Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - Nationstar Mortgage Holdings Inc. | d541266dex992.htm |

| 8-K - 8-K - Nationstar Mortgage Holdings Inc. | d541266d8k.htm |

FOURTH QUARTER AND FULL YEAR 2017 RESULTS MARCH 1, 2018 INVESTOR SUPPLEMENT Exhibit 99.1

IMPORTANT INFORMATION This presentation contains summarized information concerning Nationstar Mortgage Holdings Inc. (the “Company”) and the Company’s business, operations, financial performance and trends. No representation is made that the information in this presentation is complete. For additional financial, statistical and business related information, as well as information regarding business and segment trends, see the Company’s most recent Annual Report on Form 10-K (“Form 10-K”) and Quarterly Reports on Form 10-Q filed with the U.S. Securities and Exchange Commission (the “SEC”), as well as the Company’s other reports filed with the SEC from time to time. Such reports are or will be available in the Investor Information section of the Company’s website (www.nationstarholdings.com) and the SEC’s website (www.sec.gov). FORWARD LOOKING STATEMENTS This communication contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 including, but not limited to, WMIH’s and Nationstar’s expectations or predictions of future financial or business performance or conditions. All statements other than statements of historical or current fact included in this communication that address activities, events, conditions or developments that we expect, believe or anticipate will or may occur in the future are forward-looking statements. Forward-looking statements give our current expectations and projections relating to our financial condition, results of operations, plans, objectives, future performance and business and these statements are not guarantees of future performance. Forward-looking statements may include the words “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “strategy,” “future,” “opportunity,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Such forward-looking statements involve risks and uncertainties that may cause actual events, results or performance to differ materially from those indicated by such statements. Certain of these risks are identified and discussed in WMIH’s Form 10-K for the year ended December 31, 2016 under Risk Factors in Part I, Item 1A and Nationstar’s Form 10-K for the year ended December 31, 2016 under Risk Factors in Part I, Item 1A. These risk factors will be important to consider in determining future results and should be reviewed in their entirety. These forward-looking statements are expressed in good faith, and WMIH and Nationstar believe there is a reasonable basis for them. However, there can be no assurance that the events, results or trends identified in these forward-looking statements will occur or be achieved. Forward-looking statements speak only as of the date they are made, and neither WMIH nor Nationstar is under any obligation, and expressly disclaim any obligation, to update, alter or otherwise revise any forward-looking statement, except as required by law. Readers should carefully review the statements set forth in the reports, which WMIH and Nationstar have filed or will file from time to time with the SEC. In addition to factors previously disclosed in WMIH’s and Nationstar’s reports filed with the SEC and those identified elsewhere in this communication, the following factors, among others, could cause actual results to differ materially from forward-looking statements or historical performance: ability to meet the closing conditions to the merger, including approval by shareholders of WMIH and Nationstar on the expected terms and schedule and the risk that regulatory approvals required for the merger are not obtained or are obtained subject to conditions that are not anticipated; delay in closing the merger; failure to realize the benefits expected from the proposed transaction; the effects of pending and future legislation; risks associated with investing in mortgage loans and mortgage servicing rights and changes in interest rates; risks related to disruption of management time from ongoing business operations due to the proposed transaction; business disruption following the transaction; macroeconomic factors beyond WMIH’s or Nationstar’s control; risks related to WMIH’s or Nationstar’s indebtedness and other consequences associated with mergers, acquisitions and divestitures and legislative and regulatory actions and reforms. Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results. NON-GAAP MEASURES This presentation contains certain references to non-GAAP measures. Please refer to the Appendix and Notes for more information on non-GAAP measures.

This communication is being made in respect of the proposed merger transaction involving WMIH Corp. (“WMIH”) and Nationstar Mortgage Holdings Inc. (“Nationstar”). WMIH intends to file a registration statement on Form S-4 with the SEC, which will include a joint proxy statement of WMIH and Nationstar and a prospectus of WMIH, and each party will file other documents regarding the proposed transaction with the SEC. Any definitive proxy statement(s)/prospectus(es) will also be sent to the stockholders of WMIH and/or Nationstar, as applicable, seeking any required stockholder approval. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. Before making any voting or investment decision, investors and security holders of WMIH and Nationstar are urged to carefully read the entire registration statement(s) and proxy statement(s)/prospectus(es), when they become available, and any other relevant documents filed with the SEC, as well as any amendments or supplements to these documents, because they will contain important information about the proposed transaction. The documents filed by WMIH and Nationstar with the SEC may be obtained free of charge at the SEC’s website at www.sec.gov. In addition, the documents filed by WMIH may be obtained free of charge from WMIH at www.wmih-corp.com, and the documents filed by Nationstar may be obtained free of charge from Nationstar at www.nationstarholdings.com. Alternatively, these documents, when available, can be obtained free of charge from WMIH upon written request to WMIH Corp., 800 Fifth Avenue, Suite 4100, Seattle, Washington 98104, Attn: Secretary, or by calling (206) 922-2957, or from Nationstar upon written request to Nationstar Mortgage Holdings Inc., 8950 Cypress Waters Blvd, Dallas, TX 75019, Attention: Corporate Secretary, or by calling (469) 549-2000. WMIH and Nationstar and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of WMIH and/or Nationstar, as applicable, in favor of the approval of the merger. Information regarding WMIH’s directors and executive officers is contained in WMIH’s Annual Report on Form 10-K for the year ended December 31, 2016, its Quarterly Report on Form 10-Q for the quarterly periods ended March 31, 2017, June 30, 2017 and September 30, 2017 and its Proxy Statement on Schedule 14A, dated April 18, 2017, which are filed with the SEC(1). Information regarding Nationstar’s directors and executive officers is contained in Nationstar’s Annual Report on Form 10-K for the year ended December 31, 2016, its Quarterly Report on Form 10-Q for the quarterly periods ended March 31, 2017, June 30, 2017 and September 30, 2017, and its Proxy Statement on Schedule 14A, dated April 11, 2017, which are filed with the SEC. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the registration statement(s) and the proxy statement(s)/prospectus(es) and other relevant documents filed with the SEC when they become available. Free copies of these documents may be obtained as described in the preceding paragraph. ADDITIONAL INFORMATION FOR STOCKHOLDERS

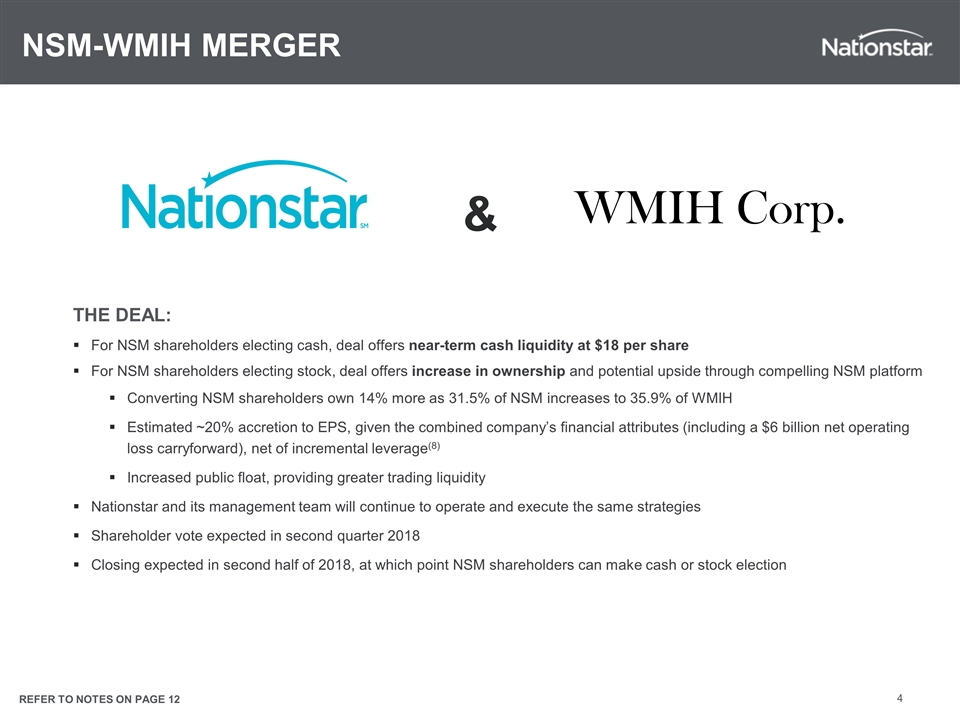

NSM-WMIH MERGER WMIH Corp. & THE DEAL: For NSM shareholders electing cash, deal offers near-term cash liquidity at $18 per share For NSM shareholders electing stock, deal offers increase in ownership and potential upside through compelling NSM platform Converting NSM shareholders own 14% more as 31.5% of NSM increases to 35.9% of WMIH Estimated ~20% accretion to EPS, given the combined company’s financial attributes (including a $6 billion net operating loss carryforward), net of incremental leverage(8) Increased public float, providing greater trading liquidity Nationstar and its management team will continue to operate and execute the same strategies Shareholder vote expected in second quarter 2018 Closing expected in second half of 2018, at which point NSM shareholders can make cash or stock election REFER TO NOTES ON PAGE 12

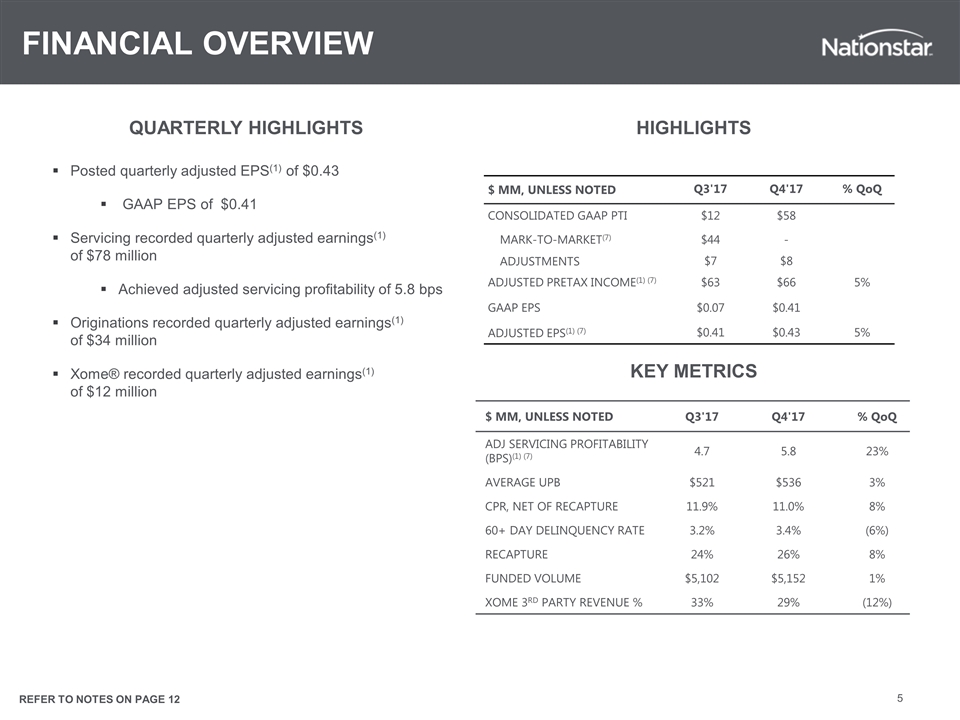

$ MM, UNLESS NOTED Q3'17 Q4'17 % QoQ CONSOLIDATED GAAP PTI $12 $58 MARK-TO-MARKET(7) $44 - ADJUSTMENTS $7 $8 ADJUSTED PRETAX INCOME(1) (7) $63 $66 5% GAAP EPS $0.07 $0.41 ADJUSTED EPS(1) (7) $0.41 $0.43 5% Posted quarterly adjusted EPS(1) of $0.43 GAAP EPS of $0.41 Servicing recorded quarterly adjusted earnings(1) of $78 million Achieved adjusted servicing profitability of 5.8 bps Originations recorded quarterly adjusted earnings(1) of $34 million Xome® recorded quarterly adjusted earnings(1) of $12 million HIGHLIGHTS FINANCIAL OVERVIEW QUARTERLY HIGHLIGHTS $ MM, UNLESS NOTED Q3'17 Q4'17 % QoQ ADJ SERVICING PROFITABILITY (BPS)(1) (7) 4.7 5.8 23% AVERAGE UPB $521 $536 3% CPR, NET OF RECAPTURE 11.9% 11.0% 8% 60+ DAY DELINQUENCY RATE 3.2% 3.4% (6%) RECAPTURE 24% 26% 8% FUNDED VOLUME $5,102 $5,152 1% XOME 3RD PARTY REVENUE % 33% 29% (12%) KEY METRICS REFER TO NOTES ON PAGE 12

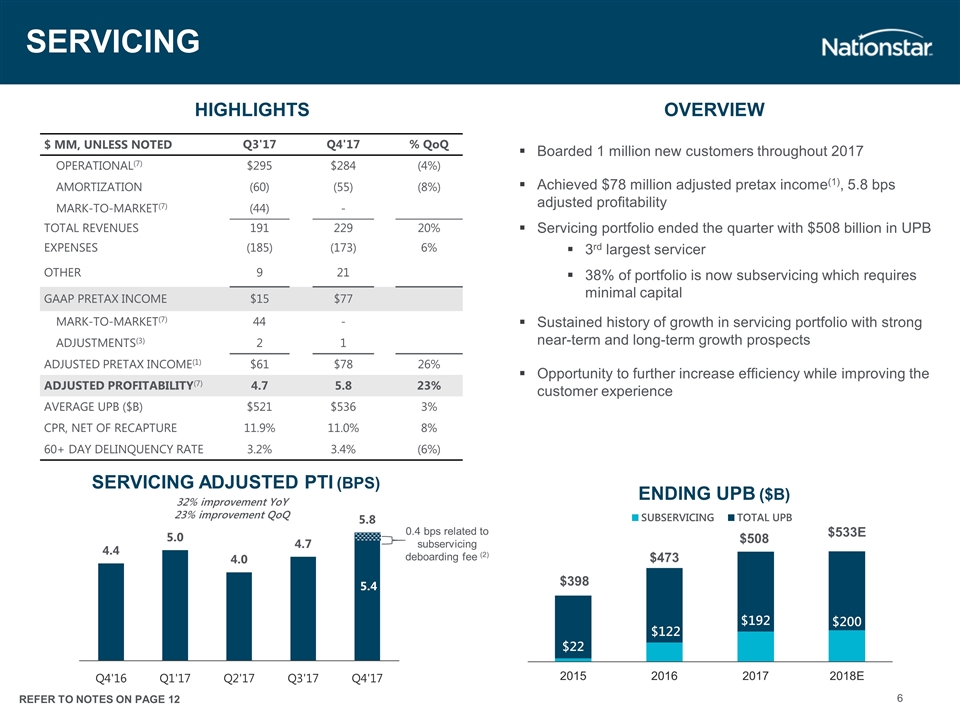

SERVICING HIGHLIGHTS $ MM, UNLESS NOTED Q3'17 Q4'17 % QoQ OPERATIONAL(7) $295 $284 (4%) AMORTIZATION (60) (55) (8%) MARK-TO-MARKET(7) (44) - TOTAL REVENUES 191 229 20% EXPENSES (185) (173) 6% OTHER 9 21 GAAP PRETAX INCOME $15 $77 MARK-TO-MARKET(7) 44 - ADJUSTMENTS(3) 2 1 ADJUSTED PRETAX INCOME(1) $61 $78 26% ADJUSTED PROFITABILITY(7) 4.7 5.8 23% AVERAGE UPB ($B) $521 $536 3% CPR, NET OF RECAPTURE 11.9% 11.0% 8% 60+ DAY DELINQUENCY RATE 3.2% 3.4% (6%) OVERVIEW Boarded 1 million new customers throughout 2017 Achieved $78 million adjusted pretax income(1), 5.8 bps adjusted profitability Servicing portfolio ended the quarter with $508 billion in UPB 3rd largest servicer 38% of portfolio is now subservicing which requires minimal capital Sustained history of growth in servicing portfolio with strong near-term and long-term growth prospects Opportunity to further increase efficiency while improving the customer experience ENDING UPB ($B) SERVICING ADJUSTED PTI (BPS) 0.4 bps related to subservicing deboarding fee (2) 32% improvement YoY 23% improvement QoQ REFER TO NOTES ON PAGE 12

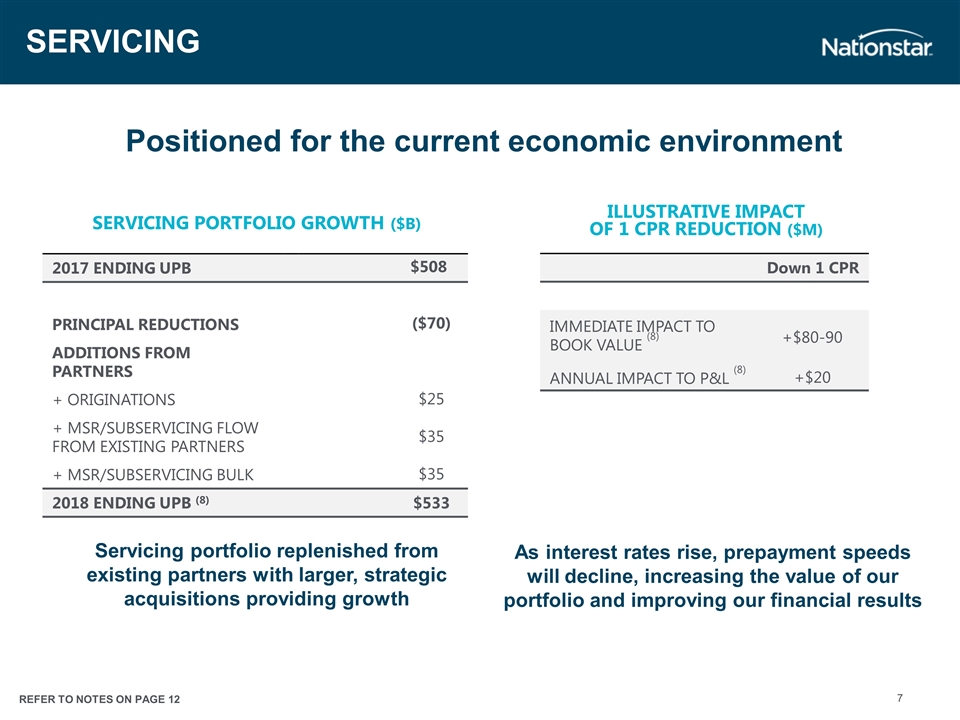

2017 ENDING UPB $508 PRINCIPAL REDUCTIONS ($70) ADDITIONS FROM PARTNERS + ORIGINATIONS $25 + MSR/SUBSERVICING FLOW FROM EXISTING PARTNERS $35 + MSR/SUBSERVICING BULK $35 2018 ENDING UPB (8) $533 SERVICING As interest rates rise, prepayment speeds will decline, increasing the value of our portfolio and improving our financial results ILLUSTRATIVE IMPACT OF 1 CPR REDUCTION ($M) SERVICING PORTFOLIO GROWTH ($B) Servicing portfolio replenished from existing partners with larger, strategic acquisitions providing growth Down 1 CPR IMMEDIATE IMPACT TO BOOK VALUE (8) +$80-90 ANNUAL IMPACT TO P&L (8) +$20 Positioned for the current economic environment REFER TO NOTES ON PAGE 12

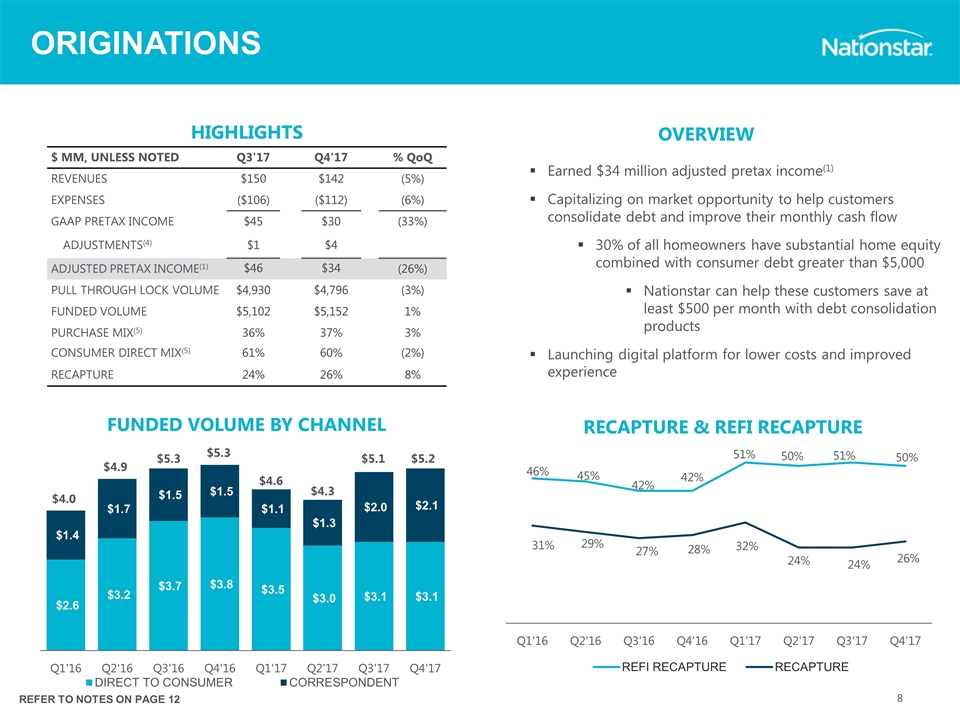

HIGHLIGHTS $ MM, UNLESS NOTED Q3'17 Q4'17 % QoQ REVENUES $150 $142 (5%) EXPENSES ($106) ($112) (6%) GAAP PRETAX INCOME $45 $30 (33%) ADJUSTMENTS(4) $1 $4 ADJUSTED PRETAX INCOME(1) $46 $34 (26%) PULL THROUGH LOCK VOLUME $4,930 $4,796 (3%) FUNDED VOLUME $5,102 $5,152 1% PURCHASE MIX(5) 36% 37% 3% CONSUMER DIRECT MIX(5) 61% 60% (2%) RECAPTURE 24% 26% 8% ORIGINATIONS OVERVIEW Earned $34 million adjusted pretax income(1) Capitalizing on market opportunity to help customers consolidate debt and improve their monthly cash flow 30% of all homeowners have substantial home equity combined with consumer debt greater than $5,000 Nationstar can help these customers save at least $500 per month with debt consolidation products Launching digital platform for lower costs and improved experience $4.0 $4.9 $5.3 $5.3 $4.6 $4.3 $5.1 $5.2 FUNDED VOLUME BY CHANNEL RECAPTURE & REFI RECAPTURE REFER TO NOTES ON PAGE 12

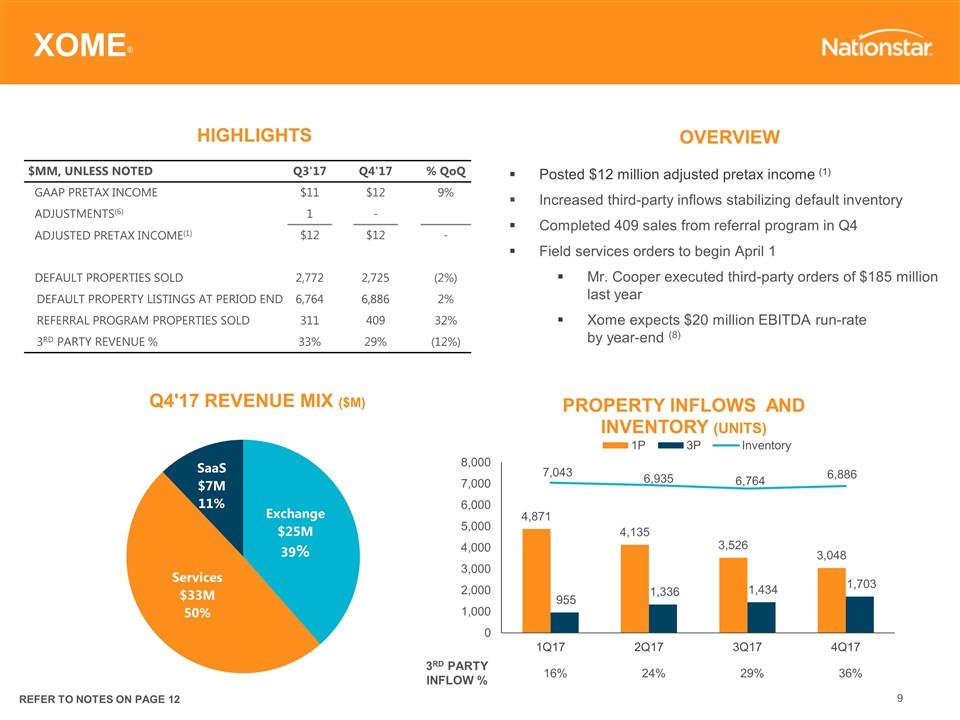

Posted $12 million adjusted pretax income (1) Increased third-party inflows stabilizing default inventory Completed 409 sales from referral program in Q4 Field services orders to begin April 1 Mr. Cooper executed third-party orders of $185 million last year Xome expects $20 million EBITDA run-rate by year-end (8) OVERVIEW HIGHLIGHTS XOME® Q4'17 REVENUE MIX ($M) 3RD PARTY INFLOW % 16% 24% 29% 36% $MM, UNLESS NOTED Q3'17 Q4'17 % QoQ GAAP PRETAX INCOME $11 $12 9% ADJUSTMENTS(6) 1 - - ADJUSTED PRETAX INCOME(1) $12 $12 - DEFAULT PROPERTIES SOLD 2,772 2,725 (2%) DEFAULT PROPERTY LISTINGS AT PERIOD END 6,764 6,886 2% REFERRAL PROGRAM PROPERTIES SOLD 311 409 32% 3RD PARTY REVENUE % 33% 29% (12%) REFER TO NOTES ON PAGE 12

NATIONSTAR GOALS 2018 TARGETS(8) Increase efficiency and reduce costs while providing best in class customer experience CPR, net of recapture remains at 11% Launch digital mortgage application in 2H’18 Execute new customer acquisition, purchase, and correspondent initiatives Continue to win third-party business and grow referral programs Capture property inspection and preservation orders starting in April XOME ORIGINATIONS SERVICING 6.0+ ADJUSTED PROFITABILITY BASIS POINTS $140 ANNUAL ADJUSTED PRETAX INCOME MILLION INITIATIVES $60 ANNUAL ADJUSTED PRETAX INCOME MILLION Cost optimization of corporate groups Reduce corporate debt expense CORPORATE $30 ANNUAL SAVINGS FROM PRIOR YEAR MILLION REFER TO NOTES ON PAGE 12

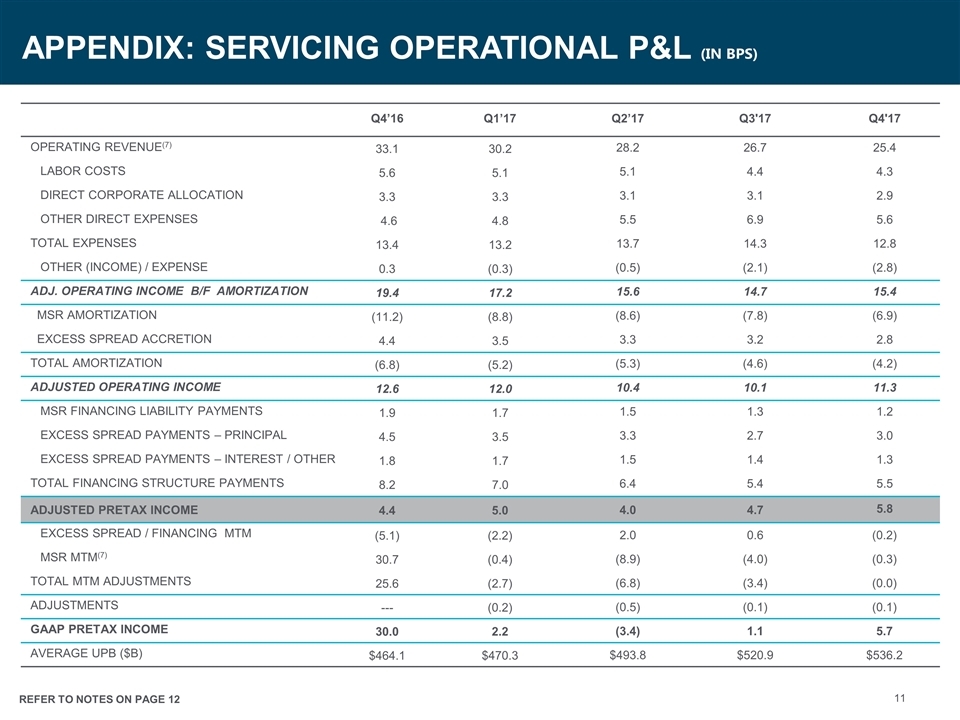

Q4’16 Q1’17 Q2’17 Q3'17 Q4'17 Operating Revenue(7) 33.1 30.2 28.2 26.7 25.4 Labor costs 5.6 5.1 5.1 4.4 4.3 Direct corporate allocation 3.3 3.3 3.1 3.1 2.9 Other direct expenses 4.6 4.8 5.5 6.9 5.6 Total Expenses 13.4 13.2 13.7 14.3 12.8 Other (income) / expense 0.3 (0.3) (0.5) (2.1) (2.8) Adj. operating income b/f amortization 19.4 17.2 15.6 14.7 15.4 MSR amortization (11.2) (8.8) (8.6) (7.8) (6.9) Excess spread accretion 4.4 3.5 3.3 3.2 2.8 Total amortization (6.8) (5.2) (5.3) (4.6) (4.2) Adjusted operating income 12.6 12.0 10.4 10.1 11.3 MSR financing liability payments 1.9 1.7 1.5 1.3 1.2 Excess spread payments – principal 4.5 3.5 3.3 2.7 3.0 Excess spread payments – interest / other 1.8 1.7 1.5 1.4 1.3 Total financing structure payments 8.2 7.0 6.4 5.4 5.5 Adjusted Pretax income 4.4 5.0 4.0 4.7 5.8 Excess Spread / Financing MTM (5.1) (2.2) 2.0 0.6 (0.2) MSR MTM(7) 30.7 (0.4) (8.9) (4.0) (0.3) Total MTM adjustments 25.6 (2.7) (6.8) (3.4) (0.0) ADJUSTMENTS --- (0.2) (0.5) (0.1) (0.1) GAAP Pretax Income 30.0 2.2 (3.4) 1.1 5.7 Average UPB ($B) $464.1 $470.3 $493.8 $520.9 $536.2 Appendix: Servicing Operational P&L (in bps) REFER TO NOTES ON PAGE 12

The Company utilizes non-GAAP (or “adjusted”) financial measures as the measures provide additional information to assist investors in understanding and assessing the Company’s and our business segments’ ongoing performance and financial results, as well as assessing our prospects for future performance. The adjusted financial measures facilitate a meaningful analysis and allow more accurate comparisons of our ongoing business operations because they exclude items that may not be indicative of or are unrelated to the Company’s and our business segments’ core operating performance, and are better measures for assessing trends in our underlying businesses. These adjustments are consistent with how management views our businesses. Management uses non-GAAP financial measures in making financial, operational and planning decisions and evaluating the Company’s and our business segment’s ongoing performance. Adjusted earnings (loss) eliminates the effects of mark-to-market adjustments which primarily reflects unrealized gains or losses based on the changes in fair value measurements of MSRs and their related financial liabilities for which a fair value accounting election was made. These adjustments which can be highly volatile and material due to changes in credit markets, are not necessarily reflective of the gains and losses that will ultimately be realized by the Company. Adjusted earnings (loss) also eliminates, as applicable, restructuring costs, rebranding and integration costs, gain (losses) on sales of fixed assets, certain legal settlement costs that are not considered normal operational matters, and other adjustments based on facts and circumstances that would provide investors a supplemental means for evaluating the Company’s core operating performance. 2. In Q4’17 the Company recorded a $5 million deboard fee related to the termination of a subservicing agreement. 3. The Company launched our own reverse servicing system and terminated our existing contract with a subservicer. As a result, Q3'17 adjustments include duplicative staffing costs associated with boarding the reverse portfolio from a subservicer to Nationstar platform. Q4’17 adjustments associated with consulting expense. 4. Q3'17 & Q4’17 adjustments include costs associated with IT development expense. 5. Based on a percentage of pull through adjusted lock volume. 6. Q3'17 adjustment include costs associated with transaction expenses. We reevaluated the presentation related to certain GNMA early buyout activities and reclassified these items from operational revenues to mark-to-market revenues. The effect of this change is a $20 million reduction in adjusted pretax income for 2017 versus the prior presentation. GAAP income before taxes and cash flow were not affected by this reclassification. Estimates of future profitability and illustrative economic value are forward looking and based on a number of factors outside our control. Results could differ materially. The fair value improvement is referenced in Table 39 of the 10K. APPENDIX: NOTES