Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Spirit Airlines, Inc. | form8k30618.htm |

March 6, 2018

2

Statements in this release and certain oral statements made from time to time by representatives of the Company contain various forward-looking

statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, which represent the Company's expectations or beliefs concerning future events. The words “expects,” “estimates,” “plans,”

“anticipates,” “indicates,” “believes,” “forecast,” “guidance,” “outlook,” “may,” “will,” “should,” “seeks,” “targets” and similar expressions are

intended to identify forward-looking statements. Similarly, statements that describe the Company's objectives, plans or goals, or actions the

Company may take in the future, are forward-looking statements. Forward-looking statements include, without limitation, statements regarding

the Company's intentions and expectations regarding revenues, cost of operations, the delivery schedule of aircraft on order, and announced new

service routes. All forward-looking statements are based upon information available to the Company at the time the statement is made. The

Company has no intent, nor undertakes any obligation, to publicly update or revise any forward-looking statement, whether as a result of new

information, future events, or otherwise, except as required by law. Forward-looking statements are subject to a number of factors that could

cause the Company's actual results to differ materially from the Company's expectations, including the competitive environment in the airline

industry; the Company's ability to keep costs low; changes in fuel costs; the impact of worldwide economic conditions on customer travel behavior;

the Company's ability to generate non-ticket revenues; and government regulation. Additional information concerning these and other factors is

contained in the Company's Securities and Exchange Commission filings, including but not limited to the Company's Annual Report on Form 10-K,

Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K.

All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary

statements set forth or referred to above. Forward-looking statements speak only as of the date of this presentation. You should not put undue

reliance on any forward-looking statements.

Disclaimer

Bob Fornaro

Chief Executive Officer

4

• Further improve our overall Guest experience

• Strengthen our footprint for the future

• Drive ancillary revenue

• Maintain our relative cost advantage

• Deliver earnings growth

Our 2018 Priorities

Welcome Aboard!

5 Further Improving our Guest Experience – on the ground & in the air

Streamlined Booking Process

Self Bag Tagging

Easy Purchase Options for Extras

Electronic Boarding Pass

Friendly Infight Experience

6

65%

70%

75%

80%

85%

90%

95%

2015 2016 2017 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18

94%

96%

98%

100%

2015 2016 2017 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18

(3)

Improving Operational Performance

• Labor disruptions and hurricane impacts

were felt from May to September 2017 on

A:14, Completion Factor, and Complaints

• Excluding the summer, the operational

improvements in 2017 were pronounced

1. Arrivals within 14 minutes of scheduled arrival time as reported by the Department of Transportation.

2. Percentage of scheduled flights completed.

3. Labor and weather disruption adjusted.

Completion Factor(2) D.O.T. On-Time %(1)

2018 Goal

7 Serving Over 235 Non-Stop Markets

• 500+ daily flights, 65 destinations

• Diversified network

• Primarily low frequency, point-to-point

• Serve most of the Top 25 U.S. metros, many

small/mid-size U.S. markets and 27

international destinations

• Demographic affinity between Ft. Lauderdale

& Caribbean/Latin America

ST. CROIX

8 Being Nimble is in our DNA

• Dramatically grown large leisure markets such

as Las Vegas & Orlando

• Diversified the network by adding more

small/mid-size cities

• Grown our international footprint

• Added more seasonal differentiation to the

network

• Invested in improving operational reliability

• Improved our reputation

In response to changes in the competitive environment beginning in 2015, Spirit has

focused on diversifying its network and improving its brand reputation

.

Winter Seasonal

• Winter seasonal only • Increased frequency in

winter

Summer seasonal

• Summer seasonal only • Increased frequency in

summer

Lima

9

• New routes added March-December

2017 • Routes added/planned to begin in 2018

Guayaquil

Recent Growth Focused on Mid-to-Long Haul Domestic Markets

10 3 Types of Core Spirit Markets

International

Chicago

Detroit

Dallas

Houston

Baltimore

Los Angeles

Atlanta

NY Metro

Orlando

Ft. Lauderdale

Las Vegas

New Orleans

Myrtle Beach

Unique niche developed in

Visiting Friends & Relative

(VFR) Markets

Large int’l leisure markets

Big Origination Cities Large Leisure Destinations International

Building a network to designed to serve low fare leisure passengers

11 Continuing to Broaden and Diversify our Network

0

50

100

150

200

250

300

350

400

Top 25 - Top 25 Top 25 - SMID SMID - SMID Int'l VFR Int'l Leisure

Add'l markets currently

meeting our threshold for

growth

Routes served as of December

2017

Top 25 = Top 25 U.S. metro area per most recent U.S. census; SMID = small/mid-size metros.

Ro

ut

es

• Growth will tend towards large

urban centers, mid-size cities, and

select international markets

• 2018 year-over-year capacity

growth is estimated at 23%

• New destinations include

• Columbus, OH

• Richmond, VA

• Guayaquil, Ecuador

• Cap Haitien, Haiti

• Over 90% of our new routes in

2018 connect existing destinations

• Between 2019 and 2021, we’re

planning on low to mid-teens

capacity growth

Ted Christie

President & Chief Financial Officer

13 Initiatives to Drive Revenue

Ancillary Production

• Enhanced customer data analysis with ongoing multi-

variate testing

• Dynamic pricing of seats, bags, and bundled offerings

• E-commerce initiatives

Base Fare Initiatives

• 360º strategic review of competitive dynamics of all

markets

• Adding new processes to enhance strategic planning and

revenue management strategies

• New programs resulting in growth of our active email

database

$55.03

$54.24

$51.87

$53.00

$40

$45

$50

$55

$60

2014 2015 2016 2017 2018E

Non-Ticket on Path to Recovery

$55+

Non-ticket revenue per passenger segment

14

15%

27%

62% 65%

90%

40%

56%

98%

107%

128%

0%

20%

40%

60%

80%

100%

120%

140% FY2012 FY2017

Spirit’s Relative Cost Advantage has Grown

Spirit’s Relative Cost Advantage Has Grown

S-L Adjusted CASM – Ex Fuel % Higher than Spirit

1. Cost data based on public company reports for the twelve months ended 12/31/17 and 12/31/12. Reflects mainline operations only. Stage length adjusted to 1000 miles. formula = CASM x (airline stage length / 1000)^0.5. Stage

length for American, JetBlue, and Southwest derived from company reports; Delta and United derived from Form 41 data. Excludes special items and unrealized mark-to-market gains and losses for all carriers. .

• Spirit’s unit cost advantage is our most

important asset

• We believe that our relative cost advantage

will increase over the next five years

• Spirit’s opportunities to further improve its

cost structure include

• Cost benefits as we further improve our

operational reliability

• Opportunities to increase utilization

• “Juniority” benefit - adding new flight crew

members mitigates inflationary unit cost

pressures of an aging workforce

• Increased scale benefits as we grow

• Commitment to a low cost mindset

15

• High asset utilization

• Maximize real estate on aircraft (high seat density)

• High aircraft utilization (hrs./day)

• Cost effective use of facilities (flights per gate/day, efficient

use of other airport space)

• Keeping it simple

• No premium class of service

• No specialty clubs

• No special services/amenities that drive costs without an

associated revenue benefit

• Optimize the variable component of our cost structure

• Flexible outsourcing at stations

• Lease gates on an as- needed basis - avoid initial long-term

commitments

Built for Low Cost

4.9

(1.5)

(0.5)

(6.5)

(0.9)

1.1

(8.0)

(6.0)

(4.0)

(2.0)

0.0

2.0

4.0

6.0

2012 2013 2014 2015 2016 2017

Adj. Cost per Available Seat Mile Ex-Fuel

Year-over-Year % Change

(%)

1. See Appendix for reconciliation detail of Spirit’s Adjusted CASM ex-fuel.

Growth contributes, but our primary cost advantages come from being built for low cost

16

• New Pilot Contract gives us tools to run a better airline

• Flexibility

• Recoverability

• Better operations = lower costs

• Including the Pilot Contract and associated increases in

productivity and efficiencies, Spirit estimates its 2018

CASM Ex-fuel1 will be flat to down 1%

• We are confident we can achieve flattish CASM ex-fuel in

2019 as well

5 Year Pilot Contract

1. Excludes special items. Special items include $75 million of one-time ratification incentives.

5.00

5.10

5.20

5.30

5.40

5.50

5.60

20

17

O

pe

ra

ti

on

al

D

is

ru

pt

io

ns

A

ir

cr

af

t

Re

nt

St

ag

e

SW

B

D

&

A

O

th

er

, N

et

20

18

E

2018E CASM Ex-Fuel

Flat to Down 1%

Year-over-Year

17 Consistent Delivery of High Margins

17.1

19.2

23.7

20.9

15.2

0

5

10

15

20

25

2013 2014 2015 2016 2017

(%) SAVE Operating Margin(1)

1. Excludes special items and unrealized mark-to-market gains for all periods. See Appendix for reconciliation detail to most comparable GAAP measure.

2. Excludes impact of pilot related disruptions

3. The Company estimates labor disruptions and Hurricanes Harvey, Irma & Maria , negatively impacted results by approximately $80 million (approximately $65 million of revenue loss and $15 million of

additional operating costs, primarily related to higher passenger re-accommodation expense, partially offset by lower fuel expense). The Company estimates that without this impact, its adjusted operating

margin for the twelve months ended 12/31/17 would have been 17.8%.

0

3

6

9

12

15

18

LUV SAVE JBLU DAL AAL UAL

(%) 2017 Operating Margin(1)

(2)

17.8(3)

As we grow, we are targeting markets with mid-teens or higher operating margins

18 Diversified Fleet Size is an Advantage

Having a mixture of A319s, A320s, and A321s enhances our ability to optimize aircraft

size for market selection

• Smaller or developing markets

• Ideally sized for daily or less than

daily frequency to small-midsize

markets

A319 (145) Seats

• Mature medium to large markets

A320 (182) Seats

• Large, high volume markets

• Excellent for markets constrained by slot

or gate limitations

A321 (228) Seats

Spirit’s Fleet Year-End 2018E

• A319 31 aircraft

• A320 61 aircraft

• A321 30 aircraft

Total: 122 aircraft

19 Current Fleet Order Sub-Optimal Given Remaining Opportunities

15

30

45

60

YE18E YE19E YE20E YE21E

(MM) Cumulative Capacity (ASMs) 2018 to 2021E

Current Fleet Order Target

1. Current fleet = total capacity based on the current number of aircraft scheduled for delivery, net of retirements.

• Our current 2019E aircraft deliveries

equate to less than 10% capacity growth in

2019

• Exploring opportunities that would allow

us to grow 2019 capacity between 13% to

15%

• Over the next several years, we are

targeting a low to mid-teens growth rate

20 Key Investment Highlights

Operating

Margin

Consistently among the best in the U.S. industry

Industry leading with stable ancillary revenue stream

Youngest of any major U.S. airline

Strong cash balance and sustainable leverage

Profitable, diverse opportunities in both domestic and foreign markets

Fleet

Growth

Opportunities

Balance

Sheet

Cost

Structure

Appendix

23 Guidance Summary

Metric 2018E(1)

Capacity (ASMs) year-over-year % change 23%

CASM ex-fuel year-over-year % change Flat to Down 1%

Capex (aircraft) (2) $354MM

Pre-delivery deposits $167MM

Capex (other) (3) $128MM

• Flight equipment purchase obligations for 2019 and 2020 are estimated to be $775 million

and $821 million, respectively (includes aircraft, spare engines, and net pre-delivery

deposits).

(1) 2017 estimates are based on guidance as of 003/01/18. 2018 and 2019 flight equipment purchase obligations are as of 12/31/17.

(2) Includes amounts related to 10 delivered or scheduled to be delivered in 2018, net of $130 million funded as pre-delivery deposits for these aircraft.

(3) Includes the purchase of nine spare engines.

24 Aircraft Delivery Schedule

A319 A320 CEO A320 NEO A321 CEO Total

31 51 5 25 112

1Q18 - 1 - 5 6

2Q18 - 1 - - 1

3Q18 - 2 - - 2

4Q18 - 1 - - 1

31 56 5 30 122

1Q19 - 2 - - 2

2Q19 - 4 - - 4

3Q19 - - 3 - 3

4Q19 - - 6 - 6

31 62 14 30 137

2020 (5) - 16 - 11

2021 (5) - 18 - 13

Total Aircraft Year-end 2021 21 62 48 30 161

Total Aircraft Year-end 2017

Total Aircraft Year-end 2018

Total Aircraft Year-end 2019

Aircraft Delivery Schedule (net of Scheduled Retirements) as of February 06, 2018

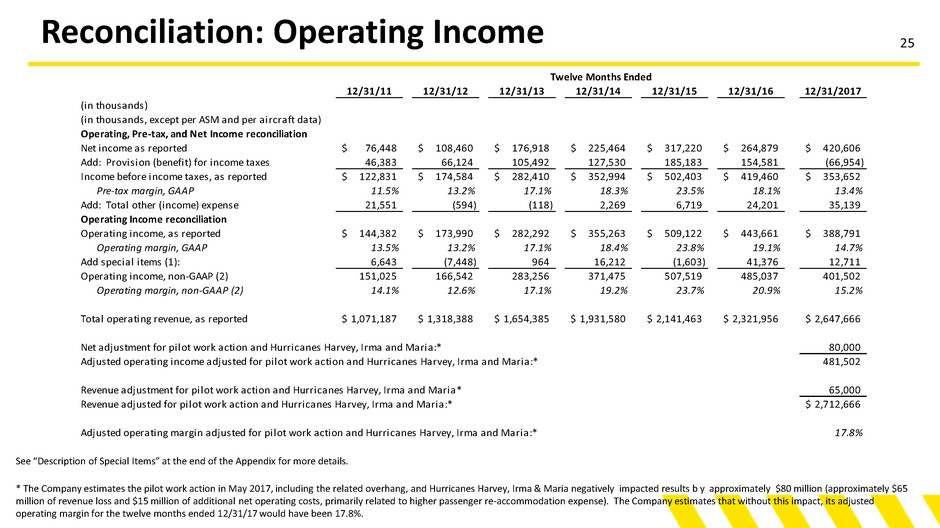

25 Reconciliation: Operating Income

See “Description of Special Items” at the end of the Appendix for more details.

* The Company estimates the pilot work action in May 2017, including the related overhang, and Hurricanes Harvey, Irma & Maria negatively impacted results b y approximately $80 million (approximately $65

million of revenue loss and $15 million of additional net operating costs, primarily related to higher passenger re-accommodation expense). The Company estimates that without this impact, its adjusted

operating margin for the twelve months ended 12/31/17 would have been 17.8%.

12/31/11 12/31/12 12/31/13 12/31/14 12/31/15 12/31/16 12/31/2017

(in thousands)

(in thousands, except per ASM and per aircraft data)

Operating, Pre-tax, and Net Income reconciliation

Net income as reported 76,448$ 108,460$ 176,918$ 225,464$ 317,220$ 264,879$ 420,606$

Add: Provision (benefit) for income taxes 46,383 66,124 105,492 127,530 185,183 154,581 (66,954)

Income before income taxes, as reported 122,831$ 174,584$ 282,410$ 352,994$ 502,403$ 419,460$ 353,652$

Pre-tax margin, GAAP 11.5% 13.2% 17.1% 18.3% 23.5% 18.1% 13.4%

Add: Total other (income) expense 21,551 (594) (118) 2,269 6,719 24,201 35,139

Operating Income reconciliation

Operating income, as reported 144,382$ 173,990$ 282,292$ 355,263$ 509,122$ 443,661$ 388,791$

Operating margin, GAAP 13.5% 13.2% 17.1% 18.4% 23.8% 19.1% 14.7%

Add special items (1): 6,643 (7,448) 964 16,212 (1,603) 41,376 12,711

Operating income, non-GAAP (2) 151,025 166,542 283,256 371,475 507,519 485,037 401,502

Operating margin, non-GAAP (2) 14.1% 12.6% 17.1% 19.2% 23.7% 20.9% 15.2%

Total operating revenue, as reported 1,071,187$ 1,318,388$ 1,654,385$ 1,931,580$ 2,141,463$ 2,321,956$ 2,647,666$

Net adjustment for pilot work action and Hurricanes Harvey, Irma and Maria:* 80,000

Adjusted operating income adjusted for pilot work action and Hurricanes Harvey, Irma and Maria:* 481,502

Revenue adjustment for pilot work action and Hurricanes Harvey, Irma and Maria* 65,000

Revenue adjusted for pilot work action and Hurricanes Harvey, Irma and Maria:* 2,712,666$

Adjusted operating margin adjusted for pilot work action and Hurricanes Harvey, Irma and Maria:* 17.8%

Twelve Months Ended

26 Reconciliation: CASM

See “Description of Special Items” for more details.

(in thousands except CASM data in cents)

Total operating expenses, as reported 2,258,875$

Less special items (1): 12,711

Total operating expenses excluding special items 2,246,164$

Less economic fuel expense 615,581

Total operating expenses excluding special items and fuel 1,630,583$

Available seat miles (ASMs) 29,592,819

Cost per ASM (CASM) 7.63

Adjusted CASM (2) 7.59

Adjusted CASM Ex-fuel (2) 5.51

Twelve Months Ended

December 31, 2017

27 Reconciliation: CASM Ex-Fuel

See “Description of Special Items” for more details.

2011 2012 2013 2014 2015 2016 2017

(in thousands except CASM data in cents)

Total operating expenses, as reported 926,804$ 1,144,398$ 1,372,093$ 1,576,317$ 1,632,341$ 1,878,295$ 2,258,875$

Special items (1) (7,494) 699 3,053 2,277 41,376 12,711

Total operating expenses excluding special items 923,365$ 1,151,892$ 1,371,394$ 1,573,264$ 1,630,064$ 1,836,919$ 2,246,164$

Aircraft fuel, as reported (1) 388,046 471,763 551,746 612,909 461,447 447,553 615,581

Total operating expenses excluding special items

and fuel 535,319$ 680,129$ 819,648$ 960,355$ 1,168,617$ 1,389,366$ 1,630,583$

Available seat miles (ASMs) 9,352,553 11,344,731 13,861,393 16,340,142 21,246,156 25,494,645 29,592,819

Cost per ASM (CASM) - GAAP 9.91 10.09 9.90 9.65 7.68 7.37 7.63

CASM excluding special items & aircraft fuel 5.72 6.00 5.91 5.88 5.50 5.45 5.51

Strike-Adjusted CASM excluding fuel and special items

Year-over-year %change 4.9% -1.5% -0.5% -6.5% -0.9% 1.1%

Year Ended December 31,

28

(1) Special items include loss on disposal of assets, special charges, unrealized losses (gains) arising from mark-to-market

adjustments to outstanding fuel derivatives, and other items. Special charges (credits) include: (i) for 2011, amounts

relating to exit facility costs associated with moving our Detroit, Michigan maintenance operations to Fort. Lauderdale,

Florida and termination costs in connection with the IPO during the three months ended June30, 2011 comprised of

amounts paid to Indigo Partners, LLC to terminate its professional service agreement with Spirit and fess paid to three

individual, unaffiliated holders of the Company’s subordinated notes, and (ii) for 2012, recognition of a gain on the sale

of four carrier slots at Ronald Reagan National Airport and secondary offering costs related to the sale of 9.4 million

shares by Oaktree Capital Management, and , (iii) 2016 and 2017, amounts primarily related to lease termination costs.

Other items include (i) for 2014, additional Federal Exercise Tax of $9.3 million related to fuel purchased in prior years,

and (ii) 2017, supplemental rent adjustment for liability accrued in prior years related to certain maintenance reserves

and return conditions that are no longer probable.

(2) Excludes special items.

Description of Special Items