Attached files

| file | filename |

|---|---|

| 10-K - FORM 10-K - CNB FINANCIAL CORP/PA | d506004d10k.htm |

| EX-31.2 - EX-31.2 - CNB FINANCIAL CORP/PA | d506004dex312.htm |

| EX-21 - EX-21 - CNB FINANCIAL CORP/PA | d506004dex21.htm |

| EX-32.2 - EX-32.2 - CNB FINANCIAL CORP/PA | d506004dex322.htm |

| EX-31.1 - EX-31.1 - CNB FINANCIAL CORP/PA | d506004dex311.htm |

| EX-32.1 - EX-32.1 - CNB FINANCIAL CORP/PA | d506004dex321.htm |

| EX-23.1 - EX-23.1 - CNB FINANCIAL CORP/PA | d506004dex231.htm |

Exhibit 99.1

2017

ANNUAL REPORT

“When we were looking at putting up a new building or adding In June 2017, CNB Bank hosted its sixth annual charity golf tournament and significant equipment, ERIEBANK has always been our partner in raised $23,800 to benefit the local American Cancer Society (ACS) chapter. The helping us expand.” money raised was used to purchase a vehicle, for the second year in a row and

- Bill Witkowski, Owner of Port Erie Plastics was donated to the ACS Road to Recovery program. The vehicle will provide transportation to and from treatment for people with cancer who do not have a ride or are unable to drive themselves.

Over the past six years the CNB charity golf tournament has raised $130,350 for the ACS, which was used to support programs such as the Wig Program, Hope Lodge, and Road to Recovery.

to co -your workers customers, and community, every time.

Employee experience is a top priority for CNB and they utilize a reward and recognition program that enables employees to recognize their co-workers for exceptional customer service or going above and beyond for one other. In a social media style news feed, employees can post comments and send one another points for a job well done.

CNB acknowledges that happy employees make happy customers and incentivizes its staff to award these points to one another. The points can then be redeemed for gift cards, merchandise, or experiences, such as golf with the President, or donut delivery for the team.

Each month an exceptional experience is chosen by the market Presidents and that employee is awarded with an additional prize.

TABLE OF

CONTENTS

Message to the Shareholders 4-5 Consolidated Financial Highlights 6-7 Board of Directors and Executive Management 8 Shareholder Information 9 CNB Bank 2017 Highlights 10-11 ERIEBANK 2017 Highlights 12-13 FCBank 2017 Highlights 14 BankOnBuffalo 2017 Highlights 15

2017 ANNUAL REPORT HIGHLIGHTS 3

MESSAGE TO OUR SHAREHOLDERS

To Our Shareholders, Customers, Employees & Friends:

Change, challenge and opportunity were at the forefront as we entered 2017. The United States was in the midst of a political upheaval it hadn’t seen in recent history, if ever. The banking community, as well as the overall business world, was in very uncertain times. Eventually, we saw signs of regulatory relief through the very fact that the pace of new regulations virtually came to a halt. This slowdown was much needed by both the industry and our customers. It was time to assess whether the new rules and regulations that have bombarded Financial Institutions on behalf of customers are really having the effect that was intended. This evaluation process will result in some much-needed changes and adjustments to better serve the consumers of financial products. Later in the year, tax reform came. The boost that this new law put into every household and business will provide for additional opportunities, at least in the short run. As the year came to a close, 2017 was a year of very positive change for both employers and employees alike.

CNB’s primary focus has been on our customer’s experience with services and delivery options. We have worked hard to differentiate our offerings as well as to provide newer products such as online commercial treasury services, mobile access and new card technology, to name a few. Then there are the future payment technologies such as person to person (P2P), business to business (B2B), person to business (P2B) and business to person (B2P). These services will continually take more and more cash out of the payment system thus making our efforts against cybercrime more critical than ever. CNB has worked hard to solidify its cyber awareness. We have partnered with various experts to safeguard and monitor our e-commerce activities both internally and externally. Finally, as we consider customer experience, the evolution of delivery channels continues. Our offices have changed from traditional teller lines to universal associates who are trained to handle most customer needs efficiently at any of our locations. More and more optionality appears within our online solutions to allow customers to bank when they want, in the way they want.

Another focus laid out in our strategic plan has included leadership in our communities. CNB strongly believes in fostering an environment of leadership. Our team is encouraged to dedicate time to community organizations that are important to them. It is our mission to provide leadership, time and resources to causes that enhance our communities. A clear example of this is our financial commitment to the Erie Downtown Development Corporation through ERIEBANK. In addition, members of our team will participate in various aspects of this entity’s revitalization of downtown Erie to include being a director. It is an important aspect of our culture to aid our communities and assist them in providing better quality of life for all.

Our success exists within our team. A renewed approach to our team members began several years ago. Today, everyone at CNB has more benefit options available to them than ever before. Our starting wages increased at the beginning of 2018 again, for the third time in five years. More paid time off has been provided to all employees. Consistent, appropriate training is made available to every associate, every year. A group of our newest employees were asked to evaluate our benefits package to determine what, if anything, should be changed. Student loan debt was raised as an item that is hindering the ability of many to advance their lifestyle as the cost of a college education continues to soar out of control. As a result, a program is now being offered to help alleviate some of these mounting pressures. One of the biggest keys to our success has been the art of collaboration. Every team member has a voice in what we do for our customers. Together we make decisions to more effectively service our communities. This allows CNB to not only make decisions more quickly but to implement and ultimately get solutions to market faster as everyone is part of the process and each become change agents, not just task masters.

4 CNB FINANCIAL CORPORATION

The last strategic plan had five pillars of success, as was laid out in the shareholder letter for 2016’s annual report. This year, the focus is more concentrated on three key principles:

1. Be the source of exceptional experiences

2. Foster an environment of leadership

3. Position for long-term growth

I briefly touched on the first two elements which we believe tie into the third. Along with successful communities and valued team members, we have vibrant markets to provide for long-term organic growth opportunities. Buffalo, Cleveland, Columbus and Erie are all markets of growth. We’ve only just begun development of our franchise in these cities, with the exception of Erie, where we are celebrating twelve years and still going strong. Using our business model of four community banks working together, CNB has a sound organic opportunity that is moving in the right direction. These three principles provide the Corporation with the ability to produce significant financial rewards. The 2017 annual report provides you with the result of solid earnings and growth over another year. A few highlights are organic loan growth of 15%, ROE of 11.23% and EPS of $1.77. Both the ROE and EPS measures exclude the adjustment for the new tax law.

I would like to recognize and thank two board members who have recently retired, Bill Falger and Jim Ryan. Bill was the President & CEO for CNB and personally provided me with insight and a vision that helped move the Corporation forward. He has also provided much knowledge and experience as a member of the Board for the past eight years since his retirement from the Bank. Jim has been an inspiration and ambassador of the growth we’ve experienced over the past 19 years. His optimism and energy will be missed inside the boardroom. Jim’s drive was key to our BankOnBuffalo initiative. Gentleman, thank you for all your contributions and best of luck to you as you move toward your next adventures.

In closing, I want to extend a sincere thank you to our customers for doing business with us and the confidence you have in our products, services, and employees; to our first-class employees for their dedication and commitment to our customers and the financial services industry; and to our shareholders for your ownership and support of our strategic vision and execution.

Joseph B. Bower, Jr.

President and Chief Executive Officer

2017 ANNUAL REPORT HIGHLIGHTS 5

CONSOLIDATED FINANCIAL

HIGHLIGHTS

(dollars in thousands, except per share data)

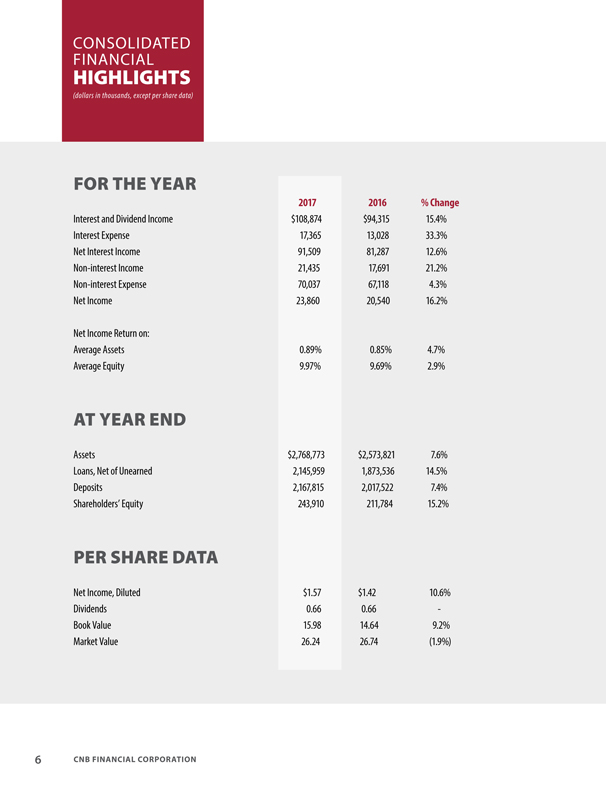

FOR THE YEAR

2017 2016 % Change

Interest and Dividend Income $108,874 $94,315 15.4% Interest Expense 17,365 13,028 33.3% Net Interest Income 91,509 81,287 12.6% Non-interest Income 21,435 17,691 21.2% Non-interest Expense 70,037 67,118 4.3% Net Income 23,860 20,540 16.2%

Net Income Return on:

Average Assets 0.89% 0.85% 4.7% Average Equity 9.97% 9.69% 2.9%

AT YEAR END

Assets $2,768,773 $2,573,821 7.6% Loans, Net of Unearned 2,145,959 1,873,536 14.5% Deposits 2,167,815 2,017,522 7.4% Shareholders’ Equity 243,910 211,784 15.2%

PER SHARE DATA

Net Income, Diluted $1.57 $1.42 10.6% Dividends 0.66 0.66 -Book Value 15.98 14.64 9.2% Market Value 26.24 26.74 (1.9%)

6 CNB FINANCIAL CORPORATION

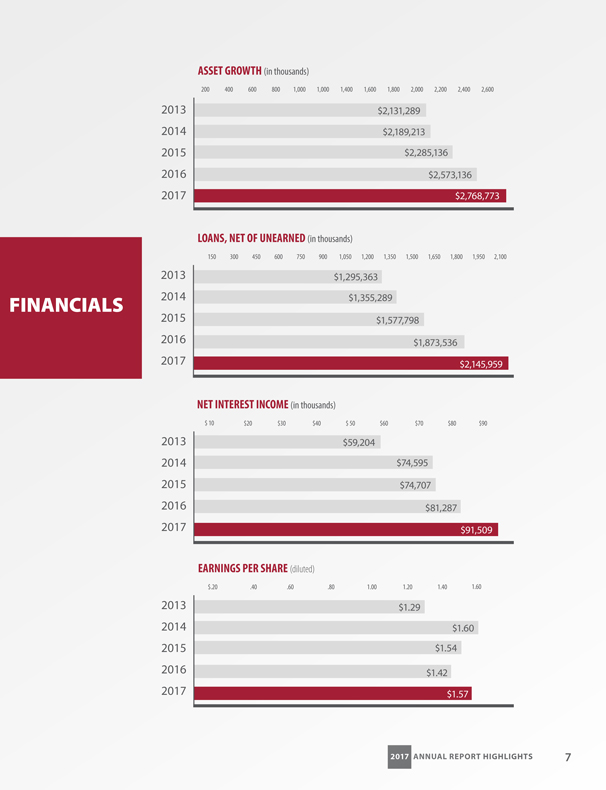

ASSET GROWTH (in thousands)

200 400 600 800 1,000 1,000 1,400 1,600 1,800 2,000 2,200 2,400 2,600

2013 $2,131,289 2014 $2,189,213 2015 $2,285,136 2016 $2,573,136 2017 $2,768,773

LOANS, NET OF UNEARNED (in thousands)

150 300 450 600 750 900 1,050 1,200 1,350 1,500 1,650 1,800 1,950 2,100

2013 $1,295,363

FINANCIALS 2014 $1,355,289

2015 $1,577,798

2016 $1,873,536

2017 $2,145,959

NET INTEREST INCOME (in thousands)

$ 10 $20 $30 $40 $ 50 $60 $70 $80 $90

2013 $59,204

2014 $74,595 2015 $74,707 2016 $81,287 2017 $91,509

EARNINGS PER SHARE (diluted)

$.20 .40 .60 .80 1.00 1.20 1.40 1.60

2013 $1.29

2014 $1.60 2015 $1.54 2016 $1.42 2017

$1.57

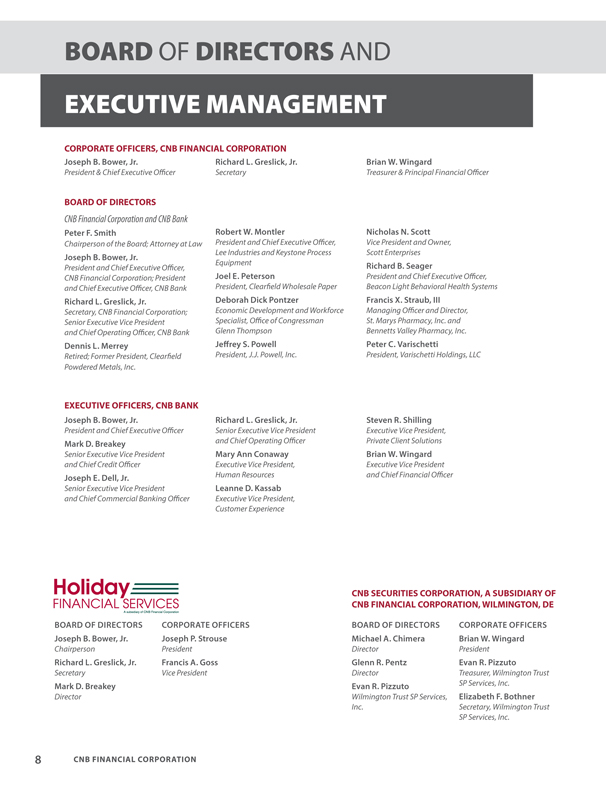

BOARD OF DIRECTORS AND EXECUTIVE MANAGEMENT

CORPORATE OFFICERS, CNB FINANCIAL CORPORATION

Joseph B. Bower, Jr. Richard L. Greslick, Jr. Brian W. Wingard

President & Chief Executive Officer Secretary Treasurer & Principal Financial Officer

BOARD OF DIRECTORS

CNB Financial Corporation and CNB Bank

Peter F. Smith Robert W. Montler Nicholas N. Scott

Chairperson of the Board; Attorney at Law President and Chief Executive Officer, Vice President and Owner, Lee Industries and Keystone Process Scott Enterprises

Joseph B. Bower, Jr.

Equipment Richard B. Seager

President and Chief Executive Officer,

CNB Financial Corporation; President Joel E. Peterson President and Chief Executive Officer, and Chief Executive Officer, CNB Bank President, Clearfield Wholesale Paper Beacon Light Behavioral Health Systems

Richard L. Greslick, Jr. Deborah Dick Pontzer Francis X. Straub, III

Secretary, CNB Financial Corporation; Economic Development and Workforce Managing Officer and Director, Senior Executive Vice President Specialist, Office of Congressman St. Marys Pharmacy, Inc. and and Chief Operating Officer, CNB Bank Glenn Thompson Bennetts Valley Pharmacy, Inc.

Dennis L. Merrey Jeffrey S. Powell Peter C. Varischetti

Retired; Former President, Clearfield President, J.J. Powell, Inc. President, Varischetti Holdings, LLC Powdered Metals, Inc.

EXECUTIVE OFFICERS, CNB BANK

Joseph B. Bower, Jr. Richard L. Greslick, Jr. Steven R. Shilling

President and Chief Executive Officer Senior Executive Vice President Executive Vice President, Mark D. Breakey and Chief Operating Officer Private Client Solutions Senior Executive Vice President Mary Ann Conaway Brian W. Wingard and Chief Credit Officer Executive Vice President, Executive Vice President Joseph E. Dell, Jr. Human Resources and Chief Financial Officer Senior Executive Vice President Leanne D. Kassab and Chief Commercial Banking Officer Executive Vice President, Customer Experience

CNB SECURITIES CORPORATION, A SUBSIDIARY OF CNB FINANCIAL CORPORATION, WILMINGTON, DE

BOARD OF DIRECTORS CORPORATE OFFICERS BOARD OF DIRECTORS CORPORATE OFFICERS Joseph B. Bower, Jr. Joseph P. Strouse Michael A. Chimera Brian W. Wingard

Chairperson President Director President

Richard L. Greslick, Jr. Francis A. Goss Glenn R. Pentz Evan R. Pizzuto

Secretary Vice President Director Treasurer, Wilmington Trust

Mark D. Breakey Evan R. Pizzuto SP Services, Inc. Director Wilmington Trust SP Services, Elizabeth F. Bothner Inc. Secretary, Wilmington Trust SP Services, Inc.

8 CNB FINANCIAL CORPORATION

SHAREHOLDER

INFORMATION

ANNUAL MEETING QUARTERLY SHARE DATA

The Annual Meeting of the Shareholders of CNB Financial Corporation For information regarding the Corporation’s quarterly share data, will be held Tuesday, April 17, 2018 at 2:00 p.m. at the Corporation’s please refer to Item 5 in the 2017 Form 10-K. headquarters in Clearfield, PA. MARKET MAKERS

CORPORATE ADDRESS The following firm has chosen to make a market in the stock of the CNB Financial Corporation Corporation. Inquiries concerning their services should be directed to:

31 S. Second Street

Boenning & Scattergood, Inc. P.O. Box 42 1700 Market Street, Ste 1420 Clearfield, PA 16830 Philadelphia, PA 19103 (800) 492-3221 (800) 842-8928

STOCK TRANSFER AGENT & REGISTRAR

American Stock Transfer & Trust Company, LLC 6201 15th Avenue Brooklyn, NY 11219 (800) 937-5449

FORM 10-K

Shareholders may obtain a copy of the Annual Report to the Securities and Exchange Commission on Form 10-K by writing to: CNB Financial Corporation

31 S. Second Street P.O. Box 42 Clearfield, PA 16830 ATTN: Shareholder Relations

2017 ANNUAL REPORT HIGHLIGHTS 9

CNB BANK 2017 HIGHLIGHTS

On February 24, 2017, CNB expanded its market presence in Central Pennsyl-vania with a full-service office in Blair County. The new community office is conveniently located in Duncansville, off Plank Road, near Convention Center Boulevard. The facility signifies a multi-million dollar investment by CNB and features a customer and community focus throughout the branch that includes a local based team, images of the Blair County region, an Inter-net kiosk, coffee station, digital displays, open transaction areas with cash dispensers, a self-service coin counter, and a new ATM.

Nine local subcontractors, which together employ 135 individuals, worked on construction of the building for approximately eight months, from July 2016 through February 2017.

Interior of the new community office in Blair County.

In June, 2017 twenty employees successfully graduated as the inaugural class of the CNB Leadership Institute. Given the growth the Bank has been experiencing, and the additional leadership depth that was needed across the entire organization, in 2015 CNB’s senior leadership team felt that it was the right time to enhance the importance of management succession planning and select the inaugural class from within the organization.

CNB Leadership Institute Graduates

The six-session program spanned over the course of 18 months with each session lasting three days. The curriculum focuses on topics such as servant leadership, building self-awareness and individual development through the DiSC personal assessment tool, emotional intelligence, leading and working in high performing teams, effective presentation skills, project management, managing change and conflict, and effective feedback and coaching skills.

The program design also places a focus on leveraging senior leadership to support and reinforce key concepts, creates a long term focus on continuous learning and personal development, and uses simulations and collaborative activities to enhance competencies and reinforce CNB’s values and vision.

A subsidiary of CNB Financial Corporation, CNB Bank is a regional independent community bank with office locations in North Central and Nortwestern Pennsylvania, Northeast Ohio, and Buffalo, New York, with over 500 employees who make customer service more responsive and reliable. For 153 years, the Bank has strived to be more customer-driven than its competitors and to build long-term customer relationships by being reliable and competitively priced.

10 CNB FINANCIAL CORPORATION

CNB BANK SENIOR MANAGEMENT AND OFFICERS

Gregory M. Dixon Vickie L. Baker Tyler A. Kirkwood

Market Executive Assistant Vice President, Market Manager Commercial Banking Officer

Jeffrey W. Alabran James C. Davidson Jacklyn M. Lantzy

Senior Vice President, Commercial Banking Assistant Vice President, Private Banking Community Office Manager, Blair County

Christopher L. Stott Kay E. DellAntonio Lisa A. Marchiori

Senior Vice President, Director of Private Banking Assistant Vice President, Commercial Banking Community Office Manager, DuBois

Craig C. Ball Denise J. Greene James V. Masone

Vice President, Wealth & Asset Management Assistant Vice President, Private Banking Assistant Commercial Banking Officer

Timothy D. Clapper Heather Koptchak Alesia N. McElwee

Vice President, Commercial Banking Assistant Vice President, Market Manager Community Office Manager, Clearfield Main

Michael E. Haines Katie A. Penoyer Dustin A. Minarchick

Vice President, Commercial Banking Assistant Vice President, Treasury Services Commercial Banking Officer

Eric A. Johnson Heather D. Serafini Andrew V. Nedzinski

Vice President, Wealth & Asset Management Assistant Vice President, Private Banking Commercial Banking Officer

R. Michael Love Katie M. Whysong Nadine J. Rodgers

Vice President, Wealth & Asset Management Assistant Vice President, Commercial Banking Banking Officer

Glenn R. Pentz Judy L. Barry Douglas M. Shaffer

Vice President, Wealth & Asset Management Banking Officer, Portfolio Manager Community Office Manager, Punxsutawney

C. Brett Stewart Lori L. Curtis Lori D. Shimel

Vice President, Commercial Banking Community Office Manager, Philipsburg Plaza Community Office Manager, Houtzdale

Calvin R. Thomas, Jr. Danielle D. Daniels Dorthy M. Turner

Vice President, Wealth & Asset Management Commercial Banking Officer Wealth & Asset Management Officer

Joseph H. Yaros Autumn F. Farley Kevin C. Wain

Vice President, Commercial Banking Commercial Banking Officer Community Office Assistant Manager, Mary A. Baker Caroline Henry Clearfield Industrial Park Road Assistant Vice President, Market Manager Community Office Manager, Karthaus and Kylertown Gregory R. Williams Banking Officer

ADMINISTRATIVE SERVICES

Cory K. Johnston Rebecca A. Coleman Erin L. Brimmeier

Vice President, Controller Assistant Vice President, Operations Operations Officer

Julie L. Martin Andrew D. Franson Michael A. Chimera

Vice President, Commercial Services Assistant Vice President, Wealth & Asset Operations Assistant Controller

Robin W. Mink Officer Thomas W. Grice

Vice President, Senior Treasury Product Kylie L. Graham IT Branch/Project Manager, Officer and Sales Team Leader Assistant Vice President, Compliance Matthew J. Mills

Eileen F. Ryan Carla M. Higgins IT Manager, Officer Vice President, Mortgage Lending Assistant Vice President, Quality Assurance Manager Brenda L. Terry

Ruth Anne Ryan-Catalano Shannon L. Irwin Banking Officer Vice President, Retail Banking Assistant Vice President, Human Resources Sherry Wallace

John H. Sette Paul A. McDermott Mortgage Banking Officer Vice President, Information Technology Assistant Vice President, Facilities Jessica A. Zupich

Carolyn B. Smeal Amy B. Potter Enterprise Support Officer Vice President, Administration Assistant Vice President, Marketing Joel M. Zupich

Susan M. Warrick B.J. Sterndale Credit Officer Vice President, Operations Assistant Vice President, Training

2017 ANNUAL REPORT HIGHLIGHTS 11

ERIEBANK 2017 HIGHLIGHTS

2017 was a year of grand announcements for ERIEBANK. They kicked everything off with a new community office in Ashtabula, Ohio, in February 2017. The new 4,200 square foot facility represents a significant expansion of the commercial banking service ERIEBANK first began offering to Ashtabula businesses in 2014. The new facility signifie a multi-million dollar investment by ERIEBANK. Ten local subcontractors, which togethe employ more than 100 individuals, worked on construction of the building for approxi mately eight months, from May 2016 through January 2017.

In March, 2017, the formation of an Ohio Advisory Board and the appointment o seven inaugural members was announced. The board provides leadership and guidance as ERIEBANK continues to develop its presence in the northeast Ohio region. Ribbon cutting ceremony at new community office in Ashtabula, Ohio.

As a compliment to ERIEBANK’s sponsorship of 8 Great Tuesdays, a free concert series held annually at the Liberty Park Amphitheater in Erie and organized by the Erie Western PA Port Authority, a new initiative named 8 Great Charities was launched in July, 2017. The contest benefiting local non-profit organizations featured a nomination phase, open to the public via the Bank’s Facebook page, and resulted in eight different organizations receiving a total of $8,000 in donations.

In November, 2017 ERIEBANK announced its investment of $2.5 million in the Erie Downtown Equity Fund in support of the Erie Downtown Development Corporation (EDDC). The EDDC is a privately funded non-profit organization led by business, university and community leaders seeking to drive economic growth in Erie’s downtown through real estate development.

8 Great Charities Finalists

ERIEBANK was the first financial services institution to announce its commitment to fund the collaborative effort. Karl Sanchack, president and CEO of the Erie Innovation District, emphasized the importance of ERIEBANK’s announcement. “The EDDC needs multi-entity engagement to achieve its goals, and adding the financial expertise of ERIEBANK to this collaboration is simply fantastic. It’s a signpost to a successful future.”

Ending the year with one last major announcement and further solidifying ERIEBANK’s commitment to the community, ERIEBANK and the Greater Regional Erie Athletic Team Training Inc. (G.R.E.A.T.T.) together announced that, through a partnership, the former Family First Sports Park will soon begin a $9.1 million renovation of the facility and be named ERIEBANK Sports Park.

ERIEBANK is supporting the park through financing as well as donations of funds and expertise to move the project forward, committing to a strategic partnership to strengthen the park’s success for years to come.

David Zimmer, ERIEBANK President announcing the naming of ERIEBANK Sports Park.

Headquartered in Erie, Pennsylvania, ERIEBANK is a division of CNB Bank. Presently, there are eight full service offices in Pennsylvania, which house its commercial, retail and private banking divisions, and three full service offices in Ohio. Five of those offices are in Erie, two in Meadville, and one in Warren, Penn-sylvania. The three offices in Ohio are located in Mentor and Ashtabula. In addition, ERIEBANK Investment Advisors provides wealth and asset management services, retirement plans and other employee benefit plans.

12 CNB FINANCIAL CORPORATION

ERIEBANK SENIOR MANAGEMENT AND OFFICERS

David J. Zimmer Timothy J. Roberts Russell G. Daniels

President Vice President, Commercial Banking Retail Banking Officer/Community Office Assistant

Steven M. Cappellino Paul D. Sallie Manager, West 12th Street Senior Vice President, Vice President, Private Banking Erin L. Bednaro

Regional Manager, Crawford County John M. Schulze Community Office Manager, Interchange

William L. DeLuca, Jr. Vice President, Commercial Banking Robert P. Cannon

Senior Vice President, Commercial Banking William J. Vitron, Jr. Community Office Manager, Midland Andrew L. Meinhold Vice President, ERIEBANK Investment Advisors Kimberly L. Coleman Senior Vice President, Regional Manager, Lake County Thomas J. Walker Banking Officer, David P. Bogardus Vice President, Commercial Banking Commercial Loan Documentation Specialist Vice President, Commercial Banking J. Allen Weaver Tracie A. Harmon

Betsy C. Bort Vice President, Community Office Manager, Vernon Vice President, Commercial Banking Commercial Banking Team Leader Jaclyn R. Italiani Scott O. Calhoun Kelly S. Buck Community Office Manager, Downtown Vice President, Commercial Banking Assistant Vice President, Private Banking Barbara V. Keim

Timothy A. Flenner Chrystal M. Fairbanks Banking Officer, Portfolio Manager Vice President, Commercial Banking Assistant Vice President, Community Office Manager/ Brenda G. Shaffer Christine Hartog Private Banking, Ashtabula Community Office Manager, Harborcreek Vice President, Market Manager, Jessica A. Figoli Justin R. Singer

Community Office Manager, Mentor Assistant Vice President, Private Banking Commercial Banking Officer

Katie J. Jones Denise E. Gelofsack Helicia E. Sonney

Vice President, Market Manager Assistant Vice President, Portfolio Manager Community Office Manager, Asbury

Joshua P. Miller Allison M. Hodas Theresa L. Swanson

Vice President, ERIEBANK Investment Advisors Assistant Vice President, Commercial Banking Community Office Manager, Warren

Larry G. Morton, Jr. Bryan G. Kusich Mary J. Taormina

Vice President, ERIEBANK Investment Advisors Assistant Vice President, Commercial Banking Community Office Manager, Meadville

Gregory A. Noon Barbara A. Macks John R. VanTassel

Vice President, Commercial Banking Assistant Vice President, Treasury Services Officer

Benjamin V. Palazzo ERIEBANK Investment Advisors Abigail L. Williams

Vice President, Commercial Banking James R. Miale Community Office Manager, West 12th Street Assistant Vice President, Commercial Banking Debra A. Masone Community Office Assistant Manager, Meadville

ERIEBANK BOARD OF ADVISORS

Joseph B. Bower, Jr. Jane M. Earll Jerome T. Osborne, III

President and Chief Executive Officer, Esquire; Retired Pennsylvania State Senator President, JTO, Inc. CNB Financial Corporation, CNB Bank David K. Galey Thomas W. Reams

Mark D. Breakey Retired; Former Treasurer and Chief Financial Vice President, C. H. Reams & Associates, Inc. Senior Executive Vice President and Officer, Greenleaf Corporation Nick Scott, Jr.

Chief Credit Officer, CNB Bank Richard L. Greslick, Jr.

Vice President & Owner, Scott Enterprises Gary L. Clark Senior Executive Vice President James E. Spoden Chief Executive Officer, and Chief Operating Officer, CNB Bank; Esquire, MacDonald Illig Jones & Britton, LLP Reed Manufacturing Company Secretary, CNB Financial Corporation

David J. Zimmer Donald W. Damon Charles “Boo” Hagerty

Chairperson of the Board; President, ERIEBANK Retired; Former ERIEBANK Senior Vice President President, Hamot Health Foundation

Joseph E. Dell, Jr. Thomas M. Kennedy

Senior Executive Vice President President, Professional Development Associates, Inc. and Chief Commercial Banking Officer

ERIEBANK OHIO ADVISORY BOARD

Dr. Lundon Albrecht Bryce A. Heinbaugh Shawn Neece

Owner, Albrecht Family Dentistry; Managing Partner and Founder, Director, NMS Certified Public Accountants Dental Consultant, Coltene Whaledent IEN Risk Management Consultants Joseph T. Svete Jennifer Brown Richard J. Kessler President, Svete & McGee Company, LPA Economic Development Specialist, CT Consultants President, Society of Rehabilitation

Richard T. Flenner, Jr. Kevin D. Malecek

Retired; Former President, Lake National Bank Senior Development Officer, Lakeland Foundation and Lakeland Community College

2017 ANNUAL REPORT HIGHLIGHTS 13

The major announcement at FCBank in 2017 was the welcoming of Jenny Saunders as President. Jenny took over leadership of the FCBank team in October 2017. Jenny is a veteran banker with over 30 years of community banking experience.

FCBank, a division of CNB Bank, is headquartered in Worth-ington, Ohio with seven full service offices in the communities of Bucyrus, Shiloh, Cardington, Fredericktown, Worthington, Dublin, and Upper Arlington, plus one loan production office in Lancaster, Ohio. FCBank is driven by a strong focus on meeting the financial needs of businesses and individuals in a way only FCBank headquarters located in Worthington, Ohio. a community bank can deliver. FCBank offers commercial, retail, and private banking services, along with wealth and asset Jenny Saunders, FCBank President management services through FC Financial Services.

FCBANK SENIOR MANAGEMENT AND OFFICERS

Jenny L. Saunders Jack L. Trachtenberg Jared Butler

President Vice President, Private Banking Team Leader Senior Systems Adminstration Team Leader

Neal S. Clark Dean J. Vande Water Ashley N. Lutz

Senior Vice President, Commercial Banking Vice President, Commercial Banking Officer Donna M. Conley Commercial Real Estate Team Leader Michelle P. Muchow Vice President, Commercial Banking Leader William R. Diehl Executive Assistant, Banking Officer John G. Hock Assistant Vice President, Commercial Banking J. Ralph Parker Vice President, Commercial Banking Annette D. Lester Senior Credit Officer

Steven W. Howard Assistant Vice President , Travis M. Smith

Vice President, Community Office Manager, Cardington Commercial Banking Officer Wealth & Asset Management Team Leader Bernard J. McGuinness Elaine M. Wilson

Robert P. Linnabary Assistant Vice President, Business Development Community Office Manager, Fredericktown Vice President, Commercial Banking Jillian V. Price Christopher A. Winegardner

Linda K. Salters Assistant Vice President, Private Banking Community Office Manager, Worthington Vice President, Market Manager Sam P. Rawal Clara J. McClung Assistant Vice President, Private Banking Community Office Assistant Manager, Worthington

FCBANK BOARD OF ADVISORS

Joseph B. Bower, Jr. Richard L. Greslick, Jr. Jenny L. Saunders

President and Chief Executive Officer, Senior Executive Vice President & Chairperson of the Board, President, FCBank CNB Financial Corporation, CNB Bank Chief Operating Officer, CNB Bank; Sam Shim Mark D. Breakey Secretary, CNB Financial Corporation Board Member, Worthington City Schools Senior Executive Vice President & Lawrence A. Morrison Julie Young Chief Credit Officer, CNB Bank CPA and Partner, Kleshinski, Morrison & Morris, LLP Human Resources Attorney, JMY Law, LLC

Jennifer Carney Jason Pohl

Partner and Co-Founder, Partner and Co-Founder, Centric Consulting, LLC Carney Ranker Architects, Ltd.

14 CNB FINANCIAL CORPORATION

BankOnBuffalo, a division of CNB Bank, experienced major growth in 2017. The newest bank in the Buffalo area opened its first full-service office within the Electric Tower in downtown Buffalo on February 21, 2017.

Previously a loan production office, services now available include deposit accounts, private banking, real estate, commercial, industrial, residential and consumer loans and lines of credit, treasury services, online banking, mobile banking, merchant credit card processing, remote deposit and accounts receivable handling.

In April, 2017 the formation of a BankOnBuffalo Advisory Board and the appointment of eleven inaugural members was announced. The local Board will provide leader-

Ribbon Cutting ceremony at the Orchard Park

ship and guidance as BankOnBuffalo expands upon its initial entry into the Buffalo market community office that opened November 2, 2017. in serving the financial needs of the region’s small to middle market businesses.

November 2017 was a month of celebration. On November 2, 2017, the Bank expanded into Buffalo’s Southtowns by opening a full-service community office in Orchard Park. On November 16, 2017, a third branch location opened in Williamsville, New York.

BankOnBuffalo, a division of CNB Bank, is headquartered in Buffalo, New York with three full service offices in the communties of Buffalo, Orchard Park, and Williamsville. BankOnBuffalo is being developed by local people and businesses. This local decision-making will increase the level of service provided to the communities of Buffalo and bring growth to the entire region. BankOnBuffalo offers commercial, retail, and private banking services, along with wealth and asset management services through BankOnBuffalo Investment Advisors.

Interior of completely renovated Orchard Park community office.

BANK ON BUFFALO SENIOR MANAGEMENT AND OFFICERS

Martin T. Griffith Rosanne Faraci Annette A. Tomlin

President Vice President, Credit Administration Vice President, Regional Retail Banking Officer

Maria E. Barth Kathleen B. Kane David G. Hawker

Senior Vice President, Commercial Banking Vice President, Regional Retail Market Manager Assistant Vice President, Commercial Banking

David P. Paul Kelly A. Navagh Monica R. Neimeier

Senior Vice President, Wealth & Asset Management Vice President, Treasury Services Banking Officer, Portfolio Manager

Gregory G. Emminger Michael J. Noah

Vice President, Commercial Banking Vice President, Commercial Banking

BANK ON BUFFALO BOARD OF ADVISORS

Joseph B. Bower, Jr. Richard L. Greslick, Jr. Michael Newman

President and Chief Executive Officer, Senior Executive Vice President & Owner and Executive Vice President, NOCO, Inc. CNB Financial Corporation, CNB Bank Chief Operating Officer, CNB Bank; Secretary, Peter J. Romano, Jr.

Mark D. Breakey CNB Financial Corporation President and CEO, United Materials, LLC Senior Executive Vice President & Martin T. Griffith Stephen J. Schop Chief Credit Officer, CNB Bank Chairperson of the Board, Managing Partner, Schop, Powell & Associates Joseph E. Dell, Jr. President, BankOnBuffalo

Mark A. Tronconi

Senior Executive Vice President & Gerry Murak Partner at Tronconi, Segarra & Associates Chief Commercial Banking Officer, CNB Bank Principal and Founder, Murak & Associates, LLC; CEO and Board Chairman, SoPark Corporation; President, CEO, and Founder, Precision Scientific Instruments, Inc.

2017 ANNUAL REPORT HIGHLIGHTS 15

Each depositor insured to at least $250,000

Backed by the full faith and credit of the

United States FDIC government

Federal Deposit Insurance Corporation •www.fdic.gov

The common stock of the Corporation trades on the NASDAQ Global Select Market under the symbol CCNE.