Attached files

| file | filename |

|---|---|

| EX-23.1 - EXHIBIT 23.1 - AKAMAI TECHNOLOGIES INC | exhibit231_10k2017.htm |

| 10-K - FORM 10-K - AKAMAI TECHNOLOGIES INC | akam10k123117.htm |

| EX-32.2 - EXHIBIT 32.2 - AKAMAI TECHNOLOGIES INC | exhibit322_10k2017.htm |

| EX-32.1 - EXHIBIT 32.1 - AKAMAI TECHNOLOGIES INC | exhibit321_10k2017.htm |

| EX-31.2 - EXHIBIT 31.2 - AKAMAI TECHNOLOGIES INC | exhibit312_10k2017.htm |

| EX-31.1 - EXHIBIT 31.1 - AKAMAI TECHNOLOGIES INC | exhibit311_10k2017.htm |

| EX-21.1 - EXHIBIT 21.1 - AKAMAI TECHNOLOGIES INC | exhibit211_10k2017.htm |

| EX-10.2 - EXHIBIT 10.2 - AKAMAI TECHNOLOGIES INC | exhibit102_10k2017.htm |

EXHIBIT 10.19

150 BROADWAY AT KENDALL CENTER

CAMBRIDGE, MASSACHUSETTS

INDEX TO LEASE

FROM

BOSTON PROPERTIES LIMITED PARTNERSHIP

TO

AKAMAI TECHNOLOGIES, INC.

TABLE OF CONTENTS

Page

ARTICLE 1 BASIC LEASE PROVISIONS AND INCORPORATION OF EXHIBITS 2

1.1 INTRODUCTION 2

1.2 BASIC DATA 2

1.3 INCORPORATION EXHIBITS 5

ARTICLE 2 PREMISES 5

2.1 DEMISE AND LEASE OF PREMISES 5

2.2 APPURTENANT RIGHTS AND RESERVATIONS. 5

ARTICLE 3 LEASE TERM AND EXTENSION OPTION 9

3.1 TERM 9

i

3.2 EXTENSION OPTION 9

ARTICLE 4 CONDITION OF PREMISES 10

4.1 CONDITION OF PREMISES 11

4.2 TENANT ALLOWANCE 11

4.3 TENANT’S OFFSET RIGHT 13

ARTICLE 5 ANNUAL FIXED RENT AND ELECTRICITY 14

5.1 FIXED RENT 14

5.2 ELECTRICITY 15

ARTICLE 6 TAXES 15

6.1 DEFINITIONS 15

6.2 TENANT’S PAYMENT OF REAL ESTATE TAXES 16

6.3 TENANT’S RIGHT TO CONTEST REAL ESTATE TAXES 17

ARTICLE 7 LANDLORD’S REPAIRS AND SERVICES AND TENANT’S ESCALATION PAYMENTS 18

7.1 STRUCTURAL REPAIRS 18

7.2 OTHER REPAIRS TO BE MADE BY LANDLORD 18

7.3 SERVICES TO BE PROVIDED BY LANDLORD 19

7.4 OPERATING EXPENSES DEFINED 19

7.5 TENANT’S ESCALATION PAYMENTS 25

ii

7.6 NO DAMAGE 27

7.7 TENANT’S AUDIT RIGHTS 28

7.8 SERVICES TO BE PROVIDED BY TENANT 30

ARTICLE 8 TENANT’S REPAIRS 31

8.1 TENANT’S REPAIRS AND MAINTENANCE 31

ARTICLE 9 ALTERATIONS 31

9.1 LANDLORD’S APPROVAL 31

9.2 CONFORMITY OF WORK 33

9.3 PERFORMANCE OF WORK, GOVERNMENTAL PERMITS AND INSURANCE 33

9.4 LIENS 34

9.5 NATURE OF ALTERATIONS 35

9.6 INCREASES IN TAXES 36

ARTICLE 10 PARKING 36

10.1 PARKING PRIVILEGES 36

10.2 PARKING CHARGES 36

10.3 GARAGE OPERATION 37

10.4 LIMITATIONS 38

10.5 PARKING LOCATION; PERMITTED GARAGES 38

iii

ARTICLE 11 CERTAIN TENANT COVENANTS 39

11.1 PAYMENT 39

11.2 USE AND OCCUPANCY 39

11.3 NO OBSTRUCTION 40

11.4 COMPLIANCE WITH LAW – TENANTS PARTICULAR USE 40

11.5 FLOOR LOAD 40

11.6 TAXES ON PERSONAL PROPERTY 41

11.7 ATTORNEYS’ FEES 41

11.8 COMPLIANCE WITH LAW 41

11.9 VENDORS 41

11.10 OFAC 41

ARTICLE 12 ASSIGNMENT AND SUBLETTING 42

12.1 RESTRICTIONS ON TRANSFER 42

12.2 TENANT’S 42

12.3 LANDLORD’S TERMINATION RIGHT 43

12.4 CONSENT OF LANDLORD 43

12.5 EXCEPTIONS 45

iv

12.6 PROFIT ON SUBLEASING OR ASSIGNMENT 46

12.7 ADDITIONAL CONDITIONS 46

12.8 EXPEDITED DISPUTE RESOLUTION 48

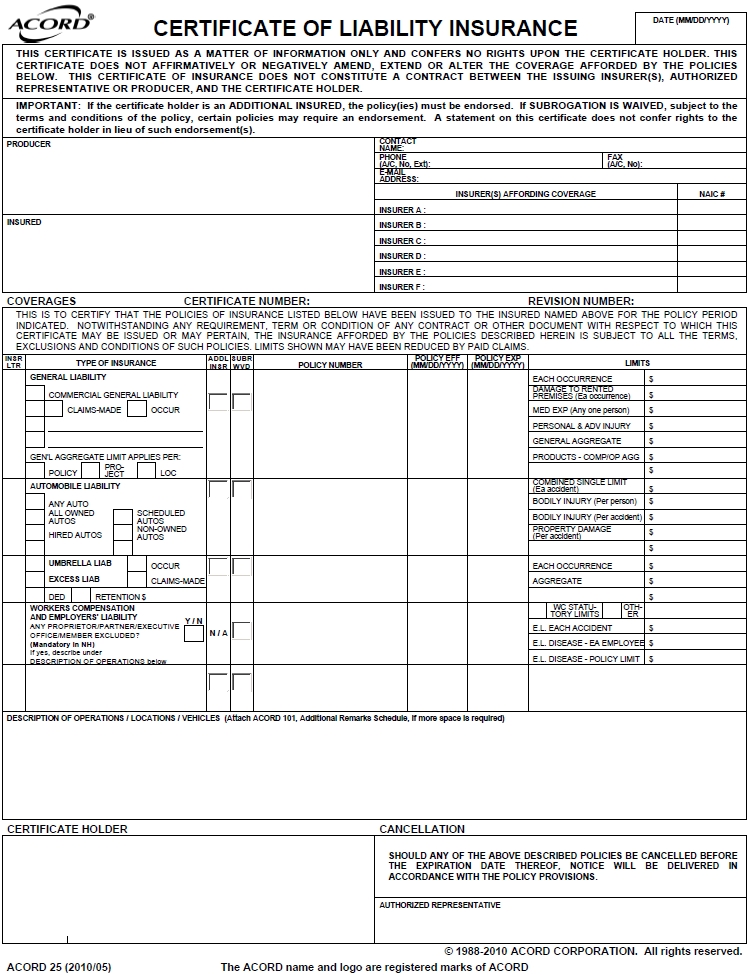

ARTICLE 13 INDEMNITY AND COMMERCIAL GENERAL LIABILITY INSURANCE 49

13.1 TENANT’S INDEMNITY 49

13.2 TENANT’S RISK 50

13.3 TENANT’S COMMERCIAL GENERAL LIABILITY INSURANCE 51

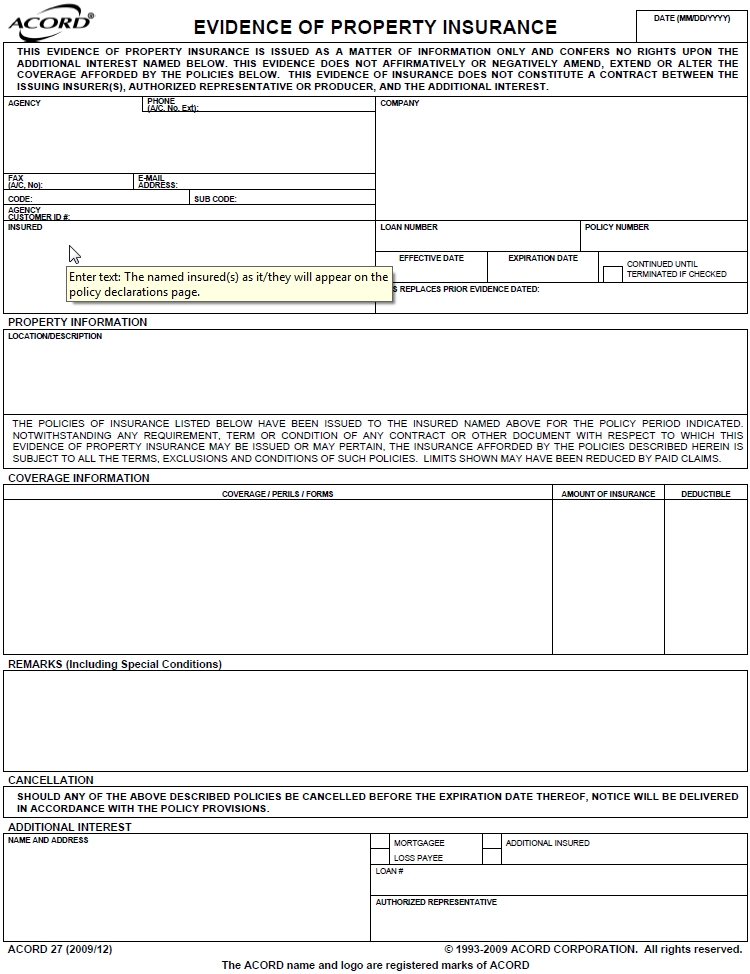

13.4 TENANT’S PROPERTY INSURANCE 51

13.5 TENANT’S OTHER INSURANCE 52

13.6 REQUIREMENTS FOR TENANT’S INSURANCE 52

13.7 ADDITIONAL INSUREDS 53

13.8 CERTIFICATES OF INSURANCE 53

13.9 SUBTENANTS AND OTHER OCCUPANTS 53

13.10 NO VIOLATION OF BUILDING POLICIES 54

13.11 TENANT TO PAY PREMIUM INCREASES 54

13.12 LANDLORD’S INSURANCE 54

13.13 WAIVER OF SUBROGATION 55

v

13.14 TENANT’S WORK 56

13.15 LANDLORD’S INDEMNITY 56

13.16 TENANT’S SELF INSURANCE 56

ARTICLE 14 FIRE, CASUALTY AND TAKING 57

14.1 DAMAGE RESULTING FROM CASUALTY 57

14.2 UNINSURED CASUALTY 60

14.3 RIGHTS OF TERMINATION FOR TAKING 60

14.4 AWARD 61

14.5 TIME OF THE ESSENCE 61

ARTICLE 15 DEFAULT 61

15.1 TENANT’S DEFAULT 61

15.2 TERMINATION; RE-ENTRY 62

15.3 CONTINUED LIABILITY; RE-LETTING 63

15.4 LIQUIDATED DAMAGES 63

15.5 WAIVER OF REDEMPTION 64

15.6 LANDLORD’S DEFAULT; TENANT’S SELF HELP 64

ARTICLE 16 MISCELLANEOUS PROVISIONS 66

16.1 WAIVER 66

vi

16.2 CUMULATIVE REMEDIES 66

16.3 QUIET ENJOYMENT 66

16.4 SURRENDER 67

16.5 BROKERAGE 67

16.6 INVALIDITY OF PARTICULAR PROVISIONS 67

16.7 PROVISIONS BINDING, ETC 68

16.8 RECORDING 68

16.9 NOTICES AND TIME FOR ACTION 68

16.10 WHEN LEASE BECOMES BINDING 69

16.11 PARAGRAPH HEADINGS 69

16.12 RIGHTS OF MORTGAGEE 69

16.13 RIGHTS OF GROUND LESSOR 70

16.14 NOTICE TO MORTGAGEE AND GROUND LESSOR 70

16.15 ASSIGNMENT OF RENTS 71

16.16 STATUS REPORT AND FINANCIAL STATEMENTS 71

16.17 LANDLORD’S SELF-HELP 72

16.18 HOLDING OVER 72

vii

16.19 ENTRY BY LANDLORD 73

16.20 TENANT’S PAYMENTS 74

16.21 LATE PAYMENT 74

16.22 COUNTERPARTS 75

16.23 ENTIRE AGREEMENT 75

16.24 LIMITATION OF LIABILITY 75

16.25 NO PARTNERSHIP 76

16.26 INTENTIONALLY OMITTED 76

16.27 WAIVER OF TRIAL BY JURY 76

16.28 GOVERNING LAW 76

16.29 TENANT’S SIGNAGE 76

16.30 AUTHORITY OF PARTIES 77

16.31 COMPLIANCE WITH LAWS 77

16.32 ARBITRATION. 77

16.33 ELECTRONIC SIGNATURES 78

16.34 LEWIN PARK 78

16.35 TRANSPORTATION PROGRAM 78

viii

16.36 SECURITY DEPOSIT 78

ENUMERATION OF EXHIBITS:

Schedule 1 | -- Annual Fixed Rent. |

Exhibit A-1 | -- Plan of Premises. |

Exhibit A-2 | -- Description of the Lot. |

Exhibit A-3 | -- Plan of Lot. |

Exhibit B | -- Landlord’s Services. |

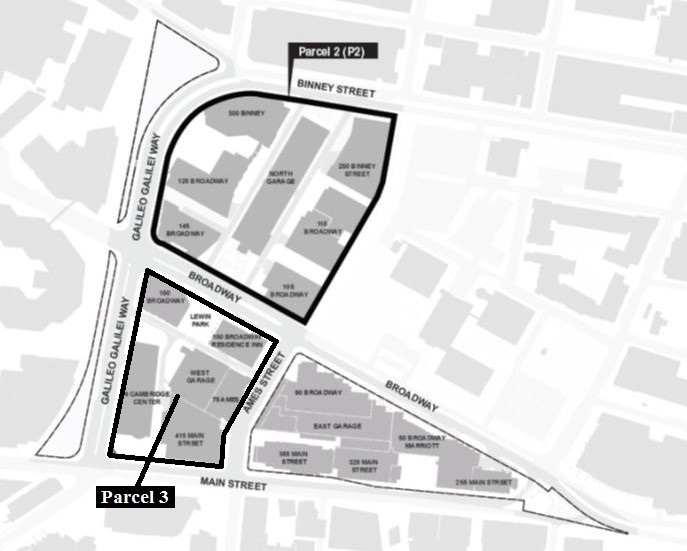

Exhibit C | -- Development Area Map. |

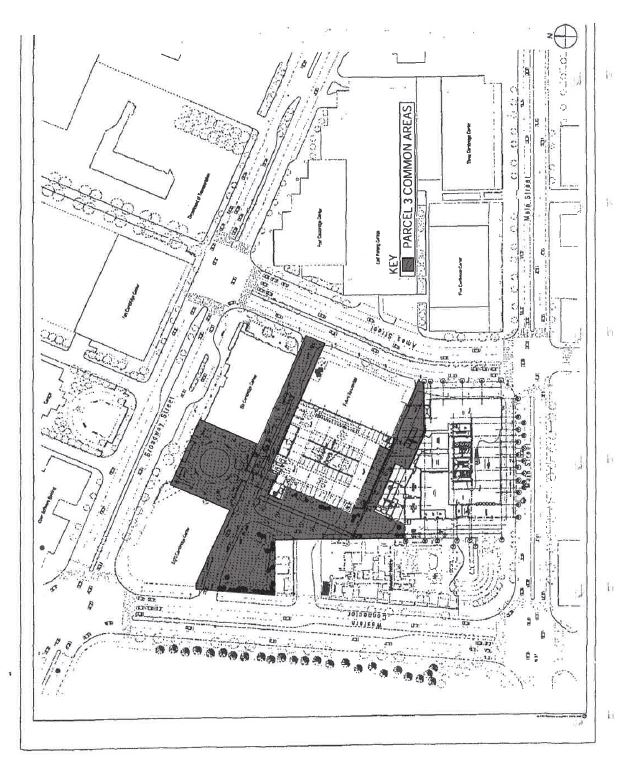

Exhibit D-1 | -- Common Areas of Parcel 3 of the Development Area |

Exhibit D-2 | -- Location of Lewin Park as of the Execution Date of the Lease. |

Exhibit E | -- Form of Commencement Date Agreement. |

Exhibit F | -- Broker Determination of Prevailing Market Rent. |

Exhibit G | -- Form of Certificate of Insurance. |

Exhibit H | -- Rules and Regulations. |

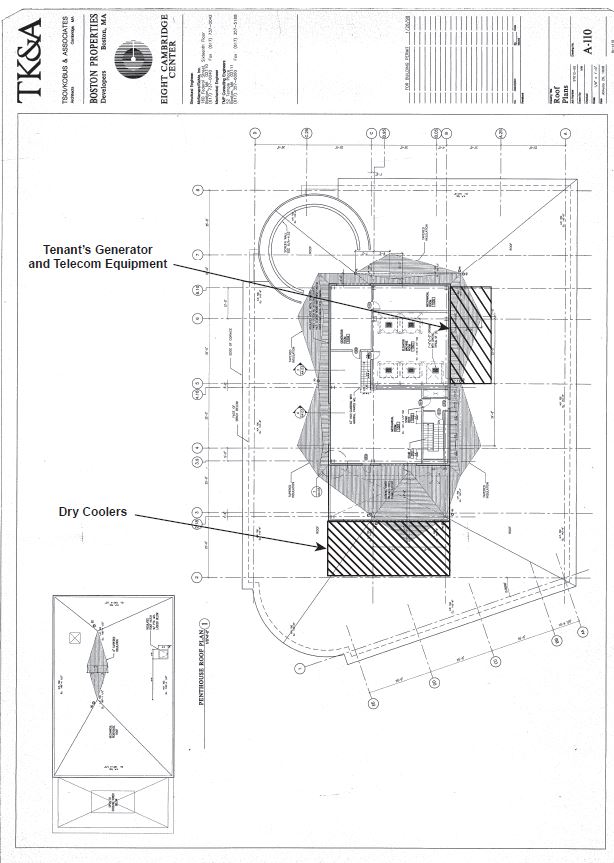

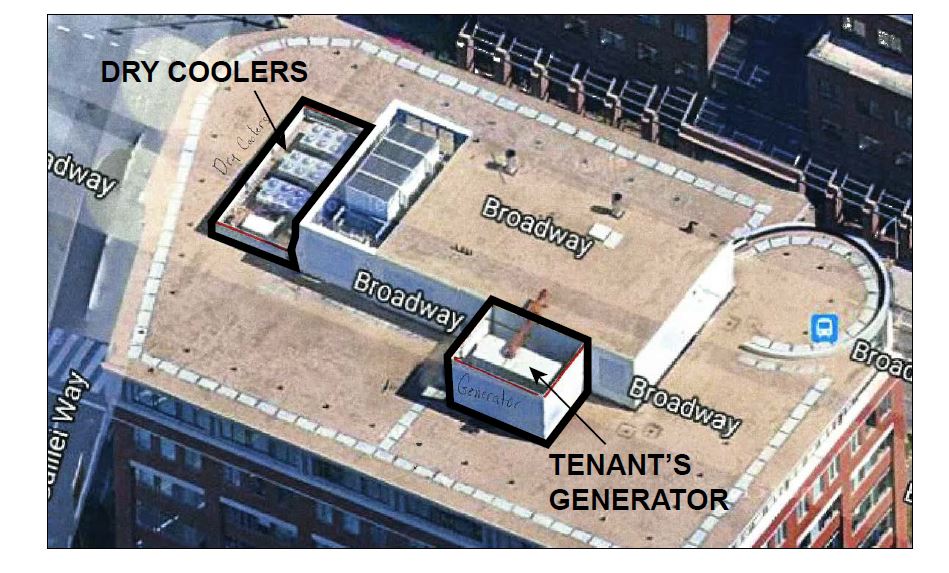

Exhibit I-1 | -- Permitted Rooftop Area |

Exhibit I-2 | -- Existing Rooftop Area |

Exhibit J | -- Form of Lien Waivers |

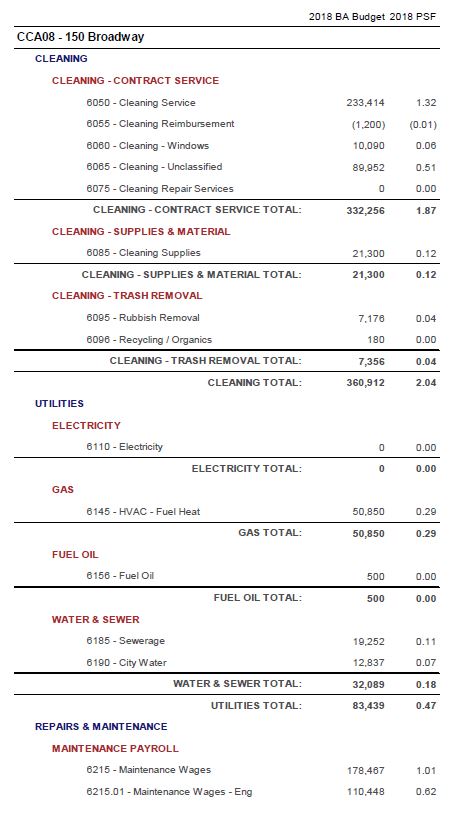

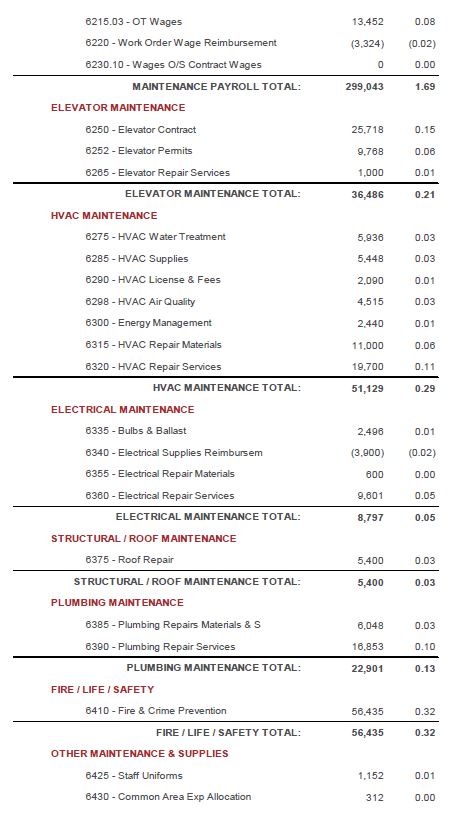

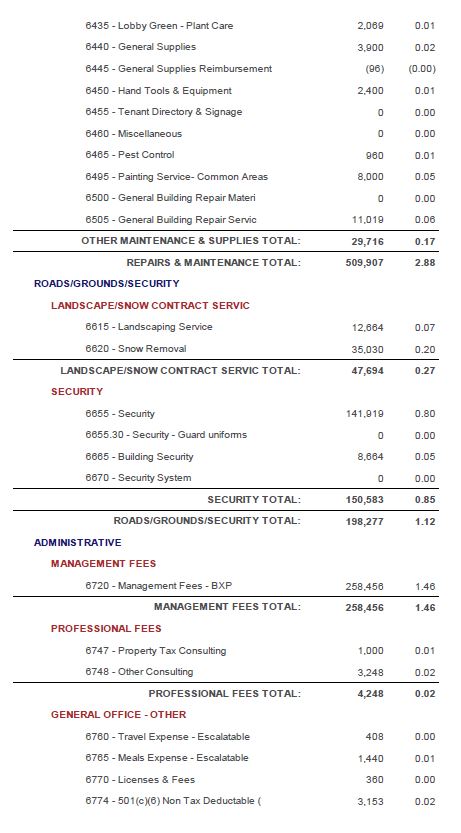

Exhibit K | -- Sample Operating Expense Budget |

Exhibit L | -- Building Management System |

ix

150 BROADWAY AT KENDALL CENTER

CAMBRIDGE, MASSACHUSETTS

AMENDED AND RESTATED LEASE DATED DECEMBER 20, 2017

THIS INSTRUMENT (THIS “RESTATED LEASE”) IS AN INDENTURE OF LEASE in which the Landlord and the Tenant are the parties hereinafter named, and which relates to space in the building known as 150 Broadway at Kendall Center and having an address at 150 Broadway, Cambridge, Massachusetts.

R E C I T A L S

A.Tenant currently leases the Premises from Landlord pursuant to that certain Lease between Landlord and Tenant, dated as of October 1, 2007, as amended by that certain First Amendment to Lease, dated as of November 7, 2016 (collectively, the “Existing 150 Lease”).

B.The Trustees of Eleven Cambridge Center Trust, a Massachusetts nominee trust and an affiliate of Landlord (the “145 Broadway Landlord”), and Tenant are parties to that certain Lease, dated as of November 7, 2016 (the “145 Broadway Lease”), pursuant to which Tenant leases certain premises (the “145 Broadway Premises”) in the building (the “145 Broadway Building”) known as and numbered 145 Broadway, Cambridge, Massachusetts, which 145 Broadway Premises are more particularly described in the 145 Broadway Lease.

C.Landlord, the 145 Broadway Landlord, and Tenant are parties to that certain Must Take Premises and Right of First Offer Agreement, dated as of November 7, 2016 (the “MTP Agreement”), pursuant to which Tenant agreed to lease certain other premises (the “Must Take Premises”) from Landlord (or an affiliate of Landlord) in addition to the 145 Broadway Premises.

D.In accordance with Section 2.1 of the MTP Agreement, Landlord delivered the MTP Designation Notice (as defined in the MTP Agreement) to Tenant on August 29, 2017, in which Landlord designated the Building (referred to in the MTP Agreement as the 150 Broadway Building) as the Must Take Premises. Accordingly, this Restated Lease constitutes the MTP Lease (as defined in the MTP Agreement).

E.If, as and when the Commencement Date (as defined in the 145 Broadway Lease) occurs under the 145 Broadway Lease (such date being referred to herein as the “Restatement Effective Date”), this Restated Lease shall amend and restate the Existing 150 Lease in its entirety as of the Restatement Effective Date (provided that all obligations of either party that accrued under the Existing 150 Lease prior to the Restatement Effective Date shall continue in full force and effect as provided for and as set forth in the Existing 150 Lease).

F.The provisions of the Existing 150 Lease shall remain in full force and effect until 11:59 p.m. on the day immediately prior to the Restatement Effective Date. If the 145 Broadway Lease is terminated prior to the Restatement Effective Date, then this Restated Lease shall immediately become null and void and the Existing 150 Lease shall continue in full force and effect. From and after the Restatement Effective Date, all references herein to the “Lease” shall be deemed to mean this Restated Lease.

The parties to this instrument hereby agree with each other as follows:

Article 1

BASIC LEASE PROVISIONS AND INCORPORATION OF EXHIBITS

BASIC LEASE PROVISIONS AND INCORPORATION OF EXHIBITS

1.1 INTRODUCTION. The following sets forth the basic data and identifying exhibits elsewhere hereinafter referred to in this lease, and, where appropriate, constitute definitions of the terms hereinafter listed.

1.2 BASIC DATA.

Execution Date: | December __, 2017 | |

Landlord: | BOSTON PROPERTIES LIMITED PARTNERSHIP, a Delaware limited partnership | |

Present Mailing Address of Landlord: | Boston Properties Limited Partnership Prudential Center 800 Boylston Street, Suite 1900 Boston, Massachusetts 02199-8103 Attention: Regional General Counsel | |

Landlord’s Construction Representative: | Michael Tilford | |

Tenant: | Akamai Technologies, Inc., a Delaware corporation | |

Present Mailing Address of Tenant: | Akamai Technologies, Inc. 145 Broadway Cambridge, Massachusetts 02142 Attention: Real Property Administrator with a copy to: McCarter & English, LLP 265 Franklin Street Boston, Massachusetts 02110 Attention: Cynthia B. Keliher, Esq. | |

Commencement Date: | The Restatement Effective Date (as defined in the Recitals) | |

Expiration Date: | The last day of the One Hundred Eightieth (180th) complete calendar month following the Commencement Date (plus the partial month, if any, immediately following the Commencement Date). | |

Lease Term: (sometimes called the “Original Lease Term”) | The period beginning on the Commencement Date and ending on the Expiration Date, unless extended or sooner terminated as hereinafter provided. | |

Extension Option: | One (1) period of ten (10) years as provided in and on the terms set forth in Section 3.2 hereof. | |

2

Lease Year: | Any twelve (12) month period during the Lease Term commencing as of the Commencement Date, or as of any anniversary of the Commencement Date, except that if the Commencement Date does not occur on the first day of a calendar month, then (i) the first Lease Year shall further include the partial calendar month in which the first anniversary of the Commencement Date occurs, and (ii) the remaining Lease Years shall be the successive twelve-(12)-month periods following the end of such first Lease Year. | |

Annual Fixed Rent: | To be determined in accordance with Schedule 1 attached hereto. | |

Tenant Electricity: | As provided in Section 5.2 hereof. | |

Additional Rent: | All charges and other sums payable by Tenant to Landlord as set forth in this Lease, in addition to Annual Fixed Rent. | |

Building: | The building known as and numbered 150 Broadway, Kendall Center, Cambridge, Massachusetts. | |

Total Rentable Floor Area of the Building: | 177,226 square feet | |

Premises: | The entire first (1st) through ninth (9th) floors of the Building, as shown on the floor plans annexed hereto as Exhibit A-1 and incorporated herein by reference, being the entire rentable area of the Building. | |

Rentable Floor Area of the Premises: | 177,226 square feet | |

Lot: | The property consisting of Tract IVA of Parcel 3 of the Development Area, as described in Exhibit A‑2 and as shown on Exhibit A‑3, each as attached hereto and incorporated herein by reference. | |

Plan of Lot: | The plan attached hereto as Exhibit A-3. | |

Property: | The Building and Lot. | |

Development Area: | The area of the Kendall Center development, as shown on Exhibit C. | |

Common Areas of Parcel 3 of the Development Area: | The vehicular roadways, open spaces and sidewalks located on Parcel 3 of the Development Area. The current Common Areas of Parcel 3 of the Development Area are shown on Exhibit D‑1 attached hereto. | |

3

Permitted Uses: | General business and professional offices, research and development offices, research, experimental and testing laboratory and accessory and ancillary uses in connection therewith, as permitted under the Zoning Ordinance of the City of Cambridge (the “Zoning Ordinance”); provided however, the Permitted Uses shall not include manufacturing of biotechnology and pharmaceutical products or uses accessory or ancillary thereto. As accessory or ancillary to the Permitted Uses, the following uses shall be permitted to the extent the same comply with Legal Requirements (including, without limitation, the Zoning Ordinance): (i) food service, daycare service and health and fitness facilities for employees and visitors, (ii) a so-called Network Operations Command Center, Broadcast Operations Command Center and/or Security Operations Command Center, (iii) training and/or conference center facilities, (iv) server rooms and (v) engineering and/or fabrication laboratories. Landlord hereby acknowledges that the foregoing uses are permitted uses under the Zoning Ordinance as of the date hereof provided that Tenant undertakes such uses in compliance with the Zoning Ordinance. | |

Broker: | CRESA Partners Boston, Inc. | |

ARTICLE 2

PREMISES

PREMISES

2.1 DEMISE AND LEASE OF PREMISES. Subject to and in accordance with the terms and provisions of this Lease, Landlord hereby demises and leases to Tenant, and Tenant hereby hires and accepts from Landlord, the Premises.

2.2 APPURTENANT RIGHTS AND RESERVATIONS.

(A) Tenant shall have, as appurtenant to the Premises, the non-exclusive right to use in common with others, but not in a manner or extent that would materially interfere with the normal operation and use of the Building as an office building (and as a multi-tenant office building if Tenant at any time leases less than the entirety of the Building), and subject to reasonable rules of general applicability from time to time made by Landlord of which Tenant is given notice (provided that the same do not increase the monetary obligations of Tenant, or materially increase any of the other obligations of Tenant, under this Lease, do not materially derogate from the rights of Tenant under this Lease, and are uniformly enforced): (a) the pipes, ducts, shafts, conduits, wires and appurtenant fixtures serving the Premises, and (b) the Common Areas of Parcel 3 of the Development Area. Notwithstanding anything to the contrary herein, Landlord has no obligation to allow any particular telecommunication service provider to have access to the Building or to the Premises, but Landlord agrees not to unreasonably withhold, condition or delay approval of Tenant’s desired provider(s). Landlord hereby approves Comcast, LightTower, Windstream, Cogent, AT&T, Masergy, XO Communications, Verizon, CenturyLink, Zayo (formerly known as AboveNet), Level3, and Hurricane Electric as Tenant’s telecommunications service provider(s). If Landlord permits such access, Landlord may condition such access upon the payment to Landlord by the service provider of fees assessed by Landlord in its sole

4

discretion; provided, however, that and so long as (x) Tenant’s telecommunications service provider does not provide telecommunications service to any other tenant of the Building or (y) Tenant is leasing all of the Building, Landlord shall not require such service provider to pay any fees for such access.

Landlord reserves the right from time to time, without unreasonable interference with Tenant’s use of and access to the Building: to install, use, maintain, repair, replace and relocate for service to the Premises pipes, ducts, conduits, wires and appurtenant fixtures, wherever located in the Premises or on the Lot, provided that any such installations, replacements and relocations above shall be located so far as practicable in the central core area of the Building, above ceiling surfaces, below floor surfaces or within perimeter walls. All access to the Premises by Landlord shall be subject to the terms and provisions of Section 16.19 below. Subject to temporary interruption resulting from fire, casualty, maintenance activity, the actions of governmental authorities and other conditions not reasonably within Landlord’s control, Tenant shall have access to the Premises and, for pass holders, their Assigned Garage (as defined in Section 10.1), 24 hours per day, 365 days per year. Such right of access shall be subject to such reasonable security procedures (e.g., presentation of building access card, guard desk sign-in, and the like) as may be adopted by Landlord from time to time.

(B) Changes to Layout: Landlord shall not change the layout of the Building and the other improvements on the Lot in any way that (i) changes the number of buildings, (ii) changes, in any material respect, the configuration or orientation of the Building or materially alters the existing location of the Building, (iii) changes the number of floors or, in any material respect, the size of any floor of the Building, (iv) permanently moves the location of the entrance to the Building (though temporary relocation in the context of repairs or renovations shall not be thereby prohibited), (v) would otherwise materially alter the Premises or materially and adversely affect Tenant’s use of the Premises for the Permitted Use or materially and adversely affect Tenant’s access to the Premises and the Building, or (vi) would prevent the Premises and the Building from being considered a first-class office location (each of the foregoing, a “Material Layout Change”). Landlord shall give Tenant prior written notice of any changes which it reasonably believes are Material Layout Changes that it desires to make. All Material Layout Changes shall be subject to Tenant’s prior written approval, which approval shall not be unreasonably withheld or conditioned, and shall be granted or denied (with reasonable explanation of the grounds for such denial) within five (5) business days after notice thereof. Changes to the layout of the Building and other the improvements on the Lot which are not Material Layout Changes shall not require Tenant’s approval.

(C) Stairwell Access: Tenant shall have the right to use the emergency stairwell for the purpose of pedestrian access between the floors of the Premises and to make cosmetic improvements thereto, provided that, at Tenant’s sole cost and expense: (i) Tenant obtains all necessary governmental permits and approvals, if any, for such use or improvements, and (ii) Tenant installs a card reader or other limited access system (“Tenant’s Internal Access System”) at each entry point of the Premises from the emergency stairwell used by Tenant for interfloor access; provided, however, the foregoing clause (ii) is not required so long as Tenant leases the entirety of the Building, and (iii) Tenant shall be responsible for (and Landlord shall have no liability for) any security issues that may arise within the Premises as the result of the use of the emergency stairwell for interfloor access between portions of the Premises. Moreover, in the event that Tenant uses the emergency stairwell for such interfloor access between portions of the Premises, then the emergency stairwell will be treated as part of the Premises with respect to all of Tenant’s indemnification and insurance obligations.

(D) Rooftop Equipment: Subject to the following provisions hereof, Tenant shall have the exclusive right from time to time during the Lease Term within the portion of the roof of the Building

5

shown on Exhibit I-1 attached hereto (“Tenant’s Rooftop Area”) to (i) maintain, repair and replace the three (3) existing supplemental HVAC units (“Tenant’s HVAC Equipment”) located on the portion of the roof of the Building shown on Exhibit I-2 attached hereto, (ii) maintain, repair and replace the existing emergency generator and diesel fuel tank (collectively, “Tenant’s Generator”) located on the portion of the roof of the Building shown on Exhibit I-2 attached hereto and (iii) install, maintain, repair and replace equipment for telecommunications, data transmission and other similar technologies, in each case to be utilized by Tenant, for the purpose of Tenant’s conduct of the Permitted Uses within the Premises and/or within other premises leased by Tenant in the Kendall Square, Cambridge area, and by its permitted subtenants and assignees and Permitted Transferees (as herein defined) hereunder only (“Tenant’s Communications Equipment”). Any future replacements or installations of Tenant’s HVAC Equipment shall be located within the area shown as “Dry Coolers” on Exhibit I-1. Any future replacements or installations of Tenant’s Generator shall be located within the area shown as “Tenant’s Generator and Telecom Equipment” on Exhibit I-1. Any future replacements or installations of Tenant’s Communications Equipment shall be located within the area shown as “Tenant’s Generator and Telecom Equipment” and/or the area shown as “Dry Coolers” on Exhibit I-1.

In connection with the installation of Tenant’s Communications Equipment, as well as any replacement of Tenant’s Generator or Tenant’s HVAC Equipment or installation of new generator or HVAC equipment (which new generator and/or HVAC equipment shall be subject to the provisions hereof applicable to Tenant’s Generator and/or Tenant’s HVAC Equipment, as the case may be), as contemplated in this Section 2.2(D), Tenant shall submit to Landlord plans and specifications (including, but not limited to, design and size) therefor and the proposed exact location thereof within Tenant’s Rooftop Area (including but not limited to the size and aesthetics of such items and the architectural compatibility and relationship between the same and the general area of the Lot). Landlord shall respond within ten (10) business days after its receipt of such plans and specifications either indicating its approval (which approval shall not be unreasonably withheld, delayed or conditioned) or stating with reasonable specificity its reasons for disapproval. If Landlord fails to respond within such ten (10) business day period, Tenant may re-send such request to Landlord via registered or certified mail, return receipt requested, or recognized overnight delivery service, with the following statement in bold at the beginning of such request, “WARNING: POSSIBLE DEEMED APPROVAL NOTICE. Failure to respond to this request within ten (10) days may lead to deemed approval of such request”. Should Landlord fail to respond to such second request within ten (10) days after receipt thereof, such failure shall be deemed to be approval of such plans and specifications by Landlord.

In addition to the foregoing, it is understood and agreed that the exercise of rights by Tenant under this Section 2.2(D) shall be subject to Tenant obtaining and keeping in full force and effect, at Tenant’s sole cost and expense, all permits, approvals, licenses and other determinations as shall be necessary or required under all applicable laws, ordinances, rules, regulations, statutes, by-laws, court decisions, and orders, policies and requirements of all public authorities (“Legal Requirements”) with respect the use and operation of Tenant’s HVAC Equipment, Tenant’s Generator and/or Tenant’s Communications Equipment (Landlord hereby agreeing to cooperate with Tenant in obtaining any such approval, provided that Landlord shall not be put to any third party cost or expense in connection therewith). It is further understood and agreed that rights set forth in this Section 2.2(D) with respect to Tenant’s Communications Equipment but not with respect to Tenant’s Generator or Tenant’s HVAC Equipment shall only be exercisable by Tenant on the conditions (which conditions may be waived by Landlord at any time upon written notice to Tenant) that: (i) there is no Event of Default at the time of Tenant’s request for approval of said plans and specifications hereunder; (ii) Tenant directly leases seventy-five percent (75%) or more of the Building (inclusive of any permitted subleases under Article XII below); and (iii) this Lease is still in full force and effect. Tenant shall, at Tenant’s sole cost, be

6

responsible for the maintenance and repair of Tenant’s HVAC Equipment, Tenant’s Generator and any such Tenant’s Communications Equipment. Tenant’s HVAC Equipment, Tenant’s Generator and any such Tenant’s Communications Equipment shall be at the sole risk of Tenant, except to the extent of Landlord’s negligence, Landlord having no obligation with respect to any insurance relating thereto. In performing the work necessary to maintain Tenant’s HVAC Equipment or Tenant’s Generator or to install or maintain Tenant’s Communications Equipment, Tenant shall engage a contractor approved by Landlord, which approval shall not be unreasonably withheld, delayed or conditioned; provided that, in Landlord’s reasonable judgment, such contractor will be able to preserve Landlord’s roof warranty. Landlord shall respond within ten (10) business days after its receipt of written request for Landlord’s approval of such contractor (which approval shall not be unreasonably withheld, delayed or conditioned) or stating with reasonable specificity its reasons for disapproval. If Landlord fails to respond within such ten (10) business day period, Tenant may re-send such request to Landlord via registered or certified mail, return receipt requested, or recognized overnight delivery service, with the following statement in bold at the beginning of such request, “WARNING: POSSIBLE DEEMED APPROVAL NOTICE. Failure to respond to this request within ten (10) days may lead to deemed approval of such request”. Should Landlord fail to respond to such second request within ten (10) days after receipt thereof, such failure shall be deemed to be approval of such contractor by Landlord. Tenant shall provide Landlord with evidence on an annual basis of the existence of a maintenance contract for Tenant’s Generator with a contractor approved by Landlord as aforesaid.

Tenant shall have no rights to license, sublease, assign or otherwise transfer its rights to install and use Tenant’s Communications Equipment (other than to permitted subtenants and assignees and Permitted Transferees). Subject to the rights expressly granted in this subsection (D) in connection with Tenant’s Communications Equipment, Landlord hereby reserves the right (at its sole discretion but without impairing the roof rights of Tenant as set forth herein) to install and to permit others to install, use and maintain antennas and similar installations on the rooftop of the Building, provided that any agreement with a third party granting the right to install telecommunications equipment shall contain language prohibiting interference with Tenant’s Communications Equipment and shall provide Landlord with a termination right if such interference is not remedied after a reasonable period of time. If measurable interference shall occur, Tenant shall provide notice thereof to Landlord and Landlord shall use reasonable efforts to cause the same to be remedied; however, if despite such efforts the same are not remedied within a period reasonably necessary to cure such interference, Landlord shall exercise the termination right set forth in its agreement with such interfering party.

Tenant’s Generator shall be used solely to provide back-up power in the event of an outage for Tenant’s lights and plugs in the Premises and dedicated heating, ventilation and air conditioning systems serving the Premises, but not for the purposes of running any life-safety systems or equipment (it being understood and agreed that such dedicated HVAC systems (including, without limitation, Tenant’s HVAC Equipment) may not function during such an outage, even if connected to Tenant’s Generator, to the extent that the base building systems are not functioning). Landlord shall have no obligation to provide any services to Tenant’s Generator. Tenant shall, at its sole cost and expense and otherwise in accordance with the provisions of this Section 2.2(D), arrange for all utility services required for the operation of Tenant’s Generator.

Tenant, at Tenant’s expense, shall repair any damage to the Building and the Lot resulting from Tenant’s installation (if applicable), operation, maintenance, repair, replacement or removal of Tenant’s HVAC Equipment, Tenant’s Generator and Tenant’s Communications Equipment. Landlord, at Landlord’s expense and not as an Operating Expense under this Lease, shall repair any damage to the Building and the Lot resulting from Landlord’s or any such third party’s installation, operation,

7

maintenance, repair, replacement or removal of antennas and similar installations serving parties other than Tenant as set forth in this Section 2.2(D) (except to the extent such installations are utilized by Landlord solely in connection with the operation of the Building, in which event such costs may be included in Operating Expenses for the Building in accordance with Article VII hereof). Upon the expiration or earlier termination of the Lease Term, Tenant, at Tenant’s expense, shall remove (i) any Tenant’s HVAC Equipment installed on the roof of the Building after the Execution Date to the extent that Landlord conditioned its consent to such installation on such removal, (ii) Tenant’s Generator and (iii) Tenant’s Communications Equipment and restore the portion of the roof and/or the Building on or in which the same were located as nearly as practicable to its condition prior to the installation thereof (reasonable wear and tear, damage by Landlord and damage by Casualty and Taking (as those terms are defined in Article XIV) excepted). Notwithstanding anything to the contrary contained herein, upon the expiration or earlier termination of the Lease Term, Tenant shall not be required to remove the following (“Non-Removal HVAC Units”): (a) the three (3) supplemental HVAC units existing on the roof of the Building as of the Execution Date (the “Existing HVAC Units”) or (b) any replacements of such Existing HVAC Units, provided that the total number of Non-Removal HVAC Units shall never exceed three (3).

ARTICLE 3

LEASE TERM AND EXTENSION OPTION

LEASE TERM AND EXTENSION OPTION

3.1 TERM. The Term of this Lease shall be the period specified in Section 1.2 hereof as the “Lease Term”, unless sooner terminated or extended as herein provided. The Commencement Date of the Lease Term hereof shall be the date set forth in Section 1.2. As soon as may be convenient after the Commencement Date has been determined, Landlord and Tenant agree to join with each other in the execution, in the form attached hereto as Exhibit E, of a Commencement Date Agreement in which the Commencement Date, Lease Term and final Schedule 1 shall be stated.

3.2 EXTENSION OPTION.

(A) On the conditions (which conditions Landlord may waive by written notice to Tenant) that at the time of exercise of the herein described option to extend (i) there then exists no Event of Default, (ii) this Lease is still in full force and effect, and (iii) Tenant has neither assigned this Lease nor sublet more than fifty percent (50%) of the Rentable Floor Area of the Premises, except pursuant to a transfer not requiring Landlord’s consent, as set forth in Section 12.5 hereof, Tenant shall have the right to extend the Term hereof upon all the same terms, conditions, covenants and agreements herein contained (except for the Annual Fixed Rent which shall be adjusted during the option period as hereinbelow set forth) for one (1) period of ten (10) years as hereinafter set forth. Tenant’s option to extend the Lease Term is sometimes herein referred to as the “Extension Option” and the option period is sometimes herein referred to as the “Extended Term”. Notwithstanding any implication to the contrary, Landlord has no obligation to make any additional payment to Tenant in respect of any construction allowance or the like except as otherwise provided herein or to perform any work to the Premises except as otherwise provided herein as a result of the exercise by Tenant of such option.

(B) If Tenant desires to exercise said option to extend the Term, then Tenant shall give notice exercising such option to extend (the “Exercise Notice”) to Landlord, not later than twenty-four (24) months prior to the Expiration Date. Within thirty (30) days after Landlord’s receipt of the Exercise Notice, Landlord shall provide Landlord’s quotation to Tenant of a proposed Annual Fixed Rent for the Premises for the Extended Term (“Landlord’s Rent Quotation”). Notwithstanding the foregoing or anything herein to the contrary, in no event shall Landlord be obligated to provide Landlord’s quotation to Tenant of a proposed Annual Fixed Rent for the Premises more than twenty-four (24) months prior to the

8

Expiration Date. If at the expiration of thirty (30) days after the date when Landlord provides such quotation to Tenant (the “Negotiation Period”), Landlord and Tenant have not reached agreement on a determination of an Annual Fixed Rent for the Premises for the Extended Term and executed a written instrument extending the Lease Term pursuant to such agreement, then Tenant shall have the right, for fifteen (15) days following the expiration of the Negotiation Period, to either (x) make a request to Landlord for a broker determination (the “Broker Determination”) of the Prevailing Market Rent (as defined in Exhibit F) for such Extended Term, which Broker Determination shall be made in the manner set forth in Exhibit F or (y) withdraw the Exercise Notice (in which event this Section 3.2 shall be deemed null and void and of no further force or effect, and the Lease Term shall expire as of the Expiration Date). If Tenant timely shall have requested the Broker Determination with respect to the Extended Term, then the Annual Fixed Rent for the Premises for the Extended Term shall be one hundred percent (100%) of the Prevailing Market Rent as determined by the Broker Determination. If Tenant does not timely request the Broker Determination in accordance with the provisions of this subsection (B) and the parties shall not otherwise have agreed in writing during the Negotiation Period upon an Annual Fixed Rent for the Extended Term, the Exercise Notice shall be deemed to have been withdrawn by Tenant.

(C) Upon the first to occur of (x) the mutual written agreement by Landlord and Tenant during the Negotiation Period on the Annual Fixed Rent to be payable during the Extended Term or (y) the timely request by Tenant for the Broker Determination in accordance with the provisions of subsection (B) above, then this Lease and the Lease Term hereof shall automatically be deemed extended, for the Extended Term, without the necessity for the execution of any additional documents, except that Landlord and Tenant agree to enter into an instrument in writing setting forth the Annual Fixed Rent for the Extended Term as determined in the relevant manner set forth in this Section 3.2; and in such event all references herein to the Lease Term or the term of this Lease shall be construed as referring to the Lease Term, as so extended, unless the context clearly otherwise requires. Notwithstanding anything contained herein to the contrary, in no event shall the Lease Term hereof be extended for more than ten (10) years after the Expiration Date hereof unless otherwise agreed to by the parties.

ARTICLE 4

CONDITION OF PREMISES

CONDITION OF PREMISES

4.1 CONDITION OF PREMISES. Tenant currently occupies the Premises pursuant to the Existing 150 Lease. On the Commencement Date, Tenant shall accept the Premises in their then “as-is” condition without any obligation on Landlord’s part to perform any additions, alterations, improvements, demolition or other work therein or pertaining thereto; provided, however, that Landlord shall perform the work (“Landlord’s BMS Work”) necessary to replace the Building’s existing building management system in accordance with the specification attached hereto as Exhibit L (the “BMS Specification”); provided, however, recognizing that Landlord’s BMS Work will be performed after the Commencement Date, Landlord reserves the right to make such modifications to the BMS Specification as Landlord reasonably determines are necessary so long as the building management system installed by Landlord is substantially equivalent to the system described on the BMS Specification. Landlord shall perform Landlord’s BMS Work after the Commencement Date at its sole cost and expense. Landlord and Tenant agree to coordinate with one another in good faith with respect to the performance of Landlord’s BMS Work (including the scheduling thereof, which scheduling may include, without limitation, a requirement that up to twenty-five percent (25%) of the work be performed after normal business hours) in order to minimize any interference with Tenant’s operations in the Premises. The foregoing shall not, however, abrogate any of Landlord’s repair, replacement, maintenance and/or restoration obligations (i) arising under the Existing 150 Lease prior to the Commencement Date, or (ii) arising hereunder from and after the Commencement Date.

9

4.2 TENANT ALLOWANCE.

(A) For the purposes hereof, a “requisition” shall mean written documentation, together with (i) an AIA requisition form with respect to work performed pursuant to Tenant’s construction contract with its general contractor, (ii) invoices from Tenant’s service providers, showing in reasonable detail the cost of the item in question or of the improvements installed to date in the Premises, (iii) lien waivers in the form attached hereto as Exhibit J (provided that Tenant shall not be required to deliver any lien waivers with respect to any items of work covered by Tenant’s first requisition for Landlord’s Contribution to the extent Tenant had not paid the service provider(s) at issue prior to the date of such requisition, but Tenant shall deliver the lien waivers and evidence of payment in full of the items of work covered by such first requisition within thirty (30) days following the disbursement of Landlord’s Contribution with respect to such first requisition) and (iv) certifications from Tenant that the amount of the requisition in question does not exceed the cost of the items, services and work covered by such certification. Furthermore, the final requisition shall be accompanied by final lien waivers. Except with respect to work and/or materials previously paid for by Tenant, as evidenced by paid invoices and written lien waivers provided to Landlord, Landlord shall have the right to pay Landlord’s Contribution jointly to both Tenant and Tenant’s contractor(s) and vendor(s), if a lien has been filed against the Building or the Lot on account of Tenant’s Work which has not been discharged or bonded over. Tenant shall submit requisition(s) no more often than monthly.

Notwithstanding anything contained herein to the contrary:

(i) Landlord shall have no obligation to advance funds on account of Landlord’s Contribution unless and until Landlord has received the requisition in question, together with the certifications required above.

(ii) Tenant shall not be entitled to any portion of Landlord’s Contribution, and Landlord shall have no obligation to pay Landlord’s Contribution in respect of any requisition submitted after the date which is five (5) years after the Commencement Date, it being understood and agreed that irrespective of said time period, Tenant shall not be entitled to any payment or credit on account of any unused portions of Landlord’s Contribution nor shall there be any application of the same toward Annual Fixed Rent or Additional Rent owed by Tenant under this Lease.

(iii) Landlord shall have no obligation to fund any portion of Landlord’s Contribution to the extent that (a) at the time of the requisition Tenant is in default of its monetary or material non-monetary obligations under this Lease beyond the expiration of any notice and cure period (it being understood and agreed that if Tenant cures a default prior to the expiration of the applicable cure period, or if Tenant cures a default thereafter and Landlord has not terminated this Lease, Tenant shall be entitled to such payment from Landlord) (subject in all cases to the rights of Tenant to submit a dispute in accordance with Section 16.32 of the Lease), or (b) there are any liens (unless bonded to the reasonable satisfaction of Landlord) filed against Tenant’s interest in this Lease or against the Building or the Property arising solely out of Tenant’s Work, provided it is acknowledged that the filing of a Notice of Contract does not constitute a lien for purposes of this Section 4.2.

(iv) Landlord shall pay the cost shown on each requisition submitted by Tenant to Landlord (or, if applicable, Landlord’s Proportion (as hereinafter defined) of

10

such cost) within thirty (30) days of submission thereof by Tenant to Landlord until the entirety of Landlord’s Contribution has been exhausted. Landlord and Tenant acknowledge that Tenant’s Work may be comprised of separate individual projects (each, a “Project”). With respect to each requisition relating to a Project with a total cost that is anticipated to exceed the then-remaining portion of Landlord’s Contribution, Landlord shall only be required to disburse a portion of Landlord’s Contribution towards the total costs set forth on each such requisition in an amount equal to the same proportion (“Landlord’s Proportion”) as the then-remaining portion of Landlord’s Contribution bears to the total cost of such Project reasonably budgeted for by Tenant towards which Landlord’s Contribution may be applied (with Tenant being fully and solely responsible for the remainder of the amount shown in the requisition). By way of example, if Landlord disburses $9,291,950 for the first (1st) Project and the second (2nd) Project is budgeted to cost $8,000,000, then Landlord’s Proportion with respect to the second (2nd) Project would be fifty percent (50%) (i.e., the remaining $4,000,000 of Landlord’s Contribution divided by $8,000,000) and Landlord would only be required to disburse fifty percent (50%) of the total costs set forth on each requisition for the second (2nd) Project. Notwithstanding the foregoing, if upon completion of the Tenant’s Work, the total costs of Tenant’s Work equals or exceeds the total amount of Landlord’s Contribution, then Landlord shall pay the unpaid balance of Landlord’s Contribution to Tenant within thirty (30) days after Tenant’s final requisition therefor.

(B) Notwithstanding anything to the contrary contained herein, Landlord shall be under no obligation to apply any portion of Landlord’s Contribution for any purposes other than as provided in this Section, nor shall Landlord be deemed to have assumed any obligations, in whole or in part, of Tenant to any contractors, subcontractors, suppliers, workers or materialmen. Further, in no event shall Landlord be required to make application of any portion of Landlord’s Contribution on account of any supervisory fees, overhead, management fees or other payments to Tenant, or any partner or affiliate of Tenant. In the event that such cost of Tenant’s Work is less than Landlord’s Contribution, Tenant shall not be entitled to any payment or credit nor shall there be any application of the same toward Annual Fixed Rent or Additional Rent owed by Tenant under this Lease. Within thirty (30) days after receipt of an invoice from Landlord, Tenant shall pay to Landlord, as Additional Rent, as a fee for Landlord’s review of any plans with respect to which Landlord’s approval is required under this Section 4.2 an amount equal to the sum of: (i) $150.00 per hour of time spent by Landlord’s staff to review Tenant’s plans for Tenant’s Work, plus (ii) if required in Landlord’s reasonable judgment, third party expenses incurred by Landlord to review Tenant’s plans for Tenant’s Work. Tenant shall also reimburse Landlord for any overtime charges for the Building’s on-site engineer to oversee any portions of Tenant’s Work which require such engineer’s presence and which must be performed after hours (such as shutdown of life-safety systems). There shall be no construction management fee payable with respect to Landlord’s review or oversight of Tenant’s plans or Tenant’s Work, except as aforesaid.

4.3 TENANT’S OFFSET RIGHT. If Landlord fails timely to pay any portion of Landlord’s Contribution when properly due and as to which Tenant has satisfied the requisition conditions, and such failure shall continue for thirty (30) days after written notice from Tenant to Landlord, then Tenant may deliver a second notice (an “Offset Notice”) to Landlord, which notice shall specify the requisition that has not been timely paid, the date upon which it was sent to Landlord, and if Landlord fails to (i) send Tenant written notice which disputes that the specified requisition (or portion thereof) of Landlord’s Contribution is due from Landlord and submitting the same to arbitration under Section 16.32 below (or if Landlord has timely disputed Tenant's demand, has submitted such dispute to arbitration in accordance with said Section 16.32 and has thereafter failed to pay Tenant the amount of

11

any final, unappealable arbitration award against Landlord within thirty (30) days after the issuance thereof) within such five (5) business day period, or (ii) disburse the amount expressly referenced in the Offset Notice within five (5) business days, then Tenant shall have the right to have such unpaid amount credited against the next installment(s) of Annual Fixed Rent thereafter due under this Lease, until such sums due Tenant have been fully paid by Landlord or fully credited and accounted for. Any amounts for which Landlord fails to timely reimburse Tenant under this Section 4.3 shall bear interest at rate of interest set forth in Section 16.21 hereof from the date due until the date paid. Any disputes arising under this Section 4.3 shall be submitted to arbitration under Section 16.32 hereof, and the arbitrator’s decision shall be conclusive and binding on the parties.

ARTICLE 5

ANNUAL FIXED RENT AND ELECTRICITY

ANNUAL FIXED RENT AND ELECTRICITY

5.1 FIXED RENT. Tenant agrees to pay to Landlord, or as directed by Landlord, in the manner specified below, or at such other place/in such other manner as Landlord shall from time to time designate by notice, (1) on the Commencement Date, and thereafter monthly, in advance, on the first day of each and every calendar month during the Original Lease Term, an amount equal to one-twelfth (1/12) of the Annual Fixed Rent specified in Section 1.2 hereof and (2) on the first day of each and every calendar month during the Extended Term (if exercised), an amount equal to one-twelfth of the Annual Fixed Rent as determined in Section 3.2 for the Extended Term. Until notice of some other designation is given, Annual Fixed Rent and all other charges for which provision is herein made shall be paid by remittance to or to the order of Boston Properties Limited Partnership either (i) by ACH transfer to Bank of America in Dallas, Texas, Bank Routing Number 111 000 012 or (ii) by mail to P.O. Box 3557, Boston, Massachusetts 02241-3557, and in the case of (i) referencing Account Number 3756454460, Account Name of Boston Properties, LP, Tenant’s name and the Prudential Center address. All remittances received by Boston Properties Limited Partnership, as aforesaid, or by any subsequently designated recipient, shall be treated as a payment to Landlord.

Annual Fixed Rent for any partial month shall be paid by Tenant to Landlord at such rate on a pro rata basis, and, if the Commencement Date shall be other than the first day of a calendar month, the first payment of Annual Fixed Rent which Tenant shall make to Landlord shall be a payment equal to a proportionate part of such monthly Annual Fixed Rent for the partial month from the Commencement Date to the last day of the said partial month. If Tenant has already paid Annual Fixed Rent under the Existing 150 Lease for the month in which the Commencement Date occurs, then an appropriate adjustment shall also be made by the parties under the Existing 150 Lease.

Additional Rent payable by Tenant on a monthly basis, as elsewhere provided in this Lease, likewise shall be prorated, and the first payment on account thereof shall be determined in similar fashion and shall commence on the Commencement Date, and other provisions of this Lease calling for monthly payments shall be read as incorporating this undertaking by Tenant.

The Annual Fixed Rent and all other charges for which provision is made in this Lease shall be paid by Tenant to Landlord without setoff, deduction or abatement, except as otherwise expressly provided herein.

5.2 ELECTRICITY. Tenant covenants and agrees to make application to the appropriate utility company or utility provider for electrical service to the Premises in the quantum required for Tenant’s use of the Premises (“Tenant’s Electricity”) and to make any deposit (including but not limited to, such letters of credit) as such utility company or provider shall require. Tenant covenants

12

and agrees to pay, punctually as and when due, all electricity charges and rates for and relating to the Premises and from time-to-time if requested by Landlord to provide Landlord with evidence of payment to, and good standing with, such utility company or provider as Landlord may reasonably require. Furthermore, (i) Tenant shall provide Landlord, within ten (10) business days after written request therefor, with readily available information regarding Tenant’s consumption of electricity, water/sewer, and/or other utilities at the Premises as may be reasonably required by Landlord in connection with any LEED or similar environmental grading system applicable to the Building or any Legal Requirements, and (ii) Landlord shall provide Tenant, within ten (10) business days after written request therefor, with readily available information regarding consumption of electricity, water/sewer, and/or other utilities at the Property as may be reasonably required by Tenant in connection with any LEED or similar environmental grading system applicable to the Premises or any Legal Requirements.

ARTICLE 6

TAXES

TAXES

6.1 DEFINITIONS. With reference to the real estate taxes referred to in this Article VI, it is agreed that terms used herein are defined as follows:

(A) “Tax Year” means the 12-month period beginning July 1 each year during the Lease Term or if the appropriate governmental tax fiscal period shall begin on any date other than July 1, such other date.

(B) “Landlord’s Tax Expenses Allocable to the Premises” means the same proportion of Landlord’s Tax Expenses as the Total Rentable Floor Area of the Premises bears to the Total Rentable Floor Area of the Building.

(C) “Landlord’s Tax Expenses” with respect to any Tax Year means the aggregate “real estate taxes” (as hereinafter defined) with respect to that Tax Year, reduced by any abatement refunds after the deduction of Abatement Expenses (as hereinafter defined) with respect to that Tax Year.

(D) “Real Estate Taxes” means all taxes and special assessments of every kind and nature and user fees and other like fees assessed by any governmental authority on the Property which Landlord shall be obligated to pay in connection with the ownership, leasing and operation of the Property and reasonable expenses and fees actually incurred by Landlord in connection with any formal or informal proceedings for negotiation or abatement of taxes (collectively, “Abatement Expenses”). The amount of special taxes or special assessments to be included shall be limited to the amount of the installment (plus any interest other than penalty interest payable thereon) of such special tax or special assessment required to be paid during the year in respect of which such taxes are being determined. In the event that any such special taxes or special assessments are not payable in installments but rather in one lump sum, the full amount thereof shall be amortized over the useful life of the municipal improvement to which the special tax or assessment relates as determined by Landlord in its reasonable discretion in accordance with generally accepted accounting principles and practices (or over a period of ten (10) years if the useful life of the improvement is not readily determinable) on a straight-line basis at the rate of ten percent (10%) per annum, and only the amounts payable pursuant to such amortization schedule during the then-remaining Lease Term shall be included within the definition of “real estate taxes” hereunder. There shall be excluded from such real estate taxes all income, estate, succession, inheritance and transfer taxes and all late penalties; provided, however, that if at any time during the Lease Term the present system of ad valorem taxation of real property shall be changed so that in lieu of, or in addition to, the whole or any part of the ad valorem tax on real property, there shall be assessed on Landlord a capital levy or other tax

13

on the gross rents received with respect to the Lot or Building, or a federal, state, county, municipal, or other local income, franchise, excise or similar tax, assessment, levy or charge (distinct from any now in effect in the jurisdiction in which the Property is located) measured by or based, in whole or in part, upon any such gross rents, then any and all of such taxes, assessments, levies or charges, to the extent so measured or based, shall be deemed to be included within the term “real estate taxes” but only to the extent that the same would be payable if the Property were the only property of Landlord.

6.2 TENANT’S PAYMENT OF REAL ESTATE TAXES.

(A) Not later than ninety (90) days after the end of the first Tax Year or fraction thereof and of each succeeding Tax Year during the Lease Term or fraction thereof at the end of the Lease Term, Landlord shall render Tenant a statement in reasonable detail and according to usual accounting practices certified by a representative of Landlord, showing for the preceding Tax Year or fraction thereof, as the case may be, Landlord’s Tax Expenses Allocable to the Premises. Said statement to be rendered to Tenant shall also show for the preceding Tax Year or fraction thereof as the case may be the amounts of real estate taxes already paid by Tenant as additional rent, and the amount of real estate taxes remaining due from, or overpaid by, Tenant for the Tax Year or other period covered by the statement. Within thirty (30) days after the date of delivery of such statement, Tenant shall pay to Landlord the balance of the amounts, if any, required to be paid pursuant to the above provisions of this Section 6.2 with respect to the preceding Tax Year or fraction thereof, or within thirty (30) days thereafter Landlord shall refund any amounts due from it to Tenant pursuant to the above provisions of this Section 6.2 (provided that Tenant is not then in default in any payments of Annual Fixed Rent or Additional Rent beyond any applicable notice and cure period, in which event Landlord may, at its option and upon prior notice to Tenant, credit such amounts owed by Landlord against the amounts owed by Tenant).

(B) Tenant shall make payments monthly on account of Landlord’s Tax Expenses Allocable to the Premises anticipated for the then current Tax Year at the time and in the manner herein provided for the payment of Annual Fixed Rent. The amount to be paid to Landlord shall be an amount reasonably estimated on an annual basis by Landlord based upon the prior Tax Year’s bills (and may subsequently be readjusted by Landlord once the preliminary and/or actual tax bills for such Tax Year have been received by Landlord) to be sufficient to cover, in the aggregate, a sum equal to Landlord’s Tax Expenses Allocable to the Premises for each Tax Year during the Lease Term.

(C) Landlord hereby covenants and agrees to pay all real estate taxes prior to the same becoming delinquent and to provide Tenant with copies of the tax bills for the Property within ten (10) days after Landlord’s receipt thereof and with a copy of receipt for payment within ten (10) days after Landlord’s payment thereof (provided, however, that Landlord’s failure to provide Tenant with such materials shall not constitute a default of Landlord under this Lease).

6.3 TENANT’S RIGHT TO CONTEST REAL ESTATE TAXES.

(A) To the extent permitted by applicable law and provided that (i) there shall not then be existing an Event of Default, (ii) Tenant shall not have assigned its interest in this Lease (other than an assignment permitted without Landlord’s consent under Section 12.2 below) and (iii) Tenant shall directly lease the Building in its entirety (inclusive of any permitted subleases under Article XII below), Tenant shall have the right, after prior written notice to Landlord, to contest the amount or validity, in whole or in part, of any of the real estate taxes by appropriate proceedings diligently conducted in good faith; provided, however, that as a continuing condition to such right, Tenant shall be required to continue to

14

make payments to Landlord respecting real estate taxes as and at the times provided in Section 6.2 above notwithstanding any such contest.

Tenant further agrees that each such contest shall be promptly and diligently prosecuted in good faith to a final conclusion except only as provided herein. Landlord agrees to cooperate with Tenant in any such proceeding provided that the same shall be at the sole cost and expense of Tenant. Within ten (10) days after Tenant’s written request, Landlord shall execute such documents as Tenant may reasonably request to contest the amount or validity, in whole or in part, of any of the real estate taxes. Any such contest by Tenant shall not be discontinued unless and until Tenant has given to Landlord written notice of Tenant’s intent to so discontinue and if Landlord shall not by notice to Tenant (the “Assumption Notice”) within fifteen (15) days after receipt of Tenant’s notice elect to assume, at Landlord’s sole cost and expense, the continued prosecution and conduct of such contest, then Tenant may discontinue the same. In the event Landlord shall give such Assumption Notice, Tenant shall cooperate at Landlord’s sole cost and expense with Landlord in all respects as may be necessary for Landlord’s continuation of such contest, but Tenant shall have no other obligation for the prosecution and conduct of such contest.

(B) Notwithstanding anything to the contrary set forth in subsection (A) above, Tenant shall have no right to initiate any contest respecting real estate taxes if there shall be less than twelve (12) full calendar months remaining in the Lease Term as it may have been extended.

(C) In addition, so long as the conditions set forth in subsection (A) above have been met and subject to Tenant’s payment of the Abatement Expenses in accordance with Section 6.1 above, Landlord will, upon receipt of the written request of Tenant, apply for an abatement of real estate taxes within the applicable statutory timeframes for initiating such proceedings and diligently pursue the same to completion, provided that Tenant has provided Landlord with such notice reasonably prior to the expiration of any applicable statutory period for filing the appeal.

ARTICLE 7

LANDLORD’S REPAIRS AND SERVICES AND TENANT’S ESCALATION PAYMENTS

LANDLORD’S REPAIRS AND SERVICES AND TENANT’S ESCALATION PAYMENTS

7.1 STRUCTURAL REPAIRS. Except for normal and reasonable wear and use and except as otherwise specifically provided in this Lease, Landlord shall, throughout the Lease Term, at Landlord’s sole cost and expense, but subject to inclusion or exclusion in Operating Expenses in accordance with Section 7.4, keep and maintain in good order, condition and repair the following portions of the Building: the structural portions and structural integrity of the roof, loading dock(s), the exterior and load bearing walls, the foundation, exterior glass and exterior windows, the structural columns and floor slabs, and all other structural elements of the Building and the other improvements on the Property; provided however, that Tenant shall pay to Landlord, as Additional Rent, the cost of any and all such repairs to the extent required as a result of direct repairs, alterations, or installations made by Tenant or any subtenant, assignee, licensee or concessionaire of Tenant or any of their respective agents, servants, employees, customers or contractors or to the extent of any loss, destruction or damage caused by the negligent act or omission or willful misconduct of Tenant, any subtenant, assignee, licensee or concessionaire of Tenant or any of their respective agents, servants, employees, customers, or contractors.

7.2 OTHER REPAIRS TO BE MADE BY LANDLORD. Except for normal and reasonable wear and use and except as otherwise provided in this Lease, and subject to provisions for reimbursement by Tenant as contained in Section 7.5, Landlord agrees to keep and maintain in good and first class order, condition and repair the common areas and facilities of the Building, including the heating, ventilating, air conditioning, plumbing, and the other base Building systems and equipment,

15

including, without limitation, the Building generator (collectively, the “Base Building Systems”), except that Landlord (excepting Landlord’s negligence and misconduct) shall in no event be responsible to Tenant for (a) the condition, repair or maintenance of any supplemental heating, ventilating or air conditioning equipment or other supplemental utilities systems or services installed by Tenant (including, without limitation, Tenant’s HVAC Equipment) (collectively, “Tenant’s Supplemental Systems”), (b) the condition of glass in and about the Premises (other than for glass in exterior walls for which Landlord shall be responsible unless the damage thereto is attributable to Tenant’s negligence or misuse, in which event the responsibility therefor shall be Tenant’s), (c) Tenant’s Generator or (d) any condition in the Premises caused by any negligent act or omission or willful misconduct of Tenant, any subtenant, assignee, licensee or concessionaire of Tenant or any of their respective agents, servants, employees, customers, or contractors. Without limitation, Landlord shall not be responsible to make any improvements or repairs to the Premises other than as expressly provided in this Lease. In connection with the foregoing, it is understood and agreed that Landlord shall have no obligation to maintain Tenant’s Property (as defined in Section 13.4 below), Tenant’s Supplemental Systems, Tenant’s Generator or Tenant’s Communications Equipment, except to the extent necessitated by the negligent act or omission or willful misconduct of Landlord or its agents, servants, employees or contractors.

7.3 SERVICES TO BE PROVIDED BY LANDLORD. Except as otherwise provided in this Lease and subject to provisions for reimbursement by Tenant as contained herein, including without limitation in Section 7.5 and in Exhibit B hereto, Landlord agrees to furnish services, utilities, facilities and supplies set forth in Exhibit B hereto equal in quality comparable to those customarily provided by landlords in high quality and first class office buildings in Cambridge. In addition, Landlord agrees to furnish, at Tenant’s expense, reasonable additional Building operation services which are usual and customary in similar office buildings in Cambridge, and such additional special Building services as may be mutually agreed upon by Landlord and Tenant, upon reasonable and equitable rates from time to time established by Landlord and, provided Tenant requests such rates at the time such additional services are mutually agreed upon, approved by Tenant. Tenant agrees to pay to Landlord, as Additional Rent, the cost of any such additional special Building services requested by Tenant and for the cost of any additions, alterations, improvements or other work performed by Landlord in the Premises at the request of Tenant within thirty (30) days after being billed therefor.

7.4 OPERATING EXPENSES DEFINED.

(i) compensation, wages and all fringe benefits, worker’s compensation insurance premiums and payroll taxes paid to, for or with respect to all persons for their services in the operating, maintaining or cleaning of the Building or the Lot (provided that if such persons are not employed at the Building or the Lot on a full-time basis, such costs will be prorated to reflect the actual amount of time spent by such persons on the operation, maintenance or cleaning of the Building or the Lot);

(ii) payments under service contracts with independent contractors for operating, maintaining or cleaning of the Building or the Lot;

(iii) steam, water, sewer, gas, oil, electricity and telephone charges (excluding such utility charges separately chargeable to tenants for additional or separate services and electricity charges paid by Tenant in the manner set forth in Section 5.2);

(iv) cost of maintenance, cleaning and repairs (excluding repairs (i) not properly chargeable against income, (ii) reimbursed from contractors under guarantees, (iii)

16

reimbursed under Landlord’s property insurance or (iv) reimbursed under manufacturers’ warranties);

(v) cost of snow removal and care of landscaping for the Property;

(vi) cost of cleaning supplies and equipment used at the Building;

(vii) premiums for insurance carried with respect to the Building or Property (including, without limitation, liability insurance, insurance against loss in case of Casualty and of monthly installments of Annual Fixed Rent and any Additional Rent which may be due under this Lease and other leases of space in the Building for not more than twelve (12) months in the case of both Annual Fixed Rent and Additional Rent and, if there be any first mortgage on the Building, including such insurance as may be required by the holder of such first mortgage);

(viii) management fees of three percent (3%) of the gross receivable rents of the Building (that is, all base rent (including escalations thereto), percentage rent, occupancy charges and additional rent, including payments on account of Operating Expenses for the Building (other than management fees) and real estate taxes received from tenants or other occupants of the Building, specifically excluding insurance, parking revenues, and casualty and condemnation proceeds); provided, however, if Tenant is providing services in accordance with the provisions of Section 7.8 below, then for purposes of calculating the management fees only, those costs shall be added back in to the Operating Expenses for the Building that are included in calculating the management fees;

(ix) the Building’s Proportionate Share of the costs of maintaining and repairing the Common Areas of Parcel 3 of the Development Area, for which purposes the “Building’s Proportionate Share” shall be a fraction, the numerator of which shall be the Total Rentable Floor Area of the Building and the denominator of which shall be the sum of (x) the Total Rentable Floor Area of the Building plus (y) the total rentable floor area of the other buildings from time to time located on Parcel 3 of the Development Area;

(x) depreciation for capital expenditures, subject to and in accordance with the provisions of Section 7.4(C) below;

(xi) the cost of furnishing material and supplies related directly to furnishing conditioned water for heating and cooling of the Building; and

(xii) all other reasonable and necessary expenses paid in connection with the operating, cleaning and maintenance of the Building and the Lot and properly chargeable against income.

(B) Notwithstanding the foregoing, the following shall be excluded from Operating Expenses for the Building:

(i) All capital expenditures, repairs and replacements and all depreciation, except as otherwise explicitly provided in Section 7.4(C) below;

17

(ii) Leasing fees or commissions, advertising and promotional expenses, legal fees, the cost of tenant improvements, build out allowances, expenses relating to painting, renovation or redecorating, moving expenses, assumption of rent under existing leases and other concessions incurred in connection with leasing space in the Building;

(iii) Interest on indebtedness, points, fees, debt amortization, ground rent, and refinancing costs or other costs associated with any debt associated therewith, for any mortgage or ground lease of the Building or the Lot;

(iv) Legal, auditing, consulting and professional fees and other costs (other than those reasonable and necessary legal, auditing, consulting and professional fees and other costs incurred in connection with the normal and routine maintenance and operation of the Building and/or the Lot, consistent with those being charged by other owners of similar office buildings in the Kendall Square Urban Renewal Area) paid or incurred in connection with financings, refinancings, sales or syndications of any of Landlord’s interest in the Building or the Lot including but not limited to, fees incurred by Landlord to resolve any dispute or enforce or negotiate any lease terms in connection therewith;

(v) Real estate taxes (provided that real estate taxes shall be payable as provided in Article VI), franchise taxes or income taxes imposed on Landlord;

(vi) Costs incurred in performing work or furnishing services for any tenant (including Tenant), whether at such tenant’s or Landlord’s expense, to the extent that such work or services is in excess of any work or service that Landlord is obligated to furnish to Tenant at Landlord’s expense (e.g., if Landlord agrees to provide extra cleaning to another tenant, the cost thereof would be excluded since Landlord is not obligated to furnish extra cleaning to Tenant);

(vii) The cost of any item or service to the extent to which Landlord is actually reimbursed or compensated by, any tenant or any third party relating to insurance (or costs which would have been reimbursed or compensated by such insurance if Landlord had maintained the insurance required to be maintained by Landlord under this Lease), condemnation awards, rebates or refunds, and/or any expenses for repairs or maintenance to the extent covered by service contracts, warranties or guarantees;

(viii) Costs payable solely by any retail tenants or other tenants, if any, of the Building;

(ix) The cost of repairs, restoration or replacements incurred by reason of Casualty or Taking, provided that Operating Expenses shall include the cost of any deductible on any insurance maintained by Landlord which provides a recovery for such repair, restoration or replacement, but the amount of said deductible to be so included in Operating Expenses shall not exceed $100,000 (which such amount shall be increased on an annual basis as of each anniversary of the Commencement Date by the corresponding percentage increase in the Consumer Price Index for Urban Wage Earners and Clerical Workers, U.S. City Average, All-Item Series A (1982-1984=100) for the immediately preceding twelve (12) month period) per Casualty event;

18

(x) Insurance premiums to the extent any tenant causes Landlord’s existing insurance premiums to increase or requires Landlord to purchase additional insurance because of such tenant’s use of the Building for purposes other than the Permitted Uses;

(xi) Any advertising, promotional or marketing expenses for the Building;

(xii) The cost of any service or materials provided by any party related to Landlord, to the extent such costs exceed the reasonable cost for such service or materials absent such relationship in buildings similar to, and in the vicinity of, the Building;

(xiii) Payments for rented equipment, the cost of which equipment would constitute a capital expenditure if the equipment were purchased;

(xiv) Penalties and interest for late payment of any obligations of Landlord, including, without limitation, real estate taxes, insurance, equipment leases and other past due amounts;

(xv) Operating Expense reserves;

(xvi) Contributions to charitable organizations;

(xvii) Salaries or other compensation paid to employees above the grade of Regional Property Manager;

(xviii) The cost of assessment, remediation or removal of “Hazardous Materials” (as defined in Section 11.2) in the Building or on the Lot required pursuant to the terms and provisions of this Lease and/or by Hazardous Materials Laws, except to the extent caused by Tenant or Tenant’s subtenants, or by their respective contractors, subcontractors, agents, employees or invitees;

(xix) The cost of acquiring, installing, moving or restoring objects of art;

(xx) The initial cost of tools and equipment used in Landlord’s operation of the Building;

(xxi) Costs of repairs, replacements, alterations or improvements necessary to make any portion of the Building or the Lot comply with any applicable law in effect as of the Execution Date of this Restated Lease (including, without limitation, the Americans With Disabilities Act of 1990, the Federal Occupational Safety and Health Act of 1970 (as amended) and any laws, rules, regulations relating to environmental, health or safety matters), except to the extent the need for such repairs, replacements, alterations or improvements is caused by (i) alterations, improvements or installations made by or on behalf of Tenant or (ii) Tenant’s particular use of the Premises for the conduct of its business operations therein;

(xxii) Costs of the construction, repair, maintenance and operation of the Permitted Garages (as hereinafter defined) including, but not limited to, salaries and benefits of any attendants, electricity, insurance and real estate taxes and all expenses of Landlord set forth in Section 10.3 hereof;

19

(xxiii) The cost of repairs necessitated by Landlord’s negligence or willful misconduct;

(xxiv) The cost to correct any penalty or fine incurred by Landlord due to Landlord’s violation of any federal, state or local law or regulation (except to the extent such violation was caused by Tenant’s breach of any of its obligations under this Lease);

(xxv) Costs and expenses incurred for the administration of the entity which constitutes Landlord, as the same are distinguished from the costs of operation, management, maintenance and repair of the Property, including, without limitation, entity accounting and legal matters;

(xxvi) The cost of performing work or furnishing service to or for any tenant other than Tenant, at Landlord’s expense, to the extent such work or service is in excess of any work or service Landlord is obligated to provide to Tenant or generally to other tenants in the Building at Landlord’s expense;

(xxvii) The costs relating to creating or maintaining Landlord’s existence as a corporation, limited partnership or other entity;

(xxviii) The cost of installing, operating and maintaining any special service in the Building such as an observatory, broadcasting facility, restaurant, luncheon club or athletic or recreation club;

(xxix) The cost of any utilities being paid by Tenant directly to the utility company under Section 5.2 above;

(xxx) The cost of obtaining and/or maintaining mortgage enhancement insurance or any similar financial product and any investment management fee or similar fee;

(xxxi) The costs and expenses of construction mitigation measures for development, construction or operation on the other properties in the Development Area;

(xxxii) Subject to Section 7.4(A)(viii) above, the cost of any services which Tenant is providing itself pursuant to Section 7.8 below; and

(xxxiii) Costs, expenses and other amounts payable and/or incurred pursuant to (i) the Parking Garage Lease dated March 19, 1990 between Cambridge Center North Trust, as Lessor, and Landlord, as Lessee, notice of which is dated March 19, 1990 and recorded with the Registry at Book 20450, Page 204, as the same may be amended from time to time, and (ii) the Parking Garage Sublease dated May 16, 1984 between the Trustees of First Cambridge Center Parking Trust, as Lessor, and Landlord, as Lessee, notice of which is recorded in Book 15582, Page 42 and filed as Document No. 660700, as the same may be amended from time to time.

(xxxiv) The cost of obtaining any LEED certification for the Building (as opposed to costs associated with maintaining any such certification, which costs may be included in Operating Expenses); provided, however that the cost of obtaining LEED

20

certification (or its equivalent) may be included in Operating Expenses to the extent such certification (or its equivalent) is required by any Legal Requirements that first become applicable to the Building or the Property after the Commencement Date.