Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CARVER BANCORP INC | tv487850_8k.htm |

Exhibit 99.1

February 28, 2018 Annual Meeting of Shareholders

Executive Summary President and CEO Michael Pugh¡¦s Key Message Points: „X Fiscal Year 2017 was a year in transition „X BDO USA appointed as new independent external auditor „X Carver reduced regular operating and non-recurring expenses „X Carver significantly improved its regulatory infrastructure „X Carver continues to maintain a strong and high quality loan portfolio „X Carver remains a well capitalized financial institution 1

Forward Looking Statements Certain statements contained in this presentation are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such forward-looking statements which may be identified by the use of such words as “believe,” “expect,” “anticipate,” “intend,” “should,” “could,” “planned,” “estimated,” “potential” and similar terms and phrases. Forward-looking statements are subject to risks and uncertainties, including, but not limited to, those related to the economic environment, particularly in the market areas in which Carver Bancorp, Inc. (the “Company”) and Carver Federal Savings Bank (the “Bank”) operate, competitive products and pricing, fiscal and monetary policies of the U.S. Government, changes in government regulations affecting financial institutions, including regulatory fees and capital requirements, changes in prevailing interest rates, credit risk management, asset-liability management, the financial and securities markets and the availability of and costs associated with sources of liquidity. The Company wishes to caution readers not to place undue reliance on any forward-looking statements, which speak only as of the date made. The Company wishes to advise readers that the factors listed above could affect the Company’s financial performance and could cause the actual results for future periods to differ materially from any opinions or statements expressed with respect to future periods in any current statements. The Company and the Bank undertake no obligation to update these forward-looking statements to reflect events or circumstances that occur after the date on which such statements were made. 2

Performance: Key Operating Metrics 2013 - 2017* Net Income ($ in thousands) Return on Average Assets 3.14% 3.41% 3.05% 3.17% 3.11% 2013 2014 2015 2016 2017 112.93% 106.27% 117.29% 100.51% 110.47% 2013 2014 2015 2016 2017 0.10% (0.22)% (0.18)% (0.25)% (0.41)% $590 $(1,324) $(1,152) $(1,767) $(2,853) Net Interest Margin Efficiency Ratio Note: 2013, 2014, 2015, & 2016 balances have been restated from previously reported results. *Carver Bank’s Fiscal Year begins April 1 and ends March 31. 3

$638 $639 $675 $739 $688 $496 $509 $528 $607 $579 $359 $383 $479 $583 $540 2013 2014 2015 2016 2017 Total Assets Total Deposits Net Loans Maintaining a Strong Balance Sheet* ($ in millions) Note: 2013, 2014, 2015, & 2016 balances have been restated from previously reported results. *Carver Bank’s Fiscal Year begins April 1 and end s March 31. 4

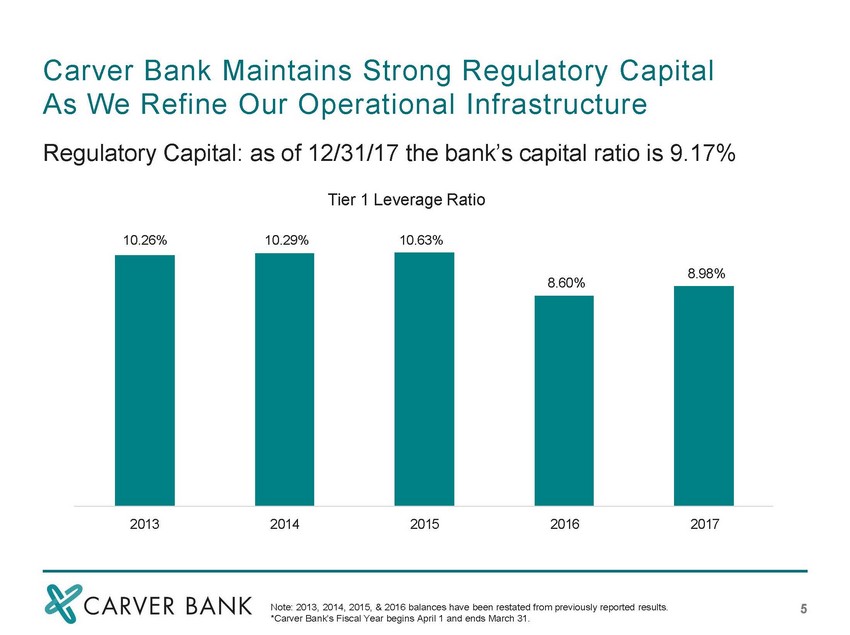

9.83% 10.32% 10.35% 8.60% 8.98% 2013 2014 2015 2016 2017 Carver Bank Maintains Strong Regulatory Capital As We Refine Our Operational Infrastructure 5 Tier 1 Leverage Ratio Regulatory Capital: as of 12/31/17 the bank’s capital ratio is 9.17% Note: 2013, 2014, 2015, & 2016 balances have been restated from previously reported results. *Carver Bank’s Fiscal Year begins April 1 and ends March 31. 10.26% 10.29% 10.63%

Credit Quality For The Bank Remains Strong* Note: 2013, 2014, 2015, & 2016 balances have been restated from previously reported results. *Carver Bank’s Fiscal Year begins April 1 and ends March 31. Non-performing loans to total loans (NPL) 6

Continued Strength in our Asset Quality* Non-performing assets to total assets (NPA) Note: 2013, 2014, 2015, & 2016 balances have been restated from previously reported results. *Carver Bank’s Fiscal Year begins April 1 and ends March 31. $739,054

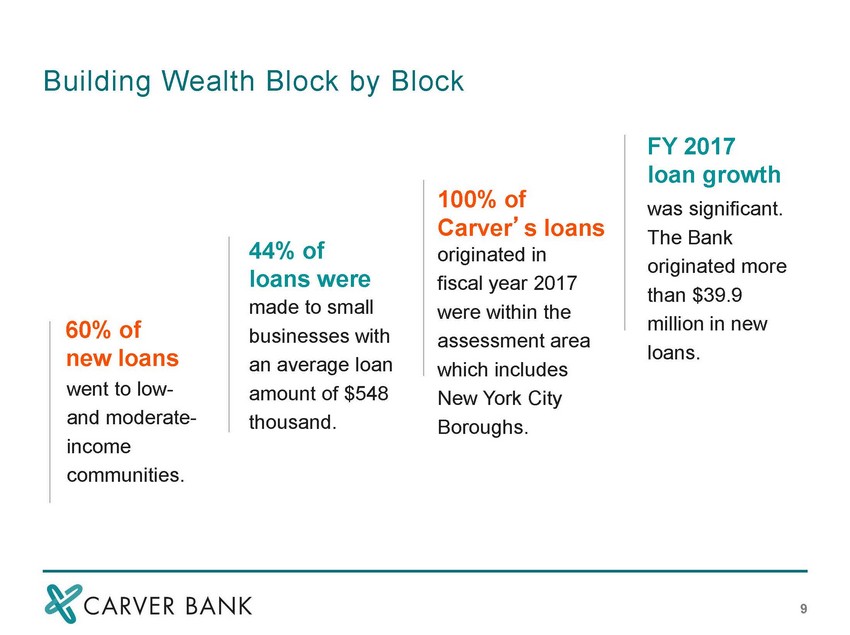

Building Wealth Block by Block originated in fiscal year 2017 were within the assessment area which includes New York City Boroughs. 100% of Carver’s loans made to small businesses with an average loan amount of $548 thousand. 44% of loans were went to low- and moderate-income communities. 60% of new loans FY 2017 loan growth was significant. The Bank originated more than $39.9 million in new loans. 9

Carver’s Lending Impact by Borough of Carver’s loans are focused in the New York City boroughs of Manhattan, Brooklyn, Queens, and the Bronx. 62% Borough No. of Loans Aggregate Loan Amount ($MM) Percentage of Loan Portfolio Brooklyn 281 $161 30% Manhattan 145 $103 19% Queens 80 $44 8% Bronx 38 $28 5% Totals 544 $336 62% Average 136 $84 15.5% 10

Our Customers, Our Community Lower Eastside Service Center, Inc. (“LESC”). Valerie C. Waters, President and CEO LESC, a Community based behavioral health non-profit organization, provides a wide array of services for New Yorkers impacted by substance abuse, HIV, mental health issues and homelessness. Employs: 220 full-time employees Smile Design Manhattan. Dr. Lee Gause, DDS A privately-owned practice offers a wide range of services including scheduled cleanings, digital x-rays, Invisalign, dental implants, ceramic implants, porcelain veneers, and root canals utilizing the latest in dental technology. Employs: 14 full-time employees Museum of Contemporary African Diasporan Arts (“MOCADA”). James Bartlett, Executive Director MOCADA is the first museum of its kind serving Brooklyn's underserved communities, and providing exposure to visual art and artistic productions. Employs: 14 full-time employees 11

Carver Community Development Corporation (“CCDC”) FY2017 Highlights: •Awarded the maximum grant of $227M for the Bank Enterprise Award through The US Treasury Department supporting our mission to serve urban communities and support financial literacy •Conducted 942 Money Smart financial education workshops •Provided 189 hours of technical assistance to non-profits that serve low-to-moderate individuals •Hosted Profit Mastery Workshops and certified 75 small business owners through hands on training focused on building wealth and increasing financial performance knowledge CCDC is an entity of Carver, Bancorp. Its mission is to serve communities, non profit organizations and small businesses across Manhattan, Brooklyn and Queens by: •Facilitating private investment and corporate philanthropy •Creating wealth building opportunities through financial education and technical assistance 12

Customer Access and Convenience Remain a Priority Nine Full Service Branches, Three ATMs and 55,000 ATM Network UPPER MANHATTAN BROOKLYN QUEENS •Atlantic Terminal Branch •Bedford -Stuyvesant Restoration Plaza •Crown Heights •Flatbush •Atlantic Terminal Shopping Mall •Atlantic Center Shopping Mall •Fulton Street at Ralph Avenue BRANCHES ATMs BRANCHES •Main Branch 125th Street – Lenox •145th Street and Bradhurst •Malcolm X Boulevard BRANCHES •Jamaica Center •St. Albans 13

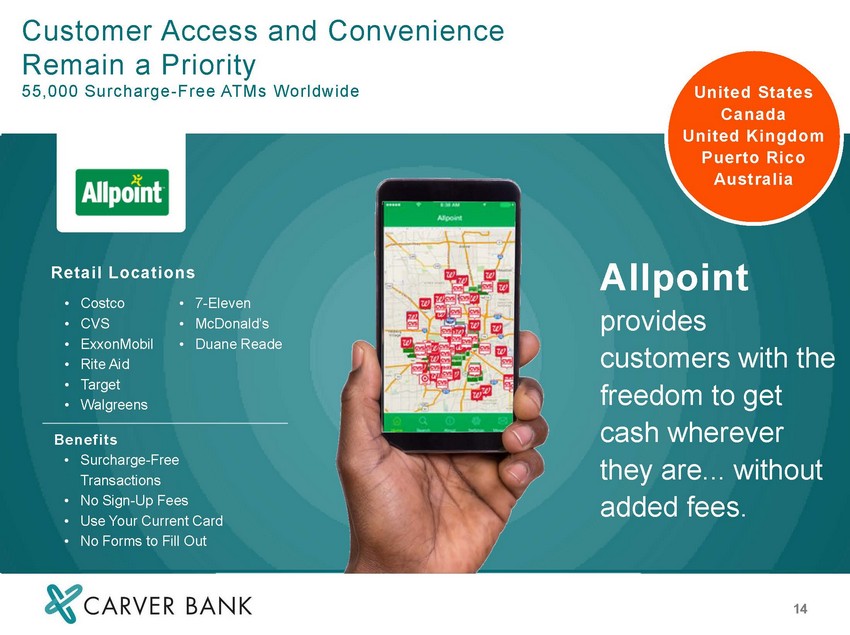

Customer Access and Convenience Remain a Priority 55,000 Surcharge-Free ATMs Worldwide United States Canada United Kingdom Puerto Rico Australia •Costco •CVS •ExxonMobil •Rite Aid •Target •Walgreens •7-Eleven •McDonald’s •Duane Reade Allpoint provides customers with the freedom to get cash wherever they are... without added fees. Benefits •Surcharge-Free Transactions •No Sign-Up Fees •Use Your Current Card •No Forms to Fill Out Retail Locations 14

We are proud to announce our newly remodeled state-of-the-art branch located in Crown Heights - serving our customers and community for more than 40 years. Our New Crown Heights Branch 15

Path to Sustained Performance – FY2018 Strengthening our earnings Regulatory excellence Building our infrastructure Enhancing our ability to acquire customers by implementing new applications, products, and services for customers seeking technology solutions. Strengthening our operational foundation by developing and acquiring human capital and expertise, broadening our systems integrated capabilities, and driving greater alignment of systemic and operational oversight controls Developing operational efficiencies, reducing expenses and building strength in our underwriting, credit and risk management capabilities 16