Attached files

| file | filename |

|---|---|

| 8-K - 8-K - REVA Medical, Inc. | rva-8k_20180307.htm |

Exhibit 99.1

REVA MEDICAL REPORTS FOURTH QUARTER AND FULL YEAR 2017 FINANCIAL RESULTS

Demonstrates Early Commercial Progress of the Fantom Bioresorbable Scaffold

San Diego, California (Wednesday, March 7, 2017, PST) – REVA Medical, Inc. (ASX: RVA) (“REVA” or the “Company”), a leader in bioresorbable polymer technologies for vascular medical applications, today reported financial results for the fourth quarter and year ended December 31, 2017, demonstrating early progress in commercialization of the Fantom bioresorbable scaffold.

“During the fourth quarter of 2017 we continued our focus on commercialization of Fantom and rebuilding the bioresorbable scaffold market by educating physicians on the unique advantages of Fantom compared to first generation scaffolds,” stated Reggie Groves, Chief Executive Officer of REVA Medical. “We commenced sales of Fantom in July 2017 following CE Mark approval in April 2017. In the fourth quarter, we more than doubled the size of our customer base and saw a 3-fold increase in the number of customers reordering Fantom. Physicians continue to provide very positive feedback about Fantom’s performance.”

Fantom is a second-generation bioresorbable scaffold made from Tyrocore™, REVA’s proprietary bioresorbable polymer. Fantom offers differentiated features compared to first generation scaffolds including thinner profiles, improved ease-of-use, and full x-ray visibility. The Company released positive 12-month follow up data from its FANTOM II clinical trial in May 2017 and expects to release full two-year follow up data at the EuroPCR conference in May 2018.

In February 2018, the Company announced CE Mark and first implant of Fantom Encore, a third-generation scaffold, with a market-leading 95 micron strut profile in the 2.5 millimeter diameter. REVA will launch Fantom Encore in select centers while it secures CE Mark for the 3.0 and 3.5 millimeter diameter sizes. Full commercial launch is planned later this year.

Fourth Quarter 2017 Operating Results

The Company completed its second quarter of commercial sales of its Fantom bioresorbable scaffold (“BRS”) and reported total billings for shipped product of $98,000 with $28,000 of revenue recognized for the fourth quarter of 2017 compared to no billings or revenue for the same period in 2016. Shipped product included a combination of new customer orders and reorders from existing customers.

During the fourth quarter, we welcomed our first two sales managers to the commercial team. We have added three additional managers in the first quarter of 2018. The commercial team is focused on building product utilization and opening new accounts in Germany, Switzerland and Austria, which are the initial countries identified as part of REVA’s targeted launch. The Company plans to expand geographically as it moves into additional phases of launch.

R&D expenses were $2.6 million for the fourth quarter of 2017, a decrease of $1.4 million, or 35%, compared to $4.0 million for the same period in 2016. The decrease was due primarily to net decreases in material costs and testing services of $0.7 million and personnel costs of $0.6 million; both relate to our transition from a research-stage to a commercial-stage company.

Selling, general and administrative (SG&A) expenses were $2.8 million for the fourth quarter of 2017, an increase of $0.7 million, or 33%, compared to $2.1 million for the same period in 2016. The increase was due primarily to increases in personnel costs of $0.3 million, audit related fees of $0.2 million and sales and marketing expenses of $0.2 million. These increases are all related to initiation of commercial activity in 2017.

HEAD OFFICE: 5751 Copley Drive, San Diego, CA 92111 • +1 (858) 966-3000 • +1 (858) 966-3099 (FAX) • www.revamedical.com

AUSTRALIAN OFFICE: Suite 4, Level 14, 6 O’Connell Street, Sydney NSW 2000 • +61 2 9237 2800 • ARBN 146 505 777

REVA Medical, Inc.Page 2

Interest expense was $1.5 million for the fourth quarter of 2017, compared to $0.5 million for the same period in 2016. The increase is due to interest on both the convertible notes issued in November 2014 (“2014 Notes”) and May and June 2017 (“2017 Notes”) in the fourth quarter of 2017 as compared to interest on only the 2014 Notes in the fourth quarter of 2016.

Gain on change in fair values of convertible notes and warrant liability was $7.1 million for the fourth quarter of 2017, compared to a gain of $21.8 million for the same period in 2016. The gain/(loss) on change in fair values of convertible notes is impacted by the number of Notes outstanding for each period, as well as other factors that drive fair value, including the market trading price of our common stock.

The Company’s net income was $0.2 million for the fourth quarter of 2017, or $0.00 per share (basic) and a loss of $0.10 per share (diluted), compared to net income of $15.2 million, or $0.36 per share (basic) and a loss of $0.11 per share (diluted), for the same period in 2016.

Year-to-Date Financial Results

Commercial sales of the Fantom bioresorbable scaffold commenced in July 2017. The Company reported total billings for shipped product of $203,000 with $45,000 of revenue recognized for the year ended December 31, 2017 compared to no billings or revenue for 2016.

R&D expenses were $12.8 million for the year ended December 31, 2017, a decrease of $5.4 million, or 30%, compared to $18.2 million for 2016. The decrease was due primarily to a $1.7 million decrease in R&D materials, $1.3 million decrease in stock-based compensation, $1.2 million decrease in clinical costs, $0.6 million decrease in personnel costs and a $0.5 million decrease in testing and validation costs. The decreases in R&D materials and testing and validation costs were related to reduced activities in these areas as we transitioned from R&D to commercialization. The decreases in stock-based compensation and personnel costs were related to the reduction in force that occurred in the third quarter of 2017. The decrease in clinical costs was related to decreased activity in 2017 as enrollment of patients in the FANTOM II clinical trial was completed in March 2016.

SG&A expenses were $8.6 million for the year ended December 31, 2017, consistent with 2016. Although SG&A expenses in 2017 and 2016 were consistent, stock-based compensation decreased by $1.4 million in 2017, which was offset by increases of $0.5 million in personnel expenses, $0.4 million in sales and marketing expenses, $0.4 million in audit and tax expenses and $0.1 million in consulting expenses. The decrease in stock-based compensation and increase in personnel expenses was primarily related to executive retirements that occurred in the third quarter of 2017. The increase in sales and marketing expenses was related to the launch of Fantom in the second quarter of 2017. The increases in audit and tax expenses and consulting expenses were related to the accounting for the convertible notes issued in 2017 and for items related to commercialization.

Interest expense was $6.7 million for the year ended December 31, 2017, compared to $2.1 million for 2016. The year ended December 31, 2017 included transaction expenses of $2.1 million related to the 2017 Notes as well as interest expense on the 2017 Notes for seven to eight months and interest expense on the 2014 Notes for the year. The year ended December 31, 2016 included interest expense for the 2014 Notes only for the year.

Gain on change in fair values of convertible notes and warrant liability was $35.7 million for the year ended December 31, 2017, compared to a loss of $25.2 million for 2016. The gain/(loss) on change in fair values of convertible notes is impacted by the number of Notes outstanding for each period, as well as other factors that drive fair value, including the market trading price of our common stock.

The Company’s net income was $7.1 million for the year ended December 31, 2017, or $0.17 per share (basic) and a loss of $0.40 per share (diluted), compared to a net loss of $54.1 million, or $1.28 per share (basic and diluted), for 2016.

HEAD OFFICE: 5751 Copley Drive, San Diego, CA 92111 • +1 (858) 966-3000 • +1 (858) 966-3099 (FAX) • www.revamedical.com

AUSTRALIAN OFFICE: Suite 4, Level 14, 6 O’Connell Street, Sydney NSW 2000 • +61 2 9237 2800 • ARBN 146 505 777

REVA Medical, Inc.Page 3

About Fantom and Fantom Encore

Fantom and Fantom Encore are sirolimus-eluting bioresorbable scaffolds developed as an alternative to metallic stents for the treatment of coronary artery disease. Scaffolds provide restoration of blood flow, support the artery through the healing process, and then disappear (or “resorb”) from the body over a period of time. This resorption is intended to allow the return of natural movement and function of the artery. Fantom and Fantom Encore are the only bioresorbable scaffolds made from Tyrocore, REVA’s proprietary tyrosine-derived polymer designed specifically for vascular scaffold applications. Tyrocore is inherently radiopaque, making Fantom and Fantom Encore the first and only bioresorbable scaffolds that are fully visible under x-ray. Fantom and Fantom Encore are designed with thin strut profiles while maintaining strength and with distinct ease-of-use features such as expansion with one continuous inflation.

About REVA Medical

REVA Medical is a medical device company focused on the development and commercialization of bioresorbable polymer technologies for vascular applications. The Company’s lead products are the Fantom and Fantom Encore bioresorbable vascular scaffolds for the treatment of coronary artery disease. REVA is located in San Diego, California, USA and employs over 50 people in the U.S. and Europe.

Fantom, Fantom Encore, and Tyrocore are trademarks of REVA Medical, Inc.

The Company will conduct a conference call to review its fourth quarter and full year 2017 financial results and provide a business update. The call is scheduled for 1:30 p.m. US PST on Wednesday, March 7, 2017 (which is 8:30 a.m. AEST on Thursday, 8 March 2017) and may be accessed within the United States and Canada by dialing 1-877-312-5413 five minutes prior to the scheduled start time. Callers in Australia may access the call toll-free by dialing 1800 005 989. The conference ID is 1986218 for all locations.

Forward-Looking Statements

This announcement contains or may contain forward-looking statements that are based on management's beliefs, assumptions, and expectations and on information currently available to management. All statements that are not statements of historical fact, including those statements that address future operating plans or performance and events or developments that may occur in the future, are forward-looking statements, such as those statements regarding the projections and timing surrounding commercial operations and sales, clinical trials, pipeline product development, and future financings. No undue reliance should be placed on forward-looking statements. Although management believes forward-looking statements are reasonable as and when made, forward-looking statements are subject to a number of risks and uncertainties that may cause actual results to vary materially from those expressed in forward-looking statements, including the risks and uncertainties that are described in the "Risk Factors" section of our Annual Report on Form 10-K filed with the US Securities and Exchange Commission (the “SEC”) on February 28, 2017, and as updated in our periodic reports thereafter. Any forward-looking statements in this announcement speak only as of the date when made. REVA does not assume any obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

|

|

United States |

Australia |

Australia |

|

|

Investor & Media Enquiries: |

Investor Enquiries: |

Media Enquiries: |

|

|

REVA Medical, Inc. |

Inteq Limited |

Buchan Consulting |

|

|

Brandi Roberts |

Kim Jacobs |

Rebecca Wilson |

|

|

Chief Financial Officer |

+61 438 217 279 |

+61 3 9866 4722 |

|

|

+1 858-966-3003 |

Andrew Cohen |

|

|

|

Cheryl Liberatore |

+61 408 333 452 |

|

|

|

Director, Communications |

|

|

|

|

+1 858-966-3045 |

|

|

|

|

ir@teamreva.com |

|

|

HEAD OFFICE: 5751 Copley Drive, San Diego, CA 92111 • +1 (858) 966-3000 • +1 (858) 966-3099 (FAX) • www.revamedical.com

AUSTRALIAN OFFICE: Suite 4, Level 14, 6 O’Connell Street, Sydney NSW 2000 • +61 2 9237 2800 • ARBN 146 505 777

REVA Medical, Inc.Page 4

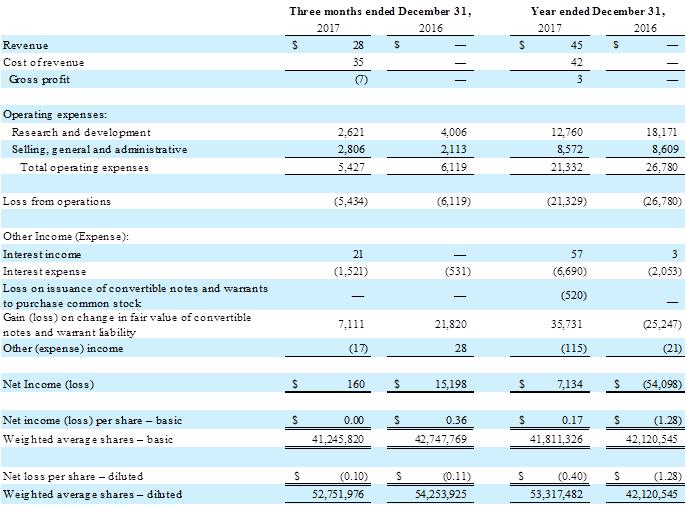

REVA Medical, Inc.

Unaudited Condensed Consolidated Statements of Operations

(In thousands, except per share data)

HEAD OFFICE: 5751 Copley Drive, San Diego, CA 92111 • +1 (858) 966-3000 • +1 (858) 966-3099 (FAX) • www.revamedical.com

AUSTRALIAN OFFICE: Suite 4, Level 14, 6 O’Connell Street, Sydney NSW 2000 • +61 2 9237 2800 • ARBN 146 505 777

REVA Medical, Inc.Page 5

|

|

|

December 31, |

|

|

December 31, |

|

||

|

|

|

2017 |

|

|

2016 |

|

||

|

Cash, cash equivalents and investment securities |

|

$ |

20,014 |

|

|

$ |

6,674 |

|

|

|

|

|

|

|

|

|

|

|

|

Total assets |

|

|

22,661 |

|

|

|

9,483 |

|

|

|

|

|

|

|

|

|

|

|

|

Convertible notes and accrued interest |

|

|

108,147 |

|

|

|

95,859 |

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities |

|

|

115,474 |

|

|

|

99,076 |

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ deficit |

|

|

(92,813 |

) |

|

|

(89,593 |

) ) ))) |

HEAD OFFICE: 5751 Copley Drive, San Diego, CA 92111 • +1 (858) 966-3000 • +1 (858) 966-3099 (FAX) • www.revamedical.com

AUSTRALIAN OFFICE: Suite 4, Level 14, 6 O’Connell Street, Sydney NSW 2000 • +61 2 9237 2800 • ARBN 146 505 777