Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FIRST BUSINESS FINANCIAL SERVICES, INC. | fbiz4q17ceoletter8-k.htm |

Exhibit 99.1

Dear Shareholders and Friends of First Business:

During 2017, we shared our plans to rebuild and reshape our SBA business, create efficiency in our operations through a core conversion and charter consolidations, and other measured steps to move closer to our targeted performance. I am encouraged to say that, as we reflect on the past year, we see positive trends and anticipate that our efforts will translate into favorable results in 2018.

2017 RESULTS

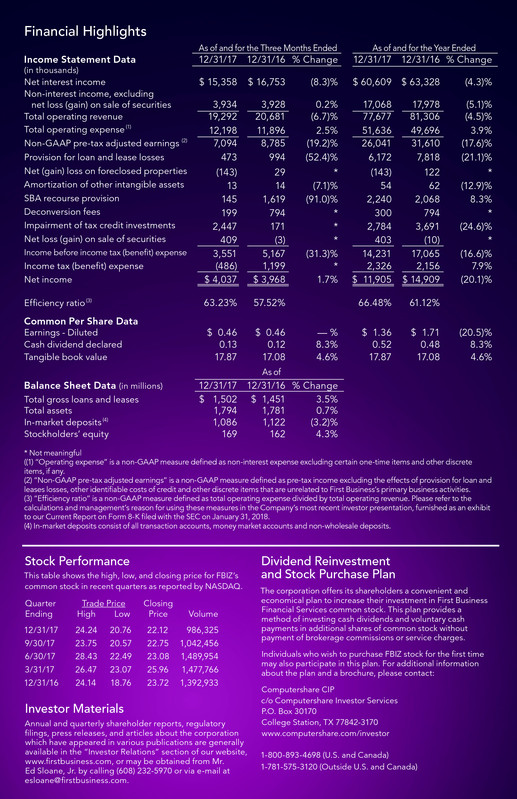

In 2017, First Business earned $11.9 million, or $1.36 per diluted share, compared to $14.9 million, or $1.71 per share, in 2016. Our deliberate pause in SBA lending, coupled with an elevated loan loss provision related to isolated and previously disclosed credit issues, significantly reduced earnings in what otherwise would have been a solid year for our core operating metrics.

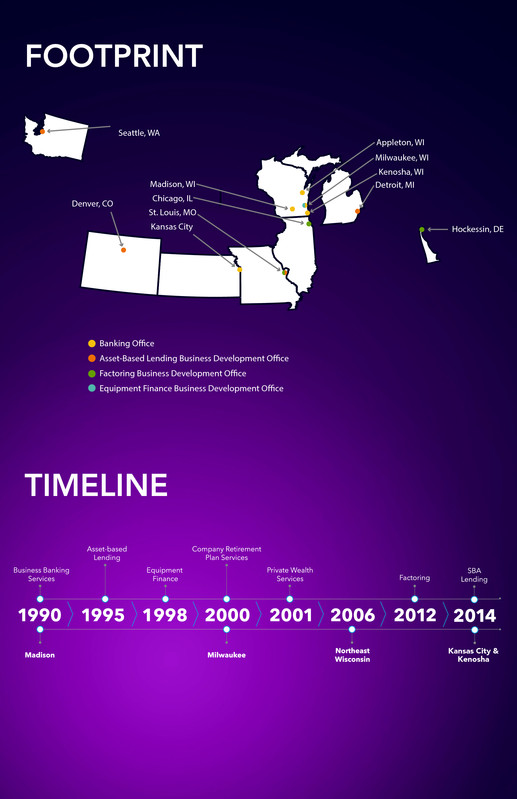

Our expanded team of Business Development Officers (“BDOs”) generated strong production late in the fourth quarter, driving gross loans and leases receivable to a record $1.502 billion at December 31, 2017. The growth of nearly $35 million during the fourth quarter represented an increase of 9.5% on an annualized basis. This demonstrates First Business’s momentum heading into 2018, as fourth quarter production was responsible for nearly 70% of our total $51 million in loan growth for the full year. Anticipated runoff in our Kansas City market muted otherwise solid full-year loan growth as loan balances across our established Wisconsin markets increased nearly $92 million compared to the prior year end, reflecting solid execution of our focused business banking model. We expect recent hires in Kansas City will allow us to outpace portfolio runoff in this market in 2018.

Full-year net interest margin of 3.58% remained comfortably above our targeted 3.50% threshold, demonstrating the strength of our commercial focused in-market deposit base and flexible funding model. Our cost of interest-bearing deposits rose just one basis point from 2016 to 2017, despite the Federal Reserve raising its target rate four times over the last 15 months. Our total funding cost, which rose just four basis points from 2016 to 2017, also benefited from our continued shift from using brokered CDs to FHLB advances as our preferred source of wholesale funding. We use FHLB advances to match fund our fixed-rate loans in order to mitigate interest rate risk, which is increasingly important in this rising rate environment. We expect to maintain in-market deposits within a range of 60% to 70% of total bank funding. This percentage was 68.9% at the end of 2017 and has remained consistently above 60% since 2012. We are pleased with our current position given increased deposit pricing pressure in the rising rate environment, and believe this flexibility, made possible by our limited branch banking model, is a key advantage in the industry.

Growing the size and sources of non-interest income is another priority for First Business. Trust and investment services fee revenue growth continued to stand out in 2017 and remained our largest source of non-interest income. Fees earned from this business reached a record $6.7 million, increasing 25% from 2016. While SBA loan sales were nominal in 2017, we believe steady and gradual expansion of our rebuilt SBA lending program will help elevate the Company’s fee income ratio towards our current strategic target of 25%. Fee income was 22% of total revenue in both 2017 and 2016.

The most significant driver of expense levels over the past two years was SBA recourse provision related to the sold portion of the acquired SBA loan portfolio. Recourse provision expense was $2.2 million in 2017 and $2.1 million in 2016, bringing our recourse reserve for SBA loans sold to $2.8 million, or 2.8% of total sold SBA loans outstanding at December 31, 2017. We believe the frequency and volatility in SBA recourse provision will diminish over time as we continue to originate new SBA loans with our rebuilt platform, the acquired portfolio amortizes down, businesses become more seasoned, and ongoing remediation efforts mitigate potential losses from those legacy credits. At year end, the sold portfolio of SBA loans originated prior to 2017 was $84 million, down $18 million from $102 million the year before.

From an asset quality perspective, we made great progress during the fourth quarter. Diligent work on both our SBA and conventional loan portfolios resulted in significant improvement in our overall asset quality metrics. While still elevated from our historical standards, and from where we intend to get to, we were very pleased to see our level of non-performing assets ("NPAs") drop substantially, decreasing by 23% in the quarter to 1.53% of total assets. This is the third consecutive quarter of improvement in the level of NPAs, a trend we will strive to continue.

Additionally, we saw a major reduction in loan loss provision levels in the fourth quarter. In previous 2017 CEO letters, we discussed two unique loan relationships which created the vast majority of our credit costs for 2017. As those two situations had a negative impact on provision and earnings in previous quarters, loan loss provision declined precipitously to $473,000 in the fourth quarter, marking the lowest level of provision in nine quarters.

Overall, we are encouraged by the improvement in profitability metrics at the end of 2017. Fourth quarter return on average assets (“ROA”) of 0.91% and return on average equity (“ROE”) of 9.57% each exceeded full-year 2016 levels of 0.82% and 9.40%, respectively. We will not be satisfied until First Business returns to levels of performance that generate 1% ROA, 12% ROE, and above-market revenue growth in a prudent and sustainable manner.

SBA POISED FOR GROWTH

Our extensive overhaul of the acquired SBA lending platform over the past two years is essentially complete as we enter 2018. We implemented best practices in the critical areas of credit, operations, and compliance while assembling a team of highly experienced SBA professionals. Within the past 15 months, we hired a Director of SBA Credit, a Senior Director of SBA Operations, and a SBA Compliance Manager, all of whom have been critical in executing our strategy for growth.

With these major pieces of the rebuild in place, we are now actively adding producers to move toward the appropriate mix of producers and internal support staff to drive an optimal level of efficiency in our SBA business model. Following the fourth quarter addition of two BDOs, our SBA production team today is roughly half the size it was at peak levels of production two years ago. Loans originated through our revamped nationwide SBA platform are meeting our quality, compliance, and profitability expectations, and we expect to return to targeted SBA production staffing levels by the end of 2018. We are optimistic about our strengthening pipeline and believe it positions us well for consistent growth as we move through 2018.

EXECUTION IN 2018

Through economic cycles and across all phases of our evolution as a company, we have prioritized investments in our franchise to drive future growth and success. It is in our DNA as an entrepreneurial bank, much like the entrepreneurial clients we serve.

In fact, during 2017 alone we’ve actively recruited and successfully attracted 16 BDOs, filling both open positions and opportunistically adding four new positions to build our team during industry consolidation. This successful recruiting improved the ratio of producers to support staff in our Kansas City, Northeast Wisconsin, and Milwaukee regions. We completed a charter consolidation to create capacity within our existing workforce to accommodate future growth in a highly efficient manner. The December 2017 Kansas City core system conversion improved information quality and accessibility for the benefit of clients and employees alike. We completely rebuilt our SBA lending franchise from the ground up, forgoing near-term revenues to gain long-term sustainability, scalability, and profitability. All of these initiatives will contribute to the gradual improvement of First Business’s efficiency ratio back to our targeted 58-62% range.

We have positioned our company for future growth, and today we believe we have achieved a level of normalized operations that moves us toward this efficiency goal. We will continue cultivating earnings streams that we expect will create a path to above-market revenue growth across economic cycles – analogous to the success of our trust and private wealth management business, which we entered in 2001. Since 2011, this business has grown fee revenues at a compound annual rate of 18%, driven by growth in assets under management and administration of 15% per year. The rate and consistency of growth in this business is the model for our developing SBA business, and for any other business lines.

Importantly, like our peers, our efforts will benefit from the reduction in federal corporate tax rates beginning in 2018. However, unlike our peers, we are not changing how we run our company. Some banks have announced increased investments in technology, employees and community giving. We have not made similar announcements on how we will "spend" the tax savings, as we have historically been doing all of these things. At First Business, we have consistently invested for future growth, and as a result, the benefit of the tax reductions will flow completely to the bottom line.

As previously announced on January 26, 2018, our Board of Directors declared a quarterly cash dividend on common stock of $0.14 per share, a 7.7% increase over the quarterly dividend declared in October 2017. This increase reaffirms our commitment to returning value to our shareholders and reflects our confidence that 2017 results provide momentum for profitable growth in 2018 and beyond.

Investing for tomorrow is foundational at First Business. We are proud of our history of consistently investing in our franchise and look forward to sharing our continued success in the coming quarters.

Sincerely,

Corey Chambas, President and CEO