Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE - EPR PROPERTIES | ex991-eprx12312017earnings.htm |

| 8-K - 8-K - EPR PROPERTIES | a8-kforearningsrelease1231.htm |

Exhibit 99.2

Supplemental Operating and Financial Data |

Fourth Quarter and Year Ended December 31, 2017 |

TABLE OF CONTENTS | ||||||||

SECTION | PAGE | |||||||

Company Profile | ||||||||

Investor Information | ||||||||

Selected Financial Information | ||||||||

Selected Balance Sheet Information | ||||||||

Selected Operating Data | ||||||||

Funds From Operations and Funds From Operations as Adjusted | ||||||||

Adjusted Funds From Operations | ||||||||

Capital Structure | ||||||||

Summary of Ratios | ||||||||

Summary of Mortgage Notes Receivable | ||||||||

Capital Spending and Disposition Summaries | ||||||||

Property Under Development - Investment Spending Estimates | ||||||||

Financial Information and Total Investment by Segment | ||||||||

Lease Expirations | ||||||||

Top Ten Customers by Revenue from Continuing Operations | ||||||||

Net Asset Value (NAV) Components | ||||||||

Annualized GAAP Net Operating Income | ||||||||

Guidance | ||||||||

Definitions-Non-GAAP Financial Measures | ||||||||

Appendix-Reconciliation of Certain Non-GAAP Financial Measures | ||||||||

| ||

Q4 2017 Supplemental | Page 2 | |

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS | ||||

With the exception of historical information, certain statements contained or incorporated by reference herein may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), such as those pertaining to our acquisition or disposition of properties, our capital resources, future expenditures for development projects, and our results of operations and financial condition. Forward-looking statements involve numerous risks and uncertainties and you should not rely on them as predictions of actual events. There is no assurance the events or circumstances reflected in the forward-looking statements will occur. You can identify forward-looking statements by use of words such as “will be,” “intend,” “continue,” “believe,” “may,” “expect,” “hope,” “anticipate,” “goal,” “forecast,” “pipeline,” “estimates,” “offers,” “plans,” “would,” or other similar expressions or other comparable terms or discussions of strategy, plans or intentions contained or incorporated by reference herein. In addition, references to our budgeted amounts and guidance are forward-looking statements. Forward-looking statements necessarily are dependent on assumptions, data or methods that may be incorrect or imprecise. These forward-looking statements represent our intentions, plans, expectations and beliefs and are subject to numerous assumptions, risks and uncertainties. Many of the factors that will determine these items are beyond our ability to control or predict. For further discussion of these factors see “Item 1A. Risk Factors” in our most recent Annual Report on Form 10-K and, to the extent applicable, our Quarterly Reports on Form 10-Q.

For these statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. You are cautioned not to place undue reliance on our forward-looking statements, which speak only as of the date hereof or the date of any document incorporated by reference herein. All subsequent written and oral forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. Except as required by law, we do not undertake any obligation to release publicly any revisions to our forward-looking statements to reflect events or circumstances after the date hereof.

NON-GAAP INFORMATION

This document contains certain non-GAAP measures. These non-GAAP measures, as calculated by the Company, are not necessarily comparable to similarly titled measures reported by other companies. Additionally, these non-GAAP measures are not measurements of financial performance or liquidity under GAAP and should not be considered alternatives to the Company's other financial information determined under GAAP. See pages 31 through 33 for definitions of certain non-GAAP financial measures used in this document and the reconciliations of certain non-GAAP measures in the Appendix on pages 34 through 41.

| ||

Q4 2017 Supplemental | Page 3 | |

COMPANY PROFILE | ||||

THE COMPANY | |||||

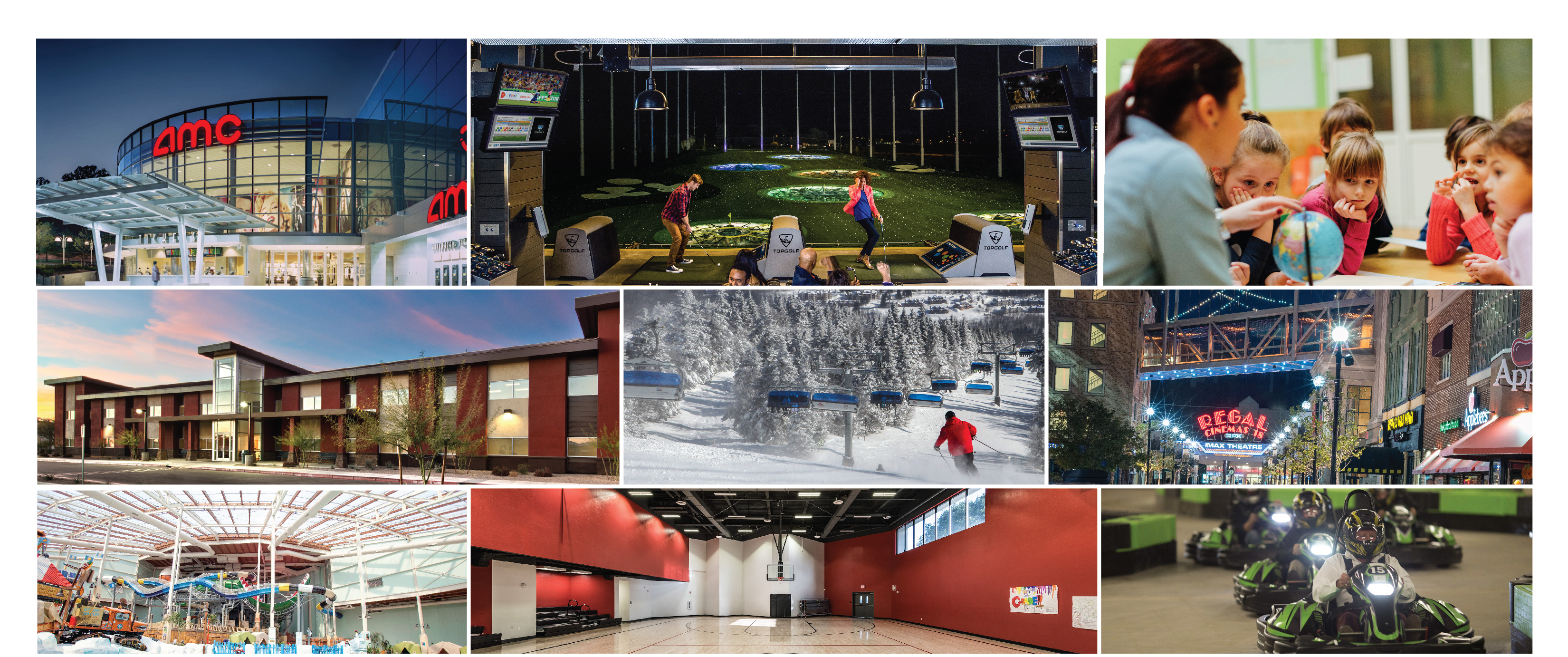

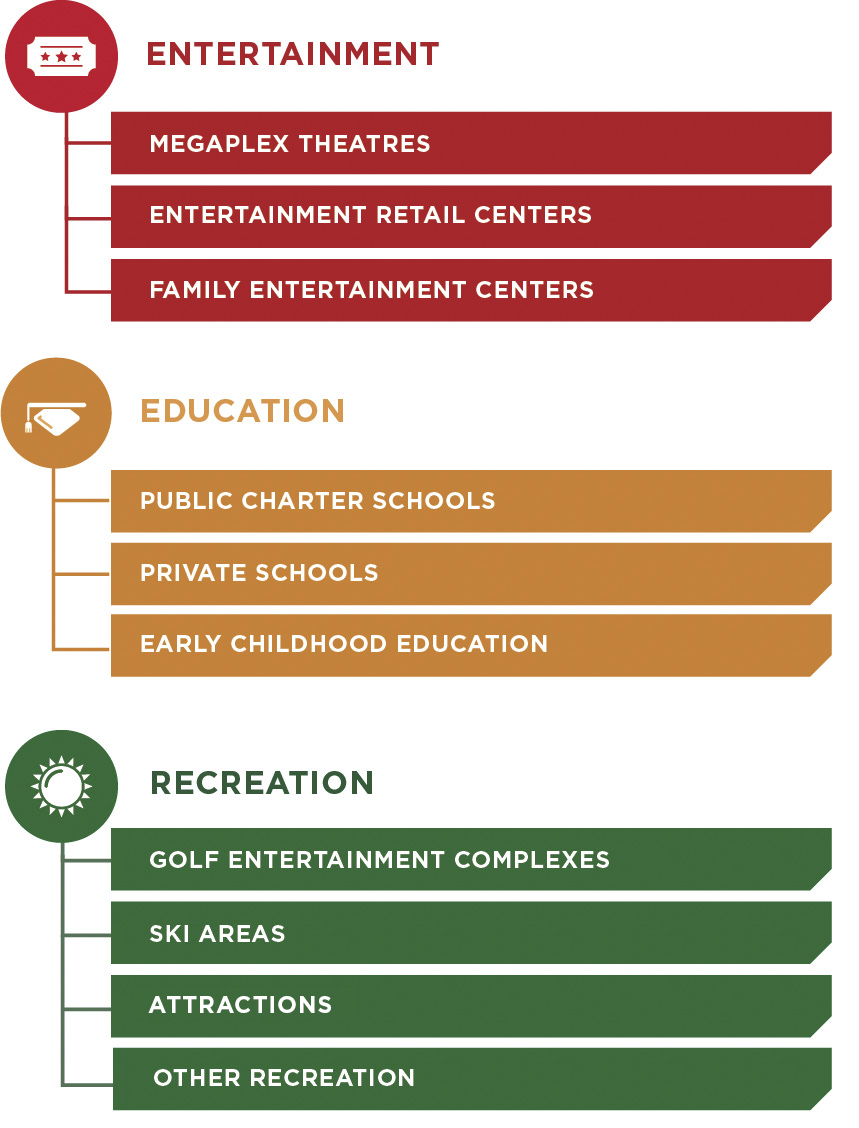

EPR Properties (“EPR” or the “Company”) is a self-administered and self-managed real estate investment trust. EPR was formed in August 1997 as a Maryland real estate investment trust (“REIT”), and an initial public offering was completed on November 18, 1997. | |||||

Since that time, the Company has grown into a leading specialty real estate investment trust with an investment portfolio that includes Entertainment, Education, Recreation and Other specialty investments. | |||||

| |||||

COMPANY STRATEGY | ||||

Our vision is to become the leading specialty REIT by focusing our unique knowledge and resources on select underserved real estate segments which provide the potential for outsized returns. | ||||

EPR’s primary business objective is to enhance shareholder value by achieving predictable growth in Funds from Operations (“FFO”) and dividends per share. Central to our growth is remaining focused on acquiring or developing properties in our primary investment segments: Entertainment, Education and Recreation. We may also pursue opportunities to provide mortgage financing for these investment segments in certain situations where this structure is more advantageous than owning the underlying real estate. | ||||

Our segment focus is consistent with our strategic organizational design which is structured around building centers of knowledge and strong operating competencies in each of our primary segments. Retention and building of this knowledge depth creates a competitive advantage allowing us to more quickly identify key market trends. | ||||

To this end we will deliberately apply information and our ingenuity to identify properties which represent potential logical extensions within each of our segments, or potential future investment segments. As part of our strategic planning and portfolio management process we assess new opportunities against the following five key underwriting principles: | ||||

INFLECTION OPPORTUNITY - Renewal or restructuring in an industry’s properties | ||||

ENDURING VALUE - Real estate devoted to and improving long-lived activities | ||||

EXCELLENT EXECUTION - Market-dominant performance that creates value beyond tenant credit | ||||

ATTRACTIVE ECONOMICS - Accretive initial returns along with growth in yield | ||||

ADVANTAGEOUS POSITION - Sustainable competitive advantages | ||||

| ||

Q4 2017 Supplemental | Page 4 | |

INVESTOR INFORMATION | ||

SENIOR MANAGEMENT | ||

Greg Silvers | Mark Peterson | |

President and Chief Executive Officer | Executive Vice President and Chief Financial Officer | |

Jerry Earnest | Craig Evans | |

Senior Vice President and Chief Investment Officer | Senior Vice President, General Counsel and Secretary | |

Tonya Mater | Mike Hirons | |

Vice President and Chief Accounting Officer | Senior Vice President - Strategy and Asset Management | |

COMPANY INFORMATION | ||

CORPORATE HEADQUARTERS | TRADING SYMBOLS | |

909 Walnut Street, Suite 200 | Common Stock: | |

Kansas City, MO 64106 | EPR | |

888-EPR-REIT | Preferred Stock: | |

www.eprkc.com | EPR-PrC | |

EPR-PrE | ||

STOCK EXCHANGE LISTING | EPR-PrG | |

New York Stock Exchange | ||

EQUITY RESEARCH COVERAGE | ||

Bank of America Merrill Lynch | Jeffrey Spector/Joshua Dennerlein | 646-855-1363 |

Citi Global Markets | Michael Bilerman/Nick Joseph | 212-816-4471 |

FBR & Co. | David Corak | 703-312-1610 |

Janney Montgomery Scott | Rob Stevenson | 646-840-3217 |

J.P. Morgan | Anthony Paolone | 212-622-6682 |

Kansas City Capital Associates | Jonathan Braatz | 816-932-8019 |

Keybanc Capital Markets | Jordan Sadler/Craig Mailman | 917-368-2280 |

Ladenburg Thalmann | John Massocca | 212-409-2056 |

RBC Capital Markets | Michael Carroll/Wes Golladay | 440-715-2649 |

Stifel | Simon Yarmak | 443-224-1345 |

SunTrust Robinson Humphrey | Ki Bin Kim | 212-303-4124 |

EPR Properties is followed by the analysts identified above. Please note that any opinions, estimates, forecasts or recommendations regarding EPR Properties’ performance made by these analysts are theirs alone and do not represent opinions, estimates, forecasts or recommendations of EPR Properties or its management. EPR Properties does not by its reference above or distribution imply its endorsement of or concurrence with such information, conclusions or recommendations.

| ||

Q4 2017 Supplemental | Page 5 | |

SELECTED FINANCIAL INFORMATION | |||||||||||||||

(UNAUDITED, DOLLARS AND SHARES IN THOUSANDS) | |||||||||||||||

THREE MONTHS ENDED DECEMBER 31, | YEAR ENDED DECEMBER 31, | ||||||||||||||

Operating Information: | 2017 | 2016 | 2017 | 2016 | |||||||||||

Revenue | $ | 147,700 | $ | 130,831 | $ | 575,991 | $ | 493,242 | |||||||

Net income available to common shareholders of EPR Properties | 54,668 | 52,190 | 234,218 | 201,176 | |||||||||||

Adjusted EBITDA (1) | 139,984 | 113,835 | 507,722 | 428,408 | |||||||||||

Interest expense, net | 35,271 | 26,834 | 133,124 | 97,144 | |||||||||||

Recurring principal payments | 197 | 2,516 | 3,241 | 9,963 | |||||||||||

Capitalized interest | 2,046 | 2,715 | 9,879 | 10,697 | |||||||||||

Straight-lined rental revenue | (7,085 | ) | 6,062 | 4,332 | 17,012 | ||||||||||

Dividends declared on preferred shares | 6,438 | 5,951 | 24,293 | 23,806 | |||||||||||

Dividends declared on common shares | 75,297 | 61,095 | 291,179 | 244,043 | |||||||||||

General and administrative expense | 9,596 | 10,234 | 43,383 | 37,543 | |||||||||||

DECEMBER 31, | |||||||||||||||

Balance Sheet Information: | 2017 | 2016 | |||||||||||||

Total assets | $ | 6,191,493 | $ | 4,865,022 | |||||||||||

Accumulated depreciation | 741,334 | 635,535 | |||||||||||||

Total assets before accumulated depreciation (gross assets) | 6,932,827 | 5,500,557 | |||||||||||||

Cash and cash equivalents | 41,917 | 19,335 | |||||||||||||

Debt | 3,028,827 | 2,485,625 | |||||||||||||

Deferred financing costs, net | 32,852 | 29,320 | |||||||||||||

Net debt (1) | 3,019,762 | 2,495,610 | |||||||||||||

Equity | 2,927,325 | 2,185,901 | |||||||||||||

Common shares outstanding | 74,125 | 63,647 | |||||||||||||

Total market capitalization (using EOP closing price) | 8,243,194 | 7,409,787 | |||||||||||||

Net debt/total market capitalization | 37 | % | 34 | % | |||||||||||

Net debt/gross assets | 44 | % | 45 | % | |||||||||||

Net debt/Adjusted EBITDA (2) | 5.39 | 5.48 | |||||||||||||

Adjusted net debt/Annualized adjusted EBITDA (1)(3)(4) | 5.37 | 5.37 | |||||||||||||

(1) See pages 31 through 33 for definitions. | |||||||||||||||

(2) Adjusted EBITDA is for the quarter multiplied times four. See pages 31 through 33 for definitions. See calculation on page 40. | |||||||||||||||

(3) Adjusted net debt is net debt less 40% times property under development. See pages 31 through 33 for definitions. | |||||||||||||||

(4) Annualized adjusted EBITDA is adjusted EBITDA for the quarter further adjusted for in-service projects, percentage rent and participating interest and other non-recurring items which is then multiplied times four. These calculations can be found on page 40 under the reconciliation of Adjusted EBITDA and Annualized Adjusted EBITDA. See pages 31 through 33 for definitions. | |||||||||||||||

| ||

Q4 2017 Supplemental | Page 6 | |

SELECTED BALANCE SHEET INFORMATION | ||||||||||||||||||||||||

(UNAUDITED, DOLLARS IN THOUSANDS) | ||||||||||||||||||||||||

ASSETS | 4TH QUARTER 2017 | 3RD QUARTER 2017 | 2ND QUARTER 2017 | 1ST QUARTER 2017 | 4TH QUARTER 2016 | 3RD QUARTER 2016 | ||||||||||||||||||

Rental properties: | ||||||||||||||||||||||||

Entertainment | $ | 2,762,801 | $ | 2,696,125 | $ | 2,549,940 | $ | 2,545,532 | $ | 2,511,432 | $ | 2,483,321 | ||||||||||||

Education | 1,005,340 | 1,033,149 | 938,673 | 877,716 | 848,883 | 811,359 | ||||||||||||||||||

Recreation | 1,420,690 | 1,361,445 | 1,320,216 | 754,521 | 715,323 | 650,350 | ||||||||||||||||||

Other | 156,734 | 156,659 | 156,420 | 156,390 | 155,659 | 155,071 | ||||||||||||||||||

Less: accumulated depreciation | (741,334 | ) | (711,384 | ) | (676,364 | ) | (661,029 | ) | (635,535 | ) | (609,103 | ) | ||||||||||||

Land held for development | 33,692 | 33,674 | 33,672 | 22,530 | 22,530 | 22,530 | ||||||||||||||||||

Property under development | 257,629 | 284,211 | 271,692 | 331,934 | 297,110 | 263,026 | ||||||||||||||||||

Mortgage notes receivable: (1) | ||||||||||||||||||||||||

Entertainment | 31,105 | 39,679 | 36,418 | 33,735 | 37,669 | 36,032 | ||||||||||||||||||

Education | 337,499 | 329,991 | 303,271 | 288,409 | 243,315 | 70,609 | ||||||||||||||||||

Recreation | 602,145 | 602,701 | 601,910 | 349,653 | 332,994 | 331,726 | ||||||||||||||||||

Other | — | — | — | — | — | 2,511 | ||||||||||||||||||

Investment in direct financing leases, net | 57,903 | 57,698 | 93,307 | 103,095 | 102,698 | 189,152 | ||||||||||||||||||

Investment in joint ventures | 5,602 | 5,616 | 5,581 | 5,522 | 5,972 | 6,159 | ||||||||||||||||||

Cash and cash equivalents | 41,917 | 11,412 | 70,872 | 14,446 | 19,335 | 7,311 | ||||||||||||||||||

Restricted cash | 17,069 | 24,323 | 24,255 | 28,523 | 9,744 | 20,463 | ||||||||||||||||||

Accounts receivable, net | 93,693 | 99,213 | 106,480 | 96,267 | 98,939 | 81,217 | ||||||||||||||||||

Other assets | 109,008 | 108,498 | 102,543 | 99,538 | 98,954 | 99,236 | ||||||||||||||||||

Total assets | $ | 6,191,493 | $ | 6,133,010 | $ | 5,938,886 | $ | 5,046,782 | $ | 4,865,022 | $ | 4,620,970 | ||||||||||||

LIABILITIES AND EQUITY | ||||||||||||||||||||||||

Liabilities: | ||||||||||||||||||||||||

Accounts payable and accrued liabilities | $ | 136,929 | $ | 140,582 | $ | 142,526 | $ | 101,438 | $ | 119,758 | $ | 101,019 | ||||||||||||

Common dividends payable | 25,203 | 25,046 | 25,044 | 22,022 | 20,367 | 20,361 | ||||||||||||||||||

Preferred dividends payable | 4,982 | 5,951 | 5,952 | 5,952 | 5,951 | 5,951 | ||||||||||||||||||

Unearned rents and interest | 68,227 | 85,198 | 71,098 | 61,579 | 47,420 | 55,636 | ||||||||||||||||||

Line of credit | 210,000 | 170,000 | — | 150,000 | — | 200,000 | ||||||||||||||||||

Deferred financing costs, net | (32,852 | ) | (33,951 | ) | (34,086 | ) | (28,231 | ) | (29,320 | ) | (18,885 | ) | ||||||||||||

Other debt | 2,851,679 | 2,851,876 | 2,827,006 | 2,494,613 | 2,514,945 | 2,067,461 | ||||||||||||||||||

Total liabilities | 3,264,168 | 3,244,702 | 3,037,540 | 2,807,373 | 2,679,121 | 2,431,543 | ||||||||||||||||||

Equity: | ||||||||||||||||||||||||

Common stock and additional paid-in- capital | 3,479,755 | 3,421,631 | 3,417,750 | 2,755,783 | 2,677,709 | 2,669,330 | ||||||||||||||||||

Preferred stock at par value | 148 | 138 | 139 | 139 | 139 | 139 | ||||||||||||||||||

Treasury stock | (121,591 | ) | (121,539 | ) | (121,533 | ) | (120,955 | ) | (113,172 | ) | (107,136 | ) | ||||||||||||

Accumulated other comprehensive income | 12,483 | 10,919 | 9,698 | 8,606 | 7,734 | 4,698 | ||||||||||||||||||

Distributions in excess of net income | (443,470 | ) | (422,841 | ) | (404,708 | ) | (404,164 | ) | (386,509 | ) | (377,604 | ) | ||||||||||||

Total equity | 2,927,325 | 2,888,308 | 2,901,346 | 2,239,409 | 2,185,901 | 2,189,427 | ||||||||||||||||||

Total liabilities and equity | $ | 6,191,493 | $ | 6,133,010 | $ | 5,938,886 | $ | 5,046,782 | $ | 4,865,022 | $ | 4,620,970 | ||||||||||||

(1) Includes related accrued interest receivable. | ||||||||||||||||||||||||

| ||

Q4 2017 Supplemental | Page 7 | |

SELECTED OPERATING DATA | |||||||||||||||||||||||

(UNAUDITED, DOLLARS IN THOUSANDS) | |||||||||||||||||||||||

4TH QUARTER 2017 | 3RD QUARTER 2017 | 2ND QUARTER 2017 | 1ST QUARTER 2017 | 4TH QUARTER 2016 | 3RD QUARTER 2016 | ||||||||||||||||||

Rental revenue and tenant reimbursements: | |||||||||||||||||||||||

Entertainment | $ | 74,383 | $ | 70,621 | $ | 69,403 | $ | 68,840 | $ | 69,147 | $ | 67,950 | |||||||||||

Education | 12,862 | 21,479 | 22,333 | 22,357 | 22,971 | 19,905 | |||||||||||||||||

Recreation | 33,909 | 32,171 | 29,384 | 17,299 | 17,084 | 15,958 | |||||||||||||||||

Other | 2,292 | 2,290 | 2,290 | 2,290 | 2,290 | 2,290 | |||||||||||||||||

Mortgage and other financing income: | |||||||||||||||||||||||

Entertainment | 981 | 1,151 | 1,096 | 1,179 | 1,260 | 1,294 | |||||||||||||||||

Education (1) | 9,106 | 9,023 | 8,868 | 8,549 | 7,311 | 7,319 | |||||||||||||||||

Recreation | 13,590 | 14,140 | 13,104 | 7,906 | 7,540 | 8,384 | |||||||||||||||||

Other | — | — | — | — | 1 | 34 | |||||||||||||||||

Other income | 577 | 522 | 1,304 | 692 | 3,227 | 2,476 | |||||||||||||||||

Total revenue | $ | 147,700 | $ | 151,397 | $ | 147,782 | $ | 129,112 | $ | 130,831 | $ | 125,610 | |||||||||||

Property operating expense | 12,891 | 6,340 | 6,072 | 6,350 | 5,915 | 5,626 | |||||||||||||||||

Other expense | 242 | — | — | — | — | — | |||||||||||||||||

General and administrative expense | 9,596 | 12,070 | 10,660 | 11,057 | 10,234 | 9,091 | |||||||||||||||||

Costs associated with loan refinancing or payoff | 58 | 1,477 | 9 | 5 | — | 14 | |||||||||||||||||

Gain on early extinguishment of debt | — | — | (977 | ) | — | — | — | ||||||||||||||||

Interest expense, net | 35,271 | 34,194 | 32,967 | 30,692 | 26,834 | 24,265 | |||||||||||||||||

Transaction costs | 135 | 113 | 218 | 57 | 2,988 | 2,947 | |||||||||||||||||

Impairment charges | — | — | 10,195 | — | — | — | |||||||||||||||||

Depreciation and amortization | 37,027 | 34,694 | 33,148 | 28,077 | 28,351 | 27,601 | |||||||||||||||||

Income before equity in income in joint ventures and other items | 52,480 | 62,509 | 55,490 | 52,874 | 56,509 | 56,066 | |||||||||||||||||

Equity in (loss) income from joint ventures | (14 | ) | 35 | 59 | (8 | ) | 118 | 203 | |||||||||||||||

Gain on sale of real estate | 13,480 | 997 | 25,461 | 2,004 | 1,430 | 1,615 | |||||||||||||||||

Income tax (expense) benefit | (383 | ) | (587 | ) | (475 | ) | (954 | ) | 84 | (358 | ) | ||||||||||||

Net income | 65,563 | 62,954 | 80,535 | 53,916 | 58,141 | 57,526 | |||||||||||||||||

Preferred dividend requirements | (6,438 | ) | (5,951 | ) | (5,952 | ) | (5,952 | ) | (5,951 | ) | (5,951 | ) | |||||||||||

Preferred share redemption costs | (4,457 | ) | — | — | — | — | — | ||||||||||||||||

Net income available to common shareholders of EPR Properties | $ | 54,668 | $ | 57,003 | $ | 74,583 | $ | 47,964 | $ | 52,190 | $ | 51,575 | |||||||||||

(1) Represents income from owned assets under direct financing leases and 19 mortgage notes receivable. | |||||||||||||||||||||||

| ||

Q4 2017 Supplemental | Page 8 | |

FUNDS FROM OPERATIONS AND FUNDS FROM OPERATIONS AS ADJUSTED | ||||||||||||||||||||||||

(UNAUDITED, DOLLARS IN THOUSANDS EXCEPT PER SHARE INFORMATION) | ||||||||||||||||||||||||

FUNDS FROM OPERATIONS ("FFO") (1): | 4TH QUARTER 2017 | 3RD QUARTER 2017 | 2ND QUARTER 2017 | 1ST QUARTER 2017 | 4TH QUARTER 2016 | 3RD QUARTER 2016 | ||||||||||||||||||

Net income available to common shareholders of EPR Properties | $ | 54,668 | $ | 57,003 | $ | 74,583 | $ | 47,964 | $ | 52,190 | $ | 51,575 | ||||||||||||

Gain on sale of real estate (excluding land sale) | (13,480 | ) | (997 | ) | (25,461 | ) | (2,004 | ) | — | (549 | ) | |||||||||||||

Real estate depreciation and amortization | 36,797 | 34,457 | 32,906 | 27,880 | 28,179 | 27,147 | ||||||||||||||||||

Allocated share of joint venture depreciation | 55 | 55 | 54 | 54 | 55 | 56 | ||||||||||||||||||

Impairment of direct financing lease - residual value portion (2) | — | — | 2,897 | — | — | — | ||||||||||||||||||

FFO available to common shareholders of EPR Properties | $ | 78,040 | $ | 90,518 | $ | 84,979 | $ | 73,894 | $ | 80,424 | $ | 78,229 | ||||||||||||

FFO available to common shareholders of EPR Properties | $ | 78,040 | $ | 90,518 | $ | 84,979 | $ | 73,894 | $ | 80,424 | $ | 78,229 | ||||||||||||

Add: Preferred dividends for Series C preferred shares | 1,940 | 1,941 | 1,941 | 1,941 | 1,941 | 1,941 | ||||||||||||||||||

Add: Preferred dividends for Series E preferred shares | 1,940 | — | — | — | — | — | ||||||||||||||||||

Diluted FFO available to common shareholders of EPR Properties | $ | 81,920 | $ | 92,459 | $ | 86,920 | $ | 75,835 | $ | 82,365 | $ | 80,170 | ||||||||||||

FUNDS FROM OPERATIONS AS ADJUSTED (1): | ||||||||||||||||||||||||

FFO available to common shareholders of EPR Properties | $ | 78,040 | $ | 90,518 | $ | 84,979 | $ | 73,894 | $ | 80,424 | $ | 78,229 | ||||||||||||

Costs associated with loan refinancing or payoff | 58 | 1,477 | 9 | 5 | — | 14 | ||||||||||||||||||

Gain on insurance recovery (included in other income) | — | — | (606 | ) | — | (847 | ) | (1,825 | ) | |||||||||||||||

Termination fee included in gain on sale | 13,275 | 954 | 3,900 | 1,920 | — | 549 | ||||||||||||||||||

Preferred share redemption costs | 4,457 | — | — | — | — | — | ||||||||||||||||||

Gain on early extinguishment of debt | — | — | (977 | ) | — | — | — | |||||||||||||||||

Transaction costs | 135 | 113 | 218 | 57 | 2,988 | 2,947 | ||||||||||||||||||

Gain on sale of land | — | — | — | — | (1,430 | ) | (1,066 | ) | ||||||||||||||||

Deferred income tax expense (benefit) | (99 | ) | 227 | 50 | 634 | (401 | ) | (44 | ) | |||||||||||||||

Impairment of direct financing lease - allowance for lease loss portion (2) | — | — | 7,298 | — | — | — | ||||||||||||||||||

FFO as adjusted available to common shareholders of EPR Properties | $ | 95,866 | $ | 93,289 | $ | 94,871 | $ | 76,510 | $ | 80,734 | $ | 78,804 | ||||||||||||

FFO as adjusted available to common shareholders of EPR Properties | $ | 95,866 | $ | 93,289 | $ | 94,871 | $ | 76,510 | $ | 80,734 | $ | 78,804 | ||||||||||||

Add: Preferred dividends for Series C preferred shares | 1,940 | 1,941 | 1,941 | 1,941 | 1,941 | 1,941 | ||||||||||||||||||

Add: Preferred dividends for Series E preferred shares | 1,940 | — | — | — | — | — | ||||||||||||||||||

Diluted FFO as adjusted available to common shareholders of EPR Properties | $ | 99,746 | $ | 95,230 | $ | 96,812 | $ | 78,451 | $ | 82,675 | $ | 80,745 | ||||||||||||

FFO per common share: | ||||||||||||||||||||||||

Basic | $ | 1.06 | $ | 1.23 | $ | 1.16 | $ | 1.15 | $ | 1.26 | $ | 1.23 | ||||||||||||

Diluted | 1.06 | 1.22 | 1.15 | 1.15 | 1.25 | 1.22 | ||||||||||||||||||

FFO as adjusted per common share: | ||||||||||||||||||||||||

Basic | $ | 1.30 | $ | 1.27 | $ | 1.30 | $ | 1.19 | $ | 1.27 | $ | 1.24 | ||||||||||||

Diluted | 1.29 | 1.26 | 1.29 | 1.19 | 1.26 | 1.23 | ||||||||||||||||||

Shares used for computation (in thousands): | ||||||||||||||||||||||||

Basic | 73,774 | 73,663 | 73,159 | 64,033 | 63,635 | 63,627 | ||||||||||||||||||

Diluted | 73,832 | 73,724 | 73,225 | 64,102 | 63,716 | 63,747 | ||||||||||||||||||

Weighted average shares outstanding-Diluted EPS | 73,832 | 73,724 | 73,225 | 64,102 | 63,716 | 63,747 | ||||||||||||||||||

Effect of dilutive Series C preferred shares | 2,083 | 2,072 | 2,063 | 2,053 | 2,044 | 2,036 | ||||||||||||||||||

Effect of dilutive Series E preferred shares | 1,592 | — | — | — | — | — | ||||||||||||||||||

Adjusted weighted-average shares outstanding-diluted | 77,507 | 75,796 | 75,288 | 66,155 | 65,760 | 65,783 | ||||||||||||||||||

(1) See pages 31 through 33 for definitions. | ||||||||||||||||||||||||

(2) Impairment charges recognized during the three months ended June 30, 2017 total $10.2 million and related to our investment in direct financing leases, net, consisting of $2.9 million related to the residual value portion and $7.3 million related to the allowance for lease loss portion. | ||||||||||||||||||||||||

| ||

Q4 2017 Supplemental | Page 9 | |

ADJUSTED FUNDS FROM OPERATIONS | ||||||||||||||||||||||||

(UNAUDITED, DOLLARS IN THOUSANDS EXCEPT PER SHARE INFORMATION) | ||||||||||||||||||||||||

ADJUSTED FUNDS FROM OPERATIONS ("AFFO") (1): | 4TH QUARTER 2017 | 3RD QUARTER 2017 | 2ND QUARTER 2017 | 1ST QUARTER 2017 | 4TH QUARTER 2016 | 3RD QUARTER 2016 | ||||||||||||||||||

FFO available to common shareholders of EPR Properties | $ | 78,040 | $ | 90,518 | $ | 84,979 | $ | 73,894 | $ | 80,424 | $ | 78,229 | ||||||||||||

Adjustments: | ||||||||||||||||||||||||

Amortization of above/below market leases, net and tenant allowances | (66 | ) | (55 | ) | (31 | ) | 45 | 45 | 42 | |||||||||||||||

Transaction costs | 135 | 113 | 218 | 57 | 2,988 | 2,947 | ||||||||||||||||||

Non-real estate depreciation and amortization | 230 | 237 | 242 | 197 | 172 | 454 | ||||||||||||||||||

Deferred financing fees amortization | 1,588 | 1,598 | 1,525 | 1,456 | 1,265 | 1,187 | ||||||||||||||||||

Costs associated with loan refinancing or payoff | 58 | 1,477 | 9 | 5 | — | 14 | ||||||||||||||||||

Gain on insurance recovery (included in other income) | — | — | (606 | ) | — | (847 | ) | (1,825 | ) | |||||||||||||||

Termination fees included in gain on sale | 13,275 | 954 | 3,900 | 1,920 | — | 549 | ||||||||||||||||||

Share-based compensation expense to management and trustees | 3,576 | 3,605 | 3,503 | 3,458 | 2,882 | 2,778 | ||||||||||||||||||

Maintenance capital expenditures (2) | (1,207 | ) | (1,125 | ) | (1,590 | ) | (1,601 | ) | (2,409 | ) | (805 | ) | ||||||||||||

Straight-lined rental revenue | 7,085 | (2,357 | ) | (4,009 | ) | (5,051 | ) | (6,062 | ) | (4,597 | ) | |||||||||||||

Non-cash portion of mortgage and other financing income | (719 | ) | (905 | ) | (901 | ) | (555 | ) | (862 | ) | (962 | ) | ||||||||||||

Preferred share redemption costs | 4,457 | — | — | — | — | — | ||||||||||||||||||

Gain on early extinguishment of debt | — | — | (977 | ) | — | — | — | |||||||||||||||||

Gain on sale of land | — | — | — | — | (1,430 | ) | (1,066 | ) | ||||||||||||||||

Deferred income tax expense (benefit) | (99 | ) | 227 | 50 | 634 | (401 | ) | (44 | ) | |||||||||||||||

Impairment of direct financing lease - allowance for lease loss portion | — | — | 7,298 | — | — | — | ||||||||||||||||||

AFFO available to common shareholders of EPR Properties | $ | 106,353 | $ | 94,287 | $ | 93,610 | $ | 74,459 | $ | 75,765 | $ | 76,901 | ||||||||||||

AFFO available to common shareholders of EPR Properties | $ | 106,353 | $ | 94,287 | $ | 93,610 | $ | 74,459 | $ | 75,765 | $ | 76,901 | ||||||||||||

Add: Preferred dividends for Series C preferred shares | 1,940 | 1,941 | 1,941 | 1,941 | 1,941 | 1,941 | ||||||||||||||||||

Add: Preferred dividends for Series E preferred shares | 1,940 | — | — | — | — | — | ||||||||||||||||||

Diluted AFFO available to common shareholders of EPR Properties | $ | 110,233 | $ | 96,228 | $ | 95,551 | $ | 76,400 | $ | 77,706 | $ | 78,842 | ||||||||||||

Weighted average diluted shares outstanding (in thousands) | 73,832 | 73,724 | 73,225 | 64,102 | 63,716 | 63,747 | ||||||||||||||||||

Effect of dilutive Series C preferred shares | 2,083 | 2,072 | 2,063 | 2,053 | 2,044 | 2,036 | ||||||||||||||||||

Effect of dilutive Series E preferred shares | 1,592 | — | — | — | — | — | ||||||||||||||||||

Adjusted weighted-average shares outstanding-diluted | 77,507 | 75,796 | 75,288 | 66,155 | 65,760 | 65,783 | ||||||||||||||||||

AFFO per diluted common share | $ | 1.42 | $ | 1.27 | $ | 1.27 | $ | 1.15 | $ | 1.18 | $ | 1.20 | ||||||||||||

Dividends declared per common share | $ | 1.02 | $ | 1.02 | $ | 1.02 | $ | 1.02 | $ | 0.96 | $ | 0.96 | ||||||||||||

AFFO payout ratio (3) | 72 | % | 80 | % | 80 | % | 89 | % | 81 | % | 80 | % | ||||||||||||

(1) See pages 31 through 33 for definitions. | ||||||||||||||||||||||||

(2) Includes maintenance capital expenditures and certain second generation tenant improvements and leasing commissions. | ||||||||||||||||||||||||

(3) AFFO payout ratio is calculated by dividing dividends declared per common share by AFFO per diluted common share. | ||||||||||||||||||||||||

| ||

Q4 2017 Supplemental | Page 10 | |

CAPITAL STRUCTURE AS OF DECEMBER 31, 2017 | |||||||||||||||||||||||||||

(UNAUDITED, DOLLARS IN THOUSANDS) | |||||||||||||||||||||||||||

CONSOLIDATED DEBT | |||||||||||||||||||||||||||

PRINCIPAL PAYMENTS DUE ON DEBT: | |||||||||||||||||||||||||||

MORTGAGES | BONDS/TERM LOAN/OTHER (1) | UNSECURED CREDIT FACILITY (3) | UNSECURED SENIOR NOTES | TOTAL | WEIGHTED AVG INTEREST RATE | ||||||||||||||||||||||

YEAR | AMORTIZATION | MATURITIES | |||||||||||||||||||||||||

2018 | $ | 65 | $ | 11,619 | (2) | $ | — | $ | — | $ | — | $ | 11,684 | 6.19% | |||||||||||||

2019 | — | — | — | — | — | — | —% | ||||||||||||||||||||

2020 | — | — | — | — | 250,000 | (2) | 250,000 | 7.75% | |||||||||||||||||||

2021 | — | — | — | — | — | — | —% | ||||||||||||||||||||

2022 | — | — | — | 210,000 | 350,000 | 560,000 | 4.53% | ||||||||||||||||||||

2023 | — | — | 400,000 | — | 275,000 | 675,000 | 3.73% | ||||||||||||||||||||

2024 | — | — | — | — | 148,000 | 148,000 | 4.35% | ||||||||||||||||||||

2025 | — | — | — | — | 300,000 | 300,000 | 4.50% | ||||||||||||||||||||

2026 | — | — | — | — | 642,000 | 642,000 | 4.69% | ||||||||||||||||||||

2027 | — | — | — | — | 450,000 | 450,000 | 4.50% | ||||||||||||||||||||

2028 | — | — | — | — | — | — | —% | ||||||||||||||||||||

Thereafter | — | — | 24,995 | — | — | 24,995 | 1.60% | ||||||||||||||||||||

Less: deferred financing costs, net | — | — | — | — | — | (32,852 | ) | —% | |||||||||||||||||||

$ | 65 | $ | 11,619 | $ | 424,995 | $ | 210,000 | $ | 2,415,000 | $ | 3,028,827 | 4.62% | |||||||||||||||

BALANCE | WEIGHTED AVG INTEREST RATE | WEIGHTED AVG MATURITY | |||||||||||||||||||||||||

Fixed rate secured debt | $ | 11,684 | 6.19 | % | 0.08 | ||||||||||||||||||||||

Fixed rate unsecured debt (1) | 2,765,000 | 4.84 | % | 6.75 | |||||||||||||||||||||||

Variable rate secured debt | 24,995 | 1.60 | % | 29.58 | |||||||||||||||||||||||

Variable rate unsecured debt | 260,000 | 2.49 | % | 4.35 | |||||||||||||||||||||||

Less: deferred financing costs, net | (32,852 | ) | — | % | — | ||||||||||||||||||||||

Total | $ | 3,028,827 | 4.62 | % | 6.71 | ||||||||||||||||||||||

(1) Includes $350 million of term loan that has been fixed through interest rate swaps through February 7, 2022. | |||||||||||||||||||||||||||

(2) Subsequent to December 31, 2017, the Company paid off its remaining mortgage debt and redeemed all of the outstanding 7.75% Senior Notes due July 15, 2020. | |||||||||||||||||||||||||||

(3) Unsecured Revolving Credit Facility Summary: | |||||||||||||||||||||||||||

BALANCE | RATE | ||||||||||||||||||||||||||

COMMITMENT | AT 12/31/2017 | MATURITY | AT 12/31/2017 | ||||||||||||||||||||||||

$1,000,000 | $ | 210,000 | February 27, 2022 | 2.49% | |||||||||||||||||||||||

Note: This facility has a seven month extension available at the Company's option (solely with respect to the unsecured revolving credit portion of the facility) and includes an accordion feature in which the maximum borrowing amount under the combined unsecured revolving credit and term loan facility can be increased from $1.4 billion to $2.4 billion, in each case, subject to certain terms and conditions. | |||||||||||||||||||||||||||

| ||

Q4 2017 Supplemental | Page 11 | |

CAPITAL STRUCTURE AS OF DECEMBER 31, 2017 AND 2016 | ||||||||

(UNAUDITED, DOLLARS IN THOUSANDS) | ||||||||

CONSOLIDATED DEBT (continued) | ||||||||

SUMMARY OF DEBT: | December 31, 2017 | December 31, 2016 | ||||||

Mortgage note payable, 6.07%, paid in full on January 6, 2017 | $ | — | $ | 9,331 | ||||

Mortgage note payable, 6.06%, paid in full on February 1, 2017 | — | 8,615 | ||||||

Mortgage notes payable, 5.73%-5.95%, paid in full on April 3, 2017 | — | 30,486 | ||||||

Mortgage notes payable, 4.00%, paid in full on April 6, 2017 | — | 88,629 | ||||||

Mortgage notes payable, 5.86%, paid in full on July 3, 2017 | — | 22,139 | ||||||

Mortgage note payable, 5.29%, paid in full on July 7, 2017 | — | 3,298 | ||||||

Mortgage note payable, 6.19%, prepaid in full on January 2, 2018 | 11,684 | 12,452 | ||||||

Senior unsecured notes payable, 7.75%, prepaid in full on February 28, 2018 | 250,000 | 250,000 | ||||||

Unsecured revolving variable rate credit facility, LIBOR + 1.00%, due February 27, 2022 | 210,000 | — | ||||||

Senior unsecured notes payable, 5.75%, due August 15, 2022 | 350,000 | 350,000 | ||||||

Unsecured term loan payable, LIBOR + 1.10%, $350,000 fixed at 2.71% through April 5, 2019 and 3.15% from April 6, 2019 to February 7, 2022, due February 27, 2023 | 400,000 | 350,000 | ||||||

Senior unsecured notes payable, 5.25%, due July 15, 2023 | 275,000 | 275,000 | ||||||

Senior unsecured notes payable, 4.35%, due August 22, 2024 | 148,000 | 148,000 | ||||||

Senior unsecured notes payable, 4.50%, due April 1, 2025 | 300,000 | 300,000 | ||||||

Senior unsecured notes payable, 4.56%, due August 22, 2026 | 192,000 | 192,000 | ||||||

Senior unsecured notes payable, 4.75%, due December 15, 2026 | 450,000 | 450,000 | ||||||

Senior unsecured notes payable, 4.50%, due June 1, 2027 | 450,000 | — | ||||||

Bonds payable, variable rate, due August 1, 2047 | 24,995 | 24,995 | ||||||

Less: deferred financing costs, net | (32,852 | ) | (29,320 | ) | ||||

Total debt | $ | 3,028,827 | $ | 2,485,625 | ||||

| ||

Q4 2017 Supplemental | Page 12 | |

CAPITAL STRUCTURE | |||||||

SENIOR NOTES | |||||||

SENIOR DEBT RATINGS AS OF DECEMBER 31, 2017 | |||||||

Moody's | Baa2 (stable) | ||||||

Fitch | BBB- (stable) | ||||||

Standard and Poor's | BBB- (stable) | ||||||

SUMMARY OF COVENANTS | |||||||

The Company has outstanding senior unsecured notes with fixed interest rates of 4.50%, 4.75%, 5.25%, 5.75% and 7.75%. Interest on these notes is paid semiannually. These senior unsecured notes contain various covenants, including: (i) a limitation on incurrence of any debt that would cause the Company's debt to adjusted total assets ratio to exceed 60%; (ii) a limitation on incurrence of any secured debt which would cause the Company’s secured debt to adjusted total assets ratio to exceed 40%; (iii) a limitation on incurrence of any debt which would cause the Company’s debt service coverage ratio to be less than 1.5 times; and (iv) the maintenance at all times of total unencumbered assets not less than 150% of the Company’s outstanding unsecured debt. | |||||||

The following is a summary of the key financial covenants for the Company's 4.50%, 4.75%, 5.25%, 5.75% and 7.75% senior unsecured notes, as defined and calculated per the terms of the notes. These calculations, which are not based on U.S. generally accepted accounting principles, or GAAP, measurements, are presented to investors to show the Company's ability to incur additional debt under the terms of the senior unsecured notes only and are not measures of the Company's liquidity or performance. The actual amounts as of December 31, 2017 and September 30, 2017 are: | |||||||

Actual | Actual | ||||||

NOTE COVENANTS | Required | 4th Quarter 2017 (1) | 3rd Quarter 2017 (1) | ||||

Limitation on incurrence of total debt (Total Debt/Total Assets) | ≤ 60% | 44% | 45% | ||||

Limitation on incurrence of secured debt (Secured Debt/Total Assets) | ≤ 40% | 1% | 1% | ||||

Debt service coverage (Consolidated Income Available for Debt Service/Annual Debt Service) | ≥ 1.5 x | 3.7x | 3.7x | ||||

Maintenance of total unencumbered assets (Unencumbered Assets/Unsecured Debt) | ≥ 150% of unsecured debt | 218% | 217% | ||||

(1) See page 14 for detailed calculations. | |||||||

Note: The above excludes the private placement notes. Subsequent to December 31, 2017, we redeemed all of the outstanding 7.75% Senior Unsecured Notes due July 15, 2020. | |||||||

| ||

Q4 2017 Supplemental | Page 13 | |

CAPITAL STRUCTURE | ||||||||||||||||||||

SENIOR NOTES | ||||||||||||||||||||

(UNAUDITED, DOLLARS IN THOUSANDS) | ||||||||||||||||||||

COVENANT CALCULATIONS | ||||||||||||||||||||

TOTAL ASSETS: | December 31, 2017 | TOTAL DEBT: | December 31, 2017 | |||||||||||||||||

Total Assets per balance sheet | $ | 6,191,493 | Secured debt obligations | $ | 36,679 | |||||||||||||||

Add: accumulated depreciation | 741,334 | Unsecured debt obligations: | ||||||||||||||||||

Less: intangible assets | 28,869 | Unsecured debt | 3,025,000 | |||||||||||||||||

Total Assets | $ | 6,961,696 | Outstanding letters of credit | — | ||||||||||||||||

Guarantees | 24,735 | |||||||||||||||||||

Derivatives at fair market value, net, if liability | — | |||||||||||||||||||

Total unsecured debt obligations: | 3,049,735 | |||||||||||||||||||

TOTAL UNENCUMBERED ASSETS: | December 31, 2017 | Total Debt | $ | 3,086,414 | ||||||||||||||||

Unencumbered real estate assets, gross | $ | 6,304,107 | ||||||||||||||||||

Cash and cash equivalents | 41,917 | |||||||||||||||||||

Land held for development | 33,692 | |||||||||||||||||||

Property under development | 257,629 | |||||||||||||||||||

Total Unencumbered Assets | $ | 6,637,345 | ||||||||||||||||||

CONSOLIDATED INCOME AVAILABLE FOR DEBT SERVICE: | 4TH QUARTER 2017 | 3RD QUARTER 2017 | 2ND QUARTER 2017 | 1ST QUARTER 2017 | TRAILING TWELVE MONTHS | |||||||||||||||

Adjusted EBITDA per bond documents | $ | 124,971 | (1) | $ | 132,987 | $ | 130,444 | $ | 111,705 | $ | 500,107 | |||||||||

Less: straight-line rental revenue | 7,085 | (2,357 | ) | (4,009 | ) | (5,051 | ) | (4,332 | ) | |||||||||||

CONSOLIDATED INCOME AVAILABLE FOR DEBT SERVICE | $ | 132,056 | $ | 130,630 | $ | 126,435 | $ | 106,654 | $ | 495,775 | ||||||||||

ANNUAL DEBT SERVICE: | ||||||||||||||||||||

Interest expense, gross | $ | 37,360 | $ | 36,753 | $ | 35,599 | $ | 33,483 | $ | 143,195 | ||||||||||

Less: deferred financing fees amortization | (1,588 | ) | (1,598 | ) | (1,525 | ) | (1,456 | ) | (6,167 | ) | ||||||||||

ANNUAL DEBT SERVICE | $ | 35,772 | $ | 35,155 | $ | 34,074 | $ | 32,027 | $ | 137,028 | ||||||||||

DEBT SERVICE COVERAGE | 3.7 | 3.7 | 3.7 | 3.3 | 3.6 | |||||||||||||||

(1) Includes straight-line rental revenue write off and bad debt expense related to CLA. | ||||||||||||||||||||

| ||

Q4 2017 Supplemental | Page 14 | |

CAPITAL STRUCTURE AS OF DECEMBER 31, 2017 | ||||||||||||||||

(UNAUDITED, DOLLARS IN THOUSANDS EXCEPT SHARE INFORMATION) | ||||||||||||||||

EQUITY | ||||||||||||||||

SECURITY | SHARES OUTSTANDING | PRICE PER SHARE AT DECEMBER 31, 2017 | LIQUIDIATION PREFERENCE | DIVIDEND RATE | CONVERTIBLE | CONVERSION RATIO AT DECEMBER 31, 2017 | CONVERSION PRICE AT DECEMBER 31, 2017 | |||||||||

Common shares | 74,125,080 | $65.46 | N/A | (1) | N/A | N/A | N/A | |||||||||

Series C | 5,399,050 | $26.92 | $134,976 | 5.750% | Y | 0.3857 | $64.82 | |||||||||

Series E | 3,449,115 | $36.85 | $86,228 | 9.000% | Y | 0.4616 | $54.16 | |||||||||

Series G | 6,000,000 | $25.03 | $150,000 | 5.750% | N | N/A | N/A | |||||||||

CALCULATION OF TOTAL MARKET CAPITALIZATION: | ||||||||||||||||

Common shares outstanding at December 31, 2017 multiplied by closing price at December 31, 2017 | $ | 4,852,228 | ||||||||||||||

Aggregate liquidation value of Series C preferred shares (2) | 134,976 | |||||||||||||||

Aggregate liquidation value of Series E preferred shares (2) | 86,228 | |||||||||||||||

Aggregate liquidation value of Series G preferred shares (2) | 150,000 | |||||||||||||||

Net debt at December 31, 2017 (3) | 3,019,762 | |||||||||||||||

Total consolidated market capitalization | $ | 8,243,194 | ||||||||||||||

(1) Total monthly dividends declared in the fourth quarter of 2017 were $1.02 per share. | ||||||||||||||||

(2) Excludes accrued unpaid dividends at December 31, 2017. | ||||||||||||||||

(3) See pages 31 through 33 for definitions. | ||||||||||||||||

| ||

Q4 2017 Supplemental | Page 15 | |

SUMMARY OF RATIOS | |||||||||||

(UNAUDITED) | |||||||||||

4TH QUARTER 2017 | 3RD QUARTER 2017 | 2ND QUARTER 2017 | 1ST QUARTER 2017 | 4TH QUARTER 2016 | 3RD QUARTER 2016 | ||||||

Net debt to total market capitalization | 37% | 35% | 33% | 34% | 34% | 30% | |||||

Net debt to gross assets | 44% | 44% | 42% | 46% | 45% | 43% | |||||

Net debt/Adjusted EBITDA (1)(2) | 5.39 | 5.66 | 5.28 | 5.89 | 5.48 | 5.18 | |||||

Adjusted net debt/Annualized adjusted EBITDA (3)(4) | 5.37 | 5.38 | 5.08 | 5.54 | 5.37 | 5.08 | |||||

Interest coverage ratio (5) | 3.6 | 3.6 | 3.6 | 3.3 | 3.7 | 3.9 | |||||

Fixed charge coverage ratio (5) | 3.1 | 3.1 | 3.1 | 2.8 | 3.1 | 3.2 | |||||

Debt service coverage ratio (5) | 3.6 | 3.6 | 3.6 | 3.1 | 3.4 | 3.6 | |||||

FFO payout ratio (6) | 96% | 84% | 89% | 89% | 77% | 79% | |||||

FFO as adjusted payout ratio (7) | 79% | 81% | 79% | 86% | 76% | 78% | |||||

AFFO payout ratio (8) | 72% | 80% | 80% | 88% | 81% | 80% | |||||

(1) See pages 31 through 33 for definitions. | |||||||||||

(2) Adjusted EBITDA is for the quarter multiplied times four. See calculation on page 40. | |||||||||||

(3) Adjusted net debt is net debt less 40% times property under development. See pages 31 through 33 for definitions. | |||||||||||

(4) Annualized adjusted EBITDA is Adjusted EBITDA for the quarter further adjusted for in-service projects, percentage rent and participating interest and other non-recurring items which is then multiplied times four. These calculations can be found on page 40 under the reconciliation of Adjusted EBITDA and Annualized Adjusted EBITDA. See pages 31 through 33 for definitions. | |||||||||||

(5) See page 17 for detailed calculation. | |||||||||||

(6) FFO payout ratio is calculated by dividing dividends declared per common share by FFO per diluted common share. | |||||||||||

(7) FFO as adjusted payout ratio is calculated by dividing dividends declared per common share by FFO as adjusted per diluted common share. | |||||||||||

(8) AFFO payout ratio is calculated by dividing dividends declared per common share by AFFO per diluted common share. | |||||||||||

| ||

Q4 2017 Supplemental | Page 16 | |

CALCULATION OF INTEREST, FIXED CHARGE AND DEBT SERVICE COVERAGE RATIOS | |||||||||||||||||||||||

(UNAUDITED, DOLLARS IN THOUSANDS) | |||||||||||||||||||||||

INTEREST COVERAGE RATIO (1): | 4TH QUARTER 2017 | 3RD QUARTER 2017 | 2ND QUARTER 2017 | 1ST QUARTER 2017 | 4TH QUARTER 2016 | 3RD QUARTER 2016 | |||||||||||||||||

Net income | $ | 65,563 | $ | 62,954 | $ | 80,535 | $ | 53,916 | $ | 58,141 | $ | 57,526 | |||||||||||

Impairment charges | — | — | 10,195 | — | — | — | |||||||||||||||||

Transaction costs | 135 | 113 | 218 | 57 | 2,988 | 2,947 | |||||||||||||||||

Interest expense, gross | 37,360 | 36,753 | 35,599 | 33,483 | 29,549 | 27,196 | |||||||||||||||||

Depreciation and amortization | 37,027 | 34,694 | 33,148 | 28,077 | 28,351 | 27,601 | |||||||||||||||||

Share-based compensation expense | |||||||||||||||||||||||

to management and trustees | 3,576 | 3,605 | 3,503 | 3,458 | 2,882 | 2,778 | |||||||||||||||||

Costs associated with loan refinancing or payoff | 58 | 1,477 | 9 | 5 | — | 14 | |||||||||||||||||

Interest cost capitalized | (2,046 | ) | (2,492 | ) | (2,550 | ) | (2,791 | ) | (2,715 | ) | (2,931 | ) | |||||||||||

Straight-line rental revenue | 7,085 | (2,357 | ) | (4,009 | ) | (5,051 | ) | (6,062 | ) | (4,597 | ) | ||||||||||||

Gain on early extinguishment of debt | — | — | (977 | ) | — | — | — | ||||||||||||||||

Gain on sale of real estate | (13,480 | ) | (997 | ) | (25,461 | ) | (2,004 | ) | (1,430 | ) | (1,615 | ) | |||||||||||

Gain on insurance recovery | — | — | (606 | ) | — | (847 | ) | (1,825 | ) | ||||||||||||||

Deferred income tax expense (benefit) | (99 | ) | 227 | 50 | 634 | (401 | ) | (44 | ) | ||||||||||||||

Interest coverage amount | $ | 135,179 | $ | 133,977 | $ | 129,654 | $ | 109,784 | $ | 110,456 | $ | 107,050 | |||||||||||

Interest expense, net | $ | 35,271 | $ | 34,194 | $ | 32,967 | $ | 30,692 | $ | 26,834 | $ | 24,265 | |||||||||||

Interest income | 43 | 67 | 82 | — | — | — | |||||||||||||||||

Interest cost capitalized | 2,046 | 2,492 | 2,550 | 2,791 | 2,715 | 2,931 | |||||||||||||||||

Interest expense, gross | $ | 37,360 | $ | 36,753 | $ | 35,599 | $ | 33,483 | $ | 29,549 | $ | 27,196 | |||||||||||

Interest coverage ratio | 3.6 | 3.6 | 3.6 | 3.3 | 3.7 | 3.9 | |||||||||||||||||

FIXED CHARGE COVERAGE RATIO (1): | |||||||||||||||||||||||

Interest coverage amount | $ | 135,179 | $ | 133,977 | $ | 129,654 | $ | 109,784 | $ | 110,456 | $ | 107,050 | |||||||||||

Interest expense, gross | $ | 37,360 | $ | 36,753 | $ | 35,599 | $ | 33,483 | $ | 29,549 | $ | 27,196 | |||||||||||

Preferred share dividends | 6,438 | 5,951 | 5,952 | 5,952 | 5,951 | 5,951 | |||||||||||||||||

Fixed charges | $ | 43,798 | $ | 42,704 | $ | 41,551 | $ | 39,435 | $ | 35,500 | $ | 33,147 | |||||||||||

Fixed charge coverage ratio | 3.1 | 3.1 | 3.1 | 2.8 | 3.1 | 3.2 | |||||||||||||||||

DEBT SERVICE COVERAGE RATIO (1): | |||||||||||||||||||||||

Interest coverage amount | $ | 135,179 | $ | 133,977 | $ | 129,654 | $ | 109,784 | $ | 110,456 | $ | 107,050 | |||||||||||

Interest expense, gross | $ | 37,360 | $ | 36,753 | $ | 35,599 | $ | 33,483 | $ | 29,549 | $ | 27,196 | |||||||||||

Recurring principal payments | 197 | 192 | 437 | 2,415 | 2,516 | 2,551 | |||||||||||||||||

Debt service | $ | 37,557 | $ | 36,945 | $ | 36,036 | $ | 35,898 | $ | 32,065 | $ | 29,747 | |||||||||||

Debt service coverage ratio | 3.6 | 3.6 | 3.6 | 3.1 | 3.4 | 3.6 | |||||||||||||||||

(1) See pages 31 through 33 for definitions. Amounts above include the impact of discontinued operations, which is separately classified in the income statement. See Appendix on pages 34 through 41 for reconciliations of certain non-GAAP financial measures. | |||||||||||||||||||||||

| ||

Q4 2017 Supplemental | Page 17 | |

SUMMARY OF MORTGAGE NOTES RECEIVABLE | |||||||||

(UNAUDITED, DOLLARS IN THOUSANDS) | |||||||||

SUMMARY OF MORTGAGE NOTES RECEIVABLE | OPERATING SEGMENT | DECEMBER 31, 2017 | DECEMBER 31, 2016 | ||||||

Mortgage note and related accrued interest receivable, borrower exercised conversion option on December 22, 2017 | Entertainment | $ | — | $ | 1,637 | ||||

Mortgage note and related accrued interest receivable, 10.25%, prepaid in full December 28, 2017 | Education | — | 3,508 | ||||||

Mortgage note and related accrued interest receivable, 9.00%, due March 11, 2018 | Education | 1,454 | 1,454 | ||||||

Mortgage note and related accrued interest receivable, 7.00%, due July 31, 2018 | Education | 1,474 | 1,375 | ||||||

Mortgage note and related accrued interest receivable, 7.50%, due January 6, 2019 | Education | 9,056 | — | ||||||

Mortgage notes and related accrued interest receivable, 7.00% and 10.00%, due May 1, 2019 | Recreation | 174,265 | 164,743 | ||||||

Mortgage note, 7.00%, due December 20, 2021 | Education | 57,890 | 70,304 | ||||||

Mortgage notes, 8.50%, due April 6, 2022 | Recreation | 249,213 | — | ||||||

Mortgage note and related accrued interest receivable, 7.85%, due December 28, 2026 | Recreation | 5,803 | 5,635 | ||||||

Mortgage note and related accrued interest receivable, 7.85%, due January 3, 2027 | Recreation | 10,880 | — | ||||||

Mortgage note and related accrued interest receivable, 9.25%, due June 28, 2032 | Entertainment | 31,105 | 36,032 | ||||||

Mortgage note and related accrued interest receivable, 9.00%, due December 31, 2032 | Education | 5,173 | 5,327 | ||||||

Mortgage notes and related accrued interest receivable, 9.50%, due April 30, 2033 | Education | 33,269 | 30,849 | ||||||

Mortgage note, 11.31%, due July 1, 2033 | Recreation | 12,249 | 12,530 | ||||||

Mortgage note and related accrued interest receivable, 8.50% to 9.15%, due June 30, 2034 | Education | 8,711 | 7,230 | ||||||

Mortgage note and related accrued interest receivable, 9.50%, due August 31, 2034 | Education | 12,564 | 12,473 | ||||||

Mortgage note, 11.26%, due December 1, 2034 | Recreation | 51,050 | 51,250 | ||||||

Mortgage notes, 10.43%, due December 1, 2034 | Recreation | 37,562 | 37,562 | ||||||

Mortgage note, 10.88%, due December 1, 2034 | Recreation | 4,550 | 4,550 | ||||||

Mortgage note, 8.14%, due January 5, 2036 | Recreation | 21,000 | 21,000 | ||||||

Mortgage note, 10.25%, due May 31, 2036 | Recreation | 17,505 | 17,505 | ||||||

Mortgage note and related accrued interest receivable, 9.95%, due July 31, 2036 | Education | 6,304 | 6,083 | ||||||

Mortgage note, 9.75%, due August 1, 2036 | Recreation | 18,068 | 18,219 | ||||||

Mortgage note and related accrued interest receivable, 9.75%, due December 31, 2036 | Education | 9,838 | 4,712 | ||||||

Mortgage note and related accrued interest receivable, 8.50%, due April 30, 2037 | Education | 4,717 | — | ||||||

Mortgage note and related accrued interest receivable, 8.75%, due June 30, 2037 | Education | 4,111 | — | ||||||

Mortgage note and related accrued interest receivable, 8.50%, due July 31, 2037 | Education | 4,235 | — | ||||||

Mortgage note, 8.75%, due August 31, 2037 | Education | 11,330 | — | ||||||

Mortgage note and related accrued interest receivable, 10.14%, due September 30, 2037 | Education | 2,500 | — | ||||||

Mortgage note and related accrued interest receivable, 8.80%, due September 30, 2037 | Education | 11,684 | — | ||||||

Mortgage note and related accrued interest receivable, 8.50%, due November 30, 2037 | Education | 9,631 | — | ||||||

Mortgage note and related accrued interest receivable, 7.50%, due October 27, 2038 | Education | 658 | — | ||||||

Mortgage notes, 7.25%, due November 30, 2041 | Education | 142,900 | 100,000 | ||||||

Total mortgage notes and related accrued interest receivable | $ | 970,749 | $ | 613,978 | |||||

| ||

Q4 2017 Supplemental | Page 18 | |

CAPITAL SPENDING AND DISPOSITION SUMMARIES | ||||||||

(UNAUDITED, DOLLARS IN THOUSANDS) | ||||||||

2017 CAPITAL SPENDING | LOCATION | OPERATING SEGMENT | CAPITAL SPENDING THREE MONTHS ENDED DECEMBER 31, 2017 | CAPITAL SPENDING YEAR ENDED DECEMBER 31, 2017 | ||||

Development and redevelopment of megaplex theatres | various | Entertainment | $ | 37,227 | $ | 99,142 | ||

Acquisition of megaplex theatres | various | Entertainment | — | 154,144 | ||||

Development of other entertainment and retail projects | various | Entertainment | 17,085 | 58,899 | ||||

Investment in mortgage note receivable for megaplex theatre converted to lease | Houston, TX | Entertainment | 464 | 7,480 | ||||

Investment in mortgage notes receivable for public charter schools | various | Education | 2,051 | 54,683 | ||||

Investment in mortgage notes receivable for early childhood education and private schools | various | Education | — | 42,900 | ||||

Development of public charter school properties | various | Education | 6,294 | 52,513 | ||||

Acquisition and development of early childhood education centers | various | Education | 7,137 | 97,229 | ||||

Acquisition and development of private school properties | various | Education | 978 | 7,802 | ||||

Development of Topgolf golf entertainment facilities | various | Recreation | 24,201 | 114,146 | ||||

Additions to mortgage note and notes receivable at Schlitterbahn waterpark | various | Recreation | 60 | 11,135 | ||||

Acquisition of fitness facilities | various | Recreation | — | 28,363 | ||||

Investment in mortgage note receivables for fitness facility | Omaha, NE | Recreation | 238 | 10,946 | ||||

Development and redevelopment of ski properties | various | Recreation | 638 | 2,812 | ||||

Development of waterpark | Powells Point, NC | Recreation | 698 | 33,264 | ||||

Acquisition of other recreation facilities | various | Recreation | 10,815 | 34,339 | ||||

Investment in waterpark hotel for casino and resort project | Sullivan County, NY | Recreation | 18,517 | 40,948 | ||||

Acquisition of CNL Lifestyle Properties | various | Recreation | — | 730,788 | ||||

Investment in casino and resort project | Sullivan County, NY | Other | 77 | 1,079 | ||||

Total investment spending | $ | 126,480 | $ | 1,582,612 | ||||

Other capital acquisitions, net | various | n/a | 986 | 4,715 | ||||

Total capital spending | $ | 127,466 | $ | 1,587,327 | ||||

2017 DISPOSITIONS AND MORTGAGE NOTE PAYDOWNS (EXCLUDING PRINCIPAL PAYMENTS) | LOCATION | OPERATING SEGMENT | NET PROCEEDS THREE MONTHS ENDED DECEMBER 31, 2017 | NET PROCEEDS YEAR ENDED DECEMBER 31, 2017 | ||||

Sale of public charter school properties | various | Education | $ | 52,489 | $ | 105,955 | ||

Sale of retail space | various | Entertainment | — | 2,621 | ||||

Sale of attraction property and family entertainment centers from CNL acquisition | various | Recreation | — | 9,250 | ||||

Sale of theatre property | San Diego, CA | Entertainment | — | 35,338 | ||||

Sale of early childhood education center properties | various | Education | 737 | 1,879 | ||||

Sale of entertainment retail center | Suffolk, VA | Entertainment | — | 34,448 | ||||

Mortgage note paydown | Chicago, IL | Entertainment | — | 4,000 | ||||

Mortgage note paydown | Wrightwood, CA | Recreation | 737 | 737 | ||||

Mortgage note paydown | Dallas, TX | Education | 3,420 | 3,420 | ||||

Total dispositions and mortgage note paydowns (excluding recurring principal payments) | $ | 57,383 | $ | 197,648 | ||||

| ||

Q4 2017 Supplemental | Page 19 | |

PROPERTY UNDER DEVELOPMENT - INVESTMENT SPENDING ESTIMATES AT DECEMBER 31, 2017 (1) | |||||||||||||||||||||||||||||||

(UNAUDITED, DOLLARS IN THOUSANDS) | |||||||||||||||||||||||||||||||

DECEMBER 31, 2017 | OWNED BUILD-TO-SUIT SPENDING ESTIMATES | ||||||||||||||||||||||||||||||

PROPERTY UNDER DEVELOPMENT | # OF PROJECTS | 1ST QUARTER 2018 | 2ND QUARTER 2018 | 3RD QUARTER 2018 | 4TH QUARTER 2018 | THEREAFTER | TOTAL EXPECTED COSTS (2) | % LEASED | |||||||||||||||||||||||

Entertainment | $ | 66,889 | 12 | $ | 23,101 | $ | 6,950 | $ | 1,500 | $ | — | $ | 3,323 | $ | 101,763 | 100% | |||||||||||||||

Education | 24,729 | 7 | 4,535 | 8,700 | 8,200 | 6,400 | 15,637 | 68,201 | 100% | ||||||||||||||||||||||

Recreation (3) | 125,217 | 5 | 34,673 | 35,150 | 32,750 | 33,250 | 45,516 | 306,556 | 100% | ||||||||||||||||||||||

Total Build-to-Suit | 216,835 | 24 | $ | 62,309 | $ | 50,800 | $ | 42,450 | $ | 39,650 | $ | 64,476 | $ | 476,520 | |||||||||||||||||

Non Build-to-Suit Development | 35,088 | ||||||||||||||||||||||||||||||

Resorts World Catskills | 5,706 | ||||||||||||||||||||||||||||||

Total Property Under Development | $ | 257,629 | |||||||||||||||||||||||||||||

DECEMBER 31, 2017 | OWNED BUILD-TO-SUIT IN-SERVICE ESTIMATES | ||||||||||||||||||||||||||||||

# OF PROJECTS | 1ST QUARTER 2018 | 2ND QUARTER 2018 | 3RD QUARTER 2018 | 4TH QUARTER 2018 | THEREAFTER | TOTAL IN-SERVICE (2) | ACTUAL IN-SERVICE 4TH QUARTER 2017 | ||||||||||||||||||||||||

Entertainment | 12 | $ | 29,058 | $ | 51,705 | $ | 21,000 | $ | — | $ | — | $ | 101,763 | $ | 54,612 | ||||||||||||||||

Education | 7 | 10,607 | — | 12,200 | 17,309 | 28,085 | 68,201 | 26,842 | |||||||||||||||||||||||

Recreation | 5 | 21,322 | — | 56,412 | 28,260 | 200,562 | 306,556 | 49,362 | |||||||||||||||||||||||

Total Build-to-Suit | 24 | $ | 60,987 | $ | 51,705 | $ | 89,612 | $ | 45,569 | $ | 228,647 | $ | 476,520 | $ | 130,816 | ||||||||||||||||

DECEMBER 31, 2017 | MORTGAGE BUILD-TO-SUIT SPENDING ESTIMATES | ||||||||||||||||||||||||||||||

MORTGAGE NOTES RECEIVABLE | # OF PROJECTS | 1ST QUARTER 2018 | 2ND QUARTER 2018 | 3RD QUARTER 2018 | 4TH QUARTER 2018 | THEREAFTER | TOTAL EXPECTED COSTS (2) | ||||||||||||||||||||||||

Entertainment | $ | — | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | ||||||||||||||||

Education | 32,018 | 5 | 2,356 | 4,450 | 4,250 | 3,450 | 8,879 | 55,403 | |||||||||||||||||||||||

Recreation | 5,803 | 1 | 250 | 250 | — | — | — | 6,303 | |||||||||||||||||||||||

Total Build-to-Suit Mortgage Notes | 37,821 | 6 | $ | 2,606 | $ | 4,700 | $ | 4,250 | $ | 3,450 | $ | 8,879 | $ | 61,706 | |||||||||||||||||

Non Build-to-Suit Mortgage Notes | 932,928 | ||||||||||||||||||||||||||||||

Total Mortgage Notes Receivable | $ | 970,749 | |||||||||||||||||||||||||||||

(1) This schedule includes only those properties for which the Company has closed on a contract (lease or mortgage) and commenced construction as of December 31, 2017. | |||||||||||||||||||||||||||||||

(2) "Total Expected Cost" and "Total In-Service" each reflect the total capital costs expected to be funded by the Company through completion (including capitalized interest or accrued interest as applicable). | |||||||||||||||||||||||||||||||

(3) Recreation includes costs related to waterpark hotel at Resorts World Catskills. | |||||||||||||||||||||||||||||||

Note: This schedule includes future estimates for which the Company can give no assurance as to timing or amounts. Development projects have risks. See Item 1A - "Risk Factors" in the Company's most recent Annual Report on Form 10-K and, to the extent applicable, the Company's Quarterly Reports on Form 10-Q. | |||||||||||||||||||||||||||||||

| ||

Q4 2017 Supplemental | Page 20 | |

FINANCIAL INFORMATION BY SEGMENT | ||||||||||||||||||||||

FOR THE THREE MONTHS ENDED DECEMBER 31, 2017 | ||||||||||||||||||||||

(UNAUDITED, DOLLARS IN THOUSANDS) | ||||||||||||||||||||||

ENTERTAINMENT | EDUCATION | RECREATION | OTHER | SUBTOTAL | CORPORATE/UNALLOCATED | CONSOLIDATED | ||||||||||||||||

Rental revenue | $ | 70,288 | $ | 12,826 | $ | 33,909 | $ | 2,292 | $ | 119,315 | $ | — | $ | 119,315 | ||||||||

Tenant reimbursements | 4,095 | 36 | — | — | 4,131 | — | 4,131 | |||||||||||||||

Other income | — | — | — | — | — | 577 | 577 | |||||||||||||||

Mortgage and other financing income | 981 | 9,106 | 13,590 | — | 23,677 | — | 23,677 | |||||||||||||||

Total revenue | 75,364 | 21,968 | 47,499 | 2,292 | 147,123 | 577 | 147,700 | |||||||||||||||

Property operating expense | 6,115 | 6,163 | 31 | 387 | 12,696 | 195 | 12,891 | |||||||||||||||

Other expense | — | — | — | — | — | 242 | 242 | |||||||||||||||

Total investment expenses | 6,115 | 6,163 | 31 | 387 | 12,696 | 437 | 13,133 | |||||||||||||||

General and administrative expense | — | — | — | — | — | (9,596 | ) | (9,596 | ) | |||||||||||||

Straight-line rental revenue write-off related to Children's Learning Adventure USA, LLC ("CLA") | — | 9,010 | — | — | 9,010 | — | 9,010 | |||||||||||||||

Bad debt expense related to CLA | — | 6,003 | — | — | 6,003 | — | 6,003 | |||||||||||||||

Adjusted EBITDA (1) | $ | 69,249 | $ | 30,818 | $ | 47,468 | $ | 1,905 | $ | 149,440 | $ | (9,456 | ) | $ | 139,984 | |||||||

46 | % | 21 | % | 32 | % | 1 | % | 100 | % | |||||||||||||

Reconciliation to Consolidated Statements of Income: | ||||||||||||||||||||||

Costs associated with loan refinancing or payoff | (58 | ) | (58 | ) | ||||||||||||||||||

Interest expense, net | (35,271 | ) | (35,271 | ) | ||||||||||||||||||

Transaction costs | (135 | ) | (135 | ) | ||||||||||||||||||

Depreciation and amortization | (37,027 | ) | (37,027 | ) | ||||||||||||||||||

Equity in loss from joint ventures | (14 | ) | (14 | ) | ||||||||||||||||||

Gain on sale of real estate | 13,480 | 13,480 | ||||||||||||||||||||

Income tax expense | (383 | ) | (383 | ) | ||||||||||||||||||

Straight-line rental revenue write-off related to CLA | (9,010 | ) | (9,010 | ) | ||||||||||||||||||

Bad debt expense related to CLA | (6,003 | ) | (6,003 | ) | ||||||||||||||||||

Net income | 65,563 | |||||||||||||||||||||

Preferred dividend requirements | (6,438 | ) | (6,438 | ) | ||||||||||||||||||

Preferred share redemption costs | (4,457 | ) | (4,457 | ) | ||||||||||||||||||

Net income available to common shareholders of EPR Properties | $ | 54,668 | ||||||||||||||||||||

(1) See pages 31 through 33 for definitions. | ||||||||||||||||||||||

| ||

Q4 2017 Supplemental | Page 21 | |

FINANCIAL INFORMATION BY SEGMENT | ||||||||||||||||||||||

FOR THE YEAR ENDED DECEMBER 31, 2017 | ||||||||||||||||||||||

(UNAUDITED, DOLLARS IN THOUSANDS) | ||||||||||||||||||||||

ENTERTAINMENT | EDUCATION | RECREATION | OTHER | SUBTOTAL | CORPORATE/UNALLOCATED | CONSOLIDATED | ||||||||||||||||

Rental revenue | $ | 267,729 | $ | 78,994 | $ | 112,763 | $ | 9,162 | $ | 468,648 | $ | — | $ | 468,648 | ||||||||

Tenant reimbursements | 15,518 | 37 | — | — | 15,555 | — | 15,555 | |||||||||||||||

Other income | 614 | 1 | — | — | 615 | 2,480 | 3,095 | |||||||||||||||

Mortgage and other financing income | 4,407 | 35,546 | 48,740 | — | 88,693 | — | 88,693 | |||||||||||||||

Total revenue | 288,268 | 114,578 | 161,503 | 9,162 | 573,511 | 2,480 | 575,991 | |||||||||||||||

Property operating expense | 23,175 | 6,314 | 117 | 1,407 | 31,013 | 640 | 31,653 | |||||||||||||||

Other expense | — | — | — | — | — | 242 | 242 | |||||||||||||||

Total investment expenses | 23,175 | 6,314 | 117 | 1,407 | 31,013 | 882 | 31,895 | |||||||||||||||

General and administrative expense | — | — | — | — | — | (43,383 | ) | (43,383 | ) | |||||||||||||

Gain on insurance recovery (1) | (606 | ) | — | — | — | (606 | ) | — | (606 | ) | ||||||||||||

Rental revenue adjustment related to CLA | — | 1,612 | — | — | 1,612 | — | 1,612 | |||||||||||||||

Bad debt expense related to CLA | — | 6,003 | — | — | 6,003 | — | 6,003 | |||||||||||||||

Adjusted EBITDA (2) | $ | 264,487 | $ | 115,879 | $ | 161,386 | $ | 7,755 | $ | 549,507 | $ | (41,785 | ) | $ | 507,722 | |||||||

49 | % | 21 | % | 29 | % | 1 | % | 100 | % | |||||||||||||

Reconciliation to Consolidated Statements of Income: | ||||||||||||||||||||||

Costs associated with loan refinancing or payoff | (1,549 | ) | (1,549 | ) | ||||||||||||||||||

Gain on early extinguishment of debt | 977 | 977 | ||||||||||||||||||||

Interest expense, net | (133,124 | ) | (133,124 | ) | ||||||||||||||||||

Transaction costs | (523 | ) | (523 | ) | ||||||||||||||||||

Impairment charges | (10,195 | ) | (10,195 | ) | ||||||||||||||||||

Depreciation and amortization | (132,946 | ) | (132,946 | ) | ||||||||||||||||||

Equity in income from joint ventures | 72 | 72 | ||||||||||||||||||||

Gain on sale of real estate | 41,942 | 41,942 | ||||||||||||||||||||

Income tax expense | (2,399 | ) | (2,399 | ) | ||||||||||||||||||

Gain on insurance recovery (1) | 606 | 606 | ||||||||||||||||||||

Rental revenue adjustment related to CLA | (1,612 | ) | (1,612 | ) | ||||||||||||||||||

Bad debt expense related to CLA | (6,003 | ) | (6,003 | ) | ||||||||||||||||||

Net income | 262,968 | |||||||||||||||||||||

Preferred dividend requirements | (24,293 | ) | (24,293 | ) | ||||||||||||||||||

Preferred share redemption costs | (4,457 | ) | (4,457 | ) | ||||||||||||||||||

Net income available to common shareholders of EPR Properties | $ | 234,218 | ||||||||||||||||||||

(1) Included in other income. See reconciliation on page 41. | ||||||||||||||||||||||

(2) See pages 31 through 33 for definitions. | ||||||||||||||||||||||

| ||

Q4 2017 Supplemental | Page 22 | |

FINANCIAL INFORMATION BY SEGMENT | ||||||||||||||||||||||

FOR THE THREE MONTHS ENDED DECEMBER 31, 2016 | ||||||||||||||||||||||

(UNAUDITED, DOLLARS IN THOUSANDS) | ||||||||||||||||||||||

ENTERTAINMENT | EDUCATION | RECREATION | OTHER | SUBTOTAL | CORPORATE/UNALLOCATED | CONSOLIDATED | ||||||||||||||||

Rental revenue | $ | 65,129 | $ | 22,971 | $ | 17,084 | $ | 2,290 | $ | 107,474 | $ | — | $ | 107,474 | ||||||||

Tenant reimbursements | 4,018 | — | — | — | 4,018 | — | 4,018 | |||||||||||||||

Other income | 27 | 1,648 | 847 | — | 2,522 | 705 | 3,227 | |||||||||||||||

Mortgage and other financing income | 1,260 | 7,311 | 7,540 | 1 | 16,112 | — | 16,112 | |||||||||||||||

Total revenue | 70,434 | 31,930 | 25,471 | 2,291 | 130,126 | 705 | 130,831 | |||||||||||||||

Property operating expense | 5,488 | — | — | 243 | 5,731 | 184 | 5,915 | |||||||||||||||

Total investment expenses | 5,488 | — | — | 243 | 5,731 | 184 | 5,915 | |||||||||||||||

General and administrative expense | — | — | — | — | — | (10,234 | ) | (10,234 | ) | |||||||||||||

Gain on insurance recovery (1) | — | — | (847 | ) | — | (847 | ) | — | (847 | ) | ||||||||||||

Adjusted EBITDA (2) | $ | 64,946 | $ | 31,930 | $ | 24,624 | $ | 2,048 | $ | 123,548 | $ | (9,713 | ) | $ | 113,835 | |||||||

52 | % | 26 | % | 20 | % | 2 | % | 100 | % | |||||||||||||

Reconciliation to Consolidated Statements of Income: | ||||||||||||||||||||||

Interest expense, net | (26,834 | ) | (26,834 | ) | ||||||||||||||||||

Transaction costs | (2,988 | ) | (2,988 | ) | ||||||||||||||||||

Depreciation and amortization | (28,351 | ) | (28,351 | ) | ||||||||||||||||||

Equity in income from joint ventures | 118 | 118 | ||||||||||||||||||||

Gain on sale of real estate | 1,430 | 1,430 | ||||||||||||||||||||

Income tax benefit | 84 | 84 | ||||||||||||||||||||

Gain on insurance recovery (1) | 847 | 847 | ||||||||||||||||||||

Net income | 58,141 | |||||||||||||||||||||

Preferred dividend requirements | (5,951 | ) | (5,951 | ) | ||||||||||||||||||

Net income available to common shareholders of EPR Properties | $ | 52,190 | ||||||||||||||||||||

(1) Included in other income. See reconciliation on page 41. | ||||||||||||||||||||||

(2) See pages 31 through 33 for definitions. | ||||||||||||||||||||||

| ||

Q4 2017 Supplemental | Page 23 | |

FINANCIAL INFORMATION BY SEGMENT | ||||||||||||||||||||||

FOR THE YEAR ENDED DECEMBER 31, 2016 | ||||||||||||||||||||||

(UNAUDITED, DOLLARS IN THOUSANDS) | ||||||||||||||||||||||

ENTERTAINMENT | EDUCATION | RECREATION | OTHER | SUBTOTAL | CORPORATE/UNALLOCATED | CONSOLIDATED | ||||||||||||||||

Rental revenue | $ | 250,659 | $ | 77,768 | $ | 62,527 | $ | 8,635 | $ | 399,589 | $ | — | $ | 399,589 | ||||||||

Tenant reimbursements | 15,588 | 7 | — | — | 15,595 | — | 15,595 | |||||||||||||||

Other income | 249 | 1,648 | 4,482 | — | 6,379 | 2,660 | 9,039 | |||||||||||||||

Mortgage and other financing income | 6,187 | 32,539 | 30,190 | 103 | 69,019 | — | 69,019 | |||||||||||||||

Total revenue | 272,683 | 111,962 | 97,199 | 8,738 | 490,582 | 2,660 | 493,242 | |||||||||||||||

Property operating expense | 21,303 | — | 8 | 662 | 21,973 | 629 | 22,602 | |||||||||||||||

Other expense | — | — | — | 5 | 5 | — | 5 | |||||||||||||||

Total investment expenses | 21,303 | — | 8 | 667 | 21,978 | 629 | 22,607 | |||||||||||||||

General and administrative expense | — | — | — | — | — | (37,543 | ) | (37,543 | ) | |||||||||||||

Gain on insurance recovery (1) | (202 | ) | — | (4,482 | ) | — | (4,684 | ) | — | (4,684 | ) | |||||||||||

Adjusted EBITDA (2) | $ | 251,178 | $ | 111,962 | $ | 92,709 | $ | 8,071 | $ | 463,920 | $ | (35,512 | ) | $ | 428,408 | |||||||

54 | % | 24 | % | 20 | % | 2 | % | 100 | % | |||||||||||||

Reconciliation to Consolidated Statements of Income: | ||||||||||||||||||||||

Costs associated with loan refinancing or payoff | (905 | ) | (905 | ) | ||||||||||||||||||

Interest expense, net | (97,144 | ) | (97,144 | ) | ||||||||||||||||||

Transaction costs | (7,869 | ) | (7,869 | ) | ||||||||||||||||||

Depreciation and amortization | (107,573 | ) | (107,573 | ) | ||||||||||||||||||

Equity in income from joint ventures | 619 | 619 | ||||||||||||||||||||

Gain on sale of real estate | 5,315 | 5,315 | ||||||||||||||||||||

Income tax expense | (553 | ) | (553 | ) | ||||||||||||||||||

Gain on insurance recovery (1) | 4,684 | 4,684 | ||||||||||||||||||||

Net income | 224,982 | |||||||||||||||||||||

Preferred dividend requirements | (23,806 | ) | (23,806 | ) | ||||||||||||||||||

Net income available to common shareholders of EPR Properties | $ | 201,176 | ||||||||||||||||||||

(1) Included in other income. See reconciliation on page 41. | ||||||||||||||||||||||

(2) See pages 31 through 33 for definitions. | ||||||||||||||||||||||

| ||

Q4 2017 Supplemental | Page 24 | |

TOTAL INVESTMENT BY SEGMENT | ||||||||||||||||

AS OF DECEMBER 31, 2017 AND 2016 | ||||||||||||||||

(UNAUDITED, DOLLARS IN THOUSANDS) | ||||||||||||||||

As of December 31, 2017 | ||||||||||||||||

ENTERTAINMENT | EDUCATION | RECREATION | OTHER | CONSOLIDATED | ||||||||||||

Rental properties, net of accumulated depreciation | $ | 2,156,131 | $ | 943,804 | $ | 1,347,562 | $ | 156,734 | $ | 4,604,231 | ||||||

Add back accumulated depreciation on rental properties | 606,670 | 61,536 | 73,128 | — | 741,334 | |||||||||||

Land held for development | 4,457 | 12,420 | — | 16,815 | 33,692 | |||||||||||

Property under development | 101,252 | 25,454 | 125,217 | 5,706 | 257,629 | |||||||||||

Mortgage notes and related accrued interest receivable, net | 31,105 | 337,499 | 602,145 | — | 970,749 | |||||||||||

Investment in direct financing leases, net | — | 57,903 | — | — | 57,903 | |||||||||||

Investment in joint ventures | 5,602 | — | — | — | 5,602 | |||||||||||

Intangible assets, gross (1) | 26,466 | 1,230 | 7,513 | — | 35,209 | |||||||||||

Notes receivable and related accrued interest receivable, net (1) | 1,976 | — | 3,107 | — | 5,083 | |||||||||||

Total investments (2) | $ | 2,933,659 | $ | 1,439,846 | $ | 2,158,672 | $ | 179,255 | $ | 6,711,432 | ||||||

% of total investments | 44 | % | 21 | % | 32 | % | 3 | % | 100 | % | ||||||

As of December 31, 2016 | ||||||||||||||||

ENTERTAINMENT | EDUCATION | RECREATION | OTHER | CONSOLIDATED | ||||||||||||

Rental properties, net of accumulated depreciation | $ | 1,957,586 | $ | 805,967 | $ | 676,550 | $ | 155,659 | $ | 3,595,762 | ||||||

Add back accumulated depreciation on rental properties | 553,846 | 42,916 | 38,773 | — | 635,535 | |||||||||||

Land held for development | 4,457 | 1,258 | — | 16,815 | 22,530 | |||||||||||

Property under development | 87,670 | 105,366 | 98,371 | 5,701 | 297,108 | |||||||||||

Mortgage notes and related accrued interest receivable, net | 37,669 | 243,315 | 332,994 | — | 613,978 | |||||||||||

Investment in direct financing leases, net | — | 102,698 | — | — | 102,698 | |||||||||||

Investment in joint ventures | 5,972 | — | — | — | 5,972 | |||||||||||

Intangible assets, gross (1) | 28,597 | 190 | — | — | 28,787 | |||||||||||

Notes receivable and related accrued interest receivable, net (1) | 1,987 | 1,588 | 1,190 | — | 4,765 | |||||||||||

Total investments (2) | $ | 2,677,784 | $ | 1,303,298 | $ | 1,147,878 | $ | 178,175 | $ | 5,307,135 | ||||||

% of total investments | 50 | % | 25 | % | 22 | % | 3 | % | 100 | % | ||||||

(1) Included in other assets in the consolidated balance sheets as of December 31, 2017 and 2016 in the Company's Annual Report on Form 10-K. Reconciliation is as follows: | ||||||||||||||||

12/31/2017 | 12/31/2016 | |||||||||||||||

Intangible assets, gross | $ | 35,209 | $ | 28,787 | ||||||||||||

Less: accumulated amortization on intangible assets | (6,340 | ) | (14,008 | ) | ||||||||||||

Notes receivable and related accrued interest receivable, net | 5,083 | 4,765 | ||||||||||||||

Prepaid expenses and other current assets | 75,056 | 79,410 | ||||||||||||||

Total other assets | $ | 109,008 | $ | 98,954 | ||||||||||||

(2) See pages 31 through 33 for definitions. | ||||||||||||||||

| ||

Q4 2017 Supplemental | Page 25 | |

LEASE EXPIRATIONS | ||||||||||||||||||||||||||||||

AS OF DECEMBER 31, 2017 | ||||||||||||||||||||||||||||||

(UNAUDITED, DOLLARS IN THOUSANDS) | ||||||||||||||||||||||||||||||

MEGAPLEX THEATRES | EDUCATION PORTFOLIO | RECREATION PORTFOLIO | ||||||||||||||||||||||||||||

YEAR | TOTAL NUMBER OF PROPERTIES | RENTAL REVENUE FOR THE YEAR ENDED DECEMBER 31, 2017 (1) | % OF TOTAL REVENUE | TOTAL NUMBER OF PROPERTIES | FINANCING INCOME/RENTAL REVENUE FOR THE YEAR ENDED DECEMBER 31, 2017 | % OF TOTAL REVENUE | TOTAL NUMBER OF PROPERTIES | RENTAL REVENUE FOR THE YEAR ENDED DECEMBER 31, 2017 | % OF TOTAL REVENUE | |||||||||||||||||||||

2018 | 4 | $ | 8,572 | 2 | % | 1 | $ | 272 | — | % | — | $ | — | — | % | |||||||||||||||

2019 | 3 | 8,261 | 1 | % | — | — | — | % | — | — | — | % | ||||||||||||||||||

2020 | 3 | 3,943 | 1 | % | — | — | — | % | — | — | — | % | ||||||||||||||||||

2021 | 8 | 10,966 | 2 | % | — | — | — | % | — | — | — | % | ||||||||||||||||||

2022 | 10 | 19,949 | 3 | % | — | — | — | % | — | — | — | % | ||||||||||||||||||

2023 | 8 | 16,163 | 3 | % | — | — | — | % | — | — | — | % | ||||||||||||||||||

2024 | 14 | 27,156 | 5 | % | 1 | 3,064 | 1 | % | — | — | — | % | ||||||||||||||||||

2025 | 4 | 9,399 | 2 | % | — | — | — | % | 1 | 1,233 | — | % | ||||||||||||||||||

2026 | 7 | 12,961 | 2 | % | — | — | — | % | 1 | 3,806 | 1 | % | ||||||||||||||||||

2027 | 20 | 29,070 | 5 | % | — | — | — | % | 3 | 14,005 | 2 | % | ||||||||||||||||||

2028 | 8 | 12,749 | 2 | % | — | — | — | % | — | — | — | % | ||||||||||||||||||

2029 | 10 | 12,397 | 2 | % | — | — | — | % | 2 | 1,875 | — | % | ||||||||||||||||||

2030 | 22 | 31,309 | 6 | % | — | — | — | % | — | — | — | % | ||||||||||||||||||

2031 | 11 | 18,117 | 3 | % | 13 | 6,171 | 1 | % | — | — | — | % | ||||||||||||||||||

2032 | 5 | 3,748 | 1 | % | 10 | 10,960 | 2 | % | 5 | 5,726 | 1 | % | ||||||||||||||||||

2033 | 8 | 4,816 | 1 | % | 9 | 8,145 | 1 | % | 2 | 3,131 | 1 | % | ||||||||||||||||||

2034 | 2 | 1,977 | — | % | 14 | 24,140 | 4 | % | 7 | 11,094 | 2 | % | ||||||||||||||||||

2035 | 2 | 2,297 | — | % | 20 | 10,508 | 2 | % | 11 | 40,887 | 7 | % | ||||||||||||||||||

2036 | 2 | 2,393 | — | % | 14 | 14,049 | 2 | % | 5 | 9,567 | 2 | % | ||||||||||||||||||

2037 | 3 | 3,175 | 1 | % | 9 | (2) | 3,104 | 1 | % | 15 | 20,172 | 4 | % | |||||||||||||||||

Thereafter | — | — | — | % | 3 | (3) | 1,505 | — | % | 2 | 1,267 | — | % | |||||||||||||||||

154 | $ | 239,418 | 42 | % | 94 | $ | 81,918 | 14 | % | 54 | $ | 112,763 | 20 | % | ||||||||||||||||

Note: This schedule relates to owned megaplex theatres, public charter schools, early education centers, private schools, ski areas, attractions and golf entertainment complexes only, which together represent approximately 76% of total revenue for the year ended December 31, 2017. This schedule excludes properties under construction, land held for development and investments in mortgage notes receivable. | ||||||||||||||||||||||||||||||

(1) Consists of rental revenue and tenant reimbursements. | ||||||||||||||||||||||||||||||

(2) Excludes five leases that have been terminated, however the former tenant, CLA, continues to occupy the properties. | ||||||||||||||||||||||||||||||

(3) Excludes two leases that have been terminated, however the former tenant, CLA, continues to occupy the properties. | ||||||||||||||||||||||||||||||

| ||

Q4 2017 Supplemental | Page 26 | |

TOP TEN CUSTOMERS BY PERCENTAGE OF TOTAL REVENUE | |||||||

(UNAUDITED, DOLLARS IN THOUSANDS) | |||||||

PERCENTAGE OF TOTAL REVENUE | PERCENTAGE OF TOTAL REVENUE | ||||||

FOR THE THREE MONTHS ENDED | FOR THE YEAR ENDED | ||||||

CUSTOMERS | ASSET TYPE | DECEMBER 31, 2017 | DECEMBER 31, 2017 | ||||

1. | AMC Theatres | Entertainment | 20% | 20% | |||

2. | Topgolf | Recreation | 10% | 9% | |||

3. | Regal Entertainment Group | Entertainment | 10% | 9% | |||

4. | Cinemark | Entertainment | 6% | 6% | |||

5. | Camelback Resort | Recreation | 4% | 4% | |||

6. | Premier Parks | Recreation | 4% | 3% | |||

7. | Och-Ziff Real Estate Funds | Recreation | 4% | 3% | |||

8. | Basis Independent Schools | Education | 4% | 3% | |||

9. | Imagine Schools | Education | 3% | 3% | |||

10. | Southern Theatres | Entertainment | 3% | 2% | |||

Total | 68% | 62% | |||||

| ||

Q4 2017 Supplemental | Page 27 | |

NET ASSET VALUE (NAV) COMPONENTS | ||||||||||||||

AS OF DECEMBER 31, 2017 | ||||||||||||||

(UNAUDITED, DOLLARS AND SHARES IN THOUSANDS) | ||||||||||||||

ANNUALIZED CASH NET OPERATING INCOME (NOI) RUN RATE (FOR NAV CALCULATIONS) (1) | ||||||||||||||

OWNED | FINANCED | TOTAL | ||||||||||||

Megaplex | $ | 220,188 | $ | 176 | $ | 220,364 | ||||||||