Attached files

| file | filename |

|---|---|

| EX-31.4 - RULE 13A-14(A)/15D-14(A) CERTIFICATION OF CHIEF FINANCIAL OFFICER - MCDERMOTT INTERNATIONAL INC | mcdermott3363401-ex314.htm |

| EX-31.3 - RULE 13A-14(A)/15D-14(A) CERTIFICATION OF CHIEF EXECUTIVE OFFICER - MCDERMOTT INTERNATIONAL INC | mcdermott3363401-ex313.htm |

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(Amendment No. 1)

| (Mark One) | |

| ☑ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the Fiscal Year Ended December 31, 2017 | |

| OR | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 001-08430

(Exact name of registrant as specified in its charter)

| REPUBLIC OF PANAMA | ||

| (STATE OR OTHER JURISDICTION OF INCORPORATION | 72-0593134 | |

| OR ORGANIZATION) | (I.R.S. EMPLOYER IDENTIFICATION NO.) | |

| 4424 West Sam Houston Parkway North | ||

| HOUSTON, TEXAS | 77041 | |

| (ADDRESS OF PRINCIPAL EXECUTIVE OFFICES) | (ZIP CODE) |

Securities Registered Pursuant to Section 12(b) of the Act:

| Title of each class | Name of each Exchange on which registered | |

| Common Stock, $1.00 par value | New York Stock Exchange |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☑ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☑

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☑ | Accelerated filer | ☐ | ||

| Non-accelerated filer | ☐ | (Do not check if a smaller reporting company) | Smaller reporting company | ☐ | |

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

The aggregate market value of the registrant’s common stock held by nonaffiliates of the registrant on the last business day of the registrant’s most recently completed second fiscal quarter (based on the closing sales price on the New York Stock Exchange on June 30, 2017) was approximately $2 billion.

The number of shares of the registrant’s common stock outstanding at March 2, 2018 was 285,147,901.

INDEX TO ANNUAL REPORT ON FORM 10-K

For the Year Ended December 31, 2017

2

McDermott International, Inc. (“McDermott,” “we,” “us” or “our”) is filing this Amendment No. 1 on Form 10-K/A (this “Amendment”) to amend our annual report on Form 10-K for the year ended December 31, 2017, originally filed with the Securities and Exchange Commission (“SEC”) on February 21, 2018 (the “Original Filing” or “our Form 10-K”), solely for the purpose of including the information required by Part III of Form 10-K because we do not intend to file our definitive proxy statement for the 2018 Annual Meeting of Stockholders before the date that is 120 days after our fiscal year end.

In accordance with Rule 12b-15 under the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), Part III, Items 10 through 14 of the Original Filing are hereby amended and restated in their entirety, and Part IV, Item 15 of the Original Filing is hereby amended and restated in its entirety, with the only changes being the addition of new certifications by our principal executive officer and principal financial officer filed herewith. This Amendment does not amend or otherwise update any other information in the Original Filing. Accordingly, this Amendment should be read in conjunction with the Original Filing and with our filings with the SEC subsequent to the Original Filing.

3

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

Our Board of Directors oversees, monitors and directs management in the long-term interests of McDermott and our stockholders. The Board of Directors maintains a strong commitment to corporate governance and has implemented policies and procedures that we believe are among the best practices in corporate governance. Our Articles of Incorporation provide that, at each annual meeting of stockholders, all directors shall be elected annually for a term expiring at the next succeeding annual meeting of stockholders or until their respective successors are duly elected and qualified. All directors, with the exception of Philippe Barril, were elected at our annual meeting of stockholders held on May 5, 2017. Mr. Barril was appointed as a director by our Board of Directors effective September 1, 2017.

The following profiles provide certain information about each of our nine directors. Age and other information in each director’s biography are as of March 1, 2018.

4

| Directors |

|

PHILIPPE BARRIL

Chief Operating Officer Age 53 Director Since 2017 |

Philippe Barril joined SBM Offshore N.V. (“SBM”), a provider of floating production solutions to the offshore energy industry, in March 2015, and has served as Chief Operating Officer and a member of the Management Board of SBM since April 2015. Previously, he served as President and Chief Operating Officer of Technip S.A. from January 2014 to January 2015; Executive Vice President and Chief Operating Officer, Onshore and Offshore, Technip S.A. (“Technip”) from September 2011 to December 2013; Senior Vice President, Offshore Segment, Technip France, from June 2010 to September 2011; and Senior Vice President, Offshore & Onshore Product Lines and Technologies, Technip France, from November 2009 to May 2010. Prior to joining Technip, Mr. Barril served in roles of increasing responsibility for companies in the offshore oil and gas construction industry, including in engineering and project management, with significant experience in Africa and the Mediterranean. Mr. Barril holds a graduate degree in Engineering from the Ecole Centrale de Lyon in France. The Board of Directors believes Mr. Barril is qualified to serve as a director in consideration of his executive leadership and international operations experience within the oilfield engineering and construction industry. Mr. Barril’s extensive industry expertise and wealth of relevant operating experience is of great significance to McDermott. |

|

JOHN F. BOOKOUT, III

Partner Age 64 Director Since 2006 Former Public ●Tesoro Corporation (2006-2010) |

Mr. Bookout currently serves as a Partner at Apollo Global Management, LLC, (“Apollo”) a global investment management firm, since June 2016. Previously, he served as a Senior Advisor at Apollo from October 2015 to June 2016, and Managing Director of Energy and Infrastructure at Kohlberg Kravis Roberts & Co. (“KKR”), a private equity firm, from March 2008 until his retirement from KKR in June 2015. For the majority of his career, Mr. Bookout worked in oil and gas, exploration and development, petroleum refining and marketing and natural gas and electric utility industries. Prior to joining KKR, he served as a director of McKinsey & Company, a global management consulting firm, which he joined in 1978. During Mr. Bookout’s career with McKinsey, he held several leadership roles, including Managing Partner and Head of North American and European energy practices and was responsible for McKinsey’s 17 global industry practices. Mr. Bookout also served as a director of Tesoro Corporation, an independent refiner and marketer of petroleum products, from 2006 to 2010. Mr. Bookout has a Bachelor of Arts degree in Economics from Rice University and an M.B.A. from Stanford Graduate School of Business. The Board of Directors believes Mr. Bookout is qualified to serve as a director in consideration of his broad experience in executive leadership and as a public company director within the oil and gas exploration and development industry and the petroleum refining and marketing industry. Mr. Bookout’s expertise in private equity and finance, together with his extensive global energy experience, adds significant value to McDermott’s strategic decision making process. |

5

|

DAVID DICKSON

President and Chief Executive Officer Age 50 Director Since 2013 Tenure 4 years 6 months |

Mr. Dickson has served as a member of our Board of Directors and as President and Chief Executive Officer since December 2013, prior to which he served as our Executive Vice President and Chief Operating Officer from October 2013. Mr. Dickson has over 25 years of offshore oilfield engineering and construction business experience, including 11 years of experience with Technip and its subsidiaries. From September 2008 to October 2013, he served as President of Technip U.S.A. Inc., with oversight responsibilities for all of Technip’s North American operations. In addition to being the President of Technip U.S.A. Inc., Mr. Dickson also had responsibility for certain operations in Latin America. Mr. Dickson also supported the Technip organization by managing key customer accounts with international oil companies based in the United States. The Board of Directors believes Mr. Dickson is qualified to serve as a director in consideration of his position as our President and Chief Executive Officer, his extensive executive leadership experience in and significant knowledge of the offshore oilfield engineering and construction business, and his broad understanding of the expectations of our core customers. |

|

STEPHEN G. HANKS

Former President and Chief Executive Officer, Washington Group International, Inc. Age 67 Director Since 2009 Current Public ●Lincoln Electric Holdings, Inc. (since 2006) – Finance Committee Chair and Compensation and Executive Development Committee

●Babcock & Wilcox Enterprises, Inc. (since July 2015) – Governance Chair, Compensation Committee and Lead Independent Director

Former Public ●Washington Group International, Inc. (2000-2007)

●URS Corporation (2007-2008)

●The Babcock & Wilcox Company (2010- June 2015) |

Mr. Hanks has held various roles over a 30-year career with Washington Group International, Inc. (and its predecessor, Morrison Knudsen Corporation), an integrated engineering, construction, and management solutions company for businesses and governments worldwide. From 1994 to 1995, Mr. Hanks served as Executive Vice President Administration and Finance of Morrison Knudsen Corporation and later served as Washington Group International, Inc.‘s President and Chief Executive Officer and was a member of its board of directors from 2000 through 2007. From November 2007 until his retirement in January 2008, he was President of the Washington Division of URS Corporation. He formerly served as Executive Vice President, Chief Legal Officer and Secretary for Washington Group International. He has also served as a director of Lincoln Electric Holdings, Inc., a global leader in arc welding, robotic welding systems, plasma and oxyfuel cutting equipment and brazing and soldering alloys, since 2006, and as a director of Babcock & Wilcox Enterprises, Inc., a global leader in energy and environmental technologies and services for the power and industrial markets, since July 2015. Mr. Hanks has a Bachelor of Science degree in Accounting from Brigham Young University, a Master’s degree in Business Administration from the University of Utah and a Juris Doctor degree from the University of Idaho. The Board of Directors believes Mr. Hanks is qualified to serve as a director in consideration of his extensive experience in the international engineering and construction business and his broad knowledge in accounting, auditing and financial reporting, and his legal background. Having served in executive and director capacities at several public companies, Mr. Hanks brings to the Board a valuable perspective on its oversight responsibilities, on corporate governance issues and on outstanding customer service across many global industrial sectors. |

6

|

ERICH KAESER

Former Chief Executive Officer, Siemens Middle East Age 62 Director Since 2016 |

Prior to his retirement in December 2014, Mr. Kaeser served in key executive and advisory positions, with a strong focus on the Middle East markets, throughout his 35 year career at Siemens AG, a global conglomerate producing energy-efficient and resource-saving technologies across a variety of industrial sectors. Mr. Kaeser served as Executive Advisor to the Siemens AG Board and Regional Middle East Management from December 2013 to December 2014, and as Chief Executive Officer, Siemens Middle East, responsible for overseeing the Siemens business in 16 countries, from August 2008 to November 2013. He also served as Senior Vice President, Head of Corporate Development and Regional Strategies Africa, Middle East, C.I.S., Siemens AG from May 2007 to August 2008, and in several other managerial and executive capacities within the Energy, Industry, Infrastructure and Cities sectors since commencing his career at Siemens in 1979, including: Senior Vice President, Head of Corporate Development and Regional Strategies Africa, Middle East, C.I.S., Siemens A.G., from 2007 to 2008, Managing Director—Branch Offices Jordan, Syria and Lebanon, Siemens A.G., from 2006 to 2007, General Manager—Power Transmission & Distribution Systems, Lower Gulf (UAE, Qatar, Bahrain, Oman, Yemen), Siemens LLC, from 2005 to 2006, President Transportation Systems – Turnkey Systems (worldwide), Siemens A.G., from 2004 to 2005, and Chief Executive Officer of Siemens Ltd. in Saudi Arabia, from 2000 to 2004. Since January 2015, Mr. Kaeser has served as an Executive Advisor for MKS Consultancy FZ LLC (a member of QRC Group A.G.), an international management consulting and executive recruitment company. Mr. Kaeser holds a Bachelor degree in Electrical Power Engineering from the Regensburg University of Applied Sciences in Germany. The Board of Directors believes Mr. Kaeser is qualified to serve as a director in consideration of the breadth of his experience in the energy and supporting infrastructure businesses and his extensive international operations experience, particularly in the Middle East. Mr. Kaeser brings to the Board significant managerial and operational expertise in the international energy industry and provides key insight into McDermott’s international operations and strategy. |

|

GARY LUQUETTE

Non-Executive Chairman of the Board Former President and Chief Executive Officer, Frank’s International, N.V. Age 62 Director Since 2013 Current Public ●Southwestern Energy Company (since 2017) – Chair of Health, Safety, Environment & Corporate Responsibility Committee

Former Public ●Frank’s International N.V. (2013–2017) |

From January 2015 until November 2016, Mr. Luquette served as President and Chief Executive Officer of Frank’s International N.V. (“Frank’s”), a global provider of engineered tubular services to the oil and gas industry, following which he served as a special advisor to Frank’s until his retirement in December 2016. He also served as a member of Frank’s Supervisory Board from November 2013 until May 2017. From 2006 until September 2013, he served as President of Chevron North America Exploration and Production, a unit of Chevron Corporation. Mr. Luquette began his career with Chevron in 1978 and, prior to serving as President, held several other key exploration and production positions in Europe, California, Indonesia and Louisiana, including Managing Director of Chevron Upstream Europe, Vice President, Profit Center Manager, Advisor and Engineer. He has served as a director of Southwestern Energy Company, an independent energy company engaged in natural gas and oil exploration, development and production, natural gas gathering and marketing, since 2017. He has also served on the board of directors for the United Way of Greater Houston and has also been a member of the American Petroleum Institute and was the former chair of its Upstream Committee. Mr. Luquette has a Bachelor of Science degree in Civil Engineering from the University of Louisiana at Lafayette. The Board of Directors believes Mr. Luquette is qualified to serve as a director in consideration of his extensive senior management, operational and international experience in the global oil and gas exploration and production industry and the oilfield services industry. Our Board benefits from his valuable upstream customer perspective and his knowledge and understanding of the subsea sector and our core customers. |

7

|

WILLIAM H. SCHUMANN, III

Former Executive Vice President, FMC Technologies, Inc. Age 67 Director Since 2012 Current Public ●Avnet, Inc. (since 2010) – Non-Executive Chairman of the Board, Audit and Corporate Governance Committees

●Andeavor (since 2016) – Governance and Audit Committees

Former Public ●AMCOL International Corporation (2012-2014)

●URS Corporation (March 2014-October 2014)

●UAP Holding Corp. (2005-2008) |

From 2005 until his retirement in August 2012, Mr. Schumann served as Executive Vice President of FMC Technologies, Inc. (“FMC”), a global provider of technology solutions for the energy industry. During his 31 year career at FMC, and its predecessor, FMC Corporation, he also served in the following positions: Chief Financial Officer of FMC from 2001 until 2011; Chief Financial Officer of FMC Corporation from 1999 until 2001; Vice President, Corporate Development from 1998 to 1999; Vice President and General Manager, Agricultural Products Group from 1995 to 1998; Regional Director, North America Operations, Agricultural Products Group from 1993 to 1995; Executive Director of Corporate Development from 1991 to 1993, and other various management positions from the time he joined FMC in 1981. He also has served as a director of Avnet, Inc., an industrial distributor of electronic components and products, since February 2010 and has served as Avnet's Non-Executive Chairman of the Board since 2012, and as a director of Andeavor (prior to August 2017, named Tesoro Corporation), an independent refiner and marketer of petroleum products, since November 2016. Mr. Schumann has a Bachelor of Science degree in Systems Engineering from the University of California, Los Angeles, and a Master of Science degree in Management Science from University of Southern California Marshall Graduate School of Business. The Board of Directors believes Mr. Schumann is qualified to serve as a director in consideration of his valuable experience acquired from serving in several executive leadership and board positions at public companies within the energy industry and his broad knowledge in the areas of accounting, auditing and financial reporting. Mr. Schumann brings to the Board managerial, operational and financial expertise in the global energy industry. |

|

MARY SHAFER-MALICKI

Former Senior Vice President and Chief Executive Officer, BP Angola Age 57 Director Since 2011 Current Public ●Wood PLC (since 2012) – Nomination, Remuneration, and Safety & Assurance Committees

●QEP Resources, Inc. (since July 2017)—Audit and Governance Committees

Former Public ●Ausenco Limited (2011-2016) |

From July 2007 until her retirement in March 2009, Ms. Shafer-Malicki was Senior Vice President and Chief Executive Officer of BP Angola, a subsidiary of BP p.l.c. (“BP”), an oil and natural gas exploration, production, refining and marketing company. Previously, she held several other executive leadership positions during her 25 year career with BP p.l.c. and its predecessor company, Amoco Corp. (which was acquired by BP in 1998), including Chief Operating Officer of BP Angola from January 2006 to June 2007, Director General of BP Vietnam, from 2003 to 2004, and various other international engineering and managerial positions. In addition to working with a number of non-profit organizations, Ms. Shafer-Malicki has also served as a director of QEP Resources, Inc., an energy company specialized in natural gas and oil exploration, since July 2017; Wood PLC, a leading independent services provider for the oil and gas and power generation markets, since June 2012; and Ausenco Limited, an Australian company providing engineering design, project management, process controls and operations solutions to a variety of industries, from January 2011 through December 2016. Ms. Shafer-Malicki has a Bachelor of Science degree in Chemical Engineering from Oklahoma State University. The Board of Directors believes Ms. Shafer-Malicki is qualified to serve as a director in consideration of her diverse experience in the upstream energy and supporting infrastructure businesses and her significant international operations experience, having served in executive and director roles for public companies in Europe, the Asia Pacific region and Africa. Ms. Shafer-Malicki’s significant experience in international oil and gas allows her to provide valuable insight into McDermott’s operations, strategy, commercial, safety, supply chain management and core customers. |

8

|

DAVID A. TRICE

Former President and Chief Executive Officer, Newfield Exploration Company Age 69 Director Since 2009 Current Public ●New Jersey Resources Corporation (since 2004) – Compensation, and Nominating and Governance Committee

●QEP Resources, Inc. (since 2011) – Lead Director, Compensation Committee, Nominating and Governance Committee Chair

●Select Energy Services (since November 2017)

Former Public ●Hornbeck Offshore Services, Inc. (2002-2011)

●Newfield Exploration Company (2000-2010)

●Grant Prideco, Inc. (2003-2008) |

From February 2000 until his retirement in May 2009, Mr. Trice was President and Chief Executive Officer of Newfield Exploration Company, an oil and natural gas exploration and production company, and served as chairman of its board from September 2004 to May 2010. He previously served in several other key leadership positions at Newfield, including Vice President and Chief Financial Officer, Chief Operating Officer and President, and Vice President of Finance and International. Prior to his career at Newfield, Mr. Trice served as President and Chief Executive Officer of Huffco Group, Inc., from 1991 to May 1997. He began his career in 1973 as an attorney. Mr. Trice has also served as a director of: New Jersey Resources Corporation, an energy company providing retail and wholesale services across the United States and Canada, since 2004; QEP Resources, Inc., an energy company specialized in natural gas and oil exploration, since 2011; and Select Energy Services, Inc., a company providing end to end water and chemical solutions to oilfield operators, since November 2017. Mr. Trice has an Accounting and Management Services Degree from Duke University and a Juris Doctorate from Columbia University School of Law. The Board of Directors believes Mr. Trice is qualified to serve as a director in consideration of his significant experience gained from serving in executive leadership and board positions at public companies within the oil and gas exploration and production business. With his extensive knowledge in the areas of accounting, auditing and financial reporting and his legal background, Mr. Trice offers the Board valuable insight on risk oversight, financial policy, executive compensation and corporate governance matters. |

The following profiles provide certain information about each of our current executive officers who serve at the direction of the Board of Directors. Age and other information are as of March 1, 2018. The profile of our President and Chief Executive Officer, David Dickson, can be found in the Director profiles above.

| Executive Officers |

|

STUART SPENCE

Executive Vice President and Chief Financial Officer Age 48 Tenure 3 years 7 months |

Mr. Spence has served as our Executive Vice President and Chief Financial Officer since August 2014. Mr. Spence has over 25 years of combined financial and operational management experience with companies in the oilfield products and services and engineering and construction businesses. Immediately prior to joining McDermott, Mr. Spence served as Vice President, Artificial Lift for Halliburton Company, where he had overall strategic and operational responsibility for Halliburton’s artificial lift product and service line. Previously, he served as Senior Director, Strategy and Marketing for Halliburton’s Completion and Production Division. Mr. Spence joined Halliburton following Halliburton’s acquisition of Global Oilfield Services Inc. in November 2011. He served as Executive Vice President and Chief Financial Officer of Global Oilfield Services from 2008 to May 2011 and as Executive Vice President, Strategy, in May 2011 in connection with the sale to Halliburton. His prior experience also includes positions of increasing financial and management responsibility at: Green Rock Energy, LLC; and Vetco International Ltd. (holding company for Aibel Ltd., an oilfield facilities maintenance and construction company, and Vetco Gray, Inc., a subsea production and drilling equipment company). |

9

|

JOHN FREEMAN

Senior Vice President, General Counsel and Corporate Secretary Age 56 Tenure 7 months |

Mr. Freeman has served as our Senior Vice President, General Counsel and Corporate Secretary since August 2017. He has more than 30 years of legal and compliance experience in both the private and public sectors. Prior to joining McDermott, Mr. Freeman served at TechnipFMC plc as Special Advisor to the Integration of Technip and FMC from January 2017 to August 2017, and, before the combination of those two companies, served in various executive roles at Technip, including: Global General Counsel, Technip Group (Paris, France) from November 2015 through January 2017; Executive Vice President, Technip Group Legal Business & Operations Counsel (Paris, France), from May 2015 through October 2015; and Vice President, General Counsel, Corporate Secretary & Regional Compliance Officer, Technip USA, Inc. (Houston, Texas), from April 2009 through April 2015. From 2004 to 2009, Mr. Freeman held various senior legal and compliance positions at Baker Hughes Incorporated, after having served in several roles of increasing responsibility for Pennzoil-Quaker State Company and as an attorney at a Washington, D.C. law firm. He began his legal career in 1989 as a prosecuting attorney for the U.S. federal government. |

|

JONATHAN KENNEFICK

Senior Vice President, Project Execution and Delivery Age 49 Tenure 26 years |

Mr. Kennefick has served as our Senior Vice President, Project Execution and Delivery, since November 2015. Mr. Kennefick joined McDermott in 1992 and has served in various positions of increasing responsibility, including: Vice President of Quality, Health, Safety, Environment and Security, from March 2014 to November 2015; Vice President, Operations—Middle East and India, from May 2012 to March 2014; Director of Operations, from June 2010 to May 2012; and General Manager, Marine Operations, from March 2008 to June 2010. |

|

BRIAN MCLAUGHLIN

Senior Vice President, Commercial Age 47 Tenure 12 years |

Mr. McLaughlin has served as our Senior Vice President, Commercial, since September 2015. Previously, he served as our: VP Commercial, Offshore, from 2014 to September 2015; General Manager, Business Development—Middle East and India, from 2010 to 2014; Senior Director, Business Development—Middle East and India, from 2008 to 2010; and, Proposals Manager, Middle East, from 2006 to 2008. Prior to joining McDermott, Mr. McLaughlin held roles of increasing responsibility at Al Faris, Abu Dhabi, ALE Middle East and Weir Pumps. |

|

LINH AUSTIN

Vice President, Middle East and Caspian Age 48 Tenure 3 years 3 months |

Mr. Austin has served as our Vice President and General Manager, Middle East and Caspian, since January 2016 and, previously, as our Senior Director Operations, Middle East from January 2015 to January 2016. Mr. Austin has over 20 years of executive and operational experience in the oil and gas industry, including two years in the Middle East with Abu Dhabi Marine Operating Company (ADMA-OPCO). Prior to joining McDermott, he served as Senior Advisor for ADMA-OPCO from August 2013 until January 2015. Prior to his employment with ADMA-OPCO, Mr. Austin served with BP and Atlantic Richfield Company in various operational and project leadership roles in the upstream and the downstream sectors with increasing levels of responsibility since 1993. |

|

ANDREW LEYS

Vice President, Human Resources Age 39 Tenure 10 years |

Mr. Leys has served as our Vice President, Human Resources since July 2016. Prior to his current position, Mr. Leys served as Senior Director, HR & Crewing for Marine Assets & Operations from April 2014 to June 2016. Prior to rejoining McDermott in 2014, he served as Director of HR Operations for Technip North America from January 2012 to April 2014. He also served as McDermott’s Director of HR for Atlantic Operations from November 2010 to January 2012 and Director of HR for Marine from September 2006 to November 2010. Before joining McDermott in 2006, Andrew served with Smith International, Inc. as Global Compensation Manager from July 2005 to September 2006 and as a Compensation Analyst from May 2003 to June 2005. |

|

CHRIS KRUMMEL

Vice President, Finance and Chief Accounting Officer Age 49 Tenure 1 year 6 months |

Mr. Krummel has served as our Vice President, Finance and Chief Accounting Officer since October 2016. Previously, Mr. Krummel served as a consultant of American Industrial Partners, a firm engaging in private equity investments in industrial businesses in the United States and Canada, from November 2015 through July 2016; Chief Financial Officer and Vice President of EnTrans International, LLC, a global manufacturer of aluminum tank trailers, heavy lift trailers and oilfield pressure pumping equipment used in hydraulic fracturing and other well services, from September 2014 to October 2015; and Chief Accounting Officer, Vice President and Corporate Controller / Vice President of Finance of Cameron International, a worldwide provider of flow equipment products, systems and services to oil, gas and process industries from April 2008 until August 2014. Mr. Krummel has also served as a member of the Board of Directors of Eco-Stim Energy Solutions, Inc., an environmentally-focused well stimulation and completion company, since January 2014. |

10

|

IAN PRESCOTT

Vice President, Asia Age 54 Tenure 3 months |

Mr. Prescott has served as our Vice President, Asia since January 2018. Mr. Prescott has more than 28 years of extensive operational, marketing and business unit responsibilities for production and processing solutions businesses in the upstream oil and gas sector, including engineering and fabrication. Prior to joining McDermott, he served as: Senior Vice President for SNC-Lavalin Group, Inc., from August 2015 to December 2017; Chief Executive Officer for Global Process Systems from May 2010 to May 2015; and Director, Asia for Global Process Systems from January 2008 to May 2010. He has also held key leadership positions with PAE (Thailand) PLC and Aker Solutions ASA (prior to 2008, known as Aker Kvaerner). |

|

SCOTT MUNRO

Vice President, Americas, Europe and Africa Age 43 Tenure 4 years 3 months |

Mr. Munro has served as our Vice President, Americas, Europe and Africa, since January 2015. Previously, he served as our Vice President and General Manager, North Sea and Africa, from April 2014 to January 2015; and Vice President, Projects and Operations Subsea, from the time he joined McDermott in January 2014 through March 2014. Prior to joining McDermott, Mr. Munro was Vice President, Commercial, for Technip U.S.A. Inc., a subsidiary of Technip, from 2010 to 2013; and Vice President Offshore Unit, Technip France, an operating unit of Technip, from 2013 to 2014. Mr. Munro has management experience in the oil and gas industry, having worked in the United Kingdom, United States, Canada, Brazil and France in a variety of operational and project management roles in organizations such as Coflexip Stena Offshore Group S.A., Acergy, S.A., Chevron Corporation and Technip. |

| Section 16(a) Beneficial Ownership Reporting Compliance |

Section 16(a) of the Securities Exchange Act of 1934 requires our directors and executive officers, and persons who own 10% or more of our voting stock, to file reports of ownership and changes in ownership of our equity securities with the SEC and the NYSE. Directors, executive officers and persons who own 10% or more of our voting stock are required by SEC regulations to furnish us with copies of all Section 16(a) forms they file. Based solely on a review of the copies of those forms furnished to us, or written representations that no forms were required, we believe that our directors, executive officers and persons who own 10% or more of our voting stock complied with all Section 16(a) filing requirements during the year ended December 31, 2017.

| Corporate Governance Guidelines, Committee Charters and Code of Conduct and Ethics |

We are committed to maintaining the highest standards of corporate governance and promoting a culture that encourages trust and high ethical standards. The Board of Directors has built a strong and effective governance framework through the adoption of Corporate Governance Guidelines and written charters for each of its three standing Committees designed to promote the long-term interests of stockholders and support Board and management accountability. The Board of Directors has also adopted a Code of Ethics that applies to our Chief Executive Officer, Chief Financial Officer and other senior financial and accounting officers, which is consistent with regulations of the Securities and Exchange Commission and New York Stock Exchange listing standards. Copies of all of those documents as well as other principal governance documents are maintained within the corporate governance section on our Web site found at www.mcdermott.com under “INVESTORS—Corporate Governance” and “WHO WE ARE—Leadership—Board Committees.”

| Director Nominations |

In 2017, our Governance Committee engaged an independent director search firm in order to assist in selecting director candidates. After review and consideration of prospective candidates identified by the firm, Mr. Barril was appointed to the Board effective September 1, 2017 in consideration of his extensive experience in our industry and other qualifications.

Any stockholder may nominate one or more persons for election as one of our directors at the annual meeting of stockholders if the stockholder complies with the notice, information and consent provisions contained in our By-Laws.

11

The Governance Committee will consider candidates identified through the processes described above and will evaluate the candidates, including incumbents, based on the same criteria. The Governance Committee also takes into account the contributions of incumbent directors as Board members and the benefits to us arising from their experience on the Board. Although the Governance Committee will consider candidates identified by stockholders, the Governance Committee has sole discretion whether to recommend those candidates to the Board.

| Audit Committee and Audit Committee Financial Experts |

The Board of Directors has a separately-designated standing Audit Committee established in accordance with Section 3(a)(58)(A) of the Exchange Act. Current members of the Audit Committee are Messrs. Schumann (Chair), Bookout, Hanks and Kaeser and Ms. Shafer-Malicki. Principal functions of our Audit Committee include:

| ● |

Monitoring our financial reporting process and internal control system. |

| ● |

Overseeing the preparation of our financial statements. |

| ● |

Monitoring our compliance with legal and regulatory financial requirements, including our compliance with the applicable reporting requirements established by the U.S. Securities and Exchange Commission (the “SEC”) and the requirements of Audit Committees as established by the New York Stock Exchange (“NYSE”). |

| ● |

Evaluating the independence, qualifications, performance and compensation of our independent registered public accounting firm. |

| ● |

Overseeing the performance of our internal audit function. |

| ● |

Overseeing certain aspects of our Ethics and Compliance Program relating to financial matters, books and records and accounting and as required by applicable statutes, rules and regulations. |

| ● |

Providing an open avenue of communication among our independent registered public accounting firm, financial and senior management, the internal audit department and the Board. |

Our Board of Directors has determined that all members of the Audit Committee are independent and financially literate under New York Stock Exchange Listed Company Manual Sections 303A.02 and 303A.07, respectively, and that Messrs. Schumann, Bookout, Hanks and Kaeser and Ms. Shafer-Malicki each qualify as an “audit committee financial expert,” within the definition established by the SEC.

ITEM 11. EXECUTIVE COMPENSATION

| Compensation Discussion & Analysis |

Introduction

The following Compensation Discussion and Analysis, or CD&A, provides information relevant to understanding the 2017 compensation of our executive officers and former executive officers identified in the Summary Compensation Table, whom we refer to as our NEOs, with the exception of Ms. Liane Hinrichs, our former Senior Vice President, General Counsel and Corporate. NEOs, as used in the CD&A, include only the named executive officers who remained employed in their same position with McDermott through the date of this Amendment. For 2017, our NEOs and their respective titles were as follows:

| ● |

David Dickson, our President and Chief Executive Officer; |

| ● |

Stuart Spence, our Executive Vice President and Chief Financial Officer; |

| ● |

Linh Austin, our Vice President, Middle East and Caspian; |

| ● |

Brian McLaughlin, our Senior Vice President, Commercial; and |

| ● |

Scott Munro, our Vice President, Americas, Europe and Africa. |

The following discussion also contains statements regarding future individual and company performance targets and goals. These targets and goals are disclosed in the limited context of our compensation programs and should not be understood to be statements of management’s expectations or estimates of results or other guidance. We caution investors not to apply these statements in other contexts.

12

| CD&A Executive Summary |

Our Business, the Macro Environment and our 2017 Operating Strategy

McDermott is a leading provider of integrated engineering, procurement, construction and installation (“EPCI”), front-end engineering and design and module fabrication services for offshore, upstream field developments worldwide. We deliver fixed and floating production facilities, pipeline installations and subsea systems from concept to commissioning for complex offshore and subsea oil and gas projects. Operating in approximately 20 countries across the Americas, Europe, Africa, Asia and Australia, our integrated resources include a diversified fleet of marine vessels, fabrication facilities and engineering offices. We support our activities with comprehensive project management and procurement services, while utilizing our fully integrated capabilities in both shallow water and deepwater construction. Our customers include national, major integrated and other oil and gas companies, and we operate in most major offshore oil and gas producing regions throughout the world. McDermott generally has 40 or fewer active contracts at any given time, which typically span a duration of one to three years, are performed in a variety of jurisdictions, and may individually range from less than $50 million to more than $2 billion in total contract value. We execute our contracts through a variety of methods, principally fixed-price, but also including cost reimbursable, cost-plus, day-rate and unit-rate basis or some combination of those methods. These contracts are often performed in difficult conditions, and the cost and gross profit we realize on these contracts could vary materially from the estimated amounts due to supplier, contractor and subcontractor performance, changes in job conditions, unanticipated weather conditions, variations in labor and equipment productivity, increases in the cost of raw materials over the term of the contract or our own performance.

The demand for our EPCI services and our ability to book new work is dependent upon the capital expenditures of oil and gas companies for the construction of development projects. Since the start of the most recent substantial decline in the price of oil, many oil and gas companies made significant reductions in their capital expenditure budgets for 2015, 2016 and 2017. Though some of our customers have reduced their current levels of spending on offshore exploration, development and production programs, including by deferring or delaying certain capital projects, we have seen, and expect to continue to see, other capital projects continue, as they are economically viable or strategically necessary in a variety of oil and gas price environments. Notwithstanding this continued challenging macro environment, in 2017 McDermott remained focused on growing its leadership position in the Middle East, building upon strengthened customer alignment and relationships with a new technology focus, proactively seeking ways to improve its cost structure and managing its cost base, deepening integration to build efficiencies and further enhance capabilities and building backlog in markets where capital is available for investment.

Since David Dickson’s appointment as Chief Executive Officer in December 2013, McDermott has transformed as a company and positioned itself for the anticipated upturn in the oilfield services industry through a turnaround, stabilization of the business and optimization via cost-reduction initiatives. McDermott has also been focused on sustainability and growth, through strategic asset investment and the proposed combination with Chicago Bridge & Iron Company N.V. (“CB&I”) announced in late 2017.

| 1 | 2 | 3 | ||

Stabilization

●New leadership took countermeasures to stop multi-year EBIT

decline

●Stronger relationships with key customers—signaled a

transformation of McDermott |

Optimization

●Undertook cost-reduction programs and business development efforts

across existing business lines

●Additional measures taken to improve process and asset

refreshment |

Sustainability and Growth

●Maintain strong focus on strengthening customer

relationships

●Maintain strong focus on operational and cost

effectiveness |

13

In 2017 our operating strategy was to maintain a sustainable, profitable and growth-oriented business, with a focus on stockholders, customers and other stakeholders. In furtherance of this strategy, our 2017 goals were to:

| ● |

increase operating income via improved project execution; |

| ● |

increase cash flow by prioritizing our liquidity needs; |

| ● |

increase backlog and bookings to support our future business; |

| ● |

promote pricing discipline on order intake operating margins; and |

| ● |

efficiently allocate capital to profitable investments to grow our business. |

2017 Performance Highlights

Solid, consistent operational performance driven by the One McDermott Way, consistent focus on liquidity and strong customer relationships drove the execution of McDermott’s strategy and goals in 2017.

|

|

| |

| REVENUES | OPERATING INCOME | |

| $3.0B | $324.2M | |

|

|

|

|

| |

| ORDER INTAKE | BACKLOG | |

| $2.6B | $3.9B1 | |

|

|

| 1 |

Our adoption of Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 606, Revenue from Contracts with Customers, as of January 1, 2018, will result in a decrease in our backlog of between $205 million and $220 million. See Note 3, Revenue Recognition, to the Consolidated Financial Statements included in the Original Filing for additional information. |

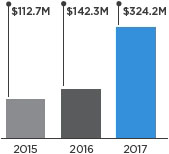

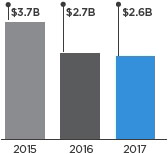

McDermott's 2017 financial performance was highlighted by operating income of $324.2 million, which represents a 128% increase year over year. This was the highest level of operating income achieved in over five years and resulted in the highest operating income margin since prior to 2010. Additionally, 2017 reported revenues were the second highest achieved since 2013. Strong order intake of $2.6 billion resulted in solid year-end backlog of $3.9 billion leading into 2018.

14

In addition to the significant financial performance highlights noted above, McDermott also achieved the following noteworthy strategic and operational highlights:

| ● |

Entry into the Business Combination Agreement with CB&I and certain of its subsidiaries under which McDermott and CB&I have agreed to combine their businesses; |

| ● |

Entry into a new $810 million credit agreement, with a sublimit of up to $300 million available for revolving loans, representing an increase in letter of credit capacity from $450 million and extended maturity; |

| ● |

Entry into strategic Memoranda of Understanding (“MOUs”) with Saudi Aramco for (1) a land lease at the planned new maritime facility at Ras Al-Khair in Saudi Arabia and (2) the expansion and development of our physical and human capital within Saudi Arabia; and |

| ● |

The acquisition and subsequent sale-leaseback of the deepwater pipelay and construction vessel Amazon. |

In evaluating the performance of David Dickson, our President and Chief Executive Officer, the Board has considered these financial, strategic and operational results, as well as other financial and leadership goals detailed further below, and believes that Mr. Dickson has succeeded in positioning McDermott as a stronger, more durable company, particularly during a difficult business cycle and extended challenging macro environment.

Compensation Philosophy and 2017 Compensation Program Design and Levels

The Compensation Committee is committed to targeting reasonable and competitive total direct compensation for our NEOs, with a significant portion of that compensation being performance-based. Our compensation programs are designed to align with and drive achievement of our business strategies and provide competitive opportunities. Accordingly, achievement of most of those opportunities depends on the attainment of performance goals and/or stock price performance. McDermott’s compensation programs are designed to provide compensation that:

| Attracts, motivates and retains high-performing executives |

|

Provides performance-based incentives to reward achievement of short and long-term business goals and strategic objectives while recognizing individual contributions |

|

Aligns the interests of our executives with those of our stockholders |

The Compensation Committee has designed and administered compensation programs aligned with this philosophy and is committed to continued outreach to stockholders to understand and address comments on our compensation programs.

Reflecting this philosophy, our NEO compensation arrangements in 2017 provided for the continuing use of three elements of target total direct compensation: annual base salary, annual incentive provided under our Executive Incentive Compensation Plan, or EICP, and long-term incentives, or LTI. In making compensation decisions for 2017, the Compensation Committee considered McDermott’s operating strategy and goals and significantly improved operational and financial performance, with appreciation of the “lower for longer” macro oil and gas environment and comments received during the 2017 stockholder outreach program.

15

With respect to plan design, the Compensation Committee maintained consistency:

| ● |

in the 2017 EICP performance metrics, with the continued use of operating income, free cash flow, order intake and order intake operating margin; and |

| ● |

in the 2017 LTI performance metric, with the continued use of relative Return on Average Invested Capital, or relative ROAIC, in consideration of McDermott’s transformation from turnaround and stabilization to optimization for future growth. |

|

Performance metrics and performance levels used within elements of annual and long-term compensation are |

| 2017 EXECUTIVE INCENTIVE COMPENSATION PLAN | ||||||

|

GOAL |

|

PERFORMANCE METRIC | |||

| Drive profitability via improved project execution |

|

Operating Income | ||||

| Prioritize liquidity needs |

|

Free Cash Flow | ||||

| Support future business |

|

Order Intake | ||||

| Promote pricing discipline on new work |

|

Order Intake Operating Margin | ||||

| 2017 LONG-TERM INCENTIVE PLAN — PERFORMANCE UNITS | ||||||

|

GOAL |

|

PERFORMANCE METRIC | |||

| Efficiently allocate capital to profitable investments |

|

Relative Return on Average Invested Capital | ||||

| Generate returns for stockholders |

|

Stock Price Increase | ||||

With respect to levels of compensation, the Compensation Committee generally sought to bring 2017 NEO compensation more in line with market range (generally, within 15% of market median as further described below). For 2017 NEO compensation, the Compensation Committee provided:

| ● |

Average annual base salary increases of approximately 6.4% to further align the NEO’s annual base salaries with market range and, in certain instances, for internal pay equity considerations. |

| ● |

Increases in annual target bonus awards, resulting in an increase in each NEO's performance-based compensation. As a result of McDermott’s 2017 financial performance, each NEO was eligible to earn 1.578x of his target EICP award, subject to adjustment by the Compensation Committee based on his achievement of individual performance goals. |

| ● |

Increases to the value of long-term incentives awarded to Messrs. Dickson and Spence as compared to 2016, based on their individual performance and to further align the value of their LTI with market range. |

16

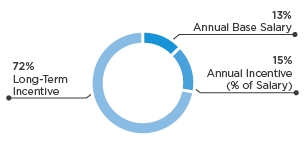

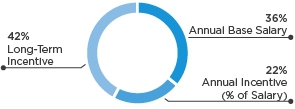

The mix of target total direct compensation for Mr. Dickson for 2017 is shown in the chart below.

|

|

| CEO TARGET 2017 COMPENSATION |

Impact of 2017 Say on Pay Vote on Executive Compensation and Stockholder Outreach

|

|

| STOCKHOLDER OUTREACH CYCLE |

|

2017 Stockholder Say on Pay Vote In 2017, over 96% of our stockholders voted in favor of our executive compensation program. During both the Spring and Fall of 2017, we reached out to stockholders representing approximately 40% of our outstanding shares of common stock and other stakeholders to gain insight regarding their perspectives on corporate governance and compensation matters. Based on our strong recent financial performance, enhancements to our compensation and governance programs and positive say-on-pay results, limited meetings were requested by stockholders, which we believe is an indication of our stockholders’ support of our current compensation and governance framework. Our Board considered the 2017 say on pay vote and the matters discussed during our 2017 stockholder and stakeholder outreach efforts in considering any changes or enhancements to our compensation and governance programs. |

17

Executive Compensation Policies and Practices

Below we highlight certain of our executive compensation and governance policies and practices, including both those which we utilize to drive performance and those which we prohibit because we do not believe they would serve our stockholders’ long-term interests:

| What we do | |||

|

Pay for Performance |

A significant portion of target total direct compensation is tied to performance, including 100% of annual incentive compensation and 50% of the NEOs’ target value long-term incentive compensation. | |

|

Meaningful Stock Ownership Guidelines |

We have stock ownership guidelines for our NEOs that generally require the retention of a dollar value of qualifying McDermott securities of 5x base salary for our CEO, 3x base salary for the other NEOs and 5x annual retainer for directors. | |

|

Double Trigger Change in Control Agreements & Equity Agreements |

Our change in control agreements and, beginning in 2016, our equity award agreements provide benefits only upon an involuntary termination or constructive termination of the executive officer within one year following a change in control. | |

|

Independent Compensation Consultant |

The Compensation Committee retains an independent compensation consultant to advise on executive compensation program and practices. | |

|

Annual Compensation Risk Assessment |

Our compensation consultant assists the Compensation Committee in conducting an annual risk assessment of our compensation programs. | |

|

Annual Advisory Vote on NEO Compensation |

We value our stockholders’ input on our executive compensation programs, and our Board of Directors seeks an annual advisory vote from stockholders to approve NEO compensation. | |

|

Modest Directed Perquisite Program |

The Compensation Committee provides reimbursement to members of McDermott’s executive committee, or EXCOM (which includes all of our NEOs), for financial planning and required executive physicals, in a combined amount not to exceed $20,000. | |

|

Annual Review of Share Utilization |

We evaluate share utilization levels annually by reviewing overhang levels (the dilutive impact of equity compensation on our stockholders) and annual run rates (the aggregate stock awarded as a percentage of total outstanding shares). | |

|

Clawback Policy |

We have a clawback policy that allows McDermott to recover, under certain circumstances, compensation paid to executive officers. | |

| What we prohibit | |||

|

Derivatives Trading, Hedging or Pledging of McDermott Stock |

Members of the Board of Directors and employees are prohibited from engaging in derivatives trading, hedging or pledging of our common stock. | |

|

Excise Tax Gross-Ups |

We do not provide excise tax gross-ups in our change in control agreements. | |

|

Repricing of Underwater Stock Options |

Our equity incentive plans do not permit repricing or exchange of underwater stock options without stockholder approval. | |

|

Employment Contracts |

None of our current NEOs has an employment contract with McDermott providing for ongoing employment. |

18

| 2017 Compensation Program |

What We Pay and Why: Elements of Total Direct Compensation

TARGET TOTAL DIRECT COMPENSATION

The Compensation Committee seeks to provide reasonable and competitive compensation. As a result, it targets the elements of total direct compensation, or “TDC,” for our NEOs generally within approximately 15% of the median compensation of our market for comparable positions. Throughout this CD&A, we refer to compensation that is within approximately 15% of market median as “market range” compensation.

The Compensation Committee may set TDC or individual elements of TDC above or below the market range to account for a NEO’s performance, experience, tenure in the role, internal pay equity and other factors or situations that are not typically captured by looking at standard market data and practices and which the Compensation Committee deems relevant to the appropriateness or competitiveness of a NEO’s compensation.

When making decisions regarding individual compensation elements, the Compensation Committee also considers the effect on the NEO’s target TDC and target total cash-based compensation (annual base salary and annual incentives at target level), as applicable. The Compensation Committee’s goal is to establish target compensation for each element that, when combined, creates a target TDC award for each NEO that is reasonable and competitive and supports our compensation philosophy and objectives.

ELEMENTS OF TOTAL DIRECT COMPENSATION

Total direct compensation is comprised of three elements: annual base salary, annual incentive and long-term incentives.

ANNUAL BASE SALARY

We pay base salaries to provide a fixed level of compensation that helps attract and retain executives. Base salary levels recognize an executive officer’s experience, skill and performance, with the goal of being market competitive based on the officer’s role and responsibilities within the organization. Adjustments may be made based on individual performance, inflation, pay relative to market and internal pay equity considerations.

ANNUAL INCENTIVE

The Compensation Committee administers our annual incentive compensation program under our Executive Incentive Compensation Plan, or EICP. The EICP is a cash incentive plan designed to motivate and reward our NEOs and other key employees for their contributions to strategic business goals and other factors that we believe drive our earnings and promote creation of stockholder value. In 2017, EICP bonus pool funding was entirely based on our financial performance, with each participant’s actual bonus award determined by achievement of the participant’s individual performance goals.

19

Financial Performance Goals. For 2017 EICP awards, the Compensation Committee approved financial metric performance goals based on consolidated operating income, consolidated free cash flow (defined as consolidated cash from operations less consolidated capital expenditures), order intake (including change orders) and operating margins on order intake, weighted as set forth below. McDermott established the 2017 financial performance goals with consideration of management’s internal forecast of 2017 financial results, with the exception of the order intake operating margin goals, which were established at an increase over the forecast 2017 results.

|

Weight |

Financial Metric Performance Goal |

Reason Metric Selected | Performance Level |

Business Result Goal ($/%) |

Funding Multiple | ||||

|

Operating Income | Reflects execution performance |

Threshold | 170M | 0.5x | ||||

| Target | 227M | 1.0x | |||||||

| Maximum | 284M | 2.0x | |||||||

|

Free Cash Flow | Prioritizes liquidity needs | Threshold | (62)M | 0.5x | ||||

| Target | (50)M | 1.0x | |||||||

| Maximum | (37)M | 2.0x | |||||||

|

Order Intake | Forward-looking leading indicator to drive future performance |

Threshold | 2,417M | 0.5x | ||||

| Target | 3,222M | 1.0x | |||||||

| Maximum | 4,028M | 2.0x | |||||||

|

|

Order Intake Operating Margin |

Promotes pricing discipline on order intake |

Threshold | * | 0.5x | ||||

| Target | * | 1.0x | |||||||

| Maximum | * | 2.0x |

| * |

Due to the nature of our business, Order Intake Operating Margin Threshold, Target and Maximum business goals are competitively sensitive and therefore are not disclosed. |

McDermott’s actual performance against the stated goals determines the funding for each financial performance goal, with the weighted sum of each funding multiple determining the financial metric result.

2017 Financial Performance Results Under the EICP. McDermott’s actual 2017 financial performance results against the stated performance goals under the EICP were as follows:

| Financial Metric Performance Goal | Actual Result ($/%) |

Funding Multiple |

Weight | Weighted Funding Multiple | ||||

| Operating Income | 324.2M | 2.000x | 25% | 0.500x | ||||

| Free Cash Flow | 16.9M | 2.000x | 25% | 0.500x | ||||

| Order Intake | 2,564.4M | 0.592x | 30% | 0.178x | ||||

| Order Intake Operating Margin | * | 2.000x | 20% | 0.400x | ||||

| Total EICP Bonus Pool Funding Multiple | 1.578x |

| * |

Due to the nature of our business, Order Intake Operating Margin results are competitively sensitive and therefore are not disclosed. |

Accordingly, each NEO was eligible to earn 1.578x of his target EICP award, subject to modification by the Compensation Committee, based on his achievement of individual performance goals.

Individual Performance Goals. Following the determination of the EICP bonus pool funding multiple, an individual participant’s award was determined based on the achievement of the participant’s individual performance goals. In no event could any NEO’s annual bonus exceed two times his or her target EICP award opportunity. The Compensation Committee had the discretion to reduce the amount of payout to any participant, even if performance goals were achieved.

20

LONG-TERM INCENTIVES

The Compensation Committee believes that the interests of our stockholders are best served when a significant percentage of executive compensation is comprised of equity that appreciates in value contingent on increases in the value of our common stock and other performance measures that reflect improvements in McDermott’s business fundamentals. Therefore, LTI compensation represents the single largest element of our NEOs’ total direct compensation. The Compensation Committee maintained the performance-based component of LTI at 50% in 2017, and allocated LTI compensation to executive officers, including the NEOs, as follows:

| Performance Units | Restricted Stock Units | |

| 50% | 50% |

Performance Units. Performance units are intended to align the NEOs’ interests with those of our stockholders, with a focus on long-term results. The performance units awarded in 2017 are structured to be paid out, if at all, in shares of McDermott common stock, cash equal to the fair market value of the shares otherwise deliverable, or any combination thereof, at the sole discretion of the Compensation Committee, at the end of a three-year performance period, to the extent the applicable performance goals are met. Relative return on average invested capital, or ROAIC, was used as the performance metric for the performance units granted in 2017, as the Compensation Committee believed that this metric tied specifically to our strategy of appropriately investing capital to grow the business. The number of performance units earned is determined based on both (1) our average ROAIC, and (2) our relative ROAIC improvement as compared to a competitor peer group comprised of both domestic and international peers, in each case over the three-year performance period. Based on this performance, up to 200% of a participant’s target award may be earned, with earned awards between the amounts shown calculated by linear interpolation. We compute McDermott’s ROAIC improvement by subtracting McDermott’s 2016 ROAIC from the three-year performance period average ROAIC. Similar calculations are done for each member of the competitor peer group, following which the median competitor peer group ROAIC improvement is calculated. The amount by which McDermott’s ROAIC improvement exceeds the competitor peer group median ROAIC improvement determines whether the threshold, target or maximum earned award is achieved.

| MDR 3-Year Average ROAIC | < 6% | ≥ 6% and < 10% | ≥ 10% | |||||

| Performance Level | Amount by which MDR ROAIC Improvement Exceeds Competitor Peer Group Median ROAIC Improvement |

Earned Award |

Earned Award |

Earned Award | ||||

| Maximum | ≥ 6% | 50% | 200% | 200% | ||||

| Target | 2% | 50% | 100% | 100% | ||||

| Threshold | 0% | 50% | 50% | 50% | ||||

| < 0% | 0% | 0% | 50% |

Restricted Stock Units. Restricted stock units, or RSUs, are intended to promote the retention of employees, including the NEOs. The RSUs granted in 2017 generally vest in one-third increments on the first, second and third anniversaries of the grant date. The RSUs may be paid out in shares of McDermott common stock, cash equal to the fair market value of the shares otherwise deliverable, or any combination thereof, at the sole discretion of the Compensation Committee.

2017 NEO Compensation

For 2017 NEO compensation, the Compensation Committee provided:

| ● |

Average annual base salary increases of approximately 6.4% to further align the NEOs’ annual base salaries with market range and, in certain instances, for internal pay equity considerations. |

| ● |

Increases in annual target bonus awards, resulting in an increase in each NEO’s performance-based compensation. As a result of McDermott’s 2017 financial performance, each NEO was eligible to earn 1.578x of his target EICP award, subject to adjustment by the Compensation Committee based on his achievement of individual performance goals. |

| ● |

Increases to the value of long-term incentives awarded to Messrs. Dickson and Spence, as compared to 2016, based on their individual performance and to further align the value of their LTI with market range. |

21

The compensation of each NEO is discussed in more detail on the following pages.

|

DAVID DICKSON McDermott Tenure: |

2017 TARGET TOTAL DIRECT COMPENSATION  |

|

Annual Base Salary – In 2017, Mr. Dickson received an increase in his annual base salary of approximately 6% to more closely align his annual base salary with market range. Annual Incentive – In February 2017, the Compensation Committee approved the following individual performance goals as a component of Mr. Dickson’s 2017 EICP award: ● Financial – Deliver financial performance in line with forecast, with a focus on continuing to build backlog, maintain capital discipline and implement a new capital structure

● Strategic – Position McDermott for long-term stability and growth during a period of difficult macro-environment through exploration and evaluation of both organic and inorganic strategic opportunities, including strategic asset acquisitions

● QHSES – Continue focus on quality, health, safety, environment and security, or QHSES, statistics, with increased focus on the cost of non-quality and further development of McDermott’s Taking the Lead initiative

● Relationships – Continue development of relationships with customers, potential partners, the investment community, governments and banks

● Internal Organization – Continue development of effectiveness and efficiency of internal organization, and continued enhancement of processes for talent management and succession planning

| |

| The Governance Committee’s assessment of these individual performance goals considered McDermott’s continued financial and operational performance improvements during 2017. Notably, McDermott’s 2017 financial results reflected revenues of $3.0 billion, operating income of $324.2 million and order intake (including change orders) of $2.6 billion, which resulted in year-end backlog of $3.9 billion. These results reflect continued, significant improvements since Mr. Dickson was elected as President and Chief Executive Officer in 2013, and were achieved despite the difficult, “lower for longer” oil and gas market. Additionally, Mr. Dickson positioned McDermott for significant growth through: the proposed combination with CB&I, which was announced in late 2017; the entry into MOUs with Saudi Aramco for (1) a land lease at the planned new maritime facility at Ras Al-Khair in Saudi Arabia and (2) the expansion and development of our physical and human capital within Saudi Arabia; and the acquisition and subsequent sale-leaseback of the deepwater pipelay and construction vessel Amazon. Under his oversight, McDermott’s QHSES performance has continued on a positive trend with peer leading safety statistics, increased focus on the cost of non-quality and the deployment of McDermott’s Taking the Lead initiative, designed to promote consistency in quality, safety and performance across the globe as well as operating in an environmentally conscious and socially responsible manner. During 2017, Mr. Dickson also continued improving relationships with customers, potential joint venture or consortium counterparties, the investment community, governments and banks. Finally, following significant executive management changes in prior years, in 2017 Mr. Dickson remained focused on building and optimizing the executive management team as required for achievement of McDermott’s operating strategy, while improving talent management and succession planning for key roles. In 2017, Mr. Dickson received an increase in his target EICP award from 100% to 110% of his annual base salary earned. In consideration of the Governance Committee’s assessment of Mr. Dickson’s achievement of his individual performance goals as discussed above, the Compensation Committee awarded Mr. Dickson a final EICP award of $1,694,575. Long-Term Incentive – Mr. Dickson received an increase in his 2017 target long-term incentive award, based on his individual performance and to bring his target long-term incentive award closer to the market median. | |

22

|

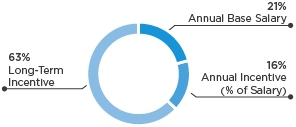

STUART SPENCE McDermott Tenure: |

2017 TARGET TOTAL DIRECT COMPENSATION

|

|

Annual Base Salary – In 2017, Mr. Spence received an increase in his annual base salary of approximately 7% to more closely align his annual base salary with market range. Annual Incentive – In 2017, Mr. Spence received an increase in his target EICP award from 70% to 75% of his annual base salary earned. Based on the Compensation Committee’s and Mr. Dickson’s assessment of Mr. Spence’s achievement of his individual performance goals, the Compensation Committee awarded Mr. Spence a final EICP award of $652,552. Long-Term Incentive – Mr. Spence received an increase in his 2017 target long-term incentive award, based on his individual performance and to bring his target long-term incentive award closer to the market median. | |

|

LINH AUSTIN McDermott Tenure: |

2017 TARGET TOTAL DIRECT COMPENSATION

|

|

Annual Base Salary – In 2017, Mr. Austin received an increase in his annual base salary of approximately 8% to more closely align his annual base salary with market range and for internal pay equity considerations. Annual Incentive – In 2017, Mr. Austin received an increase in his target EICP award from 50% to 60% of his annual base salary earned. Based on the Compensation Committee’s and Mr. Dickson’s assessment of Mr. Austin’s achievement of his individual performance goals, the Compensation Committee awarded Mr. Austin a final EICP award of $335,226. Long-Term Incentive – The Compensation Committee maintained consistency in Mr. Austin’s 2017 target long-term incentive award as compared to 2016. | |

23

|

BRIAN McLAUGHLIN McDermott Tenure: |

2017 TARGET TOTAL DIRECT COMPENSATION  |

|

Annual Base Salary – In 2017, Mr. McLaughlin received an increase in his annual base salary of approximately 7% to more closely align his annual base salary with market range and for internal pay equity considerations. Annual Incentive – In 2017, Mr. McLaughlin received an increase in his target EICP award from 50% to 60% of his annual base salary earned. Based on the Compensation Committee’s and Mr. Dickson’s assessment of Mr. McLaughlin’s achievement of his individual performance goals, the Compensation Committee awarded Mr. McLaughlin a final EICP award of $342,150. Long-Term Incentive – The Compensation Committee maintained consistency in Mr. McLaughlin’s 2017 target long-term incentive award as compared to 2016. | |

|

SCOTT MUNRO McDermott Tenure: |

2017 TARGET TOTAL DIRECT COMPENSATION  |

|

Annual Base Salary – In 2017, Mr. Munro received an increase in his annual base salary of approximately 8% to more closely align his annual base salary with market range and for internal pay equity considerations. Annual Incentive – In 2017, Mr. Munro received an increase in his target EICP award from 50% to 60% of his annual base salary earned. Based on the Compensation Committee’s and Mr. Dickson’s assessment of Mr. Munro’s achievement of his individual performance goals, the Compensation Committee awarded Mr. Munro a final EICP award of $315,699. Long-Term Incentive – The Compensation Committee maintained consistency in Mr. Munro’s 2017 target long-term incentive award as compared to 2016. | |

LIANE HINRICHS

Ms. Hinrichs served as McDermott’s Senior Vice President, General Counsel and Corporate Secretary until August 13, 2017, following which she served as Vice President, Legal, until her retirement in December 2017. Ms. Hinrichs’ 2017 target direct compensation was comprised of an annual base salary of $490,000, annual incentive target award of 70% of annual base salary earned in 2017 and long-term incentive awards with a target value of $1,000,000.

In connection with Ms. Hinrichs’ retirement, we entered into a separation agreement with Ms. Hinrichs providing for various compensation-related benefits in exchange for, among other things, her agreement to comply with several restrictive covenants. Under that separation agreement, Ms. Hinrichs received: (1) a lump-sum cash payment in the amount of $1,666,000; (2) an amount of 2017 bonus under the EICP based on the higher of (i) Ms. Hinrichs’ target EICP award for 2017 and (ii) the EICP bonus pool funding multiple times Ms. Hinrichs’ target EICP award for 2017; (3) contribution to the McDermott International, Inc. Director and Executive Deferred Compensation Plan in respect of 2017 in the amount of $44,412; (4) payment of an amount to fund twelve months of continuing health insurance coverage under

24

the Consolidated Omnibus Budget Reconciliation Act; (5) payment in an amount equal to $15,000, which represented the cost of executive-level financial planning; (6) accrued but unutilized vacation pay; and (7) payment of Ms. Hinrichs’ reasonable legal fees incurred in connection with the negotiation and execution of the separation agreement.

Additionally, Ms. Hinrichs received the following relating to her outstanding equity awards under the 2014 LTIP and the 2016 LTIP: (1) each then outstanding portion of her March 5, 2015 RSU award, February 26, 2016 RSU award and February 28, 2017 RSU award which would, absent her retirement, have remained outstanding and continued to vest would, subject to certain conditions, vest and be settled on the first to occur of (i) the date such award would otherwise be settled in accordance with the terms of the 2014 LTIP or 2016 LTIP, as applicable, and the applicable grant agreement as if Ms. Hinrichs’ employment had continued through March 15, 2020, and (ii) March 15, 2018; (2) each then outstanding portion of her March 5, 2015 performance units award, February 26, 2016 performance units award and February 28, 2017 performance units award, which would, absent her retirement, have remained outstanding and continued to vest would, subject to certain conditions, vest and be settled in accordance with the terms of the 2014 LTIP or 2016 LTIP, as applicable, and the applicable grant agreement (including the corporate performance conditions that determine the amount, if any, of such award that will become vested and payable) as if her employment had continued through March 15, 2020. Any vested stock options awarded to Ms. Hinrichs under the McDermott International, Inc. 2009 Long-Term Incentive Plan will remain exercisable until the stated maximum expiration date in the applicable grant agreement, notwithstanding any provision providing for earlier termination in the event of termination of employment.

2017 Other Compensation Elements

PERQUISITES

In 2017 our Compensation Committee continued its approach with respect to perquisites started in 2016, and provided for financial planning services and an executive physical to be reimbursed to the participant or paid directly to the participant’s provider of choice, in a combined amount not to exceed $20,000, rather than providing an allowance to be used for a company-required physical and any other purpose determined by the participant, as in prior years. No other perquisites were available to the participants in the perquisite program, with the exception of any company-required spousal travel for (1) the Chief Executive Officer, and (2) the remaining participants, including our NEOs, as approved by the Chief Executive Officer. There were no reimbursements to any perquisite program participants for company-required spousal travel in 2017.