Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Cornerstone Building Brands, Inc. | a2018q1exhibit991.htm |

| 8-K - 8-K - Cornerstone Building Brands, Inc. | ncs201803068-k.htm |

Our Mission & Vision

1Q Supplemental

Presentation

March 6, 2018

Our Mission & Vision

Forward-looking Statements

2

Certain statements and information in this presentation may constitute forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. The words “believe,” “anticipate,” “plan,” “intend,” “foresee,” “guidance,” “potential,” “expect,”

“should,” “will” “continue,” “could,” “estimate,” “forecast,” “goal,” “may,” “objective,” “predict,” “projection,” or similar expressions are

intended to identify forward-looking statements (including those contained in certain visual depictions) in this presentation. These

forward-looking statements reflect the Company's current expectations and/or beliefs concerning future events. The Company believes

the information, estimates, forecasts and assumptions on which these statements are based are current, reasonable and complete. Our

expectations with respect to the second quarter of fiscal 2018 that are contained in this presentation are forward looking statements

based on management’s best estimates, as of the date of this presentation. These estimates are unaudited, and reflect management’s

current views with respect to future results. However, the forward-looking statements in this presentation are subject to a number of

risks and uncertainties that may cause the Company's actual performance to differ materially from that projected in such statements.

Among the factors that could cause actual results to differ materially include, but are not limited to, industry cyclicality and seasonality

and adverse weather conditions; challenging economic conditions affecting the nonresidential construction industry; volatility in the U.S.

economy and abroad, generally, and in the credit markets; substantial indebtedness and our ability to incur substantially more

indebtedness; our ability to generate significant cash flow required to service our existing debt, including our secured term loan facility,

and obtain future financing; our ability to comply with the financial tests and covenants in our existing and future debt obligations;

operational limitations or restrictions in connection with our debt; increases in interest rates; recognition of asset impairment charges;

commodity price increases and/or limited availability of raw materials, including steel; interruptions in our supply chain; our ability to

make strategic acquisitions accretive to earnings; retention and replacement of management and other key personnel; enforcement and

obsolescence of intellectual property rights; fluctuations in customer demand; costs related to environmental clean-ups and liabilities;

competitive activity and pricing pressure; increases in energy prices; volatility of the Company's stock price; dilutive effect on the

Company's common stockholders of potential future sales of the Company's common stock held by our sponsor; substantial governance

and other rights held by our sponsor; breaches of our information system security measures and damage to our major information

management systems; hazards that may cause personal injury or property damage, thereby subjecting us to liabilities and possible losses,

which may not be covered by insurance; changes in laws or regulations, including the Dodd–Frank Act; the timing and amount of our stock

repurchases; and costs and other effects of legal and administrative proceedings, settlements, investigations, claims and other

matters. See also the “Risk Factors” in the Company's Annual Report on Form 10-K for the fiscal year ended October 29, 2017, and other

risks described in documents subsequently filed by the Company from time to time with the SEC, which identify other important factors,

though not necessarily all such factors, that could cause future outcomes to differ materially from those set forth in the forward-looking

statements. The Company expressly disclaims any obligation to release publicly any updates or revisions to these forward-looking

statements, whether as a result of new information, future events, or otherwise.

Our Mission & Vision

1Q 2018 Financial Overview (Page 1 of 2)

3

Sales were $421.3 million, an increase of $29.6 million or 7.6% from $391.7 million

in the prior year’s first quarter

• Revenues for the quarter benefited from continued commercial discipline in the pass-

through of higher material costs across the segments, combined with strong volume

growth in both Metal Components and the Insulated Metal Panels (‘IMP’) segments

Gross profit margins for the period were 21.8%, compared to 21.4% in the prior

year period

• Gross margins increased primarily as a result of growth in the IMP segment and favorable

commercial discipline, partially offset by higher transportation costs and lower margins in

the CENTRIA coil coating business as it is integrated into the Metal Coil Coating segment

ESG&A Costs increased to $74.8 million (17.7% of sales) from $69.0 million (17.6%

of sales) in the prior year’s first quarter

The quarter included a special charge of $4.6 million related to the acceleration of

retirement benefits of the former CEO

Without the special charge, ESG&A for the quarter would have been 16.7% of sales

Operating income was $12.9 million, up from $9.9 million in the prior year period

Our Mission & Vision

4

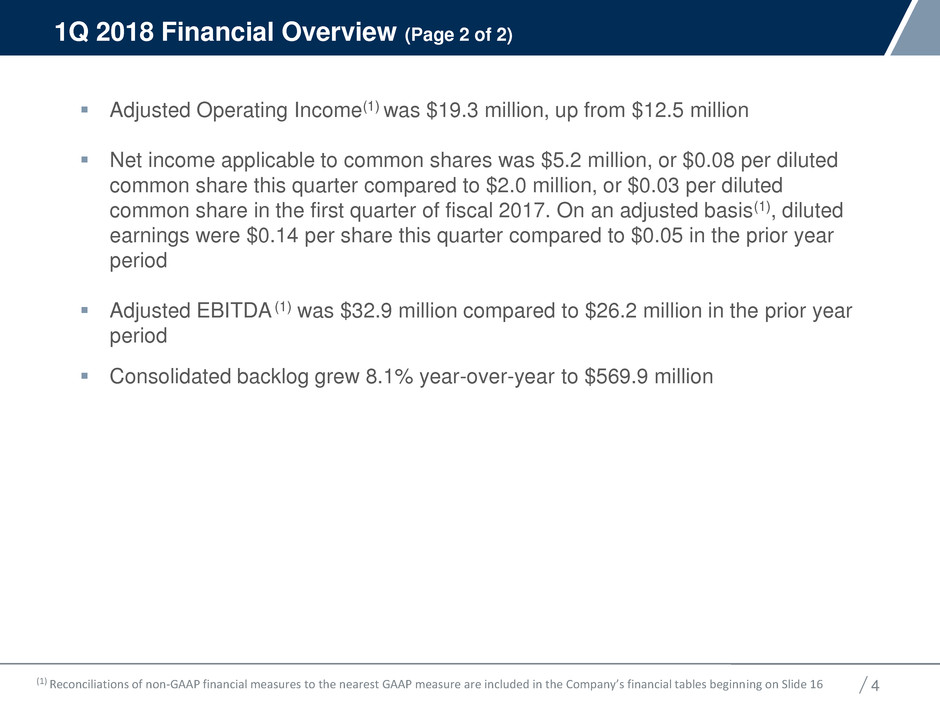

1Q 2018 Financial Overview (Page 2 of 2)

Adjusted Operating Income(1) was $19.3 million, up from $12.5 million

Net income applicable to common shares was $5.2 million, or $0.08 per diluted

common share this quarter compared to $2.0 million, or $0.03 per diluted

common share in the first quarter of fiscal 2017. On an adjusted basis(1), diluted

earnings were $0.14 per share this quarter compared to $0.05 in the prior year

period

Adjusted EBITDA (1) was $32.9 million compared to $26.2 million in the prior year

period

Consolidated backlog grew 8.1% year-over-year to $569.9 million

(1) Reconciliations of non-GAAP financial measures to the nearest GAAP measure are included in the Company’s financial tables beginning on Slide 16

Our Mission & Vision

5

Commercial

• Backlog in the Engineered Building Systems segment at the end of the quarter

increased 8.4% to $373.3 million

• The Engineered Building Systems and Metal Components legacy distribution

channels continue to expand their product offerings, leveraging products from the

other business lines and recognizing the following revenue growth

o IMP intersegment sales increased 4.1% year-over-year

o Engineered Building Systems backlog for IMP orders are up 26% year-over-year

o Door intersegment sales were flat year-over-year, while external sales increased 45.4%

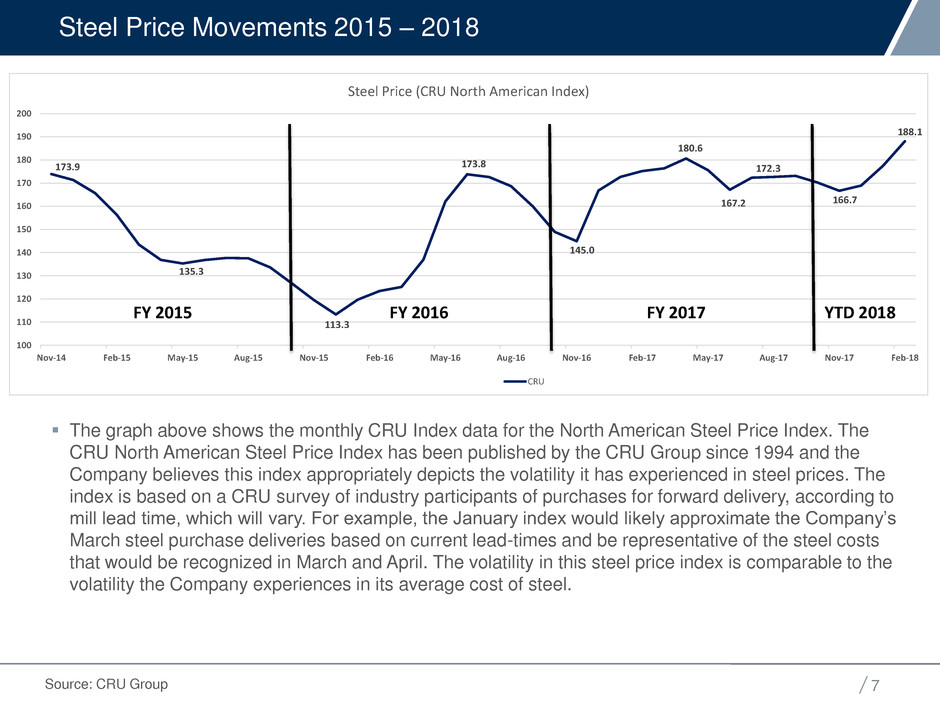

Steel Costs

• Steel costs continue to be elevated and recent announcements regarding possible

tariffs is likely to lead to continued price increases

• The Company has seen similar events in fiscal 2002, 2004 and 2008

Manufacturing

• There was increased utilization and efficiencies in the IMP and Metal Components

segments, however lower volumes in the Buildings segment reduced manufacturing

utilization

1Q 2018 Operational Overview

Our Mission & Vision

1Q 2018 Segment Overview (1)

6

Engineered Building Systems

• Revenues increased 3.8% to $157.0 million from $151.3 million in the prior year period, as

a result of commercial discipline passing through higher input costs, offset by lower

tonnage volumes

• Operating margin improved 100 basis points as a result of lower ESG&A costs, improved

commercial discipline, partially offset by lower plant utilization and higher transportation

costs

Metal Components

• Revenue grew 9.4% to $146.8 million from $134.2 million in the prior year period primarily

as a result of higher external volumes and the pass-through of increased materials costs

• Operating margins improved 240 basis points as a result of improved operating leverage

across the cost structure on higher volumes, partially offset by higher transportation costs

Insulated Metal Panels

• Revenue increased 16.4% to $110.8 million from $95.2 million in the prior year on strong

commercial discipline on rising input costs and increasing sales volumes

• Operating margins increased 410 basis points on improved operating leverage across the

cost structure on higher volumes and committed commercial discipline on rising input costs

Metal Coil Coating

• Revenues were $88.3 million in both the current quarter and prior year. Operating margins

were impacted by less favorable product mix and lower margins in the CENTRIA coil

coating operations as that business is integrated in the Metal Coil Coating segment

(1) Segment revenue includes intersegment sales

Our Mission & Vision

173.9

135.3

113.3

173.8

145.0

180.6

167.2

172.3

166.7

188.1

100

110

120

130

140

150

160

170

180

190

200

Nov-14 Feb-15 May-15 Aug-15 Nov-15 Feb-16 May-16 Aug-16 Nov-16 Feb-17 May-17 Aug-17 Nov-17 Feb-18

Steel Price (CRU North American Index)

CRU

Steel Price Movements 2015 – 2018

7 Source: CRU Group

The graph above shows the monthly CRU Index data for the North American Steel Price Index. The

CRU North American Steel Price Index has been published by the CRU Group since 1994 and the

Company believes this index appropriately depicts the volatility it has experienced in steel prices. The

index is based on a CRU survey of industry participants of purchases for forward delivery, according to

mill lead time, which will vary. For example, the January index would likely approximate the Company’s

March steel purchase deliveries based on current lead-times and be representative of the steel costs

that would be recognized in March and April. The volatility in this steel price index is comparable to the

volatility the Company experiences in its average cost of steel.

FY 2015 FY 2016 FY 2017 YTD 2018

Our Mission & Vision

1Q 2018 Financial Summary

8 (1) Reconciliations of non-GAAP financial measures to the nearest GAAP measure are included in the Company’s financial tables beginning on Slide 16

(Dollars in millions, except per share amounts)

January 28,

2018

January 29,

2017 % Chg.

Sales 421.3$ 391.7$ 7.6%

Gross Profit 91.9$ 84.0$ 9.5%

Gross Profit Margin 21.8% 21.4% 1.9%

Income from Operations 12.9$ 9.9$ 30.5%

Net Income 5.2$ 2.0$ 157.4%

Diluted EPS 0.08$ 0.03$ 166.7%

Adjusted Op ting Income

1

19.3$ 12.5$ 54.5%

Adjusted EBITDA

1

32.9$ 26.2$ 25.6%

Adjusted Diluted EPS

1

0.14$ 0.05$ 180.0%

Fiscal Three Months Ended

Our Mission & Vision

9

1Q 2018 Revenues and Volumes – by Segment

($ in millions)

(1) Calculated as the year-over-year change in the tonnage volumes shipped

1Q-'18 1Q-'17 % Chg.

% Vol.

Chg.

1

1Q-'18 1Q-'17 % Chg.

% Vol.

Chg.

1

1Q-'18 1Q-'17 % Chg.

% Vol.

Chg.

1

1Q-'18 1Q-'17 % Chg.

% Vol.

Chg.

1

Third-Party 148.3$ 145.0$ 2.3% -3.1% Third-Party 127.5$ 115.6$ 10.4% 6.1% Third-Party 97.5$ 82.4$ 18.3% N/A Third-Party 48.0$ 48.7$ -1.4% -15.5%

Internal 8.7 6.2 39.0% 39.3% Internal 19.3 18.6 5.0% -3.0% Internal 13.3 12.8 3.9% N/A Internal 40.3 39.7 1.7% 2.9%

Total Sales 157.0$ 151.3$ 3.8% -0.4% Total Sales 146.8$ 134.2$ 9.4% 4.4% Total Sales 110.8$ 95.2$ 16.4% N/A Total Sales 88.3$ 88.3$ 0.0% -7.4%

Metal Coil CoatingMetal ComponentsEngineered Building Systems Insulated Metal Panels

$-

$20.0

$40.0

$60.0

$80.0

$100.0

$120.0

$140.0

$160.0

$180.0

1Q-'18 1Q-'17

Engineered Building

Systems

Third-Party Internal

$-

$20.0

$40.0

$60.0

$80.0

$100.0

$120.0

$140.0

$160.0

1Q-'18 1Q-'17

Metal Components

Third-Party Internal

$-

$20.0

$40.0

$60.0

$80.0

$100.0

$120.0

1Q-'18 1Q-'17

Insulated Metal Panels

Third-Party Internal

$-

$10.0

$20.0

$30.0

$40.0

$50.0

$60.0

$70.0

$80.0

$90.0

$100.0

1Q-'18 1Q-'17

Metal Coil Coating

Third-Party Internal

Engineered Building

Systems

35%Metal

Components

30%

Insulated

Metal Panels

23%

Metal Coil Coating

12%

Consolidated 3rd Party Revenue

1Q 2018

Engineered Building

Systems

37%

Metal

Components

30%

Insulated Metal

Panels

21%

Metal Coil

Coating

12%

Consolidated 3rd Party Revenue

1Q 2017

Our Mission & Vision

1Q 2018 Business Segment Results

10

(Dollars in millions)

$145.0

$115.6

$82.4

$48.7

$391.7

$148.3

$127.5

$97.5

$48.0

$421.3

Buildings Components IMP Coatings Consolidated

(1) Reconciliation of non-GAAP financial measures to the nearest GAAP measure are included in the Company’s financial tables beginning on Slide 16

Third Party Revenue

$6.5

[VALUE]

$2.2

$6.7

$9.9

$8.3

$17.1

$7.1

$5.4

$12.9

Buildings Components IMP Coatings Consolidated

Operating Income

Adjusted Operating Income(1)

$10.6

$14.0

$6.6

$8.8

$26.2

$12.4

$17.3

$12.8

$7.4

$32.9

Buildings Components IMP Coatings Consolidated

2017

2018

Adjusted EBITDA(1)

$8.4

$12.7

$2.2

$6.7

$12.5

$9.6

$15.7

$8.7

$5.4

$19.3

Buildings Components IMP Coatings Consolidated

Our Mission & Vision

Gross Margin Reconciliation

11

Gross Margin 1Q 2017 21.4%

Commercial sales discipline 1.00%

Net impact of higher transportation costs (0.40%)

Lower plant utilization in the Engineered Building Systems

segment, net

(0.20%)

Gross Margin 1Q 2018 21.8%

For the quarter, gross profit was $91.9 million compared to $83.9 million in the

first quarter of fiscal 2017

The favorable commercial sales discipline was executed by the IMP, Metal

Components and Engineered Building Systems segments

Note: Basis point attributions in the above tables are approximate

Our Mission & Vision

12

Net Income:

Net income was $5.2 million compared to $2.0 million in the prior year’s first quarter

Adjusted EBITDA(1):

(Dollars in millions)

1Q Net Income and Adjusted EBITDA

(1) Reconciliations of non-GAAP financial measures to the nearest GAAP measure are included in the Company’s financial tables beginning on Slide 16

$26.2

$32.9 $6.7 $0.6

$(1.1)

$0.7

$(0.2)

$-

$5.0

$10.0

$15.0

$20.0

$25.0

$30.0

$35.0

$40.0

Adjusted EBITDA 1Q

2017

Volume, net Product Mix and

Margin Expansion

Net changes in

ESG&A costs

Net change in other

income and expense

Other Adjusted EBITDA 1Q

2018

Our Mission & Vision

1Q 2018 Cash Flow Summary

13

Cash and Cash Equivalents, as of 1Q 2018 4Q 2017 3Q 2017 2Q 2017 1Q 2017

Beginning balance $ 65,658 $ 45,923 $ 49,682 $ 15,789 $ 65,403

Cash provided by (used in) operating activities (6,580) 63,277 (7,294) 38,254 (30,363)

Cash provided by (used in) investing activities (5,860) (5,781) 4,100 (4,483) (4,120)

Cash provided by (used) in financing activities (41,035) (37,622) (961) 271 (15,217)

Exchange rate effects 237 (139) 396 (149) 86

Ending balance $ 12,420 $ 65,658 $ 45,923 $ 49,682 $ 15,789

Stock Repurchases

• During the quarter, the Company utilized $24.4 million to repurchase approximately 1.5 million

shares at an average share price of $16.08. Approximately $5.6 million remains available for

share repurchases under the $50.0 million plan launched in October 2017

• In December 2017, the CD&R Funds completed a registered underwritten public offering of 7.15

million shares of the Company’s common stock at a price to the public of $19.36 per share. As

part of that transaction the Company purchased 1.15 million shares of the 7.15 million for a total

amount of $22.3 million

(Dollars in thousands)

Our Mission & Vision

1Q 2018 Results Compared to Guidance

14

($ in millions)

Range

Low High 1Q Actuals

Revenues $390.0 $410.0 $421.3

Gross Profit Margin 21.5% 23.5% 21.8%

ESG&A Expenses $70.0 $74.0 $74.8

Intangible Asset Amortization $2.3 $2.5 $2.4

Total Depreciation & Amortization

(inclusive of Intangible amortization above)

$10.0 $11.0 $10.4

Interest Expense $7.0 $7.4 $7.5

Effective Tax Rate 34.0% 37.0% 17.6%

Adjusted EBITDA (1) $24.0 $34.0 $32.9

Revenues for the quarter reflect strong commercial discipline across Engineered Building

Systems, Metal Components and IMP

Gross profit margins improved year-over-year, however most of the growth came from lower

margin product groups

ESG&A results included a special charge of $4.6 million related to the acceleration of

retirement benefits of the prior CEO

The effective tax rate guidance was provided prior to the recent enactment of the Tax Cuts

and Jobs Act in December 2017

(1) Reconciliation of non-GAAP financial measures to the nearest GAAP measure are included in the Company’s financial tables beginning on Slide 16

Our Mission & Vision

2Q 2018 Guidance (1)

15

($ in million)

2Q Range

Low High

Revenues $430.0 $450.0

Gross Profit Margin 21.0% 24.0%

ESG&A Expenses $74.0 $78.0

Intangible Asset Amortization $2.3 $2.5

Total Depreciation & Amortization

(inclusive of Intangible Asset Amortization above)

$10.2 $10.8

Interest Expense $5.1 $5.6

Effective Tax Rate 25.5% 27.5%

Adjusted EBITDA $29.0 $39.0

Guidance for ESG&A excludes the amortization of intangible assets, which is shown as a separate

line item above

Total Depreciation & Amortization includes the intangible amortization and is reported on the

Company’s Statements of Operations within Cost of Goods Sold, ESG&A Expense and Intangible

Asset Amortization

Weighted average diluted common shares is expected to be 66.3 million for 2Q 2018

Total capital expenditures for fiscal 2018 are expected to be in the range of $45.0 million to $55.0

million

(1) See “Forward Looking Statements” on Slide 2

Our Mission & Vision

Reconciliation of Net Income (Loss) and Adjusted Net Income (Loss) per

Diluted Common Share

16

(Dollars in thousands, except per share amounts)

January 28, January 29,

2018 2017

Net income per diluted common share, GAAP basis 0.08$ 0.03$

Restructuring and impairment charges 0.02$ 0.03

Strategic development and acquisition related costs 0.01$ 0.00

Acceleration of CEO retirement benefits 0.07$ -

Discrete tax effects of U.S. Tax Reform (0.01)$ -

Tax effect of applicable non-GAAP adjustments (1) (0.03)$ (0.01)

Adjusted net income per diluted common share (2) 0.14$ 0.05$

January 28, January 29,

2018 2017

Net income applicable to common shares, GAAP basis 5,211$ 2,031$

Restructuring and impairment charges 1,094 2,264

Strategic development and acquisition related costs 727 357

Acceleration of CEO retirement benefits 4,600 -

Discrete tax effects of U.S. tax reform (323) -

Tax effect of applicable non-GAAP adjustments (1) (1,775) (1,022)

Adjusted net income applicable to common shares (2) 9,534$ 3,630$

#DIV/0!

(2) The Company discloses a tabular comparison of Adjusted net income per diluted common share and Adjusted net income applicable to common

shares, which are non-GAAP measures, because they are referred to in the text of our press releases and are instrumental in comparing the results

from period to period. Adjusted net income per diluted common share and Adjusted net income applicable to common shares should not be considered

in isolation or as a substitute for net income per diluted common share and net income applicable to common shares as reported on the face of our

consolidated statements of operations.

(1) The Company calculated the tax effect of non-GAAP adjustments by applying the applicable statutory tax rate for the period to each applicable non-

GAAP item.

Fiscal Three Months Ended

Fiscal Three Months Ended

Our Mission & Vision

Business Segments (Page 1 of 2)

17

(Dollars in thousands)

Trailing Trailing

Twelve

Months

Twelve

Months

May 1, July 31, October 30, January 29, January 29, April 30, July 30, October 29, January 28, January 28,

2016 2016 2016 2017 2017 2017 2017 2017 2018 2018

Total Sales:

Engineered Building Systems 138,023$ 181,029$ 204,208$ 151,263$ 674,523$ 162,624$ 191,910$ 188,183$ 156,964$ 699,681$

Metal Components 130,293 166,512 166,532 134,173 597,510 154,895 166,305 181,288 146,832 649,320

Insulated Metal Panels 89,433 105,694 110,001 95,195 400,323 102,937 119,730 123,542 110,794 457,003

Metal Coil Coating 79,829 96,684 95,987 88,340 360,840 86,729 95,261 98,550 88,343 368,883

Total sales 437,578 549,919 576,728 468,971 2,033,196 507,185 573,206 591,563 502,933 2,174,887

Less: Intersegment sales (65,331) (87,566) (96,414) (77,268) (326,579) (86,721) (103,821) (102,837) (81,584) (374,963)

Total net sales 372,247$ 462,353$ 480,314$ 391,703$ 1,706,617$ 420,464$ 469,385$ 488,726$ 421,349$ 1,799,924$

External Sales

Engineered Building Systems 134,454$ 175,471$ 196,596$ 145,021$ 651,542$ 154,456$ 182,164$ 178,222$ 148,288$ 663,130$

Metal Components 111,748 140,560 139,968 115,557 507,833 133,290 140,639 155,183 127,528 556,640

Insulated Metal Panels 79,882 94,059 92,648 82,441 349,030 86,773 98,026 105,064 97,513 387,376

Metal Coil Coating 46,163 52,263 51,102 48,684 198,212 45,945 48,556 50,257 48,020 192,778

Total extermal sales 372,247$ 462,353$ 480,314$ 391,703$ 1,706,617$ 420,464$ 469,385$ 488,726$ 421,349$ 1,799,924$

Operating Income

Engineered Building Systems 7,193$ 19,561$ 22,830$ 6,503$ 56,087$ 6,894$ 14,948$ 13,043$ 8,263$ 43,148$

Metal Components 13,071 26,803 21,254 12,376 73,504 19,997 23,276 23,119 17,089 83,481

Insulated Metal Panels 2,782 8,911 7,513 2,192 21,398 19,377 11,468 14,895 7,071 52,811

Metal Coil Coating 6,686 10,531 9,310 6,706 33,233 6,227 7,107 1,419 5,376 20,129

Corporate (19,138) (22,271) (21,516) (17,891) (80,816) (20,023) (22,702) (19,151) (24,901) (86,777)

Total operating income 10,594$ 43,535$ 39,391$ 9,886$ 103,406$ 32,472$ 34,097$ 33,325$ 12,898$ 112,792$

Adjusted Operating Income (1)

Engineered Building Systems 6,415$ 19,615$ 23,103$ 8,413$ 57,546$ 7,217$ 15,889$ 13,738$ 9,572$ 46,416$

Metal Components 13,503 27,005 21,357 12,681 74,546 19,706 23,188 23,188 15,686 81,768

Insulated Metal Panels 2,986 8,979 7,917 2,192 22,074 10,387 11,711 15,696 8,655 46,449

Met l Coil Coating 6,725 10,531 9,310 6,706 33,272 6,227 7,107 7,419 5,376 26,129

Corporate (18,234) (21,050) (20,829) (17,485) (77,598) (19,899) (21,405) (18,786) (19,970) (80,060)

Total adjusted operating income 11,395$ 45,080$ 40,858$ 12,507$ 109,840$ 23,638$ 36,490$ 41,255$ 19,319$ 120,702$

(1) The Company discloses a tabular comparison of Adjusted operating income (loss), which is a non-GAAP measure, because it is instrumental in comparing the results from period to period. Adjusted operating income (loss) should not be

considered in isolation or as a substitute for operating income (loss) as reported on the face of our statements of operations.

Fiscal Three Months EndedFiscal Three Months Ended

Our Mission & Vision

Business Segments (Page 2 of 2)

18

(Dollars in thousands)

Trailing Trailing

Twelve

Months

Twelve

Months

May 1, July 31, October 30, January 29, January 29, April 30, July 30, October 29, January 28, January 28,

2016 2016 2016 2017 2017 2017 2017 2017 2018 2018

Adjusted EBITDA (2)

Engineered Building Systems 9,789$ 21,122$ 25,140$ 10,648$ 66,699$ 9,377$ 19,435$ 15,242$ 12,382$ 56,436$

Metal Components 14,820 28,462 22,736 14,043 80,061 21,060 24,509 24,694 17,315 87,578

Insulated Metal Panels 7,126 13,368 12,113 6,619 39,226 14,985 16,016 20,794 12,770 64,565

Metal Coil Coating 8,891 12,747 11,159 8,843 41,640 8,236 9,170 9,484 7,434 34,324

Corporate (15,171) (17,871) (17,486) (13,980) (64,508) (16,689) (18,756) (16,273) (17,026) (68,744)

Total adjusted EBITDA 25,455$ 57,828$ 53,662$ 26,173$ 163,118$ 36,969$ 50,374$ 53,941$ 32,875$ 174,159$

Operating Income Margin

Engineered Building Systems 5.2 % 10.8 % 11.2 % 4.3 % 8.3 % 4.2 % 7.8 % 6.9 % 5.3 % 6.2 %

Metal Components 10.0 % 16.1 % 12.8 % 9.2 % 12.3 % 12.9 % 14.0 % 12.8 % 11.6 % 12.9 %

Insulated Metal Panels 3.1 % 8.4 % 6.8 % 2.3 % 5.3 % 18.8 % 9.6 % 12.1 % 6.4 % 11.6 %

Metal Coil Coating 8.4 % 10.9 % 9.7 % 7.6 % 9.2 % 7.2 % 7.5 % 1.4 % 6.1 % 5.5 %

Consolidated 2.8 % 9.4 % 8.2 % 2.5 % 6.1 % 7.7 % 7.3 % 6.8 % 3.1 % 6.3 %

Adjusted Operating Income Margin

Engineered Building Systems 4.6 % 10.8 % 11.3 % 5.6 % 8.5 % 4.4 % 8.3 % 7.3 % 6.1 % 6.6 %

Metal Components 10.4 % 16.2 % 12.8 % 9.5 % 12.5 % 12.7 % 13.9 % 12.8 % 10.7 % 12.6 %

Insulated Metal Panels 3.3 % 8.5 % 7.2 % 2.3 % 5.5 % 10.1 % 9.8 % 12.7 % 7.8 % 10.2 %

Metal Coil Coating 8.4 % 10.9 % 9.7 % 7.6 % 9.2 % 7.2 % 7.5 % 7.5 % 6.1 % 7.1 %

Consolidated 3.1 % 9.8 % 8.5 % 3.2 % 6.4 % 5.6 % 7.8 % 8.4 % 4.6 % 6.7 %

Adjusted EBITDA Margin

Engineered Building Systems 7.1 % 11.7 % 12.3 % 7.0 % 9.9 % 5.8 % 10.1 % 8.1 % 7.9 % 8.1 %

Metal Components 11.4 % 17.1 % 13.7 % 10.5 % 13.4 % 13.6 % 14.7 % 13.6 % 11.8 % 13.5 %

Insulated Metal Panels 8.0 % 12.6 % 11.0 % 7.0 % 9.8 % 14.6 % 13.4 % 16.8 % 11.5 % 14.1 %

Metal Coil Coating 11.1 % 13.2 % 11.6 % 10.0 % 11.5 % 9.5 % 9.6 % 9.6 % 8.4 % 9.3 %

Consolidated 6.8 % 12.5 % 11.2 % 6.7 % 9.6 % 8.8 % 10.7 % 11.0 % 7.8 % 9.7 %

(2) The Company's Credit Agreement defines Adjusted EBITDA. Adjusted EBITDA excludes non-cash charges for goodwill and other asset impairments and stock compensation as well as certain special charges. As such, the historical

information is presented in accordance with the definition above. Concurrent with the amendment and restatement of the Term Loan facility, the Company entered into an Asset-Based Lending facility which has substantially the same definition

of Adjusted EBITDA except that the ABL facility caps certain special charges. The Company is disclosing Adjusted EBITDA, which is a non-GAAP measure, because it is used by management and provided to investors to provide comparability

of underlying operational results.

Fiscal Three Months Ended Fiscal Three Months Ended

Our Mission & Vision

19

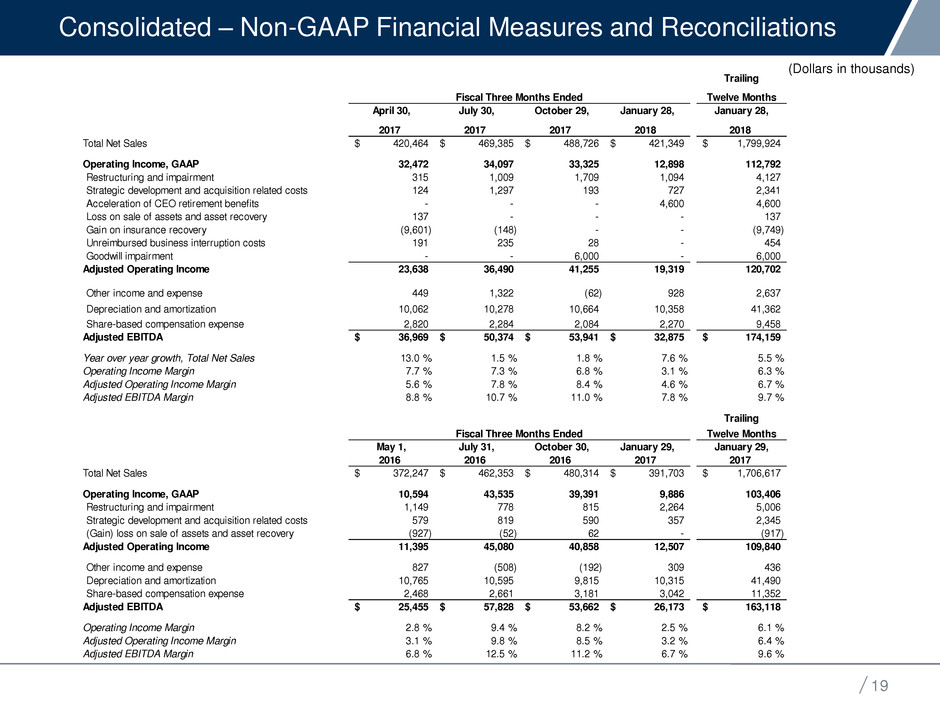

(Dollars in thousands)

Consolidated – Non-GAAP Financial Measures and Reconciliations

Trailing

Twelve Months

April 30, July 30, October 29, January 28, January 28,

2017 2017 2017 2018 2018

Total Net Sales 420,464$ 469,385$ 488,726$ 421,349$ 1,799,924$

Operating Income, GAAP 32,472 34,097 33,325 12,898 112,792

Restructuring and impairment 315 1,009 1,709 1,094 4,127

Strategic development and acquisition related costs 124 1,297 193 727 2,341

Acceleration of CEO retirement benefits - - - 4,600 4,600

Loss on sale of assets and asset recovery 137 - - - 137

Gain on insurance recovery (9,601) (148) - - (9,749)

Unreimbursed business interruption costs 191 235 28 - 454

Goodwill impairment - - 6,000 - 6,000

Adjusted Operating Income 23,638 36,490 41,255 19,319 120,702

Other income and expense 449 1,322 (62) 928 2,637

Depreciation and amortization 10,062 10,278 10,664 10,358 41,362

Share-based compensation expense 2,820 2,284 2,084 2,270 9,458

Adjusted EBITDA 36,969$ 50,374$ 53,941$ 32,875$ 174,159$

Year over year growth, Total Net Sales 13.0 % 1.5 % 1.8 % 7.6 % 5.5 %

Operating Income Margin 7.7 % 7.3 % 6.8 % 3.1 % 6.3 %

Adjusted Operating Income Margin 5.6 % 7.8 % 8.4 % 4.6 % 6.7 %

Adjusted EBITDA Margin 8.8 % 10.7 % 11.0 % 7.8 % 9.7 %

Trailing

Twelve Months

May 1, July 31, October 30, January 29, January 29,

2016 2016 2016 2017 2017

Total Net Sales 372,247$ 462,353$ 480,314$ 391,703$ 1,706,617$

Operating Income, GAAP 10,594 43,535 39,391 9,886 103,406

Restructuring and impairment 1,149 778 815 2,264 5,006

Strategic development and acquisition related costs 579 819 590 357 2,345

(Gain) loss on sale of assets and asset recovery (927) (52) 62 - (917)

Adjusted Operating Income 11,395 45,080 40,858 12,507 109,840

Other income and expense 827 (508) (192) 309 436

Depreciation and amortization 10,765 10,595 9,815 10,315 41,490

Share-based compensation expense 2,468 2,661 3,181 3,042 11,352

Adjusted EBITDA 25,455$ 57,828$ 53,662$ 26,173$ 163,118$

Operating Income Margin 2.8 % 9.4 % 8.2 % 2.5 % 6.1 %

Adjusted Operating Income Margin 3.1 % 9.8 % 8.5 % 3.2 % 6.4 %

Adjusted EBITDA Margin 6.8 % 12.5 % 11.2 % 6.7 % 9.6 %

Fiscal Three Months Ended

Fiscal Three Months Ended

Our Mission & Vision

Engineered Building Systems – Non-GAAP Financial Measures and

Reconciliations

20

(Dollars in thousands)

Trailing

Twelve Months

April 30, July 30, October 29, January 28, January 28,

2017 2017 2017 2018 2018

Total Sales 162,624$ 191,910$ 188,183$ 156,964$ 699,681$

External Sales 154,456 182,164 178,222 148,288 663,130

Operating Income, GAAP 6,894 14,948 13,043 8,263 43,148

Restructuring and impairment 186 941 695 1,136 2,958

Strategic development and acquisition related costs - - - 173 173

Loss on sale of assets and asset recovery 137 - - - 137

Adjusted Operating Income 7,217 15,889 13,738 9,572 46,416

Other income and expense (125) 1,291 (694) 733 1,205

Depreciation and amortization 2,285 2,255 2,198 2,077 8,815

Adjusted EBITDA 9,377$ 19,435$ 15,242$ 12,382$ 56,436$

Year over year growth, Total sales 17.8 % 6.0 % (7.8)% 3.8 % 3.7 %

Year over year growth, External Sales 14.9 % 3.8 % (9.3)% 2.3 % 1.8 %

Operating Income Margin 4.2 % 7.8 % 6.9 % 5.3 % 6.2 %

Adjusted Operating Income Margin 4.4 % 8.3 % 7.3 % 6.1 % 6.6 %

Adjusted EBITDA Margin 5.8 % 10.1 % 8.1 % 7.9 % 8.1 %

Trailing

Twelve Months

May 1, July 31, October 30, January 29, January 29,

2016 2016 2016 2017 2017

Total Sales 138,023$ 181,029$ 204,208$ 151,263$ 674,523$

External Sales 134,454 175,471 196,596 145,021 651,542

Operating Income, GAAP 7,193 19,561 22,830 6,503 56,087

Restructuring and impairment 149 106 211 1,910 2,376

(Gain) loss on sale of assets and asset recovery (927) (52) 62 - (917)

Adjusted Operating Income 6,415 19,615 23,103 8,413 57,546

Other income and expense 938 (931) (362) (41) (396)

Depreciation and amortization 2,436 2,438 2,399 2,276 9,549

Adjusted EBITDA 9,789$ 21,122$ 25,140$ 10,648$ 66,699$

Operating Income Margin 5.2 % 10.8 % 11.2 % 4.3 % 8.3 %

Adjusted Operating Income Margin 4.6 % 10.8 % 11.3 % 5.6 % 8.5 %

Adjusted EBITDA Margin 7.1 % 11.7 % 12.3 % 7.0 % 9.9 %

Fiscal Three Months Ended

Fiscal Three Months Ended

Our Mission & Vision

Metal Components– Non-GAAP Financial Measures and Reconciliations

21

Trailing

Twelve Months

April 30, July 30, October 29, January 28, January 28,

2017 2017 2017 2018 2018

Total Sales 154,895$ 166,305$ 181,288$ 146,832$ 649,320$

External Sales 133,290 140,639 155,183 127,528 556,640

Operating Income, GAAP 19,997 23,276 23,119 17,089 83,481

Restructuring and impairment 129 60 69 (1,403) (1,145)

Gain on insurance recovery (420) (148) - - (568)

Adjusted Operating Income 19,706 23,188 23,188 15,686 81,768

Other income and expense 52 55 84 53 244

Depreciation and amortization 1,302 1,266 1,422 1,576 5,566

Adjusted EBITDA 21,060$ 24,509$ 24,694$ 17,315$ 87,578$

Year over year growth, Total sales 18.9 % (0.1)% 8.9 % 9.4 % 8.7 %

Year over year growth, External Sales 19.3 % 0.1 % 10.9 % 10.4 % 9.6 %

Operating Income Margin 12.9 % 14.0 % 12.8 % 11.6 % 12.9 %

Adjusted Operating Income Margin 12.7 % 13.9 % 12.8 % 10.7 % 12.6 %

Adjusted EBITDA Margin 13.6 % 14.7 % 13.6 % 11.8 % 13.5 %

Trailing

Twelve Months

May 1, July 31, October 30, January 29, January 29,

2016 2016 2016 2017 2017

Total Sales 130,293$ 166,512$ 166,532$ 134,173$ 597,510$

External Sales 111,748 140,560 139,968 115,557 507,833

Operating Income, GAAP 13,071 26,803 21,254 12,376 73,504

Restructuring and impairment 432 202 103 305 1,042

Adjusted Operating Income 13,503 27,005 21,357 12,681 74,546

Other income and expense 167 92 (27) 28 260

Depreciation and amortization 1,150 1,365 1,406 1,334 5,255

Adjusted EBITDA 14,820$ 28,462$ 22,736$ 14,043$ 80,061$

Operating Income Margin 10.0 % 16.1 % 12.8 % 9.2 % 12.3 %

Adjusted Operating Income Margin 10.4 % 16.2 % 12.8 % 9.5 % 12.5 %

Adjusted EBITDA Margin 11.4 % 17.1 % 13.7 % 10.5 % 13.4 %

Fiscal Three Months Ended

Fiscal Three Months Ended

(Dollars in thousands)

Our Mission & Vision

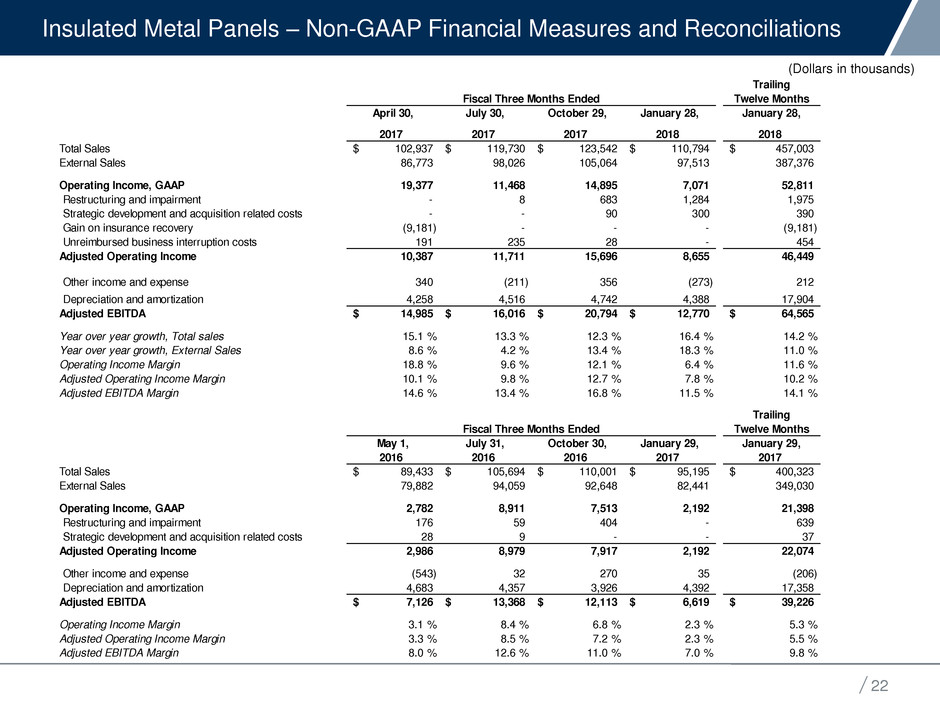

22

Trailing

Twelve Months

April 30, July 30, October 29, January 28, January 28,

2017 2017 2017 2018 2018

Total Sales 102,937$ 119,730$ 123,542$ 110,794$ 457,003$

External Sales 86,773 98,026 105,064 97,513 387,376

Operating Income, GAAP 19,377 11,468 14,895 7,071 52,811

Restructuring and impairment - 8 683 1,284 1,975

Strategic development and acquisition related costs - - 90 300 390

Gain on insurance recovery (9,181) - - - (9,181)

Unreimbursed business interruption costs 191 235 28 - 454

Adjusted Operating Income 10,387 11,711 15,696 8,655 46,449

Other income and expense 340 (211) 356 (273) 212

Depreciation and amortization 4,258 4,516 4,742 4,388 17,904

Adjusted EBITDA 14,985$ 16,016$ 20,794$ 12,770$ 64,565$

Year over year growth, Total sales 15.1 % 13.3 % 12.3 % 16.4 % 14.2 %

Year over year growth, External Sales 8.6 % 4.2 % 13.4 % 18.3 % 11.0 %

Operating Income Margin 18.8 % 9.6 % 12.1 % 6.4 % 11.6 %

Adjusted Operating Income Margin 10.1 % 9.8 % 12.7 % 7.8 % 10.2 %

Adjusted EBITDA Margin 14.6 % 13.4 % 16.8 % 11.5 % 14.1 %

Trailing

Twelve Months

May 1, July 31, October 30, January 29, January 29,

2016 2016 2016 2017 2017

Total Sales 89,433$ 105,694$ 110,001$ 95,195$ 400,323$

External Sales 79,882 94,059 92,648 82,441 349,030

Operating Income, GAAP 2,782 8,911 7,513 2,192 21,398

Restructuring and impairment 176 59 404 - 639

Strategic development and acquisition related costs 28 9 - - 37

Adjusted Operating Income 2,986 8,979 7,917 2,192 22,074

Other income and expense (543) 32 270 35 (206)

Depreciation and amortization 4,683 4,357 3,926 4,392 17,358

Adjusted EBITDA 7,126$ 13,368$ 12,113$ 6,619$ 39,226$

Operating Income Margin 3.1 % 8.4 % 6.8 % 2.3 % 5.3 %

Adjusted Operating Income Margin 3.3 % 8.5 % 7.2 % 2.3 % 5.5 %

Adjusted EBITDA Margin 8.0 % 12.6 % 11.0 % 7.0 % 9.8 %

Fiscal Three Months Ended

Fiscal Three Months Ended

Insulated Metal Panels – Non-GAAP Financial Measures and Reconcili tions

(Dollars in thousands)

Our Mission & Vision

23

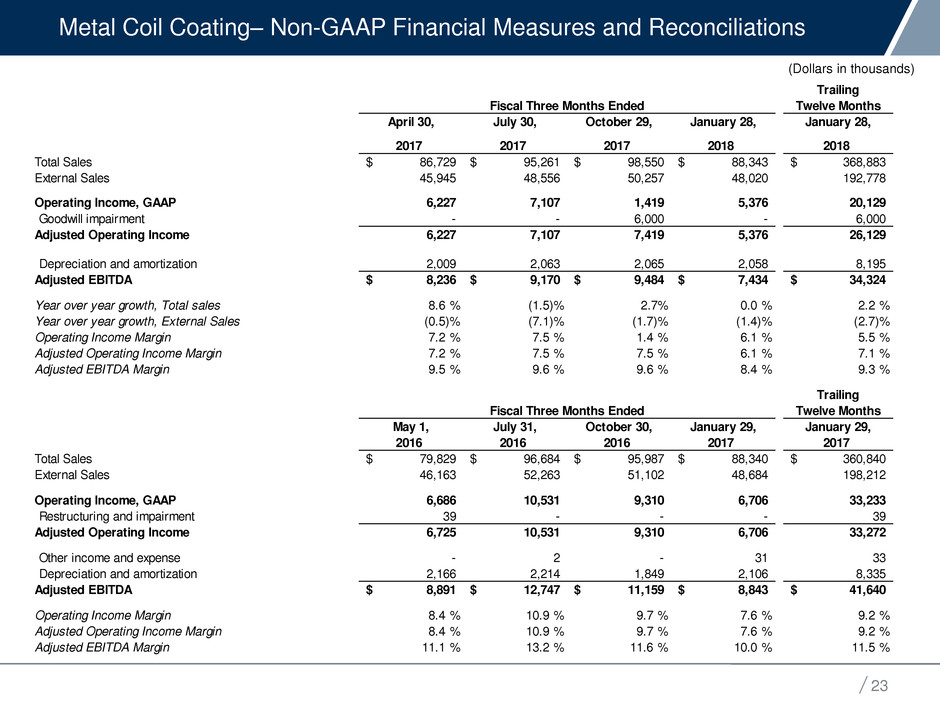

Metal Coil Coating– Non-GAAP Financial Measures and Reconciliations

(Dollars in thousands)

Trailing

Twelve Months

April 30, July 30, October 29, January 28, January 28,

2017 2017 2017 2018 2018

Total Sales 86,729$ 95,261$ 98,550$ 88,343$ 368,883$

External Sales 45,945 48,556 50,257 48,020 192,778

Operating Income, GAAP 6,227 7,107 1,419 5,376 20,129

Goodwill impairment - - 6,000 - 6,000

Adjusted Operating Income 6,227 7,107 7,419 5,376 26,129

Depreciation and amortization 2,009 2,063 2,065 2,058 8,195

Adjusted EBITDA 8,236$ 9,170$ 9,484$ 7,434$ 34,324$

Year over year growth, Total sales 8.6 % (1.5)% 2.7% 0.0 % 2.2 %

Year over year growth, External Sales (0.5)% (7.1)% (1.7)% (1.4)% (2.7)%

Operating Income Margin 7.2 % 7.5 % 1.4 % 6.1 % 5.5 %

Adjusted Operating Income Margin 7.2 % 7.5 % 7.5 % 6.1 % 7.1 %

Adjusted EBITDA Margin 9.5 % 9.6 % 9.6 % 8.4 % 9.3 %

Trailing

Twelve Months

May 1, July 31, October 30, January 29, January 29,

2016 2016 2016 2017 2017

Total Sales 79,829$ 96,684$ 95,987$ 88,340$ 360,840$

External Sales 46,163 52,263 51,102 48,684 198,212

Operating Income, GAAP 6,686 10,531 9,310 6,706 33,233

Restructuring and impairment 39 - - - 39

Adjusted Operating Income 6,725 10,531 9,310 6,706 33,272

Other income and expense - 2 - 31 33

Depreciation and amortization 2,166 2,214 1,849 2,106 8,335

Adjusted EBITDA 8,891$ 12,747$ 11,159$ 8,843$ 41,640$

Operating Income Margin 8.4 % 10.9 % 9.7 % 7.6 % 9.2 %

Adjusted Operating Income Margin 8.4 % 10.9 % 9.7 % 7.6 % 9.2 %

Adjusted EBITDA Margin 11.1 % 13.2 % 11.6 % 10.0 % 11.5 %

Fiscal Three Months Ended

Fiscal Three Months Ended

Our Mission & Vision

K. DARCEY MATTHEWS

Vice President, Investor Relations

E: darcey.matthews@ncigroup.com

281.897.7785

ncibuildingsystems.com