Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - Foamix Pharmaceuticals Ltd. | exhibit_32-2.htm |

| EX-32.1 - EXHIBIT 32.1 - Foamix Pharmaceuticals Ltd. | exhibit_32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - Foamix Pharmaceuticals Ltd. | exhibit_31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - Foamix Pharmaceuticals Ltd. | exhibit_31-1.htm |

| EX-23.1 - EXHIBIT 23.1 - Foamix Pharmaceuticals Ltd. | exhibit_23-1.htm |

| EX-10.8 - EXHIBIT 10.8 - Foamix Pharmaceuticals Ltd. | exhibit_10-8.htm |

| EX-10.7 - EXHIBIT 10.7 - Foamix Pharmaceuticals Ltd. | exhibit_10-7.htm |

| EX-10.6 - EXHIBIT 10.6 - Foamix Pharmaceuticals Ltd. | exhibit_10-6.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

Amendment No. 1

|

(Mark One)

|

|

|

☒

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the fiscal year ended December 31, 2017

|

|

|

or

|

|

|

☐

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the transition period from to

|

|

Commission File Number 001-33299

Foamix Pharmaceuticals Ltd.

(Exact name of registrant as specified in its charter)

|

Israel

(State or other jurisdiction of

incorporation or organization)

|

Not Applicable

(I.R.S. Employer

Identification Number)

|

2 Holzman Street, Weizmann Science Park

Rehovot 7670402, Israel

(Address of principal executive offices, including zip code)

+972-8-9316233

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class:

|

Name of Each Exchange on Which Registered:

|

|

|

Ordinary shares, par value NIS 0.16 per share

|

NASDAQ Global Market

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☐

|

Accelerated filer ☒

|

|

Non-accelerated filer ☐ (Do not check if a smaller reporting company)

|

Smaller reporting company ☐

|

|

Emerging growth company ☒

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2).

Yes ☐ No ☒

The aggregate market value of the registrant’s ordinary shares, par value NIS 0.16 per share, held by non-affiliates of the registrant on June 30, 2017, the last business day of the registrant’s most recently completed second fiscal quarter, was approximately $121 million (based on the closing sales price of the registrant’s ordinary shares on that date). Ordinary shares held by each director and executive officer of the registrant, as well as shares held by each holder of more than 10% of the ordinary shares known to the registrant, have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

The total number of shares outstanding of the registrant’s ordinary shares, par value NIS 0.16 per share, as of February 26, 2018, was 37,551,199.

DOCUMENTS INCORPORATED BY REFERENCE

None

ii

EXPLANATORY NOTE

This Amendment No. 1 (this “Amendment”) on Form 10-K/A amends the Annual Report on Form 10-K of Foamix Pharmaceuticals Ltd. for the year ended December 31, 2017 as originally filed with the Securities and Exchange Commission on February 27, 2018 (the “Original Filing”), to correct (i) an inadvertent reversal between the numerical data in the two columns labeled “Bonus” and “Non-Equity Incentive Plan Compensation” in the table titled “Summary Compensation Table” in “Item 11—Executive Compensation”, (ii) a clerical error in the amount of “All Other Compensation” of Mr. Yohan Hazot in the same table, and (iii) an inadvertent omission of the reference to “emerging growth company” in the paragraph in the cover page preceding the list of types of filers.

Except as described above, this Amendment does not amend or otherwise update any other information in the Original Filing. For the convenience of the reader, this Amendment restates in its entirety our Original Filing. This Amendment is presented as of the filing date of the Original Filing and does not reflect events occurring subsequent to the date of the Original Filing.

We have also updated the signature page, the consent of our independent registered public accounting firm in Exhibit 23.1 and the certifications of our Principal Executive Officer and Principal Financial Officer in Exhibits 31 and 32.

iii

FOAMIX PHARMACEUTICALS LTD.

FORM 10-K

TABLE OF CONTENTS

|

Page No.

|

||

|

2

|

||

| 2 | ||

| 20 | ||

| 47 | ||

| 47 | ||

| 47 | ||

| 47 | ||

|

47

|

||

|

47

|

||

|

49

|

||

|

50

|

||

|

59

|

||

|

F-1

|

||

|

61

|

||

|

61

|

||

|

61

|

||

|

62

|

||

|

62

|

||

|

68

|

||

|

76

|

||

|

79

|

||

|

79

|

||

|

80

|

||

|

80

|

||

| 80 | ||

|

82

|

iv

DEFINITIONS

Unless otherwise indicated, all references to the “company,” “we,” “us,” “our” and “Foamix” refer to Foamix Pharmaceuticals Ltd. and its subsidiary, Foamix Pharmaceuticals Inc., a Delaware corporation.

References to the “Companies Law” are to Israel’s Companies Law, 5759-1999, as currently amended;

References to the “Exchange Act” are to the Securities Exchange Act of 1934, as amended;

References to the “FDA” are to the United States Food and Drug Administration;

References to “NASDAQ” are to the NASDAQ Global Stock Market;

References to “ordinary shares” are to our ordinary shares, par value of NIS 0.16 per share;

References to the “SEC” are to the United States Securities and Exchange Commission;

References to the “Securities Act” are to the Securities Act of 1933, as amended; and

References to “U.S. dollars” and “$” are to currency of the United States of America, and references to “NIS” are to New Israeli Shekels.

USE OF TRADEMARKS

“Foamix”, the Foamix logo and other trademarks or service marks of Foamix appearing in this Annual Report on Form 10-K are the property of Foamix. This Form 10-K also contains trade names, trademarks and service marks of others, which are the property of their respective owners. We do not intend our use or display of other companies’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, these other companies.

FORWARD-LOOKING STATEMENTS

This annual report contains express or implied “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and other U.S. Federal securities laws.

These forward-looking statements include, but are not limited to, statements regarding the following matters:

| - |

U.S. Food and Drug Administration, or FDA, approval of, or other regulatory action in the U.S. and elsewhere with respect to, our product candidates;

|

| - |

the commercial launch of current or future product candidates;

|

| - |

our ability to achieve favorable pricing for our product candidates;

|

| - |

our expectations regarding the commercial supply of our product candidates;

|

| - |

third-party payor reimbursement for our product candidates;

|

| - |

our estimates regarding anticipated expenses, capital requirements and needs for additional financing;

|

| - |

the patient market size of any diseases and market adoption of our products by physicians and patients;

|

| - |

the timing, cost or other aspects of the commercialization of our product candidates;

|

| - |

the completion of, and receiving favorable results of, clinical trials for our product candidates;

|

| - |

application for and issuance of patents to us by the United States Patent and Trademark Office, or U.S. PTO, and other governmental patent agencies;

|

| - |

development and approval of the use of our product candidates for additional indications; and

|

| - |

our expectations regarding licensing, business transactions and strategic operations.

|

In some cases, forward-looking statements are identified by terminology such as “may,” “will,” “could,” “should,” “expects,” “plans,” “anticipates,” “believes,” “intends,” “estimates,” “predicts,” “potential,” or “continue” or the negative of these terms or other comparable terminology. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results or performance to differ materially from those projected. These statements are only current predictions and are subject to known and unknown risks, uncertainties, and other factors that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from those anticipated by the forward-looking statements. In addition, historic results of scientific research and clinical and preclinical trials do not guarantee that the conclusions of future research or trials would not be different, and historic results referred to in this Annual Report on Form 10-K may be interpreted differently in light of additional research and clinical and preclinical trials results. The forward-looking statements contained in this annual report are subject to risks and uncertainties, including those discussed under “Item 1A—Risk Factors” and in our other filings with the Securities and Exchange Commission, or the SEC. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance, or achievements. Except as required by law, we are under no duty to (and expressly disclaim any such obligation to) update or revise any of the forward-looking statements, whether as a result of new information, future events or otherwise, after the date of this annual report.

STATEMENTS BY RESEARCH OR FORECAST FIRMS

We do not endorse or adopt any third-party research or forecast firms’ statements or reports referred to in this annual report and assume no responsibility for the contents or opinions represented in such statements or reports, nor for the updating of any information contained therein.

Overview

We are a clinical-stage specialty pharmaceutical company focused on developing and commercializing our proprietary minocycline foam for the treatment of acne, rosacea and other skin conditions. Our lead product candidates, FMX101 for moderate-to-severe acne and FMX103 for treatment of moderate-to-severe papulopustular rosacea, are novel topical foam formulations of the antibiotic minocycline. Based on the results demonstrated in our Phase II and Phase III clinical trials for FMX101 and our Phase II clinical trial for FMX103, we believe these product candidates have the potential to provide a fast, effective and well-tolerated treatment for their respective indications, which are currently underserved and commonly treated by oral prescription products such as oral minocycline, oral doxycycline and various other non-foam topical therapies.

We are currently investing the majority of our efforts and resources to advance our third pivotal Phase III clinical trial (Study 22) for FMX101 in the U.S. We announced the first patient enrolled in this trial on August 3, 2017. We expect to have top-line results from this trial in the third quarter of 2018. In March of 2017, we announced the results of the double-blind stage of our two initial Phase III clinical trials. Statistical significance was demonstrated in both co-primary efficacy endpoints in one study (Study 05), however, statistical significance was demonstrated in only one of the co-primary efficacy endpoints in the second study (Study 04). Statistical significance was also demonstrated for FMX101 compared to vehicle in the pooled analysis of the co-primary endpoints as well as key secondary endpoints. The third trial was initiated following a Type B meeting conducted with the FDA in June of 2017. During this meeting, we confirmed that achieving statistically significant results for FMX101 versus vehicle in both co-primary efficacy endpoints in a third independent clinical trial would be sufficient for establishing an efficacy claim. A previous Phase II clinical trial of FMX101 also demonstrated clinically and statistically significant results in all primary and secondary endpoints. In January 2018, we announced the completion of a long-term safety study that was an extension of our two initial Phase III clinical trials for FMX101. The results from the study showed FMX101 to be well-tolerated and to have an acceptable safety profile.

We are also investing significant efforts and resources to advance our two pivotal Phase III clinical trials in the U.S. for FMX103, minocycline foam for moderate-to-severe papulopustular rosacea, after our Phase II clinical trial for FMX103 demonstrated clinically and statistically significant results in all primary and secondary endpoints. We announced the enrollment of the first patient in our Phase III trials on June 12, 2017. We expect to have top-line results from the blinded stage of both trials by the end of the third quarter or in the beginning of the fourth quarter of 2018, and to complete the trials, including a long-term safety extension study, in 2019.

In addition, we successfully completed a Phase II clinical trial with FDX104, our proprietary doxycycline foam for the management of moderate-to-severe rash associated with epidermal growth factor receptor inhibitor (EGFRI) anticancer treatments, and we are currently assessing our various options with regard to this product candidate, including seeking out licensing opportunities for it. We have also successfully completed a Phase II clinical trial of FMX102, our minocycline foam for the treatment of impetigo, including impetigo caused by methicillin-resistant staphylococcus aureus, or MRSA. However, as described in previous reports, we have been contemplating the commercial viability of this product candidate for some time, given its limited market dominated by generic products, and following additional analysis of its potential we have recently decided to discontinue its further development in light of our current priorities and our other ongoing research and development efforts.

We developed FMX101, FMX102, FMX103 and FDX104 using our proprietary technology, which includes our foam-based platforms. This technology enables us to formulate and stabilize a wide variety of drugs and deliver them directly to their target site. We have independently developed a series of proprietary foam platforms, each having unique pharmacological features and characteristics. Our foam platforms may offer significant advantages over alternative delivery options and are suitable for multiple application sites. We believe our proprietary foam-based platform may serve as a foundation in developing a potential pipeline of products across a range of conditions.

Beside our in-house development projects, we have entered into development and license agreements relating to our technology with various pharmaceutical companies such as Bayer HealthCare AG, Mylan N.V. and Actavis Laboratories. Our total revenues from such agreements from our inception through December 31, 2017 were approximately $28.1 million.

2

In the third quarter of 2015, Bayer began selling Finacea® Foam (azelaic acid) 15%, or Finacea, for the treatment of rosacea in the U.S. Finacea is a prescription foam product which was developed as part of a research and development collaboration between Foamix and Bayer, utilizing one of Foamix’s proprietary foam technology platforms. According to our license agreement with Bayer, we are entitled to royalties and certain contingent payments upon the commercialization of Finacea based on Bayer’s net sales of Finacea. In 2017 we were entitled to receive royalty payments from Bayer in a total amount of $3.5 million for sales of Finacea. In January 2018, we filed a Complaint along with Bayer AG and Bayer HealthCare Pharmaceuticals Inc., alleging patent infringement under the patent laws of the United States arising out of the submission by defendant Teva Pharmaceuticals USA, Inc. of an Abbreviated New Drug Application, or ANDA, to the FDA, seeking approval to manufacture and sell a generic version of Bayer’s Finacea. In February 2018, Bayer and Foamix filed a Complaint alleging patent infringement under the patent laws of the United States arising out of the submission by defendant Perrigo UK FINCO Limited Partnership, or Perrigo, of an ANDA to the FDA, seeking approval to manufacture and sell a generic version of Bayer’s Finacea. See also “Item 1A—Risk Factors—Risks Related to Our Intellectual Property—We have received notice letters of ANDAs submitted for drug products that are generic versions of Finacea and we are involved in lawsuits to protect or enforce our patents, which could be expensive, time consuming and unsuccessful.”

Product Candidates and Pipeline

The following chart provides a summary of the developmental pipeline for our lead product candidates:

|

Product Candidate

|

Preclinical

|

Phase II

|

Phase III

|

Planned Milestones

|

|

FMX101 (4%) for Moderate-Severe Acne

|

|

Study 04 / 05 top-line results announced

Long-term safety study completed

3rd Phase III initiated August 2017

Top-line results – Q3 / Q4 2018

NDA filing – H2 2018

|

||

|

FMX103 (1.5%) for Moderate-Severe Rosacea

|

|

Phase II completed

Phase III initiated June 2017

Top-line results – end of Q3 or beginning of Q4 2018

NDA filing – 2019

|

||

FMX101 for moderate-to-severe acne

Our lead product candidate, FMX101, minocycline foam 4%, is a novel topical foam formulation of minocycline for the treatment of moderate-to-severe acne.

Market opportunity

Acne is characterized by areas of scaly red skin, non-inflammatory blackheads and whiteheads, inflammatory lesions, papules and pustules and occasionally boils and scarring. It affects approximately 40 to 50 million people in the U.S. alone, of whom approximately 10 million suffer from moderate-to-severe acne. For most people, acne diminishes over time and tends to disappear or decrease, by age 25. However, some individuals continue to suffer from acne well into their 30s, 40s and later.

The current U.S. market size for acne is considerable and estimated at approximately $3 billion, presenting significant unmet needs of patients and healthcare providers to be addressed. We believe that our FMX101 product candidate for this indication, if approved, may provide a new treatment alternative for patients and healthcare providers who are unsatisfied with their current therapies.

Limitations of oral minocycline for acne

Oral minocycline, such as Solodyn, has been widely prescribed for the treatment of moderate-to-severe acne. According to the product label of Solodyn, inflammatory lesions were reduced by 44% at week 12, and a positive effect on the reduction of non-inflammatory acne lesions versus vehicle was not demonstrated. According to its product label, the most common adverse systemic side effects of Solodyn include diarrhea, dizziness, drowsiness, indigestion, lightheadedness, loss of appetite, nausea, sore mouth, throat or tongue and vomiting.

In 2009, the FDA added oral minocycline to its Adverse Event Reporting System, a list of medications under investigation by the FDA, due to its severe side effects. In 2011, we conducted a blind survey of 40 U.S. dermatologists. The results of the survey revealed that 90% of the dermatologists surveyed who prescribed oral minocycline were concerned about its side effects, and 76% of these dermatologists stated they would prefer prescribing a topical minocycline product over an existing oral medication, assuming the topical treatment was safe, effective and approved by the FDA.

3

FMX101 clinical trials

FMX101 Phase II clinical trial

We conducted a randomized, double-blind, dose-ranging, controlled Phase II clinical trial in Israel over 12 weeks with 150 patients between 12 and 25 years old with a mean age of approximately 16.5 years, each presenting with a minimum of 20 inflammatory and 25 non-inflammatory facial acne lesions. The patients were randomly divided into three groups of 50 patients each, with one group receiving a 1% concentration of our minocycline foam, a second group receiving a 4% concentration and a third control group receiving our foam vehicle without minocycline, which we refer to as the vehicle. Each patient received one application daily before bedtime.

The primary efficacy endpoints of the trial were:

| · |

the reduction in inflammatory and non-inflammatory lesions (as well as the total counts of facial lesions) over the course of the 12-week treatment period;

|

| · |

improvement in the investigator’s global assessment, or IGA, based on the uniform graded scale adopted for the trial, ranging from “clear” skin with no inflammatory or non-inflammatory lesions to “severe acne”, as well as safety and tolerability.

|

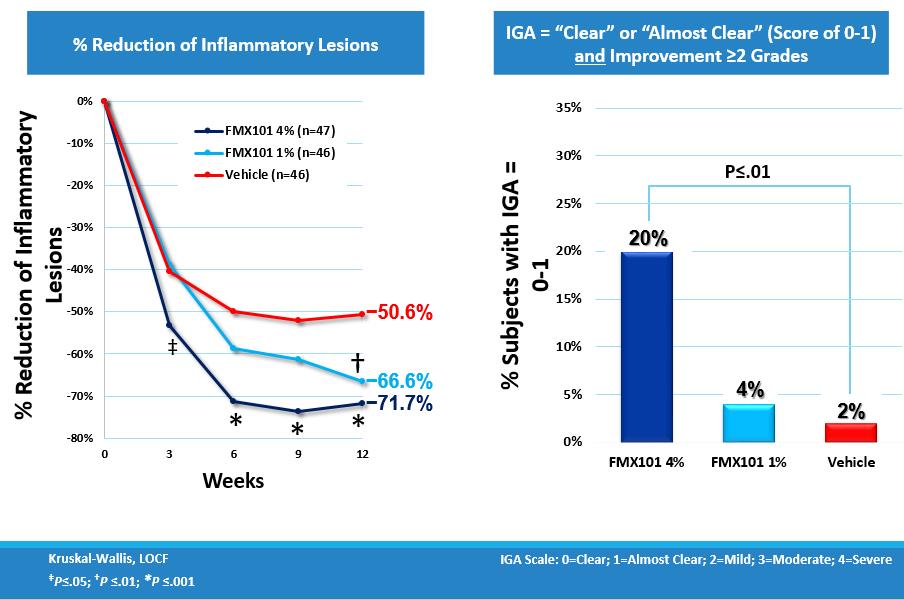

The trial was completed in 2013 and showed a dose-dependent effect that was statistically significant for both primary endpoints of the trial. Notably, the effect on inflammatory lesions became statistically significant in the 4% dosage group versus the vehicle-only treatment group after just three weeks of therapy, and there was an approximate 72% reduction in inflammatory lesions reached in the 4% dosage group after 12 weeks of treatment. Additionally, for the patients in the 4% dosage group, the effect on non-inflammatory lesions also became statistically significant versus the vehicle-only group after twelve weeks of therapy, with approximately a 73% reduction in non-inflammatory lesions.

The percent of patients with IGA improvement of at least two grades and a grading of clear or almost clear (score of 0 or1) at the completion of the trial was 20% in the 4% dosage group, compared with 4% in the 1% dosage group and 2% in the vehicle-only treatment.

The safety and tolerability profile of the drug was also favorable, with no serious adverse events and no reported drug-related systemic side effects. The cases of skin reaction in the trial were few, mild and transient, with all reactions subsiding by week 12 of treatment, and there was similar incidence of skin reaction in all three groups.

The following charts show the reduction of inflammatory lesion count from baseline and over the trial period for the 4% dosage, 1% dosage and vehicle treatment groups and the percentage of patients who met the IGA success criterion:

While we did not file a formal application for an IND with the FDA in connection with the FMX101 Phase II clinical trial, the trial was conducted in compliance with the International Conference of Harmonization, or ICH, good clinical practice, or GCP, guidelines and applicable Israel Ministry of Health regulations. The trial protocol complied with the procedures, criteria and endpoints specified by the FDA’s 2005 draft industry guidance for acne trials. Because minocycline, the active ingredient in FMX101, is a well-known drug with an established safety profile, the ethical committee for our Phase II clinical trial and the Israeli Ministry of Health allowed us to conduct the Phase II clinical trial of FMX101 without having first conducted a Phase I clinical trial.

4

We completed a Phase I maximum use pharmacokinetics study of FMX101, intended to characterize the systemic absorption of minocycline after repeated maximum-dose applications in patients with moderate-to-severe acne, and to assess the relative bioavailability of topically-applied FMX101 compared to orally-administered Solodyn (minocycline HCl). The study enrolled 30 patients with moderate-to-severe acne on their face and on two or more other regions (neck, upper chest, upper back or arms) in a single-center, nonrandomized, open-label, active-controlled, two-period and two-treatment evaluation. Each of the patients received a single dose of Solodyn, 1 mg/kg in accordance with its approved instructions for use, and one week later received 4 grams of FMX101 applied topically once daily for 21 days. The study showed that the bioavailability, or systemic exposure, of minocycline following topical FMX101 administration was approximately 700 times lower than that of Solodyn, and that FMX101 was well-tolerated with no serious adverse events being reported.

In addition, we completed a single-center, non-randomized, open-label study to evaluate multiple dose topical administration of FMX101 4% minocycline foam in 20 subjects with ages ranging from 9 years to 16 years 11 months years of age with moderate to severe acne vulgaris. The objectives were to characterize minocycline pharmacokinetics after administration of FMX101 4% once daily for 7 days under maximal use conditions and to evaluate the safety and tolerability.

The levels of minocycline were relatively constant over the entire sampling interval on day 7. The overall average plasma concentration of minocycline, across all age ranges, was comparable with the equivalent adult study. Concentrations tended to be slightly higher in the subjects aged 9 to 11 years (approximately 3.5 ng/mL) and subjects aged 12 to 14 years (approximately 2.5 ng/mL) than the subjects aged 15 years to 16 years 11 months (approximately 1.7 ng/mL). Similar to the study in adult patients, FMX101 was well-tolerated with no serious adverse events being reported.

A series of Phase I human dermal safety studies, were completed in 2016. Results of these trials were as expected and no safety signals were detected.

As part of our overall development plan for FMX101, we have conducted a series of animal safety studies, which revealed no signs of toxicity. We completed a long-term, 39-week dermal toxicity study in mini pigs, which included concentrations of our minocycline foam up to 16%. Results from this study also reflect no toxicity associated with our drug product.

We also held an End of Phase II meeting with the FDA to review the clinical development plan for FMX101, and implemented the comments we received from the FDA regarding overall study design, primary efficacy endpoints, and safety assessments in the FMX101 Phase III program.

FMX101 initial two Phase III clinical trials

Based on the results of the Phase II clinical trial, as described above, and guidance from the FDA in a pre-IND meeting, we conducted two multi-center pivotal Phase III clinical trials in the U.S. for FMX101 (minocycline foam 4%) in moderate-to severe acne, known as Studies 04 and 05.

In November 2016 we completed patient enrollment resulting in an intent-to-treat population of 961 patients with moderate-to-severe acne enrolled between the two trials. Patients were randomized on a 2:1 basis (active compound versus vehicle-only), initially into a 12-week double-blind phase where they were treated topically once daily with either FMX101 (minocycline foam 4%) or the respective foam vehicle. The two co-primary efficacy endpoints of both trials were: (1) the absolute change from baseline in inflammatory lesion counts in each treatment group at week 12; and (2) the proportion of patients achieving success at week 12 as defined by an IGA score of 0 “clear” or 1 “almost clear” and at least a two-grade improvement from baseline at week 12. Safety evaluation includes reported adverse events, assessments of tolerability, clinical laboratory tests and vital signs. Patients who completed the 12-week double-blind portion of the trials had the option to continue in a long-term open-label safety extension, aimed at evaluating the safety of intermittent use of FMX101 for up to nine additional months.

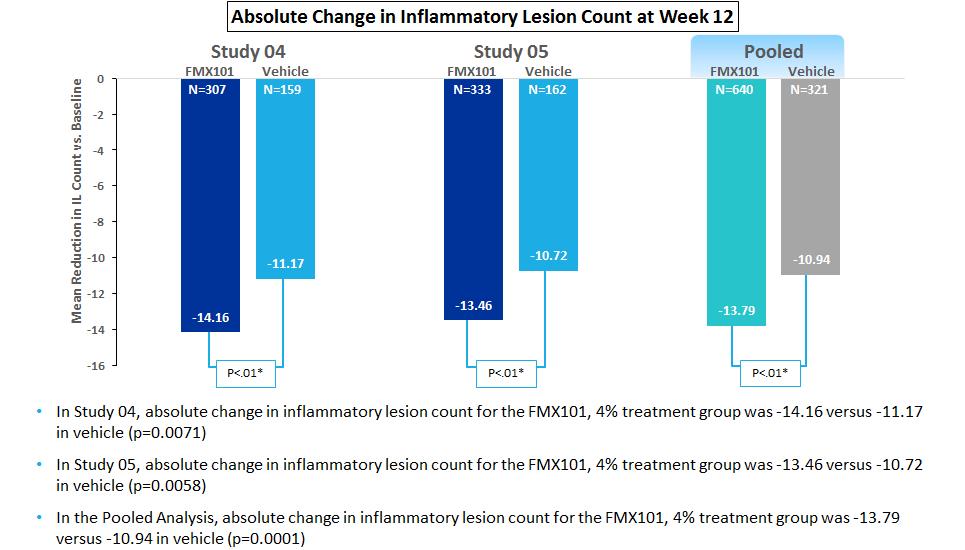

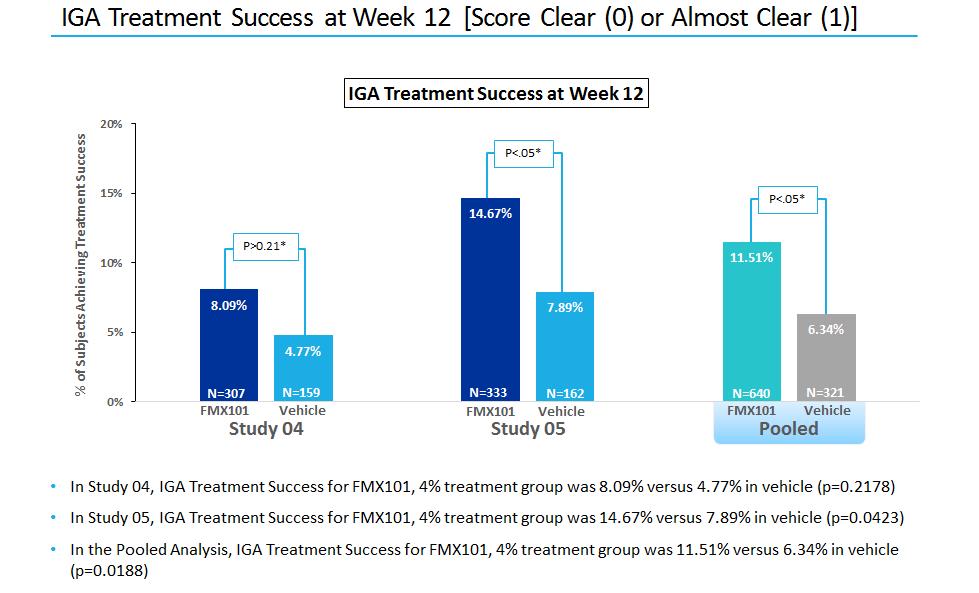

On March 27, 2017 we announced top-line data from our two Phase III clinical trials for FMX101. In the intent-to-treat analysis, FMX101 demonstrated statistical significance compared to vehicle on both co-primary endpoints in Study 05 (specifically the absolute reduction in inflammatory lesions at week 12, and investigator global assessment treatment success (IGA0/1) at week 12 compared to baseline). In Study 04, statistical significance was demonstrated for FMX101 compared to vehicle in the co-primary endpoint of absolute reduction in inflammatory lesions. However, statistical significance was not achieved in the co-primary endpoint of IGA0/1.

On May 3, 2017 we provided new data from our two Phase III clinical trials for FMX101, including a pooled analysis of our co-primary endpoints and certain secondary clinical endpoints (absolute reduction of non-inflammatory lesions at week 12; and percent change in inflammatory lesions at weeks 3, 6, 9 and 12). Statistical significance was demonstrated for FMX101 compared to vehicle in the pooled analysis of the co-primary endpoints as well as the secondary endpoints presented.

5

The following charts show the reduction of inflammatory lesion count from baseline for FMX101 4% and vehicle treatment groups in each of Studies 04 and 05 and on a pooled basis at week 12:

The following charts show the percentage of patients who met the IGA treatment success criterion at week 12 (defined as at least a 2 grade point reduction from baseline IGA score and a final score of “clear” (0) or “almost clear” (1)) for FMX101 4% and vehicle treatment groups in each of Studies 04 and 05 and on a pooled basis at week 12:

FMX101 third Phase III clinical trial

On June 21, 2017, following the top-line data from Studies 04 and 05, we held a Type B Meeting with the FDA, during which we confirmed that statistically significant findings from a third study would constitute replication of the Study 05 results and would be sufficient for establishing an efficacy claim. This confirmation reaffirmed our plans for conducting a third Phase III trial for FMX101.

On August 3, 2017 we announced the dosing of the first patient in our third Phase III acne clinical trial, known as Study 22, which is designed as a double-blind, vehicle-controlled, multi-center trial conducted at approximately 80 sites throughout the U.S. that will enroll a target number of 1,500 patients with moderate-to-severe acne. Patients are randomized 1:1 to either FMX101 4% dosage or vehicle, with once daily treatment for 12 weeks. The primary endpoints are identical to the primary endpoints in Studies 04 and 05.

We selected Premier Research International LLC, or Premier Research, as our designated clinical research organization (CRO) for the execution of our third Phase III trial in acne. Premier Research has significant experience in the execution of global clinical trial programs and is a recognized leader in clinical trial management within the field of dermatology. We expect to have top-line results from the trial in the third quarter of 2018 and to complete the trial by the end of 2018.

6

FMX101 open-label safety extension study

On January 4, 2018, we announced positive safety data for our Phase III open-label safety extension study, evaluating FMX101 in moderate-to-severe acne for a treatment period of up to one year. The open-label safety extension enrolled a total of 657 patients, all of whom had completed 12 weeks of FMX101 or vehicle treatment in the preceding double-blind phase of Studies 04 and 05. Patients continued open-label treatment with FMX101 for up to an additional 40 weeks. 291 patients completed a total of 52 weeks on FMX101 therapy, which exceeds the subject sample size requirements specified in the regulatory guidance for this type of safety evaluation (ICH E1A, 1995). No serious drug-related adverse events were reported in this comprehensive safety evaluation, which validated earlier data demonstrating that FMX101 appears to be well-tolerated and has an acceptable safety profile. More specifically, the study found that:

| · |

non-dermal adverse events were comparable in type and frequency with those reported during the double-blinded portion of Studies 04 and 05, with the most frequently reported treatment-emergent adverse event being nasopharyngitis, or common cold. Three patients discontinued the study for non-dermal adverse events, two of them for abdominal pain and one for back pain;

|

| · |

application-site adverse events occurred in less than 2% of patients during the additional 40 weeks of open-label treatment. Four patients discontinued the study for an application-site adverse event – two patients for worsening of acne, one for contact dermatitis and one for localized facial edema. In the assessment of facial dermal tolerability at week 52, more than 95% of patients had “none” or “mild” signs and symptoms such as erythema, dryness, hyperpigmentation, peeling, and itching, and no severe local tolerability scores were recorded;

|

| · |

subject satisfaction with FMX101 treatment remained high when re-assessed at week 52, which was consistent with scores obtained at the end of the double-blind phase of Studies 04 and 05 at week 12.

|

Efficacy was also measured as a secondary endpoint in the open-label study for FMX101, and was based on summary statistics from observed cases. During the study, patients were allowed to discontinue therapy with FMX101 if they believed their acne was under control. Patients could re-start therapy as needed and were also allowed to use other acne medications concomitantly. As a result, no claim of statistical difference was made between any of the treatment arms, however notable findings were observed:

| · |

At week 52, 37.7% of patients from Study 04 had an Investigator’s Global Assessment (IGA) score of 0 (clear) or 1 (almost clear) and 50.3% of subjects from Study 05 had an IGA score of 0 or 1.

|

| · |

At week 52, patients from Study 04 had a 64.3% reduction in inflammatory lesions and patients from Study 05 had a 78% reduction in inflammatory lesions.

|

| · |

At week 52, patients from Study 04 had a 52.5% reduction in non-inflammatory lesions and patients from Study 05 had a 59.6% reduction in non-inflammatory lesions.

|

Next steps

We expect to develop FMX101 through the FDA’s 505(b)(2) regulatory pathway, which permits the filing of a new drug application where at least some of the information required for approval comes from studies that were not conducted by or for the applicant, and for which the applicant has not received a right of reference. This approach could expedite the development program for FMX101 by potentially decreasing the amount of clinical data that we would need to generate in order to obtain FDA approval. For additional information see “Item 1A—Risk Factors—Risks Related to Our Business and Industry—If the FDA does not conclude that FMX101 or FMX103 satisfy the requirements under Section 505(b)(2) of the Federal Food Drug and Cosmetics Act, or Section 505(b)(2), or if the requirements for this product candidate under Section 505(b)(2) are not as we expect, the approval pathway for this product candidate will likely take significantly longer, cost significantly more and entail significantly greater complications and risks than anticipated, and in either case may not be successful.”

FMX103 for moderate-to-severe papulopustular rosacea

Our product candidate, FMX103, minocycline foam 1.5%, is a novel topical foam formulation of minocycline for the treatment of moderate-to-severe papulopustular rosacea.

Market opportunity

Papulopustular rosacea is a chronic skin disease causing inflammatory lesions (papules and pustules) on the face. It can create psychosocial burdens, such as embarrassment, anxiety and low self-esteem that adversely affect quality of life. Rosacea is most frequently seen in adults between 30 and 50 years of age and affects more than 16 million people in the U.S. alone. There is no known cure for rosacea and the exact root cause of the disease remains unknown as well, though both genetic and environmental factors are thought to have an impact on its outbreak. Mild papulopustular rosacea is currently treated by topical antimicrobials (such as metronidazole, clindamycin and ivermectin) or azelaic acid, while the mainstay for the treatment of moderate-to-severe rosacea are systemic antibiotics such as minocycline and doxycycline.

The current U.S. market size for rosacea is estimated to be approximately $1.0 billion, and we believe that our FMX103 product candidate for this indication, if approved, can offer advantages over other currently available products.

FMX103 clinical trials

FMX103 Phase II clinical trials

In the third quarter of 2016 we announced positive top-line results from our Phase II trial evaluating FMX103. The double-blind, randomized, vehicle-controlled Phase II trial was conducted in 18 sites in Germany and included 233 patients with moderate-to-severe rosacea. Patients were randomized to receive either one of two doses of FMX103 minocycline foam (3% or 1.5%) or vehicle foam once daily over 12 weeks, followed up by a four-week post-treatment evaluation. The efficacy endpoints were (a) the absolute change in the number of inflammatory lesions – papules and pustules (primary endpoint), and (b) improvement of the IGA (first secondary endpoint). Safety and tolerability were also evaluated. The mean baseline lesion count for all groups ranged from 30.6 to 34.5 and the IGA scores were all moderate (score 3) or severe (score 4) with approximately 50-60% of the subjects having a severe rating.

7

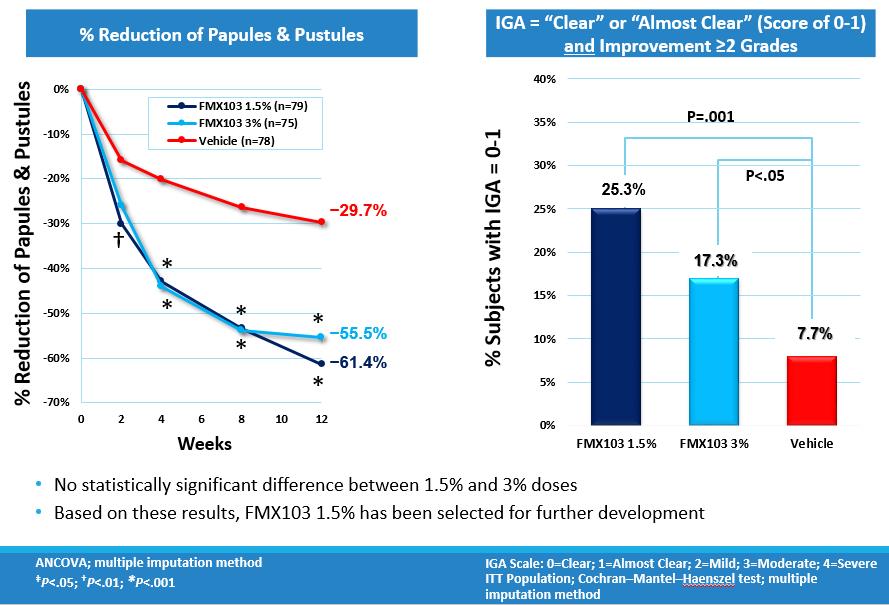

At week 12, statistically significant results were demonstrated in the reduction of inflammatory lesions (papules and pustules) versus vehicle in both the 1.5% and 3% doses of FMX103. The mean reduction in lesion count of each treatment group versus its baseline was 21.1 for the 1.5% dose, 19.9 for the 3% dose and 7.8 for vehicle. The corresponding percent reductions were 61.4% and 55.5% for the FMX103 1.5% and 3% groups, respectively, and 29.7% for the vehicle. The trial further showed a significant improvement in IGA scores. Both the 1.5% and 3% doses of FMX103 were significantly better compared to vehicle alone in reducing the IGA score by two grades and in reaching a “clear” (score=0) or “almost clear” (score=1) rating at week 12 (p<0.01 and p<0.05, respectively). The percentage of subjects achieving IGA success, defined as at least a two-grade point reduction and a rating of clear or almost clear (score of 0 or 1), was 25.3 for the 1.5% dose, 17.3 for the 3% dose, and 7.7 for vehicle. Both the 1.5% and 3% doses were efficacious and there was no statistically significant difference between these two doses.

The following charts show the percent reduction of inflammatory lesions (papules & pustules) and the percentage of patients who met the IGA success criterion:

FMX103 also appeared to be generally safe and well-tolerated. During the Phase II trial, there were no serious adverse events and no drug related systemic adverse events were reported. A few patients overall exhibited treatment-related dermal adverse events (four in the 3% group, five in the vehicle group and none in the 1.5% group). Four patients discontinued the trial due to an adverse event – three in the 3% group and one in the vehicle group.

FMX103 Phase III clinical trials

In December 2016, we conducted a pre-IND meeting with the FDA to confirm that our clinical and non-clinical programs outlined were sufficient to submit an IND and to begin our Phase III clinical trials, utilizing the results of toxicology, pharmacology and human safety studies that were completed for FMX101.

On June 12, 2017 we announced that the first patient had been dosed in our Phase III program to evaluate the efficacy and safety of our topical minocycline foam 1.5% FMX103 for the treatment of moderate-to-severe rosacea. The Phase III program consists of two multi-center trials, (referred to as Studies 11 and 12) conducted at approximately 80 sites throughout the U.S., implementing protocols and endpoints in accordance with the FDA’s guidance as provided in the pre-IND meeting. Each trial is expected to enroll approximately 750 patients with moderate-to-severe papulopustular rosacea into a 12-week double-blind, vehicle-controlled phase. Patients are randomized on a 2:1 basis (1.5% minocycline foam versus vehicle) and treated once daily for 12 weeks in the initial double-blind portions of the trials. The primary efficacy endpoints are (a) the dichotomized IGA score where treatment success is defined as at least a 2-step improvement resulting in a 0 (clear) or 1 (almost clear) score at week 12 compared to day 0 / baseline, and (b) the absolute change in the inflammatory lesion count at week 12 compared to day 0 / baseline. Safety evaluation will include reported adverse events, assessments of tolerability, clinical laboratory tests and vital signs. The two double-blinded efficacy trials will be followed by an open-label safety extension study (Study 13) to evaluate the safety of FMX103 for up to an additional 40 weeks.

8

As in our third Phase III trial in acne, we selected Premier Research as our designated CRO for the execution of our two Phase III trials in rosacea as well as the open-level safety extension study. We expect to have top-line results from the blinded stage of the trials by the end of the third quarter or in the beginning of the fourth quarter of 2018 and to complete these trials in 2019.

FDX104 for chemotherapy-induced rash

FDX104 is a topical foam formulation of the antibiotic doxycycline for the treatment of severe acne-like rashes induced by chemotherapy.

EGFRI induced-rash and lack of designated treatment

Between 45% and 95% of cancer patients taking epidermal growth-factor receptor inhibitors (EGRFI), such as cetuximab (Erbitux®, Eli Lilly), panitumumab (Vectibix®, Amgen) and erlotinib (Tarceva®, Genentech) are affected by these severe acne-like rashes, which typically occur in cosmetically sensitive areas such as the face and upper trunk. These symptoms can lead to patients modifying their dosage of EGFRI drugs and potentially stop treatment altogether. While there are no approved drugs for the treatment of these rashes, oral doxycycline and minocycline are often used to treat these conditions, but they have significant shortcomings, including systemic side effects such as diarrhea, nausea and skin redness.

FDX104 Phase II clinical trial

In the fourth quarter of 2015, we completed a Phase II clinical trial for FDX104 on patients with metastatic colon cancer who were treated with cetuximab or panitumumab, to prevent the serious rash-like dermal side effects that can be induced by these chemotherapeutic agents. The results showed a statistically significant effect of FDX104 in reducing the severity of these dermal effects, although our assessment of the limited commercial potential of the product in combination with our current priorities has caused us to re-assess our near term efforts with regard to the product.

Twenty-four patients were enrolled and received trial drug in a multicenter, randomized, double-blind, placebo-controlled trial, to evaluate the safety and efficacy of FDX104. Each patient acted as his or her own control by treating one side of the face with FDX104 and the other side with the matching foam vehicle in a blinded and randomized manner. Photographs of the face were taken at each trial visit and were used for the grading of rash severity in a blinded manner by an independent dermatologist at the end of the trial (general rash severity score, or GSS). Rash severity was also performed at each visit by the investigator (modified MASCC EGFR inhibitor papulopustular eruption grading scale, or MESTT). The GSS ratings of rash severity were: none = 0, mild = 1, moderate = 2 and severe = 3. The key findings were:

| · |

The severity of rash on the FDX104 treatment side of the face was overall better than in the vehicle-treated side when analyzed in the ITT population (N=24 patients);

|

| · |

the mean maximal rash severity in the ITT population was 1.33 and 1.71 in the FDX104-treated and placebo-treated sides respectively; and

|

| · |

9 of the 24 patients in the trial (37.5%) developed severe (grade 3) rash during the study on the vehicle-treated side, while only 4 of the 24 patients in the study (16.7%) developed severe rash on the FDX104-treated side.

|

Comparison of the two treatments (FDX104 and vehicle) on the prevention of rash based on clinical importance reached statistical significance (p<0.05, Wilcoxon Signed-Rank test). MESTT-based analyses had similar but non-statistically significant results. FDX104 was well-tolerated during the study. No drug-related systemic adverse events were recorded. Local reactions were noted in 5 patients, all were mild and 4 were resolved before the end of the study.

While the results of the FDX104 Phase II clinical trial were generally positive, we are assessing our various options with regard to FDX104 in light of our current focus and priorities. This includes seeking out licensing opportunities for the product and discontinuing its further in-house clinical development in the near term so as to better focus on additional research and development efforts.

FMX102 for impetigo

FMX102 is a formulation of our minocycline foam currently being developed for the treatment of impetigo.

Impetigo and limitations of current standard of care

Impetigo is a highly contagious bacterial skin infection that primarily afflicts preschool-aged children, and is typically caused by staphylococcus aureus, including methicillin-resistant staphylococcus aureus, or MRSA. It usually results in red sores and lesions on the face, neck, arms and legs. The topical antibiotic Bactroban and other mupirocin-based topical products are the current standard of care for the treatment of impetigo. According to its product label, Bactroban achieves a clinical efficacy rate of between 71% and 96% for impetigo after eight to 12 days of three-times daily treatment. According to the product label for Altabax, the most recently approved topical treatment for impetigo, it achieves a success rate of 89% for impetigo after five days of twice-daily treatment.

9

FMX102 Phase II clinical trial

We conducted a randomized, double-blind Phase II clinical trial in Israel over seven days with 32 pediatric patients ages two to 15 with at least two impetigo lesions. Of these patients, 32% were diagnosed with MRSA infection. The patients were randomly divided into two groups of 16 patients each, with one group receiving a 1% concentration of our minocycline foam and the other group receiving a 4% concentration of our minocycline foam, applied to each patient twice a day. No vehicle-only control was used, as ethical guidelines for pediatric trials in Israel do not permit the use of control groups.

The primary efficacy endpoints of the trial were (a) clinical success, defined as a total absence of treated lesions or certain specific improvements in the lesions during the trial and the continuous absence of the treated lesions or certain specific improvements in the lesions at follow-up; (b) bacteriological success, measured by elimination of the bacteria in the lesion as shown by a bacterial culture at end of treatment or follow-up or by the lack of any material to culture as a result of the lesion healing; and (c) safety and tolerability.

The trial was completed in 2012 and showed that approximately 80% of the patients in both groups met the clinical success criteria after three days of treatment. Clinical response at the end of the treatment (on day 7) was 92% for the 1% dosage and 100% for the 4% dosage, and all patients (100%) showed success by the fourteenth day of the trial. In a post-hoc analysis of the clinical trial results, eleven of the patients in this trial were also diagnosed with methicillin-resistant staphylococcus aureus (MRSA). Bacteriological success was reached in all 11 patients by the end of the trial and no presence of MRSA was detected. The safety and tolerability profile of the drug was favorable, and no drug-related side effects were reported during the trial.

In October 2015 we held a Pre-IND meeting with the FDA to seek guidance with regards to the preclinical and clinical activities that are required to advance the development program of FMX102. The FDA requested that we conduct a photo-safety study prior to further evaluation of our clinical development plan. We began this photo-safety study in 2016. In 2017, further work on FMX102 was de-prioritized as we focused on our clinical development work for FMX101 and FMX103. Following our further evaluation of the clinical development plan this year and the potential market for FMX102 in the U.S., and considering the treatment currently available for impetigo, we concluded that the business opportunity presented by this product is insufficient to justify further investment of our resources in its advancement at this time, and have discontinued its development.

Development and License Agreements

Parallel to the development of our product candidates, we have entered into development and license agreements with various pharmaceutical companies, including Bayer HealthCare AG, Mylan N.V. and Actavis Laboratories, combining our foam technology with drugs selected by the licensee to create new product offerings for patients. Each license agreement entitles us to service payments, contingent payments and royalties from sales of any new products that are commercialized. Each agreement is exclusive only to the specific drug that is licensed, leaving us the rights to commercialize and develop products with other drugs for the same indications using our proprietary foam technology while also allowing the licensee to apply the new products to any indication with its specific drug.

In September 2015, Bayer began selling Finacea® Foam (azelaic acid) 15%, or Finacea, in the U.S. Finacea is a prescription topical drug which was developed through a collaboration between Bayer and Foamix. It is the first prescription product developed using our proprietary technology that has been approved by the FDA for sale in the U.S. Bayer listed in the Orange Book several patents that were licensed from Foamix in connection with the development of Finacea Foam. According to our license agreement with Bayer, we are entitled to receive royalties and certain contingent payments upon the commercialization of Finacea. In 2017 we were entitled to a total of $3.5 million from Bayer in royalties from sales of Finacea. In January 2018 Bayer and Foamix filed a complaint alleging patent infringement under the patent laws of the United States that arises out of the submission by defendant Teva of an ANDA to the FDA seeking approval to manufacture and sell a generic version of Bayer’s Finacea Foam. In February 2018 Bayer and Foamix filed a complaint alleging patent infringement under U.S. patent law arising from Perrigo’s submission of an ANDA to the FDA seeking approval to manufacture and sell a generic version of Bayer’s Finacea. See also “Item1A—Risk Factors—Risks Related to Our Intellectual Property—We have received notice letters of ANDAs submitted for drug products that are generic versions of Finacea Foam and we are involved in lawsuits to protect or enforce our patents, which could be expensive, time consuming and unsuccessful”.

Our total revenues from all development and license agreements from our inception to December 31, 2017 were approximately $28.1 million.

Additional Research and Development

In addition to FMX101 for the treatment of moderate-to-severe acne, FMX103 for the treatment of moderate-to-severe rosacea and licensed products resulting from our development and license agreements with various pharmaceutical companies, we are developing a series of product candidates for various indications to which we own worldwide rights, and which are all based on formulations and adaptations of our patented, versatile foam platforms or other dosage forms.

10

We intend to selectively proceed into clinical trials with these formulations under the FDA’s 505(b)(2) regulatory pathway wherever possible, and according to our identification of unmet needs and potential market opportunities.

Our research and development expenses totaled $57.8 million, $25.9 million and $10.7 million in 2017, 2016 and 2015, respectively. In the ordinary course of business we enter into agreements with third parties such as contract research organizations, or CROs, medical institutions, clinical investigators and contract laboratories, to conduct our clinical trials and aspects of our research and preclinical testing. These CROs and other third parties provide us with project management, monitoring, regulatory consulting and investigative services, and their fees are part of our research and development expenses.

Intellectual Property

Our intellectual property and proprietary technology are essential to the development, manufacture, and sale of FMX101 and FMX103 and our future pipeline products. We seek to protect our intellectual property, core technologies and other know-how, through a combination of patents, trademarks, trade secrets, non-disclosure and confidentiality agreements, licenses, assignments of invention and other contractual arrangements with our employees, consultants, partners, suppliers, customers and others. Additionally, we rely on our research and development program, clinical trials, know-how and marketing and distribution programs to advance our products.

We submit applications directly or under the Patent Cooperation Treaty, or PCT, which is an international patent law treaty that provides a unified procedure for filing a single initial patent application to seek patent protection for an invention simultaneously in any one of the designated member states. Although a PCT application does not issue as a patent, it allows the applicant to seek protection in any of the member states through national-phase applications.

We also submit applications for a single European patent application covering member states. If granted, the European patent must be validated in each national member state in which the patent is to continue and becomes a bundle of individual national patents.

Our most important patents are several U.S. patents relating to our lead product candidates, FMX101 and FMX103 which are expected to remain in effect until 2030. These patents relate to a composition of matter comprising a claim to a formulation of a tetracycline antibiotic, which can include minocycline or doxycycline and therefore may be less protective than patents that claim a new drug. We also have patent applications claiming compositions of matter, which relate to FMX101 and FMX103 pending in each of the following international markets: Canada, the European Union, India and Mexico.

Our other patents granted in the U.S. have claims relating to certain formulations of our foam platforms and other technology, including emulsion foams, hydrophobic foams, hydroalcoholic and aqueous foams.

As of December 31, 2017 we had a patent portfolio of 165 granted patents in certain countries worldwide, including 62 granted patents in the U.S. Additionally, as of December 31, 2017 we had over 40 pending patent applications worldwide, of which over 30 are pending in the U.S., describing and claiming our various foam based platforms and other technology. Our other pending applications relate to various foam platforms such as emulsion foam, hydrophobic foam, hydro-alcoholic foam and water-free foams, as well as specialty foams (such as potent solvent foams).

Competition

The medical and pharmaceutical industries in which we operate are intensely competitive and subject to significant technological change and changes in practice. While we believe that our innovative technology, knowledge, experience and resources provide us with competitive advantages, we may face competition from many different sources with respect to FMX101, FMX103 and our other pipeline products or any product candidates that we may seek to develop or commercialize in the future. Possible competitors may include pharmaceutical companies, academic and medical institutions, governmental agencies and public and private research institutions. These prospective competitors have the ability to effectively discover, develop, test and obtain regulatory approvals for products that compete with ours, as well as the ability to effectively commercialize, market and promote approved products, including communicating the effectiveness, safety and value of products to actual and prospective customers and medical staff.

At the end of 2014 we became aware that a privately-held active pharmaceutical ingredient and drug product intermediate manufacturer, Hovione, had submitted an IND for Phase I and II clinical trials of a new topical gel suspension containing minocycline non-hydrochloride for the treatment of inflammatory skin disease, including acne and rosacea. On December 4 2017, Hovione announced the commencement of a Phase II clinical trial for the treatment of moderate to severe papulopustular rosacea. In 2015 we became aware that another company, BioPharmX Corporation (NYSE MKT: BPMX), was developing a topical hydrophilic gel containing minocycline hydrochloride for the treatment of acne, known as BPX-01. BioPharmX announced the results of its Phase IIa and Phase IIb clinical trials for BPX-01 in April 2016 and May 2017, respectively, and in November 2017 it announced that it had gained concurrence with FDA on the design of a planned Phase III clinical trial for BPX-01 for treatment of acne. Earlier that year, in September 2017, BioPharmX announced interim results of a feasibility study with BPX-01 for treatment of rosacea, later renamed BPX-04. If ultimately approved and launched in the U.S., these products would become direct competitors to FMX101 and FMX103.

11

Further, we are developing certain topical products with various licensees combining our proprietary technology with a drug selected by the licensee. While the licenses we grant are exclusive with respect to the specific drug which is licensed, our agreements with these licensees allow them to commercialize the licensed developed products for any topical dermatological application, not just for the specific indication for which each product was originally intended. If any such licensed product proves to be effective for moderate-to severe acne, impetigo, rosacea, chemotherapy-induced rash, or any other indication that we are pursuing with FMX101, FMX103 or our other product candidates, we may face competition from these licensees, as they are not bound by non-compete restrictions. Although we believe that FMX101, FMX103 and our other product candidates can outperform the licensed products in the specific indications our product candidates are targeting, such licensed products may nevertheless pose a competitive challenge, as they will have the benefit of our foam technology coupled with the licensees’ greater resources, experience and brand recognition, extensive marketing channels and other capabilities, and possibly the advantage of entering the market before us.

In addition to products that are currently available, other products may be introduced to treat acne, rosacea, impetigo and other skin disorders during the time that we engage in necessary development. Accordingly, if one of our pipeline products is approved, our main challenge in the market would be to convince dermatologists, pediatricians or other physicians seeking alternatives to oral or other existing treatments to use our product instead. While we are still in the preliminary stages, based on our studies, we believe that our pipeline products could be more effective than the current non-topical alternatives and exhibit significantly less adverse side effects.

Government Regulation

Our business is subject to extensive government regulation. Regulation by governmental authorities in the U.S. and other jurisdictions is a significant factor in the development, manufacture and marketing of our foam delivered treatments and in our ongoing research and development activities.

Product approval process in the U.S.

Review and approval of drugs

In the U.S., the FDA regulates drugs under the Federal Food, Drug, and Cosmetic Act and implementing regulations and other laws, including the Public Health Service Act. Drugs require the submission of an NDA, and approval by the FDA prior to being marketed in the U.S. The process of obtaining regulatory approvals and the subsequent compliance with appropriate federal, state, local and foreign statutes and regulations requires the expenditure of substantial time and financial resources. Failure to comply with the applicable U.S. requirements at any time during the product development process, approval process or after approval may subject an applicant to a variety of administrative or judicial sanctions and enforcement actions brought by the FDA, the Department of Justice or other governmental entities. Possible sanctions may include the FDA’s refusal to approve pending NDAs, withdrawal of an approval, imposition of a clinical hold, issuance of warning letters, product recalls, product seizures, total or partial suspension of production or distribution, injunctions, fines, refusals of government contracts, restitution, disgorgement and civil or criminal penalties.

The process required by the FDA prior to marketing and distributing a drug in the U.S. generally involves the following:

| · |

completion of laboratory tests, animal studies and formulation studies in compliance with the FDA’s good laboratory practice, or GLP, or other applicable regulations;

|

| · |

submission to the FDA of an application for an investigational new drug, or IND designation, which must become effective before human clinical trials may begin;

|

| · |

approval by an independent institutional review board, or IRB, at each clinical site before each trial may be initiated;

|

| · |

performance of adequate and well-controlled human clinical trials in accordance with good clinical practice, or GCP, to establish the safety and efficacy of the proposed drug for its intended use;

|

| · |

preparation and submission to the FDA of an NDA or supplemental NDA;

|

| · |

satisfactory completion of an FDA advisory committee review, if applicable;

|

| · |

satisfactory completion of one or more FDA inspections of the manufacturing facility or facilities at which the product or components thereof are produced, to assess compliance with current good manufacturing processes, or cGMP, and to assure that the facilities, methods and controls are adequate to preserve the drug’s identity, strength, quality and purity; and

|

| · |

payment of user fees and FDA review and approval of the NDA.

|

Preclinical studies

Preclinical studies include laboratory evaluation, as well as animal studies to assess the potential safety and efficacy of the product candidate. Preclinical safety tests must be conducted in compliance with the FDA’s GLP regulations. The results of the preclinical tests, together with manufacturing information and analytical data, are submitted to the FDA as part of an IND which must become effective before clinical trials may be commenced.

12

Clinical trials in support of an NDA

Clinical trials involve the administration of an investigational product to human subjects under the supervision of qualified investigators in accordance with GCP requirements, which include, among other things, the requirement that all research subjects provide their informed consent in writing before their participation in any clinical trial. Clinical trials are conducted under written trial protocols detailing, among other things, the objectives of the trial, the parameters to be used in monitoring safety, and the effectiveness criteria to be evaluated. A protocol for each clinical trial and any subsequent protocol amendments must be submitted to the FDA as part of the IND. An IND becomes effective 30 days after receipt by the FDA, unless before that time the FDA raises concerns or questions related to a proposed clinical trial and places the trial on clinical hold. In such a case, the IND sponsor and the FDA must resolve any outstanding concerns before the clinical trial can begin.

In addition, an IRB representing each institution participating in the clinical trial must review and approve the plan for any clinical trial before it commences at that institution, and the IRB must conduct continuing review and reapprove the trial at least annually. The IRB must review and approve, among other things, the trial protocol and informed consent information to be provided to trial subjects. An IRB must operate in compliance with FDA regulations. Information about certain clinical trials must be submitted within specific timeframes to the National Institutes of Health for public dissemination on their ClinicalTrials.gov website.

Clinical trials are typically conducted in three sequential phases, which may overlap or be combined:

| · |

Phase I: The drug is initially introduced into healthy human subjects or patients with the target disease or condition and tested for safety, dosage tolerance, absorption, metabolism, distribution, excretion and, if possible, to gain an early indication of its effectiveness and to determine optimal dosage.

|

| · |

Phase II: The drug is administered to a limited patient population to identify possible short-term adverse effects and safety risks, to preliminarily evaluate the efficacy of the product for specific targeted diseases and to determine dosage tolerance and optimal dosage.

|

| · |

Phase III: The drug is administered to an expanded patient population, generally at geographically dispersed clinical trial sites, in well-controlled clinical trials to generate enough data to statistically evaluate the efficacy and safety of the product for approval, to establish the overall risk-benefit profile of the product, and to provide adequate information for the labeling of the product.

|

Submission of an NDA to the FDA

The results of the preclinical studies and clinical trials, together with other detailed information, including information on the manufacture, control and composition of the product, are submitted to the FDA as part of an NDA requesting approval to market the product candidate for a proposed indication. Under the Prescription Drug User Fee Act, as amended, applicants are required to pay fees to the FDA for reviewing an NDA. These user fees, as well as the annual fees required for commercial manufacturing establishments and for approved products, can be substantial. The NDA review fee alone exceeded $2,038,000 for fiscal year 2017, subject to certain limited deferrals, waivers and reductions that may be available. The manufacturer or sponsor under an approved NDA are also subject to annual product and establishment user fees, currently exceeding $97,000 per product and $512,000 per establishment for fiscal year 2017. Although these fees were reduced from fiscal year 2016, they are typically increased annually. Each NDA submitted to the FDA for approval is typically reviewed for administrative completeness and reviewability within 45 to 60 days following submission of the application. If found complete, the FDA will “file” the NDA, thus triggering a full review of the application. The FDA may refuse to file any NDA that it deems incomplete or not properly reviewable at the time of submission.

Before approving an NDA, the FDA may inspect the facilities at which the product is manufactured or facilities that are significantly involved in the product development and distribution process, and will not approve the product unless cGMP compliance is satisfactory. The FDA may deny approval of an NDA if applicable statutory or regulatory criteria are not satisfied, or may require additional testing or information, which can delay the approval process. FDA approval of any application may include many delays or may never be granted. If a product is approved, the approval will impose limitations on the indicated uses for which the product may be marketed, may require that warning statements be included in the product labeling, may require that additional studies or trials be conducted following approval as a condition of the approval, may impose restrictions and conditions on product distribution, prescribing or dispensing in the form of a risk management plan, or impose other limitations.

Once a product is approved, marketing the product for other indicated uses or making certain manufacturing or other changes requires FDA review and approval of a supplement NDA or a new NDA, which may require additional clinical data and review fees. In addition, further post-marketing testing and surveillance to monitor the safety or efficacy of a product may be required. Also, product approvals may be withdrawn if compliance with regulatory standards is not maintained or if safety or manufacturing problems occur following initial marketing. In addition, new government requirements may be established that could delay or prevent regulatory approval of our product candidate under development.

13

505(b)(2) NDAs

As an alternative path to FDA approval for modifications to formulations or uses of products previously approved by the FDA, an applicant may submit an NDA under Section 505(b)(2) of the Federal Food, Drug and Cosmetic Act, or FDCA. Section 505(b)(2) was enacted as part of the Hatch-Waxman Amendments and permits the filing of an NDA where at least some of the information required for approval comes from studies or trials not conducted by or for the applicant. If the 505(b)(2) applicant can establish that reliance on FDA’s previous findings of safety and effectiveness is scientifically appropriate, it may eliminate the need to conduct certain preclinical studies or clinical trials of the new product. The FDA may also require companies to perform additional studies or measurements, including clinical trials, to support the change from the approved reference, or “listed” drug. The FDA may then approve the new product candidate for all, or some, of the label indications for which the reference drug has been approved, as well as for any new indication sought by the 505(b)(2) applicant.

To the extent that a Section 505(b)(2) NDA relies on clinical trials conducted for a previously approved drug product or the FDA’s prior findings of safety and effectiveness for a previously approved drug product, the Section 505(b)(2) applicant must submit patent certifications in its Section 505(b)(2) application with respect to any patents for the previously approved product on which the applicant’s application relies that are listed in the FDA’s Publication of Approved Drug Products with Therapeutic Equivalence Evaluations, commonly known as the ‘Orange Book’. Specifically, the applicant must certify for each listed patent that, in relevant part, (i) the required patent information has not been filed; (ii) the listed patent has expired; (iii) the listed patent has not expired, but will expire on a particular date and approval is not sought until after patent expiration; or (iv) the listed patent is invalid, unenforceable or will not be infringed by the proposed new product.

A certification that the new product will not infringe the previously approved product’s listed patent or that such patent is invalid or unenforceable is known as a Paragraph IV certification. If the applicant does not challenge one or more listed patents through a Paragraph IV certification, the FDA will not approve the Section 505(b)(2) NDA application until all the listed patents claiming the referenced product have expired. Further, the FDA will also not approve, as applicable, a Section 505(b)(2) NDA application until any non-patent exclusivity, such as, for example, five-year exclusivity for obtaining approval of a new chemical entity, three-year exclusivity for an approval based on new clinical trials, or pediatric exclusivity, listed in the Orange Book for the referenced product, has expired.

If the Section 505(b)(2) NDA applicant has provided a Paragraph IV certification to the FDA, the applicant must also send notice of the Paragraph IV certification to the owner of the referenced NDA for the previously approved product and relevant patent holders within 20 days after the Section 505(b)(2) NDA has been accepted for filing by the FDA. The NDA and patent holders may then initiate a patent infringement suit against the Section 505(b)(2) applicant. Under the FDCA, the filing of a patent infringement lawsuit within 45 days of receipt of the notification regarding a Paragraph IV certification automatically prevents the FDA from approving the Section 505(b)(2) NDA until the earliest to occur of 30 months beginning on the date the patent holder receives notice, expiration of the patent, settlement of the lawsuit, or until a court deems the patent unenforceable, invalid or not infringed. Even if a patent infringement claim is not brought within the 45-day period, a patent infringement claim may be brought under traditional patent law, but it does not invoke the 30-month stay.

Moreover, in cases where a Section 505(b)(2) application containing a Paragraph IV certification is submitted after the fourth year of a previously approved drug’s five-year exclusivity period and the patent holder brings suit within 45 days of notice of certification, the 30-month period is automatically extended to prevent approval of the Section 505(b)(2) application until the date that is seven and one-half years after approval of the previously approved reference product. The court also has the ability to shorten or lengthen either the 30 month or the seven and one-half year period if either party is found not to be reasonably cooperating in expediting the litigation.

In addition to patent protections applicable to a listed drug, a Section 505(b)(2) application may be subject to periods of statutory market exclusivity afforded to an approved new drug. Statutory market exclusivity provides the holder of an approved NDA limited protection from new competition in the marketplace for the innovation represented by its approved drug product, and precludes approval of certain 505(b)(2) applications for prescribed periods of time. Exclusivity is available for new chemical entities, as well as for significant changes in already approved drug products, such as a new use. FDA may refuse to approve a Section 505(b)(2) application to the extent it is subject to the market exclusivity.

Notwithstanding the approval of many products by the FDA pursuant to Section 505(b)(2), over the last few years, some pharmaceutical companies and others have objected to the FDA’s interpretation of Section 505(b)(2). If the FDA changes its interpretation of Section 505(b)(2), or if the FDA’s interpretation is successfully challenged in court, this could delay or even prevent the FDA from approving any Section 505(b)(2) NDA that we submit.

The FDA regulations and other applicable regulations and policies provide incentives to manufacturers to create modified, non-infringing versions of a drug to facilitate the approval of an ANDA or other application for generic substitutes.

14

Post-approval requirements