Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - WINMARK CORP | wina-20171230ex32213be67.htm |

| EX-32.1 - EX-32.1 - WINMARK CORP | wina-20171230ex321ac883c.htm |

| EX-31.2 - EX-31.2 - WINMARK CORP | wina-20171230ex31221c8f0.htm |

| EX-31.1 - EX-31.1 - WINMARK CORP | wina-20171230ex311f69969.htm |

| EX-23.1 - EX-23.1 - WINMARK CORP | wina-20171230ex2317e8001.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark one)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 30, 2017, or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 000-22012

WINMARK CORPORATION

(exact name of registrant as specified in its charter)

|

Minnesota |

41-1622691 |

|

(State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) |

605 Highway 169 North, Suite 400, Minneapolis, Minnesota 55441

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, Including Area Code: (763) 520-8500

Securities registered pursuant to Section 12 (b) of the Act:

|

Title of Each Class |

|

Name of Each Exchange On Which Registered |

|

Common Stock, no par value per share |

|

NASDAQ Global Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days:

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act:

|

Large accelerated filer ◻ Non-accelerated filer ◻ |

(Do not check if a smaller reporting company) |

Accelerated filer ☒ Smaller reporting company ◻ Emerging growth company ◻ |

||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act. ☐

Yes ☐ No ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant, computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter was $316,418,727.

Shares of no par value Common Stock outstanding as of March 5, 2018: 3,849,506 shares.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive Proxy Statement for the Registrant’s Annual Meeting of Shareholders to be held on April 25, 2018 have been incorporated by reference into Items 10, 11, 12, 13 and 14 of Part III of this report

WINMARK CORPORATION AND SUBSIDIARIES

INDEX TO ANNUAL REPORT ON FORM 10-K

|

|

|

|

|

|

|

|

|

|

PAGE |

|

|

|

|

|

| 1 | ||

|

|

|

|

| 9 | ||

|

|

|

|

| 12 | ||

|

|

|

|

| 12 | ||

|

|

|

|

| 12 | ||

|

|

|

|

| 12 | ||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PAGE |

|

|

|

|

|

| 13 | ||

|

|

|

|

| 15 | ||

|

|

|

|

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

15 | |

|

|

|

|

| 23 | ||

|

|

|

|

| 24 | ||

|

|

|

|

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

49 | |

|

|

|

|

| 49 | ||

|

|

|

|

| 49 | ||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PAGE |

|

|

|

|

|

| 50 | ||

|

|

|

|

| 50 | ||

|

|

|

|

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

50 | |

|

|

|

|

|

Certain Relationships and Related Transactions, and Director Independence |

50 | |

|

|

|

|

| 50 | ||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PAGE |

|

|

|

|

|

| 51 | ||

|

|

|

|

| 53 | ||

|

|

|

|

|

|

54 |

Background

We are a franchisor of five value-oriented retail store concepts that buy, sell and trade gently used merchandise. Each of our retail store brands emphasizes consumer value by offering high-quality used merchandise at substantial savings from the price of new merchandise and by purchasing customers’ used goods that have been outgrown or are no longer used. Our concepts also offer a limited amount of new merchandise to customers. As of December 30, 2017, we had 1,211 franchised stores across the United States and Canada. In addition, we provide franchise consulting and advisory services to new and emerging franchisors through Winmark Franchise Partners, which we launched in 2017.

We operate a middle-market equipment leasing business through our wholly owned subsidiary, Winmark Capital Corporation. Our middle-market leasing business serves large and medium-sized businesses and focuses on technology-based assets which typically cost more than $250,000. The businesses we target generally have annual revenue of between $30 million and several billion dollars. We generate middle-market equipment leases primarily through business alliances, equipment vendors and directly from customers.

Additionally, we operate a small-ticket financing business through our wholly owned subsidiary, Wirth Business Credit, Inc. Our small-ticket financing business serves small businesses and focuses on assets which generally have a cost of $5,000 to $100,000.

Our significant assets are located within the United States, and we generate all revenues from United States operations other than franchising revenues from Canadian operations of approximately $3.8 million, $3.3 million and $2.9 million for 2017, 2016 and 2015, respectively. For additional financial information, please see Item 6 — Selected Financial Data and Item 8 — Financial Statements and Supplementary Data. We were incorporated in Minnesota in 1988.

Franchise Operations

Our retail brands with their fiscal year 2017 system-wide sales, which we define as estimated revenues generated by all franchise locations, are summarized as follows:

Plato’s Closet® - $456 million.

We began franchising the Plato’s Closet brand in 1999. Plato’s Closet stores buy and sell used clothing and accessories geared toward the teenage and young adult market. Customers have the opportunity to sell their used items to Plato’s Closet stores and to purchase quality used clothing and accessories at prices lower than new merchandise.

Once Upon A Child® - $329 million.

We began franchising the Once Upon A Child brand in 1993. Once Upon A Child stores buy and sell used and, to a lesser extent, new children’s clothing, toys, furniture, equipment and accessories. This brand primarily targets parents of children ages infant to 12 years. These customers have the opportunity to sell their used children’s items to a Once Upon A Child store when outgrown and to purchase quality used children’s clothing, toys, furniture and equipment at prices lower than new merchandise.

Play It Again Sports® - $223 million.

We began franchising the Play It Again Sports brand in 1988. Play It Again Sports stores buy, sell, trade and consign used and new sporting goods, equipment and accessories for a variety of athletic activities including team sports (baseball/softball, hockey, football, lacrosse, soccer), fitness, ski/snowboard and golf among others. The stores offer a flexible mix of merchandise that is adjusted to adapt to seasonal and regional differences.

1

Style Encore® - $37 million.

We began franchising the Style Encore brand in 2013. Style Encore stores buy and sell used women’s apparel, shoes and accessories. Customers have the opportunity to sell their used items to Style Encore stores and to purchase quality used clothing, shoes and accessories at prices lower than new merchandise.

Music Go Round® - $33 million.

We began franchising the Music Go Round brand in 1994. Music Go Round stores buy, sell, trade and consign used and, to a lesser extent, new musical instruments, speakers, amplifiers, music-related electronics and related accessories.

The following table presents the royalties and franchise fees contributed by our franchised retail brands for each of the past three years and the corresponding percentage of consolidated revenues for each such year:

|

|

|

Total Royalties and Franchise Fees |

|

|

|

|

|

|

|

|||||||

|

|

|

(in millions) |

|

% of Consolidated Revenue |

|

|||||||||||

|

|

|

2015 |

|

2016 |

|

2017 |

|

2015 |

|

2016 |

|

2017 |

|

|||

|

Plato’s Closet |

|

$ |

19.1 |

|

$ |

19.5 |

|

$ |

20.2 |

|

27.5 |

% |

29.2 |

% |

29.0 |

% |

|

Once Upon A Child |

|

|

13.0 |

|

|

14.2 |

|

|

14.5 |

|

18.7 |

|

21.3 |

|

20.8 |

|

|

Play It Again Sports |

|

|

9.5 |

|

|

9.2 |

|

|

9.3 |

|

13.6 |

|

13.9 |

|

13.3 |

|

|

Style Encore |

|

|

1.2 |

|

|

1.7 |

|

|

2.2 |

|

1.8 |

|

2.6 |

|

3.1 |

|

|

Music Go Round |

|

|

0.9 |

|

|

1.0 |

|

|

1.0 |

|

1.3 |

|

1.5 |

|

1.4 |

|

|

|

|

$ |

43.7 |

|

$ |

45.6 |

|

$ |

47.2 |

|

62.9 |

% |

68.5 |

% |

67.6 |

% |

The following table presents a summary of our retail brands franchising activity for the fiscal year ended December 30, 2017:

|

|

|

|

|

|

|

|

|

|

|

AVAILABLE |

|

|

|

|

|

|

|

|

TOTAL |

|

|

|

|

|

TOTAL |

|

FOR |

|

COMPLETED |

|

|

|

|

|

|

12/31/2016 |

|

OPENED |

|

CLOSED |

|

12/30/2017 |

|

RENEWAL |

|

RENEWALS |

|

% RENEWED |

|

|

Plato’s Closet |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Franchises - US and Canada |

|

468 |

|

14 |

|

(6) |

|

476 |

|

26 |

|

26 |

|

100 |

% |

|

Once Upon A Child |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Franchises - US and Canada |

|

348 |

|

18 |

|

(6) |

|

360 |

|

24 |

|

24 |

|

100 |

% |

|

Play It Again Sports |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Franchises - US and Canada |

|

283 |

|

6 |

|

(8) |

|

281 |

|

18 |

|

17 |

|

94 |

% |

|

Style Encore |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Franchises - US and Canada |

|

52 |

|

11 |

|

(2) |

|

61 |

|

— |

|

— |

|

N/A |

|

|

Music Go Round |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Franchises - US |

|

35 |

|

0 |

|

(2) |

|

33 |

|

4 |

|

4 |

|

100 |

% |

|

Total Franchised Stores |

|

1,186 |

|

49 |

|

(24) |

|

1,211 |

|

72 |

|

71 |

|

99 |

% |

Retail Brands Franchising Overview

We use franchising as a business method of distributing goods and services through our retail brands to consumers. We, as franchisor, own a retail business brand, represented by a service mark or similar right, and an operating system for the franchised business. We then enter into franchise agreements with franchisees and grant the franchisee the right to use our business brand, service marks and operating system to manage a retail business. Franchisees are required to operate their retail businesses according to the systems, specifications, standards and formats we develop for the business brand. We train the franchisees how to operate the franchised business. We also provide continuing support and service to our franchisees.

We have developed value-oriented retail brands based on a mix of used and, to a lesser extent, new merchandise. We franchise rights to franchisees who open franchised locations under such brands. The key elements of our franchise strategy include:

|

· |

franchising the rights to operate retail stores offering value-oriented merchandise; |

|

· |

attracting new, qualified franchisees; and |

|

· |

providing initial and continuing support to franchisees. |

2

Offering Value-Oriented Merchandise

Our retail brands provide value to consumers by purchasing and reselling used merchandise that consumers have outgrown or no longer use at substantial savings from the price of new merchandise. By offering a combination of high-quality used and value-priced new merchandise, we benefit from consumer demand for value-oriented retailing. In addition, we believe that among national retail operations our retail store brands provide a unique source of value to consumers by purchasing used merchandise. We also believe that the strategy of buying used merchandise increases consumer awareness of our retail brands.

Attracting Franchisees

Our franchise marketing program for retail brands seeks to attract prospective franchisees with experience in management and operations and an interest in being the owner and operator of their own business. We seek franchisees who:

|

· |

have a sufficient net worth; |

|

· |

have prior business experience; and |

|

· |

intend to be integrally involved with the management of the business. |

At December 30, 2017, we had 62 signed retail franchise agreements, of which the majority are expected to open in 2018.

We began franchising in Canada in 1991 and, as of December 30, 2017, had 101 franchised retail stores open in Canada. The Canadian retail stores are operated by franchisees under agreements substantially similar to those used in the United States.

Retail Brand Franchise Support

As a franchisor, our success depends upon our ability to develop and support competitive and successful franchise brands. We emphasize the following areas of franchise support and assistance.

Training

Each franchisee must attend our training program regardless of prior experience. Soon after signing a franchise agreement, the franchisee is required to attend new owner orientation training. This course covers basic management issues, such as preparing a business plan, lease evaluation, evaluating insurance needs and obtaining financing. Our training staff assists each franchisee in developing a business plan for their retail store with financial and cash flow projections. The second training session is centered on store operations. It covers, among other things, point-of-sale computer training, inventory selection and acquisition, sales, marketing and other topics. We provide the franchisee with operations manuals that we periodically update.

Field Support

We provide operations personnel to assist the franchisee in the opening of a new business. We also have an ongoing field support program designed to assist franchisees in operating their retail stores. Our franchise support personnel visit each retail store periodically and, in most cases, a business assessment is made to determine whether the franchisee is operating in accordance with our standards. The visit is also designed to assist franchisees with operational issues.

Purchasing

During training each franchisee is taught how to evaluate, purchase and price used goods directly from customers. We have developed specialized computer point-of-sale systems for our brands that provide the franchisee with standardized pricing information to assist in the purchasing of used items.

3

We provide centralized buying services, which on a limited basis include credit and billing for the Play It Again Sports franchisees. Our Play It Again Sports franchise system uses several major vendors for new product including Nautilus, Wilson Sporting Goods, Champro Sports, Easton Sports, CCM Hockey and Bauer Hockey. The loss of any of the above vendors would change the vendor mix, but not significantly change our products offered.

To provide the franchisees of our Play It Again Sports, Once Upon A Child and Music Go Round systems a source of affordable new product, we have developed relationships with our significant vendors and negotiated prices for our franchisees to take advantage of the buying power a franchise system brings.

Our typical Once Upon A Child franchised store purchases approximately 30% of its new product from Rachel’s Ribbons, Wild Side Accessories, Melissa & Doug and Nuby. The loss of any of the above vendors would change the vendor mix, but not significantly change our products offered.

Our typical Music Go Round franchised store purchases approximately 50% of its new product from KMC/Musicorp, RapcoHorizon Company, D’Addario, GHS Corporation and Ernie Ball. The loss of any of the above vendors would change the vendor mix, but not significantly change our products offered.

There are no significant vendors of new products to our typical Plato’s Closet and Style Encore franchised stores as new product is an extremely low percentage of sales for these brands.

Retail Advertising and Marketing

We encourage our franchisees to implement a marketing program that includes the following: television, radio, point-of-purchase materials, in store signage and local store marketing programs as well as email marketing promotions, website promotions and participation in social and digital media. Franchisees of the respective retail brands are required to spend a minimum of 5% of their gross sales on approved advertising and marketing. Franchisees may be required to participate in regional cooperative advertising groups.

Computerized Point-Of-Sale Systems

We require our retail brand franchisees to use a retail information management computer system in each store, which has evolved with the development of new technology. This computerized point-of-sale system is designed specifically for use in our franchise retail stores. The current system includes our proprietary Data Recycling System software, a dedicated server, two or more work station registers, a receipt printer, a report printer and a bar code scanner, together with software modules for inventory management, cash management and customer information management. Our franchisees purchase the computer hardware from us. The Data Recycling System software is designed to accommodate buying of used merchandise. This system provides franchisees with an important management tool that reduces errors, increases efficiencies and enhances inventory control. We provide point-of-sale system support through our Computer Support Center located at our Company headquarters.

The Retail Franchise Agreement

We enter into franchise agreements with our franchisees. The following is a summary of certain key provisions of our current standard retail brand franchise agreement. Except as noted, the franchise agreements used for each of our retail brands are generally the same.

Each franchisee must execute our franchise agreement and pay an initial franchise fee. At December 30, 2017, the franchise fee for all brands was $25,000 for an initial store in the U.S. and $33,500CAD for an initial store in Canada. Once a franchisee opens its initial store, it can open additional stores, in any brand, by paying a $15,000 franchise fee for a store in the U.S. and $20,000CAD for a store in Canada, provided an acceptable territory is available and the franchisee meets the brand’s additional store standards. The franchise fee for our initial retail store and additional retail store in Canada is based upon the exchange rate applied to the United States franchise fee on the last business day of the preceding fiscal year. The franchise fee in March 2018 for an initial retail store in Canada will be $31,500CAD, and an additional retail store in Canada will be $19,000CAD. Typically, the franchisee’s initial store is open for business approximately 12 months from the date the franchise agreement is signed. The franchise agreement has an initial term of 10 years, with subsequent 10-year renewal periods, and grants the franchisee an exclusive geographic area, which will vary in size depending upon population, demographics and other factors. Under current franchise agreements, franchisees of the respective brands are required to pay us weekly continuing fees (royalties) equal to the percentage of

4

gross sales outlined in their Franchise Agreements, generally ranging from 4% to 5% for all of our brands except Music Go Round, which is 3%.

Each Franchisee is required to pay us an annual marketing fee of $500 or $1,000. Each new or renewing franchisee is required to spend 5% of its gross sales for advertising and promoting its franchised store. Existing franchisees with older Franchise Agreements may only be required to spend 3% to 4% of their gross sales on advertising and promotion. Currently, for all of the retail brands except Play It Again Sports, we have the option to increase the minimum advertising expenditure requirement from 5% to 6% of the franchisee’s gross sales, of which up to 2% would be paid to us as an advertising fee for deposit into an advertising fund. While we currently do not have the option to increase the advertising expenditure requirement for Play It Again Sports franchisees, we may also require those franchisees to pay 2% of their gross sales into an advertising fund. This fund, if initiated, would be managed by us and would be used for advertising and promotion of the franchise system.

During the term of a franchise agreement, franchisees agree not to operate directly or indirectly any competitive business. In addition, franchisees agree that after the end of the term or termination of the franchise agreement, franchisees will not operate any competitive business for a period of two years and within a reasonable geographic area.

Although our franchise agreements contain provisions designed to assure the quality of a franchisee’s operations, we have less control over a franchisee’s operations than we would if we owned and operated a retail store. Under the franchise agreement, we have a right of first refusal on the sale of any franchised store, but we are not obligated to repurchase any franchise.

Renewal of the Franchise Relationship

At the end of the 10-year term of each franchise agreement, each franchisee has the option to “renew” the franchise relationship by signing a new 10-year franchise agreement. If a franchisee chooses not to sign a new franchise agreement, a franchisee must comply with all post termination obligations including the franchisee’s noncompetition clause discussed above. We may choose not to renew the franchise relationship only when permitted by the franchise agreement and applicable state law.

We believe that renewing a significant number of these franchise relationships is important to the success of the Company. During the past three years, we renewed 99% of franchise agreements up for renewal.

Retail Franchising Competition

Retailing, including the sale of teenage, children’s and women’s apparel, sporting goods and musical instruments, is highly competitive. Many retailers have substantially greater financial and other resources than we do. Our franchisees compete with established, locally owned retail stores, discount chains and traditional retail stores for sales of new merchandise. Full line retailers generally carry little or no used merchandise. Resale, thrift and consignment shops and garage and rummage sales offer competition to our franchisees for the sale of used merchandise. Also, our franchisees increasingly compete with online used and new goods marketplaces such as eBay, craigslist and many others.

Our Plato’s Closet franchise stores primarily compete with specialty apparel stores such as American Eagle, Gap, Abercrombie & Fitch, Old Navy, Hollister and Forever 21. We compete with other franchisors in the teenage resale clothing retail market.

Our Once Upon A Child franchisees compete primarily with large retailers such as Babies “R” Us, Wal-Mart, Target and various specialty children’s retail stores such as Gap Kids. We compete with other franchisors in the specialty children’s resale retail market.

Our Play It Again Sports franchisees compete with large retailers such as Dick’s Sporting Goods, Academy Sports & Outdoors as well as regional and local sporting goods stores. We also compete with Target and Wal-Mart.

Our Style Encore franchise stores compete with a wide range of women’s apparel stores. We also compete with other franchisors in the women’s resale clothing retail market.

Our Music Go Round franchise stores compete with large musical instrument retailers such as Guitar Center as well as local independent musical instrument stores.

5

Our retail franchises may face additional competition in the future. This could include additional competitors that may enter the used merchandise market. We believe that our franchisees will continue to be able to compete with other retailers based on the strength of our value-oriented brands and the name recognition associated with our service marks.

We also face competition in connection with the sale of franchises. Our prospective franchisees frequently evaluate other franchise opportunities before purchasing a franchise from us. We compete with other franchise companies for franchisees based on the following factors, among others: amount of initial investment, franchise fee, royalty rate, profitability, franchisor services and industry. We believe that our franchise brands are competitive with other franchises based on the fees we charge, our franchise support services and the performance of our existing franchise brands.

Winmark Franchise Partners™

During 2017, we announced the launch of an initiative to provide consulting services, support and capital to emerging franchisors. Under the Winmark Franchise Partners mark, we leverage our experience in franchising through strategic partnering with select companies interested in franchising to grow their brands. We anticipate that this concept will create additional revenue streams while being synergistic with our existing business.

Equipment Leasing Operations

We operate a middle-market leasing business through Winmark Capital Corporation, a wholly owned subsidiary. We operate a small-ticket financing business through Wirth Business Credit, Inc., a wholly owned subsidiary. We incorporated both of these subsidiaries in April 2004. To differentiate ourselves from our competitors in the leasing industry, we offer innovative lease and financing products and concentrate on building long-term relationships with our customers and business alliances.

Winmark Capital Corporation

Winmark Capital Corporation is engaged in the business of providing non-cancelable leases for high-technology and business-essential assets to both larger organizations and smaller, growing companies. We target businesses with annual revenue between $30 million and several billion dollars. We focus on transactions that have terms from two to three years. Such transactions are generally larger than $250,000 and include high-technology equipment and/or business essential equipment, including computers, telecommunications equipment, storage systems, network equipment and other business-essential equipment. The leases are retained in our portfolio to accommodate equipment additions and upgrades to meet customers’ changing needs.

Industry

The high-technology equipment industry has been characterized by rapid and continuous advancements permitting broadened user applications and reductions in processing costs. The introduction of new equipment generally does not cause existing equipment to become obsolete but usually does cause the market value of existing equipment to decrease, reflecting the improved performance per dollar cost of the new equipment. Users frequently replace equipment as their existing equipment becomes inadequate for their needs or as increased processing capacity is required, creating a secondary market in used equipment.

Generally, high-technology equipment, such as information technology equipment, does not suffer from material physical deterioration if properly maintained. As required under our leases, our leased equipment must be kept under continual maintenance, in accordance with the manufacturer’s specifications, most often provided by the manufacturer. The economic life and residual value of information technology equipment is subject to, among other things, the development of technological improvements and changes in sale and maintenance terms initiated by the manufacturer.

6

Business Strategy

Our business strategy allows us to differentiate ourselves from our competitors in the leasing industry. Key elements of this strategy include:

|

· |

Relationship Focus. We maintain a focused, long-term, customer-service approach to our business. |

|

· |

Full Service. We can service the equipment leasing needs of both large organizations as well as smaller, growing companies. |

|

· |

Asset Ownership. We differentiate ourselves with our commitment to retain ownership of our leases throughout the lease term. |

Leasing and Sales Activities

Our middle-market lease products are marketed nationally through our offices in Minneapolis, Minnesota and Santa Barbara, California.

We market our leasing services directly to end-users and indirectly through business alliances, and through vendors of equipment, software, value-added services and consulting services. We directly market to customers and prospects by telephone canvassing and by establishing relationships with business alliances in the local business community.

We generally lease high-technology and other business-essential equipment. Additionally, we may lease operating system and application software to our customers, but typically only with a hardware lease. Our standard lease agreement, entered into with each customer, is a noncancelable “net” lease which contains “hell-or-high water” provisions under which the customer, upon acceptance of the equipment, must make all lease payments regardless of any defects or performance of the equipment, and which require the customer to maintain and service the equipment, insure the equipment against casualty loss and pay all property, sales and other taxes related to the equipment. We retain ownership of the equipment we lease and, in the event of default by the customer, we or the financial institution to whom the lease payment has been assigned may declare the customer in default, accelerate all lease payments due under the lease and pursue other available remedies, including repossession of the equipment. Upon expiration of the initial term or extended lease term, depending on the structure of the lease, the customer may:

|

· |

return the equipment to us; |

|

· |

renew the lease for an additional term; or |

|

· |

purchase the equipment. |

If the equipment is returned to us, it will typically be sold into the secondary-user marketplace.

Wirth Business Credit, Inc.

Our small-ticket financing operation serves the needs of small businesses. Small-ticket financing transactions are typically between $5,000 and $100,000, have terms of between two and four years and cover business essential assets, including computers, printing equipment, security systems, telecommunications equipment, production equipment and other assets. Our financing transactions are generally full pay out transactions, which means, after paying all required payments under the financing agreement, the customer owns the asset. Key elements of our small-ticket business strategy include a focus on both business owners and equipment vendor relationships as well as providing fast credit decisions, flexible terms and an easy to understand process.

The small ticket finance industry is highly fragmented and competitive. Small business owners typically finance their businesses through one of many possible sources including banks, vendor captive finance companies, leasing brokers, credit card companies and independent leasing companies. These sources of funding typically limit their focus to certain types of transactions and may base their decision on credit quality, geography, size of transaction, type of asset or other criteria.

7

Financing

To date, we have funded the vast majority of our leases internally using our available cash or debt.

Winmark Capital Corporation may from time to time arrange permanent financing of leases through non-recourse discounting of lease rentals with various financial institutions at fixed interest rates. The proceeds from the assignment of the lease rentals will generally be equal to the present value of the remaining lease payments due under the lease, discounted at the interest rate charged by the financial institution. Interest rates obtained under this type of financing are negotiated on a transaction-by-transaction basis and reflect the financial strength of the customer, the term of the lease and the prevailing interest rates. In the event of a default by a customer in non-recourse financing, the financial institution has a first lien on the underlying leased equipment, with no further recourse against us. The institution may, however, take title to the collateral in the event the customer fails to make lease payments or certain other defaults by the customer occur under the terms of the lease. Our use of lease discounting is dependent upon having leases that are attractive to financial institutions as well as our available cash balances.

Equipment Leasing Competition

We compete with a variety of equipment financing sources that are available to businesses, including: national, regional and local finance companies that provide lease and loan products; financing through captive finance and leasing companies affiliated with major equipment manufacturers; credit card companies; and commercial banks, savings and loans, and credit unions. Many of these companies are substantially larger than we are and have considerably greater financial, technical and marketing resources than we do.

Some of our competitors have a lower cost of funds and access to funding sources that are not available to us. A lower cost of funds could enable a competitor to offer leases with yields that are much less than the yields that we offer, which might cause us to lose lease origination volume. In addition, certain of our competitors may have higher risk tolerances or different risk assessments, which could enable them to establish more origination sources and end user customer relationships and increase their market share. We have and will continue to encounter significant competition.

Government Regulation

Fourteen states, the Federal Trade Commission and six Canadian Provinces impose pre-sale franchise registration and/or disclosure requirements on franchisors. In addition, a number of states have statutes which regulate substantive aspects of the franchisor-franchisee relationship such as termination, nonrenewal, transfer, discrimination among franchisees and competition with franchisees.

Additional legislation, both at the federal and state levels, could expand pre-sale disclosure requirements, further regulate substantive aspects of the franchise relationship and require us to file our Franchise Disclosure Documents with additional states. We cannot predict the effect of future franchise legislation, but do not believe there is any imminent legislation currently under consideration which would have a material adverse impact on our operations.

Although most states do not directly regulate the commercial equipment lease financing business, certain states require licensing of lenders and finance companies, and impose limitations on interest rates and other charges, and a disclosure of certain contract terms and constrain collection practices. We believe that we are currently in compliance with all material statutes and regulations that are applicable to our business.

Trademarks and Service Marks

Plato’s Closet®, Once Upon A Child®, Play It Again Sports®, Style Encore®, Music Go Round®, Winmark®, Wirth Business Credit® and Winmark Capital®, among others, are our registered service marks. We have filed a trademark registration for Winmark Franchise Partners™. These marks are of considerable value to our business. We intend to protect our service marks by appropriate legal action where and when necessary. Each service mark registration must be renewed every 10 years. We have taken, and intend to continue to take, all steps necessary to renew the registration of all our material service marks.

8

Seasonality

Our Plato’s Closet and Once Upon A Child franchise brands have experienced higher than average sales volumes during the spring months and during the back-to-school season. Our Play It Again Sports franchise brand has experienced higher than average sales volumes during the winter season. Overall, the different seasonal trends of our brands partially offset each other and do not result in significant seasonality trends on a Company-wide basis. Our equipment leasing business is not seasonal; however, quarter to quarter results often vary significantly.

Employees

As of December 30, 2017, we employed 107 employees.

Available Information

We maintain a Web site at www.winmarkcorporation.com, the contents of which are not part of or incorporated by reference into this Annual Report on Form 10-K. We make our annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K (and amendments to those reports) available on our Web site via a link to the U.S. Securities and Exchange Commission (SEC) Web site, free of charge, as soon as reasonably practicable after such reports have been filed with or furnished to the SEC.

We are dependent on franchise renewals.

Each of our franchise agreements is 10 years long. At the end of the term of each franchise agreement, each franchisee may, if certain conditions are met, “renew” the franchise relationship by signing a new 10-year franchise agreement. As of December 30, 2017 each of our five franchised retail brands have the following number of franchise agreements that will expire over the next three years:

|

|

|

2018 |

|

2019 |

|

2020 |

|

|

Plato’s Closet |

|

30 |

|

45 |

|

46 |

|

|

Once Upon A Child |

|

16 |

|

27 |

|

29 |

|

|

Play It Again Sports |

|

13 |

|

16 |

|

26 |

|

|

Music Go Round |

|

3 |

|

4 |

|

2 |

|

|

Style Encore |

|

— |

|

— |

|

— |

|

|

|

|

62 |

|

92 |

|

103 |

|

We believe that renewing a significant number of these franchise relationships is important to our continued success. If a significant number of franchise relationships are not renewed, our financial performance would be materially and adversely impacted.

We are dependent on new franchisees.

Our ability to generate increased revenue and achieve higher levels of profitability depends in part on increasing the number of franchises open. Unfavorable macro-economic conditions may affect the ability of potential franchisees to obtain external financing and/or impact their net worth, both of which could lead to a lower level of openings than we have historically experienced. There can be no assurance that we will sustain our current level of franchise openings.

We are in the early stages of a new franchising initiative.

We are currently investing in a new initiative to provide consulting services, support and capital to emerging franchisors. There can be no assurance that we will be successful in this undertaking and that it will not have a negative impact on our financial performance.

9

We may make additional investments outside of our core businesses.

From time to time, we have and may continue to make investments both inside and outside of our current businesses. To the extent that we make additional investments that are not successful, such investments could have a material adverse impact on our financial results.

We may sell franchises for a territory, but the franchisee may not open.

We believe that a substantial majority of franchises awarded but not opened will open within the time period permitted by the applicable franchise agreement or we will be able to resell the territories for most of the terminated or expired franchises. However, there can be no assurance that substantially all of the currently sold but unopened franchises will open and commence paying royalties to us.

Our retail franchisees are dependent on supply of used merchandise.

Our retail brands are based on offering customers a mix of used and new merchandise. As a result, the ability of our franchisees to obtain continuing supplies of high quality used merchandise is important to the success of our brands. Supply of used merchandise comes from the general public and is not regular or highly reliable. In addition, adherence to federal and state product safety and other requirements may limit the amount of used merchandise available to our franchisees. In addition to laws and regulations that apply to businesses generally, our franchised retail stores may be subject to state or local statutes or ordinances that govern secondhand dealers. There can be no assurance that our franchisees will avoid supply problems with respect to used merchandise.

We may be unable to collect accounts receivable from franchisees.

In the event that our ability to collect accounts receivable significantly declines from current rates, we may incur additional charges that would affect earnings. If we are unable to collect payments due from our franchisees, it would materially adversely impact our results of operations and financial condition.

We operate in extremely competitive industries.

Retailing, including the sale of teenage, children’s and women’s apparel, sporting goods and musical instruments, is highly competitive. Many retailers have significantly greater financial and other resources than us and our franchisees. Individual franchisees face competition in their markets from retailers of new merchandise and, in certain instances, resale, thrift and other stores that sell used merchandise. We may face additional competition as our franchise systems expand and if additional competitors enter the used merchandise market.

Our equipment leasing businesses compete with a variety of equipment financing sources that are available to businesses, including: national, regional, and local finance companies that provide leases and loan products; financing through captive finance and leasing companies affiliated with major equipment manufacturers; and commercial banks, savings and loans, credit unions and credit cards. Many of these companies are substantially larger than we are and have considerably greater financial, technical and marketing resources than we do. There can be no assurances that we will be able to successfully compete with these larger competitors.

We are subject to credit risk in our lease portfolio and our allowance for credit losses may be inadequate to absorb losses.

In our leasing business, if we inaccurately assess the creditworthiness of our customers, we may experience a higher number of lease defaults than expected, which would reduce our earnings. For our middle-market customers, we serve a wide range of businesses from smaller companies that may be financed by venture capital investors to larger organizations that may be financed by private equity firms and larger independent public or private companies. In many cases, our credit analysis relies on the customer’s current or projected financials. If we fail to adequately assess the risks of our customer’s business plans, we may experience credit losses. For our small-ticket customers, there is typically only limited publicly available financial and other information about their businesses. Accordingly, in making credit decisions, we rely upon the accuracy of information from the small business owner and/or third party sources, such as credit reporting agencies. If the information we obtain from small business owners and/or third party sources is incorrect, our ability to make appropriate credit decisions will be impaired.

10

We may incur concentration of credit risk in our lease portfolio. As of December 30, 2017, leased assets with one customer represented approximately 30% of our total net investment in leases.

If losses from leases exceed our allowance for credit losses, our operating income will be reduced. In connection with our leases, we record an allowance for credit losses to provide for estimated losses. Determining the appropriate level of the allowance is an inherently uncertain process and therefore our determination of this allowance may prove to be inadequate to cover losses in connection with our portfolio of leases. Losses in excess of our allowance for credit losses would cause us to increase our provision for credit losses, reducing or eliminating our operating income. Any such significant increase in losses could have a material adverse impact on our financial results.

Deterioration in economic or business conditions may negatively impact our leasing business.

In an economic slowdown or recession, our equipment leasing businesses may face an increase in delinquent payments, lease defaults and credit losses. The volume of leasing business for our new and existing customers may decline, as well as the credit quality of our customers. Because we extend credit to many emerging and leveraged companies through our subsidiary Winmark Capital Corporation and primarily to small businesses through our subsidiary Wirth Business Credit, Inc., our customers may be particularly susceptible to economic slowdowns or recessions. Any protracted economic slowdowns or recessions may make it difficult for us to maintain the volume of lease originations for new and existing customers, and may deteriorate the credit quality of new leases. Any of these events may slow the growth of our leasing portfolio and impact the profitability of our leasing operations.

We are subject to restrictions in our line of credit and note facilities. Additionally, we are subject to counter party risk in our line of credit facility.

The terms of our $50.0 million line of credit and $37.5 million note facility impose certain operating and financial restrictions on us and require us to meet certain financial tests including tests related to minimum levels of debt service coverage and tangible net worth and maximum levels of leverage. As of December 30, 2017, we were in compliance with all of our financial covenants under these facilities; however, failure to comply with these covenants in the future may result in default under one or both of these sources of capital and could result in acceleration of the related indebtedness. Any such acceleration of indebtedness would have an adverse impact on our business activities and financial condition.

Sustained credit market deterioration could jeopardize the counterparty obligations of one or both of the banks participating in our line of credit facility, which could have an adverse impact on our business if we are not able to replace such credit facility or find other sources of liquidity on acceptable terms.

We have indebtedness.

We incurred indebtedness in connection with the purchase of shares in the 2015 Tender Offer and the 2017 Tender Offer (see Note 6 — “Shareholders’ Equity (Deficit)” and Note 7 — “Debt”). We expect to generate the cash necessary to pay our expenses, finance our leasing business and to pay the principal and interest on all of our outstanding debt from cash flows provided by operating activities and by opportunistically using other means to repay or refinance our obligations as we determine appropriate. Our ability to pay our expenses, finance our leasing business and meet our debt service obligations depends on our future performance, which may be affected by financial, business, economic, and other factors. If we do not have enough money to pay our debt service obligations, we may be required to refinance all or part of our existing debt, sell assets, borrow more money or raise equity. In such an event, we may not be able to refinance our debt, sell assets, borrow more money or raise equity on terms acceptable to us or at all. Also, our ability to carry out any of these activities on favorable terms, if at all, may be further impacted by any financial or credit crisis which may limit access to the credit markets and increase our cost of capital.

We are subject to government regulation.

As a franchisor, we are subject to various federal and state franchise laws and regulations. Fourteen states, the Federal Trade Commission and six Canadian Provinces impose pre-sale franchise registration and/or disclosure requirements on franchisors. In addition, a number of states have statutes which regulate substantive aspects of the franchisor-franchisee relationship such as termination, nonrenewal, transfer, discrimination among franchisees and competition with franchisees.

11

Additional legislation, both at the federal and state levels, could expand pre-sale disclosure requirements, further regulate substantive aspects of the franchise relationship and require us to file our franchise offering circulars with additional states. Future franchise legislation could impose costs or other burdens on us that could have a material adverse impact on our operations. In addition, evolving labor and employment laws, rules and regulations could result in potential claims against us as a franchisor for labor and employment related liabilities that have historically been borne by franchisees.

Although most states do not directly regulate the commercial equipment lease financing business, certain states require licensing of lenders and finance companies, impose limitations on interest rates and other charges, constrain collection practices and require disclosure of certain contract terms. Laws or regulations may be adopted with respect to our equipment leases or the equipment leasing industry, and collection processes. Any new legislation or regulation, or changes in the interpretation of existing laws, which affect the equipment leasing industry could increase our costs of compliance.

We may be unable to protect against data security risks.

We have implemented security systems with the intent of maintaining the physical security of our facilities and protecting our employees, franchisees, lessees, customers’, clients’ and suppliers’ confidential information and information related to identifiable individuals against unauthorized access through our information systems or by other electronic transmission or through the misdirection, theft or loss of physical media. These include, for example, the appropriate encryption of information. Despite such efforts, we are subject to potential breach of security systems which may result in unauthorized access to our facilities or the information we are trying to protect. Because the techniques used to obtain unauthorized access are constantly changing and becoming increasingly more sophisticated and often are not recognized until launched against a target, we may be unable to anticipate these techniques or implement sufficient preventative measures. If unauthorized parties gain physical access to one of our facilities or electronic access to our information systems or such information is misdirected, lost or stolen during transmission or transport, any theft or misuse of such information could result in, among other things, unfavorable publicity, governmental inquiry and oversight, difficulty in marketing our services, allegations by our customers and clients that we have not performed our contractual obligations, litigation by affected parties and possible financial obligations for damages related to the theft or misuse of such information, any of which could have a material adverse effect on our business.

ITEM 1B: UNRESOLVED STAFF COMMENTS

None.

We lease 41,016 square feet at our headquarters facility in Minneapolis, Minnesota. We are obligated to pay rent monthly under the lease, and will pay an average of $664,000 annually over the remaining term that expires in 2019. We are also obligated to pay estimated taxes and operating expenses as described in the lease, which change annually. The total rentals, taxes and operating expenses paid may increase if we exercise any of our rights to acquire additional space described in the lease. We are in the process of renewing the lease for our headquarters facility, and our facilities are sufficient to meet our current and immediate future needs.

We are not a party to any material litigation and are not aware of any threatened litigation that would have a material adverse effect on our business.

ITEM 4: MINE SAFETY DISCLOSURES

Not applicable.

12

ITEM 5: MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS, AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information, Holders, Dividends

Winmark Corporation’s common stock trades on the NASDAQ Global Market under the symbol “WINA”. The table below sets forth the high and low sales prices of our common stock as reported by NASDAQ for the quarterly periods indicated:

|

FY 2017: |

|

First |

|

Second |

|

Third |

|

Fourth |

|

||||

|

High |

|

$ |

127.50 |

|

$ |

137.75 |

|

$ |

136.90 |

|

$ |

139.05 |

|

|

Low |

|

$ |

109.90 |

|

$ |

112.00 |

|

$ |

124.70 |

|

$ |

121.55 |

|

|

FY 2016: |

|

First |

|

Second |

|

Third |

|

Fourth |

|

||||

|

High |

|

$ |

101.61 |

|

$ |

102.00 |

|

$ |

109.49 |

|

$ |

133.08 |

|

|

Low |

|

$ |

88.00 |

|

$ |

91.26 |

|

$ |

92.12 |

|

$ |

102.55 |

|

At March 5, 2018, there were 3,849,506 shares of common stock outstanding held by approximately 66 shareholders of record. Shareholders of record do not include holders who beneficially own common stock held in nominee or “street name”.

We declared and paid cash dividends per common share of the following amounts in each of the quarterly periods indicated:

|

|

|

First |

|

Second |

|

Third |

|

Fourth |

|

||||

|

FY 2017: |

|

$ |

0.10 |

|

$ |

0.11 |

|

$ |

0.11 |

|

$ |

0.11 |

|

|

FY 2016: |

|

$ |

0.07 |

|

$ |

0.10 |

|

$ |

0.10 |

|

$ |

0.10 |

|

Any future declaration of dividends will be subject to the discretion of our Board of Directors and subject to our results of operations, financial condition, cash requirements, compliance with loan covenants and other factors deemed relevant by our Board of Directors.

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

|

|

|

|

|

|

|

|

Total Number of |

|

Maximum Number |

|

|

|

|

|

|

|

|

|

Shares Purchased as |

|

of Shares that may |

|

|

|

|

Total Number of |

|

Average Price |

|

Part of a Publicly |

|

yet be Purchased |

|

|

|

Period |

|

Shares Purchased |

|

Paid Per Share |

|

Announced Plan(1) |

|

Under the Plan |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

October 1, 2017 to November 4, 2017 |

|

— |

|

$ |

— |

|

— |

|

142,988 |

|

|

November 5, 2017 to December 2, 2017 |

|

— |

|

$ |

— |

|

— |

|

142,988 |

|

|

December 3, 2017 to December 30, 2017 |

|

— |

|

$ |

— |

|

— |

|

142,988 |

|

|

(1) |

The Board of Directors’ authorization for the repurchase of shares of the Company’s common stock was originally approved in 1995 with no expiration date. The total shares approved for repurchase has been increased by additional Board of Directors’ approvals and is currently limited to 5,000,000 shares, of which 142,988 may still be repurchased. |

13

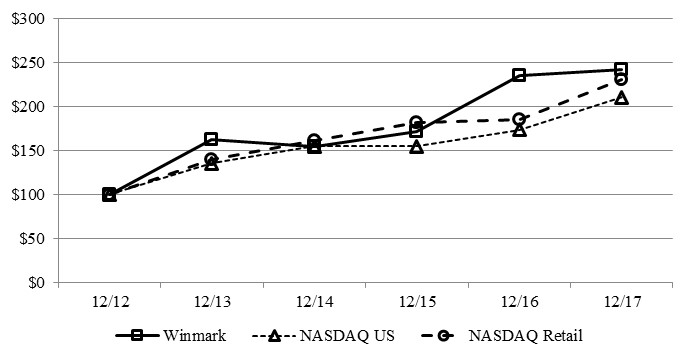

Performance Graph

In accordance with the rules of the SEC, the following graph compares the performance of our common stock on the NASDAQ Stock Market to the NASDAQ US Benchmark TR composite index and to the NASDAQ US Benchmark Retail TR industry index, of which we are a component. The graph compares on an annual basis the cumulative total shareholder return on $100 invested on December 29, 2012 through our fiscal year ended December 30, 2017 and assumes reinvestment of all dividends. The performance graph is not necessarily indicative of future investment performance.

14

ITEM 6: SELECTED FINANCIAL DATA

The following table sets forth selected financial information for the periods indicated. The information should be read in conjunction with the consolidated financial statements and related notes discussed in Items 8 and 15, and Management’s Discussion and Analysis of Financial Condition and Results of Operations discussed in Item 7.

|

|

|

Fiscal Year Ended |

|

|||||||||||||

|

|

|

(in thousands except per share data) |

|

|||||||||||||

|

|

|

December 30, |

|

December 31, |

|

December 26, |

|

December 27, |

|

December 28, |

|

|||||

|

|

|

2017 |

|

2016 |

|

2015 |

|

2014 |

|

2013 |

|

|||||

|

Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Royalties |

|

$ |

45,644 |

|

$ |

43,995 |

|

$ |

41,908 |

|

$ |

38,972 |

|

$ |

36,344 |

|

|

Leasing income |

|

|

18,470 |

|

|

17,283 |

|

|

21,566 |

|

|

16,247 |

|

|

14,524 |

|

|

Merchandise sales |

|

|

2,572 |

|

|

2,217 |

|

|

2,817 |

|

|

2,729 |

|

|

2,327 |

|

|

Franchise fees |

|

|

1,530 |

|

|

1,625 |

|

|

1,788 |

|

|

1,990 |

|

|

1,459 |

|

|

Other |

|

|

1,530 |

|

|

1,460 |

|

|

1,369 |

|

|

1,241 |

|

|

1,077 |

|

|

Total revenue |

|

|

69,746 |

|

|

66,580 |

|

|

69,448 |

|

|

61,179 |

|

|

55,731 |

|

|

Cost of merchandise sold |

|

|

2,433 |

|

|

2,101 |

|

|

2,653 |

|

|

2,620 |

|

|

2,206 |

|

|

Leasing expense |

|

|

3,269 |

|

|

2,324 |

|

|

5,759 |

|

|

1,631 |

|

|

1,592 |

|

|

Provision for credit losses |

|

|

9 |

|

|

18 |

|

|

(150) |

|

|

63 |

|

|

(45) |

|

|

Selling, general and administrative expenses |

|

|

25,251 |

|

|

23,836 |

|

|

24,095 |

|

|

23,806 |

|

|

22,198 |

|

|

Income from operations |

|

|

38,784 |

|

|

38,301 |

|

|

37,091 |

|

|

33,059 |

|

|

29,780 |

|

|

Interest expense |

|

|

(2,366) |

|

|

(2,343) |

|

|

(1,802) |

|

|

(484) |

|

|

(213) |

|

|

Interest and other income (expense) |

|

|

13 |

|

|

(12) |

|

|

(64) |

|

|

14 |

|

|

23 |

|

|

Income before income taxes |

|

|

36,431 |

|

|

35,946 |

|

|

35,225 |

|

|

32,589 |

|

|

29,590 |

|

|

Provision for income taxes |

|

|

(11,866) |

|

|

(13,728) |

|

|

(13,425) |

|

|

(12,522) |

|

|

(11,358) |

|

|

Net income |

|

$ |

24,565 |

|

$ |

22,218 |

|

$ |

21,800 |

|

$ |

20,067 |

|

$ |

18,232 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per common share - diluted |

|

$ |

5.66 |

|

$ |

5.13 |

|

$ |

4.69 |

|

$ |

3.85 |

|

$ |

3.48 |

|

|

Weighted average shares outstanding - diluted |

|

|

4,340 |

|

|

4,330 |

|

|

4,652 |

|

|

5,217 |

|

|

5,241 |

|

|

Cash dividends per common share |

|

$ |

0.43 |

|

$ |

0.37 |

|

$ |

0.27 |

|

$ |

5.23 |

|

$ |

0.19 |

|

|

Balance Sheet Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Working capital |

|

$ |

11,912 |

|

$ |

15,436 |

|

$ |

16,920 |

|

$ |

3,857 |

|

$ |

24,376 |

|

|

Total assets |

|

|

48,405 |

|

|

48,582 |

|

|

47,406 |

|

|

54,728 |

|

|

53,036 |

|

|

Total debt |

|

|

67,588 |

|

|

45,400 |

|

|

66,400 |

|

|

18,500 |

|

|

— |

|

|

Shareholders’ equity (deficit) |

|

|

(30,678) |

|

|

(7,852) |

|

|

(30,674) |

|

|

21,610 |

|

|

38,145 |

|

|

Selected Financial Ratios: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Return on average assets |

|

|

50.7 |

% |

|

46.3 |

% |

|

42.7 |

% |

|

37.2 |

% |

|

37.8 |

% |

|

Return on average equity |

|

|

N/A |

% |

|

N/A |

% |

|

N/A |

% |

|

67.2 |

% |

|

65.0 |

% |

ITEM 7: MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Overview

As of December 30, 2017, we had 1,211 franchises operating under the Plato’s Closet, Once Upon A Child, Play It Again Sports, Style Encore and Music Go Round brands and had a leasing portfolio of $41.3 million. Management closely tracks the following financial criteria to evaluate current business operations and future prospects: royalties, leasing activity, and selling, general and administrative expenses.

Our most significant source of franchising revenue is royalties received from our franchisees. During 2017, our royalties increased $1.6 million or 3.7% compared to 2016.

Leasing income net of leasing expense in 2017 was $15.2 million compared to $15.0 million in 2016. Fluctuations in period-to-period leasing income and leasing expense result primarily from the manner and timing in which leasing income and leasing expense is recognized over the term of each particular lease in accordance with accounting guidance

15

applicable to leasing. For this reason, we believe that more meaningful levels of leasing activity are the purchases of equipment for lease customers and the medium- to long-term trend in the size of the leasing portfolio. During 2017, we purchased $25.4 million in equipment for lease customers compared to $26.2 million in 2016 and $22.2 million in 2015. Our leasing portfolio (net investment in leases — current and long-term) was $41.3 million at December 30, 2017 compared to $41.4 million at December 31, 2016 and $39.0 million at December 26, 2015.

Management continually monitors the level and timing of selling, general and administrative expenses. The major components of selling, general and administrative expenses include salaries, wages and benefits, advertising, travel, occupancy, legal and professional fees. During 2017, selling, general and administrative expense increased $1.4 million, or 5.9%, compared to the same period last year.

Management also monitors several nonfinancial factors in evaluating the current business operations and future prospects including franchise openings and closings and franchise renewals. The following is a summary of our franchising activity for the fiscal year ended December 30, 2017:

|

|

|

|

|

|

|

|

|

|

|

AVAILABLE |

|

|

|

|

|

|

|

|

TOTAL |

|

|

|

|

|

TOTAL |

|

FOR |

|

COMPLETED |

|

|

|

|

|

|

12/31/2016 |

|

OPENED |

|

CLOSED |

|

12/30/2017 |

|

RENEWAL |

|

RENEWALS |

|

% RENEWED |

|

|

Plato’s Closet |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Franchises - US and Canada |

|

468 |

|

14 |

|

(6) |

|

476 |

|

26 |

|

26 |

|

100 |

% |

|

Once Upon A Child |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Franchises - US and Canada |

|

348 |

|

18 |

|

(6) |

|

360 |

|

24 |

|

24 |

|

100 |

% |

|

Play It Again Sports |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Franchises - US and Canada |

|

283 |

|

6 |

|

(8) |

|

281 |

|

18 |

|

17 |

|

94 |

% |

|

Style Encore |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Franchises - US and Canada |

|

52 |

|

11 |

|

(2) |

|

61 |

|

— |

|

— |

|

N/A |

|

|

Music Go Round |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Franchises - US |

|

35 |

|

— |

|

(2) |

|

33 |

|

4 |

|

4 |

|

100 |

% |

|

Total Franchised Stores |

|

1,186 |

|

49 |

|

(24) |

|

1,211 |

|

72 |

|

71 |

|

99 |

% |

Renewal activity is a key focus area for management. Our franchisees sign 10-year agreements with us. The renewal of existing franchise agreements as they approach their expiration is an indicator that management monitors to determine the health of our business and the preservation of future royalties. In 2017, we renewed 99% of franchise agreements up for renewal. This percentage of renewal has ranged between 97% and 100% during the last three years.

Our ability to grow our operating income is dependent on our ability to: (i) effectively support our franchise partners so that they produce higher revenues, (ii) open new franchises, (iii) increase lease originations and minimize write-offs in our leasing portfolios, and (iv) control our selling, general and administrative expenses. A detailed description of the risks to our business along with other risk factors can be found in Item 1A “Risk Factors”.

16

Results of Operations

The following table sets forth selected information from our Consolidated Statements of Operations expressed as a percentage of total revenue and the percentage change in the dollar amounts from the prior period:

|

|

Fiscal Year Ended |

|

Fiscal 2017 |

|

Fiscal 2016 |

|

||||

|

|

December 30, |

|

December 31, |

|

December 26, |

|

over (under) |

|

over (under) |

|

|

|

2017 |

|

2016 |

|

2015 |

|

2016 |

|

2015 |

|

|

Revenue: |

|

|

|

|

|

|

|

|

|

|

|

Royalties |

65.4 |

% |

66.1 |

% |

60.3 |

% |

3.7 |

% |

5.0 |

% |

|

Leasing income |

26.5 |

|

26.0 |

|

31.0 |

|

6.9 |

|

(19.9) |

|

|

Merchandise sales |

3.7 |

|

3.3 |

|

4.1 |

|

16.0 |

|

(21.3) |

|

|

Franchise fees |

2.2 |

|

2.4 |

|

2.6 |

|

(5.9) |

|

(9.1) |

|

|

Other |

2.2 |

|

2.2 |

|

2.0 |

|

4.8 |

|

6.6 |

|

|

Total revenue |

100.0 |

|

100.0 |

|

100.0 |

|

4.8 |

|

(4.1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of merchandise sold |

(3.5) |

|

(3.2) |

|

(3.8) |

|

15.8 |

|

(20.8) |

|

|

Leasing expense |

(4.7) |

|

(3.5) |

|

(8.3) |

|

40.7 |

|

(59.7) |

|

|

Provision for credit losses |

— |

|

— |

|

0.2 |

|

(51.4) |

|

112.4 |

|

|

Selling, general and administrative expenses |

(36.2) |

|

(35.8) |

|

(34.7) |

|

5.9 |

|

(1.1) |

|

|

Income from operations |

55.6 |

|

57.5 |

|

53.4 |

|

1.3 |

|

3.3 |

|

|

Interest expense |

(3.4) |

|

(3.5) |

|

(2.6) |

|

1.0 |

|

30.0 |

|

|

Interest and other income (expense) |

— |

|

— |

|

(0.1) |

|

205.7 |

|

(80.8) |

|

|

Income before income taxes |

52.2 |

|

54.0 |

|

50.7 |

|

1.3 |

|

2.0 |

|

|

Provision for income taxes |

(17.0) |

|

(20.6) |

|

(19.3) |

|

(13.6) |

|

2.3 |

|

|

Net income |

35.2 |

% |

33.4 |

% |

31.4 |

% |

10.6 |

% |

1.9 |

% |

Revenue

Revenues for the year ended December 30, 2017 totaled $69.7 million compared to $66.6 million and $69.4 million for the comparable periods in 2016 and 2015, respectively.

Royalties and Franchise Fees