Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ANI PHARMACEUTICALS INC | tv487940_8k.htm |

Exhibit 99.1

A Specialty Pharmaceutical Company NASDAQ: ANIP GENERIC AND BRANDED PRESCRIPTION DRUG PRODUCTS Corporate Presentation March 7, 2018

Forward - Looking Statements To the extent any statements made in this presentation deal with information that is not historical, these are forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements about price increases, the Company’s future operations, products financial position, operating results and prospects , the Company’s pipeline or potential markets therefore, and other statements that are not historical in nature, particularly those that utilize terminology such as “anticipates,” “will,” “expects,” “plans,” “potential,” “future,” “believes,” “intends,” “continue,” other words of similar meaning, derivations of such words and the use of future dates. Uncertainties and risks may cause the Company’s actual results to be materially different than those expressed in or implied by such forward - looking statements. Uncertainties and risks include, but are not limited to, the risk that the Company may face with respect to importing raw materials; increased competition; acquisitions; contract manufacturing arrangements; delays or failure in obtaining product approval from the U.S. Food and Drug Administration; general business and economic conditions; market trends; products development; regulatory and other approvals and marketing. More detailed information on these and additional factors that could affect the Company’s actual results are described in the Company’s filings with the Securities and Exchange Commission, including its most recent annual report on Form 10 - K and quarterly reports on Form 10 - Q, as well as its proxy statement. All forward - looking statements in this presentation speak only as of the date of this presentation and are based on the Company’s current beliefs, assumptions, and expectations. The Company undertakes no obligation to update or revise any forward - looking statement, whether as a result of new information, future events or otherwise. 2

Corporate Overview Generic Drugs ▪ 24 commercial products ▪ 70 pipeline products; 40 previously approved ▪ Addressable market of pipeline = $1.7B Branded Drugs ▪ 11 commercial products ▪ 4 pipeline products previously approved ▪ Addressable market of pipeline = $1.4B CMO / Manufacturing ▪ 4 CMO clients representing 7 SKUs ▪ 177,000 ft 2 of US based facilities ▪ Significant capacity ▪ Capabilities: Solid oral, liquids, extended release, high containment ▪ U.S. based specialty pharmaceutical company (NASDAQ: ANIP) with a commercial portfolio of 35 brand and generic Rx products ▪ Differentiated generic strategy including acquisition and re - commercialization of previously approved products, as well as traditional development ▪ Baudette, MN manufacturing footprint comprised of two sites and ~165 of our ~180 employees ▪ 2018 Financial Guidance: $212M - $228M Revenues / $90M - $100M Adjusted non - GAAP EBITDA Core Strategic Focus Create long term shareholder value by: ▪ Building a sustainable and growing portfolio of Brand and Generic Rx products via internal development and acquisition ▪ Leverage tech transfer team and manufacturing facilities to move acquired products to ANI sites ▪ Advancing a transformational opportunity to re - commercialize Cortrophin ® Gel

Name Role Industry Experience Joined ANI Previous Affiliation Arthur Przybyl President and CEO 25+ years 2009 Stephen Carey VP, Finance and CFO 20 2016 Robert Schrepfer SVP, BD and Specialty Sales 15 2013 James Marken SVP, Operations & Prod. Development 20 2007 David Sullivan, PhD VP, Quality Operations 20 2014 Ellen Camos VP, Regulatory Affairs 15 2012 Mark Ginski, PhD VP, Corticotropin Development 20 2016 Karen Quinn, PhD VP, Corticotropin Regulatory Affairs 30 2017 Experienced Senior Management Team

Financial Highlights - 4Q and Full Year 2017 Posted record annual Net Revenue, Adjusted non - GAAP EBITDA and Adjusted non - GAAP EPS Net revenues increased 24% from prior year in 4Q and 37% on a full year basis Adjusted non - GAAP EBITDA increased 10% from prior year in 4Q and 21% on a full year basis 2017 GAAP loss due to $13.1M 4Q tax charge due to implementation of Tax Cuts and Jobs Act (1) See Appendix A for US GAAP reconciliations 5 ($ in millions, except per share data) 2017 2016 2017 2016 Net revenues 47.3$ 38.2$ 176.8$ 128.6$ Net (loss) / income (9.6)$ (1.1)$ (1.1)$ 3.9$ GAAP (loss) / earnings per diluted share (0.83)$ (0.09)$ (0.09)$ 0.34$ Adjusted non-GAAP EBITDA (1) 19.7$ 17.9$ 74.2$ 61.1$ Adjusted non-GAAP diluted 1.08$ 0.90$ 3.91$ 2.96$ earnings per share (1) Three Months Ended Year Ended December 31, December 31,

Strong Capital Position 6 $31.1 million of cash as of December 31, 2017 ▪ 2017 cash flow from operations of $39.4 million ▪ 2017 free cash flow of $29.0 million Net leverage of 2.0x based upon mid - point of 2018 guidance New $125 million senior secured credit facility includes undrawn $50 million revolver Beneficiary of 2017 Tax Cuts and Jobs Act ▪ Favorable impact of reduced cash tax burden worth approximately $10 - $13 million Improved ability to continue to invest in: ▪ value generating business development opportunities ▪ our U.S. based manufacturing and development capabilities ▪ research and development

Financial Highlights - 2017 Net Revenues Generic sales gains driven by 2017 and annualization of 2016 launches Brand sales gains reflect the late February 2017 introduction of InnoPran XL ® and Inderal ® XL as well as increased sales of Inderal ® LA which launched in Q2 2016 Contract manufacturing reflects timing and volume of customer orders 7 Note: Figures may not foot / cross - foot due to rounding. ($ in millions) 2017 2016 $ % Generic pharmaceutical products 118.4$ 95.2$ 23.2$ 24% Branded pharmaceutical products 50.9 26.4 24.5 93% Contract manufacturing 7.0 5.5 1.5 27% Contract services and other income 0.4 1.4 (1.0) -70% Total net revenues 176.7$ 128.5$ 48.2$ 37% Year Ended Variance December 31, to Prior Year

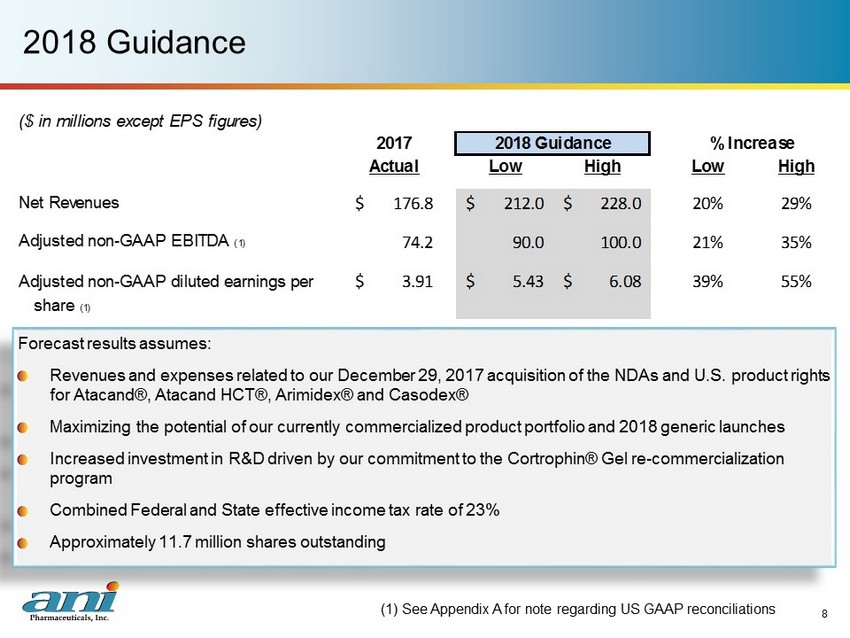

2018 Guidance Forecast results assumes: Revenues and expenses related to our December 29, 2017 acquisition of the NDAs and U.S. product rights for Atacand ®, Atacand HCT®, Arimidex ® and Casodex ® Maximizing the potential of our currently commercialized product portfolio and 2018 generic launches Increased investment in R&D driven by our commitment to the Cortrophin ® Gel re - commercialization program Combined Federal and State effective income tax rate of 23% Approximately 11.7 million shares outstanding (1) See Appendix A for note regarding US GAAP reconciliations 8 ($ in millions except EPS figures) 2017 Actual Low High Low High Net Revenues 176.8$ 212.0$ 228.0$ 20% 29% Adjusted non-GAAP EBITDA (1) 74.2 90.0 100.0 21% 35% Adjusted non-GAAP diluted earnings per 3.91$ 5.43$ 6.08$ 39% 55% share (1) 2018 Guidance % Increase

$30 $56 $76 $129 $177 $220 ** $8 $27 $43 $61 $74 $95 ** 7 10 16 25 31 0 5 10 15 20 25 30 35 $0 $30 $60 $90 $120 $150 $180 $210 $240 2013 2014 2015 2016 2017 2018 Net Revenues Adjusted EBITDA Commercial Products * Growth Led by New Product Introductions 9 ($’s in millions) * 2017 products do not include the four products acquired from AstraZeneca on December 29, 2017, as net revenues from these products commenced in 2018. ** Midpoint of 2018 annual guidance, as presented in February 27, 2018 Earnings Release guidance

10 Sales and Marketing Overview

Propranolol ER Capsules (AG) Generic Rx Product Portfolio 2016 & 2017 Product Introductions Diphenoxylate HCL and Atropine Sulfate Erythromycin Ethylsuccinate Fenofibrate Capsules (AG) HC Cream, for rectal use Indapamide Lithium Carbonate ER (AG) Mesalamine Enema (AG) Nilutamide Tablets Oxycodone Capsules Oxycodone Oral Solution (100 mg/5 mL) Pindolol 11 Continued broadening of our product offerings ▪ Twenty - four generic product families encompassing 47 SKUs ▪ $118 .4 million of full year 2017 n et sales, up 24% vs. prior year (AG) = Authorized Generic

Brand Rx AstraZeneca Transaction 12 Acquired the NDAs and U.S. rights to four brands including two hypertension and two hormone based chemotherapy drugs Purchased on December 29, 2017, for approximately $46.5 million Generated combined sales of $19.0 million in U.S. gross market sales during the trailing twelve months ended October , 2017 according to IMS Health data Opportunity to further leverage our IDC road (hormone containment) facility

Brand Rx InnoPran XL ® and Inderal ® XL 13 Two additional hypertension brands acquired in first quarter 2017: Purchased on February 23, 2017, for approximately $51 million Generated combined sales of $23.3 million in 2016 according to IMS Health data (gross sales basis) Second quarter of 2017 was first full quarter of sales and gross profit contribution

Brand Rx Product Portfolio Lithobid ® Tablets Bipolar Disorder Vancocin ® Capsules C. difficile - Associated Diarrhea Cortenema ® U lcerative Colitis Reglan ® Tablets Gastroesophageal Reflux Inderal ® LA Capsules Hypertension ▪ Total full year 2017 Brand Rx net revenues of $50.9 million, up 93% vs. prior year 14

Contract Manufacturing and Other 15 Contract manufacturing ▪ $5.5 million of 2016 and $7.0 million of 2017 net revenues ▪ Four customers – Seven products and seventeen SKUs – Contract manufacturing and contract packaging Contract services and other ▪ $1.4 million of 2016 and $0.4 million of 2017 net revenues ▪ Product development services, laboratory services, and royalties received

16 Business and Product Development Overview

Business Development Activity – Generic Products 17 NOTES DATE ANI MANUF APPROVED COST ($M) G e n e r i c s Commercial May-16 P P 1% and 2.5% HC Cream to date, 1 product commercialized Aug-15 $0.0 Rowasa® AG (Partnership with Meda) Commercial Jan-16 P $10.0 Lipofen® AG & P P $1.0 IDT Partnership (18 previously approved ANDAs) to date, 3 products commercialized Jul-15 P P Commercial Mar-15 P P $25.0 ANDA Basket 2 (22 previously approved ANDAs) (31 previously approved ANDAs) $4.5 Flecainide (flecainide tablets) to date, 3 products commercialized Jan-14 P P $12.5 ANDA Basket 1 Nimodipine & Omega (Partnership with Sofgen) Total $54.1 Nimodipine Commercial Omega in pipeline Aug-13 and Apr-14 $1.1

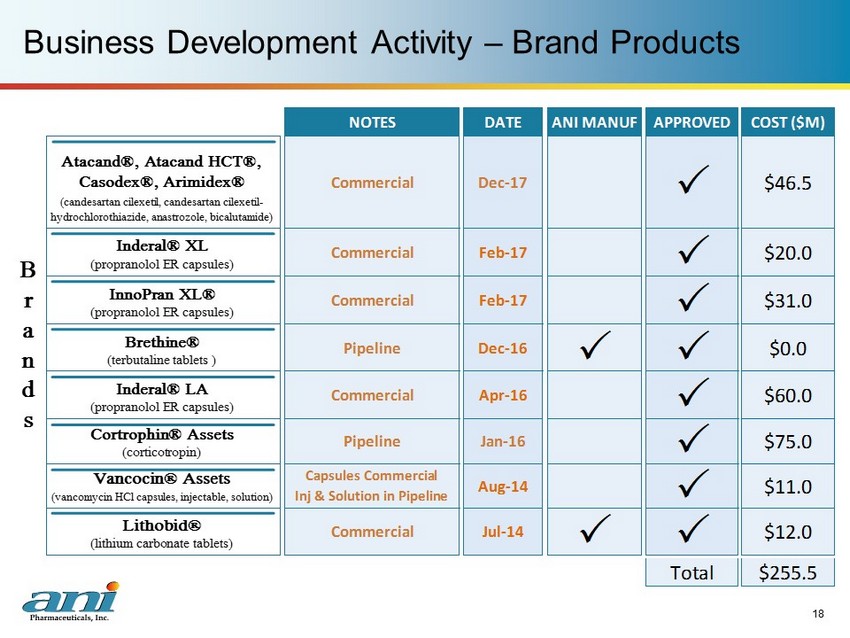

Business Development Activity – Brand Products 18 NOTES DATE ANI MANUF APPROVED COST ($M) Total $255.5 $12.0 P P $46.5 Atacand®, Atacand HCT®, Casodex®, Arimidex® (candesartan cilexetil, candesartan cilexetil- hydrochlorothiazide, anastrozole, bicalutamide) Capsules Commercial Inj & Solution in Pipeline Aug-14 P $11.0 Vancocin® Assets $0.0 Brethine® (terbutaline tablets ) Commercial Apr-16 P (corticotropin) $60.0 Inderal® LA (propranolol ER capsules) Pipeline Jan-16 P $75.0 Cortrophin® Assets $20.0 Inderal® XL (propranolol ER capsules) Commercial Feb-17 P $31.0 InnoPran XL® B r a n d s Commercial Feb-17 P (propranolol ER capsules) Pipeline Dec-16 P P Commercial Dec-17 P Lithobid® (lithium carbonate tablets) (vancomycin HCl capsules, injectable, solution) Commercial Jul-14

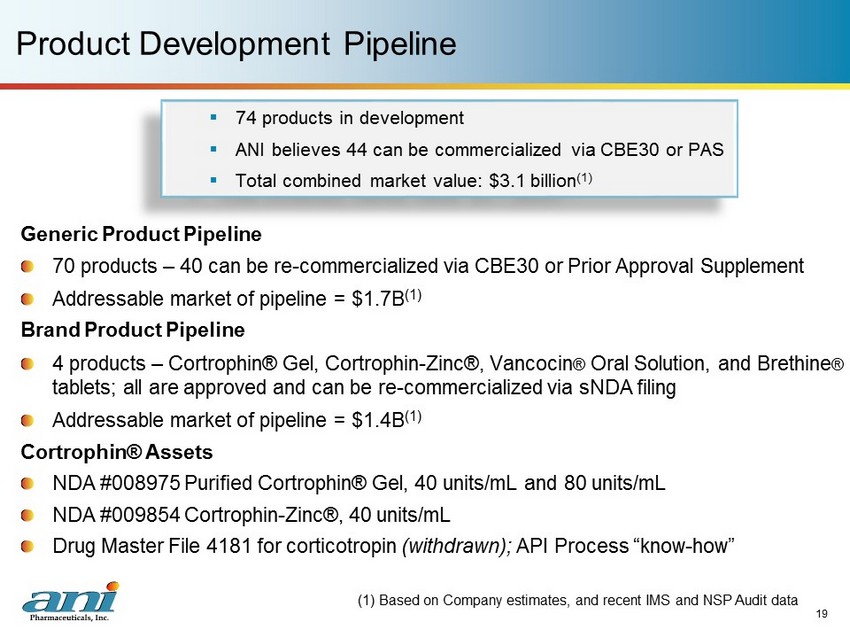

19 Product Development Pipeline Generic Product Pipeline 70 products – 40 can be re - commercialized via CBE30 or Prior Approval Supplement Addressable market of pipeline = $1.7B (1) Brand Product Pipeline 4 products – Cortrophin ® Gel, Cortrophin - Zinc®, Vancocin ® Oral Solution, and Brethine ® tablets; all are approved and can be re - commercialized via sNDA filing Addressable market of pipeline = $1.4B (1) Cortrophin ® Assets NDA #008975 Purified Cortrophin ® Gel, 40 units/mL and 80 units/mL NDA #009854 Cortrophin - Zinc®, 40 units/mL Drug Master File 4181 for corticotropin (withdrawn); API Process “know - how” (1) Based on Company estimates, and recent IMS and NSP Audit data ▪ 74 products in development ▪ ANI believes 44 can be commercialized via CBE30 or PAS ▪ Total combined market value: $3.1 billion (1)

Cortrophin ® - A Compelling Strategic Opportunity Regulatory and Development Considerations Approved NDAs/Discontinued Marketing: Clear and abbreviated pathway to re - commercialization Acquired: NDAs, DMF* and other documentation (e.g. batch records, historical data) 20 Value Creation Provides patients, payors and physicians with valuable therapeutic option Potential to generate substantial revenues and cash flow High risk - adjusted ROI and NPV Commercial Considerations $1.2B U.S. market opportunity today Provides patients, prescribers and payors with valuable therapeutic alternative Broad label / concentrated prescriber base Durable assets: high barrier to generic entry, ANI’s products represent the last of the dormant corticotropin filings that were not withdrawn via Federal Register * DMF = drug master file

Cortrophin ® - Path to Re - Commercialization 21 Modernize Analytical Methods Manufacture API File sNDA Manufacture Drug Product Finalize Regulatory Strategy Engage FDA Source Pig Pituitary Build Dedicated ANI Team Acquisition Closed Key Steps • Establish pig pituitary supply chain • Successfully manufacture drug substance (API) • Develop/modernize analytical methods • Demonstrate process characterization (lot to lot consistency) • Manufacture drug product • Demonstrate comparability to historically manufactured product

Key Re - commercialization Milestones 22 Duration Status Additional Details Manufacture small - scale batch of corticotropin API 4 mos. Complete • Initial batch yields similar to historical yields • Analytical method development and testing ongoing Select drug product CMO 6 mos. Complete • Drug product CMO has been selected Manufacture intermediate - scale batches of corticotropin API 4 - 6 mos. Complete • Three intermediate - scale batches successfully completed • Further refined/modernized analytical methods & process • Demonstrated lot - to - lot consistency Type C meeting with FDA FDA Response March 2018 • Meeting Request submitted 4Q17; FDA granted as Type C Meeting • Information provided on ANI's regulatory plan for re - commercialization • FDA response scheduled for March 2018 Manufacture demo batches of Cortrophin ® Gel TBD Target Q2 2018 • Initiate formulation / fill / finish of drug product Manufacture commercial - scale batches of corticotropin API 2 - 3 mos. per batch Target H1 2018 • Scale - up manufacturing process 5x • Manufacture API under cGMPs • Finalize API manufacturing process in preparation for process validation/registration batches Manufacture registration batches of Cortrophin ® Gel 2 - 3 mos. per batch Target end 2018 • Process validation • Registration / Commercial batches • Initiate registration - enabling ICH stability studies Initiate registration stability for sNDA 6 mos. TBD • Six months of accelerated stability from drug substance and drug product batches at time of submission sNDA submission TBD TBD • PAS filing - PDUFA four month review time

23 Manufacturing Overview

Main Street Facility – 130K ft 2 IDC Road Facility – 47K ft 2 Overview ▪ 57,000 ft 2 of manufacturing, packaging, and warehouse ▪ Recently completed 5,500 ft 2 warehouse expansion includes additional schedule CII vault & CIII cage space ▪ 17,000 ft 2 of laboratory space for product development and analytical testing ▪ 32,000 ft 2 of manufacturing, packaging, and warehouse ▪ 100 nano - gram per eight - hour time weighted average maximum exposure limit to ensure employee safety ▪ Adding a low - humidity suite for processing and encapsulating moisture - sensitive compounds Capabilities ▪ Rx solutions, suspensions, topicals , tablets, capsules and powder for suspension ▪ DEA - licensed for Schedule II controlled substances ▪ Fully - contained high potency facility with capabilities to manufacture hormone, steroid, and oncolytic products ▪ DEA Schedule III capability Capacity ▪ Solid Dose - ~ 1.2 billion doses/ yr ▪ Liquids - ~ 53 million bottles/ yr ▪ Liquid Unit Dose - ~ 23 million doses/ yr ▪ Powder - ~ 12 million bottles/ yr ▪ Tablets - ~2.5 billion doses/ yr ▪ Capsules - ~150 million doses/ yr Manufacturing Overview

Main Street Facility Solid Dose Manufacturing ▪ Particle Size Control – Sieving, Oscillating Granulators, Fitzmills , Comils ▪ Blending / Granulating – Wet and Dry capability – Marion Paddle Mixers, V - Blender, Gemco Slant Cone – Collette Gral 600 High Shear Granulator (100 – 200kg) – Collette Gral 75 (also explosion proof) (12 – 25kg) – Hobart Planetary Mixer ▪ Drying – Gruenberg Ovens, Vector FL - 3N Fluid Bed Dryer ▪ Encapsulating Machine (pilot scale / small batch) – Zanasi , MG Suprema ▪ Rotary Tablet Presses – Courtoy R100, Killian Synthesis 300 ▪ Coating – Film / Sugar coating, Solvent & Aqueous – ACCELA - COTA and Vector Hi Coater Pans Liquid Manufacturing – Liquids / Syrups – Solutions / Suspensions / Emulsions – Lotions / Ointments Solid Dose Packaging – 7 to 1,000 units/container ▪ Tablets – Mass: 60mg – 1050mg ▪ Capsules – Mass: 100mg – 600mg Liquid Dose Packaging Capabilities ▪ Solutions, Suspensions, Enemas Unit Dose Cup Blisters Powder Filling Capability ▪ 1 ” – 5” Diameter containers Manufacturing and Packaging Capabilities by Site

IDC Road Facility Solid Dose Manufacturing ▪ Particle Size Control – Sieving, Oscillating Granulators, Fitzmills , Comils – Alpine Pin Mill (1Q18) ▪ Blending / Granulating – Wet and Dry capability – Marion Paddle Mixers, V - Blender, Gemco Cone Blenders – Gemco Formulator (jacketed) – Collette Gral 75 (also explosion proof) – Vector Granumeist GMX 600L high shear granulator – Hobart Planetary Mixer ▪ Drying – Gruenberg Ovens, Vector FL - N - 15 Fluid Bed Dryer ▪ Rotary Tablet Presses – Two Courtoy R190 – Korsch XL 200 – Two Korsch XL 400 ▪ Encapsulation – Bosch 1400L for hotmelt capsule filling (1Q18) Solid Dose Packaging – 7 to 1,000 units/container ▪ Tablets – Mass: 60mg – 1050mg ▪ Capsules – Mass: 100mg – 600mg Blister Packaging (Klockner CP - 2 and Klockner CP - 8) ▪ Physician sample / clinical size Klockner Blister Forming Machines – Multiple base material options – 4, 7, or 10 tablet blister – Cold form capable Manufacturing and Packaging Capabilities by Site

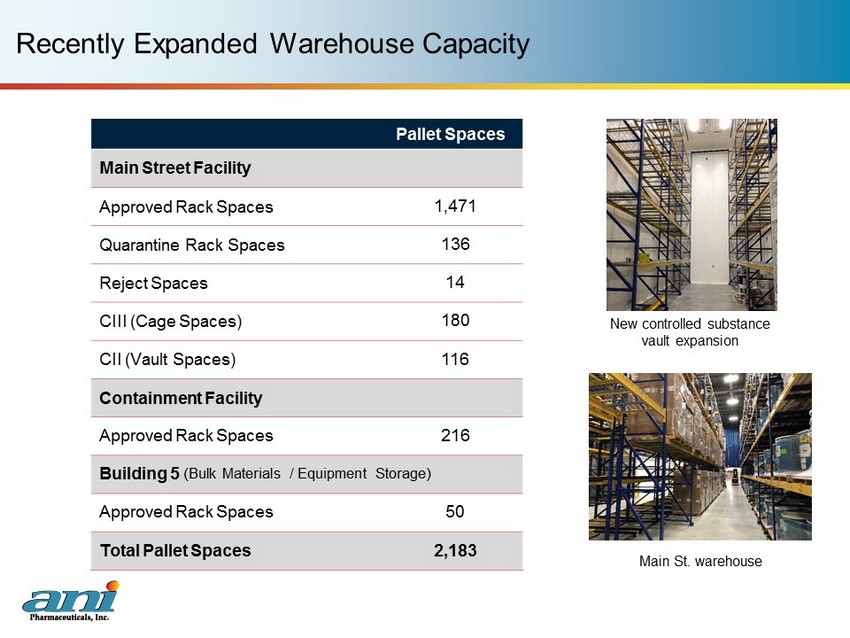

Recently Expanded Warehouse Capacity Pallet Spaces Main Street Facility Approved Rack Spaces 1,471 Quarantine Rack Spaces 136 Reject Spaces 14 CIII (Cage Spaces) 180 CII (Vault Spaces) 116 Containment Facility Approved Rack Spaces 216 Building 5 (Bulk Materials / Equipment Storage) Approved Rack Spaces 50 Total Pallet Spaces 2,183 New controlled substance vault expansion Main St. warehouse

Summary ANI is an integrated specialty generic pharmaceutical company with: ▪ Profitable base business generating organic growth ▪ Strong capital position ▪ Experienced management team ▪ US - based manufacturing assets and expertise ▪ 2018 Annual guidance (1) – Net revenues of $212 million to $228 million – Adjusted non - GAAP EBITDA (2) of $90 million to $100 million – Adjusted non - GAAP diluted earnings per share (2) of $5.43 to $6.08 ANI is focused on delivering value through: ▪ Partnerships, strategic alliances and accretive acquisitions ▪ Internal product development and leveraging manufacturing capabilities ▪ Advancing the re - commercialization of Cortrophin ® Gel 28 (1) February 27, 2018 press release (2) See Appendix A for note regarding US GAAP reconciliations

29 Appendix A

U.S. GAAP Reconciliations 30 2017 2016 2017 2016 Net (Loss)/Income (9,629)$ (1,080)$ (1,076)$ 3,934$ Add back Interest expense, net 3,026 2,859 12,035 11,327 Other income/(expense), net 3 43 (55) 74 Provision/(benefit) for income taxes 13,979 (524) 17,425 4,744 Depreciation and amortization 7,022 5,812 27,928 22,343 Intangible asset impairment charge 903 6,685 903 6,685 Add back Stock-based compensation 1,422 1,380 6,090 6,067 Excess of fair value over cost of acquired inventory 2,946 2,758 10,448 5,938 Expenses related to transaction not consummated - - 477 - Adjusted non-GAAP EBITDA 19,672$ 17,933$ 74,175$ 61,112$ Year Ended December 31, ANI Pharmaceuticals, Inc. and Subsidiaries Adjusted non-GAAP EBITDA Calculation and US GAAP to Non-GAAP Reconciliation (unaudited, in thousands) Three Months Ended December 31,

U.S. GAAP Reconciliations 31 2017 2016 2017 2016 Net (Loss)/Income (9,629)$ (1,080)$ (1,076)$ 3,934$ Add back Excess of fair value over cost of acquired inventory 2,946 2,758 10,448 5,938 Non-cash interest expense 1,758 1,784 7,113 7,048 Stock-based compensation 1,422 1,380 6,090 6,067 Depreciation and amortization expense 7,022 5,812 27,928 22343 Intangible asset impairment charge 903 6,685 903 6,685 Expenses related to transaction not consummated - - 477 - Less Tax impact of adjustments (5,199) (6,815) (19,595) (17,790) Add back Impact of Tax Cuts and Jobs Act of 2017 on Deferred Tax Assets 13,394 - 13,394 - Adjusted non-GAAP Net Income 12,617$ 10,524$ 45,682$ 34,225$ Diluted Weighted-Average Shares Outstanding 11,723 11,635 11,680 11,573 Adjusted non-GAAP Diluted Earnings per Share 1.08$ 0.90$ 3.91$ 2.96$ Three Months Ended December 31, Year Ended December 31, ANI Pharmaceuticals, Inc. and Subsidiaries Adjusted non-GAAP Net Income and Adjusted non-GAAP Diluted Earnings per Share Reconciliation (unaudited, in thousands, except per share amounts)

U.S. GAAP Reconciliations 32 Non - GAAP Financial Measures included in 2018 Guidance The Company's fiscal 2018 guidance for adjusted non - GAAP EBITDA and adjusted non - GAAP diluted earnings per share is not reconciled to the most comparable GAAP measure. This is due to the inherent difficulty of forecasting the timing or amount of items that would be included in a reconciliation to the most directly comparable forward - looking GAAP financial measures. Because a reconciliation is not available without unreasonable effort, it is not included in this presentation.