Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - Interactive Brokers Group, Inc. | a2234631zex-32_2.htm |

| EX-32.1 - EX-32.1 - Interactive Brokers Group, Inc. | a2234631zex-32_1.htm |

| EX-31.2 - EX-31.2 - Interactive Brokers Group, Inc. | a2234631zex-31_2.htm |

| EX-31.1 - EX-31.1 - Interactive Brokers Group, Inc. | a2234631zex-31_1.htm |

| EX-23.1 - EX-23.1 - Interactive Brokers Group, Inc. | a2234631zex-23_1.htm |

| EX-21.1 - EX-21.1 - Interactive Brokers Group, Inc. | a2234631zex-21_1.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

INDEX TO FINANCIAL STATEMENTS AND FINANCIAL STATEMENT SCHEDULE

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the year ended December 31, 2017

Commission File Number: 001-33440

INTERACTIVE BROKERS GROUP, INC.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

30-0390693 (I.R.S. Employer Identification No.) |

One Pickwick Plaza

Greenwich, Connecticut 06830

(Address of principal executive office)

(203) 618-5800

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of the each exchange on which registered | |

|---|---|---|

| Common Stock, par value $.01 per share | The NASDAQ Stock Market LLC (NASDAQ Global Select Market) |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the securities act. Yes ý No o

Indicate by check mark whether the registrant is not required to file reports pursuant to Section 13 or 15(d) of the act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ý | Accelerated filer o | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company o Emerging growth company o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

The aggregate market value of the voting and non-voting common equity stock held by non-affiliates of the registrant was approximately $2,544,471,315 computed by reference to the $37.42 closing sale price of the common stock on the NASDAQ Global Select Market, on June 30, 2017, the last business day of the registrant's most recently completed second fiscal quarter.

As of February 23, 2018, there were 71,475,755 shares of the issuer's Class A common stock, par value $0.01 per share, outstanding and 100 shares of the issuer's Class B common stock, par value $0.01 per share, outstanding.

Documents Incorporated by Reference: Portions of Registrant's definitive proxy statement for its 2018 annual meeting of shareholders are incorporated by reference in Part III of this Form 10-K.

ANNUAL REPORT ON FORM 10-K FOR THE YEAR ENDED DECEMBER 31, 2017

i

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

We have included or incorporated by reference in this Annual Report on Form 10-K, and from time to time our management may make statements that may constitute "forward-looking statements" within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are not historical facts, but instead represent only our beliefs regarding future events, many of which, by their nature, are inherently uncertain and outside our control. These statements include statements other than historical information or statements of current condition and may relate to our future plans and objectives and results, among other things, and may also include our belief regarding the effect of various legal proceedings, as set forth under "Legal Proceedings" in Part I, Item 3 of this Annual Report on Form 10-K, as well as statements about the objectives and effectiveness of our liquidity policies, statements about trends in or growth opportunities for our businesses, in "Management's Discussion and Analysis of Financial Condition and Results of Operations" in Part II, Item 7 of this Annual Report on Form 10-K. By identifying these statements for you in this manner, we are alerting you to the possibility that our actual results may differ, possibly materially, from the anticipated results indicated in these forward-looking statements. Important factors that could cause actual results to differ from those in the forward-looking statements include, among others, those discussed below and under "Risk Factors" in Part I, Item 1A of this Annual Report on Form 10-K and "Management's Discussion and Analysis of Financial Condition and Results of Operations" in Part II, Item 7 of this Annual Report on Form 10-K.

Factors that could cause actual results to differ materially from any future results, expressed or implied, in these forward-looking statements include, but are not limited to, the following:

- •

- general economic conditions in the markets where we operate;

- •

- increased industry competition and downward pressures on bid/offer spreads in the remaining market making business we still operate and

electronic brokerage commissions;

- •

- risks inherent to the electronic market making and brokerage businesses;

- •

- implied versus actual price volatility levels of the products in which we continue to make markets;

- •

- the general level of interest rates;

- •

- failure to protect or enforce our intellectual property rights in our proprietary technology;

- •

- our ability to keep up with rapid technological change;

- •

- system failures and disruptions;

- •

- non-performance of third-party vendors;

- •

- conflicts of interest and other risks due to our ownership and holding company structure;

- •

- the loss of key executives and failure to recruit and retain qualified personnel;

- •

- the risks associated with the expansion of our business;

- •

- our possible inability to integrate any businesses we acquire;

- •

- compliance with laws and regulations, including those relating to the securities industry; and

- •

- other factors discussed under "Risk Factors" in Part I, Item 1A of this Annual Report on Form 10-K or elsewhere in this Annual Report on Form 10-K.

We undertake no obligation to publicly update or revise any forward-looking statements to reflect events or circumstances that may arise after the date of this Annual Report on Form 10-K.

1

Overview

Interactive Brokers Group, Inc. ("IBG, Inc." or the "Company") is an automated global electronic broker and market maker (although, we have substantially exited the options market making business—see Note 2—Discontinued Operations and Costs Associated with Exit or Disposal Activities to the audited consolidated financial statements in Part II Item 8 of this Annual Report on Form 10-K). We custody and service accounts for hedge and mutual funds, registered investment advisors, proprietary trading groups, introducing brokers and individual investors. We specialize in routing orders while striving to achieve best executions and processing trades in securities, futures, foreign exchange instruments, bonds and mutual funds on more than 120 electronic exchanges and market centers around the world. In the United States ("U.S."), we conduct our business primarily from our headquarters in Greenwich, Connecticut and from Chicago, Illinois. Abroad, we conduct our business through offices located in Canada, the United Kingdom, Switzerland, Liechtenstein, India, China (Hong Kong and Shanghai), Japan and Australia. As of December 31, 2017 we had 1,228 employees worldwide.

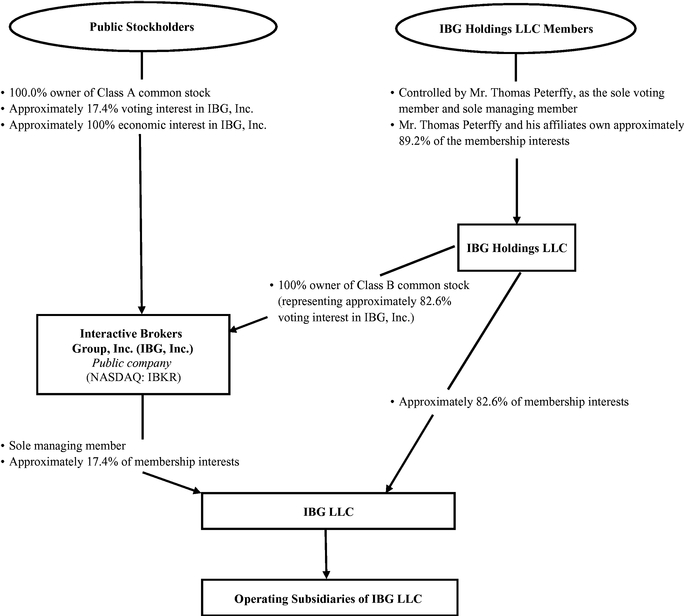

IBG, Inc. is a holding company and our primary assets are our ownership of approximately 17.4% of the membership interests of IBG LLC (the "Group"), the current holding company for our businesses. We are the sole managing member of IBG LLC. On May 3, 2007, IBG, Inc. priced its initial public offering (the "IPO") of shares of common stock. In connection with the IPO, IBG, Inc. purchased 10.0% of the membership interests in IBG LLC and began to consolidate IBG LLC's financial results into its financial statements.

When we use the terms "we," "us," and "our," we mean IBG LLC and its subsidiaries for periods prior to the IPO, and IBG, Inc. and its subsidiaries (including IBG LLC) for periods from and after the IPO. Unless otherwise indicated, the term "common stock" refers to the Class A common stock of IBG, Inc.

We are a successor to the market making business founded by our Chairman and Chief Executive Officer, Mr. Thomas Peterffy, on the floor of the American Stock Exchange in 1977. Since our inception, we have focused on developing proprietary software to automate broker-dealer functions. During that time, we have been a pioneer in developing and applying technology as a financial intermediary to increase liquidity and transparency in the capital markets in which we operate. The proliferation of electronic exchanges in the last 27 years has provided us with the opportunity to integrate our software with an increasing number of exchanges and market centers into one automatically functioning, computerized platform that requires minimal human intervention. Over four decades of developing our automated trading platforms and our automation of many middle and back office functions have allowed us to become one of the lowest cost providers of broker-dealer services and significantly increase the volume of trades we handle.

Our activities are divided into two principal business segments: (1) electronic brokerage and (2) market making (being discontinued):

- •

- As a direct market access broker, we serve the customers of both traditional brokers and prime brokers. We provide our customers with an advanced order management, trade execution and portfolio management platform at a very low cost. Our customers can simultaneously access many financial markets worldwide and trade across multiple asset classes (stocks, options, futures, foreign exchange ("forex"), bonds and mutual funds) denominated in 23 different currencies, on one screen, from a single account based in any major currency. Our large financial advisor and broker-dealer customers may "white brand" our trading interface (i.e., make our trading interface available to their customers without referencing our name), or

2

- •

- As a market maker, we provide continuous bid and offer quotations on securities and futures products listed on some electronic exchanges around the world. Our quotes are driven by proprietary mathematical models that assimilate market data and reevaluate our outstanding quotes many times per second. In the past several years our market making business has suffered from competitive pressures and, along with the rapid increase in our electronic brokerage business, we decided to discontinue our market making activities globally. On March 8, 2017 we announced our intention to discontinue our options market making activities globally and we are currently in the process of winding down these operations. Additionally, as we previously announced, we entered into a definitive transaction to transfer our U.S. options market making operations to Two Sigma Securities, LLC. This transaction closed on September 29, 2017. We intend to continue conducting certain proprietary trading activities in stocks and related instruments to facilitate our electronic brokerage customers' trading in products such as ETFs, ADRs, CFDs and other financial instruments.

they can select from among our modular functionalities, such as order routing, trade reporting or clearing on specific products or exchanges where they may not have up-to-date technology to offer their customers a comprehensive, global range of services and products. The emerging complexity of multiple market centers provided us with the opportunity of building and continuously adapting our order routing software to secure excellent execution prices for our customers.

Our electronic brokerage business benefits from our scale and volume, as well as from our proprietary technology, and expertise developed over the last 40 years. Our focus on the development and maintenance of our unique technology for trading, risk management, clearing, settlement, banking and regulatory compliance enables us to provide lower transaction costs to our customers than our competitors. In addition, we believe we gain a competitive advantage by applying the software features we have developed for a specific product or market to newly-introduced products and markets over others who may have less automated facilities or who operate only in a subset of the exchanges and market centers on which we operate. Our brokerage system contains unique architectural aspects that may impose a significant barrier to entry for firms wishing to compete in this business and permit us to compete favorably against our competitors. In addition, many of our regulatory and compliance functions have been built into our integrated order routing and custodial systems.

Our internet address is www.interactivebrokers.com and the investor relations section of our website is located at www.interactivebrokers.com/ir. We make available free of charge, on or through the investor relations section of our website, this Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, related Interactive Data exhibits, Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as well as proxy statements, registration statements, prospectus supplements, and Section 16 filings for our directors and officers, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the U.S. Securities and Exchange Commission ("SEC"). Also posted on our website are our Bylaws, our Amended and Restated Certificate of Incorporation, charters for the Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee of our board of directors, our Accounting Matters Complaint Policy, our Whistle Blower Hotline, our Corporate Governance Guidelines and our Code of Business Conduct and Ethics governing our directors, officers and employees. Within the time periods required by SEC and the NASDAQ Stock Market ("NASDAQ"), we will post on our website any amendment to the Code of Business Conduct and Ethics and any waiver applicable to any executive officer, director or senior financial officer. In addition, our website includes information concerning purchases and sales of our equity securities by our executive officers and directors, as well as disclosure relating to certain non-GAAP financial measures (as defined in Regulation G) promulgated under the Securities Act of 1933, as amended (the "Securities Act") and the Securities Exchange Act of 1934, as amended (the "Exchange Act") that we may make public orally, telephonically, by webcast, by broadcast or by similar means from time to time.

3

Our Investor Relations Department can be contacted at Interactive Brokers Group, Inc., Eight Greenwich Office Park, Greenwich, Connecticut 06831, Attn: Investor Relations, telephone: 203-618-4070, e-mail: investor-relations@interactivebrokers.com.

Our Organizational Structure and Overview of Recapitalization Transactions

The graphic below illustrates our current ownership structure and reflects current ownership percentages. The graphic below does not display the subsidiaries of IBG LLC.

Prior to the IPO, we had historically conducted our business through a limited liability company structure. Our primary assets are our ownership of approximately 17.4% of the membership interests of IBG LLC, the current holding company for our businesses, and our controlling interest and related contractual rights as the sole managing member of IBG LLC. The remaining approximately 82.6% of IBG LLC membership interests are held by IBG Holdings LLC ("Holdings"), a holding company that is owned by our founder, Chairman and Chief Executive Officer, Mr. Thomas Peterffy and his affiliates, management and other employees of IBG LLC, and certain other members. The IBG LLC membership interests held by Holdings will be subject to purchase by us over time in connection with

4

offerings by us of shares of our common stock. The below table shows the amount of IBG LLC membership interests held by IBG, Inc. and Holdings as of December 31, 2017.

| |

IBG, Inc. | Holdings | Total | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

Ownership % |

17.4 | % | 82.6 | % | 100.0 | % | ||||

Membership interests |

71,479,604 | 340,229,444 | 411,709,048 | |||||||

Purchases of IBG LLC membership interests, held by Holdings, by the Company are governed by the exchange agreement among us, IBG LLC, Holdings and the historical members of IBG LLC, (the "Exchange Agreement"), a copy of which was filed as an exhibit to our Quarterly Report on Form 10-Q for the quarter ended September 30, 2009 and filed with the SEC on November 9, 2009. The Exchange Agreement, as amended June 6, 2012, provides that the Company may facilitate the redemption by Holdings of interests held by its members through the issuance of shares of common stock through a public offering in exchange for the interests in IBG LLC being redeemed by Holdings. The June 6, 2012 amendment (the "Amendment"), which was filed as an exhibit to our Form 8-K filed with the SEC on June 6, 2012, eliminated from the Exchange Agreement an alternative funding method, which provided that upon approval by the board of directors and by agreement of the Company, IBG LLC and Holdings, redemptions could be made in cash.

At the time of the Company's IPO in 2007, three hundred sixty (360) million shares of authorized common stock were reserved for future sales and redemptions. From 2008 through 2010, Holdings redeemed 5,013,259 IBG LLC shares for a total of $114 million, which redemptions were funded using cash on hand at IBG LLC. Upon cash redemption these IBG LLC shares were retired.

In June 2011, with the consent of Holdings and the Company (on its own behalf and acting as the sole managing member of IBG LLC), IBG LLC agreed to redeem certain membership interests from Holdings through the sale of common stock and to distribute the proceeds of such sale to the beneficial owners of such membership interests. On August 4, 2011 and November 12, 2013 the Company filed "shelf" Registration Statements on Form S-3 (File Number 333-176053 and 333-192275) with the SEC for the issuance of additional shares in connection with Holdings requesting redemption of a portion of its member interests in IBG LLC. Under these shelf registration statements, the Company issued 12,643,495 shares of common stock (with a fair value of $362 million) to Holdings in exchange for an equivalent number of shares of member interests in IBG LLC.

On July 28, 2017, the Company filed a "shelf" Registration Statement on Form S-3 (File Number 333-219552) with the SEC for the issuance of additional shares in connection with Holdings requesting redemption of a portion of its member interests in IBG LLC. Under this shelf registration statement, in 2017, the Company issued 1,214,860 shares of common stock (with a fair value of $49 million) to Holdings in exchange for an equivalent number of shares of member interests in IBG LLC.

5

Segment Operating Results

| |

|

Year Ended December 31, | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

|

2017 | 2016 | 2015 | ||||||||

| |

|

(in millions) |

||||||||||

Electronic Brokerage |

Net revenues | $ | 1,405 | $ | 1,239 | $ | 1,097 | |||||

|

Non-interest expenses(1) | 545 | 483 | 561 | ||||||||

| | | | | | | | | | | | | |

|

Income before income taxes | $ | 860 | $ | 756 | $ | 536 | |||||

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

|

Pre-tax profit margin | 61 | % | 61 | % | 49 | % | |||||

Market Making |

Net revenues |

$ |

86 |

$ |

190 |

$ |

298 |

|||||

|

Non-interest expenses | 113 | 146 | 168 | ||||||||

| | | | | | | | | | | | | |

|

Income (loss) before income taxes | $ | (27 | ) | $ | 44 | $ | 130 | ||||

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

|

Pre-tax profit (loss) margin | (31 | )% | 23 | % | 44 | % | |||||

Corporate(2) |

Net revenues |

$ |

211 |

$ |

(33 |

) |

$ |

(206 |

) |

|||

|

Non-interest expenses | (5 | ) | 6 | 2 | |||||||

| | | | | | | | | | | | | |

|

Income (loss) before income taxes | $ | 216 | $ | (39 | ) | $ | (208 | ) | |||

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Total |

Net revenues | $ | 1,702 | $ | 1,396 | $ | 1,189 | |||||

|

Non-interest expenses | 653 | 635 | 731 | ||||||||

| | | | | | | | | | | | | |

|

Income before income taxes | $ | 1,049 | $ | 761 | $ | 458 | |||||

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

|

Pre-tax profit margin | 62 | % | 55 | % | 39 | % | |||||

- (1)

- Electronic

brokerage non-interest expenses include an unusual loss of $137 million in 2015. See "Management's Discussion and Analysis of Financial Condition

and Results of Operations" in Part II Item 7 of this Annual Report on Form 10-K.

- (2)

- The corporate segment includes corporate related activities, inter-segment eliminations and net gains and losses on positions held as part of our overall currency diversification strategy. Corporate net revenues include a $93 million gain from the remeasurement of our Tax Receivable Agreement liability as a result of the enactment of the Tax Cuts and Jobs Act. See "Management's Discussion and Analysis of Financial Condition and Results of Operations" in Part II Item 7 and Note 4 and to the audited consolidated financial statements in Part II, Item 8 of this Annual Report on Form 10-K.

Financial information concerning our business segments for each of 2017, 2016, and 2015 is set forth in "Management's Discussion and Analysis of Financial Condition and Results of Operations," and the audited consolidated financial statements and the notes thereto, which are in Part II, Items 7 and 8 of this Annual Report on Form 10-K.

Electronic Brokerage—Interactive Brokers

Electronic brokerage represented 94% of net revenues and 103% of income before income taxes from electronic brokerage and market making combined during 2017. We conduct our electronic brokerage business through our Interactive Brokers ("IB") subsidiaries. As an electronic broker, we execute, clear and settle trades globally for both institutional and individual customers. Capitalizing on our proprietary technology originally developed for our market making business, our systems provide our customers with the capability to monitor multiple markets around the world simultaneously and to execute trades electronically in these markets at a low cost in multiple products and currencies from a single trading account.

Since launching this business in 1993, we have grown to approximately 483 thousand institutional and individual brokerage customers. We provide our customers with what we believe to be one of the most

6

effective and efficient electronic brokerage platforms in the industry. The following are key highlights of our electronic brokerage business:

- •

- Low Costs—We provide our customers with among the industry's lowest overall

transaction costs in two ways. First, we offer among the lowest execution, commission and financing costs in the industry. Second, our customers benefit from our advanced routing of orders designed to

achieve the best available trade price. In order to illustrate this advantage, we publish monthly brokerage metrics including our customers' average net trade cost for Reg.-NMS stocks. In 2017,

customers' total all-in cost of executing and clearing U.S. Reg.-NMS stocks through IB, including brokerage commissions, regulatory and exchange fees and market impact, was 1.3 basis points of trade

money, as measured against a daily volume-weighted average price ("VWAP") benchmark.

- •

- Automated Risk Controls—Throughout the trading day, we calculate margin

requirements for each of our customers on a real-time basis across all product classes (stocks, options, futures, bonds, forex and mutual funds) and across all currencies. Our customers are alerted to

approaching margin violations and if a customer's equity falls below what is required to support that customer's margin, we attempt to automatically liquidate positions on a real-time basis to bring

the customer's account into margin compliance. This is done to protect IB, as well as the customer, from excessive losses.

- •

- IB Universal AccountSM—From a single point of entry in one IB

Universal AccountSM our customers are able to transact in 23 currencies, across multiple classes of tradable, primarily exchange-listed products, including stocks, options, futures,

bonds, forex and mutual funds traded on more than 120 exchanges and market centers in 26 countries around the world seamlessly.

- •

- IB SmartRoutingSM—Our customers benefit from our advanced order

routing technology. IB SmartRoutingSM retains control of the customer's order, continuously searches for the best available price and, unlike most other routers, dynamically routes and

re-routes all or parts of a customer's order to achieve optimal execution and among the lowest execution and commission costs in the industry. To highlight the quality of our price executions, we

publish on our website independent measurements performed by a third party provider of transaction analysis to illustrate IB's net price improvement versus the industry. We also offer Transaction Cost

Analysis reporting to allow customers to track execution performance by criteria including trade date, trade price, underlying security and exchange.

- •

- Flexible and Customizable System—Our platform is designed to provide an efficient

customer experience, beginning with a highly automated account opening process and ending with a fast trade execution, with real-time position monitoring. Our sophisticated interface provides

interactive real-time views of account balances, positions, profits or losses, buying power and "what-if" scenarios to enable our customers to more easily make informed investment decisions and trade

efficiently. Our system is configured to remember the user's preferences and is specifically designed for multi-screen systems. When away from their main workstations, customers are able to access

their accounts through our IB WebTraderSM or MobileTraderSM interfaces.

- •

- Interactive AnalyticsSM and IB Option AnalyticsSM—We offer our customers state-of-the-art tools, which include a customizable trading platform, advanced analytic tools and over 60 sophisticated order types and algorithms. We also provide a real-time option analytics window which displays values that reflect the rate of change of an option's price with respect to a unit change in each of a number of risk dimensions.

7

- •

- Probability Lab® (Patent Pending)—The Probability Lab provides

customers with an intuitive, visual method to analyze market participants' future stock price forecasts based on current option prices. This tool compares a customer's stock price forecast versus that

of the market, and scans the entire option universe for the highest Sharpe ratio multi-leg option strategies that take advantage of the customer's forecast.

- •

- IB Risk NavigatorSM—We offer free to all customers our real-time

market risk management platform that unifies exposure across multiple asset classes around the globe. The system is capable of identifying overexposure to risk by starting at the portfolio level and

drilling down into successively greater detail within multiple report views. Report data is updated every ten seconds or upon changes to portfolio composition. Predefined reports allow the

summarization of a portfolio from different risk perspectives, and allow views of Exposure, Value at Risk ("VaR"), Delta, Gamma, Vega and Theta, profit and loss and position quantity measures for the

different portfolio views. The system also offers the customer the ability to modify positions through "what-if" scenarios that show hypothetical changes to the risk summary.

- •

- White Branding—Our large financial advisor and broker-dealer customers may "white

brand" our trading interface, account management and reports with their firm's identity. Broker-dealer customers can also select from among our modular functionalities, such as order routing, trade

reporting or clearing, on specific products or exchanges where they may not have up-to-date technology, in order to offer to their customers a complete global range of services and products.

- •

- Securities Financing Services—We offer a suite of automated Stock Borrow and

Lending tools, including our depth of availability, transparent rates, global reach and dedicated service representatives. Our Stock Yield Enhancement Program allows our customers to lend their

fully-paid stock shares to us in exchange for cash collateral. In turn, we lend these stocks in exchange for collateral and earn stock lending fees. We pay our customers a rebate on the cash

collateral generally equal to 50% of the income we earn from lending the shares. This allows customers holding fully-paid long stock positions to enhance their returns.

- •

- Investors' Marketplace—The Investors' Marketplace is an expansion of our Money

Manager Marketplace and our Hedge Fund Capital Introduction program. This program is the first electronic meeting place that brings together individual investors, financial advisors, money managers,

fund managers, research analysts, technology providers, business developers and administrators, allowing them to interact to form connections and conduct business.

- •

- Trade Desk—We offer broker-assisted trading through our block trade desk, which is

ideal when customers are away from their computer, or if they just want another set of eyes watching their orders and updating them on market changes.

- •

- Model Portfolios—Model Portfolios offer advisors an efficient and time-saving

approach to investing customer assets. They allow advisors to create groupings of financial instruments based on specific investment themes, and then invest customer funds into these models.

- •

- Portfolio Builder—Portfolio Builder allows our customers to set up an investment strategy based on research and rankings from top buy-side providers and fundamental data; use filters to define the universe of equities that will comprise their strategy and back-test their strategy using up to three years of historical performance; work in hypothetical mode to adjust the strategy until the historical performance meets their standards; and with the click of a button let the system create the orders to invest in a strategy and track its performance in their portfolio.

8

- •

- Greenwich Compliance—Greenwich Advisor Compliance Services ("Greenwich Compliance")

offers direct expert registration and start-up compliance services, as well as answers to basic day-to-day compliance questions for experienced investors and traders looking to start their own

investment advisor firms. Greenwich Compliance professionals have regulatory and industry experience, and can help investment advisors trading on the IB platform meet their registration and compliance

needs.

- •

- IB Asset Management—IB Asset Management (formerly known as Covestor) recruits

registered financial advisors, vets them, analyzes their investment track records, and groups them by their risk profile. Retail investors who are interested in having their individual accounts

robo-traded are grouped by their risk and return preferences. Retail investors can assign their accounts to be traded by one or more advisors. IB Asset Management also offers to IB customers Smart

Beta Portfolios which combine the benefits of actively managed fund stock selection techniques with passive ETF low cost automation to provide broad market exposure and potentially higher returns.

- •

- Interactive Brokers Debit Mastercard®—Interactive Brokers Debit

Mastercard® allows customers to spend and borrow directly against their account at lower rates than credit cards, personal loans and home equity lines of credit, with no monthly minimum

payments and no late fees. Customers can use their card to make purchases and ATM withdrawals anywhere Debit Mastercard® is accepted around the world.

- •

- Insured Bank Deposit Sweep Program—Our Insured Bank Deposit Sweep Program provides eligible IB customers with up to $2,500,000 of Federal Deposit Insurance Corporation ("FDIC") insurance on their eligible cash balances in addition to the existing $250,000 Securities Investor Protection Corporation ("SIPC") coverage for total coverage of $2,750,000. Customers continue earning the same competitive interest rates currently applied to cash held in IB accounts. IB sweeps each participating customer's eligible credit balances daily to one or more banks, up to $246,500 per bank, allowing for the accrual of interest and keeping within the FDIC protected threshold. Cash balances above $2,750,000 remain subject to safeguarding under the SEC's Customer Protection Rule 15c3-3.

We are able to provide our customers with high-speed trade execution at low commission rates, in large part because of our proprietary technology. As a result of our advanced electronic brokerage platform, we attract sophisticated and active investors. No single customer represented more than 1.5% of our commissions in 2017.

Market Making—Timber Hill

Market making represented 6% of net revenues from electronic brokerage and market making combined during 2017. We conduct our market making business primarily through our Timber Hill ("TH") subsidiaries. On March 8, 2017 we announced our intention to discontinue our options market making activities globally, and we are currently in the process of winding down these operations. Additionally, as previously announced, we entered into a definitive transaction to transfer our U.S. options market making operations to Two Sigma Securities, LLC. This transaction closed on September 29, 2017. We intend to continue conducting certain proprietary trading activities in stocks and related instruments to facilitate our electronic brokerage customers' trading in products such as ETFs, ADRs, CFDs and other financial instruments. However, we do not expect this activity to be of sufficient size as to require reporting these activities as a separate operating segment after we discontinue our options market making activities.

As a market maker, we provide liquidity by offering competitively tight bid/offer spreads over a broad base of tradable, exchange-listed products, including equity derivative products, equity index derivative products, equity securities and futures. As principal, we commit our own capital and derive revenues or

9

incur losses from the difference between the price paid when securities are bought and the price received when those securities are sold. Historically, our profits have been principally a function of transaction volume and price volatility of electronic exchange-traded products rather than the direction of price movements. Other factors, including the ratio of actual to implied volatility and shifts in foreign currency exchange rates, can also have a meaningful impact on our results, as described further in "Business Environment" in Part II, Item 7 of this Annual Report on Form 10-K.

Our strategy is to calculate quotes at which supply and demand for a particular security are likely to be in balance a few seconds ahead of the market and execute small trades at tiny but favorable differentials. Because we provide continuous bid and offer quotations and we are continuously both buying and selling quoted securities, we may have either a long or a short position in a particular product at a given point in time. As a matter of practice, we will generally not take portfolio positions in either the broad market or the financial instruments of specific issuers in anticipation that prices will either rise or fall. Our entire portfolio is evaluated many times per second and continuously rebalanced throughout the trading day, thus minimizing the risk of our portfolio at all times. This real-time rebalancing of our portfolio, together with our real-time proprietary risk management system, enables us to curtail risk and trade efficiently. Our quotes are based on our proprietary model rather than customer order flow.

As of December 31, 2017, we continue to conduct market making operations in Canada through our subsidiary, Timber Hill Canada Company ("THC") at the Toronto Stock Exchange and Canadian Derivatives Exchange Bourse de Montreal Inc.; in India through our subsidiary, Interactive Brokers (India) Private Limited ("IBI"), which is a member of the National Stock Exchange of India Ltd. and the Bombay Stock Exchange; and in Hong Kong through our subsidiary, Interactive Brokers Hong Kong Limited, a member of the cash and derivatives markets of the Hong Kong Exchange. All other options market making operations we previously conducted were discontinued during 2017. We expect to continue assessing whether and when to discontinue the remaining operations.

Most of the above trading activities take place on exchanges, and all securities and commodities that we trade are cleared by exchange owned or authorized clearing houses.

Technology

Our proprietary technology is the key to our success. We believe that integrating our system with electronic exchanges and market centers results in transparency, liquidity and efficiencies of scale. Together with the IB SmartRoutingSM system and our low commissions, this approach reduces overall transaction costs to our customers and, in turn, increases our transaction volume and profits. Over the past 40 years, we have developed an integrated trading system and communications network and have positioned our company as an efficient conduit for the global flow of risk capital across asset and product classes on electronic exchanges around the world, permitting us to have one of the lowest cost structures in the industry. We believe that developing, maintaining and continuing to enhance our proprietary technology provides us and our customers with the competitive advantage of being able to adapt quickly to the changing environment of our industry and to take advantage of opportunities presented by new exchanges, products or regulatory changes before our competitors.

Our proprietary technology infrastructure enables us to provide our customers with the ability to execute trades at among the lowest commission costs in the industry. Customer trades are both automatically captured and reported in real time in our system. Our customers trade on more than 120 exchanges and market centers in 26 countries around the world. These exchanges and market centers are all partially or fully electronic, meaning that a customer can buy or sell a product traded on that exchange via an electronic link from his or her computer terminal through our system to the exchange. We offer our products and services through a global communications network that is designed to provide secure, reliable and timely access to the most current market information. We provide our customers with a variety of means to connect to our brokerage systems, including dedicated point-to-point data lines, virtual private networks and the Internet.

10

Specifically, our customers receive worldwide electronic access connectivity through our Trader Workstation (our real-time Java-based trading platform), our proprietary Application Programming Interface ("API"), and/or industry standard Financial Information Exchange ("FIX") connectivity. Customers who want a professional quality trading application with a sophisticated user interface utilize our Trader Workstation, which can be accessed through a desktop or variety of mobile devices. Customers interested in developing program trading applications in MS-Excel, Java, Visual Basic or C++ utilize our API. Large institutions with FIX infrastructure prefer to use our FIX solution for seamless integration of their existing order gathering and reporting applications.

While many brokerages, including some online brokerages, rely on manual procedures to execute many day-to-day functions, we employ proprietary technology to automate, or otherwise facilitate, many of the following functions:

- •

- account opening process;

- •

- order routing and best execution;

- •

- seamless trading across all types of securities and currencies around the world from one account;

- •

- order types and analytical tools offered to customers;

- •

- delivery of customer information, such as confirmations, customizable real-time account statements and audit trails;

- •

- customer service; and

- •

- risk management through automated real-time credit management of all new orders and margin monitoring.

Research and Development

One of our core strengths is our expertise in the rapid development and deployment of automated technology for the financial markets. Our core software technology is developed internally, and we do not generally rely on outside vendors for software development or maintenance. To achieve optimal performance from our systems, we are continuously rewriting and upgrading our software. Use of the best available technology not only improves our performance but also helps us attract and retain talented developers. Our software development costs are low because the employees who oversee the development of the software are often the same employees who design the application, evaluate its performance, and participate along with our quality assurance professionals in our robust quality assurance testing procedures. The involvement of our developers in each of these processes enables us to add features and further refine our software rapidly.

Our internally-developed, fully integrated trading and risk management systems are unique and transact across all product classes on more than 120 electronic exchanges and market centers and in 23 currencies around the world. These systems have the flexibility to assimilate new exchanges and new product classes without compromising transaction speed or fault tolerance. Fault tolerance, or the ability to maintain system performance despite exchange malfunctions or hardware failures, is crucial to ensuring best executions for our customers. Our systems are designed to detect exchange malfunctions and quickly take corrective actions by re-routing pending orders.

Our company is technology-focused, and our management team is hands-on and technology-savvy. Most members of the management team write detailed program specifications for new applications. The development queue is prioritized and highly disciplined. Progress on programming initiatives is generally tracked on a bi-weekly basis by a steering committee consisting of senior executives. This enables us to prioritize key initiatives and achieve rapid results. All new business starts as a software development project. We generally do not engage in any business that we cannot automate and incorporate into our platform prior to entering into the business.

11

The rapid software development and deployment cycle is achieved by our ability to leverage a highly integrated, object-oriented development environment. The software code is modular, with each object providing a specific function and being reusable in multiple applications. New software releases are tracked and tested with proprietary automated testing tools. We are not hindered by disparate and often limiting legacy systems assembled through acquisitions. Virtually all of our software has been developed and maintained with a unified purpose.

For over 40 years, we have built and continuously refined our automated and integrated, real-time systems for world-wide trading, risk management, clearing and cash management, among others. We have also assembled a proprietary connectivity network between us and exchanges around the world. Efficiency and speed in performing prescribed functions are always crucial requirements for our systems. As a result, our trading systems are able to assimilate market data, recalculate and distribute streaming quotes for tradable products in all product classes many times per second.

Risk Management Activities

The core of our risk management philosophy is the utilization of our fully integrated computer systems to perform critical, risk-management activities on a real-time basis. In our market making business, our real-time integrated risk management system seeks to ensure that our overall positions are continuously hedged at all times, curtailing risk. In our electronic brokerage business, integrated risk management seeks to ensure that each customer's positions are continuously credit checked and brought into compliance if equity falls short of margin requirements, curtailing bad debt losses.

We actively manage our global currency exposure on a continuous basis by maintaining our equity in a basket of currencies we call the GLOBAL. We define the GLOBAL as consisting of fractions of a U.S. dollar, Euro, Japanese yen, British pound, Hong Kong dollar, Canadian dollar, Indian rupee, Swiss franc, Chinese renminbi, Australian dollar, Mexican peso, Swedish krona, Norwegian krone, and Danish krone. We currently transact business and are required to manage balances in each of these 14 currencies. The currencies comprising the GLOBAL and their relative proportions can change over time. For example, in light of our decision to wind down our options market making activities globally, we removed the Singapore dollar (SGD) and realigned the relative weight of the U.S. dollar (USD) versus the other currency components to better reflect our businesses going forward. The new composition went into effect as of the close of business on March 31, 2017. Additional information regarding our currency diversification strategy is set forth in "Quantitative and Qualitative Disclosures about Market Risk" in Part II, Item 7A of this Annual Report on Form 10-K.

Electronic Brokerage

We calculate margin requirements for each of our customers on a real-time basis across all product classes (stocks, options, futures, forex, bonds and mutual funds) and across all currencies. Recognizing that our customers are experienced investors, we expect our customers to manage their positions proactively and we provide tools to facilitate our customers' position management. However, if a customer's equity falls below what is required to support that customer's margin, we will automatically liquidate positions on a real-time basis to bring the customer's account into margin compliance. We do this to protect us, as well as the customer, from excessive losses. These systems further contribute to our low-cost structure. The entire credit management process is completely automated.

As a safeguard, all liquidations are displayed on custom built liquidation monitoring screens that are part of the toolset our technical staff uses to monitor performance of our systems at all times the markets around the world are open. In the event our systems absorb erroneous market data from exchanges, which prompts liquidations, risk specialists on our technical staff have the capability to halt liquidations that meet specific criteria. The liquidation halt function is highly restricted.

12

Our customer interface includes color coding on the account screen and pop-up warning messages to notify customers that they are approaching their margin limits. This feature allows customers to take action, such as entering margin reducing trades, to avoid having us liquidate their positions. These tools and real-time margining allow our customers to understand their trading risk at any moment of the day and help us maintain low commissions.

Market Making

We employ certain hedging and risk management techniques to protect us from a severe market dislocation. Our risk management policies are developed and implemented by our Chairman and our steering committee, which is comprised of senior executives of our various companies. Our strategy is to calculate quotes a few seconds ahead of the market and execute small trades at a tiny but favorable differential as a result. This strategy is made possible by our proprietary pricing model, which evaluates and monitors the risks inherent in our portfolio, assimilates market data and reevaluates the outstanding quotes in our portfolio many times per second. Our model automatically rebalances our positions throughout each trading day to manage risk exposures both on our options and futures positions and the underlying securities, and it will price the increased risk that a position would add to the overall portfolio into the bid and offer prices we post. Under risk management policies implemented and monitored primarily through our computer systems, reports to management, including risk profiles, profit and loss analysis and trading performance, are prepared on a real-time basis as well as daily and periodical bases. Although our market making is completely automated, the trading process and our risk are monitored by a team of individuals who, in real-time, observe various risk parameters of our consolidated positions. Our assets and liabilities are marked-to-market daily for financial reporting purposes and re-valued continuously throughout the trading day for risk management and asset/liability management purposes.

Operational Controls

We have automated the full cycle of controls surrounding our businesses. Key automated controls include the following:

- •

- Our technical operations team continuously monitors our network and the proper functioning of each of our nodes (exchanges and market centers,

internet service providers ("ISPs"), leased customer lines and our own data centers) around the world.

- •

- Our real-time credit manager software provides pre and post-execution controls by:

- •

- testing every customer order to ensure that the customer's account holds enough equity to support the execution of the order,

rejecting the order if equity is insufficient or directing the order to an execution destination without delay if equity is sufficient; and

- •

- continuously updating a customer account's equity and margin requirements and, if the account's equity falls below its minimum

margin requirements, automatically issuing liquidating orders in a smart sequence designed to minimize the impact on the account's equity.

- •

- Our market making system continuously evaluates securities and futures products in which we provide bid and offer quotes and changes our bids

and offers in such a way as to maintain an overall hedge and a low-risk profile. The speed of communicating with exchanges and market centers is maximized through continuous software and network

engineering maintenance, thereby allowing us to achieve real-time controls over market exposure.

- •

- Our clearing system captures trades in real-time and performs automated reconciliation of trades and positions, corporate action processing, customer account transfer, options exercise, securities lending and inventory management, allowing us to effectively manage operational risk.

13

- •

- Our accounting system operates with automated data feeds from clearing and banking systems, allowing us to produce financial statements for all

parts of our business every day by mid-day on the day following trade date.

- •

- Software developed to interface with the accounting and market making systems performs daily profit and loss reconciliations, which provide tight financial controls over market making functions.

Transaction Processing

Our transaction processing is automated over the full life cycle of a trade. Our fully automated smart router system searches for the best possible combination of prices available at the time a customer order is placed and immediately seeks to execute that order electronically or send it where the order has the highest possibility of execution at the best price. Our market making software generates and disseminates to exchanges and market centers continuous bid and offer quotes on tradable, exchange-listed products.

At the moment a trade is executed, our systems capture and deliver this information back to the source, either to the customer via the brokerage system or the market making system, in most cases within a fraction of a second. Simultaneously, the trade record is written into our clearing system, where it flows through a chain of control accounts that allow us to reconcile trades, positions and money until the final settlement occurs. Our integrated software tracks other important activities, such as dividends, corporate actions, options exercises, securities lending, margining, risk management and funds receipt and disbursement.

IB SmartRoutingSM

IB SmartRoutingSM searches for the best destination price in view of the displayed prices, sizes and accumulated statistical information about the behavior of market centers at the time an order is placed, and IB SmartRoutingSM immediately seeks to execute that order electronically. Unlike other smart routers, IB SmartRoutingSM never relinquishes control of the order, and constantly searches for the best price. It continuously evaluates fast-changing market conditions and dynamically re-routes all or parts of the order seeking to achieve optimal execution. IB SmartRoutingSM represents each leg of a spread order independently and enters each leg at the best possible venue. IB SmartRouting AutorecoverySM re-routes a customer's U.S. options order in the case of an exchange malfunction, and we undertake the risk of double executions. In addition, IB SmartRoutingSM checks each new order to see if it could be executed against any of its pending orders. As the system gains more users, this feature becomes more important for customers in a world of multiple exchanges, market centers and penny priced orders because it increases the possibility of best executions for our customers ahead of customers of other brokers. As a result of this feature, our customers have a greater chance of executing limit orders and can do so sooner than those who use other routers.

Clearing and Margining

Our activities in the U.S. are entirely self-cleared. We are a clearing member of OCC (the Options Clearing Corporation), the Chicago Mercantile Exchange Clearing House ("CMECH"), The Depository Trust & Clearing Corporation and ICE Clear U.S.

In addition, we are fully or partially self-cleared in Canada, the United Kingdom, Switzerland, France, Germany, Belgium, Austria, the Netherlands, Norway, Sweden, Denmark, Finland, India, Hong Kong, and Australia.

14

Customers

We established our electronic brokerage subsidiary, Interactive Brokers LLC ("IB LLC"), in 1993 to enhance the use of our global network of trading interfaces, exchange and clearinghouse memberships, and regulatory registrations assembled over the prior 17 years to serve our market making business. We realized that electronic access to market centers worldwide through our network could easily be utilized by the very same floor traders and trading desk professionals who, in the coming years, would be displaced by the conversion of exchanges from open outcry to electronic systems.

We currently service approximately 483 thousand cleared customer accounts. Our customers reside in over 200 countries and territories around the world. Our target customer is one that requires the latest in trading technology, worldwide access and expects low overall transaction costs. Our customers are mainly comprised of "self-service" individuals, former floor traders, trading desk professionals, electronic retail brokers, hedge funds, financial advisors who are comfortable with technology, as well as introducing brokers and banks that require global access.

Our customers primarily fall into two groups based on services provided: cleared customers and non-cleared customers, the latter also known as trade execution customers. By offering portfolio margining and other institutional services, we have been able to persuade many of our trade execution hedge fund customers to utilize our cleared business solution, which benefits the hedge funds in terms of cost savings. Prime brokers may offer increased leverage over Regulation T credit limitations and the Financial Industry Regulatory Authority ("FINRA") margin requirements through offshore entities and joint back office arrangements. Through portfolio margining, we are able to offer similar leverage with lower margin requirements that reflect the reduced risk of a hedged portfolio.

- •

- Cleared Customers: We provide trade execution and clearing services to our cleared customers who are generally attracted to our low

commissions, low financing rates, high interest paid and best price execution. From small market making groups and individual market makers, our cleared customer base has expanded over the years to

include institutional and individual traders and investors, financial advisors and introducing brokers.

- •

- Trade Execution Customers: We offer trade execution for customers who choose to clear with another prime broker or a custodian bank; these customers are able to take advantage of our low commissions for trade execution as well as our best price execution.

Our non-cleared customers include online brokers and the customer trading units of commercial banks. These customers are attracted by our IB SmartRoutingSM technology as well as our direct access to stock, options, futures, forex and bond markets worldwide.

Our customers receive worldwide electronic access connectivity in one of three ways: the Trader Workstation via desktop or mobile device, our proprietary API, and/or industry standard FIX connectivity.

Employees and Culture

We take pride in our technology-focused company culture and embrace it as one of our fundamental strengths. We remain committed to improving our technology and we try to minimize corporate hierarchy to facilitate efficient communication among employees. We have assembled what we believe is a highly talented group of employees. As we grow, we expect to continue to provide significant rewards for our employees who provide substantial value to us and the world's financial markets.

As of December 31, 2017, we had 1,228 employees, of which 1,213 own shares of the Company either vested, unvested or both, all of whom were employed on a full-time basis. None of our employees are covered by collective bargaining agreements. We believe that our relations with our employees are good.

15

Competition

Electronic Brokerage

The market for electronic brokerage services is rapidly evolving and highly competitive. We believe that we fit neither within the definition of a traditional broker nor that of a traditional prime broker. Our primary competitors include the prime brokerage and electronic brokerage arms of major commercial and investment banks and brokers, such as Goldman Sachs, Morgan Stanley and JP Morgan; and offerings to target professional traders by large retail online brokers. We also encounter competition to a lesser extent from full commission brokerage firms, including Merrill Lynch and Morgan Stanley, as well as other financial institutions, most of which provide online brokerage services. The electronic brokerage businesses of many of our competitors are relatively insignificant in the totality of their firms' business.

Market Making

The competitive environment for market makers has evolved considerably in the past several years, most notably with the rise in high frequency traders ("HFTs"), which transact significant trading volume on electronic exchanges by using complex algorithms and high-speed execution software that analyzes market conditions. HFTs that are not registered market makers operate with fewer regulatory restrictions and are able to move more quickly and trade more cheaply. This issue has been an area of focus amongst regulators who examine the practices of HFTs and their impact on market structure.

As previously described we are in the process of discontinuing our options market making activities globally.

Regulation

Our securities and derivatives businesses are extensively regulated by U.S. federal and state regulators, foreign regulatory agencies, numerous exchanges and self-regulatory organizations of which our subsidiaries are members. In the current era of heightened regulation of financial institutions, we expect to incur increasing compliance costs, along with the industry as a whole. Our approach has been to build many of our regulatory and compliance functions into our integrated market making, order routing and custodial systems.

Overview

As a registered U.S. broker-dealer, IB LLC and Timber Hill LLC ("TH LLC") are subject to the rules and regulations of the Exchange Act, and as members of various exchanges, we are also subject to such exchanges' rules and requirements. Additionally, IB LLC is subject to the Commodity Exchange Act and rules promulgated by the Commodity Futures Trading Commission ("CFTC") and the various commodity exchanges of which it is a member. We are also subject to the requirements of various self-regulatory organizations such as FINRA and the National Futures Association ("NFA"). Our foreign affiliates are similarly regulated under the laws and institutional framework of the countries in which they operate.

U.S. broker-dealers and futures commission merchants are subject to laws, rules and regulations that cover all aspects of the securities and derivatives business, including:

- •

- sales methods;

- •

- trade practices;

- •

- use and safekeeping of customers' funds and securities;

16

- •

- capital structure;

- •

- risk management;

- •

- record-keeping;

- •

- financing of customers' purchases; and

- •

- conduct of directors, officers and employees.

In addition, the businesses that we may conduct are limited by our agreements with and our oversight by regulators. Participation in new business lines, including trading of new products or participation on new exchanges or in new countries often requires governmental and/or exchange approvals, which may take significant time and resources. As a result, we may be prevented from entering new businesses that may be profitable in a timely manner, or at all.

As certain of our subsidiaries are members of FINRA, we are subject to certain regulations regarding changes in control of our ownership. FINRA Rule 1017 generally provides that FINRA approval must be obtained in connection with any transaction resulting in a change in control of a member firm. FINRA defines control as ownership of 25% or more of the firm's equity by a single entity or person and would include a change in control of a parent company. As a result of these regulations, our future efforts to sell shares or raise additional capital may be delayed or prohibited by FINRA.

Net Capital Rule

The SEC, FINRA, CFTC and various other regulatory agencies within the U.S. have stringent rules and regulations with respect to the maintenance of specific levels of net capital by regulated entities. Generally, a broker-dealer's capital is net worth plus qualified subordinated debt less deductions for certain types of assets. The Net Capital Rule requires that at least a minimum part of a broker-dealer's assets be maintained in a relatively liquid form.

If these net capital rules are changed or expanded, or if there is an unusually large charge against our net capital, our operations that require the intensive use of capital would be limited. A large operating loss or charge against our net capital could adversely affect our ability to expand or even maintain these current levels of business, which could have a material adverse effect on our business and financial condition.

The U.S. regulators impose rules that require notification when net capital falls below certain predefined criteria. These rules also dictate the ratio of debt-to-equity in the regulatory capital composition of a broker-dealer, and constrain the ability of a broker-dealer to expand its business under certain circumstances. If a firm fails to maintain the required net capital, it may be subject to suspension or revocation of registration by the applicable regulatory agency, and suspension or expulsion by these regulators could ultimately lead to the firm's liquidation. Additionally, the Net Capital Rule and certain FINRA rules impose requirements that may have the effect of prohibiting a broker-dealer from distributing or withdrawing capital and requiring prior notice to U.S. regulators and approval from FINRA for certain capital withdrawals.

As of December 31, 2017, aggregate excess regulatory capital for all of the operating companies was $4.5 billion.

IB LLC and TH LLC are subject to the Uniform Net Capital Rule (Rule 15c3-1) under the Exchange Act and IB LLC to the CFTC's minimum financial requirements (Regulation 1.17) under the Commodities Exchange Act; and THE is subject to the Swiss Financial Market Supervisory Authority eligible equity requirement. Additionally, Interactive Brokers Hong Kong Limited ("IBHK") is subject to the Hong Kong Securities and Futures Commission financial resource requirement; Interactive Brokers Australia Pty Limited ("IBA") is subject to the Australian Securities Exchange liquid capital

17

requirement; Timber Hill (Lichtenstein) AG is subject to the Financial Market Authority Liechtenstein eligible capital requirements; Timber Hill Canada Company ("THC") and Interactive Brokers Canada Inc. ("IBC") are subject to the Investment Industry Regulatory Organization of Canada risk adjusted capital requirement; Interactive Brokers (U.K.) Limited ("IBUK") is subject to the U.K. Financial Conduct Authority financial resources requirement; Interactive Brokers (India) Private Limited ("IBI") is subject to the National Stock Exchange of India net capital "requirements; and Interactive Brokers Securities Japan, Inc. ("IBSJ") is subject to the Japanese Financial Supervisory Agency capital requirements.

The following table summarizes capital, capital requirements and excess regulatory capital:

| |

Net Capital/ Eligible Equity |

Requirement | Excess | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

(in millions) |

|||||||||

IB LLC |

$ | 3,548 | $ | 495 | $ | 3,053 | ||||

TH LLC |

279 | 1 | 278 | |||||||

THE |

614 | 92 | 522 | |||||||

Other regulated operating companies |

773 | 121 | 652 | |||||||

| | | | | | | | | | | |

|

$ | 5,214 | $ | 709 | $ | 4,505 | ||||

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

As of December 31, 2017, all of the operating companies were in compliance with their respective regulatory capital requirements. For additional information regarding our net capital requirements see Note 14 to the audited consolidated financial statements in Part II, Item 8 of this Annual Report on Form 10-K.

Protection of Customer Assets

To conduct customer activities, IB LLC is obligated under rules mandated by its primary regulators, the SEC and the CFTC, to segregate cash or qualified securities belonging to customers. In accordance with the Securities Exchange Act of 1934, IB LLC is required to maintain separate bank accounts for the exclusive benefit of customers. In accordance with the Commodity Exchange Act, IB LLC is required to segregate all monies, securities and property received from commodities customers in specially designated accounts. IBC, IBUK, IBHK, IBSJ, IBI and IBA are subject to similar requirements within their respective jurisdictions.

To further enhance the protection of our customers' assets, in 2011, IB LLC sought and received approval from FINRA to perform the customer reserve computation on a daily basis, instead of once per week. IB LLC has been performing daily computations since December 2011, along with daily adjustments of the money set aside in safekeeping for our customers.

Supervision and Compliance

Our Compliance Department supports and seeks to ensure proper operations of our market making and electronic brokerage businesses. The philosophy of the Compliance Department, and our company as a whole, is to build automated systems to try to eliminate manual steps in the compliance process and then to augment these systems with experienced staff members who apply their judgment where needed. We have built automated systems to handle wide-ranging compliance issues such as trade and audit trail reporting, financial operations reporting, enforcement of short sale rules, enforcement of margin rules and pattern day trading restrictions, review of employee correspondence, archival of required records, execution quality and order routing reports, approval and documentation of new customer accounts, and anti-money laundering and anti-fraud surveillance. In light of our automated operations and our automated compliance systems, we have a smaller and more efficient Compliance Department than many traditional securities firms. Nonetheless, we have increased the staffing in our Compliance Department over the past several years to meet the increased regulatory burdens faced by all industry participants.

18

Our electronic brokerage and market making companies have Chief Compliance Officers who report to the Company's CEO, General Counsel and its Audit and Compliance Committee. In the U.S., these Chief Compliance Officers, plus certain other senior staff members, are FINRA and NFA registered principals with supervisory responsibility over the various aspects of our businesses. Similar roles are undertaken by staff in certain non-U.S. locations as well. Staff members in the Compliance Department and in other departments of the firm are also registered with FINRA, NFA or other regulatory organizations.

Patriot Act and Increased Anti-Money Laundering ("AML") and "Know Your Customer" Obligations

Registered broker-dealers traditionally have been subject to a variety of rules that require that they "know their customers" and monitor their customers' transactions for potential suspicious activities. With the passage of the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001 (the "Patriot Act"), broker-dealers are subject to even more stringent requirements. Likewise, the SEC, CFTC, foreign regulators, and the various exchanges and self-regulatory organizations, of which IB companies are members, have passed numerous AML and customer due diligence rules. Significant criminal and civil penalties can be imposed for violations of the Patriot Act, and significant fines and regulatory penalties can also be imposed for violations of other governmental and self-regulatory organization AML rules.

As required by the Patriot Act and other rules, we have established comprehensive anti-money laundering and customer identification procedures, designated AML compliance officers, trained our employees and conducted independent audits of our programs. Our anti-money laundering screening is conducted using a mix of automated and manual reviews and has been structured to comply with regulations in various jurisdictions. We collect required information through our new account opening process and screen accounts against databases for the purposes of identity verification and for review of negative information and appearance on government lists, including the Office of Foreign Assets and Control, Specially Designated Nationals and Blocked Persons lists. Additionally, we have developed methods for risk control and continue to add upon specialized processes, queries and automated reports designed to identify money laundering, fraud and other suspicious activities.

Dodd-Frank Reform Act

The Dodd-Frank Wall Street Reform and Consumer Protection Act imposes strict reporting and disclosure requirements on the financial services industry. We have enhanced the evidence of our supervisory review of controls over financial reporting and Management continues to monitor accounting and regulatory rulemaking developments for their potential effect on our financial statements and internal controls over financial reporting.

Business Continuity Planning

Federal regulators and industry self-regulatory organizations have passed a series of rules in the past several years requiring regulated firms to maintain business continuity plans that describe what actions firms would take in the event of a disaster (such as a fire, natural disaster or terrorist incident) that might significantly disrupt operations. We have developed business continuity plans that describe steps that we and our employees would take in the event of various scenarios. We have built a backup site for certain key operations at our Chicago facilities that would be utilized in the event of a significant outage at our Greenwich headquarters. In addition, we have strengthened the infrastructure at our Greenwich headquarters and have built redundancy of systems so that certain operations can be handled from multiple offices. We continually evaluate opportunities to further our business continuity planning efforts.

19

Foreign Regulation

Our international subsidiaries are subject to extensive regulation in the various jurisdictions where they have operations. The most significant of our international subsidiaries are: IBC and THC, registered to do business in Canada as an investment dealer and securities dealer, respectively; IBUK, registered to do business in the U.K. as a broker; THE, registered to do business in Switzerland as a securities dealer; IBI, registered to do business in India as a stock broker; IBHK, registered to do business in Hong Kong as a securities dealer; IBA, registered to do business in Australia as a securities dealer and futures broker; and IBSJ, registered in Japan as a financial instruments firm with the Kanto Regional Finance Bureau and the Financial Supervisory Agency.

In Canada, both THC and IBC are subject to the Investment Industry Regulatory Organization of Canada ("IIROC") risk adjusted capital requirement. In the United Kingdom, IBUK is subject to the U.K Financial Conduct Authority financial resources requirement. In Switzerland, THE is subject to the Swiss Financial Market Supervisory Authority eligible equity requirement. In India, IBI is subject to the National Stock Exchange and Bombay Stock Exchange capital requirements. In Hong Kong, the Securities and Futures Commission ("SFC") regulates our subsidiary, IBHK, as a securities dealer. The compliance requirements of the SFC include, among other things, net capital requirements and stockholders' equity requirements. The SFC regulates the activities of the officers, directors, employees and other persons affiliated with IBHK and requires the registration of such persons. In Australia, IBA is subject to the Australian Securities Exchange liquid capital requirement. In Japan, IBSJ is subject to the Financial Supervisory Agency, the Osaka Securities Exchange and the Tokyo Stock Exchange capital requirements.

Executive Officers and Directors of Interactive Brokers Group, Inc.

The following table sets forth the names, ages and positions of our current directors and executive officers:

Name

|

Age | Position | |||

|---|---|---|---|---|---|