Attached files

| file | filename |

|---|---|

| 8-K - 8-K INVESTOR PRESENTATION - ANTARES PHARMA, INC. | atrs-8k_20180305.htm |

NASDAQ: ATRS Raymond James & Associates 39th Annual Institutional Investors Conference March 5, 2018 Robert F. Apple President and Chief Executive Officer Antares Pharma (NASDAQ: ATRS) Exhibit 99.1

Safe Harbor Statement 2 This presentation contains forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are subject to certain risks and uncertainties that can cause actual results to differ materially from those described. Factors that may cause such differences include but are not limited to: the timing of the commercial launch of the Makena subcutaneous auto injector product in the U.S. and future market acceptance and revenue from the Makena subcutaneous auto injector product; the outcome of the Type A meeting with the U.S. Food and Drug Administration (FDA), the Company’s ability to resolve the deficiencies identified by the FDA in the Complete Response Letter, the timeframe associated with such resolution and whether any such response will be accepted by the FDA, FDA approval of the Company’s NDA for XYOSTED and future market acceptance and revenue for XYOSTED; successful completion of the transaction with Ferring International Center, S.A. and satisfaction of the various conditions in the Ferring asset purchase agreement and payment of the full purchase price; Teva’s expectations about timing and approval of the VIBEX® epinephrine pen ANDA by the FDA and potential product launch of the same, the therapeutic equivalence rating thereof, and any future revenue from the same; FDA action with respect to Teva’s Abbreviated New Drug Application (“ANDA”) for the Teriparatide multi-dose pen and the timing and approval, if any, by the FDA of the same; FDA action with respect to Teva’s ANDA for the Exenatide pen and the timing and approval, if any, by the FDA of the same; Teva’s ability to successfully commercialize VIBEX® Sumatriptan Injection USP and the amount of revenue from the same; continued growth of prescriptions and sales of OTREXUP®; the timing and results of research projects, clinical trials, and product candidates in development; actions by the FDA or other regulatory agencies with the respect to the Company’s products or product candidates of its partners; continued growth in product, development, licensing and royalty revenue; the Company’s ability to obtain financial and other resources for its research, development, clinical, and commercial activities and other statements regarding matters that are not historical facts, and involve predictions. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance, achievements or prospects to be materially different from any future results, performance, achievements or prospects expressed in or implied by such forward-looking statements. In some cases you can identify forward-looking statements by terminology such as ''may'', ''will'', ''should'', ''would'', ''expect'', ''intend'', ''plan'', ''anticipate'', ''believe'', ''estimate'', ''predict'', ''potential'', ''seem'', ''seek'', ''future'', ''continue'', or ''appear'' or the negative of these terms or similar expressions, although not all forward-looking statements contain these identifying words. Additional information concerning these and other factors that may cause actual results to differ materially from those anticipated in the forward-looking statements is contained in the "Risk Factors" section of the Company's Annual Report on Form 10-K for the year ended December 31, 2016, and in the Company's other periodic reports and filings with the Securities and Exchange Commission. The Company cautions investors not to place undue reliance on the forward-looking statements contained in this presentation. All forward-looking statements are based on information currently available to the Company on the date hereof, and the Company undertakes no obligation to revise or update these forward-looking statements to reflect events or circumstances after the date of this presentation, except as required by law. ©2018 Copyright Antares Pharma, Inc. All Rights Reserved.

Antares Pharma A Growing, Revenue Generating State-of-the-Art Specialty Pharmaceutical Company An Innovative Leader in Self-Administered Injection Technology Two combination products approved and on the U.S. market (OTREXUP®, Sumatriptan) and one combination product approved in Europe with marketing authorizations in 17 countries and awaiting patent clearance (Teriparatide) One sNDA Drug Device Combination Product partnered with AMAG (Makena®) and FDA approved 2/14/18 Three ANDA drug device combination products submitted by Teva to U.S. FDA with first to file status (Epinephrine pen, Exenatide, Teriparatide) awaiting potential FDA approval One NDA for a Drug Device Combination Product submitted to the FDA (XYOSTED™) 12/16 – CRL received 10/17 – Type A meeting held with FDA 2/21/18 to discuss potential regulatory path forward Novel Drug Delivery Technology Can Provide Multiple Product Opportunities and Life Cycle Management Solutions Auto-injector platform and Multi-dose pen platform Strong Balance Sheet - $37.4 million in cash, cash equivalents and short term investments at September 30, 2017

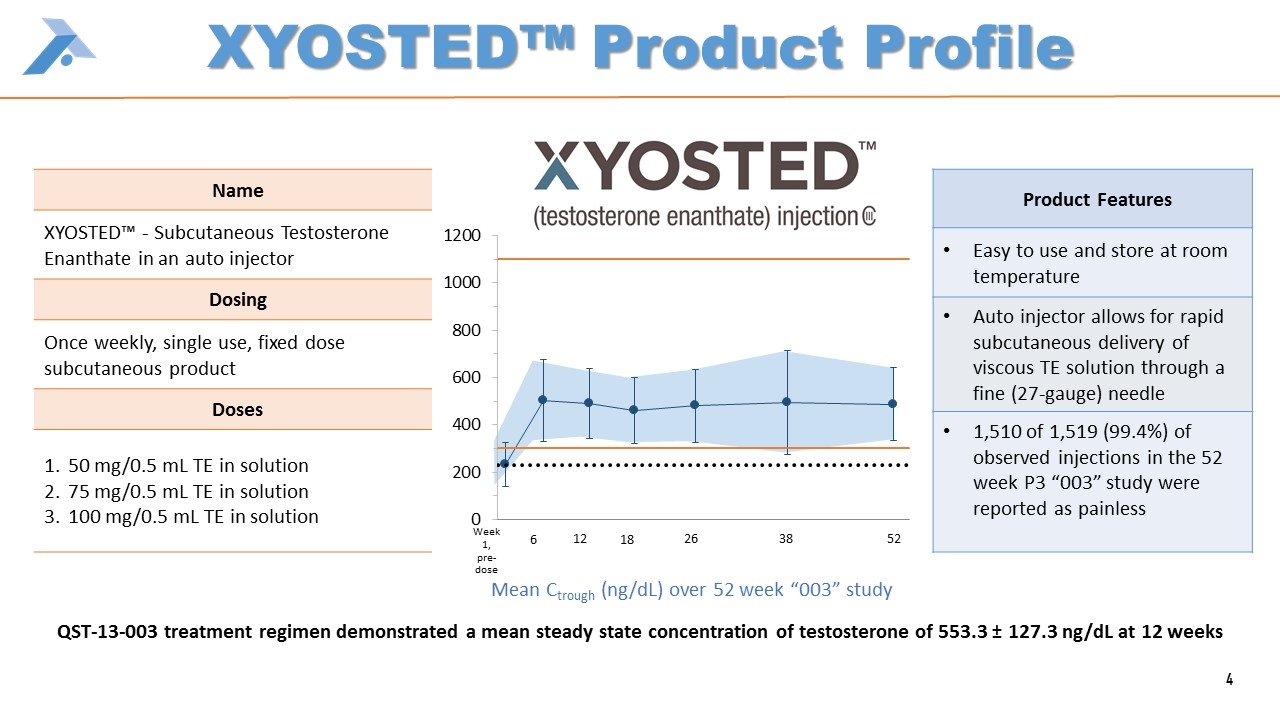

Name XYOSTED™ - Subcutaneous Testosterone Enanthate in an auto injector Dosing Once weekly, single use, fixed dose subcutaneous product Doses 50 mg/0.5 mL TE in solution 75 mg/0.5 mL TE in solution 100 mg/0.5 mL TE in solution Product Features Easy to use and store at room temperature Auto injector allows for rapid subcutaneous delivery of viscous TE solution through a fine (27-gauge) needle 1,510 of 1,519 (99.4%) of observed injections in the 52 week P3 “003” study were reported as painless XYOSTED™ Product Profile Mean Ctrough (ng/dL) over 52 week “003” study 6 12 18 26 38 52 Week 1, pre-dose QST-13-003 treatment regimen demonstrated a mean steady state concentration of testosterone of 553.3 ± 127.3 ng/dL at 12 weeks

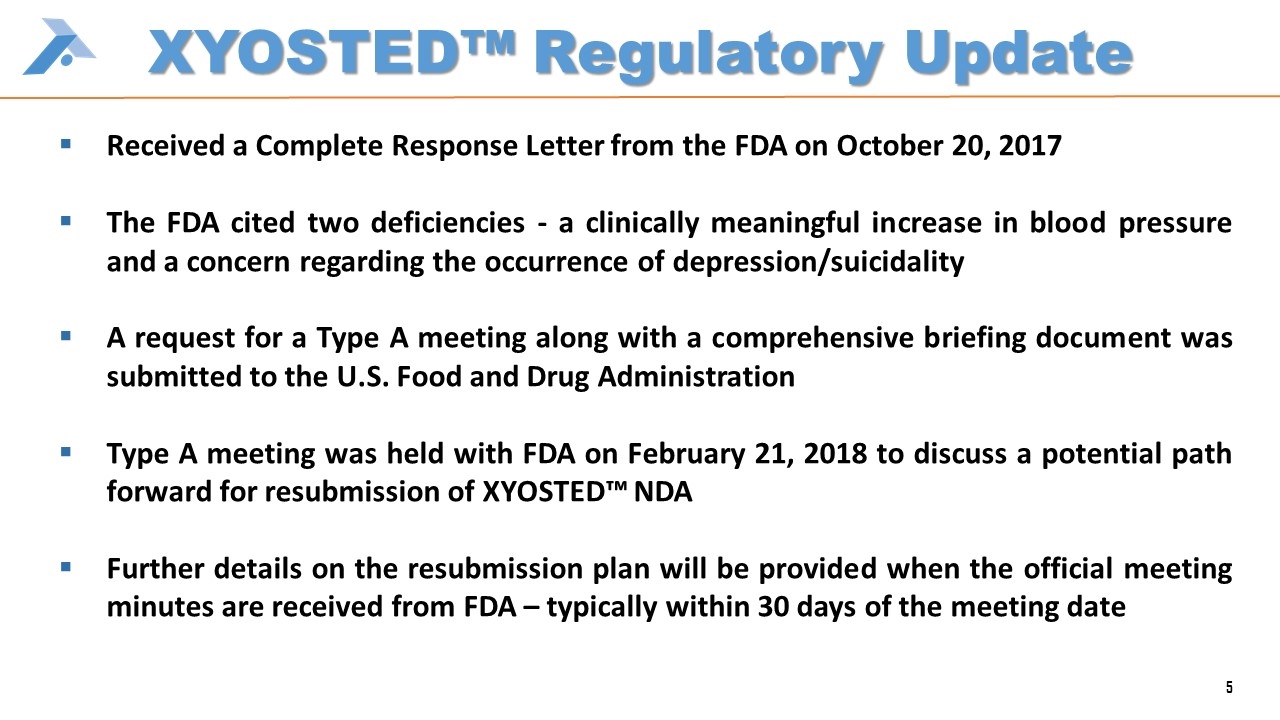

XYOSTED™ Regulatory Update Received a Complete Response Letter from the FDA on October 20, 2017 The FDA cited two deficiencies - a clinically meaningful increase in blood pressure and a concern regarding the occurrence of depression/suicidality A request for a Type A meeting along with a comprehensive briefing document was submitted to the U.S. Food and Drug Administration Type A meeting was held with FDA on February 21, 2018 to discuss a potential path forward for resubmission of XYOSTED™ NDA Further details on the resubmission plan will be provided when the official meeting minutes are received from FDA – typically within 30 days of the meeting date

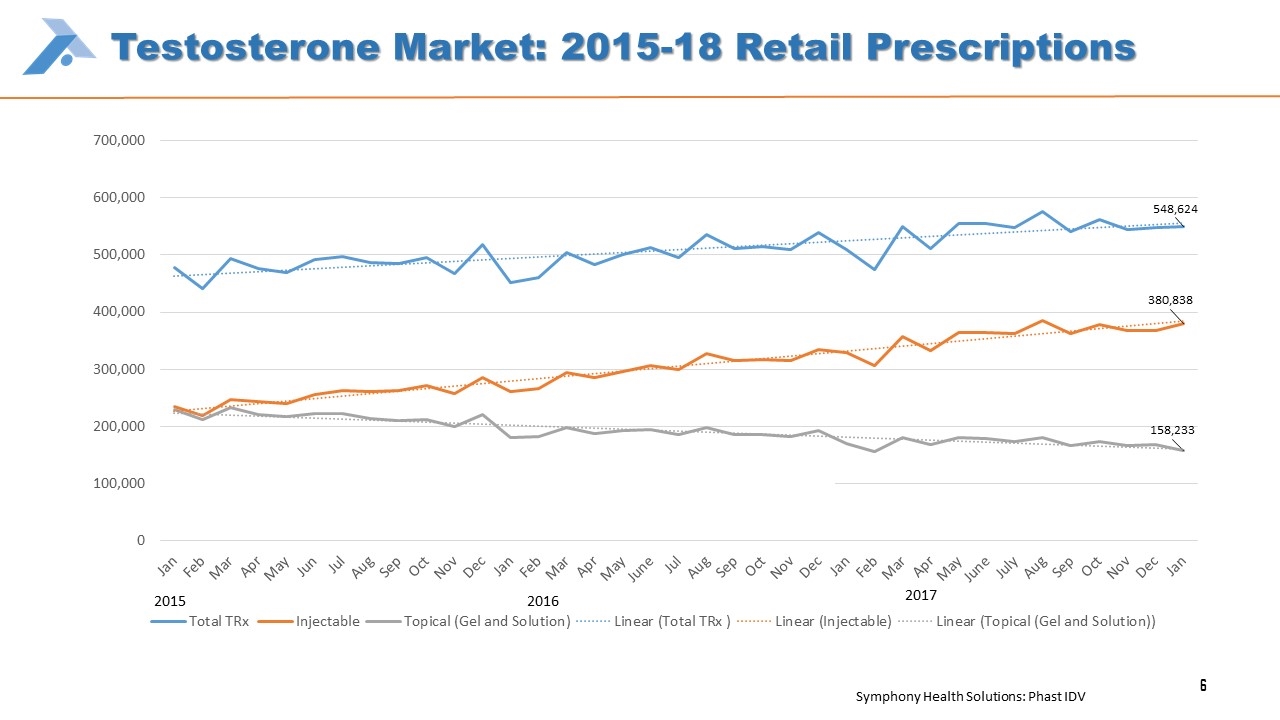

Testosterone Market: 2015-18 Retail Prescriptions Symphony Health Solutions: Phast IDV 2016 2015 6

ZOMAJET™ Sale to Ferring Pharmaceuticals Needle-free asset sale to Ferring executed October 10, 2017 for up to $14.5 million Milestone Payments: $2.0M paid upon signing in October 2017 $2.75M received Q118 $4.75M at Closing (~Q2 2018) $5M at Completion (~Q4 2018)

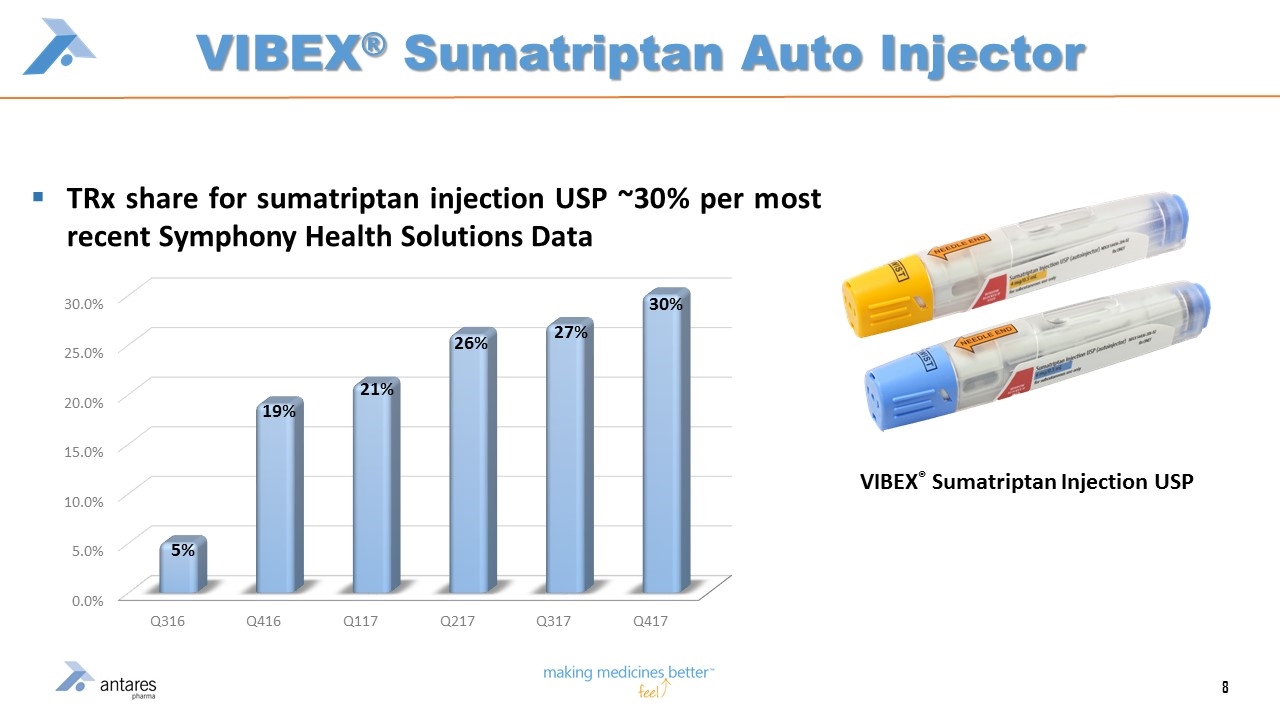

VIBEX® Sumatriptan Auto Injector TRx share for sumatriptan injection USP ~30% per most recent Symphony Health Solutions Data VIBEX® Sumatriptan Injection USP

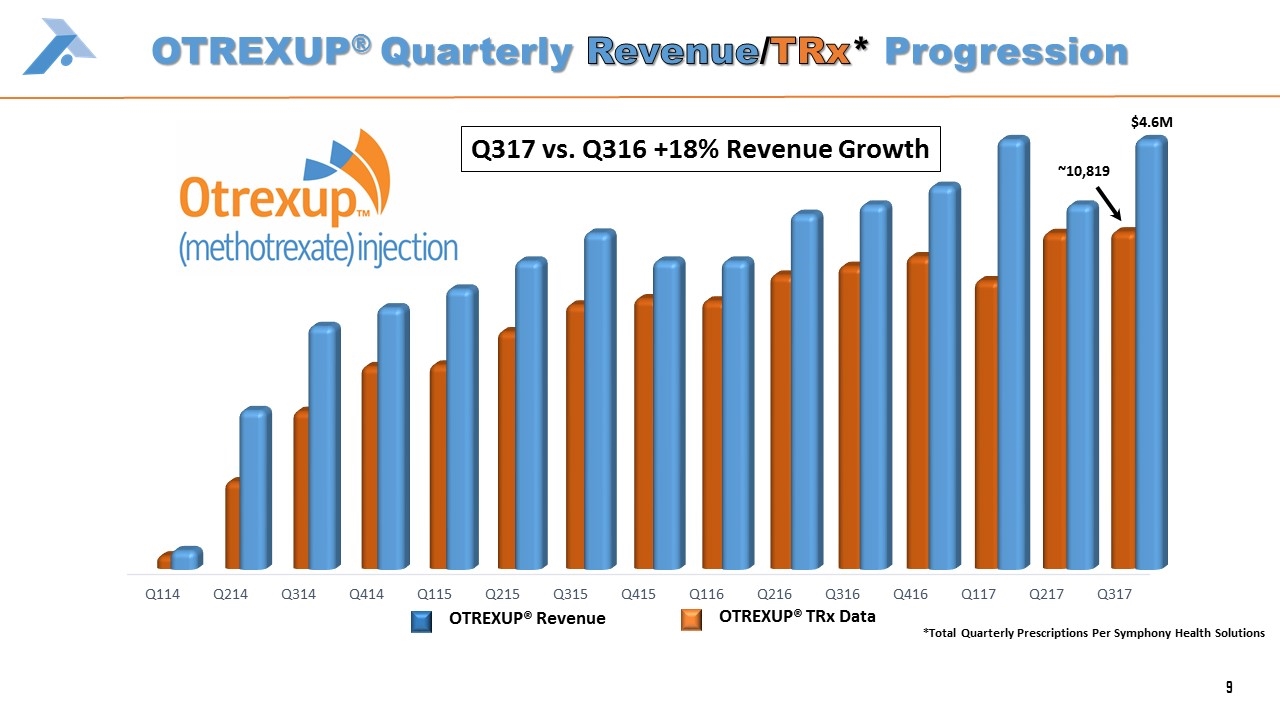

*Total Quarterly Prescriptions Per Symphony Health Solutions ~10,819 Q317 vs. Q316 +18% Revenue Growth $4.6M OTREXUP® TRx Data OTREXUP® Revenue OTREXUP® Quarterly Revenue/TRx* Progression

Makena® – FDA Approved AMAG/Makena® collaboration began in 2014 Alliance terms: Cost plus product transfer price (fully packaged QuickShot® device), plus royalty on net sales and sales performance milestones QuickShot® device used to develop a once-weekly subcutaneous injection of Makena® Potentially better patient compliance and easier administration Currently administered IM with a large-gauge needle from a single dose vial, QuickShot® product administered sub-Q through a fine-gauge nonvisible needle Makena® sNDA approved by FDA February 14, 2018 First FDA approval of Quickshot® auto-injector AMAG expects to launch Makena® in the second half of March 2018

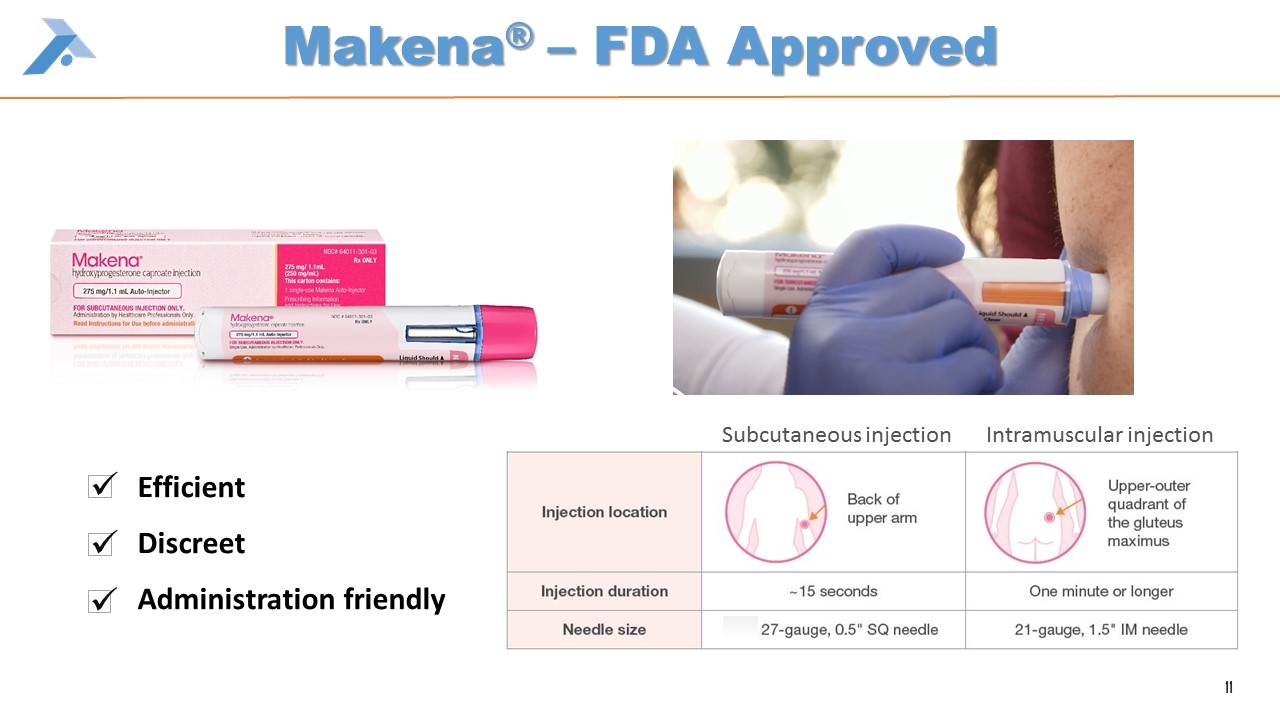

Makena® – FDA Approved Subcutaneous injection Intramuscular injection Efficient Discreet Administration friendly ü ü ü

VIBEX® Epinephrine Teva filed ANDA amendment with FDA in December 2014, Complete Response Letter (CRL) issued February 2016, Teva submitted responses to CRL in Q117 and continue to work with FDA toward a potential regulatory approval Teva targeting a launch in early 2018 Shipped ~$20 million worth of devices to date (9/30/17) Agreement with Teva – ATRS will receive margins on device sales and mid-to-high single digit royalty on overall product sales High visibility for the need of an AB rated generic EpiPen® EpiPen® is a registered trademark of the Mylan Companies

Generic Byetta® (exenatide) Multi-Dose Pen Teva filed ANDA against Byetta (exenatide) and they continue to work through the regulatory process for approval with the FDA – Antares believes Teva has first to file status and 180 days of marketing exclusivity Teva settled paragraph IV litigation with AstraZeneca and Amylin, free to launch upon FDA approval Symphony retail sales of Byetta in 2017 ~$259 million ATRS will supply devices at reasonable margin plus receive high single digit to mid-teens royalty on Teva end sales

Generic Forteo® (teriparatide) Multi-Dose Pen 14 Teva’s ANDA accepted in February 2016 and they continue to work through the regulatory process for teriparatide using the ANDA pathway – Antares believes Teva has first to file status and 180 days of marketing exclusivity – US patent litigation has been settled, settlement terms undisclosed In December 2016, Teva reported the successful completion of the registration process for teriparatide in Europe, and the Public Assessment Report for the Decentralized Procedure was just published - the product was filed in 17 countries which addresses the majority of the value in Europe - awaiting patent clearance in EU Teriparatide injection is the first product approved using ATRS multi-dose pen technology Lilly reported 2017 Forteo® revenue of $1.75 billion* - $965 million U.S. - $784 million ROW ATRS will supply devices at reasonable margin plus receive high single digit to mid-teens royalty on Teva end sales * 2017 Lilly 10k

ATRS Investment Considerations A revenue generating Specialty Pharmaceutical Company poised for continued growth Potential Near-Term Catalysts: XYOSTED™ CRL received 10/17 – Type A meeting held 2/21/18 – awaiting FDA meeting minutes Sumatriptan Injection USP – Q417 TRx share ~30% per most recent quarterly Symphony data Continued revenue growth of OTREXUP™ - Q317 vs. Q316 +18% Finished product sales and royalty revenue anticipated from Makena® to be launched by AMAG in March 2018 Additional milestone payments expected to be received in 2018 from ZOMAJET® sale Potential FDA approval of Epinephrine Pen ANDA Expect to add to pipeline strategic new drug/device R&D combination product in the next 6 months Robust Drug and Device Pipeline*: XYOSTED™ - Epinephrine – Exenatide - Teriparatide Strong balance sheet – $37.4 million in cash, cash equivalents and short term investments at 9/30/17 *Not approved in the U.S. (Teriparatide approved in Europe in December 2016) 15

NASDAQ: ATRS Raymond James & Associates 39th Annual Institutional Investors Conference March 5, 2018 Robert F. Apple President and Chief Executive Officer Antares Pharma (NASDAQ: ATRS)