Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Sabra Health Care REIT, Inc. | a8-kwellsfargopresentation.htm |

DEDICATED TO VALUE CREATION,

COMMITTED TO OUR OPERATOR ROOTS

21st Annual Wells Fargo Real Estate Securities Conference

February 28 – March 1, 2018

21st Annual Wells Fargo Real Estate Securities Conference 2 2/28/2018

Our operational expertise and entrepreneurial spirit make Sabra uniquely

positioned to succeed in our dynamic industry. We have the size,

know-how, balance sheet and passion to deliver long-term value to our

shareholders while promoting a high quality of care.

POSITIONED TO PERFORM

3

WE’VE BEEN OPPORTUNISTICALLY

EXECUTING OUR STRATEGY AND IT SHOWS

STRONG BALANCE SHEET

Investment Grade: BBB- / BBB- / Ba1

5.49x (5.94x with JV Debt) Leverage1

DIVERSIFIED PORTFOLIO

Top 3 Relationships = 28% of Pro Forma Annualized

Cash NOI1

Top 5 Relationships = 40% of Pro Forma Annualized

Cash NOI1

CONSISTENT GROWTH

7% Normalized AFFO per Share CAGR Since 20114

67% Total Shareholder Return Since 20105

SCALE

$6.1B Enterprise Value2

728 Properties / Investments in 45 States and

Canada3

(1) Pro forma as of 12/31/2017, adjusted for the Enlivant and North American Healthcare transactions, the remaining CCP and Genesis rent reductions and the transition of five skilled nursing/transitional care facilities to an

existing Sabra operator completed subsequent to 12/31/2017.

(2) Based on Sabra’s balance sheet as of 12/31/2017. Share price as of 2/26/2018.

(3) Adjusted for the Enlivant and North American Healthcare transactions completed subsequent to 12/31/2017. Includes investments in properties held in unconsolidated joint ventures.

(4) As of 12/31/2017.

(5) As of 2/26/2018.

21st Annual Wells Fargo Real Estate Securities Conference 2/28/2018

4

“THE STRONGER SABRA

YOU SEE TODAY IS THE

PRODUCT OF CREATIVE

AND TIMELY EXECUTION

OF OUR STRATEGY.”

– Rick Matros, Chief Executive Officer

STRATEGY

21st Annual Wells Fargo Real Estate Securities Conference 2/28/2018

5

WE ARE BUILDING A BETTER REIT BY INVESTING IN

THE SUCCESS OF OUR PARTNERS

Investment

Invest in high-quality, strong-performing senior housing and SNF portfolios

Increase relationship diversification

Grow private-pay exposure

Develop purpose-built senior housing

Finance

Maintain a fortress balance sheet

Employ a conservative dividend policy

Operations

Advance the quality of care in our facilities through our operational expertise

Drive operational efficiencies

STRATEGY

21st Annual Wells Fargo Real Estate Securities Conference 2/28/2018

6

ENTERPRISE VALUE 1

$773.3M vs $6.1B

INVESTMENTS 2

86 vs 728

RELATIONSHIPS 2

1 vs 73

2010 VS 2017

WHO WE ARE NOW IS WHO WE'VE ALWAYS BEEN—

FOCUSED, OPPORTUNISTIC AND FORWARD-THINKING

STRATEGY

(1) Based on Sabra’s balance sheet as of 12/31/2017. Share price as of 2/26/2018.

(2) As of 12/31/2017, adjusted for the Enlivant and North American Healthcare transactions completed subsequent to 12/31/2017. Includes investments in properties held in unconsolidated joint ventures.

21st Annual Wells Fargo Real Estate Securities Conference 2/28/2018

7

“WHEN IT COMES

TO EXECUTING

OUR STRATEGY,

WE DO WHAT WE

SAY WE ARE

GOING TO DO.”

– Talya Nevo-Hacohen,

Chief Investment Officer

STRATEGY IN ACTION

21st Annual Wells Fargo Real Estate Securities Conference 2/28/18

8

On January 2, 2018, we completed our previously announced

transaction with affiliates of Enlivant and TPG Real Estate for a total

of $491 million.

• Acquired 11 Senior Housing communities under our Senior

Housing - Managed property structure that are operated by

Enlivant.

• Acquired a 49% equity interest in an entity that collectively owns

172 Senior Housing communities managed by Enlivant.

• Option to acquire the remaining 51% by January 2021.

• Projected unlevered cash yield of 6.3% (post cap-ex yield of 5.7%).

Also in January, we acquired the remaining two Skilled

Nursing/Transitional Care facilities that were part of the North

American Healthcare portfolio transaction for $42.8 million, with an

initial cash yield of 8.0%.

EXCELLENT EXECUTION

STRATEGY IN ACTION

21st Annual Wells Fargo Real Estate Securities Conference 2/28/2018

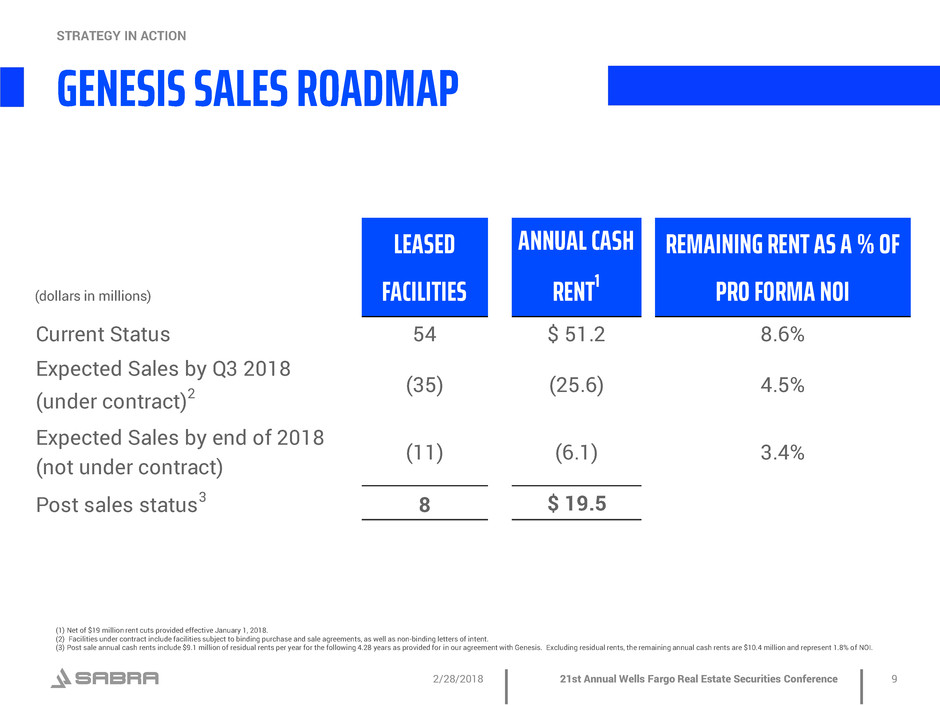

(dollars in millions)

LEASED

FACILITIES

ANNUAL CASH

RENT1

REMAINING RENT AS A % OF

PRO FORMA NOI

Current Status 54 $ 51.2 8.6%

Expected Sales by Q3 2018

(under contract)2

(35) (25.6) 4.5%

Expected Sales by end of 2018

(not under contract)

(11) (6.1) 3.4%

Post sales status3 8 $ 19.5

9

(1) Net of $19 million rent cuts provided effective January 1, 2018.

(2) Facilities under contract include facilities subject to binding purchase and sale agreements, as well as non-binding letters of intent.

(3) Post sale annual cash rents include $9.1 million of residual rents per year for the following 4.28 years as provided for in our agreement with Genesis. Excluding residual rents, the remaining annual cash rents are $10.4 million and represent 1.8% of NOI.

GENESIS SALES ROADMAP

STRATEGY IN ACTION

21st Annual Wells Fargo Real Estate Securities Conference 2/28/2018

10

Proprietary Information Technology System

• Supports the efficient and accurate collection of tenant, financial,

asset management and acquisitions information.

• Furthers our ability to drive value to shareholders by enabling our

team to remain lean, yet effective.

CREATING OPERATING

EFFICIENCIES

STRATEGY IN ACTION

21st Annual Wells Fargo Real Estate Securities Conference 2/28/2018

11

“WE HAVE THE SKILLS AND ACCESS TO CAPITAL TO

TAKE ON DEALS OF ANY SIZE, BUT MORE IMPORTANT,

WE ARE NOT AFRAID TO STEP OUTSIDE THE

PROVERBIAL BOX. WE CREATIVELY SOURCE,

STRUCTURE AND FINANCE DEALS.”

– Talya Nevo-Hacohen, Chief Investment Officer

INVESTMENT THESIS

21st Annual Wells Fargo Real Estate Securities Conference 2/28/2018

12

FOCUSED STRATEGY, CREATIVE EXECUTION,

CONSISTENT GROWTH

Unique, Accretive Investments

Utilize our operational and asset management expertise to identify and capitalize on

new opportunities where off-market price dislocation exists.

Support Partner Expansion

Be the capital partner of choice for the expansion and growth aspirations of our leading

operators with regional expertise and favorable demographics.

Creatively Financed Development

Pursue strategic development opportunities. Minimize risk by making smaller initial

investments in purpose-built facility development projects. Opportunistically utilize

preferred equity and mezzanine debt investment structures.

Optimize Portfolio

Continue to curate our portfolio to optimize diversification and maintain a mix of

assets well positioned for the future of health care delivery.

INVESTMENT THESIS

21st Annual Wells Fargo Real Estate Securities Conference 2/28/2018

13

“WE CONTINUE TO

REFINE OUR PORTFOLIO

TO SUPPORT THE

CHANGING NEEDS OF

PATIENTS. THE REAL

ESTATE IS IMPORTANT,

BUT IT'S WHAT GOES

ON INSIDE THAT

REALLY MATTERS.”

PORTFOLIO

– Peter Nyland, Executive Vice President Asset Management

21st Annual Wells Fargo Real Estate Securities Conference 2/28/2018

9

Year Wtd. Avg. Remaining

Lease Term1

14

SUPERIOR RETURNS START WITH

A STRONG PORTFOLIO

728

Investments1

PORTFOLIO

82% 87% 83% 79%

Average Occupancy1

1.38x 1.09x 3.60x

Rent Coverage1

73

Relationships1

37%

Skilled Mix1

SNF/TC SH - Leased SH - Managed

SNF/TC SH - Leased Hosp/Oth.

(1) Pro forma as of 12/31/2017, adjusted for the Enlivant and North American Healthcare transactions completed subsequent to 12/31/2017. Includes investments in properties held in unconsolidated joint ventures.

21st Annual Wells Fargo Real Estate Securities Conference 2/28/2018

Hosp/Oth.

15

PROJECTS

30

CURRENT TOTAL INVESTMENT

$226M

EXPECTED REAL ESTATE VALUE 1

$584M

COMPLETED AND

PLANNED PROJECTS

PROPRIETARY PIPELINE OF PURPOSE-BUILT ASSETS

ENHANCES THE QUALITY OF OUR PORTFOLIO

PORTFOLIO

(1) Represents the value of completed projects at Sabra’s purchase price and the projected purchase price for those projects still in development but for which Sabra has option rights as of 12/31/2017.

21st Annual Wells Fargo Real Estate Securities Conference 2/28/2018

16

Senior Housing -

Leased

14%

Senior Housing -

Managed

11%

Specialty Hospitals

and Other

8%

Interest and Other

Income

2%

Skilled Nursing /

Transitional Care

65%

EFFECTIVE ASSET MANAGEMENT AND

STRONG OPERATOR RELATIONSHIPS

We continually look for

opportunities to enhance

the value of our real estate

and improve the quality of

care delivered.

PORTFOLIO

Asset Mix

Based on Pro Forma Annualized Cash NOI for the year ended 12/31/2017. See the appendix to this presentation for the definition of Pro Forma Annualized Cash NOI.

21st Annual Wells Fargo Real Estate Securities Conference 2/28/2018

17

HIGH

QUALITY

OF CARE

STRONG PERFORMANCE

21st Annual Wells Fargo Real Estate Securities Conference 2/28/2018

18

“SABRA PROVIDES MORE THAN JUST CAPITAL;

IT IS A PARTNER IN OUR SUCCESS BY

PROVIDING INDUSTRY METRIC INTELLIGENCE,

PURCHASING LEVERAGE AND AN IMPORTANT

HEALTH CARE PERSPECTIVE.”

– Stephen Silver, Managing Member, Cadia Healthcare

OPERATORS

21st Annual Wells Fargo Real Estate Securities Conference 2/28/2018

19

OUR OPERATORS ARE DRIVEN BY AN UNWAVERING

PASSION: ADVANCING THE QUALITY OF CARE

We Partner With Operators Who Are:

Highly engaged

Nimble

Regional experts

In markets with favorable demographics

Well positioned for the future of health care delivery

OPERATORS

21st Annual Wells Fargo Real Estate Securities Conference 2/28/2018

20

WE OFFER MORE THAN JUST CAPITAL; WE ARE

A PARTNER IN OUR OPERATORS’ SUCCESS

We Improve Operating Efficiencies:

Share best practices

Facilitate group purchasing

Share operational expertise

We Invest In Our Mutual Success:

Redevelopment

Expansion

Strategic development

OPERATORS

21st Annual Wells Fargo Real Estate Securities Conference 2/28/2018

21

Senior Care Centers

10%

Enlivant

9%

Genesis

8%

Avamere

7%

Signature

6%

Other

60%

Relationship Concentration

WE SAID WE WERE GOING TO DIVERSIFY

OUR OPERATOR BASE

We’ve cultivated strong

relationships with leading

regional care providers

who share our passion for

delivering high-quality

care.

OPERATORS

Based on Pro Forma Annualized Cash NOI for the year ended 12/31/2017. See the appendix to this presentation for the definition of Pro Forma Annualized Cash NOI.

21st Annual Wells Fargo Real Estate Securities Conference 2/28/2018

22

LEADERSHIP

“WHEN WE PUT OUR MINDS TO SOMETHING,

WE GET IT DONE.”

– Rick Matros, Chief Executive Officer

21st Annual Wells Fargo Real Estate Securities Conference 2/28/2018

23

OUR CARE-DRIVEN

APPROACH IS AS UNIQUE AS

OUR LEADERSHIP TEAM

Entrepreneurial

Operational expertise

Fresh thinking

Lean organizational structure

Harold Andrews, Jr.

Chief Financial Officer

Rick Matros

Chairman of the Board and

Chief Executive Officer

Talya Nevo-Hacohen

Chief Investment Officer

21st Annual Wells Fargo Real Estate Securities Conference 2/28/2018

24

“WE’VE CONSISTENTLY

DELIVERED VALUE TO

OUR STOCKHOLDERS

WHILE MAINTAINING A

STRONG BALANCE

SHEET.”

– Harold Andrews, Jr., Chief Financial Officer

PERFORMANCE

21st Annual Wells Fargo Real Estate Securities Conference 2/28/2018

25

SUPERB EXECUTION OF A CONSISTENT

STRATEGY FUELS LONG-TERM GROWTH

67%

Sabra

52%

Healthcare REIT Composite1

57%

SNL U.S. Healthcare REIT Equity

Total Shareholder Return

as of 2/26/2018

(1) Healthcare REIT Composite is comprised of CTRE, HCN, HCP, LTC, MPW, NHI, OHI, SNH and VTR.

PERFORMANCE

21st Annual Wells Fargo Real Estate Securities Conference 2/28/2018

-100%

-50%

0%

50%

100%

150%

200%

Jan-11 Jan-12 Jan-13 Jan-14 Jan-15 Jan-16 Jan-17 Jan-18

SBRA SNL U.S. Healthcare REIT Equity Healthcare REIT Composite

$1.51

$1.59

$1.77

$2.12 $2.14

$2.26

$2.31 $2.32

$1.29

$1.33

$1.38

$1.54

$1.62

$1.68

$1.76

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

$0.50

$1.00

$1.50

$2.00

$2.50

2011 2012 2013 2014 2015 2016 2017 2018

Guidance

Normalized AFFO / Share Dividend / Share Genesis Concentration SNF Concentration

26

RELIABLE EARNINGS GROWTH WHILE

TRANSFORMING OUR PORTFOLIO

PERFORMANCE

21st Annual Wells Fargo Real Estate Securities Conference 2/28/2018

(1) 2018 Guidance reflects the midpoint.

(2) Based on Pro Forma Annualized Cash NOI for the year ended 12/31/2017. See the appendix to this presentation for the definition of Pro Forma Annualized Cash NOI.

1

2 2

27

Investment-grade balance sheet: BBB- / BBB- / Ba1

Primarily fixed rate (87.2%), unsecured borrowings1,2

Cost of permanent debt is 4.04%3

Well-laddered maturity schedule

More than $350 million of available liquidity4

FORTIFIED BALANCE SHEET WITH LOW

LEVERAGE AND ENHANCED LIQUIDITY

PERFORMANCE

(1) As of 12/31/2017.

(2) Includes variable rate debt swapped to fixed and excludes borrowing under our revolving credit facility.

(3) Pro forma cost of permanent debt as of 12/31/2017 includes our share of the unconsolidated joint venture debt and excludes revolving credit facility balance which had an interest rate of 2.81% as of 12/31/2017.

(4) Pro forma as of 12/31/2017.

21st Annual Wells Fargo Real Estate Securities Conference 2/28/2018

Preferred Equity

2%

Common Equity

Value

47%

Secured Debt

4%

Unsecured Debt

47%

Capital Structure1

28

TOTAL MARKET

CAPITALIZATION

$6.6B

BALANCED CAPITAL

STRUCTURE

Our diverse menu of capital

options ensures that we

have ready access to low-

cost capital to fund our

growth.

PERFORMANCE

(1) As of 12/31/2017. Common equity value estimated using outstanding common stock of 178.2 million shares and Sabra closing price of $17.41 as of 2/26/2018.

21st Annual Wells Fargo Real Estate Securities Conference 2/28/2018

Our Credit Facility which includes a

$1.0 billion Revolving Credit Facility

(with $359.0 million available as of

12/31/2017) contains an accordion

feature that can increase the total

available borrowings to $2.5 billion

(up from $2.1 billion plus CAD

$125.0 million today).

29

(1) Pro forma information is adjusted for the Enlivant and North American Healthcare transactions,, the remaining Genesis and CCP rent reductions, and the transition of five skilled nursing/transitional care facilities to an existing Sabra operator completed

subsequent to 12/31/2017.

(2) Investment Grade Peers consists of HCP, HCN, VTR and OHI. The metrics used to calculate Investment Grade Peers Median are sourced from most recent public filings with the SEC and may not be calculated in a manner identical to Sabra’s metrics.

(3) Pro Forma Net Debt to Adjusted EBITDA is calculated based on Pro Forma Annualized Adjusted EBITDA, which includes Annualized Adjusted EBITDA and assumes that the Enlivant and North American Healthcare transactions completed subsequent to

12/31/2017, the previously announced rent repositioning program for certain of our tenants who were legacy tenants of CCP, the rent reductions for Genesis and the transition of five skilled nursing/transitional care facilities to an existing Sabra operator were

completed as of January 1, 2017. Pro Forma Net Debt to Adjusted EBITDA - Incl. Unconsolidated Joint Venture is calculated based on Pro Forma Annualized Adjusted EBITDA, as adjusted, which includes Pro Forma Annualized Adjusted EBITDA and is further

adjusted to include the Company's share of the unconsolidated joint venture interest expense. See "Reconciliations of Non-GAAP Financial Measures" on our website at http://www.sabrahealth.com/ investors/financials/reports-presentations/non-gaap for

additional information.

STRONG INVESTMENT GRADE CREDIT METRICS

SABRA PRO

FORMA 4Q17 1

INVESTMENT GRADE

PEERS MEDIAN 2

Net Debt to Adjusted EBITDA 5.5x3 5.6x

Net Debt to Adjusted EBITDA

(includes JV Debt) 5.9x

3 6.8x

Interest Coverage Ratio 4.2x 4.2x

Debt as a % of Asset Value 50% 46%

Secured Debt as a % of Asset

Value 8% 5%

PERFORMANCE

21st Annual Wells Fargo Real Estate Securities Conference 2/28/2018

30

500

200

500

100

104

200

1,000

641

359

$4

$103

$205

$1,161

$1,004

$204

$5 $5

$505

$204

200

400

600

800

1,000

1,200

1,400

1,600

2018 2019 2020 2021 2022 2023 2024 2025 2026 2027+

Unsecured Bonds Mortgage Debt / Secured Debt Term Loans Line of Credit Available Line of Credit

FAVORABLE PROFILE WITH STAGGERED MATURITIES

DEBT MATURITY PROFILE1

PERFORMANCE

(1) As of 12/31/2017

(2) $500 million of 5.5% unsecured bonds due 2021 are currently redeemable.

(3) $200 million of 5.375% unsecured bonds due 2023 are redeemable on or after June 1, 2018.

(4) Term loans are pre-payable at par.

21st Annual Wells Fargo Real Estate Securities Conference 2/28/2018

2

3

4

31

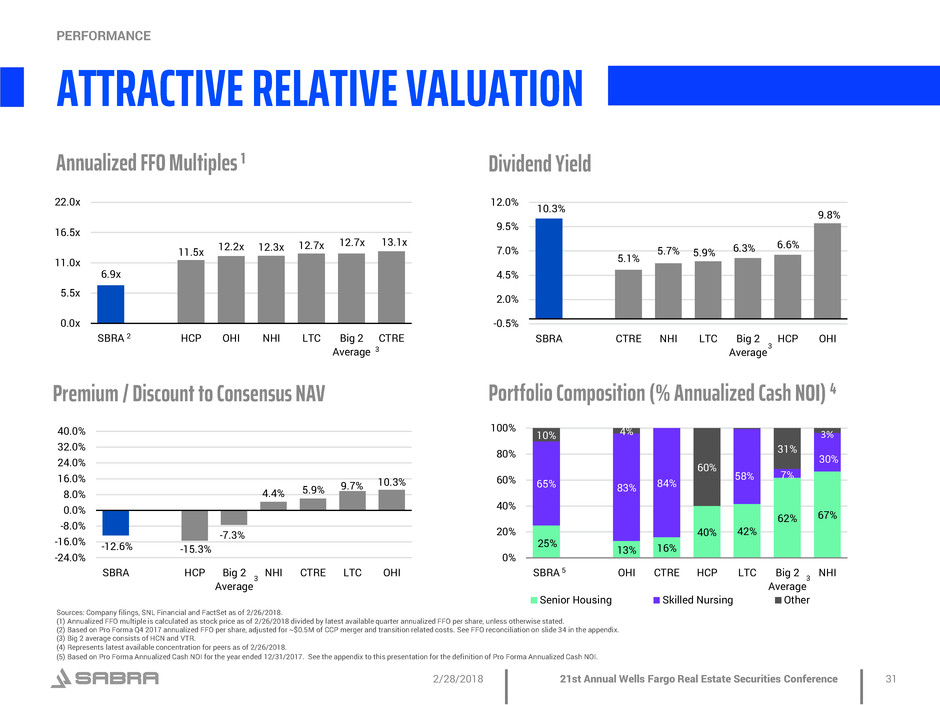

6.9x

11.5x 12.2x 12.3x 12.7x

12.7x 13.1x

0.0x

5.5x

11.0x

16.5x

22.0x

SBRA HCP OHI NHI LTC Big 2

Average

CTRE

10.3%

5.1%

5.7% 5.9% 6.3%

6.6%

9.8%

-0.5%

2.0%

4.5%

7.0%

9.5%

12.0%

SBRA CTRE NHI LTC Big 2

Average

HCP OHI

-12.6% -15.3%

-7.3%

4.4% 5.9%

9.7% 10.3%

-24.0%

-16.0%

-8.0%

0.0%

8.0%

16.0%

24.0%

32.0%

40.0%

SBRA HCP Big 2

Average

NHI CTRE LTC OHI

25% 13% 16%

40% 42%

62% 67%

65% 83% 84%

58% 7%

30%

10% 4%

60%

31%

0%

20%

40%

60%

80%

100%

SBRA OHI CTRE HCP LTC Big 2

Average

NHI

Senior Housing Skilled Nursing Other

3%

Annualized FFO Multiples 1 Dividend Yield

Premium / Discount to Consensus NAV Portfolio Composition (% Annualized Cash NOI) 4

Sources: Company filings, SNL Financial and FactSet as of 2/26/2018.

(1) Annualized FFO multiple is calculated as stock price as of 2/26/2018 divided by latest available quarter annualized FFO per share, unless otherwise stated.

(2) Based on Pro Forma Q4 2017 annualized FFO per share, adjusted for ~$0.5M of CCP merger and transition related costs. See FFO reconciliation on slide 34 in the appendix.

(3) Big 2 average consists of HCN and VTR.

(4) Represents latest available concentration for peers as of 2/26/2018.

(5) Based on Pro Forma Annualized Cash NOI for the year ended 12/31/2017. See the appendix to this presentation for the definition of Pro Forma Annualized Cash NOI.

ATTRACTIVE RELATIVE VALUATION

PERFORMANCE

3 3

3 3

2

21st Annual Wells Fargo Real Estate Securities Conference 2/28/2018

5

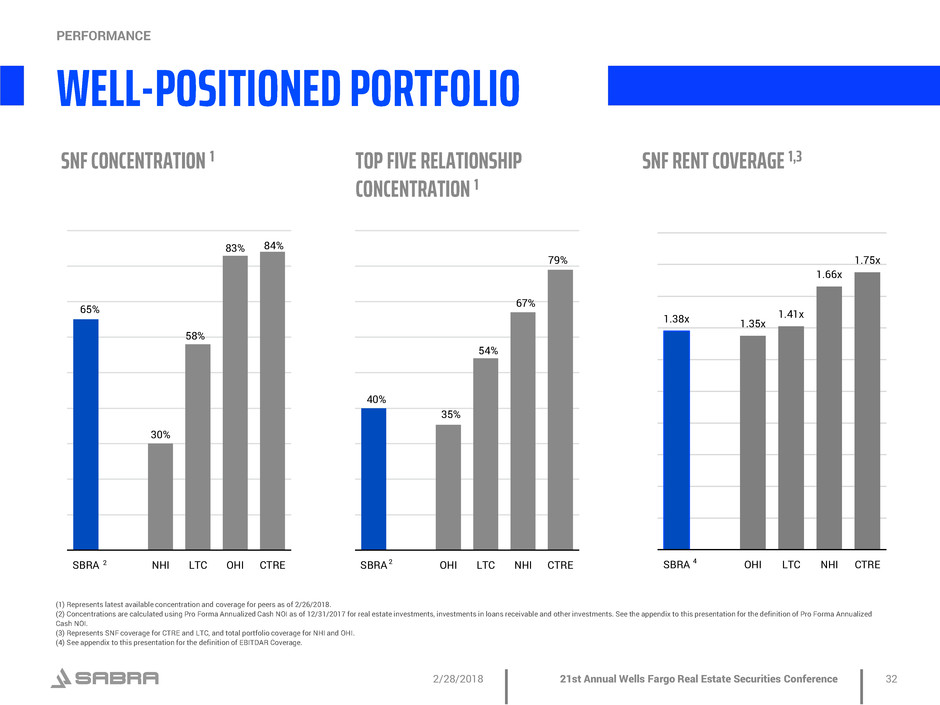

1.38x 1.35x

1.41x

1.66x

1.75x

SBRA OHI LTC NHI CTRE

32

SNF CONCENTRATION 1 SNF RENT COVERAGE 1,3 TOP FIVE RELATIONSHIP

CONCENTRATION 1

(1) Represents latest available concentration and coverage for peers as of 2/26/2018.

(2) Concentrations are calculated using Pro Forma Annualized Cash NOI as of 12/31/2017 for real estate investments, investments in loans receivable and other investments. See the appendix to this presentation for the definition of Pro Forma Annualized

Cash NOI.

(3) Represents SNF coverage for CTRE and LTC, and total portfolio coverage for NHI and OHI.

(4) See appendix to this presentation for the definition of EBITDAR Coverage.

WELL-POSITIONED PORTFOLIO

PERFORMANCE

65%

30%

58%

83% 84%

SBRA NHI LTC OHI CTRE

40%

35%

54%

67%

79%

SBRA OHI LTC NHI CTRE2 2 4

21st Annual Wells Fargo Real Estate Securities Conference 2/28/2018

33

APPENDIX

21st Annual Wells Fargo Real Estate Securities Conference 2/28/2018

34

PRO FORMA FFO RECONCILIATION1

APPENDIX

21st Annual Wells Fargo Real Estate Securities Conference 2/28/2018

(1) Pro forma as of 12/31/2017, adjusted for the Enlivant and North American Healthcare transactions, the remaining CCP and Genesis rent reductions and the transition of five skilled nursing/transitional care facilities to an existing Sabra operator completed

subsequent to 12/31/2017.

(2) Costs incurred during the three months ended 12/31/2017. Please refer to 10-K for additional details.

(Dollars in thousands, except per share amounts)

Pro Forma Three Months Ended

December 31, 2017

Net income attributable to common stockholders 55,832$

Depreciation and amortization of real estate assets and real estate assets related to

noncontrolling interests

55,043

Impairment of real estate 1,326

FFO Attributable to Common Stockholders 112,201$

Adjustments:

CCP Merger and transition costs 2 505

FFO Attributable to Common Stockholders (Excluding Non-Recurring Merger Related Costs) 112,706$

Weighted average number of common shares outstanding, diluted 178,428,200

FFO Per Share (Excluding Non-Recurring Merger Related Costs) 0.63$

FFO Per Share Annualized (Excluding Non-Recurring Merger Related Costs) 2.53$

Share Price (as of 2/26/2018) 17.41$

FFO Multiple (Excluding Non-Recurring Merger Related Costs) 6.9x

35

Adjusted EBITDA.* Adjusted EBITDA is calculated as earnings before interest, taxes, depreciation and amortization (“EBITDA”) excluding the impact of merger-related costs, stock-based

compensation expense under the Company’s long-term equity award program, and loan loss reserves. Adjusted EBITDA is an important non-GAAP supplemental measure of operating performance.

Annualized Cash Net Operating Income (“Annualized Cash NOI”).* The Company believes that net income attributable to common stockholders as defined by GAAP is the most appropriate earnings

measure. We consider Annualized Cash NOI an important supplemental measure because it allows investors, analysts and our management to evaluate the operating performance of our

investments. We define Annualized Cash NOI as annual revenues less operating expenses and non-cash revenues. Annualized Cash NOI excludes all other financial statement amounts included in

net income.

EBITDAR Coverage. Represents the ratio of EBITDAR to recognized rent for owned facilities (excluding Senior Housing - Managed). EBITDAR Coverage is a supplemental measure of an

operator/tenant’s ability to meet their cash rent and other obligations to the Company. However, its usefulness is limited by , among other things, the same factors that limit the usefulness of

EBITDAR. EBITDAR Coverage includes only Stabilized Facilities and excludes significant tenants with meaningful credit enhancement through guarantees (which include Genesis, Holiday and three

former CCP tenants), two Ancillary Supported Tenants and facilities for which data is not available or meaningful.

Funds From Operations Attributable to Common Stockholders (“FFO”), Normalized FFO, Adjusted FFO (“AFFO”) and Normalized AFFO.* See the definitions included in the accompanying

Reconciliations of Non-GAAP Financial Measures for information regarding FFO, Normalized FFO, AFFO and Normalized AFFO.

Occupancy. Occupancy percentage represents the facilities’ average operating occupancy for the period indicated. The percentages are calculated by dividing the actual census from the period

presented by the available beds/units for the same period. Occupancy for independent living facilities can be greater than 100% for a given period as multiple residents could occupy a single unit.

Occupancy includes only Stabilized Facilities and excludes facilities for which data is not available or meaningful.

Pro Forma Annualized Cash NOI.* Pro Forma Annualized Cash NOI for purposes of this presentation is calculated as Annualized Cash NOI for the year ended 12/31/2017, adjusted for the Enlivant

and North American Healthcare transactions completed subsequent to 12/31/2017, the remaining Genesis and CCP rent reductions, and the transition of five skilled nursing/transitional care

facilities to an existing Sabra operator.

Senior Housing. Senior housing communities include independent living, assisted living, continuing care retirement and memory care communities.

Senior Housing - Managed. Senior Housing communities operated by third-party property managers pursuant to property management agreements.

Skilled Mix. Total Medicare and non-Medicaid managed care patient revenue at Skilled Nursing/Transitional Care facilities divided by the total revenues at Skilled Nursing/Transitional Care facilities

for the period indicated. Skilled Mix includes only Stabilized Facilities and excludes facilities for which data is not available or meaningful.

Skilled Nursing/Transitional Care. Skilled nursing/transitional care facilities include skilled nursing, transitional care, multi-license designation and mental health facilities.

Specialty Hospitals and Other. Includes acute care, long-term acute care, rehabilitation and behavioral hospitals, facilities that provide residential services, which may include assistance with

activities of daily living, and other facilities not classified as Skilled Nursing/Transitional Care or Senior Housing.

Stabilized Facility. At the time of acquisition, the Company classifies each facility as either stabilized or pre-stabilized. In addition, the Company may classify a facility as pre-stabilized after

acquisition. Circumstances that could result in a facility being classified as pre-stabilized include newly completed developments, facilities undergoing major renovations or additions, facilities being

repositioned or transitioned to new operators, and significant transitions within the tenants’ business model. Such facilities will be reclassified to stabilized upon maintaining consistent occupancy

(85% for Skilled Nursing/Transitional Care Facilities and 90% for Senior Housing Communities) but in no event beyond 24 months after the date of classification as pre-stabilized. Stabilized Facilities

exclude (i) Senior Housing – Managed communities, (ii) facilities held for sale, (iii) facilities being sold pursuant to the Company’s CCP portfolio repositioning, (iv) facilities being transitioned from

leased by the Company to being operated by the Company, and (v) facilities acquired during the three months preceding the period presented.

* Non-GAAP Financial Measures: Reconciliations, definitions and important discussions regarding the usefulness and limitations of the Non-GAAP Financial Measures used in this report can be

found at http://www.sabrahealth.com/investors/financials/reports-presentations/non-gaap.

DEFINITIONS

PERFORMANCE

21st Annual Wells Fargo Real Estate Securities Conference 2/28/2018

36

This presentation contains “forward-looking” statements that may be identified, without limitation, by the use of “expects,” “believes,” “intends,” “should” or comparable terms or the

negative thereof. Forward-looking statements in this presentation include, but are not limited to, all statements regarding our planned and pending sales of Genesis facilities (including

the expected proceeds from, and timing of, sales) and our strategic and operational plans, as well as all statements regarding expected future financial position, results of operations,

cash flows, liquidity, financing plans, business strategy, the expected amounts and timing of dividends, projected expenses and capital expenditures, competitive position, growth

opportunities and potential investments, plans and objectives for future operations and compliance with and changes in governmental regulations. These statements are made as of

the date hereof and are subject to known and unknown risks, uncertainties, assumptions and other factors— many of which are out of the Company’s control and difficult to forecast—

that could cause actual results to differ materially from those set forth in or implied by our forward-looking statements. These risks and uncertainties include but are not limited to: our

dependence on the operating success of our tenants; operational risks with respect to our Senior Housing - Managed communities (as defined below); the effect of our tenants

declaring bankruptcy or becoming insolvent; our ability to find replacement tenants and the impact of unforeseen costs in acquiring new properties; the impact of litigation and rising

insurance costs on the business of our tenants; the anticipated benefits of our merger with Care Capital Properties, Inc. (“CCP”) may not be realized; the anticipated and unanticipated

costs, fees, expenses and liabilities related to our merger with CCP; our ability to implement the previously announced rent repositioning program for certain of our tenants who were

legacy tenants of CCP on the timing or terms we have previously disclosed; our ability to dispose of facilities currently leased to Genesis Healthcare, Inc. (“Genesis”) on the timing or

terms we have previously disclosed; the possibility that Sabra may not acquire the remaining majority interest in the Enlivant Joint Venture; risks associated with our investments in

joint ventures; changes in healthcare regulation and political or economic conditions; the impact of required regulatory approvals of transfers of healthcare properties; competitive

conditions in our industry; our concentration in the healthcare property sector, particularly in skilled nursing/transitional care facilities and senior housing communities, which makes

our profitability more vulnerable to a downturn in a specific sector than if we were investing in multiple industries; the significant amount of and our ability to service our indebtedness;

covenants in our debt agreements that may restrict our ability to pay dividends, make investments, incur additional indebtedness and refinance indebtedness on favorable terms;

increases in market interest rates; our ability to raise capital through equity and debt financings; changes in foreign currency exchange rates; the relatively illiquid nature of real estate

investments; the loss of key management personnel or other employees; uninsured or underinsured losses affecting our properties and the possibility of environmental compliance

costs and liabilities; the impact of a failure or security breach of information technology in our operations; our ability to maintain our status as a real estate investment trust (“REIT”);

changes in tax laws and regulations affecting REITs (including the potential effects of the Tax Cuts and Jobs Act); compliance with REIT requirements and certain tax and tax

regulatory matters related to our status as a REIT; and the ownership limits and anti-takeover defenses in our governing documents and under Maryland law, which may restrict change

of control or business combination opportunities.

Additional information concerning risks and uncertainties that could affect our business can be found in our filings with the Securities and Exchange Commission (the “SEC”), including

Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2017. Forward-looking statements made in this presentation are not guarantees of future performance,

events or results, and you should not place undue reliance on these forward-looking statements, which speak only as of the date hereof. The Company assumes no, and hereby

disclaims any, obligation to update any of the foregoing or any other forward-looking statements as a result of new information or new or future developments, except as otherwise

required by law.

TENANT AND BORROWER INFORMATION

This presentation includes information (e.g., EBITDAR coverage and occupancy percentage) regarding certain of our tenants that lease properties from us and our borrowers, most of

which are not subject to SEC reporting requirements. Genesis is subject to the reporting requirements of the SEC and is required to file with the SEC annual reports containing audited

financial information and quarterly reports containing unaudited financial information. The information related to our tenants and borrowers that is provided in this presentation has

been provided by, or derived from information provided by, such tenants and borrowers. We have not independently verified this information. We have no reason to believe that such

information is inaccurate in any material respect. We are providing this data for informational purposes only. Genesis’s filings with the SEC can be found at www.sec.gov.

FORWARD-LOOKING STATEMENTS

PERFORMANCE

21st Annual Wells Fargo Real Estate Securities Conference 2/28/2018