Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - Cuentas Inc. | f8k022618_nextgrouphold.htm |

Exhibit 99.1

Letter of Intent

____________________________________________________

February 26, 2018

Juan Martin Gomez, Chief Executive Officer

Cima Telecom, Inc.

1728 SW 22nd Street

Suite 700

Miami, Florida 33145

| Re: | Cima Group - License of Knetic and Auris Technology Platforms |

Dear Mr. Gomez:

This letter of intent (“Letter”), upon your execution and return, will confirm the basic terms upon which Next Group Holdings, Inc. (“Next Group”, “NXGH” or the “Company”), shall move forward in the negotiation of definitive agreements to license the Knetic and Auris technology platforms (collectively, the “Platform”) owned byCima Telecom, Inc. (“Cima”), in exchange for equity securities in Next Group.

This Letter has been prepared and executed to serve as an aid to the negotiation of definitive agreements between Next Group and Cima. Cima and Next Group agree that the terms of the license and equity security acquisition transactions proposed in this Letter (collectively, the “Transactions”) may be modified by Next Group or Cima in their discretion, but only with their mutual written consent. Consequently, except for the provisions of this paragraph and Paragraphs 6 through and including 15 of this Letter (which shall be legally binding on, and inure to the benefit of, the parties hereto), this Letter is not intended to constitute, and does not constitute, a binding contract or agreement of any party hereto, and no party hereto will be liable to the other party because of a failure to enter into an agreement or engage in the Transactions upon the terms discussed herein or at all. Next Group and Cima agree that neither of them shall be legally bound with respect to the Transactions unless and until Cima and Next Group execute definitive agreements effectuating and memorializing the Transactions.

Subject to the terms and conditions set forth in this Letter, the parties agree as follows:

1. Cima intends to grant Next Group a fully paid, royalty-free, world-wide, perpetual, non-sublicensable license (the “License”) to utilize the Auris and Knetic platforms and intellectual properties included in such platforms for the Financial Technology (“FINTECH”) worldwide vertical (annex 1 to this letter of intent includes a description of the Auris and Knetic platforms) (the “Platforms”).The License to be granted shall be exclusive for use within the FINTECH space, which for purposes of the License shall be defined as “connecting banking and prepaid card usage.”Cima will agree to not license the Platforms to any other person or entity for use within the FINTECH space. Rather, Next Group shall have the right to grant its customers, and its customers’ end-users, access to the services provided by the Platforms. Next Group may transfer the License to any subsidiaries or affiliates (as shall be defined in the License Agreement (as hereinafter defined); provided that Next Group shall not have the right to sell, assign, sub-license, or convey the License or Platforms to any third-parties. As consideration for the License, Next Group intends to convey to Cima shares of capital stock of Next Group (the “Shares”)comprising an ownership interest of twenty-five percent (25%) of the issued and outstanding equity securities of Next Group (the “Purchase Price”), based upon Next Group’s valuation of Fifty Million Dollars ($50,000,000.00). Cima and Next Group anticipate that the closing of the Transaction (the “Closing”) will take place as soon as reasonably practicable, and will work towards a Closing to occur within sixty (60) days of the execution and delivery of this Letter by the Parties. Simultaneously with the Closing, Cima will deliver the source code for the Platform to an escrow agent, to hold in escrow subject to the terms and conditions of an escrow agreement in a form acceptable to Cima (the “Escrow Agreement”).

Cima Telecom, Inc.

Attention: Juan Martin Gomez

February 26, 2018

Page 2 of 6

2. Next Group and Cima intend to enter into a definitive purchase agreement (“Purchase Agreement”) incorporating the terms and conditions of this Letter relating to the acquisition of the Shares, and such customary representations, warranties, covenants and conditions, including indemnification provisions, confidentiality provisions, and other customary provisions for Purchase Agreements of this type which are reasonably acceptable to the parties.

3. Cima and Next Group intend to execute certain instruments and documents ancillary to the Purchase Agreement (the “Ancillary Documents”), which set forth and govern the rights, preferences, and restrictions relating to Cima’s ownership interest in, and the operation of, Next Group, including, without limitation: (i) standard financial reporting and information rights, including, without limitation, monthly, year-to-date, and annual income, balance sheet, and cash flow statements; (ii) voting rights; and (iii) the right to request that the shareholders of Next Group elect one (1) director selected by Cima to Next Group’s board of directors (the “Board”), and if the shareholders do not elect such individual to the Board, then the right to require Next Group’s management to present a proxy to its shareholders recommending that the director selected by Cima be elected to the Board. The Ancillary Documents may include, without limitation, an amended and restated certificate of incorporation, amended and restated by-laws, voting agreement, investors’ rights agreement, and such other documents and instruments reasonable necessary to effectuate the Transaction.

4. Next Group and Cima further intend to execute an exclusive license agreement (“License Agreement”), memorializing the worldwide License of the Platforms, and an agreement governing the administration of the Platforms (the “Administration Agreement”). Additionally, Next Group and Cima intend to execute a software maintenance and support agreement (“Maintenance Agreement”, collectively, with the Escrow Agreement, License Agreement, and Administration Agreement, the “Platform Agreements”), commencing as of the Closing of the Transaction and continuing for a period of four (4) years thereafter, pursuant to which Cima will provide certain maintenance and support services to Next Group in connection with the Platform, and Next Group will pay Cima Three Million Five Hundred Thousand Dollars ($3,500,000.00), as follows: (a) year-one: Five Hundred Thousand Dollars ($500,000.00), paid over the second (2nd) six-month period of the year; (b) year-two: Five Hundred Thousand Dollars ($500,000.00); (c) year-three: One Million Dollars ($1,000,000.00); and (d) year-four: One Million Five Hundred Thousand Dollars ($1,500,000.00). The agreed upon maintenance and support services costs set forth above will not be increased by Cima during the term of the Maintenance Agreement.

Cima Telecom, Inc.

Attention: Juan Martin Gomez

February 26, 2018

Page 3 of 6

5. The execution and delivery of the Purchase Agreement, Ancillary Documents, and Platform Agreements are material conditions of the Transactions, and shall be delivered at Closing.

6. The terms and conditions of the Transactions will be subject to and conditioned upon: (i) Cima’s complete and reasonable investigation and analysis of Next Group and its businesses (the “Due Diligence Investigation”); (ii) the Parties negotiating and signing a definitive Purchase Agreement, Ancillary Documents, and Platform Documents(including any conditions set forth therein); and (iii) the Parties obtaining all third party consents and approvals, if any, necessary for Cima’s acquisition or receipt of the Shares(“Third Party Consents”).

7. Each party hereto will bear its own costs and expenses in connection with the transactions contemplated by this Letter, including the costs and expenses of accountants, lawyers and advisors.

8. Next Group acknowledges that following the execution of this Letter, Cima anticipates the expenditure of substantial efforts and resources in the conduct of its Due Diligence Investigation of Next Group and its businesses, and the preparation and negotiation of the Purchase Agreement and Ancillary Documents. Accordingly, Next Group agrees that it and its officers, members, managers, directors, employees, representatives and agents will not, directly or indirectly, from the date this Letter is executed and delivered by both Parties, and for one hundred eighty (180) days thereafter (such period, the “Exclusivity Period”) (a) license, develop, create, or purchase a platform for the purpose or purposes that Next Group intends to use the Platforms; or (b) solicit, initiate, encourage or facilitate the invitation of inquiries or proposals or offers from any person or entity (other than Cima or any of its Affiliates, or any of their respective members, managers, directors, officers, shareholders, employees, representatives and agents) concerning the licensing or development of a platform for the purpose or purposes that Next Group intends to use the Platforms. For purposes of this letter of intent, “Affiliate” with respect to any person means any person that, directly or indirectly, through one or more intermediaries, controls the subject person or any person which is controlled by or is under common control with a controlling person. For purposes of this definition, “control” (including the correlative terms “controlling”, “controlled by” and “under common control with”), with respect to any person, means possession, directly or indirectly, of the power to direct or cause the direction of the management or policies of such person, whether through the ownership of voting securities or by contract or otherwise.

9. Each party hereto shall be responsible for all fees, costs and expenses that may become due and owing to any broker or finder retained by such party, and each such party shall indemnify and hold harmless the other party in connection therewith.

10. This Letter constitutes the entire agreement between the parties hereto with respect to the matters covered herein. This Letter supersedes any prior written or oral, or simultaneous oral, negotiations, understandings or agreements by or among the parties hereto or their affiliates, relating, directly or indirectly, to the matters contemplated by this Letter, it being acknowledged and agreed by the Parties, by the execution and delivery of this Letter, that any such writings, which shall include, without limitation, any agreements, instruments, documents, letters of intent, or term sheets, by and among the Parties, are hereby deemed null and void, terminated, and of no force and effect, unless set forth herein.

Cima Telecom, Inc.

Attention: Juan Martin Gomez

February 26, 2018

Page 4 of 6

11. This Letter shall be governed by, and construed in accordance with, the laws of the State of Florida, without reference to conflict of laws principles. Any disputes under this Agreement shall be brought in the state courts and the Federal courts located in Miami-Dade County, Florida, and the parties hereto hereby consent to the personal jurisdiction and venue of these courts.

12. This Letter may be executed in counterparts, each of which when executed by a party hereto and delivered to the other party, shall constitute an original.

13. Each of Cima and Next Group agrees not to disclose to any other person and to keep confidential (i) the fact that this Letter has been executed by the parties; (ii) that discussions and/or negotiations are taking place concerning a possible transaction involving Cima and Next Group, (iii) any of the terms or conditions set forth in this Letter, including without limitation, the proposed purchase price, and/or (iv) any other facts or circumstances with respect to any of the foregoing described terms in clauses (i) through and including clauses (iii) (including the status thereof). Notwithstanding the foregoing, each of Cima and Next Group may disclose such information (a) to their respective accountants, investment bankers, lawyers and other professional advisors in connection with such party’s efforts to close the Transaction as contemplated by this letter of intent, or otherwise as required by applicable law, rule or regulation; (b) to the persons reasonably necessary to obtain the Third Party Consents; or (c) via press release or other disclosure; provided, however, that the other Party has reviewed such press release or disclosure and has consented, in writing, to the publication or dissemination of same.

14. In the event either Party commences an action against the other to enforce its rights under this Letter, the party prevailing in any such action shall be entitled to recover all out-of-pocket costs reasonably incurred, including reasonable attorneys’ fees, costs and expense, from the other Party.

15. Each of the parties hereto hereby agrees to negotiate the Purchase Agreement, Ancillary Documents, and Platform Documents in good faith, and diligently work towards consummating the Transactions. In the event that a party hereto incurs fees, costs, damages, or losses as a result of the failure of the other party to negotiate in good faith, or diligently work towards consummating the Transactions, such other party shall be liable for the fees, costs, damages, and losses incurred by the party as a result of the other party’s actions or omissions.

[Signatures on following page.]

Cima Telecom, Inc.

Attention: Juan Martin Gomez

February 26, 2018

Page 5 of 6

If this Letter is consistent with your understanding of our agreement in principle, please so acknowledge by signing the enclosed copy of this letter and returning the signed copy to the undersigned.

| Very truly yours, | ||

| Next Group Holdings, Inc. | ||

| By: | /s/ Arik Maimon | |

| Arik Maimon, Chief Executive Officer | ||

Acknowledged and agreed to this 26th day of February 2018, by:

| Cima Telecom, Inc. | ||

| By: | /s/ Juan Martin Gomez | |

| Juan Martin Gomez, Chief Executive Officer | ||

Cima Telecom, Inc.

Attention: Juan Martin Gomez

February 26, 2018

Page 6 of 6

Annex 1

Cima Group – Auris and Knetik Description

Aris:

| ● | Provides innovative solutions that are at the core of the digital economy, which manage and support global communications and electronic transactions. | |

| ● | Provides cloud-based BSS/OSS core digital platforms to communications service providers, enabling them to enter into the digital economy. | |

| ● | One-stop-shop solution enabling its clients with its source code and platforms to focus on their business. | |

| ● | Combines technology and business knowledge to work as one. | |

| ● | Additional information available at www.auris.com. |

Knetik:

| ● | Platform as a Service provider that offers services for management of online digital experiences. | |

| ● | Powers personalization, engagement, and monetization enabling clients to rapidly deploy next-generation services leveraging a robust and scalable back-end. | |

| ● | Used by innovative media, gaming, e-commerce, and education companies worldwide. | |

| ● | Additional information available at www.knetik.com. |

[CONFIDENTIAL]

CIMA GROUP

Valuation of:

Technology Platform

Valuation estimate as of:

October 31, 2017

Report date: December 11, 2017

t 305.774.2945 f 305.774.1504 201 Alhambra Circle, Suite 701 | Coral Gables, FL 33134 w www.lllgpa.com

| Pg. 1 |

December 11, 2017

Mr. Juan M. Gomez

CEO

CIMA Group

1728 S.W. 22nd Street

Suite 700

Coral Gables, Florida 33145

Dear Mr. Juan Gomez:

As requested, we have performed an appraisal of a Technology Platform of CIMA GROUP (the “Platform”), as of October 31, 2017, under the strategic partnership between Next Group Holdings, Inc. (“Next Group”) and CIMA Group (the “Company,” referred collectively as the “Parties”).

We certify that, to the best of our knowledge and belief:

| ● | The statements of fact contained in this report are true and correct, subject to the assumptions and conditions stated. |

| ● | The reported analyses and conclusions are limited only by the reported assumptions and limiting conditions, and is our personal, unbiased professional analyses, opinions, and conclusions. |

| ● | We have no present or prospective interest in the property that is the subject of this report, and we have no personal interest or bias with respect to the parties involved. |

| ● | Our compensation is on a fixed fee basis and is not contingent upon the reporting of a predetermined value or direction in value that favors the cause of the client, the amount of the value estimate, the attainment of a stipulated result, or the occurrence of a subsequent event. |

| ● | Our analyses, our opinions, and conclusions were developed, and this report has been prepared, in conformity with the Uniform Standards of Professional Appraisal Practice and the Statement of Standards for Valuation Services No. 1. |

| ● | No one provided significant professional assistance other than the individuals listed in Appendix B of this report. |

In addition, as required by the adequate disclosure rules of the Internal Revenue Service, we hereby stipulate that this appraisal fulfills all of the following requirements:

(i) The appraisal is prepared by an appraiser who satisfies all of the following requirements:

| (A) | The appraiser is an individual who holds himself out to the public as an appraiser or performs appraisals on a regular basis. |

| (B) | Because of the appraiser’s qualifications, as described in the appraisal that details the’appraiser’s background, experience, education, and membership, if any, in professional appraisal associations, the appraiser is qualified to make appraisals of the type of property being valued. |

t 305.774.2945 f 305.774.1504 201 Alhambra Circle, Suite 701 | Coral Gables, FL 33134 w www.lllgpa.com

| Pg. 2 |

| (C) | The appraiser is not the donor or donee of the property or a member of the family of the donor or donee, as defined in section 2032A(e)(2), or any person employed by the donor, the donee, or a member of the fam i l y of eit her; and |

(ii) The appraisal contains all of the following:

| (A) | The date of and purpose of the appraisal. |

| (B) | A description of the property. |

| (C) | A description of the appraisal process employed. |

| (D) | A description of the management assumptions. hypothetical conditions, and any limiting conditions and restrictions on the transferred property that affect the analyses, opinions, and conclusions. |

| (E) | The information considered in determining the appraised value, including in the case of an ownership interest in a business, all financial data that was used in determining the value of the interest that is sufficiently detailed so that another person can replicate the process and arrive at the appraised value. |

| (F) | The appraisal procedures followed, and the reasoning that supports the analysis, opinions, and conclusions. |

| (G) | The valuation method utilized, the rationale for the valuation method, and the procedure used in determining the fair market value of the asset transferred. |

| (H) | The specific basis for the valuation, such as specific comparable sales or transactions, sales of similar interests, asset-based approaches. merger-acquisition transactions, etc. (Reg. Section 301.6501(c)-1 ). |

We appreciated the opportunity to assist you in th is valuation .

| Sincerely, | |

| /s/ Luis M. Barahona | |

| Luis M. Barahona, MBA | |

| /s/ Raimundo Lopez-Lima Levi | |

| Raimundo Lopez-Lima Levi, CPA */CFF | |

| * - regulated in the State of Florida |

t 305.774.2945 f 305.774.1504 201 Alhambra Circle, Suite 701 | Coral Gables, FL 33134 w www.lllgpa.com

| Pg. 3 |

TABLE OF CONTENTS

| ASSUMPTIONS AND LIMITING CONDITIONS | 5 |

| DESCRIPTION OF THE COMPANY | 6 |

| DESCRIPTION OF THE PLATFORM | 7 |

| VALUATION APPROACHES | 9 |

| INCOME APPROACH: RELIEF OF ROYALTY METHOD | 11 |

| RECONCILIATION OF VALUES | 13 |

| APPENDIX A – ROYALTY RATES COMPARABLES | 14 |

| APPENDIX B – PROFESSIONAL QUALIFICATIONS | 52 |

| APPENDIX C – SOURCES OF INFORMATION | 55 |

| APPENDIX D – EXHIBITS | 56 |

t 305.774.2945 f 305.774.1504 201 Alhambra Circle, Suite 701 | Coral Gables, FL 33134 w www.lllgpa.com

| Pg. 4 |

ASSUMPTIONS AND LIMITING CONDITIONS

| ● | Information estimates and opinions contained in this report are obtained from sources considered reliable; however, LOPEZ LEVI LOWENSTEIN GLINSKY, P.A. has not independently verified such information and no liability, for such sources, is assumed by this appraiser. |

| ● | Possession of this report, or a copy thereof, does not carry with it the right of publication of all or part of it, nor may it be used for any purpose without the previous written consent of the appraiser, and in any event only with proper authorization. Authorized copies of this report will be signed in blue ink by LOPEZ LEVI LOWENSTEIN GLINSKY, P.A. Unsigned copies, or copies not signed in blue ink, should be considered to be incomplete. |

| ● | None of the contents of this valuation report shall be conveyed to any third party or to the public through any means without the express written consent of LOPEZ LEVI LOWENSTEIN GLINSKY, P.A. |

| ● | No investigation of titles to property or any claims on ownership of the property by any individuals or company has been undertaken. Unless otherwise stated in our report, title is assumed to be clear and free of encumbrances and as provided to the appraiser. |

| ● | It is assumed that there are no regulations of any government entity to control or restrict the use of the underlying assets, unless specifically referred to in the report and that the underlying assets will not operate in violation of any applicable government regulations, codes, ordinances or statutes. |

| ● | We assume that there are no hidden or unexpected conditions of the business that would adversely affect value, other than as indicated in this report. |

| ● | Users of this valuation report should be aware that valuations are based upon assumptions regarding future earnings potential, and/or certain asset values that may or may not materialize. Therefore, the actual results achieved in the future will vary from the assumptions utilized in this valuation, and the variations may be material. |

| ● | The estimate of value included in this report assumes that the Company’s management will maintain the character and integrity of the Company through any reorganization or reduction of any owner’s/manager’s participation in the existing activities of the Company. |

t 305.774.2945 f 305.774.1504 201 Alhambra Circle, Suite 701 | Coral Gables, FL 33134 w www.lllgpa.com

| Pg. 5 |

DESCRIPTION OF THE COMPANY

Headquartered in Miami and with offices in Orlando, Buenos Aires, Guayaquil and Madrid; the Company is a technology and service partner that is focused on innovation to support the evolution of consumer behavioral trends. The Company has strategically expanded its portfolio to include solutions in the Communications, Finance, Healthcare, Education, Analytics, IoT, Gaming, Media and Insurance sectors. The Company assists its clients to compete in today's digital economy.

Under the Letter of Intent dated July 6, 2017, the Parties have agreed to the following terms:

| ● | The Company provides the Platform services at cost and Next Group shall provide the banking and distribution relationships. |

| ● | The Parties will split net revenues as follows: |

| o | For any product placed unto the Platform by Next Group, Next Group shall receive sixty five percent of the net revenue realized and the Company shall receive thirty five percent of the net revenues; |

| o | For any product placed unto the Platform by the Company, the Company shall receive 65% of the net revenue realized and Next Group shall receive thirty five percent of the net revenues realized. |

| o | Next Group shall exchange with the Company certain commercial and business information. |

| o | Similarly, the Company shall exchange certain commercial and business information. |

t 305.774.2945 f 305.774.1504 201 Alhambra Circle, Suite 701 | Coral Gables, FL 33134 w www.lllgpa.com

| Pg. 6 |

DESCRIPTION OF THE PLATFORM

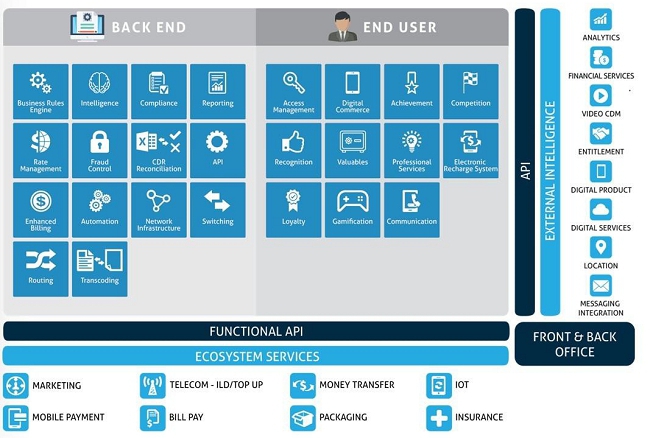

The Platform is a comprehensive technology software that enables firms to develop and establish communications via cell phones, Internet, data analytics, retail sales, money transfers and loyalty programs with their clients. The Platform can be utilized in several industries and the Company is planning to market in the telecommunications industry. Figure 1 depicts the main capabilities of the Platform.

Figure 1. Capabilities and Functionalities of the Platform

t 305.774.2945 f 305.774.1504 201 Alhambra Circle, Suite 701 | Coral Gables, FL 33134 w www.lllgpa.com

| Pg. 7 |

Figure 2 represents the components of the Platform: Knetik and Auris as well as the capabilities of both platforms. Knetik is mainly used for business analytics and communications; whereas Auris is used is for money transactions and sales as well as the development of customer loyalty programs.

Figure 2. Components of the Platform

t 305.774.2945 f 305.774.1504 201 Alhambra Circle, Suite 701 | Coral Gables, FL 33134 w www.lllgpa.com

| Pg. 8 |

VALUATION APPROACHES

We considered the three basic approaches generally recognized in the valuation profession in estimating the value of the subject interest as of January 1, 2007. The three approaches are the 1) Market Approach, 2) Cost Approach, and 3) Income Approach. The following paragraphs contain an explanation of these three approaches.

Cost Approach

Also referred to as the cost approach or the replacement cost approach. This approach is generally applicable in liquidation situations, whereby the aggregate value of the individual underlying assets is greater than the value derived collectively from the assets as currently used in the business. This approach is often utilized to value real estate entities or holding companies as well as technology platforms and software. As such, we utilized this approach to value the Platform.

Since the Platform is composed by Knetik and Auris, we valued those two technology units independently. In the case of Knetik, it is important that it also has a component called Splyt which was acquired in 2015 for $13 million dollars. Splyt is a data analytics and testing platform that enhances the capabilities of Knetik.

As it is shown in Exhibit 1, the fair market value of the Platform as of the Valuation Date is $29,629,000.

Income Approach

Under the income approach, the appraiser considers the earning capacity of the subject company to determine its value. This involves determining the projected income stream that a potential buyer of the business can expect to receive. Two common income approach valuation methods are the capitalization of returns and the discounted future returns methods.

Capitalization Returns Method

The capitalization returns method is generally used when an entity’s future operations are not expected to change significantly from its current normalized operations. To apply this method, an entity’s current operations, either earnings or cash flows, are divided or multiplied by a capitalization rate to estimate value. An entity’s capitalization rate is generally derived from its discount rate and can be stated as either a divisor or a multiplier.

Discounted Future Returns Method

The discounted future returns approach may be used when an entity’s future returns can be estimated and are expected to differ significantly from its current operations. To utilize this approach, an entity’s future operations are forecasted until a stabilized level is obtained, and a terminal value is then determined. The entity’s estimated future returns and terminal value are then adjusted to their present values using a discount rate.

t 305.774.2945 f 305.774.1504 201 Alhambra Circle, Suite 701 | Coral Gables, FL 33134 w www.lllgpa.com

| Pg. 9 |

Under this method, we utilized the Relief from Royalty Method, which “looks at the costs an investor can save by owning the right instead of leasing it. If he/she owns the applicable right, he/she can achieve the value by calculating what the rent would typically have been in terms of licensing fees (also called royalties) for licensing the same right from another business.”1

In valuation theory, a discount rate represents the total expected rate of return, stated as a percentage, that a buyer or investor would demand on the purchase of an asset, given the level of risk inherent in the asset. The discount rate is not utilized as a divisor or multiplier; instead, it is used to determine present value factors that discount a future benefit stream to a present value.

We utilized the income approach in valuing the Platform.

Market Approach

The market approach assumes that value can be estimated by analyzing recent sales of comparable assets/interests. The use of this approach requires a thorough search for guideline or comparable companies/funds (both public and privately-held) and thorough analysis and adjustments of such guideline data.

The market approach involves finding pricing multiples from guideline data and applying it to the subject interest being valued. We searched for similar technology platforms, but we will not able to identify those that have similar capabilities. We utilized this approach in order to determine an appropriate royalty rate. Appendix A shows the comparable royalty rates.

1 Danish Patent and Trademark Office: IP Tradeportal http://ip-tradeportal.com/valuation/methods-for- valuation/quantitative-valuation/income-methods/relief-from-royalty-method.aspx

t 305.774.2945 f 305.774.1504 201 Alhambra Circle, Suite 701 | Coral Gables, FL 33134 w www.lllgpa.com

| Pg. 10 |

INCOME APPROACH: RELIEF OF ROYALTY METHOD

“This method is sometimes considered an income approach valuation method, because the estimated royalty income is capitalized to reach an indication of value.”2 “In the relief from royalty method, the subject intangible asset is valued by reference to the amount of royalty income it would generate if the intangible asset was instead licensed in an arm’s-length transaction. In using this method, arm’s-length royalty or license agreements are analyzed. The licensing transactions selected should reflect similar risk and return investment characteristics that make them comparative to the subject intangible asset. The net revenues expected to be generated by the subject intangible asset from all sources during its expected remaining life are then multiplied by the selected benchmark royalty rate. The product is an estimate of the royalty income that could hypothetically be generated by licensing the subject intangible asset. The estimated royalty stream, which the owner is relieved from paying since the intangible asset is already owned, is capitalized. This results in an indication of the value of owning the intangible asset.”3

The steps to utilize this method are as follows:

Step 1: Determine the benchmark royalty rate.

We did a search in the database of Royalty Source in order to identify similar transactions or intangible assets that have similar risk/return profile. Those twenty similar transactions are shown in Exhibit 2 and in Appendix A. The companies in general, are larger and more diversified than the Company. In view of this, a reasonable royalty rate would be on the low end of the ranges shown of in Exhibit 2. As such, we computed the average between the first quartile and the first quintile, arriving at a royalty rate of 3.5% of revenues. We deemed this rate as representative of a royalty rate applicable for the Company’s Platform.

Step 2: Determination of the Cash Flow Derived from the Relief of Royalty Method

The estimated revenues for the next five years were provided by management, which involves both the direct and the telecommunications income that it would be derived from the platform. This is shown in the table below. We applied the royalty rate selected in the step above and deducted corporate income taxes and arrived at the forecasted cash flows shown below.

| Source | 2018 | 2019 | 2020 | 2021 | 2022 | |||||||||||||||||||

| Revenue | ||||||||||||||||||||||||

| Telco suscription | Provided by | $ | 200,792,583 | $ | 571,486,583 | $ | 942,180,583 | $ | 1,112,082,000 | $ | 1,112,082,000 | |||||||||||||

| Direct revenues (Cuentas Distribution) | management | 2,100,851 | 16,359,775 | 45,864,295 | 90,614,095 | 150,630,770 | ||||||||||||||||||

| Total | $ | 202,893,434 | $ | 587,846,358 | $ | 988,044,878 | $ | 1,202,696,095 | $ | 1,262,712,770 | ||||||||||||||

| Selected royalty rate | Exhibit 2 | 3.50 | % | 3.50 | % | 3.50 | % | 3.50 | % | 3.50 | % | |||||||||||||

| Royalty savings | 7,101,270 | 20,574,623 | 34,581,571 | 42,094,363 | 44,194,947 | |||||||||||||||||||

| Income taxes | 40 | % | (2,840,508 | ) | (8,229,849 | ) | (13,832,628 | ) | (16,837,745 | ) | (17,677,979 | ) | ||||||||||||

| Net cash flow | 4,260,762 | 12,344,774 | 20,748,942 | 25,256,618 | 26,516,968 | |||||||||||||||||||

2 Robert F. Reilly and Robert P. Schweis: “Valuing Intangible Assets”

3 Ibid

t 305.774.2945 f 305.774.1504 201 Alhambra Circle, Suite 701 | Coral Gables, FL 33134 w www.lllgpa.com

| Pg. 11 |

Step 3. Determination of WACC

WACC has two components: the first one is the cost of equity, which was used the build-up method, and the second, is the tax effected cost of debt. This was computed in Exhibit 4.

Step 4. Determination of the Fair Market Value of the Platform as of the Valuation Date

We assumed that the Agreement would be renovated each period into perpetuity, which made us compute a terminal value for the royalty cash flows. Then, we computed the present value of total cash flow and arrived at a fair market value of the platform of $19.74 million. This is shown in the table below:

| Source | 2018 | 2019 | 2020 | 2021 | 2022 | |||||||||||||||||

| Net cash flow | 4,260,762 | 12,344,774 | 20,748,942 | 25,256,618 | 26,516,968 | |||||||||||||||||

| WACC | 57.75 | % | ||||||||||||||||||||

| Present value factor | 0.6339 | 0.4018 | 0.2547 | 0.1615 | 0.1024 | |||||||||||||||||

| Present value of cash flows | 2,700,959 | 4,960,716 | 5,285,522 | 4,078,474 | 2,714,420 | |||||||||||||||||

| Present Value | $ | 19,740,091 | ||||||||||||||||||||

| Fair market value of the Platform | $ | 19,740,000 | ||||||||||||||||||||

t 305.774.2945 f 305.774.1504 201 Alhambra Circle, Suite 701 | Coral Gables, FL 33134 w www.lllgpa.com

| Pg. 12 |

RECONCILIATION OF VALUES

After consideration of relevant factors and the analysis as presented in this report, the estimated fair market values of the Platform under the approaches considered and used are shown in the below. It should be noted that under the fair market value standard, a hypothetical willing buyer is more inclined to derive financial returns from his/her investment in the Platform. As such, we assigned more weight to the fair market value computed under the Income Approach.

| Cost Approach | Income Approach | |||||||||||

| Fair Market Value of the Platform | $ | 29,628,758 | $ | 19,740,091 | ||||||||

| Weights | 20 | % | 80 | % | ||||||||

| Weighted Average | $ | 21,717,824 | ||||||||||

| Fair Market Value of the Platform (rounded to the nearest thousandth) | $ | 21,718,000 |

t 305.774.2945 f 305.774.1504 201 Alhambra Circle, Suite 701 | Coral Gables, FL 33134 w www.lllgpa.com

| Pg. 13 |

APPENDIX A – ROYALTY RATES COMPARABLES

Royalty Source Intellectual Property Database

-A service provided by AUS Consultants-

Software: Business Enterprise

12/10/2017

| Licensee: | EMPIRICAL VENTURES LTD EMPIRICAL VENTURES, INC.; Go-Page Corp |

| Licensor: | 3493734 MANITOBA LTD |

| Royalty Rate, % (low range): | 1 |

| Royalty Rate, % (high range): | 2 |

| Upfront Fee: | $5,000 |

Licensed Property:

This Agreement was made on May 19, 2004 and amended on November 17, 2005.

The Canadian Vendor agrees to sell, assign and transfer to the Canadian Purchaser the Technology.

“Technology” means and shall include any Patents and all of the information, data, schematics blueprints, drawings, registered and unregistered trademarks, trade-names, copyrights, designs expertise, and know-how of every nature and kind related to this Soft Ware Program.

The technology being exchanged is marketed under the trade name "Darrwin" and includes a travel reservation service -- hotel and airline booking.

The Vendor has utilized the Technology to develop and market this Soft Ware Program/ Travel Reservation Service.

The Vendor has developed certain information, expertise, know-how, show-how related to a proprietary Soft Ware Program, marketed under the trade name “Darrwin”.

Migrate all code from Windows 2000 to XP Professional and Longhorn

Upgrade Billing System

Upgrade Hotel Booking System

Upgrade Hotel and Event Conformation System

Upgrade Airline Interconnect

Enhance System Interface

Total Upgrades and New Programming

Our plan is to provide as our principal product, the “Darrwin” software program and to commercialize this software program that provides the ability to make and secure reservations for hotels and various other services via the internet.

t 305.774.2945 f 305.774.1504 201 Alhambra Circle, Suite 701 | Coral Gables, FL 33134 w www.lllgpa.com

| Pg. 14 |

Compensation Detail:

Upfront Fee: The sum of Five Thousand USD ($5,000) as a non-refundable deposit, and the sum of Three Thousand USD ($3,000) Payable upon execution of this agreement, in consideration for additional legal expenses and opportunity costs as a result of these amendments; and the sum of Ten Thousand USD ($10,000) Payable March 16, 2006.

Royalty: A royalty of Two (2%) Percent calculated on the Net Sales Revenue of any product that uses all or any portion of the Technology until, development costs incurred to date have been recovered to a maximum of USD Two Hundred Fifty Thousand ($250,000) Dollars. After which the royalty shall be reduced to One (1%) Percent.

Source: Form SB-2/A EMPIRICAL VENTURES INC Exhibit 10.1, 04/06/2006; SB-2 EMPIRICAL VENTURES, INC. EX-10.1 ,11/15/2004;

http://www.sec.gov/Archives/edgar/data/1301704/000109635006000084/ex10one.htm

The source of information provided in this report has been gathered from public financial records, news releases, and other articles and references. While we believe the sources to be reliable, this does not guarantee the accuracy or completeness of the information provided. Copyright© AUS Consultants, Inc.

t 305.774.2945 f 305.774.1504 201 Alhambra Circle, Suite 701 | Coral Gables, FL 33134 w www.lllgpa.com

| Pg. 15 |

Royalty Source Intellectual Property Database

-A service provided by AUS Consultants-

| Software: Business Enterprise | ||

| 12/10/2017 | ||

| Licensee: | AMAZING TECHNOLOGIES CORP. | |

| Licensor: | 4159748 CANADA INC | |

| Royalty Rate, % (low range): | 1 | |

| Royalty Rate, % (high range): | 1 | |

| Upfront Fee: | $150,000 |

Licensed Property:

This Software License Agreement dated as of March 15th, 2005.

A Canadian Licensor, an entity owned and controlled by our director, hereby grants to Licensee a perpetual, worldwide, exclusive right and license under the copyrights and other intellectual property rights in the software to use, reproduce, distribute and make derivative works based upon such Business Process Management (BPM) Software.

This platform can be best viewed as a rules-based design, modeling, integration and execution environment. It resides atop other middleware components and supports real-time aggregation and event- driven processing. The three core components of the BPM platform are: 1) a process and workflow automation engine that provides an integrated, graphical environment for both low and high level business processes and the rules that govern their execution; 2) a messaging integration layer that facilitates data translation and real-time communication between disparate applications, data sources and personnel; and 3) technology adaptors that support cross middleware integration (for major product suites) and integration for custom business logic.

BPM provides the ability to monitor and manage processes and transactions while facilitating the modification and re-use of existing process models. It is designed to free up IT resources and reduce development and maintenance costs because all of this can be done by business analysts instead of expensive programmers.

Term: Perpetuity, unless termination occurs.

Territory: Worldwide

Compensation Detail:

Upfront Fee: The terms of the Agreement provided for a one-time payment of $150,000.

Royalty: Ongoing royalty payment of one percent (1%) of gross proceeds received from the Licensed software, up to a maximum of $1 million. The software License Agreement calls for minimum quarterly royalty payments of $25,000.

t 305.774.2945 f 305.774.1504 201 Alhambra Circle, Suite 701 | Coral Gables, FL 33134 w www.lllgpa.com

| Pg. 16 |

Source: Form 10SB12G AMAZING TECHNOLOGIES CORP. Exhibit 10.5, 09/20/2005; 10SB12G/A AMAZING TECHNOLOGIES CORP. ,01/04/2006; http://www.sec.gov/Archives/edgar/data/1323595/000104746905023141/a2159980zex-10_5.htm

The source of information provided in this report has been gathered from public financial records, news releases, and other articles and references. While we believe the sources to be reliable, this does not guarantee the accuracy or completeness of the information provided. Copyright© AUS Consultants, Inc.

t 305.774.2945 f 305.774.1504 201 Alhambra Circle, Suite 701 | Coral Gables, FL 33134 w www.lllgpa.com

| Pg. 17 |

Royalty Source Intellectual Property Database

-A service provided by AUS Consultants-

| Software: Business Enterprise | ||

| 12/10/2017 | ||

| Licensee: | DELTA CAPITAL TECHNOLOGIES INC | |

DELTA CAPITAL TECHNOLOGIES INC/NY; INTREPID GLOBAL IMAGING 3D, INC.; MANGAPETS, INC.; NEWMARK VENTURES INC; SPINE PAIN MANAGEMENT, INC; VERSA CARD, INC. |

||

| Licensor: | 827109 ALBERTA LTD | |

| Royalty Rate, % (low range): | 15 | |

| Royalty Rate, % (high range): | 15 | |

| Upfront Fee: | $50,000 |

Licensed Property:

This Agreement is entered into as of June 1, 1999.

The Canadian Company acquired the rights to an exclusive worldwide license to the relBuilder Enterprise Suite of business intelligent e-Commerce and e-Business software from an Alberta, Canada based private company. The License Agreement allows the Company to distribute licenses for the Software through sub-licenses. The Company is responsible for the funding, the creation and management of a distribution network for the Software, the ongoing development of the Software and any future products or services it acquires.

Brand Name: relBuilder Enterprise Suite

The Software consists of a software engine (the relBuilder) which is the core technology for a suite of six enterprise-class applications which permit companies and organizations to engage in e-Business.

1. Enterprise Commerce Application: The Company’s Enterprise e-Commerce Application provides merchants with the ability to implement cross selling, up selling, product dependencies, product interactions, comparative shopping, competitive shopping, and consumer shopping assistance wizards. Using this application, merchants and organizations have the ability to apply the technology to the on- line and in-store presentation of product information that begins the customer relationship. This technology can operate on a standalone basis or can enhance other e-Commerce solutions.

2. Back Office Application: The Back Office Application integrates existing general ledger, accounts receivable and payable, inventory, warehouse and other related back office functions with the Core Technology utilizing IBM’s new San Francisco software architecture.

3. Enterprise Document Assembly Application: The Document Assembly Application is a content manager and document assembly tool that maximizes re-use of corporate information by bringing together data that is usually scattered across company-wide systems.

t 305.774.2945 f 305.774.1504 201 Alhambra Circle, Suite 701 | Coral Gables, FL 33134 w www.lllgpa.com

| Pg. 18 |

The assembly of data can be used for everything from contract building, to information portal construction and management, to dynamic document creation and presentation.

4. Enterprise Project Management Application: The Project Management Application is equipped to handle cross-project resource analysis, cross-project roll-ups of complex costing and estimating functions and integrates with leading GroupWare (such as Microsoft Exchange or Lotus Notes) to provide project- based calendaring and scheduling. The Project Management Application provides a real-time graphical presentation of underlying data, and the user interface changes to intelligently reflect additions or deletions in the data.

5. Enterprise Customer Service Application: The Customer Service Application has the ability to map complex call requirements, implement sophisticated operational logic and can integrate with a web server to allow for web-based customer self-service or call center operations from within the office environment to across the globe.

6. Enterprise Contact Management Application: The Contact Management Application integrates with leading directory servers (such as Microsoft Exchange and Lotus Notes) to enable highly complex mapping of names, addresses, companies, contact information, corporate hierarchies, active and non- active projects, and histories.

The term of the License is three (3) years beginning on the date this Agreement takes effect.

Territory: Worldwide

Compensation Detail:

Upfront Fee: The License Agreement, requires the Company to pay to AltaCo a non-refundable lump sum license fee of $50,000.

Royalty: Under the License Agreement, the Company is required to pay a royalty payment of 15% of net sales with minimum amounts of C$50,000 in the first year, C$200,000 in the second year, and C$300,000 in the third year.

Source: Form 10 A DELTA CAPITAL TECHNOLOGIES INC Exhibit 10SB12G/A, 12/20/1999 http://www.sec.gov/Archives/edgar/data/1066764/000100515099001169/0001005150-99-001169.txt

The source of information provided in this report has been gathered from public financial records, news releases, and other articles and references. While we believe the sources to be reliable, this does not guarantee the accuracy or completeness of the information provided. Copyright© AUS Consultants, Inc.

t 305.774.2945 f 305.774.1504 201 Alhambra Circle, Suite 701 | Coral Gables, FL 33134 w www.lllgpa.com

| Pg. 19 |

Royalty Source Intellectual Property Database

-A service provided by AUS Consultants-

| Software: Business Enterprise | ||

| 12/10/2017 | ||

| Licensee: | MILLENNIUM SOFTWARE INC | |

| Licensor: | ABACUS SYSTEMS LTD | |

| Royalty Rate, % (low range): | 5 | |

| Royalty Rate, % (high range): | 10 | |

| Upfront Fee: |

Licensed Property:

This License Agreement is entered into effective as of the 8th of December, 1999.

An exclusive worldwide license is hereby to copy, duplicate, sell, distribute, sub-license the Products through Internet websites.

Software

CheckMy Banking 2000

CheckMY Loans 2000

CheckMy Mortgage 2000

CheckMy Banking Deluxe 2000

CheckMY Loans Deluxe 2000

CheckMy Mortgage Deluxe 2000

CheckMy Banking 2000 User Guide

CheckMY Loans 2000 User Guide

CheckMy Mortgage 2000 User Guide

User Guides

Easy Learning Guide to CheckMy Banking

Easy Learning Guide to CheckMy Loans

Easy Learning Guide to CheckMy Mortgage

CheckMy Banking 2000 contains routines which enable users of Quicken to export account data directly into CheckMy Banking 2000. CheckMy Banking 2000 contains check clearing functions which calculate the cost of check clearing delays. It organizes accounts into person and business use folders.

CheckMy Loans 2000 provides a new powerful personal loan management system. The software updates monthly loan balances, interest due and paid amounts and provides loan reports. It contains 25 software calculators for various 'what-if' possibilities, such as calculating interest savings with loan consolidation, savings arising from early loan repayments, higher monthly repayments. The software checks lenders loan interest and loan terms and finds true values.

t 305.774.2945 f 305.774.1504 201 Alhambra Circle, Suite 701 | Coral Gables, FL 33134 w www.lllgpa.com

| Pg. 20 |

CheckMy Mortgage 2000 is a smart mortgage calculator which contains several advanced new ‘mortgager comparison’ and forecasts of property value' features. The software calculates mortgage amortization schedules, refinance balances and total mortgage interest costs. The software provides 'compare mortgages' and 'refinance' sections which calculate alternative financial results from different mortgages. The software is aimed at personal users who wish to keep watch on their mortgage finances. Country settings screen allows users to select US, Canadian, or UK mortgage calculations routines.

These Products will be promoted on the Company's Internet site www.mlnsoft.com. The Products are designed to run on personal computers. There are three software products; CheckMy Banking 2000, CheckMy Loans 2000, and CheckMy Mortgage 2000. All three products are designed for personal and small business users. The software runs on Windows 95 or 98 computer systems. CheckMy Banking 2000 provides an expansion product for users of Quicken. Quicken (Copyright: Intuit, Inc., Mountain View) is the leading software product for the easy and efficient organization of personal and small business financial records. There are believed to be several million users of Quicken worldwide. CheckMy Banking 2000 calculates bank charges, interest and cleared and net balances, which Quicken does not.

Territory: Worldwide

Compensation Detail:

Royalty: Millennium agrees to pay Abacus royalties (herein referred to as Royalties) and fee payments (Fees) based on Net Sales Revenues earned by Millennium from sale of the Products on the following basis:

A 10% Royalty of the Net Sales Revenues of CheckMy 2000 Software.

A 10% Royalty of the Net Sales Revenues of CheckMy 2000 Easy Learning Guides.

A 5% Fee based on Net Sales Revenues of Products for the provision of technical support for all

Products supplied by Abacus.

Net Sales Revenues for the purposed of calculating and determining Royalties and Fees for the duration of this license will be sales revenues received by Millennium from the sale of Products, before distributor discounts, less full provision for credits provided for returned Products and provision for bad debts which remain unrecovered after 12 months.

Source: Form 10SB12G/A MILLENNIUM SOFTWARE INC Exhibit 10.1, 03/03/2000 http://www.sec.gov/Archives/edgar/data/1100730/000104589300000001/0001045893-00-000001.txt

The source of information provided in this report has been gathered from public financial records, news releases, and other articles and references. While we believe the sources to be reliable, this does not guarantee the accuracy or completeness of the information provided. Copyright© AUS Consultants, Inc.

t 305.774.2945 f 305.774.1504 201 Alhambra Circle, Suite 701 | Coral Gables, FL 33134 w www.lllgpa.com

| Pg. 21 |

Royalty Source Intellectual Property Database

-A service provided by AUS Consultants-

Software: Business Enterprise 12/10/2017 |

||

| Licensee: | POSITIVE SOFTWARE COMPANY | |

Licensor: |

ACTIVE IQ TECHNOLOGIES, INC. |

|

Royalty Rate, % (low range): |

7.5 |

|

Royalty Rate, % (high range): |

7.5 | |

| Upfront Fee: |

Licensed Property:

This agreement was granted in March 2002.

Licensor granted a non-exclusive license to an unaffiliated third party, to use, sell and distribute the Licensor's branded Network.

The Licensor's branded Network is an eBusiness product for small to medium-sized businesses. The Network includes eCommerce, Account Management, customer service and support, and trading partner connectivity. The Network applications integrate with a customer's existing accounting software to quickly help get the customer online by accessing information that already exists in its accounting system. Leveraging the power of the Internet, these applications allow an organization to extend beyond the traditional four walls of their enterprise to integrate their operations with their customers, suppliers and partners.

Compensation Detail:

Royalty: Licensor is entitled to monthly royalty payments of 7.5% of all fees or charges accrued or received by the grantee.

Source: Form S-3/A ACTIVE IQ TECHNOLOGIES INC, 05/15/2002 http://www.sec.gov/Archives/edgar/data/912875/000095013702003124/c64205a5s-3a.txt

The source of information provided in this report has been gathered from public financial records, news releases, and other articles and references. While we believe the sources to be reliable, this does not guarantee the accuracy or completeness of the information provided. Copyright© AUS Consultants, Inc.

t 305.774.2945 f 305.774.1504 201 Alhambra Circle, Suite 701 | Coral Gables, FL 33134 w www.lllgpa.com

| Pg. 22 |

Royalty Source Intellectual Property Database

-A service provided by AUS Consultants-

Software: Business Enterprise 12/10/2017 |

||

| Licensee: | LOGILITY INC | |

| Licensor: | AMERICAN SOFTWARE INC | |

| Royalty Rate, % (low range): | 30 | |

| Royalty Rate, % (high range): | 30 | |

| Upfront Fee: |

Licensed Property:

This Memorandum of Understanding is entered into as of May 1, 2005.

In a related party transaction, the Licensee entered into a Memorandum of Understanding (MOU) with the Licensor for the resale of the Licensor's New Generation Computing’s (“NGC”) products by the Licensee’s personnel.

Licensor's products refer to enterprise resource planning and supply chain management software solutions.

This MOU will remain in effective for twelve (12) months from the Effective Date and shall automatically renew for successive one-year periods.

Compensation Detail:

Royalty: Specifically, Logility Inc will pay a royalty equal to 30% of the net License fees recognized allocated to the ASI products sold, after discounts and revenue recognition adjustments. Any maintenance fees included in the arrangement will be pro-rated based on the net License fees.

Source: Form 10-Q Logility Inc Exhibit 10.1, 12/14/2005; 10-Q Logility Inc ,03/12/2007;

http://www.sec.gov/Archives/edgar/data/1043915/000119312505242452/dex101.htm

The source of information provided in this report has been gathered from public financial records, news releases, and other articles and references. While we believe the sources to be reliable, this does not guarantee the accuracy or completeness of the information provided. Copyright© AUS Consultants, Inc.

t 305.774.2945 f 305.774.1504 201 Alhambra Circle, Suite 701 | Coral Gables, FL 33134 w www.lllgpa.com

| Pg. 23 |

Royalty Source Intellectual Property Database

-A service provided by AUS Consultants-

Software: Business Enterprise 12/10/2017 |

||

| Licensee: | APTUS CORP | |

| Licensor: | APPGEN TECHNOLOGIES, INC. AND MARK ANDRE | |

| Royalty Rate, % (low range): | 5.5 | |

| Royalty Rate, % (high range): | 5.5 | |

| Upfront Fee: |

Licensed Property:

This amendment is effective April 15, 2004 to the original distribution agreement dated January 23, 2004.

The amended Distribution Agreement includes a buyout provision.

The original agreement was in conjunction with an acquisition of the Licensor's accounting software application.

The Licensor's has accounting software applications, Used computer equipment and used office furniture and equipment, Trade and company name(s), The web site and the domain name, Customer lists, Marketing materials, Software documentation and manuals, and VAR and dealer lists.

This agreement is perpetual.

Compensation Detail:

Royalty: We will pay a royalty of 5.5%, in perpetuity, on all gross proceeds from the sale of the Appgen Custom Suite and MyBooks Professional products.

Source: Form SB-2/A APTUS CORP , 11/01/2004 http://www.sec.gov/Archives/edgar/data/1274037/000127403704000030/apsb26.txt

The source of information provided in this report has been gathered from public financial records, news releases, and other articles and references. While we believe the sources to be reliable, this does not guarantee the accuracy or completeness of the information provided. Copyright© AUS Consultants, Inc.

t 305.774.2945 f 305.774.1504 201 Alhambra Circle, Suite 701 | Coral Gables, FL 33134 w www.lllgpa.com

| Pg. 24 |

Royalty Source Intellectual Property Database

-A service provided by AUS Consultants-

Software: Business Enterprise 12/10/2017 |

||

| Licensee: | KACHING KACHING, INC. | |

| BOXWOODS, INC; | ||

| DUKE MINING COMPANY, INC.; SOMEBOX, INC. |

||

Licensor: |

BEYOND COMMERCE |

|

BOOMJ INC; REEL ESTATE SERVICES INC. |

||

Royalty Rate, % (low range): |

5 |

|

Royalty Rate, % (high range): |

7 | |

| Upfront Fee: |

Licensed Property:

This Master License Agreement is made this 21st day of October, 2009.

Company hereby appoints Distributor, a related party, as the Exclusive Master Licensor and Distributor to sell, license and distribute the Back-end Processing Services and I-supply shopping system to any and all third parties.

Company has developed an infrastructure known as the I-Supply Shopping System, which includes certain proprietary technology which enables I-Supply, among other things, to be able to process e- commerce transactions on the Internet in an efficient and effective manner and to track customer orders from the time the order is placed through delivery to the consumer’s designated ship to address (Back- end Processing Technology).

Distributor is in the business of establishing, licensing, marketing and selling to third parties and consumers e-commerce shopping solutions and e-commerce stores, which will enable each such consumer to operate his or her own Retail Web Stores (RWS).

The term of this Agreement shall commence as of the Effective Date and continue for a period of (Five) year(s) (the “Initial Term”).

Compensation Detail:

Royalty: As compensation for the Back-end Processing Services and Order Processing to be rendered by the Company under this Agreement, Kaching Kaching agrees to pay to the Company the following: Within 5 days following the end of each month, Kaching Kaching shall pay to the Company an amount equal five percent (5%) of the aggregate gross sales made from sales of all RWSs during the prior month for which the Company was providing the Back-end Processing Services and Order Processing.

t 305.774.2945 f 305.774.1504 201 Alhambra Circle, Suite 701 | Coral Gables, FL 33134 w www.lllgpa.com

| Pg. 25 |

Upon the one year anniversary date of this Agreement the amount due to Company under this section 4.1 shall be increased by two percent (2%) for a total of seven percent (7%) of the aggregate gross sales made from the sale of all RWSs during the remaining four years of the Agreement. In addition, Kaching Kaching shall pay to the Company an amount equal two percent (2%) of the aggregate gross sales made through all RWSs during the prior month for which the Company was providing the Back-end Processing Services and Order Processing.

Source: Form 8-K BEYOND COMMERCE Exhibit 10.40, 04/27/2010 http://www.sec.gov/Archives/edgar/data/1386049/000135448810001312/byoc_ex1040.htm

The source of information provided in this report has been gathered from public financial records, news releases, and other articles and references. While we believe the sources to be reliable, this does not guarantee the accuracy or completeness of the information provided. Copyright© AUS Consultants, Inc.

t 305.774.2945 f 305.774.1504 201 Alhambra Circle, Suite 701 | Coral Gables, FL 33134 w www.lllgpa.com

| Pg. 26 |

Royalty Source Intellectual Property Database

-A service provided by AUS Consultants-

Software: Business Enterprise 12/10/2017 |

||

| Licensee: | PURCHASESOFT INC | |

| GREENTREE SOFTWARE INC; | ||

| NETSHARE SOLUTIONS | ||

Licensor: |

COMPUTER INFORMATION ENTERPRISES INC |

|

Royalty Rate, % (low range): |

10 |

|

Royalty Rate, % (high range): |

10 | |

| Upfront Fee: |

Licensed Property:

On February 16, 2004, the parties successfully closed all agreements, including an Asset Purchase Agreement. In addition to the purchase of assets the Licensor entered into a License Agreement.

The License Agreement grants the worldwide, exclusive license to use the Intellectual Property to manufacture, market, sublicense or otherwise commercialize products using the technology included in the Intellectual Property.

The property licensed is used in the Software Business and includes any and all patents, patent registrations, patent applications, data rights, utility models, business processes, trademarks, trade secrets, know how, trade names, registered or unregistered designs, mask works, copyrights, moral rights and any other form of proprietary protection afforded by law to intellectual property.

ImageLink is a document management system that is tightly-integrated with Microsoft's Solomon IV and Great Plains accounting ERP Systems. The product offers a secure environment for the storage and retrieval of documents. It is a useful tool for companies that are striving to be in compliance with Sarbanes-Oxley or HIPPA. There are various levels of user access which can be established by a central authority. A company can protect documents from unauthorized alteration and access of documents can be monitored by authorized personnel.

AP-Distar is a high-end product solution that provides accounts payable image capture, data entry and distributed authorization for accounting systems. AP-Distar lends itself to generic integration with any SQL-based accounting system.

Solomon and Great Plains ERP systems allow one to access documents within the accounting system, or for non-accounting applications.

The Licensor intends, through their operations of the Software Business, to develop and market products that provide businesses with document imaging solutions that are integrated with a customer’s Solomon or Great Plains ERP software.

t 305.774.2945 f 305.774.1504 201 Alhambra Circle, Suite 701 | Coral Gables, FL 33134 w www.lllgpa.com

| Pg. 27 |

Territory: Worldwide

Compensation Detail:

Royalty: The License Agreement requires us to pay a royalty of 10% of gross revenues for product sales transactions.

Source: Form 8-K PURCHASESOFT INC , 02/24/2004 http://www.sec.gov/Archives/edgar/data/727063/000110465904005631/a04-2701_18k.htm

The source of information provided in this report has been gathered from public financial records, news releases, and other articles and references. While we believe the sources to be reliable, this does not guarantee the accuracy or completeness of the information provided. Copyright© AUS Consultants, Inc.

t 305.774.2945 f 305.774.1504 201 Alhambra Circle, Suite 701 | Coral Gables, FL 33134 w www.lllgpa.com

| Pg. 28 |

Royalty Source Intellectual Property Database

-A service provided by AUS Consultants-

Software: Business Enterprise 12/10/2017 |

||

| Licensee: | ACCELERATED ACQUISITIONS V INC | |

| DEMAND POOLING, INC. | ||

Licensor: |

DEMAND POOLING GLOBAL SERVICES LLC |

|

Royalty Rate, % (low range): |

1.25 |

|

Royalty Rate, % (high range): |

1.25 | |

| Upfront Fee: | $10 |

Licensed Property:

This Agreement was entered into on April 15, 2010.

The Licensor granted the Licensee an exclusive, non-transferable, license (with a limited right of sublicense) to allow Licensee to install, use and apply the Technology and conduct its business in the worldwide Territory.

Licensor holds all rights, title and interest to a certain invention entitled “DEPO Technology”

The Intellectual Property consists of the following components developed and designed to advance a business concept and it is this Business Concept combined with the technology and Company expertise for which the Licensor is seeking patent protection.

DEPO’s intellectual Property consists of the following components developed and designed advance a business concept (“Business Concept”) and it is this Business Concept combined with the technology and Company expertise for which DEPO is seeking patent protection.

The Business Concept consists of a number of approaches that facilitate improved pricing and greater affordability for products that state and local governments, the Company’s target market, purchase on a repetitive basis. While the Business Concept is equally applicable for non-state and local governmental entities, such as utilities and a variety of others, the Licensor has chosen to initially target the state and local governmental marketplace.

The Business Concept has, as its core product, the aggregation of demand for high-ticket capital equipment and selected commodities. The proprietary software facilitates cooperative purchases of similar products, even though each individual participant may maintain its own unique product specifications. Secondly, in order to favorably impact the various and disparate entities’ abilities to participate, the Licensor will facilitate pooled financing in a manner that results in greater financing flexibility for the participants, as well as improved “marketability” of their financing instruments, improved pricing, terms and conditions. In addition, in order to purchase new capital equipment, most buyers must typically dispose of older equipment and the Company will offer the ability to auction, on a global basis, in order to improve the “recovery” on the disposal of surplus equipment, ultimately resulting in more funding available for purchase of new equipment and lower life-cycle costing for equipment they employ.

t 305.774.2945 f 305.774.1504 201 Alhambra Circle, Suite 701 | Coral Gables, FL 33134 w www.lllgpa.com

| Pg. 29 |

Datacenter

The DEPO system utilizes a highly secure, fault tolerant, enterprise-class data center, designed to provide 100% uptime. Maintenance of the facilities, operation and management of the Datacenter is outsourced to Databank LLC, 400 S. Akard St., Dallas, Texas 75202, in the former home of the Dallas Federal Reserve Bank, which enables DEPO to benefit from a state-of-the art infrastructure facility, while not having to commit significant resources, capital or human, to the build-out and ownership of the infrastructure. The ability to expand our capacity and scalability requirements (space, power, networking and redundancy capability) is virtually without limitation.

Security of the installed assets, information, applications and client data are of paramount importance. Security at the Datacenter is provided on a 24/7/365 basis. Card access is required to gain access, along with biometric hand scanning upon entry, and annual SAS 70 Audits are performed to ensure the delivery of services at the highest possible levels.

Uptime of the website is essential for DEPO to provide consistent and reliable services to our users. To ensure this level of service, our systems have reliable UPS/Backup Generators and reliable utility power. The UPS/Backup Generator power supply provides: true A+B power configurations, all UPS and Generator deployments provide N+1 redundancy, 800KVA MGE UPS Systems, 1200 KVA CAT UPS Systems, 2.0 megawatt generators, 1.5 megawatt generators. There are six utility feeds from the CBD grid, N+3 Transformers with ATS switches and the feeds to building are concrete encased. Cooling systems employ 3,500 Ton cooling tower capacity, 30 Ton Liebert CRAC Units, designed with N+1 redundancy and 80,000 gallon reserve make-up water tank.

Network

For the Internet, the network architecture utilizes redundant N+1 Core and N+1 access Foundry XMR, MLX and Cisco 6500 routers to provide a Highly Redundant and Highly Available Multi-Homed Internet Aggregation Hub. This coupled with multiple 10 Gigabit IP trunks from multiple Tier 1 Internet service providers makes the IP Hub would be considered highly robust. Embedded sFlow per port supports scalable hardware-based traffic monitoring across all switch ports without impact performance. Connectivity is provided by multiple vendors including: AboveNet, AirBand, Cogent, Time Warner, XO, Looking Glass, Level 3, InnerCity Fibernet, FiberLight, MCI, Qwest, Consolidated Communications, Texas Lone Star Network, TerraStar, Clearwire Communications, Current Communications and Verizon. The CBD fiber optic network is built upon 432 strands of fiber and available duct.

Application

The DEPO system utilizes what is referred to as an “n-tiered” architecture for reliability, scalability and redundancy. The system is comprised of multiple applications which manage the functionality and business logic between databases, Web portal and back-office applications. The core application is developed in Java, .Net 2.0 and utilizes various state-of-the- art tools for the Graphical User Interface. This allows rapid development and deployment of future enhancements.

Rigorous Methodologies and Procedures are utilized for: Application Development and Deployment, Quality Assurance, Standardize Style Guide, Project Management, Offshore Development, Change Management Control, Testing and Quality Measurement Standards.

The fully functional web-based platform automates the business process for facilitating cooperative buying (“demand aggregation”) of capital assets and a limited number of commodities (motor fuel and water treatment chemicals) primarily among state and local governments (“SLGs”) in order to obtain volume-discount pricing for products that are not typically the subject of meaningful price discounting in the volumes typically purchased by individual entities.

t 305.774.2945 f 305.774.1504 201 Alhambra Circle, Suite 701 | Coral Gables, FL 33134 w www.lllgpa.com

| Pg. 30 |

The Company expects to remain substantially dependent upon additional platform development by the Licensor, although the Company may seek platform enhancements from other sources or may enhance its application internally.

“Territory” means worldwide.

Compensation Detail:

Upfront Fee: This agreement witnesses that in consideration of US$10.00, the parties enter the agreement.

Royalty: Licensee shall pay Licensor a royalty of one and one-quarter percent of all gross revenues resulting from the use of the Technology. Licensee shall pay Licensor two percent of all royalties and fees received from any sublicensees.

Source: Form 8-K ACCELERATED ACQUISITIONS V INC Exhibit 10.1, 05/03/2010 http://www.sec.gov/Archives/edgar/data/1444145/000114420410023738/v183055_ex10-1.htm

The source of information provided in this report has been gathered from public financial records, news releases, and other articles and references. While we believe the sources to be reliable, this does not guarantee the accuracy or completeness of the information provided. Copyright© AUS Consultants, Inc.

t 305.774.2945 f 305.774.1504 201 Alhambra Circle, Suite 701 | Coral Gables, FL 33134 w www.lllgpa.com

| Pg. 31 |

Royalty Source Intellectual Property Database

-A service provided by AUS Consultants-

Software: Business Enterprise 12/10/2017 |

||

| Licensee: | ACCELERATED ACQUISITIONS V INC | |

| DEMAND POOLING, INC. | ||

Licensor: |

DEMAND POOLING GLOBAL SERVICES LLC |

|

Royalty Rate, % (low range): |

10 |

|

Royalty Rate, % (high range): |

10 | |

| Upfront Fee: | $10 |

Licensed Property:

This Agreement is dated April 15, 2010.

The Licensor hereby granted the Licensee a License with a limited right of subLicense, to use the Intellectual Property. The License is exclusive (North American) and non-exclusive International (outside North America), with a 20 year term. The License shall become effective upon execution hereof and continue until the end of the Term provided Licensee has generated revenues net of expenses incurred in the normal course of operations, or has funded, a minimum of US$10,000,000 for “qualifying research, development and commercialization expenses”.

The Original Invention means a certain invention entitled “DPGS Technology.

Demand Pooling Global Services, LLC (“DPGS”) has developed certain intellectual Property consisting of the components outlined in the following paragraphs, and developed and designed to advance a business concept (“Business Concept”) and it is this Business Concept, combined with the technology and company expertise for which DPGS is seeking patent protection and which is the technology that is the subject of the Licensing Agreement between DPGS, as licensor and Accelerated Acquisitions V, Inc., as licensee (the “Company”).

The Business Concept consists of a number of approaches that facilitate improved pricing and greater affordability for products that state and local governments, the Company’s initial target market, purchase on a repetitive basis. While the Business Concept is equally applicable for non-governmental entities, such as utilities and a variety of other commercial enterprises, the Company has chosen to initially target the state and local governmental marketplace.

The Business Concept has, as its core product, a web-based electronic platform that facilitates the aggregation of demand (or “cooperative purchasing”) for high-ticket capital equipment and selected commodities. The Licensor's proprietary software facilitates cooperative purchases of similar products, even though each individual participant may maintain its own unique product specifications.

t 305.774.2945 f 305.774.1504 201 Alhambra Circle, Suite 701 | Coral Gables, FL 33134 w www.lllgpa.com

| Pg. 32 |

Datacenter

The DPGS system utilizes a leased facilities and capacity in a highly secure, fault tolerant, enterprise-class data center, designed to provide 100% uptime. Maintenance of the facilities, operation and management of the datacenter is outsourced to Databank LLC, 400 S. Akard St., Dallas, Texas 75202, in the former home of the Dallas Federal Reserve Bank, which enables DPGS and the Company to benefit from a state-of-the art infrastructure facility, while not having to commit significant resources, capital or human, to the build- out and ownership of the infrastructure. The ability to expand capacity and scalability requirements (space, power, networking and redundancy capability) is virtually without limitation. Security of the installed assets, information, applications and client data are of paramount importance. Security at the Datacenter is provided on a 24/7/365 basis. Card access is required to gain access, along with biometric hand scanning upon entry, and annual SAS 70 Audits are performed to ensure the delivery of services at the highest possible levels. Uptime of the website is essential for the Company to provide consistent and reliable services to our users. To ensure this level of service, our systems have reliable UPS/Backup Generators and reliable utility power. The UPS/Backup Generator power supply provides: true A+B power configurations, all UPS and Generator deployments provide N+1 redundancy, 800KVA MGE UPS Systems, 1200 KVA CAT UPS Systems, 2.0 megawatt generators, 1.5 megawatt generators. There are six utility feeds from the CBD grid, N+3 Transformers with ATS switches and the feeds to building are concrete encased. Cooling systems employ 3,500 Ton cooling tower capacity, 30 Ton Liebert CRAC Units, designed with N+1 redundancy and 80,000 gallon reserve make-up water tank.

Network

For the Internet, the network architecture utilizes redundant N+1 Core and N+1 access Foundry XMR, MLX and Cisco 6500 routers to provide a Highly Redundant and Highly Available Multi-Homed Internet Aggregation Hub. This coupled with multiple 10 Gigabit IP trunks from multiple Tier 1 Internet service providers makes the IP Hub would be considered highly robust. Embedded sFlow per port supports scalable hardware-based traffic monitoring across all switch ports without impact performance. Connectivity is provided to Databank by multiple vendors including: AboveNet, AirBand, Cogent, Time Warner, XO, Looking Glass, Level 3, InnerCity Fibernet, FiberLight, MCI, Qwest, Consolidated Communications, Texas Lone Star Network, TerraStar, Clearwire Communications, Current Communications and Verizon. The CBD fiber optic network is built upon 432 strands of fiber and available duct. The Company benefits from Databank’s significant level of redundancy and the users of the Company’s offering benefit from the consequent reliability of services which the Company can offer.

Application