Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K MARCH 6 2018 - CREE, INC. | form8k030618_2.htm |

© 2018 Cree, Inc. All rights reserved

Cree Acquires Infineon Technologies RF Power Business

EXPANDING LEADERSHIP IN RF POWER

March 6, 2018

© 2018 Cree, Inc. All rights reserved 2

Note on Forward-Looking Statements

This presentation includes forward-looking statements involving risks and uncertainties, both known and unknown, that may cause Cree’s actual results to differ materially from those

indicated in the forward-looking statements. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about the

anticipated benefits of the transaction, including future financial and operating results.

Actual results, including with respect to our targets and prospects, could differ materially due to a number of factors, including the possibility that anticipated benefits of the proposed

transaction will not be realized; the risk that we may not obtain sufficient orders to achieve our targeted revenues; price competition in key markets; the risk that our results will suffer if

we are unable to balance fluctuations in customer demand and capacity; the risk that we are not able to enter into contractual arrangements with the customers of the acquired

business; risks associated with acquisitions generally; the risk that we are not able to develop and expand customer bases and accurately anticipate demand from end customers, which

can result in increased inventory and reduced orders as we experience wide fluctuations in supply and demand; our ability to lower costs; product mix; risks associated with our ability to

complete development and commercialization of products under development; risks associated with the ramp-up of production of new products and our entry into new business

channels; the rapid development of new technology and competing products that may impair demand or render our products obsolete; the potential lack of customer acceptance for our

products; and other factors discussed in our filings with the Securities and Exchange Commission (SEC), including our report on Form 10-K for the fiscal year ended June 25, 2017, and

subsequent reports filed with the SEC.

The forward-looking statements in this presentation represent Cree's judgment as of the date of this presentation. Except as required under the U.S. federal securities laws and the rules

and regulations of the SEC, Cree disclaims any intent or obligation to update any forward-looking statements after the date of this release, whether as a result of new information, future

events, developments, changes in assumptions or otherwise.

Note Regarding Non-GAAP Financial Measures

This presentation includes certain non-GAAP financial measures and targets. Cree's management evaluates results and makes operating decisions using both GAAP and non-GAAP

measures included in this presentation. Non-GAAP results exclude certain costs, charges and expenses which are included in GAAP results. By including these non-GAAP measures,

management intends to provide investors with additional information to further analyze the Company's performance, core results and underlying trends. Non-GAAP results are not

prepared in accordance with GAAP and non-GAAP information should be considered a supplement to, and not a substitute for, financial statements prepared in accordance with GAAP.

Forward-Looking Statements & Non-GAAP Measures

© 2018 Cree, Inc. All rights reserved 3

WOLFSPEED

A Powerhouse Semiconductor company focused on Silicon Carbide (SiC)

and Gallium Nitride (GaN)

• Large multi-decade growth opportunities with SiC and GaN in Electric Vehicles, Solar energy,

Telecommunications, Industrial, and Mil/Aero

• Invest to expand scale and to accelerate growth of SiC Materials, Power Devices and GaN

RF Devices where SiC and GaN have distinct advantage

• Objectives: High growth, strong gross margins with good fall through to the bottom line

Cree’s Transformation Path

© 2018 Cree, Inc. All rights reserved 4

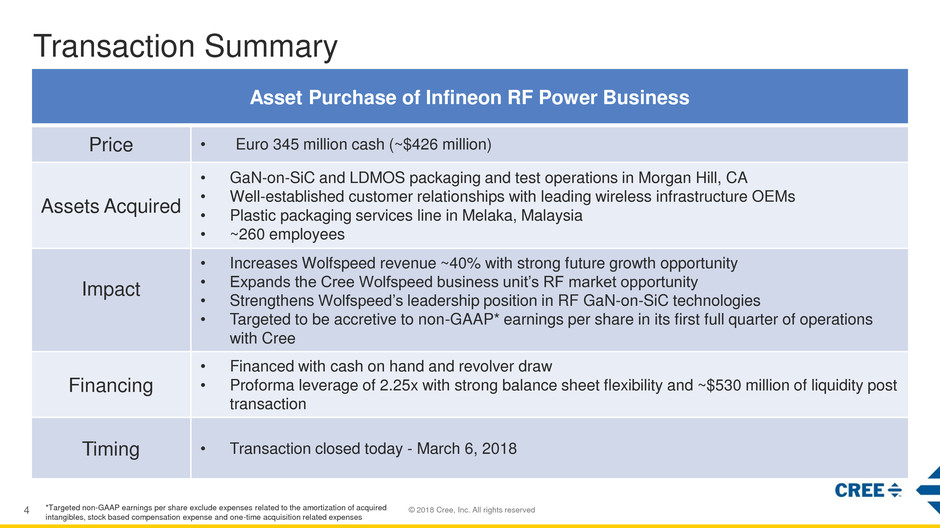

Transaction Summary

Asset Purchase of Infineon RF Power Business

Price • Euro 345 million cash (~$426 million)

Assets Acquired

• GaN-on-SiC and LDMOS packaging and test operations in Morgan Hill, CA

• Well-established customer relationships with leading wireless infrastructure OEMs

• Plastic packaging services line in Melaka, Malaysia

• ~260 employees

Impact

• Increases Wolfspeed revenue ~40% with strong future growth opportunity

• Expands the Cree Wolfspeed business unit’s RF market opportunity

• Strengthens Wolfspeed’s leadership position in RF GaN-on-SiC technologies

• Targeted to be accretive to non-GAAP* earnings per share in its first full quarter of operations

with Cree

Financing

• Financed with cash on hand and revolver draw

• Proforma leverage of 2.25x with strong balance sheet flexibility and ~$530 million of liquidity post

transaction

Timing • Transaction closed today - March 6, 2018

*Targeted non-GAAP earnings per share exclude expenses related to the amortization of acquired

intangibles, stock based compensation expense and one-time acquisition related expenses

© 2018 Cree, Inc. All rights reserved 5

Positions Wolfspeed to further enable faster 4G networks and the revolutionary transition to 5G

Strengthens Wolfspeed’s leadership position in RF GaN-on-SiC technologies

• Increased scale – increases Wolfspeed revenue by ~$115 million in the first 12 months

• Broader product offering - silicon LDMOS and GaN RF packaged devices

• Additional RF expertise - 70+ engineers, silicon and GaN know-how, extensive IP

• Unique positioning – only Wolfspeed is vertically integrated from SiC wafers to devices

Provides access to additional markets and customers

• Offering packaged devices expands Wolfspeed’s RF market opportunity

• Existing relationships with the top OEMs in wireless infrastructure provide direct market access

Adds in-house packaging expertise and capability

• GaN-on-SiC and LDMOS packaging and test operations in Morgan Hill, CA

Financially attractive

Targeted to be accretive to non-GAAP* earnings per share in its first full quarter of operations with Cree

Business supports achieving our 40/20/20 long-range margin model presented at our Investor Day on

February 26, 2018

Strategic Rationale

*Targeted non-GAAP earnings per share exclude expenses related to the amortization of acquired

intangibles, stock based compensation expense and one-time acquisition related expenses

© 2018 Cree, Inc. All rights reserved 6

Key Takeaways

Strengthens

Market Position

Added scale, packaging capabilities and domain expertise will help extend our considerable

technology leadership position

Expands TAM

Offering packaged devices allows us to address more of the overall RF market opportunity,

including gaining customer relationships with the top OEMs in wireless infrastructure

Accelerates

Growth

Increases Wolfspeed revenue by about 40%

Financial

Flexibility Intact

Balance sheet remains strong with approximately $530 million in available liquidity, and

leverage is modest at ~2.25x trailing EBITDA

© 2018 Cree, Inc. All rights reserved