Attached files

| file | filename |

|---|---|

| EX-10.35 - EXHIBIT 10.35 - Spark Therapeutics, Inc. | exhibit1035pfizerlicenseag.htm |

| EX-32.2 - EXHIBIT 32.2 - Spark Therapeutics, Inc. | spark20171231ex-322.htm |

| EX-32.1 - EXHIBIT 32.1 - Spark Therapeutics, Inc. | spark-20171231exx321.htm |

| EX-31.2 - EXHIBIT 31.2 - Spark Therapeutics, Inc. | spark-20171231exx312.htm |

| EX-31.1 - EXHIBIT 31.1 - Spark Therapeutics, Inc. | spark-20171231exx311.htm |

| EX-23.1 - EXHIBIT 23.1 - Spark Therapeutics, Inc. | exhibit231-kpmg2017consent.htm |

| EX-21.1 - EXHIBIT 21.1 - Spark Therapeutics, Inc. | exhibit211listofsubsidiari.htm |

| EX-10.37 - EXHIBIT 10.37 - Spark Therapeutics, Inc. | exhibit1037novartislicensi.htm |

| EX-10.36 - EXHIBIT 10.36 - Spark Therapeutics, Inc. | exhibit1036novartissupplya.htm |

| 10-K - 10-K - Spark Therapeutics, Inc. | spark-201710xk.htm |

Tenant: Spark Therapeutics, Inc.

Brandywine Realty Trust Premises: 3025 Market St., Suites 016, 026, 200 & 300

LEASE

THIS LEASE (“Lease”) is entered into as of November 20, 2017, between BRANDYWINE 3025 MARKET, LP, a Pennsylvania limited partnership (“Landlord”), and SPARK THERAPEUTICS, INC., a Delaware corporation (“Tenant”).

In consideration of the mutual covenants stated below, and intending to be legally bound, the parties covenant and agree as follows:

1.KEY DEFINED TERMS.

(a) “Abatement Period” means the period that begins on the Commencement Date and ends on the day immediately prior to the 7-month anniversary of the Commencement Date. During the Abatement Period, no Fixed Rent is due or payable, but Tenant shall pay to Landlord: (i) Tenant’s Share (as defined in Section 5(a)) of Operating Expenses (as defined in Section 5(a)); (ii) utilities as set forth in Section 6; (iii) use and occupancy taxes; and (iv) all other amounts due Landlord with the exception of Fixed Rent.

(b) “Additional Rent” means all costs and expenses other than Fixed Rent that Tenant is obligated to pay Landlord pursuant to this Lease.

(c) “Broker” means Jones Lang LaSalle.

(d) “Building” means the building located at 3001-3025 Market Street, Philadelphia, Pennsylvania 19104, containing approximately 282,709 rentable square feet. Landlord represents and warrants that the Building and the Premises have been measured in accordance with the Building Owners and Managers Association International Standard Method for Measuring Floor Area in Office Buildings, ANSI/BOMA Z65.1-2010.

(e) “Business Hours” means the hours of 8:30 a.m. to 5:30 p.m. on weekdays, and 8:00 a.m. to 1:00 p.m. on Saturdays, excluding Building holidays.

(f) “Commencement Date” means the date that is the earliest of: (i) the date on which Tenant first conducts any business in all or any portion of the Lower Level Space or Suite 200; (ii) Substantial Completion (as defined in Exhibit C) of the Leasehold Improvements (as defined in Exhibit C) in the Lower Level Space and Suite 200; or (iii) the Outside Commencement Date. The “Outside Commencement Date” means June 1, 2018; provided however, the Outside Commencement Date shall be pushed back on a day-for-day basis for each day, if any, that Substantial Completion is delayed due to Force Majeure Events (as defined in Section 25(g)) or Landlord Delay (as defined in Exhibit C).

(g) “Common Areas” means, to the extent applicable, the lobby, parking facilities, passenger elevators, rooftop terrace, fitness or health center, plaza and sidewalk areas, multi-tenanted floor restrooms, and other similar areas of general access at the Project or designated for the benefit of Building tenants, and the areas on multi-tenant floors in the Building devoted to corridors, elevator lobbies, and other similar facilities serving the Premises.

(h) “Delivery Date” means the date that Landlord and Tenant execute this Lease.

(i) “Expiration Date” means the last day of the Term, or such earlier date of termination of this Lease pursuant to the terms hereof.

(j) “Fixed Rent” means fixed rent in the amounts set forth below:

Office Lease

With respect to Suite 200 only:

TIME PERIOD | FIXED RENT PER R.S.F. OF SUITE 200 | ANNUALIZED FIXED RENT | MONTHLY INSTALLMENT |

Commencement Date – end of Abatement Period | $0.00 | $0.00 | $0.00 |

Fixed Rent Start Date – end of Rent Period 1 | $35.00 | $1,842,925.00 | $153,577.08 |

Rent Period 2 | $35.88 | $1,889,261.40 | $157,438.45 |

Rent Period 3 | $36.78 | $1,936,650.90 | $161,387.58 |

Rent Period 4 | $37.70 | $1,985,093.50 | $165,424.46 |

Rent Period 5 | $38.64 | $2,034,589.20 | $169,549.10 |

Rent Period 6 | $39.61 | $2,085,664.55 | $173,805.38 |

Rent Period 7 | $40.60 | $2,137,793.00 | $178,149.42 |

Rent Period 8 | $41.62 | $2,191,501.10 | $182,625.09 |

Rent Period 9 | $42.66 | $2,246,262.30 | $187,188.53 |

Rent Period 10 | $43.73 | $2,302,603.15 | $191,883.60 |

Rent Period 11 | $44.82 | $2,359,997.10 | $196,666.43 |

Rent Period 12 | $45.94 | $2,418,970.70 | $201,580.89 |

Rent Period 13 | $47.09 | $2,479,523.95 | $206,627.00 |

Rent Period 14 | $48.27 | $2,541,656.85 | $211,804.74 |

Rent Period 15 – End of Initial Term | $49.48 | $2,605,369.40 | $217,114.12 |

With respect to the Lower Level Space only:

TIME PERIOD | FIXED RENT PER R.S.F. OF LOWER LEVEL SPACE | ANNUALIZED FIXED RENT | MONTHLY INSTALLMENT |

Commencement Date – end of Abatement Period | $0.00 | $0.00 | $0.00 |

Fixed Rent Start Date – end of Rent Period 1 | $17.50 | $120,032.50 | $10,002.71 |

Rent Period 2 | $17.94 | $123,050.46 | $10,254.21 |

Rent Period 3 | $18.39 | $126,137.01 | $10,511.42 |

Rent Period 4 | $18.85 | $129,292.15 | $10,774.35 |

Rent Period 5 | $19.32 | $132,515.88 | $11,042.99 |

Rent Period 6 | $19.80 | $135,808.20 | $11,317.35 |

Rent Period 7 | $20.30 | $139,237.70 | $11,603.14 |

Rent Period 8 | $20.81 | $142,735.79 | $11,894.65 |

Rent Period 9 | $21.33 | $146,302.47 | $12,191.87 |

Rent Period 10 | $21.86 | $149,937.74 | $12,494.81 |

Rent Period 11 | $22.41 | $153,710.19 | $12,809.18 |

Rent Period 12 | $22.97 | $157,551.23 | $13,129.27 |

Rent Period 13 | $23.54 | $161,460.86 | $13,455.07 |

Rent Period 14 | $24.13 | $165,507.67 | $13,792.31 |

Rent Period 15 – End of Initial Term | $24.73 | $169,623.07 | $14,135.26 |

2

With respect to Suite 300 only:

TIME PERIOD | FIXED RENT PER R.S.F. OF SUITE 300 | ANNUALIZED FIXED RENT | MONTHLY INSTALLMENT |

Suite 300 Abatement Period (if any) | $0.00 | $0.00 | $0.00 |

Suite 300 Rent Commencement Date – end of Rent Period 2 | $35.88 | $1,727,801.40 | $143,983.45 |

Rent Period 3 | $36.78 | $1,771,140.90 | $147,595.08 |

Rent Period 4 | $37.70 | $1,815,443.50 | $151,286.96 |

Rent Period 5 | $38.64 | $1,860,709.20 | $155,059.10 |

Rent Period 6 | $39.61 | $1,907,419.55 | $158,951.63 |

Rent Period 7 | $40.60 | $1,955,093.00 | $162,924.42 |

Rent Period 8 | $41.62 | $2,004,211.10 | $167,017.59 |

Rent Period 9 | $42.66 | $2,054,292.30 | $171,191.03 |

Rent Period 10 | $43.73 | $2,105,818.15 | $175,484.85 |

Rent Period 11 | $44.82 | $2,158,307.10 | $179,858.93 |

Rent Period 12 | $45.94 | $2,212,240.70 | $184,353.39 |

Rent Period 13 | $47.09 | $2,267,618.95 | $188,968.25 |

Rent Period 14 | $48.27 | $2,324,441.85 | $193,703.49 |

Rent Period 15 – End of Initial Term | $49.48 | $2,382,709.40 | $198,559.12 |

(k) “Fixed Rent Start Date” means the day immediately following the end of the Abatement Period.

(l) “Initial Term” means the period commencing on the Commencement Date, and ending at 11:59 p.m. on: (i) if the Commencement Date is the first day of a calendar month, the day immediately prior to the 187-month anniversary of the Commencement Date; or (ii) if the Commencement Date is not the first day of a calendar month, the last day of the calendar month containing the 187-month anniversary of the Commencement Date.

(m) “Laws” means federal, state, county, and local governmental and municipal laws, statutes, ordinances, rules, regulations, codes, decrees, orders, and other such requirements, and decisions by courts in cases where such decisions are considered binding precedents in the state or commonwealth in which the Premises are located (“State”), and decisions of federal courts applying the laws of the State, including without limitation Title III of the Americans with Disabilities Act of 1990, 42 U.S.C. §12181 et seq. and its regulations.

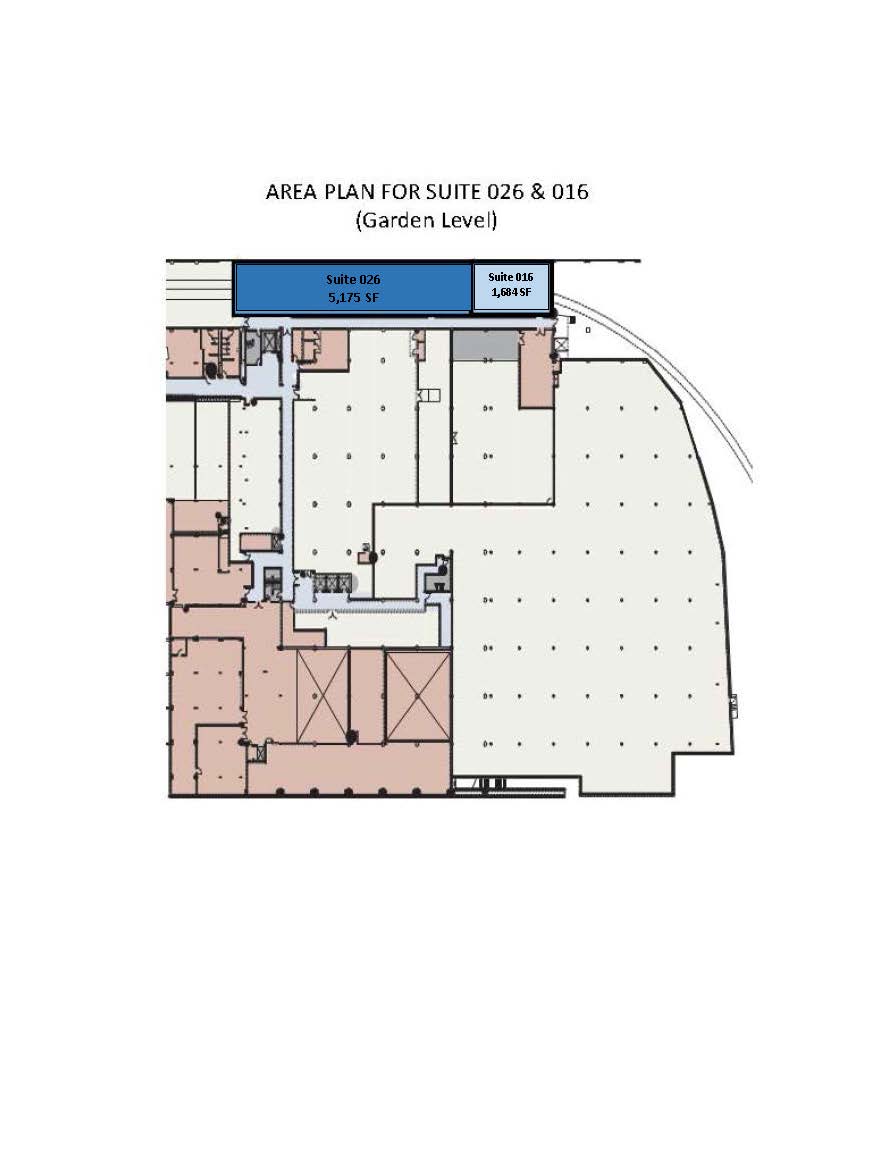

(n) “Lower Level Space” means the following suites in the Building, which are deemed to contain 6,859 rentable square feet in the aggregate and are shown on Exhibit A attached hereto: (i) Suite 016, which is deemed to contain 1,684 rentable square feet; and (ii) Suite 026, which is deemed to contain 5,175 rentable square feet.

(o) “Premises” means, collectively, the Lower Level Space and Suite 200, and, from and after Suite 300 Commencement Date (as defined in Section 2(b) below), Suite 300.

(p) “Project” means the Building, together with the parcel of land upon which the Building is located, and all Common Areas.

(q) “Rent” means Fixed Rent and Additional Rent. Landlord may apply payments received from Tenant to any obligations of Tenant then due and owing without regard to any contrary Tenant instructions or requests.

3

Additional Rent shall be paid by Tenant in the same manner as Fixed Rent, without setoff, deduction, or counterclaim, except as otherwise expressly set forth in this Lease.

(r) “Rent Period” means, with respect to the first Rent Period, the period that begins on the Commencement Date and ends on the last day of the calendar month preceding the month in which the first anniversary of the Commencement Date occurs; thereafter each succeeding Rent Period shall commence on the day following the end of the preceding Rent Period, and shall extend for 12 consecutive months, except for Rent Period 15 which ends on the last day of the Initial Term.

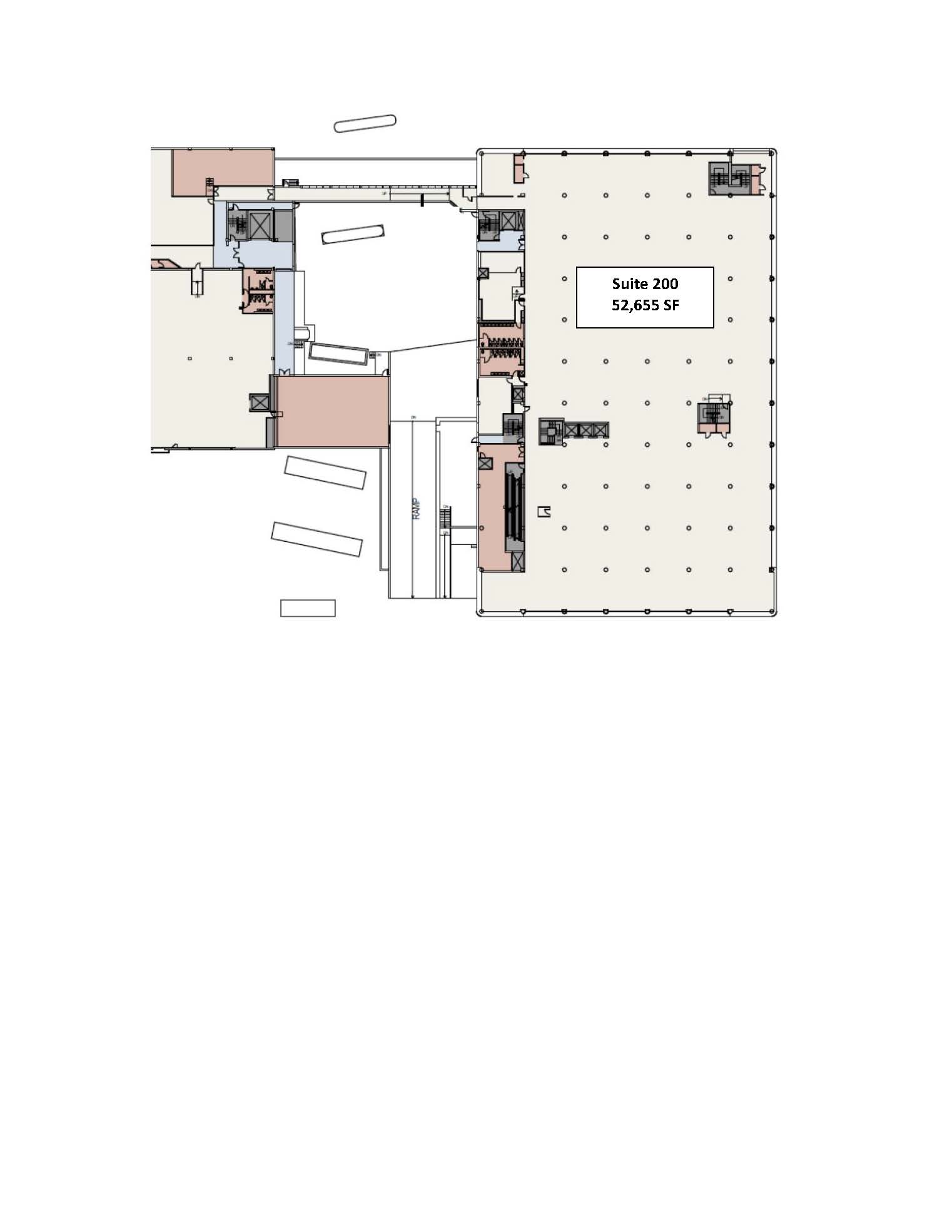

(s) “Suite 200” means Suite 200 in the Building, as shown on Exhibit A attached hereto, which is deemed to contain 52,655 rentable square feet.

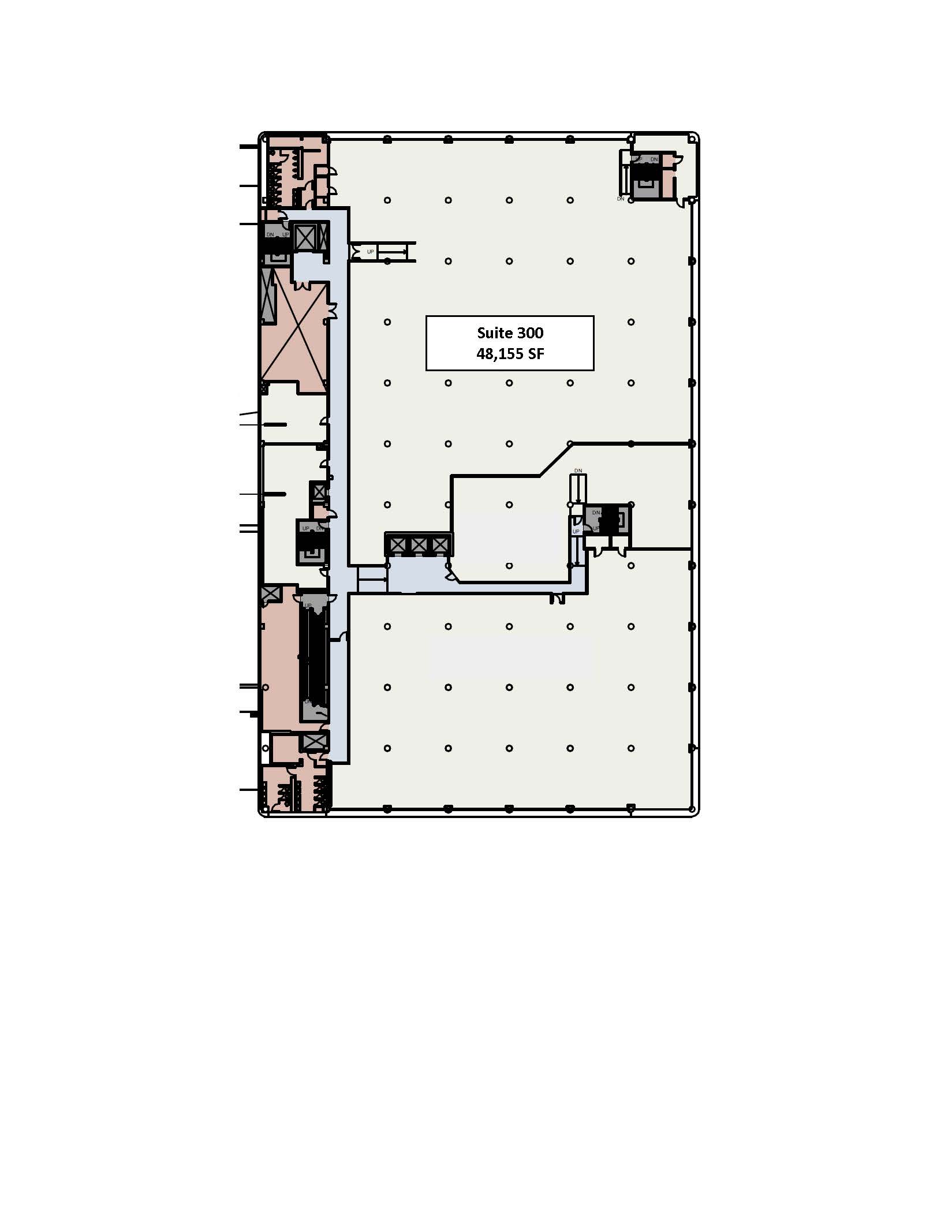

(t) “Suite 300” means Suite 300 in the Building, as shown on Exhibit A attached hereto, which is deemed to contain 48,155 rentable square feet.

(u) “Tenant’s NAICS Code” means Tenant’s 6-digit North American Industry Classification number under the North American Industry Classification System as promulgated by the Executive Office of the President, Office of Management and Budget, which is 541711.

(v) “Term” means the Initial Term together with any extension of the term of this Lease either pursuant to the express terms of this Lease or as otherwise agreed to by the parties in writing.

2.PREMISES.

(a) Landlord leases to Tenant, and Tenant leases from Landlord, the Premises for the Term subject to the terms and conditions of this Lease. Tenant accepts the Premises in their “AS IS”, “WHERE IS”, “WITH ALL FAULTS” condition except that Landlord shall: (i) provide Tenant with the Improvement Allowance (as defined in and pursuant to Exhibit C); (ii) provide Tenant with the Restroom Improvement Allowance (as defined in and pursuant to Exhibit C); (iii) perform any and all such additional repairs, maintenance, or replacements, if any, necessary to cause the Building and the Building’s structural, roof, electrical, mechanical, plumbing, and fire and life safety systems to be in good and proper working order and in full compliance with all applicable Laws as of the Delivery Date or, so long as Tenant’s legal occupancy of the Premises for the Permitted Use is not delayed, then in a timely manner (“Landlord’s Warranty Work”); and (iv) reimburse Tenant upon thirty (30) days’ invoice (together with reasonable supporting documentation and lien waivers) for costs incurred by Tenant in correcting and/or addressing material unexpected deficiencies related to Landlord’s Warranty Work in the Building and Premises discovered by Tenant in the planning and performance of the Leasehold Improvements (as defined in and pursuant to Exhibit C) and in all cases for additional costs incurred by Tenant with respect to demolition, remediation, and disposal of Hazardous Materials located within the Building or Premises during completion of the Leasehold Improvements and any initial leasehold improvements to the garden level or the fourth floor pursuant to Section 26 and 27, including, but not limited to, asbestos containing materials such as floor tile and mastic. Notwithstanding the foregoing, with respect to the removal of asbestos containing materials by Tenant during completion of the Leasehold Improvements and any initial leasehold improvements to the garden level or the fourth floor pursuant to Sections 26 or 27, Landlord and Tenant shall split equally all costs incurred by Tenant relating to the demolition, remediation and disposal of asbestos containing materials located within the Building or Premises during completion of the Leasehold Improvements or any initial leasehold improvements to the garden level or the fourth floor pursuant to Sections 26 or 27, provided if the total costs exceed $600,000 per floor (such that Tenant’s share of such costs would exceed $300,000 per floor), in addition to Landlord’s obligation to reimburse Tenant for the first $300,000 of such costs per floor (as Landlord’s 50% share of such costs), Landlord shall also pay 100% of any costs in excess of $600,000 per floor. On the Delivery Date, Landlord shall deliver possession of the Premises to Tenant for Tenant’s completion of the Leasehold Improvements. Landlord shall cooperate and coordinate the performance and scheduling of Landlord’s Warranty Work such that Landlord does not unreasonably interfere with, or delay, Tenant’s performance of the Leasehold Improvements.

(b) The Term for Suite 300 commences on the date (“Suite 300 Commencement Date”) that is the earliest of: (i) the date on which Tenant first conducts any business in all or any portion of Suite 300; (ii) Substantial

4

Completion of the Leasehold Improvements in Suite 300; or (ii) the Suite 300 Rent Commencement Date, and ends on the Expiration Date. The “Suite 300 Rent Commencement Date” means June 1, 2020; provided, however, the Suite 300 Rent Commencement Date shall be pushed back on a day-for-day basis for: (i) each day (if any) that Substantial Completion of the Leasehold Improvements in Suite 300 is delayed due to a Force Majeure Event or Landlord Delay (as defined in Exhibit C); and (ii) each day (if any) that the Suite 300 Delivery Date is delayed beyond May 1, 2019. The “Suite 300 Delivery Date” means the date that Landlord delivers possession of Suite 300 to Tenant in the condition Landlord is required to deliver the Lower Level Premises and Suite 200 to Tenant. The terms of Section 2(a) of this Lease shall apply with respect to the delivery of Suite 300 to Tenant. “Third Floor Space Abatement Period” means the period, if the Suite 300 Commencement Date occurs prior to the Suite 300 Rent Commencement Date, commencing on the Suite 300 Commencement Date and ending on the day prior to the Suite 300 Rent Commencement Date. During the Suite 300 Abatement Period (if any), no Fixed Rent is due or payable with respect to Suite 300, but Tenant shall pay to Landlord: (i) Tenant’s Share of Operating Expenses with respect to Suite 300; (ii) utilities as set forth in Section 6; and (ii) use and occupancy taxes with respect to Suite 300.

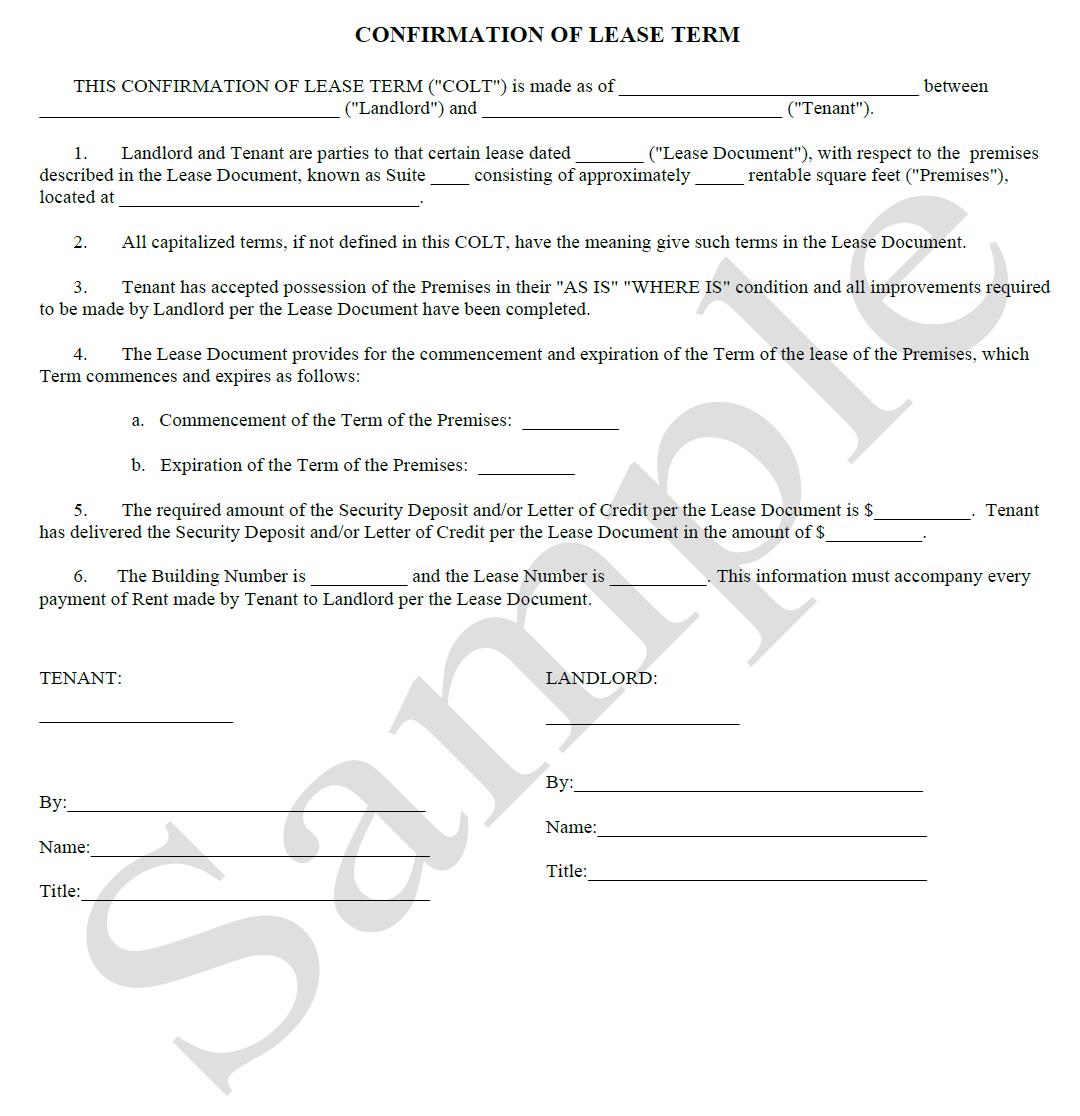

3.TERM; RENTABLE AREA. The Term shall commence on the Commencement Date. The terms and provisions of this Lease are binding on the parties upon Tenant’s and Landlord’s execution of this Lease notwithstanding a later Commencement Date for the Term. The rentable area of the Premises and the Building shall be deemed to be as stated in Section 1. By the Confirmation of Lease Term substantially in the form of Exhibit B attached hereto (“COLT”), Landlord shall notify Tenant of the Commencement Date, rentable square footage of the Premises and all other matters stated therein. The COLT shall be conclusive and binding on Tenant as to all matters set forth therein unless, within 15 days following delivery of the COLT to Tenant, Tenant contests any of the matters contained therein by notifying Landlord in writing of Tenant’s objections.

4.FIXED RENT; LATE FEE.

(a)Tenant covenants and agrees, except as otherwise expressly set forth in this Lease, to pay to Landlord during the Term, without notice, demand, setoff, deduction, or counterclaim, Fixed Rent in the amounts set forth in Section 1. The Monthly Installment of Fixed Rent, the monthly amount of Estimated Operating Expenses as set forth in Section 5, and any estimated amount of utilities as set forth in Section 6, shall be payable to Landlord in advance on or before the first day of each month of the Term. If the Fixed Rent Start Date is not the first day of a calendar month, then the Fixed Rent due for the partial month commencing on the Fixed Rent Start Date shall be prorated based on the number of days in such month. All Rent payments shall be made by electronic funds transfer as follows (or as otherwise directed in writing by Landlord to Tenant from time to time): (i) ACH debit of funds, provided Tenant shall first complete Landlord’s then-current forms authorizing Landlord to automatically debit Tenant’s bank account; or (ii) ACH credit of immediately available funds to an account designated by Landlord. “ACH” means Automated Clearing House network or similar system designated by Landlord. All Rent payments shall include the Building number and the Lease number, which numbers will be provided to Tenant in the COLT.

(b)Contemporaneously with Tenant’s execution and delivery of this Lease, Tenant shall pay to Landlord the monthly Fixed Rent for the first full calendar month after the Abatement Period.

(c)If Landlord does not receive the full payment from Tenant of any Rent when due under this Lease (without regard to any notice and/or cure period to which Tenant might be entitled), Tenant shall also pay to Landlord as Additional Rent a late fee in the amount of 5% of such overdue amount. Notwithstanding the foregoing, upon Tenant’s written request, Landlord shall waive the above-referenced late fee 1 time during any 12 consecutive months of the Term provided Tenant makes the required payment within 3 business days after receipt of notice of such late payment. With respect to any Rent payment (whether it be by check, ACH/wire, or other method) that is returned unpaid for any reason, Landlord shall have the right to assess a fee to Tenant as Additional Rent, which fee is currently $40.00 per returned payment.

5.OPERATING EXPENSES.

(a) Certain Definitions.

5

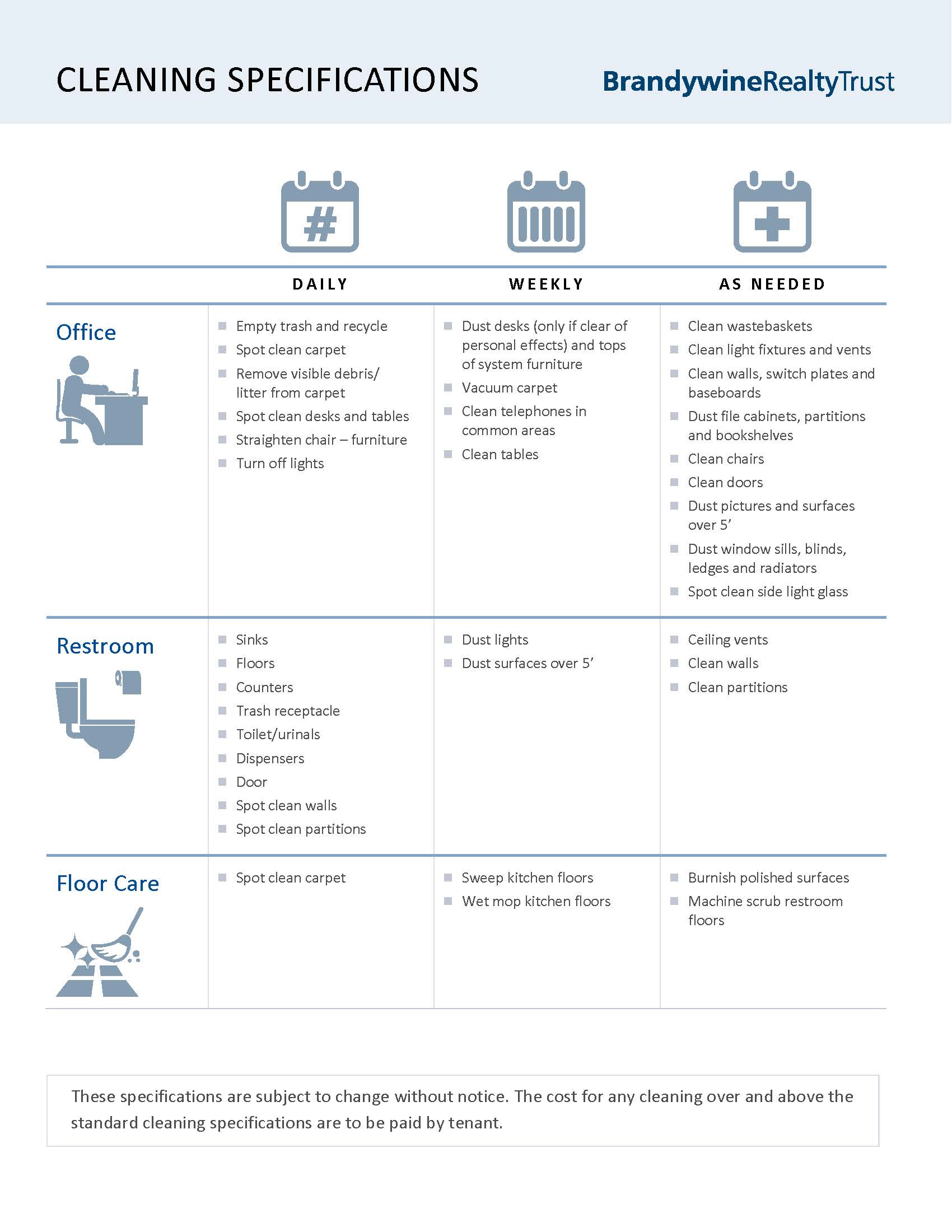

(i) “Janitorial Expenses” means all costs associated with trash and garbage removal, recycling, cleaning, and sanitizing the Building, including the Premises and the items of work set forth in Exhibit D attached hereto.

(ii) “Operating Expenses” means collectively Project Expenses, Janitorial Expenses, and Taxes.

(iii) “Project Expenses” means all costs and expenses paid, incurred, or accrued by Landlord in connection with the maintenance, operation, repair, and replacement of the Project including, without limitation: a management fee not to exceed 5% of gross rents from the Project; all costs associated with the removal of snow and ice from the Project; property management office rent; security measures; transportation program costs; capital expenditures, repairs, and replacements, if such capital expenditures, repairs and replacements are (x) required to comply with any applicable Laws that first came into effect after the Commencement Date, or are amended, become effective, or are interpreted differently after the Commencement Date or (y) intended to reduce other Project Expenses, and only if and to the extent of any actual savings resulting therefrom; and such capital expenditures, repairs and replacements shall constitute Project Expenses, only to the extent of the amortized costs of such capital item over the useful life of the improvement as reasonably determined by Landlord or, if greater, the actual savings created by such capital item for each year of the Term; concierge costs; all insurance premiums and deductibles paid or payable by Landlord with respect to the Project; and the cost of providing those services required to be furnished by Landlord under this Lease. Notwithstanding the foregoing, “Project Expenses” shall not include any of the following: (A) repairs or other work occasioned by fire, windstorm, or other insured casualty or by the exercise of the right of eminent domain to the extent Landlord actually receives insurance proceeds or condemnation awards therefor; (B) leasing commissions, accountants’, consultants’, auditors or attorneys’ fees, costs and disbursements and other expenses incurred in connection with negotiations or disputes with other tenants or prospective tenants or other occupants, or associated with the enforcement of any other leases or the defense of Landlord’s title to or interest in the real property or any part thereof; (C) costs incurred by Landlord in connection with the original construction of the Building and related facilities; (D) costs (including permit, licenses and inspection fees) incurred in renovating or otherwise improving or decorating, painting, or redecorating leased space for other tenants or other occupants or vacant space; (E) interest on debt or amortization payments on any mortgage or deeds of trust or any other borrowings and any ground rent; (F) any compensation paid to clerks, attendants or other persons in commercial concessions operated by Landlord; (G) any fines or fees for Landlord’s failure to comply with Laws; (H) legal, accounting, and other expenses related to Landlord’s financing, refinancing, mortgaging, or selling the Building or the Project; (I) any increase in an insurance premium caused by the non-general office use, occupancy or act of another tenant; (J) costs for sculpture, decorations, painting or other objects of art in excess of amounts typically spent for such items in office buildings of comparable quality in the competitive area of the Building; (K) cost of any political, charitable, or civic contribution or donation; (L) reserves for repairs, maintenance, and replacements; (M) Taxes; (N) cost of utilities directly metered or submetered to Building tenants and paid separately by such tenants; (O) fines, interest, penalties, or liens arising by reason of Landlord’s failure to pay any Project Expenses when due, except that Project Expenses shall include interest or similar charges if the collecting authority permits such Project Expenses to be paid in installments with interest thereon, such payments are not considered overdue by such authority and Landlord pays the Project Expenses in such installments; (P) costs and expenses associated with hazardous waste or hazardous substances not generated or brought to the Project by Tenant or its agents including but not limited to the cleanup of such hazardous waste or hazardous substances and the costs of any litigation (including, but not limited to reasonable attorneys’ fees) arising out of the discovery of such hazardous waste or hazardous substances; (Q) the portion of any wages, salaries, fees, or fringe benefits paid to personnel above the level of regional property manager; (R) costs of extraordinary services provided to tenants of the Building or services to which Tenant is not entitled (including, without limitation, costs specially billed to and paid by specific tenants); (S) all costs relating to activities for the solicitation and execution of leases of space in the Building, including legal fees, real estate brokers’ commissions, expenses, fees, and advertising, moving expenses, design fees, rental concessions, rental credits, tenant improvement allowances, lease assumptions or any other cost and expenses incurred in the connection with the leasing of any space in the Building; (T) costs representing an amount paid to an affiliate of Landlord (exclusive of any management fee permitted under the Operating Expense inclusions) to the extent in excess of market rates for comparable services if rendered by unrelated third parties; (U) costs arising from Landlord’s default under this Lease or any other lease for space in the Building; (V) costs of selling the Project or any portion thereof or interest therein; (W) costs or expenses arising from the gross negligence or willful misconduct of Landlord or its agents or

6

employees; (X) costs incurred to remedy, repair, or otherwise correct violations of Laws that exist on the Commencement Date; (Y) ground rents or rentals payable by Landlord pursuant to any over-lease; (Z) cost of any HVAC, janitorial or other services provided to tenants on an extra cost basis after regular business hours; (AA) with the exception of the cafeteria and fitness facility, cost of installing, operating and maintaining any specialty service not available to Tenant, such as an observatory, broadcasting facilities, child or daycare; (BB) cost of correcting defects in the design, construction or equipment of, or latent defects in, the Building or the Project; (CC) cost of any work or services performed for any facility other than the Building; (DD) any cost of painting or decorating any interior parts of the Building other than common areas; (EE) costs of relamping all light fixtures in non-public areas of the Building including, without limitation, labor materials for light tubes, bulbs, starters, ballasts and their equivalents; (FF) cost of initial cleaning and rubbish removal from the Building to be performed before final completion of the Building or tenant space; (GG) cost of initial landscaping of the Project; (HH) except as expressly provided above, cost of any item that, under generally accepted accounting principles, is properly classified as capital expenses; (II) lease payments for rental equipment (other than equipment for which depreciation is properly charged as an expense) that would constitute a capital expenditure if the equipment were purchased; (JJ) cost of the initial stock of tools and equipment for operation, repair, and maintenance of the Building or the Project; (KK) cost of acquiring, securing cleaning or maintaining sculptures, paintings and other works of art in excess of class A standards or not required by applicable Laws; (LL) direct costs or allocable costs (such as real estate taxes) associated with parking operations if there is a separate charge to Tenant, other than tenants or the public for parking; (MM) all other items for which another party compensates or pays so that Landlord shall not recover any item of cost more than once; (NN) costs of mitigation or impact fees or subsidies (however characterized), imposed or incurred prior to the date of the Lease or imposed or incurred solely as a result of another tenant’s or tenants’ use of the Building or their respective premises; (OO) costs associated with the initial construction of Drexel Square; or (PP) except as expressly set forth above, any charge for depreciation. Landlord shall not collect or be entitled to collect Operating Expenses from all of its tenants an amount in excess of 100% of the Operating Expenses actually incurred by Landlord. “Drexel Square” means the Park Easement (and commonly referred to as Drexel Square) as defined in the Declaration of Easements, Covenants and Restrictions dated October 11, 2017.

(iv) “Taxes” means all taxes, assessments, and other governmental charges, including without limitation business improvement district charges, improvement contributions paid to business improvement districts or similar organizations, and special assessments for public improvements or traffic districts, that are levied or assessed against, or with respect to the ownership of, all or any portion of the Project during the Term or, if levied or assessed prior to the Term, are properly allocable to the Term, business property operating license charges, and reasonable real estate tax appeal expenditures incurred by Landlord. “Taxes” shall not include: (i) any inheritance, estate, succession, transfer, gift, franchise, corporation, net income or profit tax or capital levy that is or may be imposed upon Landlord; or (ii) any transfer tax or recording charge resulting from a transfer of the Building or the Project; provided, however, if at any time during the Term the method of taxation prevailing at the commencement of the Term shall be altered such that in lieu of or as a substitute in whole or in part for any Taxes now levied, assessed or imposed on real estate there shall be levied, assessed or imposed: (A) a tax on the rents received from such real estate; or (B) a license fee measured by the rents receivable by Landlord from the Premises or any portion thereof; or (C) a tax or license fee imposed upon the Premises or any portion thereof, then the same shall be included in Taxes. Tenant may not file or participate in any Tax appeals for any tax lot in the Project; provided that Landlord shall engage professionals to biennially review the Taxes and Landlord shall exercise prudent business judgment in deciding to appeal and pursue appeals of Taxes. Further, “Taxes” shall not include any sales, use, use and occupancy, transaction privilege, gross receipts, or other excise tax that may at any time be levied or imposed upon Tenant, or measured by any amount payable by Tenant under this Lease, whether such tax exists on the date of this Lease or is adopted hereafter (collectively, “Other Taxes”). As Additional Rent, Tenant shall pay all Other Taxes monthly or otherwise when due, whether collected by Landlord or collected directly by the applicable governmental agency.

(v) “Tenant’s Share” means the rentable square footage of the Premises divided by the rentable square footage of the Building on the date of calculation, which on the date of this Lease is stipulated to be 21.05% (and which shall be recalculated as of the Suite 300 Commencement Date). Tenant’s Share will change during the Term if the rentable square footage of the Premises and/or the Building changes.

(b) Commencing on the Commencement Date and continuing thereafter during the Term, Tenant shall pay to Landlord in advance on a monthly basis, payable pursuant to Section 5(c) below, Tenant’s Share of Operating

7

Expenses. To the extent that any Operating Expenses are incurred by Landlord (or Landlord’s affiliate(s)) for multiple buildings or uses, Landlord shall allocate such Operating Expenses to the Building on a commercially reasonable basis. If the Building is operated as part of a complex of buildings or in conjunction with other buildings or parcels of land, then Landlord may prorate the common expenses and costs with respect to each such building or parcel of land in such manner as Landlord, in its sole but reasonable judgment, shall determine. Landlord shall calculate Operating Expenses using generally accepted accounting principles, and may allocate certain categories of Operating Expenses to the applicable tenants on a commercially reasonable basis. Notwithstanding anything herein to the contrary, Operating Expenses associated with the repair, maintenance, replacement or operation of the Park shall be allocated among the buildings comprising Schuylkill Yards from time to time and Tenant’s Share of such costs shall be the rentable square footage of the Premises divided by the rentable square footage of all buildings in Schuylkill Yards, which shall be adjusted from time to time. “Schuylkill Yards” has the same meaning as such term in the Declaration of Easements, Covenants and Restrictions dated October 11, 2017. The “Park” is the park in Schuylkill Yards.

(c) For each calendar year (or portion thereof) for which Tenant has an obligation to pay any Operating Expenses, Landlord shall send to Tenant a statement of the monthly amount of projected Operating Expenses due from Tenant for such calendar year (“Estimated Operating Expenses”), and Tenant shall pay to Landlord such monthly amount of Estimated Operating Expenses as provided in Section 5(b), without further notice, demand, setoff, deduction, or counterclaim, except as otherwise expressly set forth in this Lease. As soon as administratively available after each calendar year but no later than 150 days following the end of such calendar year, Landlord shall send to Tenant a reconciliation statement of the actual Operating Expenses for the prior calendar year (“Reconciliation Statement”). If the amount actually paid by Tenant as Estimated Operating Expenses exceeds the amount due per the Reconciliation Statement, Tenant shall receive a credit in an amount equal to the overpayment, which credit shall be applied towards future Rent until fully credited. If the credit exceeds the aggregate future Rent owed by Tenant, and there is no Event of Default, Landlord shall pay the excess amount to Tenant within 30 days after delivery of the Reconciliation Statement. If Landlord has undercharged Tenant, then Landlord shall send Tenant an invoice setting forth the additional amount due, which amount shall be paid in full by Tenant within 30 days after receipt of such invoice.

(d) If, during the Term, less than 95% of the rentable area of the Building is or was occupied by tenants, Project Expenses, Janitorial Expenses, and Project Utility Costs (other than metered electric costs separately billed to a tenant) shall be deemed for such year to be an amount equal to the costs that would have been incurred had the occupancy of the Building been at least 95% throughout such year, as reasonably determined by Landlord and taking into account that certain expenses fluctuate with the Building’s occupancy level (e.g., Janitorial Expenses) and certain expenses do not so fluctuate (e.g., landscaping). In addition, if Landlord is not obligated or otherwise does not offer to furnish an item or a service to a particular tenant or portion of the Building (e.g., if a tenant separately contracts with an office cleaning firm to clean such tenant’s premises) and the cost of such item or service would otherwise be included in Project Expenses, Janitorial Expenses, and/or Project Utility Costs, Landlord shall equitably adjust the Project Expenses, Janitorial Expenses, or Project Utility Costs so the cost of the item or service is shared only by tenants actually receiving such item or service. All payment calculations under this Section shall be prorated for any partial calendar years during the Term and all calculations shall be based upon Project Expenses, Janitorial Expenses, and Project Utility Costs as grossed-up in accordance with the terms of this Lease. Tenant’s obligations under this Section shall survive the Expiration Date.

(e) If Landlord or any affiliate of Landlord has elected to qualify as a real estate investment trust (“REIT”), any service required or permitted to be performed by Landlord pursuant to this Lease, the charge or cost of which may be treated as impermissible tenant service income under the laws governing a REIT, may be performed by an independent contractor of Landlord, Landlord’s property manager, or a taxable REIT subsidiary that is affiliated with either Landlord or Landlord’s property manager (each, a “Service Provider”). If Tenant is subject to a charge under this Lease for any such service, then at Landlord’s direction Tenant shall pay the charge for such service either to Landlord for further payment to the Service Provider or directly to the Service Provider and, in either case: (a) Landlord shall credit such payment against any charge for such service made by Landlord to Tenant under this Lease; and (b) Tenant’s payment of the Service Provider shall not relieve Landlord from any obligation under this Lease concerning the provisions of such services.

8

(f) Provided there is no outstanding Event of Default by Tenant under this Lease, Tenant shall have the right, at its sole cost and expense, to cause Landlord’s records related to a Reconciliation Statement to be audited provided: (i) Tenant provides notice of its intent to audit such Reconciliation Statement within 120 days after receipt of the Reconciliation Statement; (ii) the audit is performed by a certified public accountant that has not been retained on a contingency basis or other basis where its compensation relates to the cost savings of Tenant; (iii) any such audit may not occur more frequently than once during each 12-month period of the Term, nor apply to any year prior to the year of the then-current Reconciliation Statement being reviewed; (iv) the audit is completed within 2 months after the date that Landlord makes all of the necessary and applicable records available to Tenant or Tenant’s auditor; (v) the contents of Landlord’s records shall be kept confidential by Tenant, its auditor, and its other professional advisors, other than as required by applicable Law, or in the event of a judicial proceeding, but solely limited to information that is required to be disclosed in the judicial proceeding; and (vi) if Tenant’s auditor determines that an overpayment is due Tenant, Tenant’s auditor shall produce a detailed report addressed to both Landlord and Tenant, which report shall be delivered within 30 days after Tenant’s auditor’s completion of the audit. During completion of Tenant’s audit, Tenant shall nonetheless timely pay all of Tenant’s Share of Operating Expenses without setoff or deduction. If Tenant’s audit report discloses any discrepancy, Landlord and Tenant shall use good faith efforts to resolve the dispute. If the parties are unable to reach agreement within 20 days after Landlord’s receipt of the audit report, Tenant shall have the right to refer the matter to a mutually acceptable independent certified public accountant, who shall work in good faith with Landlord and Tenant to resolve the discrepancy; provided if Tenant does not do so within such 20-day period, Landlord’s calculations and the Reconciliation Statement at issue shall be deemed final and accepted by Tenant. The fees and costs of such independent accountant to which such dispute is referred shall be borne by the unsuccessful party. Within 30 days after resolution of the dispute, whether by agreement of the parties or a final decision of an independent accountant, Landlord shall pay or credit to Tenant, or Tenant shall pay to Landlord, as the case may be, all unpaid Operating Expenses due and owing, and if it is determined that Tenant was overcharged by more than 5% of the amount of Tenant’s Share of the Project Expenses for such year, Landlord shall reimburse Tenant the actual, reasonable cost of Tenant’s audit (including legal and accounting costs), not to exceed $5,000.

6.UTILITIES.

(a)Commencing on the Commencement Date, and continuing throughout the Term, Tenant shall pay for utility services as follows without setoff, deduction, or counterclaim (except as otherwise expressly set forth in this Lease): (i) Tenant shall pay directly to the applicable utility service provider for any utilities that are separately metered to the Premises; (ii) Tenant shall pay Landlord for any utilities that are separately submetered to the Premises based upon Tenant’s submetered usage, as well as for any maintenance and replacement costs associated with such submeters (provided such replacement costs shall only apply to submeters utilized to measure Tenant’s supplemental HVAC); (iii) Tenant shall pay Landlord for its proportionate share of any utilities serving the Premises that are not separately metered or submetered based upon its share of the area served by the applicable meter or submeter; and (iv) Tenant shall pay Landlord for Tenant’s Share of all utilities serving the Project, excluding the costs of utilities that are directly metered or submetered to Building tenants or paid separately by such tenants (“Project Utility Costs”). As of the date hereof, to Landlord’s actual knowledge, but without prejudice to Landlord’s right to make modifications from time to time:

• | Electric for the lights and plugs of the Premises is currently separately submetered. As part of the Leasehold Improvements, Tenant shall install submeters to measure its electric usage associated with HVAC for both office and lab space, as well as for any steam and chilled water usage. |

Notwithstanding anything to the contrary in this Lease, Landlord shall have the right to install meters, submeters, or other energy-reducing systems in the Premises at any time to measure any or all utilities serving the Premises, the costs of which shall be included in Project Expenses. For those utilities set forth in subsections (ii) – (iv) above, Landlord shall have the right to either invoice Tenant for such utilities separately as Additional Rent, or include such utilities in amounts due as Operating Expenses. Landlord shall have the right to reasonably estimate the utility charge, which estimated amount shall be payable to Landlord within 30 days after receipt of an invoice therefor and may be included along with the invoice for Project Expenses, provided Landlord shall be required to reconcile on an annual basis based on utility invoices received for such period. The cost of utilities payable by Tenant under this Section shall include all applicable taxes and Landlord’s then-current charges for reading the applicable meters, provided Landlord shall have the right to engage a third party to read the submeters, and Tenant shall reimburse Landlord for both the utilities

9

consumed as evidenced by the meters plus the reasonable market costs for reading the meters within 30 days after receipt of an invoice therefor. Tenant shall pay such rates as Landlord may establish from time to time, which shall not be in excess of any applicable rates chargeable by Law, or in excess of the general service rate or other such rate that would apply to Tenant’s consumption if charged by the utility or municipality serving the Building or general area in which the Building is located. If Tenant fails to pay timely any direct-metered utility charges from the applicable utility provider, Landlord shall have the right but not the obligation to pay such charges on Tenant’s behalf and bill Tenant for such costs plus the Administrative Fee (as defined in Section 17), which amount shall be payable to Landlord as Additional Rent within 30 days after receipt of an invoice therefor.

(b)For any separately metered utilities, Landlord is hereby authorized to request and obtain, on behalf of Tenant, Tenant’s utility consumption data from the applicable utility provider for informational purposes and to enable Landlord to obtain full building Energy Star scoring for the Building. Landlord, with reasonable prior written notice to Tenant shall have the right to shut down the Building systems (including electricity and HVAC systems) for required maintenance, safety inspections, or any other reason, including without limitation in cases of emergency (for which notice shall be practicable under the circumstances). Landlord shall coordinate the scheduling of any maintenance and safety inspections with Tenant to provide ample time for Landlord and Tenant to minimize any interference with Tenant’s use and occupancy of the Premises and the operation of Tenant’s business therefrom. Landlord shall use commercially reasonable efforts to schedule routine maintenance that will materially and adversely interfere with Tenant’s operations to occur during non-Business Hours. Landlord shall not be liable for any interruption in providing any utility that Landlord is obligated to provide under this Lease, unless such interruption or delay: (i) renders the Premises or any material portion thereof untenantable for the normal conduct of Tenant’s business at the Premises, and Tenant has ceased using such untenantable portion, provided Tenant shall first endeavor to use any generator that serves the Premises or of which Tenant has the beneficial use; (ii) results from Landlord’s negligence or willful misconduct; and (iii) extends for a period longer than 3 consecutive days, in which case, Tenant’s obligation to pay Fixed Rent shall be abated with respect to the untenantable portion of the Premises that Tenant has ceased using for the period beginning on the 4th consecutive day after such conditions are met and ending on the earlier of: (A) the date Tenant recommences using the Premises or the applicable portion thereof; or (B) the date on which the service(s) is substantially restored. The rental abatement described above shall be Tenant’s sole remedy in the event of a utility interruption, and Tenant hereby waives any other rights against Landlord in connection therewith. Landlord shall have the right to change the utility providers to the Project at any time. In the event of a casualty or condemnation affecting the Building and/or the Premises, the terms of Sections 14 and 15, respectively, shall control over the provisions of this Section.

(c)If Landlord reasonably determines that: (i) Tenant exceeds the design conditions for the heating, ventilation, and air conditioning (“HVAC”) system serving the Premises, introduces into the Premises equipment that overloads such system, or causes such system to not adequately perform its proper functions; or (ii) the heavy concentration of personnel, motors, machines, or equipment used in the Premises, including telephone and computer equipment, or any other condition in the Premises caused by Tenant (for example, more than one shift per day or 24-hour use of the Premises), adversely affects the temperature or humidity otherwise maintained by such system, then Landlord shall notify Tenant in writing and Tenant shall have 30 days to remedy the situation to Landlord’s reasonable satisfaction. If Tenant fails to timely remedy the situation to Landlord’s reasonable satisfaction, Landlord shall have the right to install one or more supplemental air conditioning units in the Premises with the cost thereof, including the cost of installation, operation and maintenance, being payable by Tenant to Landlord within 30 days after Landlord’s written demand. Tenant shall not change or adjust any closed or sealed thermostat or other element of the HVAC system serving the Premises without Landlord’s express prior written consent. Landlord may install and operate meters or any other reasonable system for monitoring or estimating any services or utilities used by Tenant in excess of those required to be provided by Landlord (including a system for Landlord’s engineer reasonably to estimate any such excess usage). If such system indicates such excess services or utilities, Tenant shall pay Landlord’s reasonable charges for installing and operating such system and any supplementary air conditioning, ventilation, heat, electrical, or other systems or equipment (or adjustments or modifications to the existing Building systems and equipment), and Landlord’s reasonable charges for such amount of excess services or utilities used by Tenant. All supplemental HVAC systems and equipment serving the Premises (including without limitation Tenant’s Supplemental HVAC, as defined in Section 11(a) below) shall be separately metered to the Premises at Tenant’s cost, and Tenant shall be solely responsible for all electricity registered by, and the maintenance and replacement of, such meters. Landlord has no obligation to

10

keep cool any of Tenant’s information technology equipment that is placed together in one room, on a rack, or in any similar manner (“IT Equipment”), and Tenant waives any claim against Landlord in connection with Tenant’s IT Equipment. Landlord shall have the option to require that the computer room and/or information technology closet in the Premises shall be separately submetered at Tenant’s expense, and Tenant shall pay Landlord for all electricity registered in such submeter. Within 1 month after written request, Tenant shall provide to Landlord electrical load information reasonably requested by Landlord with respect to any computer room and/or information technology closet in the Premises.

7.LANDLORD SERVICES.

(a)Subject to Tenant’s payment of Operating Expenses under Section 5 and utilities under Section 6, Landlord shall provide the following to the Premises 24 hours per day, 7 days per week during the entire Term: (i) HVAC service in the respective seasons during Business Hours in a manner consistent with the furnishing of same by other landlords of first class mixed use office and laboratory buildings in Philadelphia and providing a temperature range of 72º Fahrenheit (+/- 2 º); (ii) electricity for lighting and equipment for comparable mixed use office and laboratory buildings in the market in which the Project is located; (iii) water, sewer, and, to the extent applicable to the Building, gas service; (iv) steam during the period of October 15 through April 15 of each year during the Term; and (v) cleaning services meeting the minimum specifications set forth in Exhibit D attached hereto. Tenant, at Tenant’s expense, shall make arrangements with the applicable utility companies and public bodies to provide, in Tenant’s name, telephone, cable, and any other utility service not provided by Landlord that Tenant desires at the Premises.

(b)Landlord shall not be obligated to furnish any services, supplies, or utilities other than as set forth in this Lease; provided, however, upon Tenant’s prior request sent in accordance with Section 25(o) below, Landlord may furnish additional services, supplies, or utilities, in which case Tenant shall pay to Landlord, immediately upon demand, Landlord’s then-current charge for such additional services, supplies, or utilities, or Tenant’s pro rata share thereof, if applicable, as reasonably determined by Landlord.

(c)Notwithstanding anything to the contrary in this Lease, at its sole cost and expense Tenant shall cause all laboratory areas of the Premises to be cleaned and ensure the proper disposal of all Hazardous Materials in compliance with all applicable Laws, and Landlord shall have no responsibility for any of the foregoing.

8.USE; SIGNS; PARKING; COMMON AREAS.

(a)Tenant may use the Premises for general office use (non-medical) and storage incidental thereto, typical research and development use, and laboratory use for a pharmaceutical or biopharmaceutical company, and for no other purpose (“Permitted Use”). Tenant’s use of the Premises for the Permitted Use shall be subject to all applicable Laws, and to all reasonable requirements of the insurers of the Building. Tenant represents and warrants to Landlord, for informational purposes only, that Tenant’s current NAICS Code is set forth in Section 1 hereof, provided the foregoing shall not be construed in any manner as a restriction on the Permitted Use.

(b)Landlord shall provide Tenant with Building-standard identification signage on all Building lobby directories (to the extent installed by Landlord).

(c)Subject to the Building rules and regulations, Tenant shall have the nonexclusive right in common with others to use the Common Areas for their intended purposes. Not in limitation of the foregoing, Tenant shall have the right throughout the Term to obtain permits, up to a number equal to the Parking Permit Number (as defined below) for unreserved parking of standard-size automobiles of Tenant and its employees and business visitors within the Landlord Parking Facility (as defined below): (i) by entering from time to time into the parking garage operator’s standard agreement covering the use of parking spaces in such garage; (ii) upon the terms and subject to the conditions set forth in such agreements; and (iii) subject to Tenant’s monthly payment to such operator of its standard fee for the right to such parking spaces. To the extent not included in the fee (if any) charged for parking in the parking facility for the Building, Tenant shall be solely liable for all parking taxes (if any) imposed by the applicable governmental authority with respect to Tenant’s parking spaces. If Landlord elects (in its sole and absolute discretion) to operate the parking facility, Tenant shall pay Landlord such taxes within 15 days after receipt of an invoice therefor and Landlord

11

shall then remit such taxes to the applicable governmental authority. If the parking facility is not operated by Landlord, Tenant shall pay the operator such taxes and the operator shall then remit such taxes to the applicable governmental authority. The “Landlord Parking Facility” means the parking garage or lot owned or controlled by Landlord or an affiliate of Landlord in University City, as determined by Landlord from time to time by written notice to Tenant, but in no event shall the Landlord Parking Facility be a distance from the Building that is greater than the distance from the garage at FMC Tower. The “Parking Permit Number” means 1 multiplied by the total rentable square footage of the Premises, and then divided by 2,500. Notwithstanding the foregoing, Landlord shall have the right, by written notice to Tenant, (i) to adjust the Parking Permit Number with respect to the rentable square footage of the Lower Level Space and Suite 200 after December 1, 2019 (the “First Parking Adjustment Date”) to equal Tenant’s average monthly utilization of the Landlord Parking Facility during the prior 12-month period of occupancy of the Premises (provided the First Parking Adjustment Date shall be pushed back on a day-for-day basis for each day that the Delivery Date is delayed beyond December 1, 2017); and (ii) to adjust the Parking Permit Number with respect to the rentable square footage of Suite 300 only after December 1, 2020 (the “Second Parking Adjustment Date”) to equal Tenant’s average monthly utilization of the Landlord Parking Facility with respect to Suite 300 only (i.e. exclude from Tenant’s average monthly utilization of the Landlord Parking Facility the Parking Permit Number determined in accordance with (i) above) during the prior 12-month period of occupancy of the Premises (provided the Second Parking Adjustment Date shall be pushed back on a day-for-day basis for each day that the Suite 300 Delivery Date is delayed beyond May 1, 2019). Notwithstanding anything herein to the contrary, if Tenant expands the Premises at any time during the Term, the Parking Permit Number shall increase in accordance with the ratio provided above with respect to the expansion space and Landlord shall have the right, by written notice to Tenant to adjust the Parking Permit Number with respect to such additional space on the date that is one (1) year following the date Tenant occupies the expanded space for the operation of Tenant’s business, to equal Tenant’s average monthly utilization of the Landlord Parking Facility with respect to such expanded space only during the prior 12-month period of occupancy of the Premises.

(d)Landlord shall have the right in its sole discretion to, from time to time, construct, maintain, operate, repair, close, limit, take out of service, alter, change, and modify all or any part of the Common Areas, provided, however, Landlord shall exercise such right in a commercially reasonable manner intended to minimize interference with Tenant’s use and occupancy of the Premises and the Common Areas, and to not adversely affect the number of parking spaces available for Tenant’s use. Landlord shall maintain the Common Areas in a manner consistent with the furnishing of same by other landlords of first class office buildings in Center City Philadelphia. Landlord, Landlord’s agents, contractors, and utility service providers shall have the right to install, use, and maintain ducts, pipes, wiring, and conduits in and through the Premises provided such use does not cause the usable area of the Premises to be reduced beyond a de minimis amount.

(e)Subject to Landlord’s security measures and Force Majeure Events (as defined in Section 25(g)), Landlord shall provide Tenant with access to the Building and, if applicable, passenger elevator service for use in common with others for access to and from the Premises 24 hours per day, 7 days per week, except during emergencies. Landlord shall have the right to limit the number of elevators (if any) to be operated during repairs and during non-Business Hours. During the Term, Landlord shall provide Tenant with access to the freight elevator(s) of the Building during Business Hours on a first-come, first-served basis at no charge for the delivery and handling of laboratory materials, consumable and hazardous materials and waste. Notwithstanding the foregoing, during construction of the Leasehold Improvements, Tenant shall have the right to use the Building freight elevators from 7:00 a.m. to 3:00 p.m. on a nonexclusive, first-come, first-served basis at no charge except if Landlord reasonably determines that it is necessary for Landlord, Landlord’s contractor, or Tenant’s contractor, to employ an operating engineer to manage such nonexclusive use of the freight elevator (currently at a charge of $125 per hour), then the costs incurred by Landlord will be shared equitably among users, without markup. Landlord acknowledges and agrees that Tenant shall be permitted to reserve the freight elevators (subject to the payment of Landlord’s actual costs incurred as hereinabove provided) in one (1)-hour increments.

(f)Provided all of the Monument Signage Conditions are fully satisfied, Landlord shall install a new monument sign (“Monument Sign”) at the Building and install a panel sign for Tenant (“Panel”) on the Monument Sign on or before December 31, 2018, subject to applicable Laws and satisfaction of all of the following terms and conditions: (i) the size and location and Tenant’s specifications and design of the Panel shall be subject to Landlord’s prior written consent and generally consistent with the aesthetic standards of the Building and compatible with the

12

signage at Schuylkill Yards; (ii) Landlord shall obtain the Panel on Tenant’s behalf and at Tenant’s sole cost and expense at market rates; (iii) Landlord shall install the Panel, at Tenant’s sole cost and expense; (iv) Landlord shall maintain and repair the Monument Sign, the costs of which shall be proportionately paid by the tenants having panel signs on such Monument Sign; (v) Landlord shall maintain and repair the Panel, at Tenant’s sole cost and expense; (vi) if the Monument Sign is illuminated, Tenant shall pay its proportionate share of the costs of such illumination (equitably allocated in Landlord’s reasonable determination); and (vii) if the Panel requires replacement, such replacement shall be at Tenant’s sole cost and expense. The “Monument Signage Conditions” are that: (a) there has been no Event of Default which remains uncured; and (b) this Lease is in full force and effect. Prior to the Surrender Date (as defined in Section 18(a)), or immediately upon any of the Monument Signage Conditions no longer being satisfied, Landlord shall have the right, at Tenant’s sole but reasonable cost and expense, to remove the Panel and repair and restore the Monument Sign to its prior existing condition. With respect to clause (i) above, Landlord’s determination and selection of the size, location, specifications, and design of the Panel may take into account the necessity to reserve or reallocate space for signage for existing and future tenants of the Building and in furtherance of the foregoing, Landlord shall have the right to require that the Panel be replaced with a Panel of a different size, configuration, or design, from time to time, and the Panel’s placement on the Monument Sign may be equitably relocated on such sign by Landlord, from time to time based upon the relative sizes of the premises leased by the tenants with a panel on the Monument Sign. Tenant shall pay Landlord for all costs due under this paragraph as Additional Rent within 30 days after receipt of Landlord’s invoice therefor.

(g)To the extent permitted by applicable Laws, and provided all of the Exterior Signage Conditions are fully satisfied, the originally named Tenant shall have the nonexclusive right, at its sole cost and expense (including without limitation with respect to installation, maintenance, and removal), to place signage on one side of the exterior Building façade displaying Tenant’s corporate name and logo (“Exterior Signage”). The “Exterior Signage Conditions” are that: (a) the originally named Tenant is paying full Rent and Landlord is able to recognize revenue on a GAAP basis on at least 100% of the rentable area of the second, third and fourth floors of the Building; (b) there has been no Event of Default which remains uncured; and (c) this Lease is in full force and effect. Notwithstanding the foregoing, Tenant shall have the immediate right to install the Exterior Signage upon Tenant’s exercise of the Expansion Option or Tenant’s ROFO Notice with respect to the entire fourth floor of the Building. The Exterior Signage shall be subject to Landlord’s reasonable approval in writing as to the location, placement, color, size, design, construction, and architectural compatibility of the Exterior Signage with the exterior of the Building and the signage at Schuylkill Yards. Landlord’s approval of the Exterior Signage shall create no responsibility or liability on the part of Landlord for the completeness, design, or sufficiency thereof, or the compliance of the Exterior Signage with the requirements of applicable Laws. On or prior to the Surrender Date, or immediately if any of the Exterior Signage Conditions are no longer true, Tenant shall remove the Exterior Signage, at Tenant’s sole cost and expense, and restore and repair all parts of the Building affected by the installation or removal of the Exterior Signage, to the condition existing prior to its installation or to a condition reasonably acceptable to Landlord. Landlord shall have the right to remove the Exterior Signage at Tenant’s expense if Tenant fails to comply with the preceding sentence. Tenant understands and agrees that it is solely responsible to ensure the upkeep and condition of the Exterior Signage to its original status, normal wear and tear excepted. Specifically, any missing letters, whether by loss, destruction, wear, act of God, or otherwise, will be replaced at the full expense of Tenant and shall be repaired or replaced within 10 days after the occurrence of such deficiency. In addition to any other rights or remedies provided to Landlord in this Lease, if Tenant shall fail to complete such repair and/or replacement within such 10-day period, Landlord shall have the right, but not the obligation, to start to complete such repair and/or replacement at Tenant’s sole cost and expense, which sums shall constitute Additional Rent and be reimbursed by Tenant within 5 days following demand therefor by Landlord. Prior to constructing or installing the Exterior Signage, Tenant shall have obtained and must continue to maintain all permits and/or approvals required by applicable Laws with respect to the construction, installation, and maintenance of the Exterior Signage, and shall have provided Landlord with sufficient evidence of the existence of such permits and/or approvals and that the construction and installation of the Exterior Signage will comply in all respects with all applicable Laws. Tenant shall be solely responsible for ensuring that the Exterior Signage is in compliance with all present and future applicable Laws. Tenant, at its sole cost and expense, shall insure the Exterior Signage as part of Tenant’s Property, and shall also carry liability insurance with respect to the Exterior Signage. Tenant shall protect, defend, indemnify, and hold harmless Landlord and all Landlord Indemnitees (as defined in Section 13(a)) from and against any and all claims, damages, judgments, suits, causes of action, losses, liabilities, penalties, fines, expenses, and costs (including, without limitation,

13

sums paid in settlement of claims, attorneys’ fees, consultant fees, and expert fees and court costs) arising out of or from or related to the construction, installation, maintenance, use, or removal of the Exterior Signage.

9.TENANT’S ALTERATIONS. Tenant shall not cut, drill into, or secure any fixture, apparatus, or equipment, or make alterations, improvements, or physical additions of any kind to any part of the Premises (collectively, “Alterations”) without first obtaining the written consent of Landlord, which consent shall not be unreasonably withheld, conditioned, or delayed. All Alterations shall be completed in compliance with all applicable Laws, and Landlord’s reasonable rules and regulations for construction, and sustainable guidelines and procedures. Notwithstanding the foregoing, Landlord’s consent shall not be required for any Alteration costing less than $75,000.00 in the aggregate per calendar year, and that: (i) is nonstructural; (ii) does not impact any of the Building systems, involve electrical work, require a building permit, or materially affect the air quality in the Building; and (iii) is not visible from outside of the Premises. Tenant shall be solely responsible for the installation and maintenance of its data, telecommunication, and security systems and wiring at the Premises, which shall be done in compliance with all applicable Laws, and Landlord’s reasonable rules and regulations. With respect to all improvements and Alterations made after the date hereof, other than those made by Landlord pursuant to the express provisions of this Lease, Tenant acknowledges that: (A) Tenant is not, under any circumstance, acting as the agent of Landlord; (B) Landlord did not cause or request such Alterations to be made; (C) Landlord has not ratified such work; and (D) Landlord did not authorize such Alterations within the meaning of applicable State statutes. Nothing in this Lease or in any consent to the making of Alterations or improvements shall be deemed or construed in any way as constituting a request by Landlord, express or implied, to any contractor, subcontractor, or supplier for the performance of any labor or the furnishing of any materials for the use or benefit of Landlord. Tenant shall not overload any floor or part thereof in the Premises or the Building, including any public corridors or elevators, by bringing in, placing, storing, installing or removing any large or heavy articles, and Landlord may prohibit, or may direct and control the location and size of, safes and all other heavy articles, and may require, at Tenant’s sole cost and expense, supplementary supports of such material and dimensions as Landlord may deem necessary to properly distribute the weight.

10.ASSIGNMENT AND SUBLETTING.

(a)Except as expressly permitted pursuant to Section 10(c), neither Tenant nor Tenant’s legal representatives or successors-in-interest by operation of law or otherwise, shall sell, assign, transfer, hypothecate, mortgage, encumber, grant concessions or licenses, sublet, or otherwise dispose of all or any interest in this Lease or the Premises, or permit any person or entity other than Tenant to occupy any portion of the Premises (each of the foregoing is a “Transfer” to a “Transferee”), without Landlord’s prior written consent, which consent shall not be unreasonably withheld, conditioned, or delayed. Any Transfer undertaken without Landlord’s prior written consent (other than pursuant to Section 10(c)) shall constitute an Event of Default and shall, at Landlord’s option, be void and/or terminate this Lease. For purposes of this Lease, a Transfer shall include, without limitation, any assignment by operation of law, and any merger, consolidation, or asset sale involving Tenant, any direct or indirect transfer of control of Tenant, and any transfer of a majority of the ownership interests in Tenant (other than through the ownership of voting securities listed on a recognized securities exchange). Consent by Landlord to any one Transfer shall be held to apply only to the specific Transfer authorized, and shall not be construed as a waiver of the duty of Tenant, or Tenant’s legal representatives or assigns, to obtain from Landlord consent to any other or subsequent Transfers pursuant to the foregoing, or as modifying or limiting the rights of Landlord under the foregoing covenant by Tenant.

(b)Without limiting the bases upon which Landlord may reasonably withhold its consent to a proposed Transfer, it shall not be unreasonable for Landlord to withhold its consent if: (i) the proposed Transferee shall have a net worth that is not acceptable to Landlord in Landlord’s reasonable discretion; (ii) the proposed Transferee, in Landlord’s reasonable opinion, is not reputable and of good character; (iii) the portion of the Premises requested to be subleased renders the balance of the Premises unleasable as a separate area; (iv) Tenant is proposing to Transfer to an existing tenant of the Building or another property owned by Landlord or Landlord’s affiliate(s), or to another prospect with whom Landlord or Landlord’s affiliate(s) are then negotiating in the market of which the Building is a part; or (v) the nature of such Transferee’s proposed business operation would or might reasonably violate the terms of this Lease or of any other lease for the Building (including any exclusivity provisions), or would, in Landlord’s reasonable judgment, otherwise be incompatible with other tenancies in the Building.

14

(c)Notwithstanding the foregoing, Tenant shall have the right without the prior consent of Landlord, but after at least 10 days’ prior written notice to Landlord, to make a Transfer to any Affiliate (as defined below), or an entity into which Tenant merges or that acquires substantially all of the assets or stock of Tenant (“Surviving Entity”) (the Surviving Entity or Affiliate are also referred to as a “Permitted Transferee”); provided: (i) Tenant delivers to Landlord the Transfer Information (as defined below); (ii) if the Lease will be Transferred to a Surviving Entity, the Surviving Entity shall have a tangible net worth at least equal to the net worth of Tenant on the date of this Lease; (iii) the originally named Tenant shall not be released or discharged from any liability under this Lease by reason of such Transfer; and (iv) if the Transfer is to an Affiliate, such Transferee shall remain an Affiliate throughout the Term and if such Transferee shall cease being an Affiliate, Tenant shall notify Landlord in writing of such change and such Transfer shall be deemed an Event of Default if Landlord’s consent thereto is not given in writing within 10 business days after such notification. An “Affiliate” means a corporation, limited liability company, partnership, or other registered entity, 50% or more of whose equity interest is owned by the same persons or entities owning 50% or more of Tenant’s equity interests, a subsidiary, or a parent entity.

(d)If at any time during the Term Tenant desires to complete a Transfer, Tenant shall give written notice to Landlord of such desire together with the Transfer Information. If: (i) Tenant desires to assign this Lease or to sublease the entire Premises other than pursuant to Section 10(c), Landlord shall have the right to accelerate the Expiration Date so that the Expiration Date shall be the date on which the proposed assignment or sublease would be effective; or (ii) Tenant desires to sublease less than the entire Premises other than to an Affiliate, Landlord shall have the right to accelerate the Expiration Date with respect to the portion of the Premises that Tenant proposes to sublease. If Landlord elects to accelerate the Expiration Date pursuant to this paragraph, Tenant shall have the right to rescind its request for Landlord’s consent to the proposed assignment or sublease by giving written notice of such rescission to Landlord within 10 days after Tenant’s receipt of Landlord’s acceleration election notice. If Tenant does not so rescind its request: (A) Tenant shall deliver the Premises or the applicable portion thereof to Landlord in the same condition as Tenant is, by the terms of this Lease, required to deliver the Premises to Landlord upon the Expiration Date; and (B) Fixed Rent and Tenant’s Share shall be reduced on a per rentable square foot basis for the area of the Premises that Tenant no longer leases. If Landlord elects to accelerate the Expiration Date for less than the entire Premises, the cost of erecting any demising walls, entrances, and entrance corridors, and any other improvements required in connection therewith shall be performed by Landlord, with the cost thereof being divided evenly between Landlord and Tenant.

(e)The “Transfer Information” means the following information: (i) a copy of the fully executed assignment and assumption agreement, or sublease agreement, as applicable (with respect to a Permitted Transfer, such agreement to be delivered to Landlord within 10 business days after the transaction closes and with respect to all other Transfers, such agreement shall be provided in draft form and shall not be executed, or the effectiveness of such agreement shall be conditioned upon the receipt of Landlord’s consent, until Landlord’s consent has been given); (ii) a copy of the then-current financials of the Transferee (either audited or certified by the chief financial officer of the Transferee) (except no financials shall be required for a Transfer to an Affiliate); (iii) a copy of the formation certificate and good standing certificate of the Transferee; and (iv) such other reasonably requested information by Landlord needed to confirm or determine Tenant’s compliance with the terms and conditions of this Section.

(f)Any sums or other economic consideration received by Tenant as a result of any Transfer (except rental or other payments received that are attributable to the amortization of the cost of leasehold improvements made to the transferred portion of the Premises by Tenant for the Transferee, and other reasonable expenses incident to the Transfer, including standard leasing commissions and attorneys’ fees) whether denominated rentals under the sublease or otherwise, that exceed, in the aggregate, the total sums which Tenant is obligated to pay Landlord under this Lease (prorated to reflect obligations allocable to that portion of the Premises subject to such Transfer) shall, at Landlord’s option, be divided evenly between Landlord and Tenant, with Landlord’s portion being payable to Landlord as Additional Rent without affecting or reducing any other obligation of Tenant hereunder. This subsection (f) shall not apply to any Permitted Transfers.

(g)Regardless of Landlord’s consent to a proposed Transfer, no Transfer shall release Tenant from Tenant’s obligations or alter Tenant’s primary liability to fully and timely pay all Rent when due from time to time under this Lease and to fully and timely perform all of Tenant’s other obligations under this Lease, and the originally named Tenant and all assignees shall be jointly and severally liable for all Tenant obligations under this Lease. The

15

acceptance of rental by Landlord from any other person shall not be deemed to be a waiver by Landlord of any provision hereof. If a Transferee defaults in the performance of any of the terms of this Lease, Landlord may proceed directly against the originally named Tenant without the necessity of exhausting remedies against such Transferee. If there has been a Transfer and an Event of Default occurs, Landlord may collect Rent from the Transferee and apply the net amount collected to the Rent herein reserved; but no such collection shall be deemed a waiver of the provisions of this Section, an acceptance of such Transferee as tenant hereunder or a release of Tenant from further performance of the covenants herein contained.

11.REPAIRS AND MAINTENANCE.