Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CHART INDUSTRIES INC | gtls-march2018investorpres.htm |

© 2018 Chart Industries, Inc. Confidential and Proprietary

Chart Industries, Inc.

Investor Presentation

Exhibit 99.1

© 2018 Chart Industries, Inc. Confidential and Proprietary 2

Forward-Looking Statements

Certain statements made in this presentation are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements include statements concerning Chart Industries’ plans, objectives, future orders, revenues, margins, tax rates and tax planning,

earnings or performance, liquidity and cash flow, capital expenditures, business trends, and other information that is not historical in nature. Forward-looking

statements may be identified by terminology such as "may," "will," "should," "could," "expects," "anticipates," "believes," "projects," "forecasts," “outlook,”

“guidance,” "continue," or the negative of such terms or comparable terminology.

Forward-looking statements contained in this presentation or in other statements made by Chart Industries are made based on management's expectations and

beliefs concerning future events impacting Chart Industries and are subject to uncertainties and factors relating to Chart Industries’ operations and business

environment, all of which are difficult to predict and many of which are beyond Chart Industries’ control, that could cause Chart Industries’ actual results to

differ materially from those matters expressed or implied by forward-looking statements. Factors that could cause Chart Industries’ actual results to differ

materially from those described in the forward-looking statements include the implementation of and realization of benefits under the Tax Cuts and Jobs Act

and those other risks and uncertainties found in Item 1A (Risk Factors) in Chart Industries’ most recent Annual Report on Form 10-K filed with the SEC, which

should be reviewed carefully. The Company undertakes no obligation to update or revise any forward-looking statement.

Chart Industries is a leading diversified global manufacturer of highly engineered equipment for the industrial gas, energy, and biomedical industries. The

majority of Chart Industries' products are used throughout the liquid gas supply chain for purification, liquefaction, distribution, storage and end-use

applications, a large portion of which are energy-related. Chart Industries has domestic operations located across the United States and an international presence

in Asia, Australia, Europe and Latin America. For more information, visit: http://www.chartindustries.com.

© 2018 Chart Industries, Inc. Confidential and Proprietary 3

Company Overview

Healthcare

Chart is a leading diversified global manufacturer of highly-engineered equipment, packaged

solutions and value-add services for the energy, industrial gas and biomedical industries

Technology leader providing premium equipment to energy and industrial liquid gas

supply chain end markets

A leading supplier in all primary markets served

Global footprint for our operations on four continents with approximately 4,400

employees

Balanced expansion in the US and International markets

FY 2017 Sales by Segment

BioMed

22%

Energy &

Chemicals

23%

Distribution &

Storage

55%

FY 2017 Sales by Segment Pro Forma Hudson*

BioMed

20%

Energy, &

Chemicals

32%

Distribution &

Storage

48%

* Assumes Hudson Acquisition occurred as of 1 January 2017

© 2018 Chart Industries, Inc. Confidential and Proprietary 4

Supplier of Brazed Aluminum

Heat Exchangers (BAHX), Air

Cooled Heat Exchangers

(ACHX) and Cold Boxes

Provider of integrated

systems and aftermarket

services for gas processing,

LNG and petrochemical

applications

Technology leader

Complete portfolio of

cryogenic distribution and

storage equipment

Leading innovator in

cryogenic packaged gas and

MicroBulk systems

Over 20 years of experience

in LNG applications

Leading Supplier of Mission Critical Equipment

End-to-end provider of

respiratory therapy

equipment

Set the standard for storage

of biological materials at low

temperatures

Reliable, high quality

solutions for environmental

market applications

BioMed Distribution & Storage Energy & Chemicals

A B C

© 2018 Chart Industries, Inc. Confidential and Proprietary 5

23%

of Total Chart Sales

$211M

Backlog at 12/31/17

20%

Gross Margin

BioMed

Broad End-Market Exposure

Distribution & Storage Energy & Chemicals

Sales

b

y

Indust

ry

*

H

ig

h

li

g

h

ts

10%

35%

55%

5%

8%

7%

22%

58%

Healthcare

Life

Sciences

Environ-

mental

Manufacturing/

Fabrication

LNG

Food/

Beverage

Electronics

Healthcare

Natural Gas

Processing/

Petrochemical

10%

13%

68%

9%

Industrial

Gas

LNG

$226M $223M $540M

22%

of Total Chart Sales

$23M

Backlog at 12/31/17

36%

Gross Margin

55%

of Total Chart Sales

$228M

Backlog at 12/31/17

27%

Gross Margin

Sales

b

y

G

e

o

g

ra

p

h

y

*

75%

41%

49% 53%

4%

30%

26% 22%

9% 17%

19% 16%

4% 2%

8% 12% 6% 7%

E&C BioMed D&S Total

$226M $223M $540M $989M

United States

Asia

Europe

Middle East

Rest of World

A B C

FY 2017

FY 2017 Highlights

FY 2017

* FY 2017 as per SEC filings

HVAC, power

and refining

© 2018 Chart Industries, Inc. Confidential and Proprietary 6

Adds highly-complementary Fans business

Strengthens aftermarket presence

Consistent with core strategy to enhance Air

Cooled Heat Exchanger (ACHX) business

Expected to be accretive to growth, margins and

EPS

Significant cost synergies

Efficient use of Chart’s strong balance sheet

position

Product Split*

OEM

63%

End Market Split* Aftermarket Split*

Aftermarket

37% Fans

38%

ACHEs

62%

Industrial /

Other /

HVAC

23%

Chemical

6%

LNG

22%

Power

10%

Oil & Gas

19%

Refining

20%

Key

Products

Chart Product Offerings

End Market Mix

Axial Flow Fans ACHEs Brazed Aluminum

Heat Exchangers

Integrated

Process

Systems

Natural Gas Industrial Gas LNG

Power HVAC Refining

Oil & Gas Petrochemical

Expands Industrial Gas Offerings

Maximizes LNG Opportunity

Hudson Transaction Broadens Offering

Denotes Chart

offering pre-

acquisition

* Hudson stand-alone

© 2018 Chart Industries, Inc. Confidential and Proprietary 7

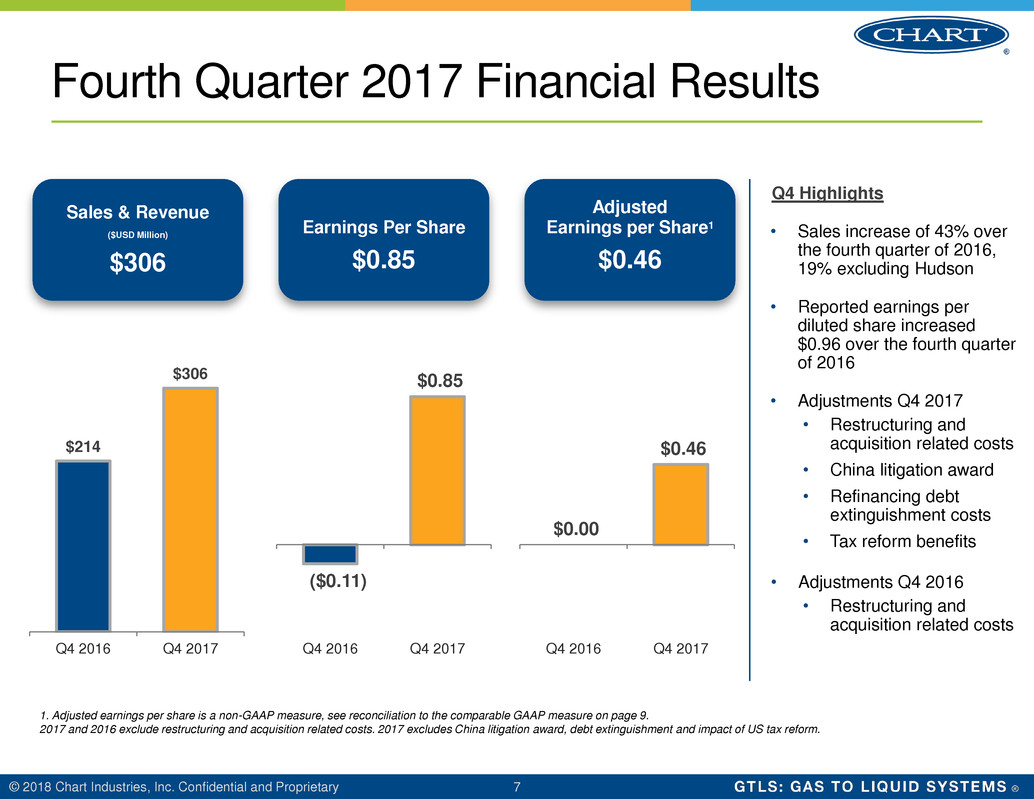

Fourth Quarter 2017 Financial Results

$214

$306

Q4 2016 Q4 2017

Sales & Revenue

($USD Million)

$306

Earnings Per Share

$0.85

Adjusted

Earnings per Share1

$0.46

($0.11)

$0.85

Q4 2016 Q4 2017

$0.00

$0.46

Q4 2016 Q4 2017

Q4 Highlights

• Sales increase of 43% over

the fourth quarter of 2016,

19% excluding Hudson

• Reported earnings per

diluted share increased

$0.96 over the fourth quarter

of 2016

• Adjustments Q4 2017

• Restructuring and

acquisition related costs

• China litigation award

• Refinancing debt

extinguishment costs

• Tax reform benefits

• Adjustments Q4 2016

• Restructuring and

acquisition related costs

1. Adjusted earnings per share is a non-GAAP measure, see reconciliation to the comparable GAAP measure on page 9.

2017 and 2016 exclude restructuring and acquisition related costs. 2017 excludes China litigation award, debt extinguishment and impact of US tax reform.

© 2018 Chart Industries, Inc. Confidential and Proprietary 8

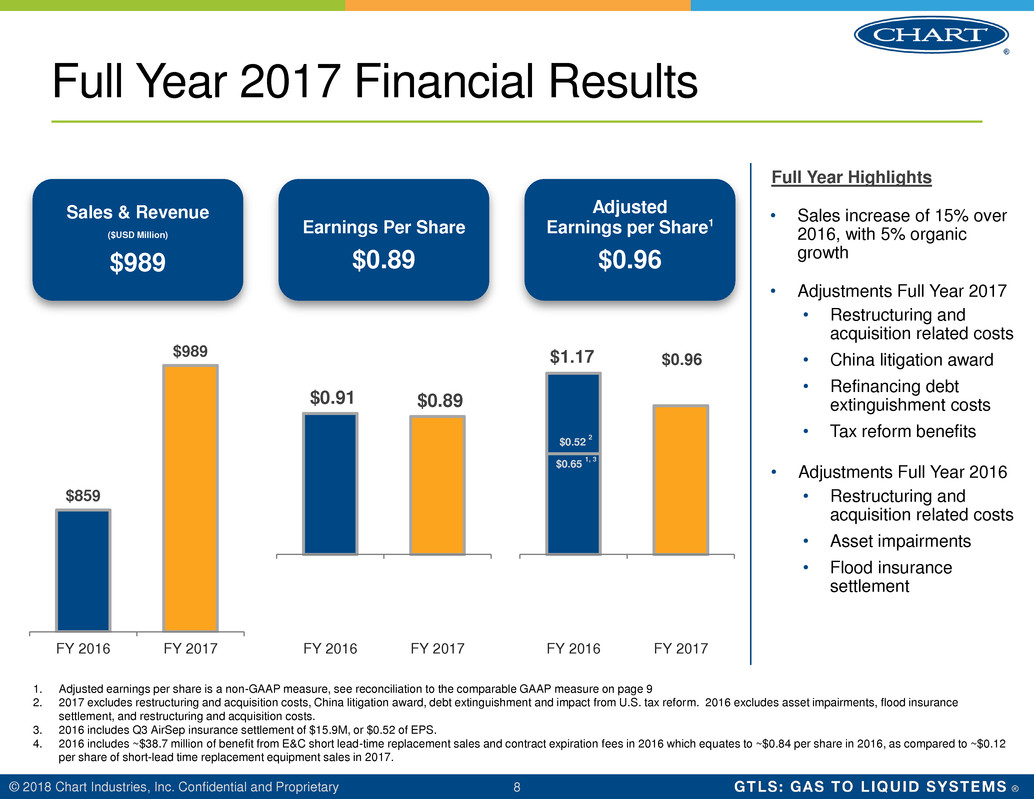

Full Year 2017 Financial Results

$859

$989

FY 2016 FY 2017

Sales & Revenue

($USD Million)

$989

Earnings Per Share

$0.89

Adjusted

Earnings per Share1

$0.96

$0.91 $0.89

FY 2016 FY 2017

$0.65

1, 3

$0.96

$0.52

2

FY 2016 FY 2017

Full Year Highlights

• Sales increase of 15% over

2016, with 5% organic

growth

• Adjustments Full Year 2017

• Restructuring and

acquisition related costs

• China litigation award

• Refinancing debt

extinguishment costs

• Tax reform benefits

• Adjustments Full Year 2016

• Restructuring and

acquisition related costs

• Asset impairments

• Flood insurance

settlement

1. Adjusted earnings per share is a non-GAAP measure, see reconciliation to the comparable GAAP measure on page 9

2. 2017 excludes restructuring and acquisition costs, China litigation award, debt extinguishment and impact from U.S. tax reform. 2016 excludes asset impairments, flood insurance

settlement, and restructuring and acquisition costs.

3. 2016 includes Q3 AirSep insurance settlement of $15.9M, or $0.52 of EPS.

4. 2016 includes ~$38.7 million of benefit from E&C short lead-time replacement sales and contract expiration fees in 2016 which equates to ~$0.84 per share in 2016, as compared to ~$0.12

per share of short-lead time replacement equipment sales in 2017.

$1.17

© 2018 Chart Industries, Inc. Confidential and Proprietary 9

Adjusted EPS

$ millions Q4 2016 Q4 2017 Change V.

PY

(Q4)

2016 FY 2017 FY Change V.

PY

(FY)

Net Income (Loss) ($3.29) $26.66 $29.95 $28.23 $28.04 ($0.19)

EPS (1) ($0.11) $0.85 $0.96 $0.91 $0.89 ($0.02)

Restructuring and acquisition-related Costs 0.11 0.11 0.00 0.24 0.57 0.33

Debt Extinguishment 0.10 0.10 0.10 0.10

China Litigation Award (2) 0.11 0.11 0.11 0.11

Tax Reform (3) (0.71) (0.71) (0.71) (0.71)

Asset Impairments 0.04 (0.04)

Flood Insurance Settlement (0.02) 0.02

Adjusted EPS (4, 5) $0.00 $0.46 $0.46 $1.17 $0.96 ($0.21)

AirSep Insurance Settlement (0.52) 0.52

Normalized Adjusted EPS on a Comparable

Basis (5, 6)

($0.00) $0.46 $0.46 $0.65 $0.96 $0.31

(1) 2016 FY includes $0.84 of EPS from short lead-time replacement equipment sales and contract expiration fees in the Energy & Chemicals (“E&C”)

segment. 2017 includes $0.12 of EPS from short lead-time replacement equipment sales in E&C.

(2) Chinese court ruling over disputed commissions to a former external sales representative.

(3) One-time adjustments related to impact of Tax Reform.

(4) Adjusted EPS (a non-gaap measure) is as reported on a historical basis.

(5) Tax effected adjustments are at normalized statutory quarterly rates.

(6) “Normalized Adjusted EPS on a Comparable Basis” is not recognized under generally accepted accounting principles (“GAAP”) and is referred to as a

“non-GAAP financial measure” in Regulation G under the Exchange Act. The Company believes this figure is of interest to investors and facilitates useful

period-to-period comparisons of the Company’s operating results, eliminating the impact of the non-recurring AirSep insurance settlement.

A

B

C

D

E

F

© 2018 Chart Industries, Inc. Confidential and Proprietary 10

2018 Guidance

FY 2018 Guidance

Sales

$1.15B - $1.20B

Up 16% – 21%

5-7% organic growth

Adjusted EPS

$1.65 - $1.90

Up 72% – 98%

Inclusive of ~$0.15 of impact from U.S. tax reform

Assumes 27% - 29% full year tax rate

Capital Expenditures

$35M - $45M

Flat to 2017

Inclusive of ~$11M for finalization of La Crosse, WI capacity expansion

© 2017 Chart Industries, Inc. Confidential and Proprietary 11

Profitable Growth Focus

Continue facility consolidation efforts to create further operating

efficiencies and leverage support functions across the business

Focus on operational excellence and strategic goals for long-

term growth when market returns

Invest in additional capacity at our brazed aluminum heat

exchanger facility and LNG vehicle tank line expansion in

Georgia

Pursue acquisition targets in our core technologies and

adjacencies

© 2018 Chart Industries, Inc. Confidential and Proprietary

www.ChartIndustries.com

12