Attached files

| file | filename |

|---|---|

| 8-K - 8-K - LIONS GATE ENTERTAINMENT CORP /CN/ | d543656d8k.htm |

Exhibit 99.1

|

LIONSGATE

LENDER PRESENTATION MARCH 2018

|

DISCLAIMER

CAUTION REGARDING FORWARD-LOOKING STATEMENTS

THIS COMMUNICATION MAY CONTAIN CERTAIN

FORWARD-LOOKING STATEMENTS, INCLUDING CERTAIN PLANS, EXPECTATIONS, GOALS, PROJECTIONS, AND STATEMENTS ABOUT LIONSGATE AND ITS BUSINESS, AND OTHER STATEMENTS THAT ARE NOT HISTORICAL FACTS. SUCH STATEMENTS ARE SUBJECT TO NUMEROUS ASSUMPTIONS, RISKS,

AND UNCERTAINTIES. STATEMENTS THAT DO NOT DESCRIBE HISTORICAL OR CURRENT FACTS, INCLUDING STATEMENTS ABOUT BELIEFS AND EXPECTATIONS, ARE FORWARD-LOOKING STATEMENTS. FORWARD-LOOKING STATEMENTS MAY BE IDENTIFIED BY WORDS SUCH AS “EXPECT”,

“ANTICIPATE”, “BELIEVE”, “INTEND”, “ESTIMATE”, “PLAN”, “TARGET”, “GOAL”, OR SIMILAR EXPRESSIONS, OR FUTURE OR CONDITIONAL VERBS SUCH AS “WILL”, “MAY”,

“MIGHT”, “SHOULD”, “WOULD”, “COULD”, OR SIMILAR VARIATIONS. THE FORWARD-LOOKING STATEMENTS ARE INTENDED TO BE SUBJECT TO THE SAFE HARBOR PROVIDED BY SECTION 27A OF THE SECURITIES ACT OF 1933, SECTION 21E OF

THE SECURITIES EXCHANGE ACT OF 1934, AND THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995.

WHILE THERE IS NO ASSURANCE THAT ANY LIST OF RISKS AND UNCERTAINTIES

OR RISK FACTORS IS COMPLETE, BELOW ARE CERTAIN FACTORS WHICH COULD CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE CONTAINED OR IMPLIED IN THE FORWARD-LOOKING STATEMENTS INCLUDING: THE SUBSTANTIAL INVESTMENT OF CAPITAL REQUIRED TO PRODUCE AND

MARKET FILMS AND TELEVISION SERIES; INCREASED COSTS FOR PRODUCING AND MARKETING FEATURE FILMS AND TELEVISION SERIES; BUDGET OVERRUNS, LIMITATIONS IMPOSED BY OUR CREDIT FACILITIES AND NOTES; UNPREDICTABILITY OF THE COMMERCIAL SUCCESS OF OUR MOTION

PICTURES AND TELEVISION PROGRAMMING; RISKS RELATED TO OUR ACQUISITION AND INTEGRATION OF ACQUIRED BUSINESSES; THE EFFECTS OF DISPOSITIONS OF BUSINESSES OR ASSETS, INCLUDING INDIVIDUAL FILMS OR LIBRARIES; THE COST OF DEFENDING OUR INTELLECTUAL

PROPERTY; TECHNOLOGICAL CHANGES AND OTHER TRENDS AFFECTING THE ENTERTAINMENT INDUSTRY; POTENTIAL ADVERSE REACTIONS OR CHANGES TO BUINESS OR EMPLOYEE RELATIONSHIPS; LITIGATION RELATING TO THE ACQUISITION OF STARZ; IMPACT OF THE TAX CUTS AND JOBS ACT

OF 2017; AND OTHER FACTORS THAT MAY AFFECT FUTURE RESULTS OF LIONSGATE AND ITS SUBSIDIARIES.

ALL FORWARD-LOOKING STATEMENTS SPEAK ONLY AS OF THE DATE THEY ARE MADE

AND ARE BASED ON INFORMATION AVAILABLE AT THAT TIME. LIONSGATE DOES NOT ASSUME ANY OBLIGATION TO UPDATE FORWARD-LOOKING STATEMENTS TO REFLECT CIRCUMSTANCES OR EVENTS THAT OCCUR AFTER THE DATE THE FORWARD-LOOKING STATEMENTS WERE MADE OR TO REFLECT

THE OCCURRENCE OF UNANTICIPATED EVENTS, EXCEPT AS REQUIRED BY FEDERAL SECURITIES LAWS. AS FORWARD-LOOKING STATEMENTS INVOLVE SIGNIFICANT RISKS AND UNCERTAINTIES, CAUTION SHOULD BE EXERCISED AGAINST PLACING UNDUE RELIANCE ON SUCH STATEMENTS.

SPECIAL NOTICE REGARDING MATERIAL NON PUBLIC INFORMATION

THIS PRESENTATION

MAY CONTAIN MATERIAL NON-PUBLIC INFORMATION CONCERNING LIONSGATE, ITS SUBSIDIARIES, AFFILIATES OR ITS SECURITIES. BY ACCEPTING THIS PRESENTATION, THE RECIPIENT AGREES, WITH RESPECT TO ANY SUCH INFORMATION, THAT IT WILL NOT TRADE IN THE SECURITIES OF

LIONSGATE AND ITS SUBSIDIARIES, OR AFFILIATES OR EFFECT OTHER SECURITIES TRANSACTIONS TO WHICH SUCH INFORMATION MAY BE RELEVANT, UNTIL SUCH TIME AS THE INFORMATION IS MADE GENERALLY AVAILABLE OR IS NO LONGER RELEVANT. THE RECIPIENT AGREES THAT THIS

RESTRICTION WILL APPLY TO ITS ENTIRE FIRM OTHER THAN ANY PERSONNEL WHO ARE PERMITTED TO TRADE BY SUCH RECIPIENT’S LEGAL OR COMPLIANCE DEPARTMENT DUE TO THE EXISTENCE OF INFORMATION BARRIERS THAT RESTRICT THE RECIPIENT’S FIRM FROM TRADING

SECURITIES ON THE BASIS OF MATERIAL NON-PUBLIC INFORMATION.

USE OF TRADEMARKS AND TRADENAMES

THIS PRESENTATION CONTAINS REFERENCES TO THE TRADEMARKS OF LIONSGATE AND TO TRADEMARKS BELONGING TO OTHER ENTITIES. SOLELY FOR CONVENIENCE, TRADEMARKS AND TRADE NAMES REFERRED TO

IN THIS REPORT, INCLUDING LOGOS, ARTWORK AND OTHER VISUAL DISPLAYS, MAY APPEAR WITHOUT THE (R) OR (TM) SYMBOLS, BUT SUCH REFERENCES ARE NOT INTENDED TO INDICATE, IN ANY WAY, THAT LIONSGATE WILL NOT ASSERT, TO THE FULLEST EXTENT UNDER APPLICABLE LAW,

ITS RIGHTS OR THE RIGHTS OF THE APPLICABLE LICENSOR TO THESE TRADEMARKS AND TRADE NAMES. LIONSGATE DOES NOT INTEND ITS USE OR DISPLAY OF OTHER COMPANIES’ TRADE NAMES OR TRADEMARKS TO IMPLY A RELATIONSHIP WITH, OR ENDORSEMENT OR SPONSORSHIP OF

LIONSGATE BY ANY OTHER COMPANY.

NON-GAAP FINANCIAL MEASURES

THIS PRESENTATION

INCLUDES CERTAIN FINANCIAL MEASURES NOT PRESENTED IN ACCORDANCE WITH GENERALLY ACCEPTED ACCOUNTING PRINCIPLES (“GAAP”) INCLUDING, BUT NOT LIMITED TO, ADJUSTED OIBDA AND CERTAIN RATIOS AND OTHER METRICS DERIVED THEREFROM. THESE NON-GAAP

FINANCIAL MEASURES ARE NOT MEASURES OF FINANCIAL PERFORMANCE IN ACCORDANCE WITH GAAP AND MAY EXCLUDE ITEMS THAT ARE SIGNIFICANT IN UNDERSTANDING AND ASSESSING THE COMPANY’S FINANCIAL RESULTS. THEREFORE, THESE MEASURES SHOULD NOT BE CONSIDERED

IN ISOLATION OR AS AN ALTERNATIVE TO NET INCOME, CASH FLOWS FROM OPERATIONS OR OTHER MEASURES OF PROFITABILITY, LIQUIDITY OR PERFORMANCE UNDER GAAP. YOU SHOULD BE AWARE THAT THE PRESENTATION OF THESE MEASURES MAY NOT BE COMPARABLE TO

SIMILARLY-TITLED MEASURES USED BY OTHER COMPANIES.

2

|

PRESENTERS & AGENDA

Presenters

MICHAEL BURNS

VICE CHAIRMAN, LIONSGATE

JEFF HIRSCH

CHIEF OPERATING OFFICER, STARZ

JIMMY BARGE

CHIEF FINANCIAL OFFICER, LIONSGATE

I. INTRODUCTION II. BUSINESS OVERVIEW III. FINANCIAL

OVERVIEW IV. TRANSACTION OVERVIEW V. Q&A

3

|

TRANSACTION SUMMARY LIONSGATE IS A PREMIER GLOBAL CONTENT LEADER OF SCALE WITH A DIVERSIFIED PRESENCE IN CONTENT PRODUCTION AND DISTRIBUTION LIONSGATE IS SEEKING CERTAIN AMENDMENTS TO ITS CREDIT FACILITIES, THAT WILL: UPSIZE THE REVOLVER TO $1,500M REDUCE THE TERM LOAN A BY $450M UPSIZE THE TERM LOAN B TO $1,025M REFRESH TENOR (5 YEAR REVOLVER / TERM LOAN A; 7 YEAR TERM LOAN B) OPENING PRICING WILL BE L+175 ON THE REVOLVER AND TERM LOAN A RELOCATE EXISTING CREDIT FACILITIES FROM THE CANADIAN PARENT ‘(LGEC)’ TO ITS US SUBSIDIARY, LIONS GATE CAPITAL HOLDINGS LLC THE TRANSACTION IS LEVERAGE-NEUTRAL, AND PRO FORMA LIONSGATE WILL HAVE SECURED LEVERAGE OF 2.6X AND TOTAL LEVERAGE OF 3.4X BASED OFF LTM 12/31/2017 COVENANT EBITDA OF $712M COMMITMENTS FROM LENDERS ARE DUE MARCH 19TH LIONSGATE IS ALSO CURRENTLY ASSESSING OPTIONS FOR POTENTIALLY MOVING ALL OR A PORTION OF LGEC’S $520M NOTES TO A SUBSIDIARY IN THE U.S. 4

|

BUSINESS OVERVIEW

LIONSGATE

5

|

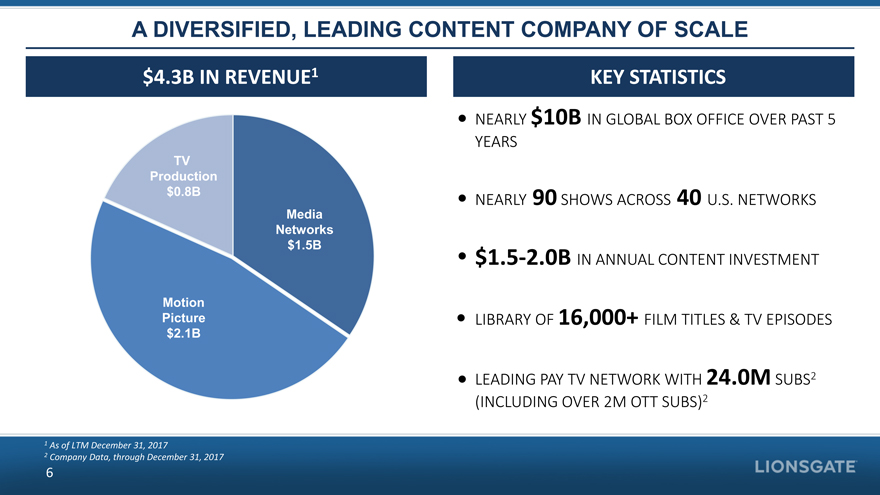

A DIVERSIFIED, LEADING CONTENT COMPANY OF SCALE $4.3B IN REVENUE1 TV Production $0.8B Media Networks $1.5B Motion Picture $2.1B KEY STATISTICS NEARLY $10B IN GLOBAL BOX OFFICE OVER PAST 5 YEARS NEARLY 90 SHOWS ACROSS 40 U.S. NETWORKS $1.5-2.0B IN ANNUAL CONTENT INVESTMENT LIBRARY OF 16,000+ FILM TITLES & TV EPISODES LEADING PAY TV NETWORK WITH 24.0M SUBS2 (INCLUDING OVER 2M OTT SUBS)2 1 As of LTM December 31, 2017 2 Company Data, through December 31, 2017 6

|

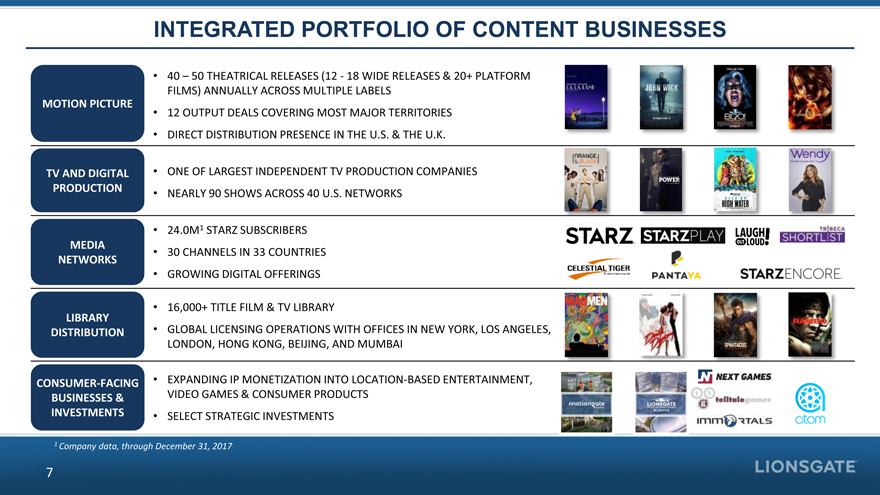

INTEGRATED PORTFOLIO OF CONTENT BUSINESSES 40 – 50 THEATRICAL RELEASES (12 - 18 WIDE RELEASES & 20+ PLATFORM FILMS) ANNUALLY ACROSS MULTIPLE LABELS 12 OUTPUT DEALS COVERING MOST MAJOR TERRITORIES DIRECT DISTRIBUTION PRESENCE IN THE U.S. & THE U.K. ONE OF LARGEST INDEPENDENT TV PRODUCTION COMPANIES NEARLY 90 SHOWS ACROSS 40 U.S. NETWORKS 24.0M1 STARZ SUBSCRIBERS 30 CHANNELS IN 33 COUNTRIES GROWING DIGITAL OFFERINGS 16,000+ TITLE FILM & TV LIBRARY GLOBAL LICENSING OPERATIONS WITH OFFICES IN NEW YORK, LOS ANGELES, LONDON, HONG KONG, BEIJING, AND MUMBAI EXPANDING IP MONETIZATION INTO LOCATION-BASED ENTERTAINMENT, VIDEO GAMES & CONSUMER PRODUCTS SELECT STRATEGIC INVESTMENTS MOTION PICTURE TV AND DIGITAL PRODUCTION MEDIA NETWORKS LIBRARY DISTRIBUTION CONSUMER-FACING BUSINESSES & INVESTMENTS 1 Company data, through December 31, 2017 7

|

A WORLD CLASS FILM BUSINESS NEARLY 40 – 50 124 $10 BILLION THEATRICAL RELEASES ACADEMY AWARD® AT THE PER YEAR, INCLUDING NOMINATIONS GLOBAL BOX OFFICE 12 – 18 AND OVER THE PAST 5 YEARS WIDE RELEASE FILMS 30 WINS 8

|

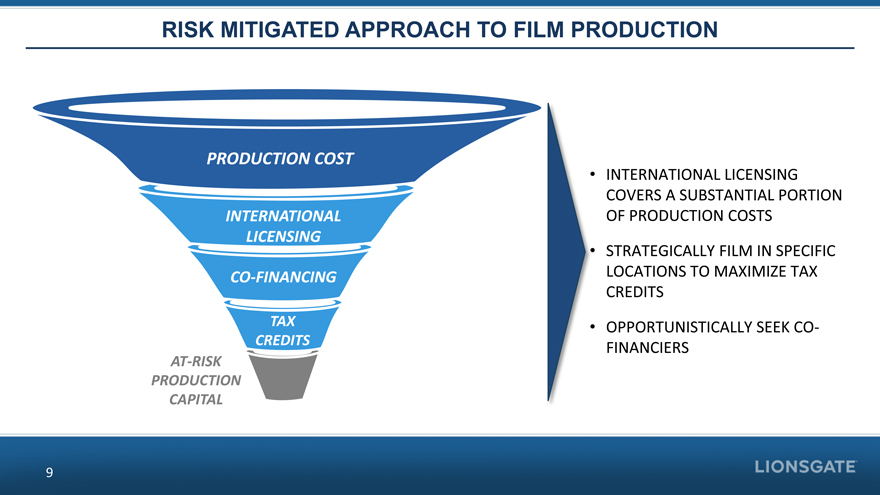

RISK MITIGATED APPROACH TO FILM PRODUCTION PRODUCTION COST INTERNATIONAL LICENSING CO-FINANCING TAX CREDITS AT-RISK PRODUCTION CAPITAL INTERNATIONAL LICENSING COVERS A SUBSTANTIAL PORTION OF PRODUCTION COSTS STRATEGICALLY FILM IN SPECIFIC LOCATIONS TO MAXIMIZE TAX CREDITS OPPORTUNISTICALLY SEEK CO-FINANCIERS 9

|

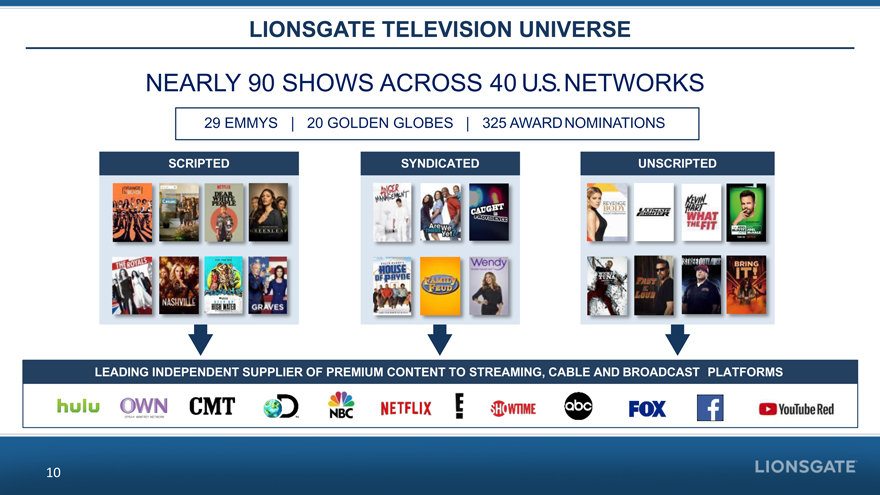

LIONSGATE TELEVISION UNIVERSE

NEARLY 90 SHOWS ACROSS 40 U.S. NETWORKS

29 EMMYS | 20 GOLDEN GLOBES | 325 AWARD NOMINATIONS

SCRIPTED SYNDICATED UNSCRIPTED

LEADING INDEPENDENT SUPPLIER OF PREMIUM

CONTENT TO STREAMING, CABLE AND BROADCAST PLATFORMS

10

|

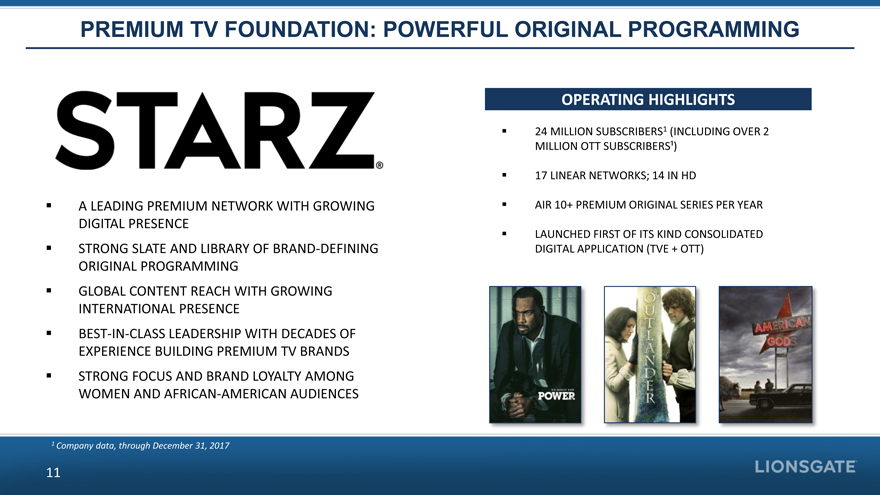

PREMIUM TV FOUNDATION: POWERFUL ORIGINAL PROGRAMMING

A LEADING PREMIUM NETWORK WITH GROWING DIGITAL PRESENCE

STRONG SLATE AND

LIBRARY OF BRAND-DEFINING ORIGINAL PROGRAMMING

GLOBAL CONTENT REACH WITH GROWING INTERNATIONAL PRESENCE

BEST-IN-CLASS LEADERSHIP WITH DECADES OF EXPERIENCE BUILDING PREMIUM TV BRANDS

STRONG FOCUS AND BRAND LOYALTY AMONG WOMEN AND AFRICAN-AMERICAN AUDIENCES

OPERATING HIGHLIGHTS

24 MILLION SUBSCRIBERS1 (INCLUDING OVER 2 MILLION OTT SUBSCRIBERS¹)

17

LINEAR NETWORKS; 14 IN HD

AIR 10+ PREMIUM ORIGINAL SERIES PER YEAR

LAUNCHED

FIRST OF ITS KIND CONSOLIDATED DIGITAL APPLICATION (TVE + OTT)

1 Company data, through December 31, 2017

11

|

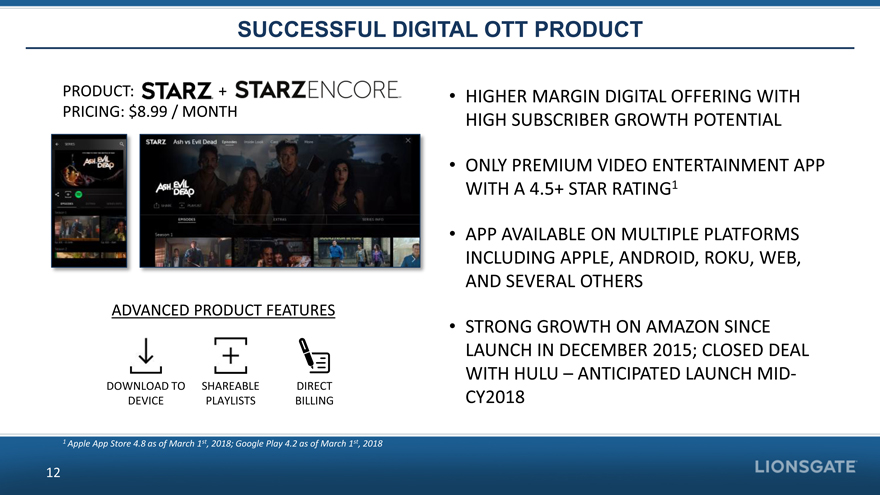

SUCCESSFUL DIGITAL OTT PRODUCT

PRODUCT: + PRICING: $8.99 / MONTH

ADVANCED PRODUCT FEATURES

DOWNLOAD TO SHAREABLE DIRECT DEVICE PLAYLISTS BILLING

HIGHER MARGIN DIGITAL OFFERING WITH HIGH

SUBSCRIBER GROWTH POTENTIAL

ONLY PREMIUM VIDEO ENTERTAINMENT APP WITH A 4.5+ STAR RATING1

APP AVAILABLE ON MULTIPLE PLATFORMS INCLUDING APPLE, ANDROID, ROKU, WEB, AND SEVERAL OTHERS

STRONG GROWTH ON AMAZON SINCE LAUNCH IN DECEMBER 2015; CLOSED DEAL WITH HULU – ANTICIPATED LAUNCH MID- CY2018

1 Apple App Store 4.8 as of March 1st, 2018; Google Play 4.2 as of March 1st, 2018

12

|

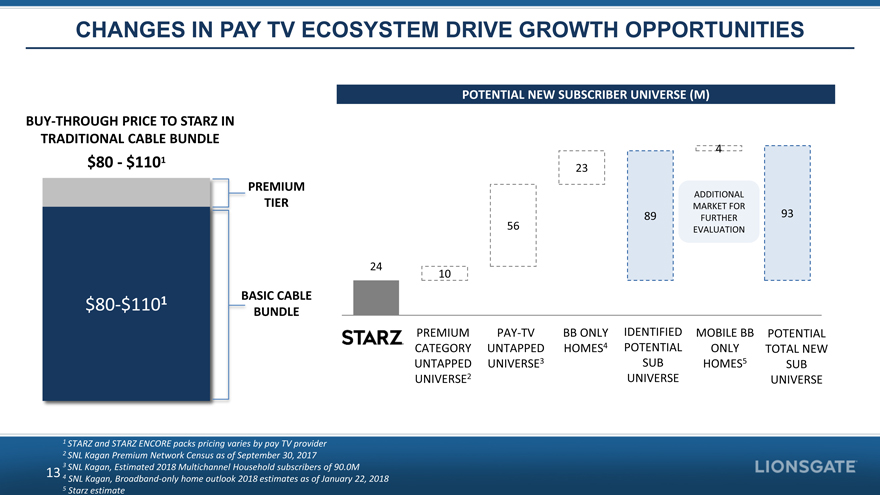

CHANGES IN PAY TV ECOSYSTEM DRIVE GROWTH

OPPORTUNITIES

POTENTIAL NEW SUBSCRIBER UNIVERSE (M)

4 23

ADDITIONAL MARKET FOR

89 FURTHER 93

56 EVALUATION

24

10

PREMIUM PAY-TV BB ONLY IDENTIFIED MOBILE BB

POTENTIAL CATEGORY UNTAPPED HOMES4 POTENTIAL ONLY TOTAL NEW UNTAPPED UNIVERSE3 SUB HOMES5 SUB UNIVERSE2 UNIVERSE UNIVERSE

BUY-THROUGH PRICE TO STARZ IN TRADITIONAL CABLE BUNDLE

$80—$1101

PREMIUM TIER

1 BASIC CABLE

$80-$110

BUNDLE

1 STARZ and STARZ ENCORE packs pricing varies by pay TV provider 2 SNL Kagan Premium

Network Census as of September 30, 2017 3 SNL Kagan, Estimated 2018 Multichannel Household subscribers of 90.0M

4

SNL Kagan, Broadband-only home outlook 2018 estimates as of January 22, 2018

5 Starz

estimate

13

|

EXECUTING ON STRATEGY BEHIND STARZ TRANSACTION

ACHIEVED SIGNIFICANT COST AND REVENUE SYNERGIES

$50M+ OF RUN-RATE OPERATING SYNERGIES $150M+ OF INCREMENTAL ANNUAL TAX SAVINGS $100M+ OF REVENUE SYNERGIES

INCREASED INVESTMENT IN

ORIGINAL PROGRAMMING TO DRIVE GROWTH

ORIGINAL PROGRAMMING MAIN DRIVER OF OTT SUBSCRIBER ACQUISITION

INCREASE IN OWNED CONTENT ALLOWS LIONSGATE TO MONETIZE GLOBAL DISTRIBUTION RIGHTS

NOTABLE

UPCOMING SERIES INCLUDE “SWEETBITTER”, “VIDA”, “HOWARDS END”, AND “THE ROOK”

IMPLEMENTING INTERNATIONAL EXPANSION PLAN

PARTNERED WITH BELL MEDIA TO BRING STARZ BRAND TO CANADA

ADDITIONAL

TERRITORIES TO FOLLOW

14

|

KEY INVESTMENT HIGHLIGHTS

DIVERSIFIED MEDIA COMPANY OF SCALE

PLATFORM-AGNOSTIC GLOBAL CONTENT-DRIVEN COMPANY RISK

MITIGATED APPROACH TO NEW FILM AND TV PRODUCTION STABLE SOURCES OF RECURRING SUBSCRIPTION REVENUE

STRONG DELEVERAGING PROFILE ACHIEVED THROUGH SUBSTANTIAL CASH

FLOW GENERATION

15

|

FINANCIAL OVERVIEW

16

|

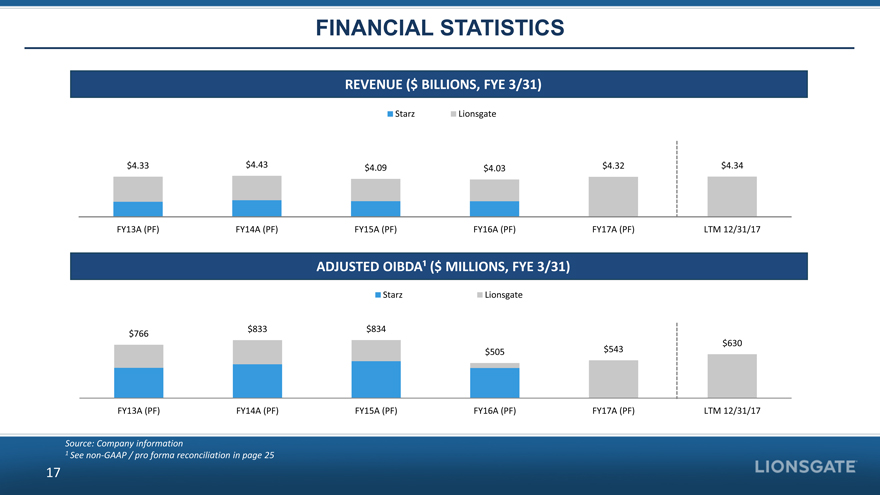

FINANCIAL STATISTICS

REVENUE ($ BILLIONS, FYE 3/31)

Starz Lionsgate

$4.33 $4.43 $4.09 $4.03 $4.32 $4.34

FY13A (PF) FY14A (PF) FY15A (PF) FY16A (PF) FY17A (PF) LTM

12/31/17

ADJUSTED OIBDA¹ ($ MILLIONS, FYE 3/31)

Starz Lionsgate

$833 $834 $766 $630 $505 $543

FY13A (PF) FY14A (PF) FY15A (PF) FY16A (PF)

FY17A (PF) LTM 12/31/17

Source: Company information

1 See non-GAAP / pro forma reconciliation in page 25

17

|

TRANSACTION OVERVIEW

18

|

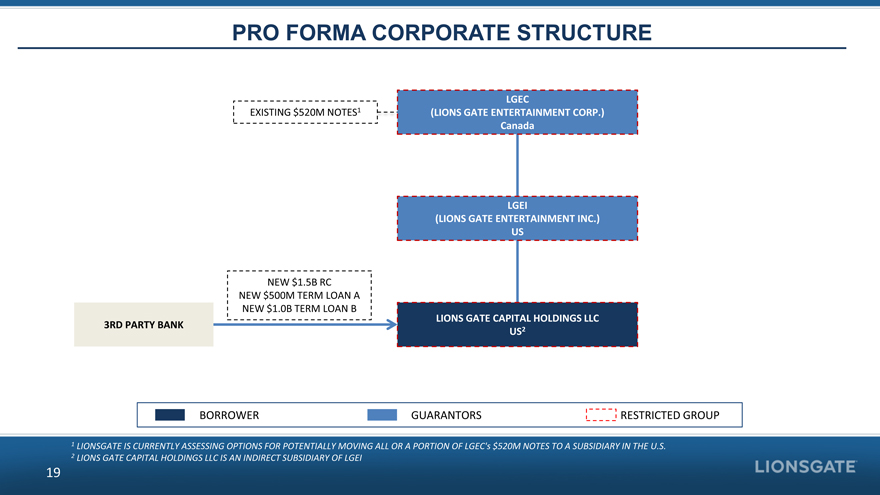

PRO FORMA CORPORATE STRUCTURE

LGEC

EXISTING $520M NOTES1 (LIONS GATE ENTERTAINMENT CORP.) Canada

LGEI

(LIONS GATE ENTERTAINMENT INC.) US

NEW $1.5B RC NEW $500M TERM LOAN A NEW $1.0B TERM LOAN B

LIONS GATE CAPITAL HOLDINGS LLC 3RD

PARTY BANK

US2

BORROWER GUARANTORS RESTRICTED GROUP

1 LIONSGATE IS CURRENTLY ASSESSING OPTIONS FOR POTENTIALLY MOVING ALL OR A PORTION OF LGEC’s $520M NOTES TO A SUBSIDIARY IN THE U.S.

2 LIONS GATE CAPITAL HOLDINGS LLC IS AN INDIRECT SUBSIDIARY OF LGEI

19

|

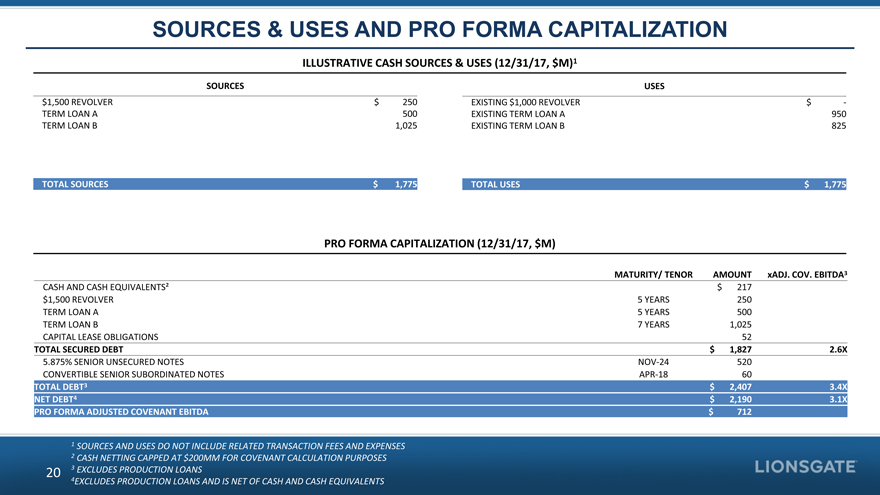

SOURCES & USES AND PRO FORMA CAPITALIZATION

ILLUSTRATIVE CASH SOURCES & USES (12/31/17, $M)1

SOURCES $1,500

REVOLVER $ 250 TERM LOAN A 500 TERM LOAN

B 1,025

USES

EXISTING $1,000 REVOLVER $ -EXISTING TERM LOAN A 950 EXISTING TERM LOAN B 825

TOTAL SOURCES $ 1,775

TOTAL USES $ 1,775

PRO FORMA CAPITALIZATION (12/31/17, $M)

MATURITY/ TENOR AMOUNT xADJ. COV. EBITDA3

CASH AND CASH EQUIVALENTS² $ 217 $1,500 REVOLVER 5 YEARS 250 TERM LOAN A 5 YEARS

500 TERM LOAN B 7 YEARS 1,025 CAPITAL LEASE OBLIGATIONS 52

TOTAL SECURED DEBT

$ 1,827 2.6X

5.875% SENIOR UNSECURED NOTES NOV-24 520 CONVERTIBLE SENIOR SUBORDINATED NOTES APR-18 60

TOTAL

DEBT3 $ 2,407 3.4X NET DEBT4

$ 2,190 3.1X PRO FORMA ADJUSTED COVENANT EBITDA $ 712

1 SOURCES AND USES DO NOT INCLUDE RELATED TRANSACTION FEES AND EXPENSES

2

CASH NETTING CAPPED AT $200MM FOR COVENANT CALCULATION PURPOSES

3 EXCLUDES PRODUCTION LOANS

4EXCLUDES PRODUCTION LOANS AND IS NET OF CASH AND CASH EQUIVALENTS

20

|

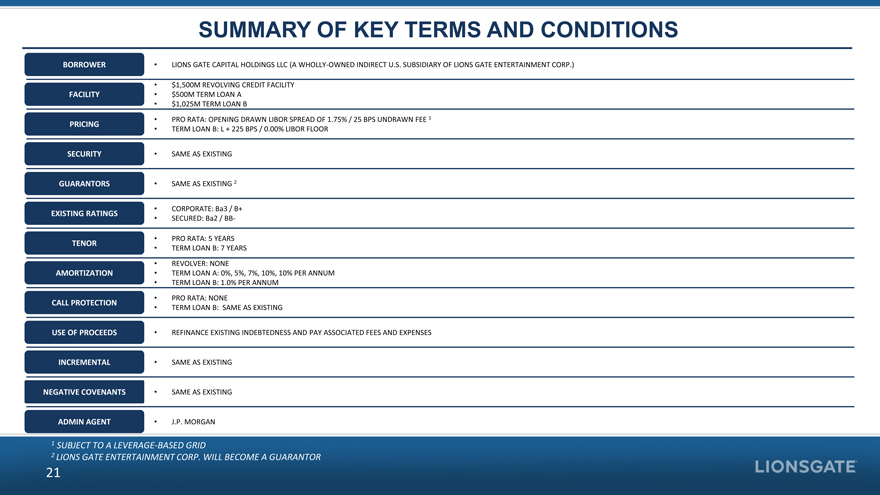

SUMMARY OF KEY TERMS AND CONDITIONS

BORROWER

FACILITY

PRICING

SECURITY

GUARANTORS

EXISTING RATINGS

TENOR AMORTIZATION CALL PROTECTION USE OF PROCEEDS

INCREMENTAL

NEGATIVE COVENANTS

ADMIN AGENT

LIONS GATE CAPITAL HOLDINGS LLC (A WHOLLY-OWNED INDIRECT U.S. SUBSIDIARY OF LIONS GATE ENTERTAINMENT CORP.)

$1,500M REVOLVING CREDIT FACILITY $500M TERM LOAN A $1,025M TERM LOAN B

PRO RATA: OPENING

DRAWN LIBOR SPREAD OF 1.75% / 25 BPS UNDRAWN FEE 1 TERM LOAN B: L + 225 BPS / 0.00% LIBOR FLOOR

SAME AS EXISTING

SAME AS EXISTING 2

CORPORATE: Ba3 / B+ SECURED: Ba2 /

BB-

PRO RATA: 5 YEARS TERM LOAN B: 7 YEARS

REVOLVER: NONE

TERM LOAN A: 0%, 5%, 7%, 10%, 10% PER ANNUM TERM LOAN B: 1.0% PER ANNUM

PRO RATA: NONE

TERM LOAN B: SAME AS EXISTING

REFINANCE EXISTING INDEBTEDNESS AND PAY ASSOCIATED FEES AND EXPENSES

SAME AS EXISTING

SAME AS EXISTING

J.P. MORGAN

1 SUBJECT TO A LEVERAGE-BASED GRID

2 LIONS GATE ENTERTAINMENT CORP. WILL BECOME A GUARANTOR

21

|

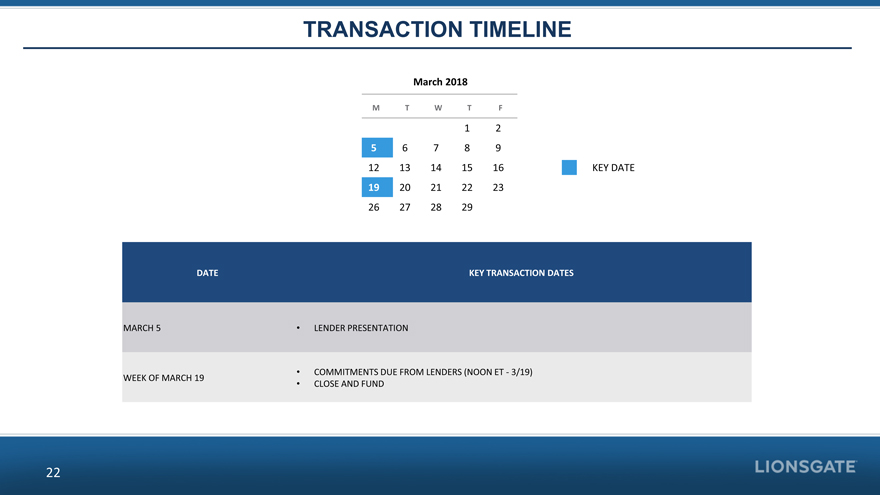

TRANSACTION TIMELINE

March 2018

M T W T F

1 2

5 6 7 8 9

12 13 14 15 16 KEY DATE

19 20 21 22 23

26 27 28 29

DATE KEY TRANSACTION DATES

MARCH 5 LENDER PRESENTATION

COMMITMENTS DUE FROM LENDERS (NOON ET—3/19) WEEK OF

MARCH 19

CLOSE AND FUND

22

|

Q&A

23

|

APPENDIX

24

|

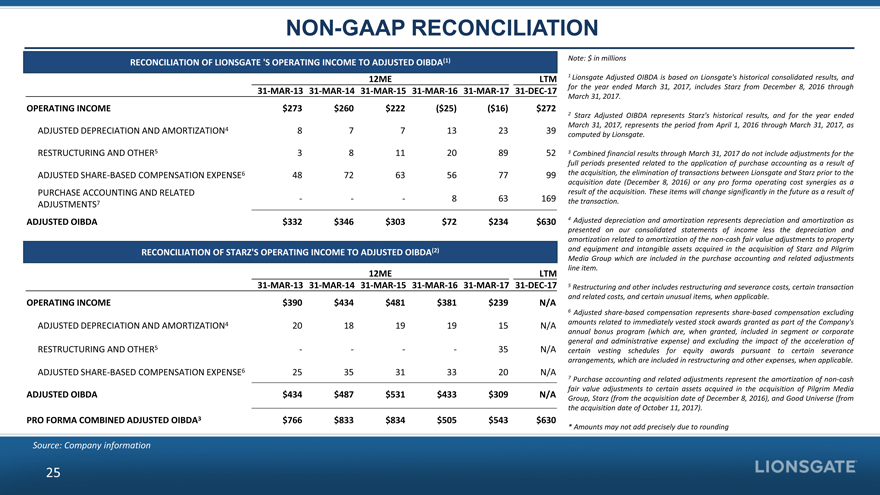

NON-GAAP

RECONCILIATION

RECONCILIATION OF LIONSGATE ‘S OPERATING INCOME TO ADJUSTED OIBDA(1)

12MELTM

31-MAR-13

31-MAR-14 31-MAR-15

31-MAR-16 31-MAR-17

31-DEC-17

OPERATING INCOME $273 $260$222($25)($16)$272

ADJUSTED DEPRECIATION AND AMORTIZATION4 877132339

RESTRUCTURING AND OTHER5 3811208952

ADJUSTED

SHARE-BASED COMPENSATION EXPENSE6 487263567799

PURCHASE ACCOUNTING AND RELATED

- --863169

ADJUSTMENTS7

ADJUSTED OIBDA $332 $346$303$72$234$630

RECONCILIATION OF STARZ’S

OPERATING INCOME TO ADJUSTED OIBDA(2)

12MELTM

31-MAR-13

31-MAR-14 31-MAR-15

31-MAR-16 31-MAR-17

31-DEC-17

OPERATING INCOME $390 $434$481$381$239N/A

ADJUSTED DEPRECIATION AND AMORTIZATION4 2018191915N/A

RESTRUCTURING AND OTHER5 ----35N/A

ADJUSTED

SHARE-BASED COMPENSATION EXPENSE6 2535313320N/A

ADJUSTED OIBDA $434 $487$531$433$309N/A

PRO FORMA COMBINED ADJUSTED OIBDA3 $766 $833$834$505$543$630

Note: $ in

millions

1 Lionsgate Adjusted OIBDA is based on Lionsgate’s historical consolidated results, and for the year ended March 31, 2017, includes Starz from

December 8, 2016 through March 31, 2017.

2 Starz Adjusted OIBDA represents Starz’s historical results, and for the year ended March 31, 2017,

represents the period from April 1, 2016 through March 31, 2017, as computed by Lionsgate.

3 Combined financial results through March 31, 2017 do

not include adjustments for the full periods presented related to the application of purchase accounting as a result of the acquisition, the elimination of transactions between Lionsgate and Starz prior to the acquisition date (December 8, 2016) or

any pro forma operating cost synergies as a result of the acquisition. These items will change significantly in the future as a result of the transaction.

4

Adjusted depreciation and amortization represents depreciation and amortization as presented on our consolidated statements of income less the depreciation and amortization related to amortization of the

non-cash fair value adjustments to property and equipment and intangible assets acquired in the acquisition of Starz and Pilgrim Media Group which are included in the purchase accounting and related

adjustments line item.

5 Restructuring and other includes restructuring and severance costs, certain transaction and related costs, and certain unusual items, when

applicable.

6 Adjusted share-based compensation represents share-based compensation excluding amounts related to immediately vested stock awards granted as part of

the Company’s annual bonus program (which are, when granted, included in segment or corporate general and administrative expense) and excluding the impact of the acceleration of certain vesting schedules for equity awards pursuant to certain

severance arrangements, which are included in restructuring and other expenses, when applicable.

7 Purchase accounting and related adjustments represent the

amortization of non-cash fair value adjustments to certain assets acquired in the acquisition of Pilgrim Media Group, Starz (from the acquisition date of December 8, 2016), and Good Universe (from the

acquisition date of October 11, 2017).

* Amounts may not add precisely due to rounding

Source: Company information

25

|

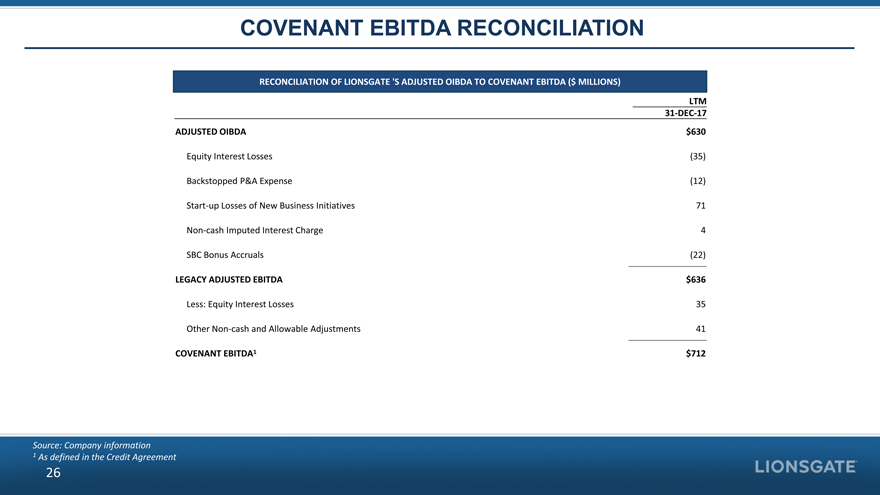

COVENANT EBITDA RECONCILIATION

RECONCILIATION OF LIONSGATE ‘S ADJUSTED OIBDA TO COVENANT EBITDA ($ MILLIONS)

LTM

31-DEC-17

ADJUSTED OIBDA $630

Equity Interest Losses (35)

Backstopped P&A Expense (12)

Start-up Losses of

New Business Initiatives 71

Non-cash Imputed Interest Charge 4

SBC Bonus Accruals (22)

LEGACY ADJUSTED EBITDA $636

Less: Equity Interest Losses 35

Other Non-cash and

Allowable Adjustments 41

COVENANT EBITDA1 $712

Source: Company information

1 As defined in the Credit Agreement

26

|

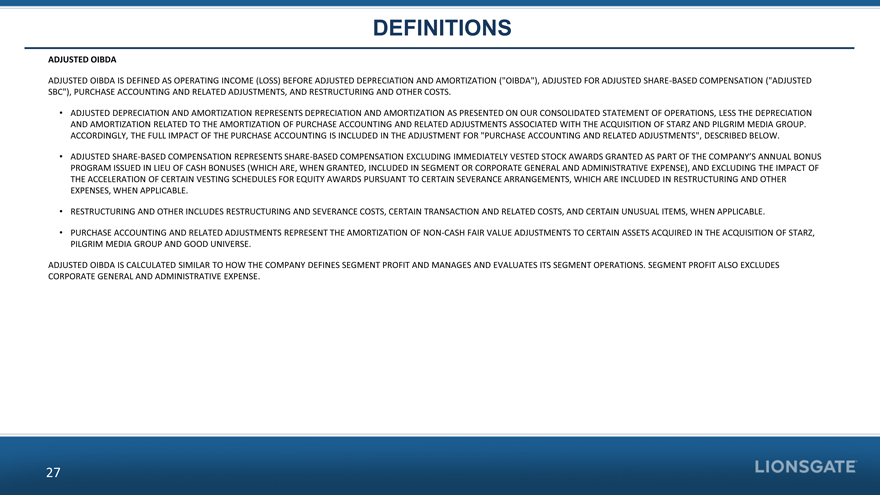

DEFINITIONS

ADJUSTED OIBDA

ADJUSTED OIBDA IS DEFINED AS OPERATING INCOME (LOSS) BEFORE ADJUSTED

DEPRECIATION AND AMORTIZATION (“OIBDA”), ADJUSTED FOR ADJUSTED SHARE-BASED COMPENSATION (“ADJUSTED SBC”), PURCHASE ACCOUNTING AND RELATED ADJUSTMENTS, AND RESTRUCTURING AND OTHER COSTS.

ADJUSTED DEPRECIATION AND AMORTIZATION REPRESENTS DEPRECIATION AND AMORTIZATION AS PRESENTED ON OUR CONSOLIDATED STATEMENT OF OPERATIONS, LESS THE DEPRECIATION AND AMORTIZATION

RELATED TO THE AMORTIZATION OF PURCHASE ACCOUNTING AND RELATED ADJUSTMENTS ASSOCIATED WITH THE ACQUISITION OF STARZ AND PILGRIM MEDIA GROUP. ACCORDINGLY, THE FULL IMPACT OF THE PURCHASE ACCOUNTING IS INCLUDED IN THE ADJUSTMENT FOR “PURCHASE

ACCOUNTING AND RELATED ADJUSTMENTS”, DESCRIBED BELOW.

ADJUSTED SHARE-BASED COMPENSATION REPRESENTS SHARE-BASED COMPENSATION EXCLUDING IMMEDIATELY VESTED STOCK

AWARDS GRANTED AS PART OF THE COMPANY’S ANNUAL BONUS PROGRAM ISSUED IN LIEU OF CASH BONUSES (WHICH ARE, WHEN GRANTED, INCLUDED IN SEGMENT OR CORPORATE GENERAL AND ADMINISTRATIVE EXPENSE), AND EXCLUDING THE IMPACT OF THE ACCELERATION OF CERTAIN

VESTING SCHEDULES FOR EQUITY AWARDS PURSUANT TO CERTAIN SEVERANCE ARRANGEMENTS, WHICH ARE INCLUDED IN RESTRUCTURING AND OTHER EXPENSES, WHEN APPLICABLE.

RESTRUCTURING AND OTHER INCLUDES RESTRUCTURING AND SEVERANCE COSTS, CERTAIN TRANSACTION AND RELATED COSTS, AND CERTAIN UNUSUAL ITEMS, WHEN APPLICABLE.

PURCHASE ACCOUNTING AND RELATED ADJUSTMENTS REPRESENT THE AMORTIZATION OF NON-CASH FAIR VALUE ADJUSTMENTS TO CERTAIN ASSETS ACQUIRED IN THE

ACQUISITION OF STARZ, PILGRIM MEDIA GROUP AND GOOD UNIVERSE.

ADJUSTED OIBDA IS CALCULATED SIMILAR TO HOW THE COMPANY DEFINES SEGMENT PROFIT AND MANAGES AND

EVALUATES ITS SEGMENT OPERATIONS. SEGMENT PROFIT ALSO EXCLUDES CORPORATE GENERAL AND ADMINISTRATIVE EXPENSE.

27

|

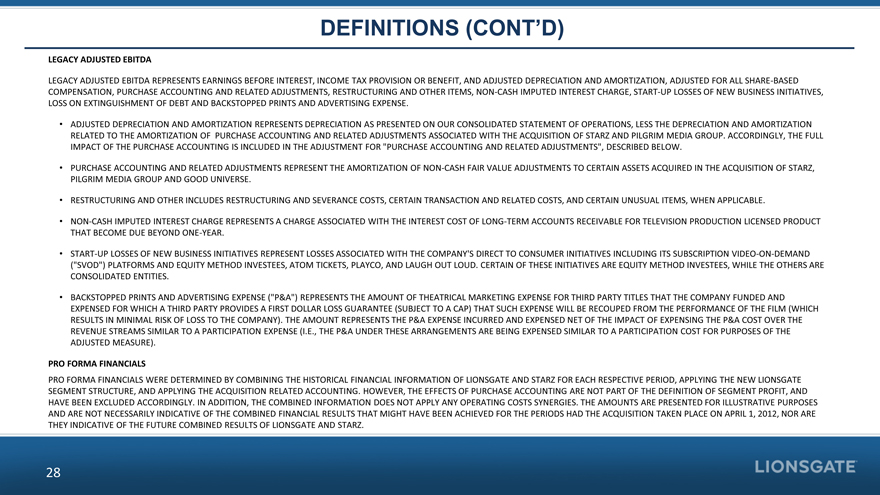

DEFINITIONS (CONT’D)

LEGACY ADJUSTED EBITDA

LEGACY ADJUSTED EBITDA REPRESENTS EARNINGS BEFORE INTEREST, INCOME TAX

PROVISION OR BENEFIT, AND ADJUSTED DEPRECIATION AND AMORTIZATION, ADJUSTED FOR ALL SHARE-BASED COMPENSATION, PURCHASE ACCOUNTING AND RELATED ADJUSTMENTS, RESTRUCTURING AND OTHER ITEMS, NON-CASH IMPUTED

INTEREST CHARGE, START-UP LOSSES OF NEW BUSINESS INITIATIVES, LOSS ON EXTINGUISHMENT OF DEBT AND BACKSTOPPED PRINTS AND ADVERTISING EXPENSE.

ADJUSTED DEPRECIATION AND AMORTIZATION REPRESENTS DEPRECIATION AS PRESENTED ON OUR CONSOLIDATED STATEMENT OF OPERATIONS, LESS THE DEPRECIATION AND AMORTIZATION RELATED TO THE

AMORTIZATION OF PURCHASE ACCOUNTING AND RELATED ADJUSTMENTS ASSOCIATED WITH THE ACQUISITION OF STARZ AND PILGRIM MEDIA GROUP. ACCORDINGLY, THE FULL IMPACT OF THE PURCHASE ACCOUNTING IS INCLUDED IN THE ADJUSTMENT FOR “PURCHASE ACCOUNTING AND

RELATED ADJUSTMENTS”, DESCRIBED BELOW.

PURCHASE ACCOUNTING AND RELATED ADJUSTMENTS REPRESENT THE AMORTIZATION OF

NON-CASH FAIR VALUE ADJUSTMENTS TO CERTAIN ASSETS ACQUIRED IN THE ACQUISITION OF STARZ, PILGRIM MEDIA GROUP AND GOOD UNIVERSE.

RESTRUCTURING AND OTHER INCLUDES RESTRUCTURING AND SEVERANCE COSTS, CERTAIN TRANSACTION AND RELATED COSTS, AND CERTAIN UNUSUAL ITEMS, WHEN APPLICABLE.

NON-CASH IMPUTED INTEREST CHARGE REPRESENTS A CHARGE ASSOCIATED WITH THE INTEREST COST OF LONG-TERM ACCOUNTS RECEIVABLE FOR TELEVISION

PRODUCTION LICENSED PRODUCT THAT BECOME DUE BEYOND ONE-YEAR.

START-UP LOSSES OF NEW

BUSINESS INITIATIVES REPRESENT LOSSES ASSOCIATED WITH THE COMPANY’S DIRECT TO CONSUMER INITIATIVES INCLUDING ITS SUBSCRIPTION VIDEO-ON-DEMAND (“SVOD”)

PLATFORMS AND EQUITY METHOD INVESTEES, ATOM TICKETS, PLAYCO, AND LAUGH OUT LOUD. CERTAIN OF THESE INITIATIVES ARE EQUITY METHOD INVESTEES, WHILE THE OTHERS ARE CONSOLIDATED ENTITIES.

BACKSTOPPED PRINTS AND ADVERTISING EXPENSE (“P&A”) REPRESENTS THE AMOUNT OF THEATRICAL MARKETING EXPENSE FOR THIRD PARTY TITLES THAT THE COMPANY FUNDED AND EXPENSED

FOR WHICH A THIRD PARTY PROVIDES A FIRST DOLLAR LOSS GUARANTEE (SUBJECT TO A CAP) THAT SUCH EXPENSE WILL BE RECOUPED FROM THE PERFORMANCE OF THE FILM (WHICH RESULTS IN MINIMAL RISK OF LOSS TO THE COMPANY). THE AMOUNT REPRESENTS THE P&A EXPENSE

INCURRED AND EXPENSED NET OF THE IMPACT OF EXPENSING THE P&A COST OVER THE REVENUE STREAMS SIMILAR TO A PARTICIPATION EXPENSE (I.E., THE P&A UNDER THESE ARRANGEMENTS ARE BEING EXPENSED SIMILAR TO A PARTICIPATION COST FOR PURPOSES OF THE

ADJUSTED MEASURE).

PRO FORMA FINANCIALS

PRO FORMA FINANCIALS WERE DETERMINED

BY COMBINING THE HISTORICAL FINANCIAL INFORMATION OF LIONSGATE AND STARZ FOR EACH RESPECTIVE PERIOD, APPLYING THE NEW LIONSGATE SEGMENT STRUCTURE, AND APPLYING THE ACQUISITION RELATED ACCOUNTING. HOWEVER, THE EFFECTS OF PURCHASE ACCOUNTING ARE NOT

PART OF THE DEFINITION OF SEGMENT PROFIT, AND HAVE BEEN EXCLUDED ACCORDINGLY. IN ADDITION, THE COMBINED INFORMATION DOES NOT APPLY ANY OPERATING COSTS SYNERGIES. THE AMOUNTS ARE PRESENTED FOR ILLUSTRATIVE PURPOSES AND ARE NOT NECESSARILY INDICATIVE

OF THE COMBINED FINANCIAL RESULTS THAT MIGHT HAVE BEEN ACHIEVED FOR THE PERIODS HAD THE ACQUISITION TAKEN PLACE ON APRIL 1, 2012, NOR ARE THEY INDICATIVE OF THE FUTURE COMBINED RESULTS OF LIONSGATE AND STARZ.

28