Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - STONERIDGE INC | tv487388_ex99-1.htm |

| 8-K - FORM 8-K - STONERIDGE INC | tv487388_8k.htm |

Fourth - Quarter 2017 Results March 1, 2018 Exhibit 99.2

2 Forward - Looking Statements Statements in this presentation contain “forward - looking statements” under the Private Securities Litigation Reform Act of 1995. These statements appear in a number of places in this report and may include statements regarding the intent, belief or current exp ect ations of the Company, with respect to, among other things, our (i) future product and facility expansion, (ii) acquisition strategy, (iii) in vestments and new product development, (iv) growth opportunities related to awarded business and (v) operational expectations. Forward - looking st atements may be identified by the words “will,” “may,” “should,” “designed to,” “believes,” “plans,” “projects,” “intends,” “expects,” “e stimates,” “anticipates,” “continue,” and similar words and expressions. The forward - looking statements are subject to risks and uncertain ties that could cause actual events or results to differ materially from those expressed in or implied by the statements. Important factors t hat could cause actual results to differ materially from those in the forward - looking statements include, among other factors: • the reduced purchases, loss or bankruptcy of a major customer or supplier; • the costs and timing of business realignment, facility closures or similar actions; • a significant change in automotive, commercial, off - highway, motorcycle or agricultural vehicle production; • competitive market conditions and resulting effects on sales and pricing; • the impact on changes in foreign currency exchange rates on sales, costs and results, particularly the Argentinian peso, Brazilia n r eal, Chinese renminbi, euro, Mexican peso and Swedish krona; • our ability to achieve cost reductions that offset or exceed customer - mandated selling price reductions; • customer acceptance of new products; • our ability to successfully launch/produce products for awarded business; • adverse changes in laws, government regulations or market conditions affecting our products or our customers’ products; • our ability to protect our intellectual property and successfully defend against assertions made against us; • liabilities arising from warranty claims, product recall or field actions, product liability and legal proceedings to which we are or may become a party, or the impact of product recall or field actions on our customers; • labor disruptions at our facilities or at any of our significant customers or suppliers; • the ability of our suppliers to supply us with parts and components at competitive prices on a timely basis; • the amount of our indebtedness and the restrictive covenants contained in the agreements governing our indebtedness, including ou r revolving credit facility; • capital availability or costs, including changes in interest rates or market perceptions; • the failure to achieve the successful integration of any acquired company or business; • risks related to a failure of our information technology systems and networks, and risks associated with current and emerging techn olo gy threats and damage from computer viruses, unauthorized access, cyber attack and other similar disruptions; and • the items described in Part I, Item IA (“Risk Factors”) of our 10 - K filed with the SEC. In addition, the forward - looking statements contained herein represent our estimates only as of the date of this release and should not be relied upon as representing our estimates as of any subsequent date. While we may elect to update these forward - looking stateme nts at some point in the future, we specifically disclaim any obligation to do so, whether to reflect actual results, changes in ass ump tions, changes in other factors affecting such forward - looking statements or otherwise. Rounding Disclosure: There may be slight immaterial differences between figures represented in our public filings compared t o w hat is shown in this presentation. The differences are the a result of rounding due to the representation of values in millions rat her than thousands in public filings.

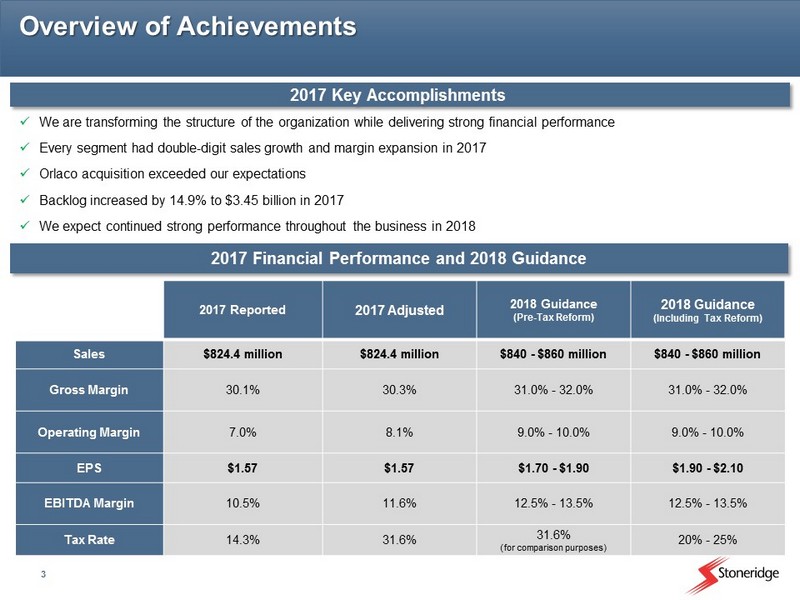

3 2017 Reported 2017 Adjusted 2018 Guidance (Pre - Tax Reform) 2018 Guidance (Including Tax Reform) Sales $824.4 million $824.4 million $840 - $860 million $840 - $860 million Gross Margin 30.1% 30.3% 31.0% - 32.0% 31.0% - 32.0% Operating Margin 7.0% 8.1% 9.0% - 10.0% 9.0% - 10.0% EPS $1.57 $1.57 $1.70 - $1.90 $1.90 - $2.10 EBITDA Margin 10.5% 11.6% 12.5% - 13.5% 12.5% - 13.5% Tax Rate 14.3% 31.6% 31.6% (for comparison purposes) 20% - 25% Overview of Achievements x We are transforming the structure of the organization while delivering strong financial performance x Every segment had double - digit sales growth and margin expansion in 2017 x Orlaco acquisition exceeded our expectations x Backlog increased by 14.9% to $3.45 billion in 2017 x We expect continued strong performance throughout the business in 2018 2017 Key Accomplishments 2017 Financial Performance and 2018 Guidance

4 Financial Performance Driving sustainable, profitable growth Q4 Year over Year Sales Adjusted Gross Profit and % Margin Adjusted Operating Income and % Margin Adjusted EBITDA and % Margin +20% +18% $’s in USD Millions $172.6 $207.4 Q4 2016 Q4 2017 $47.8 $61.0 27.7% 29.4% $40.0 $50.0 $60.0 $70.0 Q4 2016 Q4 2017 25.0% 30.0% 35.0% 40.0% +28% $10.2 $15.3 5.9% 7.4% $6.0 $11.0 $16.0 Q4 2016 Q4 2017 4.0% 6.0% 8.0% 10.0% +50% $16.4 $23.5 9.5% 11.3% $10.0 $15.0 $20.0 $25.0 Q4 2016 Q4 2017 7.0% 12.0% +44% $696.0 $824.4 2016 2017 $195.4 $249.8 28.1% 30.3% $130.0 $180.0 $230.0 $280.0 2016 2017 25.0% 30.0% 35.0% 40.0% +28% $44.1 $66.9 6.3% 8.1% $25.0 $45.0 $65.0 2016 2017 4.0% 9.0% 14.0% +52% $68.7 $95.8 9.9% 11.6% $45.0 $65.0 $85.0 2016 2017 9.0% 11.0% 13.0% +39%

5 Building a Culture of Performance and Growth

6 Control Devices Deliver growth in sensing and actuation segments Drive operational efficiency Manage ramp - down of shift - by - wire programs (~Q4) Electronics Execute product launches Capture MirrorEye opportunities Refine engineering footprint and drive global capability PST Drive track & trace growth Leverage cost structure Capitalize on macroeconomic tailwinds Keys to 2018 Success *Based on midpoint of provided guidance We expect continued strong performance by each segment in 2018

7 Expansion in Asia India and China are opportunities for growth We are expanding our capabilities in Asia to support local growth Expansion in India Joint venture with Spark Minda, Ashok Minda Group Unconsolidated – 49% minority interest Regulations and technology advancements driving growth opportunities Driver information systems and sensors for the motorcycle, passenger car and commercial vehicle markets Expansion in China To support growth in Asia we are reviewing options to lease a new facility to replace our existing facility We are targeting a new facility that would increase manufacturing capabilities, and allow for expanded in - house research and development and product testing Expected Sales Growth in China (USD in Millions) $18 $21 $25 $38 $52 2014 2015 2016 2017 2020

8 Financial performance exceeded expectations in 2017 driven by a successful acquisition and strong performance across each of our segments We have a leadership team in place capable of driving global growth and a culture of continuous improvement that will lead to continued success Opportunities in India and China will continue to provide growth We will continue to build on our successes in 2017 to drive the business forward in 2018 2017 Summary & 2018 Overview Driving shareholder v alue t hrough s trong f inancial performance and a w ell d efined long - term strategy

Financial Update

10 2017 Results 2018 Guidance (Excluding Tax Reform) Midpoint Improvement (Excluding Tax Reform) 2018 Guidance (Including Tax Reform) Midpoint Improvement (Including Tax Reform) Sales $824.4 million $840 - $860 million $25.6 million $840 - $860 million $25.6 million Adjusted Gross Margin 30.3% 31.0% - 32.0% 120 bps 31.0% - 32.0% 120 bps Adjusted Operating Margin 8.1% 9.0% - 10.0% 140 bps 9.0% - 10.0% 140 bps Adjusted EPS $1.57 $1.70 - $1.90 $0.23 EPS $1.90 - $2.10 $0.43 EPS Adjusted EBITDA Margin 11.6% 12.5% - 13.5% 140 bps 12.5% - 13.5% 140 bps Effective Tax Rate 31.6% 31.6% (for comparison purposes) --------- 20% - 25% 9.1% 4 th Quarter 2017 Summary 4 th Quarter 2017 Financial Results 2018 Guidance Sales of $ 207.4 million, an increase of 20% over Q4 2016 Control Devices sales of $ 109.6 million, an increase of 6% over Q4 2016 Electronics sales of $ 84.6 million, an increase of 52% over Q4 2016 PST sales of $ 24.4 million, an increase of 9% over Q4 2016 Adjusted operating income of $ 15.3 million ( 7.4% operating margin), an increase of 50% over Q4 2016 Control Devices operating income of $ 17.3 million ( 15.8% operating margin), an increase of 18% over Q4 2016 Electronics adjusted operating income of $5.0 million (5.9% adjusted operating margin), an increase of 82% over Q4 2016 PST adjusted operating income of $ 1.9 million (7.6% adjusted operating margin), an increase of $1.1 million over Q4 2016 Segment level financial information includes intercompany sales

11 Control Devices Financial Performance Strong global revenue performance and margin improvement continues Control Devices Overview Revenue grew by 6% compared to Q4 2016 highlighted by continued growth in our sensors and actuation business and in particular, shift - by - wire volumes Revenue grew 10% in 2017 compared to 2016 primarily due to the ramp - up of certain shift - by - wire programs as well as global growth in our sensors business, including emissions products in Asia Operating margin improved by 90 bps due to improved fixed cost leverage Q4 Year over Year Sales Operating Income and % Margin +6% +10% $’s in USD Millions $103.6 $109.6 Q4 2016 Q4 2017 $14.7 $17.3 14.2% 15.8% $10.0 $12.0 $14.0 $16.0 $18.0 Q4 2016 Q4 2017 10.0% 12.0% 14.0% 16.0% 18.0% 20.0% 22.0% 24.0% 26.0% 28.0% 30.0% +18% $410.0 $452.6 2016 2017 $61.8 $72.6 15.1% 16.0% $55.0 $60.0 $65.0 $70.0 $75.0 2016 2017 10.0% 20.0% 30.0% +17% Segment level financial information includes intercompany sales

12 Electronics Financial Performance Continued top - line performance Margin expansion continues to drive improved bottom - line performance Electronics Overview Quarter over quarter revenue growth of $28.9 million (52%) driven by Orlaco acquisition, continued growth in aftermarket products, particularly tachograph, and strong driver information systems performance Year over year revenue growth of $83.3 million (35%) and margin expansion of 120 bps Continued investment in design and development activities to drive future growth – product launches and product development Q4 Year over Year Sales Adjusted Operating Income and % Margin +52% +35% $’s in USD Millions $55.7 $84.6 Q4 2016 Q4 2017 $2.7 $5.0 4.9% 5.9% $0.0 $2.0 $4.0 $6.0 Q4 2016 Q4 2017 3.0% 5.0% 7.0% 9.0% +82% $238.6 $321.9 2016 2017 $14.8 $23.8 6.2% 7.4% $5.0 $15.0 $25.0 2016 2017 5.0% 7.0% 9.0% +61% Segment level financial information includes intercompany sales

13 PST Financial Performance Continued revenue growth and margin expansion contributing to significant operating income improvement PST Overview Revenue growth of 9% compared to Q4 2016 driven by continued growth in track and trace services as well as general strong performance in the aftermarket sales channels Continued positive macroeconomic indicators – light and commercial vehicle market improvement and motorcycle market stability Operating margin expansion of 440 bps compared to Q4 2016. Year over year operating margin improvement of 970 bps and $8.7 million. Q4 Year over Year Sales Adjusted Operating Income and % Margin $’s in USD Millions + 9 % +15% $22.4 $24.4 Q4 2016 Q4 2017 $0.7 $1.9 3.2% 7.6% $0.0 $1.0 $2.0 Q4 2016 Q4 2017 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% +$1.1m $82.6 $95.1 2016 2017 - $3.5 $5.3 - 4.2% 5.5% -$7.0 -$2.0 $3.0 2016 2017 -10.0% -8.0% -6.0% -4.0% -2.0% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% +$8.7m Segment level financial information includes intercompany sales

14 - 46.8% 23.5% GAAP Q4 Tax Rate Q4 Impact of US Tax Cuts and Jobs Act Adjusted Q4 Tax Rate Expected Impact of US Tax Cuts and Jobs Act The US Tax Cuts and Jobs Act had a positive impact on Q4 earnings due to the one - time transition tax being more than offset by the impact on our deferred tax liabilities due to a reduction in the corporate tax rate Adjusted tax rate reflects tax rate excluding considerations for US Tax Cuts and Jobs Act Q4 adjusted tax rate was 23.5% (excluding tax reform) 2017 adjusted tax rate was 31.6% (excluding tax reform) 14.3% 31.6% 14.3% GAAP 2017 Tax Rate 2017 Impact of US Tax Cuts and Jobs Act Adjusted 2017 Tax Rate Q4 Adjusted tax rate of 23.5% removing one - time impacts of tax - reform 2017 Adjusted tax rate of 31.6% Q 4 Adjusted Tax Rate 2017 Adjusted Tax Rate One - time $9.1 million tax benefit One - time $9.1 million tax benefit US Tax Cuts and Jobs Act generated significant tax benefit in Q4

15 Capital Allocation Strategy We will continue to review the best use of our capital structure in order to maximize shareholder value Net Debt and Leverage Ratio Net Debt / Adjusted EBITDA Current net debt / adjusted EBITDA leverage of 0.7x We will utilize our capital to maximize shareholder return through investment in our existing business, inorganic growth and / or return of capital to shareholders Target inorganic growth through strategic technologies, geographic expansion and / or customer diversification Available leverage for an acquisition would be 2.0x – 2.5x adjusted EBITDA depending on the opportunity 1.9x 1.6x 1.3x 0.5x 1.4x 1.2x 1.0x 0.7x

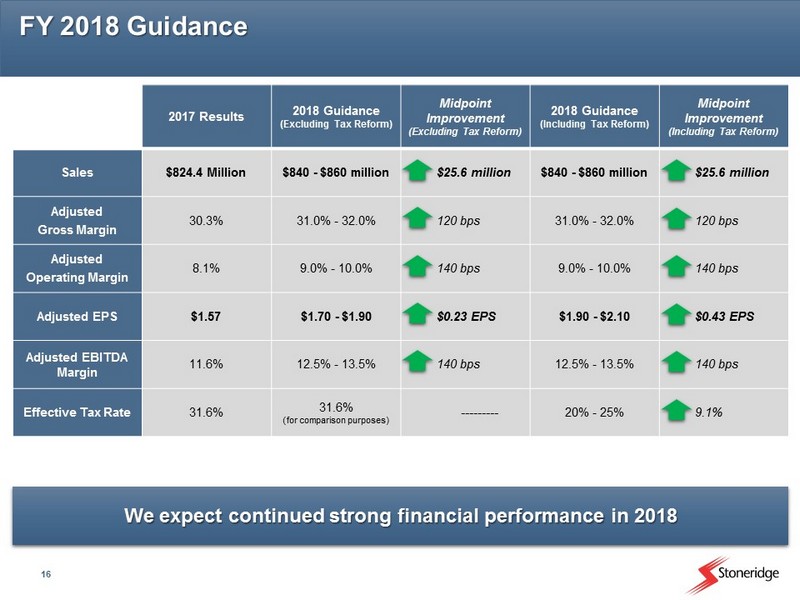

16 2017 Results 2018 Guidance (Excluding Tax Reform) Midpoint Improvement (Excluding Tax Reform) 2018 Guidance (Including Tax Reform) Midpoint Improvement (Including Tax Reform) Sales $824.4 Million $840 - $860 million $25.6 million $840 - $860 million $25.6 million Adjusted Gross Margin 30.3% 31.0% - 32.0% 120 bps 31.0% - 32.0% 120 bps Adjusted Operating Margin 8.1% 9.0% - 10.0% 140 bps 9.0% - 10.0% 140 bps Adjusted EPS $1.57 $1.70 - $1.90 $0.23 EPS $1.90 - $2.10 $0.43 EPS Adjusted EBITDA Margin 11.6% 12.5% - 13.5% 140 bps 12.5% - 13.5% 140 bps Effective Tax Rate 31.6% 31.6% (for comparison purposes) --------- 20% - 25% 9.1% FY 2018 Guidance We expect continued strong financial performance in 2018

17 All segments exceeded expectations for financial performance Control Devices – 6 % sales growth, 18% operating income growth vs. Q4 2016 Electronics – 52% sales growth, 82% adjusted operating income growth vs. Q4 2016 PST – 9 % sales growth, $1.1 million adjusted operating income growth vs. Q4 2016 US Tax Cuts and Jobs Act expected to have positive impact to earnings in 2018 Conservative balance sheet provides opportunities to deploy capital and maximize shareholder return 2018 Full - year guidance Sales growth of $25.6 million to a midpoint of $850 million ($840 - $860 million) Adjusted EBITDA margin expansion of 140 bps to a midpoint of 13.0% Adjusted EPS growth of $ 0.23 (pre - tax reform) and $ 0.43 (post - tax reform) to $1.70 - $1.90 and $1.90 - $2.10 respectively 4 th Quarter 2017 Financial Summary and 2018 Overview Driving shareholder v alue t hrough s trong f inancial performance and a w ell d efined long - term strategy Segment level financial information includes intercompany sales

Thank You

19 Appendix

20 Primary Stoneridge Foreign Currency Sensitivities SRI Currency Exposures If 5% Weaker USD N et Annual EBITDA Transaction Impact to Stoneridge* SRI Guidance Assumption vs. Dec. 31, 2017 Euro / USD Mexican Peso / USD Swedish Krona / USD Brazilia n Real / USD 1.18 1.20 Guidance December 31, 2017 3.24 3.31 Guidance December 31, 2017 18.04 19.65 Guidance December 31, 2017 *Before impact of hedging programs, approximate USD in millions. Does not consider translation impacts. $0.2 $1.0 $0.8 $1.5 7.90 8.20 Guidance December 31, 2017

21 2017 Q4 Adjustments The expense resulting from the step - up in the fair value of the earn - out due to Orlaco outperformance was $0.9 million resulting in an EPS adjustment of $ 0.03 The expense related to the step - up in the fair value of the earn - out related to the acquisition of the remaining 26% minority interest in PST was $1.9 million resulting in an EPS adjustment of $ 0.07 Expenses related to certain one - time severance costs have been adjusted to reflect normalized earnings PP&E gains related to an insurance claim at our Juarez facility have been removed to reflect normalized earnings One - time gains related to the impact of the US Tax Cuts and Jobs Act were removed to reflect normalized earnings and a normalized tax rate Adjustment Expected Q4 2017 After - Tax Impact (USD millions) Expected Q4 2017 After - Tax EPS Impact Earn - out (Electronics / Orlaco) ($0.9) ($0.03) Earn - out (PST) ($1.9) ($0.07) Severance Costs ($0.9) ($0.03) PP&E Gain on Insurance Proceeds $1.3 $0.05 Impact of US Tax Cuts and Jobs Act $9.1 $0.31 Total ($6.7) ($0.23)

22 2017 Full Year Adjustments Adjustment Expected 2017 After - Tax Impact (USD millions) Expected 2017 After - Tax EPS Impact Orlaco transaction costs ($0.8) ($0.03) Expense related to the step - up in acquired inventory ($1.2) ($0.04) Earn - out (Electronics / Orlaco) ($4.9) ($0.17) Earn - out (PST) ($2.6) ($0.09) Business Realignment Costs ($0.9) ($0.03) PP&E Gain on Insurance Proceeds $1.3 $0.05 Impact of US Tax Cuts and Jobs Act $9.1 $0.31 Total $0.0 $0.00 See the following page for detail regarding these adjustments

23 2017 Full Year Adjustments We incurred transaction costs of $0.8 million (after - tax ) related to the acquisition of Orlaco resulting in an EPS add - back of $0.03 As a result of purchase accounting, we recognized a step - up in the fair value of acquired inventory of $ 1.2 million (after - tax) resulting in an EPS add - back of $0.04 The expense resulting from the step - up in the fair value of the earn - out due to Orlaco outperformance was $4.9 million resulting in an EPS add - back of $ 0.17 The expense related to the step - up in the fair value of the earn - out related to the acquisition of the remaining 26% minority interest in PST was $2.6 million resulting in an EPS add - back of $ 0.09 Expenses related to certain one - time severance costs have been adjusted to reflect normalized earnings. The after - tax impact of this adjustment was $0.9 million resulting in an EPS add - back of $0.03. PP&E gains related to an insurance claim at our Juarez facility have been removed to reflect normalized earnings. The after - tax impact of this gain was $1.3 million and results in a reduction to reported EPS of $0.05. One - time gains related to the impact of the US Tax Cuts and Jobs Act were removed to reflect normalized earnings and a normalized tax rate. The after - tax impact of these one - time items was $9.1 million and results in a reduction to reported EPS of $0.31.

24 Income Statement Years ended December 31 (in thousands, except per share data) 2017 2016 2015 Net sales $ 824,444 $ 695,977 644,812 Costs and expenses: Cost of goods sold 576,304 500,538 467,834 Selling, general and administrative 141,893 111,145 110,371 Design and development 48,877 40,212 38,792 Operating income 57,370 44,082 27,815 Interest expense, net 5,783 6,277 6,365 Equity in earnings of investee (1,636) (1,233) (608) Other expense (income), net 641 (147) 1,828 52,582 39,185 20,230 7,533 (36,389) (547) Income from continuing operations 45,049 75,574 20,777 Discontinued operations: - - (210) Loss from discontinued operations - - (210) Net income 45,049 75,574 20,567 Net loss attributable to noncontrolling interest (130) (1,887) (2,207) Net income attributable to Stoneridge, Inc. $ 45,179 $ 77,461 22,774 Earnings per share from continuing operations attributable to Stoneridge, Inc.: Basic $ 1.61 $ 2.79 0.84 Diluted $ 1.57 $ 2.74 0.82 Basic $ 0.00 $ 0.00 (0.01) Diluted $ 0.00 $ 0.00 (0.01) Earnings per share attributable to Stoneridge, Inc.: Basic $ 1.61 $ 2.79 0.83 Diluted $ 1.57 $ 2.74 0.81 Weighted-average shares outstanding: Basic 28,082 27,764 27,338 Diluted 28,772 28,309 27,959 CONSOLIDATED STATEMENTS OF OPERATIONS Loss per share attributable to discontinued operations: Income before income taxes Provision (benefit) for income taxes Loss on disposal, net of tax

25 Segment Financial Information Years ended December 31 2017 2016 2015 Net Sales: Control Devices $ 447,528 $ 408,132 $ 333,010 Inter-segment sales 5,044 1,826 2,055 Control Devices net sales 452,572 409,958 335,065 Electronics 282,383 205,256 216,544 Inter-segment sales 39,501 33,361 22,904 Electronics net sales 321,884 238,617 239,448 PST 94,533 82,589 95,258 Inter-segment sales 563 - - PST net sales 95,096 82,589 95,258 Eliminations (45,108) (35,187) (24,959) Total net sales $ 824,444 $ 695,977 $ 644,812 Operating Income (Loss): Control Devices $ 72,555 $ 61,815 $ 44,690 Electronics 18,119 14,798 13,784 PST 2,661 (3,462) (7,542) Unallocated Corporate (35,965) (29,069) (23,117) Total operating income $ 57,370 $ 44,082 $ 27,815 Depreciation and Amortization: Control Devices $ 10,887 $ 10,276 $ 9,260 Electronics 8,143 3,971 3,666 PST 8,316 8,559 9,272 Unallocated Corporate 584 452 211 Total depreciation and amortization $ 27,930 $ 23,258 $ 22,409 Interest Expense, net: Control Devices $ 103 $ 226 $ 326 Electronics 119 142 161 PST 1,812 3,396 2,957 Unallocated Corporate 3,749 2,513 2,921 Total interest expense, net $ 5,783 $ 6,277 $ 6,365 Capital Expenditures: Control Devices $ 17,484 $ 13,261 $ 15,094 Electronics 8,158 5,665 6,538 PST 3,831 3,213 5,889 Unallocated Corporate 2,697 2,337 1,214 Total capital expenditures $ 32,170 $ 24,476 $ 28,735

26 Balance Sheet CONSOLIDATED BALANCE SHEETS December 31, December 31, (in thousands) 2017 2016 ASSETS Current assets: Cash and cash equivalents $ 66,003 $ 50,389 142,438 113,225 Inventories, net 73,471 60,117 Prepaid expenses and other current assets 21,457 17,162 Total current assets 303,369 240,893 Long-term assets: Property, plant and equipment, net 110,402 91,500 Intangible assets, net 75,243 39,260 Goodwill 38,419 931 Investments and other long-term assets, net 31,604 21,945 Total long-term assets 255,668 153,636 Total assets $ 559,037 $ 394,529 LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities: Current portion of debt $ 4,192 $ 8,626 Accounts payable 79,386 62,594 Accrued expenses and other current liabilities 52,546 41,489 Total current liabilities 136,124 112,709 Long-term liabilities: Revolving credit facility 121,000 67,000 Long-term debt, net 3,852 8,060 Deferred income taxes 18,874 9,760 Other long-term liabilities 35,115 4,923 Total long-term liabilities 178,841 89,743 Shareholders' equity: Preferred Shares, without par value, 5,000 shares authorized, none issued - - Common Shares, without par value, 60,000 shares authorized, - - Additional paid-in capital 228,486 206,504 and 2016, respectively, at cost (7,118) (5,632) Retained earnings 92,264 45,356 Accumulated other comprehensive loss (69,560) (67,913) Total Stoneridge, Inc. shareholders' equity 244,072 178,315 Noncontrolling interest - 13,762 Total shareholders' equity 244,072 192,077 Total liabilities and shareholders' equity $ 559,037 $ 394,529 December 31, 2017 and 2016, respectively, with no stated value 28,966 and 28,966 shares issued and 28,180 and 27,850 shares outstanding at Common Shares held in treasury, 786 and 1,116 shares at December 31, 2017 Accounts receivable, less reserves of $1,109 and $1,630, respectively

27 Statement of Cash Flows Years ended December 31, (in thousands) 2017 2016 2015 OPERATING ACTIVITIES: Net income $ 45,049 $ 75,574 $ 20,567 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation 21,490 19,998 18,964 Amortization, including accretion of deferred financing costs 6,764 3,615 3,833 Deferred income taxes (5,959) (38,747) (2,165) Earnings of equity method investee (1,636) (1,233) (608) (Gain) loss on fixed assets (1,796) 48 74 Share-based compensation expense 7,265 6,134 7,224 Tax benefit related to share-based compensation expense (858) (977) - Change in fair value of earn-out contingent consideration 7,485 - - Loss on disposal of Wiring business - - 210 Accounts receivable, net (15,156) (18,694) (489) Inventories, net (2,132) 4,519 (4,340) Prepaid expenses and other assets (10,177) 2,652 (295) Accounts payable 10,492 10,980 6,577 Accrued expenses and other liabilities 18,077 1,408 5,253 Net cash provided by operating activities 78,908 65,277 54,805 INVESTING ACTIVITIES: Capital expenditures (32,170) (24,476) (28,735) Proceeds from sale of fixed assets 77 652 64 Insurance proceeds for fixed assets 711 - - Business acquisition, net of cash acquired (77,258) - (469) Payments related to sale of Wiring business - - (1,230) Net cash used for investing activities (108,640) (23,824) (30,370) CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS Changes in operating assets and liabilities, net of effect of business combination:

28 Statement of Cash Flows (Cont.) Years ended December 31, (in thousands) 2017 2016 2015 FINANCING ACTIVITIES: Acquisition of noncontrolling interest, including transaction costs (1,848) - - Revolving credit facility borrowings 95,000 - - Revolving credit facility payments (41,000) (33,000) - Proceeds from issuance of debt 2,748 16,223 22,540 Repayments of debt (11,573) (25,748) (30,586) Other financing costs (61) (399) (49) Repurchase of Common Shares to satisfy employee tax withholding (2,481) (1,424) (2,924) Tax benefits related to share-based compensation expense - 977 - Net cash provided by (used for) financing activities 40,785 (43,371) (11,019) Effect of exchange rate changes on cash and cash equivalents 4,561 (2,054) (2,076) Net change in cash and cash equivalents 15,614 (3,972) 11,340 Cash and cash equivalents at beginning of period 50,389 54,361 43,021 Cash and cash equivalents at end of period $ 66,003 $ 50,389 $ 54,361 Supplemental disclosure of cash flow information: Cash paid for interest $ 5,746 $ 5,786 $ 6,092 Cash paid for income taxes, net $ 7,093 $ 3,386 $ 2,494 Supplemental disclosure of non-cash operating and financing activities: Bank payment of vendor payables under short-term debt obligations $ - $ 3,764 $ 5,323 CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

29 Reconciliations to US GAAP

30 Reconciliations to US GAAP This document contains information about Stoneridge's financial results which is not presented in accordance with accounting principles generally accepted in the United States ("GAAP"). Such non - GAAP financial measures are reconciled to their closest GAAP financial measures in the appendix of this document. The provision of these non - GAAP financial measures for 2017 and 2018 is not intended to indicate that Stoneridge is explicitly or implicitly providing projections on those non - GAAP financial measures, and actual results for such measures are likely to vary from those presented. The reconciliations include all information reasonably available to the Company at the date of this document and the adjustments that management can reasonably predict.

31 Reconciliations to US GAAP Reconciliation of Stoneridge Adjusted Gross Profit (USD in millions) Q4 2017 2017 Gross Profit $61.0 $248.1 Add: Pre-Tax Step-Up in Acquired Inventory from Orlaco - 1.6 Adjusted Gross Profit $61.0 $249.8 Reconciliation of Stoneridge Adjusted Operating Income (USD in millions) Q4 2017 2017 Operating Income $13.2 $57.4 Add: Pre-Tax Step-Up in Acquired Inventory from Orlaco - 1.6 Add: Pre-Tax Step-Up in Fair Value of Earn-Out (Orlaco) 0.9 4.9 Add: Pre-Tax Step-Up in Fair Value of Earn-Out (PST) 1.9 2.6 Add: Pre-Tax Transaction Costs Adjustment (Orlaco) - 1.2 Add: Pre-Tax Severance Costs 1.2 1.2 Less: Pre-Tax PP&E Gain on Insurance Proceeds (1.9) (1.9) Adjusted Operating Income $15.3 $66.9 Reconciliation of Q4 2017 Adjusted EPS Reconciliation of Q2 Adjusted EBITDA (USD in millions) Q4 2017 Q4 2017 EPS Net Income Attributable to Stoneridge $18.9 0.65 Add: After-Tax Step-Up in Fair Value of Acquired Inventory from Orlaco - - Add: After-Tax Step-Up in Fair Value of Earn-Out (Orlaco) 0.9 0.03 Add: After-Tax Step-Up in Fair Value of Earn-Out (PST) 1.9 0.07 Add: After-Tax Severance Costs 0.9 0.03 Less: After-Tax PP&E Gain on Insurance Proceeds (1.3) (0.05) Less: After-Tax Impact of US Tax Cut and Jobs Act (9.1) (0.31) Adjusted Net Income $12.2 $0.42

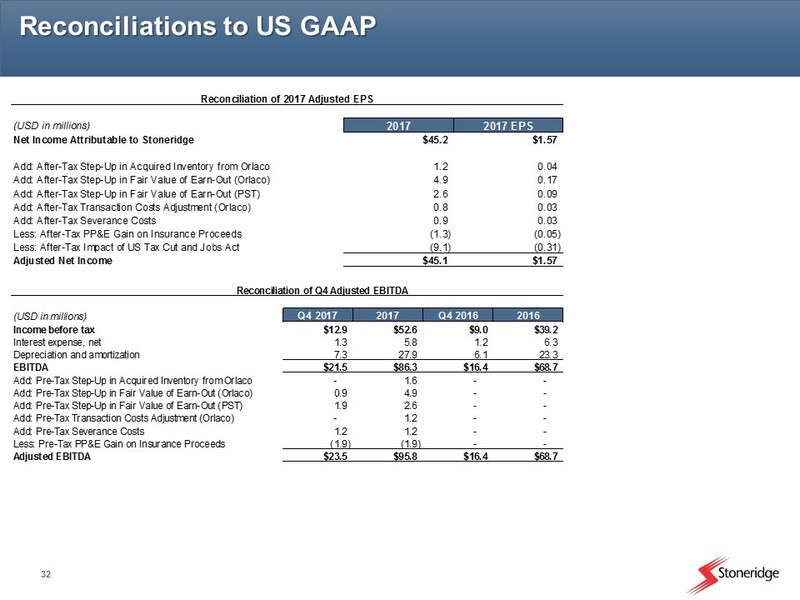

32 Reconciliations to US GAAP Reconciliation of Q4 Adjusted EBITDA (USD in millions) Q4 2017 2017 Q4 2016 2016 Income before tax $12.9 $52.6 $9.0 $39.2 Interest expense, net 1.3 5.8 1.2 6.3 Depreciation and amortization 7.3 27.9 6.1 23.3 EBITDA $21.5 $86.3 $16.4 $68.7 Add: Pre-Tax Step-Up in Acquired Inventory from Orlaco - 1.6 - - Add: Pre-Tax Step-Up in Fair Value of Earn-Out (Orlaco) 0.9 4.9 - - Add: Pre-Tax Step-Up in Fair Value of Earn-Out (PST) 1.9 2.6 - - Add: Pre-Tax Transaction Costs Adjustment (Orlaco) - 1.2 - - Add: Pre-Tax Severance Costs 1.2 1.2 - - Less: Pre-Tax PP&E Gain on Insurance Proceeds (1.9) (1.9) - - Adjusted EBITDA $23.5 $95.8 $16.4 $68.7 Reconciliation of 2017 Adjusted EPS (USD in millions) 2017 2017 EPS Net Income Attributable to Stoneridge $45.2 $1.57 Add: After-Tax Step-Up in Acquired Inventory from Orlaco 1.2 0.04 Add: After-Tax Step-Up in Fair Value of Earn-Out (Orlaco) 4.9 0.17 Add: After-Tax Step-Up in Fair Value of Earn-Out (PST) 2.6 0.09 Add: After-Tax Transaction Costs Adjustment (Orlaco) 0.8 0.03 Add: After-Tax Severance Costs 0.9 0.03 Less: After-Tax PP&E Gain on Insurance Proceeds (1.3) (0.05) Less: After-Tax Impact of US Tax Cut and Jobs Act (9.1) (0.31) Adjusted Net Income $45.1 $1.57

33 Reconciliations to US GAAP Reconciliation of Electronics Adjusted Operating Income (USD in millions) Q1 2017 Q2 2017 Q3 2017 Q4 2017 2017 Operating Income $5.6 $2.8 $4.9 $4.9 $18.1 Add: Pre-Tax Step-Up in Acquired Inventory from Orlaco 1.0 0.7 - - 1.6 Add: Pre-Tax Step-Up in Fair Value of Earn-Out (Orlaco) - 2.1 1.8 0.9 4.9 Add: Pre-Tax Severance Costs - - - 1.2 1.2 Less: Pre-Tax PP&E Gain on Insurance Proceeds - - - (1.9) (1.9) Adjusted Operating Income $6.5 $5.6 $6.7 $5.0 $23.8 Reconciliation of PST Adjusted Operating Income (USD in millions) Q1 2017 Q2 2017 Q3 2017 Q4 2017 2017 Operating Income $0.6 $1.1 $1.0 ($0.1) $2.7 Add: Pre-Tax Step-Up in Fair Value of Earn-Out (PST) - 0.2 0.5 1.9 2.6 Adjusted Operating Income $0.6 $1.3 $1.5 $1.9 $5.3