Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - BlueLinx Holdings Inc. | q42017earningsexhibit991.htm |

| 8-K - 8-K - BlueLinx Holdings Inc. | q42017earnings8k.htm |

2

This presentation includes “forward-looking statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. All of these forward-looking statements are based on estimates and assumptions made

by our management that, although believed by us to be reasonable, are inherently uncertain. Forward-looking

statements involve risks and uncertainties, including, but not limited to, economic, competitive, governmental

and technological factors outside of our control, that may cause our business, strategy or actual results to

differ materially from the forward-looking statements. These risks and uncertainties may include, among other

things: changes in the prices, supply and/or demand for products that it distributes; inventory management

and commodities pricing; new housing starts and inventory levels of existing homes for sale; general economic

and business conditions in the United States; acceptance by our customers of our privately branded products;

financial condition and creditworthiness of our customers; supply from our key vendors; reliability of the

technologies we utilize; the activities of competitors, including consolidation of our competitors; changes in

significant operating expenses; fuel costs; risk of losses associated with accidents; exposure to product liability

claims; changes in the availability of capital and interest rates; adverse weather patterns or conditions; acts of

cyber intrusion; variations in the performance of the financial markets, including the credit markets; and other

factors described in the “Risk Factors” section in the Company’s Annual Report on Form 10-K for the year

ended December 31, 2016, its Quarterly Reports on Form 10-Q, and in its periodic reports filed with the

Securities and Exchange Commission from time to time. Given these risks and uncertainties, you are

cautioned not to place undue reliance on forward-looking statements. Unless otherwise indicated, all forward-

looking statements are as of the date they are made, and we undertake no obligation to update these forward-

looking statements, whether as a result of new information, the occurrence of future events, or otherwise.

Some of the forward-looking statements discuss the company’s plans, strategies, expectations and intentions.

They use words such as “expects”, “may”, “will”, “believes”, “should”, “approximately”, “anticipates”,

“estimates”, “outlook”, and “plans”, and other variations of these and similar words, and one or more of which

may be used in a positive or negative context.

Immaterial Rounding Differences - Immaterial rounding adjustments and differences may exist between slides,

press releases, and previously issued presentations.

Forward-Looking Statements

3

BlueLinx reports its financial results in accordance with accounting principles generally accepted in the United States (“GAAP”). The

Company also believes that presentation of certain non-GAAP measures may be useful to investors. Any non-GAAP measures used

herein are reconciled to the financial tables set forth in the appendices hereto. The Company cautions that non-GAAP measures should be

considered in addition to, but not as a substitute for, the Company’s reported GAAP results.

We define Adjusted EBITDA as an amount equal to net income plus interest expense and all interest expense related items, income taxes,

depreciation and amortization, and further adjusted to exclude certain non-cash items and other adjustments to Consolidated Net Income.

Further, we also exclude, as an additional measure, the effects of the operational efficiency initiatives, to determine same-center

(comparable) Adjusted EBITDA, which is useful for period over period comparability.

We present Adjusted EBITDA (and the exclusion of the effects of the operational efficiency initiatives) because it is a primary measure

used by management to evaluate operating performance and, we believe, helps to enhance investors’ overall understanding of the

financial performance and cash flows of our business. However, Adjusted EBITDA is not a presentation made in accordance with GAAP,

and is not intended to present a superior measure of the financial condition from those determined under GAAP. Adjusted EBITDA, as

used herein, is not necessarily comparable to other similarly titled captions of other companies due to differences in methods of

calculation. We believe Adjusted EBITDA is helpful in highlighting operating trends. We also believe that Adjusted EBITDA is frequently

used by securities analysts, investors and other interested parties in their evaluation of companies, many of which present an Adjusted

EBITDA measure when reporting their results. We compensate for the limitations of using non-GAAP financial measures by using them to

supplement GAAP results to provide a more complete understanding of the factors and trends affecting the business than using GAAP

results alone.

We define the non-GAAP metrics of adjusted same-center (comparable) net sales and adjusted same-center (comparable) gross profit as

net sales and gross profit excluding the effects of both closed facilities and the inventory rationalization initiative. These measures are not

a presentation made in accordance with GAAP, and are not intended to present a superior measure of the financial condition from those

determined under GAAP. Adjusted same-center net sales and adjusted same-center gross profit, as used herein, are not necessarily

comparable to other similarly titled captions of other companies due to differences in methods of calculation.

We believe adjusted same-center net sales and adjusted same-center gross profit are helpful in presenting comparability across periods

without the full-year effect of our operational efficiency initiatives. We also believe that these non-GAAP metrics are used by securities

analysts, investors, and other interested parties in their evaluation of our company, to illustrate the effects of these initiatives. We

compensate for the limitations of using non-GAAP financial measures by using them to supplement GAAP results to provide a more

complete understanding of the factors and trends affecting the business than using GAAP results alone.

We believe supplementary GAAP-based information such as operating working capital and debt principal are helpful to investors in

explaining the impacts of our operating efficiencies. Operating working capital is defined as current assets less current liabilities plus the

current portion of long-term debt. Operating working capital is an important measure we use to determine the efficiencies of our operations

and our ability to readily convert assets into cash. Debt principal is defined as the principal amount of debt payable at the stated period-end

date and is used by management to monitor our progress in meeting our goals to reduce the debt on our balance sheet.

Non-GAAP Financial Measures

4

Key Highlights

5

Real Estate Valuation

6

Accelerating Market Demand Drivers Creates a

Long Runway for Ongoing Value Creation

7

Key Initiatives

8

9

Executive Summary – Fourth Quarter 2017 Highlights

• Net Sales of $433.6 million, up $12.0 million from Q4 2016

• Adjusted same-center net sales increased $14.7 million from Q4 2016

• Gross Profit of $55.5 million, up $3.1 million from Q4 2016

• Adjusted same-center gross profit increased $3.4 million from Q4 2016

• Gross Margin of 12.8%, up 40 basis points; best fourth quarter on record

• Specialty Product Margin of 15.3%, up 30 basis points from Q4 2016

• Structural Product Margin of 9.1%, up 110 basis points from Q4 2016

• Net Income of $53.5 million in Q4 2017, up $43.1 million from Q4 2016

• Tax benefit of $54.2 million

• Best fourth quarter on record

• Adjusted EBITDA of $9.8 million, up $4.2 million from Q4 2016

◦ Best fourth quarter on record

• Debt principal reduction of $22.5 million from Q4 2016

• Excess Availability of $63.3 million

10

Q4 Tax Overview

• On October 23, 2017, a change in control1 occurred as a result of Cerberus’

secondary offering

• No impact to our financial statements as we anticipate utilizing all of our

Federal Net Operating Losses (NOLs) of approximately $158 million as of

Q4 2017 through future earnings and real estate sales

• With the New Tax Reform Act2, the Company revalued our Deferred Tax Assets

(DTAs) along with our Deferred Valuation allowance to account for new Federal

Tax Reform rate of 21%

• The tax reform resulted in a net benefit of $0.5 million and our gross DTA

was reduced by $29.6 million

• The release of our Deferred Tax Valuation Allowance, along with other tax

adjustments resulted in a ax benefit to income taxes for the quarter of $54.2

million

• Remaining valuation allowance of $10.4 million relating primarily to our state

NOLs

1 Change in control accounted for in accordance with Internal Revenue Code Section 382

2 New Tax reform was passed on December 22, 2017 as a result of the Tax Cuts and Jobs Act

11

Executive Summary – Full Year 2017 Highlights

• Net Sales of $1.82 billion

• Adjusted same-center net sales increased $63.7 million or 3.6% from the

same period in 2016

• Gross Profit of $231.0 million

• Adjusted same-center gross profit increased $11.2 million or 5.1% from

the same period in 2016

• Gross Margin of 12.7%, an increase of 60 basis points from 2016

• Best full year gross margin on record

• Net Income of $63.0 million, up $46.9 million from 2016

• Tax benefit of $53.4 million

• Best full year net income results on record

• Diluted earnings per share of $6.81

• Adjusted EBITDA of $43.9 million; best full year results since 2006

• On a same center basis, Adjusted EBITDA increased $9.5 million or

27.4% from 2016

12

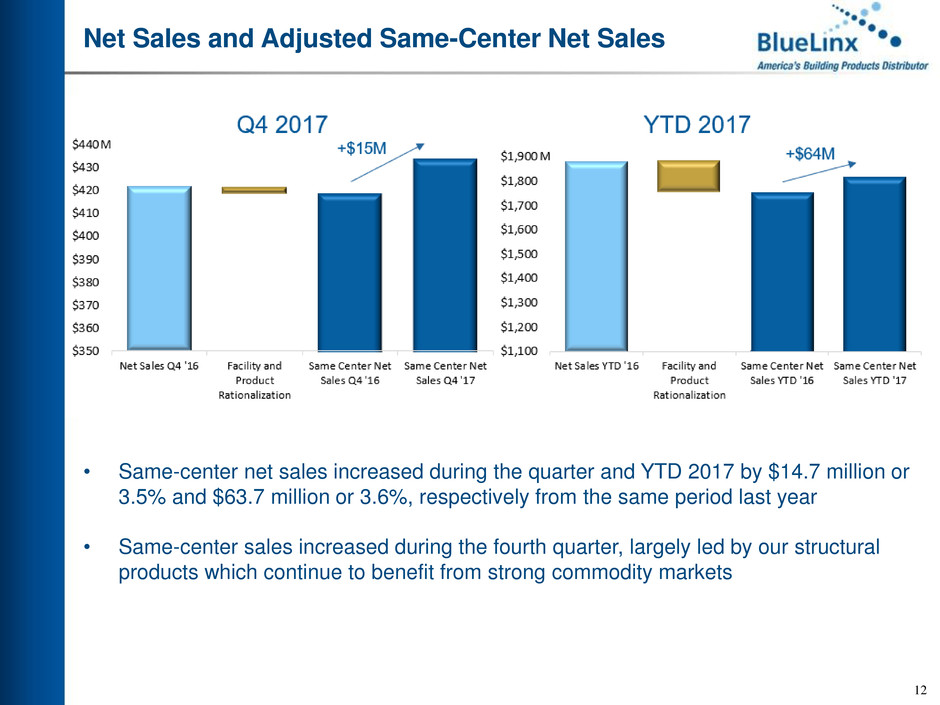

Net Sales and Adjusted Same-Center Net Sales

• Same-center net sales increased during the quarter and YTD 2017 by $14.7 million or

3.5% and $63.7 million or 3.6%, respectively from the same period last year

• Same-center sales increased during the fourth quarter, largely led by our structural

products which continue to benefit from strong commodity markets

13

Historical Fourth Quarter and Full Year Gross Margin

• Gross margin for Q4 2017 increased 40 basis points from Q4 2016

• Structural margin of 9.1%, up 110 basis points

• Specialty margin of 15.3%, up 30 basis points

• Gross margin YTD increased 60 basis points from fiscal 2016

• Structural margin of 9.2%, up 40 basis points

• Specialty margin of 15.1%, up 140 basis points

14

Historical Net Income and Adjusted EBITDA Growth

• Adjusted EBITDA continues to trend favorably due to Gross Margin growth, focus on

variable contribution margin and operational efficiencies

• 2017 Adjusted EBITDA grew $7.5 million or 20.6% over prior year

• Net Income of $63 million was best full year net income on record

1292% Compound Annual Growth Rate (CAGR) calculation for net income excludes years with negative net income

15

16

Remaining Net Operating Losses1 (NOLs)

• We continue to successfully execute on our delevering strategy and anticipate

effectively utilizing our remaining NOLs

• Real estate gains on property sales incurred in January 2018 will be sheltered by our

existing NOLs; we anticipate this real estate gain would utilize $82-92 million of

existing NOLs2

1 Net Operating Losses listed above consists of only Federal NOLs

2 NOLs used are estimated until the applicable tax return is filed. Actual usage may be different from these current estimates.

17

Remaining Deferred Tax Asset (DTA)

Valuation Allowance

• DTA valuation allowance was significantly reduced in 2017 due to the new tax reform

and the release of our DTA valuation allowance

• We will continue to evaluate the remaining deferred tax asset valuation allowance on a

quarterly basis

1 Deferred Charges include changes in various deferred tax assets

18

Adjusted EBITDA

In thousands

2017 2016 2017 2016

Q4 Q4 YTD YTD

Net income (loss) $ 53,486 $ 10,365 $ 62,994 $ 16,085

Adjustments:

Depreciation and amortization 2,167 2,251 9,032 9,342

Interest expense 4,945 5,336 21,225 24,898

Provision for (benefit from) income taxes (54,241 ) 512 (53,409 ) 1,121

Gain from sales of property — (13,395 ) (6,700 ) (28,097 )

Share-based compensation expense 661 572 2,465 2,193

Restructuring, severance, and legal 2,817 39 8,312 7,361

Refinancing-related expenses — — — — 3,518

Adjusted EBITDA $ 9,835 $ 5,680 $ 43,919 $ 36,421

Adjusted EBITDA $ 9,835 $ 5,680 $ 43,919 $ 36,421

Less: other non-GAAP adjustments — — — 1,954

Same-center Adjusted EBITDA $ 9,835 $ 5,680 $ 43,919 $ 34,467

19

Adjusted EBITDA - 5 Year Historical

In thousands

2017 2016 2015 2014 2013

Net income (loss) $ 62,994 $ 16,085 $ (11,576 ) $ (13,872 ) $ (40,618 )

Adjustments:

Depreciation and amortization 9,032 9,342 9,741 9,473 9,117

Interest expense 21,225 24,898 27,342 26,771 28,024

Provision for (benefit from) income

taxes (53,409 ) 1,121 153 312 (9,013 )

Gain from sales of property (6,700 ) (28,097 ) — (5,251 ) (5,220 )

Share-based compensation expense 2,465 2,193 2,051 2,351 3,222

Restructuring, severance, and legal 8,312 7,361 (2,903 ) 4,799 15,812

Refinancing-related expenses — — 3,518 — — —

Adjusted EBITDA $ 43,919 $ 36,421 $ 24,808 $ 24,583 $ 1,324

20

Comparable Same-Center Schedule

$ in thousands

2017 2016 2017 2016

Q4 Q4 YTD YTD

Net sales $ 433,608 $ 421,657 $ 1,815,535 $ 1,881,043

Less: non-GAAP adjustments — 2,788 — 129,184

Adjusted same-center net sales $ 433,608 $ 418,869 $ 1,815,535 $ 1,751,859

Adjusted year-over-year percentage increase -

sales 3.5 % 3.6 %

Gross profit $ 55,504 $ 52,374 $ 231,029 $ 227,406

Less: non-GAAP adjustments — 310 50 7,617

Adjusted same-center gross profit $ 55,504 $ 52,064 $ 230,979 $ 219,789

21

Debt Principal

$ in thousands

2017 2016

Q4 Q4 Change

Revolving credit facilities - principal $ 182,685 $ 176,183 $ 6,502

Mortgage - principal 97,847 126,823 (28,976 )

Total $ 280,532 $ 303,006 $ (22,474 )

22

Operating Working Capital

$ in thousands

2017 2016

Q4 Q4 Change

Current assets:

Cash $ 4,696 $ 5,540 $ (844 )

Receivables, less allowance for doubtful

accounts 134,072 125,857 8,215

Inventories, net 187,512 191,287 (3,775 )

Other current assets 17,124 23,126 (6,002 )

Total current assets $ 343,404 $ 345,810 $ (2,406 )

Current liabilities:

Accounts Payable (1) $ 92,216 $ 104,431 $ (12,215 )

Accrued compensation 9,229 8,349 880

Current maturities of long-term debt, net of

discount — 29,469 (29,469 )

Other current liabilities 16,160 12,092 4,068

Total current liabilities $ 117,605 $ 154,341 $ (36,736 )

Operating working capital $ 225,799 $ 220,938 $ 4,861

(1) Accounts payable includes bank overdrafts

23