in replacing or finding additional employees. We complement our sales approach with our Global Corporate Accounts Management team, which we use to drive greater penetration across our extensive portfolio of large blue-chip customers and engineering firms. The efforts of our sales force are further enhanced by the ongoing dialogue and interactions our field technicians have with customers, which provides us real-time feedback and serve as a source of leads on new sales opportunities. We also have a growing global product network that provides us access to commercial opportunities beyond our installed base and core geographic regions. Overall, we believe that our channels to market play a key role in our success in our core market while also allowing us to rapidly commercialize new technologies as well as scale tuck-in acquisitions. Further, our customer base consists of over 38,000 customers including a substantial majority of the industrial companies within the Fortune 500 and spans a wide array of end-markets. We face low customer concentration, with no single customer accounting for over 2% of our revenue for the fiscal year ended September 30, 2017.

Iconic brands supported by leading proprietary and differentiated technologies. We believe our brands are known across the water treatment marketplace for innovation, quality, customer service, safety and reliability. Our customers' familiarity with our brands enhances our sales capabilities and allows us to more effectively engage existing and new customers. Our reputation depends on our ability to provide our industry-leading water treatment solution offering, and we have a number of patent-protected cornerstone technologies that support our business. Leveraging these technologies allows us to offer solutions across the entire spectrum of the water treatment lifecycle. Our innovation process is supported through six global research, development and engineering ("RD&E") facilities, along with partnerships spanning leading universities research centers and other outside agencies. Our internal RD&E framework, the Evoqua Innovation Process, is fully deployed and uses a stage-gate approach to identifying, prioritizing and implementing innovation projects across the organization.

Our innovation platform has generated an extensive portfolio of intellectual property with more than 1,250 granted or pending patents. Our core and established technologies include electrodeionization and advanced oxidation, which allow for chemical free ultra-high purity water solutions; Water One, which leverages advanced sensing and analytics to provide water on demand, remote condition monitoring and predictive maintenance; and mobile treatment services, which provide expedited services in emergency situations. Our newly developed and acquired technologies include our recently acquired Defender line of regenerative media filtration, which is a leader in commercial

9

aquatics filtration; BioMag and CoMag, which address the need for capital-light solutions to increase throughput within municipal treatment facilities; and SeaCURE, which treats ballast water in order to actively remove, kill or inactivate organisms before discharge. We must continue to develop and acquire new products, services and solutions to meet the demands of our customers and compete in our markets. Our current pipeline of technologies in development includes biological wastewater diffused aeration, on-site electrolytic chlorination and electrochemical desalination, which are designed to help lower customer costs and expand our market reach.

Stable, recurring flow of business with a large installed base drives superior topline visibility. We had high visibility into approximately 80% of our overall revenue at the beginning of fiscal 2017. Approximately 55% of our revenue for fiscal 2017 was related to service, consumables and aftermarket parts that come from our repeat business and backlog. A portion of this revenue is covered by annual and multi-year industrial contracts that had a 99% and 98% renewal rate in fiscal 2016 and 2017, respectively. We generate service and aftermarket revenue from a wide range of activities, including the regular delivery and installation of consumable ion-exchange replacement bottles across 25,000 industrial customer sites and the regular replacement of approximately 400,000 ultra-filtration membranes installed across 1,800 locations on 4-6 year cycles as of December 31, 2017. In particular, more than 80% of Industrial customers who purchased capital equipment during the two fiscal years ended September 30, 2016 and 2017 have also purchased services and/or aftermarket products over the past three years. Approximately 23% of our revenue for fiscal 2017 consisted of capital orders already contracted in backlog. The remaining approximately 22% of revenue for the fiscal year ended September 30, 2017 represented book-to-bill projects, which we typically win and convert to revenue within the same fiscal year. For our capital related sales, we selectively focus on projects that we believe have the potential to produce continuing service, aftermarket and consumables sales. We believe the visibility and predictability we experience with our revenue enhances our ability to consistently drive profitability.

Well invested manufacturing and service footprint provides operating leverage and supports our growth. We believe our manufacturing, service and sales functions are capable of supporting our long-term growth targets. Our manufacturing base is currently operating at approximately 40% of its maximum capacity levels at December 31, 2017, creating an opportunity for volume and margin expansion without significant new capital investments. This dynamic also enhances our ability to absorb new acquisitions into our existing operations, though we may not be able to successfully identify, integrate or compete for acquisition targets. We have also identified and are pursuing several operational improvement campaigns including Evoqua Procurement ("ePro") and LEAN, our supply chain excellence initiative that centralizes and standardizes purchasing across the organization. These initiatives, combined with low levels of maintenance capital expenditures and efficient working capital management, create flexibility to deploy cash flow for accretive investments.

Experienced management team with proven operational capabilities that has made Evoqua an employer of choice. We are highly dependent on our leadership team, which consists of industry veterans with a track record of executing effective strategies and achieving profitable growth. Ron Keating, our CEO, is a highly experienced executive with a strategic, commercial and operational background developed in senior roles, where he reshaped organizations and corporate portfolios for growth. Ben Stas, our CFO, has held a variety of senior financial and business roles in the capital goods sector. Our leadership developed and deployed standard operating processes under the Evoqua Growth System that repositioned the business and improved margins through operational programs and standards such as LEAN operating systems, service growth and ePro, among others. These programs, combined with our newly implemented sales methodology, Evoqua EDGE, have improved our free cash flow profile and growth prospects. Our management team has also expanded our operations to new target markets and geographies and has demonstrated successful acquisition and integration capabilities. Our success

10

depends to a significant extent on our ability to retain or attract employees in senior management, skilled technical, engineering, sales and other key personnel.

After the Acquisition, we began a transformation of our business into a global organization with an independent, professional management team. We believe our transformation has made us into a premier partner and employer in our industry, resulting in differentiated capabilities and talent within our organization. We have instilled an entrepreneurial environment where employees believe in the mission and leverage the collective intellect and expertise of service technicians and engineers. To develop a safety focused culture, we have invested heavily in our environmental, health and safety ("EH&S") program, which is committed to providing employees with a safe and healthy workplace while protecting our shared environment. We are a "controlled company" within the meaning of the corporate governance standards of the NYSE. See "Risks Factors—Risks Relating to our Common Stock and this Offering—We are a "controlled company" within the meaning of the corporate governance standards of the NYSE and, as a result, will qualify for, and may rely on, exemptions from certain corporate governance requirements."

The key elements of our strategy include:

Grow and further penetrate our existing customer base. We believe our strong brands, leading position in highly fragmented markets, scalable and global offerings, leading installed base and unique ability to provide complete treatment solutions will enable us to capture a larger share of our existing customers' water treatment spend while expanding with existing and new customers into adjacent end-markets and underpenetrated regions, including by investing in our sales force and cross-selling to existing customers. Despite having the leading market share in the North American water treatment market, our share does not exceed 25% in any single market vertical according to Amane Advisors. Furthermore, our share of any given customer's water treatment related spend is often limited to select regions, thereby creating a significant opportunity to further penetrate existing customer accounts by offering additional solutions and serving more sites, both in current and new geographic regions. Our growth initiatives include both expanding our presence in our core North American market as well as replicating our leading position and strategies into underpenetrated global regions. For example, through innovative technologies such as IONPURE continuous electrodeionization and Defender aquatic regenerative media filtration systems, we have expanded our positions in markets such as Asia and the Middle East.

In order to maintain and enhance our customer relationships, we intend to continue to invest in our sales force. Since fiscal 2014 we have increased the proportion of customer facing employees by approximately 25%, developed a best-in-class training program, restructured our customer relationship management system and realigned our compensation packages. Sales of our products, services and solutions to some of our customers are also accomplished, in part, through the efforts of third-party sales representatives. Through direct sales efforts, outreach and education, we plan to continue to enhance our relationships and enable further adoption of our products, technologies and solutions by end customers and key influencers, including municipal representatives, engineering firms, designers and other system specifiers. Our performance depends, in part, on our ability to attract, incentivize and retain third-party sales representatives that will be able to market and support our products effectively, and competition for sales personnel with established customer relationships is intense.

Continued transition of our customers to a higher value-add service-based business model. Our goal is to provide "worry-free water" by combining our products and technologies with extensive service and distribution capabilities. We selectively target high value projects with opportunities for recurring business through service, parts and other aftermarket opportunities over the lifecycle of the process or capital equipment. In particular, we have developed a pipeline of smart, internet-connected monitoring

11

technologies through the deployment of our Water One smart water platform that provides us with an increasing ability to handle our customers' complete water needs through on-demand water management, predictive maintenance and service response planning. Water One also enables us to transition our customers to more accurate pricing models based on usage, which otherwise would not have been possible without technological advancement. We estimate that approximately 1.9% of our industrial customers utilized our Water One technology in fiscal 2017. Our technology solutions provide customers with increased stability and predictability in water-related costs, while enabling us to optimize our service route network and on demand offerings through predictive analytics, which we believe will result in market share gains, improved service levels, increased barriers to entry and reduced costs. Our future growth depends, in part, on our ability to develop or acquire new products, services and solutions, identify emerging technological trends in our target end markets and maintain the integrity of our information technology systems.

Drive margin expansion and cash flow improvements through continued focus on operational excellence and execution. Since fiscal 2014, we have realigned our organizational structure, achieved significant cost savings through operational efficiencies and revitalized our culture, which has energized our workforce and reduced employee turnover. This organizational realignment transformed our business into a streamlined organization focused on improved accountability, responsiveness and resulted in an overall lower cost structure. We have identified and are pursuing a number of discrete initiatives which, if successful, we expect could result in additional cost savings over the next three years. These initiatives include our ePro and supply chain improvement program to consolidate and manage global spending, our improved logistics and transportation management program, further optimizing our engineering cost structure, capturing benefits of our Water One remote system monitoring and data analytics offerings. Furthermore, as a result of significant investments we have made in our footprint and facilities, we believe have capacity to support our planned growth without commensurate increases in fixed costs.

Commercialize and drive adoption of nascent and newly acquired technologies by leveraging our sales channels and application expertise. We offer a full range of services, systems and technologies that we continually develop to meet our customers' evolving water lifecycle needs. We develop our technologies through in-house research, development and engineering and targeted tuck-in, technology-enhancing and geography-expanding acquisitions and have a reservoir of recently launched technologies and a pipeline of new offerings designed to provide customers with innovative, value-enhancing solutions. Furthermore, we have successfully completed ten technology-enhancing and geography-expanding acquisitions since April 2016 to add new capabilities and cross-selling opportunities in areas such as electrochemical and electrochlorination cells, regenerative media filtration, anodes, UV and ozone disinfection and aerobic and anaerobic biological treatment technologies. We must continue to develop and acquire new products, services and solutions to successfully compete in our markets.

We believe a key differentiator for our technology development program is our strong record of incorporating new technologies into the comprehensive solutions we provide to our customers across our platform. We are able to rapidly scale new technologies using our leading direct and third-party sales channels and our relationships with key influencers, including municipal representatives, engineering firms, designers and other system specifiers. Through our service network, we have a direct view of our customers' water needs which allows us to focus on developing and acquiring the most relevant and sought-after solutions.

We believe our continued investment in driving penetration of our recently launched technologies, robust pipeline of new capabilities and best-in-class channels to market will allow us to continue to address our customer needs across the water lifecycle.

12

Continue to evaluate and pursue accretive tuck-in acquisitions to add new technologies, attractive geographic regions and end-markets. As a complement to our organic growth initiatives, we view tuck-in acquisitions as a key element of our overall growth strategy which will enable us to accelerate our growth in our current addressable market, new geographies and new end market verticals. Our existing customer relationships, channels to market and ability to rapidly commercialize technologies provide a strong platform to drive growth in the businesses we acquire. To capitalize on these opportunities we have built an experienced team dedicated to mergers and acquisitions that has successfully completed ten technology-enhancing and geography-expanding acquisitions since April 2016, including the addition of capabilities in the attractive aquatics market, which we have typically financed through borrowings under our revolving credit facility and cash on hand. Although we may not continue to identify suitable acquisition targets and implement our growth strategy, we currently have a pipeline which includes more than 60 potential targets, which has been developed proactively by our team as well as informed by our customer base.

On November 6, 2017, we completed our initial public offering of 27,777,777 shares of common stock at a price of $18.00 per share, of which 8,333,333 shares were sold by us and 19,444,444 shares were sold by the selling stockholders, and on November 7, 2017, the selling stockholders sold an additional 4,166,666 shares of common stock as a result of the exercise in full by the underwriters of an option to purchase additional shares. Our common stock began trading on the NYSE on November 2, 2017 under the ticker symbol "AQUA." After underwriting discounts and commissions but before expenses, we received net proceeds from our initial public offering of approximately $141.0 million. We used a portion of these proceeds to repay $104.9 million of indebtedness (including accrued and unpaid interest) under our senior secured first lien term loan facility and the remainder for general corporate purposes. We did not receive any proceeds from the sale of shares by the selling stockholders.

AEA is one of the most experienced global private investment firms. Founded in 1968, AEA currently manages approximately $10 billion of capital for an investor group that includes former and current chief executive officers of major multinational corporations, family groups and institutional investors from around the world. With a staff of approximately 60 investment professionals and offices in New York, Stamford, London, Munich and Shanghai, AEA focuses on investing in companies in the consumer products/retail, industrial, specialty chemicals and related services sectors.

In addition to Evoqua, representative current and former value-added industrial products portfolio companies include B.I. Incorporated, BOA Group, CPG International, Dematic, GMS, Henry Company, Houghton International, LoneStar Group, Mettler-Toledo International, NES Global Talent, Noveon International, Pregis Corporation, Pro Mach Group, Reladyne, Sparrows Group, SRS Distribution, Symrise, TricorBraun Holdings, Unifrax Corporation, VC GB Holdings and Waters Corporation.

We are a "controlled company" within the meaning of the corporate governance standards of the NYSE. See "Risks Factors—Risks Relating to our Common Stock and this Offering—We are a "controlled company" within the meaning of the corporate governance standards of the NYSE and, as a result, will qualify for, and may rely on, exemptions from certain corporate governance requirements."

Risks Associated with Our Business

We are subject to a number of risks, including risks that may prevent us from achieving our business objectives or that may adversely affect our business, financial condition, results of operations

13

or prospects. You should carefully consider the risks discussed in the section entitled "Risk Factors," including the following risks, before investing in our common stock:

- •

- general global economic and business conditions may adversely affect demand for our products, services and solutions;

- •

- failure to compete successfully in our markets could adversely affect our business, financial condition, results of operations or prospects;

- •

- our future growth is dependent upon our ability to continue to develop and acquire our products, services and solutions and adapt our

businesses to meet the demands of our customers, comply with changes to government regulations and achieve market acceptance with acceptable margins;

- •

- our growth strategy includes acquisitions, and we may not be able to identify suitable acquisition targets or otherwise successfully implement

our growth strategy;

- •

- we may have difficulty in operating or integrating any acquired businesses, assets or product lines profitably or in otherwise successfully

implementing our growth strategy;

- •

- delays in enactment or repeals of environmental laws and regulations may make our products, services and solutions less economically beneficial

to our customers, thereby affecting demand for our products, services and solutions;

- •

- if we become subject to claims relating to handling, storage, release or disposal of hazardous materials, we could incur significant cost and

time to comply;

- •

- product defects and unanticipated or improper use of our products could adversely affect our business, reputation and financial statements;

- •

- we may incur liabilities to customers as a result of warranty claims or failure to meet performance guarantees, which could reduce our

profitability;

- •

- our inability to meet our customers' safety standards or adverse publicity affecting our reputation as a result of incidents such as workplace

accidents, mechanical failures, spills, uncontrolled discharges, damage to customer or third-party property or the transmission of contaminants or diseases could have a material adverse effect on our

sales and profitability;

- •

- our products, services and solutions, or our participation in large-scale projects, could expose us to litigation, regulatory or enforcement

actions and reputational risk;

- •

- seasonality of sales and weather conditions may adversely affect, or cause volatility in, our financial results;

- •

- government customers involve unique policy-, contract- and performance-related risks, and we face many challenges to our government contracts

or our eligibility to serve government customers, any of which could materially adversely impact our business, financial condition, results of operations or prospects;

- •

- our contracts with federal, state and local governments may be terminated or adversely modified prior to completion, which could adversely

affect our business;

- •

- the cost of complying with complex governmental regulations applicable to our business, sanctions resulting from non-compliance or reduced

demand resulting from certain changes in regulations could increase our operating costs and reduce our profit;

- •

- wastewater operations entail significant risks that may impose significant costs;

14

- •

- we are increasingly dependent on the continuous and reliable operation of our information technology systems, and a disruption of these systems

could materially adversely affect our business;

- •

- if we experience a significant data security breach or fail to detect and appropriately respond to a significant data security breach, our

business and reputation could suffer;

- •

- our substantial indebtedness could, among other things, adversely affect our financial condition, reduce or limit our available cash flows and

ability to raise additional capital to fund our operations or strategic transactions, and have other important consequences to us, including making it more difficult for us to satisfy our debt

obligations, exposing us to the risk of increased interest rates, limiting our flexibility in planning for, and reacting to changes in, our business and industry and placing us at a disadvantage

relative to our competitors;

- •

- because AEA controls a significant percentage of our common stock, it may influence all major corporate decisions, and the interests of AEA and

its affiliates, including certain of our directors, may conflict with your interests as an owner of our common stock and those of the Company; and

- •

- we are a "controlled company" within the meaning of the corporate governance standards of the NYSE and, as a result, will qualify for, and may rely on, exemptions from certain corporate governance requirements.

Addition to Board of Directors

On January 9, 2018, our Board of Directors (the "Board") increased the size of the Board by one director (to a total size of eight directors) and filled the vacancy created by such increase by appointing Mr. Peter M. Wilver, age 58, as a Class II director, effective January 9, 2018. Mr. Wilver was appointed to serve as an independent member of the Board. Mr. Wilver will hold office until the date of the Company's Annual Meeting of Stockholders for fiscal 2019 and until his successor shall be elected and qualified or until his earlier death, resignation, retirement, disqualification or removal. Mr. Wilver will serve as a member of the Audit Committee in the role of chairman.

Hiring of Chief Growth Officer

On January 16, 2018, we announced that we created a new Chief Growth Officer role focused on our organic and inorganic growth objectives. Snehal Desai, former global business director of the Dow Water & Process Solutions business (now part of DowDupont Inc.), has filled this role, and, on January 16, 2018, joined us as Executive Vice President and Chief Growth Officer. As Chief Growth Officer, Mr. Desai will oversee our corporate strategy, mergers and acquisitions, research development and engineering, strategic marketing, corporate and marketing communications, cross-selling and our smart water efforts.

Recent Acquisitions

On January 31, 2018, we acquired the assets of Pure Water Solutions, LLC, a leading provider of high-purity water equipment and systems, service deionization and resin regeneration, for a purchase price of $3.7 million at closing with up to an additional $993,000 upon the satisfaction of performance targets.

On March 9, 2018, we acquired Pacific Ozone Technology, Inc., a provider of advanced ozone disinfection systems, testing products and support services for a wide range of industrial applications,

15

for a purchase price of $6.5 million at closing with up to an additional $2.0 million upon the satisfaction of performance targets.

Evoqua Water Technologies Corp. (formerly EWT Holdings I Corp.) was incorporated as a Delaware corporation on October 7, 2013 under the name WTG Holdings I Corp. Our principal executive office is located at 210 Sixth Avenue, Pittsburgh, Pennsylvania 15222, and our telephone number at that address is (724) 772-0044. We maintain a website at www.evoqua.com, which contains information about us. The information contained on, or that can be accessed through, our website is not a part of, and should not be considered as being incorporated by reference into, this prospectus.

16

Common stock offered by the selling stockholders |

17,500,000 shares (or 20,125,000 shares if the underwriters exercise in full their option to purchase additional shares). | |

Common stock to be outstanding immediately after this offering |

113,699,024 (or 113,764,205 if the underwriters exercise in full their option to purchase additional shares), which gives effect to the net exercise (the "Net Exercise") by certain of the selling stockholders immediately prior to the pricing of this offering of a portion of their vested options and the issuance of shares of common stock upon such Net Exercise, which shares will be sold in this offering. |

|

Option to purchase additional shares from the selling stockholders |

The underwriters have an option to purchase up to an aggregate of 2,625,000 additional shares of common stock from the selling stockholders at the public offering price, less underwriting discounts and commissions. The underwriters can exercise this option at any time within 30 days from the date of this prospectus. |

|

Use of proceeds |

The selling stockholders will receive all of the net proceeds from the sale of shares in this offering. |

|

|