Attached files

| file | filename |

|---|---|

| 8-K - 8-K - HomeTrust Bancshares, Inc. | htbi-20180305x8k.htm |

Positioned for

growth

Compass Point Investor Call

March 8, 2018

Positioned for

growth 2

Forward-Looking Statements

This presentation includes “forward-looking statements” within the meaning of the Private Securities

Litigation Reform Act of 1995. Such statements often include words such as “believe,” “expect,”

“anticipate,” “estimate,” and “intend” or future or conditional verbs such as “will,” “would,” “should,”

“could,” or “may.” Forward-looking statements are not historical facts but instead represent

management’s current expectations and forecasts regarding future events many of which are

inherently uncertain and outside of our control. Actual results may differ, possibly materially, from

those currently expected or projected in these forward-looking statements. Factors that could cause

our actual results to differ materially from those described in the forward-looking statements, include

expected cost savings, synergies and other financial benefits from acquisitions might not be realized

within the expected time frames or at all, and costs or difficulties relating to integration matters might

be greater than expected; increased competitive pressures; changes in the interest rate environment;

changes in general economic conditions and conditions within the securities markets; legislative and

regulatory changes; and other factors described in HomeTrust’s latest annual Report on Form 10-K

and Quarterly Reports on Form 10-Q and other filings with the Securities and Exchange Commission-

which are available on our website at www.hometrustbanking.com and on the SEC’s website at

www.sec.gov. Any of the forward-looking statements that we make in this presentation or our SEC

filings are based upon management’s beliefs and assumptions at the time they are made and may

turn out to be wrong because of inaccurate assumptions we might make, because of the factors

illustrated above or because of other factors that we cannot foresee. We do not undertake and

specifically disclaim any obligation to revise any forward-looking statements to reflect the occurrence

of anticipated or unanticipated events or circumstances after the date of such statements. These risks

could cause our actual results for fiscal 2018 and beyond to differ materially from those expressed in

any forward-looking statements by, or on behalf of, us and could negatively affect our operating and

stock performance.

Positioned for

growth 3

HomeTrust Bancshares, Inc. Overview

Headquarters: Asheville, NC Exchange/Ticker: NASDAQ: HTBI

Founded: 1926

Number of

Employees:

481

Locations: 43 (NC, SC, VA, TN) Stock Price: $26.00

Total Assets: $3.3 billion Price to TBV: 135%

Total Loans: $2.4 billion Market Cap: $495.5 million

Total Deposits: $2.1 billion

Average Daily

Volume:

35,954

Outstanding Shares:

18,967,175 Shares Repurchased

(since Feb 19, 2013)

5,351,065

or approx. 26%

Financial data as of December 31, 2017

Market data as of March 1, 2018

Positioned for

growth 4

Strategic Operating Committee

Leader Role Age

Yrs in

Banking

Yrs

w/HTBI

Dana Stonestreet Chairman, President & Chief

Executive Officer

63 39 28

Tony VunCannon Executive Vice President & Chief

Financial Officer

52 29 25

Hunter

Westbrook

Executive Vice President & Chief

Banking Officer

54 30 5

Howard Sellinger Executive Vice President & Chief

Information Officer

64 42 42

Keith Houghton Executive Vice President & Chief

Credit Officer

55 30 3

Parrish Little Executive Vice President & Chief

Risk Officer

49 27 2

197 105

Positioned for

growth

Phase I: Created a Foundation For Growth

Lines of Business – Infrastructure and Talent

New markets for growth

Phase II: Executing Our Strategic Plan with a Sense of Urgency

Sound and Profitable Organic Growth

Loans

Deposits

Lower our efficiency ratio

Noninterest income growth

Expense management

Streamlining current processes

Repurchase shares opportunistically

Highly accretive in-market acquisitions

Phase III: Consistently improving performance

5

Transitioning to a High Performing Community Bank

Positioned for

growth

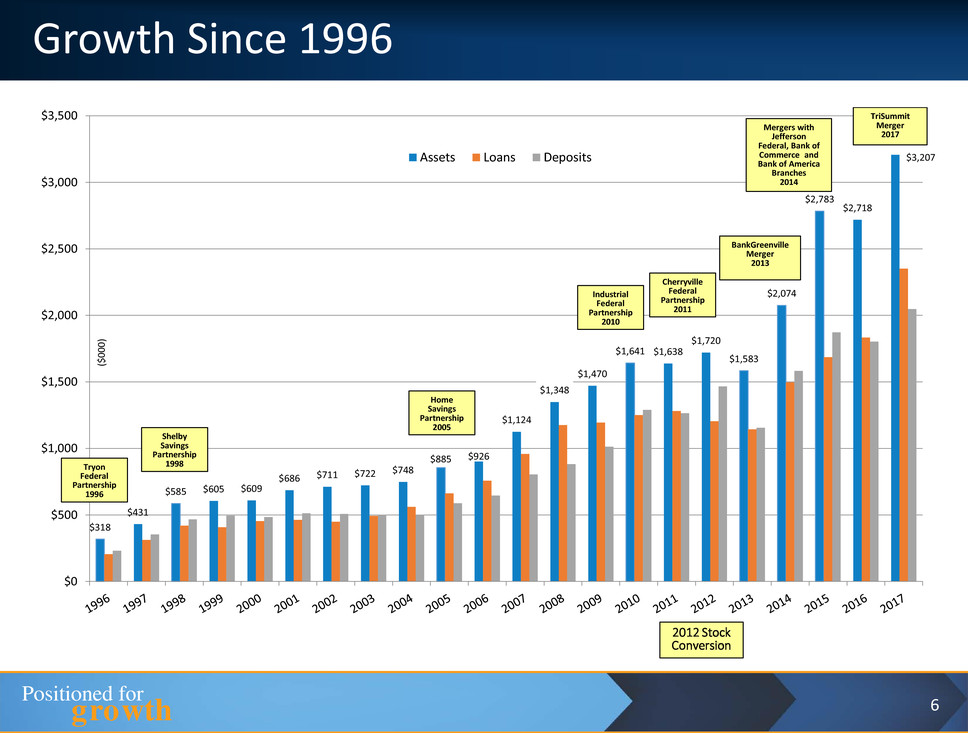

$318

$431

$585 $605 $609

$686 $711 $722

$748

$885 $926

$1,124

$1,348

$1,470

$1,641 $1,638

$1,720

$1,583

$2,074

$2,783

$2,718

$3,207

$0

$500

$1,000

$1,500

$2,000

$2,500

$3,000

$3,500

($000

)

Assets Loans Deposits

Tryon

Federal

Partnership

1996

Shelby

Savings

Partnership

1998

Home

Savings

Partnership

2005

Industrial

Federal

Partnership

2010

BankGreenville

Merger

2013

Cherryville

Federal

Partnership

2011

Mergers with

Jefferson

Federal, Bank of

Commerce and

Bank of America

Branches

2014

TriSummit

Merger

2017

2012 Stock

Conversion

6

Growth Since 1996

Positioned for

growth 7

Foundation for Growth and Performance

• Converted to stock in July 2012 and raised $211.6MM

• Added 7 larger growing markets in NC, SC, VA and East TN since conversion

• 4 whole bank acquisitions

• 3 new Commercial Loan Production Offices from “lift-outs” of existing commercial lending teams

• Purchased 8 Bank of America branches

• Added new metro markets with populations of more than 4.7 million to legacy markets of 900,000

• Added 23 new locations and $1.6 billion in assets

• Hired a Director of Mortgage Lending to expand this line of business in our new metro markets

• Added a Consumer Banking Executive to focus on improving the retail and consumer lines of business

• Hired 29 new Commercial Market Presidents / Commercial Relationship Managers to grow commercial

lending

• Added new lines of business and experienced leaders

• Indirect Auto Finance - grown portfolio to over $140 million

• Municipal Finance – portfolio of over $100 million

• Treasury Management

• SBA 7(a) Loan Program

• Equipment Finance

• Consolidated 10 branch offices

• Grown to the 2nd largest community bank headquartered in NC

Positioned for

growth 8

Strong Footprint for Growth

Positioned for

growth 9

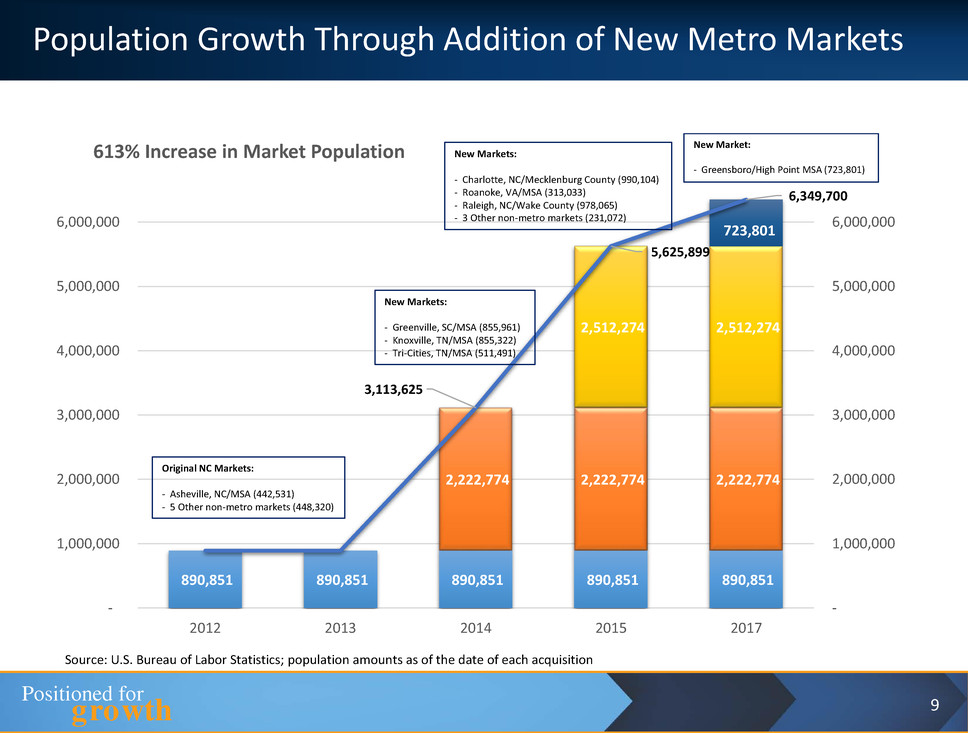

Population Growth Through Addition of New Metro Markets

890,851 890,851 890,851 890,851 890,851

2,222,774 2,222,774 2,222,774

2,512,274 2,512,274

3,113,625

5,625,899

6,349,700

-

1,000,000

2,000,000

3,000,000

4,000,000

5,000,000

6,000,000

-

1,000,000

2,000,000

3,000,000

4,000,000

5,000,000

6,000,000

2012 2013 2014 2015 2017

613% Increase in Market Population New Market:

- Greensboro/High Point MSA (723,801)

723,801

Original NC Markets:

- Asheville, NC/MSA (442,531)

- 5 Other non-metro markets (448,320)

New Markets:

- Greenville, SC/MSA (855,961)

- Knoxville, TN/MSA (855,322)

- Tri-Cities, TN/MSA (511,491)

New Markets:

- Charlotte, NC/Mecklenburg County (990,104)

- Roanoke, VA/MSA (313,033)

- Raleigh, NC/Wake County (978,065)

- 3 Other non-metro markets (231,072)

Source: U.S. Bureau of Labor Statistics; population amounts as of the date of each acquisition

Positioned for

growth 10

HomeTrust Growth Markets

Asheville, NC MSA

2017 unemployment at 3.5% down from 3.7% in 2016

No. 1 Best in the U.S. Destination for 2017, Lonely Planet, January 2017

No. 3 out of 18 for the World’s Best Cities for Millennials,

Matadornetwork.com, May 2016

No. 2 Best Startup City in America, Popular Mechanics, January 2015

No. 10 in Best Cities in the US and Canada, Travel & Leisure, July 2015

No. 34 for Best Places for Business & Careers, Forbes, November 2014

Charlotte, NC MSA

2017 unemployment at 4.0% down from 4.4% in 2016

No. 13 Fastest Growing Cities, Forbes, March 2016

No. 7 Best City to Start a Business, WalletHub, May 2016

No. 11 Highest Startup Growth, Business Insider, June 2016

No. 2 Best States for Businesses and Careers, Forbes, October 2015

Knoxville, Kingsport, Bristol, Johnson City, TN MSA Areas

Knoxville: 2017 unemployment at 2.7% down from 3.9% in 2016

Kingsport/Bristol: 2017 unemployment at 3.6% down from 4.6% in 2016

Johnson City: 2017 unemployment at 3.2% down from 4.6% in 2016

Tennessee: named the Fourth Best State in the Country for Business, Chief

Executive Magazine, 2016 Best & Worst States for Business list

Knoxville in top five for 10 Best Cities for Small Businesses, CNN Money,

August 2015

Tennessee: named 2014 State of the Year for economic development,

Business Facilities, 2014

Roanoke, VA MSA

2017 unemployment at 3.8% up from 3.7% in 2016

Virginia ranked No. 3 for Business Friendliness, CNBC 2015

Virginia ranked No. 4 for Best State for Doing Business, Forbes, 2014

Source: U.S. Bureau of Labor Statistics, Chamber of Commerce of named cities, Tennessee Department of Economic & Community Development, Virginia Economic Development

Partnership; unemployment rates as of June for each year

Raleigh, NC MSA

2017 unemployment at 3.8% down from 4.1% in 2016

No. 14 Fastest Growing Metro in U.S., U.S. Census Bureau, March 2017

No. 10 Boomtowns of 2016, SmartAssets, January 2017

#3 Best Cities For Young Professionals, Forbes, March 2016

#3 Best Cities for Young Families, Value Penguin, February 2016

Greenville, SC MSA

2017 unemployment at 3.3% down from 4.1% in 2016

No. 9 Top 10 Small Cities Where Business is Thriving, Entrepreneur, 2015

No. 6 list of America's Engineering Capitals, Forbes, 2014

No. 7 Best State for Business, Chief Executive Magazine, 2014

Best Cities for Jobs Fall 2013, Manpower Survey as reported in Forbes

Magazine

Positioned for

growth 11

New Greensboro Commercial Loan Production Office

• Announced July 31, 2017

• Strong new metro market

• Greensboro-High Point MSA with population of 723,801

• 3rd largest MSA in North Carolina behind Charlotte and Raleigh

• 7th metro market added since our stock conversion

• Natural geographic expansion – existing offices in adjacent counties

• “Lift-out” of experienced Greensboro market commercial lending team

• Robert Gray –Market President – 20 years of experience

• Chad Davis – Commercial Relationship Manager – 11 years of experience

• Previous experience includes Centura Bank, SunTrust Bank, and NewBridge Bank

• Focused on C&I lending

• Currently only 10% of our total loan portfolio

• Capitalizing on high degree of disruption in the Greensboro market due

to recent mergers

• Premier Commercial Bank → NewBridge Bank→ Yadkin → FNB

• High Point Bank → BNC Bank → Pinnacle Bank

• Carolina Bank → First Bank

Positioned for

growth 12

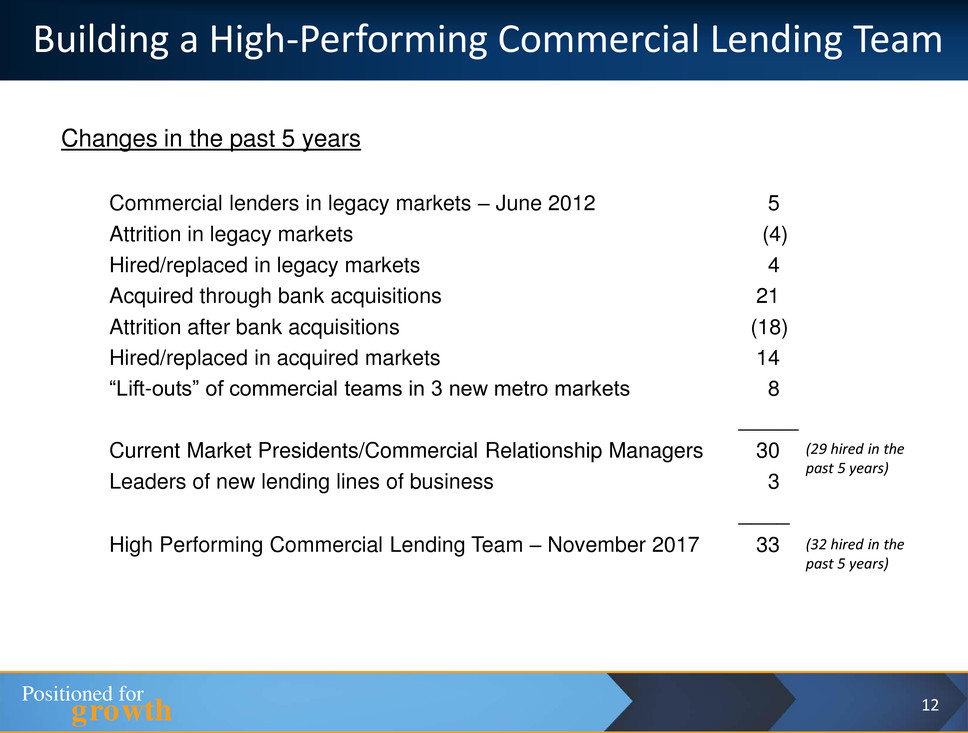

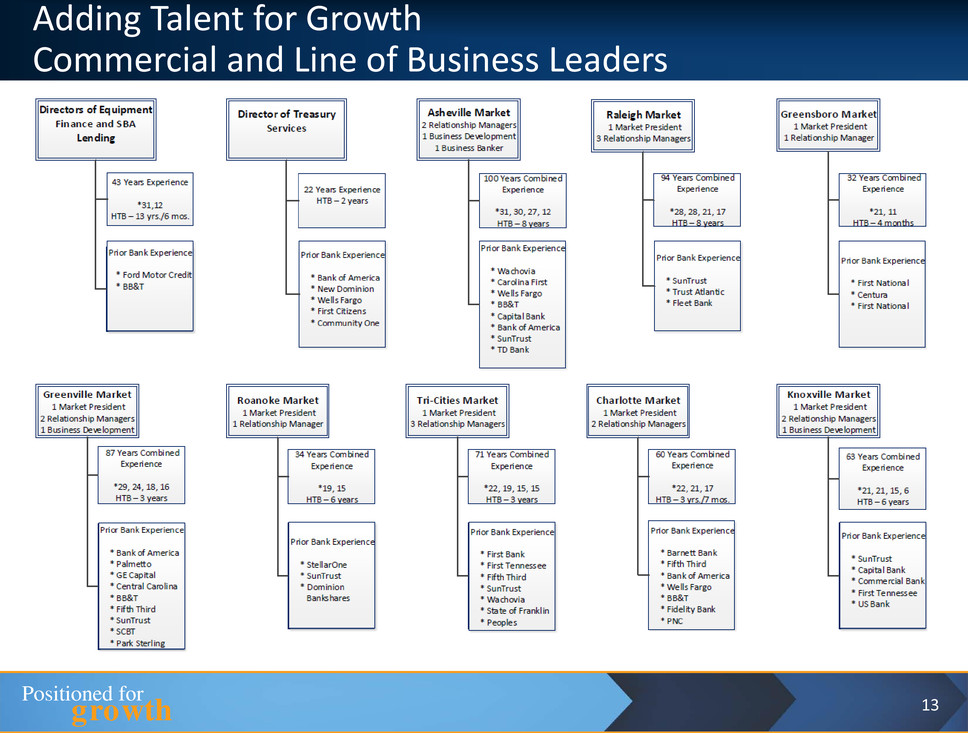

Building a High-Performing Commercial Lending Team

Changes in the past 5 years

Commercial lenders in legacy markets – June 2012 5

Attrition in legacy markets (4)

Hired/replaced in legacy markets 4

Acquired through bank acquisitions 21

Attrition after bank acquisitions (18)

Hired/replaced in acquired markets 14

“Lift-outs” of commercial teams in 3 new metro markets 8

_____

Current Market Presidents/Commercial Relationship Managers 30

Leaders of new lending lines of business 3

____

High Performing Commercial Lending Team – November 2017 33

(29 hired in the

past 5 years)

(32 hired in the

past 5 years)

Positioned for

growth 13

Adding Talent for Growth

Commercial and Line of Business Leaders

Positioned for

growth 14

5-Year Growth Since Conversion

Mutual/Stock Quarter

Conversion Ended

09/30/2012 09/30/2017 $ %

Total Assets $1,603 $3,250 $1,647 103%

Total Loan Portfolio $1,203 $2,395 $1,192 99%

Total Deposit Portfolio $1,160 $2,100 $940 81%

Checking Accounts 239 769 530 222%

Money Market/Savings 337 873 536 159%

Total Core Deposits 576 1,642 1,066 185%

Time Deposits 584 458 (126) -22%

Locations 20 43 23 115%

Conversion

Change Since

Positioned for

growth 15

Continuing To “De-Thrift” the Balance Sheet

Organic Loan Growth in Nonmortgage Loans:

Commercial

Commercial real estate (CRE)

Commercial & industrial (C&I)

Commercial Construction

Indirect Auto

SBA Lending

Equipment Finance

Core Deposit Growth:

Commercial checking

Fee generation

Planned runoff of higher rate, single service CD’s

Increasing Noninterest Income:

Mortgage banking income

Deposit fees

Treasury management

SBA Lending

Positioned for

growth 16

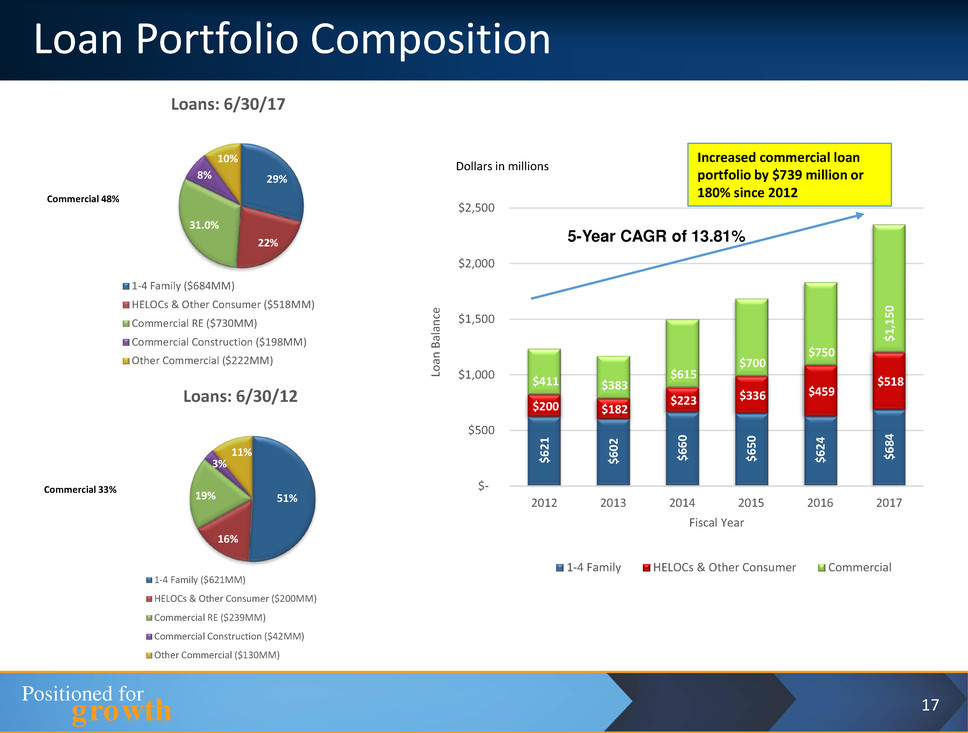

Loan Highlights

Loan Portfolio Growth:

Organic loan growth of 14% in FY 2017 vs. 4% in FY 2016 ($243MM vs $75MM)

30% growth in indirect auto loans ($32MM)

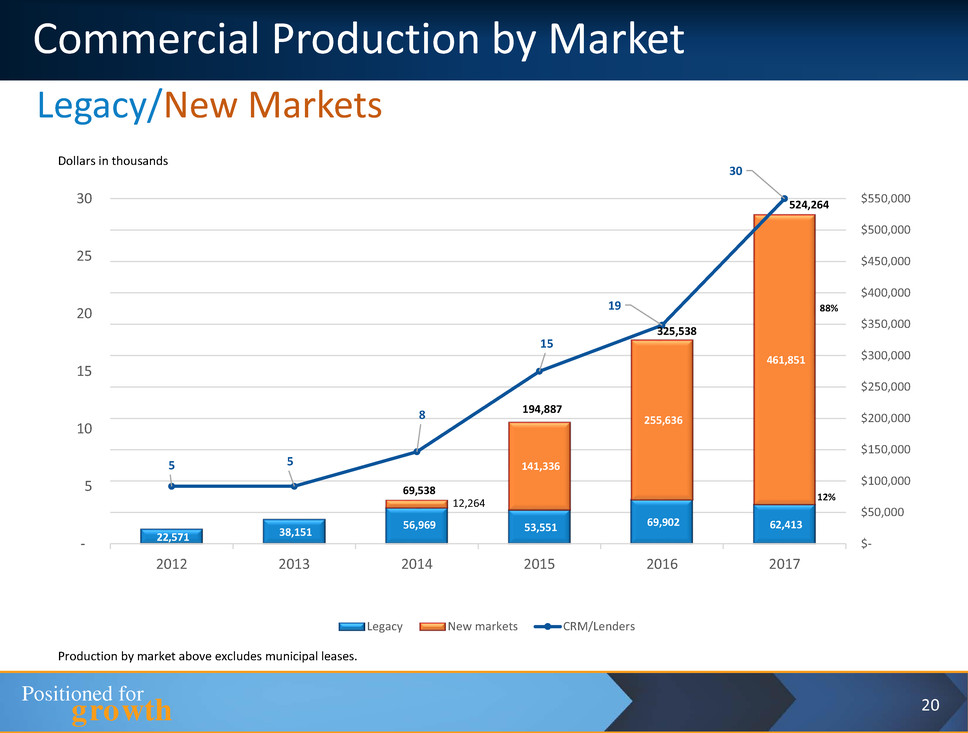

53% growth in commercial loans ($400MM* - CRE, C&I, Commercial Construction, Municipal

Leases)

88% of fiscal 2017 commercial production was from new metro markets

Recent Highlights/Enhancements:

Hired 13 new Commercial Market Presidents/Relationship Managers in last 12 months

Hired/replaced 29 Commercial Market Presidents/Relationship Managers in last 5 years

Announced new SBA 7(a) loan program

Announced new Equipment Finance line of business

Acquired United Financial – Municipal Finance line of business

Announced new Greensboro Commercial Loan Production Office with focus on C&I lending

Added 10 new mortgage loan officers in the last 12 months in 5 new metro markets

Increased total mortgage loan production by 41% ($305MM in FY 2017 vs $216MM in FY 2016)

* Includes $185 million from TriSummit Bank acquisition

Positioned for

growth 17

Loan Portfolio Composition

$

6

2

1

$

6

0

2

$

6

6

0

$

6

5

0

$

6

2

4

$

6

8

4

$200 $182

$223 $336

$459

$518 $411 $383

$615

$700

$750

$1

,150

$-

$500

$1,000

$1,500

$2,000

$2,500

2012 2013 2014 2015 2016 2017

Lo

an

B

ala

n

ce

Fiscal Year

1-4 Family HELOCs & Other Consumer Commercial

5-Year CAGR of 13.81%

29%

22%

31.0%

8%

10%

Loans: 6/30/17

1-4 Family ($684MM)

HELOCs & Other Consumer ($518MM)

Commercial RE ($730MM)

Commercial Construction ($198MM)

Other Commercial ($222MM)

Commercial 48%

Dollars in millions

51%

16%

19%

3%

11%

Loans: 6/30/12

1-4 Family ($621MM)

HELOCs & Other Consumer ($200MM)

Commercial RE ($239MM)

Commercial Construction ($42MM)

Other Commercial ($130MM)

Commercial 33%

Increased commercial loan

portfolio by $739 million or

180% since 2012

Positioned for

growth 18

Commercial Loan Production by Type

Excludes municipal leases.

Dollars in thousands

$4,013

$3,971

$28,649

$18,960

$13,389

$35,773

$34,583

$47

,955

$11

2

,349

$22,933

$16

4

,945

$13

7

,660

$92

,591

$19

2

,803

$23

8

,870

$-

$50,000

$100,000

$150,000

$200,000

$250,000

C&I Commercial Construction CRE

Origi

n

at

io

n

s

Fiscal Year

2013 2014 2015 2016 2017

Positioned for

growth 19

Commercial Real Estate Composition

12%

29%

11%

12%

7%

10%

5%

3%

11%

As of 6/30/17

Multifamily Owner Occupied Office

Retail Hospitality Shopping Centers

Industrial Healthcare Other

Positioned for

growth 20

Commercial Production by Market

22,571 38,151

56,969 53,551 69,902 62,413

12,264

141,336

255,636

461,851

5 5

8

15

19

30

-

5

10

15

20

25

30

2012 2013 2014 2015 2016 2017

$-

$50,000

$100,000

$150,000

$200,000

$250,000

$300,000

$350,000

$400,000

$450,000

$500,000

$550,000

Legacy New markets CRM/Lenders

88%

12%

69,538

Production by market above excludes municipal leases.

Dollars in thousands

194,887

524,264

325,538

Legacy/New Markets

Positioned for

growth 21

Consumer Loan Production

Dollars in thousands

$15

,839

$33

,324

$9,598 $49

,841

$53

,010

$54

,598

$87

,844

$

4

9

,7

9

4

$84

,707

$-

$10,000

$20,000

$30,000

$40,000

$50,000

$60,000

$70,000

$80,000

$90,000

$100,000

HELOC-originated/Consumer Indirect auto

Origi

n

at

io

n

s

Fiscal Year

2013 2014 2015 2016 2017

$0

Positioned for

growth 22

Mortgage Loan Production

$35

,907

$22

7

,117

$12

0

,808

$

4

9

,4

5

5

$73

,501

$68

,242

$49

,689

$7

4

,353

$

8

9

,2

9

9

$42

,493

$91

,963

$81

,577

$71

,674

$13

4

,258

$99

,220

$-

$50,000

$100,000

$150,000

$200,000

$250,000

Construction 1-4 Family Originated for Sale 1-4 Family Portfolio

Origi

n

at

io

n

s

Fiscal Year

2013 2014 2015 2016 2017

Dollars in thousands

Positioned for

growth 23

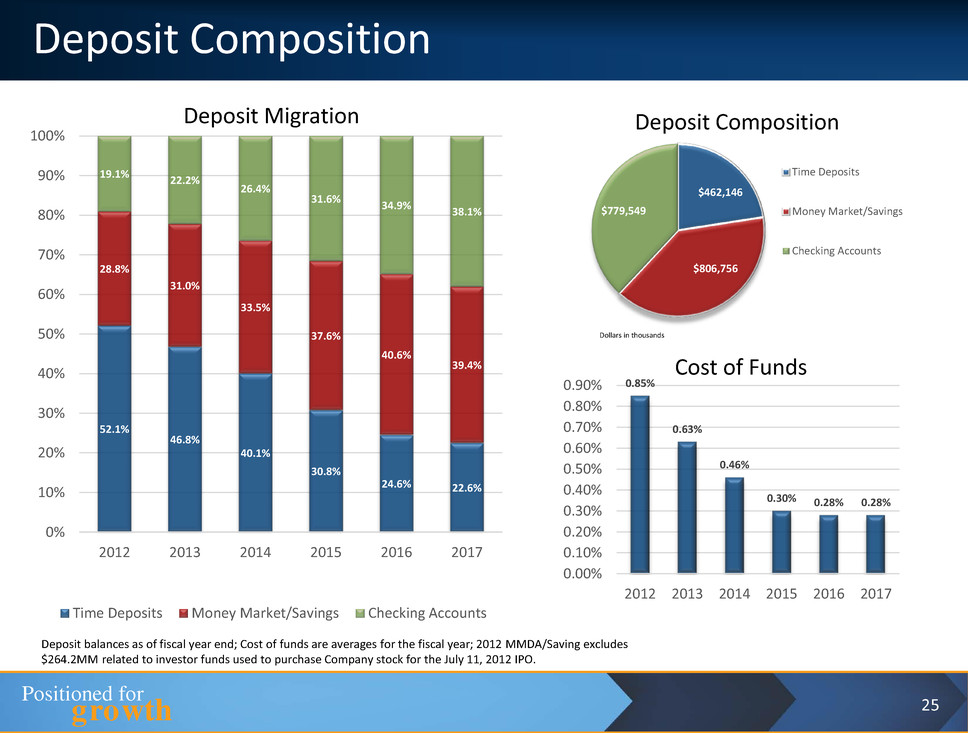

Deposit/Retail Highlights

Deposit Growth:

17% core deposit* growth in fiscal 2017 ($226MM)

24% growth in total checking accounts

41% growth in commercial checking accounts

Core deposits* now make up 77% of total deposits

Average cost of total deposits remained at .28% for fiscal 2017

Customer/Household Trends in fiscal 2017:

8% growth in total retail households

16% growth in total retail loan households

7% increase in number of deposit households

Consistently favorable trends in the number of engaged checking and ‘sweet spot’ relationships –

those households with checking, savings, and credit accounts (all 3)

Product/Process Improvements:

Introduced new Consumer Lending and HELOC origination platform (MeridianLink) in Q1 fiscal 2018

Enhanced online and mobile banking, including improvements to online account opening

Consolidated three branches concurrently with TriSummit Bank data conversion in March 2017

Continually refining staffing models to achieve/maintain optimum FT/PT balance

Construction underway for de novo branch in Cary NC, opening slated for Spring 2018

*Core deposits exclude all time deposits/certificates of deposit.

Positioned for

growth

Deposit Portfolio Mix

2012 2013 2014 2015 2016 2017

Time Deposits $629,958 $540,387 $634,154 $577,075 $442,649 $462,146

Money Market/Savings $348,519 $357,876 $530,221 $703,622 $731,137 $806,756

Checking Accounts $230,683 $256,486 $418,671 $591,429 $628,910 $779,549

Core Deposits %

(excludes time deposits)

47.90% 53.20% 59.94% 69.18% 75.45% 77.44%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

$-

$100,000

$200,000

$300,000

$400,000

$500,000

$600,000

$700,000

$800,000

$900,000 Total

Deposits:

$1,583,046

Total

Deposits:

$1,872,126

Total

Deposits:

$1,802,696

Total

Deposits:

$1,209,160

Total

Deposits:

$1,154,749

Total

Deposits:

$2,048,451

24

Dollars in

thousands

2012 MMDA/Saving excludes $264.2MM related to investor funds used to purchase Company stock for the July 11, 2012 IPO.

Positioned for

growth

52.1%

46.8%

40.1%

30.8%

24.6% 22.6%

28.8%

31.0%

33.5%

37.6%

40.6%

39.4%

19.1%

22.2%

26.4%

31.6%

34.9%

38.1%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

2012 2013 2014 2015 2016 2017

Time Deposits Money Market/Savings Checking Accounts

$462,146

$806,756

$779,549

Time Deposits

Money Market/Savings

Checking Accounts

Dollars in thousands

Deposit CompositionDeposit Migration

0.85%

0.63%

0.46%

0.30% 0.28% 0.28%

0.00%

0.10%

0.20%

0.30%

0.40%

0.50%

0.60%

0.70%

0.80%

0.90%

2012 2013 2014 2015 2016 2017

Cost of Funds

Deposit balances as of fiscal year end; Cost of funds are averages for the fiscal year; 2012 MMDA/Saving excludes

$264.2MM related to investor funds used to purchase Company stock for the July 11, 2012 IPO.

25

Deposit Composition

Positioned for

growth 26

Growing Noninterest Income

New SBA Line of Business

Gain from loan sales

Third party servicer to keep overhead low

Mortgage Banking

Expanded into 5 of our new metro markets

Added 10 new mortgage loan officers in the last 12 months

Increasing rates to enhance gain on loan sales

Moving to a “mortgage banking” model and process and away from the

“traditional thrift” model

Treasury Management

Focus on increasing fees and appropriate pricing

Additional debit card revenue from purchase card program

Increased fees from new merchant services program

Increased discipline and monitoring of fee waivers and refunds – reduced

64% in fiscal 2017

Positioned for

growth 27

Creating Efficiencies/Expense Management

Consolidated 10 branch offices

Closed 6 overlapping rural offices

Consolidated 4 offices related to acquisitions

Branch optimization staffing study reduced expense $375,000

annually

Changed health care insurance providers to avoid $700,000 increase

Reduced REO-related expense by $385,000, or 21% in fiscal 2017

Achieved 50% cost savings in TriSummit acquisition

Positioned for

growth

Nonperforming Assets / Total Assets

Net Charge-Offs & NCO / Avg. Loans

$30,640

$4

,127

0.34%

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

-

5,000

10,000

15,000

20,000

25,000

30,000

35,000

2012 2013 2014 2015 2016 2017

Net Charge-Offs NCO/Avg. Loans

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

-

5,000

10,000

15,000

20,000

25,000

30,000

35,000

40,000

2012 2013 2014 2015 2016 2017

ALL ALL/Tot. Loans

0.00%

1.00%

2.00%

3.00%

4.00%

5.00%

6.00%

2012 2013 2014 2015 2016 2017

Dollars in thousands

Provision For / (Recovery Of) Loan Losses

$15,600

$1,100

$(6,300)

$150

$- $-

(10,000)

(5,000)

-

5,000

10,000

15,000

20,000

2012 2013 2014 2015 2016 2017

Allowance for Loan Losses & ALL / Total Loans

28

Asset Quality

All data is as of or for the year ended June 30

Positioned for

growth 29

Current FHLB Leveraging Strategy

Borrowed $318 million (1) of additional short-term advances from the FHLB

Borrowings increased FHLB stock requirements to $32 million to take advantage of

high dividend rate (4.77% annualized for 4th quarter 2017)

Used funds to invest in short-term interest earning deposits (CD’s in other banks,

commercial paper, and deposits with the Federal Reserve Bank)

Increased net interest income by $1.8 million for the year

Decreased net interest margin 39 basis points – excluding this leveraging strategy,

net interest margin would be 3.88% for the year ended June 30, 2017

Will continue to impact net interest margin and ROA in fiscal 2018 while

contributing to earnings and EPS

Plan to continue reducing leveraging strategy over time

(1) Average additional borrowings for FHLB leveraging strategy for the year ended June 30, 2017.

Average additional borrowings for FHLB leveraging strategy for the six months ended December 31, 2017 was $250 million.

Positioned for

growth 30

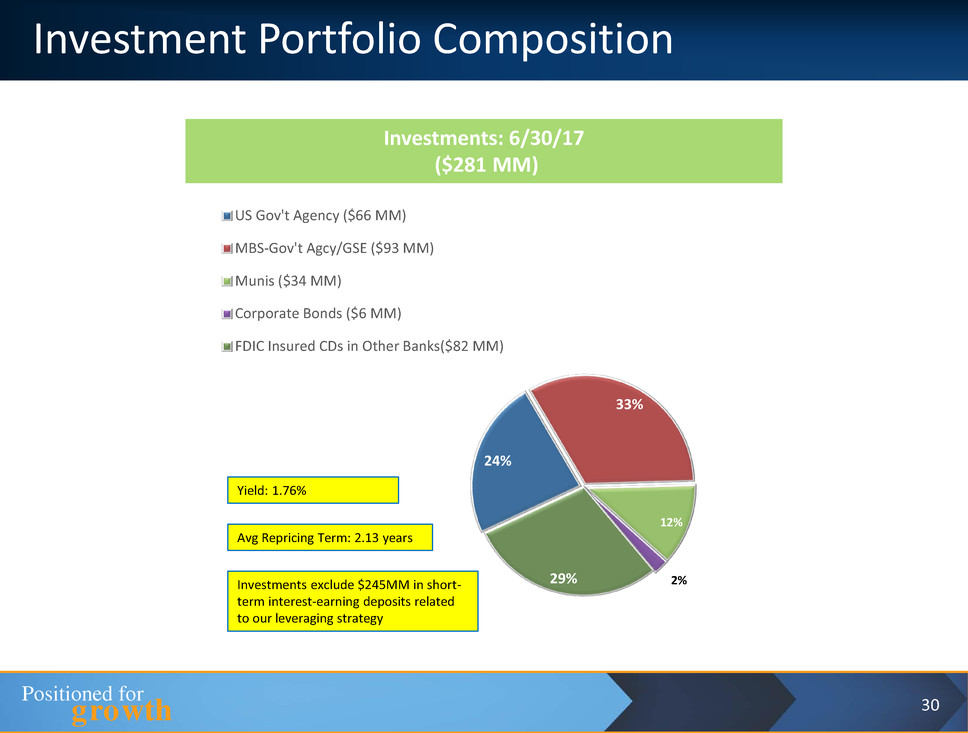

Investment Portfolio Composition

Investments: 6/30/17

($281 MM)

24%

33%

12%

2%29%

US Gov't Agency ($66 MM)

MBS-Gov't Agcy/GSE ($93 MM)

Munis ($34 MM)

Corporate Bonds ($6 MM)

FDIC Insured CDs in Other Banks($82 MM)

Yield: 1.76%

Avg Repricing Term: 2.13 years

Investments exclude $245MM in short-

term interest-earning deposits related

to our leveraging strategy

Positioned for

growth 31

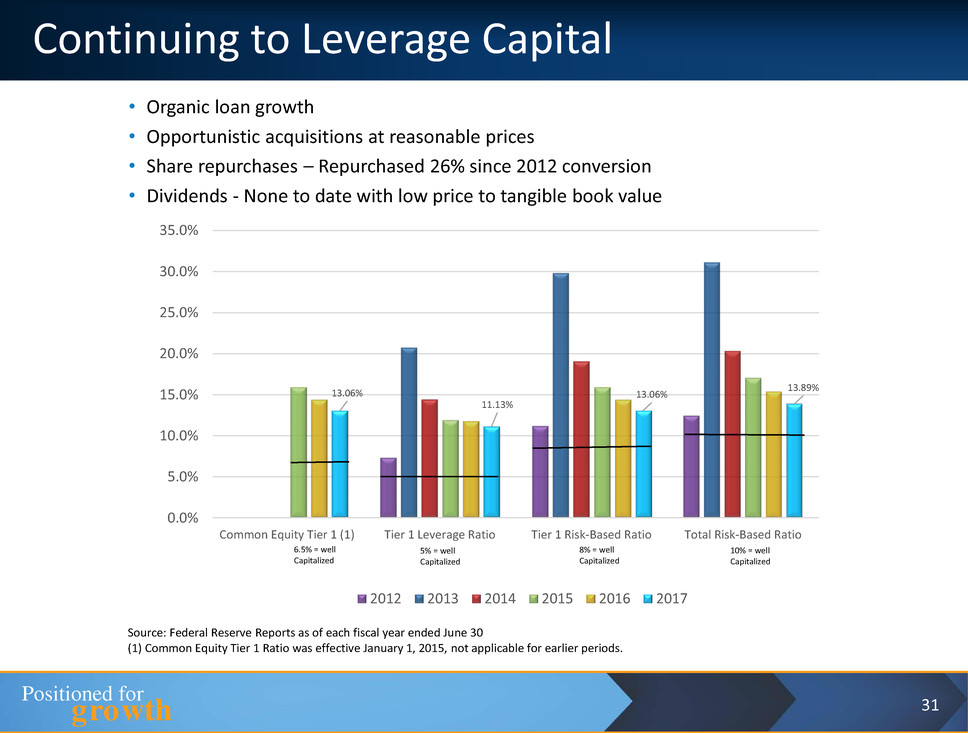

Continuing to Leverage Capital

• Organic loan growth

• Opportunistic acquisitions at reasonable prices

• Share repurchases – Repurchased 26% since 2012 conversion

• Dividends - None to date with low price to tangible book value

13.06%

11.13%

13.06%

13.89%

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

30.0%

35.0%

Common Equity Tier 1 (1) Tier 1 Leverage Ratio Tier 1 Risk-Based Ratio Total Risk-Based Ratio

2012 2013 2014 2015 2016 2017

6.5% = well

Capitalized

5% = well

Capitalized

8% = well

Capitalized

10% = well

Capitalized

Source: Federal Reserve Reports as of each fiscal year ended June 30

(1) Common Equity Tier 1 Ratio was effective January 1, 2015, not applicable for earlier periods.

Positioned for

growth 32

Opportunistic Acquisition Strategy

Geographic footprint – within or adjacent to our current market footprint

Attractive, growing market

Asset size – Target of $300 million to $800 million

Strong core deposit base

Earnings accretion of 10% or more

Minimum dilution to current tangible book value

Earnback period of 4 years or less

Significant but realistic cost savings

Reasonable price with a currency mix of cash and stock

No major credit issues

Cultural fit

Positioned for

growth

(Dollars in thousands, except per share amounts)

Source: Company documents previously filed with the SEC

33

Stock Buy Backs

Percent

Purchased of

Outstanding

Shares

Number of

Shares Total Cost

Avg Cost /

Share

1st Buy Back (completed 4/29/13) 4% 846,400 13,299$ 15.71$

2nd Buy Back (completed 12/2/13) 5% 1,041,245 17,055$ 16.38$

3rd Buy Back (completed 11/18/14) 5% 989,183 15,589$ 15.76$

4th Buy Back (completed 8/5/15) 5% 1,023,266 16,298$ 15.93$

5th Buy Back (completed on 1/20/16) 5% 971,271 18,089$ 18.62$

6th Buy Back (approved on 12/15/15) 5% 479,700 8,634$ 18.00$

Total repurchased through June 30, 2017 26% 5,351,065 88,964$ 16.63$

Remaining Shares to be purchased through 6th Buy Back 443,155

Total Shares Repurchased / Authorized 5,794,220

Positioned for

growth 34

Quarter Ended December 31, 2017 Highlights

(Dollars in thousands, except per share amounts)

As Reported 12/31/2017 12/31/2016 Amount Percent

Net income (10,666)$ 2,983$ (13,649)$ (457.56%)

EPS - diluted (0.59)$ 0.17$ (0.76)$ -447%

ROA (1.31%) 0.43% (1.74%) (404.65%)

Net interest margin (tax equivalent) 3.44% 3.33% 0.11% 3%

Noninterest income 4,787$ 3,941$ 846$ 21%

Core Earnings (1)

Net income 7,027$ 3,000$ 4,027$ 134%

EPS - diluted 0.38$ 0.17$ 0.21$ 124%

ROA 0.86% 0.43% 0.43% 100%

Organic Loan Growth

$ Growth 23,596$ 69,619$ (46,023)$ -66%

% Growth (annualized) 4.20% 16.30% (12.10%) (74.23%)

Loan originations:

Commercial portfolio 129,946$ 148,806$ (18,860)$ -13%

Retail portfolio 83,243 72,916 10,327 14%

1-4 family originated for sale 29,557 38,618 (9,061) (17%)

Total loan originations 242,746$ 260,340$ (17,594)$ -7%

Quarter Ended Change

(1) See Non-GAAP Disclosure Appendix.

Source: Company documents previously filed with the SEC

Positioned for

growth 35

Six Month Ended December 31, 2017 Highlights

As Reported 12/31/2017 12/31/2016 Amount Percent

Net income (5,099)$ 6,807$ (11,906)$ -175%

EPS - diluted (0.28)$ 0.39$ (0.67)$ -172%

ROA -0.32% 0.49% (0.81%) -165%

Net interest margin (tax equivalent) 3.43% 3.38% 0.05% 1.48%

Noninterest income 9,364$ 8,183$ 1,181$ 14%

Core Earnings (1)

Net income 12,612$ 7,295$ 5,317$ 73%

EPS - diluted 0.68$ 0.43$ 0.25$ 58%

ROA 0.78% 0.53% 0.25% 47%

Organic Loan Growth

$ Growth 66,770$ 93,639$ (26,869)$ -29%

% Growth 6.10% 11.10% (5.00%) (45%)

Loan originations:

Commercial portfolio 294,000$ 225,776$ 68,224$ 30%

Retail portfolio 163,682 147,518 16,164 11%

1-4 family originated for sale 61,981 77,526 (15,545) -20%

Total loan originations 519,663$ 450,820$ 68,843 15%

Six Months Ended Change

(Dollars in thousands, except per share amounts)

Source: Company documents previously filed with the SEC

(1) See Non-GAAP Disclosure Appendix.

Positioned for

growth

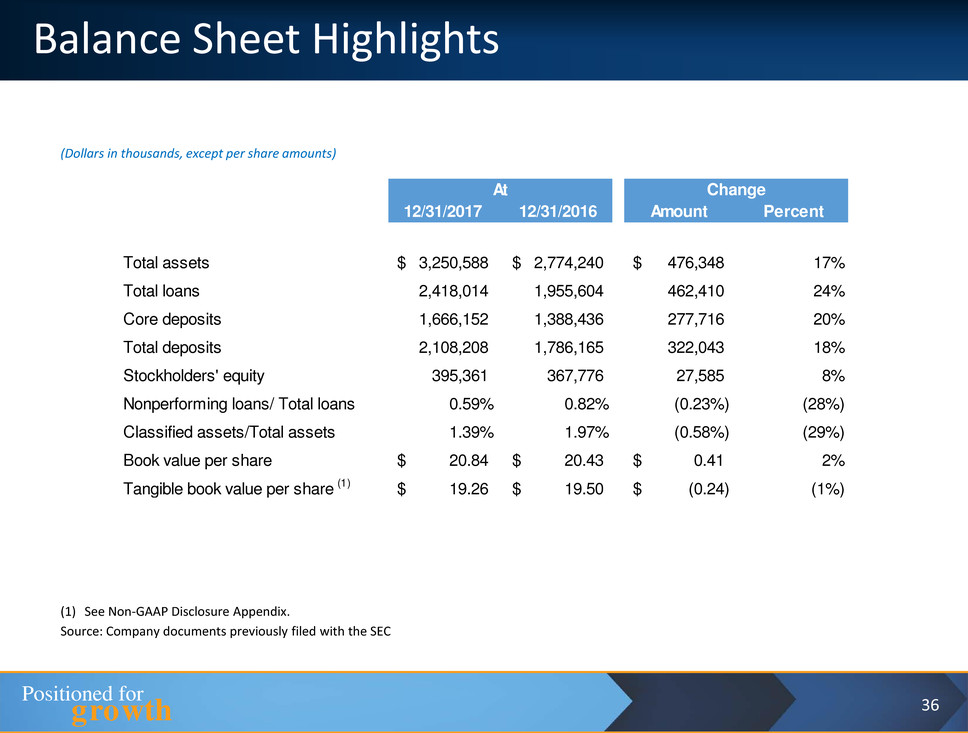

(Dollars in thousands, except per share amounts)

36

Balance Sheet Highlights

12/31/2017 12/31/2016 Amount Percent

Total assets 3,250,588$ 2,774,240$ 476,348$ 17%

Total loans 2,418,014 1,955,604 462,410 24%

Core deposits 1,666,152 1,388,436 277,716 20%

Total deposits 2,108,208 1,786,165 322,043 18%

Stock olders' equity 395,361 367,776 27,585 8%

Nonperforming loans/ Total loans 0.59% 0.82% (0.23%) (28%)

Classified assets/Total assets 1.39% 1.97% (0.58%) (29%)

Book value per share 20.84$ 20.43$ 0.41$ 2%

Tangible book value per share (1) 19.26$ 19.50$ (0.24)$ (1%)

At Change

Source: Company documents previously filed with the SEC

(1) See Non-GAAP Disclosure Appendix.

Positioned for

growth 37

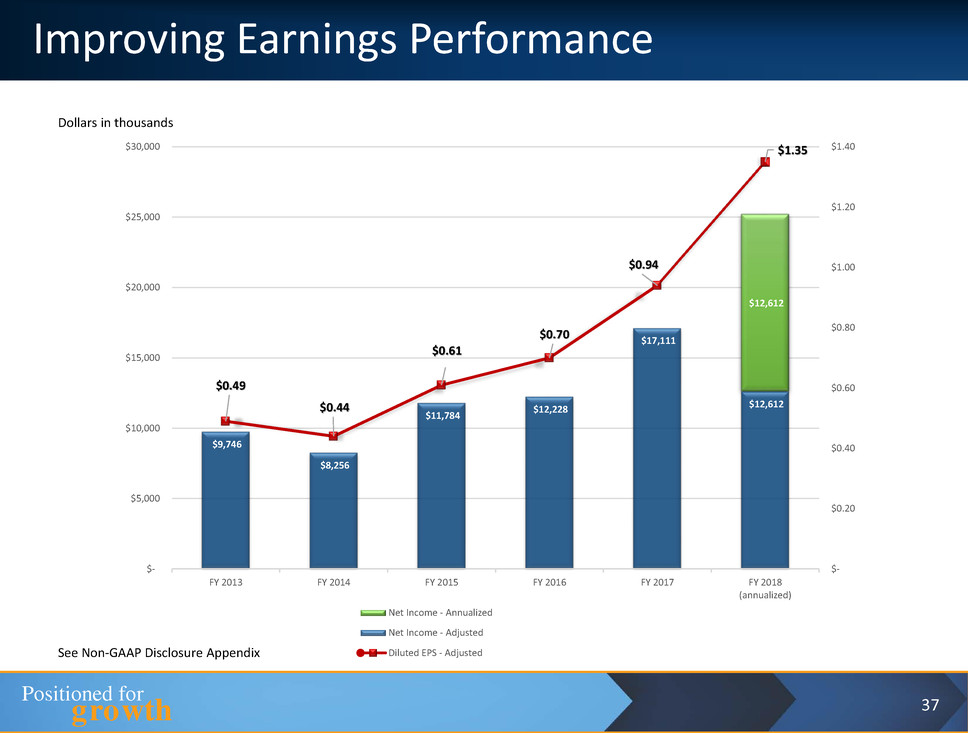

Improving Earnings Performance

$9,746

$8,256

$11,784

$12,228

$17,111

$12,612

$12,612

$0.49

$0.44

$0.61

$0.70

$0.94

$1.35

$-

$0.20

$0.40

$0.60

$0.80

$1.00

$1.20

$1.40

$-

$5,000

$10,000

$15,000

$20,000

$25,000

$30,000

FY 2013 FY 2014 FY 2015 FY 2016 FY 2017 FY 2018

(annualized)

Net Income - Annualized

Net Income - Adjusted

Diluted EPS - Adjusted

Dollars in thousands

See Non-GAAP Disclosure Appendix

Positioned for

growth 38

Market Price and Price to Tangible Book

$16.96

$15.77

$16.76

$18.50

$24.40

$25.75

96.1%

89.2%

92.8% 97.1%

126.0%

133.7%

-10.0%

10.0%

30.0%

50.0%

70.0%

90.0%

110.0%

130.0%

150.0%

$-

$5.0

$10.0

$15.0

$20.0

$25.0

$30.0

06/30/2013 06/30/2014 06/30/2015 06/30/2016 06/30/2017 12/31/2017

Market Price per Share

Price to Tangible BookSee Non-GAAP Disclosure Appendix

Positioned for

growth

100.0

120.0

140.0

160.0

180.0

200.0

220.0

240.0

260.0

07/11/12 06/30/13 06/30/14 06/30/15 06/30/2016 06/30/2017 12/30/2017

Total Return Performance

HomeTrust Bancshares, Inc. NASDAQ Bank NASDAQ Composite

39

Total Shareholder Return

Positioned for

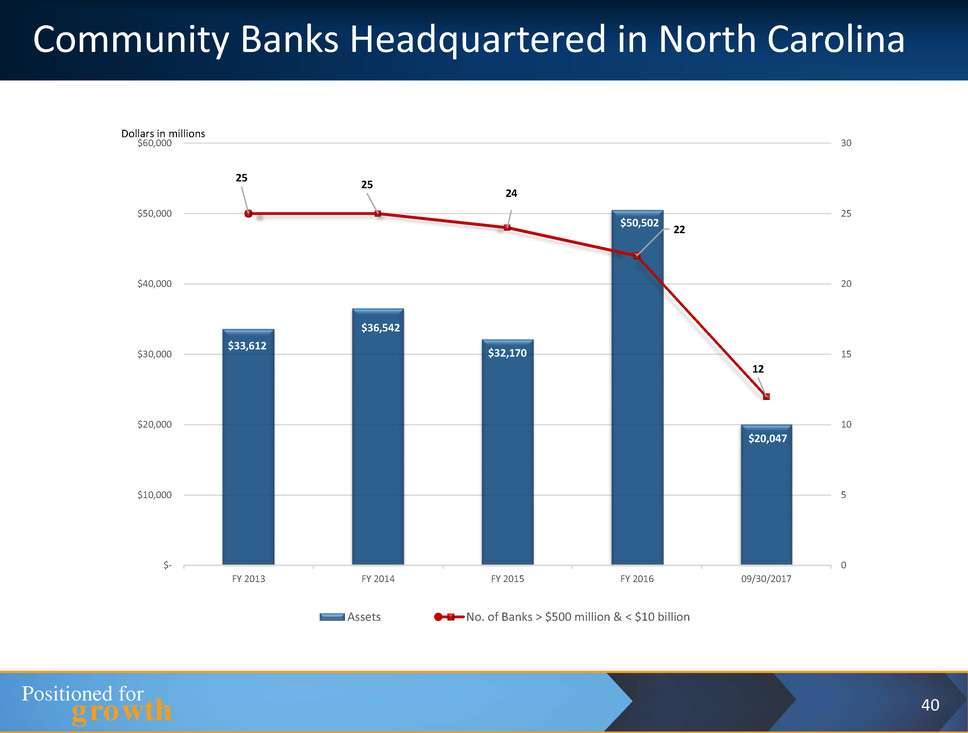

growth 40

Community Banks Headquartered in North Carolina

$33,612

$36,542

$32,170

$50,502

$20,047

25

25

24

22

12

0

5

10

15

20

25

30

$-

$10,000

$20,000

$30,000

$40,000

$50,000

$60,000

FY 2013 FY 2014 FY 2015 FY 2016 09/30/2017

Assets No. of Banks > $500 million & < $10 billion

Dollars in millions

Positioned for

growth 41

Proven Growth Strategy

• Building on Our Strong Organic Growth

• 7 new metro markets (including our new Greensboro LPO)

• Commercial lending

• Mortgage banking

• Core deposits

• Expanding into New Lines of Business

• Indirect auto

• Equipment Finance

• SBA

• Opportunistic Acquisition Strategy

• Experienced integration team and proven process

• 4 whole bank acquisitions since 2013

• 3 Commercial Loan Production Offices with “lift-outs” from other banks

• Purchased 8 Bank of America branches

Positioned for

growth 42

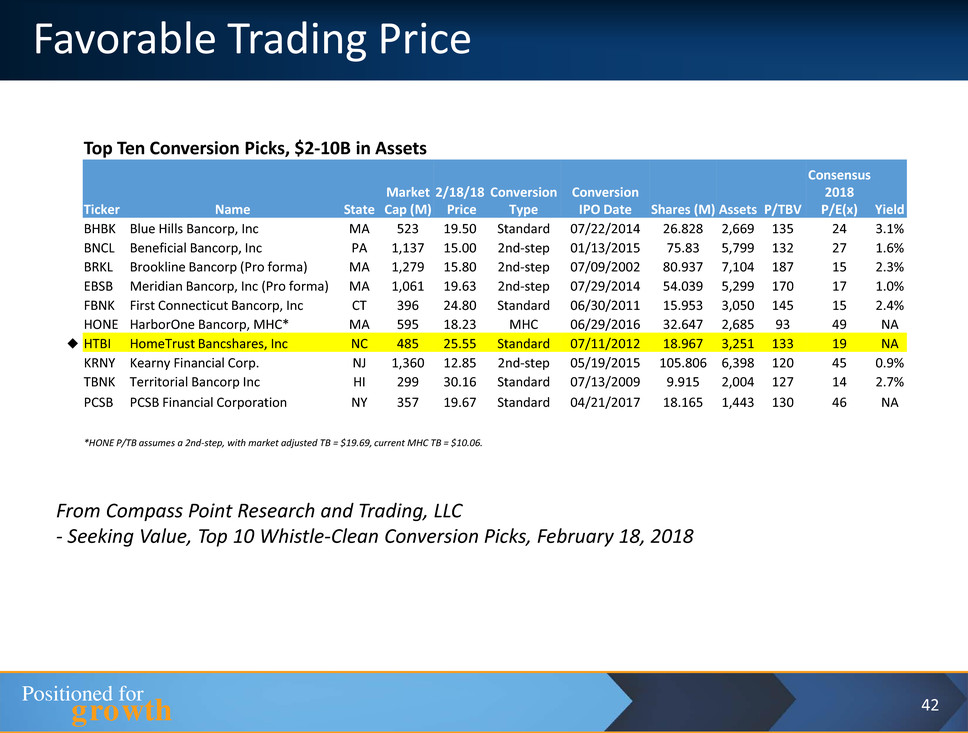

Favorable Trading Price

From Compass Point Research and Trading, LLC

- Seeking Value, Top 10 Whistle-Clean Conversion Picks, February 18, 2018

Top Ten Conversion Picks, $2-10B in Assets

Ticker Name State

Market

Cap (M)

2/18/18

Price

Conversion

Type

Conversion

IPO Date Shares (M) Assets P/TBV

Consensus

2018

P/E(x) Yield

BHBK Blue Hills Bancorp, Inc MA 523 19.50 Standard 07/22/2014 26.828 2,669 135 24 3.1%

BNCL Beneficial Bancorp, Inc PA 1,137 15.00 2nd-step 01/13/2015 75.83 5,799 132 27 1.6%

BRKL Brookline Bancorp (Pro forma) MA 1,279 15.80 2nd-step 07/09/2002 80.937 7,104 187 15 2.3%

EBSB Meridian Bancorp, Inc (Pro forma) MA 1,061 19.63 2nd-step 07/29/2014 54.039 5,299 170 17 1.0%

FBNK First Connecticut Bancorp, Inc CT 396 24.80 Standard 06/30/2011 15.953 3,050 145 15 2.4%

HONE HarborOne Bancorp, MHC* MA 595 18.23 MHC 06/29/2016 32.647 2,685 93 49 NA

HTBI HomeTrust Bancshares, Inc NC 485 25.55 Standard 07/11/2012 18.967 3,251 133 19 NA

KRNY Kearny Financial Corp. NJ 1,360 12.85 2nd-step 05/19/2015 105.806 6,398 120 45 0.9%

TBNK Territorial Bancorp Inc HI 299 30.16 Standard 07/13/2009 9.915 2,004 127 14 2.7%

PCSB PCSB Financial Corporation NY 357 19.67 Standard 04/21/2017 18.165 1,443 130 46 NA

*HONE P/TB assumes a 2nd-step, with market adjusted TB = $19.69, current MHC TB = $10.06.

Positioned for

growth 43

Investor Contacts

Dana Stonestreet

Chairman, President and CEO

dana.stonestreet@hometrustbanking.com

Hunter Westbrook

EVP/Chief Banking Officer

hunter.westbrook@hometrustbanking.com

Tony VunCannon

EVP/Chief Financial Officer/Treasurer

tony.vuncannon@hometrustbanking.com

10 Woodfin Street

Asheville, NC 28801

(828) 259-3939

www.hometrustbanking.com

Positioned for

growth

Non-GAAP Disclosure Appendix

44

Positioned for

growth

In addition to results presented in accordance with generally accepted accounting principles utilized in the

United States ("GAAP"), this presentation contains certain non-GAAP financial measures, which include:

tangible book value per share, net income excluding merger-related expenses, nonrecurring state tax

expense, gain from the sale of premises and equipment, and impairment charges for branch

consolidation; and return on assets ("ROA") and earnings per share ("EPS") excluding merger expenses,

nonrecurring state tax expense, gain from the sale of premises and equipment, and impairment charges

for branch consolidation. The Company believes these non-GAAP financial measures and ratios as

presented are useful for both investors and management to understand the effects of certain items and

provides an alternative view of the Company's performance over time and in comparison to the

Company's competitors.

Management elected to obtain additional FHLB borrowings beginning in November 2014 as part of a plan

to increase net interest income. The Company believes that showing the effects of the additional

borrowings on net interest income and net interest margins is useful to both management and investors

as these measures are commonly used to measure financial institutions performance and performance

against peers.

The Company believes these measures facilitate comparison of the quality and composition of the

Company's capital and earnings ability over time and in comparison to its competitors. These non-GAAP

measures have inherent limitations, are not required to be uniformly applied and are not audited. They

should not be considered in isolation or as a substitute for total stockholders' equity or operating results

determined in accordance with GAAP. These non-GAAP measures may not be comparable to similarly

titled measures reported by other companies.

45

Non-GAAP Disclosure Reconciliation

Positioned for

growth 46

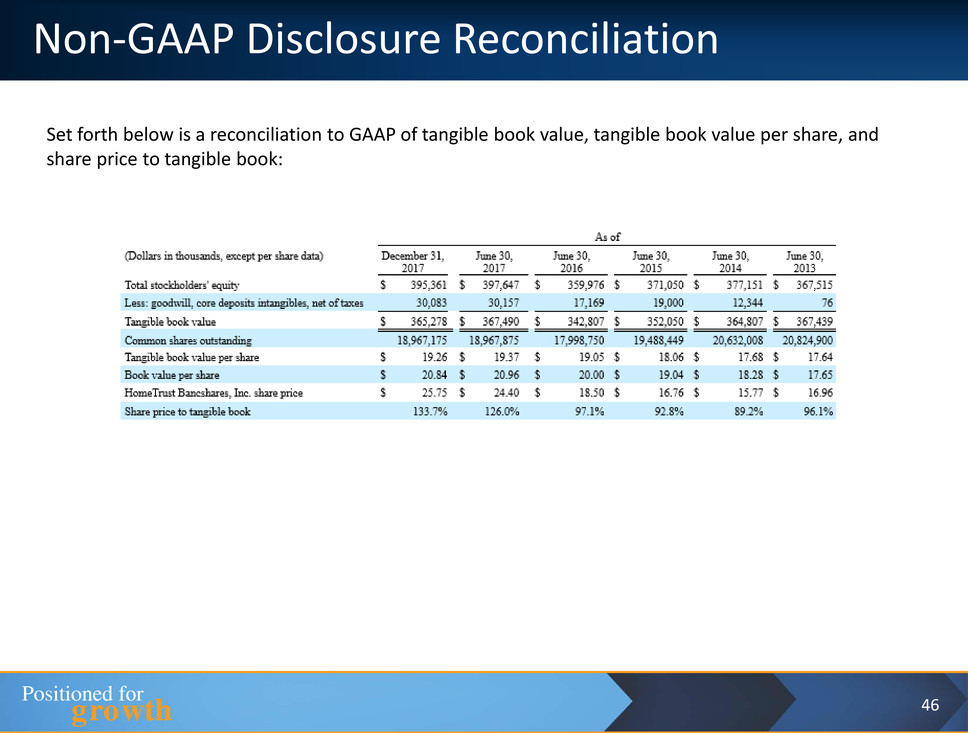

Non-GAAP Disclosure Reconciliation

Set forth below is a reconciliation to GAAP of tangible book value, tangible book value per share, and

share price to tangible book:

Positioned for

growth 47

Non-GAAP Disclosure Reconciliation

Set forth to the right is a reconciliation

to GAAP net income, ROA, and EPS as

adjusted to exclude merger-related

expenses, nonrecurring state tax

expense, gain on sale of premises and

equipment, and impairment charge for

branch consolidation:

Positioned for

growth 48

Non-GAAP Disclosure Reconciliation

Set forth to the right is a reconciliation

to GAAP net income, ROA, and EPS as

adjusted to exclude merger-related

expenses, nonrecurring state tax

expense, federal tax law change, and

gain on sale of premises and

equipment: